Abstract

The cost reflectivity of electricity distribution network tariffs has been debated in several countries, and various ways to enhance it have been investigated in recent years. However, the recent academic literature regarding the approach based on cost causation has a clear gap because no case studies show how distribution network tariffs can be determined in practice for large customer groups. This article offers a calculation methodology to determine distribution network tariffs based on cost causation along with a case study where unit prices are determined for the tariff structures still widely used today using the data for two separate network areas being operated by two Finnish distribution system operators (DSOs) in an unbundled electricity market environment. The results of the case study show that the total differences between the target and the realized turnovers in both investigated networks are smaller than 1%, which means almost a full cost recovery. In addition to traditional tariff structures, the proposed calculation methodology can also be modified to design and determine other pricing schemes. The need for systematic calculation processes is growing to improve the cost reflectivity of present tariffs and adapt to the needs of the evolving operating environment, novel tariff structures, and new emerging customer groups.

1. Introduction

Distribution network pricing has become a topic of interest in recent years as smart meter rollouts are being implemented in several countries worldwide. One central obstacle for the accurate billing of electricity and network services has been the lack of detailed consumption data; thus, smart metering is a key factor when developing pricing. In some cases, such as in Finland, smart meter rollout has already been completed and the hourly energy consumption of virtually every customer—i.e., approximately 98% of consumers—is being measured using a smart meter [1]. Smart meters have also been widely installed or are in the process of being installed in several other European countries [2]. Smart metering infrastructure provides distribution system operators (DSOs) with the ability to gather consumption measurements fast and remotely, and that information can be applied, e.g., in billing for both electrical energy and network services. From this DSO perspective, accurate billing is not the only major benefit achieved through smart metering. For instance, consumption data can also be used to improve cost reflectivity in pricing and develop novel pricing schemes [1].

In the context of this article, the focus is mainly on the cost bases used in the process of forming distribution network tariffs. Hereafter, we thus use the term “tariff” to specifically refer to the distribution network tariff. Additionally, the terms “customer group”, “customer class”, and “tariff group” are used throughout this article, and they refer to the customers of the DSO, for whom tariffs are determined, grouped in different ways.

1.1. Background Information and Literature Review

Discussion on the tariffs being applied to small-scale customers has ensued, and the cost reflectivity of the present household customer tariffs has been studied in different countries [3,4,5,6,7]. Tariffs applied to household customers in several European countries still consist of two components—fixed charges (i.e., EUR/month) and volumetric charges (i.e., c/kWh)—with an emphasis of the total distribution fee often being placed on the latter [4]. For larger commercial and industrial customers, active and reactive power charges (i.e., EUR/kW and EUR/kvar) are often applied in addition to fixed and volumetric charges. Some tariffs also include time-of-use (ToU) features for volumetric charges.

One of the main reasons why tariffs for the small-scale customer still consist mainly of two components has been the lack of adequate and cost-efficient metering infrastructure (see, e.g., [3]); however, the situation has changed due to smart meter rollouts. Additionally, in Nordic countries, the present tariff structure in use for small-scale customers is, to some extent, a remnant of the pre-unbundling time in the electricity market. When the electricity markets were restructured, there was no immediate and visible need to apply different pricing schemes to small-scale customers for electrical energy and distribution. Similar historical reasons regarding present tariff structures that are in place for small-scale customers have been reported in, e.g., New Zealand (see, e.g., [8]). As smart metering is becoming prevalent in different countries, development needs and the possibilities regarding distribution pricing have become widely discussed topics [2,3]. Among the main topics of criticism regarding present tariffs have been the emphases of volumetric charges in the distribution bills and how those volumetric charges might not best reflect the main cost drivers of the distribution network business.

One goal of tariffs is to encourage customers toward better energy efficiency, which traditionally has been thought of as an effort to reduce total electricity volume and pursued through volumetric charges. However, only a part of the costs of a DSO come from annual total energy volume. A more significant cost driver for electricity network is peak demand; this aspect should be accounted for, and the goal should be resource efficiency, which includes the DSO aspect. Another goal of tariffs is cost reflectivity, which is an essential requirement in the European legislation [9,10]. To ensure that tariffs are cost-reflective, there is a clear need for transparent and systematical calculation methods to determine tariffs based on costs, which is indeed the central focus of this article. In addition, the operational environment of DSOs is changing due to various factors, e.g., the increasing amount of small-scale distributed generation, overall changes in load profiles, the need for demand response (DR) in different parts of the electricity delivery chain, and the needs of new emerging customer types, such as prosumers, energy communities, or charging stations for electric vehicles, which then push DSOs and regulators to investigate the practices regarding distribution pricing [4,11,12,13]. The essential point is that when tariffs are being designed or reformed to futureproof them, more effort should be placed on ensuring that the calculation methods used to determine those tariffs are well founded.

Developing distribution pricing is not only limited to designing completely new tariff structures; it also concerns the currently used tariffs that can be improved to reflect the costs of operation better and mitigate cross-subsidies between customers. Although DSOs in many European countries still employ tariffs that emphasize the volumetric components over the fixed ones, in some cases, such as in Finland, DSOs have gradually shifted the emphasis to the fixed charges over several years [14]. The main issue with placing the emphasis on volumetric tariff components is that they do not reflect the actual costs of the DSOs well, as a significant portion of these costs is rather fixed in the short term, and in the long term, they are linked to the peak demand (i.e., kW) [15]. Thus, the emphasis of tariffs should be on the demand or fixed components. However, implementing tariffs that compose solely of fixed charges might be problematic since such tariffs do not offer the customers an opportunity to lower the magnitude of their distribution bills and they enable cross-subsidies between customers. For instance, in the Netherlands, distribution tariffs include only the fixed components for different small-scale customer classes and currently, demand charges based on subscribed capacity are being discussed [16,17].

Tariff design is an increasingly studied topic in the literature. Different approaches to determine tariffs have been discussed in the academic literature, such as the accounting approaches, marginal cost-based approaches, and approaches based on cost causation [18,19]. The first approaches to systematize tariff design were based on accounting approaches, while the latter two approaches based on marginal costs and cost causation were developed later. Today, recent studies seem to focus more on marginal cost-based approaches. One motivation for using marginal cost-based approaches is that, from an economic standpoint, prices set on marginal costs are considered efficient and provide customers with proper economic signals [20]. However, the issue with marginal cost-based approaches is that they seem to produce a price for a single tariff component, and since marginal costs do not cover all the expenses faced by the DSOs, there is a need to take additional measures to achieve full cost recovery, e.g., by using revenue reconciliation methods [19].

Approaches based on cost causation have been discussed to a lesser extent in the recent academic literature, although these approaches can also lead to tariffs that provide efficient economic signals [19]. However, the recent literature on the approaches based on cost causation seems to mainly consist of brief written descriptions (see, e.g., [18,19,20]). These approaches should be studied more widely since they can provide solid bases for cost-based prices and improve the overall cost reflectivity of distribution pricing. It indeed seems that there is a clear gap in the academic literature regarding the approaches that are based on cost causation, as case studies that would explain how this approach could be undertaken in practice to determine the tariffs for different customer groups are still difficult to locate.

On the other topics investigated in recent studies concerning tariffs, there has been discussion regarding other research themes. For instance, [21] presents a pricing scheme in which a peak coincidence network charge, which can be determined using long-range incremental costs, and a fixed charge are used to ensure full cost recovery. Tariffs in the case study presented in [21] are determined for four different customer groups with distributed energy resources (DERs). In the same case study [21], discrete and varying load profiles are used but smart metering data are not. In another study shown in [22], the determined tariffs are based on the turnover generated using the tariffs applied today (i.e., revenue neutrality as expressed in, e.g., [23]). This assumption is a practical one, especially from a DSO viewpoint, as companies must consider the sustainability aspect of their core business, and thus, avoiding major changes in the annual turnover is an important premise for the DSOs. In [24,25], the issue of cross-subsidy regarding tariffs is studied for a hypothetical French grid consisting of 144 households with DERs. In the studies presented in [24,25], revenue neutrality is also assumed, and the costs of a DSO are not investigated. In another study presented in [26], tariffs are studied for 6000 customers using generated load profiles for 1000 prosumers in Belgium based on a load profile generator (see [27]). The tariffs used in the study presented in [26] are not determined based on the exact costs of a DSO, and in Belgium, the regulator sets the tariffs. Lastly, in another study presented in [28], the role of tariff design is considered a critical tool for demand-side management (DSM). The article studies a rollover network capacity charge in the case of a company operating in Australia with photovoltaic panels and energy storage. The tariffs used in [28] are based on what the company focused on in the study actually paid as its electricity tariffs.

