A SWOT Analysis of the Green Hydrogen Market

Abstract

1. Introduction

2. Materials and Methods

3. Results and Discussion

3.1. Strengths

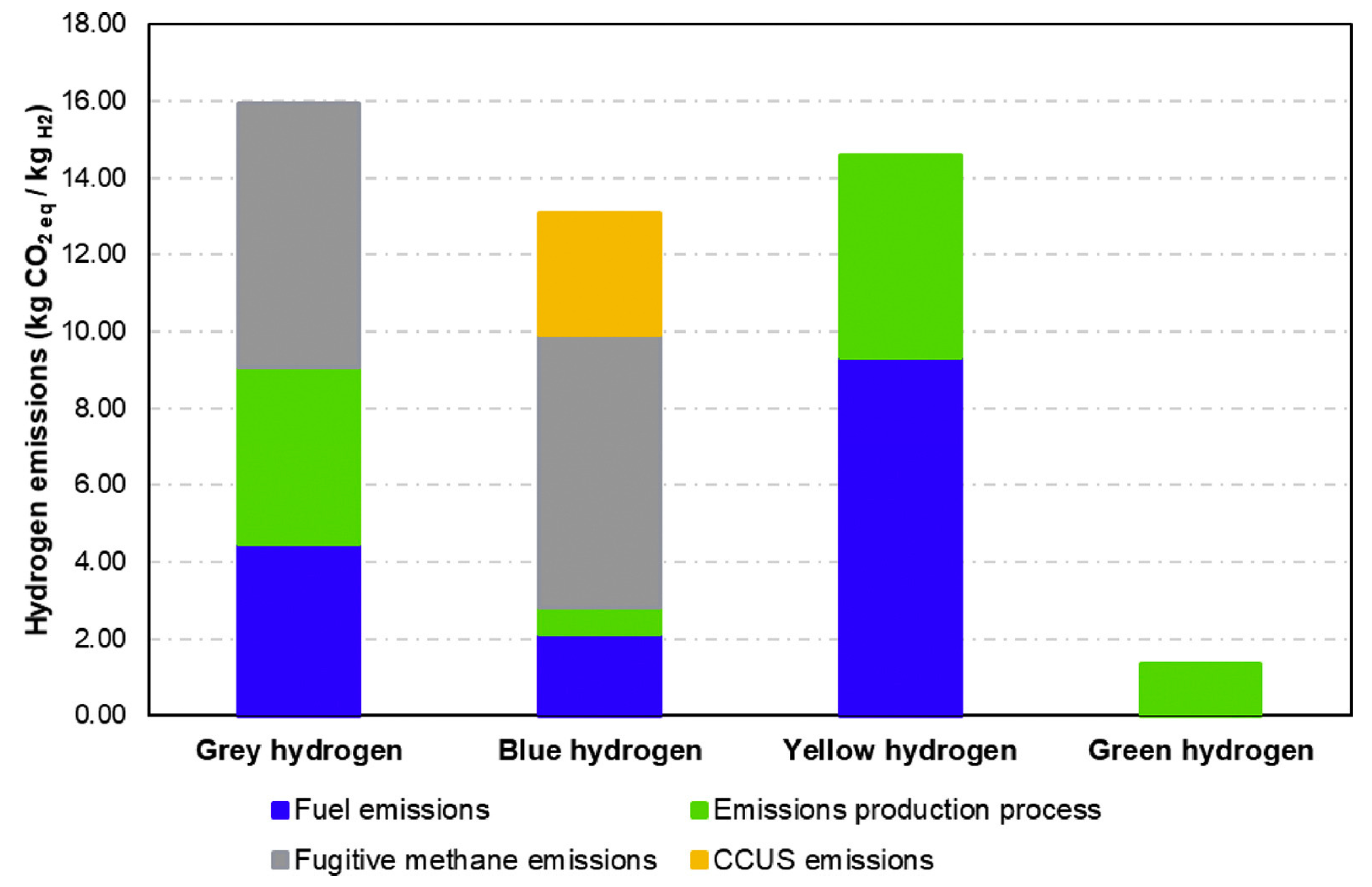

3.1.1. Environmental Benefits

3.1.2. Government Support and Policies

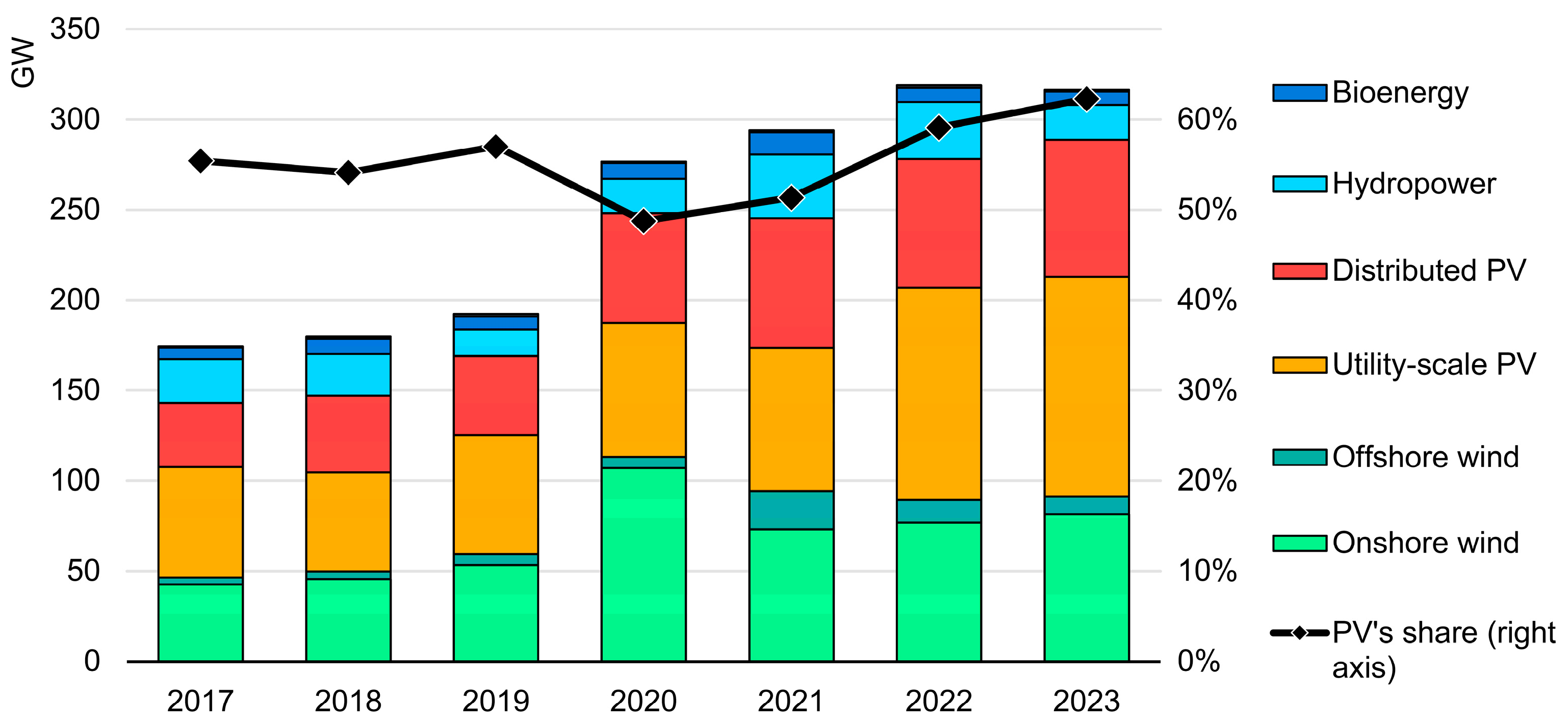

3.1.3. Increase in Renewable Energy Production

3.2. Weaknesses

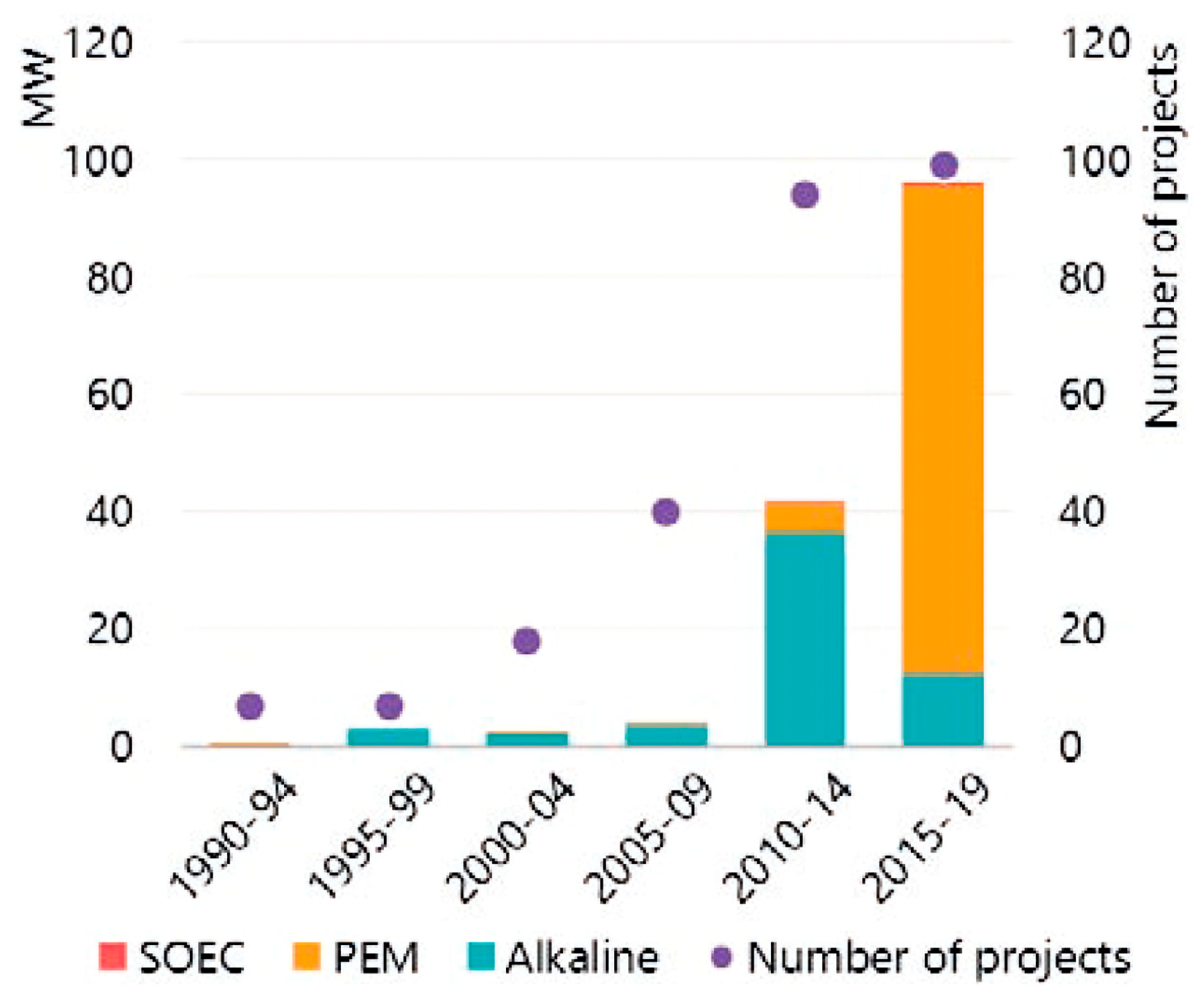

3.2.1. Underdeveloped Electrolyzer Technology

3.2.2. High Production Costs

3.2.3. Lack of H2 Storage and Transportation Infrastructure

3.3. Opportunities

3.3.1. Advances in Electrolyzer Technology

