Power System Decarbonization Assessment: A Case Study from Taiwan

Abstract

1. Introduction

- (1)

- Modern Portfolio Theory (MPT):

- (2)

- Multi Criteria Analysis (MCAs)

- (3)

- Optimal model:

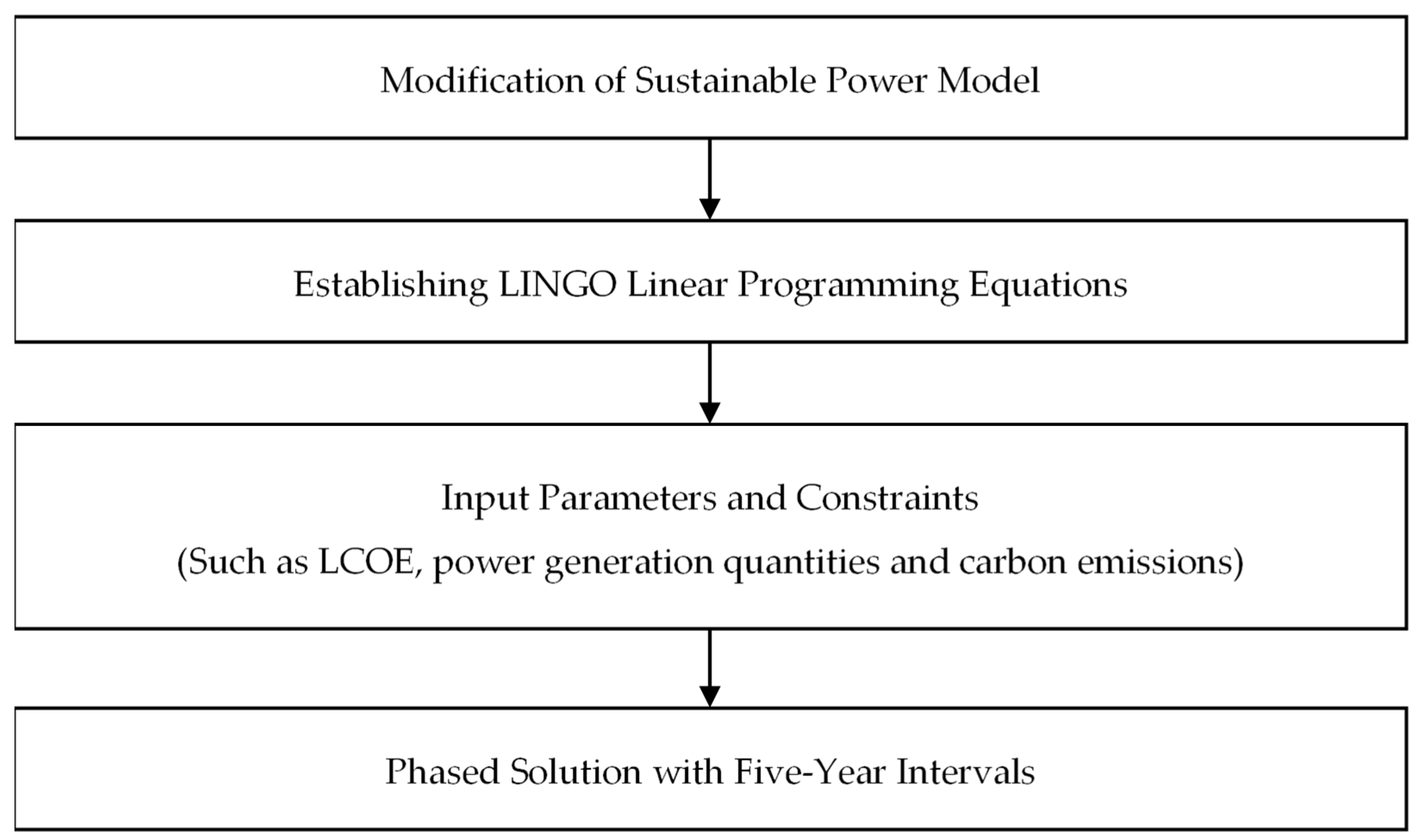

2. Sustainable Power Model

2.1. Model of Power Supply Costs

