1. Introduction

Electric vehicles (EV) are one solution which aim to reduce air pollution and greenhouse gas emission caused by internal combustion engine vehicles (ICEV) [

1]. Many countries and international organizations have tried to promote the use of EVs to address global warming. In 2010, the International Energy Agency (IEA) and the Clean Energy Ministrial (CEM) launched “the Electric Vehicles Initiative (EVI)”—a policy platform with 13 country members—to accelerate the electrification of the transportation sector [

2]. Since 2010, there has been an exponential growth in EV penetration. The number of electric cars globally has increased from 17,000 to 7.2 million in 2019 [

3]. Of this number, 3.4 million (47%) electric cars are in China. About 1.7 million (25%) are in Europe and 1.5 million (20%) are in the United States [

3].

Although the success of EV promotion in these regions may be due to the provision of direct incentives to EV users (such as EV purchase subsidies, tax credits, and tax exemptions) [

4,

5,

6], the importance of the EV charging infrastructure cannot be denied. Research has found that EV buyers may experience “range anxiety”; that is, they may be concerned with the limited capacity of their EV battery and the availability of charging stations in their driving routes [

7,

8]. To address this EV range stress, governments have developed policies and incentives to promote investment in charging stations. For instance, China set a vision for their EV charging infrastructure stating that there would be 12,000 centralized charging stations and distributed 480,000 charging points by 2020 [

9]. In 2015, France enacted the law on energy transition for green growth and it aimed to have 7 million charging points by 2030 [

10].

The Thai government has also become interested in promoting EV usage and building the EV manufacturing industry in Thailand. In 2015, the government created the national EV roadmap and set a target to create 1.2 million EVs by 2036 [

11]. Hence, the Thailand Board of Investment has provided various incentives (such as tax breaks of up to eight years and zero import duty for EV-related machines) to attract foreign direct investment in the EV industry. Many automotive companies (e.g., BMW, Mercedes Benz, BYD, FOMM, MG, Nissan, Toyota, Honda) have applied for licenses to obtain investment benefits from the Board of Investments. Regarding the EV charging infrastructure, the Ministry of Energy and the Electric Vehicle Association of Thailand (EVAT) started a pilot project to install charging stations and provided funding to subsidize the investment in 150 charging outlets for both public organizations and private sectors. Since 2015, the number of charging stations in Thailand has gradually increased to 583 in June, 2020 [

12].

As of August, 2020, almost five years after the launch of the Thai EV roadmap in 2015, minimal literature has examined the Thai EV industry and its charging infrastructure. Past research seems to have focused on the topic of EV adoption (such as factors motivating the adoption of EVs in Thailand [

13], purchase intentions [

14], benefits of EVs [

15], and life cycle cost analysis of EVs [

16]). Those focusing on the Thai charging infrastructure, nevertheless, tend to have explored the feasibility of creating fast charging stations in the Thai provinces [

17] or the optimal location of charging stations in one local area [

18]. However, reviews of the developments of the charging infrastructure and their operations are limited. Thus, a clear picture of the key players in the Thai EV charging industry and how they compete in this nascent EV adoption stage has been hard to visualize. What are their goals, strategies, and operations? Are there any business constraints from the perspective of the charging operators?

Thus, this study aimed to investigate the development of the Thai EV charging stations since 2015. The following section begins with a review of the past literature on the growth of global charging stations, the barriers to expanding the charging network, and demand-pull and technology-push policies that can address these barriers. After that, the key players in the Thai charging industry will be identified and their goals, strategies, and charging operations will be explored. The key issues that these operators have experienced will also be analyzed and recent policy recommendations and initiatives will be discussed to address these issues. As for our contributions, we hope that by answering these questions, the policy makers can use our insights and information to improve the EV policies and incentives and greatly accelerate the transition to EV in Thailand and other regions.

3. Method

To gain deep understandings of the Thai EV charging industry, a qualitative approach has been used to examine the goals, strategies, operations, and issues of the key players.

3.1. Data Collection

The authors collected primary and secondary data from various sources. First, primary data were collected through semi-structured interviews with key players in the Thai EV charging station industry. We conducted a total of 18 interviews with representatives from state enterprises (PTT, EGAT, MEA, PEA), executives and managers from large public companies (Energy Absolute, GLT) and founders and managers of start-ups in the oil and gas and green energy sector. We used a purposive sampling method [

53] and selected participants who were directly involved in the charging operations of their organizations. Twelve interviews were carried out face-to-face whilst the rest were conducted by telephone or video conferences between August 2018 and January 2020. The interviews were organized as semi-structured interviews. We asked the informants to comment on the following topics: (1) current operation of your EV charging business (goals, number of stations, investment costs, business strategy, business partners); (2) current outlook on the Thai EV industry and Thai EV charging industry; (3) policies of the government; and (4) challenges, issues, and recommendations. Most informants were willing to comment on their EV operations and the government policies, but some declined to elaborate on confidential issues (e.g., the investment costs of EV stations and the subsidies they received). The duration of interviews ranges from 15 to 40 min. We also sent an email to some informants to clarify the points that were briefly discussed in the interview and check the current status of their business (e.g., the current number of their EV stations).

Second, to complement the primary data, we collected secondary data linked to the EV charging business in Thailand from corporate websites, YouTube channels and the Facebook pages of the charging operators, government offices and YouTube influencers and EV enthusiasts (e.g., Bjørn Nyland, Teslabjorn Thai, T2LA, Welldone Guarantee, kuhu kuGeek, and Captain DIY). We found that many operators (especially start-ups) provided informative VDO interviews and showcased their chargers and applications using social media to promote their business. This secondary information about their business and operations helped us clarify the interview data. Third, we also participated in tradeshows, EV conferences, and EV policy forums to obtain data about the policies, issues, and problems from the panelists and participants. The government reports and EV industry reports (e.g., Global EV outlook), trade newspapers, research and consulting firms, the Thai Automotive Institutes, and past research studies were also checked.

3.2. Data Analysis

We used a constant comparison approach to analyze our data. This analysis approach is appropriate because it allows common or shared themes to emerge from the data and the emerged coding structure can provide a guideline for the analysis [

54,

55]. First, we reviewed each source and then summarized key points (e.g., timeline, strategies, operations, business partners) and wrote memos about the ideas and questions that we had to follow up (e.g., “why does this start-up partner with this organization?”). For the interview and VDO data, recordings or VDO files were transcribed into text documents. The texts were then coded using MaxQDA 2020 application because it allowed us to rearrange codes and verify the data faster than using manual coding methods. In the first round of coding, we coded for structure by adding keywords or themes (e.g., start-up, business partner, brand, problems, current situations, policy contexts) that best represented pieces of data. Once we finished the first coding stage, we tried to perform a constant comparison approach by comparing codes and arranging them into groups of related codes that could answer our research questions. For instance, for the question about identifying the key players in the charging industry, we subdivided codes into three groups: “Players in oil and gas sector”; “Players in energy sectors”; and “Players in the automotive sector”. In each of these groups, we then put relevant codes and created tree-structure codes (i.e., subcodes). For example, “Players in oil and gas sectors” had “PTT”, “Susco”, “Bangchak”, “Foreign Oil Retailers” as its subcodes. During the constant comparison process and verification of the data, we also wrote memos, questions, observations, and analyses. For instance, the final analysis of the constraints regarding the electricity price was drawn from the coded segment of “high electricity price” and our memo written after reviewing the VDO of MrDIY YouTube channel on “what is demand charge?” After we had a clear structure of codes that could answer our research questions, we then drafted the analysis of this paper by following the structure of the coding tree and compared the analysis with the literature.

