Abstract

This article analyzes the moderating effect the degree of economic growth has on the relationship between the development of the financial system and the microfinance industry activity. The hypotheses proposed establish that the influence of the development of the financial system on the activity of the microfinance sector will be different depending on the level of economic growth. The estimates were made using the System-GMM methodology for panel data, which allows controlling the unobservable heterogeneity and the problems of endogeneity. We find that the degree of economic growth affects the relationship between the financial sector development and microfinance activity. Under negative economic growth conditions, the development of the financial sector has a negative impact on the activity of the microfinance sector, but when economic growth is high, the development of the financial sector positively influences the activity of the microfinance sector.

1. Introduction

In recent decades, microfinance has experienced a fast and successful growth in developing countries. Microfinance institutions (MFIs) focus on providing small-scale loans to the poor, who do not have access to traditional bank financing. They seek to encourage the creation of small-scale businesses that generate incomes and contribute to poverty reduction. According to Cull et al. [1] millions of people excluded from formal financial services have gained access to finance due to MFIs.

Due to the scope and importance of microfinance, many studies have focused on this sector. Researchers have mainly analyzed its impact, outreach and sustainability. In this sense, outreach and sustainability is a widely discussed issue in this field [2,3,4]. Although sustainability and outreach are seen as competing forces, in some cases we can see them as complementary. This implies that sustainability is necessary to achieve outreach. In this sense, sustainability is the capacity of a program to remain financially viable even if subsidies and financial aids are cut off. This variable is one of the most analyzed in the studies that investigate microfinance sector development. Among these studies, an important line of research focuses on the analysis of the most favorable conditions for the development of this sector [2,5,6,7]. The results of these studies show that the macroeconomic conditions of a country, especially the development of its financial system and its economic growth, could influence the growth of the microfinance sector.

Despite the importance of the development of the financial system and economic growth for the microfinance sector, the evidence obtained so far is not conclusive, since there are different authors who find contrasting relationships (for a review of the literature on the effects of both the development of the financial system and economic growth on the microfinance sector, see, for example [5,7,8,9,10,11,12,13,14]). On one hand, while some authors find a negative relationship between financial development and microfinance, others show a positive relationship between them [5,6,15]. On the other hand, previous research has not found conclusive results regarding the relationship between economic growth and development of the microfinance sector. Some studies find that economic growth fosters the activity of MFIs, while others find that it slows down this activity [7,8,16]. This lack of conclusive results could be motivated by the fact that previous studies have separately analyzed the influence that economic growth and the financial system can have on the growth of the microfinance sector. In this context, the main contribution of this work is to analyze the effect that the degree of economic growth has on the relationship between the development of the financial system and the activity of the microfinance industry. The moderating effect of economic growth on the relationship between the development of the financial system and the activity of the microfinance sector could be the cause of the lack of conclusive results in the previous literature. In particular, we propose that the influence of the development of the financial system on the activity of the microfinance sector will differ depending on the level of economic growth. When economic growth is high, the development of the financial system will positively affect the activity of MFIs. However, when economic growth is low, the development of the financial system will negatively affect the activity of MFIs. These opposing effects can lead to incomplete or erroneous conclusions if the moderating effect of economic growth is not taken into account.

The empirical analysis was carried out using a sample of 693 microfinance institutions from 79 countries for the period 1998–2011. The estimates were made using the System-GMM methodology for panel data. This allows controlling the unobservable heterogeneity and the problems of endogeneity of the explanatory variables by using instruments.

The results show that the relationship between financial sector development and microfinance sector activity is affected by the degree of economic growth. When economic growth is negative, the development of the financial sector has a negative impact on the activity of the microfinance sector. In contrast, when economic growth is high, the development of the financial sector positively influences the activity of the microfinance sector.

The paper is structured as follows. In the second section, the theories that support the proposed hypotheses are presented. The next section describes the sample used and then presents the models and the results. The paper ends with the presentation of the main conclusions.

2. Theory and Hypotheses

The development of a country’s financial system does not benefit the whole population, because a percentage of this population is excluded from access to financial services [17,18]. In this regard, the boom in the microfinance sector has been seen as a development policy capable of addressing the deficiencies of the traditional banking system [19]. Microfinance activity focuses mainly on developing countries where financial systems are not sufficiently developed and where a significant proportion of the population does not use formal financial services [18]. Therefore, in countries with well-developed financial systems, a higher percentage of the population is covered by traditional banks and the microfinance sector has a lower level of implementation [15]. It is therefore not surprising that some research has found a negative relationship between the development of a country’s financial system and microfinance activity, suggesting that a more developed financial sector would negatively affect the microfinance sector. The main argument that supports the existence of this negative relationship is competition [9,20]. The presence of commercial banks may lead borrowers to replace their MFI loans with loans from commercial banks (due to lower borrowing costs, greater flexibility with respect to loan options and larger amounts). This substitution effect reduces the demand for MFI services, thereby preventing its development [10], so that the greater the financial development, the smaller the percentage of the population excluded from the traditional financial system and, therefore, the smaller the potential market will be for the microfinance sector [5,15]. In addition, competition may have an adverse effect on the repayment performance of MFI borrowers if they borrow multiple loans from different financial institutions [9,20].

Despite the negative relationship that some researchers have found between financial development and microfinance activity, others show a positive relationship between them, indicating that the financial sector might also encourage the development of the microfinance sector. Firstly, this relationship would be based on the fact that the development of the financial system may imply an increase of financing. This increase could be either through direct participation of the commercial banks in the microfinance sector [21,22], or by the co-financing of microfinance institutions [3,22,23]. Secondly, a greater presence of commercial banks can produce positive indirect effects, such as the use of more efficient modern banking techniques for MFIs, which help to improve their efficiency [7,10]. Greater efficiency could lead to greater financing in the financial markets, which would allow greater development of the microfinance sector [3,6,24]. Thirdly, financial development also implies more sophisticated regulation and supervision of financial institutions, which may also help improve the efficiency of MFIs [10].

