Effect of FDI on Pollution in China: New Insights Based on Wavelet Approach

Abstract

:1. Introduction

2. FDI and Pollution in China

3. Literature Review

4. Methodology

4.1. Continuous Wavelet Transformation

4.2. Wavelet Coherence and Phase Difference

4.3. Wavelet Cohesion and Wavelet-Based Causality

5. Empirical Results

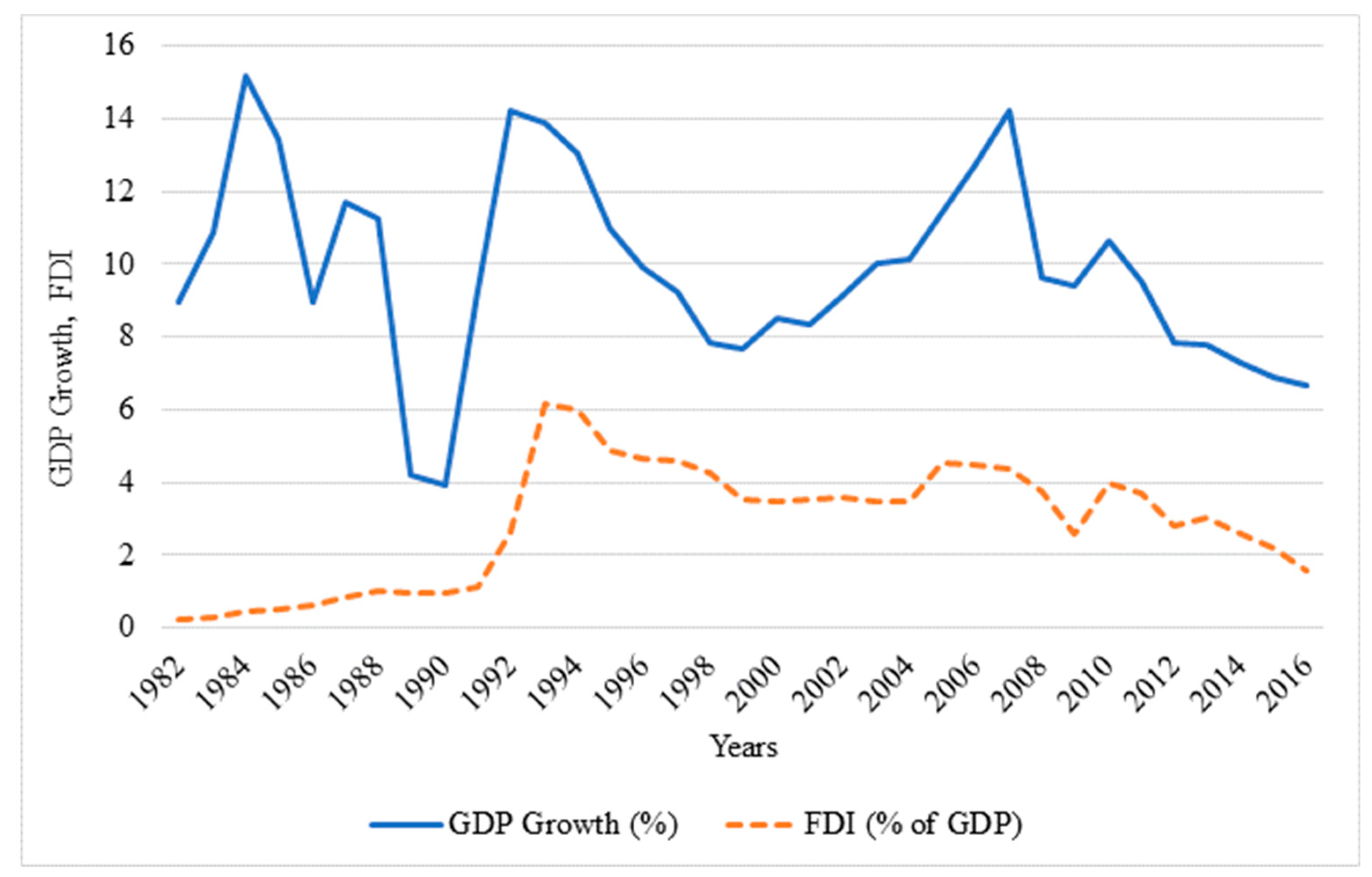

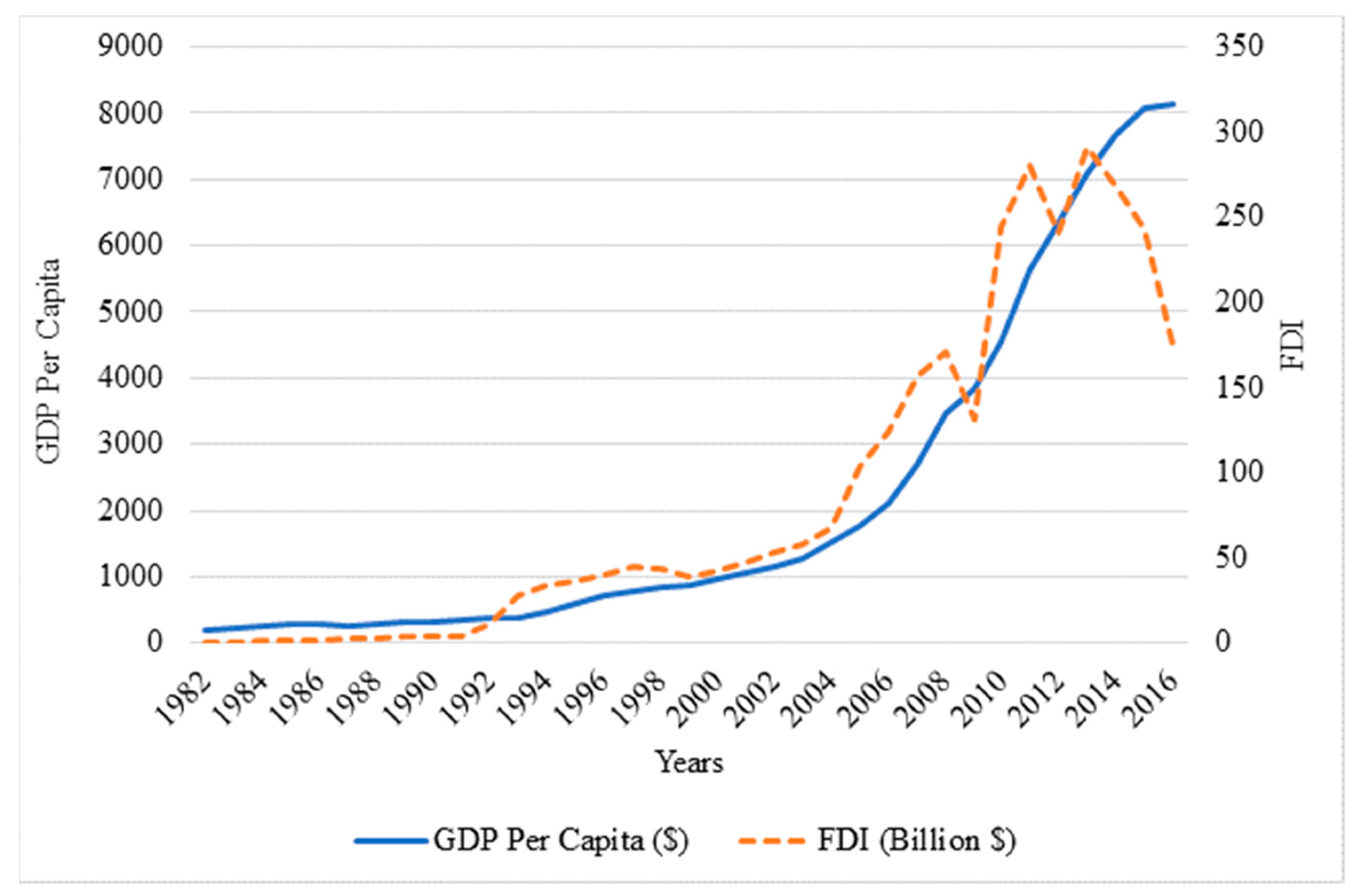

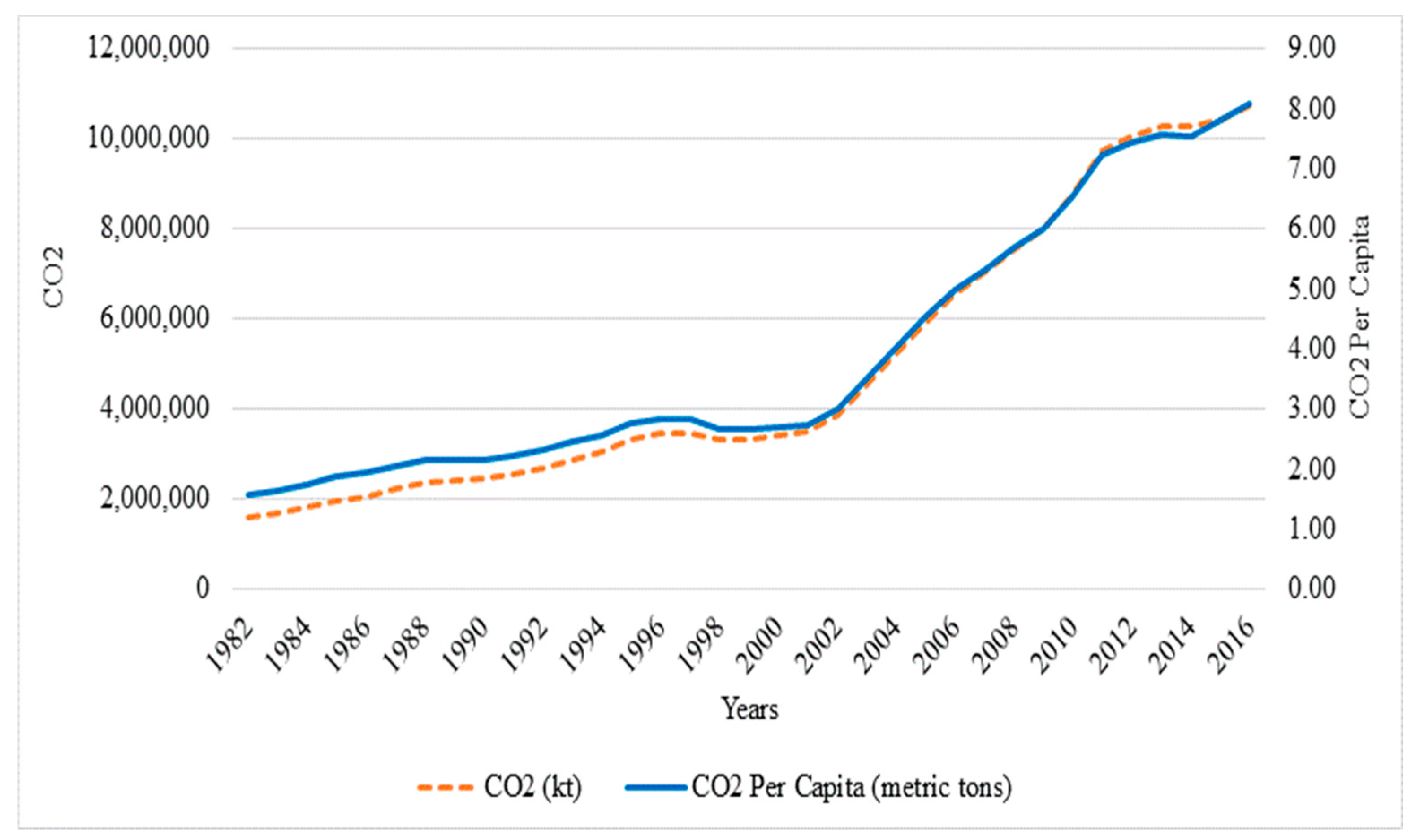

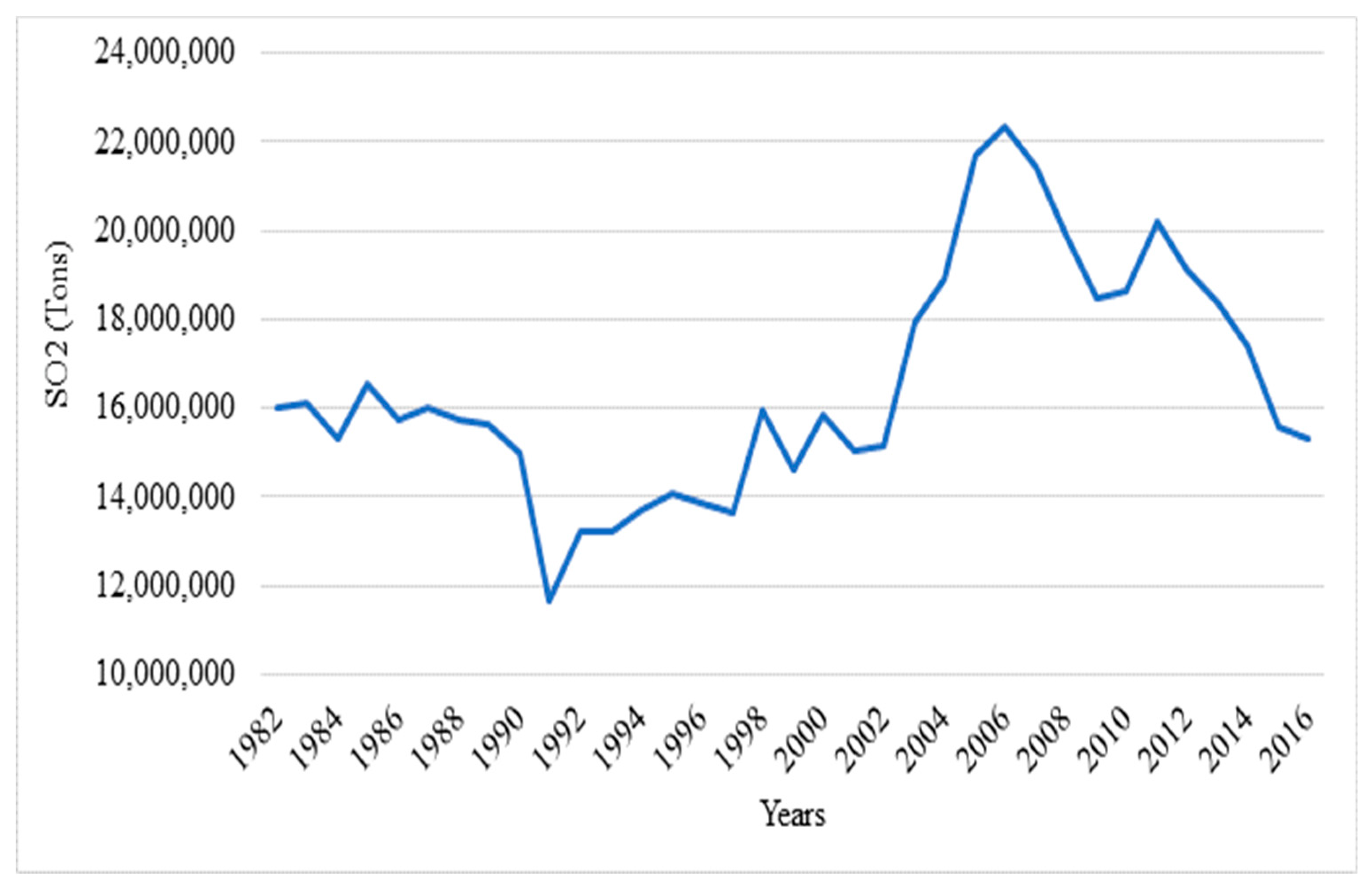

5.1. Data and Preliminary Statistics