4. Findings

The findings section begins with the discussion of the Thai EV industry (roadmap, policies, and key statistics). Then, the government policies supporting the EV charging stations will be presented. We then examine the key players, their goals, strategies, and operations in the EV charging business. This section ends with the key issues in expanding the charging network.

4.1. Thai EV Industry: Roadmap, Policies, and Key Statistics

Thailand has joined the Paris Agreement in which member countries are required to reduce greenhouse gas emissions by 20–25 per cent by the year 2030 [

56]. As a result, the transportation sector which is the main producer of carbon dioxide gas needs to decrease use of oil and gas and replace them with cleaner electric energy. Having seen the importance of EVs in addressing the global warming issue, the Thai government has become determined to promote EV adoption. It announced that EVs or the “next-generation automotive” industry was 1 of the 10 targeted industries to drive Thailand’s future economy. In 2015, the national EV roadmap was created and Thailand aimed to position itself as ASEAN’s EV hub. The government also set a target to create 1.2 million EVs by 2036 and reduce the use of ICEV and non-renewable energy [

57]. To achieve this goal, the electrification of private cars, motorcycles and commercial vehicles would be encouraged. Thus, it approved six demand-pull and technology-push measures, such as domestic demand creation, infrastructure building, EV standard setting, investment subsidies, and used battery handling [

11].

To achieve the goals of the EV roadmap, the National Energy Policy Board has set three operational phases:

Phase 1 (2015–2017): Preparing for the readiness to use EVs in public transportation. Incentives, standards, electricity retail prices, and regulations of EVs were issued.

Phase 2 (2018–2020): Preparing for the readiness to use EVs in personal transportation. The government would support the investment of EV infrastructures (e.g., EV charging stations, optimal electricity retail prices for EV charging operators).

Phase 3 (2021–2036): Expanding the EV usage and infrastructure across the country. The government will develop a smart EV charging system and implement the “vehicle to grid” (V2G) electricity system to optimize the electricity demand and supply.

Based on the EV roadmap (Phase 1 and 2), government offices (e.g., the Ministry of Energy, Ministry of Finance, Ministry of Industry, Ministry of Science and Technology, Ministry of Transportation, and the Thailand Board of Investment) have launched policies and projects to promote investment in the EV industry. For instance, the Ministry of Finance lowered the excise tax for EVs from 20–40 percent to 2–8 percent. The Ministry of Industry set up the national standard for EVs and prepared for EV battery end-of-life management. The Thailand Board of Investment issued the investment promotion schemes for the EVs, parts and charging stations.

Table 1 summarizes the key incentives (e.g., tax holiday up to eight years) and the details of investment approval. During 2018–2019, the Board of Investment approved 26 investment projects with a total worth of 2.584 billion USD. The approved projects tend to be HEV (Nissan, Honda, Toyota) and PHEV (BMW and Mercedes-Benz). Only three companies (FOMM, EA Mobility, and Takano Auto) invested in BEV. However, there has been only one company (Energy Mahanakorn) that has gained investment approval in the EV charging business.

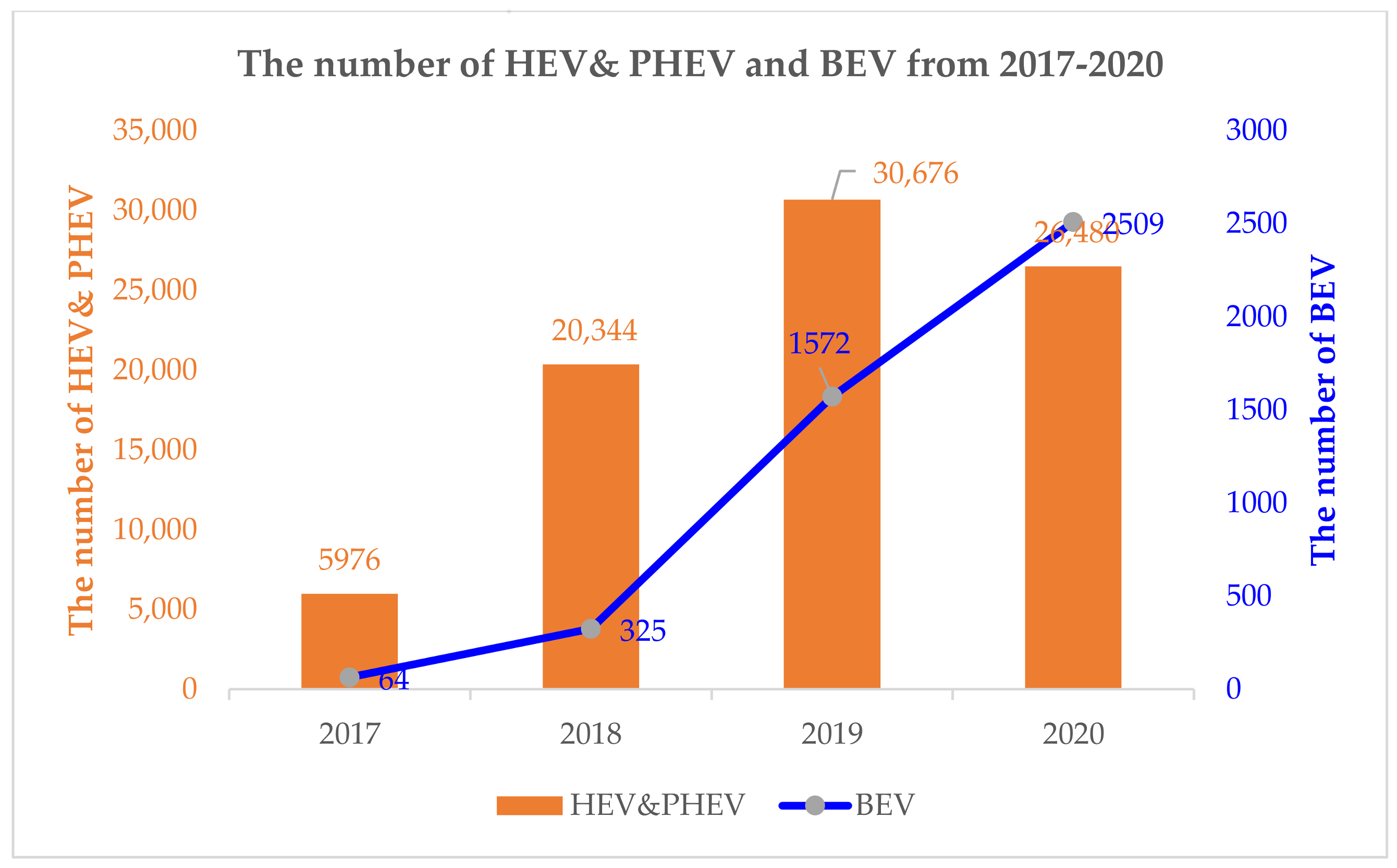

After the launch of the EV policies, the number of EV registrations has steadily increased.

