Has the “Belt and Road Initiative” Promoted Chinese OFDI in Green Energy? Evidence from Chinese Energy Engagement in BRI Countries

Abstract

1. Introduction

2. Literature Review and Hypothesis

2.1. China’s BRI and Green Energy Projects

2.2. China’s BRI, Infrastructure and Green Energy Projects

3. Materials and Methods

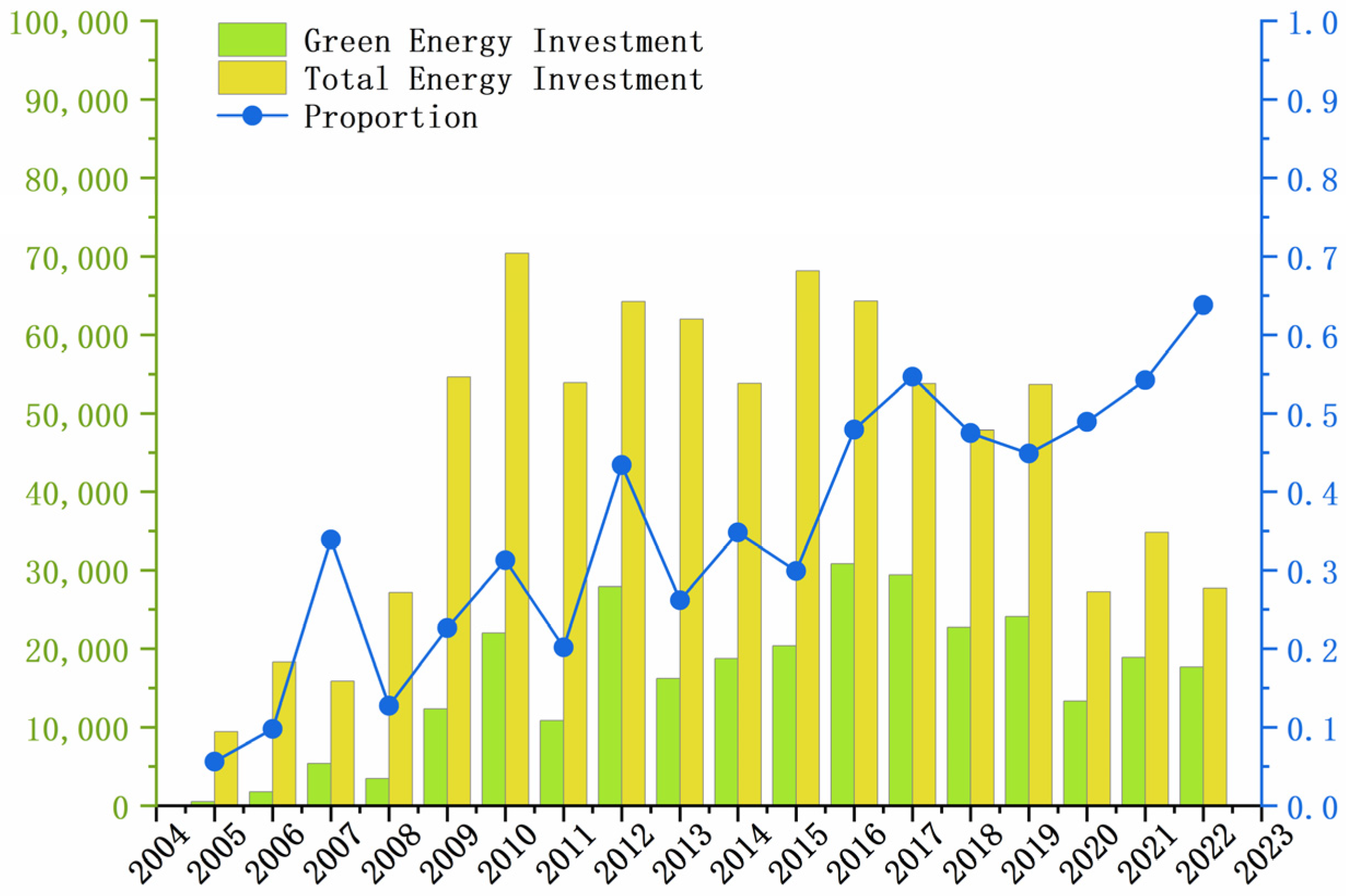

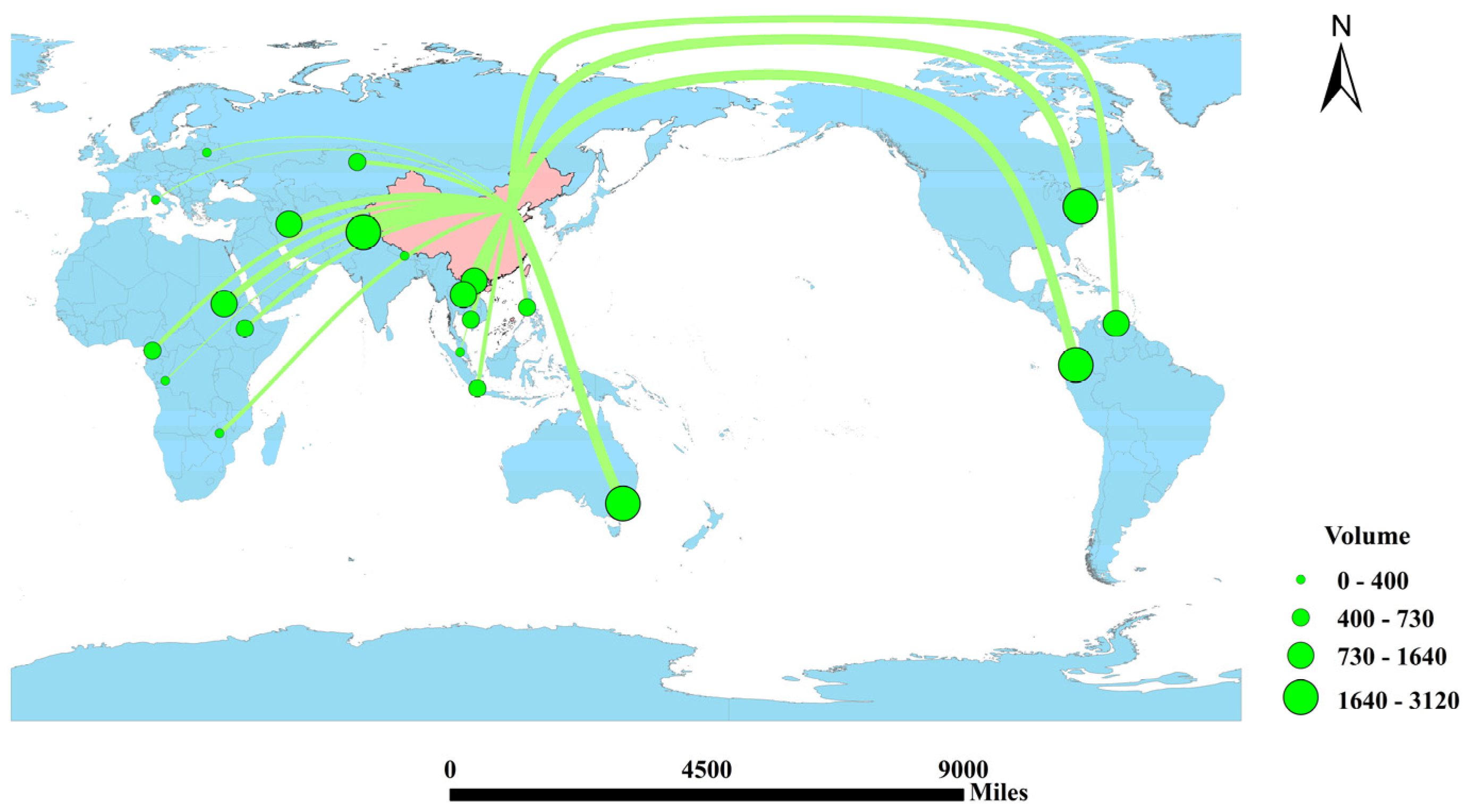

3.1. Sample and Data

3.2. Model Setting

4. Empirical Results

4.1. Benchmark Regression

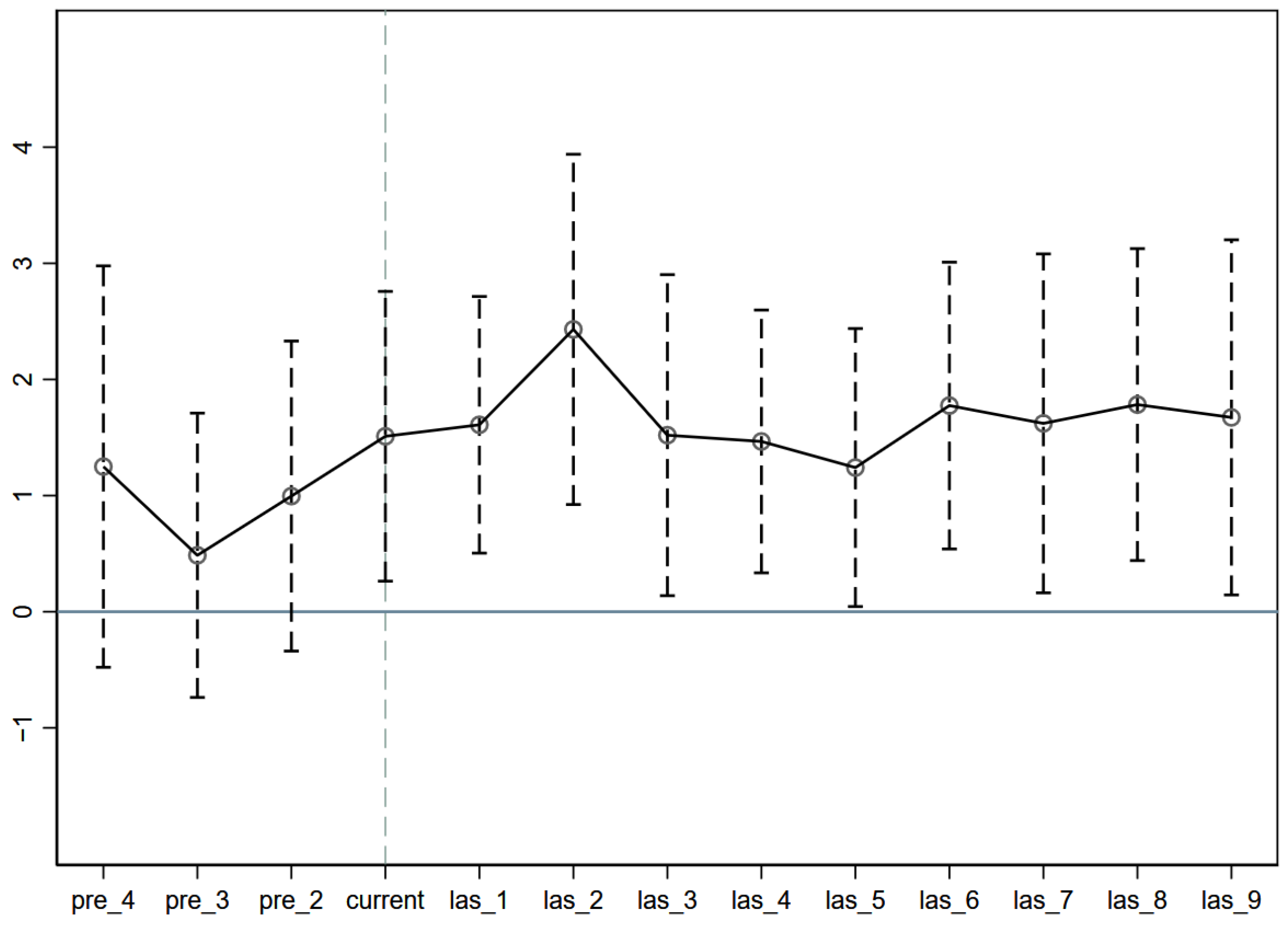

4.2. Parallel Trend Assumption Test

4.3. Robustness Tests

4.3.1. Eliminate Other Policy Interferences

4.3.2. Placebo Test

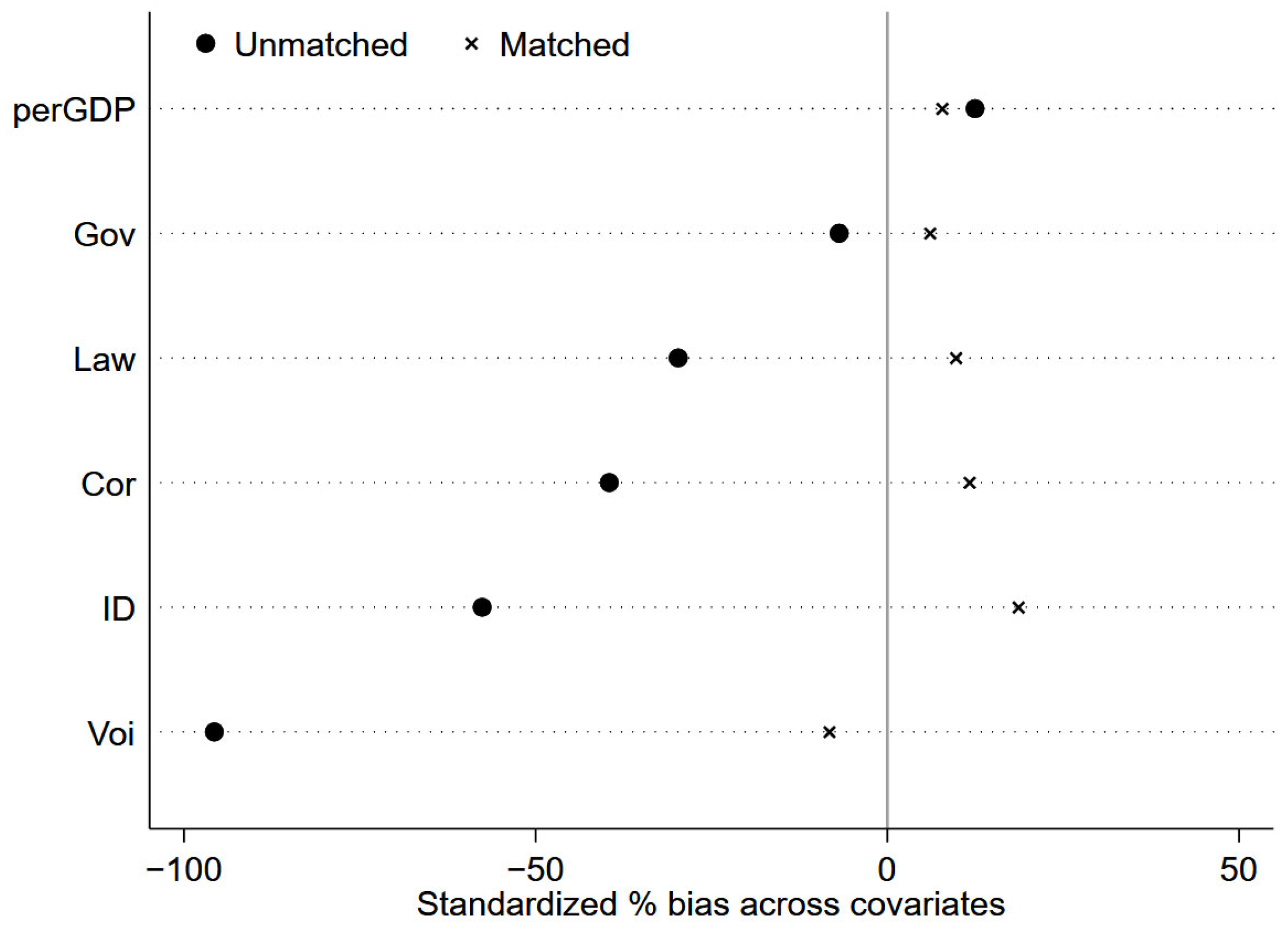

4.3.3. Sample Selection Bias