2.2. Sustainable Power Model

3. Empirical Analysis of Power Plant Cost Minimization

3.1. Scenario Setting for Net-Zero Carbon Pathway by 2050

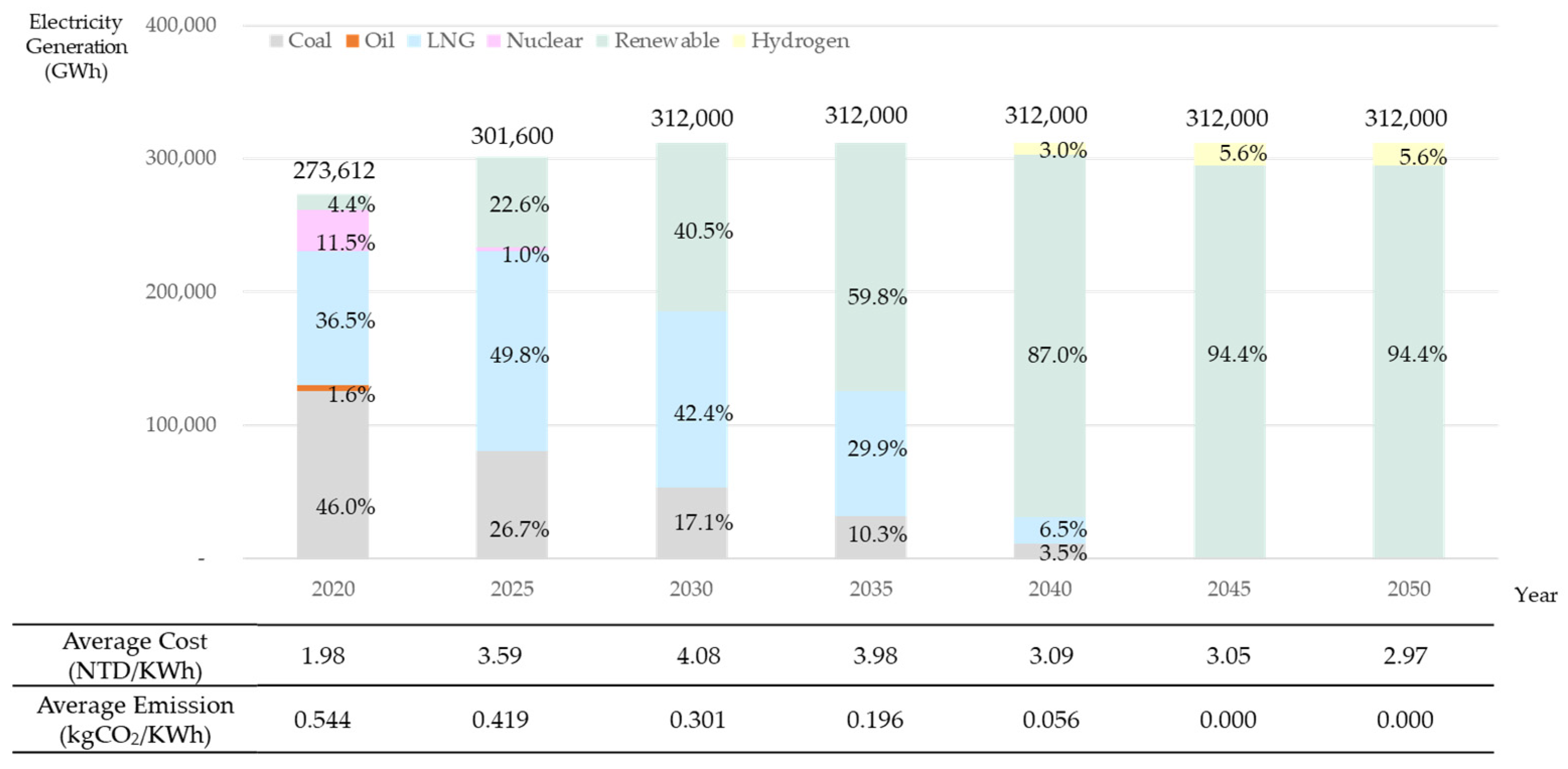

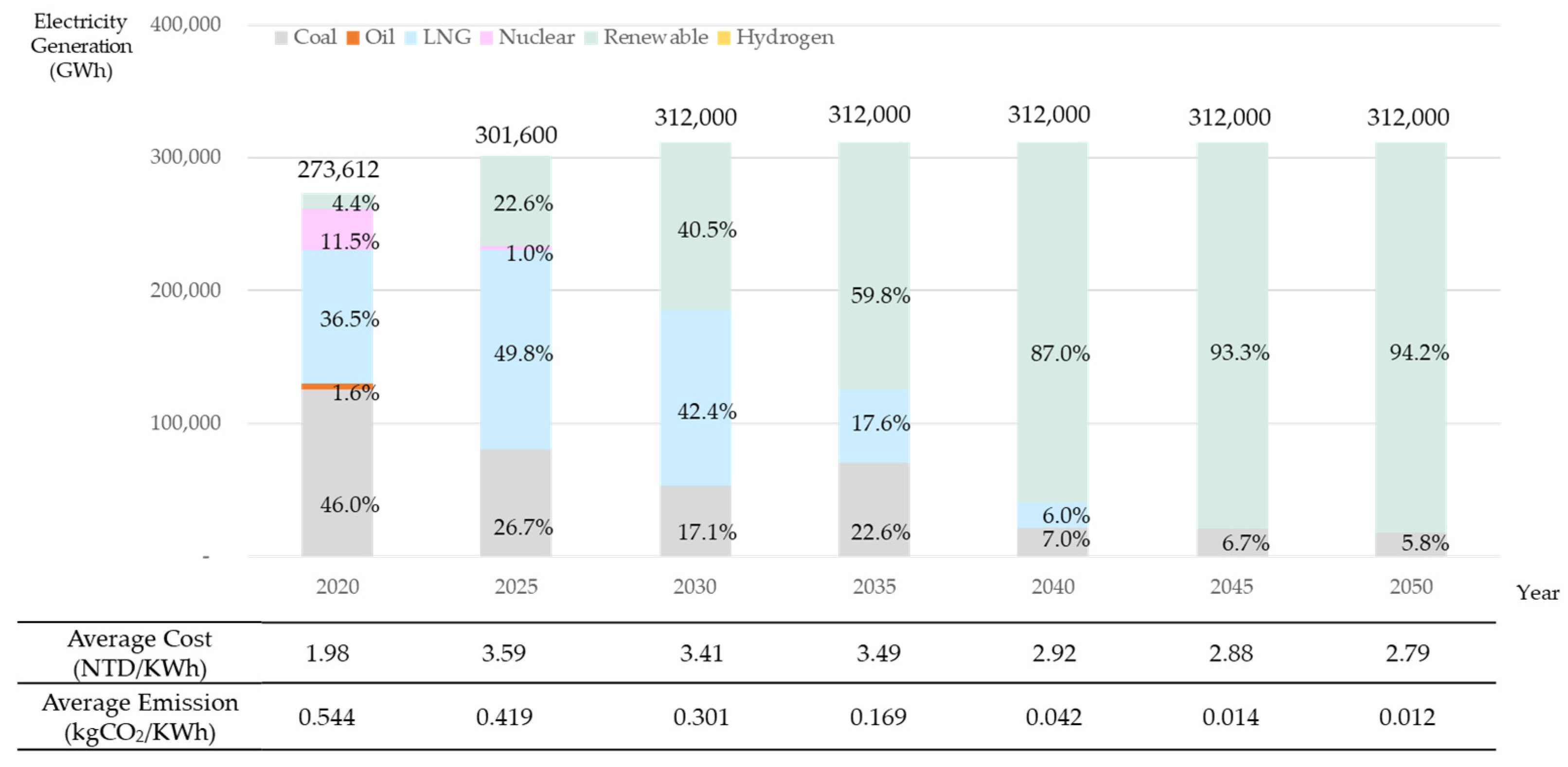

3.1.1. Sustainable: Carbon Reduction to Attain Net-Zero Emissions

- I.

