Applying Artificial Intelligence in Cryptocurrency Markets: A Survey

Abstract

:1. Introduction

- What factors influence the price of cryptocurrencies?

- What is the state-of-the-art in AI research in the domain of cryptocurrency price prediction?

- What are current gaps in the literature that may be addressed by conducting future research?

2. Cryptocurrency Markets

2.1. A Short Background on Cryptocurrencies

- Block-data is a set of messages or transactions;

- Chaining-hash is a copy of the hash value of the immediately preceding block; and

- Block-hash is the calculated value of the hash of the data block.

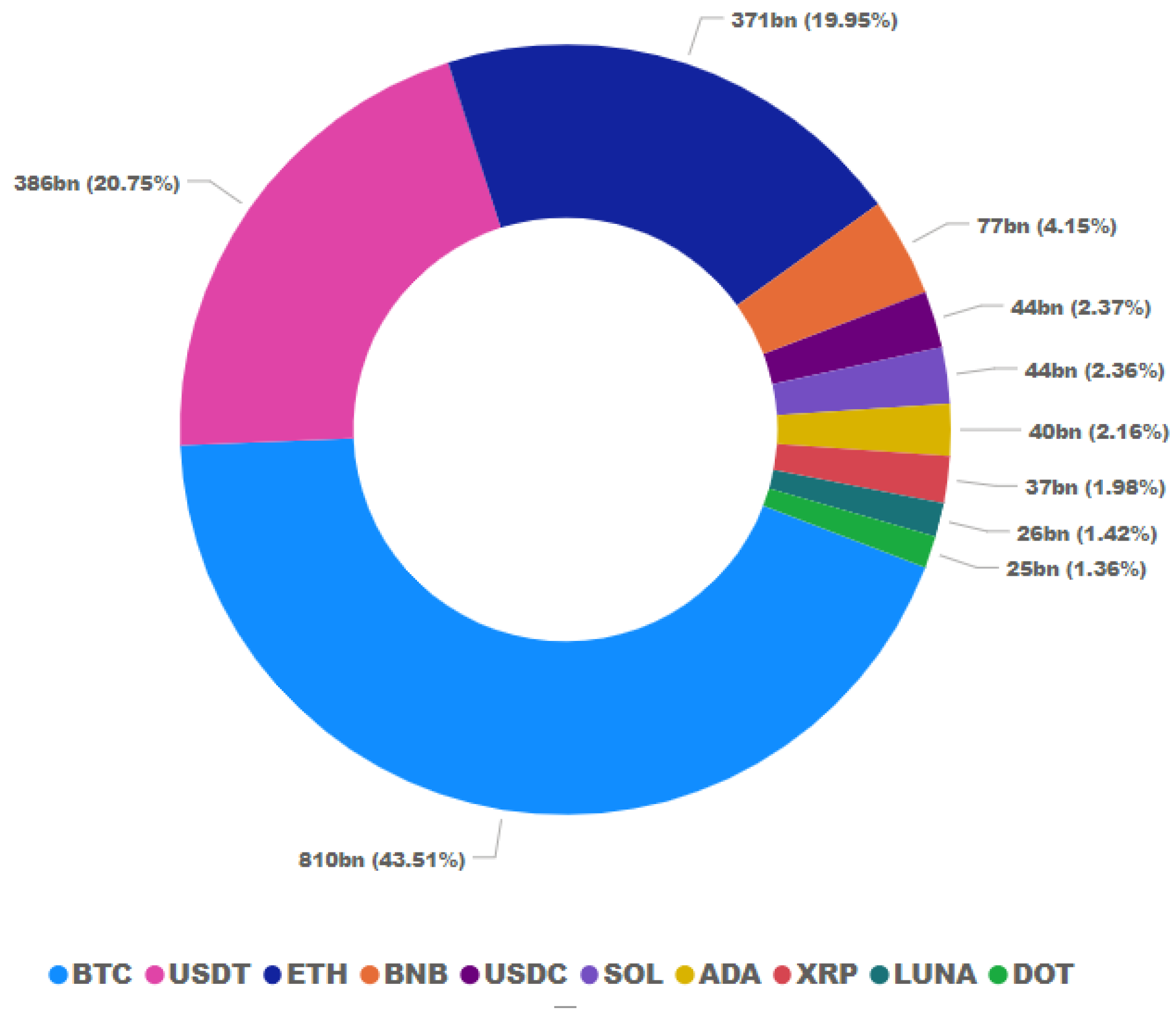

- Mining-based altcoins: they have similar characteristics to Bitcoin, and as the name implies, they use the typical mining process for generating new coins. One of the most famous leading altcoins belonging to this category is Ethereum.

- Stablecoins: One of the main issues of mining-based cryptocurrencies is high volatility and fluctuation in their prices, making their trading complicated. Hence, stablecoins were introduced to address this challenge, which is valued based on stable existing currencies such as fiat currencies. Additionally, stable assets behind stablecoins secure and support their value. For example, Diem (previously Libra), developed by Facebook, and Tether, with the highest capital among stablecoins, are two famous coins in this cryptocurrency category.

- Utility tokens: this type of cryptocurrency can give value to its investors by providing access to a future product or service. For example, Filecoin is a famous open-source cryptocurrency that aims to store data on hard drive storage spaces compared to cloud storage companies such as Amazon.

2.2. Price Determinants of Cryptocurrencies

3. Artificial Intelligence and Cryptocurrencies

3.1. Application of Machine Learning in Cryptocurrency

3.2. Reinforcement Learning

3.2.1. An Overview on Reinforcement Learning Overview

- States and observations : A state is a complete description of the circumstances of an environment, and an agent obtains all the information regarding the environment through a state. Additionally, observation is considered in case some information might be omitted due to a partial representation of a state.

