The Impact of Sustainability Practices on Corporate Financial Performance: Literature Trends and Future Research Potential

Abstract

:1. Introduction

2. Methodology

- ProQuest

- EBSCO

- Science Direct

- Emerald

- JSTOR

- Springer Link

- Scopus

3. Results

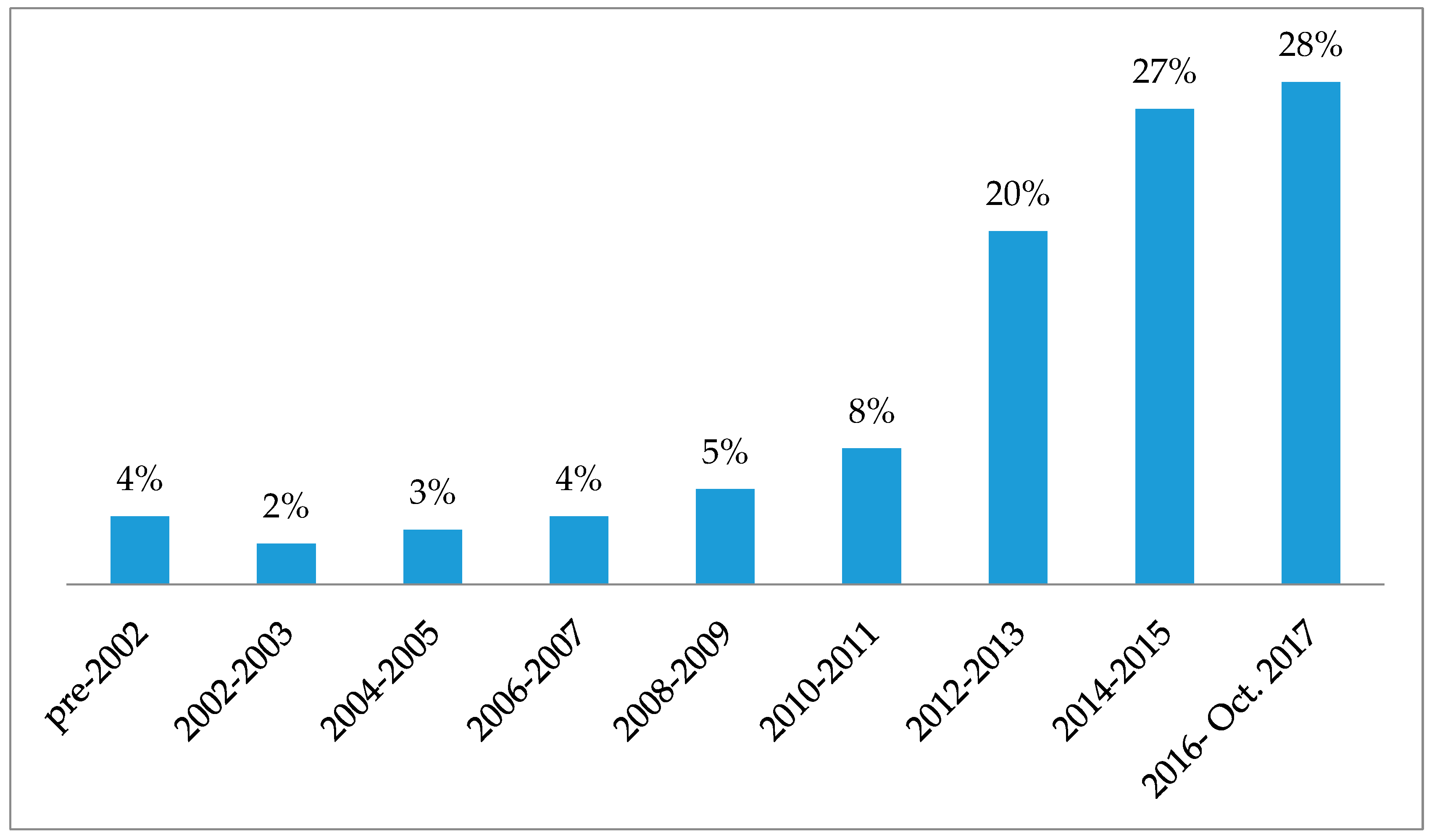

3.1. Time Period Distribution

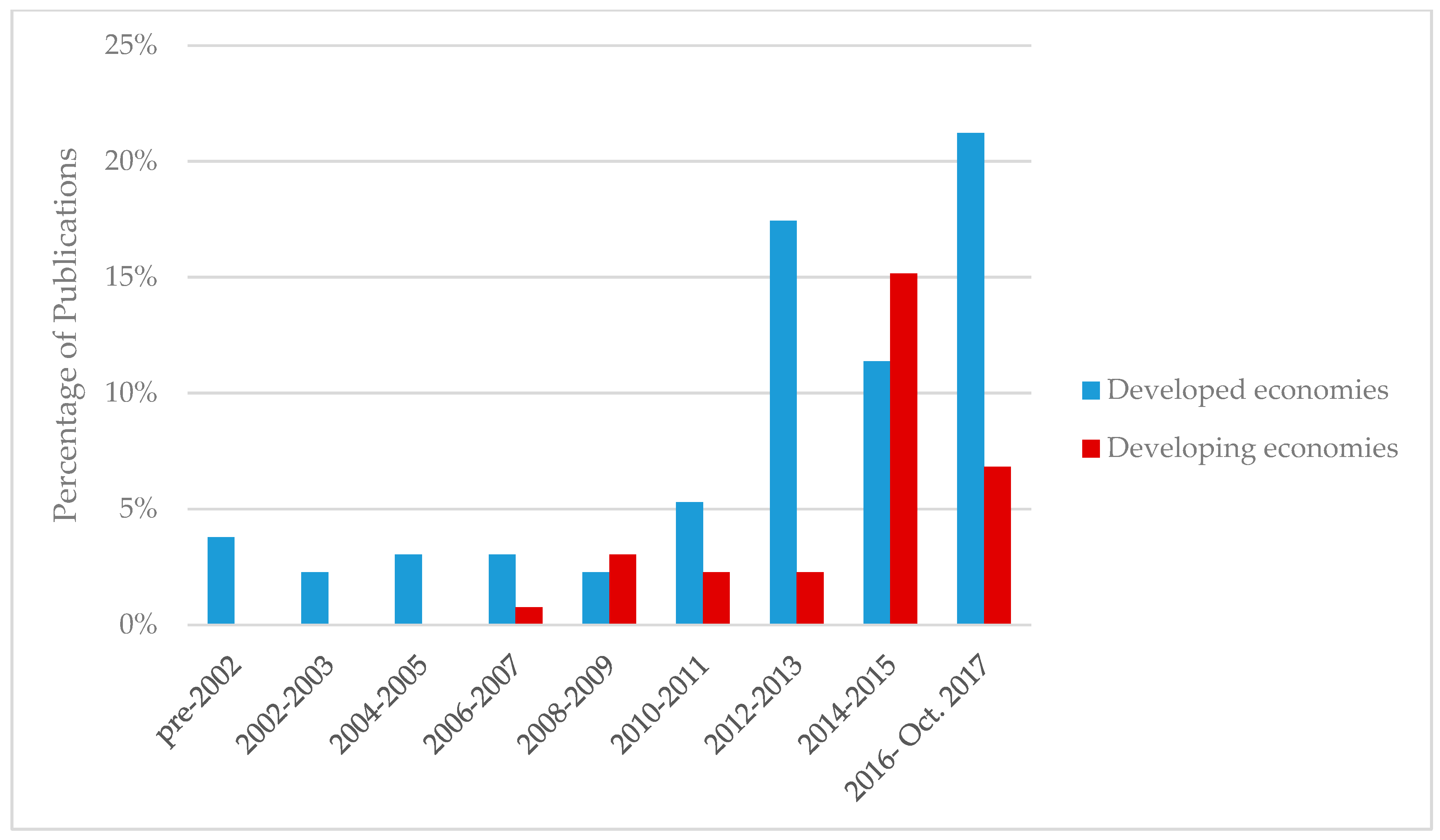

3.2. Country Distribution

3.3. Industry Distribution

3.4. Sustainability Dimension Distribution

- Single Dimension:

- Economic

- Environmental

- Social

- Bi-Combination of Dimensions:

