Assessment of Regulatory and Market Challenges in the Economic Feasibility of a Nanogrid: A Brazilian Case

Abstract

:1. Introduction

- Proposal of an economic evaluation model specifically designed for nanogrids, taking into account the uncertainties associated with both consumption and generation;

- Evaluation of the impact of tariff incentives on the economic viability of nanogrid-type microgrids with EV charging stations. In the Brazilian context, the results can be used by policy-makers to make well-founded decisions;

- An economic model based on electric quantities that allows monitoring of power, voltages, and currents on the nanogrid components throughout the entire evaluation period. Additionally, the technical impacts on the main grid, in connected mode, are available for analysis.

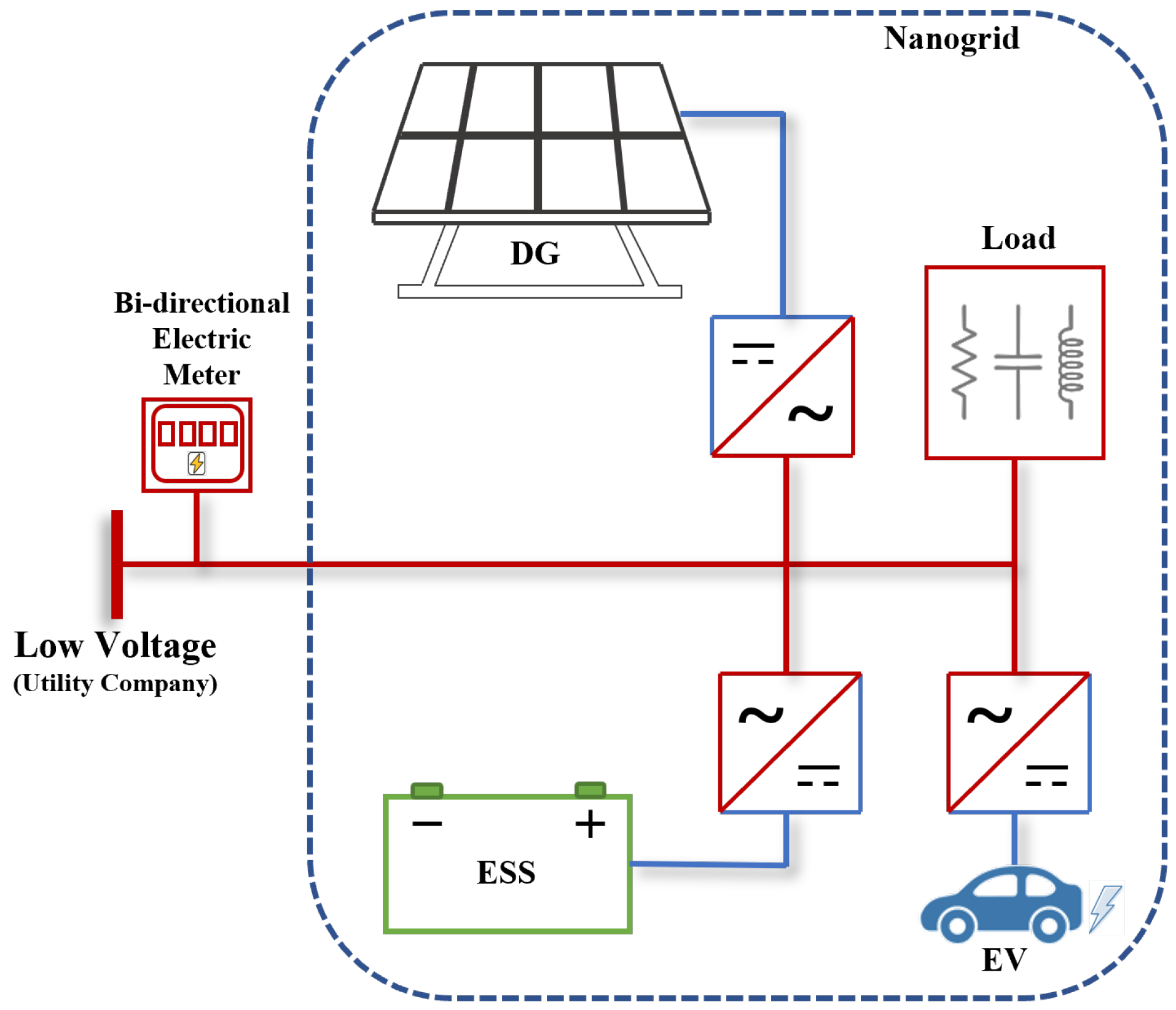

2. Background of Nanogrids

2.1. Basic Concepts

2.2. Literature Review

3. Technoeconomic Evaluation Model

