1. Introduction

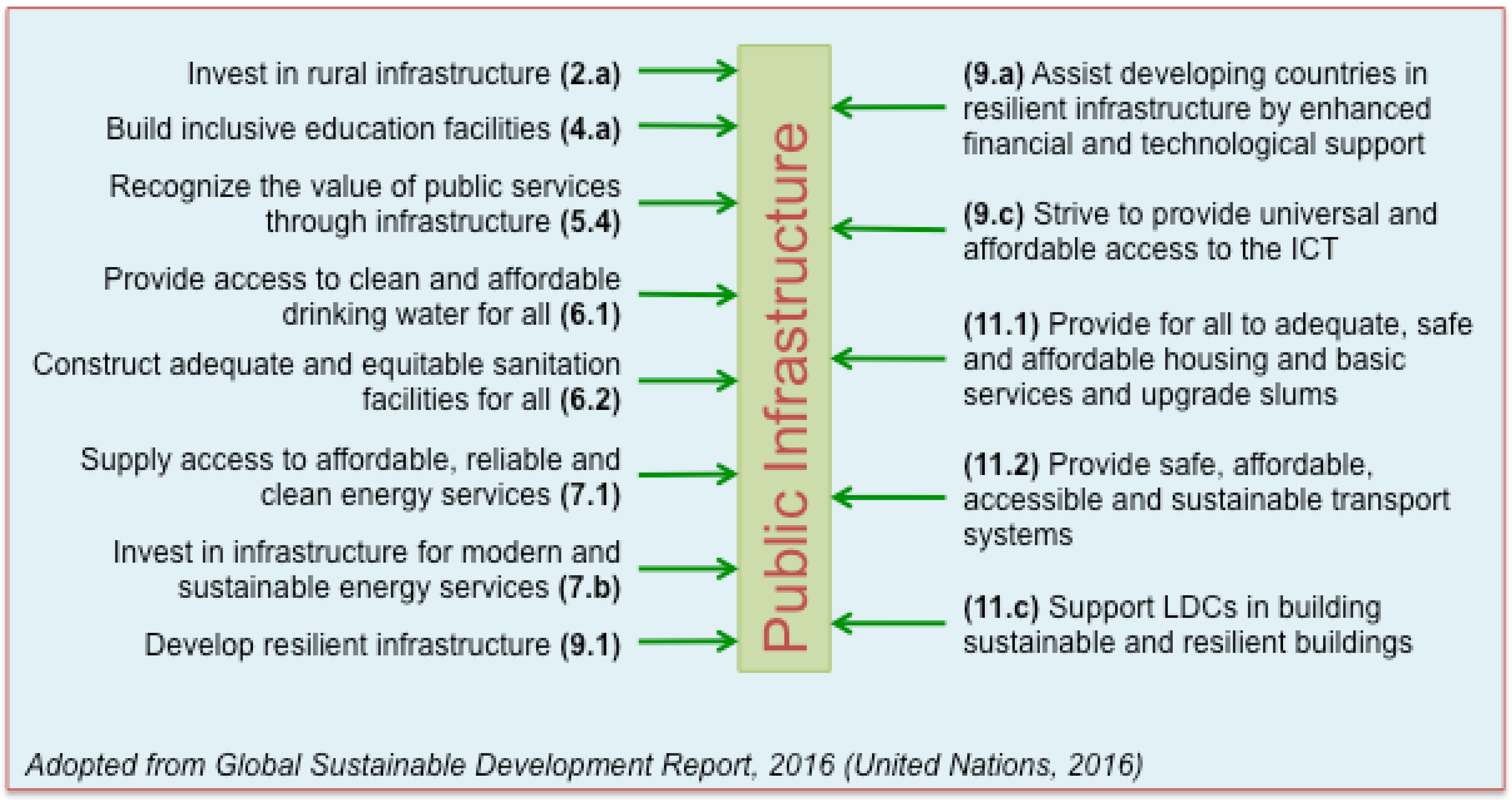

Public infrastructure plays a profound role in ensuring and sustaining the welfare of nations by satisfying almost all goals of the UN’s sustainable development goals (see

Figure 1) [

1]. In a broader perspective, public investment entails public infrastructures such as energy, water, transportation, communication, health and education along with vital intangible investments in nurturing human development, improving social efficiency, fostering quality of public operations, implementing better management structures, and conducting relevant research and development (R&D). Public infrastructure, and hence public investment, is an expensive concept as it aims to cover the whole of society by providing all needs at an adequate level. It requires substantial up front capital to construct, install, and build, as well as ongoing capital for proper operation and maintenance to ensure basic services and benefits over a long time [

2]. If public infrastructure is mainly built with debt-based financing, it may have quite serious and long-term adverse effects on the entire economy and society eventually. This study focuses on trying to understand the boundaries and effects of debt-based financing of public investments.

