1. Introduction

The digital economy and society, which are expanding on an increasing scale, are striving to achieve sustainability by searching for appropriate solutions that will ensure sustainable development. This applies not only to the economics and economic spheres but also to logistics. As more than 90% of vehicles all over the world run on oil [

1], there is a noticeable trend of desire to power vehicles with alternative energy sources. As a result, the subject of electric vehicles (EVs) is gaining popularity. Modern ways of powering vehicles, such as electrically powered engines, have the potential to be a solution consistent with the sustainable development policy [

2,

3]. As the problem of rising levels of global air pollution is serious, the use of electric cars can be a response to the achievement of sustainable development goals. While driving, electric cars do not emit harmful gases (such as carbon dioxide or nitrogen oxides), thus contributing to the limitation of the expansion of the scale of urban smog and the greenhouse effect [

4,

5,

6]. Furthermore, the purchase, possession, and use of an EV may entail positive effects, such as tax breaks, the ability to drive on bus lanes, or free parking in city centers [

7]. The most-explored subjects of scientific research in the field of EV market are: the role of electrification in public transport [

8,

9,

10,

11,

12,

13,

14], personal transport devices (for example, electric scooters) [

15,

16], electric bicycles [

17,

18,

19], or electric cars. Most studies on electric cars raise issues such as:

battery life and its optimization [

20,

21,

22,

23,

24],

charging stations for electric cars [

27],

legal regulations and facilitations for holders [

7],

business models in electric mobility [

5,

28],

ecology and environmental impact [

1].

However, from the perspective of economic sciences, factors that affect the final choice of an electric car by a consumer are the most significant. Price is the basic and the most important determinant which has the greatest impact in the process of making a purchase decision for a given good and this also includes electric vehicles [

29,

30]. Other factors that may affect a consumer’s increased willingness to buy a given car model include: car range, flexibility (including acceleration), boot size, and brand prestige [

29,

31].

It was noticed that the increase in sales of electric cars in Poland and other Central and Eastern European countries is not very dynamic. The conducted analysis may be seen as a starting point for examining the need for subsidies implementation by decision-making bodies and investments in infrastructure for electric cars.

The research gap identified on the basis of the literature review is the lack of comprehensive segmentation of the Polish electric car market. For example, conventional segmentation in automotive markets carried out in Europe (which distinguishes “classes” of cars) usually is based on prices and model sizes only. The segmentation proposed by the authors also takes into account the taxonomy analysis of similarities in terms of many other vehicle characteristics, such as engine power, load capacity, or battery and charging parameters. The study carried out in this way has the applicable character and shows that, for example, the given vehicle models are not very diverse in terms of their parameters, but vary in terms of prices. This may indicate a luxury good in the case of a more expensive model. This study fills this gap, and its purpose is to present the performed segmentation, during which the similarity of the characteristics of electric car models on the Polish market was identified and the classification of such cars was proposed. The following research questions were posed:

What are the technical parameters of an electric car in Poland?

What are the similarities among the available EVs in Poland?

What kind of car groups can be distinguished?

How will the consideration of the price change the affiliation to the specified car groups?

3. Results

3.1. Structure of the EV Market in Poland Dataset

The structure of the set was presented using descriptive statistics. For non-metric variables (“Number of seats”, “Number of doors”, “Type of brakes”, “Tire size”, “Drive type”), the frequencies of individual features were presented (see

Figure 1), while the metric variables were arbitrarily divided into 4 groups:

Battery—“Battery capacity”, “Range” (

Table 2),

Size—“Wheelbase”, “Length”, “Width”, “Height”, “Minimal empty weight”, “Permissible gross weight”, “Maximum load capacity”, “Boot capacity” (

Table 3 and

Table 4),

Performance—“Engine power”, “Maximum torque”, “Maximum speed”, “Acceleration 0–100 kph” (

Table 5 and

Table 6),

Others—“Minimal gross price”, “Maximum DC charging power”, “Energy consumption” (

Table 2).

