The Economics of Electric Vehicles with Application to Electricity Grids

Abstract

:1. Introduction

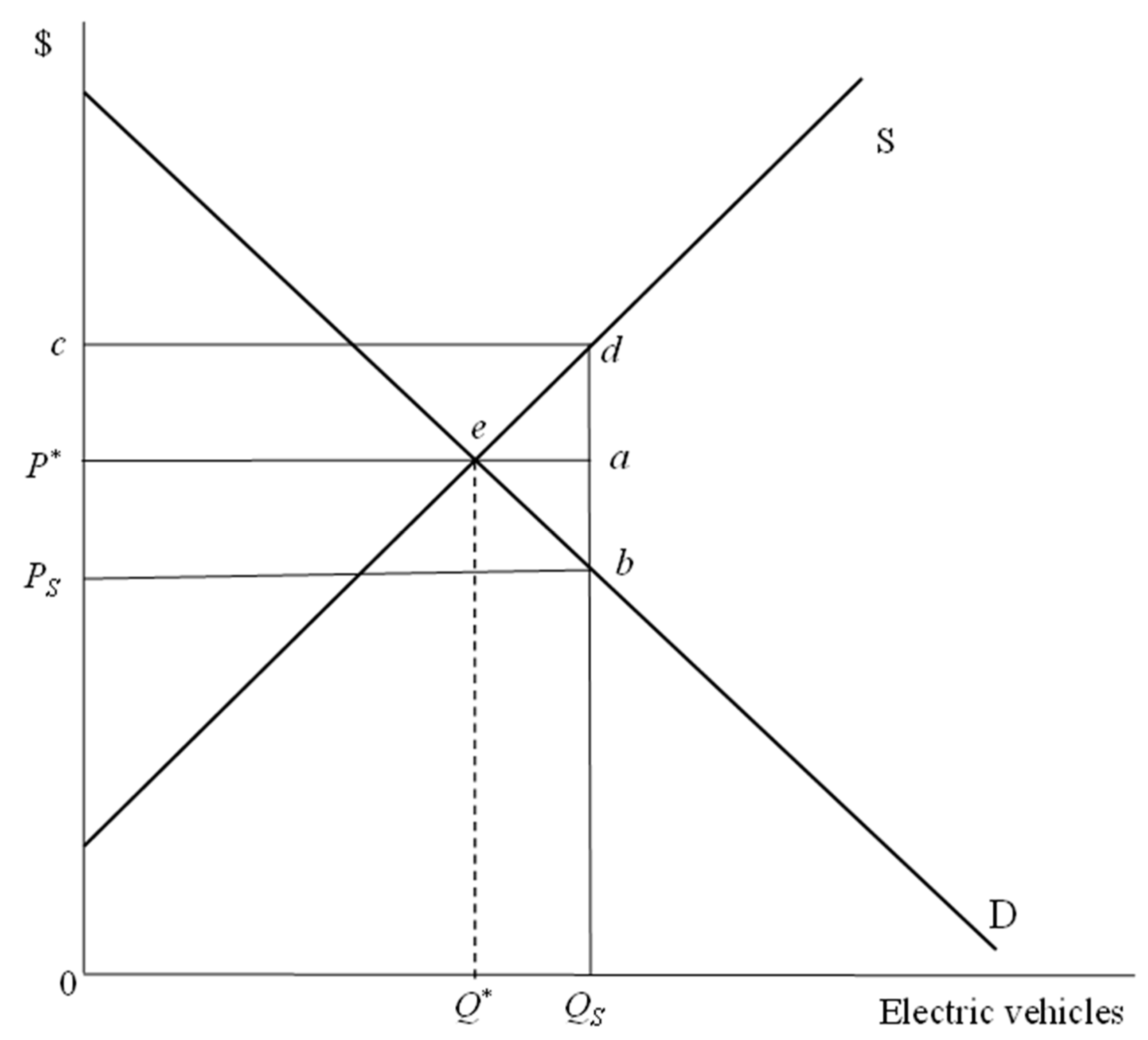

2. Economic Effects of Electric Vehicles

2.1. Direct Effects

2.2. Indirect Economic Effects

2.3. Electric Vehicle and Electricity Grids

3. Results: An Application to Canada

3.1. Electric Vehicle Registrations vs. Total Registrations

3.2. Potential Energy Sources

- Renewables include solar, wind, biomass, biofuels, and municipal solid waste sources.

