Cost-Sharing Mechanisms for A Wood Forest Product Supply Chain under Carbon Cap-and-Trade

Abstract

:1. Introduction

- In the wood forest product supply chain, will factors such as carbon quota and carbon sink cost affect the forest scale of the forestry company? And will factors such as consumers’ low-carbon preference, the price of carbon sinks, and product demand affect the emission reduction level of the manufacturer?

- Can traditional coordination mechanisms (such as cost-sharing mechanism) coordinate the wood forest product supply chain with the carbon quota?

- Which type of cost-sharing mechanism is more suitable for coordinating the emission reduction behavior of the wood forest product supply chain? What impact does the cost-sharing mechanism have on the profit of the supply chain, the total carbon emissions, and the scale of the forest?

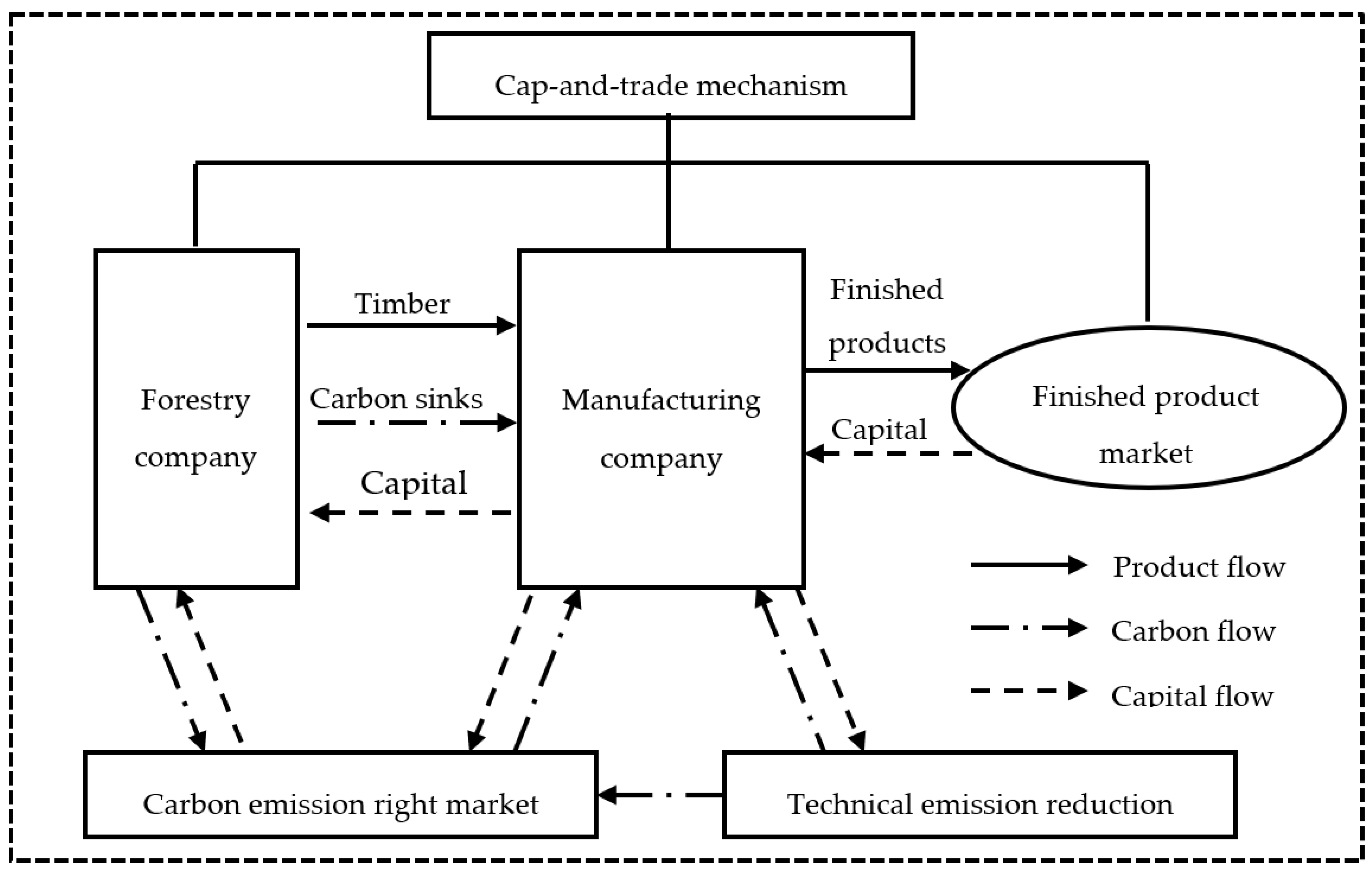

- We consider a wood forest product supply chain consisting of a forestry company and a forest products manufacturer. The two companies are oligopolistic, so the amount of forestry carbon sink produced by the forestry company has great influences on the price of carbon emission rights. Compared with the general supply chain, the forest product supply chain has the following characteristics: The forestry company can provide the raw material (timber) as well as forestry carbon sinks for the manufacturer. The forestry carbon sinks are able to offset the carbon emissions of the manufacturer, which establishes the basis for cooperation between the members of the supply chain.

- We focus on the impact of the cap-and-trade mechanism on the wood forest product supply chain and work out the optimal strategy for the forestry company and the manufacturer, so as to guide the members of the wood forest product supply chain to make the right decisions.

