Is Greece Ready for a Hydrogen Energy Transition?—Quantifying Relative Costs in Hard to Abate Industries

Abstract

:1. Introduction

2. Green Hydrogen Production: Current Trends and Costs

2.1. Hydrogen Energy Transition within the Greek Energy Sector

2.2. Green Hydrogen and Applications in Refineries

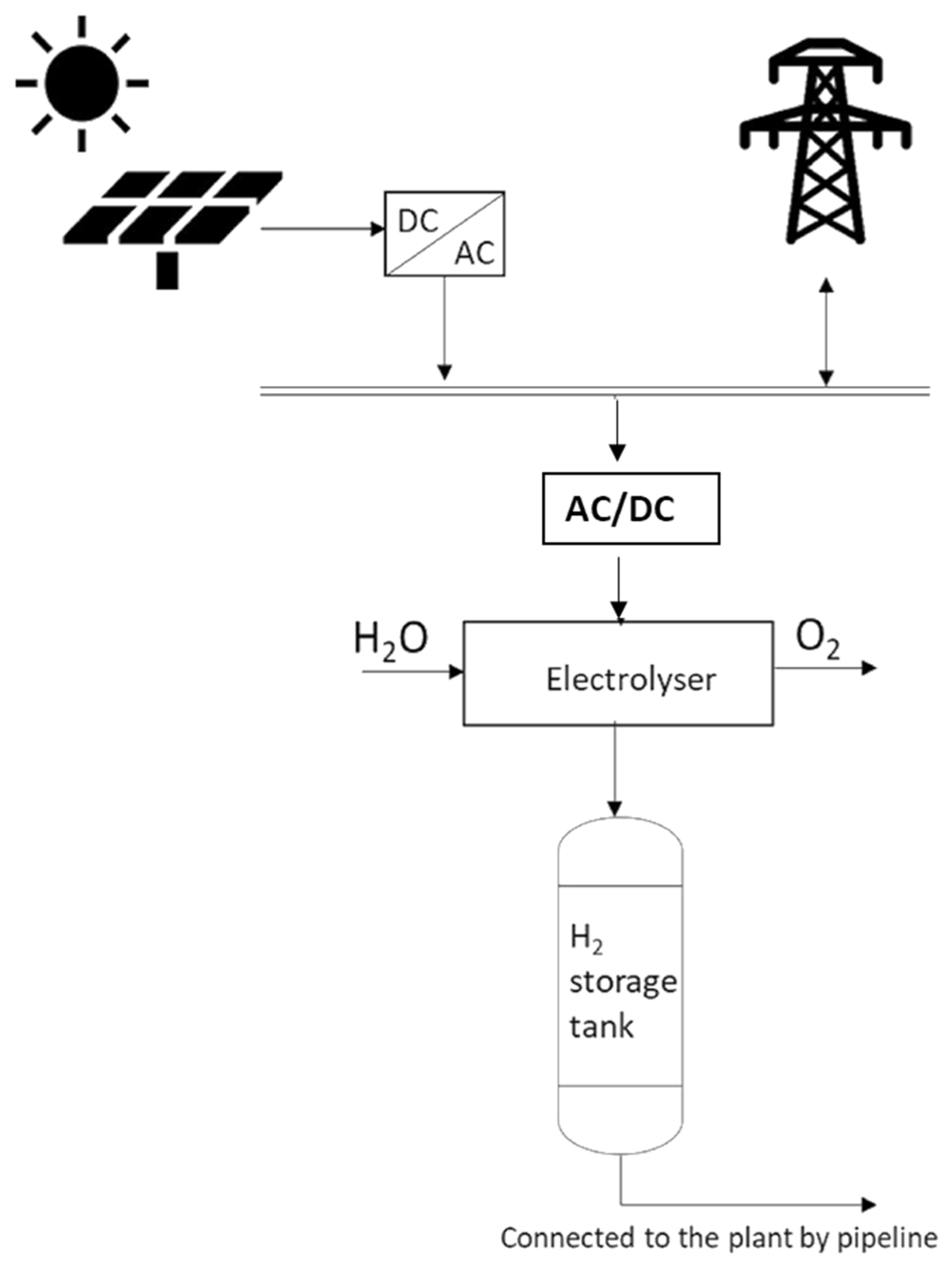

3. Scenario Design and Methodology

- Grey—Business as Usual Scenario (BAU)

- Blue—Carbon Capture Storage (CCS) Scenario for Existing Steam Methane Reformer

- Green—PV Power Purchase Agreement (PPA) Scenario

3.1. Levelized Cost of Hydrogen

- In = Cost of investment;

- Fn = Fixed operational expenditure (F-OPEX);

- Vn = Variable operational expenditure;

- En = Energy obtained in year n;

- N = Plant lifetime;

- i = Discount rate.

