Renewable Portfolio Standards, Carbon Emissions Trading and China Certified Emission Reduction: The Role of Market Mechanisms in Optimizing China’s Power Generation Structure

Abstract

:1. Introduction

2. Literature Review

3. Methodology

3.1. System Dynamics Model

3.2. System Boundary Analysis

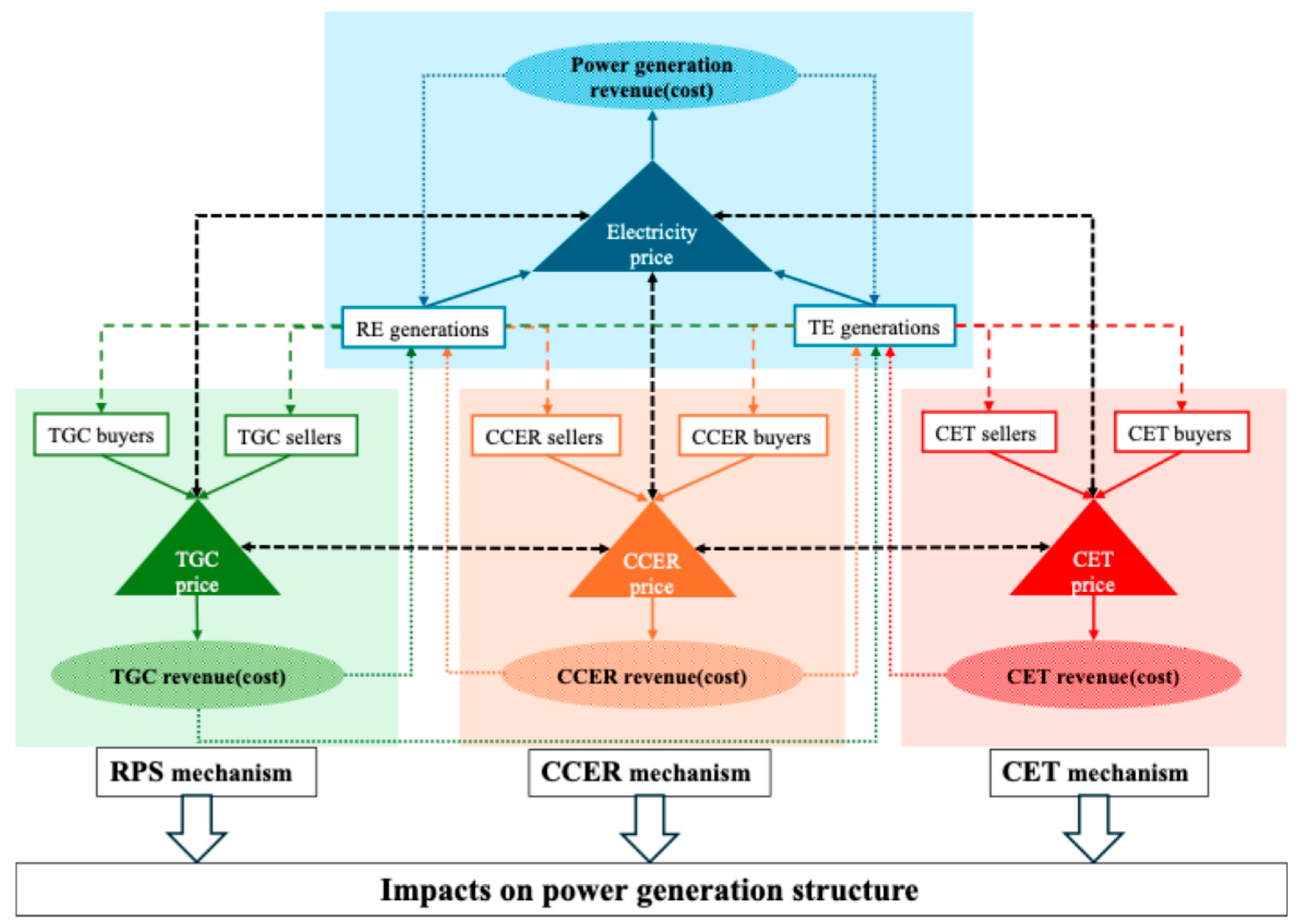

3.3. System Causality Analysis

3.4. System Structure Analysis

3.4.1. Assumptions

- (1)

- TGC, CET and CCER trading is limited to the electricity sector.

- (2)

- RE power generators only generate electricity, and there are no feed-in tariff subsidies.

- (3)

- TGCs are homogeneous and separate from electricity transactions.

- (4)

- (5)

- All RE power generation projects can apply for CCER, and the project emission reduction is equal to the project baseline emissions.

- (6)

- The environmental value of each unit of RE electricity cannot be traded in the TGC market and CCER market.

- (7)

- CET, CCER and TGCs cannot be stored, have no secondary market, and cannot be converted or offset against each other.

