Artificial Intelligence in Energy Economics Research: A Bibliometric Review

Abstract

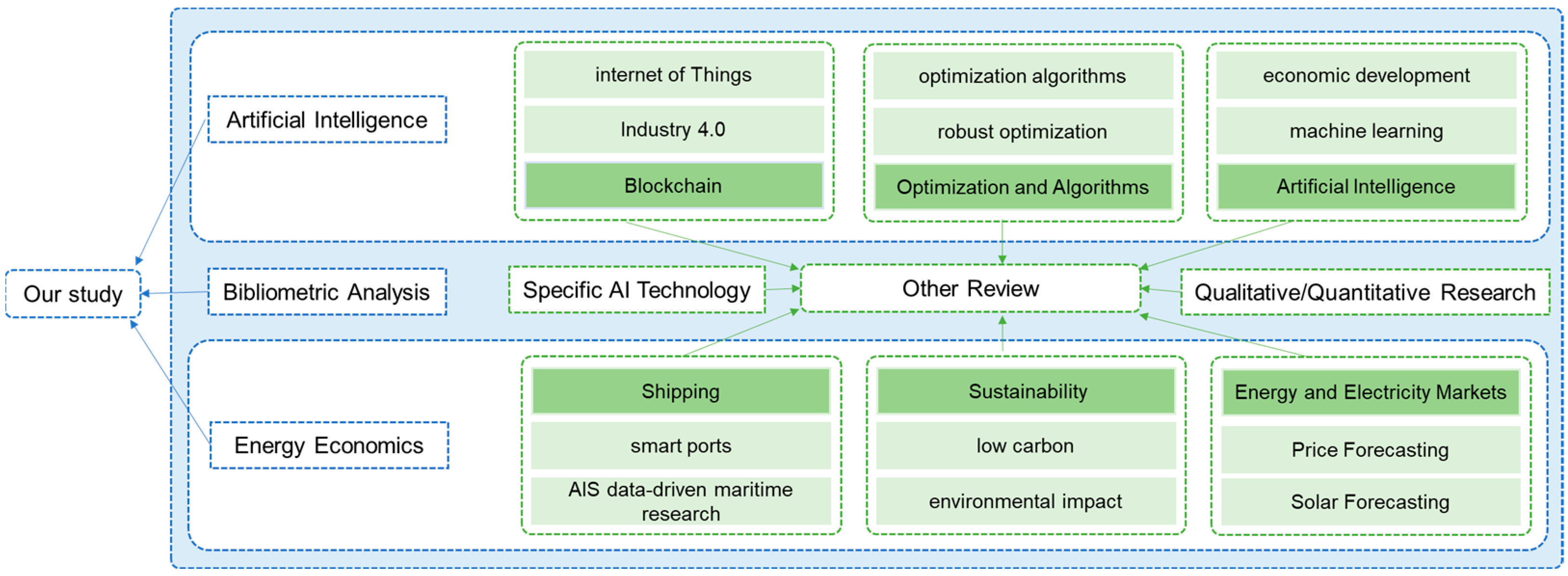

:1. Introduction

- (1)

- First, a descriptive statistical analysis is made. The basic characteristics of the publications are presented in terms of the number of publications per year, the evolution of the topics of the publications, and the areas of research.

- (2)

- To identify influential cited literature, countries, institutions and authors through network analysis.

- (3)

- To identify research themes from the perspective of keywords and to perform co-occurrence analysis, cluster analysis, burst detection and timeline analysis to identify future research hotspots.

- (4)

- To analyze future trends and challenges and limitations from current research issues.

