Cost Breakeven Point of Offshore Wind Energy in Brazil

Abstract

:1. Introduction

- Payment for the use of marine space [6].

2. Materials and Methods

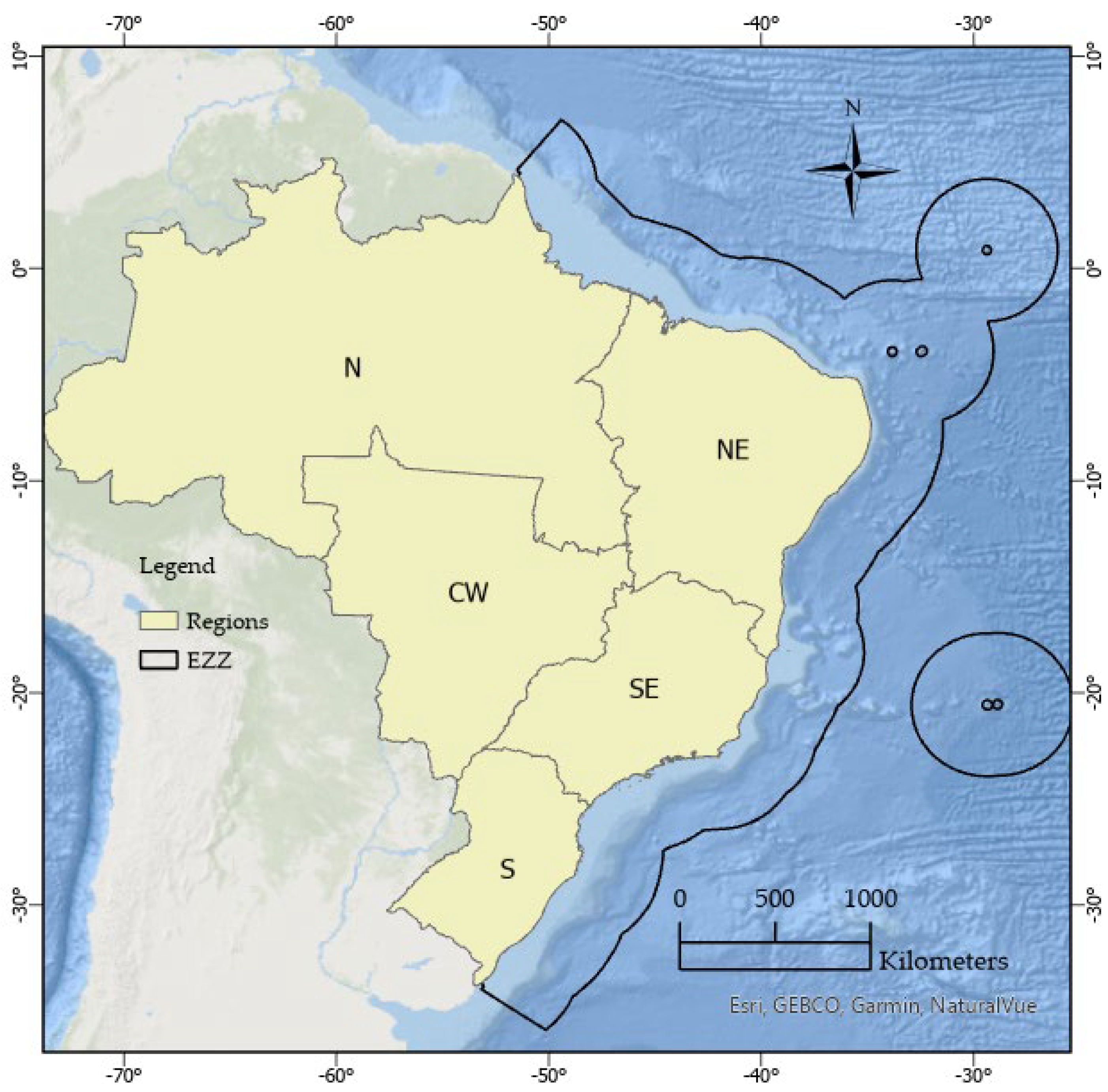

2.1. Study Area and Wind Data

2.2. Logarithmic Extrapolation

2.3. Weibull Probability Density Function

2.4. Capacity Factor

