1. Introduction

Climate change, the reduction in the consumption of resources used in the context in which they are globally limited, the reuse of waste materials, and the innovations made to protect the planet are objectives of major interest to organizations working to ensure sustainable development in a protected environment. One of these organizations is the Organization for Economic Co-operation and Development (OECD), which proposed three-pillar programs concerning Sustainable Development Goals regarding the environmental, economic, and social aspects.

The European Directive 2014/95/EU [

1], amending the provisions of Directive 2013/34/EU [

2], was created out of the need to identify among the Member States the risks related to sustainable development and to increase investor and consumer confidence [

3], starting from the premise that “meeting current needs must be achieved without compromising the ability of future generations to meet their own needs” [

4]. The Directive does not provide any specific disclosure framework but allows the use of national, European, or international frameworks while stating that, “details of the framework(s) relied upon should be disclosed” [

1]. For international frameworks, it specifically mentions the Global Reporting Initiative G.R.I., the UN’s Global Compact, the OECD’s Guidelines for Multinational Enterprises, and the International Labour Organization’s Tripartite Declaration of Principles concerning multinational enterprises and social policy [

5]. “The EU Directive is a step ahead for the proper implementation of CSR policies, transforming it in a more regulated concept and adjusting in an appropriate manner the corporate behavior for better compliance with the sustainability needs” [

6].

Directive 2014/95 lays the foundations for a new corporate reporting model that increases the level of transparency and trust by including the additional non-financial information needed to understand the impact of business activities, with sustainability being a defining element of the business strategy. Through this reporting, investors can consider both the risks and opportunities of future investments, with access to information on the environmental, social, and sustainable development issues. Non-financial reporting can help improve the entity’s image in the community by publicly assuming respect for human rights, fighting corruption, and protecting the environment.

In this directive, companies must provide information on environmental, social, and personnel issues; on respecting human rights; and the fight against corruption and bribery. The statement should also include a description of the policies, results, and risks. In this context, we can state that transparency in reporting becomes an essential feature of the companies.

Globalization has also changed the volume of information needed by investors to make economic decisions. For the majority of the time, these pieces of information must be supplemented with non-financial data on performance. Non-financial reporting, also known as sustainability reporting, is the way in which companies present information related to the environmental, social, and economic aspects related to their current activities, the company values, and also their business model [

7].

In our opinion, for a company to achieve sustainable and responsible development, the principles of sustainability and ethics must be part of the organizational culture, and, therefore, there must be a strong correlation between the company’s declarations, their acts, and their beliefs.

Sustainability and the concept of sustainable development have begun to occupy an increasingly important place in the activity of companies, and non-financial performance is taken into account more frequently when developing investment strategies [

8].

The current obligations imposed by the EU through the European Directive 2014/95/EU on the reporting of sustainability information apply to large entities of public interest and affect companies in all fields of activity [

9].

In total, the targeted entities are companies listed on the stock exchange, banks, assurance companies, and other entities in the Member States exceeding the criterion of an average number of 500 employees during the financial year [

10]. According to the CSR report [

11], quoted by Sava [

12], approximately 6000 entities are involved at the European level. In Romania, the regulation must be applied by 680 companies, out of which, 37 are listed on the Bucharest Stock Exchange, and they are required by law to publish non-financial information in 2018 for the year that ended on the 31 December 2017 [

13].

Ogrean [

14] posited that the introduction of the non-financial reporting obligation may increase the number of voluntarily reporting companies not exceeding the size criterion, that wish to be more competitive on the market.

The freedom offered by the European Directive 2014/95 in choosing the reporting model is a topic of great interest in the literature; in the absence of equivalent regulations, researchers are particularly interested in comparing the non-financial information presented by entities from different countries and industries.

The previous studies on the transposition of the Directive have been carried out in countries, such as the UK, France, Italy, Poland, and Romania. In order to identify how Directive 2014/95 was transposed into national law in the UK, France, and Italy, Aureli et al. [

15] made a textual analysis of the articles of the Directive regarding the regulatory choices or regulations set with reference to different aspects, the list of topics or content to be disclosed, the company scope of application, and the application of principles, such as the “company or explain” rule. Then, they searched for the regulation of the same aspects in the national laws transposing the Directive. The results of the study reflect an alignment of practices when the legal regulations were established and imposed by the EU, a spontaneous convergence of certain elements presented, and also significant differences that could prevent meeting the objectives established by the Directive, such as comparisons with previous years, accessibility of information, and changes in the entity’s policies.

