The Efficacy of the New Energy Vehicle Mandate Policy on Passenger Vehicle Market in China

Abstract

1. Introduction

2. Literature Review

3. Method

3.1. Relationships Between Policy Rules and Vehicle Markets

3.1.1. Relationships Between CAFC Credits Policy and Vehicle Markets

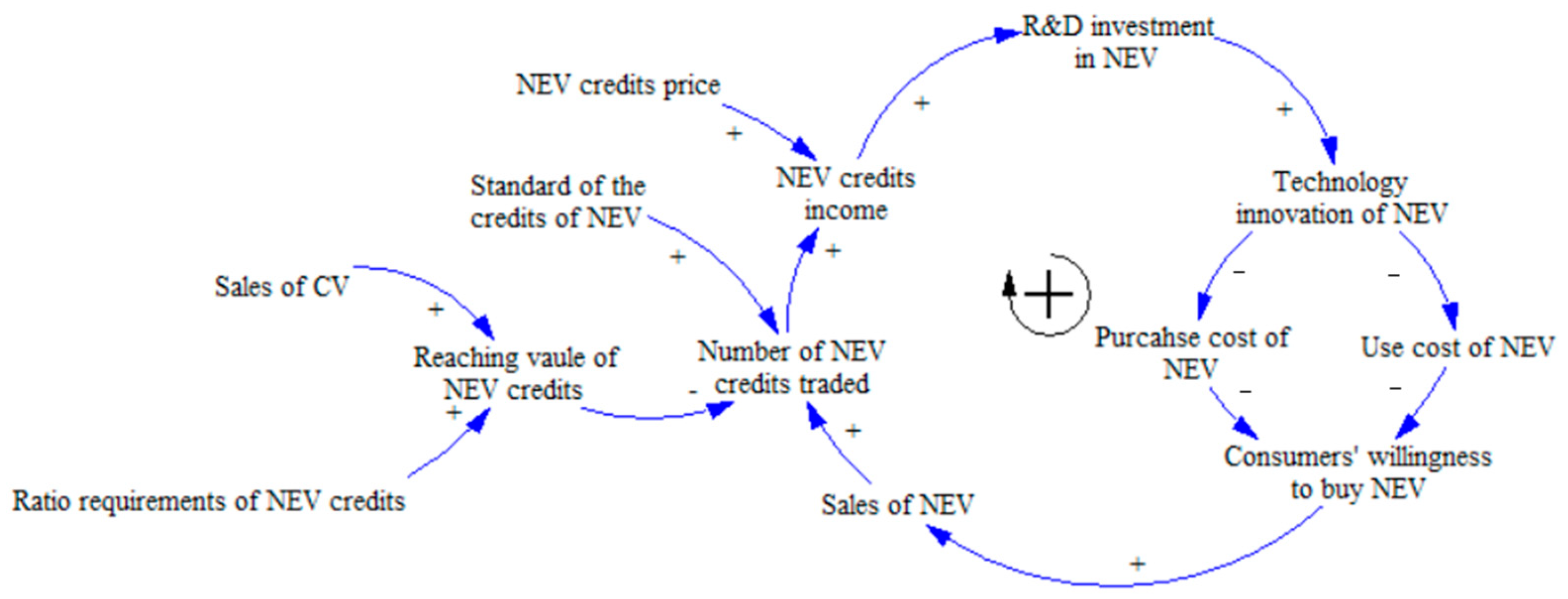

3.1.2. Relationships Between NEV Credits Policy and Vehicle Markets

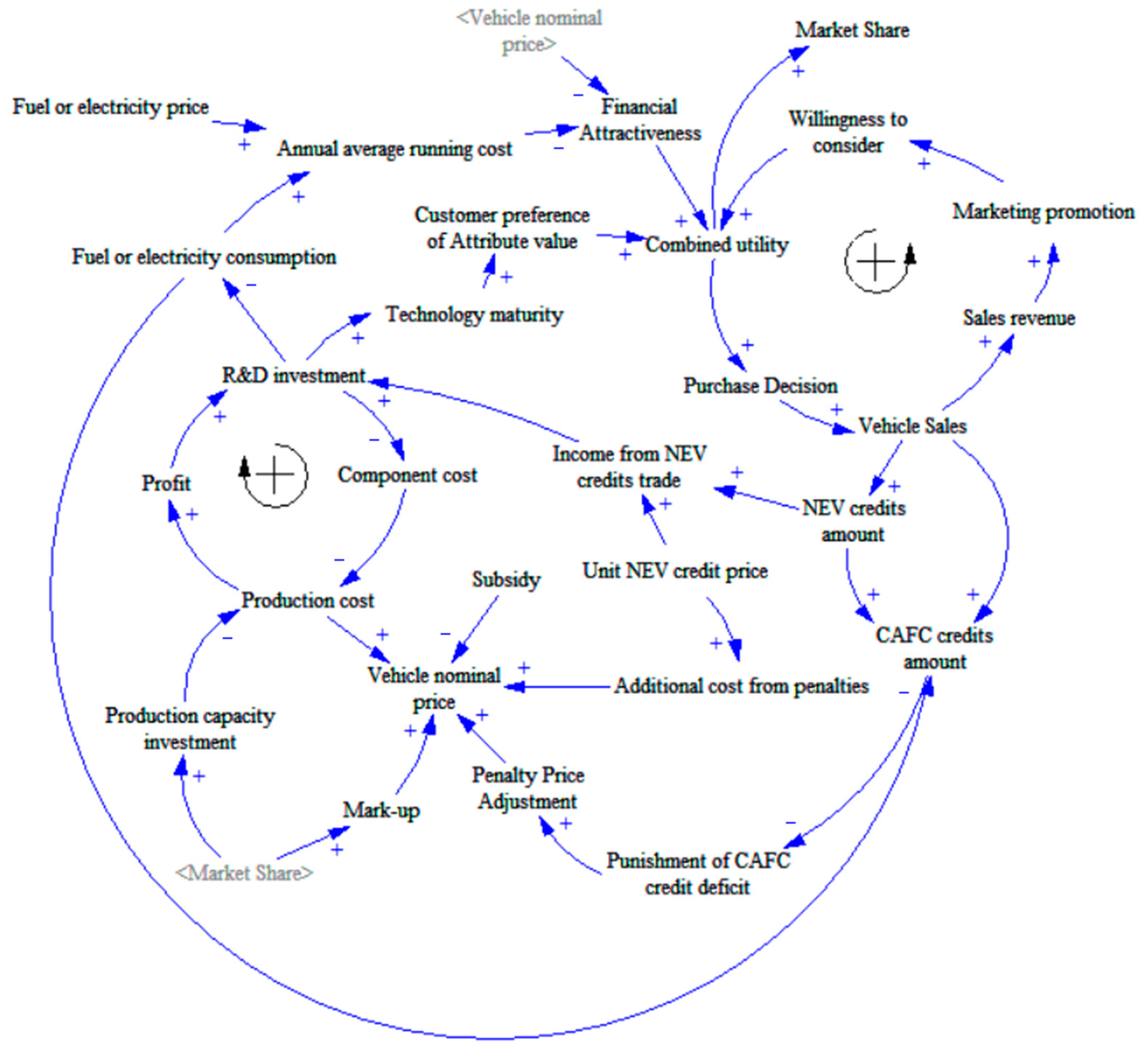