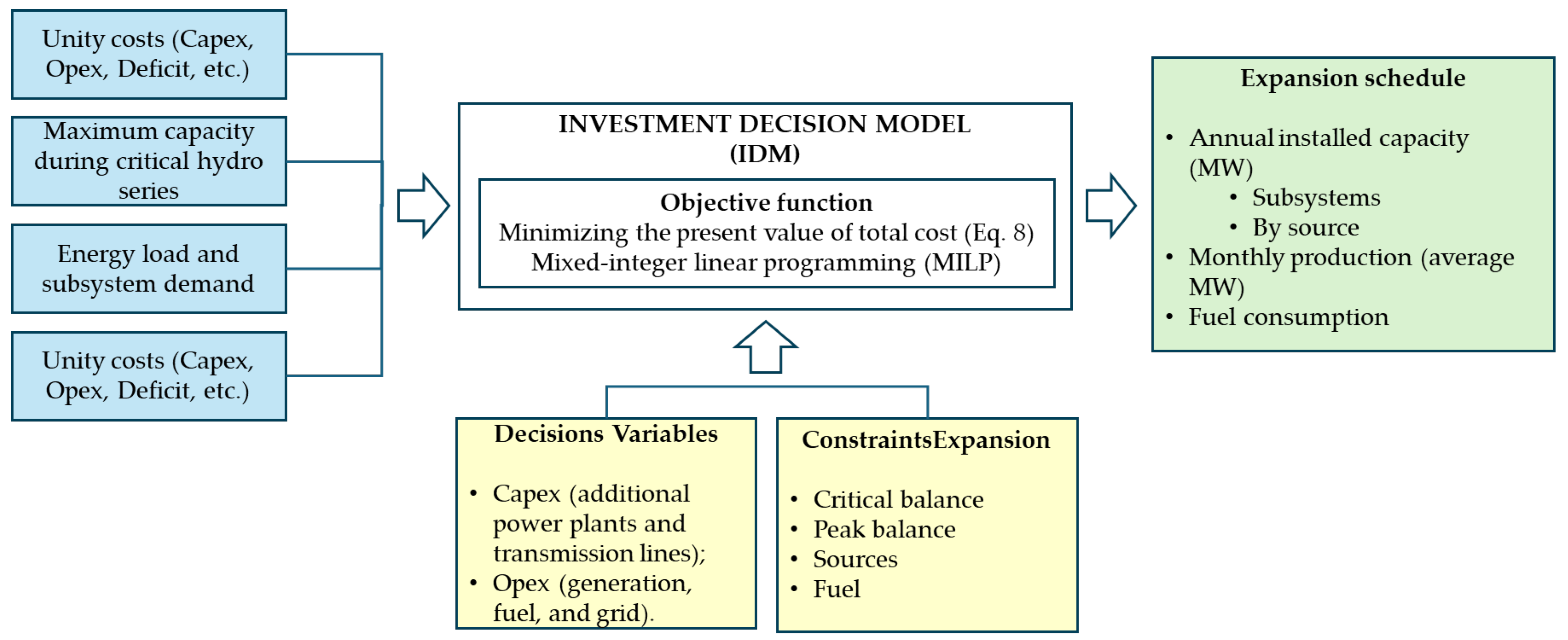

2.5. Competitiveness Assessment of Candidate Sources for Expansion

2.6. Reference Expansion Scenario

2.7. What-If Analysis: Mandatory Offshore Wind Energy

2.8. What-If Analysis: Breakeven Point

3. Results

3.1. Offshore Wind Farm Local Definition

3.2. Monthly Capacity Factor

3.3. Offshore Wind Inclusion Scenarios