- Economical–Environmental

- Social–Environmental

- Sustainability

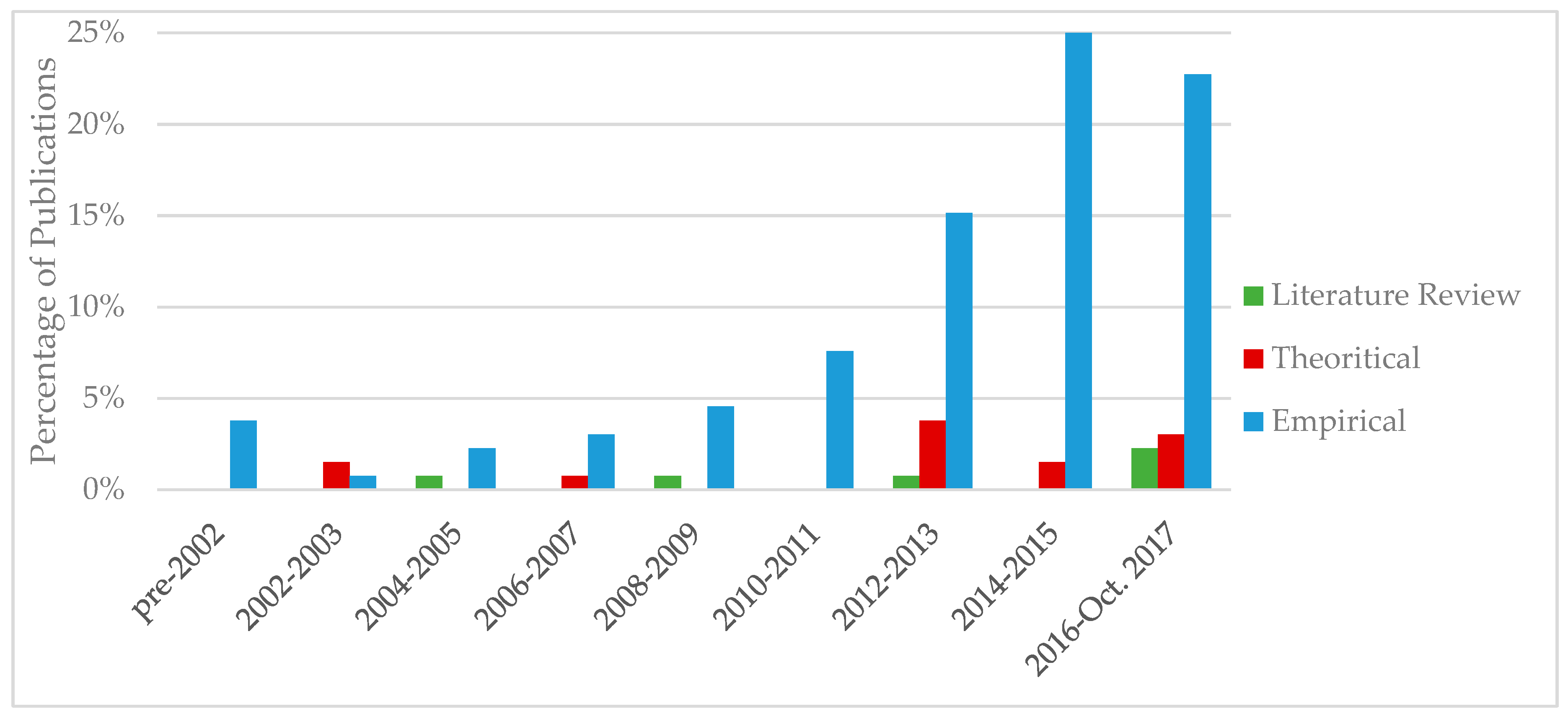

3.5. Research Type Distribution

3.6. Journal-Wise Distribution

3.7. Distribution of Methodology Approaches

3.8. Measures of Total Sustainability

3.9. Distribution of Financial Measures

3.10. Impact of Sustainability Practices on Corporate Financial Performance

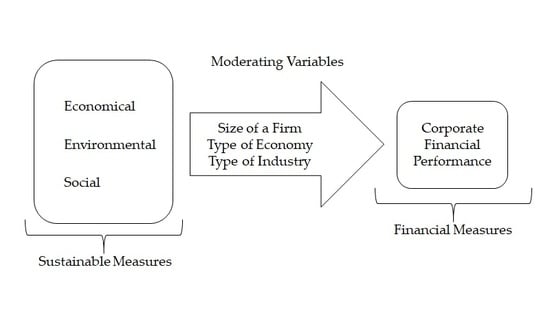

4. Discussion

Author Contributions

Conflicts of Interest

Appendix A

| Authors | Title | Year | Performance Measure |

|---|---|---|---|

| Leonidou, Constantinos N.; Katsikeas, Constantine S.; Morgan, Neil A. | “Greening” the marketing mix: do firms do it and does it pay off? | 2013 | ROA |

| Wiengarten, Frank; Lo, Chris K.; Lam, Jessie Y. | “How does Sustainability Leadership Affect Firm Performance? The Choices Associated with Appointing a Chief Officer of Corporate Social Responsibility” | 2017 | ROA |

| Golicic, Susan L.; Smith, Carlo D. | A Meta-Analysis of Environmentally Sustainable Supply Chain Management Practices and Firm Performance | 2013 | - |

| Morali, Oguz; Searcy, Cory | A Review of Sustainable Supply Chain Management Practices in Canada | 2013 | - |

| Rettab, Belaid; Brik, Anis Ben; Mellahi, Kamel | A Study of Management Perceptions of the Impact of Corporate Social Responsibility on Organisational Performance in Emerging Economies: The Case of Dubai | 2009 | ROA, ROI, Sales Growth |

| Shen, Chung-hua; Chang, Yuan | Ambition Versus Conscience, Does Corporate Social Responsibility Pay off? The Application of Matching Methods | 2009 | ROA, ROE, PTI, RGM, EPS |

| Jacobs, Brian W.; Singhal, Vinod R.; Subramanian, Ravi | An empirical investigation of environmental performance and the market value of the firm | 2010 | Return of Stock |

| Xiao, Yuchao; Faff, Robert; Gharghori, Philip; Lee, Darren | An Empirical Study of the World Price of Sustainability | 2013 | Market Return |

| Verbeeten, Frank H. M.; Gamerschlag, Ramin; Möller, Klaus | Are CSR disclosures relevant for investors? Empirical evidence from Germany | 2016 | Share price, Return Per Share RET |

| Gallego-Álvarez, Isabel; Prado-Lorenzo, José-Manuel; Rodríguez-Domínguez, Luis; García-Sánchez, Isabel-María | Are social and environmental practices a marketing tool? | 2010 | Market Value, Capital |

| Dixon-Fowler, Heather; Slater, Daniel J.; Johnson, Jonathan L.; Ellstrand, Alan E.; Romi, Andrea M. | Beyond “Does it Pay to be Green?” A Meta-Analysis of Moderators of the CEP—CFP Relationship | 2013 | ROA, Market Share |

| Hahn, Tobias; Figge, Frank | Beyond the Bounded Instrumentality in Current Corporate Sustainability Research: Toward an Inclusive Notion of Profitability | 2011 | Capital Efficiency, Market Efficiency, Total Sales |

| Haffar, Merriam; Searcy, Cory | Classification of Trade-offs Encountered in the Practice of Corporate Sustainability | 2017 | - |

| Surroca, Jordi; Tribó, Josep A.; Waddock, Sandra | Corporate responsibility and financial performance: the role of intangible resources | 2010 | Tobin’s Q |

| Harrison, Jeffrey S.; Berman, Shawn L. | Corporate Social Performance and Economic Cycles | 2016 | GDP |

| Guiral, Andrés | Corporate Social Performance, Innovation Intensity, and Financial Performance: Evidence from Lending Decisions | 2012 | - |

| Kevin Huang, Shihping; Yang, Chih-Lung | Corporate social performance: why it matters? Case of Taiwan | 2014 | ROA, ROE |

| Kang, Hsin-hong; Liu, Shu-bing | Corporate social responsibility and corporate performance: a quantile regression approach | 2014 | ROA, ROE, Pre Tax Income to Net Sales PTI, Gross Profit to Net Sales (GPS), EPS |

| Simionescu, Liliana Nicoleta; Gherghina, Stefan Cristian | Corporate social responsibility and corporate performance: empirical evidence from a panel of the Bucharest Stock Exchange listed companies | 2014 | ROA, ROE, ROS |