Thus far, governments have played a prominent role for building, owning, renovating, and operating the public infrastructures such as harnessing energy, generating and distributing electricity and water as well as the facilities of education, health, transportation, communication, sanitation, etc. The main driver for governments’ role in public investments is to protect the public from the formation of natural monopolies [

3]. Another reason for government involvement is that the private sector is reluctant to undertake responsibility and associated risks for building and operating large and expensive infrastructure projects with long-term pay back; therefore, such public infrastructure projects are commonly financed by government revenue [

4,

5], aid-based [

6,

7], equity-based [

8,

9], and debt-based financing. Debt-based financing, averaged at 75% of infrastructure projects [

10], is commonly used by countries [

11] mainly due to fact that many do not have a reliable stream of public revenue [

12], and many domestic and external creditors are always inclined to go for the guaranteed returns from a debtor country even with other means of collateral [

13,

14].

Borrowing enables individuals to balance their income and expenses (consumption) under fluctuations more than estimated levels. It also enables corporations to offset their production and investment when their sales fluctuate in severe and unpredicted levels and times. Additionally, it enables governments to smooth their revenue fluctuations and uncertainties from taxes, other incomes and expenditures. However, governments are warned to avoid borrowing beyond certain thresholds, such as the Maastricht criteria as adopted by the EU [

15], to keep their debt at controllable and safe levels providing a buffer zone when extraordinary events happen to push their debt to the levels damaging their long-term economic growth and stability [

12]. As debt levels rise beyond the estimated threshold level, borrowers’ ability to pay back their debt decreases and becomes more sensitive to income fluctuations, which puts them into even more vulnerable and risky conditions in the long-run. Furthermore, borrowing more to pay back previous debt becomes progressively more difficult and more expensive than before as interest rates set by lenders/creditors increase exponentially due to increasing risks. In this regard, lenders become unwilling to lend anymore, which leads to severe damages to economic development and the general welfare of society due to critically significant reductions in public investment. Put differently, higher debt levels cause financial volatility, damage financial stability, and reduce economic growth in the long run. As a result, higher public debt decreases economic and financial well-being, which is a main driving force for sustainable development, and this may limit essential government functions eventually affecting society and causing social instability [

16].

This study contributes to the literature in several ways. In this paper, we investigate fiscal sustainability of the countries under consideration by performing a causality test between public investment and, separately, domestic-external public debt by considering the public-debt sustainability thresholds. To the best of the authors’ knowledge, this is the first attempt to decipher domestic and external public debt effects on public investment by considering sustainability thresholds, and vice versa. This research also attempts to reveal the structural breaks of sovereign debt, long-term relationships, and causality between external-domestic public debt and public investment in terms of public-debt sustainability during the period of 2000–2015 for the countries under consideration. By conducting this study, the results enable us to make recommendations about the need for mobilizing domestic resources and innovating new financial models to promote sustainable development within public-debt sustainability. This paper concludes that performing a project for sustainable development by implementing unsustainable financing models will always end up with unsustainable economic outcomes.

The rest of this paper proceeds as follows.

Section 2 presents an extensive literature review on sovereign debt (domestic and external), relations between sustainable development and public infrastructure, and sustainable debt levels. In

Section 3, the methodology is discussed in terms of the selection of countries, unit root tests, structural breaks, and the framework for causality.

Section 4 discusses the empirical results and key findings as well as provides recommendations for filling the financial gap by mobilizing domestic resources and innovating new financial models for public infrastructure. Finally,

Section 5 concludes that performing a project for sustainable development by implementing unsustainable financing models will always end up with unsustainable economic outcomes.

1.1. Problem Statement

High global debt concentration is a great challenge that needs to be solved for sustainable economic development [

17]. Over the last decade, debt to GDP ratio on a global scale has increased relentlessly from 269% in 2007 to over 325% at the end of 2016. In other words, this ratio has risen more than 5.5% per year over the last decade [

18,

19]. This increase has high-risk for economic growth and financial stability because severe economic and financial crises are more likely to happen when the debt ratios go beyond certain thresholds [

20]. However, macroeconomic debt is not always harmful; indeed, it might even be beneficial up to a certain level, as long as it is balanced.

