Global Geopolitical Changes and New/Renewable Energy Game

Abstract

:1. Introduction

2. Literature Review

2.1. Historical Overview of Energy Transition Geopolitics

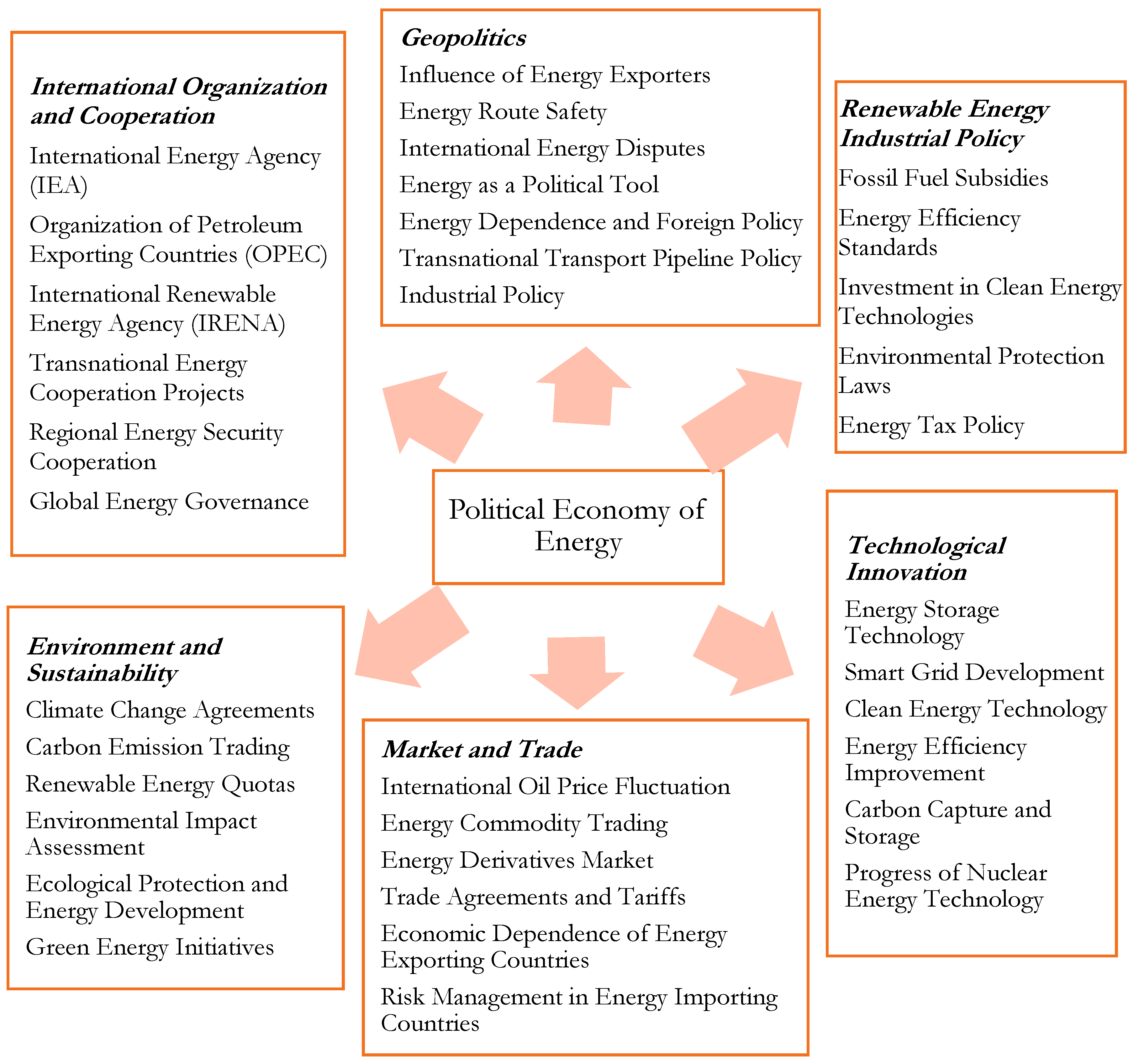

2.2. The Factors of Energy Politics and Economy

2.3. Important Events in the Political and Economic Development of Energy

2.4. Summary

3. Theoretical Framework and Research Methods

3.1. Theoretical Framework and Hypotheses

3.2. Establishment of the Game Theory Model

3.3. Analysis of the Game Theory Model

4. Results and Discussions

4.1. Economic Models and Energy System Selection

4.2. Profit Maximization and Strategic Behavior of Firms

4.3. The Impact of New and Renewable Energy (NRE) Policies on Energy Security

4.4. The Geopolitical Implications of NRE Policies and International Cooperation

5. Conclusions and Policy Recommendations

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Lin, B.; Shi, L. Do environmental quality and policy changes affect the evolution of consumers’ intentions to buy new energy vehicles. Appl. Energy 2022, 310, 118582. [Google Scholar] [CrossRef]

- Wang, Y.; Yu, L. Can the current environmental tax rate promote green technology innovation?—Evidence from China’s resource-based industries. J. Clean. Prod. 2021, 278, 123443. [Google Scholar] [CrossRef]

- Qin, B.; Wang, H.; Liao, Y.; Liu, D.; Wang, Z.; Li, F. Liquid hydrogen superconducting transmission based super energy pipeline for Pacific Rim in the context of global energy sustainable development. Int. J. Hydrogen Energy 2024, 56, 1391–1396. [Google Scholar] [CrossRef]

- Wang, C.; Yan, C.; Li, G.; Liu, S.; Bie, Z. Risk assessment of integrated electricity and heat system with independent energy operators based on Stackelberg game. Energy 2020, 198, 117349. [Google Scholar] [CrossRef]

- Jerzyniak, T.; Herranz-Surrallés, A. EU Geoeconomic Power in the Clean Energy Transition. JCMS J. Common Mark. Stud. 2024, 62, 1028–1045. [Google Scholar] [CrossRef]