3.1. Total Cost of Investment and Operation

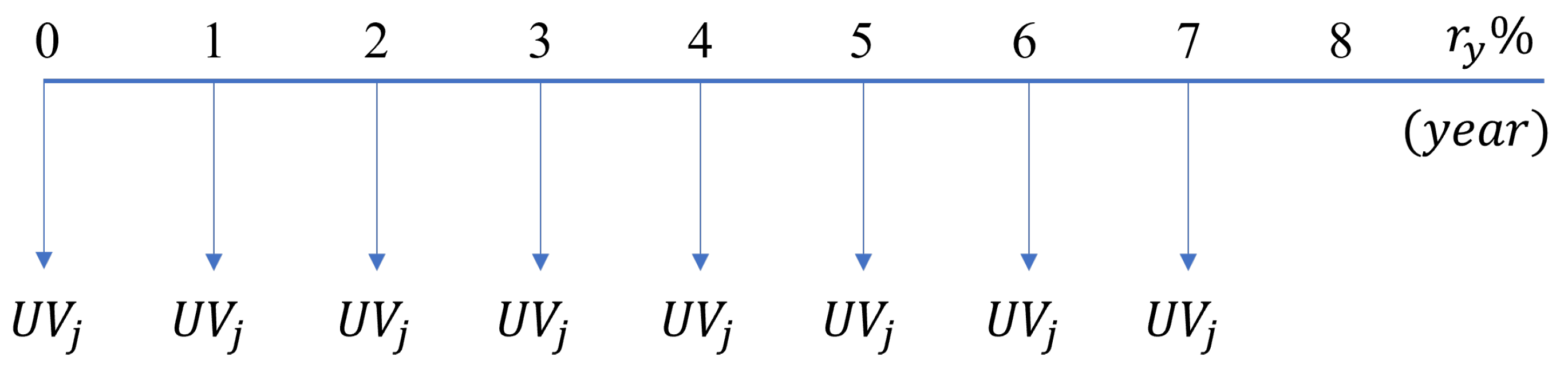

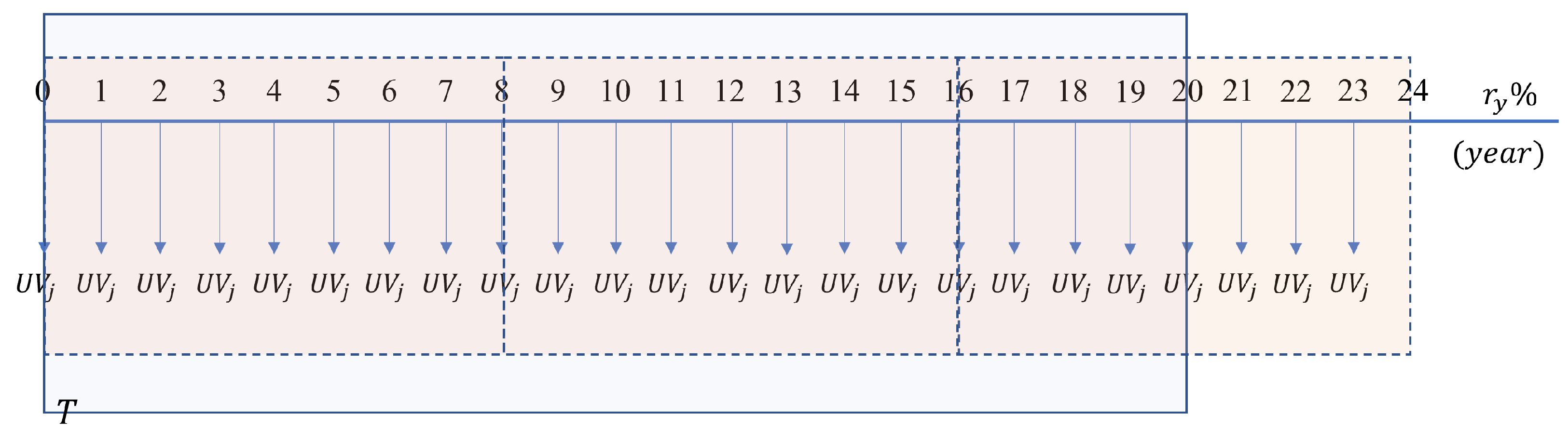

3.2. Expected Discounted Payback

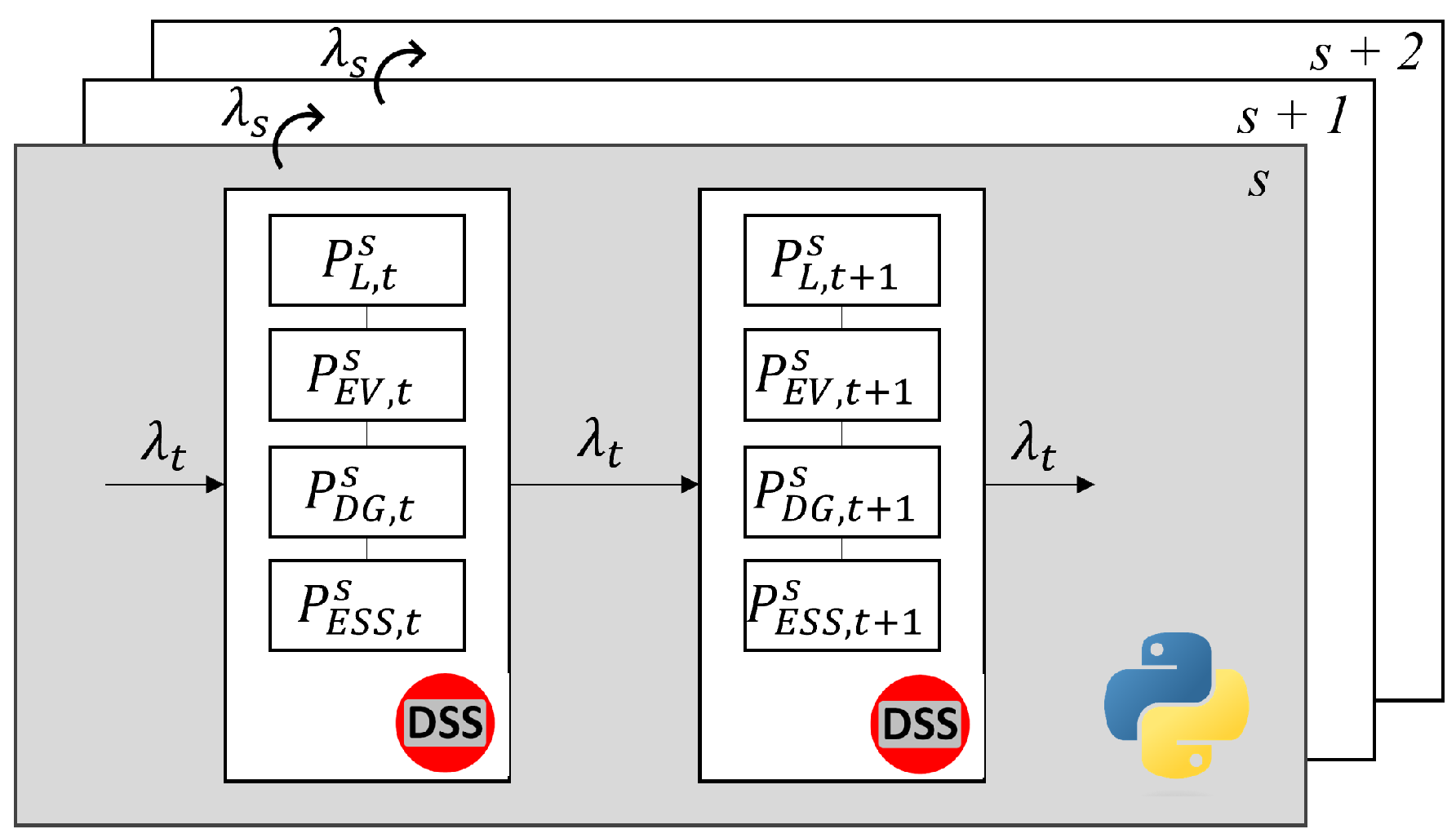

3.3. Uncertainties Representation

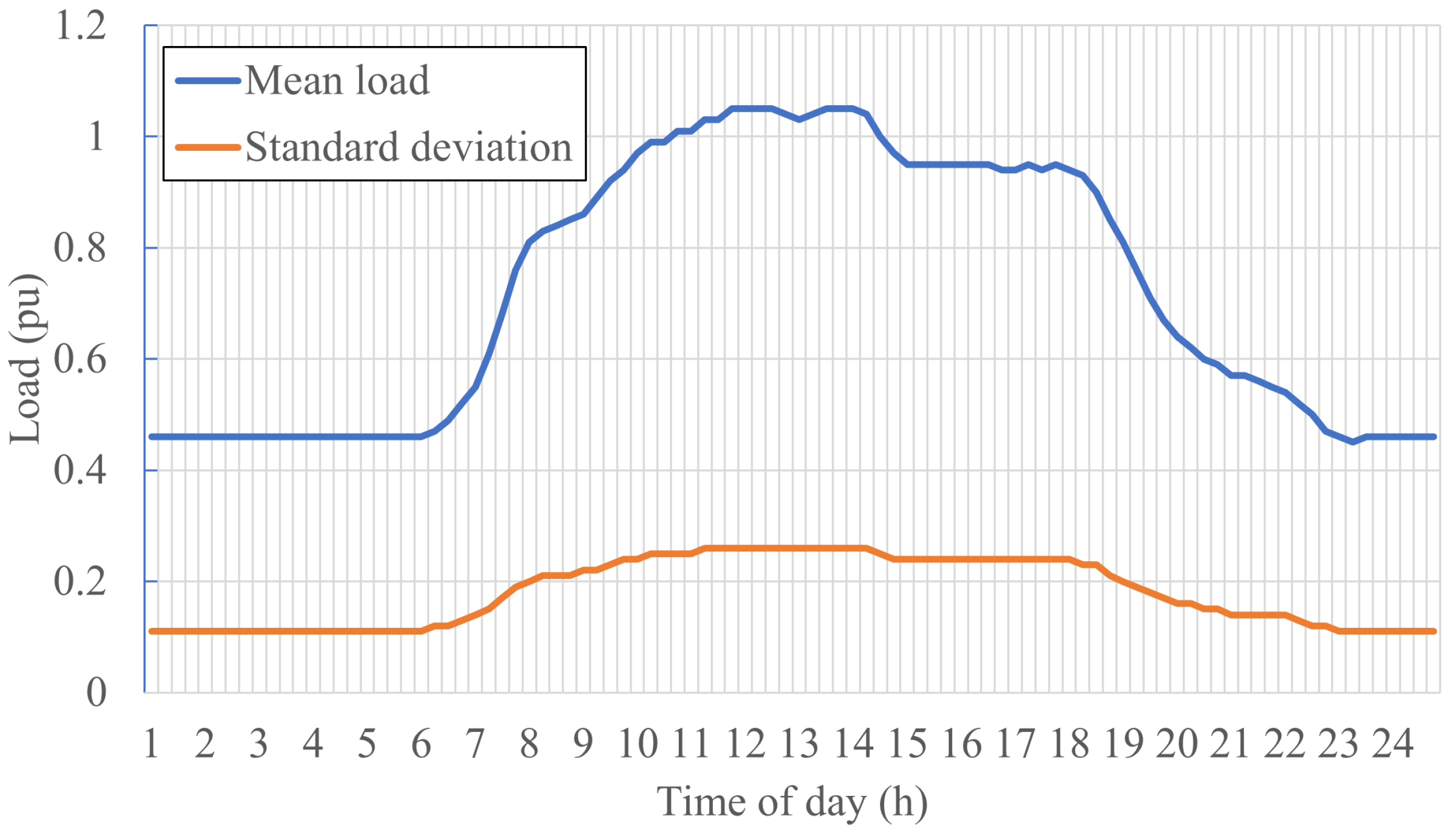

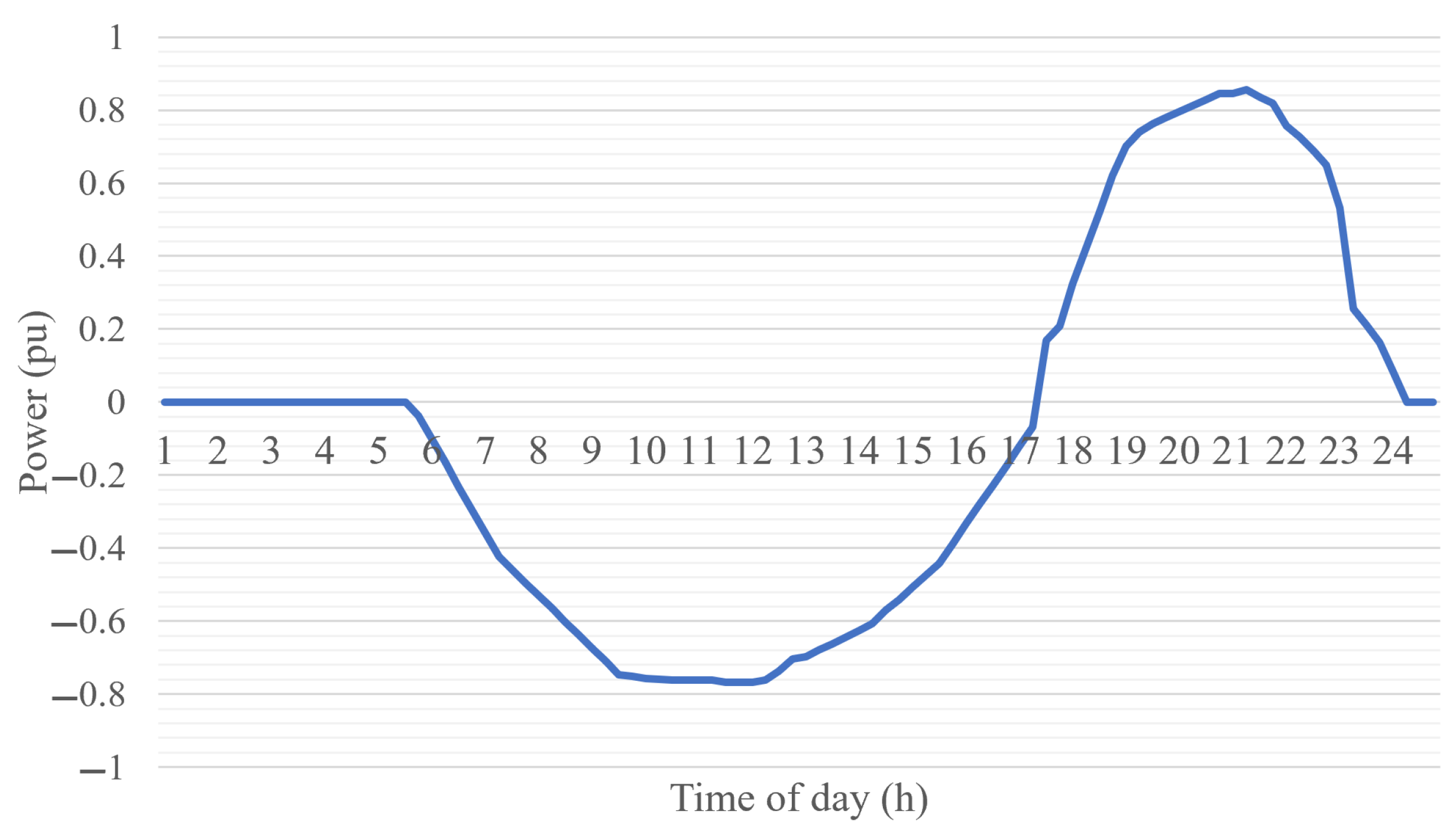