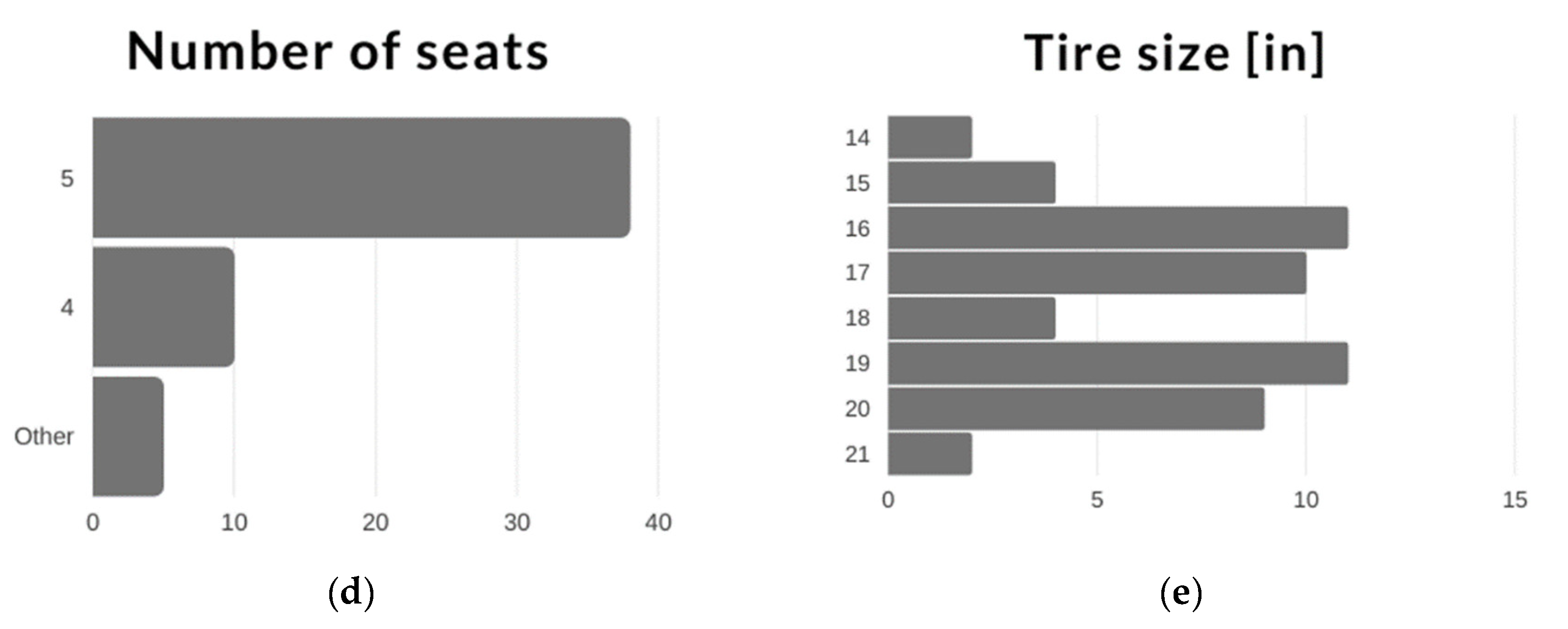

The number of doors in electric cars varies—most cars have 5 doors (88.7%). Every third electric car on the primary market is a 4-wheel drive, while the largest number is a 2-wheel drive (45.3%—front axle and 20.8%—rear axle). All cars have brakes both at the front and rear (13.5% of them have a rear drum brake (in the case of Volkswagen, Škoda, and Smart)). The vast majority (38 out of 53) has 5 seats, and only 10 out of 53 have 4 seats. Electric cars in Poland have various sizes of tires. It is worth emphasizing that the Citroën ë-c4 model is equipped with 16-inch front wheels and 17-inch rear wheels (in all trim levels). Among the variables, the number of doors, the number of seats, and the type of brakes are not very diverse among the analyzed cars. The “tire size” variable, on the other hand, does not contribute much to segmentation, as a consumer can equip their car with larger tires depending on their needs and individual preferences. Therefore, it was decided to take into account the “drive type” variable, which brings greater value to the analysis.

