Research on Vertical Cooperation and Pricing Strategy of Electric Vehicle Supply Chain

Abstract

1. Introduction

2. Literature Review

2.1. Cooperation Strategies between Supply Chain Enterprises

2.2. Pricing Strategy for Electric Vehicles

3. Problem Description and Assumptions

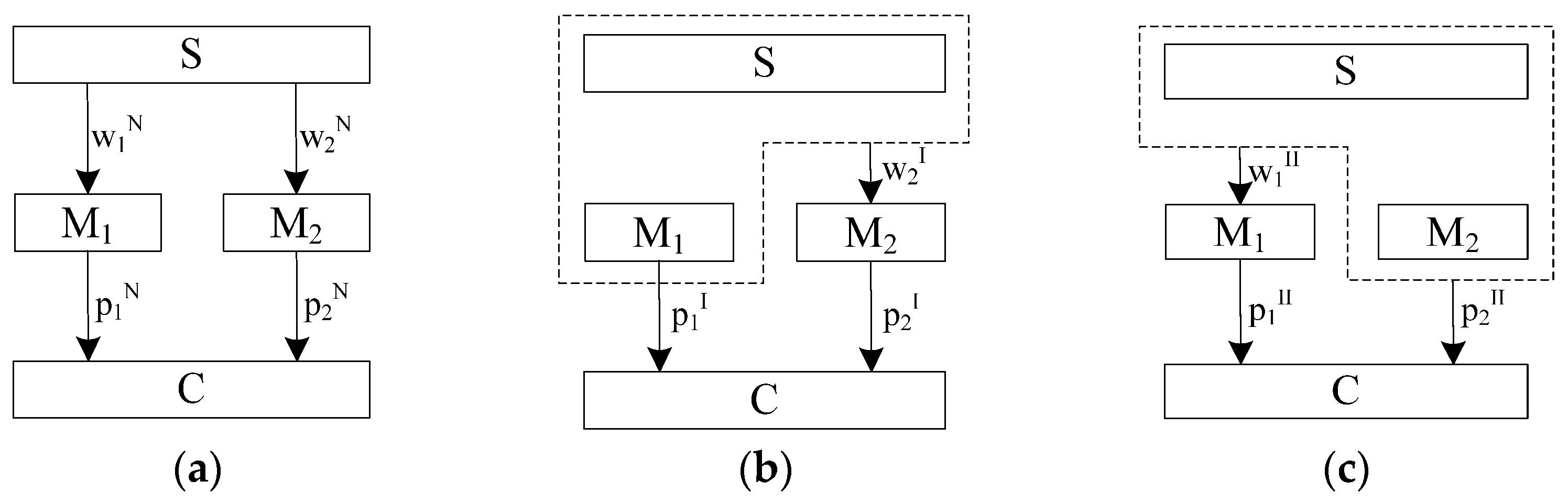

4. Models Construction

4.1. Strategy N (A Non-Cooperation Strategy between Battery Suppliers and Both Manufacturers)

4.2. Strategy I (Cooperation between Battery Suppliers and Manufacturers M1)

4.3. Strategy II (Cooperation between Battery Supplier and Manufacturer M2)

4.4. Comparative Analysis of Different Strategies

4.4.1. Comparative Analysis of Optimal Pricing for θ

- (a)

- The monotonicity of the optimal wholesale price: ;;;

- (b)

- The monotonicity of the optimal rental price: ; ;; ; ;

- (c)

- Comparative analysis of the optimal wholesale price: ; ;

- (d)

- Comparative analysis of the optimal rental price:

4.4.2. Comparative Analysis of Optimal Demand under Influence of θ

- (a)

- Monotonicity of optimal demand: ; ; ; ; ; ;

- (b)

- Comparative analysis of optimal demand: When , ; When ; ; When , .

4.4.3. Analysis of Optimal Profit Changes on θ

- (a)

- Monotonicity of manufacturers’ optimal profit: ; ; ; ;

- (b)

- Comparison of manufacturers’ optimal profits: when , ; when , ; when , .