4.3.4. Replacing the Measure of the Dependent Variable

4.3.5. Replacing the Data Processing Method

4.3.6. Staggered DID

5. Further Analysis

5.1. Mechanism Analysis

5.2. Heterogeneity Test

5.2.1. Heterogeneity Tests for Different Regions

5.2.2. Heterogeneity Tests for Developing and Developed Countries

5.2.3. Heterogeneity Tests for High-Risk and Low-Risk Countries

6. Conclusions and Policy Implications

6.1. Conclusions

6.2. Policy Implications

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Li, B.; Han, Y.; Wang, C.; Sun, W. Did Civilized City Policy Improve Energy Efficiency of Resource-Based Cities? Prefecture-Level Evidence from China. SSRN Electron. J. 2022. [Google Scholar] [CrossRef]

- Wang, J.; Shahbaz, M.; Song, M. Evaluating Energy Economic Security and Its Influencing Factors in China. Energy 2021, 229, 120638. [Google Scholar] [CrossRef]

- Su, C.-W.; Pang, L.-D.; Qin, M.; Lobonţ, O.-R.; Umar, M. The Spillover Effects among Fossil Fuel, Renewables and Carbon Markets: Evidence under the Dual Dilemma of Climate Change and Energy Crises. Energy 2023, 274, 127304. [Google Scholar] [CrossRef]

- IEA. Net Zero Roadmap: A Global Pathway to Keep the 1.5 °C Goal in Reach—Analysis; IEA: Paris, France, 2023. [Google Scholar]

- Greenpeace Sustainability Should Be Priority for China’s Belt and Road-Greenpeace. Available online: https://www.greenpeace.org/eastasia/press/1383/sustainability-should-be-priority-for-chinas-belt-and-road-greenpeace/ (accessed on 10 October 2023).