- For the purpose of promoting cooperation between the forestry company and the manufacturer, this paper designs and compares two coordination contracts: carbon emission reduction cost-sharing (ERCS) contract and a carbon sink cost-sharing (SCS) contract. It not only explores the possibility of a joint emission reduction between the manufacturer and the forestry company but also provides some new ideas for the low carbon development of the wood forest product supply chain.

2. Literature Review and Motivations

2.1. Operation Decisions for LOW-carbon Supply Chain

2.2. Collaboration and Coordination Contracts for a Low-carbon Supply Chain

2.3. Forestry Carbon Sinks

3. Basic Assumptions and Symbolic Description

3.1. Symbol Description

3.2. Main Assumption Analysis

4. Non-Cooperative Mechanism

5. Cost-Sharing Contracts

5.1. Carbon Sink Cost-Sharing (SCS) Contract

5.2. Carbon Emission Reduction Cost-Sharing (ERCS) Contract

6. Discussions and Numerical Results

6.1. Impact of a Low-Carbon Sensitivity Coefficient

- (1)

- , , ;

- (2)

- , , .

6.2. Impact of Emission Reduction Cost

- (1)

- , , ;

- (2)

- , , .

6.3. Impact of a Cost-Sharing Mechanism on the Supply Chain Profit

6.4. Impact of a Cost-Sharing Mechanism on the Carbon Emission Reduction Level

6.5. Impact of the Cost-Sharing Mechanism on the Forest Scale

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A. Proof of Proposition 1

Appendix B. Proof of Proposition 2

Appendix C. Proof of Proposition 5

Appendix D. Proof of Proposition 6

Appendix E. Proof of Proposition 7

References

- Stocker, T.F.; Qin, D.; Plattner, G.K.; Tignor, M.; Allen, S.K.; Boschung, J.; Nauels, A.; Xia, Y.; Bex, V.; Midgley, P.M. IPCC: Summary for Policymakers. In Proceedings of Climate Change 2013: The Physical Science Basis. Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Cambridge University Press: Cambridge, New York, NY, USA, 2013. [Google Scholar]

- Zhou, Y.J.; Bao, M.J.; Chen, X.H.; Xu, X.H. Co-op advertising and emission reduction cost sharing contracts and coordination in low-carbon supply chain based on fairness concerns. J. Clean. Prod. 2016, 133, 402–413. [Google Scholar] [CrossRef]