3.3.1. Reference Expansion Scenario

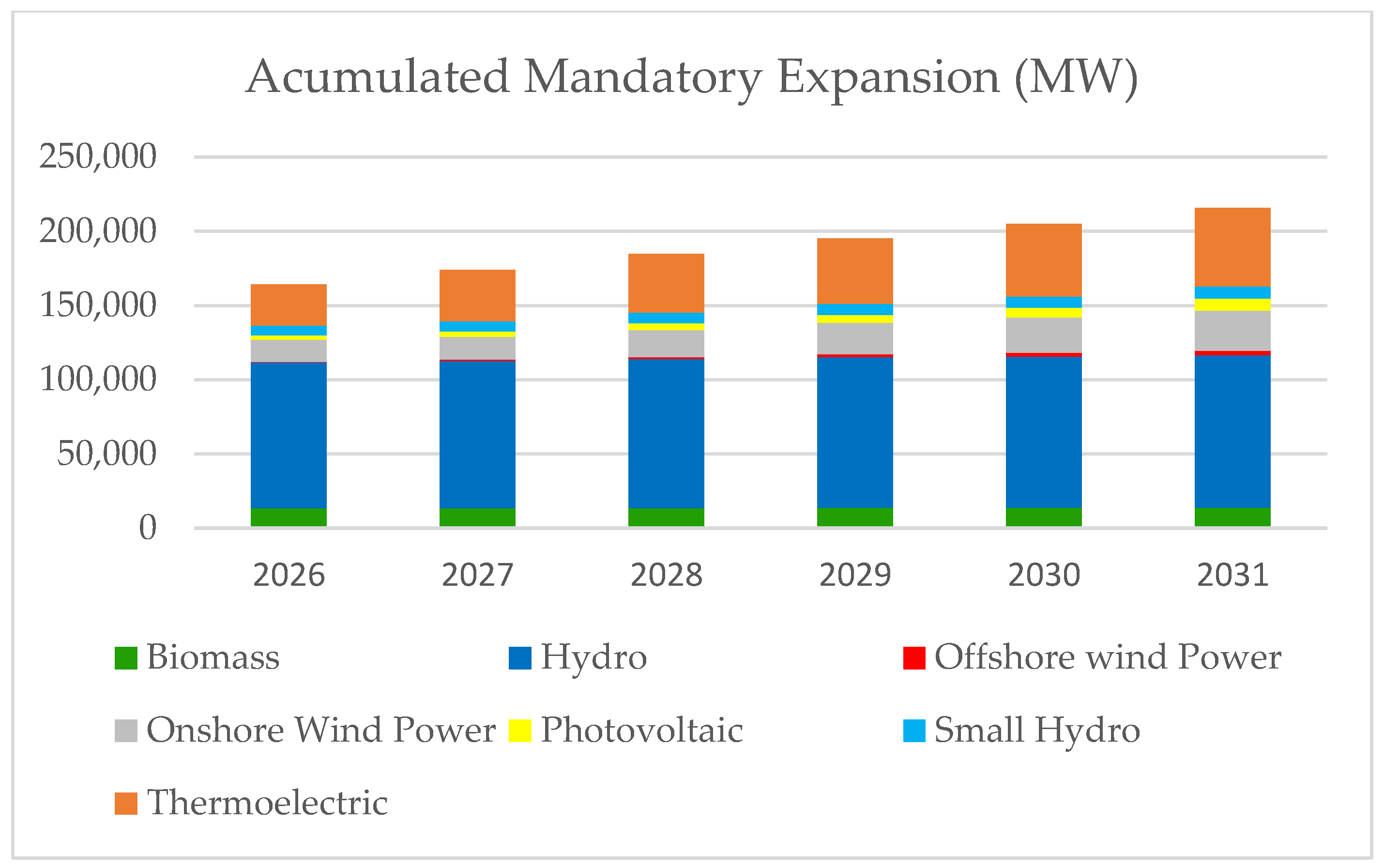

3.3.2. What-If Analysis: Mandatory Offshore Wind Energy

3.3.3. What-If Analysis: Breakeven Point

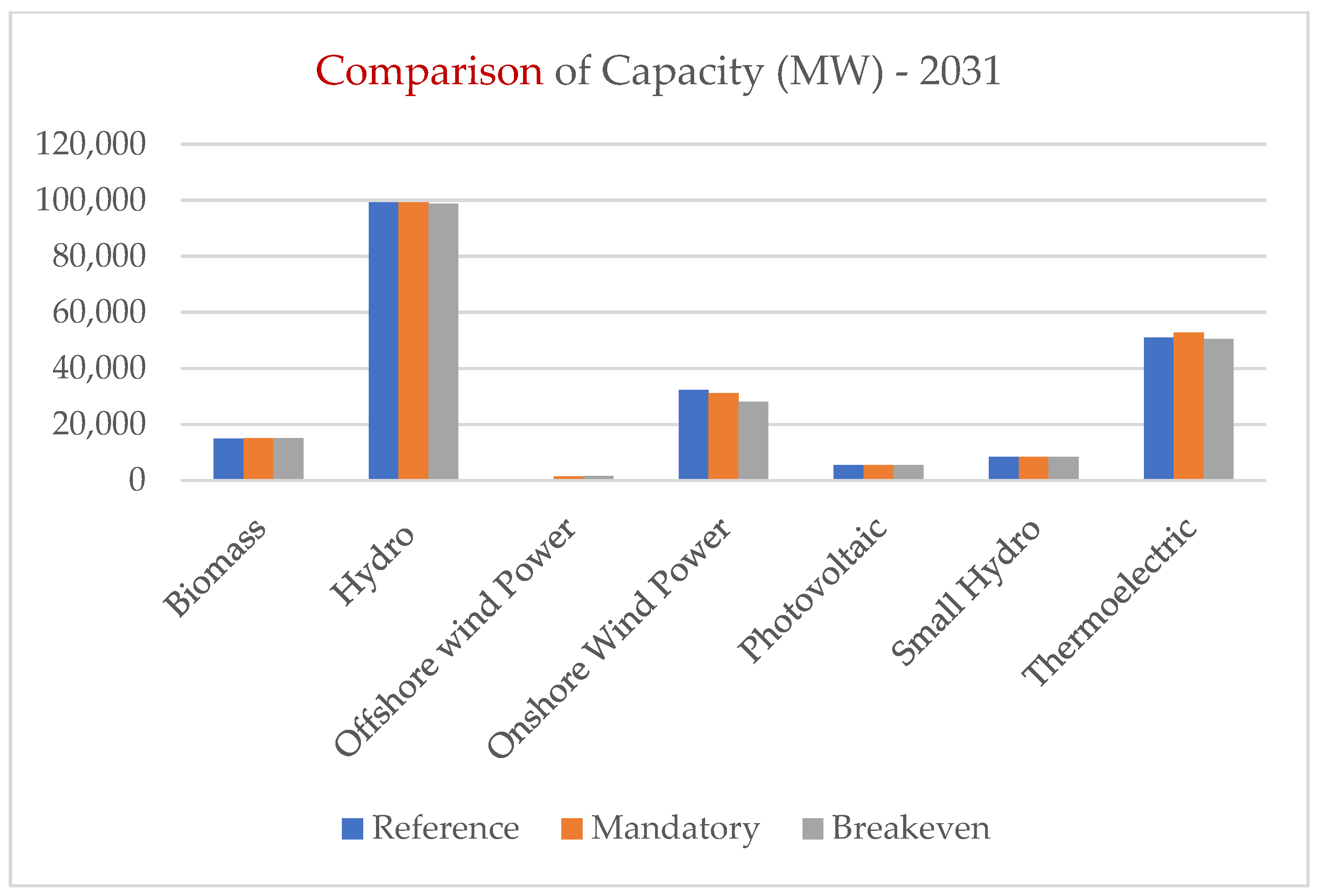

3.3.4. Comparison Between Scenarios

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| AEP | Annual Energy Production |