| Balabanis, George; Phillips, Hugh C.; Lyall, Jonathan | Corporate social responsibility and economic performance in the top British companies: are they linked? | 1998 | ROE, ROCE, Gross Profit to Sales Ratio (GPS) |

| Cochran, Philip L.; Wood, Robert A. | Corporate social responsibility and financial performance | 1984 | Operating Earnings to Assets Ratio, Operating Earnings to Sales Ratio, Excess Market Valuation |

| Lech, Aleksandra | Corporate Social Responsibility and Financial Performance. Theoretical and Empirical Aspects | 2013 | ROA, ROE |

| Karagiorgos, Theofanis | Corporate Social Responsibility and Financial Performance: An Empirical Analysis on Greek Companies | 2010 | Stock Return |

| McGuire, Jean B.; Sundgren, Alison; Schneeweis, Thomas | Corporate Social Responsibility and Firm Financial Performance | 1988 | ROA, Total Assets, Sales Growth, Asset Growth, Operating Income Growth |

| Bai, Xuan; Chang, Jeanine | Corporate social responsibility and firm performance: The mediating role of marketing competence and the moderating role of market environment | 2015 | Growth Rate, ROI, Overall Profitability |

| Gregory, Alan; Tharyan, Rajesh; Whittaker, Julie | Corporate Social Responsibility and Firm Value: Disaggregating the Effects on Cash Flow, Risk and Growth | 2014 | Book Value Per Share (BVPS), Net Income Per Share (NIPS), Long Term Debt, Total Asset, Sales |

| Chang, Yuan; Shen, Chung-Hua | Corporate Social Responsibility and Profitability—Cost of Debt as the Mediator | 2014 | ROA |

| Lizhen Chen, lzhchen ujs edu cn; Marfo, Emmanuel Opoku kwench hotmail com; Hu Xuhua, xuhuahu com | Corporate Social Responsibility behavior: Impact on Firm’s Financial Performance in an information technology driven society | 2016 | ROA, Stock Return Rate |

| Fernández-gago, Roberto; Cabeza-garcía, Laura; Nieto, Mariano | Corporate social responsibility, board of directors, and firm performance: an analysis of their relationships | 2016 | Firm Value |

| Zhu, Yan; Sun, Li-yun; Leung, Alicia S.; M | Corporate social responsibility, firm reputation, and firm performance: The role of ethical leadership | 2014 | ROE, ROI, ROS |

| Vicente Lima, Crisóstomo; Fátima de Souza, Freire; Felipe Cortes de, Vasconcellos | Corporate social responsibility, firm value and financial performance in Brazil | 2011 | Tobin’s Q, ROA, ROE |

| Przychodzen, Justyna; Przychodzen, Wojciech | Corporate sustainability and shareholder wealth | 2013 | Sustainable Growth Rate |

| Venkatraman, Sitalakshmi; Nayak, Raveendranath Ravi | Corporate sustainability: an IS approach for integrating triple bottom line elements | 2015 | Top dividends to shareholders, Business profitability, Return on average capital employed, Meeting tax obligations, Debt/Equity ratio |

| Hart, Stuart L.; Milstein, Mark B. | Creating sustainable value | 2003 | - |

| Porter, Terry; Miles, Patti | CSR Longevity: Evidence from Long-Term Practices in Large Corporations | 2013 | EBIT, EBI, Return on Pretax Income |

| Wang, Chung-Jen | Do ethical and sustainable practices matter? Effects of corporate citizenship on business performance in the hospitality industry | 2014 | ROI, Profit Growth |

| Rodgers, Waymond; Choy, Hiu Lam; Guiral, Andrés | Do Investors Value a Firm’s Commitment to Social Activities? | 2013 | Tobin’s Q, ROA, Financial Leverage, Liquidity Measure |

| Cheung, Yan-Leung; Connelly, J. T.; Jiang, Ping; Limpaphayom, Piman | Does Corporate Governance Predict Future Performance? Evidence from Hong Kong | 2011 | Tobin’s Q, Market to Book Ratio |

| Mishra, Supriti; Suar, Damodar | Does Corporate Social Responsibility Influence Firm Performance of Indian Companies? | 2010 | ROA |

| Hou, Mingjun; Liu, Heng; Fan, Peihua; Wei, Zelong | Does CSR practice pay off in East Asian firms? A meta-analytic investigation | 2016 | ROA, ROE, ROI, Profit Growth, Return of Equity, Cash Flow, Sales Growth, Tobin’s Q, Market Share, Market to Book, Stock Market Returns, Market Share Growth, Export Growth |

| Albertini, Elisabeth | Does Environmental Management Improve Financial Performance? A Meta-Analytical Review | 2013 | ROA, ROE, ROI, ROS, EPS, Tobin’s Q |

| Chien, Chin-Chen; Peng, Chih-Wei | Does going green pay off in the long run? | 2012 | ROE, ROA, EPS, Cash Flow to Total Assets (CFA) |

| Brammer, Stephen; Millington, Andrew | Does It Pay to Be Different? An Analysis of the Relationship between Corporate Social and Financial Performance | 2008 | Market Performance (share price growth plus dividend), Risk adjusted market performance (RAMP) (using government bonds returns as risk free) |

| Thornton, Ladonna M.; Autry, Chad W.; Gligor, David M.; Brik, Anis Ben | Does Socially Responsible Supplier Selection Pay Off for Customer Firms? A Cross-Cultural Comparison | 2013 | Relative Sales Revenue, Sales Growth, Market Share |

| Wahba, Hayam | Does the market value corporate environmental responsibility? An empirical examination | 2008 | Tobin’s Q |

| Chernev, Alexander; Blair, Sean | Doing Well by Doing Good: The Benevolent Halo of Corporate Social Responsibility | 2015 | - |

| Jia, Ming; Zhang, Zhe | Donating Money to Get Money: The Role of Corporate Philanthropy in Stakeholder Reactions to IPOs | 2014 | IPO agents and financing costs (Underwriter prestige, VC-backed shareholding, ration of IPO cost to financing scale), Issue market valuation premium, Retail market valuatin premium |

| Delmas, Magali A.; Nairn-Birch, Nicholas; Lim, Jinghui | Dynamics of Environmental and Financial Performance: The Case of Greenhouse Gas Emissions | 2015 | ROA, Tobin’s Q |

| Van de Velde, Eveline; Vermeir, Wim; Corten, Filip | Finance and accounting: Corporate social responsibility and financial performance | 2005 | Fama and French |

| Scholtens, Bert | Finance as a Driver of Corporate Social Responsibility | 2006 | - |

| Revelli, Christophe; Viviani, Jean-Laurent | Financial performance of socially responsible investing (SRI): what have we learned? A meta-analysis | 2015 | Return of Stock |

| Hull, Clyde Eirikur; Rothenberg, Sandra | Firm performance: the interactions of corporate social performance with innovation and industry differentiation | 2008 | ROA |

| Aguilera-Caracuel, Javier; Ortiz-de-Mandojana, Natalia | Green Innovation and Financial Performance: An Institutional Approach | 2013 | ROA |

| Molina-Azorín, José F.; Claver-Cortés, Enrique; López-Gamero, Maria D.; Tarí, Juan J. | Green management and financial performance: a literature review | 2009 | - |

| García-Sánchez, Isabel-María; Prado-Lorenzo, José-Manuel | Greenhouse gas emission practices and financial performance | 2012 | ROA, Market to Book (MtoB) |

| Nguyen, Dung K.; Slater, Stanley F. | Hitting the sustainability sweet spot: having it all | 2010 | ROA, Revenue Growth Rate, Share Value Appreciation Rate |

| Hyoung Koo, Moon; Byoung Kwon, Choi | How an organization’s ethical climate contributes to customer satisfaction and financial performance | 2014 | ROI |

| Wei, Yu-chen; Lin, Carol Yeh-yun | How can Corporate Social Responsibility Lead to Firm Performance? A Longitudinal Study in Taiwan | 2015 | ROA, Productivity (sales per employee) |

| Tang, Zhi; Hull, Clyde Eiríkur; Rothenberg, Sandra | How Corporate Social Responsibility Engagement Strategy Moderates the CSR-Financial Performance Relationship | 2012 | ROA |