- Action spaces : Each environment allows performing several actions. The set of all legitimate actions in a given environment is called an action space. Unlike a continuous action space, an agent has a finite number of available actions in a discrete action space.

- Policy : A policy is the way an agent behaves at a given time. It determines the action that has to be chosen by the agent when it is in a particular state. In a probabilistic setting, it maps the current state of the environment into a set of probabilities for taking actions from the action space.

- Rewards : A reward component is an important concept in RL. It is an immediate or instantaneous gain that an agent receives when choosing an action in the current state to move to the next state.

- Discount factor : The quantity is the discount factor and generates discounted rewards to prevent infinite cumulative rewards when running for a long period. As a general intuition, discounted rewards mean rewards today are worth more than rewards tomorrow. If it is zero, an agent considers only immediate rewards; while closer to one means that the agent evaluates its actions based on cumulative rewards in the future.

Model-Free and Model-Based Approaches

Value-Based Methods

Policy-Based Methods

3.2.2. Reinforcement Learning Applications in Cryptocurrency Markets

4. Discussion and Potential Future Research

4.1. Integration within Cryptocurrencies or with Other Financial Assets

4.2. Macroeconomic Factors as the States in RL

4.3. Minor Challenges Related to Cryptocurrencies

4.4. Sentiment Analysis

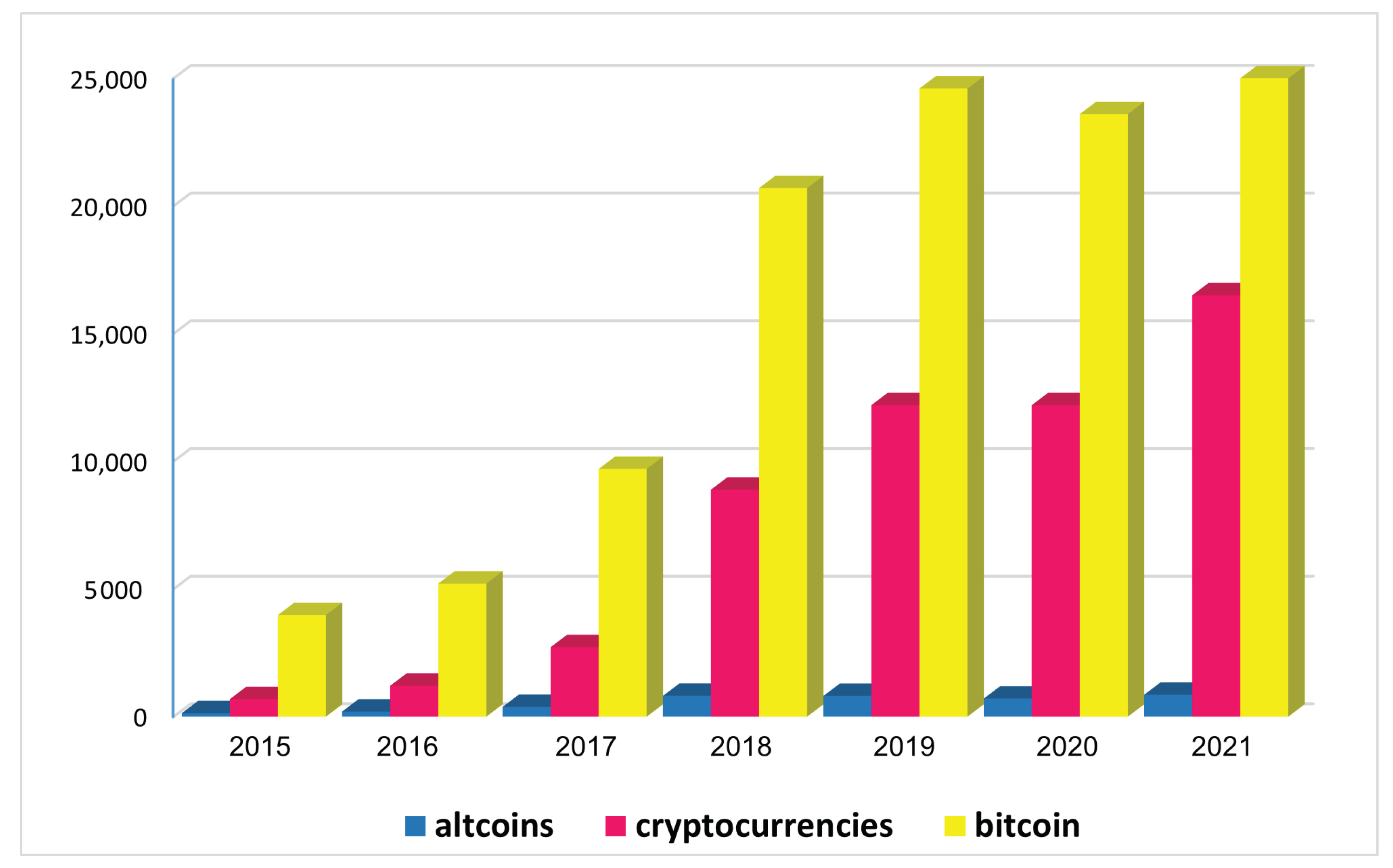

4.5. Further Attention to Altcoins

4.6. Extreme Condition Detection in Cryptocurrencies

5. Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

References

- Ciaian, P.; Rajcaniova, M.; Kancs, d. The economics of BitCoin price formation. Appl. Econ. 2016, 48, 1799–1815. [Google Scholar] [CrossRef] [Green Version]