- Wu, Z.; Fan, X.; Zhu, B.; Xia, J.; Zhang, L.; Wang, P. Do government subsidies improve innovation investment for new energy firms: A quasi-natural experiment of China’s listed companies. Technol. Forecast. Soc. Chang. 2022, 175, 121418. [Google Scholar] [CrossRef]

- Wu, H.; Hu, S. The impact of synergy effect between government subsidies and slack resources on green technology innovation. J. Clean. Prod. 2020, 274, 122682. [Google Scholar] [CrossRef]

- Bai, X.; Chen, H.; Oliver, B.G. The health effects of traffic-related air pollution: A review focused the health effects of going green. Chemosphere 2022, 289, 133082. [Google Scholar] [CrossRef]

- Isik, M.; Dodder, R.; Kaplan, P.O. Transportation emissions scenarios for New York City under different carbon intensities of electricity and electric vehicle adoption rates. Nat. Energy 2021, 6, 92–104. [Google Scholar] [CrossRef] [PubMed]

- Qi, G.; Jia, Y.; Zou, H. Is institutional pressure the mother of green innovation? Examining the moderating effect of absorptive capacity. J. Clean. Prod. 2021, 278, 123957. [Google Scholar] [CrossRef]

- Chen, Y.; Ni, L.; Liu, K. Innovation efficiency and technology heterogeneity within China’s new energy vehicle industry: A two-stage NSBM approach embedded in a three-hierarchy meta-frontier framework. Energy Policy 2022, 161, 112708. [Google Scholar] [CrossRef]

- Ma, S.; He, Y.; Gu, R.; Li, S. Sustainable supply chain management considering technology investments and government intervention. Transp. Res. Part E Logist. Transp. Rev. 2021, 149, 102290. [Google Scholar] [CrossRef]

- Tan, R.; Tang, D.; Lin, B. Policy impact of new energy vehicles promotion on air quality in Chinese cities. Energy Policy 2018, 118, 33–40. [Google Scholar] [CrossRef]

- Ge, T.; Cai, X.; Song, X. How does renewable energy technology innovation affect the upgrading of industrial structure? The moderating effect of green finance. Renew. Energy 2022, 197, 1106–1114. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Newell, P.; Carley, S.; Fanzo, J. Equity, technological innovation and sustainable behaviour in a low-carbon future. Nat. Hum. Behav. 2022, 6, 326–337. [Google Scholar] [CrossRef] [PubMed]