| CAPEX | Capital Expenditure |

| CF | Capacity Factor |

| CEPEL | Electric Power Research Center |

| DTU | Technical University of Denmark |

| EEZ | Exclusive Economic Zone |

| EPE | Energy Research Company |

| ERA5 | ECMWF Reanalysis 5th Generation |

| ECMWF | European Centre for Medium-Range Weather Forecasts |

| GIS | Geographic Information System |

| HP | Hydropower |

| IBAMA | Brazilian Institute of Environment and Renewable Natural Resources |

| IBM | International Business Machines Corporation |

| IEA | International Wind Agency |

| IDM | Investment Decision Model |

| LW | Leanwind Reference Turbine |

| NIS | National Interconnected System |

| OPEX | Operational Expenditure—Annual Operating Costs |

| PDE2031 | Energy Expansion Plan 2031 |

| PV | Present Value |

| RP | Renewable Projects |

| SEB | Brazilian Electric System |

| SUISHI | Simulator of Individual Plants in Interconnected Hydrothermal Systems |

| TP | Thermoelectric Projects |

| ZP | Interconnection Projects of Transmission |

Appendix A

| Projects | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Type | Lifetime (Years) | Investment (BRL/kW) | Charges (BRL/kW·Year) | Investment Cost (BRL/kW·Month) | Annual O&M (BRL/kW·Year) | O&M + Charges (BRL/kW·Month) | Total Monthly Cost (BRL/kW·Month) | Unit Variable Cost (BRL/MWh) | Inflexibility (% of Available Capacity) | Inflexibility (% of Installed Capacity) | Emissions (tCO₂-eq/MWh) | Earliest Start Date (Year) | Interest During Construction | TEIF | IP |

| Hidro | 30 | ||||||||||||||

| PV | 20 | 714.29 | 36.73 | 6.04 | 10.20 | 4.08 | 10.12 | 0.00 | 2023 | 3.9% | |||||

| PV Discount 2024 | 20 | 489.80 | 28.57 | 4.14 | 8.16 | 3.19 | 7.33 | 0.00 | 2034 | 3.9% | |||||

| Wind Onshore | 20 | 979.59 | 38.78 | 8.48 | 18.37 | 4.96 | 13.45 | 0.00 | 2023 | 6.4% | |||||

| Wind Offshore | 20 | 2500.82 | 77.55 | 18.54 | 61.22 | 12.05 | 30.59 | 0.00 | 2027 | 11.6% | |||||

| Biomass (Sugarcane) | 20 | 816.33 | 38.78 | 7.07 | 18.37 | 4.96 | 12.03 | 0.00 | 0% | 0% | 0.00 | 2023 | 6.4% | 2.38 | 4.60 |

| NLG Flexible | 20 | 775.51 | 48.98 | 7.04 | 28.57 | 6.74 | 13.78 | 68.57 | 0% | 0% | 0.34 | 2023 | 11.6% | 2.06 | 3.26 |

| NLG 50% | 20 | 775.51 | 48.98 | 7.04 | 28.57 | 6.74 | 13.78 | 62.65 | 50% | 47% | 0.34 | 2023 | 11.6% | 2.06 | 3.26 |

| NLG 80% | 20 | 775.51 | 48.98 | 7.04 | 28.57 | 6.74 | 13.78 | 58.57 | 80% | 76% | 0.34 | 2023 | 11.6% | 2.06 | 3.26 |

| NLG Inflexível | 20 | 775.51 | 48.98 | 7.04 | 28.57 | 6.74 | 13.78 | 55.51 | 100% | 95% | 0.34 | 2023 | 11.6% | 2.06 | 3.26 |

| Open-Cycle Natural Gas (OCGT) | 20 | 551.02 | 42.86 | 4.81 | 48.98 | 7.98 | 12.78 | 89.59 | 0% | 0% | 0.34 | 2023 | 7.2% | 2.06 | 3.26 |

| Pre-Salt Natural Gas | 20 | 1020.41 | 57.14 | 9.27 | 32.65 | 7.80 | 17.07 | 39.39 | 50% | 47% | 0.34 | 2026 | 11.6% | 2.06 | 3.26 |

| Domestic Coal | 25 | 1632.65 | 128.57 | 13.92 | 22.45 | 13.12 | 27.04 | 24.49 | 50% | 45% | 1.10 | 2026 | 13.9% | 5.00 | 5.00 |

| Small Hydropower Plant—Low CAPEX | 30 | 1020.41 | 36.73 | 7.77 | 18.37 | 4.79 | 12.56 | 0.00 | 2023 | 7.3% | |||||

| Small Hydropower Plant—Medium CAPEX | 30 | 1530.61 | 46.94 | 11.66 | 18.37 | 5.67 | 17.33 | 0.00 | 2023 | 7.3% | |||||

| Small Hydropower Plant—High CAPEX | 30 | 2040.82 | 61.22 | 15.54 | 18.37 | 6.91 | 22.46 | 0.00 | 2023 | 7.3% | |||||