- Hurri, K. Rethinking Climate Leadership: Annex I Countries’ Expectations for China’s Leadership Role in the Post-Paris UN Climate Negotiations. Environ. Dev. 2020, 35, 100544. [Google Scholar] [CrossRef]

- Tan, X.-C.; Zhu, K.-W.; Sun, Y.-L.; Zhao, W.-Y.; Chen, F. Bibliometric Research on the Development of Climate Change in the BRI Regions. Adv. Clim. Change Res. 2021, 12, 254–262. [Google Scholar] [CrossRef]

- Peng, H.-R.; Tan, X.; Managi, S.; Taghizadeh-Hesary, F. Club Convergence in Energy Efficiency of Belt and Road Initiative Countries: The Role of China’s Outward Foreign Direct Investment. Energy Policy 2022, 168, 113139. [Google Scholar] [CrossRef]

- Wu, Y.; Chen, C.; Hu, C. Does the Belt and Road Initiative Increase the Carbon Emission Intensity of Participating Countries? China World Econ. 2021, 29, 1–25. [Google Scholar] [CrossRef]

- Zhao, J.; Pan, J.; Xie, X.; Su, M. Green Outward Foreign Direct Investment and Host Country Environmental Effects: The Home Country’s Carbon Emission Reduction System Is Crucial. Energy 2024, 290, 130182. [Google Scholar] [CrossRef]

- Li, B.; Hu, J.; Chen, G.; Xiao, D.; Cheng, S. The Environmental Effects of Regional Economic Cooperation: Evidence from the Belt and Road Initiative. Front. Environ. Sci. 2022, 10, 1020502. [Google Scholar] [CrossRef]

- Tawiah, V.K.; Zakari, A.; Khan, I. The Environmental Footprint of China-Africa Engagement: An Analysis of the Effect of China–Africa Partnership on Carbon Emissions. Sci. Total Environ. 2021, 756, 143603. [Google Scholar] [CrossRef]

- Hughes, A.C. Understanding and Minimizing Environmental Impacts of the Belt and Road Initiative. Conserv. Biol. 2019, 33, 883–894. [Google Scholar] [CrossRef] [PubMed]

- Ng, L.S.; Campos-Arceiz, A.; Sloan, S.; Hughes, A.C.; Tiang, D.C.F.; Li, B.V.; Lechner, A.M. The Scale of Biodiversity Impacts of the Belt and Road Initiative in Southeast Asia. Biol. Conserv. 2020, 248, 108691. [Google Scholar] [CrossRef]

- Hopwood, B.; Mellor, M.; O’Brien, G. Sustainable Development: Mapping Different Approaches. Sustain. Dev. 2005, 13, 38–52. [Google Scholar] [CrossRef]

- Khan, I.; Zakari, A.; Zhang, J.; Dagar, V.; Singh, S. A Study of Trilemma Energy Balance, Clean Energy Transitions, and Economic Expansion in the Midst of Environmental Sustainability: New Insights from Three Trilemma Leadership. Energy 2022, 248, 123619. [Google Scholar] [CrossRef]

- Zhang, D.; Kong, Q. Green Energy Transition and Sustainable Development of Energy Firms: An Assessment of Renewable Energy Policy. Energy Econ. 2022, 111, 106060. [Google Scholar] [CrossRef]

- Huang, Y.; Yu, Y. Determinants of Chinese Energy OFDI Location Decisions and Entry Failure Risk: The Roles of Public Diplomacy Endeavors and Firm Investment Strategies. Energy 2023, 267, 126570. [Google Scholar] [CrossRef]

- Razzaq, A.; An, H.; Delpachitra, S. Does Technology Gap Increase FDI Spillovers on Productivity Growth? Evidence from Chinese Outward FDI in Belt and Road Host Countries. Technol. Forecast. Soc. Change 2021, 172, 121050. [Google Scholar] [CrossRef]

- Gong, X. Energy Security through a Financial Lens: Rethinking Geopolitics, Strategic Investment, and Governance in China’s Global Energy Expansion. Energy Res. Soc. Sci. 2022, 83, 102341. [Google Scholar] [CrossRef]

- Jackson, M.M.; Lewis, J.I.; Zhang, X. A Green Expansion: China’s Role in the Global Deployment and Transfer of Solar Photovoltaic Technology. Energy Sustain. Dev. 2021, 60, 90–101. [Google Scholar] [CrossRef]

- Liu, H.; Wang, Y.; Jiang, J.; Wu, P. How Green Is the “Belt and Road Initiative”?—Evidence from Chinese OFDI in the Energy Sector. Energy Policy 2020, 145, 111709. [Google Scholar] [CrossRef]

- Wang, B.; Lin, P. Whether China’s Overseas Energy Infrastructure Projects Dirtier or Cleaner after the Belt and Road Initiative? Energy Policy 2022, 166, 113007. [Google Scholar] [CrossRef]

- Omer, A.M. Green Energies and the Environment. Renew. Sustain. Energy Rev. 2008, 12, 1789–1821. [Google Scholar] [CrossRef]

- Midilli, A.; Dincer, I.; Ay, M. Green Energy Strategies for Sustainable Development. Energy Policy 2006, 34, 3623–3633. [Google Scholar] [CrossRef]

- Rao, A.; Lucey, B.; Kumar, S.; Lim, W.M. Do Green Energy Markets Catch Cold When Conventional Energy Markets Sneeze? Energy Econ. 2023, 127, 107035. [Google Scholar] [CrossRef]

- Seetharaman; Moorthy, K.; Patwa, N.; Saravanan; Gupta, Y. Breaking Barriers in Deployment of Renewable Energy. Heliyon 2019, 5, e01166. [Google Scholar] [CrossRef] [PubMed]

- Karakosta, C.; Doukas, H.; Psarras, J. Technology Transfer through Climate Change: Setting a Sustainable Energy Pattern. Renew. Sustain. Energy Rev. 2010, 14, 1546–1557. [Google Scholar] [CrossRef]

- Urban, F. China’s Rise: Challenging the North-South Technology Transfer Paradigm for Climate Change Mitigation and Low Carbon Energy. Energy Policy 2018, 113, 320–330. [Google Scholar] [CrossRef]

- Zeng, W. Towards Growth-Driven Environmentalism: The Green Energy Transition and Local State in China. Energy Res. Soc. Sci. 2024, 117, 103726. [Google Scholar] [CrossRef]

- Chen, Y.; Landry, D. Capturing the Rains: Comparing Chinese and World Bank Hydropower Projects in Cameroon and Pathways for South-South and North South Technology Transfer. Energy Policy 2018, 115, 561–571. [Google Scholar] [CrossRef]

- Luo, Y.; Xue, Q.; Han, B. How Emerging Market Governments Promote Outward FDI: Experience from China. J. World Bus. 2010, 45, 68–79. [Google Scholar] [CrossRef]