- Cx = CAPEX (costs associated with electrolyzers, dispensers, engineering, procurement, and construction (EPC));

- X = Quantity of spare parts related to CAPEX;

- CRF = Capital Recovery Factor (Equation (3)).

- Ca = Annualized total costs;

- Ia,n = Annualized investment;

- Fa,n = Fixed OPEX (EUR/year);

- Va,n = Variable OPEX (EUR/year)

3.2. Cost Assessment and Data

4. Results and Discussion

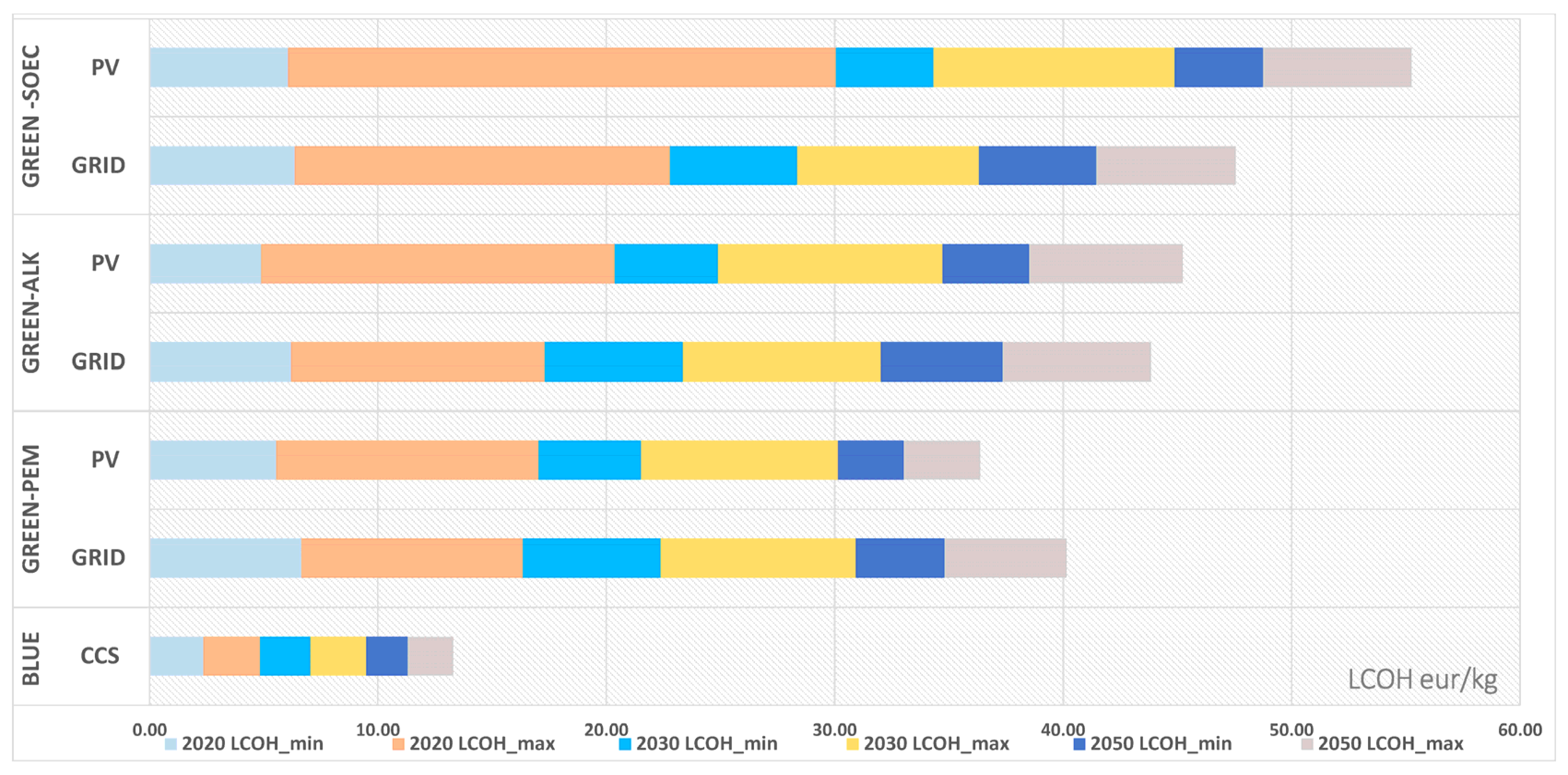

4.1. Hydrogen Production Costs

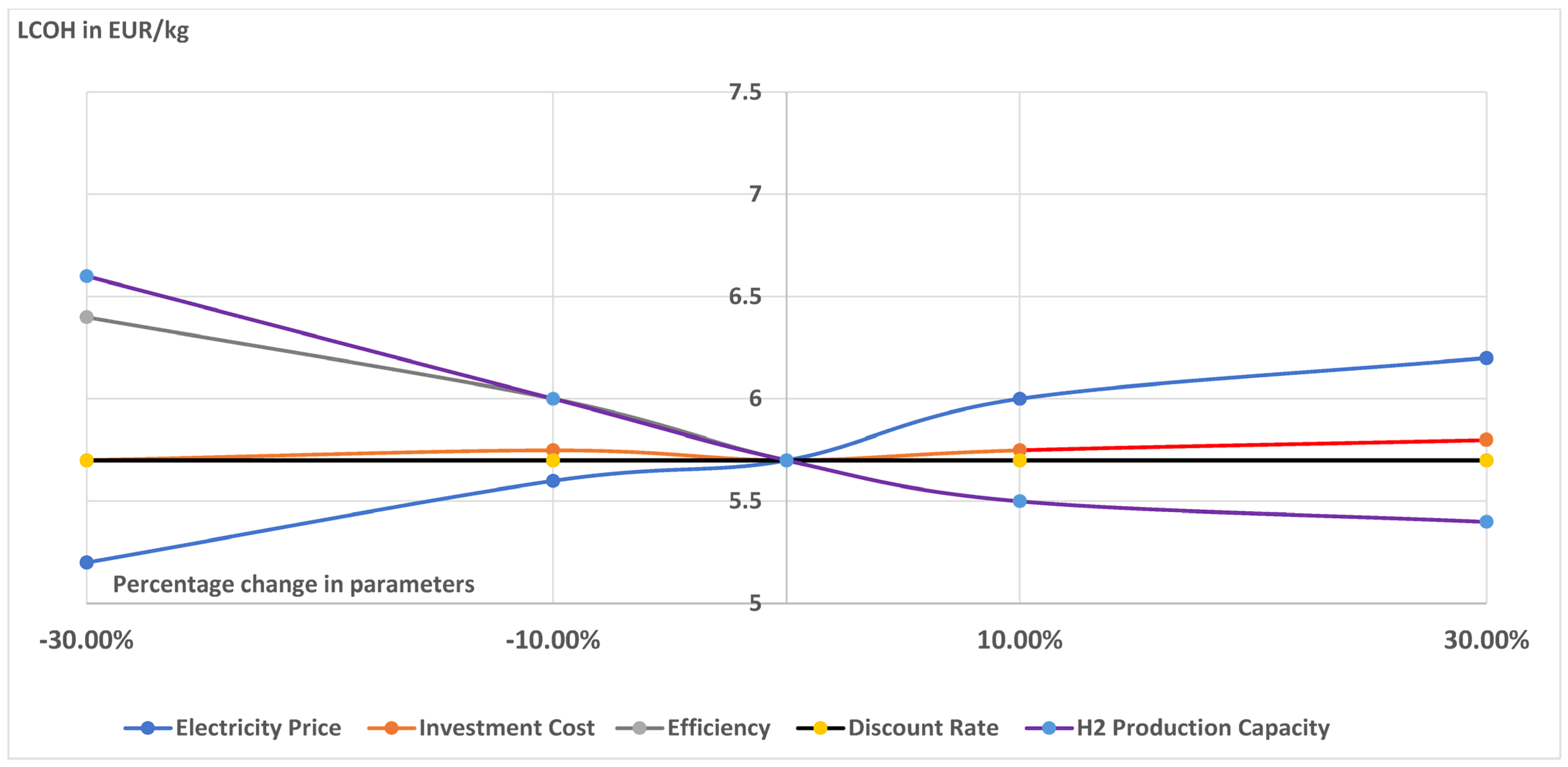

4.2. Sensitivity Analysis on LCOH

5. Conclusions and Future Outlook

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Sharma, S.; Agarwal, S.; Jain, A. Significance of hydrogen as economic and environmentally friendly fuel. Energies 2021, 14, 7389. [Google Scholar] [CrossRef]