5.2. Continuous Wavelet Transformation (CWT) Power Spectrum

5.3. Wavelet Coherency (WTC)

5.4. Wavelet Causality and Correlations

5.5. Robustness Checks

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Copeland, B.R.; Taylor, M.S. North-South Trade and the Environment. Q. J. Econ. 1994, 109, 755–787. [Google Scholar] [CrossRef]

- Tobey, J.A. Effects of Domestic Environmental Policy on Patterns of International Trade: An Empirical Test. Kyklos Int. Rev. Soc. Sci. 1990, 43, 191–2019. [Google Scholar]

- Cole, M.A. Trade, the pollution haven hypothesis and the environmental Kuznets curve: Examining the linkages. Ecol. Econ. 2004, 48, 71–81. [Google Scholar] [CrossRef]

- He, J. Pollution haven hypothesis and environmental impacts of foreign direct investment: The case of industrial emission of sulfur dioxide (SO2) in Chinese provinces. Ecol. Econ. 2006, 60, 228–245. [Google Scholar] [CrossRef]

- Kivyiro, P.; Arminen, H. Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: Causality analysis for Sub-Saharan Africa. Energy 2014, 74, 595–606. [Google Scholar] [CrossRef]

- Lan, J.; Kakinaka, M.; Huang, X. Foreign Direct Investment, Human Capital and Environmental Pollution in China. Environ. Resour. Econ. 2012, 51, 255–275. [Google Scholar] [CrossRef]

- Levinson, A.; Taylor, M.S. Unmasking the Pollution Haven Effect. Int. Econ. Rev. 2008, 49, 223–254. [Google Scholar] [CrossRef]

- Omri, A.; Nguyen, D.K.; Rault, C. Causal interactions between CO2 emissions, FDI, and economic growth: Evidence from dynamic simultaneous-equation models. Econ. Model. 2014, 42, 382–389. [Google Scholar] [CrossRef]