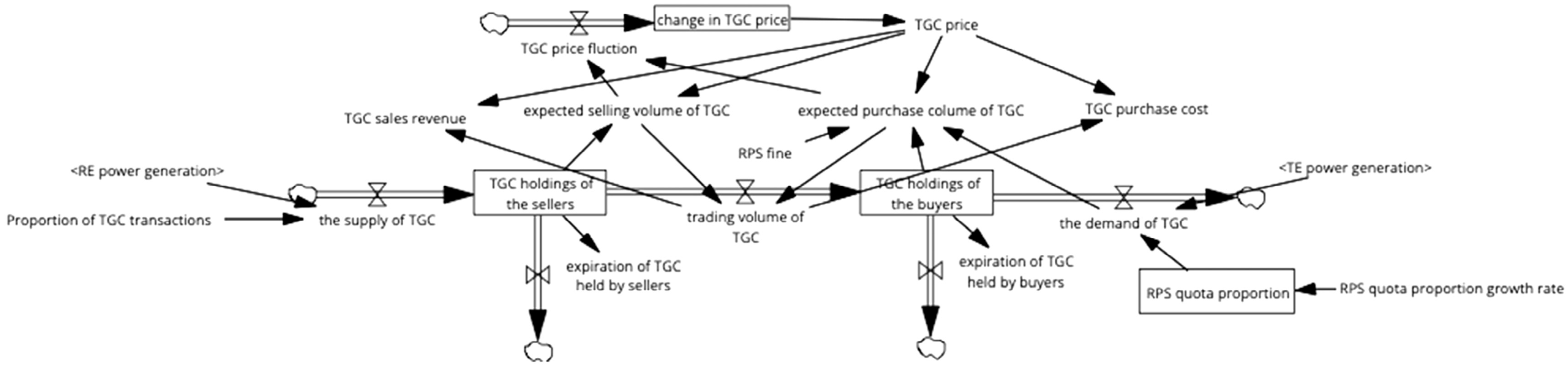

3.4.2. TGC Market Subsystem

3.4.3. CET Market Subsystem

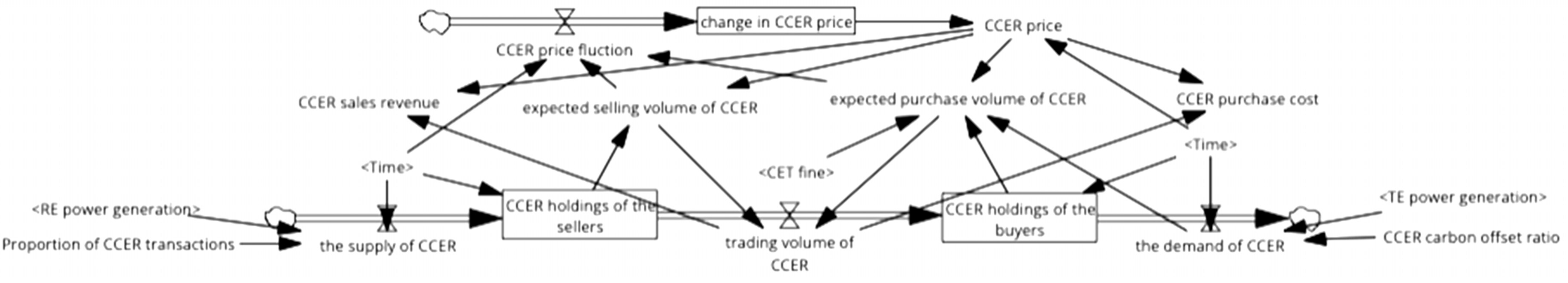

3.4.4. CCER Market Subsystem

