Multidimensional Analysis of Technological Innovation Efficiency in New Energy Vehicles: Industrial Chain Heterogeneity and Key Drivers

Abstract

1. Introduction

2. Literature Review

2.1. Measurement of Technological Innovation Efficiency of Enterprises

2.2. Key Factors Affecting the Efficiency of Technological Innovation in Enterprises

2.2.1. Internal Factors of the Enterprise

2.2.2. External Factors

2.3. Research Gaps and Contributions

3. Research Hypothesis

3.1. The Influence of External Factors on the Efficiency of Technological Innovation of Enterprises

3.1.1. Impact of Tax Incentives and Additional Deduction for R&D Expenses on Technological Innovation Efficiency of New Energy Automobile Enterprises

3.1.2. Impact of Market Competition on the Technological Innovation Efficiency of New Energy Vehicle Enterprises

3.2. The Influence of Internal Factors on the Efficiency of Technological Innovation in Enterprises

3.2.1. The Impact of Labor Quality on the Technological Innovation Efficiency of New Energy Vehicle Enterprises

3.2.2. The Impact of Financial Leverage and Financing Constraints on the Technological Innovation Efficiency of New Energy Enterprises

3.2.3. Impact of Equity Concentration on the Technological Innovation Efficiency of New Energy Enterprises

4. Research Design

4.1. Model Specification

4.1.1. DEA Model of SBM Network

4.1.2. SBM Super-Efficiency Model Incorporating Undesired Outputs

4.1.3. The DEA-BCC Model

4.1.4. Malmquist–Luenberger Index

4.1.5. Tobit Modeling

4.2. Selection of Indicators

4.2.1. Input–Output Variables

4.2.2. Influencing Factors

4.3. Sample Selection and Data Sources

5. Empirical Analysis

5.1. Measurement of Technological Innovation Efficiency in New Energy Automobile Industry

5.1.1. Static Analysis of SBM-DEA Model and DEA-BCC Model Validation

5.1.2. Based on Industry Chain Link Analysis

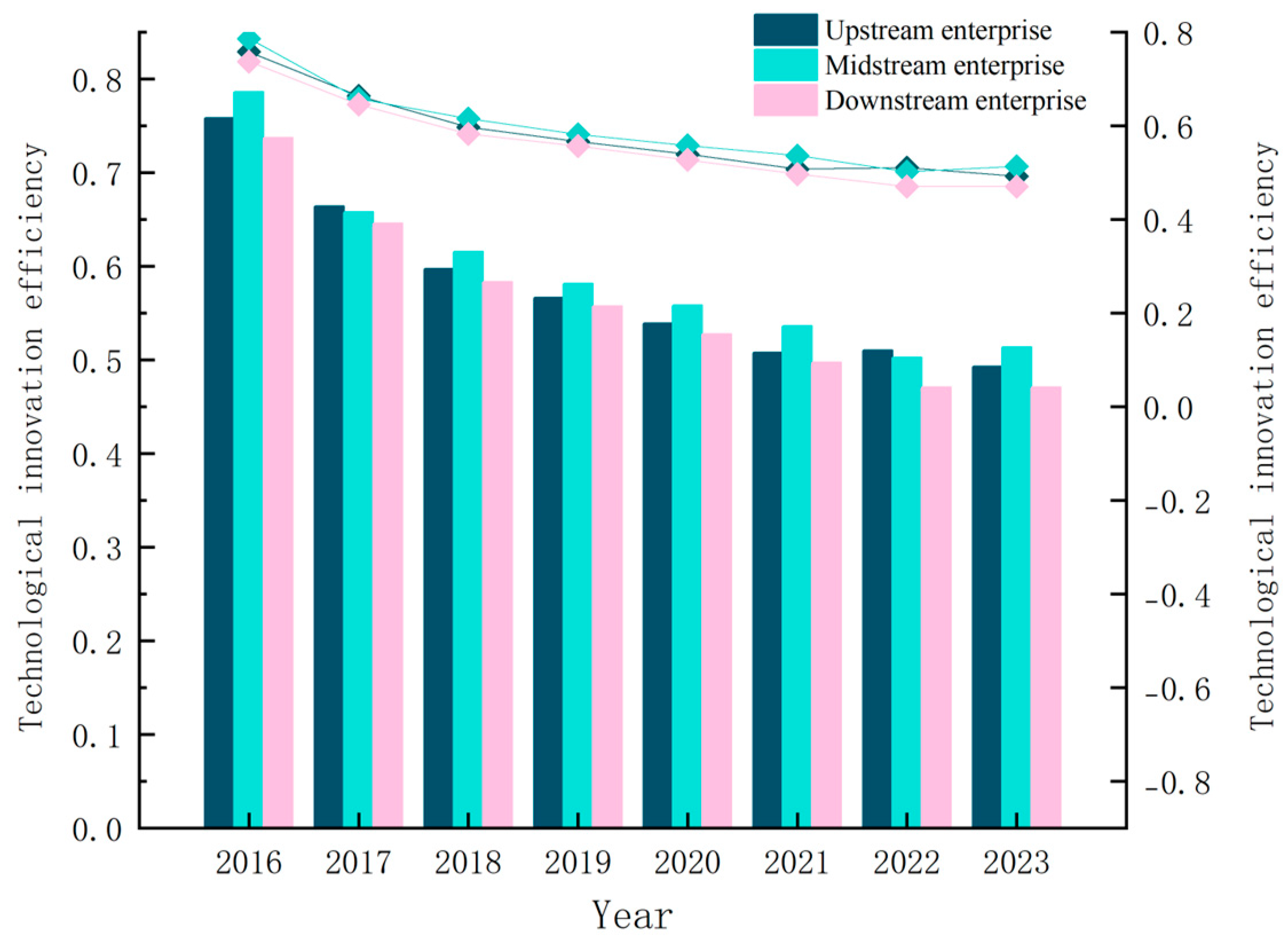

5.1.3. Dynamic Analysis of the DEA-Malmquist Index

5.2. Analysis of Research on Influencing Factors

5.2.1. Descriptive Statistics of Variables

5.2.2. Analysis of Tobit Overall Regression Results

5.2.3. Analysis by Industry Chain

6. Conclusions and Responses

6.1. Conclusions of the Study