Ultimately, the research that exists on the relationship between financial development and the activity of the microfinance sector does not show conclusive results. Some authors find evidence of a positive relationship between both sectors and others a negative relationship. In this regard, it should be noted that prior literature has found that a country’s economic growth maintains a strong relationship both with the financial sector and with the microfinance sector, and this lack of consensus could be explained by the existence of a moderating effect of economic growth on the relationship between financial system development and microfinance sector development.

The relationship between financial system development and economic growth has been studied extensively in previous literature, with most research focusing on establishing the causal relationship between them [25,26,27,28]. First, a broad proposition defends a unidirectional impact of financial development on economic growth, which means that differences in the levels of development of financial institutions have a positive impact on levels of economic growth [28,29,30]. Therefore, the development of the financial system is considered as an important factor that improves the economic growth.

A more recent line of research proposes an inverted U-relationship between financial development and long-term economic growth, suggesting that over-funding may exert a negative influence on economic growth [27,31,32,33]. On the other hand, another line proposes that the direction of causality arose from the financial sector towards economic growth in the early stages of development, while the relationship was reversed in the more advanced economies [34,35,36,37,38,39,40]. Finally, another group of studies suggest that the divergence in causality between the two magnitudes may be due to the influence of other variables, such as the degree of development of the country or the degree of financial development itself [41,42,43].

As we indicated previously, economic growth affects not only financial development but also microfinance activity. However, previous research is inconclusive. First, numerous papers find that economic growth fosters the development of the microfinance sector. Martinez [8] and Huijsman [11] show that the relationship between the economic activity of a country and the credit growth of microfinance institutions is increasingly pro-cyclical, as a result of the increased participation of MFIs in the capital markets. Ahlin, Lin, & Maio [7] and Constantinou & Ashta [12] find that an increase in the per capita income of micro entrepreneurs and the cash flows of their businesses implies a greater capacity to repay loans and to be able to borrow others (even higher). In addition, economic growth improves MFI funding sources through subsidies from private and public donors, aid organizations, and funding through capital markets [11,12].

On the other hand, Wagner & Winkler [16] argue that economic growth could slow the development of the microfinance sector. In this sense, economic growth leads to an increase in accumulated profits, which can be used by the micro entrepreneur as a source of financing (self-financing) instead of going to a microfinance institution. In addition, when the economy of a country improves, the informal sector is reduced, so the target market of MFI also decreases [44,45].

If we consider all of these pieces of evidence, we could argue that the influence of financial sector development on development in the microfinance sector may be conditioned by the degree of economic growth of the country. This moderating effect of economic growth has not been analyzed until now, which leads us to propose the hypotheses of this paper, which are based on the asymmetric effect that economic growth can exert on the relationship between financial development and the development of the microfinance sector.

Our first hypothesis refers to the relationship between both sectors in countries with lower economic growth (or economic decline). In this case, low economic growth can reduce the development of the financial sector [46,47] and the development of the microfinance sector [7,11,12]. In this sense, when economic growth is low, both sectors have lower sources of financing, which leads to direct competition, resulting in a substitution effect between the financial sector and the microfinance sector. In countries with well-developed financial systems, the share of the population covered by traditional banking is very high [15] and, therefore, the demand for microfinance services will be smaller. In addition, in this situation, a developed financial system may cause borrowers to replace scarce loans from the microfinance sector with loans from commercial banks due to the better conditions offered by traditional banks [10].

Therefore, the first hypothesis proposed would be formulated in the following terms:

Hypothesis 1.

In countries with low economic growth, the development of the financial sector slows the development of the microfinance sector, resulting in a substitution effect between both sectors.

However, our second hypothesis argues that the relationship between both sectors may be the opposite in environments of greater economic growth. Economic growth fosters the development of the financial sector [47,48,49] and the development of the microfinance sector [7,8,12]. In this sense, when economic growth is high, both sectors have greater sources of financing. In this situation, competition between both sectors would be reduced, with the traditional financial system providing more resources to co-finance the microfinance sector [22,50,51]. In addition, the presence of a developed financial system can lead to positive indirect effects on the microfinance sector. These indirect effects include modern and more efficient banking techniques [7], more financially trained loan officers [10], greater product diversification [10], or greater regulation and financial supervision that improve the efficiency of the MFIs [52]. Considering these, under favorable environments for the country’s economy, a complementary effect between the two sectors arises, which allows for more empowerment of the microfinance sector when the traditional financial sector is more developed.

The second hypothesis would be formulated in the following terms:

Hypothesis 2.

In countries with high economic growth, the development of the financial sector encourages the development of the microfinance sector, resulting in a complementary effect between both sectors.

3. Empirical Analysis

3.1. Characteristics and Composition of the Sample

To test the proposed hypotheses, we used a sample composed of 693 MFIs (4614 observations) belonging to 79 countries between 1998 and 2011, which have at least five consecutive years of available information. This condition is necessary to perform the second order serial autocorrelation test, which is fundamental to guarantee the robustness of the estimates made with the System-GMM methodology [53].

Table 1 shows the composition of the sample, distributed by geographic region, the countries comprising each region and the legal status distribution for each country.

Table 1.

Composition of the sample.