4. Application of the Technoeconomic Evaluation Model

4.1. Case Study Definition

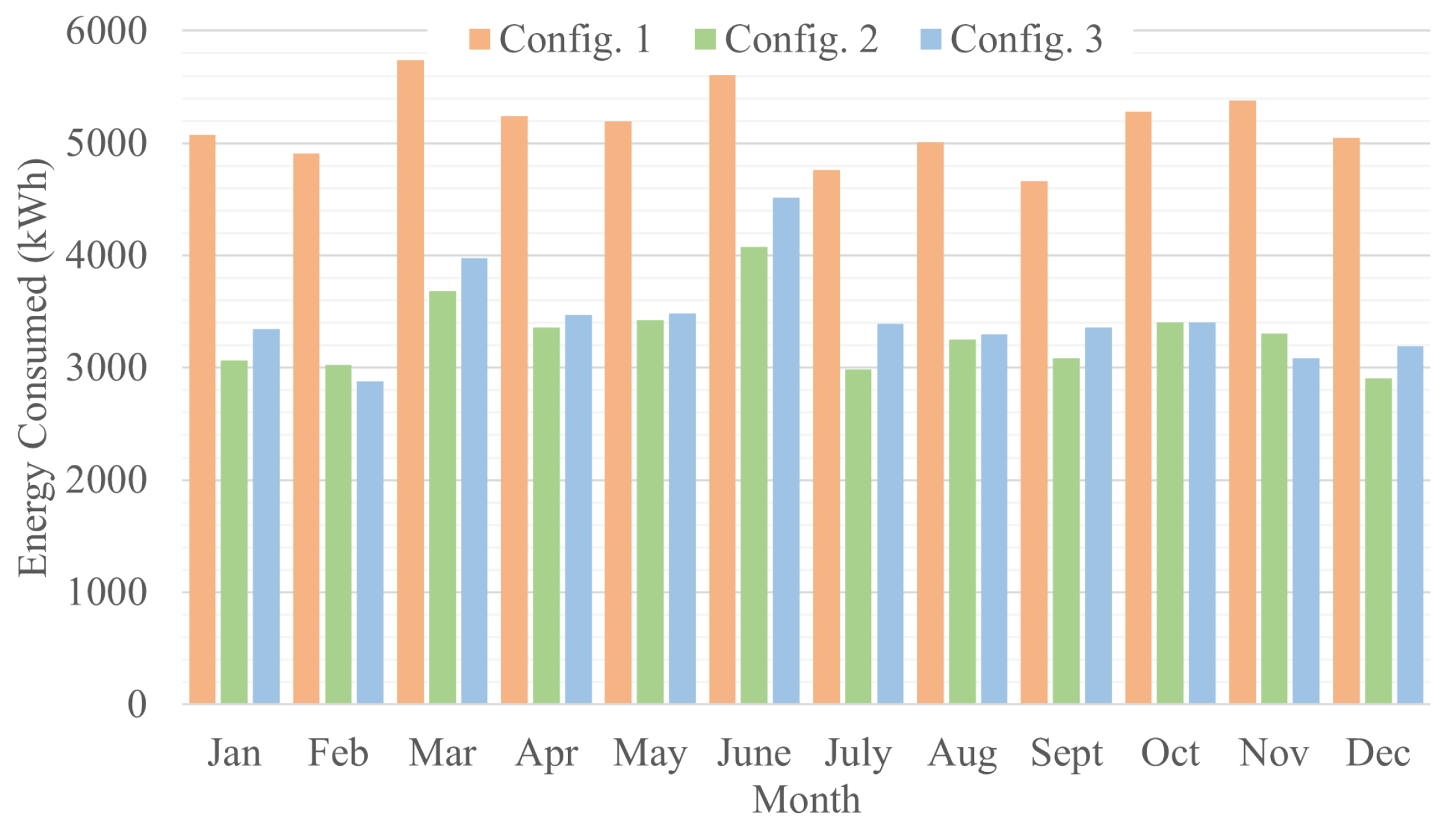

- Config. 1: Consumer unit without DG and ESS. This configuration represents a reference (“benchmark”) for evaluating the economic indicators related to the implementation of the nanogrid;