- Ji, Q.; Bouri, E.; Gupta, R.; Roubaud, D. Network causality structures among Bitcoin and other financial assets: A directed acyclic graph approach. Q. Rev. Econ. Financ. 2018, 70, 203–213. [Google Scholar] [CrossRef] [Green Version]

- Abraham, J.; Higdon, D.; Nelson, J.; Ibarra, J. Cryptocurrency price prediction using tweet volumes and sentiment analysis. SMU Data Sci. Rev. 2018, 1, 1. [Google Scholar]

- Mittal, R.; Arora, S.; Bhatia, M. Automated cryptocurrencies prices prediction using machine learning. Div. Comput. Eng. Netaji Subhas Inst. Technol. India 2018, 8, 2229–6956. [Google Scholar]

- Wu, X.; Chen, H.; Wang, J.; Troiano, L.; Loia, V.; Fujita, H. Adaptive stock trading strategies with deep reinforcement learning methods. Inf. Sci. 2020, 538, 142–158. [Google Scholar] [CrossRef]

- Dai, S.; Wu, X.; Pei, M.; Du, Z. Big data framework for quantitative trading system. J. Shanghai Jiaotong Univ. (Sci.) 2017, 22, 193–197. [Google Scholar] [CrossRef]

- Huang, B.; Huan, Y.; Xu, L.D.; Zheng, L.; Zou, Z. Automated trading systems statistical and machine learning methods and hardware implementation: A survey. Enterp. Inf. Syst. 2019, 13, 132–144. [Google Scholar] [CrossRef] [Green Version]

- Rasekhschaffe, K.C.; Jones, R.C. Machine learning for stock selection. Financ. Anal. J. 2019, 75, 70–88. [Google Scholar] [CrossRef]

- Lee, D.; Deng, R.H. Handbook of Blockchain, Digital Finance, and Inclusion: Cryptocurrency, FinTech, InsurTech, Regulation, ChinaTech, Mobile Security, and Distributed Ledger; Academic Press: Cambridge, MA, USA, 2017. [Google Scholar]

- Leong, K.; Sung, A. FinTech (Financial Technology): What is it and how to use technologies to create business value in fintech way? Int. J. Innov. Manag. Technol. 2018, 9, 74–78. [Google Scholar] [CrossRef]

- Stulz, R.M. Fintech, bigtech, and the future of banks. J. Appl. Corp. Financ. 2019, 31, 86–97. [Google Scholar] [CrossRef]

- Strobel, V. Pold87/academic-keyword-occurrence: First release. Zenodo 2018. [Google Scholar] [CrossRef]

- Fang, F.; Ventre, C.; Basios, M.; Kanthan, L.; Martinez-Rego, D.; Wu, F.; Li, L. Cryptocurrency trading: A comprehensive survey. Financ. Innov. 2022, 8, 13. [Google Scholar] [CrossRef]

- Mosavi, A.; Faghan, Y.; Ghamisi, P.; Duan, P.; Ardabili, S.F.; Salwana, E.; Band, S.S. Comprehensive review of deep reinforcement learning methods and applications in economics. Mathematics 2020, 8, 1640. [Google Scholar] [CrossRef]

- Sabry, F.; Labda, W.; Erbad, A.; Malluhi, Q. Cryptocurrencies and Artificial Intelligence: Challenges and Opportunities. IEEE Access 2020, 8, 175840–175858. [Google Scholar] [CrossRef]

- Murat Ozbayoglu, A.; Ugur Gudelek, M.; Berat Sezer, O. Deep Learning for Financial Applications: A Survey. arXiv 2020, arXiv:2002.05786. [Google Scholar] [CrossRef]

- Al-Jaroodi, J.; Mohamed, N. Blockchain in industries: A survey. IEEE Access 2019, 7, 36500–36515. [Google Scholar] [CrossRef]

- Yli-Huumo, J.; Ko, D.; Choi, S.; Park, S.; Smolander, K. Where is current research on blockchain technology?—A systematic review. PLoS ONE 2016, 11, e0163477. [Google Scholar] [CrossRef] [Green Version]

- de Leon, D.C.; Stalick, A.Q.; Jillepalli, A.A.; Haney, M.A.; Sheldon, F.T. Blockchain: Properties and misconceptions. Asia Pac. J. Innov. Entrep. 2017, 11, 286–300. [Google Scholar] [CrossRef]

- Nakamoto, S.; Bitcoin, A. A peer-to-peer electronic cash system. Bitcoin 2008, 4. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 1 November 2022).

- Ammous, S. Can cryptocurrencies fulfil the functions of money? Q. Rev. Econ. Financ. 2018, 70, 38–51. [Google Scholar] [CrossRef]

- Nabilou, H. How to regulate bitcoin? Decentralized regulation for a decentralized cryptocurrency. Int. J. Law Inf. Technol. 2019, 27, 266–291. [Google Scholar] [CrossRef]

- Chen, Y.; Bellavitis, C. Decentralized finance: Blockchain technology and the quest for an open financial system. SSRN J. 2019. [Google Scholar] [CrossRef]

- Lansky, J. Possible state approaches to cryptocurrencies. J. Syst. Integr. 2018, 9, 19–31. [Google Scholar] [CrossRef]

- Bank, E.C. Virtual Currency Schemes; EC Bank, Virtual Currency Schemes (h. 13–14); European Central Bank: Frankfurt, Germany, 2012. [Google Scholar]

- Monrat, A.A.; Schelén, O.; Andersson, K. A survey of blockchain from the perspectives of applications, challenges, and opportunities. IEEE Access 2019, 7, 117134–117151. [Google Scholar] [CrossRef]