- Hydro refers to run-of-river hydro, ‘storage hydro’ (hydraulics with large reservoir), wave, and tidal sources.

- Natural gas and oil refer to natural gas, biogas, oil, and diesel sources.

- Coal refers to coke and coal.

- Nuclear simply refers to nuclear power generation.

3.3. Monte Carlo Simulation

3.4. Discussion: Impact on Electricity Grids

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. R File Used in Monte Carlo Analysis

- library(extraDistr) #Load this library

- # To obtain random variates from a triangular distribution use:

- # rtriang(n, a = −1, b = 1, c = (a + b)/2)

- # a, b and c are minimum, maximum, and midpoint (mode, average, most likely)

- # of the distribution and n is the number of observations (iterations).

- set.seed(6) # Set random number seed to duplicate results if desired

- iter <- 10000 # Number of iterations

- jurisdiction <- c(‘Canada’, ‘British columbia’, ‘Alberta’, ‘Ontario’, ‘Quebec’)

- # Number of vehicles by jurisdiction plus average, min and max

- vehicles <- c(26302526, 3615356, 3519123, 9429566, 6007063)

- avAuto <- vehicles

- minAuto <- 0.75*vehicles

- maxAuto <- 1.25*vehicles

- # Distance traveled by vehicles in jurisdiction (km)

- avDistance <- c(15200, 15600, 13100, 16000, 14300)

- minDistance <- 0.9*avDistance

- maxDistance <- 1.2*avDistance

- # Battery efficiency energy (Wh/km)

- BatEfficiency <- rtriang(iter, 150.0, 295.0, 199.3)

- Region <- rep(0, 5); ElecMean<-Region; ElecStDev<-Region

- HydroPlants <- Region; GasPlants <- Region; Hrly <- Region

- turbines <- Region; turbcap <- Region

- for (i in 1:length(jurisdiction)){

- Region[i] <- jurisdiction[i]

- Number <- rtriang(iter, minAuto[i], maxAuto[i], avAuto[i])

- Distance <- rtriang(iter, minDistance[i], maxDistance[i], avDistance[i])

- Watts <- 0.000001*Number*Distance*BatEfficiency # MWh/8760

- ElecMean[i] <- mean(Watts) # GWh per year or MW per hour

- ElecStDev[i] <- sd(Watts) # Standard deviation

- HydroPlants[i] <- (ElecMean[i])/5100000

- GasPlants[i] <- (ElecMean[i])/5913000

- Hrly[i] <- ElecMean[i]/8760

- turbcap[i] <- 4*Hrly[i]

- turbines[i] <- (ElecMean[i])/7665

- }

- Info <- c(‘Item’, ‘Mean’, ‘Standard Deviation’)

- Output <- data.frame(rbind(jurisdiction, ElecMean, ElecStDev), row.names = Info)

- print(Output)

References

- Table: 23-10-0308-01; Vehicle Registrations, by Type of Vehicles and Fuel Type. Statistics Canada: Ottawa, ON, Canada, 2023. Available online: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=2310030801 (accessed on 19 July 2024).

- Government of Canada. Clean Energy Regulations. Available online: https://www.canada.ca/en/services/environment/weather/climatechange/climate-plan/clean-electricity-regulation.html (accessed on 19 July 2024).

- Jaeger, J. These Countries Are Adopting Electric Vehicles the Fastest; World Resources Institute: Washington, DC, USA, 14 September 2023; Available online: https://www.wri.org/insights/countries-adopting-electric-vehicles-fastest (accessed on 4 April 2024).

- Giswold, J.; Dong, M. Costing Support for EV Battery Manufacturing; Office of the Parliamentary Budget Officer: Ottawa, ON, Canada, 17 November 2023; 16p. Available online: https://distribution-a617274656661637473.pbo-dpb.ca/eaafeb418199ab141962f0b62dae824e9ab2efa95e5baddd1fb5ad774a3fe984 (accessed on 15 August 2024).

- BC Hydro. Press Release: Statement from BC Hydro on Site C Project. Available online: https://www.sitecproject.com/site-c-statement (accessed on 4 April 2024).

- BC Hydro. Site C Clean Energy Project. Available online: http://www.bchydro.com/planning_regulatory/site_c.html (accessed on 4 April 2024).