- Blondeel, M.; Price, J.; Bradshaw, M.; Pye, S.; Dodds, P.; Kuzemko, C.; Bridge, G. Global energy scenarios: A geopolitical reality check. Glob. Environ. Chang. 2024, 84, 102781. [Google Scholar] [CrossRef]

- Jin, J.; McKelvey, M. Building a sectoral innovation system for new energy vehicles in Hangzhou, China: Insights from evolutionary economics and strategic niche management. J. Clean. Prod. 2019, 224, 1–9. [Google Scholar] [CrossRef]

- Patidar, A.K.; Jain, P.; Dhasmana, P.; Choudhury, T. Impact of global events on crude oil economy: A comprehensive review of the geopolitics of energy and economic polarization. GeoJournal 2024, 89, 50. [Google Scholar] [CrossRef]

- Liu, J.; Chen, J.; Wang, C.; Chen, Z.; Liu, X. Market Trading Model of Urban Energy Internet Based on Tripartite Game Theory. Energies 2020, 13, 1834. [Google Scholar] [CrossRef]

- Miao, C.; Fang, D.; Sun, L.; Luo, Q. Natural resources utilization efficiency under the influence of green technological innovation. Resour. Conserv. Recycl. 2017, 126, 153–161. [Google Scholar] [CrossRef]

- Gong, M.; Dai, A. Multiparty Evolutionary Game Strategy for Green Technology Innovation Under Market Orientation and Pandemics. Front. Public Heal. 2022, 9, 821172. [Google Scholar] [CrossRef] [PubMed]

- Lin, B.; Ma, R. Green technology innovations, urban innovation environment and CO2 emission reduction in China: Fresh evidence from a partially linear functional-coefficient panel model. Technol. Forecast. Soc. Chang. 2022, 176, 121434. [Google Scholar] [CrossRef]

- Zhao, M.; Sun, T.; Feng, Q. Capital allocation efficiency, technological innovation and vehicle carbon emissions: Evidence from a panel threshold model of Chinese new energy vehicles enterprises. Sci. Total. Environ. 2021, 784, 147104. [Google Scholar] [CrossRef] [PubMed]

- Cao, Y.; Li, L.; Zhang, Y.; Liu, Z.; Wang, L.; Wu, F.; You, J. Co-products recovery does not necessarily mitigate environmental and economic tradeoffs in lithium-ion battery recycling. Resour. Conserv. Recycl. 2023, 188, 106689. [Google Scholar]

- Wu, G.; Xu, Q.; Niu, X.; Tao, L. How Does Government Policy Improve Green Technology Innovation: An Empirical Study in China. Front. Environ. Sci. 2022, 9, 799794. [Google Scholar] [CrossRef]

- Hammad, M.A.; Elgazzar, S.; Jereb, B.; Sternad, M. Requirements for Establishing Energy Hubs: Practical Perspective. Amfiteatru Econ. 2023, 25, 798–812. [Google Scholar] [CrossRef] [PubMed]

- Idowu, A.; Ohikhuare, O.M.; Chowdhury, M.A. Does industrialization trigger carbon emissions through energy consumption? Evidence from OPEC countries and high industrialised countries. Math. Biosci. Eng. 2023, 7, 165–186. [Google Scholar] [CrossRef]

- Awada, M.; Mestre, R. Revisiting the Energy-Growth nexus with debt channel. A wavelet time-frequency analysis for a panel of Eurozone-OECD countries. Data Sci. Financ. Econ. 2023, 3, 133–151. [Google Scholar] [CrossRef]

- Li, Z.; Huang, Z.; Su, Y. New media environment, environmental regulation and corporate green technology innovation: Evidence from China. Energy Econ. 2023, 119, 106545. [Google Scholar] [CrossRef]

- Wang, Z.; Li, X.; Xue, X.; Liu, Y. More government subsidies, more green innovation? The evidence from Chinese new energy vehicle enterprises. Renew. Energy 2022, 197, 11–21. [Google Scholar] [CrossRef]

- Dingbang, C.; Cang, C.; Qing, C.; Lili, S.; Caiyun, C. Does new energy consumption conducive to controlling fossil energy consumption and carbon emissions?-Evidence from China. Resour. Policy 2021, 74, 102427. [Google Scholar] [CrossRef]