In the study conducted in 2017, the authors, Matuszak and Rozanska [

16], stated that the analyzed Polish companies published sustainability information in accordance with the provisions of the European Directive in the Annual Report; however, the companies left out the presentation certain necessary information, such as information concerning human rights and anti-corruption.

Carini et al. [

5] examined the impact of the Directive on a sample of oil entities through a disclosure scoring system based on 148 variables grouped into the following categories: environmental, employee, social, anti-corruption and bribery, and diversity and business model. The analysis considered both the complexity of the information presented and its structure. Complexity was measured by the presence of variables in the financial and sustainability reports, and overlap referred to the presence of variables in both reports. The results of the research reflected a reasonable level of compliance with the provisions of the Directive.

Dumitru et al. [

8] studied the use of certain keywords in the annual reports of energy companies in Romania, before and after the transposition of the European directive 2014/95 and noticed a slight increase of these keywords after the implementation of the directive.

Imbrescu and Hategan [

9] studied the impacts of adopting the requirements of the directive on agriculture and public food companies. They found that non-financial reporting was important for companies who understood that sustainability can only be achieved if they are involved in CSR activities.

By qualitative and comparative analysis, Wolny [

17] investigated the changes generated by EU Directive 2014/95 in reporting environmental information given the data published by the energy sector entities listed on the Warsaw Stock Exchange during 2014–2016. The results of the study showed an improvement in reporting the activities related to environmental issues, although, during the period under review, the provisions of the directive had not yet been made mandatory for these entities.

In research conducted to determine the factors influencing the level of compliance in Romanian companies as required by the European Directive in terms of how they present non-financial information, Popescu and Bant [

13] validated, by mathematical modeling, the hypothesis that there is a relationship between the presentation of non-financial information and the field of activity of the reporting entity. They identified the highest level of 100% compliance for the oil and gas branches.

To analyze the level of non-financial and diversity disclosure, Venturelli et al. [

18] created an assessment model called the “Non-Financial Information score”(NFI), which records the required information as a percentage, using a manually performed content analysis. With an average NFI score of 49%, the results reflected that regulation could improve the quality of information disclosure made by large companies, which, at the time of the research, stood at unsatisfactory levels.

Persic and Halmi [

19] studied the manner in which Croatian companies with at least 400 employees reported information according to the Directive. The data showed that many of the disclosed sustainability indicators are “story-tellers”, meaning that they are past-oriented and qualitatively stated.

In their study on entities listed in the Spanish main market, Sierra-Garcia et al. [

20] found, through mathematical modeling, that the level of compliance with European directives depended on the sector in which the entity operated. In this study, the econometric model underlined a statistically significant, positive relationship with the environmental matters index, meaning that companies in this sector revealed more information on the environmental aspects of their operations than those in other sectors. Avram et al. [

21] also underlined the fact that entities in fields, such as oil, gas, and energy, obtained the best results for reporting non-financial data.

Knowing this, Directive 2014/95 provides companies with non-binding recommendations to give them the opportunity to choose different reporting frameworks, provided that they are specified, in our paper we studied the changes generated by the EU Directive 2014/95 regarding the way oil entities report information on environmental issues. We also investigated whether entities considered to be polluting were more sensitive to environmental factors and tended to report more information compared to those operating in other sectors [

21,

22,

23].

Measuring environmental performance is difficult [

21]. To achieve our objectives, we performed a content analysis of the Annual and Sustainability Reports published by the sampled companies between 2014 and 2018, and, for the analysis, we used the NVivo data processing program. The method used in our research brings a new perspective in the field, namely in comparing non-financial information on environmental issues between countries and sectors of activity to identify whether polluting entities reported more information than those operating in other sectors, both before (2014–2016) and after (2017–2018) the transposition of the directive.

Our paper is structured in three parts, as follows: In the first part, we present the context that determined our study and the literature on the actual knowledge in the field. In the second part, we present the hypotheses underlying the research undertaken and the study itself, highlighting and analyzing the results obtained. In the last part of the paper, we reflect discussions and conclusions, as well as the limits and future directions of the research.