- NDC Pathway: As announced by Taiwan announced in December 2022, the target is to reduce emissions by 24 ± 1% from 2005 levels by 2030, and actively moving towards net-zero emissions by 2050.

- II.

- Reduction Ambition Pathway: Based on IEA recommendations, the target is to reduce carbon emissions by 40% from 2005 levels by 2030, and achieve net-zero emissions by 2050.

3.1.2. Reliable: Stable Power Generation

3.2. Assumptions and Limitations on Power Generation Technology Design

3.3. Cost of Representative Power Plants

3.3.1. Levelized Cost of Energy (LCOE) of New Power Plants

- Construction cost (): assuming fixed thermal power generation (using construction costs in 2020), renewable energy has a rapid reduction trend because it is necessary to consider the learning effect; the reduction rate is estimated based on wholesale purchase rates provided by the Energy Bureau of the Ministry of Economic Affairs.

- Fuel cost (): future fuel prices are estimated on the basis of fuel costs in 2020 and by using the binomial stochastic process conforming to the geometric Brownian motion. More detailed parameters and the calculation process are described in the Appendix A.

- Considering that Taiwan’s future hydrogen energy will mainly be imported from abroad and that the import price includes transportation and liquefaction costs, it is difficult to directly estimate these costs. Due to the active promotion of long-term hydrogen strategies by the United States, the European Union, Australia, and Japan, it is assumed that the production and transportation technologies related to green hydrogen will mature by 2040, making the cost of hydrogen fuel lower than that of LNG.

- Operation and maintenance cost (): the annual cost is preset at 2–4% of the construction cost (depending on energy).

- Flexible cost (): only the cost of the power plant (adding energy storage facilities for renewable energy) is considered; the proportion of new renewable energy units used with energy storage units is considered to gradually increase, and the energy storage cost decreases with the maturation of technology.

- Waste cost (): the decommissioning cost is preset at 5% of the construction cost.

- Carbon emission costs (Et): these are set in reference to the carbon price settings from the IEA World Energy Outlook 2022. Under the “NDC Scenario”, this study assumes the introduction of a lower carbon price in 2025, which will gradually increase to stimulate carbon reduction behaviors. Under the “ Reduction Ambition Scenario”, this study assumes the immediate implementation of a higher carbon price in 2025 to more effectively drive carbon reduction effects.

- Carbon reduction technology cost (: with the advancement of technology and the expansion of economic scale, the cost of carbon reduction technology will gradually decrease. This study assumes that the cost of carbon reduction technology must be lower than the carbon price to ensure its practical feasibility in reducing carbon emissions.

- Discount rate(r): 3%.

- Power generation quantity(Qt): as shown in Equation (7).

- Capacity factor (): the capacity factor range (15–85%) of the thermal power unit is set according to a full load and a minimum load; renewable energy cannot be regulated with weather changes but is instead defined according to the actual value.

- Adjustment factor: thermal power is adjusted according to Equation (8), and renewable energy is not adjusted.

