Comparing the Technology Trajectories of Solar PV and Solar Water Heaters in China: Using a Patent Lens

Abstract

1. Introduction

2. Literature Review

2.1. SWH Development

2.2. Solar PV Development

3. Theoretical Framework and Methodology

3.1. Theoretical Analytical Framework

3.2. Patent Analysis Method and Data

3.2.1. First Set: Trajectories of Key Technologies

3.2.2. Second Set: Patent Citation Network (Knowledge Flow and Spillover)

3.2.3. Third Set: University‒Industry R&D Collaboration and Firm‒Firm Collaboration

3.3. Case Selection

4. Empirical Analysis and Case Study

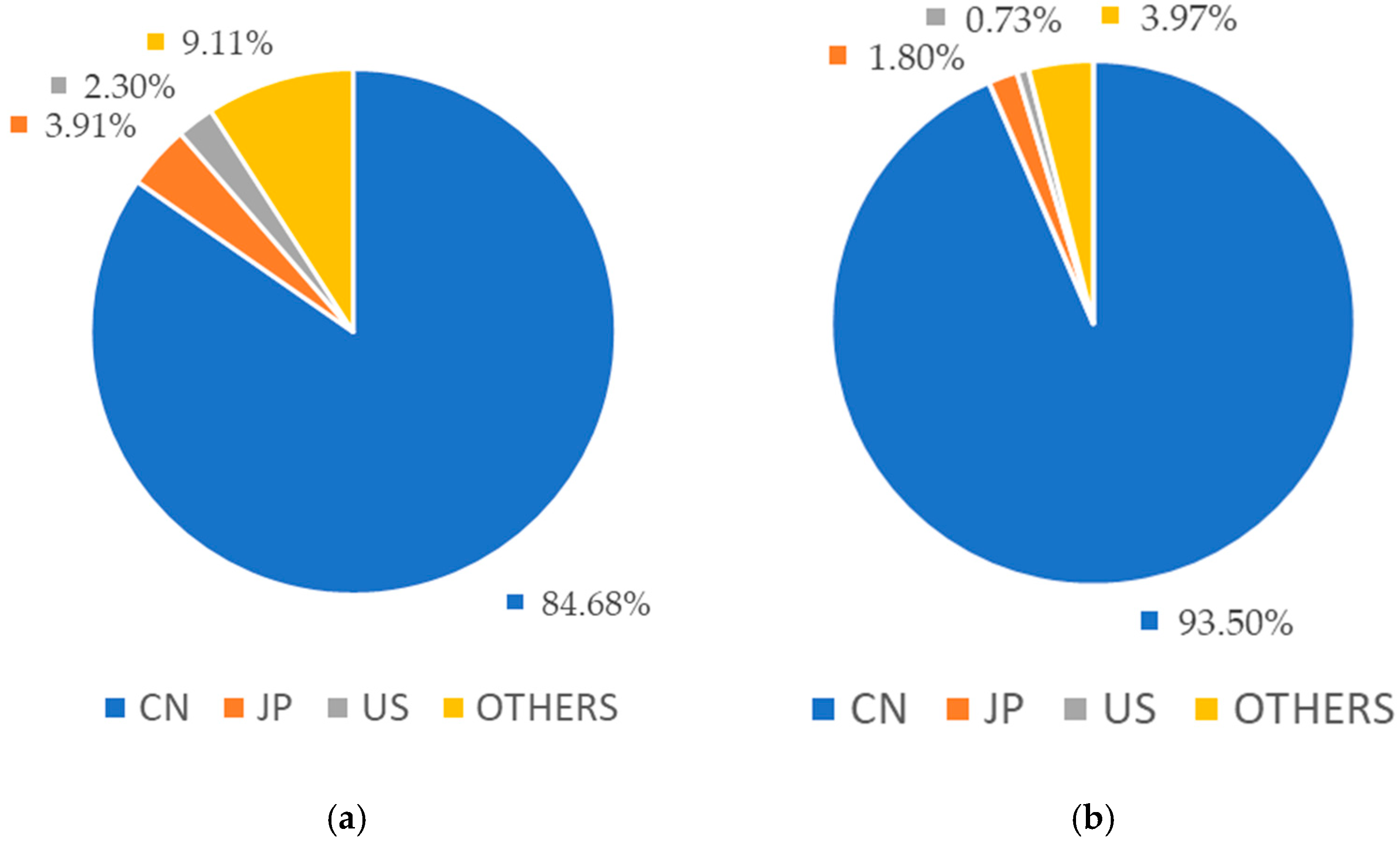

4.1. Trajectories of Key Technologies

4.2. Patent Citation Network (Knowledge Flow and Spillover)

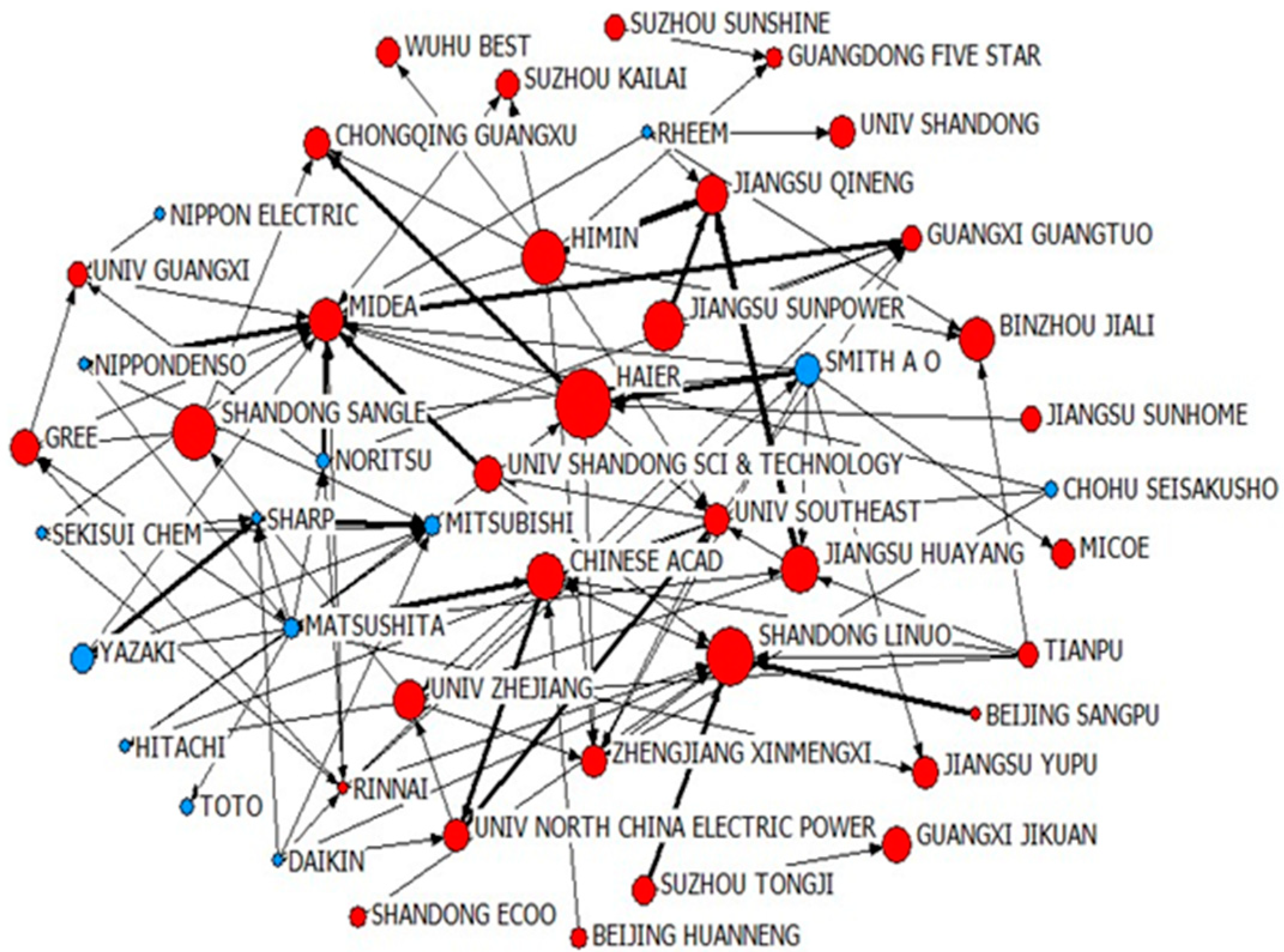

4.2.1. SWH Patent Citation Network Analysis

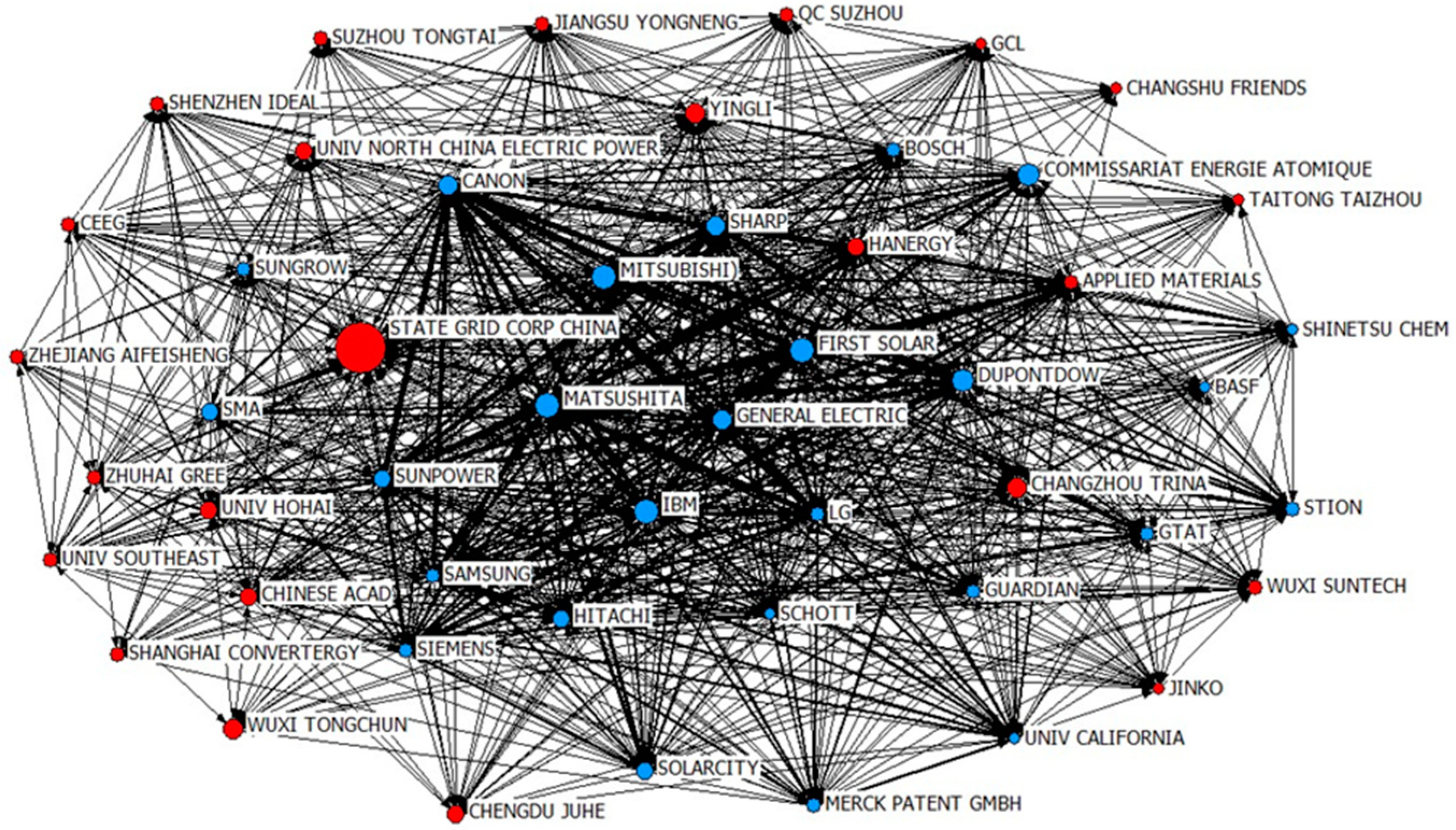

4.2.2. PV Patent Citation Network Analysis

4.3. University‒Industry R&D Collaboration and Firm‒Firm Collaboration

4.4. Comprehensive Comparison of the Chinese SWH and Solar PV Industries

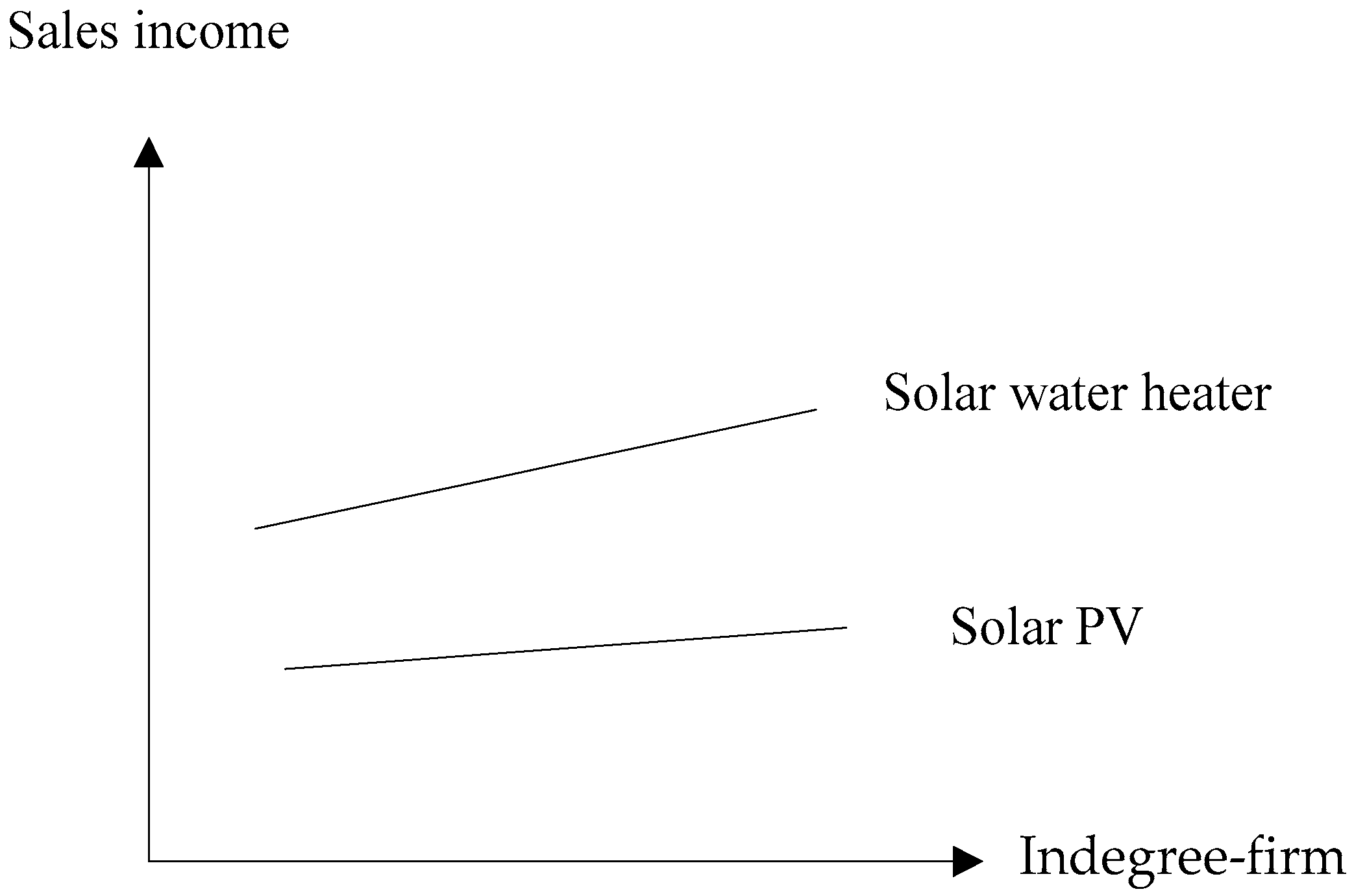

5. Influence of Patent Degree Centrality on Sales Income

6. Conclusions and Policy Implications

6.1. Discussion

6.1.1. Analysis of the Main Results

6.1.2. Driving Factors: Market Orientation, Innovation Modes, and Policy Characteristics

6.2. Policy Implications

6.3. Conclusions and Future Research

6.3.1. Conclusions

6.3.2. Limitations and Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Firms | 1995–2008 | 2009–2016 | ||||||

|---|---|---|---|---|---|---|---|---|

| Betweenness | Out-Degree Centrality | Indegree Centrality | Net Citations | Betweenness | Out-Degree Centrality | Indegree Centrality | Net Citations | |