2. Data and Methodology

2.1. The Definition of Energy Economics

2.2. Bibliometric Methods

2.3. Data Collection and Filtering

2.4. The Research Framework of the Methodology

3. Bibliometric Analysis

3.1. Descriptive Statistical Analysis

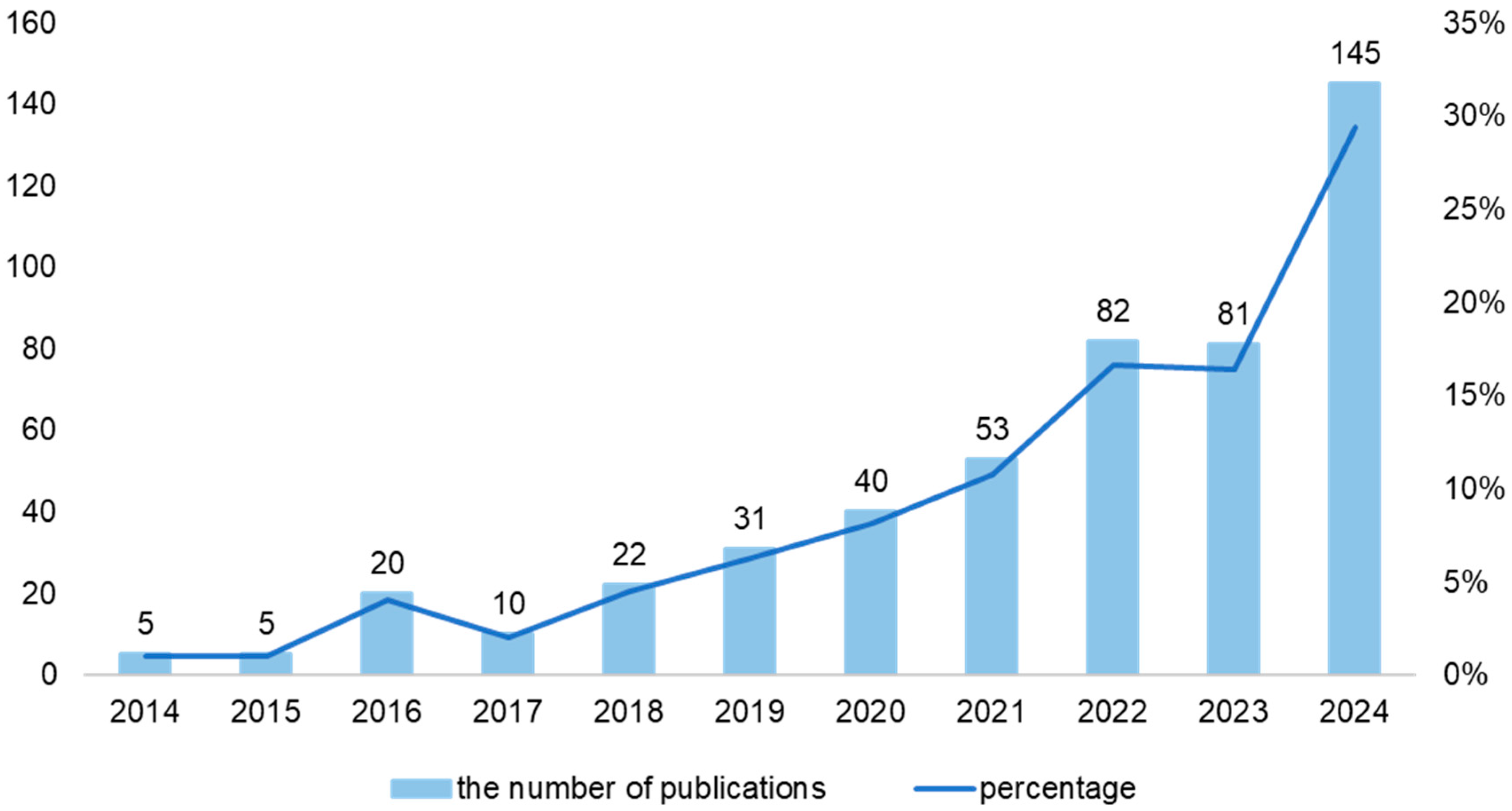

3.1.1. The Annual Trends in Publications

3.1.2. Evolution of Research Themes

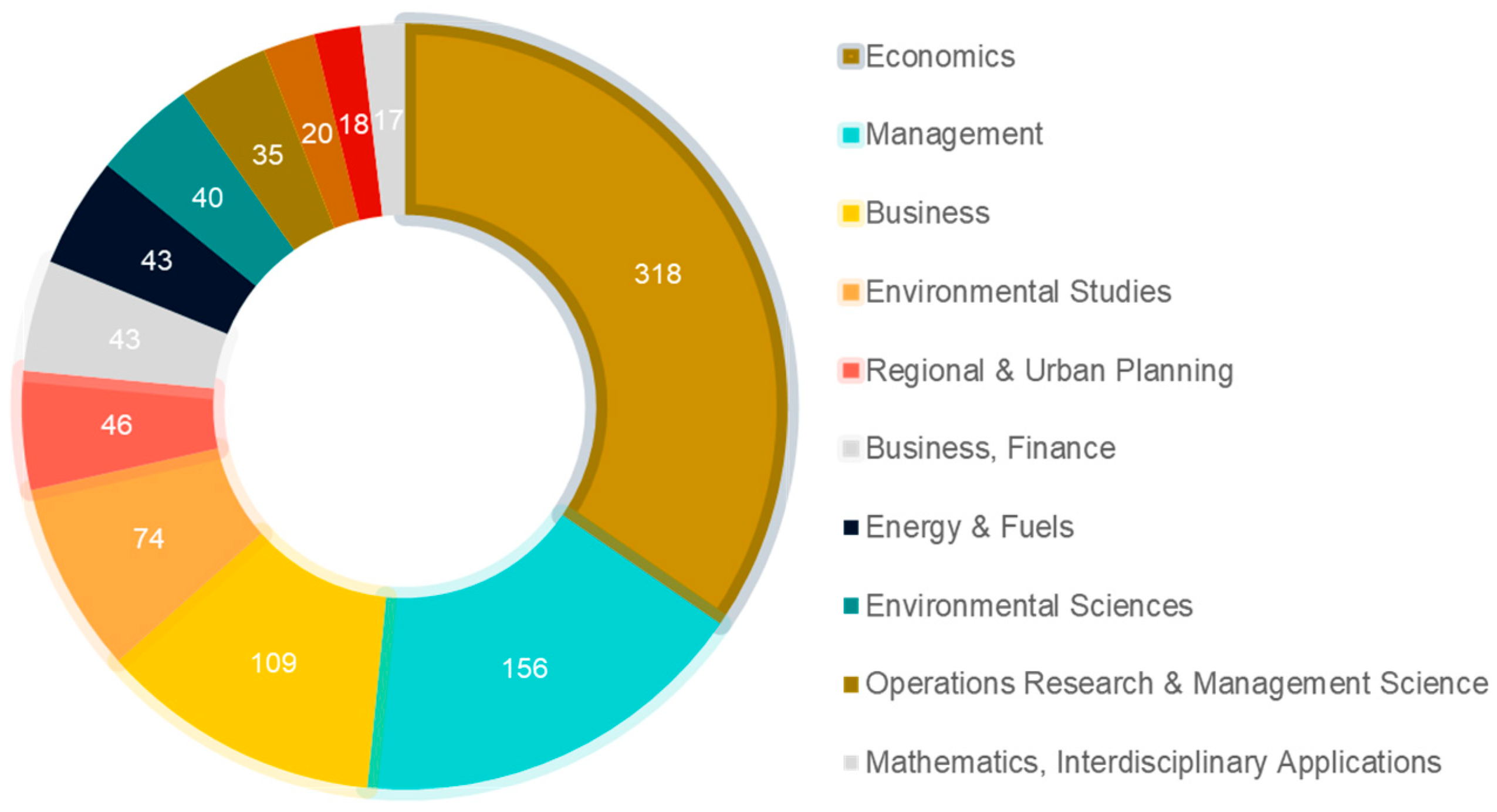

3.1.3. Top 10 Research Areas of Publications

3.2. Network Analysis

3.2.1. Citation Analysis

3.2.2. Cooperation Network of Nations

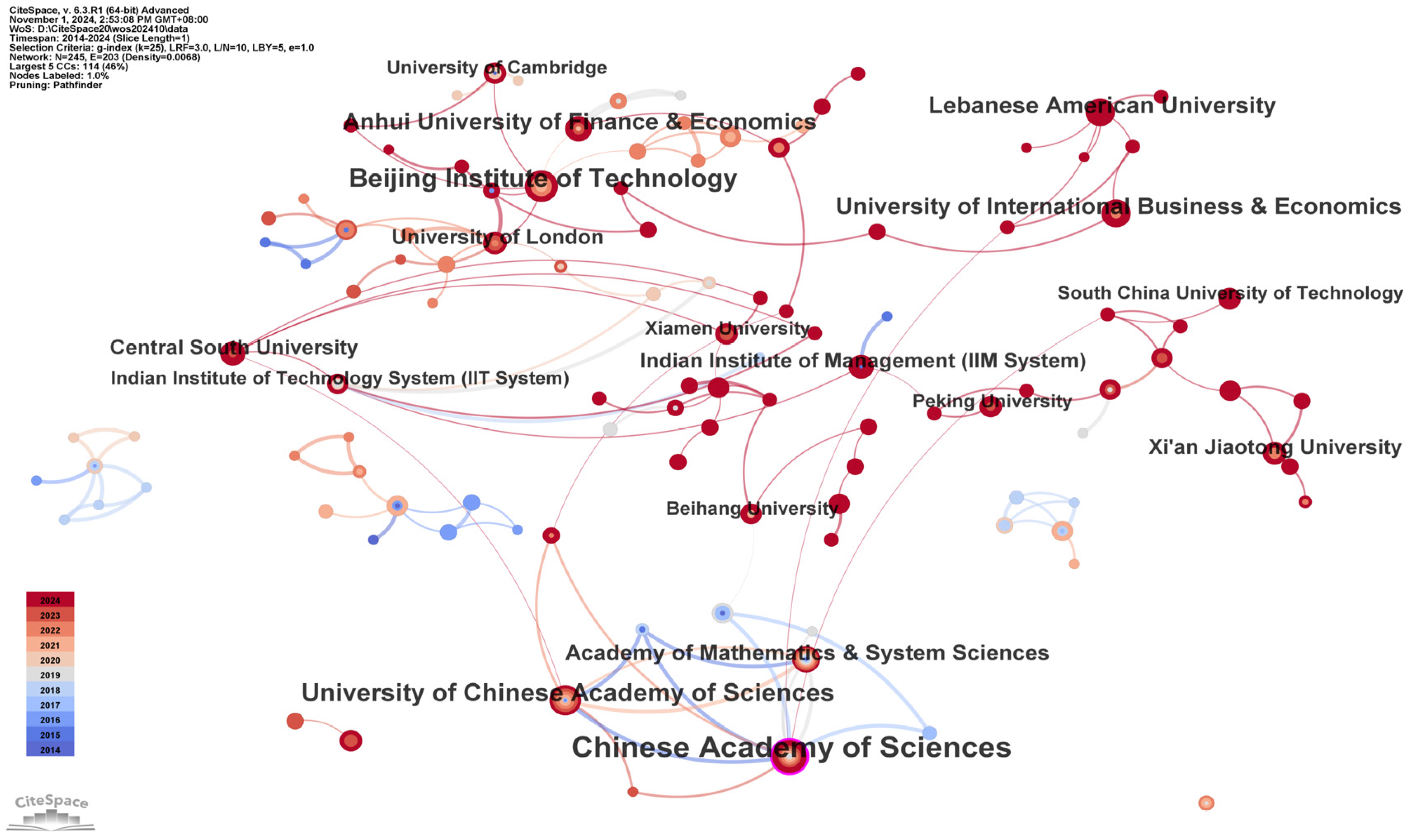

3.2.3. Institutional Cooperation Network

3.2.4. Co-Authorship Network

3.3. Keyword Analysis

3.3.1. Co-Occurrence Analysis

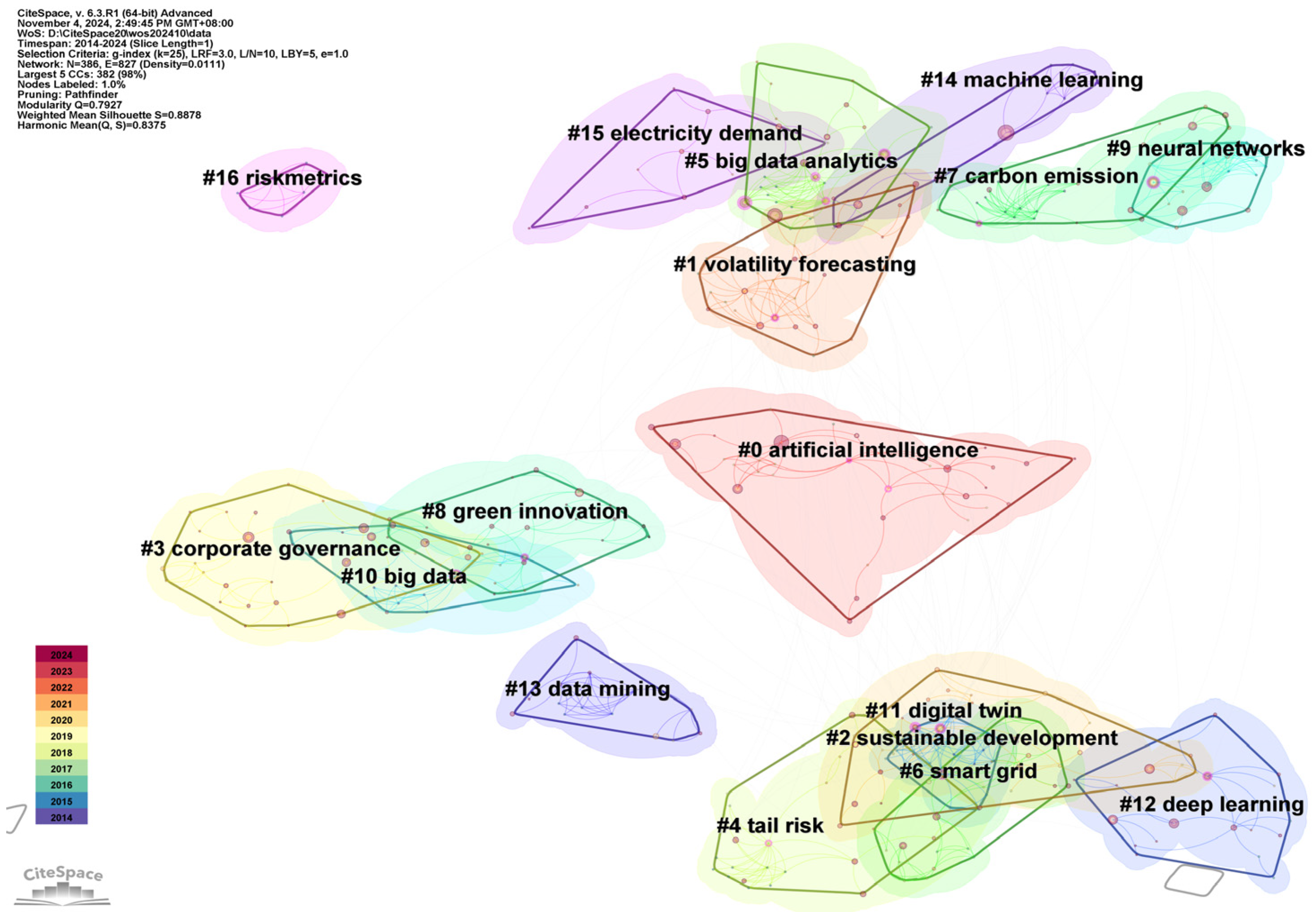

3.3.2. Keyword Clustering

- Artificial Intelligence Forecasting for Energy Markets—Energy price forecasting

- 2.

- Artificial Intelligence Innovation for Energy Systems in Businesses and Industries

- 3.

- Socio-economic impacts

- 4.

- Energy transition in economic sectors

- 5.

- Climate change and carbon emissions

3.3.3. Burst Detection Analysis of Keywords

3.3.4. Timeline Visualization

4. Further Discussion

4.1. Future Trends

4.1.1. Energy Supply-Chain Resilience and Security

4.1.2. Social Acceptance and Public Participation

4.1.3. Economic Inequality and the Technology Gap

4.1.4. Automated Methods for Energy Policy Assessment

4.1.5. Circular Economy (CE)

4.1.6. Digital Economy

4.2. Challenges

4.2.1. Government and Administrative Support

4.2.2. Policy, Law, and Intellectual Property Protection

5. Conclusions

5.1. Key Findings

- (1)