2. Materials and Methods

The first objective of our research was to identify whether entities reported more non-financial information regarding environmental issues following the application of the provisions of EU Directive 2014/95. Hence, our first research question (1): Did entities report more non-financial information after the application of the EU Directive 2014/95? To answer to this question and achieve our objective, we introduced Directive 2014/95 / EU in the NVivo program. With the help of the word frequency criteria function, we extracted the 500 most-used words. From these, we selected the terms regarding the environmental aspects. Afterward, we introduced the Annual and Sustainability Reports published by the sampled entities between 2014–2018, and we analyzed the frequency of the key terms in each report to identify the changes generated by the directive regarding the way the studied oil entities reported information on environmental issues.

We analyzed the information presented by the entities in the Annual Reports, in the Sustainability Reports, and those published on the website as follows: for Romania, out of the six companies operating in the oil field (extraction, handling, and transportation) and listed on the Bucharest Stock Exchange (BSE), we analyzed the situation of four companies, namely Conpet, Oil Terminal, OMV Petrom, and Rompetrol Rafinărie, which belong to the category of large companies exceeding the criterion of an average number of 500 employees during the financial year, which represent 67% from the total number of listed oil companies included under the European Directive 2014/95 provisions. For Greece, out of all the companies listed on the main market, the Athens Stock Exchange (ATHEX), in the oil field (four companies), we included in our study two companies (which represent 50% of the total), Motor Oil and Hellenic Petroleum, those that published their reports on the official website of the Athens Stock Exchange and that met the size criterion established by the European Directive.

In this research, we also aimed to analyze whether oil entities tended to report more information on environmental issues compared to other entities with a low degree of pollution, resulting in our second research question (2): Do oil entities have the tendency to report more information related to the environment compared to other entities that are not implied in polluting activities? Thereby, we included in the research banking institutions listed on two stock markets to obtain an overview in terms of the environmental protection measures. For Romania, we analyzed the Annual and Sustainability Reports prepared by BRD, Transilvania Bank, and Patria Bank; and, for Greece, we included the documents published by the following banking institutions listed on the ATHEX main market: Alpha Bank, Attica, Eurobank, and Piraeus Bank.

In total, for the analyzed period of time, namely, between 2014 and 2018, we studied 65 Annual and Sustainability Reports.

We have selected the oil entities from these countries based on the statistics that consider Romania and Greece as two countries showing little concern for environmental protection in terms of waste recycling. Therefore, we have analyzed the situation of oil entities in terms of actions and reporting of non-financial environmental information.