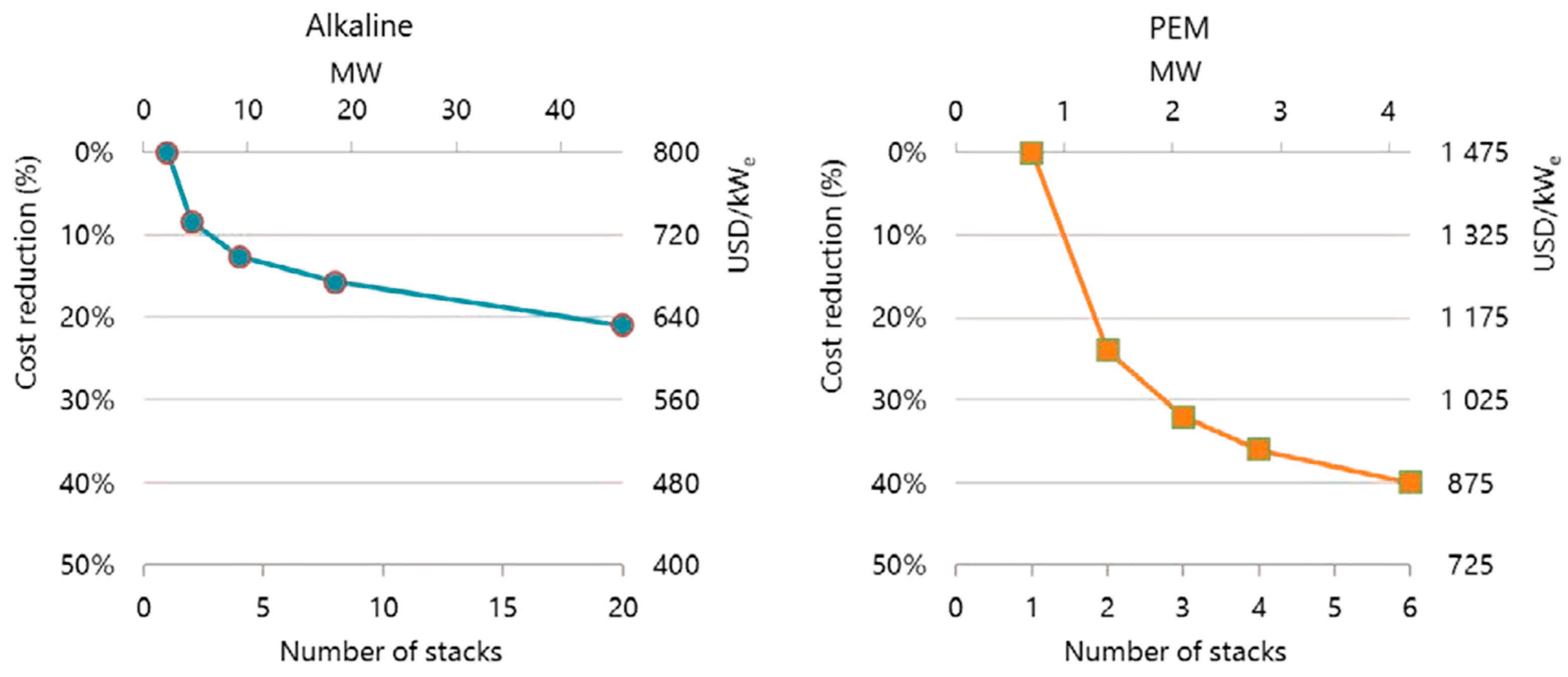

3.3.2. Expected Decrease in Electrolyzer and Renewable Energy Costs

3.3.3. Application in Different Sectors

Transportation Sector

Buildings Heat and Power Sector

Maritime Sector

3.3.4. New Employment Opportunities

3.3.5. Repurposing of Natural Gas Pipelines

3.4. Threats

3.4.1. Lack of International Standards

3.4.2. Inefficient Carbon Taxes and Carbon Lock-In

3.4.3. Renewable Energy Vulnerabilities

3.4.4. Issues with Drinking Water

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Masoudi Soltani, S.; Lahiri, A.; Bahzad, H.; Clough, P.; Gorbounov, M.; Yan, Y. Sorption-Enhanced Steam Methane Reforming for Combined CO2 Capture and Hydrogen Production: A State-of-the-Art Review. Carbon Capture Sci. Technol. 2021, 1, 100003. [Google Scholar] [CrossRef]

- Arcos, J.M.M.; Santos, D.M.F. The Hydrogen Color Spectrum: Techno-Economic Analysis of the Available Technologies for Hydrogen Production. Gases 2023, 3, 25–46. [Google Scholar] [CrossRef]

- Global Hydrogen Review 2022—Analysis. Available online: https://www.iea.org/reports/global-hydrogen-review-2022 (accessed on 27 March 2024).