3.2. System Dynamics Model Overview

3.3. Consumer Purchase Decision

3.4. Enterprises’ Research and Development Behaviors

4. Parameters and Data

5. Results

5.1. Effectiveness of NEV Mandate Policy Under Basic Scenario

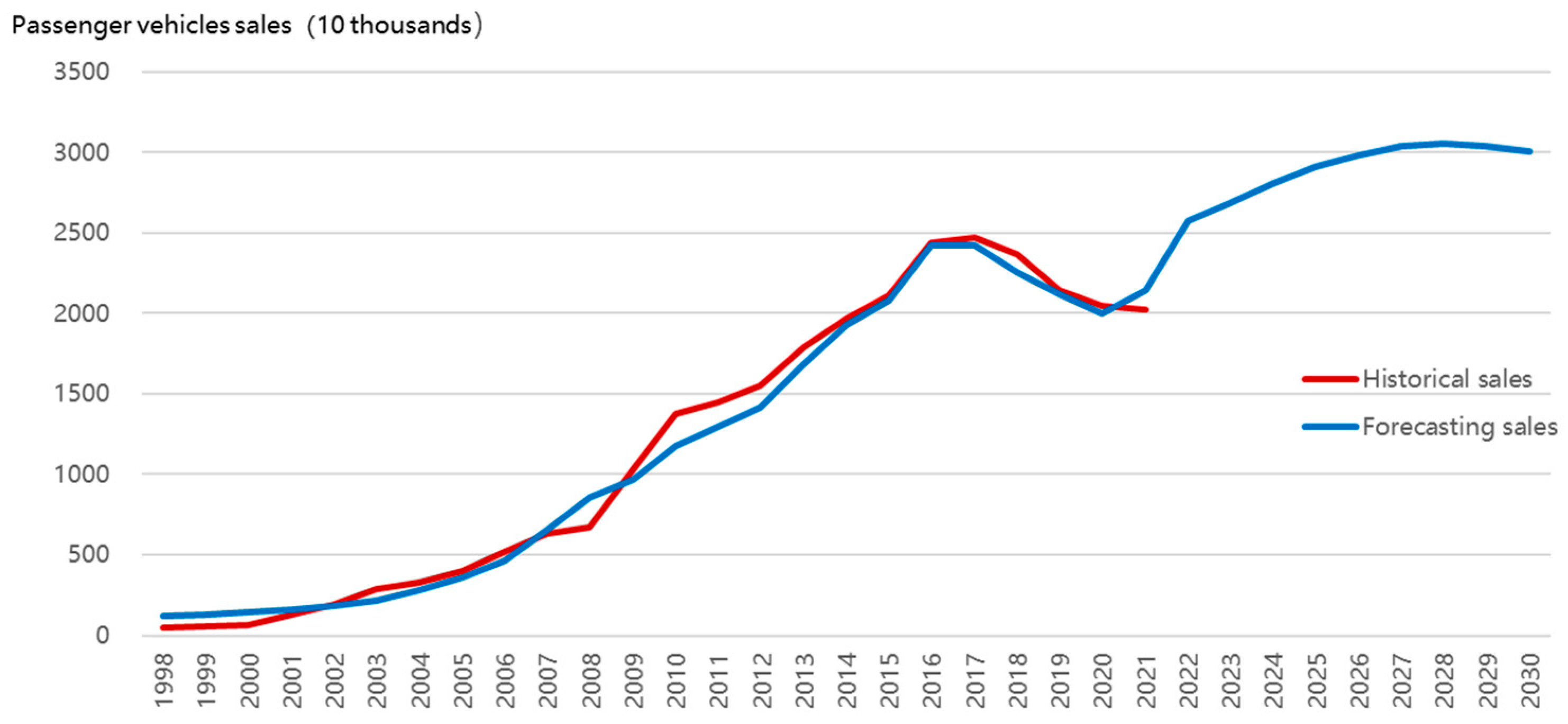

5.1.1. Overall Sales Trend of Passenger Vehicles

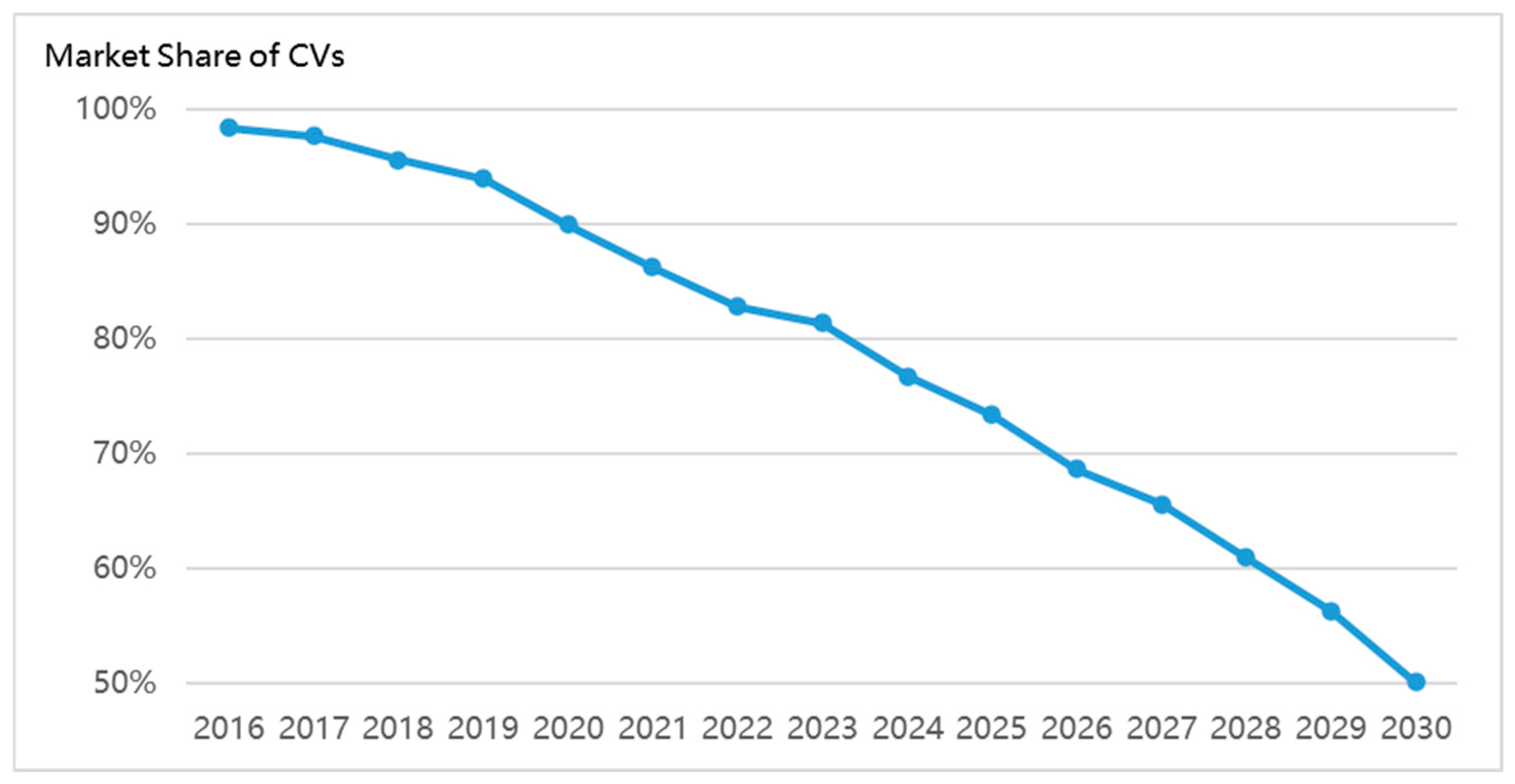

5.1.2. Sales Trend of NEVs and CVs