| NORITSU | 16.25 | 20 | 2 | 18 | 9.667 | 5 | 2 | 3 |

| PANASONIC | 67.125 | 13 | 9 | 4 | 22.5 | 12 | 1 | 11 |

| MITSUBISHI | 7.542 | 9 | 2 | 7 | 4.5 | 1 | 8 | −7 |

| HITACHI | 37.875 | 8 | 18 | −10 | 20 | 1 | 4 | −3 |

| TOTO | 13.667 | 8 | 2 | 6 | 0 | 0 | 1 | −1 |

| RINNAI | 2.5 | 5 | 2 | 3 | 54.5 | 6 | 3 | 3 |

| HAIER | 0 | 4 | 0 | 4 | 31.383 | 5 | 4 | 1 |

| SMITH A. O. | 2.625 | 3 | 1 | 2 | 42.7 | 8 | 1 | 7 |

| NIPPON ELECTRIC | 0 | 3 | 0 | 3 | 0 | 1 | 0 | 1 |

| CHOHU SEISAKUSHO | 0 | 2 | 0 | 2 | 0 | 3 | 0 | 3 |

| DAIKIN KK | 11.5 | 2 | 8 | −6 | 0 | 5 | 0 | 5 |

| RHEEM | 14.333 | 2 | 9 | −7 | 0 | 4 | 0 | 4 |

| MIDEA | 0 | 2 | 0 | 2 | 57.167 | 2 | 19 | −17 |

| NIPPO-NDENSO | 23.583 | 2 | 6 | −4 | 0 | 4 | 0 | 4 |

| SHARP | 0 | 1 | 0 | 1 | 2 | 4 | 4 | 0 |

| CHINESE ACAD | 0 | 1 | 0 | 1 | 97.383 | 4 | 6 | −2 |

| FUJI FILM | 0 | 0 | 2 | −2 | 0 | 0 | 0 | 0 |

| HIMIN | 0 | 0 | 4 | −4 | 0 | 11 | 0 | 11 |

| JIANGSU QINENG | 0 | 0 | 0 | 0 | 0 | 0 | 9 | −9 |

| JIANGSU YUPU | 0 | 0 | 0 | 0 | 0 | 0 | 2 | −2 |

| CHONGQING GUANGXU | 0 | 0 | 0 | 0 | 0 | 0 | 4 | −4 |

| GUANGXI GUANGTUO | 0 | 0 | 5 | −5 | 21 | 2 | 4 | −2 |

| JIANGSU SUNHOME | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 |

| JIANGSU SUNPOWER | 0 | 0 | 2 | −2 | 0 | 3 | 0 | 3 |

| BEIJING HUANNENG | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 |

| GUANGXI JIKUAN | 0 | 0 | 0 | 0 | 0 | 0 | 1 | −1 |

| JIANGSU HUAYANG | 0 | 0 | 5 | −5 | 29.683 | 5 | 3 | 2 |

| SEKISUI CHEM | 0 | 0 | 2 | −2 | 0 | 4 | 0 | 4 |

| SHANDONG ECOO | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 |

| SHANDONG LINUO | 0 | 0 | 0 | 0 | 65.55 | 1 | 11 | −10 |

| SHANDONG SANGLE | 0 | 0 | 1 | −1 | 14.5 | 1 | 1 | 0 |

| GREE | 0 | 0 | 0 | 0 | 2.167 | 2 | 3 | −1 |

| GUANGDONG FIVE STAR | 0 | 0 | 0 | 0 | 0 | 0 | 2 | −2 |

| SUZHOU KAILAI | 0 | 0 | 0 | 0 | 0 | 1 | 2 | −1 |

| SUZHOU SUNSHINE | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 |

| SUZHOU TONGJI | 0 | 0 | 3 | −3 | 0 | 3 | 0 | 3 |

| TIANPU | 0 | 0 | 0 | 0 | 0 | 5 | 0 | 5 |

| BINZHOU JIALI | 0 | 0 | 0 | 0 | 0 | 0 | 3 | −3 |

| UNIV GUANGXI | 0 | 0 | 0 | 0 | 2 | 1 | 4 | −3 |

| UNIV NORTH CHINA ELECTRIC POWER | 0 | 0 | 0 | 0 | 10.5 | 1 | 5 | −4 |

| UNIV SHANDONG | 0 | 0 | 0 | 0 | 0 | 0 | 1 | −1 |

| UNIV SHANDONG SCI and TECHNOLOGY | 0 | 0 | 2 | −2 | 18.583 | 3 | 1 | 2 |

| UNIV SOUTHEAST | 0 | 0 | 0 | 0 | 114.4 | 7 | 5 | 2 |

| UNIV ZHEJIANG | 0 | 0 | 0 | 0 | 114.35 | 3 | 4 | −1 |

| WUHU BEST NEW | 0 | 0 | 0 | 0 | 0 | 0 | 1 | −1 |

| YAZAKI | 0 | 0 | 0 | 0 | 3.5 | 3 | 3 | 0 |

| ZHEJIANG JIADELE | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| ZHENGJIANG XINMENGXI | 0 | 0 | 0 | 0 | 66.967 | 2 | 6 | −4 |

| BEIJING SANGPU | 0 | 0 | 0 | 0 | 0 | 2 | 0 | 2 |

| MICOE | 0 | 0 | 0 | 0 | 0 | 0 | 1 | −1 |

Appendix B

| Firms | 1995–2008 | 2009–2016 | ||||||

|---|---|---|---|---|---|---|---|---|

| Betweenness | Outdegree Centrality | Indegree Centrality | Net Citations | Betweenness | Outdegree Centrality | Indegree Centrality | Net Citations | |