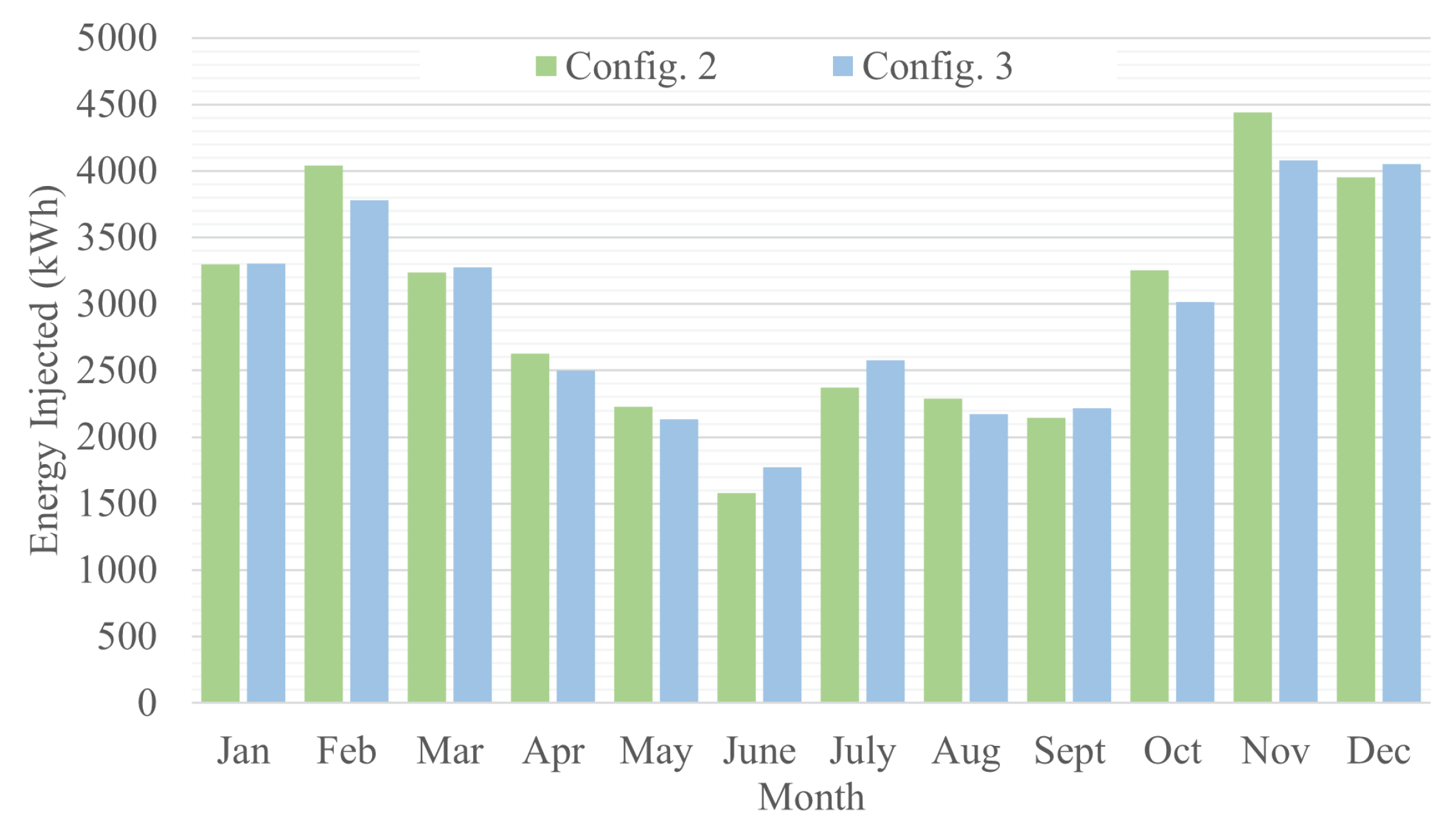

- Config. 2: Consumer unit equipped with photovoltaic distributed generation (PVDG) but without the use of ESS;

- Config. 3: Nanogrid composed of PVDG and ESS, consisting of a battery energy storage system (BESS), which is a real microgrid developed within a Brazilian research and development (R&D) project called MERGE.

4.2. Numerical Results

4.2.1. Initial Analysis

4.2.2. Evaluation of Regulatory Incentives

4.3. Final Considerations

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| ANEEL | Brazilian electricity regulatory agency |

| BESS | Battery energy storage system |

| DER | Distributed energy resource |

| DG | Distributed generation |

| EMS | Energy management system |

| ESS | Energy storage system |

| EV | Electric vehicle |

| FiT | Feed-in tariff |

| IoT | Internet of Things |

| LCOE | Levelized cost of electricity |

| MCS | Monte Carlo simulation |

| MERGE | Microgrids for efficient, reliable and greener energy |

| NPC | Net present cost |

| NPV | Net present value |

| PVDG | Photovoltaic distributed generation |

| V2G | Vehicle-to-grid |

Appendix A

References

- Hamidieh, M.; Ghassemi, M. Microgrids and Resilience: A Review. IEEE Access 2022, 10, 106059–106080. [Google Scholar] [CrossRef]

- Rana, M.M.; Atef, M.; Sarkar, M.R.; Uddin, M.; Shafiullah, G. A Review on Peak Load Shaving in Microgrid—Potential Benefits, Challenges, and Future Trend. Energies 2022, 15, 2278. [Google Scholar] [CrossRef]

- Saeed, M.H.; Fangzong, W.; Kalwar, B.A.; Iqbal, S. A Review on Microgrids’ Challenges & Perspectives. IEEE Access 2021, 9, 166502–166517. [Google Scholar] [CrossRef]

- Burmester, D.; Rayudu, R.; Seah, W.; Akinyele, D. A review of nanogrid topologies and technologies. Renew. Sustain. Energy Rev. 2017, 67, 760–775. [Google Scholar] [CrossRef]

- Naik, K.R.; Rajpathak, B.; Mitra, A.; Kolhe, M. A Review of Nanogrid Technologies for Forming Reliable Residential Grid. In Proceedings of the 2020 IEEE First International Conference on Smart Technologies for Power, Energy and Control (STPEC), Nagpur, India, 25–26 September 2020; pp. 1–6. [Google Scholar] [CrossRef]

- Castro, J.F.C.; Roncolatto, R.A.; Donadon, A.R.; Andrade, V.E.M.S.; Rosas, P.; Bento, R.G.; Matos, J.G.; Assis, F.A.; Coelho, F.C.R.; Quadros, R.; et al. Microgrid Applications and Technical Challenges—The Brazilian Status of Connection Standards and Operational Procedures. Energies 2023, 16, 2893. [Google Scholar] [CrossRef]

- OpenDSS Documentation. (Reference Guide—Version 9.0.0). Available online: https://www.epri.com/pages/sa/opendss (accessed on 10 May 2023).