Figure 1 depicts the number of HEV and PHEV, and BEV registrations in Thailand. The department of Land Transport has started to collect the number of newly-registered vehicles categorized by types of fuel (i.e., gasoline, hybrid and plug-in hybrid, and battery vehicles) since August 2017. This implies that the Thai government aims to monitor the growth of each type of EVs. Between 2017 and 2020, the number of HEV and PHEV registration has increased by 440 per cent: the number of HEVs and PHEVs was 5976 in December 2017 and rose to 26,480 by October 2020. Similarly, the number of registered BEVs in Thailand has greatly increased from 64 units in 2017 to 2509 units in 2020.

Although the number of EVs in Thailand has steadily increased, the proportion of registered EVs to the internal combustion engine vehicles has been relatively small (i.e., less than 1.36% in 2020).

Table 2 shows the number of registered HEV and PHEVs, BEVs and ICEVs from August 2017 to October 2020 and the percentage of HEV and PHEVs, BEVs to ICEVs. The table suggests an upward trend (0.49% in 2017 to 1.36% in 2020) of the ratio between EVs and ICEVs over the past four years.

Regarding the market of EVs in Thailand, the number of PHEVs and HEVs in 2020 outnumbered the number of BEVs by 10 to 1 (i.e., PHEV, HEV: 26,480 to BEV: 2509) (see

Table 2). As for the BEV models, there have been at least 13 BEV models from 11 brands (e.g., Audi, BMW, BYD, MG, Hyundai, FOMM) that are officially marketed to Thai consumers. Tesla EVs are not officially sold in Thailand. However, consumers can buy Tesla EVs from local auto dealers who normally import them from Hong Kong and the UK.

Table 3 shows the models, brands, manufacturer-suggested retail price and registration number of BEVs that were available in the Thai market in 2019. The top-three models that have the highest number of registrations in 2019 are: MG ZS EV (sub-compact SUV: 492 units), Nissan Leaf (compact sedan: 44 units), and FOMM One (L 7E; low-speed vehicle and heavy quadricycle: 82 units). Of these 13 models, only FOMM One and Takano TTE500 are now manufactured in Thailand. The price of the other 11 models is very expensive (when compared with ICEV in the same category) because of the import duty (0–80%), excise tax (8%) and home ministry tax (0.8%), and value added tax (7%). For instance, the retail price of Nissan Leaf in Thailand is around 66,688 USD and it is estimated that this price includes a total of 19,400 USD in taxes [

60]. BEV from China (e.g., MG, BYD) can be sold at a cheaper price than Japanese, Korean, and German brands because Thailand and China have a free trade agreement with 0% import tax. The Thai government uses the import duty to protect local auto manufacturers and aims to promote the investment in EV production in Thailand instead of importing BEVs from other countries.

4.2. Policies Supporting the EV Charging Stations

To implement the Thai EV roadmap 2036 (Phase 1 and 2), the government and EV promoting agencies in Thailand realized that the availability of the EV charging infrastructure would support and increase the adoption of EVs in Thailand. Thus, since 2015, the Thai government and EV promoters have promoted demand-pull and technology-push policies to drive the development of the charging stations as follows.

4.2.1. Subsidizing Charging Station Investment

To kick-start the EV charging infrastructure, the Ministry of Energy created a pilot project to subsidize the charging station investment. This project began in late 2016 under the Energy 4.0 policy [

61]. The subsidy was supported by the Energy Conservation Fund administered by the Ministry of Energy. This project aimed to subsidize 150 EV chargers (both normal and fast chargers) within three years [

62]. This subsidy scheme was open to both public organizations (e.g., government offices and academic institutions), state enterprises, and the private sector. However, the government sector will receive more support from this scheme than the private sector. For instance, if chargers are operated by the government sector, a subsidy (up to 2 million Baht, or 66,551 USD) [

1] can be used for the costs of chargers and installations. However, “if chargers are operated by the private sector, the subsidy can be used for the cost of chargers only” (manager, start-up company).

The Ministry of Energy planned to have five rounds of subsidy application periods for this three-year project (2017–2019). In the first two rounds, the subsidy scheme supported 20 normal chargers and 20 fast chargers. However, in late 2019, the initial target of 150 chargers had not been achieved because the members of the National Energy Conservation Committee were changed. Whilst waiting for new committee members, many projects that needed to be endorsed by the committee, including this subsidy scheme, were placed on hold. Thus, in January 2020, this subsidy project had only supported 48 normal chargers and 32 fast chargers in 68 locations around Thailand [

63].

4.2.2. Setting up a Temporary Electricity Selling Price for the Charging Stations and Standard of Chargers

In 2018, the National Energy Policy Commission had endorsed the time of use rate (TOU) for the electricity price for home users and charging station operators. This TOU rate aims to encourage EV users to charge their EVs during off-peak periods thereby reducing the energy demand during the peak periods. During the peak hours (09:00 a.m.–10:00 p.m.), the electricity price is set at 4.10 Baht (0.14 USD) per unit whereas during the off-peak hours (10:00 p.m.–09:00 a.m.) and weekends, the price is reduced to 2.60 Baht (0.086 USD) per unit [

64]. As for the standard chargers used in Thailand, the Thai Industrial Standard 2749 of the National Standard Organization stipulated that the AC charging type is a Type 2 charger whereas DC charging should use the CCS (Combined Charging System) charger. The Thai AC charging standard is adapted from IEC 62196-2 standard to suit the Thai context. Moreover, the CCS Configuration FF plug and socket for DC charging system was adopted for electric buses, whereas, for electric passenger cars, other plug and socket types which conform to TISI 2749-3 standards (adapted from IEC 62196-3) can be used [

11].

4.2.3. Tax Incentives for EV Charging Station Business

Along with the tax incentives (see

Table 1) for the investment in the EV industry in Thailand, the Board of Investment of Thailand provides five-year corporate tax exemption for the EV charging station business. The imported machinery and related raw materials used in the charging stations will also receive import-tax exemptions. In 2018, Energy Mahanakhon Co., Ltd. was granted tax privileges by the Board of Investment to build 3000 EV charging stations all over the country [

65].