- Descriptive statistical analysis reveals that the number of publications in AI&EE has been increasing year by year. There is strong continued interest in machine learning and artificial intelligence across countries. The most popular research areas are economics (318) and management (156). The top-ranked journal is Energy Economics, followed by Technology Forecasting and Social Change, Energy Policy, and International Journal of Forecasting in the field of energy economics.

- (2)

- In network analysis, the most influential and most cited articles are those by Gozgor et al., Lau et al., and Sinha et al. China is the country with the most achievements, with Australia and India and other countries collaborating most closely. Chinese Academy of Sciences and Beijing Institute of Technology are the most influential institutions. The scholar with the most publications in the field of AI&EE is Shouyang, Wang (8), with a total of 533 citations.

- (3)

- The keyword analysis demonstrates that the hotspots of AI&EE research are concentrated on “ machine learning”, “ impact”, “ artificial intelligence”, “model”, and so on. The keyword “investment”, with a strength of 2.98, emerged in 2022, and it is expected that academic attention will continue beyond 2024. The current prominent research themes are energy price forecasting, artificial intelligence innovations in energy systems, socio-economic impacts, energy transition, and climate change. Based on the timeline analysis, the resulting 17 clusters can be considered as the core directions of current AI&EE research.

- (4)

- Potential future research directions include energy supply-chain resilience and security, social acceptance and public participation, economic inequality and the technology gap, automated methods for energy policy assessment, the circular economy, and the digital economy. Future challenges include governmental and administrative support as well as legal and intellectual property protection. The results of the survey provide some suggestions for future research.

