Can Economic, Geopolitical and Energy Uncertainty Indices Predict Bitcoin Energy Consumption? New Evidence from a Machine Learning Approach

Abstract

1. Introduction

2. Data and Methodology

2.1. Data

2.2. Methodology

2.2.1. Support Vector Machine Regression

2.2.2. CatBoost

2.2.3. Extreme Gradient Boost Regression (XGboost)

2.2.4. The Performance Metrics

3. Empirical Findings

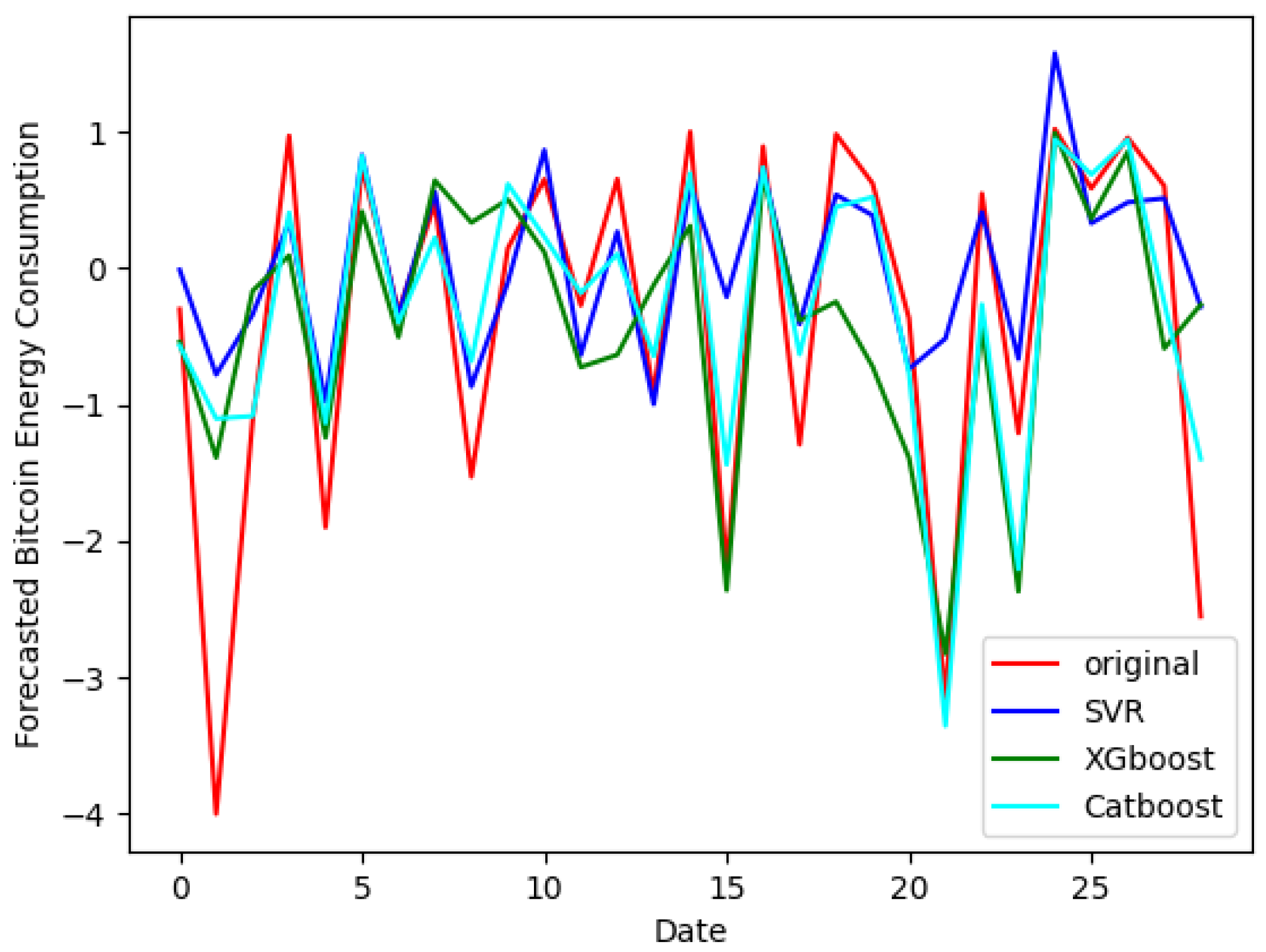

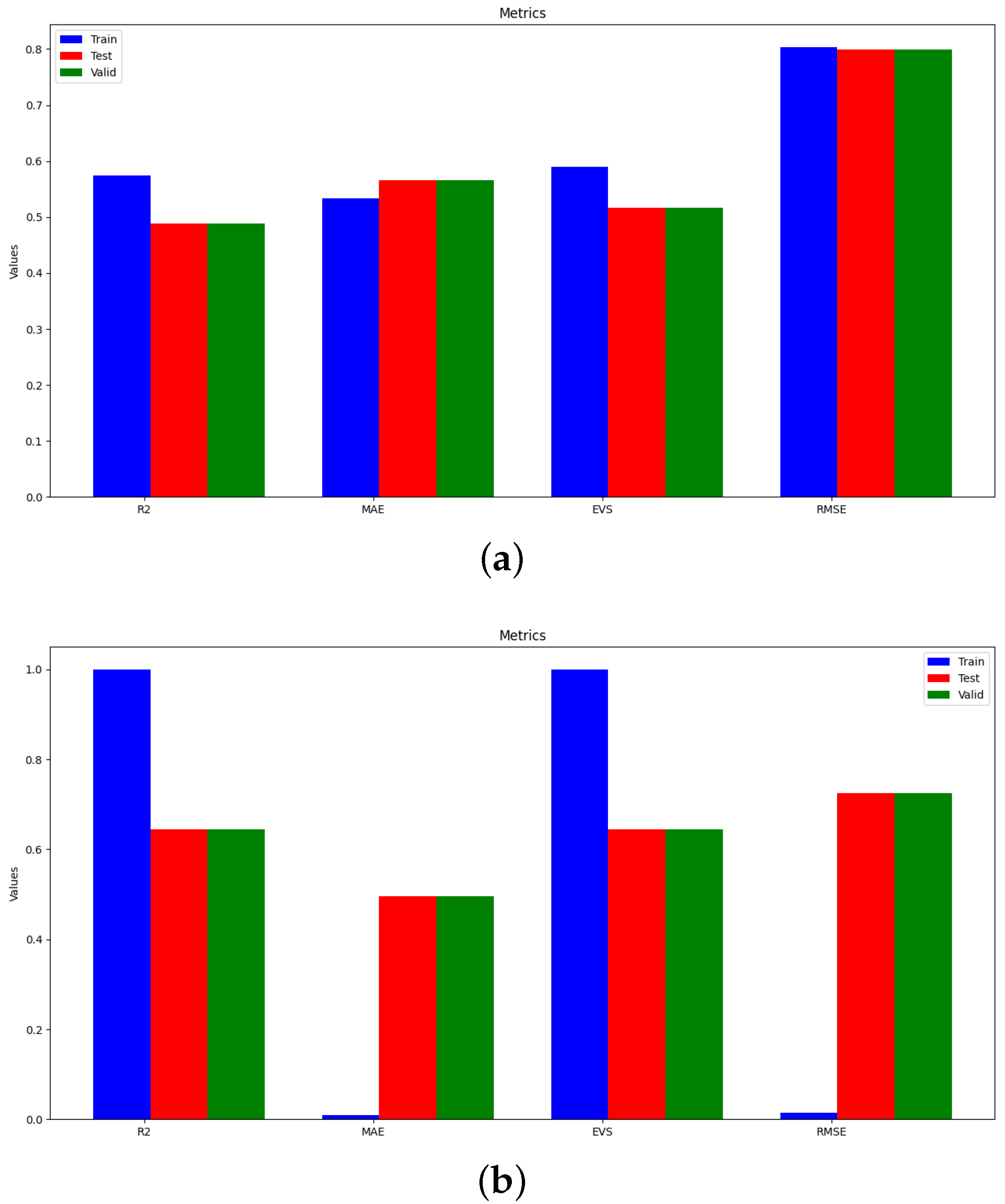

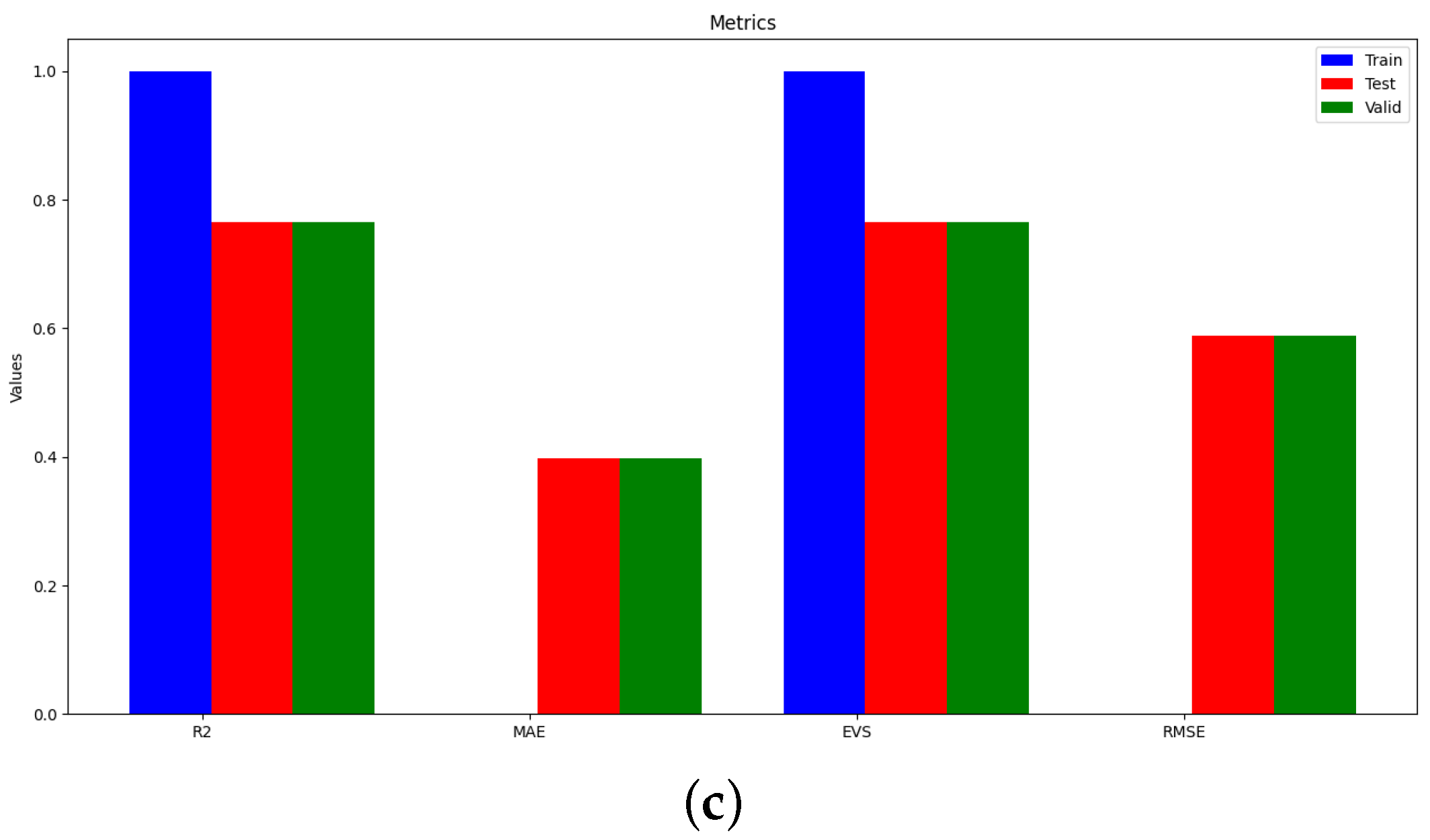