- Zhang, C.; Zheng, W.; Hong, J.; Kafouros, M. The Role of Government Policies in Explaining the Internationalization of Chinese Firms. J. Bus. Res. 2022, 141, 552–563. [Google Scholar] [CrossRef]

- Du, J.; Zhang, Y. Does One Belt One Road Strategy Promote Chinese Overseas Direct Investment? China Econ. Rev. 2018, 47, 189–205. [Google Scholar] [CrossRef]

- Shao, X. Chinese OFDI Responses to the B&R Initiative: Evidence from a Quasi-Natural Experiment. China Econ. Rev. 2020, 61, 101435. [Google Scholar] [CrossRef]

- Cheng, S.; Wang, B. Impact of the Belt and Road Initiative on China’s Overseas Renewable Energy Development Finance: Effects and Features. Renew. Energy 2023, 206, 1036–1048. [Google Scholar] [CrossRef]

- Zuo, M.; Yu, S. Dual Dividends of Multilateral Energy Cooperation: Renewable Investment Surge and Air Quality Improvements under the Belt and Road Energy Partnership. Renew. Energy 2026, 256, 124164. [Google Scholar] [CrossRef]

- BloombergNEF. Energy Transition Investment Trends. 2024. Available online: https://about.bnef.com/energy-transition-investment/ (accessed on 23 October 2024).

- Sheppard, E.S. Limits to Globalization: Disruptive Geographies of Capitalist Development; Oxford University Press: Oxford, UK, 2016; ISBN 978-0-19-968116-7. [Google Scholar]

- Fisher, D.R.; Green, J.F. Understanding Disenfranchisement: Civil Society and Developing Countries’ Influence and Participation in Global Governance for Sustainable Development. Glob. Environ. Polit. 2004, 4, 65–84. [Google Scholar] [CrossRef]

- Belt and Road Portal. Joint Communiqué of the Roundtable Summit of the “Belt and Road” International Co-Operation Forum (Full Text). Available online: https://eng.yidaiyilu.gov.cn/ (accessed on 28 March 2025).

- Liu, W.; Dunford, M.; Gao, B. A Discursive Construction of the Belt and Road Initiative: From Neo-Liberal to Inclusive Globalization. J. Geogr. Sci. 2018, 28, 1199–1214. [Google Scholar] [CrossRef]

- Shaikh, F.; Ji, Q.; Fan, Y. The Diagnosis of an Electricity Crisis and Alternative Energy Development in Pakistan. Renew. Sustain. Energy Rev. 2015, 52, 1172–1185. [Google Scholar] [CrossRef]

- Lam, P.T.I.; Law, A.O.K. Financing for Renewable Energy Projects: A Decision Guide by Developmental Stages with Case Studies. Renew. Sustain. Energy Rev. 2018, 90, 937–944. [Google Scholar] [CrossRef]

- Casier, T. The Geopolitics of the EU’s Decarbonization Strategy: A Bird’s Eye Perspective. In Decarbonization in the European Union; Dupont, C., Oberthür, S., Eds.; Palgrave Macmillan UK: London, UK, 2015; pp. 159–179. ISBN 978-1-349-68088-7. [Google Scholar]

- Kozlova, M.; Collan, M. Renewable Energy Investment Attractiveness: Enabling Multi-Criteria Cross-Regional Analysis from the Investors’ Perspective. Renew. Energy 2020, 150, 382–400. [Google Scholar] [CrossRef]

- Stram, B.N. Key Challenges to Expanding Renewable Energy. Energy Policy 2016, 96, 728–734. [Google Scholar] [CrossRef]

- Wang, Y.; Xu, A. Green Investments and Development of Renewable Energy Projects: Evidence from 15 RCEP Member Countries. Renew. Energy 2023, 211, 1045–1050. [Google Scholar] [CrossRef]

- Shahbaz, M.; Topcu, B.A.; Sarıgül, S.S.; Vo, X.V. The Effect of Financial Development on Renewable Energy Demand: The Case of Developing Countries. Renew. Energy 2021, 178, 1370–1380. [Google Scholar] [CrossRef]

- Qin, Y.; Xu, Z.; Wang, X.; Škare, M. The Effects of Financial Institutions on the Green Energy Transition: A Cross-Sectional Panel Study. Econ. Anal. Policy 2023, 78, 524–542. [Google Scholar] [CrossRef]

- Skare, M.; Gavurova, B.; Sinkovic, D. Regional Aspects of Financial Development and Renewable Energy: A Cross-Sectional Study in 214 Countries. Econ. Anal. Policy 2023, 78, 1142–1157. [Google Scholar] [CrossRef]

- Asiedu, E. On the Determinants of Foreign Direct Investment to Developing Countries: Is Africa Different? World Dev. 2002, 30, 107–119. [Google Scholar] [CrossRef]

- Bellak, C.; Leibrecht, M.; Damijan, J.P. Infrastructure Endowment and Corporate Income Taxes as Determinants of Foreign Direct Investment in Central and Eastern European Countries. World Econ. 2009, 32, 267–290. [Google Scholar] [CrossRef]

- Chen, H.; Gangopadhyay, P.; Singh, B.; Chen, K. What Motivates Chinese Multinational Firms to Invest in Asia? Poor Institutions versus Rich Infrastructures of a Host Country. Technol. Forecast. Soc. Change 2023, 189, 122323. [Google Scholar] [CrossRef]

- Cheng, L.K.; Kwan, Y.K. What Are the Determinants of the Location of Foreign Direct Investment? The Chinese Experience. J. Int. Econ. 2000, 51, 379–400. [Google Scholar] [CrossRef]

- Donaubauer, J.; Meyer, B.; Nunnenkamp, P. Aid, Infrastructure, and FDI: Assessing the Transmission Channel with a New Index of Infrastructure. World Dev. 2016, 78, 230–245. [Google Scholar] [CrossRef]

- Kinda, T. Investment Climate and FDI in Developing Countries: Firm-Level Evidence. World Dev. 2010, 38, 498–513. [Google Scholar] [CrossRef]

- Huang, Y. Understanding China’s Belt & Road Initiative: Motivation, Framework and Assessment. China Econ. Rev. 2016, 40, 314–321. [Google Scholar] [CrossRef]