5.2. Limitations

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| AI | Artificial intelligence |

| EE | Energy economics |

| PSTR | Panel smooth transition model |

| RE | Renewable energy |

| LSTM | Long short-term memory |

| WTI | West Texas intermediate |

| EU | The European Union |

| QVAR | Quantile vector autoregression |

References

- Smyth, R.; Narayan, P.K. Applied Econometrics and Implications for Energy Economics Research. Energy Econ. 2015, 50, 351–358. [Google Scholar] [CrossRef]

- Tyner, W.E.; Herath, N. Energy Economics. Appl. Eco. Perspect. Pol. 2018, 40, 174–186. [Google Scholar] [CrossRef]

- Vinuesa, R.; Azizpour, H.; Leite, I.; Balaam, M.; Dignum, V.; Domisch, S.; Felländer, A.; Langhans, S.D.; Tegmark, M.; Fuso Nerini, F. The Role of Artificial Intelligence in Achieving the Sustainable Development Goals. Nat. Commun. 2020, 11, 233. [Google Scholar] [CrossRef] [PubMed]

- Ghoddusi, H.; Creamer, G.G.; Rafizadeh, N. Machine Learning in Energy Economics and Finance: A Review. Energy Econ. 2019, 81, 709–727. [Google Scholar] [CrossRef]

- Wang, H.; Lei, Z.; Zhang, X.; Zhou, B.; Peng, J. A Review of Deep Learning for Renewable Energy Forecasting. Energy Convers. Manag. 2019, 198, 111799. [Google Scholar] [CrossRef]

- Ardakani, F.J.; Ardehali, M.M. Long-Term Electrical Energy Consumption Forecasting for Developing and Developed Economies Based on Different Optimized Models and Historical Data Types. Energy 2014, 65, 452–461. [Google Scholar] [CrossRef]

- Deo, R.C.; Ghorbani, M.A.; Samadianfard, S.; Maraseni, T.; Bilgili, M.; Biazar, M. Multi-Layer Perceptron Hybrid Model Integrated with the Firefly Optimizer Algorithm for Windspeed Prediction of Target Site Using a Limited Set of Neighboring Reference Station Data. Renew. Energy 2018, 116, 309–323. [Google Scholar] [CrossRef]

- Ghadami, N.; Gheibi, M.; Kian, Z.; Faramarz, M.G.; Naghedi, R.; Eftekhari, M.; Fathollahi-Fard, A.M.; Dulebenets, M.A.; Tian, G. Implementation of Solar Energy in Smart Cities Using an Integration of Artificial Neural Network, Photovoltaic System and Classical Delphi Methods. Sustain. Cities Soc. 2021, 74, 103149. [Google Scholar] [CrossRef]

- Lei, Y.; Wang, D.; Jia, H.; Li, J.; Chen, J.; Li, J.; Yang, Z. Multi-Stage Stochastic Planning of Regional Integrated Energy System Based on Scenario Tree Path Optimization under Long-Term Multiple Uncertainties. Appl. Energy 2021, 300, 117224. [Google Scholar] [CrossRef]

- Dimou, A.; Vakalis, S. Technoeconomic Analysis of Green Energy Transitions in Isolated Grids: The Case of Ai Stratis—Green Island. Renew. Energy 2022, 195, 66–75. [Google Scholar] [CrossRef]

- Yin, H.-T.; Wen, J.; Chang, C.-P. Going Green with Artificial Intelligence: The Path of Technological Change towards the Renewable Energy Transition. Oeconomia Copernic. 2023, 14, 1059–1095. [Google Scholar] [CrossRef]

- Maruejols, L.; Höschle, L.; Yu, X. Vietnam between Economic Growth and Ethnic Divergence: A LASSO Examination of Income-Mediated Energy Consumption. Energy Econ. 2022, 114, 106222. [Google Scholar] [CrossRef]

- Devaraj, J.; Madurai Elavarasan, R.; Shafiullah, G.; Jamal, T.; Khan, I. A Holistic Review on Energy Forecasting Using Big Data and Deep Learning Models. Int. J. Energy Res. 2021, 45, 13489–13530. [Google Scholar] [CrossRef]

- Iorgovan, D. Artificial Intelligence and Renewable Energy Utilization. Proc. Int. Conf. Bus. Excell. 2024, 18, 2776–2783. [Google Scholar] [CrossRef]

- Mostafa, M.M.; El-Masry, A.A. Oil Price Forecasting Using Gene Expression Programming and Artificial Neural Networks. Econ. Model. 2016, 54, 40–53. [Google Scholar] [CrossRef]

- Mercadal, I. Dynamic Competition and Arbitrage in Electricity Markets: The Role of Financial Players. Am. Econ. J.-Microecon. 2022, 14, 665–699. [Google Scholar] [CrossRef]

- Guo, L.; Huang, X.; Li, Y.; Li, H. Forecasting Crude Oil Futures Price Using Machine Learning Methods: Evidence from China. Energy Econ. 2023, 127, 107089. [Google Scholar] [CrossRef]

- Mangla, S.K.; Srivastava, P.R.; Eachempati, P.; Tiwari, A.K. Exploring the Impact of Key Performance Factors on Energy Markets: From Energy Risk Management Perspectives. Energy Econ. 2024, 131, 107373. [Google Scholar] [CrossRef]

- Thakur, J.; Hesamzadeh, M.R.; Date, P.; Bunn, D. Pricing and Hedging Wind Power Prediction Risk with Binary Option Contracts. Energy Econ. 2023, 126, 106960. [Google Scholar] [CrossRef]

- Fang, G.; Deng, Y.; Ma, H.; Zhang, J.; Pan, L. Energy Financial Risk Management in China Using Complex Network Analysis. J. Organ. End. User Comput. 2023, 35, 29. [Google Scholar] [CrossRef]

- Duesterhoeft, M.; Schiemann, F.; Walther, T. Let’s Talk about Risk! Stock Market Effects of Risk Disclosure for European Energy Utilities. Energy Econ. 2023, 125, 106794. [Google Scholar] [CrossRef]

- Gong, X.; Li, M.; Guan, K.; Sun, C. Climate Change Attention and Carbon Futures Return Prediction. J. Futures Mark. 2023, 43, 1261–1288. [Google Scholar] [CrossRef]

- Janczura, J.; Wojcik, E. Dynamic Short-Term Risk Management Strategies for the Choice of Electricity Market Based on Probabilistic Forecasts of Profit and Risk Measures. The German and the Polish Market Case Study. Energy Econ. 2022, 110, 106015. [Google Scholar] [CrossRef]

- Li, S.-T.; Chiu, K.-C.; Wu, C.-C. Apply Big Data Analytics for Forecasting the Prices of Precious Metals Futures to Construct a Hedging Strategy for Industrial Material Procurement. Manag. Decis. Econ. 2023, 44, 942–959. [Google Scholar] [CrossRef]

- Zhang, L.; Padhan, H.; Singh, S.K.; Gupta, M. The Impact of Renewable Energy on Inflation in G7 Economies: Evidence from Artificial Neural Networks and Machine Learning Methods. Energy Econ. 2024, 136, 107718. [Google Scholar] [CrossRef]

- Neghab, D.P.; Cevik, M.; Wahab, M.I.M.; Basar, A. Explaining Exchange Rate Forecasts with Macroeconomic Fundamentals Using Interpretive Machine Learning. Comput. Econ. 2024. [Google Scholar] [CrossRef]

- Kocaarslan, B.; Mushtaq, R. The Impact of Liquidity Conditions on the Time-Varying Link between US Municipal Green Bonds and Major Risky Markets during the COVID-19 Crisis: A Machine Learning Approach. Energy Policy 2024, 184, 113911. [Google Scholar] [CrossRef]