| Nuclear | 30 | 3877.55 | 122.45 | 32.89 | 65.31 | 16.31 | 49.20 | 7.14 | 100% | 0.00 | 2031 | 19.5% | 1.50 | 7.50 | |

| Pumped Storage Hydropower | 30 | 1224.49 | 10.20 | 9.70 | 12.24 | 5.50 | 15.20 | 0.00 | 2026 | 11.6% | |||||

| Wood Chips (Biomass) | 20 | 1224.49 | 51.02 | 11.03 | 24.49 | 6.56 | 17.59 | 40.82 | 30% | 2024 | 10.7% | 5.00 | 5.00 | ||

| Battery—Lithium-Ion (3 h) | 20 | 1224.49 | 51.02 | 10.36 | 12.24 | 5.50 | 15.85 | 0.00 | 2024 | 3.9% | |||||

| Biogas | 20 | 1530.61 | 61.22 | 13.26 | 102.04 | 14.18 | 27.44 | 0.00 | 0% | 0% | 0.34 | 2023 | 6.4% | 1.40 | 2.50 |

| Fim de Contrato GN | 20 | 310.20 | 42.86 | 2.71 | 48.98 | 7.98 | 10.68 | 61.22 | 0% | 0% | 0.34 | 2020 | 7.2% | 10.68 | 6.50 |

| Fim de Contrato Carvão | 20 | 653.06 | 81.63 | 5.70 | 48.98 | 11.34 | 17.04 | 61.22 | 0% | 0% | 0.34 | 2020 | 7.2% | 10.68 | 6.50 |

References

- Empresa de Pesquisa Energética. Plano Decenal de Expansão de Energia 2031; Empresa de Pesquisa Energética: Rio de Janeiro, Brazil, 2023. [Google Scholar]

- IBAMA. Maps of Projects Under Licensing—Offshore Wind Complexes. Available online: https://www.gov.br/ibama/pt-br/assuntos/laf/consultas/mapas-de-projetos-em-licenciamento-complexos-eolicos-offshore (accessed on 18 August 2024).

- Brazil. Law No. 15,097, of January 10, 2025. Regulates the Utilization of Energy Resources Within the Union’s Maritime Space. Official Gazette of the Union, Brasília. 2025. Available online: https://www.planalto.gov.br/ccivil_03/_Ato2023-2026/2025/Lei/L15097.htm (accessed on 29 January 2025).

- Empresa de Pesquisa Energética. Offshore Wind Power Generation: Considerations on the Limitation of the Area to be Granted. EPE-DEE-036-2023-RO; Empresa de Pesquisa Energética: Rio de Janeiro, Brazil, 2023. [Google Scholar]

- Brasil. Decreto no. 10.946, de 25 de Janeiro de 2022. Dispõe Sobre a Cessão de Uso de Espaços Físicos e o Aproveitamento de Recursos Naturais para Geração de Energia Elétrica a Partir de Empreendimentos Offshore. Diário Oficial da União. 2022. Available online: https://www.in.gov.br/en/web/dou/-/decreto-n-10.946-de-25-de-janeiro-de-2022377912884 (accessed on 2 November 2024).

- Empresa de Pesquisa Energética. Geração Eólica Offshore Considerações Sobre o Valor Devido à União Pela Cessão de Área-EPE-DEE-035-2023-RO; Empresa de Pesquisa Energética: Rio de Janeiro, Brazil, 2023. [Google Scholar]

- Brasil. Portaria Interministerial nº 3/GM/MME-MMA, de 14 de Setembro de 2022. Estabelece Procedimentos e Critérios para o Licenciamento Ambiental de Empreendimentos de Energia Eólica Offshore. Diário Oficial da União. 2022. Available online: https://www.gov.br/mme/pt-br/acesso-a-informacao/legislacao/portarias-interministeriais/portaria-interministerial-mme-mma-n-3-2022.pdf (accessed on 11 August 2024).

- Brasil. Portaria Interministerial nº 52/GM/MME-MMA, de 14 de outubro de 2022. Dispõe sobre diretrizes e critérios para a seleção e acompanhamento de projetos de energia eólica offshore. Diário Oficial da União. 2022. Available online: https://www.gov.br/mme/pt-br/acesso-a-informacao/legislacao/portarias/2022/portaria-normativa-n-52-gm-mme-2022.pdf (accessed on 11 August 2024).

- Aguirre González, M.O.; Santiso, A.M.; de Melo, D.C.; de Vasconcelos, R.M. Regulation for offshore wind power development in Brazil. Energy Policy 2020, 145, 111756. [Google Scholar] [CrossRef]

- Borba, P.C.S.; Sousa, W.C.; Shadman, M.; Pfenninger, S. Enhancing drought resilience and energy security through complementing hydro by offshore wind power—The case of Brazil. Energy Convers. Manag. 2023, 277, 116616. [Google Scholar] [CrossRef]

- Operador Nacional do Sistema Elétrico (ONS). Nota Técnica EPE-DEA-SEE-007/2024: Previsão de Carga para o Planejamento Anual da Operação Energética do Sistema Interligado Nacional (2024-2028)—2ª Revisão Quadrimestral; Operador Nacional do Sistema Elétrico (ONS): Rio de Janeiro, Brazil, 2024; Available online: https://tinyurl.com/3rr8xduh (accessed on 3 November 2024).