It is well known that the public infrastructure needs of a society are key issues to be met for a prosperous, wealthy and coherent country and world, as quality public infrastructure guarantees social and economic equity among different segments and regions, which is a fundamental pillar for sustainable development [

2,

21]. Therefore, there exists a constant and urgent need to invest in planning, building and maintenance of public infrastructure, which demands a reliable stream of financing. For example, McKinsey (2013) estimated that US

$57 trillion is needed by 2030 for global public infrastructure investments for electricity generation, transmission and distribution, water, telecommunications, and transport [

22], while the OECD [

23] estimated the figure at US

$71 trillion. The European Commission reported that the EU will need around €2 trillion for public infrastructure investments by 2020 [

24]. In the United States, if today’s investment gap in public infrastructure is not addressed, the economy is expected to lose almost US

$4 trillion in GDP by 2025, and US

$18 trillion in GDP by 2040, averaging over US

$700 billion per year [

25]. As can be seen, there is a huge financial gap to fill in public infrastructure investments. Thus, the main problem that this study aims to investigate and provide evidence for with quantification is the following: If the majority of the financing for public infrastructure comes from debt-based financing sources, either from domestic or external creditors, how may it affect the long-term economic and social development to the benefit of society? Then, the key question being answered eventually would be what are sustainable financing mechanisms to invest in public infrastructure without damaging the long-term sustainable economic and social development?

1.2. Research Questions and Objectives

Based on the discussions and problem statement, the following research questions are determined:

- (Q1)

How can the countries be classified for public debt sustainability?

- (Q2)

How do the countries behave during economic crises in terms of external and domestic debt?

- (Q3)

Do the countries have a long-term relationship between sovereign debt and public investment?

- (Q4)

Does any causality exist between sovereign debt and public investment? If so, which directions do the countries have causality between them in terms of public-debt sustainability zones? What is the meaning of these causalities?

- (Q5)

Is there any pattern in causality results in terms of public-debt sustainability?

- (Q6)

What and why do countries need to do for mobilizing domestic savings and innovating alternative financial models to promote sustainable development?

The main objective of this paper is to evaluate sustainable financing for sustainable development by using the terms of “sovereign debt” and “public investment” in order to analyze how public investment reacts against external and domestic public debts, and to assess the need for mobilizing domestic resources and creating new financial models.

In line with the research questions above, the following specific objectives are set for this study:

- (i)

To set debt sustainability levels to classify countries into sustainable, quasi-sustainable, and unsustainable debt zones according to their gross government debt-to-GDP ratios.

- (ii)

To investigate the structural breaks of sovereign debt (external and domestic) for obtaining meaningful results on economic crises.

- (iii)

To evaluate a long-term relationship between external–domestic public debt and public infrastructure with a cointegration test analysis.

- (iv)

To explore the causality between external–domestic public debt and public infrastructure investments for selected countries.

- (v)

To conclude with a need for mobilizing domestic savings and innovating alternative financial models to promote sustainable development.

This study’s ultimate aim is to establish empirical evidence with a quantitative methodology to support the idea of filling the financial gap by mobilizing domestic resources and innovating new financial models, rather than pure debt-based financing, before sovereign debt breaches the certain thresholds for public-debt sustainability.

3. Methodology

In this section, we explain our approach and criteria to choose countries to be included for further analysis in this study as well as describe an overall framework for data analysis and data-gathering processes. Next, we present unit root tests, along with structural breaks, confirmatory analysis, and cointegration tests to analyze how the data becomes stationary and to investigate long-run relationships by sharing common trends between the datasets for each country considered in this research before providing insights into the causality.

In this regard, two criteria were employed for choosing countries:

- (i)

Twenty countries with the largest GDP were taken into consideration as the potential candidates for the analysis due to fact that they constitute a significant amount of economic activity in the World, together consisting of around 80% of global GDP (see

Appendix A.1). The debt-to-GDP ratios of these countries are ordered according to the size of their GDP (see

Figure 2). They comprise about 60% of total world population (7,523,997,000) in 2017, which is a meaningful domain for our study (see

Appendix A.2).

- (ii)

These countries were divided into three groups according to their debt-to-GDP ratios. We assumed that there were two sustainability thresholds for sovereign debt-to-GDP ratio as reported in the literature. First, the Treaty on the European Union (i.e., Maastricht Treaty) states in the second criteria of article 121 that, as a reference point, the ratio of gross government debt must not exceed 60% of their GDP at the end of each fiscal year [

15]. Second, Cecchetti, Mohanty, and Zampolli [

17] reported according to their empirical results that gross government debt should not exceed 85% of the GDP for sustainable economic growth. In this regard, this study assumes that countries fall into three debt zones, which are (a) sustainable (lower than 60% debt/GDP ratio); (b) quasi-sustainable (between 60–85% debt/GDP); and (c) unsustainable (higher than 85% debt/GDP) (see

Figure 3).