- Cader, J.; Koneczna, R.; Olczak, P. The impact of economic, energy, and environmental factors on the development of the hydrogen economy. Energies 2021, 14, 4811. [Google Scholar] [CrossRef]

- Hernandez, P.G.; Berg, T.L.; Xydis, G. Usage of Methanol Fuel Cells to Reduce Power Outages in the Etelä-Savo Region, Finland. Environments 2023, 10, 96. [Google Scholar] [CrossRef]

- Maggio, G.; Nicita, A.; Squadrito, G. How the hydrogen production from RES could change energy and fuel markets: A review of recent literature. Int. J. Hydrogen Energy 2019, 44, 11371–11384. [Google Scholar] [CrossRef]

- Gandhi, K.; Apostoleris, H.; Sgouridis, S. Catching the hydrogen train: Economics-driven green hydrogen adoption potential in the United Arab Emirates. Int. J. Hydrogen Energy 2022, 47, 22285–22301. [Google Scholar] [CrossRef]

- Baker, F. Is the United Kingdom’s hydrogen strategy an effective low carbon strategy? Int. J. Energy Prod. Manag. 2022, 7, 164–175. [Google Scholar] [CrossRef]

- International Energy Agency. Global Hydrogen Review. 2021. Available online: https://iea.blob.core.windows.net/assets/5bd46d7b-906a-4429-abda-e9c507a62341/GlobalHydrogenReview2021.pdf (accessed on 17 December 2023).

- European Commission. Communication COM/2020/301: A Hydrogen Strategy for a Climate-Neutral Europe|Knowledge for Policy. 2020. Available online: https://knowledge4policy.ec.europa.eu/publication/communication-com2020301-hydrogen-strategy-climate-neutral-europe_en (accessed on 15 December 2023).

- New Definitions for Blue and Green Hydrogen: The European Commission’s Package on Hydrogen and Decarbonized Gas Markets. Available online: https://www.insideenergyandenvironment.com/2022/01/new-definitions-for-blue-and-green-hydrogen-the-european-commissions-package-on-hydrogen-and-decarbonized-gas-markets/ (accessed on 10 December 2023).

- European Commission Delegated Regulation (European Union of XXX Supplementing Directive (European Union) 2018/2001 of the European Parliament and of the Council by Establishing a Union Methodology Setting out Detailed Rules for the Production of Renewable Liquid and Gaseous Transport Fuels of Non-Biological Origin Ref. Ares (2022) 3836651–20/05/2022. Available online: https://www.euractiv.com/wp-content/uploads/sites/2/2022/05/090166e5ec7b7157.pdf (accessed on 23 November 2023).

- da Silva Veras, T.; Mozer, T.S.; da Silva César, A. Hydrogen: Trends, production and characterization of the main process worldwide. Int. J. Hydrogen Energy 2017, 42, 2018–2033. [Google Scholar] [CrossRef]

- Benalcazar, P.; Komorowska, A. Prospects of green hydrogen in Poland: A techno-economic analysis using a Monte Carlo approach. Int. J. Hydrogen Energy 2022, 47, 5779–5796. [Google Scholar] [CrossRef]

- de Graaf, V. Clean Hydrogen: Building Block of a New Geopolitical Landscape, Spanish Inst Strateg Stud. 2021. Available online: https://lib.ugent.be/catalog/pug01:8713281 (accessed on 15 November 2023).

- Chu, K.H.; Lim, J.; Mang, J.S.; Hwang, M.H. Evaluation of strategic directions for supply and demand of green hydrogen in South Korea. Int. J. Hydrogen Energy 2022, 47, 1409–1424. [Google Scholar] [CrossRef]

- Liu, W.; Wan, Y.; Xiong, Y.; Gao, P. Green hydrogen standard in China: Standard and evaluation of low-carbon hydrogen, clean hydrogen, and renewable hydrogen. Int. J. Hydrogen Energy 2022, 47, 24584–24591. [Google Scholar] [CrossRef]

- AbouSeada, N.; Hatem, T.M. Climate action: Prospects of green hydrogen in Africa. Energy Rep. 2022, 8, 3873–3890. [Google Scholar] [CrossRef]