- Sun, Y.; Li, Y.; Wang, R.; Ma, R. Assessing the national synergy potential of onshore and offshore renewable energy from the perspective of resources dynamic and complementarity. Energy 2023, 279, 128106. [Google Scholar] [CrossRef]

- Bekirsky, N.; Hoicka, C.E.; Brisbois, M.C.; Ramirez Camargo, L. Many actors amongst multiple renewables: A systematic review of actor involvement in complementarity of renewable energy sources. Renew. Sustain. Energy Rev. 2022, 161, 112368. [Google Scholar] [CrossRef]

- Huang, K.; Luo, P.; Liu, P.; Kim, J.S.; Wang, Y.; Xu, W.; Li, H.; Gong, Y. Improving complementarity of a hybrid renewable energy system to meet load demand by using hydropower regulation ability. Energy 2022, 248, 123535. [Google Scholar] [CrossRef]

- Gandelman, D.A. Uma Metodologia para o Planejamento da Expansão do Sistema Elétrico Brasileiro Considerando Incertezas [Tese de Doutorado]; UFRJ/COPPE: Rio de Janeiro, Brazil, 2015. [Google Scholar]

- Centro de Pesquisas de Energia Elétrica (CEPEL). Modelo SUISHI: Simulação de Usinas Hidrelétricas em Sistemas Interligados. Available online: https://www.cepel.br (accessed on 1 February 2020).

- Empresa de Pesquisa Energética. Nota Técnica EPE-DEE-RE-055/2018-r1; Empresa de Pesquisa Energética: Rio de Janeiro, Brazil, 2018. [Google Scholar]

- Olauson, J. ERA5: The new champion of wind power modelling? Renew. Energy 2018, 126, 322–331. [Google Scholar] [CrossRef]

- European Centre for Medium-Range Weather Forecasts. ERA5: Fifth Generation of ECMWF Atmospheric Reanalyzes of the Global Climate; ECMWF: Reading, UK, 2017; Available online: https://www.ecmwf.int/en/forecasts/datasets/reanalysis-datasets/era5 (accessed on 2 November 2024).

- Tavares, L.F.A.; Shadman, M.; de Freitas Assad, L.P.; Silva, C.; Landau, L.; Estefen, S.F. Assessment of the offshore wind technical potential for the Brazilian Southeast and South regions. Energy 2020, 196, 117097. [Google Scholar] [CrossRef]

- Tavares, L.F.A.; Shadman, M.; de Freitas Assad, L.P.; Estefen, S.F. Influence of the WRF model and atmospheric reanalysis on the offshore wind resource potential and cost estimation: A case study for Rio de Janeiro State. Energy 2022, 240, 122767. [Google Scholar] [CrossRef]

- Santos, F.S.; do Nascimento, K.K.F.; Jale, J.S.; Xavier, S.F.A.; Ferreira, T.A.E. Brazilian wind energy generation potential using mixtures of Weibull distributions. Renew. Sustain. Energy Rev. 2024, 189, 113990. [Google Scholar] [CrossRef]

- Yadav, A.K.; Malik, H.; Yadav, V.; Alotaibi, M.A.; García Márquez, F.P.; Afthanorhana, A. Comparative analysis of Weibull parameters estimation for wind power potential assessments. Results Eng. 2024, 23, 102300. [Google Scholar] [CrossRef]

- Majid, A.A. Accurate and efficient forecasted wind energy using selected temporal metrological variables and wind direction. Energy Convers. Manag. X 2022, 16, 100286. [Google Scholar] [CrossRef]

- Tuchtenhagen, P.; de Carvalho, G.G.; Martins, G.; da Silva, P.E.; de Oliveira, C.P.; Andrade, L.M.B.; de Araújo, J.M.; Mutti, P.R.; Lucio, P.S.; Santos e Silva, C.M. WRF model assessment for wind intensity and power density simulation in the southern coast of Brazil. Energy 2020, 190, 116341. [Google Scholar] [CrossRef]

- National Renewable Energy Laboratory. Leanwind 8MW 164 RWT. NREL Turbine Models. 2021. Available online: https://nrel.github.io/turbine-models/LEANWIND_8MW_164_RWT.html (accessed on 2 November 2024).

- Technical University of Denmark. DTU 10-MW Reference Wind Turbine. DTU Wind Energy. 2021. Available online: https://gitlab.windenergy.dtu.dk/rwts/dtu-10mw-rwt (accessed on 2 November 2024).

- International Energy Agency. IEA 15-MW Offshore Reference Wind Turbine. IEA Wind. 2021. Available online: https://www.nrel.gov/docs/fy20osti/75698.pdf (accessed on 2 November 2024).