- Yu, H. Motivation behind China’s ‘One Belt, One Road’ Initiatives and Establishment of the Asian Infrastructure Investment Bank. J. Contemp. China 2017, 26, 353–368. [Google Scholar] [CrossRef]

- Ho, C.-Y.; Narins, T.P.; Sung, W. Developing Information and Communication Technology with the Belt and Road Initiative and the Digital Silk Road. Telecommun. Policy 2023, 47, 102672. [Google Scholar] [CrossRef]

- Petry, J. Beyond Ports, Roads and Railways: Chinese Economic Statecraft, the Belt and Road Initiative and the Politics of Financial Infrastructures. Eur. J. Int. Relat. 2023, 29, 319–351. [Google Scholar] [CrossRef]

- Chishti, M.Z.; Xia, X.; Du, A.M.; Özkan, O. Digital Financial Inclusion, the Belt and Road Initiative, and the Paris Agreement: Impacts on Energy Transition Grid Costs. Finance Res. Lett. 2025, 72, 106517. [Google Scholar] [CrossRef]

- American Enterprise Institute and Heritage Foundation. China Global Investment Tracker 2023. Available online: https://www.aei.org/china-global-investment-tracker/ (accessed on 23 October 2024).

- Li, J.; Umar, M.; Huo, J. The Spillover Effect between Chinese Crude Oil Futures Market and Chinese Green Energy Stock Market. Energy Econ. 2023, 119, 106568. [Google Scholar] [CrossRef]

- Hasan, K.N.; Preece, R.; Milanović, J.V. Existing Approaches and Trends in Uncertainty Modelling and Probabilistic Stability Analysis of Power Systems with Renewable Generation. Renew. Sustain. Energy Rev. 2019, 101, 168–180. [Google Scholar] [CrossRef]

- Alsayegh, O.; Alhajraf, S.; Albusairi, H. Grid-Connected Renewable Energy Source Systems: Challenges and Proposed Management Schemes. Energy Convers. Manag. 2010, 51, 1690–1693. [Google Scholar] [CrossRef]

- Zeng, J.; Bao, R.; McFarland, M. Clean Energy Substitution: The Effect of Transitioning from Coal to Gas on Air Pollution. Energy Econ. 2022, 107, 105816. [Google Scholar] [CrossRef]

- Zhao, N.; You, F. Can Renewable Generation, Energy Storage and Energy Efficient Technologies Enable Carbon Neutral Energy Transition? Appl. Energy 2020, 279, 115889. [Google Scholar] [CrossRef]

- Imbens, G.W.; Wooldridge, J.M. Recent Developments in the Econometrics of Program Evaluation. J. Econ. Lit. 2009, 47, 5–86. [Google Scholar] [CrossRef]

- Fang, K.; Wang, S.; He, J.; Song, J.; Fang, C.; Jia, X. Mapping the Environmental Footprints of Nations Partnering the Belt and Road Initiative. Resour. Conserv. Recycl. 2021, 164, 105068. [Google Scholar] [CrossRef]

- Muhammad, S.; Long, X.; Salman, M.; Dauda, L. Effect of Urbanization and International Trade on CO2 Emissions across 65 Belt and Road Initiative Countries. Energy 2020, 196, 117102. [Google Scholar] [CrossRef]

- Angrist, J.D.; Pischke, J.-S. Mostly Harmless Econometrics: An Empiricist’s Companion; Princeton University Press: Princeton, NJ, USA, 2009; ISBN 978-0-691-12034-8. [Google Scholar]

- Ryan, A.M.; Burgess, J.F.; Dimick, J.B. Why We Should Not Be Indifferent to Specification Choices for Difference-in-Differences. Health Serv. Res. 2015, 50, 1211–1235. [Google Scholar] [CrossRef]

- Schleussner, C.-F.; Rogelj, J.; Schaeffer, M.; Lissner, T.; Licker, R.; Fischer, E.M.; Knutti, R.; Levermann, A.; Frieler, K.; Hare, W. Science and Policy Characteristics of the Paris Agreement Temperature Goal. Nat. Clim. Change 2016, 6, 827–835. [Google Scholar] [CrossRef]

- Falkner, R. The Paris Agreement and the New Logic of International Climate Politics. Int. Aff. 2016, 92, 1107–1125. [Google Scholar] [CrossRef]

- Guo, J. Public Data Openness and China’s Green Total Factor Productivity: A Perspective of Data Factor. Econ. Res. J. 2025, 60, 56–72. [Google Scholar]

- Callaway, B.; Sant’Anna, P.H.C. Difference-in-Differences with Multiple Time Periods. J. Econ. 2021, 225, 200–230. [Google Scholar] [CrossRef]

- Thacker, S.; Adshead, D.; Fay, M.; Hallegatte, S.; Harvey, M.; Meller, H.; O’Regan, N.; Rozenberg, J.; Watkins, G.; Hall, J.W. Infrastructure for Sustainable Development. Nat. Sustain. 2019, 2, 324–331. [Google Scholar] [CrossRef]

- Sun, Y.; Ajaz, T.; Razzaq, A. How Infrastructure Development and Technical Efficiency Change Caused Resources Consumption in BRICS Countries: Analysis Based on Energy, Transport, ICT, and Financial Infrastructure Indices. Resour. Policy 2022, 79, 102942. [Google Scholar] [CrossRef]

- Donaldson, D. Railroads of the Raj: Estimating the Impact of Transportation Infrastructure. Am. Econ. Rev. 2018, 108, 899–934. [Google Scholar] [CrossRef]

- Yang, G.; Huang, X.; Huang, J.; Chen, H. Assessment of the Effects of Infrastructure Investment under the Belt and Road Initiative. China Econ. Rev. 2020, 60, 101418. [Google Scholar] [CrossRef]

- Arvin, M.B.; Pradhan, R.P.; Nair, M. Uncovering Interlinks among ICT Connectivity and Penetration, Trade Openness, Foreign Direct Investment, and Economic Growth: The Case of the G-20 Countries. Telemat. Inform. 2021, 60, 101567. [Google Scholar] [CrossRef]