As shown above, the recent academic literature regarding tariffs has often focused on different pricing schemes and their impacts on different stakeholders. However, in many studies, the present tariffs of utilities have been used to determine target turnovers for alternative pricing schemes (i.e., revenue neutrality). The issue when assuming revenue neutrality is that it is not always known how present tariffs, i.e., the input parameters used in the study, are calculated. It should also be noted that the presumption of revenue neutrality is not always valid because various factors can affect the annual turnover. It also seems that in recent studies, smart metering data are not widely used. The potential of using smart metering data should be used more widely to unlock the possibilities they offer for tariff design. Lastly, tariffs should be fair for all customers, and even in the case of emerging DERs, this aspect should be accounted for in the process of designing tariffs. Our view is that the academic literature lacks a study that explains how tariffs can be systematically determined from the DSO perspective based on cost causation, using cost and smart metering data. Both are used in the case study presented later in this article.

1.2. Contributions

This article presents a comprehensive calculation methodology to determine distribution network tariffs based on cost causation and a case study, in which a large number of data are applied to determine the tariffs using the proposed methodology. The novelty value and originality of this article, when compared to previous studies on tariff design, derives from the following items:

- An in-depth calculation methodology to determine tariffs based on cost causation is proposed, in which the analysis starts from the cost structure of a DSO.

- Real DSO information and hourly energy measurements are used in a case study to determine tariffs based on cost causation in two separate networks and using the proposed calculation methodology.

- The results of the case study show that this methodology can be used to determine tariffs for different customer groups systematically with good accuracy in terms of total turnover (i.e., cost recovery aspect).

- The proposed methodology can be used in different electricity market environments and modified, e.g., to determine novel tariff structures and thus account for changes in the electricity use caused by DERs and new emerging customer types.

In this article, input is provided more specifically to the aspects of practical tariff design. The case study presented here in Section 5 is based on actual hourly energy measurements of tens of thousands of customers situated in two different network areas in Finland to provide a practical view of the process of determining tariffs systematically for different customer groups based on cost causation. In the case study, tariffs are formed based on costs, and we have not assumed revenue neutrality; rather, our aim, through a calculation based on the proposed methodology, is to arrive at a turnover very close to the cost-based target. In practice, tariffs are often determined for the next year. Research-wise, to determine tariffs and investigate their impacts, and assess the validity of the used methodology, the input data should include information about the cost structure of a DSO, and consumption data should be used in the consumption analysis to forecast the expected electricity use. In the case study presented in this article, we use cost data from two networks and smart metering data collected from both networks from two consecutive years. Tariffs are determined using statistical load models (i.e., models that are based on consumption data and load modeling methods presented in [1]) and the measurement data of individual customers. The data from the first year are used as the basis for determining tariffs for the upcoming year, and the data from the second year are used as the realized consumption to study the impacts of tariffs on the annual turnover. However, the limitation of the study presented here is that it does not account for changes in electricity use that could be caused, e.g., by tariffs. Connecting the change in consumption patterns to tariff design as feedback is an important aspect of tariff design and an issue for future studies.

In the recent academic literature, it seems that no studies have been completed in which a similar approach (i.e., an approach based on cost causation) was applied on this scale, so this article fills this gap. As previously mentioned, studies in the academic literature discussing this approach seem to consist mainly of brief written descriptions; thus, the literature lacks a comprehensive description of an approach based on cost causation and a case study in which that methodology is applied using real data.

Development of distribution pricing has become a timely topic worldwide, as interest in improving the cost reflectivity of present tariffs and applying alternative pricing schemes is growing. For instance, in Finland, four DSOs have implemented tariffs that include separate demand charges for small-scale customers [29,30,31,32]. Changes have also been made or are under discussion in other European countries. Other examples of changes made to pricing from practical life can be found, e.g., in Sweden, where some DSOs have implemented demand charges to the tariffs of small-scale customers with varying billing practices (see, e.g., [33,34,35]). In Norway, demand charges based on capacity subscription are in use (see, e.g., [36,37,38]). Also, as previously mentioned, in the Netherlands, the potential of using demand charges based on subscribed capacity are being discussed (see, e.g., [16,17]).

To successfully reform tariffs and maintain public acceptance of distribution pricing, the links between costs and network use must be clear, so that the pricing is comprehensible and transparent. The case study presented in this article contributes more widely to the research field, as the methodology presented herein is not limited only to tariff structures that are being applied today but can also be used to design novel tariff schemes. Examples of alternative tariffs based on the proposed calculation methodology are presented, e.g., in [15,39,40]. However, the case study presented herein limits its investigation to show how the prices can be determined for present tariff structures using the proposed methodology. Although the development of alternative pricing schemes is highly relevant, it is outside the scope of this current article.

Designing novel distribution pricing schemes is only one of the benefits that push DSOs to investigate their pricing. However, amidst the active discussion regarding tariffs, there appears to be a gap in the academic literature, as studies related to distribution tariffs do not typically include forming tariffs based on cost causation in a systematic way using real DSO data to support these analyses. It should also be highlighted that investigating tariffs is not solely meant for research purposes. Various actors in the industry, such as DSOs and regulators, may benefit from the results of a more systematic tariff design process, and these processes may have multiple application possibilities, for example:

- Steering the change direction of pricing to improve its cost reflectivity and transparency;

- Providing information for business planning to ensure stable turnover in an evolving operational environment;

- Furthering product development, e.g., designing novel pricing schemes for both present and emerging new customer types (e.g., energy communities and electric vehicle charging stations);

- Promoting the evolving role of the DSO as a provider of a neutral platform with both the transparent and cost-based pricing, based on which various other market actors operate.

The first purpose of this article is that it operates as a description of a calculation methodology to determine tariffs based on cost causation. The second purpose of this article is that it operates as a case study that contains results based on the proposed calculation methodology using real DSO data.

1.3. Article Structure

The structure of the current article is as follows: In Section 2, general descriptions of the electricity distribution business and the cost structure of a DSO are provided. Section 3 discusses the different aspects related to distribution pricing. Section 4 offers a detailed description of the calculation phases involved in determining tariffs based on cost causation and materials of a case study, in which the data of two Finnish DSOs are used. Section 5 provides the results of the case study. The final two sections, Section 6 and Section 7, offer a discussion and conclusions.

2. Electricity Distribution Network Business

This section offers a general description of the background of tariff pricing and the regulatory framework. As the case study presented later in this article is based on the Finnish regulatory framework, background information on it is provided. Additionally, the cost structure of a DSO is discussed, and it is highlighted that the focus of this article is on an unbundled electricity market environment. However, the methodology and the results of the case study presented in this article can also be applied in other electricity market environments since electricity distribution network services are provided to customers worldwide, and the costs related to electricity distribution exist regardless of how the market is organized, although some details, e.g., the interpretation of costs, may vary between countries.

2.1. Background of the Market Structure and Regulatory Framework

DSOs recover a significant portion of their costs and gain return on the invested capital mainly through distribution network charges, which are collected from customers through tariffs. Since having parallel distribution networks is not economically viable, DSOs sill have monopolies over their operational areas. The absence of competition imposes no natural incentive on DSOs to provide their services to customers at a low price, so thus, to protect the customers from excessively high distribution charges while ensuring that the service is of a high quality, a distribution network business is affected by legislation and subjected to regulation that is supervised by national regulatory authorities.

The prevailing electricity market structure affects the pricing of network services. In certain electricity market environments, vertical integration exists, where a single entity provides the customers inside its operational area with both electrical energy and its distribution. This circumstance is the case, e.g., in several states in the United States [41]. Conversely, in many countries, transmission and distribution of electricity have been unbundled from energy generation and retail. Nordic countries are good examples of unbundled electricity market environments. For instance, in Finland, customers can purchase energy from any retailer, but locally the DSO, as a monopoly actor, provides the distribution network service to a specific area. The customer in Finland often receives two separate bills, one from the energy retailer and one from the DSO, making it clear for the customer that these are separate activities. However, in some cases, the customer may receive only one bill in which different items are separated to show which parts of the bill apply to different activities.