- Novikau, A.; Muhasilović, J. Turkey’s quest to become a regional energy hub: Challenges and opportunities. Heliyon 2023, 9, e21535. [Google Scholar] [CrossRef] [PubMed]

- Mao, Y.; Li, P.; Li, Y. Exploring the promotion of green technology innovation in the new energy vehicle industry: An evolutionary game analysis. Environ. Sci. Pollut. Res. 2023, 30, 81038–81054. [Google Scholar] [CrossRef]

- Ren, G.; Ma, G.; Cong, N. Review of electrical energy storage system for vehicular applications. Renew. Sustain. Energy Rev. 2015, 41, 225–236. [Google Scholar] [CrossRef]

- Bian, X.; Chen, P.; Gao, Z.; Fang, G. How to promote the energy transition?—An analysis based on the size and technology effect in new energy industry. Front. Energy Res. 2023, 10, 1082368. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, Y.; Huang, Y.; Li, F.; Zeng, M.; Li, J.; Wang, X.; Zhang, F. Planning and operation method of the regional integrated energy system considering economy and environment. Energy 2019, 171, 731–750. [Google Scholar] [CrossRef]

- Zuo, W.; Li, Y.; Wang, Y. Research on the optimization of new energy vehicle industry research and development subsidy about generic technology based on the three-way decisions. J. Clean. Prod. 2019, 212, 46–55. [Google Scholar] [CrossRef]

- Nilssen, T. Two Kinds of Consumer Switching Costs. RAND J. Econ. 1992, 23, 579. [Google Scholar] [CrossRef]

- Markvart, T.; Bogus, K. Solar Electricity; Wiley: New York, NY, USA, 1994. [Google Scholar]

- World Energy Council. New Renewable Energy Resources: A Guide to the Future; Kogan Page: London, UK, 1994. [Google Scholar]

- Klemperer, P. Competition when Consumers have Switching Costs: An Overview with Applications to Industrial Organization, Macroeconomics, and International Trade. Rev. Econ. Stud. 1995, 62, 515–539. [Google Scholar] [CrossRef]

- Sharpe, S.A. The Effect of Consumer Switching Costs on Prices: A Theory and its Application to the Bank Deposit Market. Rev. Ind. Organ. 1997, 12, 79–94. [Google Scholar] [CrossRef]

- Shy, O. The Economics of Network Industries; Cambridge University Press (CUP): Cambridge, UK, 2000. [Google Scholar]

- Shy, O. A quick-and-easy method for estimating switching costs. Int. J. Ind. Organ. 2002, 20, 71–87. [Google Scholar] [CrossRef]

- Shan, H.; Yang, J. Promoting the implementation of extended producer responsibility systems in China: A behavioral game perspective. J. Clean. Prod. 2020, 250, 119446. [Google Scholar] [CrossRef]

- Clements, M.T. Direct and indirect network effects: Are they equivalent? Int. J. Ind. Organ. 2004, 22, 633–645. [Google Scholar] [CrossRef]

- Farrell, J.; Saloner, G. Standardization, compatibility, and innovation. Rand J. Econ. 1985, 16, 70–83. [Google Scholar] [CrossRef]

- Katz, M.L.; Shapiro, C. Network externalities, competition, and compatibility. Am. Econ. Rev. 1985, 75, 424–440. [Google Scholar]

- Cabral, L.M.; Salant, D.J.; A Woroch, G. Monopoly pricing with network externalities. Int. J. Ind. Organ. 1999, 17, 199–214. [Google Scholar] [CrossRef]

- Rohlfs, J. A Theory of Interdependent Demand for a Communications Service. Bell J. Econ. Manag. Sci. 1974, 5, 16. [Google Scholar] [CrossRef]

- Economides, N. The economics of networks. Int. J. Ind. Organ. 1996, 14, 673–699. [Google Scholar] [CrossRef]

- Su, D.; Gu, Y.; Du, Q.; Zhou, W.; Huang, Y. Factors affecting user satisfaction with new energy vehicles: A field survey in Shanghai and Nanjing. J. Environ. Manag. 2020, 270, 110857. [Google Scholar] [CrossRef]