- Peng, H.J.; Pang, T.; Cong, J. Coordination contracts for a supply chain with yield uncertainty and low-carbon preference. J. Clean. Prod. 2018, 205, 291–302. [Google Scholar] [CrossRef]

- Ji, J.N.; Zhang, Z.Y.; Yang, L. Carbon emission reduction decisions in the retail-/dual-channel supply chain with consumers’ preference. J. Clean Prod. 2017, 141, 852–867. [Google Scholar] [CrossRef]

- Yang, L.; Zhang, Q.; J, N. Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. Int. J. of Prod. Econ. 2017, 191, 286–297. [Google Scholar] [CrossRef]

- Wang, Q.P.; Zhao, D.Z.; He, L.F. Contracting emission reduction for supply chains considering market low-carbon preference. J. Clean Prod. 2016, 120, 72–84. [Google Scholar] [CrossRef]

- Wang, C.X.; Wang, W.; Huang, R.B. Supply chain enterprise operations and government carbon tax decisions considering carbon emissions. J. Clean. Prod. 2017, 152, 271–280. [Google Scholar] [CrossRef]

- Aljazzar, S.M.; Gurtu, A.; Jaber, M.Y. Delay-in-payments–A strategy to reduce carbon emissions from supply chains. J. Clean. Prod. 2018, 170, 636–644. [Google Scholar] [CrossRef]

- Xiao, Z.; Tian, Y.X.; Yuan, Z. The impacts of regulations and financial development on the operations of supply chains with greenhouse gas emissions. Int. J. Env. Res. Pub. Heal. 2018, 15, 378. [Google Scholar] [CrossRef] [PubMed]

- Nouira, I.; Hammami, R.; Frein, Y.; Temponi, C. Design of forward supply chains: Impact of a carbon emissions-sensitive demand. Int. J. of Prod. Econ. 2016, 173, 80–98. [Google Scholar] [CrossRef]

- Toptal, A.; Özlü, H.; Konur, D. Joint decisions on inventory replenishment and emission reduction investment under different emission regulations. Int. J. Prod. Res. 2014, 52, 243–269. [Google Scholar] [CrossRef] [Green Version]

- Wu, B.; Huang, W.Y.; Liu, P.F. Carbon reduction strategies based on an NW small-world network with a progressive carbon tax. Sustainability 2017, 9, 1747. [Google Scholar] [CrossRef]

- Benjaafar, S.; Li, Y.; Daskin, M. Carbon footprint and the management of supply chain: Insights from simple models. IEEE Trans. Autom. Sci. Eng. 2013, 10, 99–116. [Google Scholar] [CrossRef]

- Chen, J.X.; Chen, J. Supply chain carbon footprinting and responsibility allocation under emission regulations[J]. J. Environ. Manage. 2017, 188, 255–267. [Google Scholar] [CrossRef] [PubMed]

- Yang, L.; Chen, Y.F.; Ji, J.N. Cooperation modes of operations and financing in a low-carbon supply chain. Sustainability 2018, 10, 821. [Google Scholar] [CrossRef]

- Xu, L.; Wang, C.; Li, H. Decision and coordination of low-carbon supply chain considering technological spillover and environmental awareness. Sci. Rep-UK 2017, 7, 3107. [Google Scholar] [CrossRef] [PubMed]

- Zhou, Y.J.; Ye, X. Differential game model of joint emission reduction strategies and contract design in a dual-channel supply chain. J. Clean Prod. 2018, 190, 592–607. [Google Scholar] [CrossRef]

- Bai, Q.G.; Xu, J.T.; Zhang, Y.Y. Emission reduction decision and coordination of a make-to-order supply chain with two products under cap-and-trade regulation. Comput. Ind. Eng. 2018, 119, 131–145. [Google Scholar] [CrossRef]

- Xu, X.P.; He, P.; Xu, H.; Zhang, Q.P. Supply chain coordination with green technology under cap-and-trade regulation. Int. J. of Prod. Econ. 2017, 183, 433–442. [Google Scholar] [CrossRef]

- Pang, Q.H.; Li, M.Z.; Yang, T.T.; Shen, Y.; Supply chain coordination with carbon trading price and consumers’ environmental awareness dependent demand. Math. Probl. Eng. 2018. Available online: https://www.hindawi.com/journals/mpe/2018/8749251/ (accessed on 19 November 2018).