In electricity distribution pricing, tariffs can be affected directly by regulation, e.g., when the regulator sets the price levels for tariffs, or indirectly, e.g., when the regulation sets limits for the turnover of the DSO while leaving each company in charge of pricing its own tariffs [11]. The latter option is applied in Finland, where DSOs (i.e., 77 different operators) form their tariffs independently, and the national regulator then oversees that the turnover, over the course of a four-year regulation period, is at a reasonable level. The allowed turnover and the reasonable rate of return is determined based on a specific calculation model as presented in [42]. The regulation focuses on the allowed turnover and the overall reasonableness of the pricing. Different DSOs naturally have different unit prices for their tariffs, but the price lists in general consist of structurally similar tariff options among the DSOs, and the customers have the freedom to choose the most suitable option from the price list of the local DSO.

Additionally, the national legislation states that the unit prices of tariffs applied by the DSO should be uniform for all customers of the same tariff group or subgroup, which in practice means that the unit prices cannot depend on the exact physical location of the customer in that specific network [43]. Among the latest changes made to legislation in Finland is that, at an average level, the distribution fees of the customers, including all taxes, cannot be raised more than 8% in a moving 12-month period [44]. The supervision of the price increase cap is not scrutinized individually for each customer, but at a customer segment level, using recently updated load profiles determined for national type consumers [45]. Lastly, Finnish DSOs must present the bases for their pricing to the regulator when asked, which supports the need to use formal and transparent calculation methods for distribution pricing.

2.2. Cost Structure of a DSO

The distribution network business is mainly driven by capital costs, and a significant portion of these costs result from network investments (i.e., depreciations). The main asset for the DSO is the electricity network, which must be built, operated, and maintained appropriately to ensure reliable and high-quality distribution of energy to the end customers.

In addition to capital costs, the cost structure of a DSO includes various other items that can be grouped into different main cost categories. Examples of the cost categories are presented here in Table 1. The proportions of cost elements vary between the DSOs depending on their individual properties and operational environments. For instance, based on the approximate values presented in the literature, e.g., [22,46,47], network-related costs (e.g., depreciations, financing costs, and operational costs) cover approximately 60–70% of the total costs. Various customer-related costs (e.g., administrative costs, metering costs, etc.) cover approximately 10–15% of the total costs. Costs related to energy consumption [e.g., load losses and use-of-system (UoS) charges paid to the transmission system operator (TSO)] form the remaining portion of the total costs.

Table 1.

Main cost elements involved in distribution network pricing and examples of relevant cost items.

3. The Determination of Distribution Network Tariffs

This section consists of a description of the general tasks of tariffs. Additionally, it discusses how the pricing of tariffs can be approached as a process. As the focus of this article is on an approach based on cost causation, we characterize it by determining the different subtasks included in that process.

3.1. Main Tasks and Requirements of Distribution Network Tariffs

To ensure that the network business remains profitable and stable, distribution pricing must be planned and realized accordingly. A functioning electricity distribution infrastructure is a central factor in the present society, and various targets are directed toward the pricing of network services, such as principles, which are often referred to as regulatory, pricing, or rate making principles, which have been widely described and discussed in the literature (see, e.g., [11,18,19,48]). In the following text, different principles, such as cost recovery, cost reflectivity, equity, non-discrimination, transparency, additivity, simplicity, and graduality are briefly discussed.

Cost recovery in distribution pricing means that the tariffs should be set so that the turnover collected from the customers in the form of distribution fees covers the appropriate costs of the DSO, so the business can remain sustainable. In the literature, this principle is also referred to as economic sustainability or revenue sufficiency [18].

Cost reflectivity in distribution pricing, in the context of the current article, means that the pricing process should lead to tariffs and distribution fees that accurately reflect the costs that the customers impose on the DSO. Cost-reflective pricing can thus mitigate cross-subsidies between different customer groups.

Non-discrimination is a principle that aims to ensure that customers with similar electricity use should face similar economic consequences (i.e., distribution fees), regardless of the end purpose of that electricity use [19].

The equity principle is related to fairness, which in tariff design means that some customers pay less than what the cost of providing a service is [11]. The simultaneous full-scale realization of both the equity and non-discrimination principles may be problematic, as DSOs serve a large variety of customer needs, some of them (e.g., low-income customers) in need of cross-subsidization.

Transparency in distribution pricing could refer to the way different principles are accounted for and how clear and intelligible tariffs and the calculation process to determine them are. From a societal standpoint, tariffs and underlying methods should be both clear and understandable for different stakeholders.

Additivity, in the context of this article, means that tariffs should be determined with the aim that the sums of turnovers generated by different tariff components would closely match the turnover targets of the total turnover targets of each customer group [20]. However, in practice, the upcoming electricity use might be difficult to forecast perfectly, and realized turnovers generated using different tariff components might differ from the original targets.

Simplicity, while being closely related to the previously discussed transparency principle, can be described as a principle aiming toward intelligible tariffs and methods. For instance, from a customer perspective, tariffs should not aim for needless complexity (e.g., in terms of the number of tariff components or the mechanisms of each component). Additionally, a reasonably simplified calculation methodology—a topic briefly discussed, e.g., in [19]—and unambiguous tariff structures might lead to a higher level of public acceptance.

Graduality, as a practical principle, aims for stability in tariff design. If tariff structures or the price levels of different tariff components must be changed, those changes should not result in sudden massive changes to customer distribution fees [23]. The changes should be made gradually, distributed over a longer period to protect the customers. From the DSO standpoint, it is important to note that, because the operating environment might face changes, there must also be a possibility for the DSO to make changes to tariffs for the business to remain sustainable.

In this article, especially from the standpoint of the proposed calculation methodology described in Section 4, the principles of cost recovery and cost reflectivity play a central role with the exception that no specific tariff structure is proposed. The purpose of this study is to propose a systematic way to calculate different tariffs using an approach based on cost causation. This choice means that the central focus is on the pricing process, i.e., the way costs are allocated to different customer groups and how cost-based tariffs are determined based on the cost responsibilities of each customer group.

To gather the needed turnover equally from different customers, one way to achieve this goal is to base the pricing on cost causation. Ideally, this process would mean that the customers should only pay for the costs they impose on the distribution system, and the tariffs would not enable cross-subsidies between customers. In practice, full-scale realization of cost causation would require the application of a very complex system of customer-specific tariffs, which is an unrealistic expectation for several reasons. For instance, the network is not planned to be equally strong for every customer, and the distances of different customers from the nearest distribution transformer can vary. This issue may lead to significant differences in how costs are distributed among customers. Another reason that full-scale implementation of cost causation is problematic is that the impact of an individual customer on the network costs might not be straightforward to determine. Lastly, the legislation in some countries does not allow for the use of customer-specific tariffs. For instance, national legislation in Nordic countries prohibits pricing tariffs based on the exact location of the customer in the grid.

Still, price differentiation between customers is applied at different levels of the network [i.e., main voltage levels, which herein are low voltage (LV), medium voltage (MV), and high voltage (HV)], so that customers situated at higher voltage levels (i.e., MV and HV) do not have to pay for LV network costs. In addition, different tariffs can be applied for consumption and production, each of which may have alternatives, such as the single rate or ToU rate options for the customer to select. Since user-specific tariffs are typically not considered an option in many countries, the cost causation principle is applied only at a customer group level.

3.2. Subtasks When Determining Distribution Network Tariffs

The tariff design process should account for the aspects noted above. The process of determining tariffs, as described in the literature, e.g., [19,49,50,51], however, often includes the following main tasks:

- Definition of the maximum total revenue allowed by the regulation;

- Definition of the tariff structures that are applied to the customers;

- Allocation of the total turnover demand for all customers of the DSO.

The task list shown above, from the standpoint of an approach that is based on cost causation, is simplified, and the order of the last two tasks is debatable. For instance, if the tariff structure is decided first and the costs are allocated to different tariff components without thorough calculation later, the pricing might not be cost-reflective. In the current article, the approach is based on cost causation and the calculation process consists of the following clearly distinguishable subtasks:

- Cost analysis (see Section 4.1.1);

- Consumption analysis (see Section 4.1.2);

- Allocation of costs (see Section 4.1.3);

- Determination of tariffs based on cost causation (see Section 4.1.4);

- Modification of tariffs to comply with other pricing targets (see Section 4.1.5).