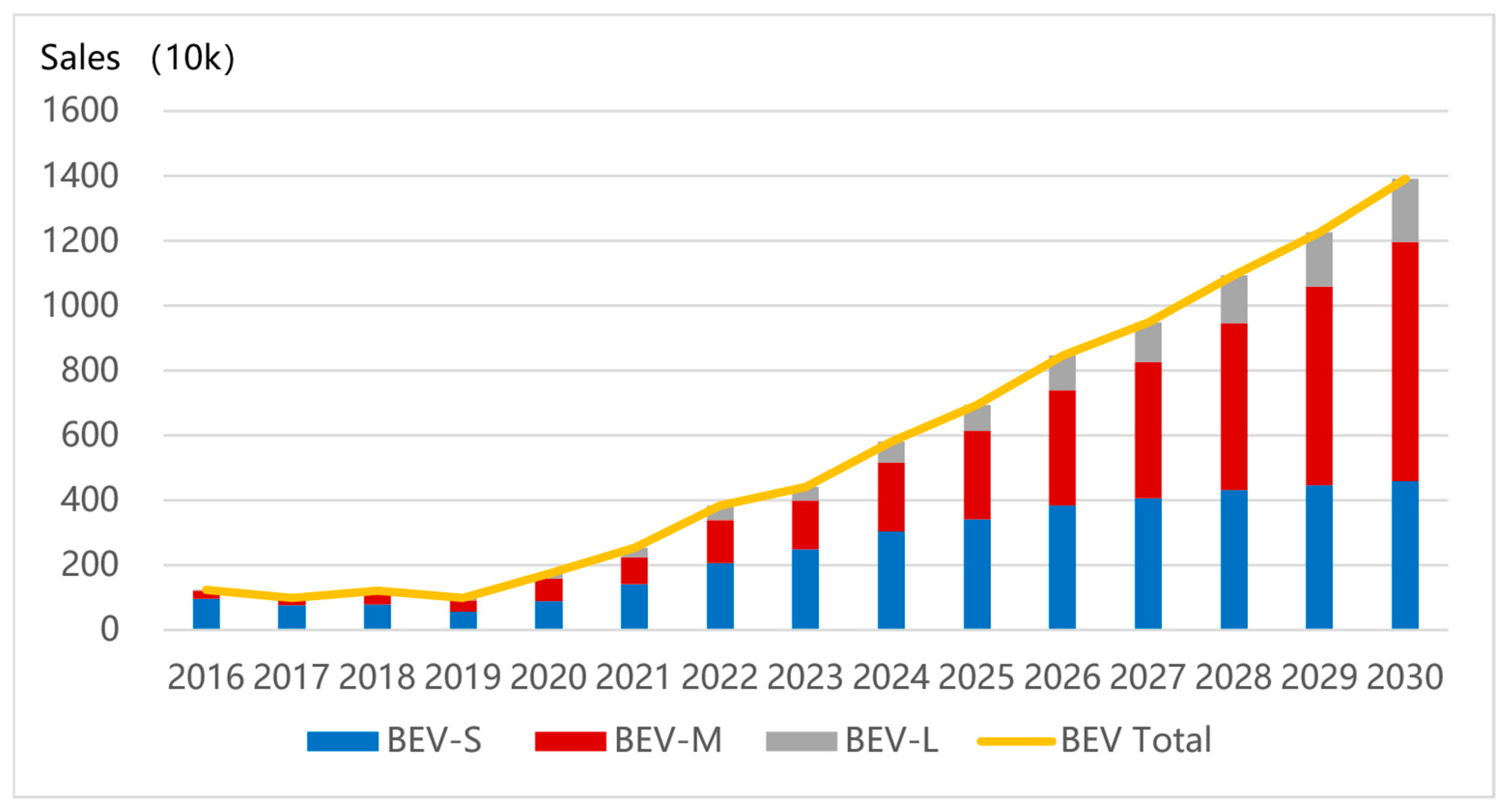

5.1.3. Market Segment Trend of BEVs

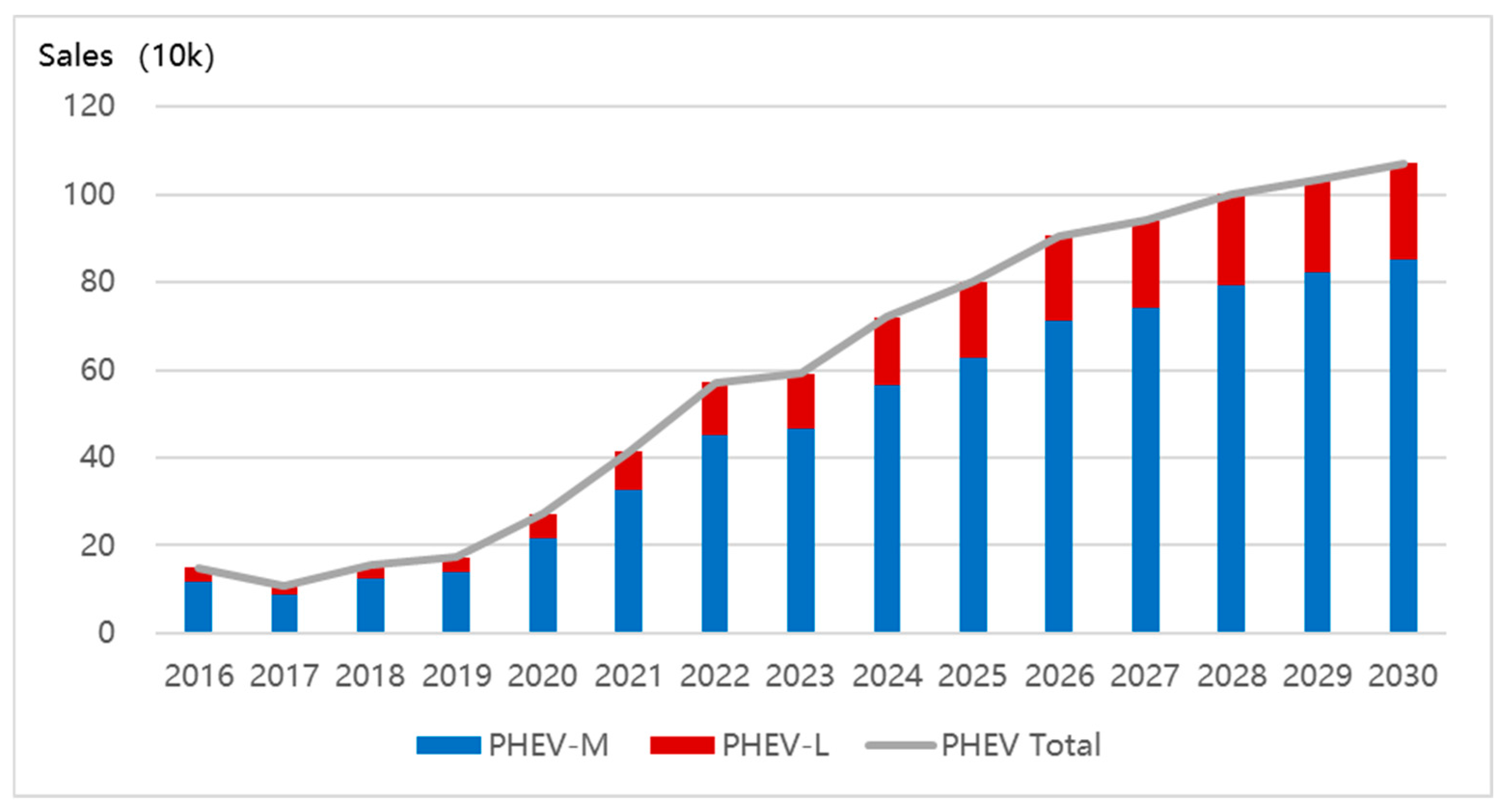

5.1.4. Market Segment Trend of PHEVs

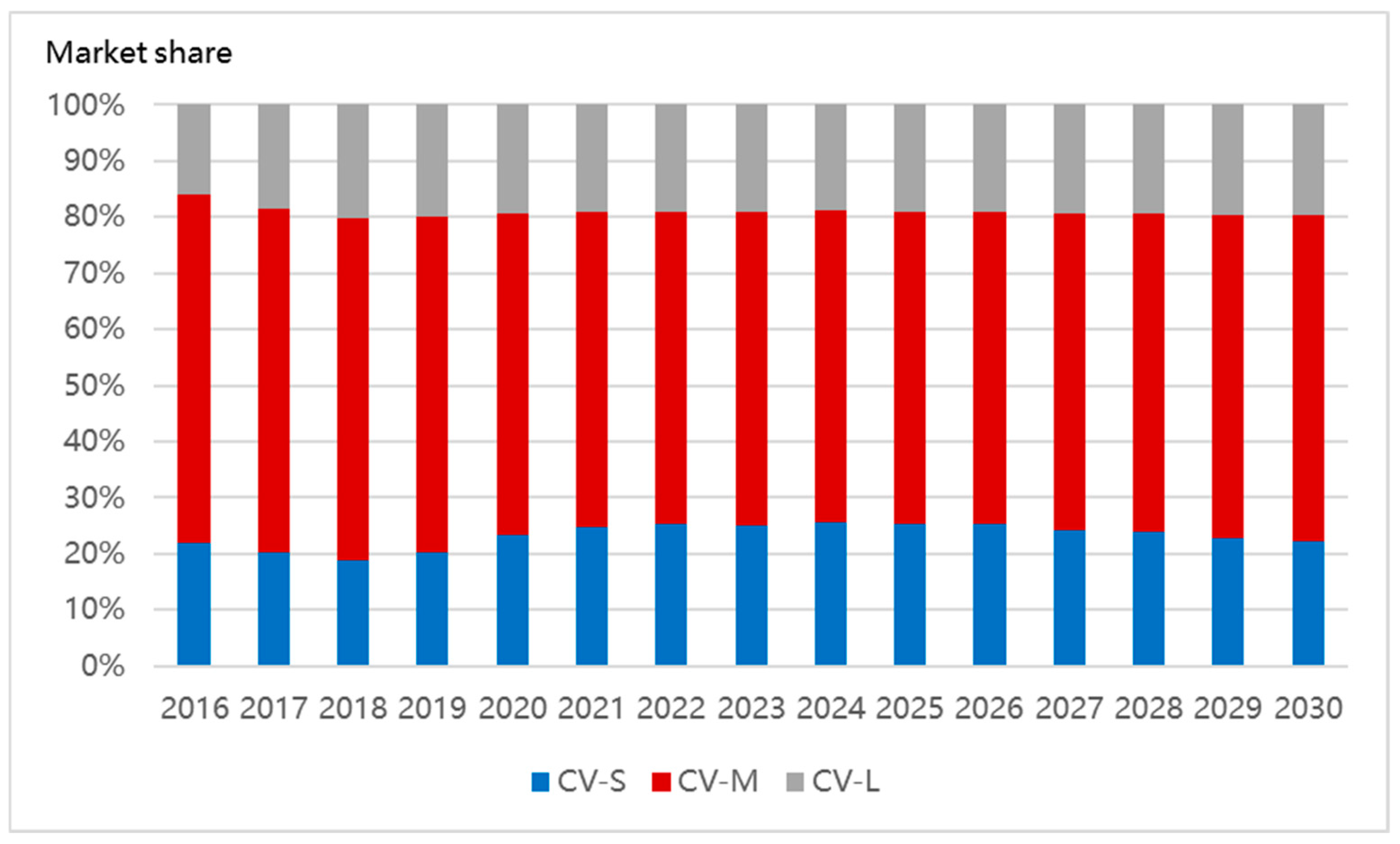

5.1.5. Market Segment Trend of CVs

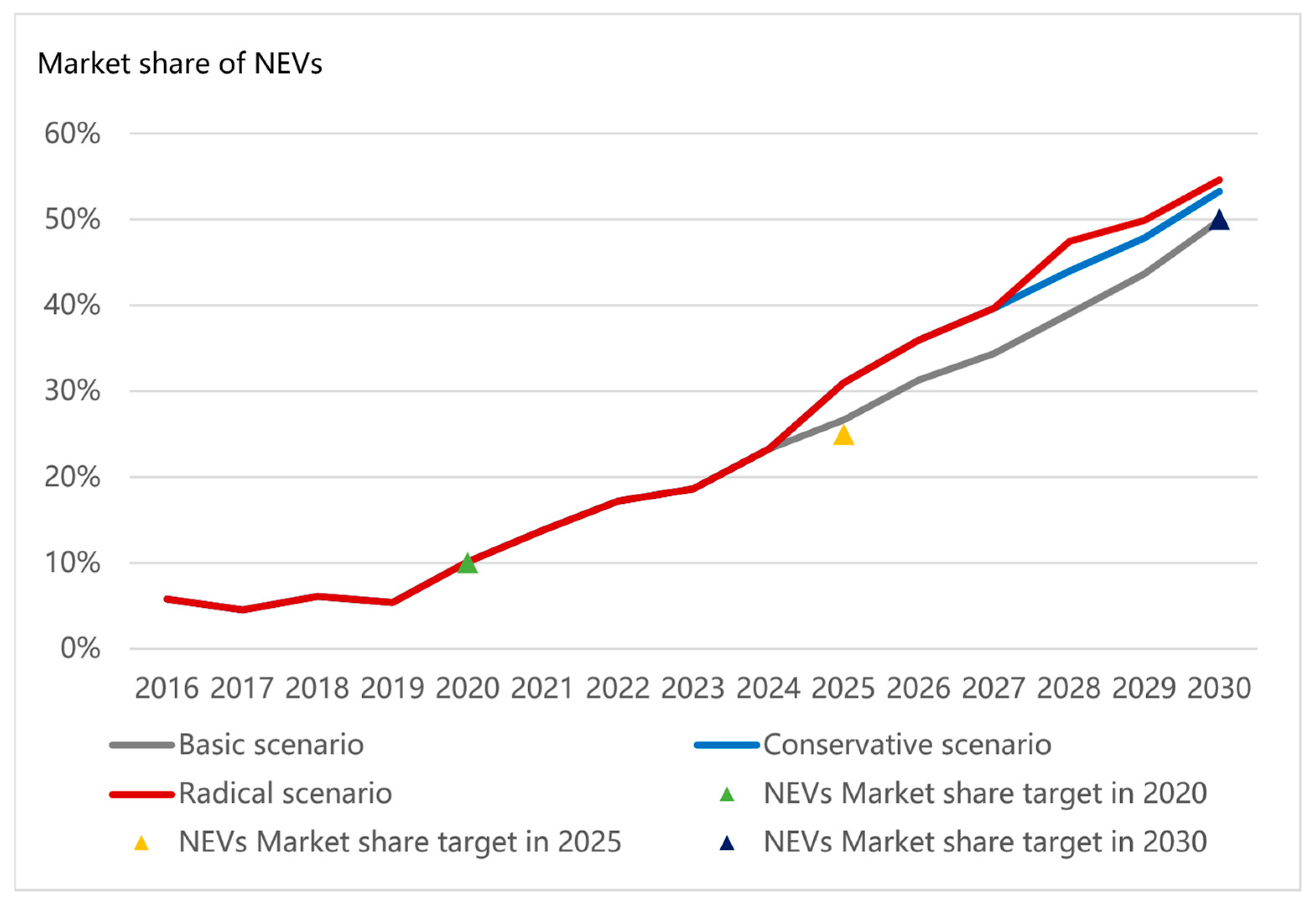

5.2. Scenarios Analysis of Changing NEV Mandate Policy’s Key Indicators

5.2.1. Selection of Key Indicators for NEV Mandate Policy