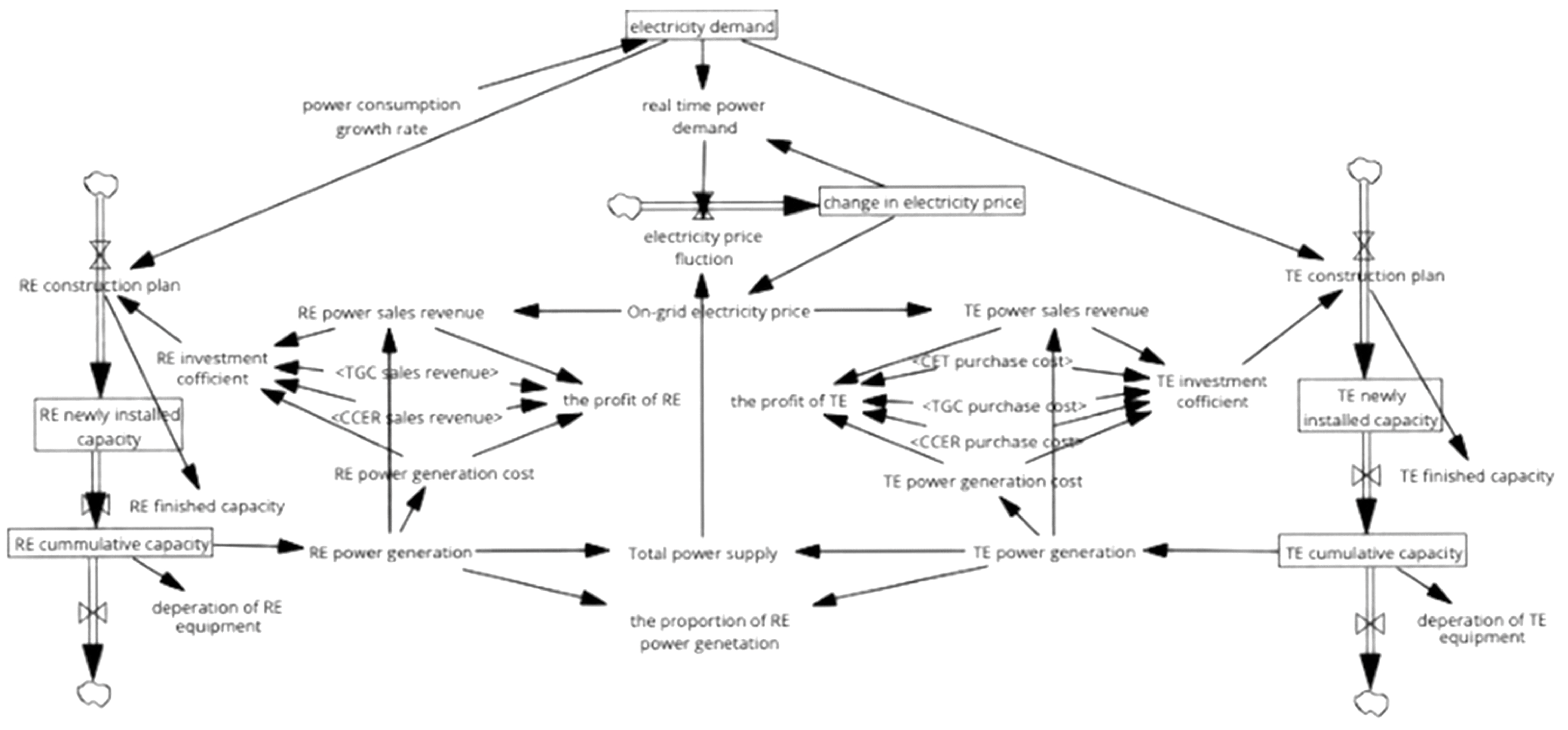

3.4.5. Electricity Market Subsystem

3.5. Data and Model Validation

4. Results and Discussion

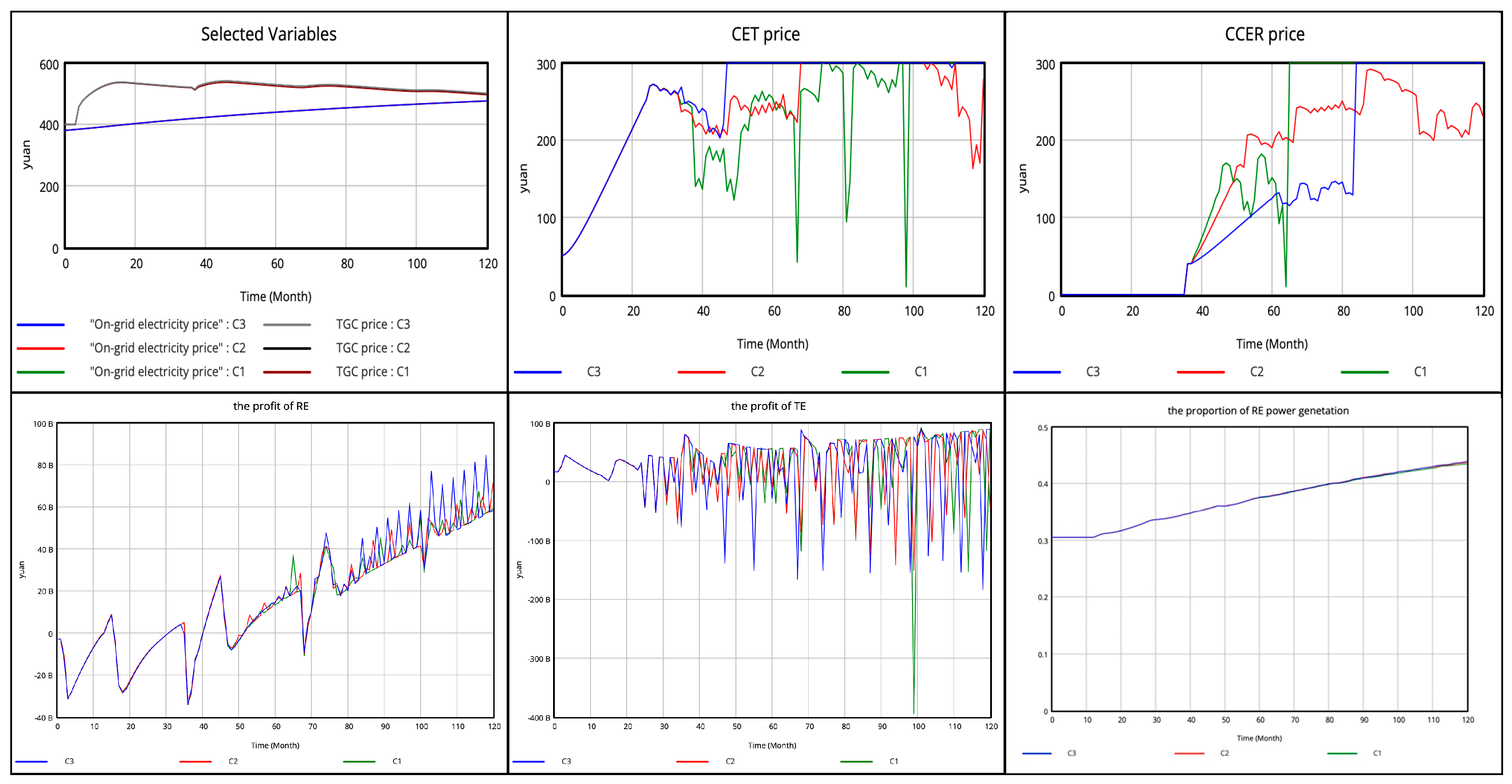