- Hermesmann, M.; Müller, T.E. Green, Turquoise, Blue, or Grey? Environmentally Friendly Hydrogen Production in Transforming Energy Systems. Prog. Energy Combust. Sci. 2022, 90, 100996. [Google Scholar] [CrossRef]

- Zainal, B.S.; Ker, P.J.; Mohamed, H.; Ong, H.C.; Fattah, I.M.R.; Rahman, S.M.A.; Nghiem, L.D.; Mahlia, T.M.I. Recent Advancement and Assessment of Green Hydrogen Production Technologies. Renew. Sustain. Energy Rev. 2024, 189, 113941. [Google Scholar] [CrossRef]

- Nikolaidis, P.; Poullikkas, A. A Comparative Overview of Hydrogen Production Processes. Renew. Sustain. Energy Rev. 2017, 67, 597–611. [Google Scholar] [CrossRef]

- Hassan, Q.; Algburi, S.; Sameen, A.Z.; Salman, H.M.; Jaszczur, M. Green Hydrogen: A Pathway to a Sustainable Energy Future. Int. J. Hydrogen Energy 2024, 50, 310–333. [Google Scholar] [CrossRef]

- Ajanovic, A.; Sayer, M.; Haas, R. The Economics and the Environmental Benignity of Different Colors of Hydrogen. Int. J. Hydrogen Energy 2022, 47, 24136–24154. [Google Scholar] [CrossRef]

- Atilhan, S.; Park, S.; El-Halwagi, M.M.; Atilhan, M.; Moore, M.; Nielsen, R.B. Green Hydrogen as an Alternative Fuel for the Shipping Industry. Curr. Opin. Chem. Eng. 2021, 31, 100668. [Google Scholar] [CrossRef]

- Dincer, I. Green Methods for Hydrogen Production. Int. J. Hydrogen Energy 2012, 37, 1954–1971. [Google Scholar] [CrossRef]

- World Energy Transitions Outlook 1.5 °C Pathway 2022 Edition. Available online: https://www.irena.org/publications/2022/mar/world-energy-transitions-outlook-2022 (accessed on 27 March 2024).

- Rahimirad, Z.; Sadabadi, A.A. Green Hydrogen Technology Development and Usage Policymaking in Iran Using SWOT Analysis and MCDM Methods. Int. J. Hydrogen Energy 2023, 48, 15179–15194. [Google Scholar] [CrossRef]

- Khan, M.I.; Al-Ghamdi, S.G. Hydrogen Economy for Sustainable Development in GCC Countries: A SWOT Analysis Considering Current Situation, Challenges, and Prospects. Int. J. Hydrogen Energy 2023, 48, 10315–10344. [Google Scholar] [CrossRef]

- Ren, J.; Gao, S.; Tan, S.; Dong, L. Hydrogen Economy in China: Strengths–Weaknesses–Opportunities–Threats Analysis and Strategies Prioritization. Renew. Sustain. Energy Rev. 2015, 41, 1230–1243. [Google Scholar] [CrossRef]

- Li, Y.; Shi, X.; Phoumin, H. A Strategic Roadmap for Large-Scale Green Hydrogen Demonstration and Commercialisation in China: A Review and Survey Analysis. Int. J. Hydrogen Energy 2022, 47, 24592–24609. [Google Scholar] [CrossRef]

- Li, Y.; Phoumin, H.; Kimura, S. Hydrogen Sourced from Renewables and Clean Energy: A Feasibility Study of Achieving Large-Scale Demonstration; ERIA Research Project Report 2021, No. 19; ERIA: Jakarta, Indonesia, 2021. [Google Scholar]

- Squadrito, G.; Maggio, G.; Nicita, A. The Green Hydrogen Revolution. Renew. Energy 2023, 216, 119041. [Google Scholar] [CrossRef]

- Zhou, Y.; Li, R.; Lv, Z.; Liu, J.; Zhou, H.; Xu, C. Green Hydrogen: A Promising Way to the Carbon-Free Society. Chin. J. Chem. Eng. 2022, 43, 2–13. [Google Scholar] [CrossRef]

- Sarker, A.K.; Azad, A.K.; Rasul, M.G.; Doppalapudi, A.T. Prospect of Green Hydrogen Generation from Hybrid Renewable Energy Sources: A Review. Energies 2023, 16, 1556. [Google Scholar] [CrossRef]

- Osman, A.I.; Mehta, N.; Elgarahy, A.M.; Hefny, M.; Al-Hinai, A.; Al-Muhtaseb, A.H.; Rooney, D.W. Hydrogen Production, Storage, Utilisation and Environmental Impacts: A Review. Environ. Chem. Lett. 2022, 20, 153–188. [Google Scholar] [CrossRef]

- Sadeghi, S.; Ghandehariun, S.; Rosen, M.A. Comparative Economic and Life Cycle Assessment of Solar-Based Hydrogen Production for Oil and Gas Industries. Energy 2020, 208, 118347. [Google Scholar] [CrossRef]

- Al-Qahtani, A.; Parkinson, B.; Hellgardt, K.; Shah, N.; Guillen-Gosalbez, G. Uncovering the True Cost of Hydrogen Production Routes Using Life Cycle Monetisation. Appl. Energy 2021, 281, 115958. [Google Scholar] [CrossRef]

- Siddiqui, O.; Dincer, I. A Well to Pump Life Cycle Environmental Impact Assessment of Some Hydrogen Production Routes. Int. J. Hydrogen Energy 2019, 44, 5773–5786. [Google Scholar] [CrossRef]

- Fernández-Dacosta, C.; Shen, L.; Schakel, W.; Ramirez, A.; Kramer, G.J. Potential and Challenges of Low-Carbon Energy Options: Comparative Assessment of Alternative Fuels for the Transport Sector. Appl. Energy 2019, 236, 590–606. [Google Scholar] [CrossRef]

- THE 17 GOALS|Sustainable Development. Available online: https://sdgs.un.org/goals (accessed on 24 February 2024).