After dividing these countries with the highest GDP into the

public-debt sustainability zones (henceforth called as

debt sustainability zones and

sustainable debt zones) according to the second criterion, the United States, China, Japan, and Germany were selected to analyze their external and domestic public debt effects on financing public infrastructure depending on their gross government debt-to-GDP ratio (see

Figure 3). China (43%), Germany (71%), and the United States (105%) fall respectively into the sustainable, quasi-sustainable, and unsustainable debt zones according to their debt-to-GDP ratios. Furthermore, Japan (248%) is also included in the study due to the fact that it falls definitely into the unsustainable debt zone because of its excessive gross government debt. These are the four pioneer countries in sustainable energy for building more than half of the global renewable power capacity [

86] and good representatives for the global economy because they constitute approximately half of the world’s GDP (see

Appendix A.2).

3.1. Data Gathering

This study empirically analyses how external and domestic public debt influences public infrastructure investments with respect to debt sustainability zones in the selected countries: China, Germany, USA, and Japan. In this regard, panel data involves public investment, external public debt, and domestic public debt spanning the 2000–2015 time period for each country, except for China (1980–2015 for external, and 1995–2015 for domestic public debt, see

Appendix A.3). Public investment is a key input in the creation of physical assets including economic infrastructure (highways, airports, seaports, energy utilities, etc.) and social infrastructure (public schools, universities, hospitals, etc.). The data for public investment was gathered from IMF Fiscal Affairs Department based on annual data for the time period of 1960–2015, which is why our analysis is limited up to 2015 [

87,

88]. External public debt was collected from the World Bank [

89] based on quarterly data considering the last quarter of each year as annual data. Domestic public debt was obtained by subtracting the external public debt from gross government debt [

90], thereby domestic public debt data is limited to the time period starting from 2000 (except for China), during which external public debt data is available.

3.2. Framework for Causality

After collecting the data, this study followed the framework as outlined in

Figure 4. This framework gives us a holistic approach to analyze the data for causality between public investment and debt for a country by comprising three parts with color-coded representation as shown in

Figure 4:

Preparation: In the orange-colored column, the data is prepared for conducting statistical analyses and tests with correlations between the datasets, cleaning the data (i.e., removing outlier and replacing missing values (if there is) with sample mean), and forecasting some missing data points at the beginning or end of the time series in case of the need for having consistent time periods with the same interval for all datasets.

Pretesting: In the blue-colored column, unit root and co-integration tests are performed as a pretest for Granger causality. First, augmented Dickey-Fuller (ADF) [

91] and Zivot-Andrew tests [

92] are selected as the unit root tests for obtaining the integration number of the time series, namely public investment, external public debt, and domestic public debt. Furthermore, Zivot-Andrew (ZA) test also gives us structural breaks in the datasets. Following ADF and ZA tests, integration numbers are investigated pairwise whether they are equal by confirmatory analysis. Second, Johansen test is chosen as the co-integration test to evaluate the long-run relationship by sharing a common trend between datasets and countries chosen for this the study.

Causality: In the green-colored column, Granger [

93] or Toda-Yamamoto Granger causality [

94] is applied on the datasets by considering the results in pretesting. If the integration numbers of related datasets are the same with each other and there is no co-integration between them, then conventional Granger causality can be performed, otherwise Toda-Yamamoto Granger causality has to be conducted.

3.3. Unit Root Tests

Granger causality, first, requires pretest for the datasets whether they are stationary or not. In the case of non-stationary, there are two main techniques to make the datasets stationary, namely taking the difference and transforming the data. To this end, all variables were transformed to their conjugate symmetry and were taken the first-difference and second-difference. Afterwards, the augmented Dickey-Fuller [

91] and Zivot-Andrew [

92] tests, along with endogenous structural breaks, were conducted for a unit root with respect to level, first, and second difference of the data.