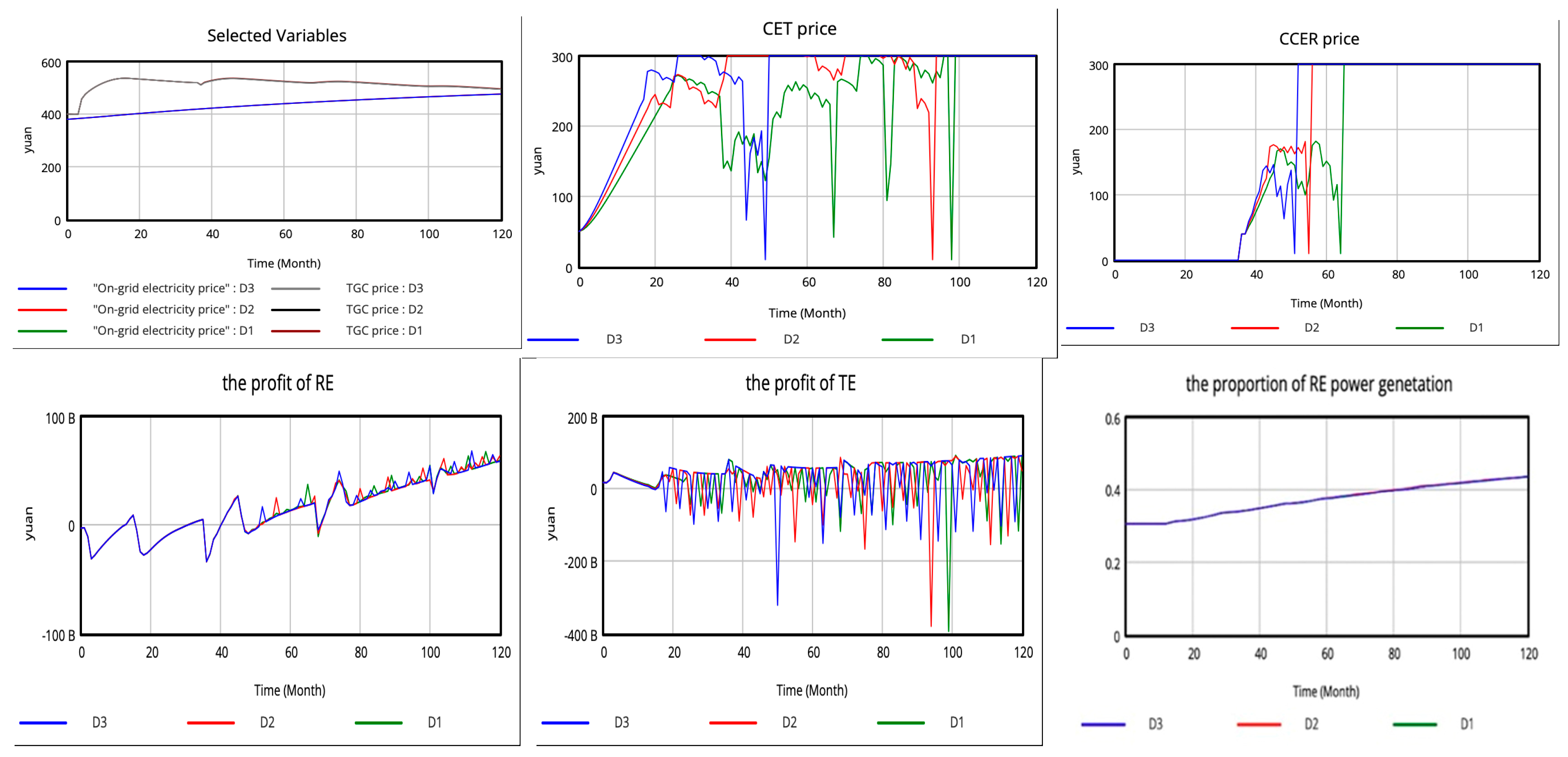

4.1. Simulation Results

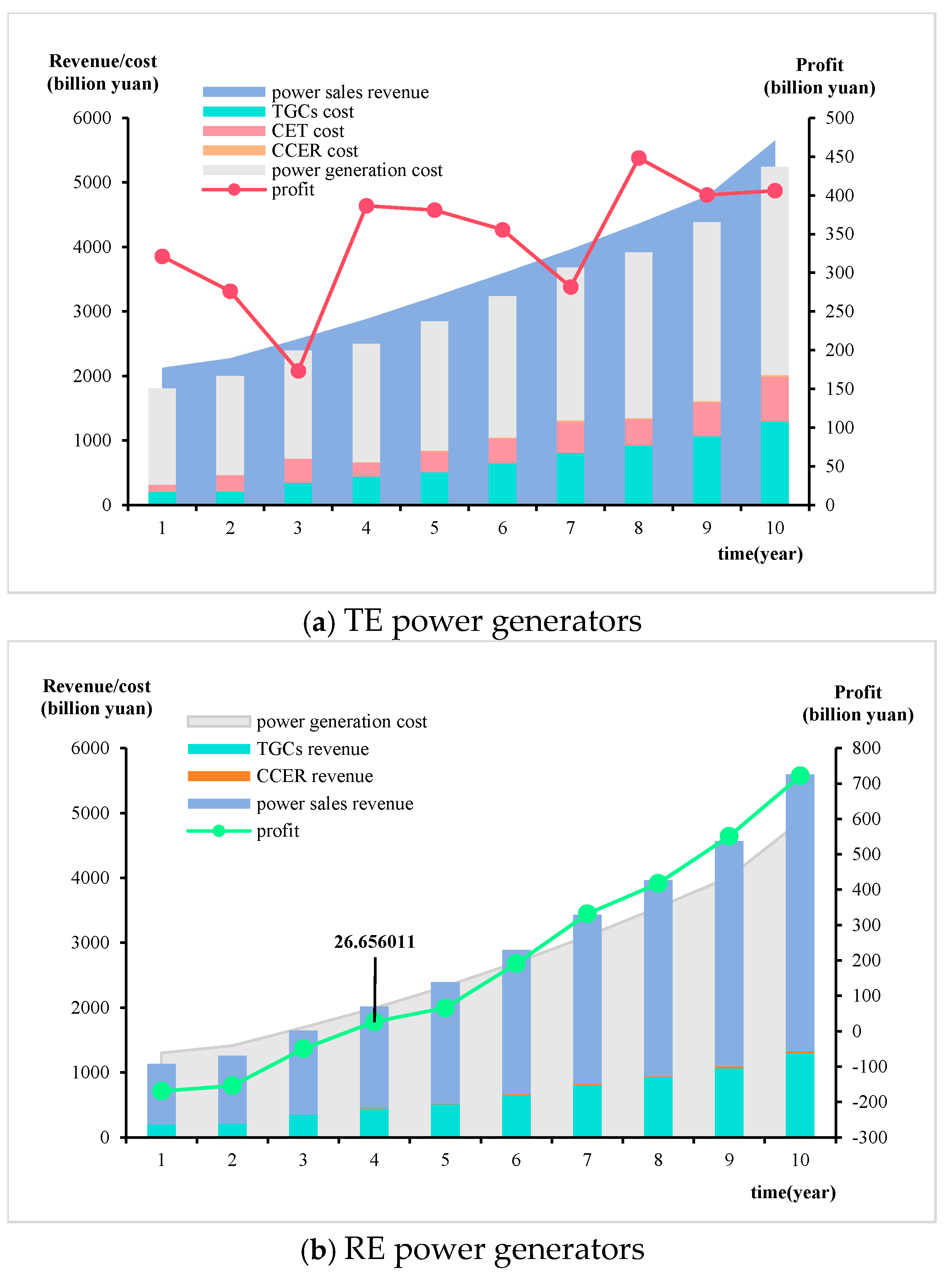

- (1)

- Market prices

- (2)

- Power generators’ profits

- (3)