4.2.4. Creating an EV Charging Consortium

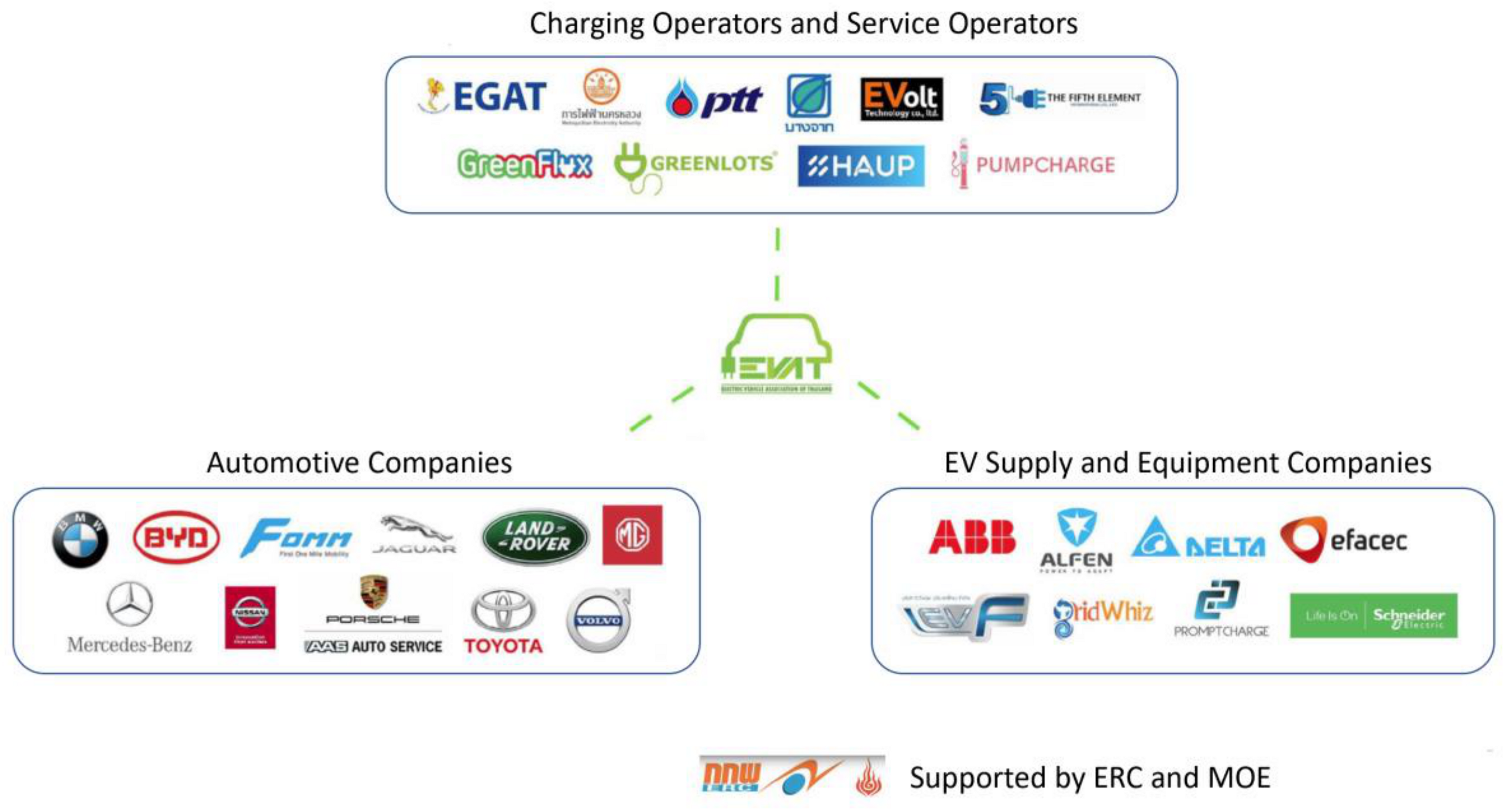

With the support of the Energy Regulatory Commission and Ministry of Energy and the Electric Vehicle Association of Thailand (EVAT), the EV charging consortium was set up in May 2018 [

66]. The charging consortium aims to enable data exchange and ensure the interoperability between the charging operators (see

Figure 2). This consortium comprises both large and small EV charging operators and service providers (e.g., EGAT, MEA, PTT, Bangchak, EVolt, the Fifth Element, GreenFlux, Greenlots, Haup, Pumpcharge), EV supply equipment companies (e.g., ABB, Alfen, Delta Electrics, Efacec, EVF, GridWhiz, Promptcharge, Schneider) and auto companies (e.g., BMW, BYD, FOMM, Jaguar, Land Rover, MG, Mercedes Benz, Nissan, Porsche, Toyota, Volvo). Although many companies have joined the consortium, key players in the charging station business (e.g., Energy Absolute and Sharge Management) have yet to join. Moreover, EV users can use the RFID card (issued by the Electric Vehicles Association of Thailand) to charge their EVs at charging stations in the consortium.

In summary, the policy developments reflect the attempts of the Thai government to use technology-push policies to boost the EV charging business. The investment subsidy of MOE and EVAT, together with temporary electricity prices and tax holidays help lower the cost of the charging station operators. The national standard of chargers provides a clear direction for the common charger types used in the EV charging business, auto companies and EV users. Moreover, the charging consortium initiatives facilitate the collaborations among the EV charging operators and lay the foundation for future interoperability of charging stations. The government expected that these policies would drive the development of charging stations and thereby ‘pull’ the demand of users to adopt EVs.

4.3. Main Players: EV Charging Investment and Operations

By realising the trend of EVs around the world and the push-policies of the Thai government, many start-ups and incumbents in the Thai oil and gas industry, green energy industry and auto industry have entered the EV charging business over the past few years. The following section discusses main players and their EV charging operations.

4.3.1. Oil and Gas Companies

Leading companies in the Thai oil and gas industry have been moderately active in the EV charging business during this period. In the Thai gas station sector, there are both local companies (e.g., Bangkchak, PTT, PTG, Susco (73% market share of oil and gas retail)) and international companies (e.g., Caltex Chevron, Esso, Shell (27% market share)). PTT is the market leader with 41.5 per cent market share (interview note, a PTT manager). Since the mid-2010s, these companies have experimented with and developed the EV charging business. This is because they wanted to prepare for the disruption in the petroleum business that catalyzed the shift from ICEV to EVs. They also see the opportunity of the EV charging service that can draw EV users to use other services (e.g., café, restaurants, convenience stores) at their stations and in turn boost the proportion of non-oil revenue (see

Table 4).

- (1).

PTT Public Company Limited

PTT is a state enterprise and it is one of the largest market capitalized companies listed on the Thai stock market. It has subsidiaries operating in the upstream sectors (e.g., PTT Exploration and Production, PTT Global Chemical, Thai Oil, and IRPC) and downstream sectors (e.g., PTT Oil and Retail) of the oil and gas industry. Regarding the EV charging station operation, this business is operated by PTT Oil and Retail. A PTT manager explained that one of the strategies of PTT Oil and Retail was to create a ‘Living community’ where PTT gas stations were not only used for gas filling, but they would be a center for activities such as car maintenance, relaxation/ hospitality (cafés), dining (fast food restaurants), parking, banking, hosteling, mailing and logistics and convenience store shopping as well as charging EVs. Thus, the PTT stations would be a hub for e-mobility (e.g., car sharing, EV charging and maintenance).

As a state enterprise under the Ministry of Energy, PTT is a significant vehicle that drives the government’s energy policies including the EV and charging station promotion policy. Thus, since 2017, PTT has participated in setting up pilot EV charging points in PTT stations in Bangkok and key tourist areas. PTT has partnered with GLT Greenlots and installed Efacec charging devices at these stations [

67]. By early 2020, PPT had 17 charging stations with 25 normal charging outlets. As for the plan for PTT EV charging stations, a PTT executive stated that PTT would “wait and see” and use “a demand-led” approach to decide when and where they would build EV charging stations. The manager also projected that in the transition period to BEV, “the charging demand would be from PHEVs over the next few years.” Thus, the oil business of PTT will not be much affected during this period. However, PTT has tried to find new non-oil growth engines and invested in promising businesses e.g., battery, energy storage and EV. For instance, in 2019, PTT invested in 24M, a US company with a semi-solid lithium-ion battery technology [

68] and partnered with WM Motors, a Chinese EV company, to explore the opportunities to manufacture EVs in Thailand [

69].