- Shahbaz, M.; Nasreen, S.; Abbas, F.; Anis, O. Does foreign direct investment impede environmental quality in high-, middle- and low-income countries? Energy Econ. 2015, 51, 275–287. [Google Scholar] [CrossRef]

- Tang, C.F.; Tan, B.W. The impact of energy consumption, income and foreign direct investment on carbon dioxide emissions in Vietnam. Energy 2015, 79, 447–454. [Google Scholar] [CrossRef]

- Wang, D.T.; Chen, W.Y. Foreign direct investment, institutional development, and environmental externalities: Evidence from China. J. Environ. Manag. 2014, 135, 81–90. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Y.J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Bin, S.; Yue, L. Impact of foreign direct investment on china’s environment: An empirical study based on industrial panel data. Soc. Sci. China 2012, 33, 89–107. [Google Scholar] [CrossRef]

- Javorcik, B.S.; Wei, S.-J. Pollution havens and foreign direct investment: Dirty secret or popular myth? Contrib. Econ. Anal. Policy 2004, 3, 1–32. [Google Scholar] [CrossRef]

- Antweiler, W.; Copeland, B.R.; Taylor, S. Is free trade good for the environnement. Am. Econ. Rev. 2001, 91, 807–908. [Google Scholar] [CrossRef]

- Eskeland, G.S.; Harrison, A.E. Moving to greener pastures? Multinationals and the pollution haven hypothesis. J. Dev. Econ. 2003, 70, 1–23. [Google Scholar] [CrossRef] [Green Version]

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement; NBER Working Paper No. 3914; MIT Press: Cambridge, MA, USA, 1991; pp. 1–57. [Google Scholar]

- Araya, M. FDI and the environment: What empirical evidence does—And does not—Tell us. In International Investment for Sustainable Development Balancing Rights and Rewards; Routledge: London, UK, 2012; pp. 46–73. [Google Scholar]

- Zhu, Q.; Sarkis, J.; Lai, K.H. Initiatives and outcomes of green supply chain management implementation by Chinese manufacturers. J. Environ. Manag. 2007, 85, 179–189. [Google Scholar] [CrossRef] [PubMed]

- Al-mulali, U. Factors affecting CO2 emission in the Middle East: A panel data analysis. Energy 2012, 44, 564–569. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.R. FDI and the capital intensity of “dirty” sectors: A missing piece of the pollution haven puzzle. Rev. Dev. Econ. 2005, 9, 530–548. [Google Scholar] [CrossRef]

- Al-mulali, U.; Tang, C.F. Investigating the validity of pollution haven hypothesis in the gulf cooperation council (GCC) countries. Energy Policy 2013, 60, 813–819. [Google Scholar] [CrossRef]

- Tamazian, A.; Chousa, J.P.; Vadlamannati, K.C. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Zhang, C.; Zhou, X. Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew. Sustain. Energy Rev. 2016, 58, 943–951. [Google Scholar] [CrossRef]

- UNCTAD. World Investment Report; United Nations Conference on Trade and Development: Geneva, Switzerland, 2018. [Google Scholar]

- Li, M.; Zhang, L. Haze in China: Current and future challenges. Environ. Pollut. 2014, 189, 85–86. [Google Scholar] [CrossRef] [PubMed]

- Liu, Q.; Wang, Q. How China achieved its 11th Five-Year Plan emissions reduction target: A structural decomposition analysis of industrial SO2 and chemical oxygen demand. Sci. Total. Environ. 2017, 574, 1104–1116. [Google Scholar] [CrossRef] [PubMed]

- Acharyya, J. FDI, Growth and the environment: Evidence from India on co2 emission during the last two decades. J. Econ. Dev. 2009, 34, 43–58. [Google Scholar]

- Akbostanci, E.; Tunç, G.I.; Türüt-Aşik, S. Pollution haven hypothesis and the role of dirty industries in Turkey’s exports. Environ. Dev. Econ. 2007, 12, 297–322. [Google Scholar] [CrossRef]

- Baek, J.; Cho, Y.; Koo, W.W. The environmental consequences of globalization: A country-specific time-series analysis. Ecol. Econ. 2009, 68, 2255–2264. [Google Scholar] [CrossRef] [Green Version]

- Chung, S. Environmental regulation and foreign direct investment: Evidence from South Korea. J. Dev. Econ. 2014, 108, 222–236. [Google Scholar] [CrossRef]