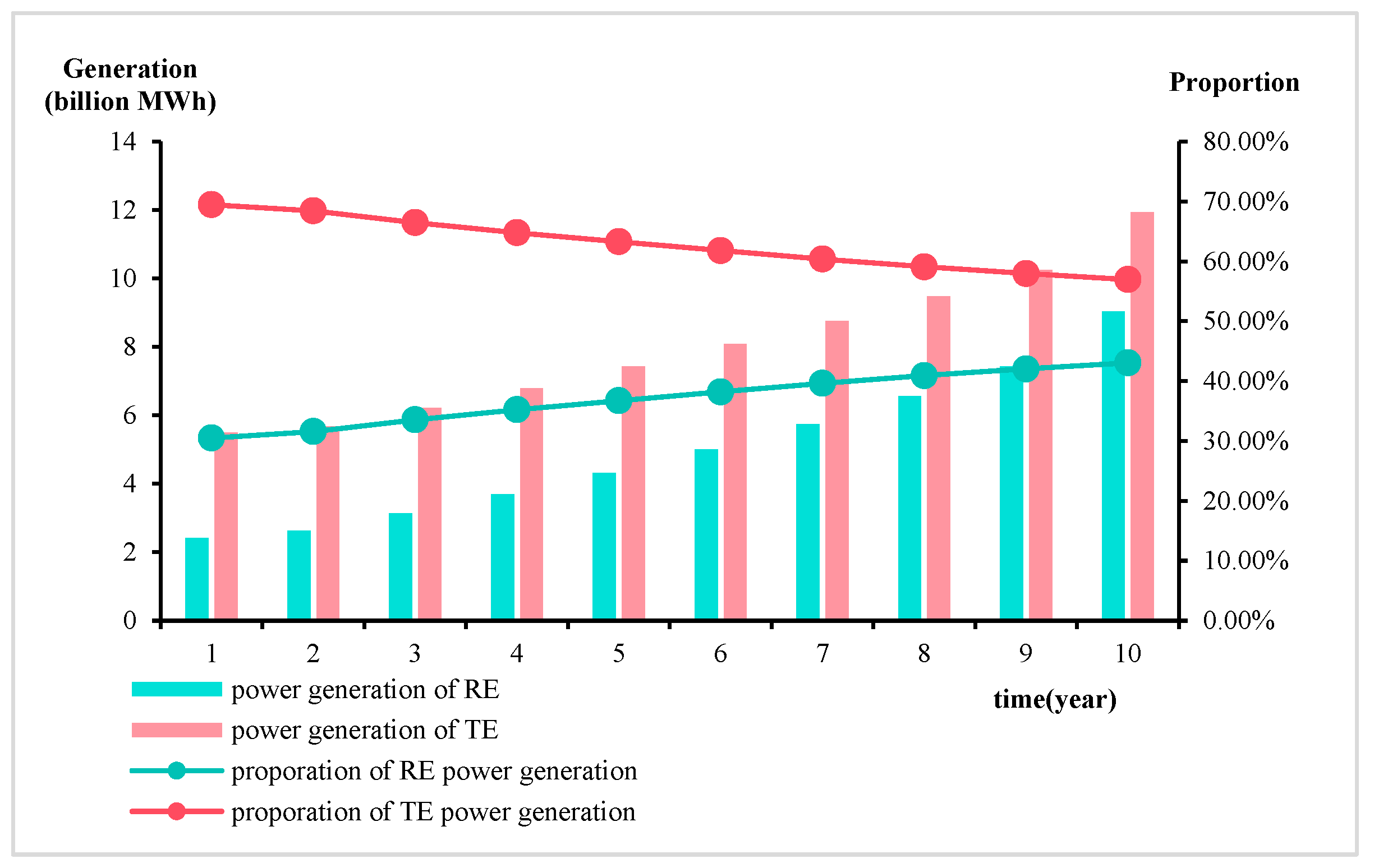

- Power generation structure

4.2. Sensitivity Analysis

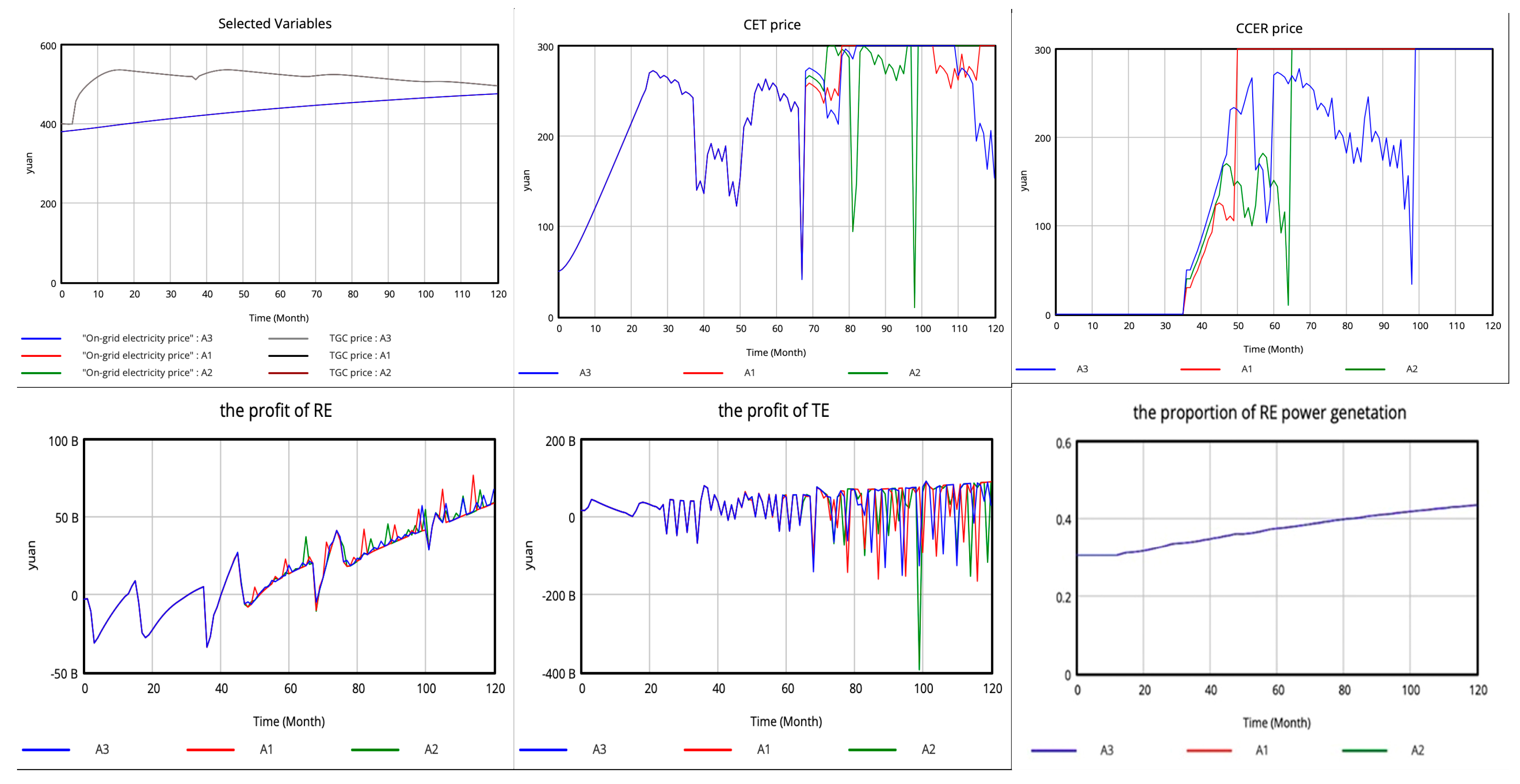

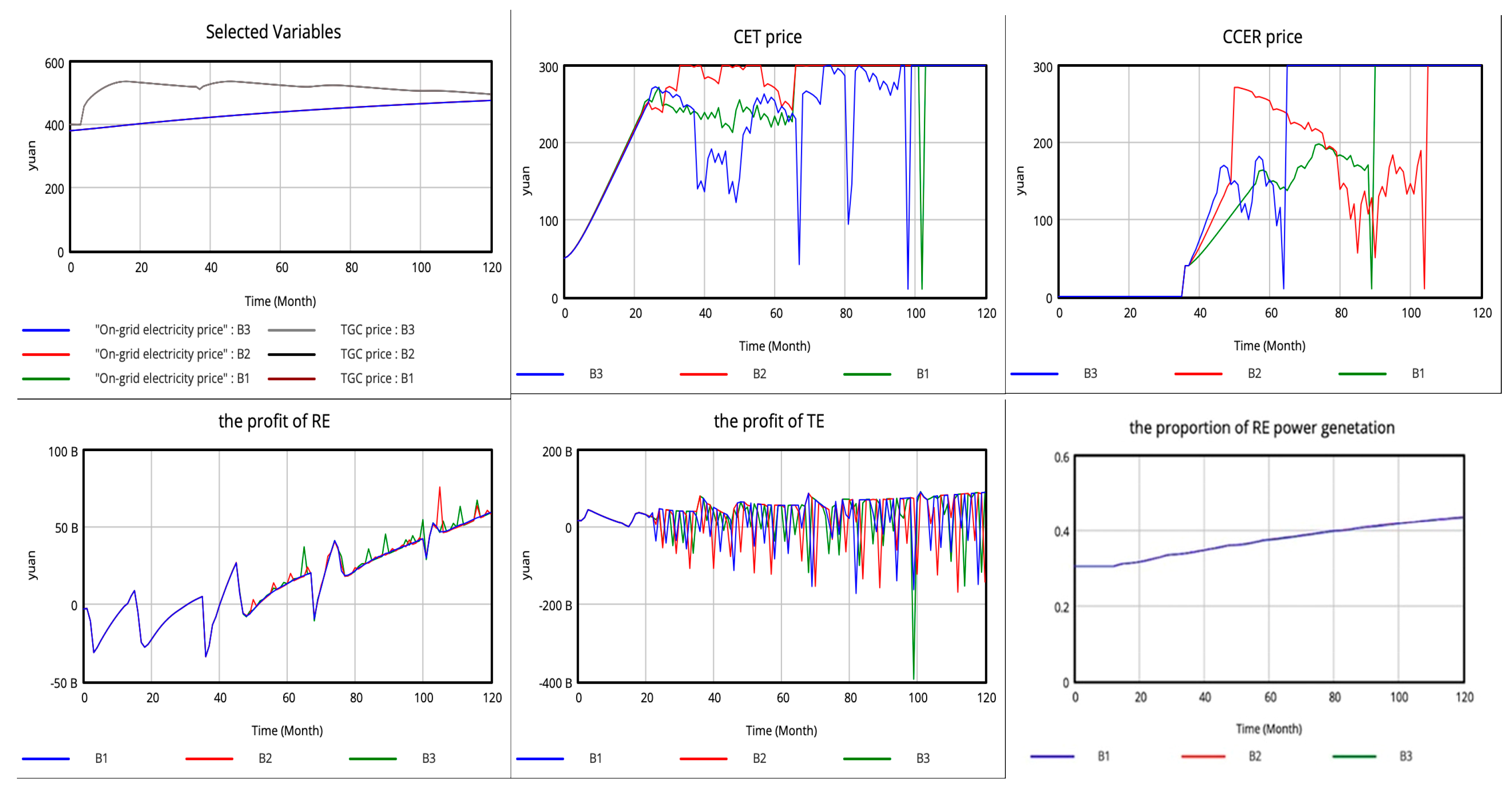

4.2.1. CCER Benchmark Price

4.2.2. CCER Offset Ratio

4.2.3. CCER Participation Proportion

4.2.4. CET Fine

4.3. Discussion

5. Conclusions and Policy Implications

5.1. Conclusions

5.2. Policy Implications

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| Parameters | |

| Proportion of RE environmental value traded in the TGC market | |

| Proportion of RE environmental value traded in CCER market | |

| RPSs quota | |

| CCER offset ratio | |

| The proportion of carbon emissions from the power sector | |

| Carbon emission factors for electricity | |

| Growth rate of electricity demand | |

| Carbon emissions per unit of GDP | |

| Price elasticity of demand for electricity | |

| Marginal cost of RE/TE power generation. | |

| Index of RE generator’s future investment and construction plan | |

| Index of TE generator’s future investment and construction plan | |

| RE/TE power annual utilization hours | |

| Variables | |

| RE/TE power generation | |

| The total supply of TGC/CET/CCER market | |

| The total demand of TGC/CET/CCER market | |

| TGCs/CET/CCER/Electricity real-time price at time t | |

| TGCs/CET/CCER/Electricity benchmark price | |

| Maximum prices for TGCs/CET/CCER | |

| Unit default fines for RPS or CET mechanisms | |

| TGCs/CET/CCER trading price | |