- He, S.; Luo, Y.S.; Sun, K. Factors affecting electric vehicle adoption intention: The impact of objective, perceived, and prospective charger accessibility. J. Transp. Land Use 2022, 15, 779–801. [Google Scholar] [CrossRef]

- Kim, S.Y.; Kang, M.J. A Study on the Factors Influencing the Purchase of Electric Vehicles. Intern. J. Internet Broad Comm. 2022, 14, 194–200. [Google Scholar]

- Machado, P.G.; Teixeira, A.C.R.; dos Santos, E.M.; Mouette, D. Electric vehicles adoption: A systematic review (2016–2020). WIREs Energy Environ. 2023, 12, e477. [Google Scholar] [CrossRef]

- Pang, J.; Ye, J.; Zhang, X. Factors influencing users’ willingness to use new energy vehicles. PLoS ONE 2023, 18, e0285815. [Google Scholar] [CrossRef] [PubMed]

- The Coming Electricity Crisis. The Coming Electricity Crisis. Available online: https://www.wsj.com/articles/electric-grid-crisis-biden-administration-climate-policy-energy-artificial-intelligence-cfc10b68 (accessed on 4 April 2024).

- CEC (Clean Energy Canada). The True Cost. Available online: https://cleanenergycanada.org/wp-content/uploads/2022/03/Report_TheTrueCost.pdf (accessed on 4 April 2024).

- Haynes, T. Electric Cars Losing Their Value Twice as fast as Petrol Alternatives. The Telegraph. Available online: https://www.telegraph.co.uk/money/consumer-affairs/electric-car-price-fall-second-hand-tesla-bmw/ (accessed on 10 May 2023).

- Mills, M.P. Mines, Minerals, and “Green” Energy: A Reality Check; Report; Manhattan Institute for Policy Research: New York, NY, USA, 2020; p. 20. Available online: https://manhattan.institute/article/mines-minerals-and-green-energy-a-reality-check (accessed on 6 March 2024).

- Mills, M.P. Electric Vehicle Illusions, Eye on the News. City J. 8 May 2023. Available online: https://www.city-journal.org/article/electric-vehicles-and-carbon-emissions?mc_cid=dd20b2f5be&mc_eid=3e8db95649 (accessed on 10 May 2023).

- Xia, C. Exploring the Determinants of Electric Vehicle Adoption in Canada: A Multi-City Study. Unpublished Master’s Thesis, Department of Economics, University of Victoria, Victoria, BC, Canada, 2024. [Google Scholar]

- CAA (Canadian Automobile Association). Electric Vehicles. 2024. Available online: https://www.caa.ca/sustainability/electric-vehicles/ (accessed on 4 April 2024).

- Government of British Columbia. Motor Fuel Tax and Carbon Tax Rates on Fuels and Substances. Available online: https://www2.gov.bc.ca/gov/content/taxes/sales-taxes/motor-fuel-carbon-tax/publications/motor-fuel-tax-and-carbon-tax-rates (accessed on 4 April 2024).

- Pittman, M. Electric Vehicles and the Impact on Infrastructure. Forbes, 29 December 2022. Available online: https://www.forbes.com/sites/forbestechcouncil/2022/12/29/electric-vehicles-and-the-impact-on-infrastructure/?sh=61fe76e1835d (accessed on 6 March 2024).

- Hayes, B. Caltrans Pilot Program Tests Replacing Gas Tax with Charging per Mile Driven. ABC EyeWitness News. 2024. Available online: https://abc7.com/post/caltrans-to-test-california-road-charge-for-miles-driven-instead-of-gas-tax/14828291/ (accessed on 9 July 2024).

- IEA (International Energy Agency). The Role of Critical Minerals in Clean Energy Transitions. In World Energy Outlook Special Report; IEA: Paris, France, 2021; p. 283. Available online: https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions (accessed on 10 May 2024).

- Michaux, S.P. Assessment of the Extra Capacity Required of Alternative Energy Electrical Power Systems to Completely Replace Fossil Fuels. GTK Report; Geological Survey of Finland: Espoo, Finland, 2021; p. 985. Available online: https://www.gtk.fi/en/research/ (accessed on 8 April 2024).

- World Nuclear Association. Mineral Requirements for Electricity Generation. 2021. Available online: https://www.world-nuclear.org/information-library/energy-and-the-environment/mineral-requirements-for-electricity-generation.aspx (accessed on 10 May 2023).