Various factors affect tariff design, such as how the electricity market is organized, how the distribution business is regulated, and the fact that cost structures, operating environments, and the mix of customers can vary between DSOs. Consequently, there is no universal one-size-fits-all solution for how exactly tariffs should be determined, and thus, the methodology proposed in this article is just one of the many possible ways to make this determination. To highlight then, the aim of this article is not to determine optimal tariffs, as defining objectives that would satisfy every aspect involved in determining tariffs is a complex task, but rather to determine tariffs systematically based on cost causation. For instance, determining a very simple tariff structure, such as tariffs consisting only of fixed charges (e.g., EUR/month), which might result in a situation where customers with high consumption are heavily subsidized by others, contradicts, e.g., cost reflectivity. Thus, discovering a global optimum from a set of solutions may prove to be very difficult. However, by determining tariffs through a systematic and repeatable process, DSOs, regulators, and other stakeholders can acquire relevant and valuable information that can be used in their decision-making.

4. Materials and Methods

This section presents a calculation methodology to determine electricity distribution network tariffs using an approach based on cost causation and the materials used in a case study where the methodology is applied to determine electricity distribution tariffs using data from two separate electricity networks operated by two DSOs in Finland. The case study is based on a situation where electricity distribution is unbundled from energy retail activity. The exact data used in the case study are not publicly available due to privacy reasons.

4.1. Methods

This section consists of a description of a calculation methodology to determine tariffs based on cost causation. That description is written from the unbundled electricity market environment viewpoint, but the methodology can be used regardless of the market structure since electricity distribution as an activity, whether separate or not, is present in energy systems worldwide. The interpretations of some of the items, e.g., cost elements, involved in the process might vary between jurisdictions, but the methodology still illustrates a way to determine tariffs based on costs using an approach that is based on cost causation. However, it should be noted that, in the final phase of the pricing process (i.e., Subtask 5 listed in Section 3.2), the practical adjustments that are needed to finalize tariffs before their implementation are not described in detail here. The reason for this is that the basis of the adjustments are often decisions, which can depend on several factors, e.g., the present state of the pricing.

4.1.1. Cost Analysis

The fundamental purpose of cost analysis is to determine annual costs and return on capital, which then form the target turnover and the cost basis of the tariffs. For the pricing to be cost reflective, it is central to recognize the different cost elements that are involved in the pricing. In short, the main cost categories are capital costs, operational costs, energy-related costs, and customer-related costs, as shown here in Table 1. However, the description of these costs at this stage is not very exact, and as such, accurate allocation of costs to customers might prove challenging, as there are both direct and indirect costs to allocate to different customer groups. To make this cost allocation easier, cost pools and cost drivers can be used as tools to distribute the costs to each customer group accordingly. An example of a set of such cost pools with their respective cost elements is depicted in Table 2.

Table 2.

Example of a selection of cost pools with their respective cost elements.

The electricity distribution business is driven mainly by its capital costs for the network infrastructure, and a significant portion of these costs results from the depreciation of network assets. Another major portion results from operation and maintenance costs. Purely energy-related costs, which consist mainly of load losses and high voltage network UoS charges that result from the fees paid to the TSO, should be treated separately from other operational costs. Annual straight-line depreciations for network assets can be determined by dividing the sum of replacement values of each network asset by their corresponding techno-economical lifetimes. However, depending on the prevailing practices, the replacement values of network assets do not always equal the actual book values or the acquisition prices [52]. For instance, in Finland, a national regulator provides the DSOs with a list of average unit prices for various network components, which are then used to determine the replacement value of the network in the regulation model. This information can then be applied in determining tariffs, as the value of the network is a key item in that regulation [42].

4.1.2. Consumption Analysis

The purpose of a consumption analysis is to provide input for the tariff design regarding both the present and the upcoming electricity use (i.e., energy volumes and demands). In this article, by demand, we mean the average hourly demand, which is the common commercial unit applied in the Finnish electricity market today. However, in the future, a higher resolution (i.e., 15 min average demand) will be applied, but that change is not likely to have immediate effects on the electricity distribution tariffs. Future consumption must be forecast, so that the price levels of tariffs can be set accordingly. If the load estimates are accurate, then the prices of tariffs can be set, so that the realized annual turnover is very close to the target. Thus, key effort should be placed on a full consumption analysis during this pricing process.

Historical load data can be applied when determining tariffs. For instance, in Finland, statistical customer class load profiles have been applied to tariff planning for years. However, these load profiles might be out of date, and so by using the data available through smart metering, new enhanced load profiles can be formed to better reflect the consumption behavior of customers today. Applying interval measurements as such might result in a larger error between the estimated and realized consumption than what would happen when statistical load profiles are applied [1]. One reason for this error is that the temperature conditions between consecutive years can vary, and, as tariffs are determined based on the used load estimates, that impact carries on affecting tariff prices and the annual turnover.

4.1.3. Allocation of Costs

The next phase in the calculation process is to combine the results of the previous two phases and allocate the costs of operation to different customer groups. Dividing customers into different groups can be carried out in many ways. One way is to group customers based on what tariff they are currently assigned to or based on which of the tariffs in the price list of the DSO is the optimal choice for each customer. Alternatively, customer groups can be formed strictly based on the electricity use profiles of customers, which would be the case, e.g., when new customer groups and tariffs are being defined and determined.

As mentioned in Section 4.1.1, cost drivers can be applied to each cost pool to direct the allocation of various cost elements. Common cost drivers discussed in the literature are peak power or demand, energy, and the number of customers, from which the first becomes a significant element [13,19,50,53]. An example of cost drivers assigned to different cost pools is shown in Table 3. The following text includes a description of how costs can be allocated to customer groups based on demand, energy, and the number of customers.

Table 3.

Respective cost drivers for different cost pools.

A straightforward method for directing costs linked to demand to each customer group is to allocate them based on the contributions of each customer group to the coincident peak demand at each voltage level. As the network is built to sustain a certain peak demand, it can be considered as a clear driver for network costs. However, the demand in question is not typically instantaneous demand, but rather hourly, half-hourly, or a quarter-hourly average demand. In this article, we consider the timeframe to be the average hourly demand. Cost shares of the demand-related costs for each user group of a specific cost pool can thus be determined by (1):

where is the hourly demand of customer group during the coincident peak hourly demands of the cost pools, which in this case are the main network levels (i.e., HV, MV, and LV networks); is the number of customer groups connected to the cost pool or, in this case, the network level; and is the total demand-related costs of the cost pool or network level.

Alternatively, the allocation of demand-related costs could be carried out based on the average of some determined number of peak demands. One potential reason to include multiple peak demand hours in the calculation is that there may be more than one hour when the demand in the studied network is equal to or very close to the maximum value. If the calculation is based on the value of a single hour, it might have a distorting impact on the cost shares of different customer groups if that situation is different during other close-to-peak demand hours. Network-specific factors, such as the timing of peak demands, should thus be accounted for in the practical tariff design so as to allocate demand-related costs accordingly.

For each customer group, the cost shares of the costs related to energy can be calculated based on their estimated annual energy consumption by (2):

where is the total annual energy consumption of customer group and signifies the costs related to energy consumption. When is being determined, it should be noted that if there are customers connected only to higher voltage levels, such as an MV network, the energy-related costs must be distributed to different network levels accordingly so as to mitigate cross-subsidization.

Lastly, the cost shares of the customer-related costs of each customer group can be calculated by (3):

where is the number of customers in customer group and signifies the customer-related costs, which can consist of a combination of the cost pools “Customer” and “Meters”, as shown in Table 3. The costs of meters can further be divided into customer groups based on what kind of a meter each customer has since costs might vary between different meters (see, e.g., [42]). The calculation method shown in (3) does not consider the differences between customer groups, and so to make the allocation more accurate, (3) could be modified by using additional coefficients or methods to account for any differences between the customer groups. For instance, some customers might require more customer service than others do, and allocating those related costs accordingly might require making modifications to (3). The calculation method shown above provides a simple way of allocating customer-related costs to customer groups, but it does not consider the said differences between each group. Lastly, the way in which customers are assigned to different groups also can affect how costs are distributed between those customers.