| Saeidi, Sayedeh Parastoo; Sofian, Saudah; Saeidi, Parvaneh; Saeidi, Sayyedeh Parisa; Saaeidi, Seyyed Alireza | How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction | 2015 | ROA, ROE, ROI, ROS, Market Share Growth, Growth in Sales |

| Koo, Chulmo; Chung, Namho; Ryoo, Sung Yul | How does ecological responsibility affect manufacturing firms’ environmental and economic performance? | 2014 | Decreased Costs |

| Lourenço, Isabel Costa; Branco, Manuel Castelo; Curto, José Dias; Eugénio, Teresa | How Does the Market Value Corporate Sustainability Performance? | 2012 | Market Value of Equity, Book Value of Equity, Net Operating Income |

| Jia, Ming; Zhang, Zhe | How Does the Stock Market Value Corporate Social Performance? When Behavioral Theories Interact with Stakeholder Theory | 2014 | Stock Return |

| Goyal, Praveen; Rahman, Zillur; Kazmi, Absar Ahmad | Identification and prioritization of corporate sustainability practices using analytical hierarchy process | 2015 | - |

| Molla, Alemayehu | Identifying IT sustainability performance drivers: Instrument development and validation | 2013 | - |

| Murtaza, Iqra Ali; Akhtar, Naeem; Ijaz, Aqsa; Sadiqa, Ayesha | Impact of Corporate Social Responsibility on Firm Financial Performance: A Case Study of Pakistan | 2014 | ROA, ROE, EPS |

| Valmohammadi, Changiz | Impact of corporate social responsibility practices on organizational performance: an ISO 26000 perspective | 2014 | ROI, Sales Growth |

| Watson, Kevin; Klingenberg, Beate; Polito, Tony; Geurts, Tom G. | Impact of environmental management system implementation on financial performance: A comparison of two corporate strategies | 2004 | ROA, Profit Margin, Operating Margin, Price to Earnings Ratio, Market to Book Ratio |

| Garg, Priyanka | Impact of Sustainability Reporting on Firm Performance of Companies in India | 2015 | ROA, Tobin’s Q |

| Shank, Todd M. PhD; Shockey, Benjamin M. B. A. | Investment strategies when selecting sustainable firms | 2016 | Return (risk related) |

| Hsu, Feng Jui; Chen, Yu-Cheng | Is a firm’s financial risk associated with corporate social responsibility? | 2015 | - |

| Shih-Fang, Lo; Sheu, Her-Jiun | Is Corporate Sustainability a Value-Increasing Strategy for Business? | 2007 | Tobin’s Q |

| Cegarra-Navarro, Juan-Gabriel; Reverte, Carmelo; Gómez-Melero, Eduardo; Wensley, Anthony K. P. | Linking social and economic responsibilities with financial performance: The role of innovation | 2016 | ROE, Sales Growth, ROA and Market Share, Before-Tax Income |

| Endrikat, Jan; Guenther, Edeltraud; Hoppe, Holger | Making sense of conflicting empirical findings: A meta-analytic review of the relationship between corporate environmental and financial performance | 2014 | - |

| Kiessling, Timothy; Isaksson, Lars; Yasar, Burze | Market Orientation and CSR: Performance Implications | 2016 | ROA |

| Endrikat, Jan | Market Reactions to Corporate Environmental Performance Related Events: A Meta-analytic Consolidation of the Empirical Evidence | 2016 | - |

| de Souza Cunha, Felipe Arias Fogliano; Samanez, Carlos Patricio | Performance Analysis of Sustainable Investments in the Brazilian Stock Market: A Study About the Corporate Sustainability Index (ISE) | 2013 | Return (risk related) |

| Tippayawong, K. Y.; Tiwaratreewit, T.; Sopadang, A. | Positive Influence of Green Supply Chain Operations on Thai Electronic Firms’ Financial Performance | 2015 | ROA, Inventory Turnover Ratio, Operating Cost Ratio, Net Profit Margin, Asset Turnover Ratio |

| Torugsa, Nuttaneeya Ann; O’Donohue, Wayne; Hecker, Rob | Proactive CSR: An Empirical Analysis of the Role of its Economic, Social and Environmental Dimensions on the Association between Capabilities and Performance | 2013 | ROA, Net Profits to Sales, Liquidity |

| Nakao, Yuriko; Amano, Akihiro; Matsumura, Kanichiro; Genba, Kiminori; Nakano, Makiko | Relationship between environmental performance and financial performance: an empirical analysis of Japanese corporations | 2007 | ROA, EPS, Tobin’s Q |

| Martínez-Ferrero, Jennifer; Frías-Aceituno, José Valeriano | Relationship Between Sustainable Development and Financial Performance: International Empirical Research | 2015 | Market Value, Book Value, Equity, Net Operating Income |

| Venkatraman, Sitalakshmi; Nayak, Raveendranath Ravi | Relationships among triple bottom line elements | 2015 | - |

| Robinson, Michael; Kleffner, Anne; Bertels, Stephanie | Signaling Sustainability Leadership: Empirical Evidence of the Value of DJSI Membership | 2011 | Cumulative Abnormal Return (CAR) |

| Wang, Taiyuan; Bansal, Pratima | Social responsibility in new ventures: profiting from a long-term orientation | 2012 | ROA, ROE, ROS, Sales Level, Market Share, Sales Growth, Cash Flow, Ability to fund business growth from profits, Overall firm performance/success |

| Quazi, Ali; Richardson, Alice | Sources of variation in linking corporate social responsibility and financial performance | 2012 | ROA, ROE, ROI, Market Return, Market Valuation, Stock Returns, Share Price, EPS, Survey Measures |

| Yu, Minna; Zhao, Ronald | Sustainability and firm valuation: an international investigation | 2015 | Tobin’s Q |

| Ameer, Rashid; Othman, Radiah | Sustainability Practices and Corporate Financial Performance: A Study Based on the Top Global Corporations | 2012 | ROA, Sales Growth, Profit Befor Tax (PBT), Cash Flow from Operating Activities (CFO) |

| Movassaghi, Hormoz; Bramhandkar, Alka | Sustainability Strategies of Leading Global Firms and Their Financial Performance: A Comparative Case Based Analysis | 2012 | ROA, ROE, EPS, Net Profit Margin, Book Value, Market Value |

| López, M. Victoria; Garcia, Arminda; Rodriguez, Lazaro | Sustainable Development and Corporate Performance: A Study Based on the Dow Jones Sustainability Index | 2007 | ROA, ROE, Profit Before Tax (PBT), Revenue, Capital, Profit Margin, Cost of Capital |

| Salzmann, Oliver; Ionescu-somers, Aileen; Steger, Ulrich | The Business Case for Corporate Sustainability: Literature Review and Research Options | 2005 | - |

| Simpson, Soni; Fischer, Bruce D.; Rohde, Matthew | The Conscious Capitalism Philosophy Pay Off: A Qualitative and Financial Analysis of Conscious Capitalism Corporations | 2013 | Stock Price, Compound Annual Growth Rate |

| Griffin, Jennifer J.; Mahon, John F. | The corporate social performance and corporate financial performance debate: Twenty-five years of incomparable research | 1997 | ROA, ROE, ROS, Total Assets, Asset Age |

| Waddock, Sandra A.; Graves, Samuel B. | The Corporate Social Performance financial Performance Link | 1997 | ROA, ROE, ROS |

| Moneva, Jose M.; Rivera-Lirio, Juana M.; Muñoz-Torres, María J. | The corporate stakeholder commitment and social and financial performance | 2007 | ROA, Return on Shareholder Fund |

| Lee, Sunghee; Jung, Heungjun | The effects of corporate social responsibility on profitability | 2016 | ROA |

| Nor, Norhasimah Md; Bahari, Norhabibi Aishah Shaiful; Adnan, Nor Amiera; Kamal, Sheh Muhammad Qamarul Ariffin Sheh; Ali, Inaliah Mohd | The Effects of Environmental Disclosure on Financial Performance in Malaysia | 2016 | ROA, ROE, EPS, Profit Margin |

| Chang, Dong-shang; Kuo, Li-chin Regina | The effects of sustainable development on firms’ financial performance - an empirical approach | 2008 | ROA, ROE, ROS |

| Isidro, Helena; Sobral, Márcia | The Effects of Women on Corporate Boards on Firm Value, Financial Performance, and Ethical and Social Compliance | 2015 | ROA, ROS, Tobin’s Q |

