Composition and Activity of the Board of Directors: Impact on ESG Performance in the Banking System

Abstract

:1. Introduction

2. Literature Review and Hypotheses Development

2.1. Women on the Board

2.2. Independent Directors

2.3. Board Size

2.4. Board Meetings

2.5. CSR Sustainability Committee

3. Research Methodology

3.1. Sample Selection and Data Sources

3.2. Dependent Variable

3.3. Independent Variables

3.4. Methodology

4. Empirical Results and Discussion

4.1. Descriptive Statistics

4.2. Correlation Results

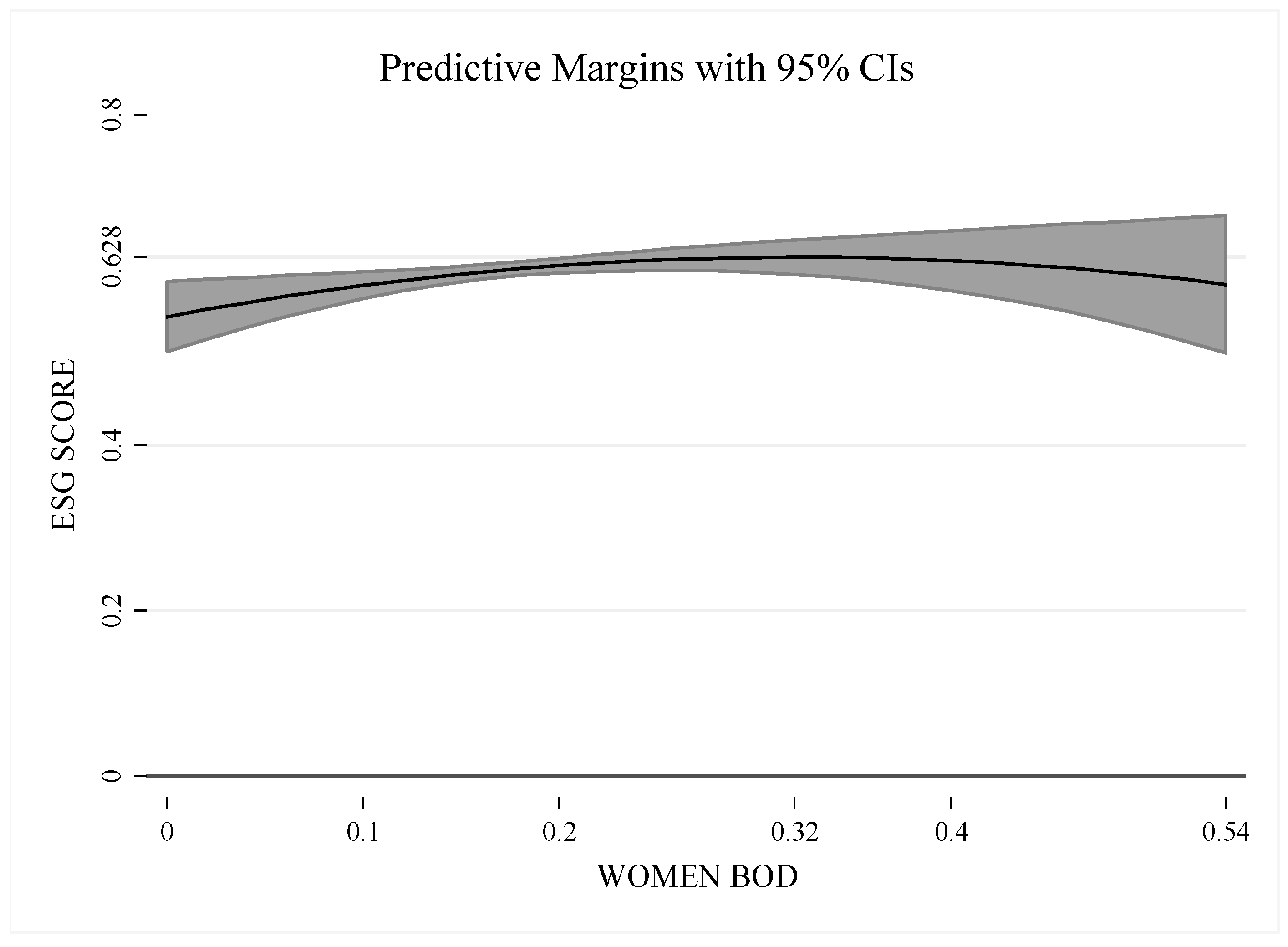

4.3. Regression Results and Discussion

4.4. Robustness Tests

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- García-Sánchez, I.M.; Martánez-Ferrero, J.; García-Meca, E. Board of Directors and CSR in Banking: The Moderating Role of Bank Regulation and Investor Protection Strength. Aust. Account. Rev. 2018, 86, 428–445. [Google Scholar] [CrossRef]

- BCBS—Basel Committee on Banking Supervision, Guidelines. Corporate Governance Principles for Banks, July 2015; BCBS: Basel, Switzerland, 2015.