- (a)

- The monotonicity of the optimal profit of the cooperative alliance:;;;;

- (b)

- Comparative analysis of the optimal profit of cooperative alliance: when ,; when , ; when , .

- (a)

- Monotonicity of the optimal profit of the whole supply chain: ; ; ;

- (b)

- The comparison of the optimal profit of the whole supply chain: when , ; when , .

5. Conclusions

- (1)

- Under Strategy N: The EV lease prices provided by the two manufacturers are all high. When the leasing preference coefficient θ is small, the optimal profit of the M2 under Strategy N is the largest; when θ is large, M1 is more profitable under Strategy N. Regardless of the value of θ, the optimal total profit of the supply chain members under Strategy N is always less than that of the cooperative alliance, and the overall optimal total profit of the supply chain is always between the two cooperative alliances.

- (2)

- Under Strategy I: When the leasing preference coefficient θ is large, the consumers who choose to rent EVs per unit under Strategy I benefited the most. At this time, M1 and the cooperative alliance S1 and the entire supply chain all have made considerable profits.

- (3)

- Under Strategy II: When the leasing preference coefficient θ is small, the demand of consumers for fixed leasing EVs under Strategy II is the strongest, and the profit of cooperative alliance S2 is greater than that of any other strategies. Constantly, the supply chain as a whole achieves the maximum optimal profit.

- (1)

- Manufacturer M1: When the leasing preference coefficient θ is large, the optimal profit of M1 under Strategy I can be improved; and under Strategy N, the M1 is the best beneficiaries.

- (2)

- Manufacturer M2: When θ is small, M2 selects Strategy N and can obtain the maximum optimal profit.

- (3)

- Battery provider S: When θ is small, selecting Strategy II can be very beneficial to the profit of the cooperative alliance S2 increases; when the θ is large, using Strategy I can increase the profit of the cooperative alliance S1.

- (4)

- EV supply chain: When θ is small, the entire supply chain under Strategy II achieves the maximum profit; when θ is large, under Strategy I, the entire supply chain is the most favorable.

Funding

Data Availability Statement

Conflicts of Interest

References

- Cao, Y.; Wei, P.P.; Li, Q.S. Research on Procurement and Quality Decision in Competitive Supply Chain. Chin. J. Manag. Sci. 2021, 29, 184–194. [Google Scholar]

- Cui, Y.; Li, Y.C.; Fu, X.B.; Tang, Y.H.; Zhong, W.Z. Double-layer Optimal Scheduling of Micro-grid System with Charging and Swapping Stations Based on Battery Swap Service Pricing Strategy and Dynamic Regulation. Power Syst. Technol. 2023, 47, 1999–2008. [Google Scholar]

- Ding, Z.; Lu, Y.; Lai, K.; Yang, M.; Lee, W.J. Optimal coordinated operation scheduling for electric vehicle aggregator and charging stations in an integrated electricity-transportation system. Electr. Power Energy Syst. 2020, 121, 106040. [Google Scholar] [CrossRef]

- Fan, Z.P.; Huang, S.; Wang, X.H. The vertical cooperation and pricing strategies of electric vehicle supply chain under brand competition. Comput. Ind. Eng. 2020, 152, 106968. [Google Scholar] [CrossRef]

- Guo, H.; Zhang, H.; Lu, J.; Zeng, R.; Han, T. Multi-party Evolution Stability Analysis of Electric Vehicles-Microgrid Interaction Mechanism. Intell. Comput. Theor. Appl. 2022, 133, 13–26. [Google Scholar]

- Huang, X.M.; Yang, S.; Shi, X.L. How Corporate Social Responsibility and External Stakeholder Concerns Affect Green Supply Chain Cooperation among Manufacturers: An Interpretive Structural Modeling Analysis. Sustainability 2021, 13, 2518. [Google Scholar] [CrossRef]

- Jian, J.; Hu, H.Y.; Zhang, F.T. Closed-loop supply chain competition strategy considering remanufacturing design. Comput. Integr. Manuf. Syst. 2022, 28, 3692–3706. [Google Scholar]