- Zhou, Y.; Li, R.; Lv, Z.; Liu, J.; Zhou, H.; Xu, C. Green hydrogen: A promising way to the carbon-free society. Chin. J. Chem. Eng. 2022, 43, 2–13. [Google Scholar] [CrossRef]

- Bujok, P.; Bjørn-Thygesen, F.; Xydis, G. Developing a sustainable energy strategy for Midtjyllands Airport, Denmark. Int. J. Sustain. Transp. 2023, 17, 273–297. [Google Scholar] [CrossRef]

- Touili, S.; Merrouni, A.A.; Azouzoute, A.; El Hassouani, Y.; Amrani, A.I. A technical and economical assessment of hydrogen production potential from solar energy in Morocco. Int. J. Hydrogen Energy 2018, 43, 22777–22796. [Google Scholar] [CrossRef]

- National Energy and Climate Plan (NECP); Ministry of Environment and Energy: Athens, Greece, 2019.

- OT, 2023, Greece Takes a Stance on Hydrogen. Available online: https://www.ot.gr/2022/11/02/english-edition/greece-takes-a-stance-on-hydrogen/ (accessed on 17 December 2023).

- Schiebahn, S.; Grube, T.; Robinius, M.; Tietze, V.; Kumar, B.; Stolten, D. Power to gas: Technological overview, systems analysis and economic assessment for a case study in Germany. Int. J. Hydrogen Energy 2015, 40, 4285–4294. [Google Scholar] [CrossRef]

- European Hydrogen Observatory. Available online: https://observatory.clean-hydrogen.europa.eu/sites/default/files/2023-11/Report%2001%20-%20November%202023%20-%20The%20European%20hydrogen%20market%20landscape.pdf (accessed on 1 March 2024).

- Hydrogen Council in Collaboration with McKinsey & Company. A Perspective on Hydrogen Investment, Market Development and Cost Competitiveness, Hydro Insights; Hydrogen Council in Collaboration with McKinsey & Company: Sydney, Australia, 2021. [Google Scholar]

- Chu, H.; Berger, L.; Grenga, T.; Wu, Z.; Pitsch, H. Effects of differential diffusion on hydrogen flame kernel development under engine conditions. Proc. Combust. Inst. 2023, 39, 2129–2138. [Google Scholar] [CrossRef]

- Park, J.; Kim, C.H.; Cho, H.S.; Kim, S.K.; Cho, W.C. Techno-economic analysis of green hydrogen production system based on renewable energy sources. Trans. Korean Hydrog. New Energy Soc. 2020, 31, 337–344. [Google Scholar] [CrossRef]

- Aziz, G.; Sarwar, S.; Khan, M.S.; Waheed, R. The prospect of green hydrogen in Saudi Arabia: An overview of theoretical and empirical approach. Environ. Sci. Pollut. Res. 2024, 31, 6597–6609. [Google Scholar] [CrossRef]

- Karayel, G.K.; Javani, N.; Dincer, I. Green hydrogen production potential for Turkey with solar energy. Int. J. Hydrogen Energy 2022, 47, 19354–19364. [Google Scholar] [CrossRef]

- Søgaard-Deakin, J.; Xydis, G. Green hydrogen production using proton membrane electrolysis of clean drinking water. J. Environ. Eng. Sci. 2024, 40, 1–9. [Google Scholar] [CrossRef]

- Sorrenti, I.; Rasmussen, T.B.; Xydis, G.; Enevoldsen, P.; You, S. Correlations between component size green hydrogen demand and breakeven price for energy islands. Renew. Sustain. Energy Rev. 2023, 183, 113439. [Google Scholar] [CrossRef]

- El-Emam, R.S.; Özcan, H. Comprehensive review on the techno-economics of sustainable large-scale clean hydrogen production. J. Clean. Prod. 2019, 220, 593–609. [Google Scholar] [CrossRef]

- Janssen, J.L.; Weeda, M.; Detz, R.J.; van der Zwaan, B. Country-specific cost projections for renewable hydrogen production through off-grid electricity systems. Appl. Energy 2022, 309, 118398. [Google Scholar] [CrossRef]

- Pelaez-Samaniego, M.R.; Riveros-Godoy, G.; Torres-Contreras, S.; Garcia-Perez, T.; Albornoz-Vintimilla, E. Production and use of electrolytic hydrogen in Ecuador towards a low carbon economy. Energy 2014, 64, 626–631. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, N.; Tong, X.; Duan, L.; Lin, T.-E.; Maréchal, F.; Van Herle, J.; Wang, L.; Yang, Y. Reversible solid-oxide cell stack based power-to-x-to-power systems: Economic potential evaluated via plant capital-cost target. Appl. Energy 2021, 290, 116700. [Google Scholar] [CrossRef]