3.4. Confirmatory Analysis

Confirmatory analysis is employed to determine whether the time series are stationary in the same integration order for both unit root tests, ADF and ZA. In this analysis, the integration orders (i.e., I(0), I(1), and I(2) show the status of being stationary in the time series in level, 1st difference, and 2nd difference, respectively) obtained by ADF and ZA test were consolidated into a table to assess the stationary status of each time series. In this sense, the datasets (i.e., domestic-external public debt and public investment) for each country may become stationary in different integration orders according to ADF and ZA unit root tests. By the confirmatory analysis, this discrepancy was taken into consideration by approaching from two different angles. First, the integration orders of each time series from both unit root tests (i.e., ADF and ZA) were taken into consideration when the dataset became stationary at the first time without looking at the significance level. Then, this time series was treated as stationary if the numbers of integration were the same with both unit root tests, otherwise the result of confirmatory analysis was considered inconclusive. Second, the integration orders of each time series from both unit root tests (i.e., ADF and ZA) were taken into consideration when the dataset became stationary with the highest significance level. After this, we compared the results from both unit root tests for each time series to determine the stationary status, same as in the first angle. These methods are called first appearance and strong stationary, respectively.

3.5. Co-Integration Test

Existing cointegration requires a long-run relationship among the datasets, implying that the deviations from the equilibrium state for a co-integrated vectors are stationary with finite variance, even if each data set is nonstationary with infinite variance [

95]. In case of the existence of a co-integration, there exists at least a unidirectional, or possibly a bidirectional, Granger causality as another important implication of the long-run relationship. Engle and Granger [

95], however, demonstrated that a vector autoregression (VAR) model in differences would be spurious due to the fact that the datasets in difference no longer have an invertible moving average if the datasets are co-integrated. Therefore, it is important to determine if the nonstationary datasets share a common trend (i.e., having co-integration) in a level before performing a VAR model for Granger causality. With the existence of co-integration among variables in levels, the VAR model cannot be used for a conventional Granger causality. In this sense, the VAR model must be replaced by either error-correction model (ECM) or by an augmented VAR model (see

Section 3.6) with Wald test for a Granger causality [

94,

95]. For this reason, a Johansen [

96] test was applied to determine the existence of the long-run equilibrium relationships between the datasets. In this study, the maximum eigenvalue (

λmax) and trace (

λtrace) statistics were employed to obtain the cointegration rank (

r) which is equivalent to the number of independent cointegrating vectors. The equations for these tests are given as follows:

where

and

are the estimated values of eigenvalue (

associated with eigenvectors

) and

T is the number of observations.

3.6. Toda-Yamamota (TY) Granger Causality

In economics, the conventional Granger causality (hereafter, Granger causality is considered as the conventional one unless otherwise stated) is the most common method to test for a causal relationship between two time series [

93]. This test requires estimating the following basic VAR(

p):

where

and

are n-dimensional vectors (i.e., each element corresponds to a variable in the datasets), and

represents an

n-dimensional vector for white noise innovation assuming that there is no correlation between them, and

denotes an

matrix of estimated parameters for lag

k. The Granger causality plays a prominent role in obtaining meaningful results in terms of relationship, along with its direction between time series for many applications in economics, although it has few limitations.

There are two main preconditions to apply Granger causality for bivariate time series as follows. First, the integration orders of the time series must be the same with each other in the confirmatory analysis. Second, co-integration among the time series must be absent to avoid spurious results; even this implies that there exists at least unidirectional Granger causality. When one of these conditions is not satisfied, Granger [

93] causality should not be performed on the time series (there are some exceptions see Reference [

97]). Toda and Phillips [

98] discussed further other limitations of the conventional Granger causality.

Toda and Yamamoto [

94] proposed a powerful, yet simple method requiring the estimation of a modified Wald test (i.e., called modified because of the modified VAR model) based on an augmented VAR(

p + dmax) model, where

dmax is a maximum integration order among the variables. This test proves that the modified Wald statistic performed in this setting converges through the asymptotic χ

2 random variable without depending on neither the integration number nor the co-integration results [

94]. In this regard, the co-integration and unit root tests become only an informative form, rather than a pretest for the Granger causality, to avoid the spurious results of pretest. To implement the TY Granger causality test, estimation of the augmented VAR(

p + dmax) model to be utilized is as follows:

where the circumflex over a variable denotes the estimation of its ordinary least squares;

dmax represents the maximum integration number; and

corresponds to the

matrix of the parameters for lag

k. In this study, lag order

p is selected by SIC technique due to the fact that the true lag order is challenging to know a priori in practice. The null hypothesis of the modified Wald test is given as follows. The

jth element of

does Granger-cause the

ith element of

, if the following null hypothesis

H0 is rejected:

TY Granger causality stipulates that the maximum integration order

must be less than or equal to the lag order

. If the variables, however, are cointegrated, then

can be greater than

[

94].

4. Empirical Results and Discussion

4.1. Unit Root Tests

To avoid the problem of spurious results, unit root tests were performed for the panel data to ensure that they were stationary in some integration orders before selecting which test (i.e., Toda-Yamamoto Granger causality or the conventional one) was more suitable for the causality.