3.3.2. Cost of Existing Power Plants (Adjusted by Fuel Price and Carbon Cost)

4. Empirical Analysis Results and Discussion

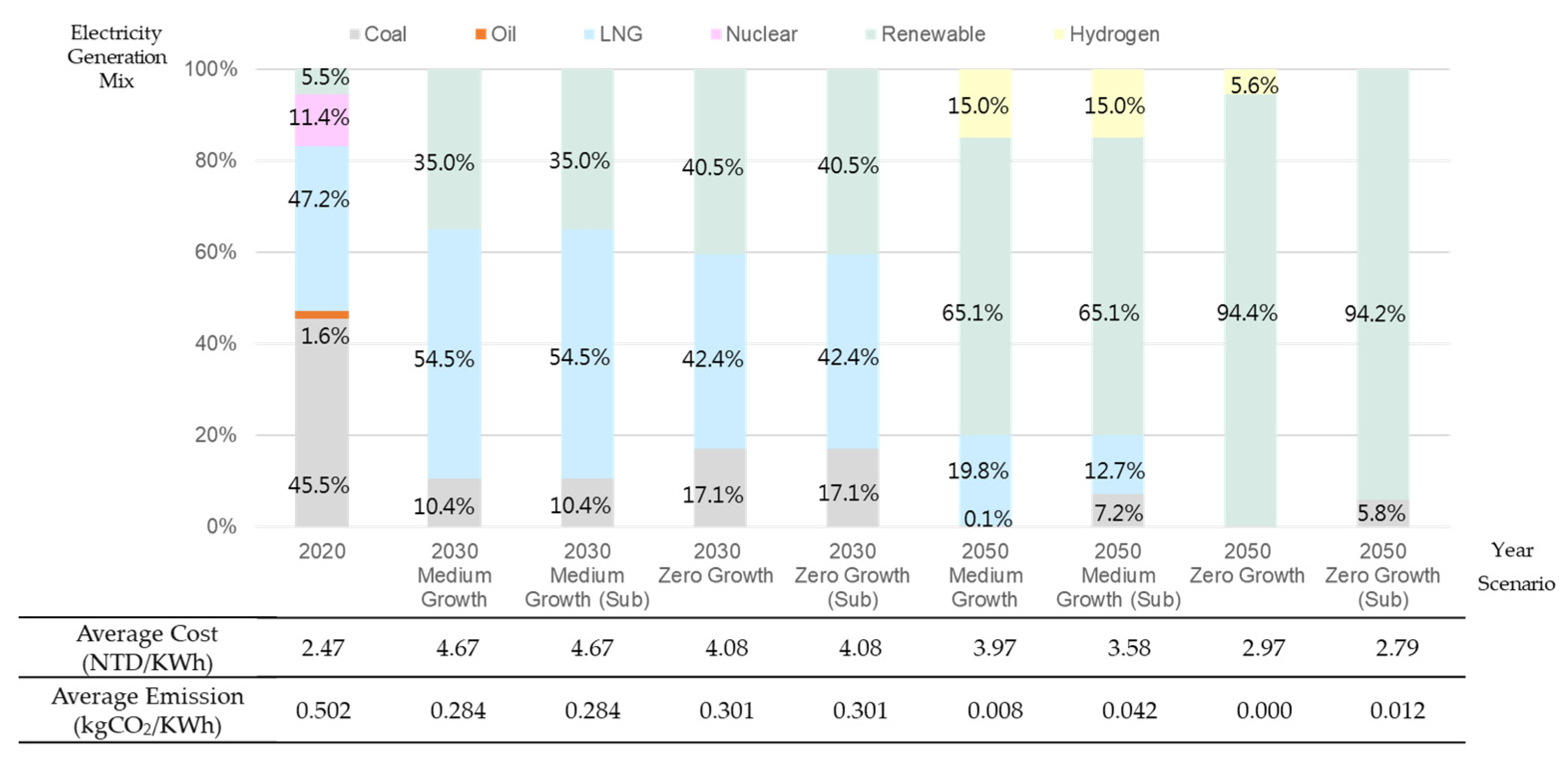

4.1. Empirical Analysis Results

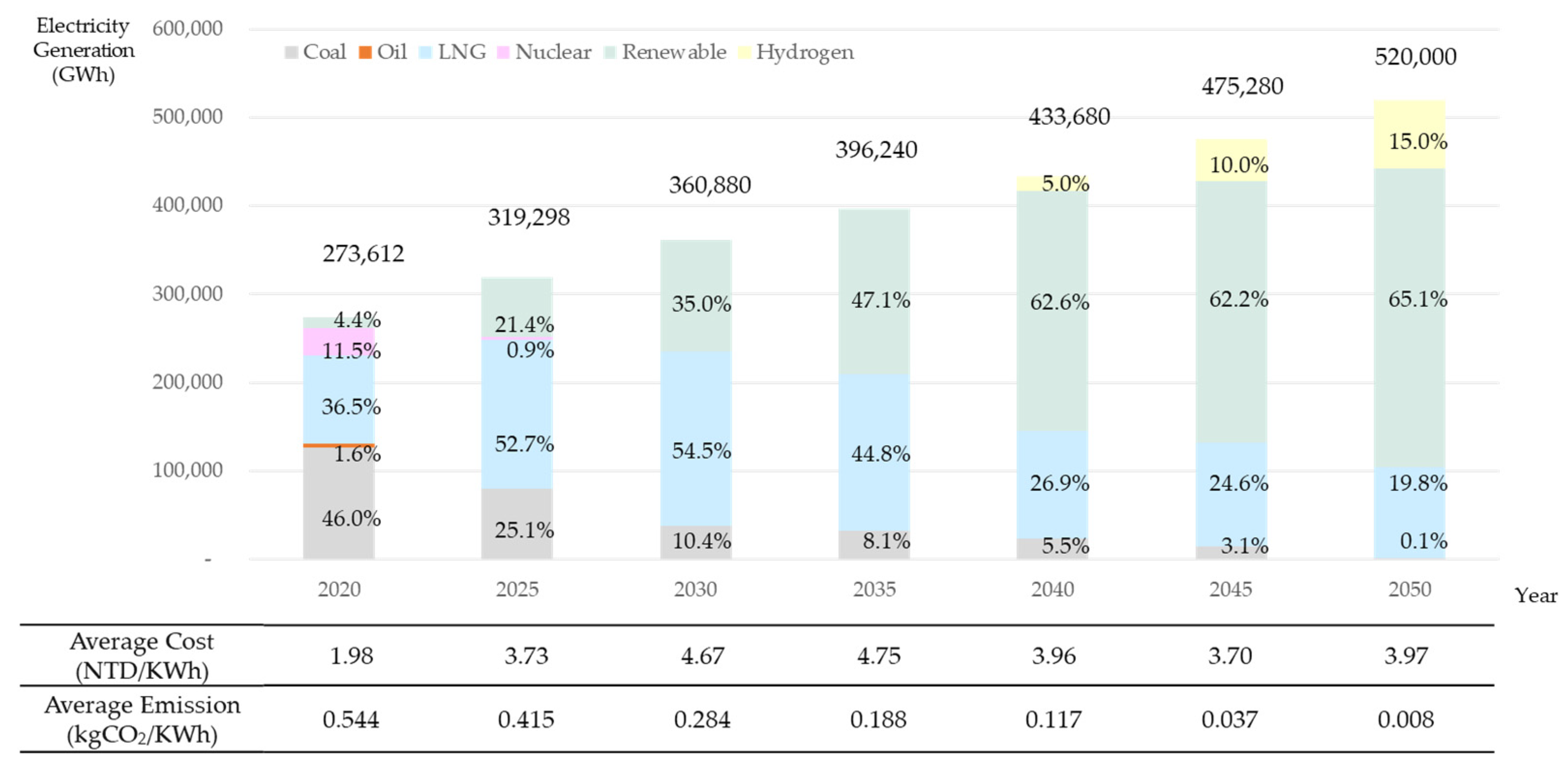

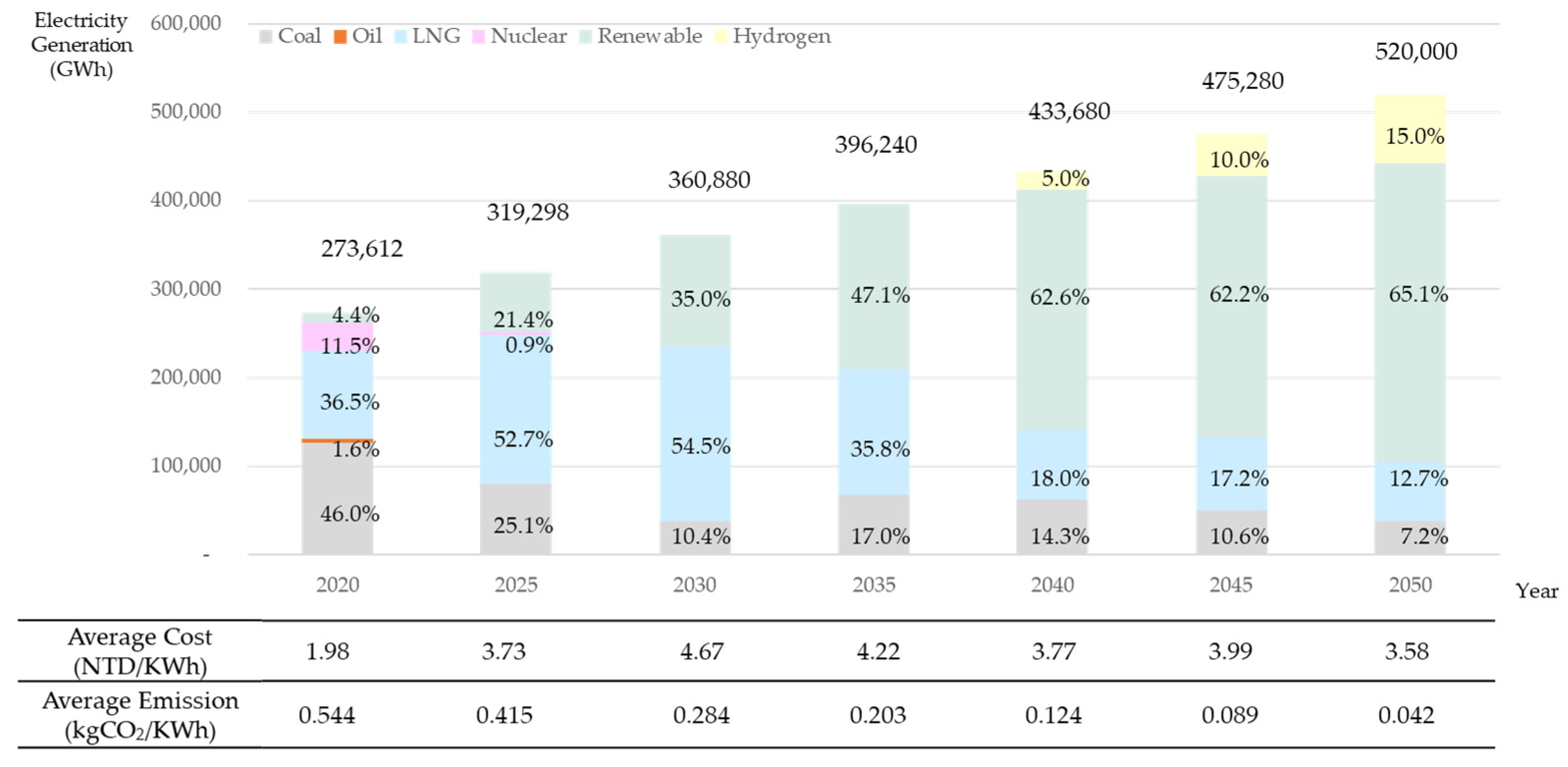

4.1.1. Medium-Growth Scenario Results

4.1.2. Zero-Growth Scenario Results

4.2. Discussion

4.2.1. The Impact of Technological Selection Priority on the Power System and Costs

4.2.2. Social Acceptance of Coal Power Coupled with CCS Technology

4.2.3. Analysis of the Impact of Zero Growth in Electricity Demand

4.2.4. Model Limitations and Future Research Directions

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. A Random Estimation of Long-term Fuel Price

| Technology | Fuel Coal | Fuel Gas | |

|---|---|---|---|

| Parameter | |||

| Average annual growth rate of power generation cost per unit of different fuels (g) (%) | −1.44 | −5.95 | |

| Risk-free interest rate (rf) (%) | 1.60 | 1.60 | |

| Average growth rate of power generation cost per unit of different fuels (u) (%) | 0.93 | 0.76 | |

| Average decrease rate of power generation cost per unit of different fuels () (%) | 1.07 | 1.32 | |