- (2).

Bangchak

Similar to PTT, Bangchak and other oil companies have started to set up EV charging outlets in their gas stations. Bangchak is a local public company operating in four main areas of the petroleum business: oil refineries, gas stations and retailing, biochemical products, natural resources and energy. To test the EV charging business, in 2018, Bangchak installed EV charger units at their headquarters and the Rajapruek station. Then, in July 2019, Bangchak signed a memorandum of understanding (MOU) with Provincial Electricity Authority (a state enterprise) to collaborate in installing 62 quick chargers at Bangchak gas stations every 100 km along the main roads in Thailand by the end of 2021 [

70].

- (3).

Susco

Susco, a local family-controlled business, has also shown interest in the EV charging business [

71]. The CEO noted that selling oil and gas will get “a gross profit around 4–5% and gain a net profit of only 1%,” but the non-oil net profit (e.g., renting, dropping points for logistic companies, EV charging, retail) is much higher. Thus, Susco installed EV chargers at seven corporate owned stations to increase the non-oil revenue.

- (4).

Foreign oil and gas companies

Regarding the foreign oil retailers in Thailand, Shell’s subsidiary, Greenlot, has collaborated with BMW Thailand, Central Group, AP Thailand, and GLT to launch the EV charging network—“ChargeNow.” Caltex Chevron signed an MOU in 2019 with Energy Absolute (a leading local EV charging station provider) to partner in the charging station business [

72]. Esso, however, has not actively pushed forward their EV charging projects in Thailand yet. The CEO of Esso stated that, Thailand will use PHEVs as a transition into BEVs over the next 10 years [

73]. The market for EV charging stations will be small in this period, similar to the US and European markets, because 90% of EV users will use home charging and only 10% will use EV charging stations.

4.3.2. Electricity State Enterprises

In the electricity sector, the key players in the EV charging business are three state enterprises: Metropolitan Electricity Authority (MEA), Provincial Electricity Authority (PEA), and Electricity Generation Authority of Thailand (EGAT) (see

Table 5). These state enterprises have piloted the EV charging stations to support the EV promotion policy of the government.

- (1).

MEA

Although the main mission of MEA is to sell electricity to users in the metropolitan area (Bangkok, Nonthaburi, and Samut Prakarn provinces), it also has three businesses linked to EV and EV charging. First, MEA launched pilot charging stations and an MEA EV App to support EV users. MEA installed EV chargers at ten local offices that has allowed registered users to charge for free at these stations. According to the Governor, “MEA does not intend to compete with the private sector in the EV charging business.” Their EV charging project aimed to kick-start EV awareness and adoption in Thailand. Furthermore, MEA has partnered with Nissan in the project of charger installation and safety training for Nissan dealers. In January 2020, MEA collaborated with Delta Electronics in installing 50 charging points in Thailand [

74]. They will also merge their EV charging solutions into the MEA app. Second, MEA supplies and sells EV chargers for home and offices. Third, MEA provides an installation service and consultation for home charging. This service will provide correct advice on the necessary equipment and safe electrical systems for home installed chargers.

- (2).

PEA

PEA’s main mission is to sell electricity to users in the provinces outside Bangkok, Nonthaburi and Samut Prakarn. Similar to MEA, PEA has set up pilot charging stations at its offices to test run the systems and collect EV charging usage data. To expand the charging network, PEA has partnered with Bangchak and will install EV chargers in Bangchak gas stations in 62 provinces by 2021 [

70]. Moreover, in February 2020, PEA and KMITL university have developed the PEA Volta app to facilitate the booking, EV charging, and payment of the charging service [

75]. PEA also has a subsidiary, PEA-Encom, which focuses on green and renewable energy and EV businesses. PEA-Encom is a dealer for FOMM EV company and sells electric tuk-tuks.

- (3).

EGAT

Although the mission of EGAT is to generate electricity and it does not directly sell electricity to end users, EGAT has helped support the pilot EV charging station project of the government. EGAT set up charging stations in its 11 power plants and offices. These stations were opened to registered users in 2018 and there was no charging fee for one year in order to test run the system and collect usage data [

76]. EGAT also worked with National Science and Technology Development Agency in an experiment project that tried to convert ICEVs into EVs [

77].

4.3.3. Green Energy Companies

Apart from the three state enterprises in the electricity sector, companies in the green and renewable energy sector, such as Energy Absolute, and GLT are also building their own charging station networks to capture the growing EV market (see

Table 6).

- (1).

Energy Absolute (EA)

Even though EA is not a member of the EV charging consortium, EA is the one of the most active companies who have actively built the charging station network in Thailand. The CEO of EA recounted that “since the Thai government intended to promote the use of EV and create an EV manufacturing hub in Thailand, EA should invest in businesses linked to the government agenda” such as battery, energy storage, EVs and EV charging stations. Thus, EA applied for licenses from the Thailand Board of Investment and set up subsidiaries such as MINE mobility research and corporation for the EV manufacturing business, EA Anywhere for EV charging business, and AMITA technology for battery manufacturing [

78].

Regarding the charging station business, EA installed charging outlets at shopping malls (Siam Paragon and Crystal Design Center) in August 2017. In 2018, EA set an ambitious target of creating 1000 charging stations to reduce the “range anxiety” of EV users. To quickly expand the charging network, EA partnered with gas stations (e.g., Caltex, Susco), shopping malls (Siam Paragon, Icon Siam, Habito T77, Seacon Square), retailers (7-11, Big-C, DoHome, Global House), electricity providers (MEA), property developers (Sansiri, Sena, Sammakorn), banks (SCB), hotels (Intercontinental, Novotel, Escape), hospitals (Samitivaj, Vibhavadi), restaurants (Dining in Green, Nittaya Kai Yang), offices (SCG, Chamchuri Square, NIDA), parking spaces (Ease park), auto dealers, and services (MG, Jaguar, Land Rover, Car Magic) [

79]. EV users can use the EA Anywhere app to search for the nearest station, reserve and pay the charging fee. In January 2020, EA has a total of 104 partners with 573 normal chargers in 376 locations. EA has already installed 240 fast chargers though they are not yet operational [

79].

- (2).

GLT

GLT is a subsidiary of Polytechnology Co., Ltd. It is a distributor of automation systems and provides engineering and controlling systems for the Thai oil and gas sector. Another business of GLT is the installation of natural gas units for vehicles. Regarding the charging station business, GLT collaborated with Shell’s Greenlots to develop charging stations and provide systems and solutions for EV charging [

80]. It is a key partner in the ChargeNow network of BMW. GLT also partnered with Efacec to import Efacec chargers into the Thai market. In 2020, it is the second biggest player in the EV charging station industry in Thailand.

4.3.4. Start-Ups

Apart from incumbents such as EA and GLT, many start-ups in the green energy sector—such as GridWhiz, Evolt, EVen, EVF, Sharge Management, Future Charge, and the Fifth Element—are interested in the sale and installation of home charging units for EV users as well as setting EV charging systems for residential and commercial areas (see

Table 7).