Table 1 reports the results of the ADF test for the panel data consisting of public investment, external public debt, and domestic public debt. The hypothesis of a unit root (i.e., non-stationary time series) for almost all datasets in levels cannot be rejected significantly. This result provides the evidence that these datasets are nonstationary except for Japan’s domestic public debt with a 1% significance level. However, all panel data in the first difference seem to be stationary at least at a 10% level of significance.

Further, the study also investigates the panel data in the second difference to check if there exists a stronger stationary state, particularly for the weaker ones (i.e., a 10% level of significance). Except for the domestic public debt of Germany and Japan, the hypothesis of a unit root for most of the datasets in the second difference can be rejected more significantly than the order of first difference (if a test statistic in second difference is less than the first difference, then it is stronger than the first difference, and vice versa). However, the public investment for China and the external public debt for the United States have weaker stationary in second difference.

Zivot and Andrews (ZA) unit root test, allowing for an endogenous structural break, was also employed to detect the possible shift in regime on the unit root test.

Table 2 shows some differences against ADF test results for the external public debt of China and the public investment of USA and Japan that are stationary in second difference rather than the first. Furthermore, the public investment for Germany and the external public debt for the United States have a weak stationary state level. Remaining results are the same with the ADF test. We also conducted the ZA test up to second difference in line with the ADF test to investigate for stronger stationary.

The structural breaks in the external and domestic public debt for the stronger stationary position have mainly occurred around the economic crisis of 2008. Moreover, the results for stronger stationary reveal significantly that the domestic public debt always precedes the external public debt in terms of structural breaks during the economic crises.

As shown in

Table 3, relatively, there exist many inconclusive results in the

first appearance technique of the confirmatory analysis. For the

strong stationary technique, however, there exists only one time series, domestic public debt for China, which is inconclusive. Therefore, the integration orders were used in the study as in the

strong stationary afterwards. The inconclusive value was replaced with the integration order in the first appearance since it is conclusive in that technique at I(1).

4.2. Cointegration Test

Engle and Granger [

95] showed that a VAR model in differences will lead to spurious results if the variables in the levels are co-integrated. Therefore, the study requires performing co-integration tests if the nonstationary variables in level share common trends before proceeding to the VAR model. In this regard, the VAR(

p) model should be replaced either by an error-correction representation (ECM) or augmented VAR(

p + dmax) model when there exists a linear combination among nonstationary variables in levels [

94,

95]. Accordingly, Johansen and Juselius [

99] co-integration tests (i.e., maximum eigenvalue and trace test) were conducted to test the long-run equilibrium relationships among the variables.

Table 4 reports the cointegration results for both maximal eigenvalue and trace test. For China, there is no cointegration for the external public debt meaning that the long-run relationship may not exist for the same variable at all. Germany has a weak cointegration at 10% significance level for the external public debt. However, remaining datasets for all countries specify a strong cointegration at 1% significance level. These results indicate that all datasets, except for external public debt of China, are required to present at least unidirectional causality.

4.3. TY Granger Causality Test

Using the time series in level, TY Granger causality tests were performed between sovereign debt (explicitly, external and domestic public) and financing public infrastructure for China, Germany, the United States, and Japan after the VAR(

p + dmax) models had been constructed for related datasets. As shown in

Table 5, the results indicate that there exists at least a unidirectional causality for almost all datasets, conforming to the long-run relationship in the co-integration test. However, the external public debt for China is the only dataset having no causality in any direction, which is consistent with the co-integration. For China, furthermore, there exists a unidirectional causality running from public investment to domestic public debt, implying that financing for public infrastructure leads to domestic public debt. In other words, China is less debt-dependent on public infrastructure because neither external nor domestic public debt does not Granger-cause public investment.

A weak unidirectional causality running from external public debt to public investment can be found at a 10% significance level for Germany, which is consistent with the cointegration results. For Germany, strong bidirectional causality exists between financing for public infrastructure and domestic public debt. In this regard, public investment affects domestic public debt, and this debt also has a direct impact on public investment.

The United States and Japan have strong bidirectional causality between both components of sovereign debt (i.e., external and domestic) and financing for public infrastructure at the 1% significance level. In these countries, the external part of sovereign debt comes into play for spending on public infrastructure. In other words, public investment has a considerable amount of influence over external public debt, and this debt also has a direct response on public investment.