- Hill, S.J.P.; Bamisile, O.; Hatton, L.; Staffell, I.; Jansen, M. The cost of clean hydrogen from offshore wind and electrolysis. J. Clean. Prod. 2024, 445, 141162. [Google Scholar] [CrossRef]

- Biggins, F.; Kataria, M.; Roberts, D.; Brown, S. Green hydrogen investments: Investigating the option to wait. Energy 2022, 241, 122842. [Google Scholar] [CrossRef]

- Schmidt, O.; Gambhir, A.; Staffell, I.; Hawkes, A.; Nelson, J.; Few, S. Future cost and performance of water electrolysis: An expert elicitation study. Int. J. Hydrogen Energy 2017, 42, 30470–30492. [Google Scholar] [CrossRef]

- Ursúa, A.; Barrios, E.L.; Pascual, J.; San Martín, I.; Sanchis, P. Integration of commercial alkaline water electrolysers with renewable energies: Limitations and improvements. Int. J. Hydrogen Energy 2016, 41, 12852–12861. [Google Scholar] [CrossRef]

- Panah, P.G.; Cui, X.; Bornapour, M.; Hooshmand, R.A.; Guerrero, J.M. Marketability analysis of green hydrogen production in Denmark: Scale-up effects on grid-connected electrolysis. Int. J. Hydrogen Energy 2022, 47, 12443–12455. [Google Scholar] [CrossRef]

- Krishnan, S.; Fairlie, M.; Andres, P.; de Groot, T.; Kramer, G.J. Power to gas (H2): Alkaline electrolysis. In Technological Learning in the Transition to a Low-Carbon Energy System; Academic Press: New York, NY, USA, 2020; pp. 165–187. [Google Scholar]

- Esposito, D.V. Membraneless electrolyzers for low-cost hydrogen production in a renewable energy future. Joule 2017, 1, 651–658. [Google Scholar] [CrossRef]

- Tsagkari, M. Energy Governance in Greece. In Handbook of Energy Governance in Europe; Springer International Publishing: Cham, Switzerland, 2022; pp. 709–736. [Google Scholar]

- Griffiths, S.; Sovacool, B.K.; Kim, J.; Bazilian, M.; Uratani, J.M. Decarbonizing the oil refining industry: A systematic review of sociotechnical systems, technological innovations, and policy options. Energy Res. Soc. Sci. 2022, 89, 102542. [Google Scholar] [CrossRef]

- LaFleur, A. Use and Optimization of Hydrogen at Oil Refineries; University of Houston: Houston, TX, USA, 2017. [Google Scholar]

- BP. 2024. Available online: https://www.bp.com/en/global/air-bp/news-and-views/press-releases/bp-refinery-in-lingen-starts-production-of-saf.html (accessed on 10 February 2024).

- REFHYNE. 2024. Available online: https://www.clean-hydrogen.europa.eu/projects-repository/refhyne_en (accessed on 10 February 2024).

- Shell, 2024, Hydrogen—What Is It? Hydrogen Fuel & Projects. Available online: https://www.shell.com/energy-and-innovation/new-energies/hydrogen.html (accessed on 15 December 2023).

- Renewablesnow. 2024. Available online: https://renewablesnow.com/news/everfuel-milks-first-h2-at-20-mw-electrolysis-plant-in-denmark-808548/ (accessed on 3 September 2023).

- Multiplhy Project. 2024. Available online: https://multiplhy-project.eu/ (accessed on 17 December 2023).

- Soltani, R.; Rosen, M.A.; Dincer, I. Assessment of CO2 capture options from various points in steam methane reforming for hydrogen production. Int. J. Hydrogen Energy 2014, 39, 20266–20275. [Google Scholar] [CrossRef]

- Huneke, F.; Göß, S.; Österreicher, J.; Dahroug, O. Power Purchase Agreements: Financial Model for Renewable Energies; Energy Brainpool: Berlin, Germany, 2018. [Google Scholar]

- EPA, DOE. Report of the Interagency Task Force on Carbon Capture and Storage; Department of Energy and Environmental Protection Agency: Washington, DC, USA, 2010. [Google Scholar]

- Viktorsson, L.; Heinonen, J.T.; Skulason, J.B.; Unnthorsson, R. A step towards the hydrogen economy—A life cycle cost analysis of a hydrogen refueling station. Energies 2017, 10, 763. [Google Scholar] [CrossRef]

- EC. ASSET Study on Hydrogen Generation in Europe: Overview of Costs and Key Benefits. 2021. Available online: https://op.europa.eu/en/publication-detail/-/publication/c4000448-b84d-11eb-8aca-01aa75ed71a1 (accessed on 21 November 2023).