The sample consists of 282 NGOs, 222 non-bank financial institutions, 98 credit unions, 56 banks, and 35 rural banks. The predominant institutions are NGOs, pioneers in the implementation of microcredit programs. However, over the years, other types of institutions have emerged in this industry, such as non-bank financial institutions, which represent the second largest group of institutions in this sample. As for the regions analyzed, the MFIs of our sample are concentrated mainly in Asia and Latin America, where the microfinance sector is more developed (the structure of the sample is similar to that employed by other microfinance studies [1,10,54,55]. In these areas we can find also the countries with more observations, like Peru, Ecuador, Mexico, Bolivia and Nicaragua in Latin America and the Caribbean, or India and Philippines in Asia.

The information needed to perform the analysis comes from three different databases. Microfinance Information Exchange, which provides the specific MFIs variables, World Development Indicators, which presents macro-environment variables and Global Financial Development, which is the source of the variables that measure financial development.

3.2. Econometric Model

The first step in the empirical analysis is the estimation of Model (1). This model analyzes the influence of financial development and economic growth on the growth of MFIs. The moderating effect of economic growth on the relationship between financial system development and MFI development is not studied in this model but will be incorporated in a later analysis.

As dependent variable, we propose the real MFI credit growth (MFIG), which is measured as the difference in logarithms of the gross loan portfolio deflated in two consecutive years. This variable has been used in the literature not only to measure the development of the microfinance sector but also for the traditional financial sector [5,7,16,56].

GROW represents the economic growth of each country, measured as the annual growth rate of real per capita GDP [2,7,57,58,59].

FD represents the degree of financial development, measured as the logarithm of private credit as a percentage of GDP, a measure widely used in research on finance and economic growth [7,25,26,59,60,61,62,63]

Model (1) also includes a set of MFI-specific variables that influence the growth of their credit portfolios, taking into account the factors that affect the supply of credit of the MFIs.

SIZE represents the size of the MFI, measured as the logarithm of total assets. This variable can influence the development of the microfinance sector through improvements in the reach and the sustainability [5,55] and the financial efficiency [54,64]. The greater the size of the MFI, the greater the possibilities of financing and thus the growth of the loan portfolio [5,7].

RISK measures the risk of the MFI, understood as the loan portfolio at risk greater than 30 days plus the value of loans written off. A negative relationship between credit risk and MFI growth is expected because poor quality of the loan portfolio will foster greater prudence in granting financing [16,65,66].

To measure the age of the MFI, three dummy variables are defined that divide microfinance entities into new (from 0–4 years), young (5–8 years), and mature (more than 8 years), classification used by the Mix Market database. Age has been shown to be a factor influencing the reach and sustainability of MFIs [5] and their development [5,16]. In this case, we find in the literature different proposals about the influence of this variable on the credit growth of MFIs. On the one hand, some authors find a negative relationship, that is, the younger the MFI, the higher the credit growth, because it is in the first years in which MFIs experience higher growth [16]. On the other hand, other authors find a positive relationship, arguing that older MFIs have greater possibilities of financing thanks to the confidence they have created over the years [5].

Finally, macro-environment variables are also included, which exert their influence on the growth of MFI credit from the perspective of the demand.

FDI represents foreign direct investment, measured as net inflows (new investment flows minus divestment) as a percentage of GDP. A negative relationship is expected with MFI credit growth, as FDI increases the number of workers in the formal economic sector, reducing the MFIs’ potential demand [5,7].

REM represents remittances received, measured as workers’ remittances received as a percentage of GDP [16,67,68].

A negative relationship is also expected, as they imply an increase in income that serves as a substitute for microcredit financing [16].

CONC represents the concentration in the microfinance sector, measured through the Herfindahl-Hirschman index [16,59,69].

A positive relationship is expected, since competition may lead to an increase in loan size, relaxed credit constraints and decreased control over customers, ultimately leading to an increase in the delinquent portfolio. As a result, this increase would slow the growth of MFI credit [58,59,69,70,71,72,73,74,75].

YEAR are dummy variables to identify the year for each observation.

Model (1) shows the effect of the variables analyzed individually. However, to test the hypotheses proposed, it is necessary to analyze whether the effect of financial development on microfinance activity is conditioned by economic growth. In order to test this effect, Model (2) is proposed:

Model (2) is based on the specification proposed in model (1), but it includes an interaction term between the financial development variable (FDit) and the economic growth variable (GROWit). This interaction of two continuous variables allows us to measure the effect of financial development on the different values that economic growth can take, not only by distinguishing situations of positive or negative economic growth. This analysis will also allow the determination of whether there is a level of economic growth that produces a change on the sign of the influence of financial development on the development of the microfinance sector.

The models proposed have been estimated using the System-GMM methodology of dynamic panel data. This estimation method is adequate to control endogeneity problems, allowing consistent and unbiased estimators using lags of the independent variable as instruments [53]. According to the evidence in the previous literature, the macro-environment indicators (FDI, REM, and CONC), the development of the financial system (FD) and the age (AGE) are considered exogenous variables, while the MFI-specific variables (SIZE and RISK) and the economic growth (GROW) are considered endogenous. Likewise, an estimation strategy has been followed for the endogenous variables that use the lags of these variables as instruments. In particular, we used the second and third lag for the difference equations and the first lag for the level equations.

Table 2.

Descriptive Statistics. Standard deviation: Std. Dev.

Table 3.

Correlation matrix. GROW: economic growth of each country; FD: financial development; SIZE: size of microfinance institutions (MFIs); RISK: risk of microfinance institutions; FDI: foreign direct investment; REM: remittances flows; CONC: concentration in the microfinance sector.

3.3. Results

The main objective of this paper is to explore how the relationship between financial development and the development of the microfinance sector may be conditioned by the degree of economic growth in the country. As a first approximation, and for purely descriptive purposes, the descriptive statistics are presented in Table 4 by dividing the sample according to whether the economic growth is negative or positive.