- Alhasnawi, B.N.; Jasim, B.H.; Esteban, M.D.; Guerrero, J.M. A Novel Smart Energy Management as a Service over a Cloud Computing Platform for Nanogrid Appliances. Sustainability 2020, 12, 9686. [Google Scholar] [CrossRef]

- Yu, H.; Shang, Y.; Niu, S.; Cheng, C.; Shao, Z.; Jian, L. Towards energy-efficient and cost-effective DC nanaogrid: A novel pseudo hierarchical architecture incorporating V2G technology for both autonomous coordination and regulated power dispatching. Appl. Energy 2022, 313, 118838. [Google Scholar] [CrossRef]

- Olukan, T.A.; Santos, S.; Al Ghaferi, A.A.; Chiesa, M. Development of a solar nano-grid for meeting the electricity supply shortage in developing countries (Nigeria as a case study). Renew. Energy 2022, 181, 640–652. [Google Scholar] [CrossRef]

- Lambert, T.; Gilman, P.; Lilienthal, P. Micropower system modeling with HOMER. Integr. Altern. Sources Energy 2005, 1, 379–418. [Google Scholar]

- Dahiru, A.T.; Tan, C.W. Optimal sizing and techno-economic analysis of grid-connected nanogrid for tropical climates of the Savannah. Sustain. Cities Soc. 2020, 52, 101824. [Google Scholar] [CrossRef]

- Dahiru, A.T.; Tan, C.W.; Salisu, S.; Lau, K.Y. Multi-configurational sizing and analysis in a nanogrid using nested integer linear programming. J. Clean. Prod. 2021, 323, 129159. [Google Scholar] [CrossRef]

- Kumar, A.; Deng, Y.; He, X.; Kumar, P.; Bansal, R.C.; Naidoo, R.M. A Renewable based Nano-grid for Smart Rural Residential Application. In Proceedings of the 2021 International Conference on Smart Energy Systems and Technologies (SEST), Vaasa, Finland, 6–8 September 2021; pp. 1–5. [Google Scholar] [CrossRef]

- Baruah, A.; Basu, M. Modelling of an off-grid roof-top residential photovoltaic nano grid system for an urban locality in India. Energy Sustain. Dev. 2023, 74, 471–498. [Google Scholar] [CrossRef]

- Dahiru, A.T.; Tan, C.W.; Bukar, A.L.; Yiew Lau, K. Energy cost reduction in residential nanogrid under constraints of renewable energy, customer demand fitness and binary battery operations. J. Energy Storage 2021, 39, 102520. [Google Scholar] [CrossRef]

- Arévalo, P.; Tostado-Véliz, M.; Jurado, F. A novel methodology for comprehensive planning of battery storage systems. J. Energy Storage 2021, 37, 102456. [Google Scholar] [CrossRef]

- Di Florio, G.; Macchi, E.G.; Mongibello, L.; Baratto, M.C.; Basosi, R.; Busi, E.; Caliano, M.; Cigolotti, V.; Testi, M.; Trini, M. Comparative life cycle assessment of two different SOFC-based cogeneration systems with thermal energy storage integrated into a single-family house nanogrid. Appl. Energy 2021, 285, 116378. [Google Scholar] [CrossRef]

- Mohand Kaci, G.; Mahrane, A.; Ghedamsi, K.; Chikh, M. Techno-economic feasibility analysis of grid-connected residential PV systems in Algeria. Energy Environ. 2022, 0958305X2211469. [Google Scholar] [CrossRef]

- Yoomak, S.; Ngaopitakkul, A. Investigation and Feasibility Evaluation of Using Nanogrid Technology Integrated Into Road Lighting System. IEEE Access 2020, 8, 56739–56754. [Google Scholar] [CrossRef]

- Bae, J.; Lee, S.; Kim, H. Comparative study on the economic feasibility of nanogrid and microgrid electrification: The case of Jeju Island, South Korea. Energy Environ. 2021, 32, 168–188. [Google Scholar] [CrossRef]

- Bahri, R.; Zeynali, S.; Nasiri, N.; Keshavarzi, M.R. Economic-environmental energy supply of mobile base stations in isolated nanogrids with smart plug-in electric vehicles and hydrogen energy storage system. Int. J. Hydrogen Energy 2023, 48, 3725–3739. [Google Scholar] [CrossRef]

- Ahmadi Jirdehi, M.; Sohrabi Tabar, V. Risk-aware energy management of a microgrid integrated with battery charging and swapping stations in the presence of renewable resources high penetration, crypto-currency miners and responsive loads. Energy 2023, 263, 125719. [Google Scholar] [CrossRef]

- Wangsupphaphol, A.; Chaitusaney, S.; Salem, M. A Techno-Economic Assessment of a Second-Life Battery and Photovoltaics Hybrid Power Source for Sustainable Electric Vehicle Home Charging. Sustainability 2023, 15, 5866. [Google Scholar] [CrossRef]