6.2. Recommendations for Countermeasures

6.2.1. Optimize Resource Management and Innovation

6.2.2. Refine Fiscal and Tax Policies

6.2.3. Balance R&D and Production for Upstream Sustainability

6.2.4. Boost Midstream Core Technological Competitiveness

6.2.5. Promote Market-Driven Downstream Innovation

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| DUM | Decision-making units |

| ML | Malmquist-Luenberger |

| TC | Technological Change |

| EC | Efficiency Change |

| PEC | Pure Efficiency Change |

| SEC | Scale Efficiency Change |

| IE | Efficiency of technological innovation |

| Qos | Qiality of labor force |

| Leve | Financial everage |

| Growth | Enterprise growth capacity |

| WW | Financing constrains |

| EC | Market competitivenes |

| OC | Shareholding concentration |

| Rded | Deduction of R&D expenses |

| Taxb | Tax incentives |

References

- Axios. Axios AM Thought Bubble: New Climate Reality. Axios. Available online: https://www.axios.com/newsletters/axios-thought-bubble-7567eb80-fdfe-11ef-9ad5-c39624c669a2 (accessed on 10 March 2025).

- Times Union. Editorial: Fiddling While the World Warms. Times Union. Available online: https://www.timesunion.com/opinion/article/editorial-fiddling-world-warms-20213267.php (accessed on 10 March 2025).

- Cheng, X.Z.; Tang, X.T. Research on the Efficiency of Technological Innovation and Influencing Factors in Strategic Emerging Industries: A Perspective from the New Energy Vehicle Industry. East China Econ. Manag. 2024, 38, 54–64. [Google Scholar] [CrossRef]

- Lutz, B.J.; Massier, P.; Sommerfeld, K.; Löschel, A. Drivers of energy efficiency in German manufacturing: A firm-level stochastic frontier analysis. Soc. Sci. Electron. Publ. 2017, 2017, 17–68. [Google Scholar] [CrossRef]

- Al-Refaie, A.; Wu, C.-W.; Sawalheh, M. DEA window analysis for assessing efficiency of blistering process in a pharmaceutical industry. Neural Comput. Appl. 2019, 31, 3703–3717. [Google Scholar] [CrossRef]

- Xiao, R.; Ding, J. Green innovation efficiency of enterprises in China and its spatial spillover effect: Based on two-stage value chain perspective. J. Shanxi Univ. Financ. Econ. 2017, 39, 14. [Google Scholar]