Table 4.

Descriptive statistics divided by economic growth.

Firstly, regarding the dependent variable, there is greater growth of MFI credit (MFIG) in those countries with positive economic growth, a difference that is statistically significant. In the case of financial development (FD), countries with positive economic growth have deeper financial systems. This positive relationship is in line with the results of the previous literature, which has been proposing a direct relationship between both variables [26,27,28,42].

Regarding the MFIs variables, there are no significant differences in the size of MFIs (SIZE), but a lower risk rate (RISK) is shown in countries with positive growth rates. Finally, among the macro-environment variables, countries with positive economic growth have greater flows of foreign direct investment (FDI) and higher remittances flows (REM), being both important factors that contribute to economic growth. However, the concentration in the microfinance sector shows no differences in countries with different economic situation.

Once the individual behavior of the variables has been analyzed in terms of positive or negative economic growth, Table 5 shows the results of the estimation of Model 1. The table shows the results of the general model proposed (Model 1.a), and also the results of a more restricted specification (Model 1.b). In this case, the model is estimated only for formal institutions (Banks, Credit union/cooperatives and rural banks), including an additional variable (REG), which controls the regulatory effect. Specifically, the variable REG is a dummy variable that takes value 1 from the year when the country begins to implement Pillar 1 of the Basel II capital agreement and 0 otherwise. The data comes from the Financial Stability Institute (FSI Survey Basel II, 2.5 and III Implementation, 2015), BIS.

Table 5.

Results Model 1.

The results of model 1.a do not show a statistically significant relationship between economic growth (GROW) or financial development (FD) and the development of the microfinance sector. However, we should take into account that in this model the influence of these variables on the microfinance industry is considered independently. Regarding the other variables, the size of MFIs (SIZE) affects positively and significantly the growth of MFIs’ credit, showing that that larger entities grow at a faster rate. This confirms the results of previous research, which explained that large MFIs have greater possibilities for financing and therefore growth of their loan portfolios [5,7]. The variable RISK negatively and significantly affects the development of MFIs, which reflects that the entities with loan portfolios of low quality are more prudent in granting loans [65,66]. Foreign direct investment (FDI) has a negative and significant influence on the development of the microfinance sector, due to its positive effect on the formal economic sector, which implies a reduction in the potential demand of the microfinance sector [5,7].

In the case of model 1.b we can observe that the regulation variable does not exert a significant influence on the growth of the MFIs. However, the size of the sample is considerably reduced, both by the type of institution and by the availability of information in compliance with the Basel agreements. The only differences observed are that economic growth seems to have a positive effect, as well as the degree of concentration of the sector, variables that in the general model showed no influence. On the other hand, the size loses the influence detected in the general model, which was expected since in selecting the formal institutions we had to eliminate the smaller ones from the sample.

The results of Model 1 show that neither economic growth nor financial development are statistically significant in explaining the development of the microfinance sector. However, as we proposed in the hypotheses, it is possible that the effect of financial development on microfinance activity is conditioned by the economic growth. The results of Model 2, which is built considering this moderating effect, are shown in Table 6.

Table 6.

Results Model 2.

In this table, we see that economic growth (GROW) has a negative influence on the growth of the microfinance sector. This result is in line with Wagner and Winkler [16], who propose that higher rates of economic growth could reduce the potential market for MFIs [44,45]. The remaining control variables are still significant and maintain the sign presented in model (1).

In this analysis we included the interaction between economic growth (GROW) and financial development (FD), which are continuous variables. This interaction of two continuous variables allows us to test the proposed hypotheses. Because of the interaction between two continuous variables, the coefficient in the analysis only reflects the relations in one specific point (when the variables that are interacted, economic growth and financial development, both have a value of 1). However, the significance and marginal effect of financial development on the growth of MFI credit will depend on the value of economic growth. To capture this marginal effect, we have to take the first derivative of Model (2) with respect to financial development.