| Increasing the path allocation ratio () (%) | 40.68 | 54.12 | |

| Decreasing path allocation ratio 1 − x (%) | 59.32 | 45.88 | |

| Year | Coal | LNG | ||||

|---|---|---|---|---|---|---|

| Low | Middle | High | Low | Middle | High | |

| 2020 | 1.30 | 1.30 | 1.30 | 1.85 | 1.85 | 1.85 |

| 2025 | 1.21 | 1.30 | 1.39 | 1.40 | 1.92 | 2.45 |

| 2030 | 1.21 | 1.30 | 1.40 | 1.41 | 2.00 | 2.58 |

| 2035 | 1.17 | 1.31 | 1.45 | 1.25 | 2.08 | 2.90 |

| 2040 | 1.17 | 1.31 | 1.45 | 1.30 | 2.16 | 3.02 |

| 2045 | 1.14 | 1.31 | 1.49 | 1.15 | 2.24 | 3.33 |

| 2050 | 1.14 | 1.32 | 1.49 | 1.20 | 2.33 | 3.47 |

| 2055 | 1.11 | 1.32 | 1.53 | 1.08 | 2.42 | 3.77 |

| 2060 | 1.12 | 1.32 | 1.53 | 1.12 | 2.52 | 3.91 |

| 2065 | 1.09 | 1.33 | 1.56 | 1.02 | 2.62 | 4.21 |

| 2070 | 1.10 | 1.33 | 1.56 | 1.06 | 2.72 | 4.38 |

| 2075 | 1.08 | 1.34 | 1.61 | 0.98 | 3.02 | 5.07 |

References

- Masson-Delmotte, V.; Zhai, P.; Pirani, A.; Connors, S.L.; Péan, C.; Berger, S.; Caud, N.; Chen, Y.; Goldfarb, L.; Gomis, M. Climate change 2021: The physical science basis. In Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2021; in press. [Google Scholar] [CrossRef]

- IEA. Net Zero by 2050; Licence: CC BY 4.0; IEA: Paris, France, 2021; Available online: https://www.iea.org/reports/net-zero-by-2050 (accessed on 20 January 2024).

- UNFCCC. Outcome of the First Global Stocktake. FCCC/PA/CMA/2023/L.17. 2023. Available online: https://undocs.org/en/FCCC/PA/CMA/2023/L.17 (accessed on 20 January 2024).

- Beccarello, M.; Di Foggia, G. Review and Perspectives of Key Decarbonization Drivers to 2030. Energies 2023, 16, 1345. [Google Scholar] [CrossRef]

- Ohta, H.; Barrett, B.F.D. Politics of climate change and energy policy in Japan: Is green transformation likely? Earth Syst. Gov. 2023, 17, 100187. [Google Scholar] [CrossRef]

- Wang, C.-K.; Lee, C.-M.; Hong, Y.-R.; Cheng, K. Assessment of energy transition policy in Taiwan—A view of sustainable development perspectives. Energies 2021, 14, 4402. [Google Scholar] [CrossRef]

- Markowitz, H. Portfolio Selection. J. Financ. 1952, 7, 77–91. [Google Scholar] [CrossRef]

- Awerbuch, S.; Yang, S. Efficient electricity generating portfolios for Europe: Maximising energy security and climate change mitigation. EIB Pap. 2007, 12, 8–37. [Google Scholar]

- deLlano-Paz, F.; Calvo-Silvosa, A.; Antelo, S.I.; Soares, I. Energy planning and modern portfolio theory: A review. Renew. Sustain. Energy Rev. 2017, 77, 636–651. [Google Scholar] [CrossRef]

- deLlano-Paz, F.; Fernandez, P.M.; Soares, I. Addressing 2030 EU policy framework for energy and climate: Cost, risk and energy security issues. Energy 2016, 115, 1347–1360. [Google Scholar] [CrossRef]

- Malala, O.N.; Adachi, T. Portfolio optimization of electricity generating resources in Kenya. Electr. J. 2020, 33, 106733. [Google Scholar] [CrossRef]

- Zhu, L.; Fan, Y. Optimization of China’s generating portfolio and policy implications based on portfolio theory. Energy 2010, 35, 1391–1402. [Google Scholar] [CrossRef]

- Zhang, S.; Zhao, T.; Xie, B.-C. What is the optimal power generation mix of China? An empirical analysis using portfolio theory. Appl. Energy 2018, 229, 522–536. [Google Scholar] [CrossRef]

- Wu, J.-H.; Huang, Y.-H. Electricity portfolio planning model incorporating renewable energy characteristics. Appl. Energy 2014, 119, 278–287. [Google Scholar] [CrossRef]

- Ryu, H.; Dorjragchaa, S.; Kim, Y.; Kim, K. Electricity-generation mix considering energy security and carbon emission mitigation: Case of Korea and Mongolia. Energy 2014, 64, 1071–1079. [Google Scholar] [CrossRef]

- Portugal-Pereira, J.; Esteban, M. Implications of paradigm shift in Japan’s electricity security of supply: A multi-dimensional indicator assessment. Appl. Energy 2014, 123, 424–434. [Google Scholar] [CrossRef]

- Jayaraman, R.; Colapinto, C.; La Torre, D.; Malik, T. Multi-criteria model for sustainable development using goal programming applied to the United Arab Emirates. Energy Policy 2015, 87, 447–454. [Google Scholar] [CrossRef]

- Choi, D.; Ahn, Y.-H.; Choi, D.G. Multi-criteria decision analysis of electricity sector transition policy in Korea. Energy Strategy Rev. 2020, 29, 100485. [Google Scholar] [CrossRef]

- Marques, A.C.; Machado, L.C.; de Morais Correia, L.M.A.; Vieira, M.J.L.; da Silva, M.L.; de Lima, M.F.M.G.; do Espírito Santo, P.P.P.; Morais, D.C.; Frej, E.A. Support for multicriteria group decision with voting procedures: Selection of electricity generation technologies. Clean. Environ. Syst. 2021, 3, 100060. [Google Scholar] [CrossRef]

- Laha, P.; Chakraborty, B. Low carbon electricity system for India in 2030 based on multi-objective multi-criteria assessment. Renew. Sustain. Energy Rev. 2021, 135, 110356. [Google Scholar] [CrossRef]

- Lee, C.-M.; Rosalez, E.R. Economic growth, carbon abatement technology and decoupling strategy-The case of Taiwan. Aerosol Air Qual. Res. 2017, 17, 1649–1657. [Google Scholar] [CrossRef]