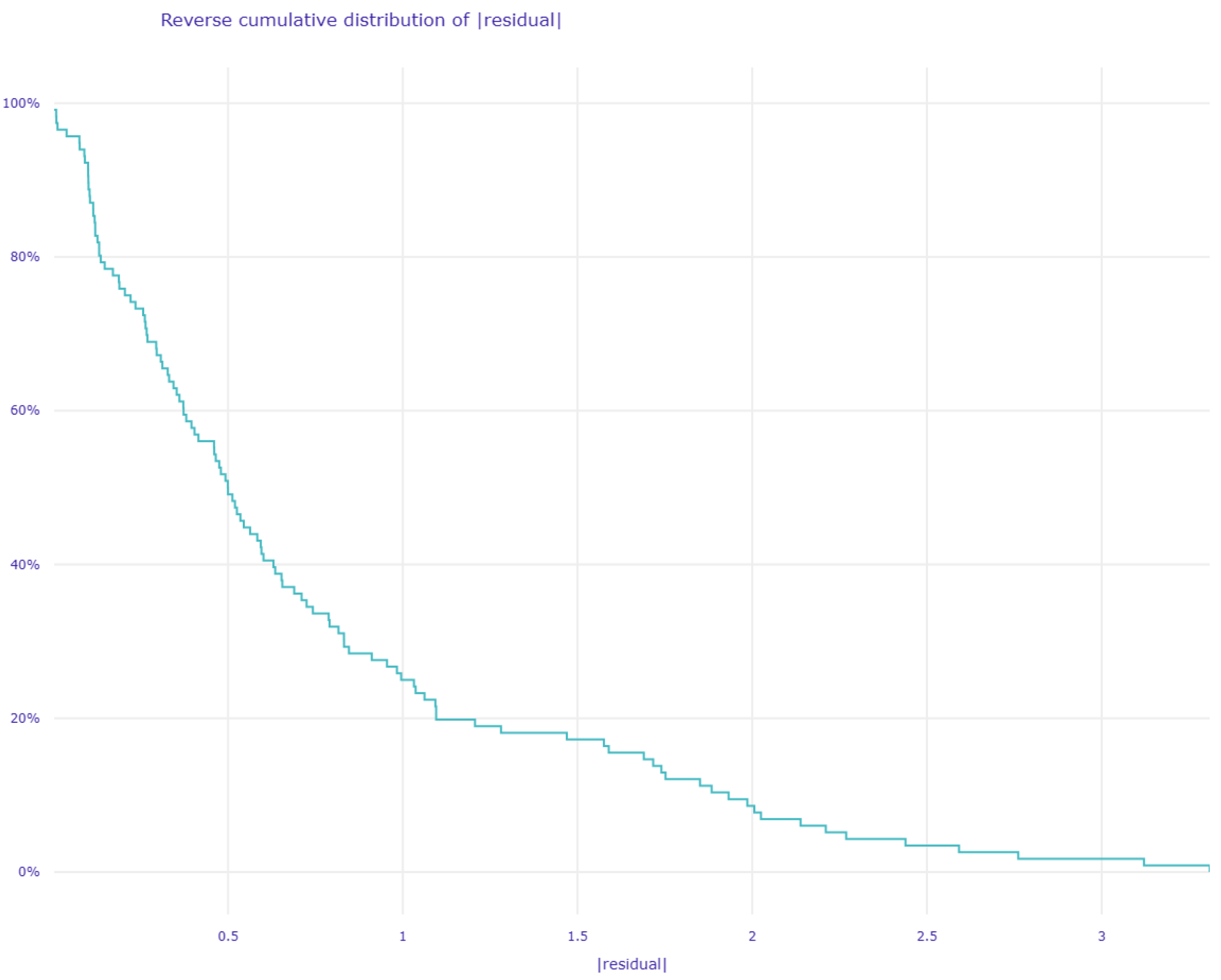

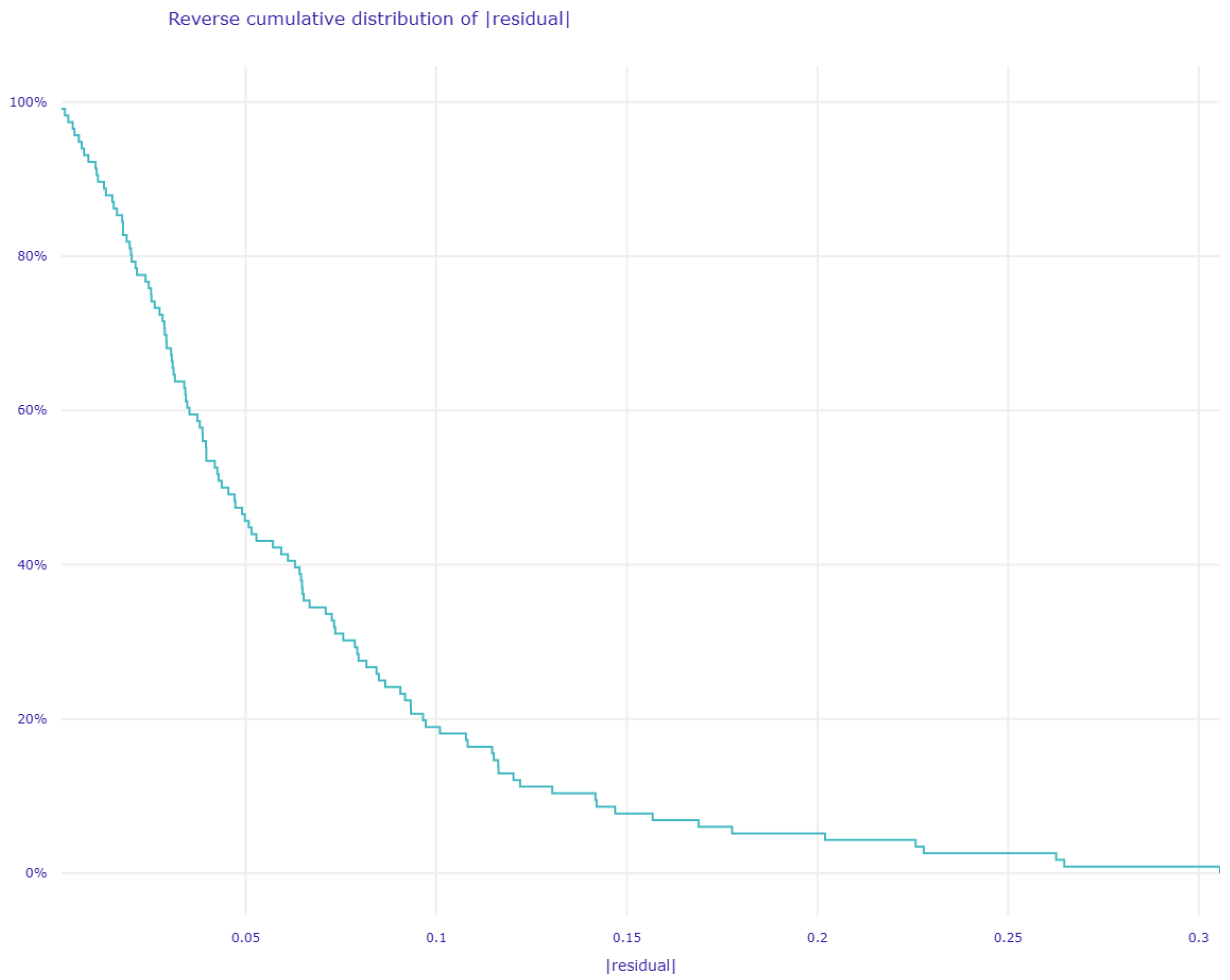

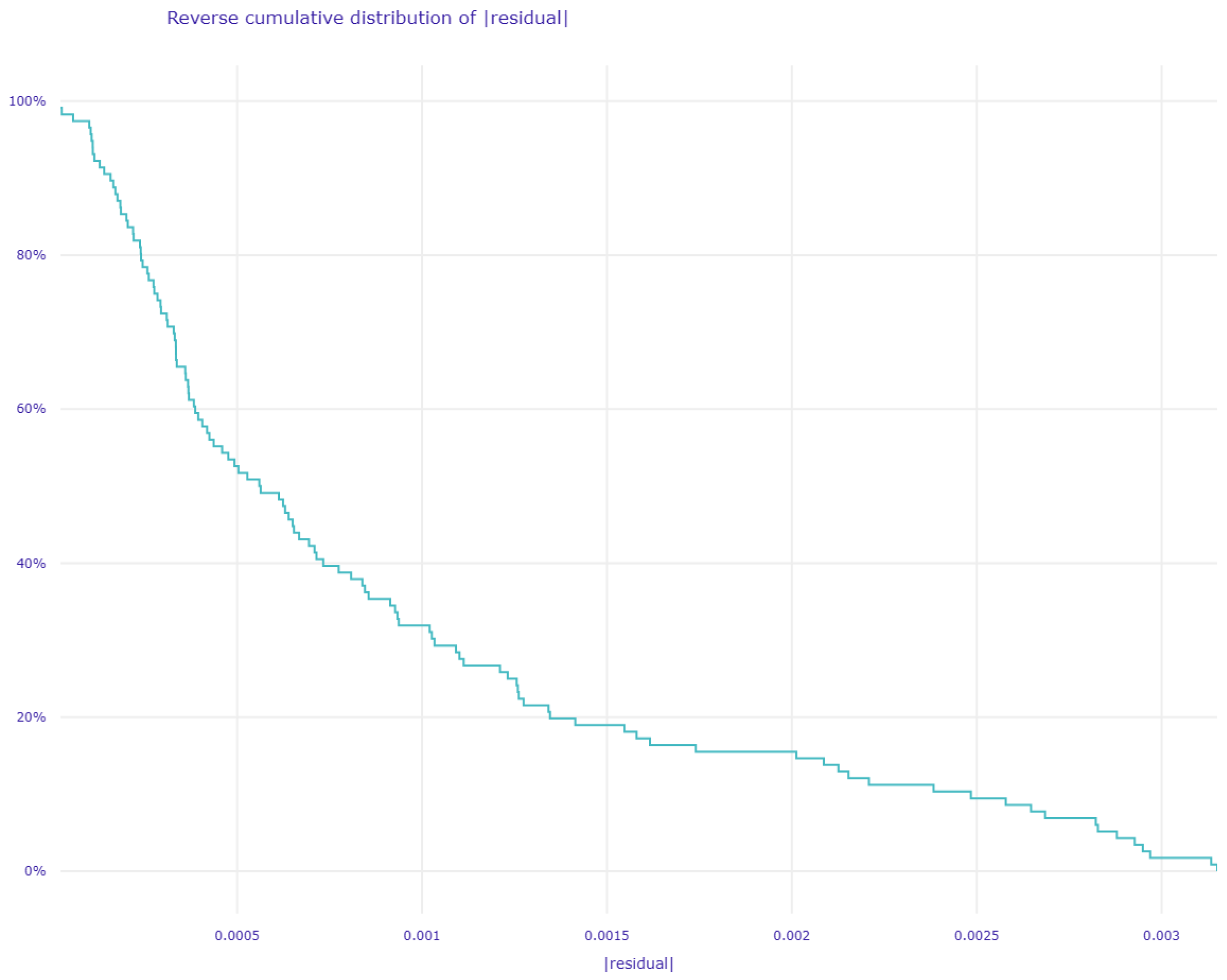

3.1. Performance Analysis

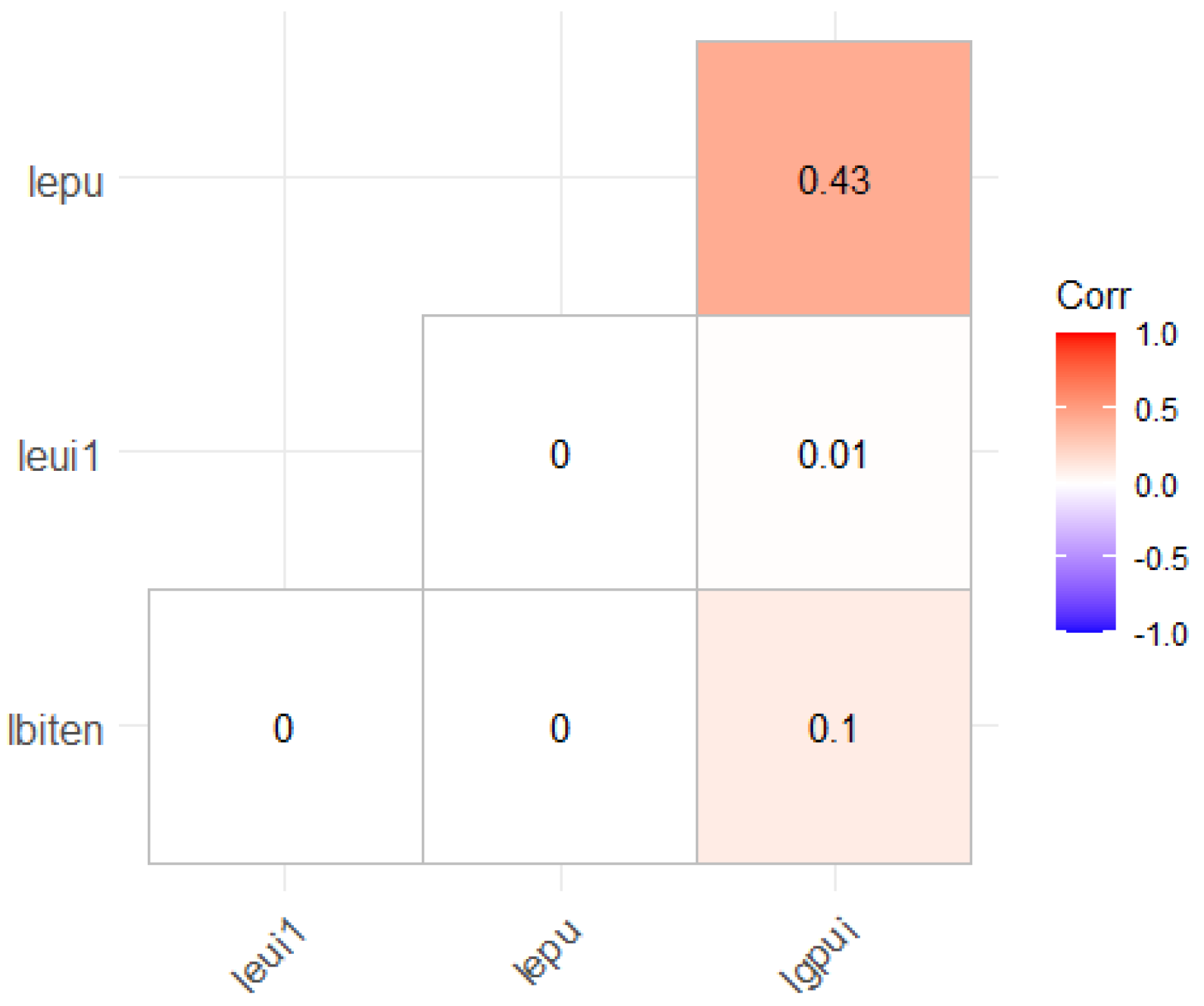

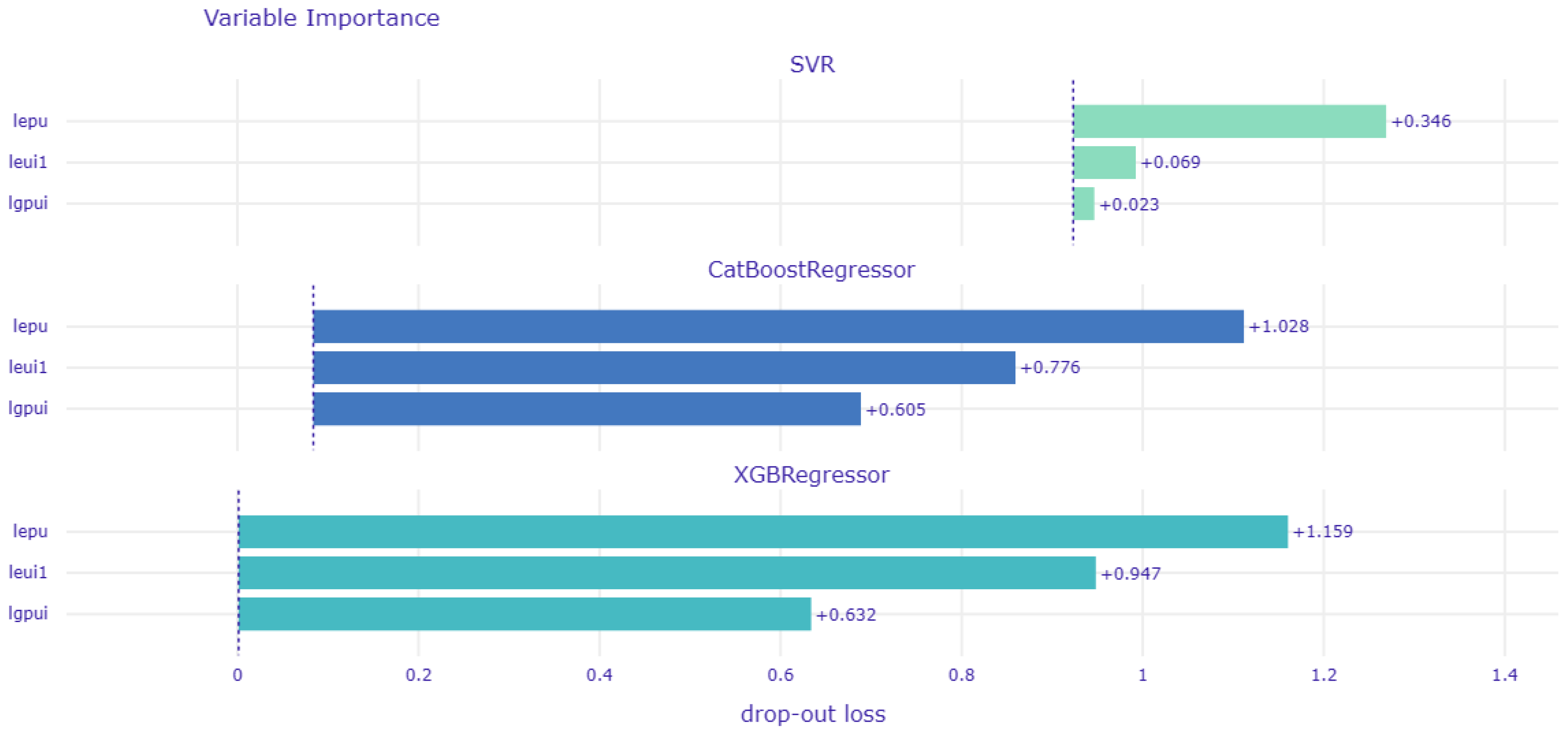

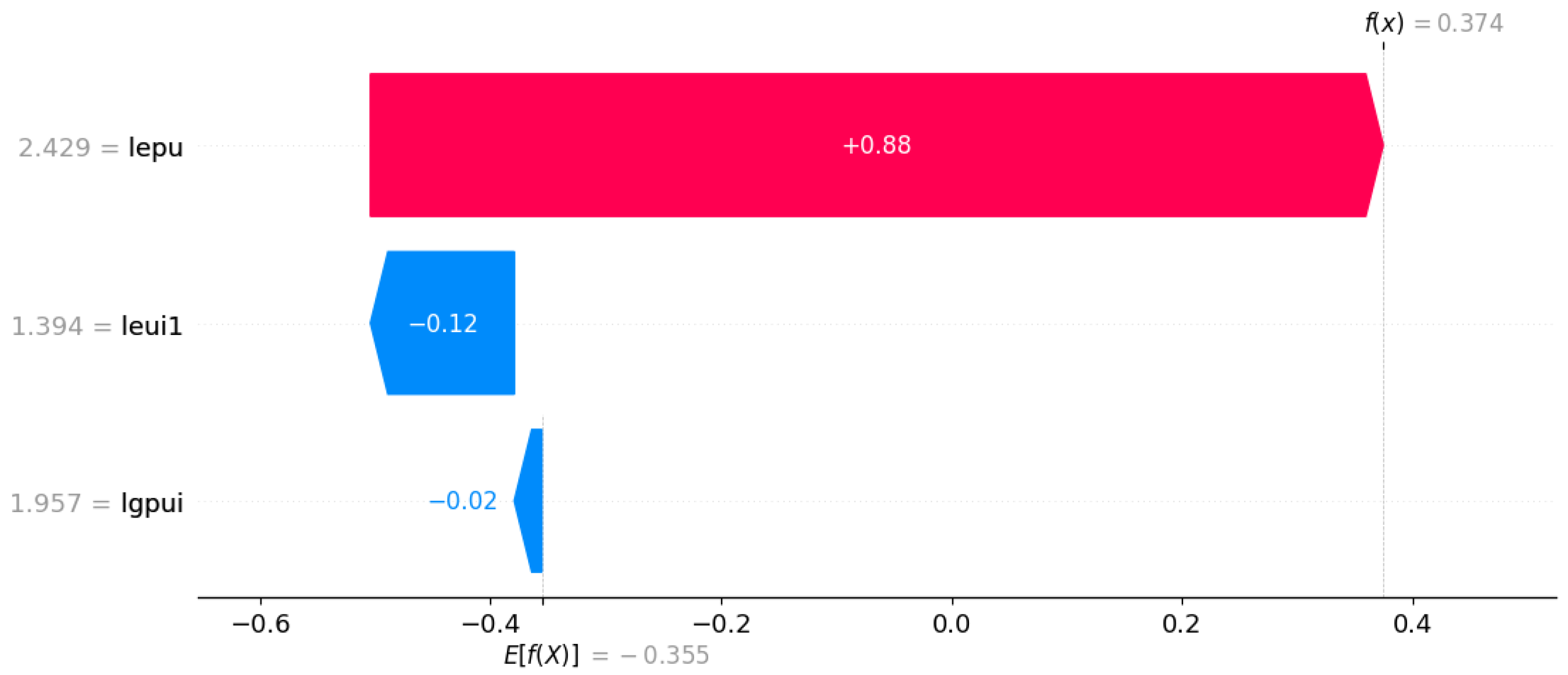

3.2. Feature Analysis

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Correction Statement

References

- Vranken, H. Sustainability of bitcoin and blockchains. Curr. Opin. Environ. Sustain. 2017, 28, 1–9. [Google Scholar] [CrossRef]