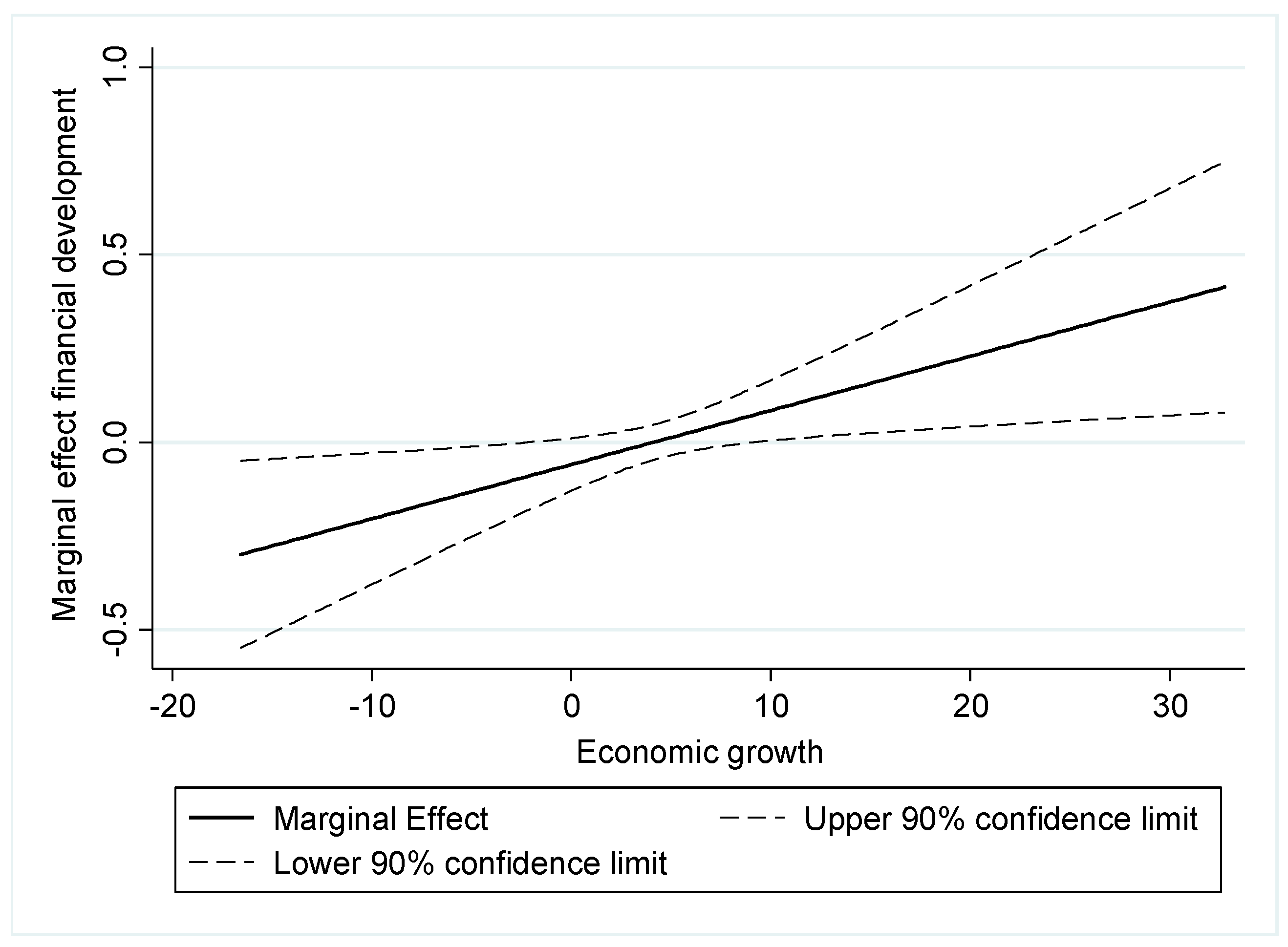

The marginal effect in Equation (3) changes with the level of economic growth (GROW); so, we need to use plots to interpret the results properly (A explanation of the interpretation of the interaction of continuous variables can be found in Brambor et al. [76] and Berry, Golder, & Milton [77]). Figure 1 reports the marginal effect of financial development (FD) on the growth of MFI credit in relation to economic growth (GROW). The dotted lines represent the 90% confidence interval (We followed Aiken, West, & Reno [78] to compute the confidence intervals). Ninety percent confidence intervals allow us to determine the conditions under which the financial development indicator has a statistically significant effect on the growth of MFI credit (whenever both upper and lower bounds of the 90% confidence interval are either above or below zero).

Figure 1.

Marginal effect of financial development (FD) considering the level of economic growth.

Figure 1 shows three clearly differentiated sections, taking into account the sign of the relationship and its statistical significance. The results show that there is a negative and significant relationship between the development of the financial sector and the development of the microfinance sector when economic growth takes values under −1.92%. Likewise, there is a positive and significant relationship when the country’s economic growth exceeds 9.08%. In contrast, there is no relationship between the development of the financial sector and the growth of the microfinance sector and when economic growth is between −1.92% and 9.08%.

These results show that when the economy is in a deep recession, the development of the traditional financial sector has a negative influence on the development of the microfinance sector, leading to greater competition and a substitution effect between both sectors, as we proposed in Hypothesis 1. On the other hand, for moderate levels of economic decline or growth levels, the traditional financial sector and the microfinance sector seem to be unrelated. It is only when the economy experiences high economic growth that the development of the traditional financial sector transfers a positive influence on the development of the microfinance sector, a relationship proposed in Hypothesis 2.

4. Conclusions

In this paper, we carried out an empirical analysis to test the influence of the development of the financial system on the development of the microfinance sector, considering the moderating effect of economic growth. In the empirical analysis, we used a sample composed of 693 MFIs (4614 observations) belonging to 79 countries between the years 1998 and 2011.

The results show the relevance of the moderating effect of economic growth in the analysis of microfinance sector development. In fact, the absence of a relationship between the financial and microfinance sectors development our first analysis appears to be caused by the opposite effect occurring depending on the degree of economic growth. On the one hand, when there is a high level of negative economic growth, there is a negative relationship between the development of the financial sector and the development of the microfinance sector. This substitution effect may appear because an economic recession slows the growth of MFIs and, therefore, their microcredit supply [8,11,12]. If we add a developed financial system, clients can move towards the traditional financial system both due to the scarcity of microcredit offers and the existence of a greater variety of loans or lower financing costs [9,10,20]. On the other hand, when the economy experiences a high degree of economic growth, there is a complementary effect, as the sources of MFI financing increase through the traditional financial system [10,13,14,22,23,50,51]. In addition, the development of the financial system can also improve the efficiency of MFIs through the implementation of banking techniques [7,10,52].

These results are especially relevant today for MFIs, their clients and policy makers.

In the case of MFIs, we have seen an increase in commercial financing that has allowed for rapid and uncontrolled growth in this sector. This, combined with the global financial crisis that has tested the structure and business model of many MFIs, makes it essential to advance the understanding of the development of the microfinance sector. In this sense, the results show that financial development has influenced the development of microfinance in two different scenarios. On the one hand, it has an influence on countries in economic decline with low financial development (where the microfinance sector serves a very high percentage of the population that is excluded from the financial system), and on the other, it has an influence in countries with very high economic growth and high financial development (where both sectors work together, without direct competition between them). So, when analyzing MFIs performance, one should consider both the economic environment and the degree of financial sector development. In this case, economic growth acts as a trigger that highlights those key variables in the development or failure of the microfinance sector. That is, if this joint effect is not taken into account, these variables can go unnoticed, which can be decisive when evaluating the success or failure of an MFI.