- HLEG—High-Level Expert Group on Sustainable Finance Financing a Sustainable European Economy, Interim Report 2017. Available online: https://ec.europa.eu/info/publications/170713-sustainable-finance-report_en (accessed on 10 January 2017).

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The Impact of Corporate Sustainability on Organizational Processes and Performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef] [Green Version]

- HLEG—High-Level Expert Group on Sustainable Finance Financing a Sustainable European Economy, Final Report 2018. Available online: https://ec.europa.eu/info/publications/180131-sustainable-finance-report_en (accessed on 6 July 2018).

- Post, C.; Rahman, N.; Rubow, E. Green Governance: Boards of Directors’ Composition and Environmental Corporate Social Responsibility. Bus. Soc. 2011, 50, 189–223. [Google Scholar] [CrossRef]

- Rao, K.K.; Tilt, C.A.; Lester, L.H. Corporate governance and environmental reporting: An Australian study. Corp. Gov. Int. J. Bus. Soc. 2012, 12, 143–163. [Google Scholar] [CrossRef]

- Zhang, L. Board demographic diversity, independence, and corporate social performance. Corp. Gov. Int. J. Bus. Soc. 2012, 12, 686–700. [Google Scholar] [CrossRef]

- Setó-Pamies, D. The relationship between women directors and corporate social responsibility. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 334–345. [Google Scholar] [CrossRef]

- Kyaw, K.; Olugbode, M.; Petracci, B. Can board gender diversity promote corporate social performance? Corp. Gov. Int. J. Bus. Soc. 2017, 17, 789–802. [Google Scholar] [CrossRef] [Green Version]

- Gangi, F.; Meles, A.; D’Angelo, E.; Daniele, L.M. Sustainable development and corporate governance in the financial system: Are environmentally friendly banks less risky? Corp. Soc. Responsib. Environ. Manag. 2018, 1–19. [Google Scholar] [CrossRef]

- Helfaya, A.; Moussa, T. Do Board’s Corporate Social Responsibility Strategy and Orientation Influence Environmental Sustainability Disclosure? UK Evidence. Bus. Strategy Environ. 2017, 26, 1061–1077. [Google Scholar] [CrossRef]

- Miralles-Quirós, M.M.; Miralles-Quirós, J.L.; Gonçalves, L.M.V. The Value Relevance of Environmental, Social, and Governance Performance: The Brazilian Case. Sustainability 2018, 10, 574. [Google Scholar] [CrossRef]

- Busch, T.; Friede, G. The Robustness of the Corporate Social and Financial Performance Relation: A Second-Order Meta-Analysis. Corp. Soc. Responsib. Environ. Manag. 2018. [Google Scholar] [CrossRef]

- Barako, D.; Brown, A. Corporate social reporting and board representation: Evidence from the Kenyan banking sector. J. Manag. Gov. 2008, 12, 309–324. [Google Scholar] [CrossRef]

- Khan, M.H.U.Z.; Halabi, A.K.; Samy, M. Corporate social responsibility (CSR] reporting: A study of selected banking companies in Bangladesh. Soc. Responsib. J. 2009, 5, 344–357. [Google Scholar] [CrossRef]

- Htay, S.N.N.; Ab Rashid, H.M.; Adnan, M.A.; Meera, A.K.M. Impact of corporate governance on social and environmental information disclosure of Malaysian listed banks: Panel data analysis. Asian J. Financ. Account. 2012, 4, 1. [Google Scholar] [CrossRef]

- Jizi, M.; Salama, A.; Dixon, R.; Stratling, R. Corporate governance and corporate social responsibility disclosure: Evidence from the US banking sector. J. Bus. Ethics 2014, 125, 601–615. [Google Scholar] [CrossRef]

- Kiliç, M.; Kuzey, C.; Uyar, A. The impact of ownership and board structure on Corporate Social Responsibility (CSR] reporting in the Turkish banking industry. Corp. Gov. Int. J. Bus. Soc. 2015, 15, 357–374. [Google Scholar] [CrossRef]

- Kanter, R. Some effects of proportions on group life: Skewed sex ratios and responses to token women. Am. J. Sociol. 1977, 82, 965–990. [Google Scholar] [CrossRef]

- Kramer, V.W.; Konrad, A.M.; Erkut, S. Critical Mass on Corporate Boards: Why Three or More Women Enhance Governance. (Wellesley Centers for Women, Report No. WCW 11); Wellesley Centers for Women: Wellesley, MA, USA, 2006; Available online: http://www.wcwonline.org/pubs/title.php?id=487 (accessed on 10 August 2017).