- Giungato, P.; Rana, R.; Tarabella, A.; Tricase, C. Current Trends in Sustainability of Bitcoins and Related Blockchain Technology. Sustainability 2017, 9, 2214. [Google Scholar] [CrossRef]

- Kugler, L. Why cryptocurrencies use so much energy. Commun. ACM 2018, 61, 15–17. [Google Scholar] [CrossRef]

- Zade, M.; Myklebost, J.; Tzscheutschler, P.; Wagner, U. Is Bitcoin the Only Problem? A Scenario Model for the Power Demand of Blockchains. Front. Energy Res. 2019, 7, 21. [Google Scholar] [CrossRef]

- Küfeoğlu, S.; Özkuran, M. Bitcoin mining: A global review of energy and power demand. Energy Res. Soc. Sci. 2019, 58, 101273. [Google Scholar] [CrossRef]

- Corbet, S.; Lucey, B.M.; Yarovaya, L. The financial market effects of cryptocurrency energy usage. SSRN Electron. J. 2019. [Google Scholar] [CrossRef]

- Huynh, A.N.Q.; Duong, D.; Burggraf, T.; Luong, H.T.T.; Bui, N.H. Energy consumption and Bitcoin market. Asia-Pac. Financ. Mark. 2022, 29, 79–93. [Google Scholar] [CrossRef]