- Kocaarslan, B. US Dollar and Oil Market Uncertainty: New Evidence from Explainable Machine Learning. Financ. Res. Lett. 2024, 64, 105375. [Google Scholar] [CrossRef]

- Zhang, L.; Ling, J.; Lin, M. Artificial Intelligence in Renewable Energy: A Comprehensive Bibliometric Analysis. Energy Rep. 2022, 8, 14072–14088. [Google Scholar] [CrossRef]

- Hou, Y.; Wang, Q. Big Data and Artificial Intelligence Application in Energy Field: A Bibliometric Analysis. Env. Sci. Pollut. Res. 2022, 30, 13960–13973. [Google Scholar] [CrossRef]

- Olu-Ajayi, R.; Alaka, H.; Sunmola, F.; Ajayi, S.; Mporas, I. Statistical and Artificial Intelligence-Based Tools for Building Energy Prediction: A Systematic Literature Review. IEEE Trans. Eng. Manag. 2024, 71, 14733–14753. [Google Scholar] [CrossRef]

- Mardani, A.; Streimikiene, D.; Balezentis, T.; Saman, M.Z.M.; Nor, K.M.; Khoshnava, S.M. Data Envelopment Analysis in Energy and Environmental Economics: An Overview of the State-of-the-Art and Recent Development Trends. Energies 2018, 11, 2002. [Google Scholar] [CrossRef]

- Wang, M.; Li, X.; Wang, S. Discovering Research Trends and Opportunities of Green Finance and Energy Policy: A Data-Driven Scientometric Analysis. Energy Policy 2021, 154, 112295. [Google Scholar] [CrossRef]

- Singhania, M.; Chadha, G.; Prasad, R. Sustainable Finance Research: Review and Agenda. Int. J. Financ. Econ. 2024, 29, 4010–4045. [Google Scholar] [CrossRef]

- Qin, Y.; Xu, Z.; Wang, X.; Skare, M. Artificial Intelligence and Economic Development: An Evolutionary Investigation and Systematic Review. J. Knowl. Econ. 2024, 15, 1666–1702. [Google Scholar] [CrossRef]

- Gao, H.; Kou, G.; Liang, H.; Zhang, H.; Chao, X.; Li, C.-C.; Dong, Y. Machine Learning in Business and Finance: A Literature Review and Research Opportunities. Financ. Innov. 2024, 10, 86. [Google Scholar] [CrossRef]

- Agrawal, R.; Majumdar, A.; Kumar, A.; Luthra, S. Integration of Artificial Intelligence in Sustainable Manufacturing: Current Status and Future Opportunities. Oper. Manag. Res. 2023, 16, 1720–1741. [Google Scholar] [CrossRef]

- Chen, C.; Dubin, R.; Kim, M.C. Emerging Trends and New Developments in Regenerative Medicine: A Scientometric Update (2000–2014). Expert. Opin. Biol. Ther. 2014, 14, 1295–1317. [Google Scholar] [CrossRef]

- Kumar, A.; Bhattacharya, T.; Shaikh, W.A.; Roy, A.; Chakraborty, S.; Vithanage, M.; Biswas, J.K. Multifaceted Applications of Biochar in Environmental Management: A Bibliometric Profile. Biochar 2023, 5, 11. [Google Scholar] [CrossRef]

- Chen, C.; Hu, Z.; Liu, S.; Tseng, H. Emerging Trends in Regenerative Medicine: A Scientometric Analysis in CiteSpace. Expert. Opin. Biol. Ther. 2012, 12, 593–608. [Google Scholar] [CrossRef]

- Synnestvedt, M.B.; Chen, C.; Holmes, J.H. CiteSpace II: Visualization and Knowledge Discovery in Bibliographic Databases. AMIA Annu. Symp. Proc. 2005, 2005, 724–728. [Google Scholar] [PubMed]

- Van Eck, N.J.; Waltman, L. Software Survey: VOSviewer, a Computer Program for Bibliometric Mapping. Scientometrics 2010, 84, 523–538. [Google Scholar] [CrossRef] [PubMed]

- Chen, C. CiteSpace II: Detecting and Visualizing Emerging Trends and Transient Patterns in Scientific Literature. J. Am. Soc. Inf. Sci. 2006, 57, 359–377. [Google Scholar] [CrossRef]

- Liu, W. The Data Source of This Study Is Web of Science Core Collection? Not Enough. Scientometrics 2019, 121, 1815–1824. [Google Scholar] [CrossRef]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a Methodology for Developing Evidence-Informed Management Knowledge by Means of Systematic Review. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Gozgor, G.; Paramati, S.R. Does Energy Diversification Cause an Economic Slowdown? Evidence from a Newly Constructed Energy Diversification Index. Energy Econ. 2022, 109, 105970. [Google Scholar] [CrossRef]

- Lau, C.K.; Gozgor, G.; Mahalik, M.K.; Patel, G.; Li, J. Introducing a New Measure of Energy Transition: Green Quality of Energy Mix and Its Impact on CO2 Emissions. Energy Econ. 2023, 122, 106702. [Google Scholar] [CrossRef]

- Sinha, A.; Bekiros, S.; Hussain, N.; Nguyen, D.K.; Khan, S.A. How Social Imbalance and Governance Quality Shape Policy Directives for Energy Transition in the OECD Countries? Energy Econ. 2023, 120, 106642. [Google Scholar] [CrossRef]

- Chishti, M.Z.; Sinha, A.; Zaman, U.; Shahzad, U. Exploring the Dynamic Connectedness among Energy Transition and Its Drivers: Understanding the Moderating Role of Global Geopolitical Risk. Energy Econ. 2023, 119, 106570. [Google Scholar] [CrossRef]

- Shahbaz, M.; Siddiqui, A.; Ahmad, S.; Jiao, Z. Financial Development as a New Determinant of Energy Diversification: The Role of Natural Capital and Structural Changes in Australia. Energy Econ. 2023, 126, 106926. [Google Scholar] [CrossRef]

- Ahmad, T.; Zhang, D.; Huang, C.; Zhang, H.; Dai, N.; Song, Y.; Chen, H. Artificial Intelligence in Sustainable Energy Industry: Status Quo, Challenges and Opportunities. J. Clean. Prod. 2021, 289, 125834. [Google Scholar] [CrossRef]

- Wang, E.-Z.; Lee, C.-C.; Li, Y. Assessing the Impact of Industrial Robots on Manufacturing Energy Intensity in 38 Countries. Energy Econ. 2022, 105, 105748. [Google Scholar] [CrossRef]

- Zhang, Y.; Ma, F.; Wang, Y. Forecasting Crude Oil Prices with a Large Set of Predictors: Can LASSO Select Powerful Predictors? J. Empir. Financ. 2019, 54, 97–117. [Google Scholar] [CrossRef]

- Acemoglu, D.; Restrepo, P. Robots and Jobs: Evidence from US Labor Markets. J. Political Econ. 2020, 128, 2188–2244. [Google Scholar] [CrossRef]

- Lee, C.-C.; Qin, S.; Li, Y. Does Industrial Robot Application Promote Green Technology Innovation in the Manufacturing Industry? Technol. Forecast. Soc. Change 2022, 183, 121893. [Google Scholar] [CrossRef]