| CANON | 24.611 | 3086 | 160 | 2926 | 16.420 | 1182 | 30 | 1152 |

| PANASONIC | 32.346 | 2638 | 841 | 1797 | 74.364 | 1188 | 425 | 763 |

| SHARP | 43.108 | 2027 | 906 | 1121 | 25.175 | 937 | 215 | 722 |

| MITSUBISHI | 25.194 | 1458 | 745 | 713 | 47.055 | 660 | 392 | 268 |

| SIEMENS | 38.797 | 1351 | 316 | 1035 | 35.950 | 564 | 220 | 344 |

| GENERAL ELECTRIC | 48.983 | 904 | 741 | 163 | 45.806 | 805 | 511 | 294 |

| HITACHI | 23.697 | 878 | 391 | 487 | 37.040 | 465 | 234 | 231 |

| UNIV CALIFORNIA | 9.387 | 791 | 403 | 388 | 5.797 | 224 | 110 | 114 |

| SAMSUNG | 33.578 | 743 | 1161 | −418 | 26.211 | 451 | 471 | −20 |

| DUPONTDOW | 9.637 | 667 | 1202 | −535 | 29.214 | 357 | 491 | −134 |

| SUNPOWER | 25.784 | 525 | 1244 | −719 | 31.027 | 499 | 957 | −458 |

| IBM | 31.027 | 516 | 1064 | −548 | 54.466 | 290 | 887 | −597 |

| MERCK PATENT GMBH | 6.271 | 498 | 466 | 32 | 1.834 | 174 | 75 | 99 |

| APPLIED MATERIALS | 22.639 | 486 | 939 | −453 | 16.984 | 452 | 152 | 300 |

| FIRST SOLAR | 29.998 | 419 | 1221 | −802 | 32.013 | 299 | 866 | −567 |

| HANERGY | 6.830 | 417 | 936 | −519 | 49.656 | 375 | 304 | 71 |

| SCHOTT | 12.176 | 411 | 314 | 97 | 3.121 | 212 | 64 | 148 |

| SHINETSU CHEM | 10.128 | 364 | 189 | 175 | 9.482 | 132 | 128 | 4 |

| GUARDIAN | 0.340 | 262 | 357 | −95 | 5.958 | 213 | 95 | 118 |

| LG | 23.651 | 239 | 1456 | −1217 | 25.175 | 286 | 813 | −527 |

| COMMISSARIAT ENERGIE ATOMIQUE | 11.250 | 194 | 565 | −371 | 24.014 | 123 | 355 | −232 |

| BASF | 3.802 | 173 | 206 | −33 | 2.288 | 133 | 75 | 58 |

| BOSCH | 11.364 | 107 | 402 | −295 | 31.395 | 107 | 263 | −156 |

| SMA | 11.261 | 75 | 213 | −138 | 20.427 | 263 | 293 | −30 |

| STION | 1.476 | 68 | 588 | −520 | 0.878 | 60 | 155 | −95 |

| SOLARCITY | 11.555 | 44 | 452 | −408 | 12.596 | 191 | 476 | −285 |

| CHINESE ACAD | 0.651 | 11 | 358 | −347 | 72.242 | 70 | 229 | −159 |

| GTAT | 0 | 8 | 505 | −497 | 2.400 | 17 | 152 | −135 |

| UNIV SOUTHEAST | 0.457 | 4 | 49 | −45 | 37.177 | 103 | 61 | 42 |

| WUXI SUNTECH | 0 | 4 | 182 | −178 | 16.120 | 51 | 55 | −4 |

| QC SUZHOU | 0 | 0 | 12 | −12 | 4.697 | 22 | 7 | 15 |

| CHANGZHOU TRINA | 0 | 0 | 221 | −221 | 63.014 | 46 | 128 | −82 |

| CHANGSHU FRIENDS | 0 | 0 | 5 | −5 | 0 | 1 | 7 | −6 |

| SHENZHEN IDEAL | 0 | 0 | 70 | −70 | 0 | 0 | 73 | −73 |

| SHANGHAI CONVERTERGY | 0 | 0 | 11 | −11 | 0 | 0 | 51 | −51 |

| STATE GRID CORP CHINA | 0 | 0 | 75 | −75 | 115.162 | 90 | 468 | −378 |

| GCL | 0 | 0 | 34 | −34 | 10.365 | 14 | 46 | −32 |

| SUNGROW | 0 | 0 | 70 | −70 | 38.841 | 44 | 189 | −145 |

| CHENGDU JUHE | 0 | 0 | 27 | −27 | 0.301 | 2 | 59 | −57 |

| SUZHOU TONGTAI | 0 | 0 | 21 | −21 | 0 | 44 | −44 | |

| TAITONG TAIZHOU | 0 | 0 | 6 | −6 | 1.631 | 8 | 38 | −30 |

| CEEG | 0 | 0 | 20 | −20 | 13.876 | 26 | 44 | −18 |

| UNIV HOHAI | 0 | 0 | 38 | −38 | 30.510 | 44 | 140 | −96 |

| NIV NORTH CHINA ELECTRIC POWER | 0 | 0 | 51 | −51 | 30.210 | 56 | 126 | −70 |

| JIANGSU YONGNENG | 0 | 0 | 30 | −30 | 15.966 | 13 | 40 | −27 |

| JINKO | 0 | 0 | 30 | −30 | 2.793 | 7 | 63 | −56 |

| WUXI TONGCHUN | 0 | 0 | 9 | −9 | 0.374 | 3 | 22 | −19 |

| YINGLI | 0 | 0 | 54 | −54 | 91.021 | 49 | 145 | −96 |

| ZHEJIANG AIFEISHENG | 0 | 0 | 6 | −6 | 0 | 12 | 6 | 6 |

| ZHUHAI GREE | 0 | 0 | 6 | −6 | 5.083 | 6 | 102 | −96 |

References

- Awan, A.; Zubair, M.; Praveen, P.; Abokhalil, A. Solar energy resource analysis and evaluation of photovoltaic system performance in various regions of saudi arabia. Sustainability 2018, 10, 1129. [Google Scholar] [CrossRef]

- Fouad, M.M.; Shihata, L.A.; Morgan, E.I. An integrated review of factors influencing the performance of photovoltaic panels. Renew. Sustain. Energy Rev. 2017, 80, 1499–1511. [Google Scholar] [CrossRef]

- Hang, Q.; Jun, Z.; Xiao, Y.; Junkui, C. Prospect of concentrating solar power in China—The sustainable future. Renew. Sustain. Energy Rev. 2008, 12, 2505–2514. [Google Scholar] [CrossRef]

- Zhao, R.; Zhao, L.; Deng, S.; Zheng, N. Trends in patents for solar thermal utilization in China. Renew. Sustain. Energy Rev. 2015, 52, 852–862. [Google Scholar] [CrossRef]

- National Energy Administration. The Cost of Photovoltaic Generation in China Has Dropped by 90%. For 10 Years. Available online: http://www.nea.gov.cn/2018-04/13/c_137108373.htm (accessed on 13 April 2018). (In Chinese)

- Zhao, X.G.; Zeng, Y.P.; Zhao, D. Distributed solar photovoltaics in China: Policies and economic performance. Energy 2015, 88, 572–583. [Google Scholar] [CrossRef]

- Urban, F.; Geall, S.; Wang, Y. Solar pv and solar water heaters in China: Different pathways to low carbon energy. Renew. Sustain. Energy. Rev. 2016, 64, 531–542. [Google Scholar] [CrossRef]

- Zhou, Y.; Pan, M.; Urban, F. Comparing the international knowledge flow of China’s wind and solar photovoltaic (pv) industries: Patent analysis and implications for sustainable development. Sustainability 2018, 10, 1883. [Google Scholar] [CrossRef]

- Chen, L.; Xu, J.; Zhou, Y. Regulating the environmental behavior of manufacturing smes: Interfirm alliance as a facilitator. J. Clean. Prod. 2017, 165, 393–404. [Google Scholar] [CrossRef]

- Chen, L.; Zhou, Y.; Zhou, D.; Xue, L. Clustering enterprises into eco-industrial parks: Can interfirm alliances help small and medium-sized enterprises? J. Clean. Prod. 2017, 168, 1070–1079. [Google Scholar] [CrossRef]

- Kong, D.; Feng, Q.; Zhou, Y.; Xue, L. Local implementation for green-manufacturing technology diffusion policy in China: From the user firms’ perspectives. J. Clean. Prod. 2016, 129, 113–124. [Google Scholar] [CrossRef]

- Hu, R.Q.; Sun, P.J.; Wang, Z.Y. An overview of the development of solar water heater industry in China. Energy Policy 2012, 51, 46–51. [Google Scholar] [CrossRef]

- Crachilov, C.; Hancock, R.; Sharkey, G. The China Greentech Report 2009. Available online: http://www.china-greentech.com/sites/default/files/CGTR2009-FullReport.pdf (accessed on 1 April 2009).

- Cao, C.; Suttmeier, R.P.; Simon, D.F. China’s 15 year science and technology plan. Phys. Today 2006, 59, 38–43. [Google Scholar] [CrossRef]

- Weiss, W.; Spörk-Dür, M.; Mauthner, F. Solar Heat Worldwide: Global Market Development and Trends in 2014; Solar Heating & Cooling Programme; International Energy Agency, AEE—Institute for Sustainable Technologies: Gleisdorf, Austria, 2015. [Google Scholar]

- Weiss, W.; Spörk-Dür, M. Solar Heat Worldwide: Global Market Development and Trends in 2017/Detailed Market Figures 2016; Solar Heating & Cooling Programme; International Energy Agency, AEE—Institute for Sustainable Technologies: Gleisdorf, Austria, 2018. [Google Scholar]

- Wang, P. China’s first copper-aluminum composite solar collector production line put into operation. Sol. Energy 1987, 3, 5. [Google Scholar]

- Li, D.J. Review of all-glass evacuated solar collector tube and the development of solar water heaters in China. Sol. Energy 2013, 4, 27. [Google Scholar]

- Yin, Z.U.T. (Beijing, China); Li, D. (Tsinghua University, Beijing, China). Personal communication, 2018.