- Bejan, C.A.; Bucerzan, D.; Crăciun, M.D. Bitcoin price evolution versus energy consumption; trend analysis. Appl. Econ. 2023, 55, 1497–1511. [Google Scholar] [CrossRef]

- Das, D.; Dutta, A. Bitcoin’s energy consumption: Is it the Achilles heel to miner’s revenue? Econ. Lett. 2020, 186, 108530. [Google Scholar] [CrossRef]

- Goczek, Ł.; Skliarov, I. What drives the Bitcoin price? A factor augmented error correction mechanism investigation. Appl. Econ. 2019, 51, 6393–6410. [Google Scholar] [CrossRef]

- Kristoufek, L. What are the main drivers of the Bitcoin price? Evidence from wavelet coherence analysis. PLoS ONE 2015, 10, e0123923. [Google Scholar] [CrossRef]

- Ciaian, P.; Rajcaniova, M.; Kancs, D. The economics of BitCoin price formation. Appl. Econ. 2016, 48, 1799–1815. [Google Scholar] [CrossRef]

- Gemici, E.; Polat, M. Relationship between price and volume in the Bitcoin market. J. Risk Financ. 2019, 20, 435–444. [Google Scholar] [CrossRef]

- El Alaoui, M.; Bouri, E.; Roubaud, D. Bitcoin price–volume: A multifractal cross-correlation approach. Financ. Res. Lett. 2019, 31. [Google Scholar] [CrossRef]