- Fang, S.; Xue, X.; Yin, G.; Fang, H.; Zhang, Y. Evaluation and improvement of technological innovation efficiency of new energy vehicle enterprises in China based on DEA-Tobit model. Sustainability 2020, 12, 7509. [Google Scholar] [CrossRef]

- Chen, V.Z.; Li, J.; Shapiro, D.M. Ownership structure and innovation: An emerging market perspective. Asia Pac. J. Manag. 2014, 31, 1–24. [Google Scholar] [CrossRef]

- Jefferson, G.H.; Su, J. Privatization and restructuring in China: Evidence from shareholding ownership, 1995–2001. J. Comp. Econ. 2006, 34, 146–166. [Google Scholar] [CrossRef]

- Zhang, Z.; Shao, Q.; La, R. Research on the efficiency of technological innovation resource allocation in national independent innovation demonstration zones. Henan Sci. 2020, 38, 9. [Google Scholar]

- Ederer, F.; Manso, G. Is pay for performance detrimental to innovation? Manag. Sci. 2013, 59, 1496–1513. [Google Scholar] [CrossRef]

- Michele, M.; James, M.; Joyce, T. Political influences on biotechnology-based innovation for European agriculture: Risk-assessment and risk management. Technol. Anal. Strateg. Manag. 2021, 33, 271–282. [Google Scholar]

- Hecker, A.; Ganter, A. The influence of product market competition on technological and management innovation: Firm-level evidence from a large-scale survey. Eur. Manag. Rev. 2013, 10, 17–33. [Google Scholar] [CrossRef]

- Amara, N.; Landry, R.; Traore, N. Managing the protection of innovations in knowledge-intensive business services. Res. Policy 2008, 37, 1530–1547. [Google Scholar] [CrossRef]

- Czarnitzki, D.; Lopes-Bento, C. Innovation subsidies: Does the funding source matter for innovation intensity and performance? Empirical evidence from Germany. Ind. Innov. 2014, 21, 380–409. [Google Scholar] [CrossRef]

- Norlia, A. Technological innovations and consumer needs: An analysis of the mobile communications market. ASEAN Mark. J. 2013, 3, 1. [Google Scholar]

- Fukuyama, H.; Weber, W.L. A directional distance function approach to dynamic efficiency measurement. Eur. J. Oper. Res. 2010, 207, 1103–1110. [Google Scholar]

- Hao, J.; Zhang, J.; Li, Y. Innovation efficiency in China’s high-tech industry: A dynamic network DEA approach. Technol. Forecast. Soc. Change 2018, 135, 1–10. [Google Scholar]

- Tengfei, L.; Ullah, A. Impact of fiscal policies and green financing on firm innovation and firm value for green economic recovery. Heliyon 2024, 10, e30145. [Google Scholar] [CrossRef]

- Bao, J.; Li, F. The impact of R&D expense deduction policy on innovation output of high-tech enterprises. Tax Res. 2024, 2024, 32–41. [Google Scholar]

- Zhu, P.; Ji, Y.; Yao, Q.; Wang, Y.S. Incentive effect of R&D expense deduction policy for high-tech enterprises: Based on an extended counterfactual model. Econ. Res. 2024, 2024. [Google Scholar]

- Sana, S.S.; Boros, E. A Structural Mathematical Model on a Two-Echelon Supply Chain System; Springer: Berlin/Heidelberg, Germany, 2022. [Google Scholar]

- Lv, H.; Qian, H. Research on improving innovation efficiency of new energy vehicle enterprises in China from the perspective of innovation value chain. Manag. Adm. 2024, 2024. [Google Scholar]

- Yu, Y.; Cheng, L.; Zhang, D.; Linton, J. How Does Market Competition Affect Enterprise Cooperative Innovation? The Moderating Role of Intellectual Property Protection and Government Subsidies; Elsevier: Amsterdam, The Netherlands, 2024. [Google Scholar]

- Autor, D.; Dorn, D.; Hanson, G.; Pisano, G.; Shu, P. Foreign competition and domestic innovation: Evidence from U.S. patents. Am. Econ. Rev. Insights 2017, 2, 357–374. [Google Scholar] [CrossRef]

- Aytun, C.; Erdogan, S.; Pata, U.K.; Cengiz, O. Associating environmental quality, human capital, financial development, and technological innovation in 19 middle-income countries: A disaggregated ecological footprint approach. Technol. Soc. 2024, 76, 102445. [Google Scholar] [CrossRef]