- The Paris Agreement|UNFCCC. Available online: https://unfccc.int/process-and-meetings/the-paris-agreement (accessed on 24 February 2024).

- The Paris Agreement—Publication|UNFCCC. Available online: https://unfccc.int/documents/184656 (accessed on 25 February 2024).

- Gomez-Echeverri, L. Climate and Development: Enhancing Impact through Stronger Linkages in the Implementation of the Paris Agreement and the Sustainable Development Goals (SDGs). Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2018, 376, 20160444. [Google Scholar] [CrossRef]

- Scita, R.; Raimondi, P.P.; Noussan, M. Green Hydrogen: The Holy Grail of Decarbonisation? An Analysis of the Technical and Geopolitical Implications of the Future Hydrogen Economy; Fondazione Eni Enrico Mattei (FEEM): Milan, Italy, 2020. [Google Scholar] [CrossRef]

- Giant Leap towards a Hydrogen Society/the Government of Japan—JapanGov. Available online: https://www.japan.go.jp/tomodachi/2020/earlysummer2020/hydrogen.html (accessed on 24 February 2024).

- Dolci, F.; Thomas, D.; Hilliard, S.; Guerra, C.F.; Hancke, R.; Ito, H.; Jegoux, M.; Kreeft, G.; Leaver, J.; Newborough, M.; et al. Incentives and Legal Barriers for Power-to-Hydrogen Pathways: An International Snapshot. Int. J. Hydrogen Energy 2019, 44, 11394–11401. [Google Scholar] [CrossRef]

- Industry News & Market Insights|Breakbulk Events & Media|Breakbulk. Available online: https://breakbulk.com/Articles/bp-orsted-launch-green-hydrogen-project (accessed on 25 February 2024).

- Noussan, M.; Raimondi, P.P.; Scita, R.; Hafner, M. The Role of Green and Blue Hydrogen in the Energy Transition—A Technological and Geopolitical Perspective. Sustainability 2020, 13, 298. [Google Scholar] [CrossRef]

- Renewable Energy Market Update—May 2022—Analysis. Available online: https://www.iea.org/reports/renewable-energy-market-update-may-2022 (accessed on 27 March 2024).

- Renewables Global Status Report—REN21. Available online: https://www.ren21.net/reports/global-status-report/ (accessed on 27 March 2024).

- Renewable Energy Statistics 2023. Available online: https://www.irena.org/Publications/2023/Jul/Renewable-energy-statistics-2023 (accessed on 27 March 2024).

- The Future of Hydrogen—Seizing today’s Opportunities. Available online: https://www.iea.org/reports/the-future-of-hydrogen (accessed on 27 March 2024).

- Electrolysers for the Hydrogen Revolution. Available online: https://www.swp-berlin.org/publikation/electrolysers-for-the-hydrogen-revolution (accessed on 27 March 2024).

- Khatib, F.N.; Wilberforce, T.; Ijaodola, O.; Ogungbemi, E.; El-Hassan, Z.; Durrant, A.; Thompson, J.; Olabi, A.G. Material Degradation of Components in Polymer Electrolyte Membrane (PEM) Electrolytic Cell and Mitigation Mechanisms: A Review. Renew. Sustain. Energy Rev. 2019, 111, 1–14. [Google Scholar] [CrossRef]

- Santoro, C.; Lavacchi, A.; Mustarelli, P.; Di Noto, V.; Elbaz, L.; Dekel, D.R.; Jaouen, F. What Is Next in Anion-Exchange Membrane Water Electrolyzers? Bottlenecks, Benefits, and Future. ChemSusChem 2022, 15, e202200027. [Google Scholar] [CrossRef]

- Brauns, J.; Turek, T. Alkaline Water Electrolysis Powered by Renewable Energy: A Review. Processes 2020, 8, 248. [Google Scholar] [CrossRef]

- Haoran, C.; Xia, Y.; Wei, W.; Yongzhi, Z.; Bo, Z.; Leiqi, Z. Safety and Efficiency Problems of Hydrogen Production from Alkaline Water Electrolyzers Driven by Renewable Energy Sources. Int. J. Hydrogen Energy 2024, 54, 700–712. [Google Scholar] [CrossRef]

- Kojima, H.; Nagasawa, K.; Todoroki, N.; Ito, Y.; Matsui, T.; Nakajima, R. Influence of Renewable Energy Power Fluctuations on Water Electrolysis for Green Hydrogen Production. Int. J. Hydrogen Energy 2023, 48, 4572–4593. [Google Scholar] [CrossRef]

- Abu, S.M.; Hannan, M.A.; Ker, P.J.; Mansor, M.; Tiong, S.K.; Mahlia, T.M.I. Recent Progress in Electrolyser Control Technologies for Hydrogen Energy Production: A Patent Landscape Analysis and Technology Updates. J. Energy Storage 2023, 72, 108773. [Google Scholar] [CrossRef]

- Guo, X.; Zhu, H.; Zhang, S. Overview of Electrolyser and Hydrogen Production Power Supply from Industrial Perspective. Int. J. Hydrogen Energy 2024, 49, 1048–1059. [Google Scholar] [CrossRef]

- Krishnan, S.; Koning, V.; Theodorus De Groot, M.; De Groot, A.; Mendoza, P.G.; Junginger, M.; Kramer, G.J. Present and Future Cost of Alkaline and PEM Electrolyser Stacks. Int. J. Hydrogen Energy 2023, 48, 32313–32330. [Google Scholar] [CrossRef]

- Hydrogen from Renewable Power: Technology Outlook for the Energy Transition. Available online: https://www.irena.org/publications/2018/Sep/Hydrogen-from-renewable-power (accessed on 27 March 2024).