- Blanco, H.; Nijs, W.; Ruf, J.; Faaij, A. Potential of Power-to-Methane in the EU energy transition to a low carbon system using cost optimization. Appl. Energy 2018, 232, 323–340. [Google Scholar] [CrossRef]

- Su, K.; Lee, C.-M. When will China achieve its carbon emission peak? A scenario analysis based on optimal control and the STIRPAT model. Ecol. Indic. 2020, 112, 106138. [Google Scholar] [CrossRef]

- Verma, M.; Verma, A.K.; Misra, A. Mathematical modeling and optimal control of carbon dioxide emissions from energy sector. Environ. Dev. Sustain. 2021, 23, 13919–13944. [Google Scholar] [CrossRef]

- Schrotenboer, A.H.; Veenstra, A.A.; uit het Broek, M.A.; Ursavas, E. A Green Hydrogen Energy System: Optimal control strategies for integrated hydrogen storage and power generation with wind energy. Renew. Sustain. Energy Rev. 2022, 168, 112744. [Google Scholar] [CrossRef]

- Sitek, P.; Wikarek, J. Mathematical programming model of cost optimization for supply chain from perspective of logistics provider. Manag. Prod. Eng. Rev. 2012, 3, 49–61. [Google Scholar]

- Sabale, R.; Jose, M. Optimization of conjunctive use of surface and groundwater by using LINGO and PSO in water resources management. Innov. Infrastruct. Solut. 2022, 7, 135. [Google Scholar] [CrossRef]

- Su, C.; Cheng, C.; Wang, P.; Shen, J.; Wu, X. Optimization model for long-distance integrated transmission of wind farms and pumped-storage hydropower plants. Appl. Energy 2019, 242, 285–293. [Google Scholar] [CrossRef]

- Vaezihir, A.; Safari, F.; Tabarmayeh, M.; Khalafi, A.A. Application of MCLP and LINGO methods to optimal design of groundwater monitoring network in an oil refinery site. J. Hydroinformatics 2021, 23, 813–830. [Google Scholar] [CrossRef]

- Copeland, T.; Antikarov, V. Real Options; Texere: New York, NY, USA, 2001. [Google Scholar]

| Scenario | Electricity Demand Growth | Reduction Pathway | Power Technologies and Decarbonization Technologies |

|---|---|---|---|

| Medium Growth | Medium Growth | NDC 1 |

|

| Medium Growth | Reduction Ambition 2 | ||

| Low Growth | Low Growth | NDC | |

| Low Growth | Reduction Ambition | ||

| Zero Growth | Zero Growth | NDC | |

| Zero Growth | Reduction Ambition |

| Year | NDC Scenario | Reduction Ambition Scenario | ||||||

|---|---|---|---|---|---|---|---|---|

| Target (%) | Overseas Carbon Credits (%) | Total Emissions (MtCO2e) | Power Sector (MtCO2e) | Target (%) | Overseas Carbon Credits (%) | Total Emissions (MtCO2e) | Power Sector (MtCO2e) | |

| 2025 | −10% | 241 | 132.6 | −10% | 241 | 132.6 | ||

| 2030 | −24% | 203.5 | 111.9 | −40% | 160.7 | 88.4 | ||

| 2035 | −39% | 163.4 | 89.8 | −60% | 107.1 | 58.9 | ||

| 2040 | −55% | 10% | 147.3 | 81 | −80% | 10% | 80.3 | 44.2 |

| 2045 | −77% | 10% | 88.4 | 48.6 | −90% | 10% | 53.6 | 29.5 |

| 2050 | −100% | 10% | 26.8 | 14.7 | −100% | 10% | 26.8 | 14.7 |

| Year | Medium Growth | Low Growth | Zero Growth | |||

|---|---|---|---|---|---|---|

| Average Annual Growth (%) | Electricity Demand (GWh) | Average Annual Growth (%) | Electricity Demand (GWh) | Average Annual Growth (%) | Electricity Demand (GWh) | |

| 2020 | - | 271,200 | - | 271,200 | - | 271,200 |

| 2030 | 2.5% | 347,000 | 2.5% | 347,000 | 1.0% | 300,000 |

| 2040 | 1.9% | 417,000 | 1.1% | 386,000 | 0% | 300,000 |

| 2050 | 1.8% | 500,000 | 1.0% | 427,500 | 0% | 300,000 |

| Energy Type | NDC Scenario | Ambitious Reduction Scenario |

|---|---|---|

| Renewable Energy | The development of renewable energy is constrained by natural conditions, with an expected limitation on the annual installation volume. The annual increase in solar PV is 3 GW by 2050, with an upper limit of 95 GW by 2050. The annual increase in wind power is 2 GW by 2035 and 3 GW by 2050, with an upper limit of 70 GW by 2050. | |

| Natural Gas | Natural gas as a bridge energy source, with the addition of new gas-fired power generation to fill the power gap. All gas-fired power generation will either transition to using CCS technology or be decommissioned early. | |

| Oil | All large oil-fired units retired by 2024. | |

| Nuclear | Following Taiwan’s “Nuclear-Free Homeland” policy since 2016 and the 2021 referendum confirming the non-restart of the Fourth Nuclear Power Plant, nuclear capacity will be zero by 2026. The study does not consider nuclear energy options, including new technologies like Small Modular Reactors (SMR) or nuclear fusion. | |

| Pumped Hydro Storage | Pumped hydro storage capacity and generation will remain at current levels. | |

| Energy Storage | A certain proportion of future solar photovoltaic and wind power generation will be equipped with energy storage systems to enhance the stability and reliability of renewable energy, and to provide a buffering mechanism for the fluctuations in power supply from renewable sources. | |

| Hydrogen Energy | Large-scale production of green hydrogen requires a significant amount of renewable energy, exceeding current plans for renewable energy, and hence, domestic hydrogen energy has not been estimated. The proportion of power generation from imported hydrogen energy should not exceed 15%, to ensure the feasibility of hydrogen imports and to avoid over-reliance on them. | |

| Coal | No new coal-fired plants and existing coal-fired plants reduce load or decommission early. | No new coal-fired plants and all existing coal-fired plants decommissioned before 2035. |

| CCS Technology | Complete trials by 2030, with a sequestration capacity reaching 1 million tons. Rapid commercialization, achieving a sequestration capacity of 40 million tons by 2040. |