- Ciaian, P.; Rajcaniova, M. Virtual relationships: Short-and long-run evidence from BitCoin and altcoin markets. J. Int. Financ. Mark. Inst. Money 2018, 52, 173–195. [Google Scholar] [CrossRef]

- Patel, M.M.; Tanwar, S.; Gupta, R.; Kumar, N. A Deep Learning-based Cryptocurrency Price Prediction Scheme for Financial Institutions. J. Inf. Secur. Appl. 2020, 55, 102583. [Google Scholar] [CrossRef]

- Xia, P.; Wang, H.; Zhang, B.; Ji, R.; Gao, B.; Wu, L.; Luo, X.; Xu, G. Characterizing cryptocurrency exchange scams. Comput. Secur. 2020, 98, 101993. [Google Scholar] [CrossRef]

- Wei, W.C. Liquidity and market efficiency in cryptocurrencies. Econ. Lett. 2018, 168, 21–24. [Google Scholar] [CrossRef]

- DeVries, P.D. An analysis of cryptocurrency, bitcoin, and the future. Int. J. Bus. Manag. Commer. 2016, 1, 1293–1302. [Google Scholar]

- Irshad, S.; Soomro, T.R. Identity theft and social media. Int. J. Comput. Sci. Netw. Secur. 2018, 18, 43–55. [Google Scholar]

- Akcora, C.G.; Dixon, M.F.; Gel, Y.R.; Kantarcioglu, M. Bitcoin risk modeling with blockchain graphs. Econ. Lett. 2018, 173, 138–142. [Google Scholar] [CrossRef] [Green Version]

- Derbentsev, V.; Datsenko, N.; Stepanenko, O.; Bezkorovainyi, V. Forecasting cryptocurrency prices time series using machine learning approach. In Proceedings of the SHS Web of Conferences, the 8th International Conference on Monitoring, Modeling & Management of Emergent Economy (M3E2 2019), Odessa, Ukraine, 22–24 May 2019; EDP Sciences: Les Ulis, France, 2019; Volume 65, p. 02001. [Google Scholar]

- Poyser, O. Exploring the dynamics of Bitcoin’s price: A Bayesian structural time series approach. Eurasian Econ. Rev. 2019, 9, 29–60. [Google Scholar] [CrossRef]

- Jang, H.; Lee, J. An empirical study on modeling and prediction of bitcoin prices with bayesian neural networks based on blockchain information. IEEE Access 2017, 6, 5427–5437. [Google Scholar] [CrossRef]

- Zeng, T.; Yang, M.; Shen, Y. Fancy Bitcoin and conventional financial assets: Measuring market integration based on connectedness networks. Econ. Model. 2020, 90, 209–220. [Google Scholar] [CrossRef]

- Corbet, S.; Meegan, A.; Larkin, C.; Lucey, B.; Yarovaya, L. Exploring the dynamic relationships between cryptocurrencies and other financial assets. Econ. Lett. 2018, 165, 28–34. [Google Scholar] [CrossRef]

- Gkillas, K.; Bekiros, S.; Siriopoulos, C. Extreme correlation in cryptocurrency markets. SSRN 2018. [Google Scholar] [CrossRef]

- Stosic, D.; Stosic, D.; Ludermir, T.B.; Stosic, T. Collective behavior of cryptocurrency price changes. Phys. A Stat. Mech. Its Appl. 2018, 507, 499–509. [Google Scholar] [CrossRef]

- Corbet, S.; Lucey, B.; Yarovaya, L. Datestamping the Bitcoin and Ethereum bubbles. Financ. Res. Lett. 2018, 26, 81–88. [Google Scholar] [CrossRef] [Green Version]

- McCarthy, J.; Minsky, M.L.; Rochester, N.; Shannon, C.E. A proposal for the dartmouth summer research project on artificial intelligence, August 31, 1955. AI Mag. 2006, 27, 12. [Google Scholar]

- Dick, S. Artificial Intelligence. HDSR, 1 July 2019. Available online: https://hdsr.duqduq.org/pub/0aytgrau (accessed on 1 November 2022).

- Artificial Intelligence the Next Digital Frontier. Available online: https://apo.org.au/node/210501 (accessed on 1 November 2022).

- Floridi, L. AI and its new winter: From myths to realities. Philos. Technol. 2020, 33, 1–3. [Google Scholar] [CrossRef] [Green Version]

- Whittaker, M.; Crawford, K.; Dobbe, R.; Fried, G.; Kaziunas, E.; Mathur, V.; West, S.M.; Richardson, R.; Schultz, J.; Schwartz, O. AI Now Report 2018; AI Now Institute at New York University: New York, NY, USA, 2018. [Google Scholar]

- Helm, J.M.; Swiergosz, A.M.; Haeberle, H.S.; Karnuta, J.M.; Schaffer, J.L.; Krebs, V.E.; Spitzer, A.I.; Ramkumar, P.N. Machine learning and artificial intelligence: Definitions, applications, and future directions. Curr. Rev. Musculoskelet. Med. 2020, 13, 69–76. [Google Scholar] [CrossRef]

- Janiesch, C.; Zschech, P.; Heinrich, K. Machine learning and deep learning. Electron. Mark. 2021, 31, 685–695. [Google Scholar] [CrossRef]

- Zhang, W.; Li, H.; Li, Y.; Liu, H.; Chen, Y.; Ding, X. Application of deep learning algorithms in geotechnical engineering: A short critical review. Artif. Intell. Rev. 2021, 54, 5633–5673. [Google Scholar] [CrossRef]

- Pang, X.; Zhou, Y.; Wang, P.; Lin, W.; Chang, V. An innovative neural network approach for stock market prediction. J. Supercomput. 2020, 76, 2098–2118. [Google Scholar] [CrossRef]