| Expected purchases volume of TGCs/CET/CCER | |

| Expected sales volume of TGCs/CET/CCER | |

| Actual trading volume of TGCs/CET/CCER | |

| TGCs/CET/CCER holding of the buyers | |

| TGCs/CET/CCER holding of the sellers | |

| TGCs/CET/CCER sales revenue | |

| TGCs/CET/CCER purchases cost | |

| GDP | Gross domestic product |

| The total demand of electricity | |

| Initial electricity demand of 2021 | |

| Real-time electricity demand | |

| RE/TE power generator’s revenue from the sale of electricity | |

| RE/TE power generator’s cost from power generation | |

| RE/TE power generator’s investment coefficient | |

| RE/TE power generator’s future investment plan | |

| RE/TE power generator’s finished installed capacity | |

| RE/TE power generator’s cumulative installed capacity | |

| Proportion of RE/TE generation to total electricity generation |

References

- The State Council Information Office of the People’s Republic of China. Available online: http://www.scio.gov.cn/zfbps/32832/Document/1695117/1695117.htm (accessed on 18 October 2021).

- Cui, H.; Zhao, T.; Wu, R. CO2 emissions from China’s power industry: Policy implications from both macro and micro perspectives. J. Clean. Prod. 2018, 200, 746–755. [Google Scholar] [CrossRef]

- Jaccard, M. Renewable portfolio standard. Encycl. Energy 2004, 5, 413–421. [Google Scholar]

- People’s Daily. Available online: http://paper.people.com.cn/rmrb/html/2023-11/17/nw.D110000renmrb_20231117_2-08.htm (accessed on 17 November 2023).