- GWEC. Global Offshore Wind Report 2024; Global Wind Energy Council: Lisbon, Portugal, 2024. [Google Scholar]

- IEA. IEA Wind TCP Task 26—Offshore Wind International Comparative Analysis; International Energy Agency: Paris, France, 2018. [Google Scholar]

- Shadman, M.; Silva, C.; Faller, D.; Wu, Z.; de Freitas Assad, L.P.; Landau, L.; Levi, C.; Estefen, S.F. Ocean Renewable Energy Potential, Technology, and Deployments: A Case Study of Brazil. Energies 2019, 12, 3658. [Google Scholar] [CrossRef]

- Vinhoza, A.; Lucena, A.F.P.; Rochedo, P.R.R.; Schaeffer, R. Brazil’s offshore wind cost potential and supply curve. Sustain. Energy Technol. Assess. 2023, 57, 103151. [Google Scholar] [CrossRef]

- ESMAP. Scenarios for Offshore Wind Development in Brazil. Offshore Wind Development Program; World Bank: Washington, DC, USA, 2024; Available online: https://documents.worldbank.org (accessed on 18 August 2024).

- Li, Z.; Tian, G.; El-Shafay, A.S. Statistical-analytical study on world development trend in offshore wind energy production capacity focusing on Great Britain with the aim of MCDA based offshore wind farm siting. J. Clean. Prod. 2022, 363, 132326. [Google Scholar] [CrossRef]

- Malleret, S.; Jansen, M.; Laido, A.S.; Kitzing, L. Profitability dynamics of offshore wind from auction to investment decision. Renew. Sustain. Energy Rev. 2024, 199, 114450. [Google Scholar] [CrossRef]

- Jansen, M.; Beiter, P.; Riepin, I.; Müsgens, F.; Guajardo-Fajardo, V.J.; Staffell, I.; Bulder, B.; Kitzing, L. Policy choices and outcomes for offshore wind auctions globally. Energy Policy 2022, 167, 113000. [Google Scholar] [CrossRef]

- Kell, N.P.; van der Weijde, A.H.; Li, L.; Santibanez-Borda, E.; Pillai, A.C. Simulating offshore wind contract for difference auctions to prepare bid strategies. Appl. Energy 2023, 334, 120645. [Google Scholar] [CrossRef]

- Pereira, A.O., Jr.; da Costa, R.C.; do Vale Costa, C.; de Moraes Marreco, J.; La Rovere, E.L. Perspectives for the expansion of new renewable energy sources in Brazil. Renew. Sustain. Energy Rev. 2013, 23, 49–59. [Google Scholar] [CrossRef]

- de Almeida, D.; Viana, D.; Simas, M.; dos Santos, S. Sinergia dos setores de petróleo e eólico offshore para desenvolvimento e descarbonização da economia azul no Brasil. Rev. Esc. Guerra Naval 2021, 27, 753–782. [Google Scholar] [CrossRef]

- Pashakolaie, V.G.; Cotton, M.; Jansen, M. The co-benefits of offshore wind under the UK Renewable Obligation scheme: Integrating sustainability in energy policy evaluation. Energy Policy 2024, 192, 114259. [Google Scholar] [CrossRef]

- Nolan, T. Is pivoting offshore the right policy for achieving decarbonization in the state of Victoria, Australia’s electricity sector? Energy Policy 2024, 190, 114136. [Google Scholar] [CrossRef]

- Shadman, M.; Amiri, M.M.; Silva, C.; Estefen, S.F.; La Rovere, E. Environmental impacts of offshore wind installation, operation and maintenance, and decommissioning activities: A case study of Brazil. Renew. Sustain. Energy Rev. 2021, 144, 110994. [Google Scholar]

- Dutra, R.M.; Szklo, A.S. Incentive policies for promoting wind power production in Brazil: Scenarios for the Alternative Energy Sources Incentive Program (PROINFA) under the New Brazilian electric power sector regulation. Renew. Energy 2008, 33, 65–76. [Google Scholar] [CrossRef]

- Nunes, A.M.M.; Santos Júnior, E.P.; de Araújo, J.M.; Melo, A.K.A.; Rolim, M.J.C.P.; Simioni, F.J.; Carvalho, M.; Coelho Junior, L.M. Impact assessment of public policies in the municipalities covered by the Brazilian Incentive program for alternative electricity sources (PROINFA). Renew. Energy 2024, 235, 121342. [Google Scholar] [CrossRef]

- Nogueira, E.C.; Morais, R.C.; Pereira, A.O., Jr. Offshore Wind Power Potential in Brazil: Complementarity and Synergies. Energies 2023, 16, 5912. [Google Scholar] [CrossRef]

- Brazil. Law No. 14.300 of January 6, 2022. Establishes the Legal Framework for Distributed Micro- and Mini-Generation. Available online: https://www.planalto.gov.br/ccivil_03/_ato2019-2022/2022/lei/L14300.htm (accessed on 6 April 2025).