Complete trials by 2030, with a sequestration capacity reaching 1 million tons. Rapid commercialization, achieving a sequestration capacity of 40 million tons by 2040. |

| Coal with CCS (Sub-Scenario) | Allowance for new coal-fired units with CCS. |

|

| Items | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 |

|---|---|---|---|---|---|---|

| Construction costs () | ||||||

| LNG (NTD/Kw) | 26,200 | 26,200 | 26,200 | 26,200 | 26,200 | 26,200 |

| Solar PV (NTD/Kw) | 37,738 | 33,766 | 30,211 | 27,031 | 24,186 | 21,640 |

| Wind (NTD/Kw) | 126,931 | 104,409 | 85,882 | 70,644 | 58,109 | 47,798 |

| Fuel costs () | ||||||

| Coal (NTD/Kwh) | 1.30 | 1.30 | 1.31 | 1.31 | 1.31 | 1.32 |

| LNG (NTD/Kwh) | 1.92 | 2.00 | 2.08 | 2.16 | 2.24 | 2.33 |

| Flexible cost () | ||||||

| Energy storage costs (NTD/Kwh) | 7.0 | 6.0 | 5.0 | 4.0 | 3.5 | 3.0 |

| Proportion of new renewable energy storage (%) | 2.0 | 5.0 | 10.0 | 20.0 | 30.0 | 40.0 |

| Carbon emission costs (Et) | ||||||

| NDC Scenario (NTD/tCO2) | 300 | 1200 | 2250 | 3300 | 4650 | 6000 |

| Reduction Ambition Scenario (NTD/tCO2) | 1500 | 2700 | 3750 | 4800 | 5400 | 6000 |

| Carbon reduction technology costs ( (NTD/tCO2) | 3000 | 2640 | 2250 | 1890 | 1500 | |

| Discount rate (r) (%) | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 |

| Year | Coal + CCS | Gas | GAS + CCS | Solar PV | Wind Power | Hydrogen (Imported) | |||

|---|---|---|---|---|---|---|---|---|---|

| NDC | Reduction Ambition | NDC | Reduction Ambition | NDC | Reduction Ambition | ||||

| 2025 | 5.78 | 6.23 | 3.29 | 3.49 | - | ||||

| 2030 | 5.14 | 5.51 | 6.47 | 6.84 | 6.58 | 6.62 | 3.24 | 2.93 | 7.29 |

| 2035 | 4.67 | 4.81 | 6.89 | 7.15 | 8.11 | 8.37 | 3.37 | 2.49 | 6.46 |

| 2040 | 4.64 | 4.65 | 7.31 | 7.46 | 6.55 | 6.56 | 3.75 | 2.17 | 5.64 |

| 2045 | 4.50 | 4.50 | 7.72 | 7.76 | 6.55 | 6.55 | 4.08 | 1.90 | 4.92 |

| 2050 | 4.32 | 4.32 | 8.03 | 8.03 | 6.52 | 6.52 | 4.23 | 1.67 | 4.22 |

| Year | 2025 Build | 2030 Build | 2035 Build | 2040 Build | 2045 Build | 2050 Build |

|---|---|---|---|---|---|---|

| 2025 | 5.78 | - | - | - | - | - |

| 2030 | 6.13 | 6.47 | - | - | - | - |

| 2035 | 6.29 | 6.60 | 6.89 | - | - | - |

| 2040 | 6.50 | 6.79 | 7.03 | 7.31 | - | - |

| 2045 | 6.87 | 7.01 | 7.19 | 7.44 | 7.72 | - |

| 2050 | 7.35 | 7.33 | 7.54 | 7.79 | 8.03 |

| Year | Coal | Gas | Renewable Energy | ||||

|---|---|---|---|---|---|---|---|

| NDC | Reduction Ambition | NDC | Reduction Ambition | Solar PV | Wind Power | Other | |

| 2025 | 1.84 | 2.84 | 2.26 | 2.78 | 4.45 | 3.77 | 3.88 |

| 2030 | 2.55 | 3.75 | 2.68 | 3.27 | 4.45 | 3.77 | 3.88 |

| 2035 | 3.40 | 4.59 | 3.17 | 3.77 | 4.45 | 3.77 | 3.88 |

| 2040 | 4.11 | 5.26 | 3.53 | 4.06 | 4.45 | 3.77 | 3.88 |

| 2045 | 5.15 | 5.72 | 4.10 | 4.36 | 4.45 | 3.77 | 3.88 |

| 2050 | 6.18 | 6.18 | 4.66 | 4.66 | 4.45 | 3.77 | 3.88 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, C.-K.; Lee, C.-M. Power System Decarbonization Assessment: A Case Study from Taiwan. Energies 2024, 17, 859. https://doi.org/10.3390/en17040859

Wang C-K, Lee C-M. Power System Decarbonization Assessment: A Case Study from Taiwan. Energies. 2024; 17(4):859. https://doi.org/10.3390/en17040859

Chicago/Turabian StyleWang, Chun-Kai, and Chien-Ming Lee. 2024. "Power System Decarbonization Assessment: A Case Study from Taiwan" Energies 17, no. 4: 859. https://doi.org/10.3390/en17040859

APA StyleWang, C.-K., & Lee, C.-M. (2024). Power System Decarbonization Assessment: A Case Study from Taiwan. Energies, 17(4), 859. https://doi.org/10.3390/en17040859