- Willis, H.; Scott, W. Distributed Power Generation; Taylor & Francis: London, UK, 2000; ISBN 9780824703363. [Google Scholar]

- Henard, D.H.; Szymanski, D.M. Why Some New Products are More Successful than Others. J. Mark. Res. 2001, 38, 362–375. [Google Scholar] [CrossRef]

- Heil, O.P.; Walters, R.G. Explaining Competitive Reactions to New Products: An Empirical Signaling Study. J. Prod. Innov. Manag. 1993, 10, 53–65. [Google Scholar] [CrossRef]

- Lilly, B.; Walters, R. Toward a model of new product preannouncement timing. J. Prod. Innov. Manag. 1997, 14, 4–20. [Google Scholar] [CrossRef]

- Calantone, R.J.; Schatzel, K.E. Strategic Foretelling: Communication-Based Antecedents of a Firm’s Propensity to Preannounce. J. Mark. 2000, 64, 17–30. [Google Scholar] [CrossRef]

- Boonea, D.S.; Lemonb, K.N.; Staelin, R. The impact of firm introductory strategies on consumers’ perceptions of future product introductions and purchase decisions. J. Prod. Innov. Manag. 2001, 18, 96–109. [Google Scholar] [CrossRef]

- Schatzel, K. Beyond the firm’s initial declaration: Are preannouncements of new product introductions and withdrawals alike? J. Prod. Innov. Manag. 2001, 18, 82–95. [Google Scholar] [CrossRef]

- Katz, M.L.; Shapiro, C. Systems Competition and Network Effects. J. Econ. Perspect. 1994, 8, 93–115. [Google Scholar] [CrossRef]

- Besen, S.M.; Farrell, J. Choosing How to Compete: Strategies and Tactics in Standardization. J. Econ. Perspect. 1994, 8, 117–131. [Google Scholar] [CrossRef]

- David, P.A. Clio and the economics of QWERTY. Am. Econ. Rev. 1985, 75, 332–337. [Google Scholar]

- Farrell, J.; Saloner, G. Installed base and compatibility: Innovation, product preannouncements, and predation. Am. Econ. Rev. 1986, 76, 940–955. [Google Scholar]

- Farrell, J.; Saloner, G. Standardization and variety. Econ. Lett. 1986, 20, 71–74. [Google Scholar] [CrossRef]

- Liebowitz, S.J.; Margolis, S.E. Path dependence, lock-in, and history. J. Law Econ. Organ. 1995, 11, 205–226. [Google Scholar] [CrossRef]

- Han, J.; Guo, J.-E.; Cai, X.; Lv, C.; Lev, B. An analysis on strategy evolution of research & development in cooperative innovation network of new energy vehicle within policy transition period. Omega 2022, 112, 102686. [Google Scholar] [CrossRef]

- Hussain, J.; Lee, C. A green path towards sustainable development: Optimal behavior of the duopoly game model with carbon neutrality instruments. Sustain. Dev. 2022, 30, 1523–1541. [Google Scholar] [CrossRef]

- Yang, T.; Yuan, Z.; Xing, C. Research on China’s fiscal and taxation policy of new energy vehicle industry technological innovation. Econ. Res. Istraz. 2022, 36, 2108100. [Google Scholar] [CrossRef]

- Carlson, E.L.; Pickford, K.; Nyga-Łukaszewska, H. Green hydrogen and an evolving concept of energy security: Challenges and comparisons. Renew. Energy 2023, 219, 119410. [Google Scholar] [CrossRef]

- Lee, C.-C.; Hussain, J. Optimal behavior of environmental regulations to reduce carbon emissions: A simulation-based dual green gaming model. Environ. Sci. Pollut. Res. 2022, 29, 56037–56054. [Google Scholar] [CrossRef] [PubMed]

- Yu, Z.; Wan, Y.J.; Jun, C.Y. Research on the factors influencing the competitiveness of Chinese NEVs: A study from the perspective of GVC. J. Bus. Res. 2021, 36, 53–71. [Google Scholar] [CrossRef]

- Yue, W.; Liu, Y.; Tong, Y.; Song, Z. Role of government subsidies in the new energy vehicle charging infrastructure industry: A three-party game perspective. Chin. J. Popul. Resour. Environ. 2021, 19, 143–150. [Google Scholar] [CrossRef]