- Caldara, D.; Iacoviello, M. Measuring Geopolitical Risk. Am. Econ. Rev. 2022, 112, 1194–1225. [Google Scholar] [CrossRef]

- Li, Y.; Jiang, S.; Li, X.; Wang, S. The Role of News Sentiment in Oil Futures Returns and Volatility Forecasting: Data-Decomposition Based Deep Learning Approach. Energy Econ. 2021, 95, 105140. [Google Scholar] [CrossRef]

- Kilian, L.; Vigfusson, R.J. The Role of Oil Price Shocks in Causing U.S. Recessions. J. Money Credit. Bank. 2017, 49, 1747–1776. [Google Scholar] [CrossRef]

- Yang, K.; Hu, N.; Tian, F. Forecasting Crude Oil Volatility Using the Deep Learning-Based Hybrid Models With Common Factors. J. Futures Mark. 2024, 44, 1429–1446. [Google Scholar] [CrossRef]

- Jiang, P.; Nie, Y.; Wang, J.; Huang, X. Multivariable Short-Term Electricity Price Forecasting Using Artificial Intelligence and Multi-Input Multi-Output Scheme. Energy Econ. 2023, 117, 106471. [Google Scholar] [CrossRef]

- Yang, K.; Xu, X.; Wei, Y.; Wang, S. Forecasting Interval-Valued Returns of Crude Oil: A Novel Kernel-Based Approach. J. Forecast. 2024, 43, 2937–2953. [Google Scholar] [CrossRef]

- Tissaoui, K.; Zaghdoudi, T.; Hakimi, A.; Nsaibi, M. Do Gas Price and Uncertainty Indices Forecast Crude Oil Prices? Fresh Evidence Through XGBoost Modeling. Comput. Econ. 2023, 62, 663–687. [Google Scholar] [CrossRef] [PubMed]

- Zhang, W.; Zeng, M. Is Artificial Intelligence a Curse or a Blessing for Enterprise Energy Intensity? Evidence from China. Energy Econ. 2024, 134, 107561. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, T.; Ren, X.; Shi, Y. AI Adoption Rate and Corporate Green Innovation Efficiency: Evidence from Chinese Energy Companies. Energy Econ. 2024, 132, 107499. [Google Scholar] [CrossRef]

- Graetz, G.; Michaels, G. Robots at Work. Rev. Econ. Stat. 2018, 100, 753–768. [Google Scholar] [CrossRef]

- Bennedsen, M.; Hillebrand, E.; Jensen, S. A Neural Network Approach to the Environmental Kuznets Curve. Energy Econ. 2023, 126, 106985. [Google Scholar] [CrossRef]

- Niet, I.; Van den Berghe, L.; van Est, R. Societal Impacts of AI Integration in the EU Electricity Market: The Dutch Case. Technol. Forecast. Soc. Change 2023, 192, 122554. [Google Scholar] [CrossRef]

- Zhang, X.; Khan, K.; Shao, X.; Oprean-Stan, C.; Zhang, Q. The Rising Role of Artificial Intelligence in Renewable Energy Development in China. Energy Econ. 2024, 132, 107489. [Google Scholar] [CrossRef]

- Zhao, Q.; Wang, L.; Stan, S.-E.; Mirza, N. Can Artificial Intelligence Help Accelerate the Transition to Renewable Energy? Energy Econ. 2024, 134, 107584. [Google Scholar] [CrossRef]

- Zhao, C.; Dong, K.; Wang, K.; Nepal, R. How Does Artificial Intelligence Promote Renewable Energy Development? The Role of Climate Finance. Energy Econ. 2024, 133, 107493. [Google Scholar] [CrossRef]

- Zhou, W.; Zhuang, Y.; Chen, Y. How Does Artificial Intelligence Affect Pollutant Emissions by Improving Energy Efficiency and Developing Green Technology. Energy Econ. 2024, 131, 107355. [Google Scholar] [CrossRef]

- Zhong, W.; Liu, Y.; Dong, K.; Ni, G. Assessing the Synergistic Effects of Artificial Intelligence on Pollutant and Carbon Emission Mitigation in China. Energy Econ. 2024, 138, 107829. [Google Scholar] [CrossRef]

- Zhong, J.; Zhong, Y.; Han, M.; Yang, T.; Zhang, Q. The Impact of AI on Carbon Emissions: Evidence from 66 Countries. Appl. Econ. 2024, 56, 2975–2989. [Google Scholar] [CrossRef]

- Ilie, A.G.; Zlatea, M.L.E.; Negreanu, C.; Dumitriu, D.; Pentescu, A. Reliance on Russian Federation Energy Imports and Renewable Energy in the European Union. Amfiteatru Econ. 2023, 25, 780. [Google Scholar] [CrossRef]

- Deng, Y.; Fang, G.; Zhang, J.; Ma, H. Dynamic Connectedness Among Oil, Food Commodity, and Renewable Energy Markets: Novel Perspective from Quantile Dependence and Deep Learning. J. Knowl. Econ. 2023, 15, 9935–9974. [Google Scholar] [CrossRef]

- Zhong, Y.; Chen, X.; Wang, Z.; Lin, R.F.-Y. The Nexus among Artificial Intelligence, Supply Chain and Energy Sustainability: A Time-Varying Analysis. Energy Econ. 2024, 132, 107479. [Google Scholar] [CrossRef]

- Cabelkova, I.; Strielkowski, W.; Streimikiene, D.; Cavallaro, F.; Streimikis, J. The Social Acceptance of Nuclear Fusion for Decision Making towards Carbon Free Circular Economy: Evidence from Czech Republic. Technol. Forecast. Soc. Change 2021, 163, 120477. [Google Scholar] [CrossRef]

- Rikap, C. Becoming an Intellectual Monopoly by Relying on the National Innovation System: The State Grid Corporation of China’s Experience. Res. Policy 2022, 51, 104472. [Google Scholar] [CrossRef]

- Neto-Bradley, A.P.; Choudhary, R.; Bazaz, A. Slipping through the Net: Can Data Science Approaches Help Target Clean Cooking Policy Interventions? Energy Policy 2020, 144, 111650. [Google Scholar] [CrossRef]

- Anwar, A.Z.; Zain, M.; Hasan, R.; Al Salman, H.; Alkhamees, B.F.; Almisned, F.A. Circular Economy Advances with Artificial Intelligence and Digital Twin: Multiple-Case Study of Chinese Industries in Agriculture. J. Knowl. Econ. 2024. [Google Scholar] [CrossRef]

- Wang, B.; Wang, J.; Dong, K.; Nepal, R. How Does Artificial Intelligence Affect High-Quality Energy Development? Achieving a Clean Energy Transition Society. Energy Policy 2024, 186, 114010. [Google Scholar] [CrossRef]

- Lai, A.; Li, Z.; Hu, X.; Wang, Q. Does Digital Economy Improve City-Level Eco-Efficiency in China? Econ. Anal. Policy 2024, 81, 1198–1213. [Google Scholar] [CrossRef]

- Duan, Y.; Edwards, J.S.; Dwivedi, Y.K. Artificial Intelligence for Decision Making in the Era of Big Data—Evolution, Challenges and Research Agenda. Int. J. Inf. Manag. 2019, 48, 63–71. [Google Scholar] [CrossRef]