- Khatiwada, D.; Vasudevan, R.A.; Santos, B.H. Decarbonization of natural gas systems in the EU—Costs, barriers, and constraints of hydrogen production with a case study in Portugal. Renew. Sustain. Energy Rev. 2022, 168, 112775. [Google Scholar] [CrossRef]

- Nel. Hydrogen Electrolysers the World’s Most Efficient and Reliable Electrolysers. 2020. Available online: http://www.silpac.com.cn/download/Electrolysers-Brochure-Rev-C.pdf (accessed on 3 September 2023).

- Sunfire, Hydrogen the Renewable Feedstock and Energy Carrier. 2022. Available online: https://www.sunfire.de/en/hydrogen (accessed on 21 November 2023).

- IEAGHG. IEAGHG Technical Report: Techno-Economic Evaluation of SMR Based Standalone (Merchant) Plant with CCS. 2017. Available online: https://ieaghg.org/exco_docs/2017-02.pdf (accessed on 3 September 2023).

- Christensen, A. Assessment of hydrogen production costs from electrolysis: United States and Europe. Int. Counc. Clean Transp. 2020, 1, 1–64. [Google Scholar]

- Statista. Available online: https://www.statista.com/statistics/1290229/carbon-intensity-power-sector-greece/ (accessed on 10 January 2024).

- Janssen, J. Fact Sheet—Steam Methane Reforming (SMR) for Hydrogen Production with Carbon Capture Using Flue Gas. 2018. Available online: https://energy.nl/wp-content/uploads/steam-methane-reforming-smr-for-hydrogen-production-with-carbon-capture-using-flue-gas-2-7.pdf (accessed on 10 January 2024).

- EU Carbon PermitsPrice—Chart—Historical Data—News. Available online: https://tradingeconomics.com/commodity/carbon (accessed on 15 January 2023).

- Eurostat. Electricity Price Statistics. 2023. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Electricity_price_statistics#Electricity_prices_for_non-household_consumers (accessed on 17 December 2023).

- Eurostat, 2024: Natural Gas Price Statistics. 2023. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Natural_gas_price_statistics (accessed on 20 January 2024).

- Zun, M.T.; McLellan, B.C. Cost Projection of Global Green Hydrogen Production Scenarios. Hydrogen 2023, 4, 932–960. [Google Scholar] [CrossRef]

- Durakovic, G.; Zhang, H.; Knudsen, B.R.; Tomasgard, A.; del Granado, P.C. Decarbonizing the European energy system in the absence of Russian gas: Hydrogen uptake and carbon capture developments in the power, heat and industry sectors. J. Clean. Prod. 2024, 435, 140473. [Google Scholar] [CrossRef]

| Factor | Year | PEM | ALK | SOEC | SMR + CCU | PV |

|---|---|---|---|---|---|---|

| Investment cost (Mil EUR/MW) | 2020 | 1.26–2.82 | 0.44–2.83 | 1.07–6.66 | 0.79–1.65 | 0.43–0.83 |

| 2030 | 0.84–2.82 | 0.36–1.53 | 0.58–3.33 | 0.91–1.29 | 0.27–0.27 | |

| 2050 | 0.77–2.74 | 0.22–0.88 | 0.39–1.14 | 0.86–1.21 | 0.16–0.16 | |

| Efficiency (LHV %) | 2020 | 56–63 | 63–70 | 74–81 | 69 | - |

| 2030 | 61–69 | 63–72 | 74–84 | 69 | - | |

| 2050 | 67–74 | 70–80 | 77–84 | 69 | - | |

| Lifetime (Hours) | 2020 | 30,000–90,000 | 50,000–90,000 | 10,000–30,000 | - | 1343 |