4.1.4. Determination of Tariffs Based on Cost Causation

The next step after compiling the turnover targets for each customer group is to determine the tariff structures that are used to generate the said turnovers. The following example provides a description that illustrates how unit prices can be calculated for a three-part tariff. Alternatively, the following process can also be applied straightforwardly to produce two-part tariffs, e.g., by combining the turnover targets of each and and forming fixed charges of tariffs based on the total turnover target that result from the combined elements. The case study and its results presented in Section 5 and Section 6 of this article are an example of producing both two- and three-part tariffs.

The unit price for demand can also be calculated in various ways. In the unit price determination, this means in practice deciding how demand is billed from customers (e.g., monthly peak hourly demand or some other option). For instance, if the demand charge is based on the monthly peak hourly demand of the customer, the unit prices of the demand charges for each customer group can be determined by (4):

where is the highest hourly demand of month for customer in customer group , and is the number of customers in that group. If the basis of the demand charge is based on some other option than monthly peak hourly demand, then the denominator of (4) must be modified to correspond with that selection.

The unit prices for the volumetric tariff components can be calculated in a similar way. The unit price for a single-rate volumetric charge for a customer group can be calculated by (5):

Alternatively, the unit prices for volumetric charges can be compiled in the following manner for two-tiered ToU rates (e.g., a different rate for nighttime and daytime) by expanding (5). The cost share of the customer group consists of the turnovers generated using the two different rates and can be expressed as (6):

where is the total energy consumption of the customer group during time (e.g., daytime), is the total energy consumption during time (e.g., nighttime), and and are the unit prices for the volumetric ToU charges for and , respectively. Alternatively, can be expressed as (7):

where is a coefficient that is greater than or equal to zero. Thus, (6) can be expressed as (8):

The unit price for the first part of the volumetric charge (i.e., applied for ) can thus be calculated by (9):

For , the unit price can be determined by (7). For instance, if the volumetric charge is higher during (e.g., daytime) than during (e.g., nighttime), then the value of is smaller than 1, meaning that the customers have an incentive to shift their consumption from to . The process of designing volumetric charges can also be expanded further to produce multiple tiers.

The fixed single-rate charges for customer groups can be determined based on the number of customers by (10) if the charge is uniform for the tariff:

However, when customers of different sizes (i.e., subgroups of tariffs) are billed differently, then the situation changes. This is the case, e.g., in Finland and Sweden (see, e.g., [33,35]) today, where many DSOs apply fixed charges as one of the tariff components, which depend on the main fuse size (i.e., where a higher fuse size leads to a higher monthly fixed charge). In the following, a method is presented to determine fixed charges that vary depending on the fuse size. The cost shares of customer groups can be expressed with the sum of turnovers that are generated from several subgroups by (11):

where is the number of customer subgroups, is the base value of the fixed charges for customer group , is the number of customers in the subgroup , and is a coefficient of the customer subgroup, which can be calculated by (12):

where is the nominal power of the connection, and is a selected reference power for the customer group. For instance, for 3 × 35 A fuse size with 230 V nominal phase voltage is approximately 24.15 kW, and, if is a very typical fuse size 3 × 25 A (i.e., approximately 17.25 kW), then the value for coefficient for 3 × 35 A fuse size is approximately 1.4.

The base value of the unit price for fixed charge can be determined for a customer group by (13):

The unit prices for fuse size dependent fixed charges for customer subgroups can be determined by (14):

Without any additional modifications, the tariff of a customer group would be composed of the formed unit prices (i.e., three separate tariff components). However, in this phase of the calculation process, tariffs are based only on cost causation, which connects the costs to the expected electricity use. Various other pricing principles are not accounted for at this stage of the pricing process. The reason is that the above focuses on determining tariffs that are based on costs. If the tariffs are changed, then they are not based only on cost causation anymore. However, it is common that the tariffs must often be modified before practical implementation, and this aspect is addressed briefly in the following section.

4.1.5. Modification of Tariffs to Comply with Other Pricing Targets

To ensure that the pricing is coherent and other principles are accounted for, tariffs based on cost causation usually must be modified before their practical implementation. The reasons that such modifications must be made are typically practical in nature and if significant change needs are indeed recognized, then they should be made gradually rather than overnight. In addition, the bases for these changes are not fully objective in every case as compromises must be made to better adjust the tariffs for practical implementation. Thus, the exact analytical description of how tariffs should be modified falls outside the scope of this article. However, the modification to finalize tariffs could be implemented by accounting for at least the following aspects:

- What is the present state of the pricing? If there are large differences between the calculated and the presently used tariffs, then the change steps needed should be distributed to relate to a longer period.

- Do tariffs encourage customers toward more efficient use of electricity? For instance, if the calculated tariffs would indicate that the tariffs should depend significantly on fixed charges, then customers would not have strong incentives to change their electricity use habits, and modifications become necessary.

- Are customers able to understand the content of their distribution bills? The tariff structure and the way each tariff component contributes to the distribution bill should be intelligible, so the customers receive clear information about what they are paying for.

Tariffs based on cost causation should be seen more as a long-term development direction, and the stability aspect should be accounted for to ensure that the total turnover of the DSO will not change dramatically, and the customers remain protected from significant price increases. The customer aspect is highly relevant and, as previously mentioned in Section 2, in Finland, the legislation prevents DSOs from making sudden changes in their pricing, at a customer segment level, that result in more than 8% increases in the annual average distribution fees, including taxes [43]. Considering the various aspects outside the calculation based on cost causation and realizing them simultaneously is a challenging task. Our focus in the case study presented in the next section is to determine the tariffs based on cost causation in a systematic way using the described methodology. Consequently, the aspects related to finalizing tariffs are ruled as being outside the scope of this article.

4.1.6. Strengths and Challenges of the Proposed Methodology

The justifications for using the proposed methodology are multiform. In the following, some of the strengths of the approach are discussed, closely reflecting some of the main principles discussed in Section 3.1, along with some of the practical challenges related to its use.

From the standpoint of cost recovery, all relevant costs are accounted for in the calculation process. There is no need to use additional revenue reconciliation methods, which is a clear strength of the proposed approach and also one central challenge of the approach based on marginal costs (see, e.g., [19]). It can be seen from the case study and the results presented in Section 5 and Section 6 here that the methodology can provide good results in terms of cost recovery.

From the standpoint of cost reflectivity, the proposed methodology includes a phase in which costs are analyzed. This methodology also connects the costs to the central cost drivers (i.e., through cost allocation phase), thereby aiming to allocate costs to customer groups based on how they impose costs on the DSO. In this regard, the approach based on cost causation is cost reflective, as also pointed out, e.g., in [20]. This aspect is also a clear strength of the methodology, and cost reflectivity is a central requirement as stated in the European legislation, e.g., in [9,10]. Lastly, it should be noted that the proposed methodology can be used to improve the cost reflectivity of existing tariffs, e.g., by recognizing what should be the development direction of the tariffs based on the results of the cost-based calculation, which is an important aspect especially in the case of regular passive customers who do not yet possess DERs.

From the standpoint of transparency and simplicity in terms of tariff design, the methodology, in its basic form, is relatively simple, clear, and transparent. The phases of the process can be clearly identified and defined. Additionally, different phases of the process can be further modified if there are any needs for improvement, e.g., by accounting for the planning function in finer detail. Transparency is also a critical item since it can significantly enhance the public acceptance and justification of distribution pricing from a societal viewpoint.

From the standpoint of flexibility regarding the process of determining tariffs, there are several strengths to this approach. To provide a few examples, first, the costs can be interpreted in different ways and the categorization of the costs to different cost pools can be modified if it is required. Overall, since the proposed methodology consists of different phases, it brings flexibility to the tariff design process, as different steps of the process can be modified and improved individually.

Secondly, the proposed approach enables the determination of multi-part tariffs for several customer categories simultaneously, as shown in Section 5 here. For instance, in the approach based on marginal costs, one-part tariffs, i.e., a single tariff component, is typically the result (see, e.g., [20]), while the potential need to use revenue reconciliation methods to ensure cost recovery leads to the use of coefficients or other methods, such as using fixed charges to avoid distorting the price signal provided by the marginal cost-based tariff component [21]. Thirdly, the proposed methodology provides a platform on which different alternative pricing schemes can be determined to collect the customer group-specific target turnovers determined in the cost allocation phase. Additionally, in the future, the proposed methodology can be expanded and modified to determine tariffs for new customer groups, such as energy storage customers and energy communities.