Regarding the home charging market, some start-ups partner with big international brands of EV equipment (ABB, Alfen, Delta Electrics, EVBox, Schneider, and Siemens), whilst the others may import smaller brand chargers from the UK, Sweden, and China. Most start-ups tend to use Facebook pages and websites to promote their products and services. Despite targeting EV users in main cities, a few companies have tried to expand dealerships to sell their products across Thailand. As for the EV charging station business, due to their limited resources, the strategy of these start-ups is to partner with shopping malls, office buildings, and property developers to install charging outlets in these locations. Some companies have also developed their own EV charging apps so that users can find, reserve, and charge their EVs at these stations. The following section will discuss the charging operations and recent developments of these start-ups.

- (1).

GridWhiz

This company was set up in 2013 and has developed an EV charging management app called, Pumpcharge, that can locate and reserve the charging outlets and help navigate EV users to the compatible charging stations [

81]. GridWhiz took part in the electric tuk-tuk project in Chiang Mai and helped PEA-Encom manage its EV charging operation.

- (2).

EVen (Chosen Energy)

Chosen Energy aimed to be “the leader in EV Charging, Smart Payment and Smart Energy Platform in Thailand and ASEAN” [

82]. It launched its smart energy EV-Box chargers (imported from the Netherlands) for homes and businesses in 2017. It installed EV-Box chargers at its business partners’ parking areas (e.g., Central Department stores, Centara Hotels, and Volvo office). EVen provides an EV charging management platform, an EV charging app and EV charging devices (e.g., EV-Box chargers). In 2019, they expanded the charging business and entered the EV charging market in Laos.

- (3).

EVF

EVF was set up in 2017 as a new business unit of a steel manufacturing company which also operates Spyder Auto Import company. EVF sells wall box chargers made in Sweden and locally branded as the Halo charger [

83]. Its wall box can be connected via Bluetooth and unlocked with facial recognition features. For the charging business, it tries to be “a one stop service for EV charging solutions.” For instance, it provides consultations to the station operators about charging unit installation as well as helping to manage the charging operations (e.g., maintenance service with a 24-h call-center) [

84]. It aims to set up charging stations in major office buildings and shopping malls (King Power), community malls (the Circle Rajapruek), and government offices (Ministry of Energy).

- (4).

The Fifth Element

This start-up targets charging stations in shopping malls [

85]. A manager of the Fifth Element remarked that “people may find it difficult to find a parking lot in these stores. So EV users can use charging stations as their parking lot while charging their EV.” Thus, they partnered with the Mall Group. The locations of their charging stations are in the EM District, the Mall Bangkapi and Bangkae, and their stations use Schneider EV link chargers.

- (5).

Evolt

Evolt tries to install their EV chargers at office buildings, universities and government areas, condominiums, and shopping malls. Their charging locations are at Whizdom 101, Thammasat University, Department of Industry Promotions (in Bangkok, Chiang Mai and KhonKaen) [

86]. An Evolt manager explained that “people will spend most of the time parking their EVs at these facilities for many hours.” Evolt also developed its own app to locate and reserve its charging stations. To attract EV users to its charging stations, they provide a free charge to registered users.

As for its home charging business, Evolt set up another company, PromptCharge, to focus on this operation. The marketing strategy was to offer a cheaper wall box charger, compared with those sold by auto companies [

87]. For instance, its 7 kwh EO Mini wall box is priced around “49,000 Baht (or 1575 USD), including the installation fee whilst the charger of auto companies may cost from 100,000 Baht (3202 USD) without the installation fee.” Promptcharge also partners with MG to install chargers for MG customers and at 53 MG dealers all over Thailand.

- (6).

Future Charge

Despite being a start-up in the EV charging business, the founder has “over 20 years of partnership with Siemens Thailand”. Thus, it is an official distributor of Siemens EV chargers and provides installation services at homes, condominiums (Knightbridge Sathorn, Paholyothin) and hotels (Carlton hotel Sukhumvit 27), offices (TMB bank, Hyundai Motor Thailand), and shopping malls (Digital Makro Ladkrabang) [

88]. It also installed EV chargers for customers of car dealers (e.g., Setpoint group, OSK motoring) and car companies (e.g., Porsche). Future Charge also offers 3-year warranties and 20 million Baht (or 640,471 USD) insurance cover for damage caused by the EV charger.

- (7).

Sharge Management

Sharge Management was founded in 2017, and provides both hardware (Scheiner and Terra wall box chargers) and software for its charging operations. It has targeted EV users with high purchasing power. Thus, it has partnered with leading department stores in Thailand (e.g., the Central group) [

89]. The locations of their charging stations are at Central Chidlom and Central Embassy. Sharge Management also partnered with leading property developers (e.g., Sansiri, Pruksa, and Singha Estate). For example, it has joined Sansiri’s EV ride sharing platform called “Smart Move” in Sansiri residential projects [

90]. It installed 81 EV charging points in Sansiri’s 25 property projects and provides EV charging solutions in the Sansiri home service app. In 2020, it had a total of 129 charging outlets in residential and commercial areas in Bangkok.

4.3.5. Automotive Companies

Besides key players in the oil, gas, and energy sector, EV charging facilities in Thailand also receive investments from automotive companies who market their EVs in Thailand (see

Table 8). This is hoped to build confidence for EV buyers that there will be enough charging stations for them. For instance, BMW’s ChargeNow network has around 39 charging outlets in its 16 stations [

91] whereas Mercedes Benz has developed the EQ-Electric Intelligence network and has 63 charging stations at leading hotels (e.g., Marriott International, Minor Hotels and Hilton) [

92]. Nissan and MG (partnered with EA Anywhere) allow their EV customers to charge Nissan Leaf and MG Zs EVs at their dealers.

In summary, the EV charging station operations of these five key players (oil and gas companies, electricity state enterprises, green energy companies, start-ups, and automotive companies) can be seen in

Table 9. Regarding the factors that drive these companies to invest in the charging station business, both local and foreign oil and gas companies wanted to prepare for the disruption in the automotive sector and to increase non-oil revenues. The strategic move of these companies in Thailand is thus mirroring the strategies used by global oil companies that have experimented, invested in or acquired charging station businesses [

87,

88]. Electricity state enterprises (MEA, PEA, EGAT), as government business arms, needed to support the EV policy and pilot projects of the Thai government. They also recognized the potential of EV charging stations as a new source of revenue. However, green energy companies (EA and GLT) and start-ups aimed to capture a new and growing market in EV charging station and green energy whereas the auto companies (BMW, Mercedes, Nissan, and MG) set up the charging station network to support their EV users and boost EV sales.