- Mylrea, M. Smart Energy-Internet-of-Things Opportunities Require Smart Treatment of Legal, Privacy and Cybersecurity Challenges. J. World Energy Law. Bus. 2017, 10, 147–158. [Google Scholar] [CrossRef]

| Document Type | Number | Percentage |

|---|---|---|

| Articles | 726 | 81.39% |

| Proceedings papers | 141 | 15.81% |

| Early Access papers | 54 | 6.05% |

| Review Articles | 24 | 2.69% |

| Book Chapters | 2 | 0.22% |

| Corrections | 2 | 0.22% |

| Editorial Material | 2 | 0.22% |

| Book Reviews | 1 | 0.11% |

| Number | Journal | TP | Percentage | IF |

|---|---|---|---|---|

| 1 | Energy Economics | 98 | 19.84% | 13.6 |

| 2 | Technological Forecasting and Social Change | 44 | 8.91% | 12.9 |

| 3 | Energy Policy | 36 | 7.29% | 9.3 |

| 4 | International Journal of Forecasting | 29 | 5.87% | 6.9 |

| 5 | Journal of Forecasting | 14 | 2.83% | 3.4 |

| 6 | Business Strategy and the Environment | 12 | 2.43% | 12.5 |

| 7 | European Journal of Operational Research | 11 | 2.23% | 6.0 |

| 8 | Computational Economics | 11 | 2.23% | 1.9 |

| 9 | International Review of Financial Analysis | 9 | 1.82% | 7.5 |

| 10 | Finance Research Letters | 8 | 1.62% | 7.4 |

| Freq | Label | Source | Title |

|---|---|---|---|

| 20 | Gozgor G (2022) [46] | Energy Economics | Does energy diversification cause an economic slowdown? Evidence from a newly constructed energy diversification index |

| 20 | Lau CK (2023) [47] | Energy Economics | Introducing a new measure of energy transition: Green quality of energy mix and its impact on CO2 emissions |

| 20 | Sinha A (2023) [48] | Energy Economics | How social imbalance and governance quality shape policy directives for energy transition in the OECD countries? |

| 19 | Chishti MZ (2023) [49] | Energy Economics | Exploring the dynamic connectedness among energy transition and its drivers: Understanding the moderating role of global geopolitical risk |

| 19 | Shahbaz M (2023) [50] | Energy Economics | Financial development as a new determinant of energy diversification: The role of natural capital and structural changes in Australia |

| 18 | Ahmad T (2021) [51] | Journal of Cleaner Production | Artificial intelligence in sustainable energy industry: Status quo, challenges and opportunities |

| 16 | Ghoddusi H (2019) [4] | Energy Economics | Machine learning in energy economics and finance: A review |

| 12 | Wang EZ (2022) [52] | Energy Economics | Assessing the impact of industrial robots on manufacturing energy intensity in 38 countries |

| 12 | Zhang YJ (2019) [53] | Journal of Empirical Finance | Forecasting crude oil prices with a large set of predictors: Can LASSO select powerful predictors? |

| 10 | Acemoglu D (2020) [54] | Journal of Political Economy | Robots and jobs: Evidence from US labor markets |

| 10 | Lee CC (2022) [55] | Technological Forecasting and Social Change | Does industrial robot application promote green technology innovation in the manufacturing industry? |

| 10 | Caldara D (2022) [56] | American Economic Review | Measuring geopolitical risk |

| 10 | Li YZ (2021) [57] | Energy Economics | The role of news sentiment in oil futures returns and volatility forecasting: Data-decomposition-based deep learning approach |

| No. | Frequency | Proportion | Centrality | Nation | Year |

|---|---|---|---|---|---|

| 1 | 196 | 40% | 0 | PEOPLES R CHINA | 2014 |

| 2 | 83 | 17% | 0 | USA | 2015 |

| 3 | 62 | 13% | 0.29 | ENGLAND | 2014 |

| 4 | 40 | 8% | 0.07 | FRANCE | 2016 |

| 5 | 38 | 8% | 0.04 | GERMANY | 2016 |

| 6 | 37 | 7% | 0.61 | AUSTRALIA | 2014 |

| 7 | 32 | 6% | 0.57 | INDIA | 2015 |

| 8 | 22 | 4% | 0 | ITALY | 2017 |

| 9 | 18 | 4% | 0.06 | SPAIN | 2018 |

| 10 | 17 | 3% | 0.18 | NETHERLANDS | 2016 |

| Number | Label | Freq | Proportion |

|---|---|---|---|

| 1 | Chinese Academy of Sciences | 17 | 3.44% |

| 2 | Beijing Institute of Technology | 11 | 2.23% |

| 3 | University of Chinese Academy of Sciences | 10 | 2.02% |

| 4 | Lebanese American University | 8 | 1.62% |

| 5 | Anhui University of Finance & Economics | 8 | 1.62% |

| 6 | University of International Business & Economics | 8 | 1.62% |

| 7 | Academy of Mathematics & System Sciences | 7 | 1.42% |

| 8 | University of London | 6 | 1.21% |

| 9 | Central South University | 6 | 1.21% |

| 10 | Indian Institute of Management (IIM System) | 6 | 1.21% |

| Total | 87 | 17.61% | |

| Number | Freq | Centrality | Keyword | Year |

|---|---|---|---|---|

| 1 | 22 | 0.35 | demand | 2015 |

| 2 | 34 | 0.3 | consumption | 2015 |

| 3 | 11 | 0.28 | decomposition | 2014 |

| 4 | 15 | 0.2 | future | 2018 |

| 5 | 31 | 0.2 | regression | 2014 |

| 6 | 13 | 0.19 | big-data analytics | 2015 |

| 7 | 12 | 0.19 | artificial neural network | 2018 |

| 8 | 34 | 0.15 | neural networks | 2014 |

| 9 | 18 | 0.15 | efficiency | 2017 |

| 10 | 17 | 0.14 | algorithm | 2016 |

| Focus | ID | Cluster | Size | Silhouette | Year | Typical Keywords and Their Centrality |

|---|---|---|---|---|---|---|

| Artificial Intelligence and the Energy Market | #0 | artificial intelligence | 35 | 0.841 | 2019 | artificial intelligence (26.41; 1.0 × 10−4); energy transition (15.57; 1.0 × 10−4); renewable energy (11.1; 0.001); Bayesian networks (8.74; 0.005); portfolio diversification (8.74; 0.005) |

| #1 | volatility forecasting | 31 | 0.901 | 2019 | volatility forecasting (13.9; 0.001); crude oil market (9.93; 0.005); artificial neural networks (9.22; 0.005); time-series forecasting (7.23; 0.01); artificial intelligence (6.6; 0.05) | |

| #4 | tail risk | 25 | 0.815 | 2017 | tail risk (6.08; 0.05); Bayesian extreme learning machine (6.08; 0.05); oil–food–renewable energy market (6.08; 0.05); crude oil shocks (6.08; 0.05); precious metal forecasting (6.08; 0.05) | |

| #5 | big-data analytics | 25 | 0.936 | 2017 | big-data analytics (12.4; 0.001); energy efficiency (9.55; 0.005); carbon emission efficiency (8.56; 0.005); heterogeneity (6.62; 0.05); electricity demand (5.28; 0.05) | |

| #6 | smart grid | 25 | 0.811 | 2018 | smart grid (11.42, 0.001); electricity market (11.42; 0.001); privacy (11.42; 0.001); risk management (7.72; 0.01); quantile regression (7.72; 0.01) | |

| #9 | neural networks | 20 | 0.955 | 2016 | neural networks (12.8; 0.001); energy intensity (11.11; 0.001); crude oil (8.75; 0.005); correlation (5.54; 0.05); choice models (5.54; 0.05) | |