- Konrad, A.M.; Kramer, V.; Erkut, S. Critical mass: The impact of three or more women on corporate boards. Organ. Dyn. 2008, 37, 145–164. [Google Scholar] [CrossRef]

- Joecks, J.; Pull, K.; Vetter, K. Gender Diversity in the Boardroom and Firm Performance: What Exactly Constitutes a “Critical Mass?”. J. Bus. Ethics 2013, 118, 61–72. [Google Scholar] [CrossRef]

- Farag, H.; Mallin, C. Board diversity and financial fragility: Evidence from European banks. Int. Rev. Financ. Anal. 2017, 49, 98–112. [Google Scholar] [CrossRef]

- Williams, R. Women on corporate boards of directors and their influence on corporate philanthropy. J. Bus. Ethics 2003, 42, 1–10. [Google Scholar] [CrossRef]

- Bear, S.; Rahman, N.; Post, C. The impact of board diversity and gender composition on corporate social responsibility and firm reputation. J. Bus. Ethics 2010, 97, 207–221. [Google Scholar] [CrossRef]

- Eagly, A.H.; Johannesen-Schmidt, M.C.; van Engen, M.L. Transformational, transactional, and laissez–faire leadership styles: A meta-analysis comparing women and men. Psychol. Bull. 2003, 129, 569–591. [Google Scholar] [CrossRef] [PubMed]

- Zhang, J.Q.; Zhu, H.; Ding, H. Board composition and corporate social responsibility: An empirical investigation in the post Sarbanes–Oxley era. J. Bus. Ethics 2013, 114, 381–392. [Google Scholar] [CrossRef]

- Nielsen, S.; Huse, M. The contribution of women on boards of directors: Going beyond the surface. Corp. Gov. Int. Rev. 2010, 18, 136–148. [Google Scholar] [CrossRef]

- Wang, J.; Coffey, B. Board composition and corporate philanthropy. J. Bus. Ethics 1992, 11, 771–778. [Google Scholar] [CrossRef]

- Ciocirlan, C.; Pettersson, C. Does workforce diversity matter in the fight against climate change? An analysis of Fortune 500 companies. Corp. Soc. Responsib. Environ. Manag. 2012, 19, 47–62. [Google Scholar] [CrossRef]

- Rupley, K.H.; Brown, D.; Marshall, R.S. Governance, media, and the quality of environmental disclosure. J. Account. Public Policy 2012, 31, 610–640. [Google Scholar] [CrossRef]

- Cabeza-García, L.; Fernández-Gago, R.; Matilla, L. Análisis de los determinantes de la transparencia en RSC desde la perspectiva del buen gobierno. Ekon. Rev. Vasca Econ. 2013, 83, 273–296. [Google Scholar]

- García-Sánchez, I.M.; Cuadrado–Ballesteros, B.; Sepulveda, C. Does media pressure moderate CSR disclosures by external directors? Manag. Decis. 2014, 52, 1014–1045. [Google Scholar] [CrossRef]

- Lone, E.J.; Amjad, A.; Khan, I. Corporate governance and corporate social responsibility disclosure: Evidence from Pakistan. Corp. Gov. Int. J. Bus. Soc. 2016, 16, 787–797. [Google Scholar] [CrossRef]

- Sundarasen, S.D.D.; Je-Yen, T.; Rajangam, N. Board composition and corporate social responsibility in an emerging market. Corp. Gov. Int. J. Bus. Soc. 2016, 16, 79–95. [Google Scholar] [CrossRef]

- Liu, C. Are women greener? Corporate gender diversity and environmental violations. J. Corp. Financ. 2018, 52, 118–142. [Google Scholar] [CrossRef]

- Glass, C.; Cook, A.; Ingersoll, A.R. Do Women Leaders Promote Sustainability? Analyzing the Effect of Corporate Governance Composition on Environmental Performance. Bus. Strategy Environ. 2016, 25, 495–511. [Google Scholar] [CrossRef]

- Khan, M.H.U.Z. The effect of corporate governance elements on corporate social responsibility (CSR] reporting: Empirical evidence from private commercial banks of Bangladesh. Int. J. Law Manag. 2010, 52, 82–109. [Google Scholar] [CrossRef]

- Walls, J.L.; Berrone, P.; Phan, P.H. Corporate governance and environmental performance: Is there really a link? Strateg. Manag. J. 2012, 33, 885–913. [Google Scholar] [CrossRef]

- Mallin, C.A.; Michelon, G.; Raggi, D. Monitoring intensity and stakeholders’ orientation: How does governance affect social and environmental disclosure? J. Bus. Ethics 2013, 114, 29–43. [Google Scholar] [CrossRef]

- Amran, A.; Lee, S.P.; Devi, S.S. The influence of governance structure and strategic corporate social responsibility toward sustainability reporting quality. Bus. Strategy Environ. 2014, 23, 217–235. [Google Scholar] [CrossRef]

- Alazzani, A.; Hassanein, A.; Aljanadi, Y. Impact of gender diversity on social and environmental performance: Evidence from Malaysia. Corp. Gov. Int. J. Bus. Soc. 2017, 17, 266–283. [Google Scholar] [CrossRef]

- Prado-Lorenzo, J.M.; García-Sánchez, I.M.; Gallego-Alvarez, I. Características del consejo de administración e información en materia de responsabilidad social corporativa. Rev. Esp. Financ. Contab. 2009, 141, 107–135. [Google Scholar]

- Deschênes, S.; Rojas, M.; Boubacar, H.; Prud’homme, B.; Ouedraogo, A. The impact of board traits on the social performance of Canadian firms. Corp. Gov. Int. Rev. 2015, 15, 293–305. [Google Scholar] [CrossRef]