5.2.2. Scenarios of Changing NEV Credits Ratio Requirements

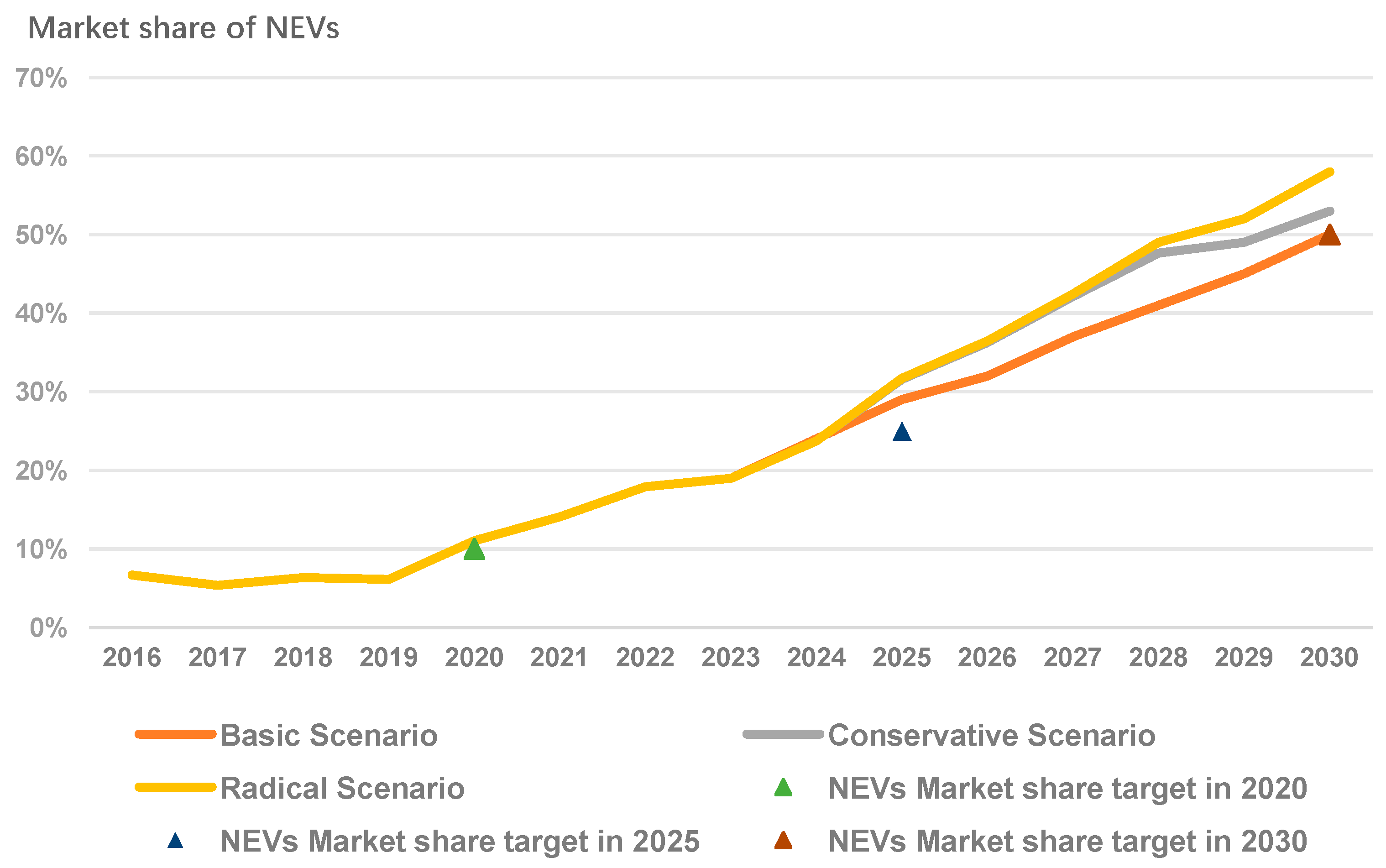

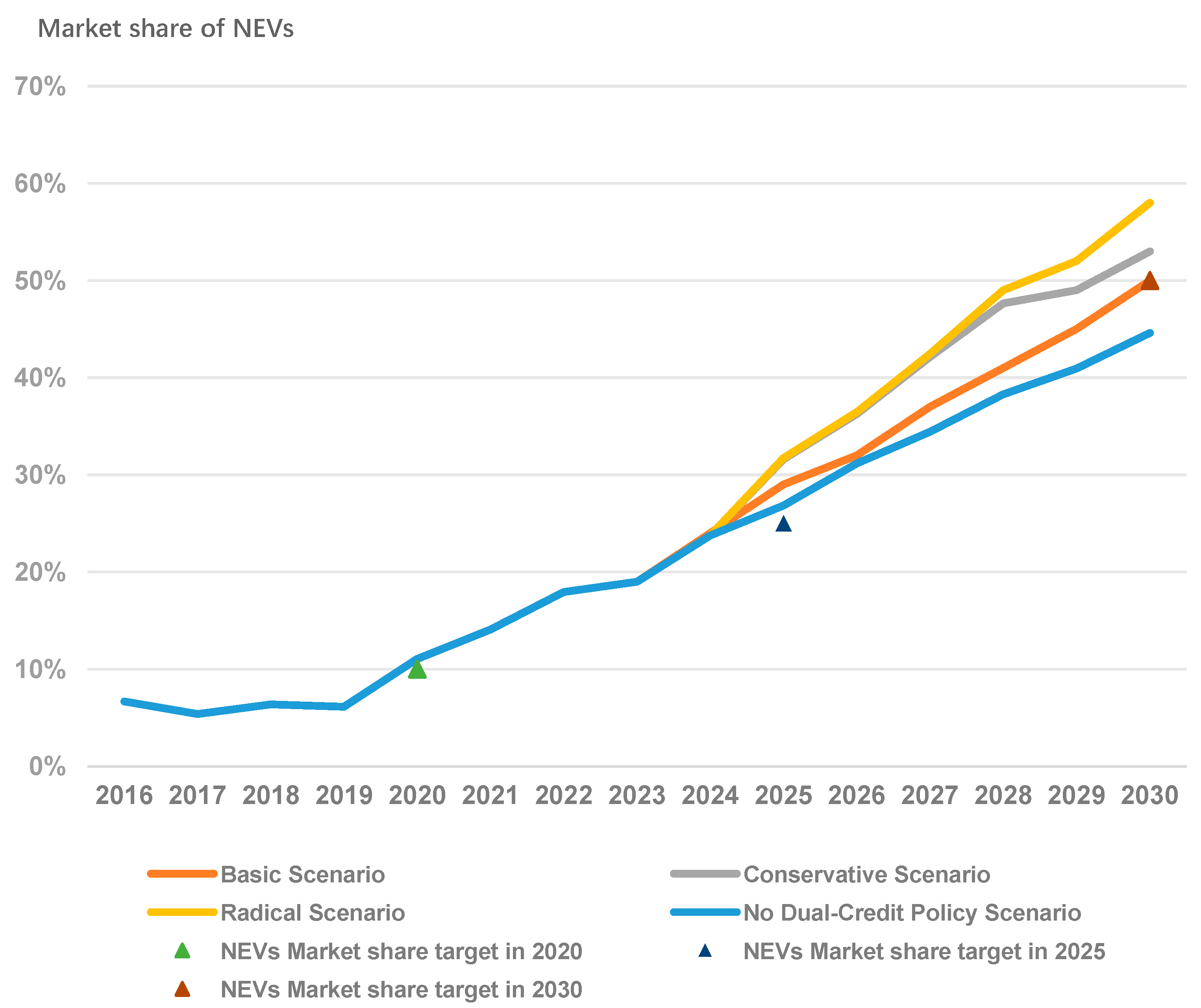

5.2.3. Scenarios of Changing NEV Credits Standard

5.2.4. Scenarios of Changing NEV Credits Ratio Requirements and Standard Synchronously

5.2.5. Scenarios for Adjusting NEV Credits Based on the Latest Draft Policy

6. Discussion

7. Conclusions

7.1. Theoretical Implications

7.2. Practical Implications

8. Research Limitations and Recommendations for Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Detailed Specifications of NEV Mandate Policy

| Year | 2016 | 2017 | 2018 | 2019 | 2020 and Beyond |

|---|---|---|---|---|---|

| cofficient | 134% | 128% | 120% | 110% | 100% |

| Year | BEV/FCV/PHEV (Electric Cruising Range ≥ 50 km) | CV (Oil Consumption ≤ 2.8 L/100 km) | Other Vehicles |