Electric car prices in Poland start from PLN 82,050 (Škoda Citigo-e iV), while the most expensive car costs a minimum of PLN 794,000 (Porsche Taycan Turbo S). Electric cars on average cost PLN 244,271.72, and prices deviate on average by 149,634.43 from the average value. Fifty percent of cars are cheaper than PLN 169,700 and at the same time, 50% are more expensive than PLN 169,700. Electric car prices are asymmetric to the right, which means that there are definitely fewer cars more expensive than the average price. Furthermore, there is a large concentration around the mean value.

The Smart forfour EQ has the smallest range in the test dataset, specified by the manufacturer as 148 km. The Tesla Model S Long Range Plus has the greatest range (652 km). The distributions for battery capacity and range are not significantly asymmetric, however, the battery capacity distribution is less concentrated around the mean value.

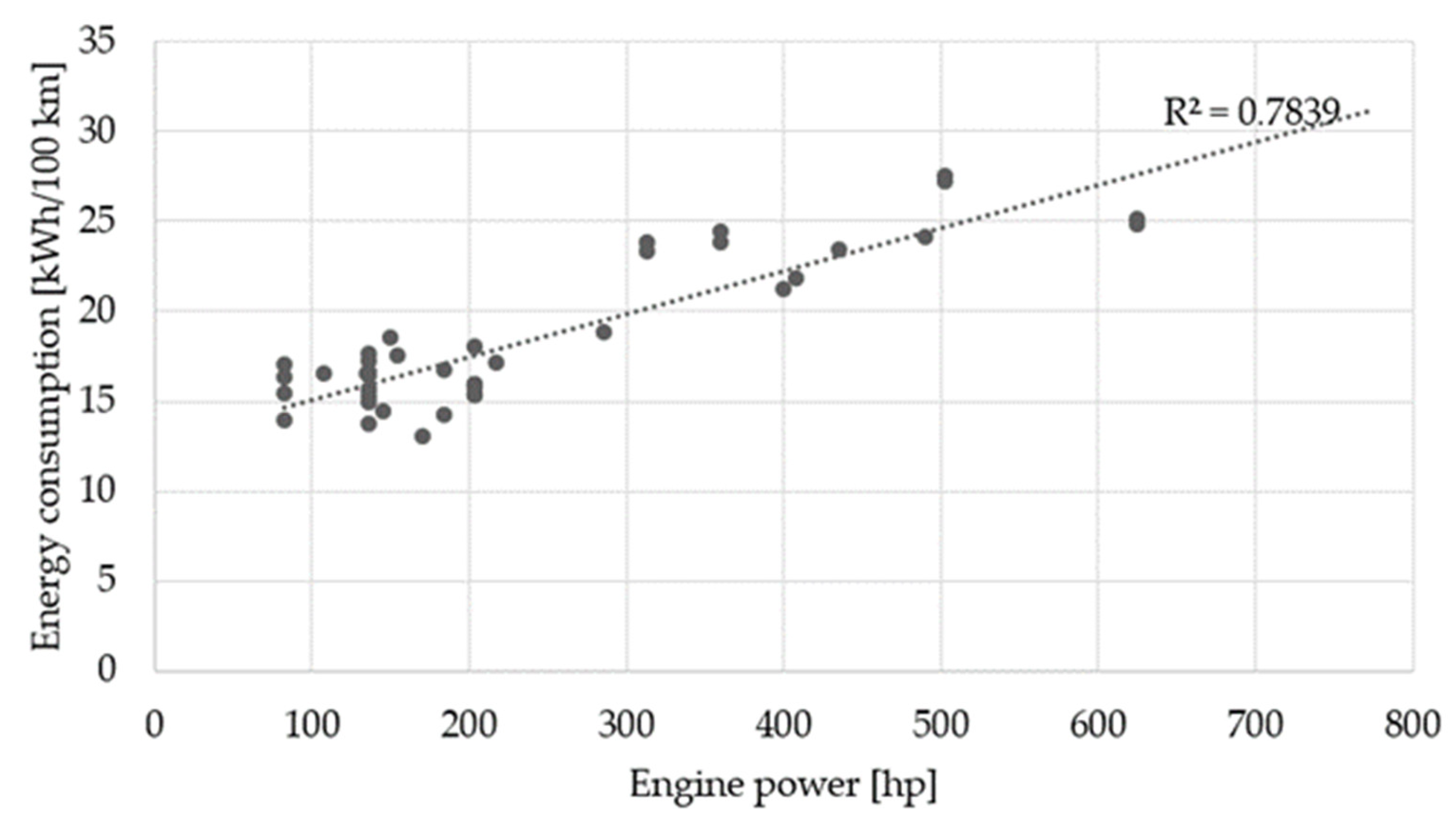

Manufacturers use different combinations of battery capacity and engine power to increase the vehicle’s range. Based on the calculated correlation coefficients, it should be concluded that there is a strong positive relationship between the battery capacity and the vehicle range. This means that the greater the battery capacity, the greater the car’s range on average. Despite the strong dependence, it was determined to take into account both of these variables in further analysis. The battery capacity, along with the possibility of charging with a higher current, translates into an increase in the competitiveness of a given model, when the car will require recharging, especially when driving longer distances. Moreover, the correlation analysis shows that a weaker motor is characterized by lower energy consumption.

The maximum DC charging power options are characterized by right-hand asymmetry, which proves the Porsche manufacturer’s pursuit of charging speed and efficiency. The maximum value of DC charging power is as much as 270 kW, and the smallest is over ten times smaller (22 kW—in case of Smart models). Electric cars are characterized by poor differentiation in terms of energy consumption. Due to the adopted criteria, this variable was not included in the further analysis. Descriptive statistics for the