- Xin-gang, Z.; Lei, X.; Ying, Z. How to promote the effective implementation of China’s renewable portfolio standards considering non-neutral technology? Energy 2022, 238, 121748. [Google Scholar] [CrossRef]

- Hu, Y.; Ren, S.; Wang, Y.; Chen, X. Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energy Econ. 2020, 85, 104590. [Google Scholar] [CrossRef]

- Zhao, X.; Wu, L.; Li, A. Research on the efficiency of carbon trading market in China. Renew. Sustain. Energy Rev. 2017, 79, 1–8. [Google Scholar] [CrossRef]

- Lin, B.; Huang, C. Analysis of emission reduction effects of carbon trading: Market mechanism or government intervention? Sustain. Prod. Consum. 2022, 33, 28–37. [Google Scholar] [CrossRef]

- Ning, Z.; Jun, P. The economic impacts of introducing CCER trading and offset mechanism into the national carbon market of China. Adv. Clim. Change Res. 2022, 18, 622. [Google Scholar]

- Lo, A.Y.; Cong, R. After CDM: Domestic carbon offsetting in China. J. Clean. Prod. 2017, 141, 1391–1399. [Google Scholar] [CrossRef]

- Wang, T.; Gong, Y.; Jiang, C. A review on promoting share of renewable energy by green-trading mechanisms in power system. Renew. Sustain. Energy Rev. 2014, 40, 923–929. [Google Scholar] [CrossRef]

- Kilinc-Ata, N. The evaluation of renewable energy policies across EU countries and US states: An econometric approach. Energy Sustain. Dev. 2016, 31, 83–90. [Google Scholar] [CrossRef]

- Kilinc-Ata, N.; Proskuryakova, L.N. The contribution of energy policies to green energy transition in the Asia-Pacific region. Renew. Energy 2024, 237, 121797. [Google Scholar] [CrossRef]

- Fan, J.L.; Wang, J.X.; Hu, J.W.; Wang, Y.; Zhang, X. Optimization of China’s provincial renewable energy installation plan for the 13th Five-year plan based on renewable portfolio standards. Appl. Energy 2019, 254, 113757. [Google Scholar] [CrossRef]

- Wu, J.; Chen, Y.; Yu, L.; Li, G.; Li, J. Has the evolution of renewable energy policies facilitated the construction of a new power system for China? A system dynamics analysis. Energy Policy 2023, 183, 113798. [Google Scholar] [CrossRef]

- Zhang, F.; Li, Y.; Li, F.; Yuan, J.; Li, Y. Decision-making behavior of power suppliers in the green certificate market: A system dynamics analysis. Energy Policy 2022, 171, 113296. [Google Scholar] [CrossRef]

- Ying, Z.; Xin-gang, Z.; Lei, X. Supply side incentive under the Renewable Portfolio Standards: A perspective of China. Renew. Energy 2022, 193, 505–518. [Google Scholar] [CrossRef]

- Ying, Z.; Xin-gang, Z.; Zhen, W. Demand side incentive under renewable portfolio standards: A system dynamics analysis. Energy Policy 2020, 144, 111652. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. Is emission trading scheme an opportunity for renewable energy in China? A perspective of ETS revenue redistributions. Appl. Energy 2020, 263, 114605. [Google Scholar] [CrossRef]

- Shi, M.; Zou, T.; Xu, J.; Wang, J. Can carbon emissions trading scheme make power plants greener? Firm-level evidence from China. Front. Energy Res. 2022, 10, 906033. [Google Scholar] [CrossRef]

- Sun, K.; Zhou, F.; Liu, X. Study on the impact of emission trading scheme on technological progress of power generation sector in China: A perspective from energy transition. Energy 2024, 302, 131750. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. What will China’s carbon emission trading market affect with only electricity sector involvement? A CGE based study. Energy Econ. 2019, 78, 301–311. [Google Scholar] [CrossRef]

- Shobande, O.A.; Ogbeifun, L.; Tiwari, A.K. Extricating the impacts of emissions trading system and energy transition on carbon intensity. Appl. Energy 2024, 357, 122461. [Google Scholar] [CrossRef]

- Li, J.; Hu, Y.; Chi, Y.; Liu, D.; Yang, S.; Gao, Z.; Chen, Y. Analysis on the synergy between markets of electricity, carbon, and tradable green certificates in China. Energy 2024, 302, 131808. [Google Scholar] [CrossRef]

- Ma, X.; Pan, Y.; Zhang, M.; Ma, J.; Yang, W. Impact of carbon emission trading and renewable energy development policy on the sustainability of electricity market: A stackelberg game analysis. Energy Econ. 2024, 129, 107199. [Google Scholar] [CrossRef]

- Li, C.; Wang, D.; Mao, J.; Chen, F. How to facilitate the implementation of the renewable portfolio standard? A system dynamics model analysis. Renew. Energy. 2024, 223, 120120. [Google Scholar] [CrossRef]

- Fikru, M.G.; Kilinc-Ata, N.; Belaïd, F. Climate policy stringency and trade in energy transition minerals: An analysis of response patterns. Res. Policy 2024, 96, 105236. [Google Scholar] [CrossRef]

- Kilinc-Ata, N.; Proskuryakova, L.N. Empirical analysis of the Russian power industry’s transition to sustainability. Util. Policy 2023, 82, 101586. [Google Scholar] [CrossRef]

- Feng, T.; Yang, Y.; Yang, Y. What will happen to the power supply structure and CO2 emissions reduction when TGC meets CET in the electricity market in China? Renew. Sustain. Energy Rev. 2018, 92, 121–132. [Google Scholar] [CrossRef]

- Chang, X.; Wu, Z.; Wang, J.; Zhang, X.; Zhou, M.; Yu, T.; Wang, Y. The coupling effect of carbon emission trading and tradable green certificates under electricity marketization in China. Renew. Sustain. Energy Rev. 2023, 187, 113750. [Google Scholar] [CrossRef]

- Liu, Y.; Mabee, W.; Zhang, H. Upgrading the development of Hubei biogas with ETS in China. J. Clean. Prod. 2019, 213, 745–752. [Google Scholar] [CrossRef]

- Li, K.; Qi, S.Z.; Yan, Y.X.; Zhang, X.L. China’s ETS pilots: Program design, industry risk, and long-term investment. Adv. Clim. Chang. Res. 2022, 13, 82–96. [Google Scholar] [CrossRef]

- Yan, Y.; Zhang, X.; Zhang, J.; Li, K. Emissions trading system (ETS) implementation and its collaborative governance effects on air pollution: The China story. Energy Policy 2020, 138, 111282. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Liu, J.Y.; Woodward, R.T. Has Chinese certified emission reduction trading reduced rural poverty in China? Aust. J. Agric. Resour. Econ. 2023, 67, 438–458. [Google Scholar] [CrossRef]

- He, Y.; Jiang, R.; Liao, N. How to promote the Chinese Certified Emission Reduction scheme in the carbon market? A study based on tripartite evolutionary game model. Energy 2023, 285, 128723. [Google Scholar] [CrossRef]