One strength that relates to practical issues is the fact that the proposed methodology provides an additional use for energy readings gathered via smart metering. This aspect brings additional value to smart metering, as the gathered data can also be used in the pursuit to ensure that the data used in the pricing process is accurate.

The challenges of the proposed methodology arise from how the costs are identified, classified, and allocated to different cost categories; how close the selected cost drivers are to the planning function of the distribution network; and other related factors. Additionally, to allocate the costs to customer groups accurately, the quantity of data required in the calculation is large, and expertise is required for the planning function of the distribution network and load modeling to form forecasts about the expected electricity use. As pointed out in [20], classifying costs accurately can be difficult. However, as pointed out in [19], reasonable simplifications can be made to offer simplicity and transparency to the tariff design.

4.2. Materials

This section describes and discusses materials used in a case study in which the proposed methodology described in Section 4 was applied to produce tariffs in two separate electricity networks. The main assumptions, overview of the networks, and the information regarding cost and consumption analyses are presented here. Section 5 presents the main results of the case study, which are the results of the cost allocation process, determined tariffs based on cost causation, and the differences between the realized and target turnovers.

4.2.1. Background Information and Main Assumptions

The calculation methodology presented in the previous section is applied in this case study, in which the data for two Finnish DSOs located in different operating environments are used. To calculate tariffs based on cost causation, decisions must be made throughout the calculation process, e.g., regarding the treatment of costs, dividing the customers into different groups, and modeling the expected electricity use. This study is based on the following main assumptions:

- Customers are assigned to the present tariff groups, which might or might not be the optimal choice for an individual customer;

- The number of customers in each tariff group remains unchanged;

- Calculated unit prices for tariffs are based strictly on the proposed methodology, i.e., cost causation; further, as this study is based on real DSO data, the unit prices applied by the DSOs in practice during the years on which the calculation is based are not considered;

- The expected use of electricity is based partly on statistical load forecasts (i.e., customer group level) and partly on the hourly measurement data (i.e., peak demand information of individual customers) from the year 2013;

- Consumption data for the second year (i.e., 2014) were used as the realized consumption.

Additionally, the two networks included in this study represent only fractions of the larger networks operated by the two DSOs. This aspect means that the tariffs are determined only for these specific network areas, not for the entire networks operated by the DSOs. As mentioned in the list above, the consumption data of tens of thousands of customers were applied from two consecutive years (i.e., 2013 and 2014). Based on the data from 2013, statistical load models were made for 2014, for which tariffs are determined. Consumption data from the second year were applied as the realized consumption to investigate how much the total turnovers would differ from the targets. Although the data used in the calculation were not recent, these items were used to demonstrate how the proposed methodology can be applied in practice to determine the tariffs based on cost causation. Additionally, in the studied networks, no major changes have happened regarding electricity use in the prior years for most customers, and it is highlighted that the data are from 2013 and 2014. If changes in consumption patterns do take place, however, they can be accounted for in the calculation process performed in the future.

4.2.2. Studied Distribution Networks

Two networks (i.e., Network I and Network II) operated by two Finnish DSOs, for which tariffs were determined, were used. Network I is situated in an urban area, where the average length of conductors (i.e., cables and overhead lines) per user is approximately 12 m. There are over 32,000 customers in that network, the majority being small-scale customers living in apartment buildings. There are also some larger customers connected to the MV network.

Network II is situated in a mixed area consisting of both urban and rural areas. The average length of conductors per user is approximately 170 m. There are over 8000 customers in this network, the majority being small-scale customers. In comparison to Network I, there is a higher number of detached houses in Network II. Additionally, in Network II, each customer is connected to the LV network.

4.2.3. Cost Structures

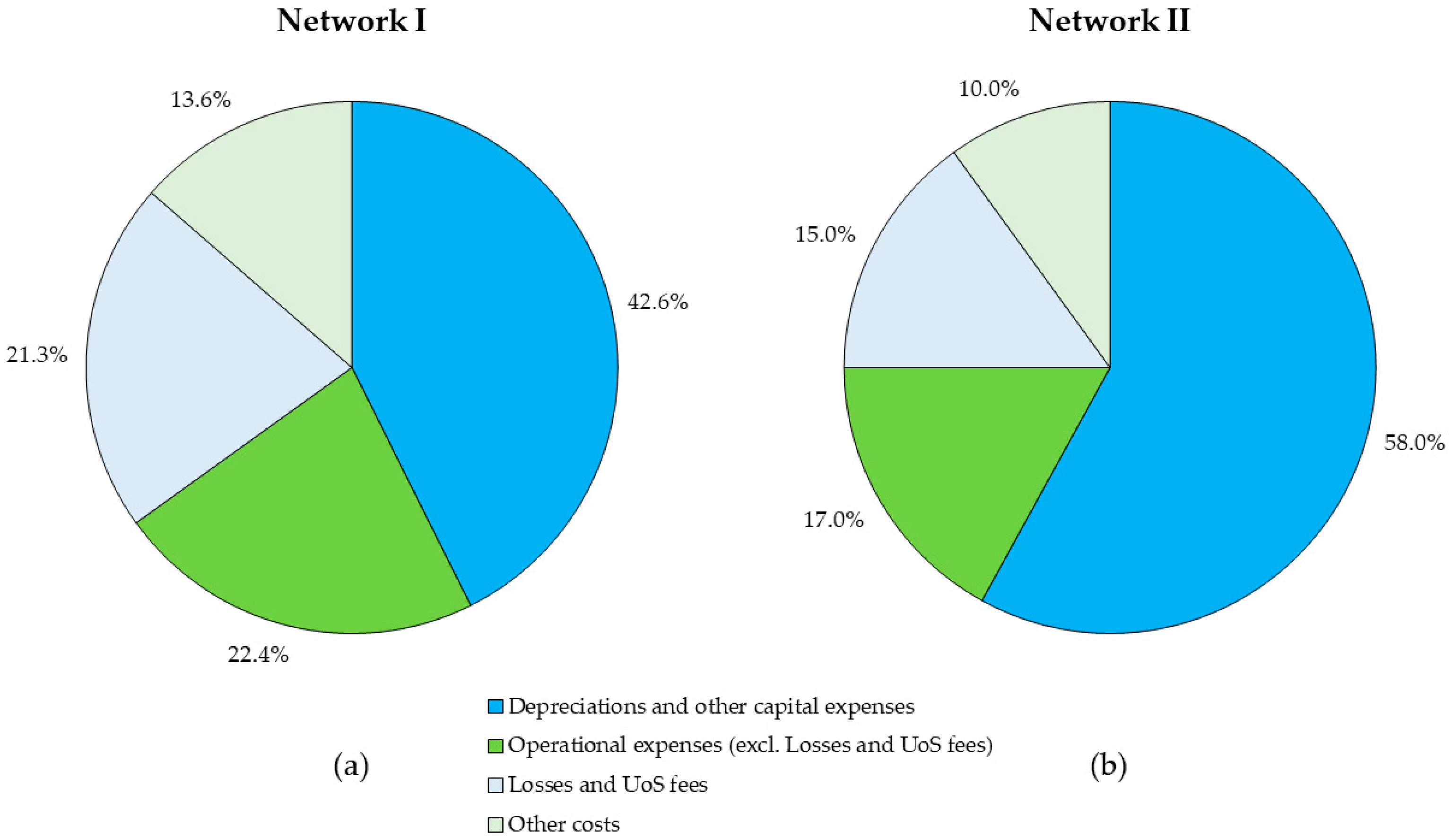

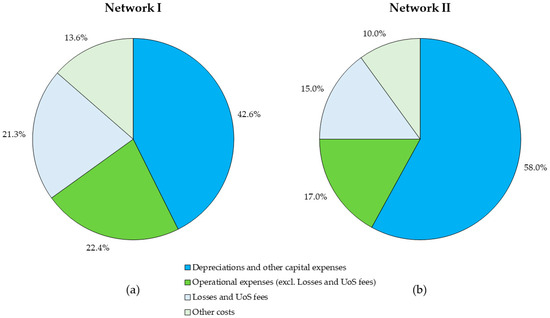

The cost structures of the studied networks are shown in Figure 1. The figure depicts only the costs; the rates of return, which are based on the value of the network, are not included. The reason is that the purpose of Figure 1 is to illustrate the basic cost structures of DSOs situated in different operational areas. Additionally, it should be noted that the magnitude of the pursued rate of return depends on the strategy of the DSO, and there is no one-size-fits-all approach to how the costs should be allocated to customer groups or tariffs. From viewing Figure 1, it can be observed that a significant portion of the costs results from costs related to the network capital.