| Artificial Intelligence and the Energy Market | #10 | big data | 20 | 0.91 | 2018 | big data (12.86; 0.001); smart cities (8.17; 0.005); imperfect quality components (5.93; 0.05); bidirectional fixed-effect model (5.93; 0.05); smart energy communities (5.93; 0.05) |

| #11 | digital twin | 20 | 0.941 | 2015 | digital twin (12.14; 0.001); market research (8.42; 0.005); patents (8.42; 0.005); multivariate forecasting (6.06; 0.05); decomposition (6.06; 0.05) | |

| #12 | deep learning | 20 | 0.9 | 2020 | deep learning (14.65; 0.001); energy price forecasting (11.04; 0.001); carbon tax (11.04; 0.001); regression analysis (7.35; 0.01); parameter instability (7.35; 0.01) | |

| #13 | data mining | 16 | 0.956 | 2017 | data mining (8.3; 0.005); artificial intelligence (AI) (8.3; 0.005); technological implications (7.86; 0.01); information technology (IT) (7.86; 0.01); correlation analysis (7.86; 0.01) | |

| #16 | riskmetrics | 7 | 1 | 2015 | riskmetrics (10.83; 0.001); leveraging (10.83; 0.001); genetic programming algorithm (10.83; 0.001); higher-order neural network (10.83; 0.001); multilayer perceptron neural network (10.83; 0.001) | |

| #19 | Gaussian processes | 1 | 0 | 2014 | Gaussian processes (13.29; 0.001); gradient-boosting machines (10.52; 0.005); load forecasting (10.52; 0.005); machine learning (0.23; 1.0); artificial intelligence (0.15; 1.0) | |

| Sustainable Development and Environmental Policy | #2 | sustainable development | 29 | 0.728 | 2020 | sustainable development (17.2; 1.0 × 10−4); Industry 4.0 (12.03; 0.001); carbon emissions (5.64; 0.05); information technology (5.45; 0.05) |

| #3 | corporate governance | 29 | 0.931 | 2021 | corporate governance (9.43; 0.005); o13 (5.81; 0.05); big-data economy (4.71; 0.05); tfp (4.71; 0.05); wind (4.71; 0.05) | |

| #7 | carbon emission | 24 | 0.96 | 2017 | carbon emission (12.7; 0.001); CO2 emissions (12.53; 0.001); green investment technology (6.33; 0.05); adaptive management (6.33; 0.05); thresholds (6.33; 0.05) | |

| #8 | green innovation | 23 | 0.901 | 2023 | green innovation (14.31; 0.001); digital transformation (14.26; 0.001); digital finance (12.45; 0.001); environmental regulation (12.45; 0.001); green technology innovation (9.51; 0.005) | |

| Energy Consumption and Demand Management | #14 | machine learning | 14 | 0.952 | 2016 | machine learning (39.53; 1.0 × 10−4); energy poverty prediction (10.49; 0.005); eco-innovation (5.24; 0.05); iot (5.24; 0.05); atfp (5.24; 0.05) |

| #15 | electricity demand | 11 | 0.828 | 2021 | electricity demand (8.86; 0.005); energy consumption structure (8.15; 0.005); copula function model (8.15; 0.005); multi-factor dynamic support vector machine model (8.15; 0.005); advanced index (8.15; 0.005) | |

| Socio-economic Impacts | #17 | theory of planned behavior | 4 | 1 | 2017 | theory of planned behavior (11.7; 0.001); compliance behavior (11.7; 0.001); IT relatedness (11.7; 0.001); compliance knowledge (11.7; 0.001); compliance support system (11.7; 0.001) |

| #18 | operational improvement | 3 | 1 | 2016 | operational improvement (12.11; 0.001); customer demand anticipation (12.11; 0.001); customer attendance (12.11; 0.001); attendance strategies (12.11; 0.001); relationship (12.11; 0.001) |

| Keywords | Year | Strength | Begin | End | 2014–2024 |

|---|---|---|---|---|---|

| demand | 2015 | 3.62 | 2015 | 2019 | ▂▃▃▃▃▃▂▂▂▂▂ |

| neural networks | 2014 | 5.14 | 2016 | 2019 | ▂▂▃▃▃▃▂▂▂▂▂ |

| artificial neural networks | 2016 | 4.13 | 2016 | 2020 | ▂▂▃▃▃▃▃▂▂▂▂ |

| time series | 2016 | 3.43 | 2016 | 2020 | ▂▂▃▃▃▃▃▂▂▂▂ |

| regression | 2014 | 2.68 | 2016 | 2018 | ▂▂▃▃▃▂▂▂▂▂▂ |

| algorithm | 2016 | 2.56 | 2016 | 2021 | ▂▂▃▃▃▃▃▃▂▂▂ |

| consumption | 2015 | 2.04 | 2017 | 2018 | ▂▂▂▃▃▂▂▂▂▂▂ |

| big data | 2014 | 3.77 | 2018 | 2020 | ▂▂▂▂▃▃▃▂▂▂▂ |

| neural network | 2018 | 2.75 | 2018 | 2021 | ▂▂▂▂▃▃▃▃▂▂▂ |

| electricity demand | 2018 | 2.3 | 2018 | 2020 | ▂▂▂▂▃▃▃▂▂▂▂ |

| artificial neural network | 2018 | 2.05 | 2018 | 2021 | ▂▂▂▂▃▃▃▃▂▂▂ |

| prices | 2018 | 2.05 | 2018 | 2019 | ▂▂▂▂▃▃▂▂▂▂▂ |

| system | 2018 | 2.03 | 2018 | 2020 | ▂▂▂▂▃▃▃▂▂▂▂ |

| prediction | 2019 | 3.33 | 2019 | 2021 | ▂▂▂▂▂▃▃▃▂▂▂ |

| power | 2019 | 2.2 | 2019 | 2021 | ▂▂▂▂▂▃▃▃▂▂▂ |

| dynamics | 2020 | 3.59 | 2020 | 2021 | ▂▂▂▂▂▂▃▃▂▂▂ |

| big data analytics | 2015 | 2.29 | 2020 | 2022 | ▂▂▂▂▂▂▃▃▃▂▂ |

| inference | 2020 | 2.05 | 2020 | 2021 | ▂▂▂▂▂▂▃▃▂▂▂ |

| ICT | 2021 | 2.07 | 2021 | 2022 | ▂▂▂▂▂▂▂▃▃▂▂ |

| investment | 2022 | 2.98 | 2022 | 2024 | ▂▂▂▂▂▂▂▂▃▃▃ |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiao, Z.; Zhang, C.; Li, W. Artificial Intelligence in Energy Economics Research: A Bibliometric Review. Energies 2025, 18, 434. https://doi.org/10.3390/en18020434

Jiao Z, Zhang C, Li W. Artificial Intelligence in Energy Economics Research: A Bibliometric Review. Energies. 2025; 18(2):434. https://doi.org/10.3390/en18020434

Chicago/Turabian StyleJiao, Zhilun, Chenrui Zhang, and Wenwen Li. 2025. "Artificial Intelligence in Energy Economics Research: A Bibliometric Review" Energies 18, no. 2: 434. https://doi.org/10.3390/en18020434

APA StyleJiao, Z., Zhang, C., & Li, W. (2025). Artificial Intelligence in Energy Economics Research: A Bibliometric Review. Energies, 18(2), 434. https://doi.org/10.3390/en18020434