- Chowdhury, R.; Rahman, M.A.; Rahman, M.S.; Mahdy, M. An approach to predict and forecast the price of constituents and index of cryptocurrency using machine learning. Phys. A Stat. Mech. Its Appl. 2020, 551, 124569. [Google Scholar] [CrossRef]

- Chen, Z.; Li, C.; Sun, W. Bitcoin price prediction using machine learning: An approach to sample dimension engineering. J. Comput. Appl. Math. 2020, 365, 112395. [Google Scholar] [CrossRef]

- Poongodi, M.; Sharma, A.; Vijayakumar, V.; Bhardwaj, V.; Sharma, A.P.; Iqbal, R.; Kumar, R. Prediction of the price of Ethereum blockchain cryptocurrency in an industrial finance system. Comput. Electr. Eng. 2020, 81, 106527. [Google Scholar]

- McNally, S. Predicting the price of Bitcoin using Machine Learning. Ph.D. Thesis, National College of Ireland, Dublin, Ireland, 2016. [Google Scholar]

- Kim, Y.B.; Kim, J.G.; Kim, W.; Im, J.H.; Kim, T.H.; Kang, S.J.; Kim, C.H. Predicting fluctuations in cryptocurrency transactions based on user comments and replies. PLoS ONE 2016, 11, e0161197. [Google Scholar] [CrossRef] [Green Version]

- Alessandretti, L.; ElBahrawy, A.; Aiello, L.M.; Baronchelli, A. Anticipating cryptocurrency prices using machine learning. Complexity 2018, 2018, 8983590. [Google Scholar] [CrossRef]

- Peng, Y.; Albuquerque, P.H.M.; de Sá, J.M.C.; Padula, A.J.A.; Montenegro, M.R. The best of two worlds: Forecasting high frequency volatility for cryptocurrencies and traditional currencies with Support Vector Regression. Expert Syst. Appl. 2018, 97, 177–192. [Google Scholar] [CrossRef]

- Lamon, C.; Nielsen, E.; Redondo, E. Cryptocurrency price prediction using news and social media sentiment. SMU Data Sci. Rev. 2017, 1, 1–22. [Google Scholar]

- Sun, X.; Liu, M.; Sima, Z. A novel cryptocurrency price trend forecasting model based on LightGBM. Financ. Res. Lett. 2020, 32, 101084. [Google Scholar] [CrossRef]

- Lahmiri, S.; Bekiros, S. Intelligent forecasting with machine learning trading systems in chaotic intraday Bitcoin market. Chaos Solitons Fractals 2020, 133, 109641. [Google Scholar] [CrossRef]

- Kotu, V.; Deshpande, B. Chapter 2: Data Mining Process. In Predictive Analytics and Data Mining; Elsevier: Amsterdam, The Netherlands, 2015; p. 26. [Google Scholar]

- Sun, Y.; Fang, M.; Wang, X. A novel stock recommendation system using Guba sentiment analysis. Pers. Ubiquitous Comput. 2018, 22, 575–587. [Google Scholar] [CrossRef]

- Long, W.; Lu, Z.; Cui, L. Deep learning-based feature engineering for stock price movement prediction. Knowl.-Based Syst. 2019, 164, 163–173. [Google Scholar] [CrossRef]

- Bekiros, S.D. Fuzzy adaptive decision-making for boundedly rational traders in speculative stock markets. Eur. J. Oper. Res. 2010, 202, 285–293. [Google Scholar] [CrossRef]

- Kim, Y.; Ahn, W.; Oh, K.J.; Enke, D. An intelligent hybrid trading system for discovering trading rules for the futures market using rough sets and genetic algorithms. Appl. Soft Comput. 2017, 55, 127–140. [Google Scholar] [CrossRef]

- Yang, H.; Liu, X.Y.; Zhong, S.; Walid, A. Deep reinforcement learning for automated stock trading: An ensemble strategy. In Proceedings of the First ACM International Conference on AI in Finance (ICAIF ’20), New York, NY, USA, 15–16 October 2020. [Google Scholar]

- Arulkumaran, K.; Deisenroth, M.P.; Brundage, M.; Bharath, A.A. Deep reinforcement learning: A brief survey. IEEE Signal Process. Mag. 2017, 34, 26–38. [Google Scholar] [CrossRef]

- Li, Y. Deep reinforcement learning: An overview. arXiv 2017, arXiv:1701.07274. [Google Scholar]

- Sutton, R.S.; Barto, A.G. Introduction to Reinforcement Learning; MIT Press: Cambridge, MA, USA, 1998; Volume 135. [Google Scholar]

- Rosenstein, M.T.; Barto, A.G.; Si, J.; Barto, A.; Powell, W.; Wunsch, D. Supervised actor-critic reinforcement learning. Learning and Approximate Dynamic Programming: Scaling Up to the Real World; IEEE: Piscataway, NJ, USA, 2004; pp. 359–380. [Google Scholar]

- Chinnamgari, S.K. R Machine Learning Projects: Implement Supervised, Unsupervised, and Reinforcement Learning Techniques Using R 3.5; Packt Publishing Ltd.: Birmingham, UK, 2019. [Google Scholar]

- Botvinick, M.; Ritter, S.; Wang, J.X.; Kurth-Nelson, Z.; Blundell, C.; Hassabis, D. Reinforcement learning, fast and slow. Trends Cogn. Sci. 2019, 23, 408–422. [Google Scholar] [CrossRef] [Green Version]