- Jain, P.K.; McInish, T.H.; Miller, J.L. Insights from bitcoin trading. Financ. Manag. 2019, 48, 1031–1048. [Google Scholar] [CrossRef]

- Alexander, C.; Heck, D.F. Price discovery, high-frequency trading and jumps in bitcoin markets. J. Financ. Stab. 2020, 50, 100776. [Google Scholar] [CrossRef]

- Li, J.; Li, N.; Peng, J.; Cui, H.; Wu, Z. Energy consumption of cryptocurrency mining: A study of electricity consumption in mining cryptocurrencies. Energy 2019, 168, 160–168. [Google Scholar] [CrossRef]

- Schinckus, C.; Canh, N.P.; Ling, C.H. Crypto-currencies trading and energy consumption. Int. J. Energy Econ. Policy 2020, 10, 355–364. [Google Scholar] [CrossRef]

- Mishra, S.P.; Jacob, V.; Radhakrishnan, S. Energy consumption–bitcoin’s achilles heel. SSRN 2017. [Google Scholar] [CrossRef]

- Corbet, S.; Lucey, B.; Yarovaya, L. Bitcoin-energy markets interrelationships-New evidence. Resour. Policy 2021, 70, 101916. [Google Scholar] [CrossRef]

- Al-Yahyaee, K.H.; Rehman, M.U.; Mensi, W.; Al-Jarrah, I.M.W. Can uncertainty indices predict Bitcoin prices? A revisited analysis using partial and multivariate wavelet approaches. N. Am. J. Econ. Financ. 2019, 49, 47–56. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Ahmed, M.Y.; Leirvik, T. Trade volume affects bitcoin energy consumption and carbon footprint. Financ. Res. Lett. 2022, 48, 102977. [Google Scholar] [CrossRef]

- Sarker, P.K.; Lau, C.K.M.; Pradhan, A.K. Asymmetric effects of climate policy uncertainty and energy prices on bitcoin prices. Innov. Green Dev. 2023, 2, 100048. [Google Scholar] [CrossRef]

- Kang, S.H.; Yoon, S.M.; Bekiros, S.; Uddin, G.S. Bitcoin as hedge or safe haven: Evidence from stock, currency, bond and derivatives markets. Comput. Econ. 2020, 56, 529–545. [Google Scholar] [CrossRef]

- Smales, L.A. Bitcoin as a safe haven: Is it even worth considering? Financ. Res. Lett. 2019, 30, 385–393. [Google Scholar] [CrossRef]

- Umar, M.; Su, C.W.; Rizvi, S.K.A.; Shao, X.F. Bitcoin: A safe haven asset and a winner amid political and economic uncertainties in the US? Technol. Forecast. Soc. Chang. 2021, 167, 120680. [Google Scholar] [CrossRef]

- Kalyvas, A.; Papakyriakou, P.; Sakkas, A.; Urquhart, A. What drives Bitcoin’s price crash risk? Econ. Lett. 2020, 191, 108777. [Google Scholar] [CrossRef]

- Wüstenfeld, J.; Geldner, T. Economic uncertainty and national bitcoin trading activity. N. Am. J. Econ. Financ. 2022, 59, 101625. [Google Scholar] [CrossRef]

- Chen, C.; Liu, L.; Zhao, N. Fear sentiment, uncertainty, and bitcoin price dynamics: The case of COVID-19. Emerg. Mark. Financ. Trade 2020, 56, 2298–2309. [Google Scholar] [CrossRef]

- Panagiotidis, T.; Stengos, T.; Vravosinos, O. The effects of markets, uncertainty and search intensity on bitcoin returns. Int. Rev. Financ. Anal. 2019, 63, 220–242. [Google Scholar] [CrossRef]

- Cheng, H.P.; Yen, K.C. The relationship between the economic policy uncertainty and the cryptocurrency market. Financ. Res. Lett. 2020, 35, 101308. [Google Scholar] [CrossRef]

- Yen, K.C.; Cheng, H.P. Economic policy uncertainty and cryptocurrency volatility. Financ. Res. Lett. 2021, 38, 101428. [Google Scholar] [CrossRef]

- Kyriazis, N.A. The effects of gold, stock markets and geopolitical uncertainty on Bitcoin prices and volatility. Glob. Econ. J. 2020, 20, 2050020. [Google Scholar] [CrossRef]

- Haq, I.U.; Ferreira, P.; Quintino, D.D.; Huynh, N.; Samantreeporn, S. Economic Policy Uncertainty, Energy and Sustainable Cryptocurrencies: Investigating Dynamic Connectedness during the COVID-19 Pandemic. Economies 2023, 11, 76. [Google Scholar] [CrossRef]

- Li, Z.Z.; Su, C.W.; Moldovan, N.C.; Umar, M. Energy consumption within policy uncertainty: Considering the climate and economic factors. Renew. Energy 2023, 208, 567–576. [Google Scholar] [CrossRef]

- Colon, F.; Kim, C.; Kim, H.; Kim, W. The effect of political and economic uncertainty on the cryptocurrency market. Financ. Res. Lett. 2021, 39, 101621. [Google Scholar] [CrossRef]

- Shaikh, I. Policy uncertainty and Bitcoin returns. Borsa Istanb. Rev. 2020, 20, 257–268. [Google Scholar] [CrossRef]

- Kevser, M. Bitcoin as an Alternative Financial Asset Class: Relations between Geopolitical Risk, Global Economic Political Uncertainty, and Energy Consumption. Pamukkale Eurasian Socioecon. Stud. 2023, 9, 117–131. [Google Scholar] [CrossRef]

- Smola, A.J.; Schölkopf, B. A tutorial on support vector regression. Stat. Comput. 2004, 14, 199–222. [Google Scholar] [CrossRef]

- Kuhn, H.; Tucker, A. Nonlinear programming. In Proceeding of the Second Berkeley Symposium on Mathematical Statistics and Probability; Neyman, J., Ed.; University of California Press: Berkeley, CA, USA, 1951. [Google Scholar]

- Smola, A.J.; Schölkopf, B.; Müller, K.R. The connection between regularization operators and support vector kernels. Neural Netw. 1998, 11, 637–649. [Google Scholar] [CrossRef]