As for the business strategy, oil and gas companies seem to use the diversify strategy to invest in non-oil businesses (i.e., EV charging) to create a new engine of growth when the world is moving towards EV usage. Some of them (e.g., PTT) have decided to set up EV chargers in their gas stations whilst others (e.g., Bangchak, Susco, and Caltex) have partnered with charging station companies (e.g., PEA and EA Anywhere) to install chargers in the gas stations. They foresaw the gradual increase of EV charging in Thailand over the next few years and would, hence, “wait and see” the rise in numbers of EVs before fully investing in the charging business. The strategy of electricity state enterprises is similar to oil and gas companies; they realized the new market of selling electricity to charging stations and EV users. Thus, during the period (2015–2020), they test ran the stations and developed apps and provide free charging to learn about EV user behaviors. Green energy companies and start-ups, however, appear to move fast to expand their EV charging network and develop mobile charging apps. Their strategy is to achieve the first-mover advantage and lock-in customers to use their service. To limit the investment costs, they tried to partner with property developers, hotel operators and shopping malls and started charging operations in the partners’ locations. Many start-ups decided to join the EV charging consortium to increase their visibility and nurture collaborations with other stakeholders in the consortium. The strategy of the auto companies is to create their own charging network that will strengthen their brand image (e.g., BMW’s ChargeNow and Mercedes-Benz’s EQ-Electric Intelligence) in locations (e.g., luxury malls and premium hotels) where their customers tend to patronize. Other auto companies (Nissan and MG) set up charging stations at their dealers to reduce operation costs and support their EV customers.

4.4. Key Issues in Expanding the Charging Station Network

Regarding the number of charging stations in Thailand, as of November 2020, the number collected by the Department of Land Transportation and EVAT shows that there are 647 EV charging stations.

Table 10 shows key service providers (EA, Evolt, EVAT/Ministry of Energy, PTT EV, ChargeNow, MEA, PEA, EGAT, EVen, and Pumpcharge) and the number of their charging stations. Most of the outlets are normal chargers (i.e., 1376 normal chargers and 706 fast chargers) [

12]. EA Anywhere has been the most active company that can expand the charging network to 405 locations by partnering with leading restaurants, shopping centers, and property developers.

EV charging stations tend to be in Bangkok, key provinces (Chiang Mai, Phuket, Nakhon Ratchasima) and tourist destinations such as Pattaya and Huahin. Many operators (e.g., EA Anywhere, MEA EV, Pumpcharge, and EVolt) developed their own mobile apps and provide functions to locate, reserve and navigate EV users to the nearest charging stations. However, users may need to download the mobile app and register with each operator before using the chargers. At the moment, there has been no single platform that allows users to use charging outlets at any stations. EV users also reported that “stations with DC fast chargers may be at the offices of PEA, EGAT, or MEA and their locations require a detour from the trip plan” [

93]. EV users further commented that some charging points may have malfunctioned but shown as normal in the system; or were occupied when they arrived at the stations. “There were queues at the stations during weekends or holidays” [

94]. Sometimes, the EV charging areas were “occupied by ICE cars whose owners could not find regular parking spaces” [

95] and there are no rules or penalties associated with parking in the EV charging spaces. The lack of EV chargers on the main road and the inconvenience of EV charging were among the factors that deterred people from adopting EVs.

Table 11 summarizes key issues and recommendations on how to develop the charging network in Thailand. A major issue of these key players involves the limited number of EVs in Thailand. Over the past five years, although the number is steadily rising, EVs are not widely adopted because the price of EVs is still very expensive in the view of customers (when compared with ICEVs). All the main players commented that they would also appreciate more demand-pull incentives from the government that can help lower the EV price. Up to now, there are no demand-pull policies—e.g., purchase subsidy or tax rebate for EV buyers. Most of the policies tend to be technology-push measures for the charging investors and EV manufacturers. Many informants of these key players suggested that the Thai government “should stimulate the EV demand by issuing direct benefits to EV buyers” during this early adoption stage of EV. Without enough EV users, the operations of EV charging stations will not be sustainable.

Moreover, informants from oil and gas companies are still uncertain about the EV charging revenue from the investment in building charging stations because the data from other countries suggest that most people tend to charge EVs at home [

33]. Hence, the charging operators (e.g., PTT and small EV charging operators) have adopted a strategy of “wait and see” and cautiously expanded their charging network due to the upfront investment being very high. For instance, a high-performance DC fast charger costs around 1 million Baht (or 32,023 USD) whilst an AC normal charger costs around 200 to 300 k Baht (6404–9607 USD). Since the number of EV users in Thailand is still low, it will take longer to recoup the investment costs. Thus, the demand-pull policies to boost EV adoption would create the customers for their EV charging business. Electricity state enterprises, however, need a clear mandate from the government before they can fully dive into the EV charging business. This is because their current mission is to generate and sell electricity; they should not be seen to “directly compete with private sectors” or having unfair competitive advantages against private sectors in the EV charging business. The government should make decisions on the suitable role of electricity state enterprises in the charging station business.

For the green energy companies and start-ups, they would prefer to have electricity selling prices that were favorable to EV charging businesses. Until early 2020 [

2], charging operators needed to pay a demand charge to electricity providers. An EV enthusiast explained that this payment heavily increases the cost of the operation [

96]. A charging station will be charged with the electricity rate of a mid-size business (i.e., a business that uses less than 12 kilovolts per month). The demand charge for them will be 210 Baht (6.72 USD) per kilowatt. If this station has just one 50 kw DC fast charge outlet, the monthly fee would be 10,500 Baht (210 Baht * 50 kw) (336 USD). This demand charge will be a fixed cost every month even if no one uses this outlet during that period.

Apart from the demand charge, the EV charging operators have to pay a usage guarantee fee every month [

96]. This fee is calculated by multiplying 70% of the previous month’s electricity bill. However, even if their real usage of the following month amounts to zero (i.e., no one uses the charging device), the operator still has to pay this usage guarantee fee (70% amount of the previous bill). For instance, if the electricity bill of an operator is 100,000 Baht (3202 USD) in April, in May, the operator still needs to pay 70,000 Baht (2,41 USD) to the electricity provider even if the real electricity bill is lower than 70,000 Baht (2241 USD). The rationale of this fee is to provide stable revenue for the electricity providers to generate enough power and motivate the electricity users to stabilize and plan their usage. However, this usage guarantee fee raises an issue for the EV charging operators because during this early stage of EV adoption, the charging demand may be fluctuating and hard to predict. For instance, in April, during the Thai New Year holiday, there may be many EV users charging at the station. However, in May, the charging activities may swing back to its normal rate. Thus, to avoid the demand charge and usage guarantee fees, operators who have installed both DC fast charge and AC normal charge outlets, do not operate the DC fast charge outlets. In summary, the demand charge and usage guarantee fee are a significant factor that increases the operational costs and slows down the expansion of the EV charging station. Hence, they should be restructured.

In addition to suitable electricity prices, some start-ups which have limited investment funds, would appreciate “more financial support” in building charging stations. Although the past subsidy program of MOE and EVAT in 2018 to support the building EV charging station is a good project, start-ups operators believed that the fund size was limited and private sectors got lower amounts of funding support than the government and state enterprises. They suggested that the government should provide more financial support during this early stage where the number of EV users is limited; and thereby the operators would receive low revenues from charging customers. The government may also rent out public space (e.g., areas near park and ride, government offices, parks) at a low price to the private charging operators to fully utilize the areas for charging facilities. These initiatives could support the private sector and expand the charging network to cover more areas. Moreover, the operators commented on the need to create the inter-operability protocol (such as privacy protection of user data and fee transfer) between charging operators. The inter-operability protocol should not only be addressed between members in the EV charging consortium, but also operators who are not in the consortium to provide convenience and good user experience for EV users.