- Grey, S. Does Size Matter? Critical Mass and New Zealand’s Women MPs’. Parliam. Aff. 2002, 55, 19–29. [Google Scholar] [CrossRef]

- Childs, S.; Krook, M.L. Critical Mass Theory and Women’s Political Representation. Political Stud. 2008, 56, 725–736. [Google Scholar] [CrossRef]

- Boulouta, I. Hidden connections: The link between board gender diversity and corporate social performance. J. Bus. Ethics 2013, 113, 185–197. [Google Scholar] [CrossRef]

- Fernandez-Feijoo, B.; Romero, S.; Ruiz, S. Does board gender composition affect corporate social responsibility reporting? Int. J. Bus. Soc. Sci. 2012, 3, 31–38. [Google Scholar]

- Fernandez-Feijoo, B.; Romero, S.; Ruiz-Blanco, S. Women on boards: Do they affect sustainability reporting? Corp. Soc. Responsib. Environ. Manag. 2014, 21, 351–364. [Google Scholar] [CrossRef]

- Cabeza-García, L.; Fernández-Gago, R.; Nieto, M. Do Board Gender Diversity and Director Typology Impact CSR Reporting? Eur. Manag. Rev. 2017. [Google Scholar] [CrossRef]

- Manita, R.; Bruna, M.G.; Dang, R.; Houanti, L.H. Board gender diversity and ESG disclosure: Evidence from the USA. J. Appl. Account. Res. 2018, 19, 206–224. [Google Scholar] [CrossRef]

- Ben-Amar, W.; Chang, M.; McIlkenny, P. Board Gender Diversity and Corporate Response to Sustainability Initiatives: Evidence from the Carbon Disclosure Project. J. Bus. Ethics 2017, 142, 369–383. [Google Scholar] [CrossRef]

- Shoham, A.; Almor, T.; Lee, S.M.; Ahammad, M.F. Encouraging environmental sustainability through gender: A micro-foundational approach using linguistic gender marking. J. Organ. Behav. 2017, 38, 1356–1379. [Google Scholar] [CrossRef]

- Liu, Y.; Wei, Z.; Xie, F. Do women directors improve firm performance in China? J. Corp. Financ. 2014, 28, 169–184. [Google Scholar] [CrossRef]

- Owen, A.L.; Temesvary, J. The performance effects of gender diversity on bank boards. J. Bank. Financ. 2018, 90, 50–63. [Google Scholar] [CrossRef] [Green Version]

- Cucari, N.; De Falco, E.S.; Orlando, B. Diversity of Board of Directors and Environmental Social Governance: Evidence from Italian Listed Companies. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 250–266. [Google Scholar] [CrossRef]

- Ortas, E.; Álvarez, I.; Zubeltzu, E. Firms’ Board Independence and Corporate Social Performance: A Meta-Analysis. Sustainability 2017, 9, 1006. [Google Scholar] [CrossRef]

- Jizi, M. The Influence of Board Composition on Sustainable Development Disclosure. Bus. Strategy Environ. 2017, 26, 640–655. [Google Scholar] [CrossRef]

- Ahmed, K.; Hossain, M.; Adams, M.B. The effects of board composition and board size on the informativeness of annual accounting earnings. Corp. Gov. Int. Rev. 2006, 14, 418–431. [Google Scholar] [CrossRef]

- Cheng, E.C.M.; Courtenay, S.M. Board composition, regulatory regime and voluntary disclosure. Int. J. Account. 2006, 41, 262–289. [Google Scholar] [CrossRef]

- Ibrahim, N.A.; Howard, D.P.; Angelidis, J.P. Board members in the service industry: An empirical examination of the relationship between corporate social responsibility orientation and directorial type. J. Bus. Ethics 2003, 47, 393–401. [Google Scholar] [CrossRef]

- Chau, G.; Gray, S.J. Family ownership, board independence and voluntary disclosure: Evidence from Hong Kong. J. Int. Account. Audit. Tax. 2010, 19, 93–109. [Google Scholar] [CrossRef]

- Haniffa, R.M.; Cooke, T.E. The impact of culture and governance on corporate social reporting. J. Account. Public Policy 2005, 24, 391–430. [Google Scholar] [CrossRef] [Green Version]

- Lim, S.; Matolcsy, Z.; Chow, D. The association between board composition and different types of voluntary disclosure. Eur. Account. Rev. 2007, 16, 555–583. [Google Scholar] [CrossRef]

- Nurhayati, R.; Taylor, G.; Tower, G. Investigating social and environmental disclosure practices by listed Indian textile firms. J. Dev. Areas 2015, 49, 361–372. [Google Scholar] [CrossRef]

- Walls, J.L.; Hoffman, A.J. Exceptional boards: Environmental experience and positive deviance from institutional norms. J. Organ. Behav. 2013, 34, 253–271. [Google Scholar] [CrossRef]

- Benomran, N.A.; Haat, M.H.C.; Hashim, H.B.; Mohamad, N.R.B. Influence of Corporate Governance on the Extent of Corporate Social Responsibility and Environmental Reporting. J. Environ. Ecol. 2015, 6, 48–68. [Google Scholar] [CrossRef]