- Zhou, Q.; Shahidehpour, M.; Li, Z.; Che, L.; Alabdulwahab, A.; Abusorrah, A. Compartmentalization Strategy for the Optimal Economic Operation of a Hybrid AC/DC Microgrid. IEEE Trans. Power Syst. 2020, 35, 1294–1304. [Google Scholar] [CrossRef]

- Newnan, D.G.; Eschenbach, T.G.; Lavelle, J.P. Engineering Economic Analysis, 11th ed.; Oxford University Press: New York, NY, USA, 2012. [Google Scholar]

- Jaglal, D.; Procopiou, A.T.; Petrou, K.; Ochoa, L.F. Bottom-up modeling of residential batteries and their effect on system-level generation cost. Electr. Power Syst. Res. 2020, 189, 106711. [Google Scholar] [CrossRef]

- Electricity Regulatory Agency (ANEEL). ResoluÇÃO Normativa Aneel Nº 1.059, DE 7 de Fevereiro de 2023. Available online: https://www2.aneel.gov.br/cedoc/ren20231059.html (accessed on 1 June 2023). (In Portuguese)

- National Institute of Meteorology (INMET). Available online: https://bdmep.inmet.gov.br/ (accessed on 1 April 2023).

- Presidency of the Republic of Brazil. Lei Nº 14.300, de 6 de Janeiro de 2022. Available online: https://www.planalto.gov.br/ccivil_03/_ato2019-2022/2022/lei/l14300.htm (accessed on 1 June 2023). (In Portuguese)

| Voltage | Peak Active Power | Peak Reactive Power | ||||

|---|---|---|---|---|---|---|

| Phase A | Phase B | Phase C | Phase A | Phase B | Phase C | |

| 220 V | 2.00 kW | 2.00 kW | 2.00 kW | 0.05 kVAr | 0.05 kVAr | 0.05 kVAr |

| Jan | Feb | Mar | Apr | May | June | July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.00 | 1.00 | 1.00 | 0.99 | 0.96 | 0.94 | 0.92 | 0.93 | 0.95 | 0.98 | 0.99 | 1.00 |

| Parameter | Values |

|---|---|

| Modules: Investment (BRL)/Lifecycle (years) | 50,000.00/25 |

| Inverter: Investment (BRL)/Lifecycle (years) | 50,000.00/7 |

| Rated module power (kWp) | 0.450 |

| Number of modules | 44 |

| Inverter rated power (kW) | 20.00 |

| Inverter rated efficiency (%) | 97.00 |

| Parameter | Values |

|---|---|

| Batteries: Investment (BRL)/Lifecycle (years) | 160,000.00/10 |

| Inverter: Investment (BRL)/Lifecycle (years) | 160,000.00/10 |

| Nominal battery bank power (kW) | 70.00 |

| Total storage capacity (kWh) | 90.00 |

| Rated inverter power (kW) | 70.00 |

| Charge efficiency (%) | 95.00 |

| Efficiency of discharge (%) | 95.00 |

| Operating reserve (%) | 15.00 |

| Battery bank stand-by losses (%) | 0.50 |

| Config. | Investment Cost (BRL) | Operation Cost (BRL) | (BRL) | (Month) |

|---|---|---|---|---|

| 1 | - | 685,381.58 | 685,381.58 | - |

| 2 | 124,860.49 | 100,402.63 | 225,263.12 | 36 |

| 3 | 528,942.42 | 132,227.22 | 586,589.93 | 223 |

| Incentive | Operation Cost (BRL) | (BRL) | (Month) |

|---|---|---|---|

| 1 | 112,584.66 | 641,527.08 | 211 |

| 2 | 138,642.03 | 667,584.45 | 228 |

| 3 | 180,690.13 | 709,632.55 | - |

| 1, 2 | 72,427.22 | 601,369.65 | 191 |

| 1, 3 | 115,264.32 | 644,206.74 | 214 |

| 2, 3 | 137,606.20 | 666,548.62 | 227 |

| 1, 2, 3 | 72,180.38 | 601,122.80 | 191 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Assis, F.A.; Coelho, F.C.R.; Castro, J.F.C.; Donadon, A.R.; Roncolatto, R.A.; Rosas, P.A.C.; Andrade, V.E.M.S.; Bento, R.G.; Silva, L.C.P.; Cypriano, J.G.I.; et al. Assessment of Regulatory and Market Challenges in the Economic Feasibility of a Nanogrid: A Brazilian Case. Energies 2024, 17, 341. https://doi.org/10.3390/en17020341

Assis FA, Coelho FCR, Castro JFC, Donadon AR, Roncolatto RA, Rosas PAC, Andrade VEMS, Bento RG, Silva LCP, Cypriano JGI, et al. Assessment of Regulatory and Market Challenges in the Economic Feasibility of a Nanogrid: A Brazilian Case. Energies. 2024; 17(2):341. https://doi.org/10.3390/en17020341

Chicago/Turabian StyleAssis, Fernando A., Francisco C. R. Coelho, José Filho C. Castro, Antonio R. Donadon, Ronaldo A. Roncolatto, Pedro A. C. Rosas, Vittoria E. M. S. Andrade, Rafael G. Bento, Luiz C. P. Silva, João G. I. Cypriano, and et al. 2024. "Assessment of Regulatory and Market Challenges in the Economic Feasibility of a Nanogrid: A Brazilian Case" Energies 17, no. 2: 341. https://doi.org/10.3390/en17020341