Figure 1.

Proportions of each cost category from total costs (excl. rate of return) in (a) Network I and (b) Network II.

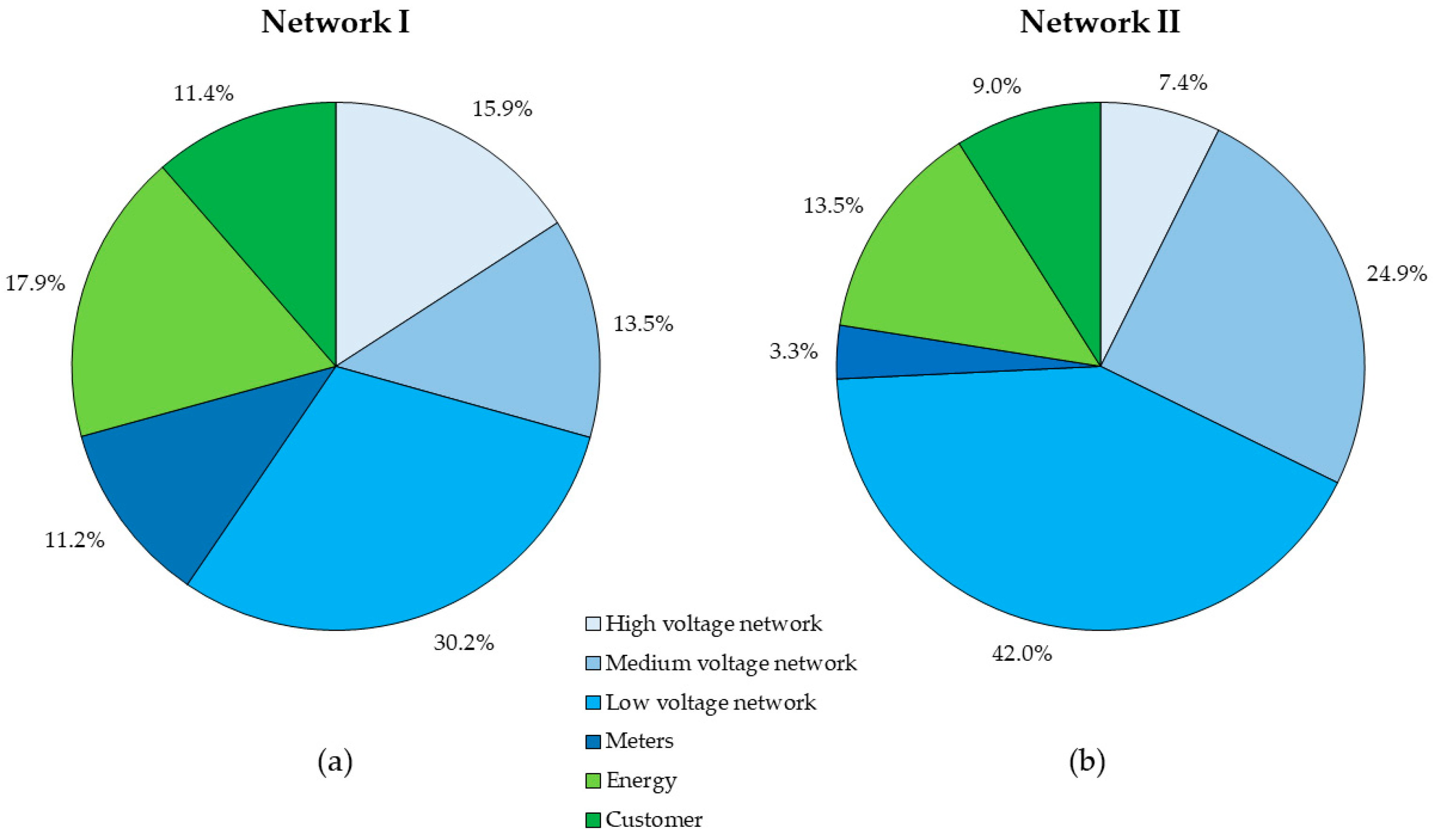

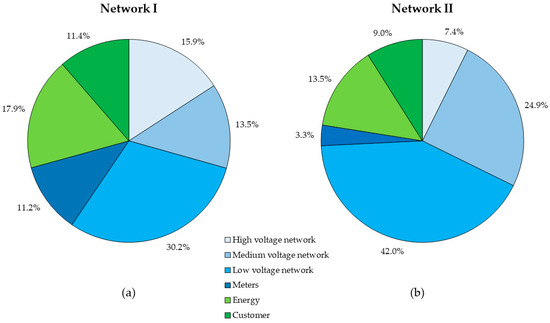

We determined network-specific rates of return based on the net present values of the studied networks and discussions with the DSOs to ensure that the overall turnover targets would be set at realistic levels. Rates of return were then included in the cost analysis to produce the total annual target turnovers by distributing them to HV, MV, and LV cost pools based on the net present values of each network level. Additionally, smart meters are an investment on which rates of return are also determined, and this aspect has been accounted for in the calculation separately from other network assets. For the studied Networks I and II, total turnover targets were approximately EUR 6.91 M and EUR 3.04 M, respectively. To facilitate the cost allocation process described in Section 4.1.3, Figure 2 depicts how the target turnovers are distributed to different cost pools.

Figure 2.

Proportions of total costs (incl. rate of return) distributed to cost pools in (a) Network I and (b) Network II.

4.2.4. Consumption Analysis

The results of the consumption analysis are presented in Table 4. The table presents information about the contribution of each customer group to the coincident peak hourly demand at different voltage levels; the sums of billing demands, i.e., denominator of (4), for customer groups; and the energy consumptions of different customer groups. The last column of the table depicts the sum of billing demands (contracted demand is used for C3 in Network II, measured demands are used for C4 in both networks and for C5 in Network II) of larger customers, and C3 in Network I, which are used separately to determine separate demand charges for these groups.

Table 4.

Relevant consumption information for the tariff design in the studied networks.

Tariff groups C1, C2, and C3 in Network I are small-scale customers, and tariff groups C4 and C5 are larger customers. In Network II, tariff groups C1, C2, and C3 are small-scale customer groups, while tariff group C4 consists of large customers. In both networks, demand charges based on measured demand are determined only for large customers, except for C3 in Network I in which the tariff includes a separate demand charge, billed according to a contracted demand. Tariffs applied to Group C1 in both networks are composed of fixed charges and a single-rate volumetric charge. Tariffs applied to groups C2 and C3 in both networks are composed of fixed charges and two-tiered ToU volumetric charges.

5. Results

The target turnovers (i.e., EUR 6.91 M and EUR 3.04 M), divided into different cost pools and resulting in portions depicted in Figure 2, are allocated to different customer groups using the methodology presented in Section 4. Energy-related costs are allocated by (2), and customer-related costs are allocated by (3), with the exception regarding meters that are allocated to tariff groups separately from other customer costs, and demand-related costs, which are allocated based on coincident demands by (1).

In Network I, there are some customers who are connected to the MV level (i.e., tariff group C5), which means that the network peak loads of the MV and LV network levels are different; so, it must be ensured that customers connected directly to the MV network pay only for using the HV and MV networks. The target turnovers are allocated to customer groups at each voltage level based on the corresponding maximum coinciding demands. In Network II, all customers are connected to the LV network, and the network costs, i.e., the HV, MV, and LV networks, are treated as one network and allocated to customer groups based on the peak hourly demand of that whole network. Cost shares based on the cost allocation of each customer group in both networks are presented in Table 5.

Table 5.

Cost shares of different tariff groups in the two networks studied, which are based on the selected cost drivers (i.e., number of customers, energy, and demand) at two network levels (i.e., MV network and LV network).