5. Discussion

This paper examined the development of charging stations in Thailand since 2015. First, we found that main players in the charging stations business in Thailand include oil and gas companies, electricity state enterprises, green energy companies, start-ups, and automotive companies. These companies spot the opportunities in the growing Thai EV market. Similar to China where the role of state enterprise and government is extensive in building the charging infrastructure [

52], the Thai government has used many technology-push policies (e.g., tax-incentives for investors and pilot stations) to jump start the EV charging stations when the number of EV users in Thailand was still very low.

Regarding the operation and strategy of these players during the nascent stage of EV adoption, many companies, especially PTT and oil retailers chose to “wait and see” and gradually expanded their charging stations. The investment in charging stations was their experiment to prepare for the disruption in the automotive sector and to increase non-oil revenues. The strategic move of these companies in Thailand is thus mirroring the strategies used by global oil companies that have experimented, invested in or acquired charging station businesses [

97,

98]. As for the Thai competition landscape between 2015 and 2020, there is no single company that can dominate the EV charging market. However, Energy Absolute seems to be the most active company that can expand the charging network to many locations. To limit the investment costs, the charging operators in Thailand tend to partner with other companies with different strengths. For instance, Bangchak and Caltex partnered with PEA and EA Anywhere in setting up charging points in gas stations. Many start-ups tried to partner with property developers, hotel operators, and shopping malls and started charging operations in the partners’ locations.

Second, the key issue in expanding the charging network in Thailand is the high investment costs and the high price (i.e., demand charge and usage guarantee fee) of selling electricity. These factors together with the low numbers of EV users in Thailand have raised a profitability concern among the charging operators. This chicken-and-egg dilemma in EV development can also be found in other regions as well [

37]. Previous studies suggest that the fast charging stations along highways will become more attractive and profitable only when there are enough EV users [

99]. Since the number of EV users in Thailand is still at the early stage, it will take longer time to recoup the investment costs. The Thai policy makers may study the policies to support EV charging stations in other countries. For example, the development of EV charging networks in the US has been led by the private sector, especially automotive, and oil companies (e.g., Supercharger network: Tesla, Chargepoint: Daimler, BMW, Siemens, Chevron and Toyota; Electrify America: Volkswagen) and there are new alternative business models of EV charging being tested (e.g., solar stations of Envision (Shell); free with advertisement-based chargers of Volta Chargers; mobile chargers of Spark Charge and Freewire) [

100]. Nevertheless, the federal and local governments also provide incentives and create a database of the EV charging stations to support the investment of the private sector. The US General Services Administration has built EV charging outlets for the employees of the federal offices. The Los Angeles Department of Water and Power subsidized EV charging stations up to 4000 USD [

101]. The US Department of Energy created a website showing a map of EV charging stations in the US. This database provides the telephone number, charging types, connectors and network, operating hours and can navigate users to the station. In China, the Central Chinese government provides funding (up to 14 million USD) to local governments for EV charging stations. The Chinese provincial governments and cities set up a funding scheme to subsidize up to 30 percent of the EV station investment [

101].

Realizing these constraints, the Thai policy makers plan to lower the investment costs and help increase profitability of the charging operators. In February 2020, the Energy Policy Administration Committee and the National Energy Policy Committee approved the “EV Charging Station Mapping” project to expand the network of EV charging stations to cover wider areas [

102]. The financial support of the charging station investment will be from the Energy Conservation Fund. Moreover, the committees set a new electricity price to reduce the investment and operating costs of the charging operators. Unlike the peak and off-peak electricity rate in the past, the new price is an all-day fixed price at 2.6369 Baht per unit [

103]. The demand charge and usage guarantee fee were also cancelled. Moreover, to guarantee the interoperability of the chargers and allow EV users to seamlessly charge at any stations in the future, in July 2020, EVAT and 11 organizations (EGAT, MEA, PEA, PTT Plc, PTT Oil and Retail, Gridwhiz, Evolt, EA, GLT Green, Chosen Energy, and the Fifth Element) signed an MOU to standardize operations, share data and set a standard charging fee [

104].

Finally, the limited number of charging stations and the low penetration of EVs appear to result from the lack of leadership and coordination in driving the EV market and EV charging station development at the national level. Realizing these shortcomings, the Thai government set up the National EV Policy Committee in February, 2020 to oversee the strategy and policy implementation to facilitate the collaborations among stakeholders [

102]. This committee comprises the Prime Minister, Deputy Prime Minister, Ministers and Permanent Secretary of the Ministry of Industry, Ministry of Transportation, Ministry of Energy, Thailand Board of Investment, National Economic and Social Development Commission, Head of the Federation of Thai Industries and the Thai Chamber of Commerce and industry experts.

To promote more EV adoption, the National EV Policy Committee first convened in March 2020 and endorsed the roadmap for “Thailand Smart Mobility 30@30” [

102]. Thailand aims to manufacture 750,000 EVs (or 30% of car manufacturing capacity (2.5 million cars)) in 2030. For the short-term goal of the roadmap (2020–2022), it will promote EV usage in the government fleet, public transportation and motorcycle taxis. Moreover, it sets the target of 60,000–110,000 EVs as personal cars by 2022. The committee also plans to have demand-pull incentives for EV users during this period e.g., a direct financial support in the “EV Pracharat” project. For example, people can exchange an old ICEV and get up to 100,000 Baht reduction for a new EV. Moreover, as the previous research suggested that EV policies should be comprehensive and well-balanced [

3,

27,

48], Thailand may benefit from using both demand-pull and technology-push incentives. An industry expert commented that although the policies of the National EV policy committee may seem promising, technology-push incentives such as regulations and stricter standards (e.g., the carbon dioxide emission tax charged to the car manufacturers or the policy to ban ICEVs by a certain year) are not used in Thailand. Hence, these “penalty policies” should be implemented along with stronger demand-pull incentives for EV users (e.g., purchase subsidies, personal tax credits, tax exemption or rebate, free access to certain areas of the city, and free usage of expressway) to drive both users and auto companies in Thailand to transition to EV faster. However, experts believe that during the Covid-19 period, the budget to support demand-pull and technology-push incentives may not be readily available since the government needs to set a budget for vaccines and economic stimulations.

Regarding the limitations of the research, since this study is a qualitative case study focusing on the development of the Thai charging stations, the findings may be difficult to generalize in other contexts. However, the authors believe that the lessons learned from this case may be applicable to other developing countries whose governments plan to promote EV adoption. State enterprises and government organizations may take a lead in building pilot charging stations. Moreover, governments should take initiatives to lower the investment costs of the charging operators such as providing demand-pull subsidies and favorable electricity selling prices. As for the future areas of research, researchers may track the charging operators in Thailand and examine how their strategies and competition landscapes evolve when more people begin to use EVs. To what extent can the new demand-pull and technology-push policies lower the investment cost of charging stations help the operators expand their charging network? Furthermore, since this study mainly focuses on the supply side of the EV charging industry, we have yet to study the demand side or the perspective of the EV users. Future research may examine the attitudes and opinions of the Thai EV users when using the charging services. The insight into the user opinions would enable the government and operators to improve the charging service and accelerate the EV adoption.