In addition, the moderating effect found has very important implications for policymakers. Therefore, the design and implementation of policies to support microfinance activities must take into account the differential effect dependent on economic growth and financial sector development. In fact, these results can shed light on the difficulties of running successful programs in other countries, which do not always achieve the degree of success expected. Our results show that these differences cannot only be due to the effectiveness of the policies, but also the manner in which these policies are affected by the economic and financial environment.

Author Contributions

Conceptualization, I.S.-F., B.T.-O. and C.L.-G.; methodology, C.L.-G. and S.S.-A.; Data collection I.S.-F. and B.T.-O.; Empirical analysis, I.S.-F., C.L.-G. and S.S.-A.; Writing—original draft preparation, I.S.-F., B.T.-O. and C.L.-G.; Writing—review and editing, C.L.-G. and S.S.-A.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Cull, R.; Demirgüç-Kunt, A.; Morduch, J. Microfinance meets the market. J. Econ. Perspect. 2009, 23, 167–192. [Google Scholar] [CrossRef]

- Ahlin, C.; Lin, J. Luck or Skill? MFI Performance in Macroeconomic Context; BREAD Working Paper 132; Centre for International Development, Harvard University: Cambridge, MA, USA, 2006. [Google Scholar]

- Hermes, N.; Lensink, R.; Meesters, A. Outreach and efficiency of microfinance institutions. World Dev. 2011, 39, 938–948. [Google Scholar] [CrossRef]

- Bogan, V.L. Capital structure and sustainability: An empirical study of microfinance institutions. Rev. Econ. Stat. 2012, 94, 1045–1058. [Google Scholar] [CrossRef]

- Vanroose, A.; D’Espallier, B. Do microfinance institutions accomplish their mission? Evidence from the relationship between traditional financial sector development and microfinance institutions’ outreach and performance. Appl. Econ. 2013, 45, 1965–1982. [Google Scholar] [CrossRef]

- Adhikary, S.; Papachristou, G. Is There a Trade-off between Financial Performance and Outreach in South Asian Microfinance Institutions? J. Dev. Areas 2014, 48, 381–402. [Google Scholar] [CrossRef]

- Ahlin, C.; Lin, J.; Maio, M. Where does microfinance flourish? Microfinance institution performance in macroeconomic context. J. Dev. Econ. 2011, 95, 105–120. [Google Scholar] [CrossRef]

- Martinez, R. Latin America and the Caribbean 2009: Microfinance Analysis and Benchmarking Report; Microfinance Information Exchange: Washington, DC, USA, 2010. [Google Scholar]

- McIntosh, C.; Wydick, B. Competition and microfinance. J. Dev. Econ. 2005, 78, 271–298. [Google Scholar] [CrossRef]

- Hermes, N.; Lensink, R.; Meesters, A. Financial Development and the Efficiency of Microfinance Institutions; University of Groningen: Groningen, The Netherlands, 2009. [Google Scholar]

- Huijsman, S. The Impact of the Economic and Financial Crisis on MFIs; Planet Finance: Stuttgart, Germany, 2011. [Google Scholar]

- Constantinou, D.; Ashta, A. Financial crisis: Lessons from microfinance. Strateg. Chang. 2011, 20, 187–203. [Google Scholar] [CrossRef]

- Rosenberg, R.; González, A.; Narain, S. The New Moneylenders: Are the Poor Being Exploited by High Microcredit Interest Rates? CGAP: Washington, DC, USA, 2009. [Google Scholar]

- Hamada, M. Commercialization of microfinance in Indonesia: The shortage of funds and the linkage program. Dev. Econ. 2010, 48, 156–176. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A.; Beck, T.; Honohan, P. Finance for All? Policies and Pitfalls in Expanding Access; World Bank Policy Research Report: Washington, DC, USA, 2008. [Google Scholar]

- Wagner, C.; Winkler, A. The vulnerability of microfinance to financial turmoil: Evidence from the global financial crisis. World Dev. 2013, 51, 71–90. [Google Scholar] [CrossRef]

- Sinclair, S. Financial Exclusion: An Introductory Survey Centre for Research into Socially Inclusive Services; Centre for Research into Socially Inclusive Services, Heriot Watt University: Edimburgo, UK, 2001. [Google Scholar]

- World Bank Group. The Little Data Book on Financial Inclusion 2015. Global Financial Inclusion Database; World Bank: Washington, DC, USA, 2015; ISBN 1464805520. [Google Scholar]

- Barr, M.S. Microfinance and Financial Development. Michigan J. Int. Law 2005, 26, 271–296. [Google Scholar]

- McIntosh, C.; Janvry, A.; Sadoulet, E. How rising competition among microfinance institutions affects incumbent lenders. Econ. J. 2005, 115, 987–1004. [Google Scholar] [CrossRef]

- Bell, C.; Rousseau, P.L. Post-independence India: A case of finance-led industrialization? J. Dev. Econ. 2001, 65, 153–175. [Google Scholar] [CrossRef]

- Isem, J.; Porteous, D. Commercial Banks and Microfinance: Evolving Models of Success; CGAP Focus Note; no. 28; World Bank: Washington, DC, USA, 2005. [Google Scholar]

- De Crombrugghe, A.; Tenikue, M.; Sureda, J. Perfomance analysis for a sample of microfinance institutions in India. Ann. Public Coop. Econ. 2008, 79, 269–299. [Google Scholar] [CrossRef]