Unit prices for present tariff structures applied in the networks were calculated based on the methodology described in Section 4 to recover the target turnovers. Tariffs based on cost causation for the two networks are presented in Table 6 and Table 7. In Network I, fixed charges of the tariffs are uniform inside the same tariff group, which is widely applied in urban areas in Finland today. One justification for this practice is that in urban areas, the impact of the demand of an individual customer on the peak demand of the network level is lower because the network in a specific area serves a greater number of customers compared to the rural areas. Additionally, in urban areas, smaller customers are often situated in apartment buildings and the peak demands of individual customers are lower than those of customers situated in detached houses. In Network II, fixed charges are based on the connection size of the customer, with a higher fuse size resulting in a higher fixed charge. This aspect is very typical for Finnish DSOs operating in rural or other sparsely populated areas, where the impact of an individual customer on the peak demand of the network is clearer when compared to the densely populated urban areas. Tiered fixed charges steer the customer to consider the connection size as large fuse sizes impose higher costs on both the customer and the DSO. Single-rate volumetric charges are formed for C1 in both networks. For other tariff groups (C2, C3, C4, and C5), the volumetric charges include ToU features, which are based either on daytime (e.g., from 7 a.m. to 22 p.m.) and nighttime (e.g., from 22 p.m. to 7 a.m.) distribution or winter workday (e.g., Mon–Sat from 7 a.m. to 22 p.m.) and other time distribution. Demand charges are formed only for larger customers (i.e., C3, C4, and C5 in Network I and C3 in Network II). The reason is that in this study, the aim was to form tariff structures that are widely used in Finland today. Additionally, based on the methodology proposed in this article, alternative tariff structures, such as demand charges for small-scale customers, can also be determined. Examples of alternative tariff structures are presented, e.g., in [15,40].

Table 6.

Unit prices of tariffs based on cost causation in Network I. Demand charge used for C3 is based on contracted demand. For C4 and C5, the billing is based on measured demand.

Table 7.

Unit prices of tariffs based on cost causation in Network II.

To evaluate the impacts of tariffs that are presented in Table 6 and Table 7 on the turnover of the DSO, differences between the target and realized turnovers are presented in Table 8 for both networks. Differences in terms of percentage varied, especially in the case of volumetric charges, but due to the cost shares of energy-related costs being relatively small in relation to the total cost, that effect does not extend to the total differences in turnovers. A more significant effect would result from differences in the case of demand charges (except for C3 in Network II because the demand in that tariff group is billed based on the contracted demand), but as can be seen in the case of C4 in Network II, a larger difference in the case of one tariff group does not necessarily result in a large difference in the total turnover. This result is because the number of customers and the target turnover in the case of C4 in Network II are not very large when compared, e.g., to C1 or C2, which generates most of the turnover. The central result from Table 8 is that, in the end, the total differences in turnovers are small, 0.12% and −0.99%, respectively, which, from the DSO standpoint, mean a negligible surplus in Network I and almost a full cost recovery in Network II. Lastly, from Table 6 and Table 7, it can be observed that the tariffs depend fundamentally on fixed charges and demand charges. This result corresponds to the aspect pointed out in Section 1.1, where a significant portion of the costs of an DSO is either fixed or related to demand.

Table 8.

Differences between the realized and target turnovers in the studied networks.

The calculated tariffs are designed to illustrate what the unit prices of tariffs would be when the calculation is based on costs and the proposed methodology in these two specific network areas. This study highlights that the networks do not cover the entire operational areas of the two DSOs from where the data come. This means that the results do not propose what the pricing should be in any real implementation for these two DSOs. Additionally, as described in Section 3, various principles are involved in pricing that must be accounted for before the tariffs are ready before practical implementation. The adjustments needed to finalize tariffs are also often open to interpretation. For instance, if the results of the calculation indicate a significant need for changes to the present pricing, then these the changes should be made gradually rather than overnight to mitigate any large changes in the distribution fees to the customers. To highlight, as there is no single analytical solution to modify tariffs and comply with several other pricing principles—e.g., gradualism regarding any changes or simplicity in terms of tariff components or their mechanisms—these aspects are ruled to be outside the scope of this article, although their relevance is recognized.

6. Discussion

The results of the case study provided good results in terms of cost recovery, especially from the DSO standpoint (i.e., realized total turnovers were less than 1% off the targets). The proposed methodology, in addition to being transparent and relatively simple, provides a systematic approach that produces concrete bases and justifications for tariffs and their unit prices. This result is a relevant aspect because the societal acceptance of tariffs should be seen as an important issue in the case of monopolies. Additionally, in jurisdictions where the DSOs must justify their prices to the regulator, using a systematic approach to determine tariffs provides solid arguments for that discussion. As the approaches based on cost causation have not been widely studied, case studies based on real data are especially lacking, so this article fills a recognized gap, and the proposed methodology provides a starting point for future studies.

Additionally, the systematic approach used was based on cost causation, although modifications to the proposed methodology might be required. It can also be applied to design alternative pricing schemes for different customer groups and even for completely new emerging customer groups, such as energy communities [54]. This aspect is highly relevant because if changes are made to how customers are distributed to different groups or if completely new customer groups are added to the mix, that will affect the cost allocation, i.e., how costs are distributed to different customer groups and leading to potential changes in the prices of other tariffs, not just those of the new customer groups. The systematic methodology presented in this article does account for this aspect (e.g., tariffs can be recalculated by using other customer group settings as an input), and it is also a central argument for as to why there is a need for this kind of calculation methodology.

However, determining tariffs based on cost causation is also a process that involves compromises and decisions, and a universal one-size-fits-all method to determine tariffs still remains to be discovered. As shown in Section 4, the calculation process includes various details, so how they are accounted for creates uncertainty as to the results. For instance, the expected consumption depends on how the loads are modeled and how accurate these models are. As pointed out in [1], using raw smart metering data as load models is not necessarily a good approach compared to using statistical load models, since electricity use can vary significantly in consecutive years, e.g., due to temperature differences. Additionally, costs of the operation might be interpreted and allocated to customer groups in different ways. For instance, the operational costs could be treated as fixed costs, and they could be allocated directly to the fixed charges instead of treating them as demand-related costs.

In terms of future research work, alternative cost allocation methods should be explored to investigate their impacts on the cost shares of different customer groups and the tariff prices. In this article, a straightforward method was applied to allocate demand-related costs to different customer groups. The results achieved by using other allocation methods, such as allocating demand-related costs based on the average of some designated number of peak demands, might be different. Additionally, different methods to allocate customer-related costs should be explored. For instance, customers have different needs for customer service, and these aspects could be reflected more accurately in the cost allocation. Lastly, changes in the consumption patterns that result from incentives included in the tariffs should be investigated and accounted for as part of the tariff design process in the future. This aspect is relevant, especially when alternative pricing schemes are investigated. Different pricing schemes might affect the consumption patterns of customers, and these changes could be accounted for, e.g., by optimizing the consumption patterns to minimize distribution costs for the customer and recalculating tariff prices.

7. Conclusions

This article discusses the pricing of electricity distribution and provides a practical methodology to calculate distribution network tariffs using an approach based on cost causation. There are various factors that affect distribution network pricing, but as illustrated in this article, the unit prices for distribution network tariffs can be determined systematically based on the proposed methodology using real DSO data. Pricing of electricity distribution is a widely discussed topic, and the cost reflectivity of tariffs has often been a topic of debate. The cost reflectivity of the pricing could be improved by using well-founded calculation methods to determine tariffs based on cost causation, especially when novel pricing schemes are being developed for small-scale customers or new emerging customer types. As there are many changes happening in the current operating environment, there is a clear need to determine tariffs based on actual costs of operation, e.g., to boost the role of the DSO as a provider of a neutral market platform. Additionally, in some cases, such as in Finland, the regulator might obligate the DSOs to present the bases for their tariffs. When the tariffs are formed systematically based on costs and cost causation, their bases are concrete and well founded. The methodology proposed in this article offers a clear and transparent way to determine tariffs for various customer groups based on cost causation. Further, the methodology can be modified to account for several aspects, e.g., the differences between the operating environments of DSOs. The results of the case study based on real data show that the total difference in targeted and realized turnovers in two different networks was less than 1%, which is a good result in terms cost recovery for the DSO.

Author Contributions