- Hitam, M.B.; Borhan, H.B. FDI, Growth and the Environment: Impact on Quality of Life in Malaysia. Procedia Soc. Behav. Sci. 2012, 50, 333–342. [Google Scholar] [CrossRef]

- List, J.A.; Co, C.Y. The effects of environmental regulations on foreign direct investment. J. Environ. Econ. Manag. 2000, 40, 1–20. [Google Scholar] [CrossRef]

- Pao, H.T.; Tsai, C.M. Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): Evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 2011, 36, 685–693. [Google Scholar] [CrossRef]

- Smarzynska, B.K.; Wei, S. Pollution Havens and Foreign Direct Investment: Dirty Secret or Popular Myth? National Bureau of Economic Research: Cambridge, MA, USA, 2001. [Google Scholar]

- Xing, Y.; Kolstad, C.D. Do lax environmental regulations attract foreign investment? Environ. Resour. Econ. 2002, 21, 1–22. [Google Scholar] [CrossRef]

- Zeng, D.Z.; Zhao, L. Pollution havens and industrial agglomeration. J. Environ. Econ. Manag. 2009, 58, 141–153. [Google Scholar] [CrossRef]

- Zhang, J.; Fu, X. Do Intra-Country Pollution Havens Exist? FDI and Environmental Regulations in China; SLPTMD Working Paper Series No. 013; Department of International Development, University of Oxford: Oxford, UK, 2008. [Google Scholar]

- Lee, C.G. Foreign direct investment, pollution and economic growth: Evidence from Malaysia. Appl. Econ. 2009, 41, 1709–1716. [Google Scholar] [CrossRef]

- Liang, F.H. Does Foreign Direct Investment Harm the Host Country’s Environment? Evidence from China. 2008. Available online: https://ssrn.com/abstract=1479864 (accessed on 9 July 2018).

- Merican, Y.; Yusop, Z.; Mohd Noor, Z.; Siong Hook, L. Foreign direct investment and the pollution in Five ASEAN nations. Int. J. Econ. Manag. 2007, 1, 245–261. [Google Scholar]

- Sbia, R.; Shahbaz, M.; Hamdi, H. A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Econ. Model. 2014, 36, 191–197. [Google Scholar] [CrossRef] [Green Version]

- Hoffmann, R.; Lee, C.; Ramasamy, B.; Yeung, M. FDI and pollution: A granger causality test using panel data. J. Int. Dev. 2005, 17, 311–317. [Google Scholar] [CrossRef]

- Kim, M.H.; Adilov, N. The lesser of two evils: An empirical investigation of foreign direct investment-pollution tradeoff. Appl. Econ. 2012, 44, 2597–2606. [Google Scholar] [CrossRef]

- Sung, B.; Song, W.Y.; Park, S.-D. How foreign direct investment affects CO2 emission levels in the Chinese manufacturing industry: Evidence from panel data. Econ. Syst. 2018, 42, 320–331. [Google Scholar] [CrossRef]

- Liu, Q.; Wang, S.; Zhang, W.; Zhan, D.; Li, J. Does foreign direct investment affect environmental pollution in China’s cities? A spatial econometric perspective. Sci. Total Environ. 2018, 613–614, 521–529. [Google Scholar] [CrossRef] [PubMed]

- Yang, J.; Wang, Y. FDI and Environmental Pollution Nexus in China. Master’s Thesis, Lund University, Lund, Sweden, 2016; pp. 1–47. [Google Scholar]

- Zheng, J.; Sheng, P. The Impact of Foreign Direct Investment (FDI) on the Environment: Market Perspectives and Evidence from China. Economies 2017, 5, 8. [Google Scholar] [CrossRef]

- Huang, J.; Chen, X.; Huang, B.; Yang, X. Economic and environmental impacts of foreign direct investment in China: A spatial spillover analysis. China Econ. Rev. 2017, 45, 289–309. [Google Scholar] [CrossRef]

- Dean, J.; Mary, L.; Wang, H. Are foreign investors attracted to weak environmental regulations? Evaluating the evidence from China. J. Dev. Econ. 2009, 90, 1–13. [Google Scholar] [CrossRef]

- Haisheng, Y.; Jia, J.; Yongzhang, Z.; Shugong, W. The impact on environmental kuznets curve by trade and foreign direct investment in China. Chin. J. Popul. Resour. Environ. 2005, 3, 14–19. [Google Scholar] [CrossRef]

- Zeng, K.; Eastin, J. International Economic Integration and Environmental Protection: The Case of China. Int. Stud. Q. 2007, 51, 971–995. [Google Scholar] [CrossRef]