- Ghasemi, R.; Mahbanooei, B.; Beigi, R.G. The relationship between labor market efficiency and innovation. In Proceedings of the 11th International Seminar on Industrial Engineering & Management (ISIEM), Sulawesi Selatan, Indonesia, 27–29 November 2018. [Google Scholar]

- Soh, F.; Grover, V. Leveraging platform boundary resources: The role of distributed sensemaking. J. Manag. Inf. Syst. 2022, 39, 366–394. [Google Scholar] [CrossRef]

- Dubiei, Y.V. Interrelation between human capital and innovation in the context of technical and technological development of a country. Sci. Bull. Natl. Min. Univ. 2020, 6. [Google Scholar] [CrossRef]

- Yuan, X.; Wang, H.; Tan, W. Impact of creative talent agglomeration on innovation efficiency of creative industries. J. Shanghai Bus. Sch. 2024, 2024. [Google Scholar]

- Shahzad, S.J.H.; Ali, P.; Ahmad, A.; Tanveer, A. Financial leverage and corporate performance: Does financial crisis owe an explanation? Pak. J. Stat. Oper. Res. 2015, 2015, 67–90. [Google Scholar] [CrossRef]

- Iqbal, N.; Xu, J.F.; Fareed, Z.; Wan, G.; Ma, L. Financial leverage and corporate innovation in Chinese public-listed firms. Eur. J. Innov. Manag. 2022, 25, 299–323. [Google Scholar] [CrossRef]

- Ren, D.; Wu, F.; Chang, X. Corporate leverage and technological innovation: Promotion or inhibition? Empirical evidence based on channel mechanism and structural heterogeneity. J. Humanit. 2021, 2021, 50–59. [Google Scholar]

- Jao, R.; Hamzah, D.; Laba, A.R.; Mediaty, M. Investor decision in estimating the effect of earning persistence, financial leverage, and foreign ownership toward company reputation and value. Int. J. Financ. Res. 2020, 11, 453–461. [Google Scholar] [CrossRef]

- Oliver, H. Incomplete contracts and public ownership: Remarks, and an application to public-private partnerships. Econ. J. 2003, 486, C69–C76. [Google Scholar]

- Wang, W.; Hu, B.; Liu, J. Can external auditing promote corporate technological innovation? Empirical evidence from Chinese firms. Audit. Econ. Res. 2020, 35, 11. [Google Scholar]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs, and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Victor, D.; Zhou, D.; Ahmed, E.H.M.; Dadhich, P.K.; Olivier, J.; Rogner, H.H.; Sheikho, K.; Yamaguchi, M.; Edenhofer, O.; Pichs-Madruga, R.; et al. Introductory chapter. In Climate Change 2014: Mitigation of Climate; Cambridge University Press: Cambridge, UK, 2014. [Google Scholar]

- Mao, J.; Guo, Y.; Cao, J. Financing platform debt and environmental pollution management. Manag. World 2022, 38, 96–118. (In Chinese) [Google Scholar]

- Smith, A.; Williams, R. Innovation Dynamics in Resource-Intensive Industries: Challenges and Opportunities. J. Ind. Econ. 2021, 69, 456–478. [Google Scholar]

| Point | Indicator Category | Indicator Name | Description of Indicators |

|---|---|---|---|

| Science and technology research and development phase | Manpower inputs | R&D personnel equivalent | Number of enterprise R&D personnel in the year (persons) |

| Capital investment | R&D investment intensity | Enterprise R&D investment expenditure/enterprise revenue | |

| Government subsidy | Enterprise government subsidies/enterprise operating income | ||

| Intermediate outputs | R&D patent applications | Total number of patents obtained by enterprises independently and jointly | |

| Transformation phase | Number of R&D effective invention patents | Number of invention patents granted to enterprises in the course of R&D and still in the protection period | |

| Energy inputs | Total energy consumption | Tons of standard coal | |

| Expected outputs | Corporate operating margin | Profit from business/revenue from business | |

| Enterprise return on net assets | Corporate net profit/shareholders’ equity | ||

| Non-expected outputs | Total pollutant emission intensity | ln (combined water pollution equivalent + air pollution emission equivalent + 1) |

| Indicator Name | Indicator Name | Variable Symbol | Description of Indicators |

|---|---|---|---|

| Efficiency of technological innovation | Efficiency of technological innovation | IE | Results from SBM-DEA calculations |

| Quality of labor force | Quality of labor force | Qos | Ratio of employees with bachelor’s degree or above to the total number of employees in the enterprise |