- Zhang, Y.; Hu, H.; Zhu, G.; You, D. The impact of environmental regulation on enterprises’ green innovation under the constraint of external financing: Evidence from China’s industrial firms. Environ. Sci. Pollut. Res. 2022, 30, 42943–42964. [Google Scholar] [CrossRef] [PubMed]

- Jember, A.G.; Xu, W.; Pan, C.; Zhao, X.; Ren, X.-C. Game and Contract Theory-Based Energy Transaction Management for Internet of Electric Vehicle. IEEE Access 2020, 8, 203478–203487. [Google Scholar] [CrossRef]

- Hussain, J.; Lee, C.-C.; Chen, Y. Optimal green technology investment and emission reduction in emissions generating companies under the support of green bond and subsidy. Technol. Forecast. Soc. Chang. 2022, 183, 121952. [Google Scholar] [CrossRef]

- Dubský, Z.; Tichý, L. The role of narratives in the discourse on energy security of the European Commission: The EU’s transition in energy relations with Russia. Extr. Ind. Soc. 2024, 17, 101392. [Google Scholar] [CrossRef]

- Ghorbani, Y.; Zhang, S.E.; Nwaila, G.T.; Bourdeau, J.E.; Rose, D.H. Embracing a diverse approach to a globally inclusive green energy transition: Moving beyond decarbonisation and recognising realistic carbon reduction strategies. J. Clean. Prod. 2023, 434, 140414. [Google Scholar] [CrossRef]

- Tan, R.; Lin, B. Public perception of new energy vehicles: Evidence from willingness to pay for new energy bus fares in China. Energy Policy 2019, 130, 347–354. [Google Scholar] [CrossRef]

- Deng, Y.; You, D.; Wang, J. Research on the nonlinear mechanism underlying the effect of tax competition on green technology innovation—An analysis based on the dynamic spatial Durbin model and the threshold panel model. Resour. Policy 2022, 76, 102545. [Google Scholar] [CrossRef]

- Cai, X.; Zhu, B.; Zhang, H.; Li, L.; Xie, M. Can direct environmental regulation promote green technology innovation in heavily polluting industries? Evidence from Chinese listed companies. Sci. Total. Environ. 2020, 746, 140810. [Google Scholar] [CrossRef]

- Cabral, L.M.B. Introduction to Industrial Organization; MIT Press: Cambridge, MA, USA, 2000; ISBN 9780262032865. [Google Scholar]

- Sun, X.; Liu, X.; Wang, Y.; Yuan, F. The effects of public subsidies on emerging industry: An agent-based model of the electric vehicle industry. Technol. Forecast. Soc. Chang. 2019, 140, 281–295. [Google Scholar] [CrossRef]

- Aswani, R.S.; Sajith, S.; Kumar, A. Can offshore wind energy bridge geopolitical asymmetries through cooperative sustainable development in the South China Sea? Asian J. Political Sci. 2023, 31, 140–160. [Google Scholar] [CrossRef]

- Chen, Z.; Wang, T.; Mao, Y. Strategies of stakeholders to promote distributed photovoltaics in China: An evolutionary game study. Energy Rep. 2022, 8, 11039–11051. [Google Scholar] [CrossRef]

- Schuetze, B.; Hussein, H. The geopolitical economy of an undermined energy transition: The case of Jordan. Energy Policy 2023, 180, 113655. [Google Scholar] [CrossRef]

- Loh, J.R.; Bellam, S. Towards net zero: Evaluating energy security in Singapore using system dynamics modelling. Appl. Energy 2024, 358, 122537. [Google Scholar] [CrossRef]

| Aspect | Strategic Benefits | Diminishing Marginal Costs | Indirect Network Externalities |

|---|---|---|---|

| Core Focus | Policy advantages for energy security and stature. | Cost reduction at scale for initial high-investment technologies. | Value increase from complementary products and services. |

| Market Impact | Spurs sector innovation and competitiveness. | Encourages investment and scale for cost-effectiveness. | Boosts system attractiveness and adoption. |

| Policy Strategy | Maximize benefits in policy design. | Incentivize scale expansion and technology adoption. | Develop synergistic technologies and infrastructure. |