- Li, H.; Shang, M.; Qin, X.H.; Li, R.; Tan, Y. Optimal cap setting and pricing in supply chains under vertical-horizontal cooperation and cap-and-trade regulation. Rairo-Oper. Res. 2021, 55, 2487–2508. [Google Scholar] [CrossRef]

- Liang, K.R.; Li, D.F. Impact of Coopetition Modes on online distribution strategy in platform Supply Chain. Chin. J. Manag. Sci. 2022, 30, 306–316. [Google Scholar]

- Liu, Z.Y.; Liu, Y.; Li, H.A. Coordination Mechanism of Supply Chain with a Retailer and Two Competitive Suppliers. Complexity 2020, 2, 1–14. [Google Scholar] [CrossRef]

- Chao, L.; Qianqian, W.; Mengyuan, Z.; Junlin, Y. Research on Competitive Pricing and Emission Reduction Strategies of Automobile Manufacturers under the “Double Points” Policy. Chin. J. Manag. Sci. 2022, 30, 65–76. [Google Scholar]

- Lu, Q.; Liu, B.N.; Yu, K.K. Effect of supplier-buyer cooperation on supply chain financing availability of SMEs. Int. J. Logist. -Res. Appl. 2021, 25, 1244–1262. [Google Scholar] [CrossRef]

- Lu, Z.; Shi, L.; Geng, L.; Zhang, J.; Li, X.; Guo, X. Non-cooperative game pricing strategy for maximizing social welfare in electrified transportation networks. Int. J. Electr. Power Energy Syst. 2021, 130, 106980. [Google Scholar] [CrossRef]

- Lu, Z.P.; Yao, Y.F.; Lu, C.Y. Research on Pricing Strategies for New Energy Electric Vehicle Exchange Models under Differential Supply Chain Structure. Syst. Eng. 2022, 40, 28–37. [Google Scholar]

- Saha, S.; Nielsen, I. Strategic Integration Decision under Supply Chain Competition in the Presence of Online Channel. Symmetry 2021, 13, 58. [Google Scholar] [CrossRef]

- Shang, W.F.; Wang, B.Y.; Xia, D.F. A game between green and non-green supply chains considering two-way government intervention and manufacturer competition. Front. Environ. Sci. 2022, 10, 1002124. [Google Scholar] [CrossRef]

- Shi, J.; Yu, N.P.; Gao, H.O. Bidding strategy for wireless charging roads with energy storage in real-time markets. Appl. Energy 2022, 327, 120035. [Google Scholar] [CrossRef]

- Su, X.; Zhang, H.; Guo, S.B. The Applications and Complexity Analysis Based on Network Embedding Behaviors under Evolutionary Game Framework. Complexity 2020, 7, 1–23. [Google Scholar] [CrossRef]

- Wang, B.; Xie, M.; Ma, G.; Ding, W.; Yang, D.; Yue, H.; Zhang, Q. Research on Electric Vehicle Aggregators Participating in Demand Response Pricing Strategy and Benefit Distribution. In Proceedings of the 2022 IEEE/IAS Industrial and Commercial Power System Asia (I&CPS Asia), Shanghai, China, 8–11 July 2022; pp. 1821–1826. [Google Scholar]

- Wang, H.; Zheng, T.; Sun, W.; Khan, M.Q. Research on the pricing strategy of park electric vehicle agent considering carbon trading. Appl. Energy 2023, 340, 121017. [Google Scholar] [CrossRef]

- Xu, S.X.; Xie, B.; Qin, W. Pricing and Investment Strategies for Electric Vehicle Charging and Exchange Modes. J. Transp. Syst. Eng. Inf. Technol. 2021, 21, 184–189. [Google Scholar]

- Yang, J.; Lin, Y.; Wu, F.; Chen, L. Subsidy and Pricing Model of Electric Vehicle Sharing Based on Two-Stage Stackelberg Game-A Case Study in China. Appl. Sci. 2019, 9, 1631. [Google Scholar] [CrossRef]