- Rao, K.; Tilt, C.A. Board diversity and CSR reporting: An Australian study. Med. Account. Res. 2016, 24, 182–210. [Google Scholar] [CrossRef]

- Walls, J.L.; Berrone, P. The Power of One to Make a Difference: How Informal and Formal CEO Power Affect Environmental Sustainability. J. Bus. Ethics 2017, 145, 293–308. [Google Scholar] [CrossRef]

- Ortiz-de-Mandojana, N.; Aguilera-Caracuel, J.; Morales-Raya, M. Corporate Governance and Environmental Sustainability: The Moderating Role of the National Institutional Context. Corp. Soc. Responsib. Environ. Manag. 2016, 23, 150–164. [Google Scholar] [CrossRef]

- Hossain, M.; Reaz, M. The Determinants and Characteristics of Voluntary Disclosure by Indian Banking Companies. Corp. Soc. Responsib. Environ. Manag. 2007, 14, 274–288. [Google Scholar] [CrossRef]

- Jensen, M.C. The modern industrial revolution, exit, and the failure of internal control mechanisms. J. Financ. 1993, 6, 831–880. [Google Scholar] [CrossRef]

- De Andres, P.; Azofra, V.; Lopez, F. Corporate Boards in OECD Countries: Size, composition, functioning and effectiveness. Corp. Gov. Int. Rev. 2005, 13, 197–210. [Google Scholar] [CrossRef]

- Dey, A. Corporate governance and agency conflicts. J. Account. Res. 2008, 46, 1143–1181. [Google Scholar] [CrossRef]

- Laksmana, I. Corporate board governance and voluntary disclosure of executive compensation practices. Contemp. Account. Res. 2008, 25, 1147–1182. [Google Scholar] [CrossRef]

- Guest, P.M. The impact of board size on firm performance: Evidence from the UK. Eur. J. Financ. 2009, 15, 385–404. [Google Scholar] [CrossRef]

- John, K.; Senbet, L.W. Corporate governance and board effectiveness. J. Bank. Financ. 1998, 22, 371–403. [Google Scholar] [CrossRef] [Green Version]

- Beiner, S.; Drobetz, W.; Schmid, F.; Zimmermann, H. Is board size an independent corporate governance mechanism? Kyklos 2004, 57, 327–356. [Google Scholar] [CrossRef]

- Larmou, S.; Vafeas, N. The relation between board size and firm performance in firm with a history of poor operating performance. J. Manag. Gov. 2010, 14, 61–85. [Google Scholar] [CrossRef]

- Krishnan, G.; Visvanathan, G. Do auditors price audit committee’s expertise? The case of accounting versus non-accounting financial experts. J. Account. Audit. Financ. 2009, 24, 115–144. [Google Scholar] [CrossRef]

- Pathan, S. Strong boards, CEO power and bank risk-taking. J. Bank. Financ. 2009, 33, 1340–1350. [Google Scholar] [CrossRef]

- Akhtaruddin, M.; Hossain, M.A.; Hossain, M.; Yao, L. Corporate governance and voluntary disclosure in corporate annual reports of Malaysian listed firms. J. Appl. Manag. Account. Res. 2009, 7, 1–19. [Google Scholar]

- Said, R.; Hj Zainuddin, Y.; Haron, H. The relationship between corporate social responsibility disclosure and corporate governance characteristics in Malaysian public listed companies. Soc. Responsib. J. 2009, 5, 212–226. [Google Scholar] [CrossRef]

- Esa, E.; Mohd Ghazali, N.A. Corporate social responsibility and corporate governance in Malaysian government-linked companies. Corp. Gov. Int. J. Bus. Soc. 2012, 12, 292–305. [Google Scholar] [CrossRef]

- Ntim, C.G.; Soobaroyen, T. Corporate Governance and Performance in Socially Responsible Corporations: New Empirical Insights from a Neo-Institutional Framework. Corp. Gov. Int. Rev. 2013, 21, 468–494. [Google Scholar] [CrossRef] [Green Version]

- Arena, C.; Bozzolan, S.; Michelon, G. Environmental reporting: Transparency to stakeholders or stakeholder manipulation? An analysis of disclosure tone and the role of the board of directors. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 346–361. [Google Scholar] [CrossRef]

- Vafeas, N. Board meeting frequency and firm performance. J. Financ. Econ. 1999, 53, 113–142. [Google Scholar] [CrossRef]

- Dienes, D.; Velte, P. The Impact of Supervisory Board Composition on CSR Reporting. Evidence from the German Two-Tier System. Sustainability 2016, 8, 63. [Google Scholar] [CrossRef]

- Lipton, M.; Lorsch, J. A modest proposal for improved corporate governance. Bus. Lawyer 1992, 48, 59–77. [Google Scholar]

- Conger, J.; Finegold, D.; Lawler, E., III. Appraising Boardroom Performance. Harv. Bus. Rev. 1998, 76, 136–148. [Google Scholar]