|---|---|---|---|

| 2016–2017 | Wi = 5 | Wi = 3.5 | Wi = 1 |

| 2018–2019 | Wi = 3 | Wi = 2.5 | Wi = 1 |

| 2020 | Wi = 2 | Wi = 1.5 | Wi = 1 |

| The standard of NEV credit from 2019 to 2020 | |

|---|---|

| Powertrain | Standard type credits |

| BEV | 0.012 × R a + 0.8 |

| PHEV | 2 |

| FCV | 0.16 × P |

| The standard of NEV credit from 2021 to 2023 b | |

| Powertrain | Standard type credits |

| BEV | 0.006 × R a + 0.42 |

| PHEV | 1.6 |

| FCV | 0.08 × P |

Appendix B. Categories of Passenger Vehicle in SD Model

| Category | Definition |

| CV-L | Large-sized (namely B and C class) conventional fuel passenger vehicles |

| CV-M | Medium-sized (namely A class) conventional fuel passenger vehicles |

| CV-S | Small-sized (namely A00 and A0 class) conventional fuel passenger vehicles |

| PHEV-L | Large -sized (namely B and C class) plug-in hybrid electric passenger vehicles |

| PHEV-M | Medium-sized (namely A class) plug-in hybrid electric passenger vehicles |

| BEV-S | Battery electric passenger vehicles with driving range: R ≤ 300 km |

| BEV-M | Battery electric passenger vehicles with driving range: 300 km < R ≤ 450 km |

| BEV-L | Battery electric passenger vehicles with driving range: R > 450 km |

Appendix C. Input Parameters About TCO of 2010

| Powertrain | Property | Unit | Size | ||

| S a | M a | L a | |||

| CV | Initial fuel consumption | L/100 km | 6 | 8 | 10 |

| Initial production capacity | vehicle/year × 104 | 500 | 1500 | 500 | |

| Unit capacity investment cost | CNY/vehicle × 104 | 1 | 1.2 | 1.5 | |

| Base fixed cost | CNY/vehicle × 104 | 1 | 1.2 | 1.5 | |

| Glider cost | CNY/vehicle × 104 | 3 | 6 | 9 | |

| Initial cost of Internal combustion engine (CV) | CNY/vehicle × 104 | 2 | 3 | 4 | |

| Fractional reduction in Internal combustion engine (CV) | — | 0.01 | 0.01 | 0.01 | |

| Initial Maturity of Internal combustion engine (CV) | — | 0.70 | 0.70 | 0.70 | |

| Maintenance cost | CNY/year | 1500 | 3000 | 4500 | |

| Insurance premium | CNY/year | 3000 | 5000 | 6000 | |

| BEV | Initial electricity consumption | kWh/100 km | 15 | 18 | 21 |

| Initial production capacity | vehicle/year × 104 | 0 | 0 | 0 | |

| Unit capacity investment cost | CNY/vehicle × 104 | 1.2 | 1.5 | 1.8 | |

| Base fixed cost | CNY/vehicle × 104 | 1.2 | 1.5 | 1.8 | |

| Glider cost | CNY/vehicle × 104 | 3 | 6 | 9 | |

| Initial cost of BEV battery | CNY/vehicle × 104 | 10 | 20 | 30 | |

| Fractional reduction in BEV battery | — | 0.1 | 0.1 | 0.1 | |

| Initial Maturity of BEV battery | — | 0.30 | 0.30 | 0.30 | |

| Maintenance cost | CNY/year | 450 | 900 | 1350 | |

| Insurance premium | CNY/year | 4500 | 6500 | 9000 | |

| PHEV | Initial electricity consumption | kWh/100 km | — | 18 | 21 |

| Initial fuel consumption | vehicle/year × 104 | — | 2 | 4 | |

| Initial production capacity | vehicle/year × 104 | — | 0 | 0 | |

| Unit capacity investment cost | CNY/vehicle × 104 | — | 1.8 | 2 | |

| Base fixed cost | CNY/vehicle × 104 | — | 2 | 2 | |

| Glider cost | CNY/vehicle × 104 | — | 6 | 9 | |

| Initial cost of Internal combustion engine (PHEV) | CNY/vehicle × 104 | — | 2 | 3 | |

| Initial cost of PHEV battery | CNY/vehicle × 104 | — | 12 | 18 | |

| Initial Maturity of PHEV battery | — | — | 0.3 | 0.3 | |

| Maintenance cost | CNY/year | — | 2000 | 3000 | |

| Insurance premium | CNY/year | — | 5500 | 7500 | |

| CV/ BEV/ PHEV | Cost of Vehicle license plate | CNY | 70,000 (megalopolis) or 0 (other cities and rural areas) | ||

| Annual travel distance | km/year | 15,000 | |||

| Purchase tax | — | 10% | |||

| Average years kept | Year | 15 | |||

| Oil price | CNY/L | 6.5 | |||

| Electricity | CNY/kWh | 0.6 (day) or 0.3 (night) | |||

| Road tolls | CNY/year | 1400 | |||

| V&V tax | CNY/year | 950 | |||

| Cost of Driving restriction | CNY/year | 1000 (megalopolis) or 0 (other cities and rural areas) | |||

| Park charges | CNY/year | 4800 (megalopolis) or 2400 (other cities) or 0 (rural area) | |||

| Cost of congestion | CNY/year | 1500 (megalopolis) or 750 (other cities) or 0 (rural area) | |||

Appendix D. Input Parameters About Attributes That Characterize Vehicles

| Attributes | Importance of Attributes to Customers | Initial Attribute Value | ||

| CV | BEV | PHEV | ||

| Environment | 0.67 | 0.73 | 0.96 | 0.7 |

| Performance | 0.94 | 0.85 | 0.72 | 0.77 |

| Reliability | 0.94 | 0.95 | 0.83 | 0.80 |

| Safety | 0.91 | 0.95 | 0.60 | 0.85 |

| Convenience | 0.80 | 1 | 0.05 | 0.60 |

| Popularity | 0.70 | — | — | — |

| Choice | 0.68 | — | — | — |

Appendix E. Calibrations

| Parameter | Value |

| Sensitivity of convenience to effective infrastructure | 1.2 |

| Base prevalence for popularity | 0.5 |

| Sensitivity of popularity to prevalence | 1 |

| Market share for base choice availability | 0.1 |

| Sensitivity of availability to sales | 0.6 |

| Base utilization | 0.7 |

| Reference utilization discrepancy | 0.1 |

| Sensitivity of adjustment to utilization | 0.5 |

| Sensitivity of capacity adjustment to policy penalty | 1.5 |

| Sensitivity of price adjustment to utilization | 0.8 |

| Sensitivity of price adjustment to penalty | 0.7 |

| Sensitivity of R&D adjustment to penalty | 1.5 |

Appendix F. The Differences Between Simulation Results and Actual Sales in 2018

| Vehicle Type | NEV | CV | Total | ||||||

| BEV | PHEV | ||||||||

| BEV-S | BEV-M | BEV-L | PHEV-M | PHEV-L | CV-S | CV-M | CV-L | ||

| Simulation Sales | 15.8 | 38.8 | 16.5 | 19.1 | 4.7 | 410.9 | 1392.4 | 479.4 | 2377.7 |

| Actual Sales | 17.2 | 41.7 | 17.7 | 20.5 | 5.1 | 426.7 | 1384.5 | 457.6 | 2371.0 |

| Difference | −7.9% | −7.0% | −6.5% | −6.8% | −7.0% | −3.7% | 0.6% | 4.8% | 0.3% |

References

- Guo, J.; Zhang, X.; Cao, Q.; Gu, F. Electric vehicles contribute to China’s energy security and carbon peaking and carbon neutrality. Bull. Chin. Acad. Sci. 2024, 39, 397–407. [Google Scholar]

- Jing, P.; Shao, D.; Liu, Y.; Chen, Y.; Zhang, S. Linking short- and long-term impacts of the government, consumers, and manufacturers on NEV sales and market share in China. J. Retail. Consum. Serv. 2025, 82, 104090. [Google Scholar] [CrossRef]

- Du, J.; Ouyang, D. Progress of Chinese electric vehicles industrialization in 2015: A review. Appl. Energy 2017, 188, 529–546. [Google Scholar] [CrossRef]