3. Results

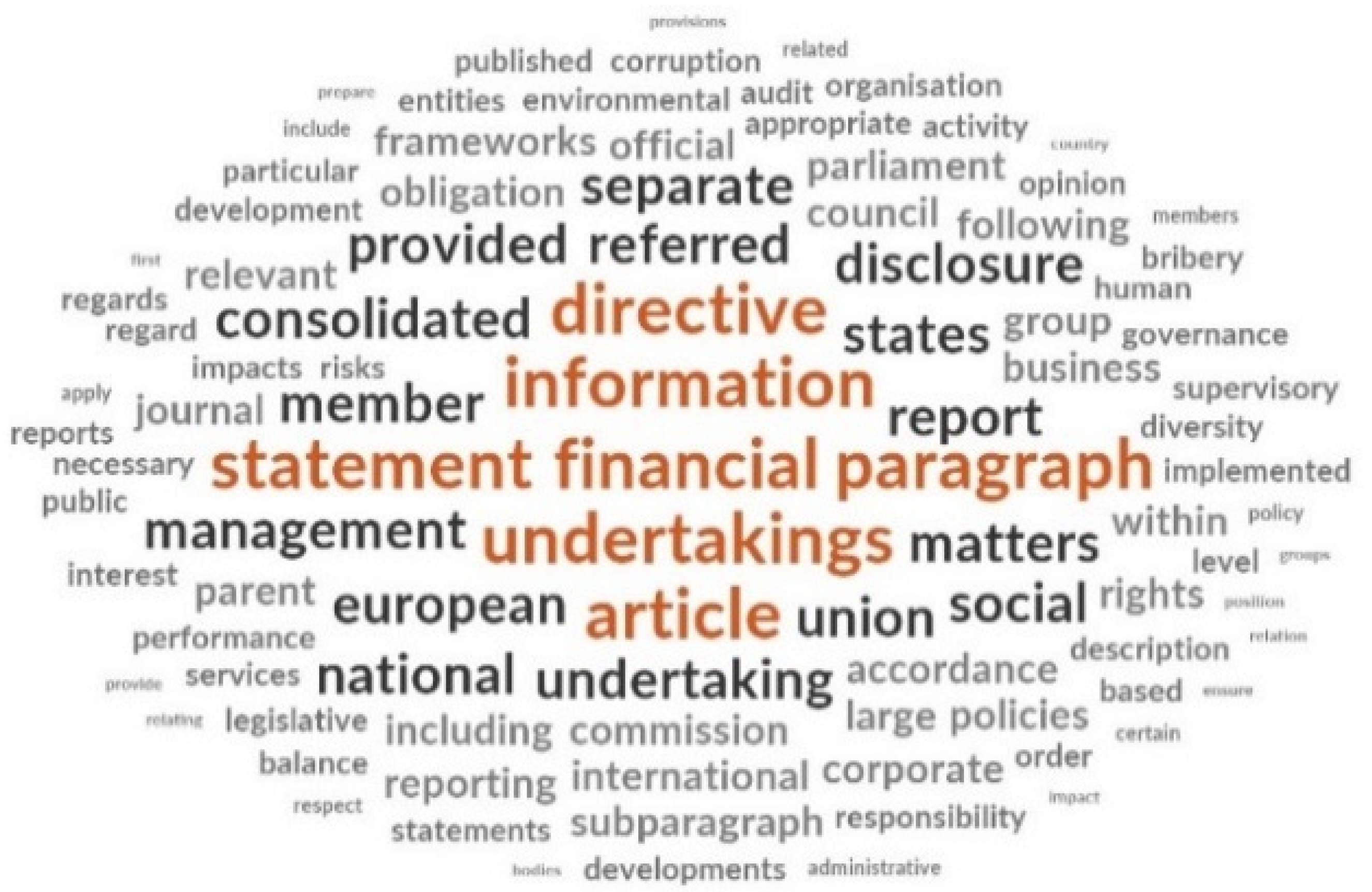

Initially, the content of the European Directive 2014/95 was examined using the word frequency criteria function, which allowed for the identification of the 500 most-used words in the analyzed document. The obtained results are synthetically reflected in

Figure 1, using “WordCloud” to highlight that the size of the words is directly proportional to the frequency of their occurrence in the Directive.

From the 500 most-used words in the directive, we manually extracted the terms regarding the environmental aspects; the results are highlighted in the following figure (

Figure 2):

With reference to the keywords regarding the environmental aspects identified in the European Directive, in the search engine text search query, we also included specific environmental terms, such as spills, waste, forest, and biodiversity. We subsequently analyzed the frequency of their occurrence in the annual and sustainability reports of the sampled entities before (2014–2016) and after (2017–2018) the transposition of the Directive in the national legislative framework of each country.

The results of the research on oil entities are presented in the following table (

Table 1):

For Romanian entities, the results presented in the previous table reflect a slight increase in the use of all keywords selected in the reports analyzed after the date on which the provisions of EU Directive 2014/95 became mandatory. In the case of entities listed on the ATHEX main market, we found that the frequency of keywords in the reports was higher than recorded for Romanian entities. However, not all terms were used more frequently after the date on which entities had time to prepare the implementation of the directive in the period of 2017–2018. Thus, keywords (such as environment, environmental, protection, and biodiversity) and non-financial key performance indicators decreased in use. Overall, after the transposition of the directive, in the period of 2017–2018, there was a slight increase in the use of selected keywords, which is in accordance with other studies in the field, such as the ones conducted by Carini et al. [

5], Dumitru et al. [

8], and Venturelli et al. [

18].

The frequency analysis of the keywords in the reports published by the banking entities highlighted the following results (

Table 2):

For the banking entities listed on the BSE, we found that in the period of 2017–2018, the frequency of use of keywords in the reports increased significantly compared to the preparation period. There have been important changes for defining terms regarding environmental issues, such as climate change, impact, and non-financial key performance indicators. For the banking entities listed on the ATHEX main market, we found that, overall, there was a slight increase in the frequency of keywords in the reports analyzed in the period of 2017–2018 compared to the period of 2014–2016.