- Zheng, S.; Kahn, M.E.; Liu, H. Regional Science and Urban Economics Towards a system of open cities in China: Home prices, FDI flows and air quality in 35 major cities. Reg. Sci. Urban Econ. 2010, 40, 1–10. [Google Scholar] [CrossRef]

- Kirkulak, B.; Qiu, B.; Yin, W. The impact of FDI on air quality: Evidence from China. J. Chin. Econ. Foreign Trade Stud. 2011, 4, 81–98. [Google Scholar] [CrossRef]

- Bao, Q.; Chen, Y.; Song, L. Foreign direct investment and environmental pollution in China: A simultaneous equations estimation. Environ. Dev. Econ. 2011, 16, 71–92. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.R.; Zhang, J. Growth, foreign direct investment, and the environment: Evidence from chinese cities. J. Reg. Sci. 2011, 51, 121–138. [Google Scholar] [CrossRef]

- Chang, N. The empirical relationship between openness and environmental pollution in China. J. Environ. Plan. Manag. 2012, 55, 783–796. [Google Scholar] [CrossRef]

- Jiang, Y. Foreign direct investment, pollution, and the environmental quality: A model with empirical evidence from the Chinese regions. Int. Trade J. 2015, 29, 212–227. [Google Scholar] [CrossRef]

- Aguiar-Conraria, L.; Azevedo, N.; Soares, M.J. Using wavelets to decompose the time-frequency effects of monetary policy. Phys. A Stat. Mech. Appl. 2008, 387, 2863–2878. [Google Scholar] [CrossRef] [Green Version]

- Rua, A. Worldwide synchronization since the nineteenth century: A wavelet-based view. Appl. Econ. Lett. 2013, 20, 773–776. [Google Scholar] [CrossRef]

- Olayeni, O.R. Causality in Continuous Wavelet Transform Without Spectral Matrix Factorization: Theory and Application. Comput. Econ. 2016, 47, 321–340. [Google Scholar] [CrossRef]

- Lee, J.W. The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 2013, 55, 483–489. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.R.; Okubo, T.; Zhou, Y. The carbon dioxide emissions of firms: A spatial analysis. J. Environ. Econ. Manag. 2013, 65, 290–309. [Google Scholar] [CrossRef] [Green Version]

- Boashash, B. Time-Frequency Signal Analysis and Processing, 2nd ed.; Academic Press: Cambridge, MA, USA, 2015. [Google Scholar]

- Crowley, P.M.; Mayes, D.G. How fused is the euro area core? An evaluation of growth cycle co-movement and synchronization using wavelet analysis. OECD J. J. Bus. Cycle Meas. Anal. 2008, 4, 63–95. [Google Scholar]

- Hallett, A.H.; Richter, C. Have the Eurozone economies converged on a common European cycle? Int. Econ. Econ. Policy 2008, 5, 71–101. [Google Scholar] [CrossRef]

- Breitung, J.; Candelon, B. Testing for short- and long-run causality: A frequency-domain approach. J. Econ. 2006, 132, 363–378. [Google Scholar] [CrossRef]

- Bouri, E.; Roubaud, D.; Jammazi, R.; Assaf, A. Uncovering frequency domain causality between gold and the stock markets of China and India: Evidence from implied volatility indices. Financ. Res. Lett. 2017, 23, 23–30. [Google Scholar] [CrossRef]

| Studies | Data Type(s) | Time Period | Main Pollutant Variable(s) | Estimation Technique | Main Finding(s) |

|---|---|---|---|---|---|

| He [4] | Panel data for 29 provinces | 1994–2001 | SO2 | Simultaneous Equation Model |

|

| Lan et al. [6] | Panel data for 29 provinces | 1996–2006 | SO2, Soot, waste water | Fixed Effect, Random Effect |

|

| Wang and Chen [11] | Panel data for 287 Cities | 2002–2009 | SO2 | Fixed Effect Model |

|

| Zhang [12] | Times Series | 1984–2009 | CO2 | Cointegration |

|

| Bin and Yue [13] | Panel Data for 36 Industries | 2001–2009 | SO2, industrial smoke, industrial waste gas, industrial waste water, COD | SYS-GMM |

|

| Zhang and Zhou [24] | Panel data for 29 provinces | 1995–2010 | CO2 | Fixed Effect |

|

| Liang [40] | Panel data for 260 cities | 1996–2003 | SO2 | OLS |

|

| Sung et al. [45] | Panel data for 28 manufacturing subsectors | 2002–2015 | CO2 | System GMM |