- Zhang, M.; Tan, J.; Cheng, E.T.C. Pricing of Chinese certified emissions reduction scheme in a supply chain under the cap-and-trade policy. Ecol. Chem. Eng. S 2024, 31, 31–48. [Google Scholar] [CrossRef]

- Wang, L.; Li, Z.; Xu, Z.; Yue, X.; Yang, L.; Wang, R.; Chen, Y.; Ma, H. Carbon emission scenario simulation and policy regulation in resource-based provinces based on system dynamics modeling. J. Clean. Prod. 2024, 460, 142619. [Google Scholar] [CrossRef]

- Sun, Y.; Liu, N.; Shang, J.; Zhang, J. Sustainable utilization of water resources in China: A system dynamics model. J. Clean. Prod. 2017, 142, 613–625. [Google Scholar] [CrossRef]

- Li, C.; Zhang, L.; Ou, Z.; Ma, J. Using system dynamics to evaluate the impact of subsidy policies on green hydrogen industry in China. Energy Policy 2022, 165, 112981. [Google Scholar] [CrossRef]

- Li, C.; Hao, Q.; Wang, H.; Hu, Y.; Xu, G.; Qin, Q.; Wang, X.; Negnevitsky, M. Assessing green methanol vehicles’ deployment with life cycle assessment-system dynamics model. Appl. Energy 2024, 363, 123055. [Google Scholar] [CrossRef]

- Li, G.; Kou, C.; Wang, Y.; Yang, H. System dynamics modelling for improving urban resilience in Beijing, China. Resour. Conserv. Recycl. 2020, 161, 104954. [Google Scholar] [CrossRef]

- Zhao, X.; Zhou, Y.; Zuo, Y.; Meng, J.; Zhang, Y. Research on optimal benchmark price of tradable green certificate based on system dynamics: A China perspective. J. Clean. Prod. 2019, 230, 241–252. [Google Scholar] [CrossRef]

- Lei, X.; Xin-gang, Z. The synergistic effect between Renewable Portfolio Standards and carbon emission trading system: A perspective of China. Renew. Energy 2023, 211, 1010–1023. [Google Scholar] [CrossRef]

- Hu, Y.; Chi, Y.; Zhou, W.; Li, J.; Wang, Z.; Yuan, Y. The interactions between renewable portfolio standards and carbon emission trading in China: An evolutionary game theory perspective. Energy 2023, 271, 127047. [Google Scholar] [CrossRef]

- National Development and Reform Commission. Available online: https://www.ndrc.gov.cn/xwdt/tzgg/202206/t20220601_1326720.html (accessed on 1 June 2022).

- Shanghai Environment and Energy Exchange. Available online: https://www.cneeex.com (accessed on 4 September 2024).

| Variables | (Initial) Value | Unit | Data Recourse | |

|---|---|---|---|---|

| 1 | GDP | 101,598.62 | billion CNY | Preliminary Gross Domestic Product (GDP) results for the fourth quarter and full year 2020 |

| 2 | RPSs quota | 15.9 | % | China Renewable Energy Development Report of 2023 and Action Plan for Carbon Dioxide Peaking Before 2030 |

| 3 | RPSs quota growth rate | 0.38 | % | |

| 4 | Electricity demand | 7.52 | billion MWh | China Power Industry Annual Development Report 2021 |

| 5 | TGCs benchmark price | 400 | CNY | Reference [42] |

| 6 | CET benchmark price | 50 | CNY | Reference [35] |

| 7 | CCER benchmark price | 40 | CNY | Reference [35] |

| 8 | The price range of TGCs | 200–800 | CNY | Reference [42] |

| 9 | The price range of CET and CCER | 10–300 | CNY/ton | Reference [35] |

| 10 | RPSs fine | 800 | CNY | The upper price of TGCs |

| 11 | CET fine | 300 | CNY | The upper price of CET |

| 12 | TE annual utilization hours | 4466 | Hour | 2023–2024 National Electricity Supply and Demand Situation Analysis and Forecast Report |

| 13 | RE annual utilization hours | 2655 a | Hour | |

| 14 | The marginal generation cost of the TE power | 540 | CNY/MWh | China power supply and demand analysis report |

| 15 | The marginal generation cost of the RE power | 270 | CNY/MWh | |

| 16 | RE newly installed capacity | 139,000 | MW | China Renewable Energy Development Report 2020 |

| 17 | TE newly installed capacity | 51,870 | MW | |

| 18 | RE cumulative installed capacity | 934,000 | MW | 14th Five-year plan for renewable energy development |

| 19 | TE cumulative installed capacity | 1,263,647 | MW | |

| 20 | RE power generation | 2.21 | billion MWh | |

| 21 | TE power generation | 5.39 | billion MWh |

| Year | Electricity Demand | Renewable Energy Power Generation | Traditional Energy Power Generation | ||||||

|---|---|---|---|---|---|---|---|---|---|

| SV | TV | Error | SV | TV | Error | SV | TV | Error | |

| 2021 | 8.31 | 8.05 | 3.10% | 2.48 | 2.41 | 2.76% | 6.02 | 5.50 | 8.70% |

| 2022 | 8.60 | 8.62 | 0.24% | 2.67 | 2.62 | 2.15% | 6.01 | 5.68 | 5.66% |

| 2023 | 9.22 | 9.23 | 0.09% | 3.00 | 3.15 | 4.87% | 6.45 | 6.21 | 3.83% |

| Average error | 1.14% | 3.26% | 6.06% | ||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, S.; Mi, F. Renewable Portfolio Standards, Carbon Emissions Trading and China Certified Emission Reduction: The Role of Market Mechanisms in Optimizing China’s Power Generation Structure. Energies 2025, 18, 894. https://doi.org/10.3390/en18040894

Yang S, Mi F. Renewable Portfolio Standards, Carbon Emissions Trading and China Certified Emission Reduction: The Role of Market Mechanisms in Optimizing China’s Power Generation Structure. Energies. 2025; 18(4):894. https://doi.org/10.3390/en18040894

Chicago/Turabian StyleYang, Shining, and Feng Mi. 2025. "Renewable Portfolio Standards, Carbon Emissions Trading and China Certified Emission Reduction: The Role of Market Mechanisms in Optimizing China’s Power Generation Structure" Energies 18, no. 4: 894. https://doi.org/10.3390/en18040894

APA StyleYang, S., & Mi, F. (2025). Renewable Portfolio Standards, Carbon Emissions Trading and China Certified Emission Reduction: The Role of Market Mechanisms in Optimizing China’s Power Generation Structure. Energies, 18(4), 894. https://doi.org/10.3390/en18040894