The analysis by activity field confirmed that oil entities tended to report more information on environmental issues compared to other entities whose activities do not register as having a high degree of pollution. These results were in accordance with the opinions expressed in the literature [

21,

22,

23] and the studies conducted by Popescu and Bant [

13] and Sierra-Garcia et al. [

20].

In the following tables (

Table 3 and

Table 4), we show, in detail, the results obtained before the directive became mandatory, namely the period of 2014–2016, compared to the period of 2017–2018:

Specialty literature describes relevant studies and experiments, such as the one conducted by the well-known American psychologist R. Zajonc [

24], who investigated the relationship between the positive meaning associated with a word and the frequency of its exposure. In the experiment, (American) subjects were introduced to Turkish words that had no significance to them. Some words were presented only once while others were presented up to 25 times during the experiment. At the end of the study, the subjects were asked to what extent the words presented in Turkish expressed something “positive” or “negative”. The results of the experiment validated the hypothesis formulated by the psychologist. The Turkish words used in the study had the quality of new stimuli. By repeatedly using these words, they became familiar to the subjects, so that they perceived them with a positive meaning. The results of the experiment emphasize the idea that, as subjects are more frequently exposed to a weak negative, neutral, or positive stimulus, a progressively positive appreciation of the stimulus is reached [

25].

An example in this case is the Volkswagen scandal. According to the US Environmental Protection Agency (EPA) [

26] between 2009–2015, the car manufacturer, Volkswagen sold approximately 11 million cars worldwide, equipped with illegal software meant to report lower fuel consumption and lower emissions than in reality. This scandal broke shortly after the company had been named the most sustainable entity in the automotive industry according to the Dow Jones Sustainability Index. Also, in the last Sustainability Report issued in 2014, before the scandal broke, the company mentioned the word “environment” 335 times and emphasized ethical principles and integrity in their statements: “in the long run, we can only succeed as a company if we act with integrity, respect statutory provisions worldwide and stand by our voluntary undertakings and ethical principles, even when this is the harder choice” [

27].

Certainly, Volkswagen is not the only company failing to integrate sustainability into its strategies and operations, and this may influence the company’s long-term development.

To avoid the impression that we are in front of an experiment demonstrating that companies frequently use terms in their reports solely to obtain a favorable perception related to environmental protection, we completed in-depth research by identifying, in the reports, the concrete measures performed by the companies for the declared purpose of environmental protection.

The identified objectives and CSR projects are presented in the following tables (

Table 5 and

Table 6):

To highlight the actions of social responsibility with the direct and immediate impact on the environment undertaken by the entities in the oil field, we analyzed the reports published between 2015–2018. The results reflect the fact that the responsibility actions undertaken by the studied entities mainly concern the aspects presented in the next figure (

Figure 3):

We found that the studied entities were aware of the impact of their activities and that they were taking measures to reduce pollution and to involve the communities where they operate in those actions. The significance of the concept of corporate social responsibility derives from this attitude of companies [

41]. From the CSR projects undertaken, we can state that the frequency of use of specific environmental terms is sustained by practical actions, like the ones described in CSR projects as presented in

Table 6.

The following figure (

Figure 4) shows, in detail, the most-used keywords in the non-financial reports of the studied entities:

The analysis underlines that the words with the highest impact—those that registered the highest frequency in the reports—were greenhouse gases, namely GHG, (in the case of oil entities) and climate change (for banking entities).

4. Discussion

The consequences of the crisis that affected all economies can also be seen in the way in which entities prepare their non-financial reporting. In the Romanian banking sector, we observed a significant increase in the frequency of use of environmental keywords, amid the faster recovery of the economy. In Greece, the problem of recession lasted longer and had a greater impact, which dispelled the concerns of the banks. The results of the analysis showed that the priority of financial institutions has been to identify solutions for economic survival and not to improve reporting. In conclusion, including from the reports of the entities listed on BSE, we proved that Romania overcame the global crisis more easily and faster compared to Greece where the banks’ choices, such as bank credits granted without guarantees, proved catastrophic in terms of the economic effects.