- Ricart, J.E.; Rodríguez, M.Á.; Sánchez, P. Sustainability in the boardroom: An empirical examination of Dow Jones Sustainability World Index leaders. Corp. Gov. Int. J. Bus. Soc. 2005, 5, 24–41. [Google Scholar] [CrossRef]

- Adawi, M.; Rwegasira, K. Corporate boards and voluntary implementation of best disclosure practices in emerging markets: Evidence from the UAE listed companies in the Middle East. Int. J. Discl. Gov. 2011, 8, 272–293. [Google Scholar] [CrossRef]

- Hussain, N.; Rigoni, U.; Orij, R.P. Corporate Governance and Sustainability Performance: Analysis of Triple Bottom Line Performance. J. Bus. Ethics 2018, 149, 411–432. [Google Scholar] [CrossRef]

- Mahmood, Z.; Kouser, R.; Ali, W.; Ahmad, Z.; Salman, T. Does Corporate Governance Affect Sustainability Disclosure? A Mixed Methods Study. Sustainability 2018, 10, 207. [Google Scholar] [CrossRef]

- Liao, L.; Luo, L.; Tang, Q. Gender diversity, board independence, environmental committee and greenhouse gas disclosure. Br. Account. Rev. 2015, 47, 409–424. [Google Scholar] [CrossRef]

- Ullman, A.H. Data in search of a theory: A critical examination of the relationships among social performance, social disclosure, and economic performance of US firms. Acad. Manag. Rev. 1985, 10, 540–557. [Google Scholar]

- Adnan, S.M.; Van Staden, C.; Hay, D. Do culture and governance structure influence CSR reporting quality: Evidence from China, India, Malaysia and the United Kingdom. In Proceedings of the 6th Asia Pacific Interdisciplinary Research in Accounting Conference, Sydney, Australia, 12–13 July 2010. [Google Scholar]

- Spitzeck, H. The development of governance structures for corporate responsibility. Corp. Gov. Int. J. Bus. Soc. 2009, 9, 495–505. [Google Scholar] [CrossRef]

- Michelon, G.; Parbonetti, A. The effect of corporate governance on sustainability disclosure. J. Manag. Gov. 2012, 16, 477–509. [Google Scholar] [CrossRef]

- Pätäri, S.; Jantunen, A.; Kyläheiko, K.; Sandström, J. Does sustainable development foster value creation? Empirical evidence from the global energy industry. Corp. Soc. Responsib. Environ. Manag. 2012, 19, 317–326. [Google Scholar] [CrossRef]

- Ferrero-Ferrero, I.; Fernández-Izquierdo, M.A.; Muñoz-Torres, M.J. The effect of the environmental, social and governance consistency on economic results. Sustainability 2016, 8, 1005. [Google Scholar] [CrossRef]

- Kassinis, G.; Panayiotou, A.; Dimou, A.; Katsifaraki, G. Gender and Environmental Sustainability: A Longitudinal Analysis. Corp. Soc. Responsib. Environ. Manag. 2016, 23, 399–412. [Google Scholar] [CrossRef]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate social responsibility and access to finance. Strateg. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Giannarakis, G.; Konteos, G.; Sariannidis, N. Financial, governance and environmental determinants of corporate social responsible disclosure. Manag. Decis. 2014, 52, 1928–1951. [Google Scholar] [CrossRef]

- Mervelskemper, L.; Streit, D. Enhancing market valuation of ESG performance: Is integrated reporting keeping its promise? Bus. Strategy Environ. 2017, 26, 536–549. [Google Scholar] [CrossRef]

- Hu, V.I.; Scholtens, B. Corporate social responsibility policies of commercial banks in developing countries. J. Sustain. Dev. 2014, 22, 276–288. [Google Scholar] [CrossRef]

- Baltagi, B.H. Econometrics, 5th ed.; Springer: Berlin, Germany, 2011. [Google Scholar]

- Schwartz-Ziv, M. Gender and Board Activeness: The Role of a Critical Mass. J. Financ. Quant. Anal. 2017, 52, 751–780. [Google Scholar] [CrossRef] [Green Version]

- Van Knippenberg, D.; De Dreu, C.K.W.; Homan, A.C. Work group diversity and group performance: An integrative model and research agenda. J. Appl. Psychol. 2004, 89, 1008–1022. [Google Scholar] [CrossRef]

- Glass, C.; Cook, A. Do Women Leaders Promote Positive Change? Analyzing the Effect of Gender on Business Practices and Diversity Initiatives. Hum. Resour. Manag. 2017. [Google Scholar] [CrossRef]

- Baselga-Pascual, L.; Trujillo-Ponce, A.; Vähämaa, E.; Vähämaa, S. Ethical Reputation of Financial Institutions: Do Board Characteristics Matter? J. Bus. Ethics 2018, 148, 489–510. [Google Scholar] [CrossRef]

- Dalton, D.R.; Hitt, M.A.; Certo, S.T.; Dalton, C.M. The fundamental agency problem and its mitigation. Acad. Manag. Ann. 2007, 1, 1–64. [Google Scholar] [CrossRef]