- Grigoriev, S.A.; Fateev, V.N.; Bessarabov, D.G.; Millet, P. Current Status, Research Trends, and Challenges in Water Electrolysis Science and Technology. Int. J. Hydrogen Energy 2020, 45, 26036–26058. [Google Scholar] [CrossRef]

- Li, D.; Motz, A.R.; Bae, C.; Fujimoto, C.; Yang, G.; Zhang, F.-Y.; Ayers, K.E.; Kim, Y.S. Durability of Anion Exchange Membrane Water Electrolyzers. Energy Environ. Sci. 2021, 14, 3393–3419. [Google Scholar] [CrossRef]

- Yu, M.; Wang, K.; Vredenburg, H. Insights into Low-Carbon Hydrogen Production Methods: Green, Blue and Aqua Hydrogen. Int. J. Hydrogen Energy 2021, 46, 21261–21273. [Google Scholar] [CrossRef]

- Longden, T.; Beck, F.J.; Jotzo, F.; Andrews, R.; Prasad, M. ‘Clean’ Hydrogen?—Comparing the Emissions and Costs of Fossil Fuel versus Renewable Electricity Based Hydrogen. Appl. Energy 2022, 306, 118145. [Google Scholar] [CrossRef]

- Serag, S.; AL-Khawlani, A.; Echchleh, A. Technical Economic Study for Electricity Production by Using (Tidal-Hydrogen) in Socotra Island, Yemen. E3S Web Conf. 2021, 314, 01002. [Google Scholar] [CrossRef]

- Green Hydrogen Cost Reduction. Available online: https://www.irena.org/publications/2020/Dec/Green-hydrogen-cost-reduction (accessed on 25 February 2024).

- Khan, M.A.; Al-Shankiti, I.; Ziani, A.; Idriss, H. Demonstration of Green Hydrogen Production Using Solar Energy at 28% Efficiency and Evaluation of Its Economic Viability. Sustain. Energy Fuels 2021, 5, 1085–1094. [Google Scholar] [CrossRef]

- Hassan, Q.; Sameen, A.Z.; Salman, H.M.; Jaszczur, M.; Al-Jiboory, A.K. Hydrogen Energy Future: Advancements in Storage Technologies and Implications for Sustainability. J. Energy Storage 2023, 72, 108404. [Google Scholar] [CrossRef]

- Ratnakar, R.R.; Gupta, N.; Zhang, K.; Van Doorne, C.; Fesmire, J.; Dindoruk, B.; Balakotaiah, V. Hydrogen Supply Chain and Challenges in Large-Scale LH2 Storage and Transportation. Int. J. Hydrogen Energy 2021, 46, 24149–24168. [Google Scholar] [CrossRef]

- Genovese, M.; Fragiacomo, P. Hydrogen Refueling Station: Overview of the Technological Status and Research Enhancement. J. Energy Storage 2023, 61, 106758. [Google Scholar] [CrossRef]

- European Commission; Directorate-General for Energy; Cihlar, J.; Villar Lejarreta, A.; Wang, A.; Melgar, F.; Jens, J.; Rio, P.; van der Leun, K.; Guidehouse; et al. Hydrogen Generation in Europe: Overview of Costs and Key Benefits; Publications Office: Luxembourg, 2020; Available online: https://op.europa.eu/en/publication-detail/-/publication/7e4afa7d-d077-11ea-adf7-01aa75ed71a1/language-en (accessed on 25 February 2024).

- Gannon, W.J.F.; Newberry, M.; Dunnill, C.W. Performance Assessment of a Low-Cost, Scalable 0.5 kW Alkaline Zero-Gap Electrolyser. Int. J. Hydrogen Energy 2022, 47, 30347–30358. [Google Scholar] [CrossRef]

- Kim, J.-H.; Lee, J.-N.; Yoo, C.-Y.; Lee, K.-B.; Lee, W.-M. Low-Cost and Energy-Efficient Asymmetric Nickel Electrode for Alkaline Water Electrolysis. Int. J. Hydrogen Energy 2015, 40, 10720–10725. [Google Scholar] [CrossRef]

- Choi, B.; Panthi, D.; Nakoji, M.; Kabutomori, T.; Tsutsumi, K.; Tsutsumi, A. A Novel Water-Splitting Electrochemical Cycle for Hydrogen Production Using an Intermediate Electrode. Chem. Eng. Sci. 2017, 157, 200–208. [Google Scholar] [CrossRef]

- Yang, G.; Mo, J.; Kang, Z.; Dohrmann, Y.; List, F.A.; Green, J.B.; Babu, S.S.; Zhang, F.-Y. Fully Printed and Integrated Electrolyzer Cells with Additive Manufacturing for High-Efficiency Water Splitting. Appl. Energy 2018, 215, 202–210. [Google Scholar] [CrossRef]

- Mo, J.; Kang, Z.; Yang, G.; Retterer, S.T.; Cullen, D.A.; Toops, T.J.; Green, J.B.; Zhang, F.-Y. Thin Liquid/Gas Diffusion Layers for High-Efficiency Hydrogen Production from Water Splitting. Appl. Energy 2016, 177, 817–822. [Google Scholar] [CrossRef]