The recession was also reflected in the oil field. When the Greek government limited daily cash withdrawals, the sale of fuel automatically decreased, as this was no longer among the subsistence priorities of the Greeks. However, the provisions of the directive had to be implemented and applied, regardless of the economic context of each country, and the deep recession in Greece placed reporting in second place for entities in this field as well. This aspect can also be observed in the results obtained, namely the insignificant increase in the number of keywords.

Thus, our results proved the existence of differences in the reporting of environmental protection issues in the two countries analyzed. Extrapolating, this indicates that the interests of the analyzed Romanian entities were primarily focused on the aspects regarding environmental protection, compared to a country severely hit by a recession. Economic conclusions, directly correlated with the financial crisis, can be drawn from such reports and we can now determine that environmental protection is a priority for countries with a functioning economy.

From the analysis undertaken, we can observe that the studied entities adopted an open attitude regarding the elaboration and disclosure of non-financial information related to the environment by making efforts to improve their reporting, even though corporate reporting is a relatively new concept [

42]. The same conclusions cannot be drawn from the implementation of other European directives on environmental protection issues, such as recycling and waste management. According to data presented by the European Commission, both Romania and Greece are among the 14 countries considered to have the highest risk of not reaching the recycling target set for 2020, which is why the two countries risk infringement proceedings [

43].

In 2020, the European Commission committed to reviewing Directive 2014/95 to strengthen the strategies for sustainable investment. This decision was made because the information reported does not present correct nor sufficient details of either the impact of the non-financial aspects on companies or of the impacts that companies have on society and the environment. The reporting requirements of the Directive are also not sufficiently detailed and are difficult to apply or they do not apply to companies whose beneficiaries require information on polluting activities. These action reveals the fact that the European Commission continues the fight against climate change and environmental degradation, still striving for constant improvement and active support from polluting entities.

Climate change affects the activities of oil companies, creating significant challenges and opportunities. As the main activity of companies is refining, they find themselves in a dual position of being both energy producers and consumers. Energy consumption implies significant operating costs and represents an important source of pollution, being the main source of carbon dioxide emissions. Therefore, these companies must implement projects aimed at reducing the level of energy consumption and carbon dioxide emissions as the energy consumed creates a significant impact on the environment. The purpose of energy efficiency management is to reduce the impact of the operations of these entities on the environment, to reduce financial expenses through economies, and to respect the national and international regulatory framework in the energy efficiency sector.

According to the International Energy Agency [

44], energy efficiency could contribute approximately 40% through the emission reductions required to maintain global warming below 2 °C. To limit global warming, it is essential to ensure carbon neutrality by the middle of the 21st century, a goal set in the Paris Agreement signed by 195 countries [

45]. Carbon neutrality means a balance between emissions and the reduction of carbon dioxide from the atmosphere through absorbents. The main absorbers are soil, forests, and oceans.

Forests are able to absorb greenhouse gas and carbon dioxide emissions. The EU wants to use this power to fight climate change and the legislation aims to prevent emissions from deforestation and obliges each EU country to offset changes in land use, which lead to CO2 emissions, through better forest management or increased forest area. According to the statistics [

46]

detailed in Figure 5, the level of absorption of greenhouse gases by forests reveals the importance of a greater number of forested areas in the EU.

Analyzing the situation from a global perspective [

47] (

Figure 6), we can state that measures must be taken to increase the forested area, considering that forests are crucial in combating global climate change, as they capture carbon dioxide and greenhouse gases from the atmosphere.

Unfortunately, the latest statistics show that from 2015 to 2018, Romania lost 72.1 kha of tree cover, equivalent to a 0.91% decrease in tree cover since 2000. Greece also lost 25.9 kha of tree cover, equivalent to a 0.71% decrease in tree cover since 2000 [

48]. The detailed situation is presented in the next figure (

Figure 7).

The respect and care for the environment should be a priority for all companies, as they operate as responsible corporate organizations in accordance with the principles of sustainable development based on environmental protection, mutual respect, and the interest for future generations to be equally able to benefit from the planet’s natural reserves, maintained in good condition. In doing so, sustainability becomes part of the organizational culture promoting responsible behavior for the stakeholders, environment, and society.