- Mnih, V.; Kavukcuoglu, K.; Silver, D.; Rusu, A.A.; Veness, J.; Bellemare, M.G.; Graves, A.; Riedmiller, M.; Fidjeland, A.K.; Ostrovski, G.; et al. Human-level control through deep reinforcement learning. Nature 2015, 518, 529–533. [Google Scholar] [CrossRef] [PubMed]

- Silver, D.; Huang, A.; Maddison, C.J.; Guez, A.; Sifre, L.; Van Den Driessche, G.; Schrittwieser, J.; Antonoglou, I.; Panneershelvam, V.; Lanctot, M.; et al. Mastering the game of Go with deep neural networks and tree search. Nature 2016, 529, 484–489. [Google Scholar] [CrossRef] [PubMed]

- Sutton, R.S.; Barto, A.G. Reinforcement Learning: An Introduction; MIT Press: Cambridge, MA, USA, 2018. [Google Scholar]

- Zhang, H.; Yu, T. Taxonomy of Reinforcement Learning Algorithms. In Deep Reinforcement Learning; Springer: Berlin/Heidelberg, Germany, 2020; pp. 125–133. [Google Scholar]

- Feinberg, V.; Wan, A.; Stoica, I.; Jordan, M.I.; Gonzalez, J.E.; Levine, S. Model-based value estimation for efficient model-free reinforcement learning. arXiv 2018, arXiv:1803.00101. [Google Scholar]

- Kaiser, L.; Babaeizadeh, M.; Milos, P.; Osinski, B.; Campbell, R.H.; Czechowski, K.; Erhan, D.; Finn, C.; Kozakowski, P.; Levine, S.; et al. Model-based reinforcement learning for atari. arXiv 2019, arXiv:1903.00374. [Google Scholar]

- Nachum, O.; Norouzi, M.; Xu, K.; Schuurmans, D. Bridging the gap between value and policy based reinforcement learning. arXiv 2017, arXiv:1702.08892. [Google Scholar]

- Kumar, A.; Zhou, A.; Tucker, G.; Levine, S. Conservative q-learning for offline reinforcement learning. arXiv 2020, arXiv:2006.04779. [Google Scholar]

- Masson, W.; Ranchod, P.; Konidaris, G. Reinforcement learning with parameterized actions. In Proceedings of the Thirtieth AAAI Conference on Artificial Intelligence, Phoenix, AZ, USA, 12–17 February 2016. [Google Scholar]

- Henderson, P.; Islam, R.; Bachman, P.; Pineau, J.; Precup, D.; Meger, D. Deep reinforcement learning that matters. In Proceedings of the AAAI Conference on Artificial Intelligence, New Orleans, LA, USA, 2–7 February 2018; Volume 32. [Google Scholar]

- Meng, W.; Zheng, Q.; Shi, Y.; Pan, G. An Off-Policy Trust Region Policy Optimization Method with Monotonic Improvement Guarantee for Deep Reinforcement Learning. IEEE Trans. Neural Netw. Learn. Syst. 2021, 33, 2223–2235. [Google Scholar] [CrossRef]

- Nachum, O.; Norouzi, M.; Xu, K.; Schuurmans, D. Trust-pcl: An off-policy trust region method for continuous control. arXiv 2017, arXiv:1707.01891. [Google Scholar]

- Jaderberg, M.; Mnih, V.; Czarnecki, W.M.; Schaul, T.; Leibo, J.Z.; Silver, D.; Kavukcuoglu, K. Reinforcement learning with unsupervised auxiliary tasks. arXiv 2016, arXiv:1611.05397. [Google Scholar]

- Mirowski, P.; Pascanu, R.; Viola, F.; Soyer, H.; Ballard, A.J.; Banino, A.; Denil, M.; Goroshin, R.; Sifre, L.; Kavukcuoglu, K.; et al. Learning to navigate in complex environments. arXiv 2016, arXiv:1611.03673. [Google Scholar]

- Liang, C.; Berant, J.; Le, Q.; Forbus, K.D.; Lao, N. Neural symbolic machines: Learning semantic parsers on freebase with weak supervision. arXiv 2016, arXiv:1611.00020. [Google Scholar]

- Cao, Q.; Lin, L.; Shi, Y.; Liang, X.; Li, G. Attention-aware face hallucination via deep reinforcement learning. In Proceedings of the IEEE Conference on Computer Vision and Pattern Recognition, Honolulu, HI, USA, 21–26 July 2017; pp. 690–698. [Google Scholar]

- Koker, T.E.; Koutmos, D. Cryptocurrency Trading Using Machine Learning. J. Risk Financ. Manag. 2020, 13, 178. [Google Scholar] [CrossRef]

- Makarov, I.; Schoar, A. Trading and arbitrage in cryptocurrency markets. J. Financ. Econ. 2020, 135, 293–319. [Google Scholar] [CrossRef] [Green Version]

- Huck, N. Large data sets and machine learning: Applications to statistical arbitrage. Eur. J. Oper. Res. 2019, 278, 330–342. [Google Scholar] [CrossRef]

- Sadighian, J. Deep Reinforcement Learning in Cryptocurrency Market Making. arXiv 2019, arXiv:1911.08647. [Google Scholar]

- Sattarov, O.; Muminov, A.; Lee, C.W.; Kang, H.K.; Oh, R.; Ahn, J.; Oh, H.J.; Jeon, H.S. Recommending Cryptocurrency Trading Points with Deep Reinforcement Learning Approach. Appl. Sci. 2020, 10, 1506. [Google Scholar] [CrossRef] [Green Version]

- Lee, K.; Ulkuatam, S.; Beling, P.; Scherer, W. Generating synthetic Bitcoin transactions and predicting market price movement via inverse reinforcement learning and agent-based modeling. J. Artif. Soc. Soc. Simul. 2018, 21, 5. [Google Scholar] [CrossRef]