size group are presented in

Table 3.

The size of the car is the basis for determining its segment in terms of size. The models of EVs available in Poland are characterized by low variability in terms of wheelbase, width, and height. In contrast, the length distribution among models is not so concentrated around the mean value. The shortest available model is the Smart fortwo EQ (269.5 cm), while the longest is the Mercedes-Benz EQV (514 cm). Electric cars in Poland weigh from 1035 to 2710 kg, while the boot capacity, according to the VDA standard, (for broader description see

Appendix A) ranges from 171 to 870 L.

Table 4 shows the values of the correlation coefficients of individual variables classified to the

size group.

The “width”, “height” and “wheelbase” variables are characterized by low variability and according to the adopted criterion, they will not be included in the classification. There are insufficient observations for “permissible gross weight” and “maximum load capacity” variables due to truncated data provided by manufacturers. Moreover, the variable “permissible gross weight” is strongly correlated with “minimal empty weight”, while the “maximum load capacity”—with “boot capacity”. Descriptive statistics for the identified

performance group are presented in

Table 5.

The models of the Smart manufacturer—fortwo EQ and forfour EQ—have the lowest engine power (82 hp), while the most powerful cars in the set are Tesla Model X Performance and Tesla Model S Performance (772 hp). Electric cars in Poland reach a maximum speed of 123 to 261 kph, with the maximum torque varying from 160 to 1140 Nm. Acceleration from 0 to 100 kph is from 2.5 to 13.1 s. When analyzing the individual performance characteristics of cars, it should be stated that despite the large variation in engine power (67.2%), there is a low variation among the maximum speed. However, these are absolute values and differ in the units of measurement. The dependencies between the individual performance parameters are presented in

Table 6.