4.4. Key Findings

To the best of our knowledge, this is the first attempt to decipher causal relationships between sovereign (explicitly, external and domestic) debt and public investment approaching from the debt sustainability perspective. In this regard, the key findings in this study can be summarized as follows:

- (i)

The integration orders show a discrepancy between ADF and ZA tests for the same time series. This study eliminates these differences by performing the strong stationary technique of confirmatory analysis. These results are used to determine dmax in TY Granger causality.

- (ii)

Two salient features are observed for the structural breaks of external and domestic public debts for all countries of interest in this study, which are China, Germany, Japan, and the United States (see

Appendix A.3 for the time periods). First, all structural breaks for external public debt and domestic public debt occurred around the 2008 global economic crisis. Second, domestic public debt always occupied structural time breaks before external public debt in a strong stationary state. Moreover, the breaks for domestic public debt are detected in 2005 for China, 2008 for Germany, 2007 for the US, and 2007 for Japan, just before the global financial crisis. Therefore, this result implies that monitoring domestic public debt may help the governments predict possible global economic crises, since GDP of our sample comprises about 50% of the global GDP. Furthermore, the United States, China, and Japan make up the top three of heavily indebted countries in the world (This data is gathered from The World Economic Outlook (WEO) database that was published by IMF on 10 October 2017).

- (iii)

This study finds that almost all the datasets share a common stochastic trend in level variables by conducting a Johansen [

96] cointegration test; even Germany has a weak cointegration at 10% significance level. As an exception, the external public debt of China shows no cointegration over the period considered.

- (iv)

This study deciphers the causal relationships, along with the directions, by performing TY Granger causality between external-domestic public debt and public investment for China, Germany, US, and Japan (see

Appendix A.3 for the time periods). China presents only unidirectional TY Granger-causality running from public investment to domestic public debt. For Germany, there exists weak unidirectional TY Granger causality running from external public debt to public investment in addition to strong bidirectional causality between pubic investment and domestic public debt. There is strong unidirectional causality from external public debt to public investment in the US. In Japan, there exists strong unidirectional causality running from domestic public debt to public investment. The findings are quite consistent with both the cointegration results and the country segmentation for debt sustainability (i.e., sustainable, quasi-sustainable, and unsustainable debt zones)

- (v)

The assumptions based on debt sustainability zones (i.e., sustainable, quasi-sustainable, and unsustainable debt zones) are confirmed by the results obtained from TY Granger causality. These zones are separated with two thresholds 60% and 85% obtained from the Treaty on European Communities [

16] and empirical studies of Cecchetti, Mohanty, and Zampolli [

17], respectively. The findings with respect to the sustainability zones can be summarized as follows:

Sustainable debt (less than 60%): China has only strong unidirectional causality running from public investment to domestic public debt. This indicates that public investment, which is one of the channels of economic growth, leads to domestic public debt, and thereby it is a less domestic debt-dependent country with respect to the investment, but vice versa is not true. Therefore, this causal relationship supports that of Tu and Padovani [

82], who demonstrate that sustainable debt policies still have been followed by the central government, but it needs to develop and enhance existing policies for the local (city) governments due to the shortage of land finance, which is a considerable financing tool for public investment. Furthermore, there is no evidence for a causal relationship between public investment and external public debt. This is parallel with the findings of Panizza and Presbitero [

71] that there is no evidence for a causal effect between public debt and economic growth in which public investment is a channel of growth.

Quasi-sustainable debt (between 60% and 85%): For Germany, there exists strong bidirectional causality between public investment and domestic public debt. This indicates that financing for public investment affects domestic debt, and vice versa. In other words, this may be considered as a push-and-pull strategy by dynamic decision-making for the fiscal policies of domestic public debt, along with public investment (i.e., government expenditure). This includes corrective actions such as to increase primary surplus demonstrated by Bohn [

72], Greiner et al. [

75], Fincke and Greiner [

81], and to decrease public investment showed by Gong et al. [

74], Heinemann [

67], and Greiner [

78]. However, there exists a weak unidirectional causality running from external public debt to public investment. Put differently, external public debt has appeared to lead public investment but only at a 10% significance level. This delicate situation for Germany requires some policy regulations to take corrective actions as stated in the domestic public debt and alternative financing systems to eliminate external-debt dependency on public infrastructure. Nevertheless, Germany still can be considered as near to a sustainable zone with caution, which is a quasi-sustainable zone. This finding is also consistent with Fincke and Greiner [

81], Fincke and Greiner [

73], and Checherita-Westphal and Rother [

70].