- Faria, L.G.D.; Andersen, M.M. Sectoral patterns versus firm-level heterogeneity—The dynamics of eco-innovation strategies in the automotive sector. Technol. Forecast. Soc. Chang. 2017, 117, 266–281. [Google Scholar] [CrossRef]

- Fan, W.; Zhu, F.S.; Moen, P. Micro-level experiences of macro-level change: A cohort perspective on China’s shift away from state-sector employment. Adv. Life Course Res. 2018, 35, 77–86. [Google Scholar] [CrossRef]

- Liu, J.S.; Kuan, C.H.; Cha, S.C.; Chuang, W.L.; Gau, G.J.; Jeng, J.Y. Photovoltaic technology development: A perspective from patent growth analysis. Sol. Energy Mater. Sol. Cells 2011, 95, 3130–3136. [Google Scholar] [CrossRef]

- IEA Photovoltaic Power Systems Programme. A Snapshot of Global PV. Available online: http://www.iea-pvps.org/index.php?id=266 (accessed on 3 May 2018).

- SolarPowerEurope. Global Market Outlook 2018–2022. Available online: http://www.solarpowereurope.org/global-market-outlook-2018-2022/ (accessed on 27 June 2018).

- Issaadi, W.; Issaadi, S.; Khireddine, A. Comparative study of photovoltaic system optimization techniques: Contribution to the improvement and development of new approaches. Renew. Sustain. Energy Rev. 2018, 82, 2112–2127. [Google Scholar] [CrossRef]

- D’Agostino, A.L.; Sovacool, B.K.; Bambawale, M.J. And then what happened? A retrospective appraisal of China’s renewable energy development project (redp). Renew. Sustain. Energy Rev. 2011, 36, 3154–3165. [Google Scholar] [CrossRef]

- Guang, X. A Brief Analysis of China’s PV Installed Data in 2017. Available online: http://guangfu.Bjx.Com.Cn/news/20180208/879829.Shtml (accessed on 8 February 2018).

- Negro, S.O.; Alkemade, F.; Hekkert, M.P. Why does renewable energy diffuse so slowly? A review of innovation system problems. Renew. Sustain. Energy Rev. 2012, 16, 3836–3846. [Google Scholar] [CrossRef]

- Zhang, J.; Da, L.; Yang, P.; Xu, Z.; Zhou, S. Development trend analysis of photovoltaic power generation. Renew. Energy Resour. 2014, 32, 127–132. [Google Scholar]

- Green, M.A. Third generation photovoltaics: Solar cells for 2020 and beyond. Phys. E Low-Dimens. Syst. Nanostructures 2002, 14, 65–70. [Google Scholar] [CrossRef]

- Jager-Waldau, A. Status of thin film solar cells in research, production and the market. Sol. Energy 2004, 77, 667–678. [Google Scholar] [CrossRef]

- Hoffmann, W. Pv solar electricity industry: Market growth and perspective. Sol. Energy Mater. Sol. Cells 2006, 90, 3285–3311. [Google Scholar] [CrossRef]

- Zhang, F.; Gallagher, K.S. Innovation and technology transfer through global value chains: Evidence from China’s pv industry. Energy Policy 2016, 94, 191–203. [Google Scholar] [CrossRef]

- Garcia-Almeida, D.J.; Klassen, N. The influence of knowledge-based factors on taxi competitiveness at island destinations: An analysis on tips. Tour. Manag. 2017, 59, 110–122. [Google Scholar] [CrossRef]

- Pavitt, K.; Pavitt, P.; Granstrand, O. Multi-technology corporations: Why they have distributed rather than distinctive core competencies. Calif. Manag. Rev. 1997, 39, 8–25. [Google Scholar]

- Burhan, M.; Singh, A.K.; Jain, S.K. Patents as proxy for measuring innovations: A case of changing patent filing behavior in indian public funded research organizations. Technol. Forecast. Soc. Chang. 2017, 123, 181–190. [Google Scholar] [CrossRef]

- Griliches, Z. Patent statistics as economic indicators: A survey. J. Econ. Lit. 1990, 28, 1661–1707. [Google Scholar]

- Dosi, G. Technological paradigms and technological trajectories: A suggested interpretation of the determinants and directions of technical change. Res. Policy 1982, 11, 147–162. [Google Scholar] [CrossRef]

- Castellacci, F. Technological paradigms, regimes and trajectories: Manufacturing and service industries in a new taxonomy of sectoral patterns of innovation. Res. Policy 2008, 37, 978–994. [Google Scholar] [CrossRef]

- Martinelli, A. An emerging paradigm or just another trajectory? Understanding the nature of technological changes using engineering heuristics in the telecommunications switching industry. Res. Policy 2012, 41, 414–429. [Google Scholar] [CrossRef]

- Xu, G.; Wu, Y.; Minshall, T.; Zhou, Y. Exploring innovation ecosystems across science, technology, and business: A case of 3d printing in China. Technol. Forecast. Soc. Chang. 2018, 136, 208–221. [Google Scholar] [CrossRef]

- Liu, P.; Zhou, Y.; Zhou, D.K.; Xue, L. Energy performance contract models for the diffusion of green-manufacturing technologies in China: A stakeholder analysis from smes’ perspective. Energy Policy 2017, 106, 59–67. [Google Scholar] [CrossRef]

- Zhou, Y.; Zhang, H.; Ding, M. How public demonstration projects affect the emergence of new industries: An empirical study of electric vehicles in China. Innov.-Manag. Policy Pract. 2015, 17, 159–181. [Google Scholar] [CrossRef]

- Zhou, Y.; Xu, G.; Minshall, T.; Liu, P. How do public demonstration projects promote green-manufacturing technologies? A case study from China. Sustain. Dev. 2015, 23, 217–231. [Google Scholar] [CrossRef]

- Zhou, Y.; Li, X.; Lema, R.; Urban, F. Comparing the knowledge bases of wind turbine firms in asia and europe: Patent trajectories, networks, and globalisation. Sci. Public Policy 2016, 43, 476–491. [Google Scholar] [CrossRef]

- Nordensvard, J.; Zhou, Y.; Zhang, X. Innovation core, innovation semi-periphery and technology transfer: The case of wind energy patents. Energy Policy 2018, 120, 213–227. [Google Scholar] [CrossRef]

- Scandura, A. University-industry collaboration and firms’ R&D effort. Res. Policy 2016, 45, 1907–1922. [Google Scholar] [CrossRef]

- McCarthy, K.J.; Aalbers, H.L. Technological acquisitions: The impact of geography on post-acquisition innovative performance. Res. Policy 2016, 45, 1818–1832. [Google Scholar] [CrossRef]

- Urban, F.; Wang, Y.; Geall, S. Prospects, politics, and practices of solar energy innovation in China. J. Environ. Dev. 2018, 27, 74–98. [Google Scholar] [CrossRef]

- Pan, M.; Zhou, Y.; Zhou, D.K. Comparing the innovation strategies of Chinese and European wind turbine firms through a patent lens. Environ. Innov. Soc. Transit. 2017. [Google Scholar] [CrossRef]