| Oikonomou, Ioannis; Brooks, Chris; Pavelin, Stephen | The Financial Effects of Uniform and Mixed Corporate Social Performance | 2014 | Book-Value to Market-Value Ratio |

| Chetty, Sukanya; Naidoo, Rebekah; Seetharam, Yudhvir | The Impact of Corporate Social Responsibility on Firms’ Financial Performance in South Africa | 2015 | ROA, ROE, EPS, Stock Returns |

| Feng, Taiwen; Wang, Dan | The Influence of Environmental Management Systems on Financial Performance: A Moderated-Mediation Analysis | 2016 | ROA, ROI, ROS, Net Profit Margin, Growth in Sales, Growth in Profit, Growth in Market Share |

| Singal, Manisha | The Link between Firm Financial Performance and Investment in Sustainability Initiatives | 2014 | Credit Rating |

| Schaltegger, Stefan; Synnestvedt, Terje | The link between ‘green’ and economic success: Environmental management as the crucial trigger between environmental and economic performance | 2002 | - |

| Wu, Junjie; Lodorfos, George; Dean, Aftab; Gioulmpaxiotis, Georgios | The Market Performance of Socially Responsible Investment during Periods of the Economic Cycle—Illustrated Using the Case of FTSE | 2017 | Share Price |

| Al-Tuwaijri, Sulaiman A.; Christensen, Theodore E.; Hughes, K. E. | The relations among environmental disclosure, environmental performance, and economic performance: a simultaneous equations approach | 2004 | Stock Return |

| Maletic, Matjaz; Maletic, Damjan; Dahlgaard, Jens J.; Dahlgaard-Park, Su Mi; Gomiscek, Bostjan | The Relationship between Sustainability- Oriented Innovation Practices and Organizational Performance: Empirical Evidence from Slovenian Organizations | 2014 | ROI, Sales Growth, Profit Growth, Market Share |

| Wagner, Marcus; Nguyen Van, Phu; Azomahou, Theophile; Wehrmeyer, Walter | The relationship between the environmental and economic performance of firms: an empirical analysis of the European paper industry | 2002 | ROE, ROS, ROCE, EBIT |

| Malik, Mahfuja | Value-Enhancing Capabilities of CSR: A Brief Review of Contemporary Literature | 2015 | Market Value of Outstanding Shares |

| Kang, Charles; Germann, Frank; Grewal, Rajdeep | Washing Away Your Sins? Corporate Social Responsibility, Corporate Social Irresponsibility, and Firm Performance | 2016 | Tobin’s Q |

| Aguinis, Herman; Glavas, Ante | What We Know and Don’t Know About Corporate Social Responsibility: A Review and Research Agenda | 2012 | - |

| Afza, Talat; Ehsan, Sadaf; Nazir, Sajid | Whether Companies Need to be Concerned about Corporate Social Responsibility for their Financial Performance or Not? A Perspective of Agency and Stakeholder Theories | 2015 | ROA, ROE, EPS, Sales growth, Tobin’s Q, Price to Earnings Ratio |

| Du, Xingqiang; Weng, Jianying; Zeng, Quan; Chang, Yingying; Pei, Hongmei | Do Lenders Applaud Corporate Environmental Performance? Evidence from Chinese Private-Owned Firms | 2017 | Interest Rate on Debt |

| Panwar, Rajat; Nybakk, Erlend; Hansen, Eric; Pinkse, Jonatan | Does the Business Case Matter? The Effect of a Perceived Business Case on Small Firms’ Social Engagement | 2017 | ROI, ROS, Sales Growth, Net Profit, Cash Flow |

| Karim, Khondkar; Suh, SangHyun; Tang, Jiali | Do ethical firms create value? | 2016 | Market Return |

| Yawar, Sadaat Ali; Seuring, Stefan | Management of Social Issues in Supply Chains: A Literature Review Exploring Social Issues, Actions and Performance Outcomes | 2017 | - |

| Rego, Arménio; Cunha, Miguel Pina; E.; Polónia, Daniel | Corporate Sustainability: A View from the Top | 2017 | - |

| Tuppura, Anni; Arminen, Heli; Pätäri, Satu; Jantunen, Ari | Corporate social and financial performance in different industry contexts: the chicken or the egg? | 2016 | ROA, Market Capitalization |

| Schmidt, Christoph G.; Foerstl, Kai; Schaltenbrand, Birte | The supply chain position paradox: green practices and firm performance | 2017 | ROI, Profits as percent of Sales, Labor productivity (sales/employees), Sales Growth |

| Busse, Christian | Doing well by doing good? the self-interest of buying firms and sustainable supply chain management | 2016 | - |

| Wang, Dan; Feng, Taiwen; Lawton, Alan | Linking Ethical Leadership with Firm Performance: A Multi-dimensional Perspective | 2017 | ROA, ROI, ROS, Sales Growth, Profit Growth, Market Share Growth, Overall Efficiency of Operations |

| Grewatsch, Sylvia; Kleindienst, Ingo | When Does It Pay to be Good? Moderators and Mediators in the Corporate Sustainability–Corporate Financial Performance Relationship: A Critical Review | 2017 | - |

| Cuadrado-Ballesteros, Beatriz; Garcia-Sanchez, Isabel-Maria; Martinez Ferrero, Jennifer | How are corporate disclosures related to the cost of capital? The fundamental role of information asymmetry | 2016 | EPS, Cost of Capital, Price Earnings Growth |

| Arouri, Mohamed; Pijourlet, Guillaume | CSR Performance and the Value of Cash Holdings: International Evidence | 2017 | EBIT, Market Value (market capitalization and total liabilities), Fama-French |

| Auer, Benjamin R. | Do Socially Responsible Investment Policies Add or Destroy European Stock Portfolio Value? | 2016 | Sharpe Ratio |

| Osazuwa, Nosakhare Peter; Che-Ahmad, Ayoib | The moderating effect of profitability and leverage on the relationship between eco-efficiency and firm value in publicly traded Malaysian firms | 2016 | ROA, Market value, Net Book Value, EPS, Leverage |

| Lipiec, Jacek | Does Warsaw Stock Exchange value corporate social responsibility? | 2016 | CAPM |

| Arevalo, Jorge A.; Aravind, Deepa | Strategic Outcomes in Voluntary CSR: Reporting Economic and Reputational Benefits in Principles-Based Initiatives | 2017 | Revenue Growth, Productivity Improvements, Cost Savings, Access to Capital |

| Oh, Hannah; Bae, John; Kim, Sang-joon | Can Sinful Firms Benefit from Advertising Their CSR Efforts? Adverse Effect of Advertising Sinful Firms’ CSR Engagements on Firm Performance | 2017 | Stock Return, Idiosyncratic Risk |

| Ibikunle, Gbenga; Steffen, Tom | European Green Mutual Fund Performance: A Comparative Analysis with their Conventional and Black Peers | 2017 | CAPM |

| Faris Alshubiri | The impact of green logistics-based activities on the sustainable monetary expansion indicators of Oman | 2017 | - |

| Székely, Nadine; Jan vom Brocke | What can we learn from corporate sustainability reporting? Deriving propositions for research and practice from over 9,500 corporate sustainability reports published between 1999 and 2015 using topic modelling technique | 2017 | - |

| (Jean) Jeon, Hyo Jin; Gleiberman, Aaron | Examining the role of sustainability and green strategies in channels: evidence from the franchise industry | 2017 | ROS |

References

- Ameer, R.; Othman, R. Sustainability Practices and Corporate Financial Performance: A Study Based on the Top Global Corporations. J. Bus. Ethics 2012, 108, 61–79. [Google Scholar] [CrossRef]

- Lourenço, I.C.; Branco, M.C.; Curto, J.D.; Eugénio, T. How Does the Market Value Corporate Sustainability Performance? J. Bus. Ethics 2012, 108, 417–428. [Google Scholar] [CrossRef]

- Haffar, M.; Searcy, C. Classification of Trade-offs Encountered in the Practice of Corporate Sustainability. J. Bus. Ethics 2017, 140, 495–522. [Google Scholar] [CrossRef]

- Busse, C. Doing Well by Doing Good? The Self-Interest of Buying Firms and Sustainable Supply Chain Management. J. Supply Chain Manag. 2016, 52, 28–47. [Google Scholar] [CrossRef]