- Eberhardt-Toth, E. Who should be on a board corporate social responsibility committee? J. Clean. Prod. 2017, 140, 1926–1935. [Google Scholar] [CrossRef]

| Name of Variable (Acronym) | Measurement | Expected Relationship with ESG SCORE | Sources |

|---|---|---|---|

| Women on the board of directors (WOMEN BOD) | Total number of women on the board of directors divided by the total number of board members | Non-linear | Rao et al. [7] Barako and Brown [15] Rupley et al. [32] |

| Critical mass of women on the board of directors (MASS WB) | Dummy variable that is equal to 1 if boards have at least three women, 0 otherwise | Positive | Post et al. [6] Fernandez-Feijoo et al. [49,50] Liu [37] Ben-Amar et al. [53] Shoham et al. [54] |

| Board independence (BOARD INDEP) | Percentage of independent board members divided by the total number of board members | Positive/Negative | Ahmed et al. [60] Chau and Gray [63] Lim et al. [65] |

| Board size (BOARD SIZE) | Total number of directors on the bank’s board | Positive | Jensen [73] De Andres et al. [74] Laksmana [76] |

| Board meetings (BOARD MEET) | Number of board meetings per year | Positive | Laksmana [76] Lipton and Lorsch [90] Conger et al. [91] |

| CSR sustainability committee (CSR COM) | Dummy variable that is equal to 1 if the bank has a CSR sustainability committee, 0 otherwise | Positive | Hussain et al. [94] Liao et al. [96] |

| Background and skills (BACK SKILLS) | Dummy variable that is equal to 1 if the bank describes the professional experience or skills of every board member or provides information about the age of individual board members, 0 otherwise | Positive | BCBS [2] |

| Bank size (BANK SIZE) | Total assets (Euro) of the bank | Positive | Setó-Pamies [9] Helfaya and Moussa [12] |

| Return on equity (ROE) | Bank’s net income divided by the value of its total shareholders’ equity | Positive/Negative | Setó-Pamies [9] Helfaya and Moussa [12] |

| Leverage (LEV) | Tier 1 Capital as percentage of total assets (proxy for the Basel 3 leverage ratio) | Positive | Helfaya and Moussa [12] |

| GDP per capita, PPP (GDP) | Gross Domestic Product (GDP) per capita based on purchasing power parity (PPP) | Positive/Negative | Fernandez-Feijoo et al. [50] Hu and Scholtens [107] |

| Variable | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|

| ESG SCORE | 0.608 | 0.237 | 0.097 | 1 |

| WOMEN BOD | 0.197 | 0.111 | 0 | 0.540 |

| MASS WB | 0.493 | 0.501 | 0 | 1 |

| BOARD INDEP | 0.609 | 0.273 | 0 | 1 |

| BOARD SIZE | 14.148 | 4.674 | 6 | 30 |

| BOARD MEET | 12.406 | 6.587 | 4 | 60 |

| CSR COMM | 0.594 | 0.492 | 0 | 1 |

| BACK SKILLS | 0.842 | 0.365 | 0 | 1 |

| BANK SIZE | 320,200,000 | 515,500,000 | 1,093,000 | 2,211,000,000 |

| ROE | −0.009 | 0.577 | −6.873 | 0.356 |

| LEV | 0.076 | 0.032 | 0.015 | 0.216 |

| GDP | 44,902.697 | 10,444.942 | 22,729.184 | 67,974.164 |

| Variable | ESG SCORE | WOMEN BOD | MASS WB | BOARD INDEP | BOARD SIZE | BOARD MEET | CSR COMM | BACK SKILLS | BANK SIZE | ROE | LEV | GDP |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ESG SCORE | 1 | |||||||||||

| WOMEN BOD | 0.47 *** | 1 | ||||||||||

| MASS WB | 0.47 *** | 0.72 *** | 1 | |||||||||

| BOARD INDEP | −0.01 | 0.11 ** | 0.01 | 1 | ||||||||

| BOARD SIZE | 0.19 *** | −0.07 | 0.30 *** | −0.27 *** | 1 | |||||||

| BOARD MEET | 0.02 | −0.06 | −0.04 | −0.10 ** | 0.08 | 1 | ||||||

| CSR COMM | 0.66 *** | 0.32 *** | 0.30 *** | −0.04 | 0.15 *** | 0.06 | 1 | |||||

| BACK SKILLS | −0.08 * | 0.03 | −0.16 *** | 0.31 *** | −0.47 *** | −0.31 *** | −0.14 *** | 1 | ||||

| BANK SIZE | 0.56 *** | 0.44 *** | 0.39 *** | 0.07 | 0.13 *** | −0.02 | 0.43 *** | 0.05 | 1 | |||

| ROE | 0.01 | 0.11 ** | 0.08 | 0.12 ** | −0.11 ** | −0.26 *** | −0.06 | 0.22 *** | 0.004 | 1 | ||

| LEV | 0.22 *** | −0.15 *** | −0.19 *** | 0.36 *** | −0.21 *** | −0.13 ** | −0.32 *** | 0.22 *** | −0.36 *** | 0.21 *** | 1 | |