| Financial leverage | Leve | Corporate government subsidies to operating income ratio (%) | |

| Financing constraints | WW | −0.091 × Cash flow/total assets—0.062 × cash dividend payment dummy variable + 0.021 × financial leverage—0.044 × firm size + 0.102 × industry average sales growth rate—0.035 × sales revenue growth rate | |

| Market competitiveness | EC | The sum of the squares of the market shares of all new energy vehicle companies in the market | |

| Shareholding concentration | OC | Proportion of shares held by the largest shareholder of the enterprise | |

| Deduction of R&D expenses | Rded | ln (R&D expenses × percentage deduction) | |

| Tax incentives | Taxb | (Amount of various types of tax rebates/ratio of the amount of various types of tax rebates to the total amount of tax payable) × 100% |

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Technical efficiency | 0.7606 | 0.6560 | 0.5987 | 0.5685 | 0.5416 | 0.5138 | 0.4946 | 0.4924 | 0.5783 |

| Pure technical efficiency | 0.7807 | 0.6677 | 0.6063 | 0.5747 | 0.5492 | 0.5207 | 0.5024 | 0.4979 | 0.5874 |

| Scale efficiency | 0.9765 | 0.9839 | 0.9876 | 0.9890 | 0.9873 | 0.9870 | 0.9862 | 0.9885 | 0.9858 |

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Technical efficiency | 0.9108 | 0.8507 | 0.8309 | 0.8270 | 0.8220 | 0.8081 | 0.7933 | 0.8025 | 0.8225 |

| Pure technical efficiency | 0.9189 | 0.8596 | 0.8473 | 0.8467 | 0.8428 | 0.8269 | 0.8146 | 0.8359 | 0.8596 |

| Scale efficiency | 0.9914 | 0.9900 | 0.9811 | 0.9774 | 0.9765 | 0.9782 | 0.9749 | 0.9731 | 0.9803 |

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | Average | |

|---|---|---|---|---|---|---|---|---|---|

| Upstream enterprise | 0.7582 | 0.6641 | 0.5972 | 0.5666 | 0.5393 | 0.5078 | 0.5104 | 0.4928 | 0.5796 |

| Midstream enterprise | 0.7863 | 0.658 | 0.6156 | 0.5815 | 0.5581 | 0.5364 | 0.5026 | 0.5136 | 0.5940 |

| Downstream enterprise | 0.7373 | 0.6459 | 0.5833 | 0.5574 | 0.5274 | 0.4972 | 0.4708 | 0.4708 | 0.5613 |

| Average value | 0.7606 | 0.6560 | 0.5987 | 0.5685 | 0.5416 | 0.5138 | 0.4946 | 0.4924 | 0.5783 |

| Year | EC | TC | PEC | SEC |

|---|---|---|---|---|

| 2016–2017 | 1.01 | 0.896 | 1.006 | 1.004 |

| 2017–2018 | 0.99 | 0.927 | 0.996 | 0.994 |

| 2018–2019 | 1.038 | 0.915 | 1.036 | 1.002 |

| 2019–2020 | 1.000 | 0.964 | 1.005 | 0.995 |

| 2020–2021 | 1.005 | 0.963 | 1.002 | 1.003 |

| 2021–2022 | 0.997 | 0.968 | 1.001 | 0.996 |

| 2022–2023 | 1.002 | 1.014 | 0.999 | 1.004 |

| Average value | 1.006 | 0.949 | 1.006 | 1.000 |

| VarName | Mean | SD | Min | Median | Max | Obs |

|---|---|---|---|---|---|---|

| IE | 0.578 | 0.562 | 0.116 | 0.182 | 1.192 | 2176 |

| Taxb | 0.197 | 0.120 | 0.205 | 0 | 0.841 | 2176 |

| Rded | 54.687 | 54.93 | 14.427 | 8.780 | 101.16 | 2126 |

| OC | 18.69 | 18.572 | 1.434 | 13.001 | 23.748 | 2176 |

| Qos | 21.66 | 17.68 | 16.10 | 0 | 93.37 | 2176 |

| Leve | 1.248 | 1.063 | 1.469 | −5.220 | 38.989 | 2176 |

| WW | −0.002 | 0 | 0.044 | −1.866 | 0 | 2176 |

| EC | 0.207 | 0.162 | 0.130 | 0 | 1 | 2176 |

| VarName | (1) | (2) | (3) | (4) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Synthesis | Upstream | Midstream | Downstream | |||||||||