- Chernev, A.; Blair, S. Doing Well by Doing Good: The Benevolent Halo of Corporate Social Responsibility. J. Consum. Res. 2015, 41, 1412–1425. [Google Scholar] [CrossRef]

- Hahn, T.; Figge, F. Beyond the Bounded Instrumentality in Current Corporate Sustainability Research: Toward an Inclusive Notion of Profitability. J. Bus. Ethics 2011, 104, 325–345. [Google Scholar] [CrossRef]

- Albertini, E. Does Environmental Management Improve Financial Performance? A Meta-Analytical Review. Organ. Environ. 2013, 26, 431–457. [Google Scholar] [CrossRef]

- Dixon-Fowler, H.; Slater, D.J.; Johnson, J.L.; Ellstrand, A.E.; Romi, A.M. Beyond “Does it Pay to be Green?” A Meta-Analysis of Moderators of the CEP–CFP Relationship. J. Bus. Ethics 2013, 112, 353–366. [Google Scholar] [CrossRef]

- Shank, T.M.P.; Shockey, B.M.B.A. Investment strategies when selecting sustainable firms. Financ. Serv. Rev. 2016, 25, 199–214. [Google Scholar]

- Endrikat, J.; Guenther, E.; Hoppe, H. Making sense of conflicting empirical findings: A meta-analytic review of the relationship between corporate environmental and financial performance. Eur. Manag. J. 2014, 32, 735–751. [Google Scholar] [CrossRef]

- Shah, K.U. Strategic organizational drivers of corporate environmental responsibility in the Caribbean hotel industry. Policy Sci. 2011, 44, 321. [Google Scholar] [CrossRef]

- Yu, M.; Zhao, R. Sustainability and firm valuation: An international investigation. Int. J. Account. Inf. Manag. 2015, 23, 289–307. [Google Scholar] [CrossRef]

- Salzmann, O.; Ionescu-somers, A.; Steger, U. The Business Case for Corporate Sustainability: Literature Review and Research Options. Eur. Manag. J. 2005, 23, 27–36. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B. The Corporate Social Performancefinancial Performance Link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Yawar, S.A.; Seuring, S. Management of Social Issues in Supply Chains: A Literature Review Exploring Social Issues, Actions and Performance Outcomes. J. Bus. Ethics 2017, 141, 621–643. [Google Scholar] [CrossRef]

- Rivera, J.M.; Munoz, M.J.; Moneva, J.M. Revisiting the Relationship Between Corporate Stakeholder Commitment and Social and Financial Performance. Sustainable Dev. 2017, 25, 482–496. [Google Scholar] [CrossRef]

- Surroca, J.; Tribó, J.A.; Waddock, S. Corporate responsibility and financial performance: the role of intangible resources. Strateg. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef] [Green Version]

- Martínez-Ferrero, J.; Frías-Aceituno, J.V. Relationship between Sustainable Development and Financial Performance: International Empirical Research. Bus. Strategy Environ. 2015, 24, 20–39. [Google Scholar] [CrossRef]

- Grewatsch, S.; Kleindienst, I. When Does It Pay to be Good? Moderators and Mediators in the Corporate Sustainability–Corporate Financial Performance Relationship: A Critical Review. J. Bus. Ethics 2017, 145, 383–416. [Google Scholar] [CrossRef]

- Aguinis, H.; Glavas, A. What We Know and Don’t Know About Corporate Social Responsibility: A Review and Research Agenda. J. Manag. 2012, 38, 932–968. [Google Scholar] [CrossRef]

- Goyal, P.; Rahman, Z.; Kazmi, A.A. Corporate sustainability performance and firm performance research. Manag. Decis. 2013, 51, 361–379. [Google Scholar] [CrossRef]

- Morali, O.; Searcy, C. A Review of Sustainable Supply Chain Management Practices in Canada. J. Bus. Ethics 2013, 117, 635–658. [Google Scholar] [CrossRef]

- Verbeeten, F.H.M.; Gamerschlag, R.; Möller, K. Are CSR disclosures relevant for investors? Empirical evidence from Germany. Manag. Decis. 2016, 54, 1359–1382. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Podsakoff, N.P.; Bachrach, D.G. Scholarly Influence in the Field of Management: A Bibliometric Analysis of the Determinants of University and Author Impact in the Management Literature in the Past Quarter Century. J. Manag. 2008, 34, 641–720. [Google Scholar] [CrossRef]

- Molina-Azorín, J.F.; Claver-Cortés, E.; López-Gamero, M.D.; Tarí, J.J. Green management and financial performance: A literature review. Manag. Decis. 2009, 47, 1080–1100. [Google Scholar] [CrossRef]

- Székely, N.; Jan vom, B. What can we learn from corporate sustainability reporting? Deriving propositions for research and practice from over 9500 corporate sustainability reports published between 1999 and 2015 using topic modelling technique. PLoS ONE 2017, 12, e0174807. [Google Scholar] [CrossRef] [PubMed]

- Bai, C.; Sarkis, J.; Dou, Y. Corporate sustainability development in China: Review and analysis. Ind. Manag. Data Syst. 2015, 115, 5–40. [Google Scholar] [CrossRef]

- Kang, H.-H.; Liu, S.-B. Corporate social responsibility and corporate performance: A quantile regression approach. Qual. Quant. 2014, 48, 3311–3325. [Google Scholar] [CrossRef]

- Singal, M. The Link between Firm Financial Performance and Investment in Sustainability Initiatives. Cornell Hosp. Q. 2014, 55, 19–30. [Google Scholar] [CrossRef]

- United Nations (UN). World Economic Situation and Prospects 2017; United Nations Publication: New York, NY, USA, 2017; pp. 151–159. [Google Scholar]

- Moldavska, A. Defining Organizational Context for Corporate Sustainability Assessment: Cross-Disciplinary Approach. Sustainability 2017, 9, 2365. [Google Scholar] [CrossRef]

- De Souza Cunha, F.A.F.; Samanez, C.P. Performance Analysis of Sustainable Investments in the Brazilian Stock Market: A Study about the Corporate Sustainability Index (ISE). J. Bus. Ethics 2013, 117, 19–36. [Google Scholar] [CrossRef]

- Robinson, M.; Kleffner, A.; Bertels, S. Signaling Sustainability Leadership: Empirical Evidence of the Value of DJSI Membership. J. Bus. Ethics 2011, 101, 493–505. [Google Scholar] [CrossRef]

- Xiao, Y.; Faff, R.; Gharghori, P.; Lee, D. An Empirical Study of the World Price of Sustainability. J. Bus. Ethics 2013, 114, 297–310. [Google Scholar] [CrossRef]

- Dyllick, T.; Hockerts, K. Beyond the business case for corporate sustainability. Bus. Strategy Environ. 2002, 11, 130–141. [Google Scholar] [CrossRef]

- Wasiluk, K.L. Beyond eco-efficiency: Understanding CS through the IC practice lens. J. Intellect. Cap. 2013, 14, 102–126. [Google Scholar] [CrossRef]

- Truant, E.; Corazza, L.; Scagnelli, S.D. Sustainability and Risk Disclosure: An Exploratory Study on Sustainability Reports. Sustainability 2017, 9, 636. [Google Scholar] [CrossRef]

- Wang, T.; Bansal, P. Social responsibility in new ventures: Profiting from a long-term orientation. Strateg. Manag. J. 2012, 33, 1135–1153. [Google Scholar] [CrossRef]

- Quazi, A.; Richardson, A. Sources of variation in linking corporate social responsibility and financial performance. Soc. Responsib. J. 2012, 8, 242–256. [Google Scholar] [CrossRef]