| GDP | −0.21 *** | 0.12 ** | −0.06 | 0.45 *** | −0.42 *** | −0.24 *** | −0.15 *** | 0.44 *** | −0.07 | 0.17 *** | 0.17 *** | 1 |

| Model | (A) | (B) | (C) |

|---|---|---|---|

| Coefficient (Robust SE) | Coefficient (Robust SE) | Coefficient (Robust SE) | |

| WOMEN BOD (lag) | 0.166 * (0.089) | 0.298 ** (0.140) | 0.446 ** (0.184) |

| MASS WB (lag) | 0.073 * (0.038) | ||

| WOMEN BOD X MASS WB (lag) | −0.315 * (0.161) | ||

| WOMEN BOD ^2 (lag) | −0.693 * (0.361) | ||

| BOARD INDEP (lag) | −0.055 * (0.030) | −0.059 ** (0.029) | −0.062 ** (0.030) |

| BOARD SIZE (lag, log) | 0.076 ** (0.038) | 0.053 (0.036) | 0.066 * (0.036) |

| BOARD MEET (lag, log) | 0.013 (0.017) | 0.013 (0.016) | 0.012 (0.016) |

| CSR COMM (lag) | 0.033 (0.022) | 0.038 * (0.022) | 0.036 * (0.022) |

| BACK SKILLS ((lag) | 0.033 ** (0. 014) | 0.035 *** (0. 013) | 0.035 ** (0. 014) |

| BANK SIZE (lag, log) | 0.110 *** (0.037) | 0.115 *** (0.037) | 0.113 *** (0.038) |

| ROE (lag) | 0.014 *** (0.005) | 0.014 *** (0.005) | 0.015 *** (0.005) |

| LEV (lag) | 0.390 (0.739) | 0.409 (0.753) | 0.333 (0.741) |

| GDP (lag, log) | 0.014 (0.151) | 0.009 (0.137) | 0.005 (0.147) |

| Observations | 406 | 406 | 406 |

| Groups | 108 | 108 | 108 |

| Year dummies χ2 | 10.39 *** | 9.48 *** | 9.28 *** |

| RegressionF | 18.71 *** | 15.67 *** | 17.31 *** |

| Model | (All) | (US) | (Europe) |

|---|---|---|---|

| Coefficient (Robust SE) | Coefficient (Robust SE) | Coefficient (Robust SE) | |

| WOMEN BOD (lag) | 0.446 ** (0.184) | 0.357 (0.228) | 0.552 *** (0.189) |

| WOMEN BOD^2 (lag) | −0.693 * (0.361) | −0.481 (0.457) | −0.664 * (0.365) |

| BOARD INDEP (lag) | −0.062 ** (0.030) | −0.007 (0.027) | −0.110 *** (0.033) |

| BOARD SIZE (lag, log) | 0.066 * (0.036) | 0.008 (0.03) | 0.114 ** (0.047) |

| BOARD MEET (lag, log) | 0.012 (0.016) | −0.016 (0. 010) | 0.032 (0.021) |

| CSR COMM (lag) | 0.036 * (0.022) | −0.027 (0.019) | 0.049 ** (0.022) |

| BACK SKILLS (lag) | 0.035 ** (0.014) | - | 0.043 *** (0.016) |

| BANK SIZE (lag, log) | 0.113 *** (0.038) | 0.023 (0.059) | −0.039 (0.066) |

| ROE (lag) | 0.015 *** (0.005) | 0.073 (0.068) | 0.019 *** (0.005) |

| LEV (lag) | 0.333 (0.741) | −0.348 (0.751) | 0.189 (1.085) |

| GDP (lag, log) | 0.005 (0.147) | 13.944 *** (2.775) | −0.004 (0.150) |

| Observations | 406 | 153 | 253 |

| Groups | 108 | 42 | 66 |

| Year dummies χ * | 9.28 *** | 15.44 *** | 4.63 *** |

| Regression F | 17.31 *** | 166.30 *** | 6.94 *** |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Birindelli, G.; Dell’Atti, S.; Iannuzzi, A.P.; Savioli, M. Composition and Activity of the Board of Directors: Impact on ESG Performance in the Banking System. Sustainability 2018, 10, 4699. https://doi.org/10.3390/su10124699

Birindelli G, Dell’Atti S, Iannuzzi AP, Savioli M. Composition and Activity of the Board of Directors: Impact on ESG Performance in the Banking System. Sustainability. 2018; 10(12):4699. https://doi.org/10.3390/su10124699

Chicago/Turabian StyleBirindelli, Giuliana, Stefano Dell’Atti, Antonia Patrizia Iannuzzi, and Marco Savioli. 2018. "Composition and Activity of the Board of Directors: Impact on ESG Performance in the Banking System" Sustainability 10, no. 12: 4699. https://doi.org/10.3390/su10124699

APA StyleBirindelli, G., Dell’Atti, S., Iannuzzi, A. P., & Savioli, M. (2018). Composition and Activity of the Board of Directors: Impact on ESG Performance in the Banking System. Sustainability, 10(12), 4699. https://doi.org/10.3390/su10124699