- Kara, S. Cobalt Red. How the Blood of the Congo Powers our Lives; St. Martin’s Press: New York, NY, USA, 2022. [Google Scholar]

- Charette, R.N. How EVs Are Reshaping Labor Markets. IEEE Spectr. 2023. Available online: https://spectrum.ieee.org/the-ev-transition-explained-2658797703 (accessed on 6 March 2024).

- California State Senate. SB 100, 100% Clean Energy. Available online: https://focus.senate.ca.gov/sb100/faqs (accessed on 9 July 2024).

- Table 17-10-0057-01; Projected Population, by Projection Scenario, Age and Gender, as of July 1 (x 1000). Statistics Canada: Ottawa, ON, Canada, 2024. [CrossRef]

- Table 20-10-0024-01; New Motor Vehicle Registrations, Quarterly. Statistics Canada: Ottawa, ON, Canada, 2024. [CrossRef]

- Table 20-10-0001-01; New Motor Vehicle Sales. Statistics Canada: Ottawa, ON, Canada. [CrossRef]

- Natural Resources Canada. ICF Grid Readiness Report. Available online: https://natural-resources.canada.ca/energy-efficiency/transportation-alternative-fuels/resource-library/3489 (accessed on 14 March 2024).

- Kintner-Meyer, M.; Davis, S.; Sridhar, S.; Bhatnagar, D.; Mahserejian, S.; Ghosal, M. Electric Vehicles at Scale–Phase I Analysis: High EV Adoption Impacts on the Western U.S. Power Grid. In PNNL Report 29894; Prepared for the U.S. Department of Energy under Contract DE-AC05-76RL01830; Pacific Northwest National Laboratory: Richland, WA, USA, 2020; 124p. [Google Scholar]

- Canada Energy Regulator. Available online: https://www.cer-rec.gc.ca/en/data-analysis/canada-energy-future/2021electricity/ (accessed on 8 March 2024).

- Table 25-10-0021-01; Electric Power, Electric Utilities and Industry, Annual Supply and Disposition. Statistics Canada: Ottawa, ON, Canada, 2024. [CrossRef]

- Natural Resources Canada. Canadian Vehicle Survey. 2010. Available online: https://oee.nrcan.gc.ca/publications/statistics/cvs08/chapter2.cfm?attr=0 (accessed on 6 March 2024).

- van Kooten, G.C. The Economics of Wind Power. Ann. Rev. Res. Econ. 2016, 8, 181–205. [Google Scholar] [CrossRef]

- Duan, J.; van Kooten, G.C.; Xuan Liu, X. Renewable Electricity Grids, Battery Storage and Missing Money. Res. Conserv. Recycl. 2020, 161, 105001. [Google Scholar] [CrossRef]

- van Kooten, G.C.; Withey, P.; Duan, J. How big a Battery? Renew. Energy 2020, 146, 196–204. [Google Scholar] [CrossRef]

- van Kooten, G.C.; Mokhtarzadeh, F. Optimal Investment in Electric Generating Capacity under Climate Policy. J. Environ. Manag. 2019, 232, 66–72. [Google Scholar] [CrossRef] [PubMed]

| Statistic | Capacity (kWh) | Energy (Wh/km) 1 | Range (km) | Weight (kg) |

|---|---|---|---|---|

| Mean | 70.2 | 199.3 | 357.5 | 1226.5 |

| Maximum | 123.0 | 295.0 | 685.0 | 2500.0 |

| Minimum | 16.7 | 150.0 | 95.0 | 300.0 |

| Median | 71.0 | 192.0 | 365.0 | 1000.0 |

| Observations | 299 | 299 | 299 | 188 |

| Canada | BC | Alberta | Ontario | Quebec | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Year | All Fuel Types | BEV & PHEV | All Fuel Types | BEV & PHEV | All Fuel Types | BEV & PHEV | All Fuel Types | BEV & PHEV | All Fuel Types | BEV & PHEV |

| 2017 | 24,618,831 | 43,807 | 3,268,655 | 8887 | 3,480,263 | 1349 | 8,711,241 | 13,547 | 5,575,518 | 18,876 |

| 2018 | 25,043,044 | 76,431 | 3,327,929 | 14,940 | 3,530,021 | 1996 | 8,875,296 | 26,252 | 5,706,344 | 31,780 |