- Wang, Q.; Zhou, J. Study on Evolution and Governance of Maker Space Ecosystem; China Social Sciences Press: Beijing, China, 2022; ISBN 978-7-5203-9855-8. [Google Scholar]

- Bakhtyar, B.; Sopian, K.; Sulaiman, M.Y.; Ahmad, S.A. Renewable Energy in Five South East Asian Countries: Review on Electricity Consumption and Economic Growth. Renew. Sustain. Energy Rev. 2013, 26, 506–514. [Google Scholar] [CrossRef]

- Erdiwansyah; Mamat, R.; Sani, M.S.M.; Sudhakar, K. Renewable Energy in Southeast Asia: Policies and Recommendations. Sci. Total Environ. 2019, 670, 1095–1102. [Google Scholar] [CrossRef]

- Kumar Singh, B. South Asia Energy Security: Challenges and Opportunities. Energy Policy 2013, 63, 458–468. [Google Scholar] [CrossRef]

- Aliyu, A.K.; Modu, B.; Tan, C.W. A Review of Renewable Energy Development in Africa: A Focus in South Africa, Egypt and Nigeria. Renew. Sustain. Energy Rev. 2018, 81, 2502–2518. [Google Scholar] [CrossRef]

- Vakulchuk, R.; Overland, I. Central Asia Is a Missing Link in Analyses of Critical Materials for the Global Clean Energy Transition. One Earth 2021, 4, 1678–1692. [Google Scholar] [CrossRef]

- Nematollahi, O.; Hoghooghi, H.; Rasti, M.; Sedaghat, A. Energy Demands and Renewable Energy Resources in the Middle East. Renew. Sustain. Energy Rev. 2016, 54, 1172–1181. [Google Scholar] [CrossRef]

- Buckley, P.J.; Clegg, L.J.; Cross, A.R.; Liu, X.; Voss, H.; Zheng, P. Erratum: The Determinants of Chinese Outward Foreign Direct Investment. J. Int. Bus. Stud. 2009, 40, 353–354. [Google Scholar] [CrossRef]

- Kolstad, I.; Wiig, A. What Determines Chinese Outward FDI? J. World Bus. 2012, 47, 26–34. [Google Scholar] [CrossRef]

- Yang, J.-H.; Wang, W.; Wang, K.-L.; Yeh, C.-Y. Capital Intensity, Natural Resources, and Institutional Risk Preferences in Chinese Outward Foreign Direct Investment. Int. Rev. Econ. Finance 2018, 55, 259–272. [Google Scholar] [CrossRef]

| Area | Country | Number |

|---|---|---|

| Central Asia | Tajikistan, Kyrgyzstan, Kazakhstan, Uzbekistan | 4 |

| West Asia | Iran, Iraq, Jordan, Israel, Saudi Arabia, Oman, Qatar, Kuwait, Georgia, UAE, Afghanistan | 11 |

| Southeast Asia | Singapore, Malaysia, Indonesia, Thailand, Laos, Cambodia, Vietnam, Philippines | 8 |

| South Asia | India, Pakistan, Sri Lanka, Nepal, Bangladesh | 5 |

| Northeast Asia | Mongolia, Russia | 2 |

| Africa | Egypt | 1 |

| Europe | Ukraine, Belarus, Poland, Czech Republic, Hungary, Croatia, Montenegro, Serbia, Greece, Romania, Bosnia and Herzegovina | 11 |

| Variables | Variable Measurement | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| perGDP | The natural logarithm of the per capital GDP | 9.432 | 1.114 | 6.972 | 11.696 |

| GDPgrowth | GDP growth (annual %) | 3.44 | 3.789 | −17.668 | 21.452 |

| Res | The total natural resources’ rents (% of GDP) | 7.317 | 8.283 | 0 | 53.971 |

| Pop | The natural logarithm of the population | 17.31 | 1.33 | 13.341 | 21.041 |

| PG | Electric power consumption—Electric power production | −19.826 | 41.081 | −274 | 27 |

| Tra | The natural logarithm of the import value from China by the host country | 22.621 | 1.820 | 16.658 | 27.066 |

| Fdi | Foreign direct investment, net inflows (% of GDP) | 3.424 | 5.857 | −37.173 | 59.91 |