- Hao, H.; Ou, X.; Du, J.; Wang, H.; Ouyang, M. China’s electric vehicle subsidy scheme: Rationale and impacts. Energy Policy 2014, 73, 722–732. [Google Scholar] [CrossRef]

- Helveston, J.P.; Liu, Y.; Feit, E.M.; Fuchs, E.; Klampfl, E.; Michalek, J.J. Will subsidies drive electric vehicle adoption? Measuring consumer preferences in the US and China. Transp. Res. Part A Policy Pract. 2015, 73, 96–112. [Google Scholar] [CrossRef]

- Wang, S.; Shi, L. EV diffusion promotion analysis under different charging market structure. Technol. Forecast. Soc. Change 2024, 208, 123730. [Google Scholar] [CrossRef]

- Zhan, W.; Wang, Z.; Deng, J.; Liu, P.; Cui, D. Integrating system dynamics and agent-based modeling: A data-driven framework for predicting electric vehicle market penetration and GHG emissions reduction under various incentives scenarios. Appl. Energy 2024, 372, 123749. [Google Scholar] [CrossRef]

- Zhu, M.; Dong, P.; Ju, Y.; Li, J.; Ran, L. Effects of government subsidies on heavy-duty hydrogen fuel cell truck penetration: A scenario-based system dynamics model. Energy Policy 2023, 183, 113809. [Google Scholar] [CrossRef]

- Han, R.; Yu, B.Y.; Tang, B.J.; Liao, H.; Wei, Y.M. Carbon emissions quotas in the Chinese road transport sector: A carbon trading perspective. Energy Policy 2017, 106, 298–309. [Google Scholar] [CrossRef]

- Shen, Y.-S.; Huang, G.-T.; Chang-Chien, C.-L.; Huang, L.H.; Kuo, C.-H.; Hu, A.H. The impact of passenger electric vehicles on carbon reduction and environmental impact under the 2050 net zero policy in Taiwan. Energy Policy 2023, 183, 113838. [Google Scholar] [CrossRef]

- Wang, Y. Comparison of California ZEV Mandate with China’s Dual-credit Regulation and Its Simulation Results. 2017. Available online: https://www.d1ev.com/kol/49713 (accessed on 27 November 2019).

- Gómez, V.; Jonatan, J.; Jochem, P. Simulating vehicle fleet composition: A review of system dynamics models. Renew. Sustain. Energy Rev. 2019, 115, 109367. [Google Scholar] [CrossRef]

- Hu, X.; Chang, S.; Li, J.; Qin, Y. Energy for sustainable road transportation in China: Challenges, initiatives and policy implications. Energy 2010, 35, 4289–4301. [Google Scholar] [CrossRef]

- Harrison, G.; Thiel, C.; Jones, L. Powertrain Technology Transition Market Agent Model (ptt-mam): An Introduction; EUR 27740; Publications Office of the European Union: Luxembourg, 18 March 2016. [Google Scholar]

- Ou, S.; Lin, Z.; Qi, L.; Li, J.; He, X.; Przesmitzki, S. The New Double-Credit Regulation: Quantifying Its Impact on Plug-In Electric Vehicle Sales and Industry Profits. In Proceedings of the Transportation Research Board 97th Annual Meeting, Washington, DC, USA, 7–11 January 2018. No. 18-04505. [Google Scholar]

- Li, Y.; Zhang, Q.; Liu, B.; Mclellan, B.; Gao, Y.; Tang, Y. Substitution effect of new-energy vehicle credit program and corporate average fuel consumption regulation for green-car subsidy. Energy 2018, 152, 223–236. [Google Scholar] [CrossRef]

- Wang, S.; Zhao, F.; Liu, Z. Impacts of a super credit policy on electric vehicle penetration and compliance with China’s corporate average fuel consumption regulation. Energy 2018, 155, 746–762. [Google Scholar] [CrossRef]

- Cui, H. China’s New Energy Vehicle Mandate Policy (Final Rule). Policy Update. ICCT Report; International Council on Clean Transportation (ICCT): Washington, DC, USA, 2018. [Google Scholar]

- Zhu, L.; Zhang, Q.; Lu, H.; Li, H.; Li, Y.; McLellan, B.; Pan, X. Study on crowdfunding’s promoting effect on the expansion of electric vehicle charging piles based on game theory analysis. Appl. Energy 2017, 196, 238–248. [Google Scholar] [CrossRef]

- Lu, L.; Ge, P.; Liu, S. The NEV mandate policy compliance cost calculation model based on energy saving and new energy technology path and its application. Auto Ind. Res. 2019, 2019, 41–44. [Google Scholar]

- Shepherd, S.; Bonsall, P.; Harrison, G. Factors affecting future demand for electric vehicles: A model based study. Transp. Policy 2012, 20, 62–74. [Google Scholar] [CrossRef]

- Sterman, J. System Dynamics: Systems Thinking and Modeling for a Complex World; Massachusetts Institute of Technology: Cambridge, MA, USA, 2002. [Google Scholar]

- Struben, J.; Sterman, J.D. Transition challenges for alternative fuel vehicle and transportation systems. Environ. Plan. B Plan. Des. 2008, 35, 1070–1097. [Google Scholar] [CrossRef]

- Train, K.E. Discrete Choice Methods with Simulation; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Van Moerkerk, M.; Crijns-Graus, W. A comparison of oil supply risks in EU, US, Japan, China and India under different climate scenarios. Energy Policy 2016, 88, 148–158. [Google Scholar] [CrossRef]

- Wang, N.; Fu, G.; Li, Y.; Gong, Z. Economy benefit and business operating service pricing model of electric taxi. J. Tongji Univ. (Nat. Sci.) 2014, 42, 0976–0982. [Google Scholar]

- Ben-Akiva, M.E.; Lerman, S.R.; Lerman, S.R. Discrete Choice Analysis: Theory and Application to Travel Demand; MIT Press: Cambridge, MA, USA, 1985; Volume 9. [Google Scholar]

- Tan, H. Research on Consumers’ Preference for Buying New Energy Vehicles and Its Influencing Factors; Jiangsu University of Science and Technology: Zhejiang, China, 2014. [Google Scholar]

- Nie, C.; Jia, S. The basic principle and evolution of the discrete selection model are reviewed. Quant. Tech. Econ. 2005, 2005, 151–159. [Google Scholar]

- Guo, J.; Li, Y. Customer selection preference analysis based on discrete selection model. Technoeconomics Manag. Res. 2012, 13, 13–16. [Google Scholar]

- Batley, R.P.; Toner, J.P.; Knight, M.J. A mixed logit model of UK household demand for alternative-fuel vehicles. Int. J. Transp. Econ./Riv. Internazionale Econ. Trasp. 2004, 23, 55–77. [Google Scholar]

- Wu, C.; Zeng, D.; Chen, Y. System dynamics modeling and simulation of technology innovation network in high-tech enterprises. Syst. Eng. Theory Pract. 2010, 70, 587–593. [Google Scholar]

- Wang, N.; Gong, Z.; Zhao, J. Consumer ownership cost model of plug-in hybrid vehicle. J. Tongji Univ. Nat. Sci. 2012, 40, 793–799. [Google Scholar]

- Forrester, J.W. Industrial Dynamics. A major breakthrough for decision makers. Harv. Bus. Rev. 1958, 36, 37–66. [Google Scholar]

- Jiao, J.; Zuo, F.; Li, L.; Yuan, H.; Li, J. Estimation of China’s alternative policies of automotive fuels—A perspective of oil dependence. J. Clean. Prod. 2017, 161, 698–707. [Google Scholar] [CrossRef]

- Ou, S.; Lin, Z.; Wu, Z.; Zheng, J.; Lyu, R.; Przesmitzki, S.; He, X. A Study of China’s Explosive Growth in the Plug-In Electric Vehicle Market; TN 37831-6283; US Department of Energy: Oak Ridge, TN, USA, 2017. [Google Scholar]