It should be noted that all the variables are highly correlated with engine power which makes it possible to state that “engine power” is the variable determining the remaining performance parameters. For this reason, it will be treated as a factor to determine the similarity of particular models so that the information of the other vehicles does not distort the classification process.

3.2. Market Segmentation

In connection with the analysis of the model dataset structure, the following variables were used for classification: “engine power”, “minimal empty weight”, “length”, “maximum DC charging power”, “battery capacity”, “range”, “drive type”, and “boot capacity”. The number of specified groups results from an arbitrary decision, supported by the analysis of coefficients quotients (see

Figure 2; analysis of coefficients quotients with the use of “boot capacity” variable inclusion is presented in

Figure A1 in

Appendix B). The process of merging into clusters is presented in

Figure 3 (another variant of merging into cluster process with the use of “boot capacity” variable inclusion is presented in

Figure A2 in

Appendix B).

Based on

Figure 2 and

Figure 3, the data set has been divided into 4 variants (subgroups). The numbers of individual clusters are presented in

Table 7.

It was arbitrarily concluded that in the case of the division into 7 classes, there are large differences in terms of their numbers, which prevents intuitive interpretation. Therefore, the first considered classification was the division into 4 classes. Cars belonging to particular groups are presented in

Table 8.

The cars in individual groupings have certain common features that allowed the formation of the names of these clusters. Their names are as follows: “premium”, “city”, “small”, and “sport”. Cars belonging to the “premium” group are very expensive to buy—the cheapest of them (Volkswagen ID.3 Pro S) costs PLN 179,900, while the average minimum purchase price for these cars is PLN 277,630. These are also largely cars of brands seen as luxurious ones [

45]. Although these EVs have large dimensions and robust components (such as a high-power engine, or usually 4-wheel drive), their main purpose is not to drive dynamically, but to provide driving pleasure in ultra-comfortable conditions. The “city” group consists of compact vehicles with a universal character, mostly for daily urban but also extra-urban driving as well as most everyday applications. The “small” cluster includes cars with small dimensions, practically suitable only for urban driving, as their range does not allow for a longer trip without the need for additional charging. The “sport” group includes cars whose main purpose is dynamic or fast driving. Vehicles from this segment are characterized by sporty attributes, i.e., have above-average engine power and torque. They are also similar in terms of their wheelbase of 290 cm and more.

The prices of the models were compared in the classes defined in

Table 8. It should be emphasized that in the split variants for 2, 3, and 4 clusters, all prices differ significantly for each class. Detailed results are presented in

Table 9.

The next step was to compare the classification including and excluding the “price” variable. The results are presented for 2 classes in

Table 10, and for 4 classes in

Table 11.

It is worth noting that in both cases the price results neither in the size of the groups in the classification nor in one of the models. It can, therefore, be argued that the models are also similar in terms of price.

4. Discussion

The research, as one of the few in this field, is complete, which means that all fully electric passenger car models sold in Poland were used. The basis for its conduct was the creation of a complete dataset using all the basic technical parameters of individual models, which proves its versatility. In Poland, the EV market of passenger cars and buses is the most developed. A specific gap in the market is the lack of electric trucks that would represent a high added value to achieve the sustainable development goals in inland freight transport.

The dataset that contains electric car data and that has been prepared for segmentation is almost complete. The deficiencies noted were minor and did not significantly affect the reliability of the results. However, attention was drawn to the fact that the structure of the official technical data varies depending on the manufacturer. Often, it does not contain all the technical data or the methodology for measuring some parameters (e.g., in terms of boot capacity, range, or energy consumption) differs. This may be a suggestion for both manufacturers and control (approval) authorities to unify and standardize the structure of technical data provided by manufacturers.

It is worth mentioning that after performing a complex segmentation considering various vehicle parameters there are cars of different sizes in individual segments. For example: in the “city” group there are small city cars (such as Opel Corsa-e or Renault Zoe), crossovers (such as Peugeot e-2008 or Hyundai Kona electric), as well as passenger vans (such as Nissan e-NV200 evalia or Citroën ë-Spacetourer). It proves that the purpose of vehicles in urban traffic does not necessarily have to appear only in models with “urban” sizes. Vehicles in this group have, among others, very similar engine power and range, and are also relatively little differentiated in terms of price.