| Coefficient | z-Value | p > |z| | Coefficient | z-Value | p > |z| | Coefficient | z-Value | p > |z| | Coefficient | z-Value | p > |z| | |

| Taxb | −0.0763 *** (0.015) | −5.08 | 0.000 | −0.00213 (−0.17) | −0.07 | 0.947 | −0.0705 *** (0.0176) | −4.00 | 0.000 | −0.200 *** (0.0486) | −4.11 | 0.000 |

| Rded | 0.00216 *** (0.00022) | 9.77 | 0.000 | 0.0176 *** (0.00046) | 3.89 | 0.000 | 0.00223 *** (0.000266) | 8.38 | 0.000 | −0.000145 (0.00074) | −0.20 | 0.845 |

| OC | 0.128 *** (0.0216) | 5.91 | 0.000 | 0.0859 ** (0.0456) | 1.88 | 0.060 | 0.119 *** (0.0255) | 4.66 | 0.000 | 0.288 *** (0.075) | 3.84 | 0.000 |

| Qos | −0.00139 *** (0.00238) | −5.84 | 0.000 | −0.00106 * (0.000561) | −1.89 | 0.058 | −0.00126 ** (0.000327) | −3.87 | 0.000 | −0.00152 *** (0.000488) | −3.11 | 0.002 |

| Leve | −0.00139 (0.00116) | −1.19 | 0.233 | 0.00247 (0.00392) | 0.63 | 0.528 | −0.00207 (0.0015) | −1.37 | 0.170 | −0.00130 (0.002) | −0.65 | 0.515 |

| WW | −0.0649 *** (0.0056) | −11.60 | 0.000 | −0.0764 ** (0.0155) | −4.93 | 0.000 | −0.0586 *** (0.00614) | −9.53 | 0.000 | −0.0651 *** (0.016) | −4.08 | 0.000 |

| EC | −0.0739 *** (0.00309) | −23.93 | 0.000 | −0.0716 *** (0.00595) | −12.05 | 0.000 | −0.0977 *** (0.00426) | −22.92 | 0.000 | −0.0404 *** (0.00533) | −7.56 | 0.000 |

| _cons | 1.799 *** (0.0593) | 30.32 | 0.000 | 1.766 *** (0.116) | 15.25 | 0.000 | 2.236 *** (0.00824) | 27.14 | 0.000 | 1.301 *** (0.0999) | 13.03 | 0.000 |

| sigma_u | 0.0877 *** (0.0054) | 16.24 | 0.000 | 0.0731 *** (0.0104) | 7.02 | 0.000 | 0.105 *** (0.00711) | 14.80 | 0.000 | 0.0718 *** (0.0123) | 5.83 | 0.000 |

| sigma_e | 0.0727 *** (0.00126) | 57.53 | 0.000 | 0.0756 *** (0.003) | 25.18 | 0.000 | 0.0670 *** (0.00139) | 48.37 | 0.000 | 0.0779 *** (0.0038) | 20.52 | 0.000 |

| N | 2127 | 400 | 1460 | 267 | ||||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Published by MDPI on behalf of the World Electric Vehicle Association. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xue, Y.; Lu, Y.; Wang, Z. Multidimensional Analysis of Technological Innovation Efficiency in New Energy Vehicles: Industrial Chain Heterogeneity and Key Drivers. World Electr. Veh. J. 2025, 16, 233. https://doi.org/10.3390/wevj16040233

Xue Y, Lu Y, Wang Z. Multidimensional Analysis of Technological Innovation Efficiency in New Energy Vehicles: Industrial Chain Heterogeneity and Key Drivers. World Electric Vehicle Journal. 2025; 16(4):233. https://doi.org/10.3390/wevj16040233

Chicago/Turabian StyleXue, Yawei, Yuchen Lu, and Zhongshuai Wang. 2025. "Multidimensional Analysis of Technological Innovation Efficiency in New Energy Vehicles: Industrial Chain Heterogeneity and Key Drivers" World Electric Vehicle Journal 16, no. 4: 233. https://doi.org/10.3390/wevj16040233

APA StyleXue, Y., Lu, Y., & Wang, Z. (2025). Multidimensional Analysis of Technological Innovation Efficiency in New Energy Vehicles: Industrial Chain Heterogeneity and Key Drivers. World Electric Vehicle Journal, 16(4), 233. https://doi.org/10.3390/wevj16040233