Unsustainable debt (more than 85%): The United States has strong bidirectional causality between domestic public debt and public investment. On the one hand, this finding supports that the US has followed sustainable debt policies [

81] in terms of domestic public debt by corrective actions including the increase in primary surplus showed by Bohn [

72], and the decrease in public investment showed by Heinemann [

67]. On the other hand, we obtain evidence on unsustainable debt policies in terms of external public debt by strong unidirectional causality running from external public debt to public investment. However, this unsustainability has incurred less vulnerability to external debt crises than the other countries due to the fact that external borrowing of the US is a large stock of domestic currency, which is in US dollars (Panizza 2008). Furthermore, global external debt is mainly denominated in US dollars, and world trade is commonly in US dollars, which is the main reserve currency in the world (Reinhart et al., 2002). Therefore, the US can tolerate more external public debt than other advanced countries because of the unique status of the US dollar stated above.

As for Japan, there is strong bidirectional causality between external public debt and public investment. This finding provides evidence that Japan has followed sustainable fiscal policies in terms of the net public debt once the high level of assets are taken into account by corrective actions, implied by bidirectional causality, including the increase in primary surplus showed by Bohn [

72], and the decrease in public investment showed by Heinemann [

67]. Although gross public debt of Japan is excessive, Japanese fiscal policy is a unique case in which external and private debt have been shifted successfully to domestic public debt since the mid-1970s [

77,

79]. On the other hand, this study supports unsustainable fiscal policies in terms of domestic public debt by strong unidirectional causality running from domestic public debt to public investment. This is parallel with the findings of Fincke and Greiner [

81] that there is no evidence that Japanese fiscal policy considers gross public debt sustainability.

4.5. Discussion and Recommendations

As in the case of a sustainable debt zone, China with a relatively low public debt/GDP ratio (less than 60%) should take necessary precautions such as avoiding excessive and misguided public investment, preventing corruption (it has been shown that the effect of public debt on economic growth is a function of corruption [

101]), and balancing public and private infrastructure investments by collaborating with private wealth through different financial and business models to keep its sovereign debt level in this zone before becoming one of the highly indebted countries. The countries in a quasi-sustainable debt zone have dynamic decision-making policies for corrective actions on domestic–external public debt and public investment to offset the sovereign debt-to-GDP ratio to keep it in a certain and safe interval. However, in this sensitive case, countries reach, but do not breach, the second sustainability limit (85%) and may even start to show weak unidirectional causality (at 10% significant level) running from public debt to public investment while struggling to keep the balance between the debt and public investment. This delicate situation, as for Germany, requires some policy regulations and alternative financing systems, rather than pure debt-based financing to reduce debt dependency on public investment, and to be on the safe side of debt sustainability and to eliminate weak debt dependency, if it exists, on public investment.

A clear implication of unsustainable external debt results for the United States and provides evidence to support recommendations in the literature to reduce unsustainable external public debt by mobilizing domestic savings through public investment via fiscal policies to achieve the sustainable development goals [

32,

102,

103,

104,

105]. For Japan, an unsustainable domestic debt zone indicates a need for innovating alternative financial models against pure debt-based financing (i.e., equity based financing or mixture of debt and equity) to ensure sustainable-domestic public debt by attracting mattress money and foreign direct investment to the domestic market, particularly for the public investment to promote sustainable economic growth; and by transferring domestic resources from nonmonetary financial stocks to the monetary financial system [

16,

32,

33,

104,

106,

107]. In these cases, shifting sovereign debt towards more sustainable-private debt (either, domestic or external) might be an alternative solution to reduce the debt-burden on the countries by creating alternative financial models for financing public infrastructure.

So far, we have discussed public debt sustainability with respect to public investment on four countries with the highest GDP, which are the four pioneer countries in sustainable energy by building renewable power capacity more than half of the global capacity [

86] and consisting of around 50% of global GDP (see

Appendix A.2), to investigate how they perform in financing for sustainable development. In what follows, we propose several directions for future research. In this work, we only analyze the four counties that are good at sustainable development with the highest GDP. To make a more comprehensive comparison and to reach a broader perspective, we plan to expand this research into the countries with lower GDP in which sustainable development is hindered by public debt. In this study, we only focus on the public debt sustainability by exploring the interrelations between public investment and public debt. Therefore, further research is needed to investigate the private investment and private debt in terms of debt sustainability, which are out of the scope of this research.

Another point to note is that the data coverage of public debt (external and domestic) provided by the World Bank and IMF is limited to around 15 years starting from 2000 for the countries of the United States, China, Germany and Japan [

89]. On the other hand, the data coverage of public investment spans up to 2015—even it is available since 1960 [

87,

88]. This limits our analysis by 15 years because the intersection of public debt and investment is between 2000 and 2015.