- Yi, Y.Y.; Chen, J. Pricing strategies for “trade-in for new fuel vehicles” and “trade-in for new energy vehicles” programs under different supply chain models. J. Ind. Eng. 2023, 37, 80–91. [Google Scholar]

- Yuan, K.F.; Wen, S.; Wu, G.Q.; Li, C. Pricing decision of power battery supply chain considering gradient utilization under BaaS business model. Comput. Integr. Manuf. Syst. 2023, 10, 1–21. [Google Scholar]

- Zeng, N.M.; Zeng, D.L.; Ren, T.H. Equilibrium decision for competition Supply Chains with Supply Risk. J. Manag. Sci. 2023, 26, 176–192. [Google Scholar]

- Zhang, Y.F.; Qin, Y. Carbon emission reduction cooperation of three-echelon supply chain under consumer environmental awareness and cap-and-trade regulation. Environ. Sci. Pollut. Res. 2022, 29, 82411–82438. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Y.F.; Qin, Y. Carbon emission reductions, pricing and social welfare of three-echelon supply chain considering consumer environmental awareness under carbon tax policy. Front. Environ. Sci. 2022, 10, 969613. [Google Scholar] [CrossRef]

- Zhao, X.; Peng, B.; Zheng, C.; Wan, A. Closed-loop supply chain pricing strategy for electric vehicle batteries recycling in China. Environ. Dev. Sustain. 2021, 24, 7725–7752. [Google Scholar] [CrossRef]

| Notations | Description |

|---|---|

| Consumer lease prices for EVs ( represents the unit lease of EV provided by M1; represents the fixed lease of EV provided by) | |

| The wholesale price of batteries provided by the battery supplier ( represents M1; represents M2) | |

| Consumer preference coefficient for unit lease EVs provided by manufacturer M1 () | |

| Consumer valuation of leased EVs | |

| The times for consumers, unit lease of EVs | |

| The utility of consumers leasing EVes ( represents M1; represents M2) | |

| Production costs of battery suppliers | |

| Manufacturers’ remaining production costs other than battery production costs ( represents M1; represents M2) | |

| Consumers demand for leasing EVs ( represents M1; represents M2) | |

| The total profit of the manufacturer ( represents M1; represents M2; represents battery supplier S) | |

| The cooperation alliance total profit of battery supplier and manufacturers ( represents M1; represents M2) |

| 0.2 | 0.5 | 0.49 | 0.5 | 0.037 | 0.7378 | 0.036 | 0.73 | 0.036 | 0.71 |

| 0.25 | 0.525 | 0.49 | 0.525 | 0.038 | 0.7375 | 0.037 | 0.725 | 0.038 | 0.71 |

| 0.3 | 0.55 | 0.49 | 0.55 | 0.039 | 0.7371 | 0.038 | 0.72 | 0.039 | 0.71 |

| 0.35 | 0.575 | 0.49 | 0.575 | 0.041 | 0.7368 | 0.039 | 0.716 | 0.041 | 0.71 |

| 0.4 | 0.6 | 0.49 | 0.6 | 0.043 | 0.7365 | 0.04 | 0.712 | 0.042 | 0.71 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, D.-D. Research on Vertical Cooperation and Pricing Strategy of Electric Vehicle Supply Chain. World Electr. Veh. J. 2024, 15, 242. https://doi.org/10.3390/wevj15060242

Wu D-D. Research on Vertical Cooperation and Pricing Strategy of Electric Vehicle Supply Chain. World Electric Vehicle Journal. 2024; 15(6):242. https://doi.org/10.3390/wevj15060242

Chicago/Turabian StyleWu, Dou-Dou. 2024. "Research on Vertical Cooperation and Pricing Strategy of Electric Vehicle Supply Chain" World Electric Vehicle Journal 15, no. 6: 242. https://doi.org/10.3390/wevj15060242

APA StyleWu, D.-D. (2024). Research on Vertical Cooperation and Pricing Strategy of Electric Vehicle Supply Chain. World Electric Vehicle Journal, 15(6), 242. https://doi.org/10.3390/wevj15060242