- Liu, Z.; Gong, B.G.; Gui, Y.M.; Zheng, X.X. Joint decision-making and the coordination of a sustainable supply chain in the context of carbon tax regulation and fairness concerns. Inter. J. Env. Res. Pub. Heal. 2015, 14, 454–460. [Google Scholar] [CrossRef] [PubMed]

- Zhou, Y.W.; Fan, H.H.; Wu, D.Y.; Qiu, J.Y. The channel selection and coordination of two-echelon low carbon supply chain in the environment of random demand. Rev. Fac. Cienc. Agrar. 2017, 32, 802–814. [Google Scholar]

- Zhou, T.; Shi, P.J.; Dai, Y.J.; Zhao, X.; Wei, S.G.; Du, L.; Wu, H.; Luo, Y.Q. Age-dependent forest carbon sink: Estimation via inverse modeling. J. Geophys. Res-Biogeo. 2015, 120, 2473–2492. [Google Scholar] [CrossRef]

- Wang, M.T. Analysis of forest carbon sinks prediction model based on economic theory. Rev. Fac. Cienc. Agrar. 2017, 32, 541–548. [Google Scholar]

- Daniels, T.L. Integrating forest carbon sequestration into a cap-and-trade program to reduce net CO2 emissions. J. Am. Plann. Assoc. 2010, 76, 463–475. [Google Scholar] [CrossRef]

- Boscolo, M.; Dijk, K.V.; Savenije, H. Financing sustainable small-scale forestry: Lessons from developing national forest financing strategies in Latin America. Forests 2010, 1, 230–249. [Google Scholar] [CrossRef]

- Newell, R.G.; Stavins, R.N. Climate change and forest sinks: Factors affecting the costs of carbon sequestration. J. Environ. Econ. Manag. 2000, 40, 211–235. [Google Scholar] [CrossRef]

- Birdsey, R.A. Carbon accounting rules and guidelines for the United States forest sector. J. Environ Qual. 2006, 35, 1518–1524. [Google Scholar] [CrossRef] [PubMed]

- Pearson, T.R.H.; Brown, S.; Sohngen, B.; Henman, J.; Ohrel, S. Transaction costs for carbon sequestration projects in the tropical forest sector. Mitig. Adapt. Strateg. Glob. Chang. 2014, 19, 1209–1222. [Google Scholar] [CrossRef]

- Williams, C.A.; Gu, H.; MacLean, R.; Masek, J.G.; Collatz, G.J. Disturbance and the carbon balance of US forests: A quantitative review of impacts from harvests, fires, insects, and droughts. Global. Planet. Change 2016, 143, 66–80. [Google Scholar] [CrossRef]

- McGarvey, J.C.; Thompson, J.R.; Epstein, H.E.; Shugart, H.H., Jr. Carbon storage in old-growth forests of the Mid-Atlantic: Toward better understanding the eastern forest carbon sink. Ecology 2016, 96, 311–317. [Google Scholar] [CrossRef]

- Dixon, R.K.; Brown, S.; Houghton, R.A.; Solomon, A.M.; Trexler, M.C.; Wisniewski, J. Carbon pools and flux of global forest ecosystems. Science 1994, 263, 185–190. [Google Scholar] [CrossRef] [PubMed]

- Pohjola, J.; Kerkelä, L.; Mäkipää, R. Credited forest carbon sinks: How the cost reduction is allocated among countries and sectors. Clim. Policy 2003, 3, 445–461. [Google Scholar] [CrossRef]