- Si, X.; Wang, X.; Li, C.; Lin, T.; Qi, J.; Cao, J. Joining 3YSZ Electrolyte to AISI 441 Interconnect Using the Ag Particle Interlayer: Enhanced Mechanical and Aging Properties. Crystals 2021, 11, 1573. [Google Scholar] [CrossRef]

- Lee, J.G.; Jeon, O.S.; Ryu, K.H.; Park, M.G.; Min, S.H.; Hyun, S.H.; Shul, Y.G. Effects of 8mol% Yttria-Stabilized Zirconia with Copper Oxide on Solid Oxide Fuel Cell Performance. Ceram. Int. 2015, 41, 7982–7988. [Google Scholar] [CrossRef]

- Gao, F.-Y.; Yu, P.-C.; Gao, M.-R. Seawater Electrolysis Technologies for Green Hydrogen Production: Challenges and Opportunities. Curr. Opin. Chem. Eng. 2022, 36, 100827. [Google Scholar] [CrossRef]

- Hu, L.; Tan, X.; Yang, X.; Zhang, K. Electrolysis of Direct Seawater: Challenges, Strategies, and Future Prospects. Chin. J. Chem. 2023, 41, 3484–3492. [Google Scholar] [CrossRef]

- Maril, M.; Delplancke, J.-L.; Cisternas, N.; Tobosque, P.; Maril, Y.; Carrasco, C. Critical Aspects in the Development of Anodes for Use in Seawater Electrolysis. Int. J. Hydrogen Energy 2022, 47, 3532–3549. [Google Scholar] [CrossRef]

- Renewable Power Generation Costs in 2022. Available online: https://www.irena.org/Publications/2023/Aug/Renewable-Power-Generation-Costs-in-2022 (accessed on 27 March 2024).

- Yilmaz, C.; Kanoglu, M.; Abusoglu, A. Thermoeconomic Cost Evaluation of Hydrogen Production Driven by Binary Geothermal Power Plant. Geothermics 2015, 57, 18–25. [Google Scholar] [CrossRef]

- Yilmaz, C. Thermoeconomic Modeling and Optimization of a Hydrogen Production System Using Geothermal Energy. Geothermics 2017, 65, 32–43. [Google Scholar] [CrossRef]

- Nadaleti, W.C.; Lourenço, V.A.; Americo, G. Green Hydrogen-Based Pathways and Alternatives: Towards the Renewable Energy Transition in South America’s Regions—Part A. Int. J. Hydrogen Energy 2021, 46, 22247–22255. [Google Scholar] [CrossRef]

- Lebrouhi, B.E.; Djoupo, J.J.; Lamrani, B.; Benabdelaziz, K.; Kousksou, T. Global Hydrogen Development—A Technological and Geopolitical Overview. Int. J. Hydrogen Energy 2022, 47, 7016–7048. [Google Scholar] [CrossRef]

- Hydrogen, Scaling Up|Hydrogen Council. Available online: https://hydrogencouncil.com/en/study-hydrogen-scaling-up/ (accessed on 27 March 2024).

- Oliveira, A.M.; Beswick, R.R.; Yan, Y. A Green Hydrogen Economy for a Renewable Energy Society. Curr. Opin. Chem. Eng. 2021, 33, 100701. [Google Scholar] [CrossRef]

- Hardman, S.; Tal, G. Who Are the Early Adopters of Fuel Cell Vehicles? Int. J. Hydrogen Energy 2018, 43, 17857–17866. [Google Scholar] [CrossRef]

- Cremonese, L.; Mbungu, G.K.; Quitzow, R. The Sustainability of Green Hydrogen: An Uncertain Proposition. Int. J. Hydrogen Energy 2023, 48, 19422–19436. [Google Scholar] [CrossRef]

- Rehbein, J.A.; Watson, J.E.M.; Lane, J.L.; Sonter, L.J.; Venter, O.; Atkinson, S.C.; Allan, J.R. Renewable Energy Development Threatens Many Globally Important Biodiversity Areas. Glob. Change Biol. 2020, 26, 3040–3051. [Google Scholar] [CrossRef]

- Mneimneh, F.; Ghazzawi, H.; Abu Hejjeh, M.; Manganelli, M.; Ramakrishna, S. Roadmap to Achieving Sustainable Development via Green Hydrogen. Energies 2023, 16, 1368. [Google Scholar] [CrossRef]

- Net Zero by 2050—Analysis. Available online: https://www.iea.org/reports/net-zero-by-2050 (accessed on 7 May 2024).

- Repurposing Onshore Pipelines for Hydrogen: Guiding Operators through the Re-Evaluation Process. Available online: https://www.dnv.com/focus-areas/hydrogen/repurposing-pipelines-for-hydrogen-guiding-operators-through-the-re-evaluation-process/ (accessed on 31 May 2024).

- Green Pipeline Project: The Natural Energy of Hydrogen. Available online: https://floene.pt/en/green-pipeline-project/ (accessed on 31 May 2024).

- Working Paper: Regional Insights into Low-Carbon Hydrogen Scale Up|World Energy Insights. Available online: https://www.worldenergy.org/publications/entry/regional-insights-low-carbon-hydrogen-scale-up-world-energy-council (accessed on 26 February 2024).