- Quayes, S. Depth of outreach and financial sustainability of microfinance institutions. Appl. Econ. 2012, 44, 3421–3433. [Google Scholar] [CrossRef]

- King, R.G.; Levine, R. Finance and Growth: Schumpeter Might Be Right. Q. J. Econ. 1993, 108, 717–737. [Google Scholar] [CrossRef]

- Levine, R. Finance and growth: Theory and evidence. In Handbook of Economic Growth; Aghion, P., Durlauf, S.N., Eds.; Elsevier: Amsterdam, The Netherlands, 2005; Volume 1, pp. 865–934. [Google Scholar]

- Samargandi, N.; Firdmuc, J.; Ghost, S. Is the Relationship Between Financial Development and Economic Growth Monotonic? Evidence from a Sample of Middle-Income Countries. World Dev. 2015, 68, 66–81. [Google Scholar] [CrossRef]

- Durusu-Ciftci, D.; Ispir, M.S.; Hakan, Y. Financial development and economic growth: Some theory and more evidence. J. Policy Model. 2016, 39, 290–306. [Google Scholar] [CrossRef]

- Rousseau, P.L.; Wachtel, P. Financial Intermediation and Economic Performance: Historical Evidence from Five Industrialized Countries. J. Money Credit Bank. 1998, 30, 657–678. [Google Scholar] [CrossRef]

- Bekaert, G.; Harvey, C.R. Capital markets: An engine for economic growth. Brown J. World Aff. 1998, 5, 33–53. [Google Scholar] [CrossRef]

- Berkes, E.; Panizza, U.; Arcand, J.-L. Too Much Finance? International Monetary Fund Working Paper WP/12/161: Washington, DC, USA, 2012. [Google Scholar]

- Cecchetti, S.; Kharroubi, E. Reassessing the Impact of Finance on Growth; Bank for International Settlements Working Paper 381: Basel, Switzerland, 2012. [Google Scholar]

- Law, S.H.; Singh, N. Does too much finance harm economic growth? J. Bank. Financ. 2014, 41, 36–44. [Google Scholar] [CrossRef]

- Patrick, H.T. Financial development and economic growth in underdeveloped countries. Econ. Dev. Cult. Chang. 1966, 14, 174–189. [Google Scholar] [CrossRef]

- Shaw, E.S. Financial Deepening in Economic Development; Oxford University Press: New York, NY, USA, 1973. [Google Scholar]

- Fritz, R.G. Time series evidence of the causal relationship between financial deepening and economic development. J. Econ. Dev. 1984, 9, 91–111. [Google Scholar]

- Jung, W.S. Financial Development and Economic Growth: International Evidence. Econ. Dev. Cult. Chang. 1986, 34, 333–346. [Google Scholar] [CrossRef]

- Demetriades, P.O.; Hussein, K.A. Does financial development cause economic growth? Time-series evidence from 16 countries. J. Dev. Econ. 1996, 51, 387–411. [Google Scholar] [CrossRef]

- Blackburn, K.; Hung, V.T.Y. A theory of growth, financial development and trade. Economica 1998, 65, 107–124. [Google Scholar] [CrossRef]

- Khan, A. Financial Development and Economic Growth. Macroecon. Dyn. 2001, 5, 413–433. [Google Scholar]

- Calderón, C.; Liu, L. The direction of causality between financial development and economic growth. J. Dev. Econ. 2003, 72, 321–334. [Google Scholar] [CrossRef]

- Fung, M.K. Financial development and economic growth: Convergence or divergence? J. Int. Money Financ. 2009, 28, 56–67. [Google Scholar] [CrossRef]

- Hassan, M.K.; Sánchez, B.; Yu, J.-S. Financial development and economic growth: New evidence from panel data. Q. Rev. Econ. Financ. 2011, 51, 88–104. [Google Scholar] [CrossRef]

- Schneider, F.; Enste, D.H. Shadow Economies: Size Causes and Consecuences. J. Econ. Lit. 2000, 38, 77–114. [Google Scholar] [CrossRef]

- Heintz, J.; Pollin, R. Informalization, Economic Growth and the Challenge of Creating Viable Labor Standards in Developing Countries; SSRN Electronic Journal. 10.2139; SSRN: New York, NY, USA, 2003; Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=427683 (accessed on 28 October 2018).

- Lucas, R.E. On the mechanics of economic development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Goodhart, C.A.E. Financial Development and Economic Growth: Explaining the Links; Palgrave Macmillan: Basingstoke, UK, 2004; ISBN 9780230374270. [Google Scholar]

- Robinson, J. The Rate of Interest and Other Essays; Macmillan: London, UK, 1952. [Google Scholar]

- Robinson, J. The Rate of Interest. In The Generalisation of the General Theory and other Essays; Palgrave Macmillan UK: London, UK, 1979; pp. 135–164. [Google Scholar]

- Bell, R.; Harper, A.; Mandivenga, D. Can commercial banks do microfinance? Lessons from the commercial bank of Zimbabwe and the co-operative bank of Kenya. Small Enterp. Dev. 2002, 13, 35–46. [Google Scholar] [CrossRef]

- Isern, J.; Ritchie, A.; Crenn, T.; Brown, M. Review of Commercial Banks and Other Formal Financial Institutions Participation in Microfinance; CGAP: Washington, DC, USA, 2003. [Google Scholar]

- Trigo, J.; Loubière, P.; Devaney, L.; Rhyne, E. Supervising and Regulating Microfinance in the Context of Financial Sector Liberalization: Lessons from Bolivia, Colombia and Mexico; Accion Internacional: Washington, DC, USA, 2004. [Google Scholar]