| 2019 | 25,426,285 | 126,563 | 3,381,707 | 29,023 | 3,583,685 | 3224 | 9,036,981 | 37,294 | 5,801,503 | 54,880 |

| 2020 | 25,744,196 | 180,729 | 3,369,266 | 45,016 | 3,549,362 | 4601 | 9,335,112 | 46,253 | 5,913,745 | 81,507 |

| 2021 | 26,223,871 | 249,245 | 3,512,196 | 65,647 | 3,554,592 | 6765 | 9,456,317 | 60,369 | 5,987,358 | 110,903 |

| 2022 | 26,302,526 | 346,534 | 3,615,356 | 91,829 | 3,519,123 | 10,468 | 9,429,566 | 87,299 | 6,007,063 | 147,321 |

| Annual increase | 1.33% | 51.23% | 2.04% | 59.53% | 0.22% | 50.65% | 1.60% | 45.16% | 1.50% | 50.82% |

| PHEV as % of EVs | 40.9% | 27.7% | 42.3% | 43.2% | 46.4% | |||||

| Capacity | Generation | |

|---|---|---|

| Coal | 6.03% | 4.99% |

| Natural Gas | 15.25% | 11.93% |

| Oil | 2.45% | 0.56% |

| Hydro | 54.97% | 61.87% |

| Nuclear | 9.01% | 13.37% |

| Wind | 8.92% | 5.67% |

| Solar | 1.85% | 0.36% |

| Biomass | 1.53% | 1.24% |

| TOTAL | 100.0% | 100.0% |

| Level | 148.9 GW | 624 TWh |

| Jurisdiction | Domestic Electricity Supply (MWh) 1 | Average Distance Driven (km/year) 2 | Average Energy per EV Annually (kWh) 3 | Total Energy Use by EVs in Jurisdiction (MWh) 4 | % of Electricity Use in Jurisdiction |

|---|---|---|---|---|---|

| Canada | 578,273,577 | 15,200 | 3030 | 1,545,468 | 0.27% |

| Alberta | 79,531,379 | 15,600 | 3030 | n.a. | n.a. |

| BC | 67,053,704 | 13,100 | 2611 | 314,233 | 0.47% |

| Ontario | 135,308,943 | 16,000 | 3189 | 476,357 | 0.35% |

| Quebec | 210,693,634 | 14,300 | 2850 | 571,187 | 0.27% |

| Item | Canada | BC | Alberta | Ontario | Quebec |

|---|---|---|---|---|---|

| Annual increase (GWh) | |||||

| Mean | 88,787.7 | 12,543.2 | 10,245.4 | 33,558.0 | 19,071.9 |

| Standard deviation | 16,177.4 | 2313.8 | 1882.1 | 6258.5 | 3488.4 |

| Hourly increase (MW) | |||||

| Mean | 10,135.6 | 1431.9 | 1169.6 | 3830.8 | 2177.2 |

| Proportional increase | 15.4% | 15.8% | 15.3% | 24.8% | 9.1% |

| Potential hydro facilities needed 2 | |||||

| Based on mean increase | 17 | 3 | 2 | 7 | 4 |

| 95% guarantee 1 | 24 | 4 | 3 | 9 | 5 |

| Potential number of 750-MW capacity gas plants needed 3 | |||||

| Based on mean increase | 15 | 3 | 2 | 6 | 4 |

| 95% guarantee 1 | 21 | 3 | 3 | 8 | 5 |

| Wind power capacity and required turbines (3.5 MW cap) | |||||

| Capacity (MW) | 40,542 | 5727 | 4678 | 15,323 | 8709 |

| Number of turbines | 11,584 | 1636 | 1337 | 4378 | 2488 |

| 95% guarantee 1 | 15,805 | 2240 | 1828 | 6011 | 3398 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

van Kooten, G.C.; Stobbe, T.E. The Economics of Electric Vehicles with Application to Electricity Grids. Energies 2024, 17, 4109. https://doi.org/10.3390/en17164109

van Kooten GC, Stobbe TE. The Economics of Electric Vehicles with Application to Electricity Grids. Energies. 2024; 17(16):4109. https://doi.org/10.3390/en17164109

Chicago/Turabian Stylevan Kooten, G. Cornelis, and Tracy E. Stobbe. 2024. "The Economics of Electric Vehicles with Application to Electricity Grids" Energies 17, no. 16: 4109. https://doi.org/10.3390/en17164109