- Wang, B.; Liu, Y.; Zhou, Y.; Wen, Z. Emerging nanogenerator technology in China: A review and forecast using integrating bibliometrics, patent analysis and technology roadmapping methods. Nano Energy 2018, 46, 322–330. [Google Scholar] [CrossRef]

- Li, X.; Zhou, Y.; Xue, L.; Huang, L. Roadmapping for industrial emergence and innovation gaps to catch-up: A patent-based analysis of OLED industry in China. Int. J. Technol. Manag. 2016, 72, 105–143. [Google Scholar] [CrossRef]

- Braun, T. Keeping the Gates of Science Journals. Handbook of Quantitative Science and Technology Research. The Use of Publication and Patent Statistics in Studies of s&t Systems; Kluwer Academic Publishers: Dordrecht, Nederland, 2005; Volume 63, pp. 95–114. [Google Scholar]

- Zhou, Y.; Pan, M.J.; Zhou, D.K.; Xue, L. Stakeholder risk and trust perceptions in the diffusion of green manufacturing technologies: Evidence from China. J. Environ. Dev. 2018, 27, 46–73. [Google Scholar] [CrossRef]

- Li, X.; Zhou, Y.; Xue, L.; Huang, L. Integrating bibliometrics and roadmapping methods: A case of dye-sensitized solar cell technology-based industry in China. Technol. Forecast. Soc. Chang. 2015, 97, 205–222. [Google Scholar] [CrossRef]

- Zhang, T. Research on technical innovation ability of evacuated tube based on patent in China. Enterp. Technol. Dev. 2015, 34, 4–7. [Google Scholar]

- Chen, C.M. Patents, citations & innovations: A window on the knowledge economy. J. Assoc. Inf. Sci. Technol. 2003, 54, 802–803. [Google Scholar] [CrossRef]

- Sharma, P.; Tripathi, R.C. Patent citation: A technique for measuring the knowledge flow of information and innovation. World Pat. Inf. 2017, 51, 31–42. [Google Scholar] [CrossRef]

- Duguet, E.; MacGarvie, M. How well do patent citations measure flows of technology? Evidence from French innovation surveys. Econ. Innov. New Technol. 2005, 14, 375–393. [Google Scholar] [CrossRef]

- D’Este, P.; Fontana, R. What drives the emergence of entrepreneurial academics? A study on collaborative research partnerships in the UK. Res. Eval. 2007, 16, 257–270. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods; Sage: Thousand Oaks, CA, USA, 2003; Volume 5, p. 11. [Google Scholar]

- Alexiev, A.S.; Volberda, H.W.; Van den Bosch, F.A.J. Interorganizational collaboration and firm innovativeness: Unpacking the role of the organizational environment. J. Bus. Res. 2016, 69, 974–984. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development; Harvard University Press: Cambridge, MA, USA, 1912. [Google Scholar]

- Romer, P.M. Increasing returns and long-run growth. J. Political Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Lucas, R.E. On the mechanics of economic development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Sharma, B. R&D strategy and Australian manufacturing industry: An empirical investigation of emphasis and effectivness. Technovation 2003, 23, 929–937. [Google Scholar] [CrossRef]

- Walters, J.; Kaminsky, J.; Gottschamer, L. A systems analysis of factors influencing household solar PV adoption in Santiago, Chile. Sustainability 2018, 10, 1257. [Google Scholar] [CrossRef]

- Lorenz, E.; Lundvall, B.A. How Europe’s economies learn. Ind. Corp. Chang. 2007, 16, 1175–1210. [Google Scholar]

- Jensen, M.B.; Johnson, B.; Lorenz, E.; Lundvall, B.A.; Lundvall, B.A. Forms of Knowledge and Modes of Innovation; Anthem Press: London, UK, 2016; pp. 155–182. [Google Scholar]

- Liu, Z.; Li, H.; Liu, K.; Yu, H.; Cheng, K. Design of high-performance water-in-glass evacuated tube solar water heaters by a high-throughput screening based on machine learning: A combined modeling and experimental study. Sol. Energy 2017, 142, 61–67. [Google Scholar] [CrossRef]

- Wu, Y.; Chen, Z.; Wu, L.; Lin, P.; Cheng, S.; Lu, P. An intelligent fault diagnosis approach for PV array based on SA-RBF kernel extreme learning machine. Energy Procedia 2017, 105, 1070–1076. [Google Scholar] [CrossRef]

- Choe, H.; Lee, D.H.; Seo, I.W.; Kim, H.D. Patent citation network analysis for the domain of organic photovoltaic cells: Country, institution, and technology field. Renew. Sustain. Energy Rev. 2013, 26, 492–505. [Google Scholar] [CrossRef]

- Kong, D.; Zhou, Y.; Liu, Y.; Xue, L. Using the data mining method to assess the innovation gap: A case of industrial robotics in a catching-up country. Technol. Forecast. Soc. Chang. 2017, 119, 80–97. [Google Scholar] [CrossRef]

| Technology Trajectory Dimensions | Patent Methods (Indicators) | Existing Literature |

|---|---|---|

| Trajectories of key technologies | Patent counts; Patent data-mining | Zhou et al. (2015) [45]; Liu (2011) [22] |

| Patent citation network (knowledge flow and spillover) | Patent counts; Patent citation frequency | Zhou et al. (2016) [45] Nordensvard et al. (2018) [46]; Zhou et al. (2018) [8] |

| University‒industry or firm‒firm relations | Experts’ interpretations; Patent network | Scandura (2016) [47]; McCarthy and Aalbers (2016) [48]; Urban et al. (2016) [7]; Urban et al. (2018) [49] |

| Industry | Category | Keywords |

|---|---|---|

| Solar PV | PV cell technology | Storage battery; silicon cell; silicon battery; solar cells; poly cell; solar cell; photovoltaic battery; thin film cell; thin film battery; thin film solar cell amorphous silicon; thin film silicon; single crystalline silicon; polycrystalline silicon; compound solar cell; compound thin film solar cell; wafer; screen print; silk screen printing; silkscreen; stencil printing; cementation; sintering; phosphorous diffusion; plasma enhanced vapor deposition; diode; diodes; graphene; ingot; ingot casting; lamination; EL test |

| Solar SWH | Evacuated tube technology | Vacuum; vacuum tube; evacuated tube; vacuum heat collection tube; evacuated collector tube; evacuated; vacuum tube coating; tube coat |

| Indicators | Time | ||

|---|---|---|---|

| 1995–2008 Network | 2009–2016 Network | Full-Time Network | |

| Density (containing self-citations) | 0.0256 | 0.0529 | 0.1016 |

| Density (excluding self-citations) | 0.0248 | 0.0472 | 0.0816 |

| Average distance | 2.021 | 2.698 | 3.434 |

| Distance-based cohesion(compactness) | 0.051 | 0.103 | 0.198 |

| Distance-weighted fragmentation (breadth) | 0.949 | 0.897 | 0.802 |

| Hybrid reciprocity (percentage of reciprocated total links) | 0.0769 | 0.0673 | 0.3697 |