| Economic Outcome | Stimulates economic growth and jobs. | Makes NRE more financially viable over time. | Enhances system economic viability through externalities. |

| Technological Impact | Supports R&D for new energy technologies. | Scale leads to technological improvements. | Complementary tech development such as smart grids. |

| Global Standing | Enhances international influence in energy. | Facilitates shared benefits through global cooperation. | Nations compete/collaborate on complementary tech advancement. |

| Sustainability Goal | Leads in low-carbon transition. | Ensures long-term cost-effective sustainable systems. | Establishes robust tech ecosystem for energy systems. |

| Aspect | Description | Theoretical Foundation | Market Dynamics |

|---|---|---|---|

| Stakeholders | National governments, energy corporations, consumers, international organizations | Game Theory, Non-cooperative game models | Strategic interactions, Rivalry, Collaboration |

| Decision Making | Entities prioritize self-interest without a cooperative framework | Bounded Rationality, Strategic Interaction | Policy Simulation, Sensitivity Analysis |

| Policy Formulation | Iterative processes, multi-level and multi-stakeholder interactions | Repeated Games, Multi-level Games | Influence of indirect network externalities |

| Economic Framework | Construction of a comprehensive framework for energy project appraisal | Incomplete Information | Equilibrium price analysis |

| Technological Advancement | NRE policies driving tech innovation and strategic international interactions | Technological progress reducing costs | |

| International Relations | Policies as mechanisms for global image curation and leadership | Pricing trends affecting market dynamics | |

| Energy Security and Sustainable Development | Transitioning towards sustainable energy systems | Consumer choices, Investment preferences |

| Aspect of NRE Policies | Description of Impact | Influence on Market Participants | Game Theory Implications |

|---|---|---|---|

| Economic Incentives | Subsidies, tax incentives | Alter corporate and consumer preferences towards NRE | Changes payoff functions, incentivizes NRE |

| Constraints | Carbon taxes, environmental regulations | Shifts cost structure away from fossil fuels | Dominant strategy for NRE emerges |

| Cost Reduction | Subsidies for NRE projects | Lowers effective cost of NRE systems | Makes “low price for NRE” more prevalent |

| Market Transition | Carbon tax on fossil fuels | Increases cost of fossil energy systems | Accelerates shift towards NRE systems |

| Innovation and Demand Shift | Policy adjustments | Stimulates original innovation and consumer demand | Catalyst for market transformation |

| Network Externalities | Positive feedback loop | Increases adoption of NRE technologies | Elevates NRE as optimal response |

| Infrastructure Investment | Charging stations, smart grids | Enhances market competitiveness of NRE systems | Amplifies attractiveness and network effects |

| Public Awareness | Education and awareness campaigns | Increases social acceptance and demand | Indirectly amplifies network externalities |

| Diversity and Adaptability | Broadens energy supply options | Increases market’s strategic landscape | Enhances stability and resilience |

| Flexibility in Supply | Diversified energy sources | Enables market stabilization and resistance to shocks | Swift reconfiguration in supply constraints |

| High Prices for NRE Systems | Low Prices for NRE Systems | |

|---|---|---|

| High Number of Manufacturers of NRE Systems () | The attractiveness of NRE systems increased, but fossil energy systems remain somewhat attractive due to the high number of manufacturers. | Fossil energy systems are more attractive, and manufacturers tend to use fossil energy. |

| Low Number of Manufacturers of NRE Systems () | NRE systems are significantly more attractive, with manufacturers turning heavily to NRE. | High prices for NRE systems may inhibit conversion, but network effects may promote some conversion. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, X.; Huang, W. Global Geopolitical Changes and New/Renewable Energy Game. Energies 2024, 17, 4115. https://doi.org/10.3390/en17164115

Zhao X, Huang W. Global Geopolitical Changes and New/Renewable Energy Game. Energies. 2024; 17(16):4115. https://doi.org/10.3390/en17164115

Chicago/Turabian StyleZhao, Xuemeng, and Weilun Huang. 2024. "Global Geopolitical Changes and New/Renewable Energy Game" Energies 17, no. 16: 4115. https://doi.org/10.3390/en17164115