Electric cars should be characterized primarily by the safety of passengers and other road users. Having disc brakes in the front and rear wheels should be standard. It has been recognized as a determinant of the higher quality of a given vehicle model. It has been noticed that the vast majority of electric vehicles have disc brakes in the front and rear axles, which proves the manufacturers’ high care for the safety and prioritizing this aspect.

The type of drive (for one or both axles) depends primarily on the main purpose of the vehicle. Hence, cars whose main application is sports driving, on light terrain or for longer distances, usually have an all-wheel-drive which guarantees greater vehicle grip and better driving characteristics. Vehicles moving mainly in urban conditions generally have two-wheel drive which has the advantage of lower production costs. The use of front- or rear-wheel drive, however, depends solely on the engineering ideas of the manufacturer.

Most EVs have 5 doors, which means they have two pairs of access doors and a trunk which is treated as an additional door. Only Smart fortwo EQ has three doors as it is a two-seater. Even 4-seater cars have two pairs of access doors. This may indicate that an electric car is treated as a practical means of transport, regardless of its main purpose. The Porsche Taycan has an unconventional luggage compartment (front), so the tailgate was not considered a door in this case. Thus, all Porsche Taycan variants were assigned a value of 4 to this variable. It should be noted that this model is primarily intended for sports racing or extreme driving, as evidenced by its belonging to the “sport” extracted segment (see

Table 8).

The size of the wheel depends almost entirely on customer preferences. Larger wheels are usually available at an extra cost on all equipment levels of a car, but the higher the level, the larger the wheel.

DC charging is available in all electric vehicles analyzed. Nevertheless, the higher the charging power, the faster the charging process of the battery. This turns out to be a significant advantage while traveling long distances, as then kilometers of range are recovered in a shorter time. It should be indicated that the charging time also depends on the generation capacity of the charging station. Moreover, manufacturers, willing to increase the range of their models, create combinations of engines with lower power and a more capacious battery, which is confirmed by their close correlation (see

Figure A3 in

Appendix B for further explanation).

The price parameter, as an important determinant of the purchase decision, was taken into account in the classification. It shows that the vehicles in specific groups do not vary much in terms of price. As a result, potential customers are able to compare cars from the preferred price group according to their own expectations for the car. The comparison can be carried out in many aspects, based on the parameters of the vehicle that are most important for a specific consumer: engine power, range, acceleration, drive type, etc.

Cars from a separate “premium” category belong mainly to the popular and generally recognized segment of SUVs, i.e., large vehicles with increased ground clearance. They will find their supporters among wealthy people who care about driving dynamics, but above all about high comfort and a sense of luxury. Rich people may also opt for an EV from the “sport” group, but then, despite the fancy nature of these cars, such customers should prioritize sports driving experience, fast driving, and dynamic acceleration over comfort.

For buyers with a slightly smaller budget to buy a car, it is proposed to consider electric cars from the “city” and “small” groups. The first group includes vehicles suitable for those who value versatility and practical use of the car in many everyday situations. They all offer a reasonable range and decent performance for a moderate price. It includes both crossovers (such as Peugeot e-2008) and city compact vehicles (such as Opel Corsa-e), which means a wider spectrum of choice for the consumer, taking into account stylistic and practical qualities. People who only need a car for urban transport and who do not care about the long range and practical aspects can choose from the offer of cars belonging to a separate “small” segment. This is the group of the smallest and cheapest electric cars, but for those who appreciate style, it also includes more expensive vehicles (such as the Honda e or Mini Cooper SE).