- Ou, S.; Zhou, Y.; Lian, J.; Jia, P.; Tian, B. Development of hybrid city bus’s driving cycle. In Proceedings of the 2011 International Conference on Electric Information and Control Engineering, Wuhan, China, 15–17 April 2011; IEEE: New York, NY, USA, 2011; pp. 2112–2116. [Google Scholar]

- SAE China. Annual Report on Vehicle Technology in China 2016; Beijing Institute of Technology Press: Beijing, China, 2016. [Google Scholar]

- Diao, Q.; Sun, W.; Yuan, X.; Li, L.; Zheng, Z. Life-cycle private-cost-based competitiveness analysis of electric vehicles in China considering the intangible cost of traffic policies. Appl. Energy 2016, 178, 567–578. [Google Scholar] [CrossRef]

- Hu, Q. China will phase out subsidies for new energy vehicles by 2020. Pet. Petrochem. Energy Sav. 2018, 8, 38. [Google Scholar]

- Fearnley, N.; Pfaffenbichler, P.; Figenbaum, E.; Jellinek, R. E-Vehicle Policies and Incentives-Assessment and Recommendations. Institute of Transport Economics Norwegian Centre for Transport Research. Oslo: Norwegian Center for Transport Research. 2015. Available online: https://www.toi.no/getfile.php?mmfileid=41187 (accessed on 21 February 2023).

- Ajanovic, A.; Haas, R. Dissemination of electric vehicles in urban areas: Major factors for success. Energy 2016, 115, 1451–1458. [Google Scholar] [CrossRef]

- GB 27999-2014; Requirements Coefficient of Company Average Fuel Consumption. China Standards Press: Beijing, China, 2014.

| Name | Description | Elements |

|---|---|---|

| Powertrain (P) | Each potential powertrain option | CV, BEV, PHEV |

| Vehicle Size (S) | Size categories of vehicles | Large, Middle, Small |

| Attributes (A) | Attributes of vehicles | Environment, Performance, Reliability, Safety, Convenience, Popularity, Choice |

| Component (Ct) | Major components of vehicle types | Electric drive system, Battery, CV engine, Body materials |

| Scenario Type | Vehicle Type | 2019–2020 | 2021–2023 | 2024–2026 | 2027–2030 | |

|---|---|---|---|---|---|---|

| NEV credits ratio requirements | Basic | —— | 10%, 12% | 14%, 16%, 18% | 18%, 18%, 18% | 18%, 18%, 18%, 18% |

| NEV credits standard | BEV | 0.012 × R + 0.8 | 0.006 × R + 0.4 | 0.006 × R + 0.4 | 0.006 × R + 0.4 | |

| PHEV | 2 | 1.6 | 1.6 | 1.6 |

| Subsidies for Charging Infrastructure | 2019–2020 | 2021–2023 | 2024–2025 | 2026–2030 |

|---|---|---|---|---|

| National Subsidies (CNY/KW) | 160 | 130 | 100 | 70 |

| Provincial Subsidies (CNY/KW) | 150 | 130 | 110 | 90 |

| Year | Scenario Type | Vehicle Type | 2019–2020 | 2021–2023 | 2024–2026 | 2027–2030 |

|---|---|---|---|---|---|---|

| NEV credits ratio requirements | Basic | —— | 10%, 12% | 14%, 16%, 18% | 18%, 18%, 18% | 18%, 18%, 18%, 18% |

| Conservative | 10%, 12% | 14%, 16%, 18% | 20%, 22%, 24% | 26%, 28%, 30%, 32% | ||

| Radical | 10%, 12% | 14%, 16%, 18% | 21%, 24%, 27% | 30%, 33%, 36%, 39% | ||

| NEV credits standard | Basic Conservative Radical | BEV | 0.012 × R + 0.8 | 0.006 × R + 0.4 | 0.006 × R + 0.4 | 0.006 × R + 0.4 |

| PHEV | 2 | 1.6 | 1.6 | 1.6 |

| Year | Scenario Type | Vehicle Type | 2019–2020 | 2021–2023 | 2024–2026 | 2027–2030 |

|---|---|---|---|---|---|---|

| NEV credits ratio requirements | Basic Conservative Radical | —— | 10%, 12% | 14%, 16%, 18% | 18%, 18%, 18% | 18%, 18%, 18%, 18% |

| NEV credits standard | Basic | BEV | 0.012 × R + 0.8 | 0.006 × R + 0.4 | 0.006 × R + 0.4 | 0.006 × R + 0.4 |

| PHEV | 2 | 1.6 | 1.6 | 1.6 | ||

| Conservative | BEV | 0.012 × R + 0.8 | 0.006 × R + 0.4 | 0.003 × R + 0.2 | 0.003 × R + 0.2 | |

| PHEV | 2 | 1.6 | 1.28 | 1.28 | ||

| Radical | BEV | 0.012 × R + 0.8 | 0.006 × R + 0.4 | 0.003 × R + 0.2 | 0.0015 × R + 0.2 | |

| PHEV | 2 | 1.6 | 1.28 | 1.02 |

| Year | Scenario Type | Vehicle Type | 2019–2020 | 2021–2023 | 2024–2026 | 2027–2030 |

|---|---|---|---|---|---|---|

| NEV credits ratio requirements | Basic | —— | 10%, 12% | 14%, 16%, 18% | 18%, 18%, 18% | 18%, 18%, 18%, 18% |

| Conservative | 10%, 12% | 14%, 16%, 18% | 20%, 22%, 24% | 26%, 28%, 30%, 32% | ||

| Radical | 10%, 12% | 14%, 16%, 18% | 21%, 24%, 27% | 30%, 33%, 36%, 39% | ||

| NEV credits standard | Basic | BEV | 0.012 × R + 0.8 | 0.006 × R + 0.4 | 0.006 × R + 0.4 | 0.006 × R + 0.4 |

| PHEV | 2 | 1.6 | 1.6 | 1.6 | ||

| Conservative | BEV | 0.012 × R + 0.8 | 0.006 × R + 0.4 | 0.003 × R + 0.2 | 0.003 × R + 0.2 | |

| PHEV | 2 | 1.6 | 1.28 | 1.28 | ||

| Radical | BEV | 0.012 × R + 0.8 | 0.006 × R + 0.4 | 0.003 × R + 0.2 | 0.0015 × R + 0.2 | |

| PHEV | 2 | 1.6 | 1.28 | 1.02 |

| Scenario Type | Vehicle Type | 2019–2020 | 2021–2023 | 2024–2025 | 2026–2030 | |

|---|---|---|---|---|---|---|

| NEV credits ratio requirements | Latest draft | —— | 10%, 12% | 14%, 16%, 18% | 28%, 38% | 38% |

| NEV credits standard | BEV | 0.012 × R + 0.8 | 0.006 × R + 0.4 | 0.0034 × R + 0.2 | 0.0034 × R + 0.2 | |

| PHEV | 2 | 1.6 | 1 | 1 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Published by MDPI on behalf of the World Electric Vehicle Association. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, N.; Li, X.; Yang, X. The Efficacy of the New Energy Vehicle Mandate Policy on Passenger Vehicle Market in China. World Electr. Veh. J. 2025, 16, 151. https://doi.org/10.3390/wevj16030151

Wang N, Li X, Yang X. The Efficacy of the New Energy Vehicle Mandate Policy on Passenger Vehicle Market in China. World Electric Vehicle Journal. 2025; 16(3):151. https://doi.org/10.3390/wevj16030151

Chicago/Turabian StyleWang, Ning, Xiufeng Li, and Xuening Yang. 2025. "The Efficacy of the New Energy Vehicle Mandate Policy on Passenger Vehicle Market in China" World Electric Vehicle Journal 16, no. 3: 151. https://doi.org/10.3390/wevj16030151

APA StyleWang, N., Li, X., & Yang, X. (2025). The Efficacy of the New Energy Vehicle Mandate Policy on Passenger Vehicle Market in China. World Electric Vehicle Journal, 16(3), 151. https://doi.org/10.3390/wevj16030151