- Shah, K.U.; Arjoon, S.; Rambocas, M. Aligning Corporate Social Responsibility with Green Economy Development Pathways in Developing Countries. Sustain. Dev. 2016, 24, 237–253. [Google Scholar] [CrossRef]

| Country | pre–2002 | 2002–2003 | 2004–2005 | 2006–2007 | 2008–2009 | 2010–2011 | 2012–2013 | 2014–2015 | 2016–October 2017 | Total |

|---|---|---|---|---|---|---|---|---|---|---|

| Japan | - | - | - | 1 | - | - | - | - | - | 1 |

| Liechtenstein | - | - | - | - | - | - | - | - | 1 | 1 |

| Belgium | - | - | 1 | - | - | - | - | - | - | 1 |

| Oman | - | - | - | - | - | - | - | - | 1 | 1 |

| Egypt | - | - | - | - | 1 | - | - | - | - | 1 |

| Romania | - | - | - | - | - | - | - | 1 | - | 1 |

| Iran | - | - | - | - | - | - | - | 1 | - | 1 |

| Slovenia | - | - | - | - | - | - | - | 1 | - | 1 |

| Denmark | - | - | - | - | - | - | - | - | 1 | 1 |

| South Africa | - | - | - | - | - | - | - | 1 | - | 1 |

| UAE | - | - | - | - | 1 | - | - | - | - | 1 |

| Thailand | - | - | - | - | - | - | - | 1 | - | 1 |

| Greece | - | - | - | - | - | 1 | - | - | - | 1 |

| Turkey | - | - | - | - | - | - | - | - | 1 | 1 |

| Netherlands | - | - | - | 1 | - | - | - | - | 1 | 2 |

| Pakistan | - | - | - | - | - | - | - | 2 | - | 2 |

| Switzerland | - | - | 1 | - | - | - | - | - | 1 | 2 |

| Finland | - | - | - | - | - | - | - | - | 2 | 2 |

| Brazil | - | - | - | - | - | 1 | 1 | - | - | 2 |

| India | - | - | - | - | - | 1 | - | 2 | - | 3 |

| South Korea | - | - | - | - | - | - | - | 2 | 1 | 3 |

| Poland | - | - | - | - | - | - | 2 | - | 1 | 3 |

| Portugal | - | - | - | - | - | - | 1 | 1 | 1 | 3 |

| France | - | - | - | - | - | 1 | 1 | 1 | 1 | 4 |

| Canada | - | - | - | - | - | 1 | 1 | - | 2 | 4 |

| Malaysia | - | - | - | - | - | - | 1 | 1 | 2 | 4 |

| Germany | - | 2 | - | - | - | - | - | 1 | 3 | 6 |

| Australia | - | - | - | - | - | - | 4 | 2 | 1 | 7 |

| UK | 1 | - | - | - | 1 | - | 2 | 2 | 2 | 8 |

| China | - | - | - | - | - | 1 | - | 4 | 4 | 9 |

| Taiwan | - | - | - | 1 | 2 | - | 1 | 6 | - | 10 |

| Spain | - | - | - | 2 | 1 | 2 | 4 | 1 | 3 | 13 |

| US | 4 | 1 | 2 | - | 1 | 2 | 8 | 5 | 8 | 31 |

| Industry | pre–2002 | 2002–2003 | 2004–2005 | 2006–2007 | 2008–2009 | 2010–2011 | 2012–2013 | 2014–2015 | 2016–October 2017 | Total |

|---|---|---|---|---|---|---|---|---|---|---|

| IT | - | - | - | - | - | - | 1 | - | - | 1 |

| Banking | - | - | - | - | - | - | 1 | - | - | 1 |

| Chemical | 1 | - | - | - | - | - | - | - | - | 1 |

| Oil & Gas | - | - | - | - | - | - | - | - | 1 | 1 |

| Electronics | - | - | - | - | - | - | - | 1 | - | 1 |

| Automotive | - | - | - | - | - | 1 | - | - | - | 1 |

| Paper | - | 1 | - | - | - | - | - | - | - | 1 |

| Food | - | - | - | - | - | - | - | 1 | - | 1 |

| Hospitality | - | - | - | - | - | - | - | 3 | - | 3 |

| Manufacturing | - | - | - | 1 | - | 1 | 1 | 2 | 2 | 7 |

| Multi Industry | 4 | 2 | 4 | 4 | 7 | 8 | 23 | 28 | 34 | 114 |

| Total | 5 | 3 | 4 | 5 | 7 | 10 | 26 | 35 | 37 | 132 |

| Country | Total |

|---|---|

| Academy of Management Executive | 1 |

| Total Quality Management & Business Excellence | 1 |

| International Review of Management and Business Research | 1 |

| Academy of Management Journal | 1 |

| Accounting, Organizations and Society | 1 |

| Academy of Management Journal (pre–1986) | 1 |

| Business and Society | 1 |

| Journal of Business Strategy | 1 |

| Chinese Management Studies | 1 |

| Journal of Consumer Research | 1 |

| Contemporary Economics | 1 |

| Journal of environmental management | 1 |

| Corporate Governance | 1 |

| Journal of Environmental Planning & Management | 1 |

| Corporate Social Responsibility & Environmental Management | 1 |

| Journal of Global Responsibility | 1 |

| European Business Review | 1 |

| Journal of Industrial Engineering and Management | 1 |

| European Online Journal of Natural and Social Sciences | 1 |

| Journal of Leadership, Accountability and Ethics | 1 |

| Financial Management | 1 |

| Journal of Management | 1 |

| Industrial Management & Data Systems | 1 |

| Journal of Marketing | 1 |

| International Journal of Accounting and Information Management | 1 |

| Journal of Marketing Theory and Practice | 1 |

| International Journal of Contemporary Hospitality Management | 1 |

| Journal of Modelling in Management | 1 |

| International Journal of Marketing & Business Communication | 1 |

| Journal of Operations Management | 1 |

| Behavioral Research in Accounting | 1 |

| Journal of the Academy of Marketing Science | 1 |

| Comparative Economic Research | 1 |

| Management & Marketing | 1 |

| Corporate Governance: An International Review | 1 |

| Management of Environmental Quality | 1 |

| European Journal of Innovation Management | 1 |

| Managerial and Decision Economics | 1 |

| Financial Services Review | 1 |

| Organizacija | 1 |

| International Journal of Climate Change Strategies and Management | 1 |

| PLoS One | 1 |

| The Journal of Applied Business and Economics | 1 |

| Procedia Economics and Finance | 1 |

| Cornell Hospitality Quarterly | 1 |

| Procedia Engineering | 1 |

| European Research Studies | 1 |

| Quality and Quantity | 1 |

| International Journal of Engineering Research in Africa | 1 |

| Review of Managerial Science | 1 |

| Corporate Social Responsibility and Environmental Management | 1 |

| Strategic Management Journal (1986–1998) | 1 |

| Business Ethics | 1 |

| Sustainable Development | 1 |

| Information Systems Frontiers | 1 |

| Taipei Economic Inquiry | 1 |

| Journal of Business Research | 2 |

| Corporate Reputation Review | 2 |

| Business Strategy and the Environment | 2 |

| Organization & Environment | 3 |

| Asia Pacific Journal of Management | 3 |

| The Journal of Management Studies | 3 |

| European Management Journal | 3 |

| Strategic Management Journal | 4 |

| Journal of Supply Chain Management | 4 |

| Management Decision | 6 |

| Social Responsibility Journal | 8 |

| Journal of Business Ethics | 36 |

| Methodology Approach | Count |

|---|---|

| Partial Least Squares | 1 |

| Path model | 1 |

| Analytic hierarchy process | 1 |

| Performance Matrix | 1 |

| ANOVA | 1 |

| Practicability | 1 |

| Predective model differences | 1 |

| Conceptual theory-building | 1 |

| Propensity score matching | 1 |

| CSRI | 1 |

| Quantile regression | 1 |

| Cumulative Portfolio | 1 |

| Risk-adjusted analysis | 1 |

| Experiment (controlled subjects) | 1 |

| Score matching | 1 |

| Granger causality test | 1 |

| Semi-structured interviews | 1 |

| Group analysis (Interviews) | 1 |

| Shareholder value creation model | 1 |

| Instrumental finality | 1 |

| Shareholder value framework | 1 |

| Active stakeholders | 1 |

| Sharpe & Treynor | 1 |

| Behavioral perspective of appointed chief officer of CSR | 1 |

| Simultaneous equation model | 1 |

| Wilcoxon signed-rank test | 1 |

| Simultaneuos equation system | 1 |

| Cumulative abnormal return | 1 |

| Socially responsible investment | 1 |

| Firms of endearment | 1 |

| Sortino and Omega | 1 |

| Hausman–Taylor modelling | 1 |

| Stakeholder/shareholder orientation | 1 |

| Annual Supersector Leader Portfolio | 1 |

| Structural modeling | 1 |

| Corporate reputation model | 1 |

| Sustainalytics Platform database | 1 |

| GRI | 1 |

| Teleological integration | 1 |

| Capital Asset Pricing Model | 1 |

| Theoretical | 1 |

| Multi-factor regressions | 1 |

| Two stage investor decision-making model | 1 |

| Environmental Kuznets curve (EKC) | 1 |

| Two-way random effects model | 1 |

| Portfolio construction | 2 |

| Structural panel vector autoregression | 2 |

| Paired t-test | 2 |

| Structural equation modeling (PLS) | 2 |

| Interviews | 2 |

| Fama and French | 2 |

| Event study | 3 |

| Hierarchical regression analysis | 3 |

| Panel data regression models | 4 |

| Content analysis | 6 |

| Structural equation modeling | 7 |

| Literature review | 7 |

| Meta analysis | 8 |

| Survey | 11 |

| Regression analysis | 48 |

| Financial Performance Measure | pre–2002 | 2002–2003 | 2004–2005 | 2006–2007 | 2008–2009 | 2010–2011 | 2012–2013 | 2014–2015 | 2016–October 2017 | Total |