It should also be noted the lack of uniformity in the assignment of passenger electric vans. Nissan e-NV200 evalia along with Citroën ë-Spacetourer (and twin models) are allocated in the “city” segment, while the Mercedes-Benz EQV belongs to the “premium” segment. However, this should not come as a surprise, as the first two models of vehicles are used only for the ordinary transport of people with moderate comfort, while the Mercedes-Benz electric van, taking into account the make’s sumptuous roots, is clearly geared to comfortable traveling in business conditions. Different target customers and a slightly different purpose of the vehicle confirm the belonging to these groups.

Taking into account the macro environment of the electric car market in Poland, a few remarks arise. A potential barrier to the development of the electric car market is the poor network of charging stations, which is incomparably smaller than the gas stations. There are 1294 publicly available charging stations in Poland (of which only 32% were DC fast-charging stations) [

46], while there are 7681 petrol stations in Poland [

47] (see

Appendix A for further explanation). Expanding the network of electric car charging stations should be an element of investment not only in the private sector but also in the interest of the state.

It has been noticed that, on the Polish market, despite the presence of many models of electric cars belonging to different segments, they are noticeably more expensive than their analogous competitors with internal combustion engines. Therefore, the governments of countries should consider preparing a number of subsidies and economic privileges (like a tax exemption) for buyers of cars with electric motors, so that they can become a real competition in terms of prices for vehicles powered by gasoline or diesel oil. By regulating the broadly understood benefits for owners and buyers of electric cars, they may also turn out to be a real response to the desire to achieve sustainable development goals. This can be an incentive to lead an eco-friendly lifestyle, which will further intensify the growing trend of buying green cars—not only fully electric but also hydrogen cars as well as conventional or plug-in hybrids.

5. Conclusions

The added value of the study is a complete and comprehensive study, which means that it includes all models of electric cars in Poland from the primary market. The methodology and framework used in the study are universal, which means that it is enough to collect the data according to the variables used to perform the analysis with miscellaneous measures. Moreover, it is worth noting that despite the fact that the study was conducted in Poland, it can also be applied in other (wider) territories, which proves its versatile character.

One of the practical implications of the study is that conducted segmentation of the electric vehicle market in Poland carried out in this way may allow consumers to comprehensively compare all fully electric cars sold domestically due to their broad characteristics. This analysis can make potential consumers get an answer to the question which electric car in a given price group is characterized by better or worse performance and how significant the differences and similarities between them are. In addition, this segmentation may turn out to be beneficial and helpful from the point of view of automotive manufacturers, as they are able to check how their cars compare to the competition. Thus, they can also answer questions if their car models require any improvement, and they are also able to check whether it is worth initiating the production of a new model in a different price segment.

The conducted analysis may prove useful for central authorities that want to introduce or better adapt benefits (such as subsidies, tax exemptions, free parking zones) for EV users, but also for other entities (private or state-owned) that want to invest in the development of infrastructure networks for electric cars. In Poland, there is a system of government subsidies for cars using alternative energy sources (such as electricity or hydrogen). However, these surcharges are not so high as to match the price of the petrol equivalent of an EV.

A significant limitation of the study was its territorial scope, taking into account only one country: Poland. Despite the completeness and comprehensiveness of the conducted segmentation, it should be noted that it only includes fully electric cars (FEVs) that are available on the primary market. This research rejects hydrogen cars, electric cars with the so-called “range extenders” and plug-in hybrids. The data acquired to create a dataset with the parameters of electric cars are based on official data provided directly by the manufacturers, but at times the data were incomplete. Data not included in the prospectuses provided by car manufacturers were sourced from the SAMAR Auto-Catalog. Despite the fact that this source is characterized by extensive information on the cars offered in Poland, it should be noted that there is no official data (for further description of SAMAR Auto-Catalog, see

Appendix A).

Further research may focus on extending the research to other markets (also from the perspective of the entire European Union). Performing a juxtaposition of the performance and price of electric cars with comparable models with combustion engines, as well as the used EV market analysis could also be the subjects of further research. The next study may be extended to use other classification methods and distance types (such as Chebyshev and Manhattan).