- Schnaubelt, M. Deep reinforcement learning for the optimal placement of cryptocurrency limit orders. Eur. J. Oper. Res. 2022, 296, 993–1006. [Google Scholar] [CrossRef]

- Lucarelli, G.; Borrotti, M. A deep Q-learning portfolio management framework for the cryptocurrency market. Neural Comput. Appl. 2020, 32, 17229–17244. [Google Scholar] [CrossRef]

- Ye, Y.; Pei, H.; Wang, B.; Chen, P.Y.; Zhu, Y.; Xiao, J.; Li, B. Reinforcement-learning based portfolio management with augmented asset movement prediction states. In Proceedings of the AAAI Conference on Artificial Intelligence, New York, NY, USA, 7–12 February 2020; Volume 34, pp. 1112–1119. [Google Scholar]

- Jiang, Z.; Liang, J. Cryptocurrency portfolio management with deep reinforcement learning. In Proceedings of the 2017 Intelligent Systems Conference (IntelliSys), London, UK, 7–8 September 2017; pp. 905–913. [Google Scholar]

- Hegazy, K.; Mumford, S. Comparitive Automated Bitcoin Trading Strategies. Available online: http://cs229.stanford.edu/proj2016/report/MumfordHegazy-ComparitiveAutomatedBitcoinTradingStrategies-report.pdf (accessed on 1 November 2022).

- Betancourt, C.; Chen, W.H. Deep reinforcement learning for portfolio management of markets with a dynamic number of assets. Expert Syst. Appl. 2021, 164, 114002. [Google Scholar] [CrossRef]

- Aamir, M.; Zaidi, S.M.A. DDoS attack detection with feature engineering and machine learning: The framework and performance evaluation. Int. J. Inf. Secur. 2019, 18, 761–785. [Google Scholar] [CrossRef]

- Weng, L.; Sun, X.; Xia, M.; Liu, J.; Xu, Y. Portfolio trading system of digital currencies: A deep reinforcement learning with multidimensional attention gating mechanism. Neurocomputing 2020, 402, 171–182. [Google Scholar] [CrossRef]

- Marcot, B.G.; Penman, T.D. Advances in Bayesian network modelling: Integration of modelling technologies. Environ. Model. Softw. 2019, 111, 386–393. [Google Scholar] [CrossRef]

- Corbet, S.; Hou, Y.G.; Hu, Y.; Larkin, C.; Oxley, L. Any port in a storm: Cryptocurrency safe-havens during the COVID-19 pandemic. Econ. Lett. 2020, 194, 109377. [Google Scholar] [CrossRef] [PubMed]

- Vidal-Tomás, D. Transitions in the cryptocurrency market during the COVID-19 pandemic: A network analysis. Financ. Res. Lett. 2021, 43, 101981. [Google Scholar] [CrossRef] [PubMed]

- Surden, H. Machine learning and law: An overview. Research Handbook on Big Data Law; Edward Elgar Publishing: Cheltenham, UK, 2021. [Google Scholar]

- Nguyen, T.V.H.; Nguyen, B.T.; Nguyen, T.C.; Nguyen, Q.Q. Bitcoin return: Impacts from the introduction of new altcoins. Res. Int. Bus. Financ. 2019, 48, 420–425. [Google Scholar] [CrossRef]

- Chakraborty, G.; Chandrashekhar, G.; Balasubramanian, G. Measurement of extreme market risk: Insights from a comprehensive literature review. Cogent Econ. Financ. 2021, 9, 1920150. [Google Scholar] [CrossRef]

- Hong, Y.; Liu, Y.; Wang, S. Granger causality in risk and detection of extreme risk spillover between financial markets. J. Econom. 2009, 150, 271–287. [Google Scholar] [CrossRef]

- Ahmed, M.; Choudhury, N.; Uddin, S. Anomaly detection on big data in financial markets. In Proceedings of the 2017 IEEE/ACM International Conference on Advances in Social Networks Analysis and Mining (ASONAM), Sydney, Australia, 31 July–3 August 2017; pp. 998–1001. [Google Scholar]

| Headers | Attributes and Definitions |

|---|---|

| Total circulation of crypto: the total number of mined cryptocurrency coins | |

| Crypto statistical info | Crypto price: the price of the coin |

| Market capitalisation: the total value of cryptocurrency in circulation | |

| Blockchain size: total size of the blockchain | |

| Avg. block size: average block size for the past 24 h | |

| Block info | Avg. trans per block: average number of transactions per block for the last 24 h |

| Avg. payments per block: the average number of payments per block for last 24 h | |

| Total no. of trans: the total number of transactions on blockchain | |

| Median (avg.) confirmation time: the median (avg.) time for a mined block to be added to the public ledger | |

| Total hash rate: the estimated number of terahashes per second | |

| Hash rate distribution: an estimation of hash rate distribution amongst the largest mining pools | |

| Mining info | Network difficulty: the difficulty of mining a new block |

| Miners revenue: total value of cryptocurrency block rewards and transaction fees paid to miners | |

| Total transaction fee | |

| Fees per transaction: average transaction fees per transaction |

| Money | Electronic | Virtual | |

|---|---|---|---|

| Attributes | |||

| Money format | Digital | Digital | |

| Acceptance | By undertakings other than the issuer | Usually within a specific virtual community | |

| Legal status | Regulated | Unregulated | |

| Issuer | Legally established electronic money institution | Non-financial private company | |

| Supply of money | Fixed | Not fixed (depends on issuer’s decisions) | |

| Supervision | Yes | No | |

| Type of risk | Mainly operational | Legal, credit, liquidity, and operational | |