|

| Liu et al. [46] | Panel for 285 cities | 2003–2014 | SO2, waste soot and dust, waste water | Spatial Panel Data Model |

|

| Yang and Wang [47] | Panel data for 30 provinces | 2005–2014 | SO2, waste water, solid waste | GMM |

|

| Zheng and Sheng [48] | Panel data for 30 provinces | 1997–2009 | CO2 | OLS, Fixed Effect, Random Effect |

|

| Huang et al. [49] | Panel data for 30 provinces | 2001–2012 | Pollution index (it covers waste water, COD, Nitrogen Oxide, SO2, soot and dust, solid waste, CO2) | Spatial Durbin Model |

|

| Haisheng et al. [51] | Panel data for 30 provinces | 1990–2002 | SO2, Industrial Waste Water | Fixed Effect Model |

|

| Zeng and Eastin [52] | Panel data for all provinces | 1996–2004 | SO2, Solid Waste, Soot | Panel OLS |

|

| Zheng et al. [53] | Panel Data for 35 cities | 1997–2006 | Particulate Matter (PM), SO2 | OLS |

|

| Kirkulak et al. [54] | Panel data for 286 cities | 2001–2007 | SO2 | Fixed Effect, Random Effect |

|

| Bao et al. [55] | Panel data for 29 provinces | 1992–2004 | SO2, industrial polluted water, chemical oxygen demand, industrial smoke, industrial solid wastes | Simultaneous Equation Model |

|

| Cole et al. [56] | Panel data for 112 major cities | 2001–2004 | Wastewater, petroleum-like matter, waste gas, SO2, soot, dust | Fixed Effect Model |

|

| Chang [57] | Time series | 1981–2008 | SO2, solid waste, waste water | Vector Autoregression (VAR) |

|

| Jiang [58] | Panel data for 28 provinces | 1997–2012 | SO2 | Fixed Effect Model |

|

| FDI (Billion $) | FDI (% of GDP) | CO2 Emissions (kt) | Per Capita CO2 Emissions (metric tons) | SO2 (tons) | |

|---|---|---|---|---|---|

| Mean | 20.80 | 2.87 | 4,962,127 | 3.89 | 16,503,924 |

| Median | 10.74 | 3.43 | 3,430,905 | 2.75 | 15,957,986 |

| Maximum | 75.06 | 7.13 | 10,871,128 | 8.23 | 22,633,287 |

| Minimum | 0.09 | 0.20 | 1,557,746 | 1.55 | 11,407,536 |

| Std. Dev. | 23.62 | 1.70 | 3,056,166 | 2.14 | 2,656,363 |

| Skewness | 1.05 | −0.02 | 0.76 | 0.79 | 0.52 |

| Kurtosis | 2.67 | 2.12 | 2.04 | 2.08 | 2.66 |

| Jarque–Bera (JB) | 26.33 *** | 4.49 | 18.76 *** | 19.58 *** | 7.06 ** |

| Probability (JB) | 0.00 | 0.11 | 0.00 | 0.00 | 0.03 |

| Observations | 140 | 140 | 140 | 140 | 140 |

| FDI (Billion $) | FDI (% of GDP) | |

|---|---|---|

| CO2 Emissions (kt) | 0.972 *** | 0.288 *** |

| 48.434 | 3.538 | |

| 0.000 | 0.001 | |

| CO2 Emissions Per Capita (metric tons) | 0.970 *** | 0.273 *** |

| 46.894 | 3.333 | |

| 0.000 | 0.001 | |

| SO2 (tons) | 0.499 *** | 0.204 *** |

| 6.762 | 2.451 | |

| 0.000 | 0.015 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jun, W.; Zakaria, M.; Shahzad, S.J.H.; Mahmood, H. Effect of FDI on Pollution in China: New Insights Based on Wavelet Approach. Sustainability 2018, 10, 3859. https://doi.org/10.3390/su10113859

Jun W, Zakaria M, Shahzad SJH, Mahmood H. Effect of FDI on Pollution in China: New Insights Based on Wavelet Approach. Sustainability. 2018; 10(11):3859. https://doi.org/10.3390/su10113859

Chicago/Turabian StyleJun, Wen, Muhammad Zakaria, Syed Jawad Hussain Shahzad, and Hamid Mahmood. 2018. "Effect of FDI on Pollution in China: New Insights Based on Wavelet Approach" Sustainability 10, no. 11: 3859. https://doi.org/10.3390/su10113859