| ID | Institution Distance | 0.61 | 0.568 | 0.008 | 2.227 |

| Gov | The efficiency of the Government | −0.107 | 0.872 | −1.807 | 2.232 |

| Cor | The control of corruption | −0.279 | 0.912 | −1.597 | 2.223 |

| Law | The level of the rule of law | −0.207 | 0.890 | −1.838 | 2.024 |

| Voi | The voice and accountability | −0.313 | 0.915 | −2.034 | 1.684 |

| (1) | (2) | |

|---|---|---|

| lnP | lnP | |

| bri × after | 0.801 ** | 0.889 ** |

| (0.378) | (0.342) | |

| _cons | 6.114 *** | 21.80 |

| (0.553) | (25.46) | |

| control | no | yes |

| country effect | yes | yes |

| time effect | yes | yes |

| Observations | 329 | 329 |

| N | 95 | 95 |

| R2 | 0.135 | 0.168 |

| Event Time | Coefficient | 95% CI Lower | 95% CI Upper |

|---|---|---|---|

| pre_4 | 1.400 | −0.29984 | 3.100203 |

| pre_3 | 0.419 | −0.72828 | 1.567036 |

| pre_2 | 0.974 | −0.35735 | 2.30453 |

| current | 1.568 ** | 0.333308 | 2.803068 |

| las_1 | 1.7160 *** | 0.579586 | 2.852549 |

| las_2 | 2.483 *** | 0.995309 | 3.970655 |

| las_3 | 1.576 ** | 0.182265 | 2.968883 |

| las_4 | 1.504 *** | 0.360644 | 2.646746 |

| las_5 | 1.266 ** | 0.083329 | 2.449139 |

| las_6 | 1.824 *** | 0.568491 | 3.078899 |

| las_7 | 1.664 ** | 0.177528 | 3.149509 |

| las_8 | 1.828 *** | 0.46613 | 3.189673 |

| las_9 | 1.702 ** | 0.192286 | 3.211064 |

| LnP | |

|---|---|

| bri × after | 0.868 ** |

| (0.340) | |

| NDCs | 0.308 |

| (0.227) | |

| _cons | 20.51 |

| (25.52) | |

| control | yes |

| country effect | yes |

| time effect | yes |

| Observations | 329 |

| N | 95 |

| R2 | 0.172 |

| (1) | (2) | (3) | |

|---|---|---|---|

| LnP | LnP | LnP | |

| dummy bri × after | 0.605 | 0.487 | 0.383 |

| (0.944) | (0.333) | (0.264) | |

| _cons | 26.48 | 26.94 | 24.72 |

| (29.61) | (29.25) | (28.42) | |

| control | yes | yes | yes |

| country effect | yes | yes | yes |

| time effect | yes | yes | yes |

| Observations | 329 | 329 | 329 |

| N | 95 | 95 | 95 |

| R2 | 0.141 | 0.143 | 0.143 |

| (1) Before Matching | (2) After Matching | |

|---|---|---|

| LnP | LnP | |

| bri×after | 0.889 ** | 1.117 *** |

| (0.342) | (0.343) | |

| _cons | 21.80 | 26.22 |

| (25.46) | (26.03) | |

| control | yes | yes |

| country effect | yes | yes |

| time effect | yes | yes |

| Observations | 329 | 268 |

| N | 95 | 92 |

| R2 | 0.168 | 0.235 |

| (1) | (2) | |||

|---|---|---|---|---|

| N | N | LnReP | LnReP | |

| bri × after | 0.871 *** | 0.762 *** | 0.597 ** | 0.648 ** |

| (0.315) | (0.261) | (0.289) | (0.322) | |

| _cons | 1.320 *** | 25.20 | 5.914 *** | −6.255 |

| (0.280) | (24.22) | (0.565) | (31.38) | |

| control | no | yes | no | yes |

| country effect | yes | yes | yes | yes |

| time effect | yes | yes | yes | yes |

| Observations | 329 | 329 | 256 | 256 |

| N | 95 | 95 | 89 | 89 |

| R2 | 0.103 | 0.165 | 0.157 | 0.196 |

| (1) | (2) | |

|---|---|---|

| qty | N | |

| bri × after | 0.911 * | 0.641 ** |

| (0.495) | (0.317) | |

| _cons | 43.67 | 40.89 * |

| (36.56) | (23.90) | |

| control | yes | yes |

| country effect | yes | yes |

| time effect | yes | yes |

| Observations | 1323 | 1323 |

| N | 94 | 94 |

| pseudo-R2 | 0.4035 | 0.2336 |

| (1) | (2) | |

|---|---|---|

| Lnqty | Lnqty | |

| ATT | 0.111 | 0.454 |

| (0.462) | (0.783) | |

| control | no | yes |

| country effect | yes | yes |

| time effect | yes | yes |

| Observations | 1330 | 1325 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Transport | Communications | Financial | Energy | |

| bri × after | 0.720 ** | 6.808 *** | 8.924 ** | 0.152 *** |

| (0.333) | (2.318) | (4.269) | (0.0446) | |

| _cons | −16.81 | −11.29 | −1668 *** | 5.682 |

| (52.17) | (294.8) | (487.2) | (6.729) | |

| control | yes | yes | yes | yes |

| country effect | yes | yes | yes | yes |

| time effect | yes | yes | yes | yes |

| Observations | 293 | 328 | 303 | 329 |

| N | 89 | 94 | 93 | 95 |

| R2 | 0.289 | 0.843 | 0.277 | 0.727 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| lnP | lnP | LnP | lnP | |

| Central Asia × bri × after | −2.443 *** | |||

| (0.431) | ||||

| Western Asia × bri × after | 0.991 | |||

| (0.950) | ||||

| Southeast Asia × bri × after | 0.715 | |||

| (0.444) | ||||

| South Asia × bri × after | 1.213 *** | |||

| (0.397) | ||||

| _cons | 34.27 | 39.15 | 16.33 | 17.86 |

| (29.17) | (32.59) | (30.15) | (29.77) | |

| control | yes | yes | yes | yes |

| country effect | yes | yes | yes | yes |

| time effect | yes | yes | yes | yes |

| Observations | 329 | 329 | 329 | 329 |

| N | 95 | 95 | 95 | 95 |

| R2 | 0.190 | 0.140 | 0.152 | 0.168 |

| (1) | (2) | |||

|---|---|---|---|---|

| Developed | Developing | High Risk | Low Risk | |

| bri × after | 1.445 | 0.680 * | 0.492 | 1.822 ** |

| (0.949) | (0.361) | (0.676) | (0.788) | |

| _cons | −14.83 | 102.0 *** | 49.68 | 304.0 ** |

| (67.35) | (36.38) | (64.22) | (119.2) | |

| control | yes | yes | yes | yes |

| country effect | yes | yes | yes | yes |

| time effect | yes | yes | yes | yes |

| Observations | 116 | 213 | 136 | 117 |

| N | 36 | 59 | 51 | 48 |

| R2 | 0.308 | 0.274 | 0.338 | 0.402 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Y.; Xu, M.; Huang, Y.; Fu, N. Has the “Belt and Road Initiative” Promoted Chinese OFDI in Green Energy? Evidence from Chinese Energy Engagement in BRI Countries. Energies 2025, 18, 5268. https://doi.org/10.3390/en18195268

Liu Y, Xu M, Huang Y, Fu N. Has the “Belt and Road Initiative” Promoted Chinese OFDI in Green Energy? Evidence from Chinese Energy Engagement in BRI Countries. Energies. 2025; 18(19):5268. https://doi.org/10.3390/en18195268

Chicago/Turabian StyleLiu, Yuli, Min Xu, Yu Huang, and Ningning Fu. 2025. "Has the “Belt and Road Initiative” Promoted Chinese OFDI in Green Energy? Evidence from Chinese Energy Engagement in BRI Countries" Energies 18, no. 19: 5268. https://doi.org/10.3390/en18195268

APA StyleLiu, Y., Xu, M., Huang, Y., & Fu, N. (2025). Has the “Belt and Road Initiative” Promoted Chinese OFDI in Green Energy? Evidence from Chinese Energy Engagement in BRI Countries. Energies, 18(19), 5268. https://doi.org/10.3390/en18195268