| 2030 | 60,000–90,000 | 72,500–100,000 | 40,000–60,000 | - | 1484 | |

| 2050 | 100,000–150,000 | 100,000–150,000 | 75,000–100,000 | - | 1499 |

| Parameter Technology | Value | Units | Source | |

|---|---|---|---|---|

| Hydrogen production | PEM | 3 | MW H2 | [56] |

| ALK | 13 | MW H2 | [56] | |

| SOEC | 2.5 | MW H2 | [57] | |

| CCU | 300 | MW H2 | [58] | |

| Lifetime | Electrolyzers | 20 | Years | [54] |

| CCU | 25 | years | [58] | |

| PV | 20 | years | [57] | |

| F-OPEX | Electrolyzers | 1.5% of CAPEX | EUR | [53] |

| CCU | 3% of CAPEX | EUR | [58] | |

| Replacement and chemical costs: annualized (REPEX) | Electrolyzers | 20% of CAPEX per replacement | EUR | [59] |

| CCU | 3% of CAPEX | EUR | [58] | |

| Emission factors | Grid electricity | 344 | gCO2/kWh e− | [60] |

| H2 production (via CCU) | 890 | gCO2/Nm3 H2 | [61] | |

| Electrolyzers’ efficiency (LHV of H2) | PEM, ALK, and SOEC | 61 | % | [57] |

| Full load hour factor (capacity) | Grid electricity | 80 | % | [53] |

| Solar electricity | 20 | % | [58] | |

| Natural gas | 95 | % | [58] | |

| ETS CO2 emissions: (carbon) tax | 82 | EUR/tCO2 | [62] | |

| Density | 0.0889 | kg/Nm3 | ||

| Lower heating value | 33.3333 | kWh/kg H2 | ||

| Discount rate | 6 | % | [53] | |

| Capacity recovery factor (CRF) | Electrolyzers | 0.0872 | ||

| Grey | 0.0782 | |||

| Blue—CCU | 0.0782 | |||

| Water consumption | PEM | 10.12 | kg/kg H2 | [54] |

| ALK | 10.12 | kg/kg H2 | [54] | |

| SOEC | 13.00 | kg/kg H2 | [57] | |

| CCU | 6.70 | kg/kg H2 | [58] | |

| Energy costs | Grid electricity (without taxes in Greece) | 0.1845 | EUR/kWh | [63] |

| Lowest cost of solar electricity (European average) | 0.02 | EUR/kWh | [64] | |

| Natural gas | 0.1171 | EUR/kWh | [64] | |

| Water costs | Electrolyzers | 1.8188 | EUR/m3 | [63] |

| CCU | 0.2 | EUR/m3 | [58] | |

| Technology | Year | |||||||

|---|---|---|---|---|---|---|---|---|

| 2020 | 2030 | 2050 | ||||||

| Min | Max | Min | Max | Min | Max | |||

| Electrolyzer | PEM | GRID | 6.65 | 9.70 | 6.03 | 8.55 | 3.88 | 5.34 |

| PV | 5.54 | 11.49 | 4.49 | 8.63 | 2.88 | 3.34 | ||

| Electrolyzer | ALK | GRID | 6.20 | 11.11 | 6.04 | 8.67 | 5.34 | 6.48 |

| PV | 4.89 | 15.48 | 4.52 | 9.83 | 3.79 | 6.72 | ||

| Electrolyzer | SOEC | GRID | 6.36 | 16.43 | 5.57 | 7.96 | 5.13 | 6.10 |

| PV | 6.06 | 24.00 | 4.27 | 10.54 | 3.88 | 6.50 | ||

| SMR | GREY—BAU | 1.92 | 2.08 | - | - | - | - | |

| BLUE—CCS | 2.36 | 2.48 | 2.20 | 2.45 | 1.82 | 2.00 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nanaki, E.A.; Kiartzis, S.; Xydis, G. Is Greece Ready for a Hydrogen Energy Transition?—Quantifying Relative Costs in Hard to Abate Industries. Energies 2024, 17, 1722. https://doi.org/10.3390/en17071722

Nanaki EA, Kiartzis S, Xydis G. Is Greece Ready for a Hydrogen Energy Transition?—Quantifying Relative Costs in Hard to Abate Industries. Energies. 2024; 17(7):1722. https://doi.org/10.3390/en17071722

Chicago/Turabian StyleNanaki, Evanthia A., Spyros Kiartzis, and George Xydis. 2024. "Is Greece Ready for a Hydrogen Energy Transition?—Quantifying Relative Costs in Hard to Abate Industries" Energies 17, no. 7: 1722. https://doi.org/10.3390/en17071722