- Arellano, M.; Bond, S. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Gutiérrez-Nieto, B.; Serrano-Cinca, C.; Mar Molinero, C. Social efficiency in microfinance institutions. J. Oper. Res. Soc. 2009, 60, 104–119. [Google Scholar] [CrossRef]

- Mersland, R.; Strøm, R.Ø. Microfinance mission drift? World Dev. 2010, 38, 28–36. [Google Scholar] [CrossRef]

- Wagner, C. From Boom to Bust: How Different Has Microfinance Been from Traditional Banking? Dev. Policy Rev. 2012, 30, 187–210. [Google Scholar] [CrossRef]

- Patten, R.H.; Rosengard, J.K.; Johnston, D.J. Microfinance Success Amidst Macroeconomic Failure: The Experience of Bank Rakyat Indonesia During the East Asian Crisis. World Dev. 2001, 29, 1057–1069. [Google Scholar] [CrossRef]

- Vogelgesang, U. Microfinance in Times of Crisis: The Effects of Competition, Rising Indebtedness, and Economic Crisis on Repayment Behavior. World Dev. 2003, 31, 2085–2114. [Google Scholar] [CrossRef]

- Assefa, E.; Hermes, N.; Meesters, A. Competition and the performance of microfinance institutions. Appl. Financ. Econ. 2013, 23, 767–782. [Google Scholar] [CrossRef]

- Rajan, R.G.; Zingales, L. American Economic Association Financial Dependence and Growth. Am. Econ. Rev. 1998, 88, 559–586. [Google Scholar]

- Levine, R.; Loayza, N.; Beck, T. Financial intermediation and growth: Causality and causes. J. Monet. Econ. 2000, 46, 31–77. [Google Scholar] [CrossRef]

- Westley, G.D. Can Financial Market Policies Reduce Income Inequality? Inter-American Development Bank: Washington, DC, USA, 2016. [Google Scholar]

- Demirgüç-Kunt, A.; Levine, R. Financial Structure and Economic Growth: A Cross-Country Comparison of Banks, Markets, and Development; MIT Press: Cambridge, UK, 2004; ISBN 9780262541794. [Google Scholar]

- Gutiérrez Goiria, J. Las Microfinanzas en el Marco de la Financiación del Desarrollo: Compatibilidad y/o Conflicto Entre Objetivos Sociales y Financieros; Universidad del País Vasco–Euskal Herriko Unibertsitatea: Leioa, Spain, 2012. [Google Scholar]

- González, A. Is Microfinance Growing Too Fast? Microfinance Information Exchange: Washington, DC, USA, 2010. [Google Scholar]

- Rozas, D. Weathering the Storm: Hazards, Beacons, and Life Rafts Lessons in Microfinance Crisis Survival from Those Who Have Been There; Center for Financial Inclusion: Washington, DC, USA, 2011. [Google Scholar]

- Hernández-Hernández, E.; Sam, A.G.; González-Vega, C.; Chen, J. Agricultural and Applied Economics Association; Agricultural and Applied Economics Association: Milwaukee, WI, USA, 2009. [Google Scholar]

- Kappel, V.; Krauss, A.; Lontzek, L. Sobreendeudamiento y Microfinanzas Construyendo un índice de alerta Temprana; Center of Microfinance, University of Zurich: Zurich, Switzerland, 2010. [Google Scholar]

- Baquero, G.; Hamadi, M.; Heinen, A. Competition, Loan Rates and Information Dispersion in Microcredit Markets. J. Money Credit Bank. 2018, 50, 893–937. [Google Scholar] [CrossRef]

- Wilhelm, U. Identificando los Principales Riesgos en las Microfinanzas; Standard & Poor’s: New York, NY, USA, 2000. [Google Scholar]

- Reille, X. The Rise, Fall, and Recovery of the Microfinance Sector in Morocco; CGAP: Washington, DC, USA, 2009. [Google Scholar]

- Chen, G.; Rasmussen, S.; Reille, X. Growth and Vulnerabilities in Microfinance; Consultative Group to Assist the Poor (CGAP): Washington, DC, USA, 2010. [Google Scholar]

- Richman, D.; Fred, A.K. Gender Composition, Competition and Sustainability of Micro Finance in Africa: Evidence from Ghana’s Microfinance Inustry; Ghana Institute of Management and Public Administration: Ghana, West Africa, 2010. [Google Scholar]

- Priyadarshee, A.; Ghalib, A.K. The Andhra Pradesh Microfinance Crisis in India: Manifestation, Causal Analysis, and Regulatory Response; Brooks World Poverty Institute Working Paper No. 157: Nueva Delhi, India, 2011. [Google Scholar]

- Bastiaensen, J.; Marchetti, P.; Mendoza Vidaurre, R.; Pérez, F.J. Las paradójicas secuelas del movimiento no pago en las microfinanzas agropecuarias en Nicaragua. Encuentro 2013, 95, 47–68. [Google Scholar]

- Brambor, T.; Clark, W.R.; Golder, M.; Beck, N.; Boehmke, F.; Gilligan, M.; Golder, S.N.; Nagler, J. Understanding Interaction Models: Improving Empirical Analysis. Political Anal. 2006, 14, 63–82. [Google Scholar] [CrossRef]

- Berry, W.D.; Golder, M.; Milton, D. Improving Tests of Theories Positing Interaction. J. Political 2012, 74, 653–671. [Google Scholar] [CrossRef]

- Aiken, L.S.; West, S.G.; Reno, R.R. Multiple Regression: Testing and Interpreting Interactions; Sage Publications: Thousand Oaks, CA, USA, 1991; ISBN 0803936052. [Google Scholar]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).