- Cheng, W.; Lee, S. How Green Are the National Hydrogen Strategies? Sustainability 2022, 14, 1930. [Google Scholar] [CrossRef]

- Baranzini, A.; Van Den Bergh, J.C.J.M.; Carattini, S.; Howarth, R.B.; Padilla, E.; Roca, J. Carbon Pricing in Climate Policy: Seven Reasons, Complementary Instruments, and Political Economy Considerations. WIREs Clim. Change 2017, 8, e462. [Google Scholar] [CrossRef]

- Want an Effective Climate Policy? Heed the Evidence. Available online: https://policyoptions.irpp.org/magazines/february-2016/want-an-effective-climatepolicy-heed-the-evidence/ (accessed on 24 February 2024).

- Rosenbloom, D.; Markard, J.; Geels, F.W.; Fuenfschilling, L. Why Carbon Pricing Is Not Sufficient to Mitigate Climate Change—And How “Sustainability Transition Policy” Can Help. Proc. Natl. Acad. Sci. USA 2020, 117, 8664–8668. [Google Scholar] [CrossRef]

- Tvinnereim, E.; Mehling, M. Carbon Pricing and Deep Decarbonisation. Energy Policy 2018, 121, 185–189. [Google Scholar] [CrossRef]

- Zárate-Toledo, E.; Patiño, R.; Fraga, J. Justice, Social Exclusion and Indigenous Opposition: A Case Study of Wind Energy Development on the Isthmus of Tehuantepec, Mexico. Energy Res. Soc. Sci. 2019, 54, 1–11. [Google Scholar] [CrossRef]

- Tawalbeh, M.; Al-Othman, A.; Kafiah, F.; Abdelsalam, E.; Almomani, F.; Alkasrawi, M. Environmental Impacts of Solar Photovoltaic Systems: A Critical Review of Recent Progress and Future Outlook. Sci. Total Environ. 2021, 759, 143528. [Google Scholar] [CrossRef]

- Tammaro, M.; Salluzzo, A.; Rimauro, J.; Schiavo, S.; Manzo, S. Experimental Investigation to Evaluate the Potential Environmental Hazards of Photovoltaic Panels. J. Hazard. Mater. 2016, 306, 395–405. [Google Scholar] [CrossRef]

- Mueller, J.T.; Brooks, M.M. Burdened by Renewable Energy? A Multi-Scalar Analysis of Distributional Justice and Wind Energy in the United States. Energy Res. Soc. Sci. 2020, 63, 101406. [Google Scholar] [CrossRef]

- Henningsson, M.; Jönsson, S.; Bengtsson, J.; Bluhm, G.; Bolin, K.; Bodén, B.; Ek, K.; Hammarlund, K.; Hannukka, I.-L.; Johansson, C.; et al. The Effects of Wind Power on Human Interests. A Synthesis. Report 6545, 2013, The Swedish Environmental Protection Agency. ISBN 978-91-620-6545-4. Available online: https://tethys.pnnl.gov/sites/default/files/publications/Henningsson-et-al-2013.pdf (accessed on 25 February 2024).

- Nazir, M.S.; Mahdi, A.J.; Bilal, M.; Sohail, H.M.; Ali, N.; Iqbal, H.M.N. Environmental Impact and Pollution-Related Challenges of Renewable Wind Energy Paradigm—A Review. Sci. Total Environ. 2019, 683, 436–444. [Google Scholar] [CrossRef]

| Strengths | Weaknesses |

|---|---|

|

|

| Opportunities | Threats |

|

|

| Electrolyzer | Study | Potential Improvements | Source |

|---|---|---|---|

| AWE | Zero-gap design using a polyethersulphone membrane | Higher efficiencies, reduction in ohmic losses and cost | [59] |

| Zero-gap design with porous nickel electrodes | Cost-effective and higher current density | [60] | |

| Configuration with manganese dioxide intermediate electrode | Ohmic loss reduction, high-purity gas | [61] | |

| PEM | Additive manufacturing of multifunctional plate | Reduced weight, high efficiencies, and ultralow ohmic resistance | [62] |

| Titanium thin and well-tunable liquid/gas diffusion layers | Higher efficiencies, lower voltage | [63] | |

| SOEC | Interconnected 3YSZ electrolyte and AISI441 by Ag particle intercalation | Good mechanical and stability performance | [64] |

| 8 mol.% yttria-stabilized zirconia with copper oxide electrolyte | Higher ionic conductivity | [65] |

| Year | AWE | PEM | SOEC | |||

|---|---|---|---|---|---|---|

| Efficiency (%) | Stack Lifetime (h) | Efficiency (%) | Stack Lifetime (h) | Efficiency (%) | Stack Lifetime (h) | |

| 2020 | 63–70 | 50,000–90,000 | 56–63 | 30,000–90,000 | 74–81 | 10,000–30,000 |

| 2030 | 63–72 | 72,500–100,000 | 61–69 | 60,000–90,000 | 74–84 | 40,000–60,000 |

| 2050 | 70–80 | 100,000–150,000 | 67–74 | 100,000–150,000 | 77–84 | 75,000–100,000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Simões, F.L.D.; Santos, D.M.F. A SWOT Analysis of the Green Hydrogen Market. Energies 2024, 17, 3114. https://doi.org/10.3390/en17133114

Simões FLD, Santos DMF. A SWOT Analysis of the Green Hydrogen Market. Energies. 2024; 17(13):3114. https://doi.org/10.3390/en17133114

Chicago/Turabian StyleSimões, Francisco L. D., and Diogo M. F. Santos. 2024. "A SWOT Analysis of the Green Hydrogen Market" Energies 17, no. 13: 3114. https://doi.org/10.3390/en17133114

APA StyleSimões, F. L. D., & Santos, D. M. F. (2024). A SWOT Analysis of the Green Hydrogen Market. Energies, 17(13), 3114. https://doi.org/10.3390/en17133114