|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | - | - | - | - | - | - | - | 1 | - | 1 |

| Book to Market Ratio | - | - | - | - | - | - | - | 1 | - | 1 |

| Market Efficiency | - | - | - | - | - | 1 | - | - | - | 1 |

| Asset Age | 1 | - | - | - | - | - | - | - | - | 1 |

| Access to Capital | - | - | - | - | - | - | - | - | 1 | 1 |

| Asset Growth | 1 | - | - | - | - | - | - | - | - | 1 |

| Book Value of Equity | - | - | - | - | - | - | 1 | - | - | 1 |

| Asset Turnover Ratio | - | - | - | - | - | - | - | 1 | - | 1 |

| Capital Efficiency | - | - | - | - | - | 1 | - | - | - | 1 |

| Cash flow to total assets CFA | - | - | - | - | - | - | 1 | - | - | 1 |

| Credit Rating | - | - | - | - | - | - | - | 1 | - | 1 |

| Net Book Value | - | - | - | - | - | - | - | - | 1 | 1 |

| Debt/Equity Ratio | - | - | - | - | - | - | - | 1 | - | 1 |

| Net Profit | - | - | - | - | - | - | - | - | 1 | 1 |

| Operating Ratio | - | - | - | - | - | - | - | 1 | - | 1 |

| Idiosyncratic Risk | - | - | - | - | - | - | - | - | 1 | 1 |

| Pretax Income | - | - | - | - | 1 | - | - | - | - | 1 |

| Inventory Turnover Ratio | - | - | - | - | - | - | - | 1 | - | 1 |

| Pretax Profit Margin | - | - | - | - | - | - | - | 1 | - | 1 |

| Book Value Per Share | - | - | - | - | - | - | - | 1 | - | 1 |

| Price Earnings Growth | - | - | - | - | - | - | - | - | 1 | 1 |

| Compound Annual Growth Rate | - | - | - | - | - | - | 1 | - | - | 1 |

| Ratio of IPO Cost to Financing Scale | - | - | - | - | - | - | - | 1 | - | 1 |

| Firm Value | - | - | - | - | - | - | - | - | 1 | 1 |

| Risk Adjusted Market Performance | - | - | - | - | 1 | - | - | - | - | 1 |

| Interest Rate on Debt | - | - | - | - | - | - | - | - | 1 | 1 |

| Sharpe Ratio | - | - | - | - | - | - | - | - | 1 | 1 |

| Stock Price | - | - | - | - | - | - | 1 | - | - | 1 |

| Equity | - | - | - | - | - | - | - | 1 | - | 1 |

| Venture Capital Backed Shareholding | - | - | - | - | - | - | - | 1 | - | 1 |

| Cumulative Abnormal Return | - | - | - | - | - | 1 | - | - | - | 1 |

| Underwriter Prestige | - | - | - | - | - | - | - | 1 | - | 1 |

| Book Value | - | - | - | - | - | - | 1 | 1 | - | 2 |

| Dividend | - | - | - | - | 1 | - | - | 1 | - | 2 |

| Revenue | - | - | - | 1 | - | - | 1 | - | - | 2 |

| Revenue Growth | - | - | - | - | - | 1 | - | - | 1 | 2 |

| Cost of Capital | - | - | - | 1 | - | - | - | - | 1 | 2 |

| Fama-French | - | - | 1 | - | - | - | - | - | 1 | 2 |

| Market Valuation | 1 | - | - | - | - | - | 1 | - | - | 2 |

| Cost Savings | - | - | - | - | - | - | - | 1 | 1 | 2 |

| Profitability | - | - | - | - | - | - | - | 2 | - | 2 |

| Labor Productivity | - | - | - | - | - | - | - | 1 | 1 | 2 |

| Return (risk related) | - | - | - | - | - | - | 1 | - | 1 | 2 |

| Operating Margin | 1 | - | 1 | - | - | - | - | - | - | 2 |

| (P/E) Ratio | - | - | 1 | - | - | - | - | 1 | - | 2 |

| Leverage | - | - | - | - | - | - | 1 | - | 1 | 2 |

| Market Valuation Premium | - | - | - | - | - | - | - | 2 | - | 2 |

| Liquidity | - | - | - | - | - | - | 2 | - | - | 2 |

| Profit Before Tax | - | - | - | 1 | - | - | 1 | - | - | 2 |

| Capital | - | - | - | 1 | - | 1 | - | - | - | 2 |

| Capital Asset Pricing Model | - | - | - | - | - | - | - | - | 2 | 2 |

| Gross Profit Ratio | 1 | - | - | - | - | - | - | 1 | - | 2 |

| Market Return | - | - | - | - | - | - | 2 | - | 1 | 3 |

| Return on Capital Employed (ROCE) | 1 | 1 | - | - | - | - | - | 1 | - | 3 |

| Operating Income | 1 | - | - | - | - | - | 1 | 1 | - | 3 |

| Total Assets | 2 | - | - | - | - | - | - | 1 | - | 3 |

| Cash Flow | - | - | - | - | - | - | 2 | - | 2 | 4 |

| Market to Book Ratio | - | - | 1 | - | - | 1 | 1 | - | 1 | 4 |

| Profit Growth | - | - | - | - | - | - | - | 2 | 3 | 5 |

| Share Price | - | - | - | - | 1 | 1 | 1 | - | 2 | 5 |

| Earnings (EBI, EBT, EBIT) | - | 1 | - | - | - | - | 3 | - | 2 | 6 |

| Market Capitalization | - | - | - | - | - | 1 | 2 | 2 | 3 | 8 |

| Profit Margin | - | - | 1 | 1 | 1 | - | 2 | 1 | 3 | 9 |

| Stock Return | - | - | 1 | - | - | 2 | 1 | 3 | 3 | 10 |

| Market Share | - | - | - | - | - | - | 3 | 2 | 5 | 10 |

| ROS | 2 | 1 | - | - | 1 | - | 2 | 4 | 4 | 14 |

| Tobin’s Q | - | - | - | 2 | 1 | 3 | 2 | 5 | 2 | 15 |

| EPS | - | - | - | 1 | 1 | - | 4 | 5 | 4 | 15 |

| ROI | - | - | - | - | 1 | - | 2 | 7 | 5 | 15 |

| Sales | 1 | - | - | - | 1 | 1 | 4 | 5 | 6 | 18 |

| ROE | 3 | 1 | - | 2 | 2 | 1 | 6 | 8 | 4 | 27 |

| ROA | 4 | - | 1 | 3 | 4 | 3 | 14 | 13 | 11 | 53 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alshehhi, A.; Nobanee, H.; Khare, N. The Impact of Sustainability Practices on Corporate Financial Performance: Literature Trends and Future Research Potential. Sustainability 2018, 10, 494. https://doi.org/10.3390/su10020494

Alshehhi A, Nobanee H, Khare N. The Impact of Sustainability Practices on Corporate Financial Performance: Literature Trends and Future Research Potential. Sustainability. 2018; 10(2):494. https://doi.org/10.3390/su10020494

Chicago/Turabian StyleAlshehhi, Ali, Haitham Nobanee, and Nilesh Khare. 2018. "The Impact of Sustainability Practices on Corporate Financial Performance: Literature Trends and Future Research Potential" Sustainability 10, no. 2: 494. https://doi.org/10.3390/su10020494

APA StyleAlshehhi, A., Nobanee, H., & Khare, N. (2018). The Impact of Sustainability Practices on Corporate Financial Performance: Literature Trends and Future Research Potential. Sustainability, 10(2), 494. https://doi.org/10.3390/su10020494