- Prokhorenkova, L.; Gusev, G.; Vorobev, A.; Dorogush, A.V.; Gulin, A. CatBoost: Unbiased boosting with categorical features. In Proceedings of the Advances in Neural Information Processing Systems 31 (NeurIPS 2018), Montreal, QC, Canada, 3–8 December 2018; Volume 31. [Google Scholar]

- Biecek, P.; Burzykowski, T. Explanatory Model Analysis: Explore, Explain, and Examine Predictive Models; CRC Press: Boca Raton, FL, USA, 2021. [Google Scholar]

- Tissaoui, K.; Zaghdoudi, T.; Hakimi, A.; Nsaibi, M. Do gas price and uncertainty indices forecast crude oil prices? Fresh evidence through XGBoost modeling. Comput. Econ. 2023, 62, 663–687. [Google Scholar] [CrossRef] [PubMed]

- Zaghdoudi, T.; Tissaoui, K.; Hakimi, A.; Ben Amor, L. Dirty versus renewable energy consumption in China: A comparative analysis between conventional and non-conventional approaches. Ann. Oper. Res. 2024, 334, 601–622. [Google Scholar] [CrossRef] [PubMed]

- Jabeur, S.B.; Mefteh-Wali, S.; Viviani, J.L. Forecasting gold price with the XGBoost algorithm and SHAP interaction values. Ann. Oper. Res. 2024, 334, 679–699. [Google Scholar] [CrossRef]

- Tissaoui, K.; Abidi, I.; Azibi, N.; Nsaibi, M. Spillover Effects between Crude Oil Returns and Uncertainty: New Evidence from Time-Frequency Domain Approaches. Energies 2024, 17, 340. [Google Scholar] [CrossRef]

- Tissaoui, K.; Zaghdoudi, T.; Boubaker, S.; Hkiri, B.; Talbi, M. Testing the Nonlinear Long-and Short-Run Distributional Asymmetries Effects of Bitcoin Prices on Bitcoin Energy Consumption: New Insights through the QNARDL Model and XGBoost Machine-Learning Tool. Energies 2024, 17, 2810. [Google Scholar] [CrossRef]

- Ma, J.; Cheng, J.C.; Xu, Z.; Chen, K.; Lin, C.; Jiang, F. Identification of the most influential areas for air pollution control using XGBoost and Grid Importance Rank. J. Clean. Prod. 2020, 274, 122835. [Google Scholar] [CrossRef]

- Lundberg, S.M.; Lee, S.I. A unified approach to interpreting model predictions. In Proceedings of the Advances in Neural Information Processing Systems 30 (NIPS 2017), Long Beach, CA, USA, 4–9 December 2017; Volume 30. [Google Scholar]

- Shapley, L.S. A value for n-person games. In Contributions to the Theory of Games II; Kuhn, H., Tucker, A., Eds.; Princeton University Press: Princeton, NJ, USA, 1953. [Google Scholar]

- Jabeur, S.B.; Gharib, C.; Mefteh-Wali, S.; Arfi, W.B. CatBoost model and artificial intelligence techniques for corporate failure prediction. Technol. Forecast. Soc. Chang. 2021, 166, 120658. [Google Scholar] [CrossRef]

| Lbiten | Lepu | Lgpui | Leui1 | |

|---|---|---|---|---|

| Mean | −0.350501 | 2.238642 | 1.974425 | 1.337927 |

| Median | −0.267285 | 2.223725 | 1.957165 | 1.347119 |

| Maximum | 1.028177 | 2.633746 | 2.510848 | 1.636055 |

| Minimum | −4 | 1.936006 | 1.782484 | 1.084911 |

| Std.Dev | −0.858997 | 0.161923 | 0.107920 | 0.119716 |

| Skewness | 1.214402 | 0.220873 | 1.406369 | 0.013209 |

| Kurtosis | 2.859118 | 2.109713 | 6.868520 | 2.568617 |

| Jarque–Berra | 17.95191 *** | 5.967659 * | 138.2148 *** | 1.128519 |

| Observations | 145 | 145 | 145 | 145 |

| Target | Definition | Time | Sources |

|---|---|---|---|

| lbiten | Cambridge Bitcoin Electricity | Monthly | https://ccaf.io/cbnsi/cbeci |

| Consumption Index | (accessed on 26 June 2024) | ||

| Regressors | |||

| lepu | Economic Policy | Monthly | https://www.policyuncertainty.com/ |

| Uncertainty Index | |||

| lgpui | Geopolitical Risk Index | Monthly | https://www.policyuncertainty.com/ |

| leui1 | Energy Uncertainty Index | Monthly | https://www.policyuncertainty.com/ |

| MSE | RMSE | MAE | EVS | ||

|---|---|---|---|---|---|

| SVR | 1.090215 | 1.044134 | 0.746476 | 0.58911 | 0.57428 |

| CatBoost Regressor | 0.007618 | 0.087281 | 0.064597 | 0.766071 | 0.76588 |

| XGB Regressor | 0.000002 | 0.001229 | 0.000891 | 0.9998528 | 0.999852 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zaghdoudi, T.; Tissaoui, K.; Maâloul, M.H.; Bahou, Y.; Kammoun, N. Can Economic, Geopolitical and Energy Uncertainty Indices Predict Bitcoin Energy Consumption? New Evidence from a Machine Learning Approach. Energies 2024, 17, 3245. https://doi.org/10.3390/en17133245

Zaghdoudi T, Tissaoui K, Maâloul MH, Bahou Y, Kammoun N. Can Economic, Geopolitical and Energy Uncertainty Indices Predict Bitcoin Energy Consumption? New Evidence from a Machine Learning Approach. Energies. 2024; 17(13):3245. https://doi.org/10.3390/en17133245

Chicago/Turabian StyleZaghdoudi, Taha, Kais Tissaoui, Mohamed Hédi Maâloul, Younès Bahou, and Niazi Kammoun. 2024. "Can Economic, Geopolitical and Energy Uncertainty Indices Predict Bitcoin Energy Consumption? New Evidence from a Machine Learning Approach" Energies 17, no. 13: 3245. https://doi.org/10.3390/en17133245

APA StyleZaghdoudi, T., Tissaoui, K., Maâloul, M. H., Bahou, Y., & Kammoun, N. (2024). Can Economic, Geopolitical and Energy Uncertainty Indices Predict Bitcoin Energy Consumption? New Evidence from a Machine Learning Approach. Energies, 17(13), 3245. https://doi.org/10.3390/en17133245