- Lindroth, A.; Lagergren, F.; Grelle, A.; Klemedtsson, L.; Langvall, O.; Weslien, P.; Tuulik, J. Storms can cause Europe-wide reduction in forest carbon sink. Global Change Biol. 2010, 15, 346–355. [Google Scholar] [CrossRef]

- Gren, I.M.; Carlsson, M. Economic value of carbon sequestration in forests under multiple sources of uncertainty. J. Forest Econ. 2013, 19, 174–189. [Google Scholar] [CrossRef]

- Zhou, W.; Gao, L. The impact of carbon trade on the management of short-rotation forest plantations. Forest Policy Econ. 2016, 62, 30–35. [Google Scholar] [CrossRef]

- Cachon, G.P.; Lariviere, M.A. Supply chain coordination with revenue-sharing contracts: Strengths and limitations. Manag. Sci. 2005, 51, 30–44. [Google Scholar] [CrossRef]

| Notation | Meaning |

|---|---|

| the marginal contribution rate of carbon quota to the market price of carbon emission rights | |

| the effect of unit carbon sink amount on the market price of carbon emission rights | |

| the initial market price of carbon emission rights | |

| superscript, represents the carbon sink cost-sharing mechanism | |

| current year’s management cost of timber forests, | |

| current year’s management cost of carbon sink forests, | |

| basic market demand for finished products | |

| the actual market demand for finished products | |

| the initial carbon emission of unit product produced by manufacturer | |

| the manufacturer’s unit amount of emission reduction | |

| the threshold of the manufacturer’s unit amount of emission reduction determined by negotiation between the two parties under the technical emission reduction cost sharing mechanism | |

| the carbon quota allocated to the manufacturer initially | |

| the amount of timber required for unit finished product, and the timber order quantity of manufacturer can be expressed as follows: | |

| superscript, represents the non-cost-sharing mechanism | |

| unit price for the product, we assume that the finished products produced by the manufacturer meet the requirements of the consumer, and the price is determined by the market | |

| unit price for the timber | |

| unit price for the forestry carbon sink (that is the market price of the carbon emission rights as well) | |

| the amount of timber forests of the forestry company, | |

| total carbon emissions of the manufacturer, which meets the formula | |

| the total forest scale of the forestry company, which is a decision variable of the forestry company | |

| the amount of carbon sink forests of the forestry company, | |

| the threshold of the forestry company’s scale of carbon sink forests determined by negotiation between the two parties under the carbon sink cost sharing mechanism | |

| superscript, represents the carbon emission reduction cost-sharing mechanism | |

| demand sensitivity coefficient to the emission reduction level, and the market demand for finished products can be expressed by the following formula:[4] | |

| carbon sequestration rate of unit carbon sink, which is calculated by the carbon conversion coefficient and the proportion of carbon fixed in wood products for a long time [20] | |

| the technical emission reduction cost coefficient of the manufacturer | |

| profit of the manufacturer | |

| profit of the forestry company |

| Parameters | ||||||||

| Values | 0.02 | 0.005 | 25 | 0.8 | 5000 | 3 | 600 | [1000,3600] |

| Parameters | ||||||||

| Values | 60 | [100,200] | 500 | 120 | 40 | 5 | [0,1] | 1 |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, M.; Peng, H.; Wang, S. Cost-Sharing Mechanisms for A Wood Forest Product Supply Chain under Carbon Cap-and-Trade. Sustainability 2018, 10, 4345. https://doi.org/10.3390/su10124345

Sun M, Peng H, Wang S. Cost-Sharing Mechanisms for A Wood Forest Product Supply Chain under Carbon Cap-and-Trade. Sustainability. 2018; 10(12):4345. https://doi.org/10.3390/su10124345

Chicago/Turabian StyleSun, Mingjun, Hongjun Peng, and Shuai Wang. 2018. "Cost-Sharing Mechanisms for A Wood Forest Product Supply Chain under Carbon Cap-and-Trade" Sustainability 10, no. 12: 4345. https://doi.org/10.3390/su10124345