| Exchange | No. Supported Coins | Transaction Fee (%) | Headquarter Location | Founded |

|---|---|---|---|---|

| Binance | 320+ | 0.100 | Malta | 2017 |

| Coinbase | 40+ | 0.500 | San Francisco, US | 2012 |

| BitMex | 160+ | 0.075 | Eden Island, Seychelles | 2014 |

| Okex | 230 | 0.150 | Malta | 2017 |

| Huobi | 310+ | 0.200 | Seychelles | 2013 |

| Bitfinex | 30+ | 0.200 | Hong Hong | 2012 |

| Kraken | 60 | 0.260 | San Fransisco, US | 2011 |

| Bitterx | 320+ | 0.350 | Seattle, US | 2014 |

| BitStamp | 10+ | 0.500 | Luxembourg | 2011 |

| KuCoin | 270+ | 0.100 | Mahe, Seychelles | 2017 |

| No | Reference | No | Reference | No | Reference |

|---|---|---|---|---|---|

| 1 | Mittal et al. [4] | 6 | Chowdhury et al. [51] | 11 | Chen et al. [52] |

| 2 | Poongodi et al. [53] | 7 | McNally [54] | 12 | Kim et al. [55] |

| 3 | Patel et al. [28] | 8 | McNally [54] | 13 | Derbentsev et al. [34] |

| 4 | Alessandretti et al. [56] | 9 | Peng et al. [57] | 14 | Lamon et al. [58] |

| 5 | Sun et al. [59] | 10 | Jang and Lee [36] | 15 | Lahmiri and Bekiros [60] |

| No | Method | Baseline(s) | Prediction Feature | Frequency Prediction | Performance Metric(s) | Data Period | Crypto(s) | Data Source(s) |

|---|---|---|---|---|---|---|---|---|

| 1 | Multivariate LR | - | Highest price | 1D | F-score | - | 10 coins | kaggle.com |

| 2 | LR and SVM | - | Price | 1H | Cost function accuracy score | - | Ethereum | etherchain.org |

| 3 | LSTM and GRU | LSTM | Price | 1D, 3D, 7D | MAE, MSE, MAPE, and RMSE | 2016–2020 | Litecoin Monero | investing.com |

| 4 | LSTM, regression | Simple moving average strategy | Cumulative Return | 3D, 5D, 7D, and 10D | Geometric mean return Sharpe ratio | 2015–2018 | 10 coins | coinmarketcap.com |

| 5 | LightGBM | SVM and RF | Price | 2D, 2W, and 2M | AUC indicator | 2018 | 42 coins | investing.com |

| 6 | Gboosted trees, NNs, and K-NN | LSTM, RNN, and ARIMA | Closing price | 1D | RMSE and squared correlation | 2016–2019 | 9 coins and cci30 | coinmarketcap.com cci30.com |

| 7 | LDA, LR, RF, XGB, QDA, SVM, and LSTM | - | Price | 1D and 5 min | Precision, accuracy, recall, and F1-score | 2017–2019 | Bitcoin | coinmarketcap.com Bitcoinity.org blockchain.com |

| 8 | RF, LSTM, and RNN | ARIMA | Price | 1D | Sensitivity, specificity, precision, accuracy, and RMSE | 2013–2016 | Bitcoin | Coindesk Blockchain.info |

| 9 | SVR-GARCH, and SVR | Price | 1H and 1D | RMSE and MAE | 2016–2017 | Bitcoin, Ethereum, and DashCoin | alt19.com fxhistoricaldata.com | |

| 10 | BNN | SVR, and LR | Price | 1D | RMSE and MAPE | 2011–2017 | Bitcoin | Bitcoincharts.com |

| 11 | VADER | - | Price | 1D | Pearson R and p-value | 2018 | Bitcoin and Ethereum | Twitter’s API, Google Trends |

| 12 | AODE | - | Price | - | Accuracy rate, F-measure, and Matthews correlation coefficient | 2013–2015 | Bitcoin, Ethereum, and Ripple | Coindesk CoinMarketCap Etherscan RippleCharts |

| 13 | BART | ARIMA and ARFIMA | Price | 5D, 10D, 14D, 21D, and 30D | RMSE | 2017–2019 | Bitcoin, Ethereum, and Ripple | Yahoo Finance |

| 14 | Logistic Regression, SVM, and Naive Bayes | - | Price | 1D | Confusion matrix accuracy | 2017 | Bitcoin, Ethereum, and Litecoin | Kaggle.com, Twitter’s API |

| 15 | SVR, GRP, RT, kNN, FFNN, BRNN, and RBFNN | - | Price | 5 min | RMSE | 2016–2018 | Bitcoin | - |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Amirzadeh, R.; Nazari, A.; Thiruvady, D. Applying Artificial Intelligence in Cryptocurrency Markets: A Survey. Algorithms 2022, 15, 428. https://doi.org/10.3390/a15110428

Amirzadeh R, Nazari A, Thiruvady D. Applying Artificial Intelligence in Cryptocurrency Markets: A Survey. Algorithms. 2022; 15(11):428. https://doi.org/10.3390/a15110428

Chicago/Turabian StyleAmirzadeh, Rasoul, Asef Nazari, and Dhananjay Thiruvady. 2022. "Applying Artificial Intelligence in Cryptocurrency Markets: A Survey" Algorithms 15, no. 11: 428. https://doi.org/10.3390/a15110428

APA StyleAmirzadeh, R., Nazari, A., & Thiruvady, D. (2022). Applying Artificial Intelligence in Cryptocurrency Markets: A Survey. Algorithms, 15(11), 428. https://doi.org/10.3390/a15110428