| Outdegree centrality | 4.95% | 6.64% | 4.86% |

| Indegree centrality | 4.41% | 11.60% | 3.93% |

| Firms | 1995–2008 | 2009–2016 | ||||||

|---|---|---|---|---|---|---|---|---|

| Between-ness | Out-Degree Centrality | Indegree Centrality | Net Citations | Between-ness | Out-Degree Centrality | Indegree Centrality | Net Citations | |

| PANASONIC | 67.125 | 13 | 9 | 4 | 22.5 | 12 | 1 | 11 |

| MIDEA | 0 | 2 | 0 | 2 | 57.167 | 2 | 19 | −17 |

| CHINESE ACADEMY OF SCIENCES | 0 | 1 | 0 | 1 | 97.383 | 4 | 6 | −2 |

| HIMIN | 0 | 0 | 4 | −4 | 0 | 11 | 0 | 11 |

| SHANDONG ECOO | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 |

| SHANDONG LINUO | 0 | 0 | 0 | 0 | 65.55 | 1 | 11 | −10 |

| BEIJING SANGPU | 0 | 0 | 0 | 0 | 0 | 2 | 0 | 2 |

| MICOE | 0 | 0 | 0 | 0 | 0 | 0 | 1 | ‒1 |

| Indicators | Time | ||

|---|---|---|---|

| 1995–2008 Network | 2009–2016 Network | Full-Time Network | |

| Density (containing self-citations) | 0.4000 | 0.5076 | 0.5556 |

| Density (excluding self-citations) | 0.3967 | 0.4992 | 0.5482 |

| Average distance | 1.347 | 1.528 | 1.472 |

| Distance-based cohesion (compactness) | 0.498 | 0.710 | 0.735 |

| Distance-weighted fragmentation (breadth) | 0.502 | 0.290 | 0.265 |

| Hybrid reciprocity (percentage of reciprocated total links) | 0.4507 | 0.4612 | 0.4710 |

| Out-degree centrality | 23.712% | 17.723% | 23.344% |

| In-degree centrality | 9.390% | 13.466% | 10.574% |

| Firms | 1995–2008 | 2009–2016 | ||||||

|---|---|---|---|---|---|---|---|---|

| Between-ness | Outdegree Centrality | Indegree Centrality | Net Citations | Between-ness | Outdegree Centrality | Indegree Centrality | Net Citations | |

| CANON | 24.611 | 3086 | 160 | 2926 | 16.420 | 1182 | 30 | 1152 |

| PANASONIC | 32.346 | 2638 | 841 | 1797 | 74.364 | 1188 | 425 | 763 |

| APPLIED MATERIALS | 22.639 | 486 | 939 | −453 | 16.984 | 452 | 152 | 300 |

| FIRST SOLAR | 29.998 | 419 | 1221 | −802 | 32.013 | 299 | 866 | −567 |

| HANERGY | 6.830 | 417 | 936 | −519 | 49.656 | 375 | 304 | 71 |

| QC SUZHOU | 0 | 0 | 12 | −12 | 4.697 | 22 | 7 | 15 |

| GCL | 0 | 0 | 34 | −34 | 10.365 | 14 | 46 | −32 |

| YINGLI | 0 | 0 | 54 | −54 | 91.021 | 49 | 145 | −96 |

| Dimensions | Indicators | Chinese SWH Industry | Chinese PV Industry | ||

|---|---|---|---|---|---|

| 1995–2008 | 2009–2016 | 1995–2008 | 2009–2016 | ||

| Trajectories of key technologies | 1. Technological lifecycles | low-development stage, but having key technology by indigenous innovation | fast-development stage | low-development stage | fast-development stage |

| 2. Type of organization that originally developed key technologies | academia institutes (universities and science research institutes) | both academia institutes and firms | |||

| 3. Start time to develop the key technologies | in 1980s | around 2008 | |||

| Patent citation network intense | 1. Network position | periphery | core | periphery | close to the center |

| 2. Network role | knowledge consumers | knowledge spillovers | knowledge consumers | knowledge spillovers | |

| 3. Competition level | low | ordinary | low | intense | |

| 4. Driving force | market | technology innovation | |||

| 5. Future competition roles | knowledge spillovers | technology innovators and global leaders | |||

| Type of collaboration | 1. University‒industry R&D collaboration | mainly university‒industry mode | both university‒industry R&D and firm‒firm modes | ||

| 2. Firm‒firm collaboration | |||||

| Variable | Sales Income (ln) | ||

|---|---|---|---|

| Controls | Model 1 | Model 2 | Model 3 |

| Fixed-asset total (ln) | 0.736 *** (0.03) | 0.731 *** (0.034) | 0.720 *** (0.035) |

| Age | 0.015 * (0.01) | 0.019 ** (0.01) | 0.020 ** (0.01) |

| Industry (dummy) | 0.554 *** (0.203) | 0.39 * (0.231) | −0.222 (0.248) |

| Predictors | |||

| Outdegree | −0.006 (0.006) | −0.005 (0.01) | |

| Indegree | 0.001 (0.003) | ||

| Indegree-university | 0.434 (0.605) | ||

| Indegree-firm | 0.300 * (0.163) | ||

| Indegree—university*industry | −0.416 (0.616) | ||

| Indegree—firm*industry | −0.288 * (0.16) | ||

| R2 | 0.794 | 0.80 | 0.81 |

| N | 159 | 159 | 159 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Urban, F.; Zhou, Y.; Chen, L. Comparing the Technology Trajectories of Solar PV and Solar Water Heaters in China: Using a Patent Lens. Sustainability 2018, 10, 4166. https://doi.org/10.3390/su10114166

Wang Y, Urban F, Zhou Y, Chen L. Comparing the Technology Trajectories of Solar PV and Solar Water Heaters in China: Using a Patent Lens. Sustainability. 2018; 10(11):4166. https://doi.org/10.3390/su10114166

Chicago/Turabian StyleWang, Yawei, Frauke Urban, Yuan Zhou, and Luyi Chen. 2018. "Comparing the Technology Trajectories of Solar PV and Solar Water Heaters in China: Using a Patent Lens" Sustainability 10, no. 11: 4166. https://doi.org/10.3390/su10114166

APA StyleWang, Y., Urban, F., Zhou, Y., & Chen, L. (2018). Comparing the Technology Trajectories of Solar PV and Solar Water Heaters in China: Using a Patent Lens. Sustainability, 10(11), 4166. https://doi.org/10.3390/su10114166