| Parameters | Considerations |

|---|---|

| Annual average wind velocity | |

| Water depth | |

| Distance to the port | |

| Onshore substation terminal accessibility | <50 km |

| Marine protected areas | Excluded |

| Distance to the shore |

| Region | MA | RN | RJ | RS |

|---|---|---|---|---|

| Water depth (m) | 20 | 20 | 20 | 20 |

| Distance to shore (km) | 48 | 29 | 28 | 18 |

| Wind Turbine | Region | CF [%] | AEP [GWh/yr] |

|---|---|---|---|

| LW 8-MW | MA | 37 | 26 |

| RN | 43 | 30 | |

| RJ | 35 | 24.5 | |

| RS | 39.5 | 27.7 | |

| DTU 10-MW | MA | 47 | 41 |

| RN | 54 | 47.7 | |

| RJ | 42 | 36.7 | |

| RS | 46.4 | 40.7 | |

| IEA 15-MW | MA | 55 | 71.7 |

| RN | 63 | 82.3 | |

| RJ | 48 | 62.8 | |

| RS | 52 | 68.4 |

| System Expansion Summary—Installed Generation Capacity (MW) | ||||||||

|---|---|---|---|---|---|---|---|---|

| Technology | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | Total |

| Biomass | 13,335 | 92 | 92 | 92 | 92 | 92 | 92 | 552 |

| Hydro | 97,630 | 547 | 854 | 1214 | 1381 | 277 | 907 | 5179 |

| Offshore wind | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Onshore wind | 14,968 | 2375 | 2375 | 2375 | 2375 | 2375 | 3000 | 14,875 |

| Photovoltaic | 2072 | 731 | 731 | 731 | 731 | 731 | 2000 | 5657 |

| Small hydro | 6309 | 300 | 300 | 300 | 300 | 300 | 300 | 1200 |

| Thermoelectric | 22,327 | 5282 | 6134 | 5119 | 4600 | 4700 | 4793 | 30,628 |

| System Expansion Summary—Installed Generation Capacity (MW) | ||||||||

|---|---|---|---|---|---|---|---|---|

| Technology | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | Total |

| Biomass | 13,335 | 92 | 92 | 92 | 92 | 92 | 92 | 552 |

| Hydro | 97,630 | 547 | 854 | 1214 | 1381 | 277 | 907 | 5179 |

| Offshore wind | 0 | 500 | 500 | 500 | 500 | 500 | 500 | 3000 |

| Onshore Wind | 14,968 | 0 | 399 | 2786 | 2815 | 3000 | 2976 | 11,976 |

| Photovoltaic | 2072 | 837 | 837 | 837 | 837 | 837 | 2024 | 6208 |

| Small Hydro | 6309 | 300 | 300 | 300 | 300 | 300 | 300 | 1800 |

| Thermoelectric | 22,327 | 5282 | 6975 | 4850 | 4600 | 4700 | 4150 | 30,557 |

| System Expansion Summary—Installed Generation Capacity (MW) | ||||||||

|---|---|---|---|---|---|---|---|---|

| Technology | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | Total |

| Biomass | 13,335 | 92 | 92 | 92 | 92 | 92 | 92 | 552 |

| Hydro | 97,630 | 547 | 854 | 1214 | 1381 | 277 | 907 | 5179 |

| Offshore wind | 0 | 0 | 0 | 0 | 0 | 0 | 57 | 57 |

| Onshore wind | 14,968 | 0 | 2540 | 3000 | 3000 | 3000 | 3000 | 14,540 |

| Photovoltaic | 2072 | 948 | 948 | 948 | 948 | 948 | 2000 | 6738 |

| Small Hydro | 6309 | 0 | 0 | 77 | 300 | 300 | 300 | 977 |

| Thermoelectric | 22,327 | 6020 | 6045 | 4850 | 4600 | 4700 | 4150 | 30,365 |

| Capacity (MW)—Electric Matrix at End of Period—2031 | |||

|---|---|---|---|

| Technology | Reference | Mandatory | Breakeven |

| Biomass | 13,887 | 13,887 | 13,887 |

| Hydro | 102,809 | 102,809 | 102,809 |

| Offshore wind | 0 | 3000 | 57 |

| Onshore wind | 29,843 | 26,944 | 29,508 |

| Photovoltaic | 7729 | 8280 | 8810 |

| Small Hydro | 8109 | 8109 | 7286 |

| Thermoelectric | 52,955 | 52,884 | 52,692 |

| Total | 215,332 | 215,914 | 215,049 |

| Scenario | Total cost USD (MM) |

|---|---|

| Reference scenario | 84.174 |

| Mandatory | 89.102 |

| Breakeven point | 84.204 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guimarães, R.V.; Shadman, M.; Silva, S.R.; Estefen, S.F.; Tolmasquim, M.T.; Pereira, A.O., Jr. Cost Breakeven Point of Offshore Wind Energy in Brazil. Energies 2025, 18, 2198. https://doi.org/10.3390/en18092198

Guimarães RV, Shadman M, Silva SR, Estefen SF, Tolmasquim MT, Pereira AO Jr. Cost Breakeven Point of Offshore Wind Energy in Brazil. Energies. 2025; 18(9):2198. https://doi.org/10.3390/en18092198

Chicago/Turabian StyleGuimarães, Rodrigo Vellardo, Milad Shadman, Saulo Ribeiro Silva, Segen F. Estefen, Maurício Tiomno Tolmasquim, and Amaro Olimpio Pereira, Jr. 2025. "Cost Breakeven Point of Offshore Wind Energy in Brazil" Energies 18, no. 9: 2198. https://doi.org/10.3390/en18092198

APA StyleGuimarães, R. V., Shadman, M., Silva, S. R., Estefen, S. F., Tolmasquim, M. T., & Pereira, A. O., Jr. (2025). Cost Breakeven Point of Offshore Wind Energy in Brazil. Energies, 18(9), 2198. https://doi.org/10.3390/en18092198