1. Introduction

This paper aims at identifying the main changes in the environment that are moving companies towards greater flexibility, by adopting outsourcing and their effect on the organizational structure of companies that are evolving towards virtual forms of organization. In line with this aim, it is appropriate to start by observing the genesis of outsourcing in order to observe how it is changing under pressures from the environment that are leading it towards extreme forms.

The term outsourcing was first used in 1982 to indicate the business strategy through which an enterprise regularly entrusts the productive and economic processes or activities (even entire organizational functions) originally undertaken in-house to an outside organization, which carries out the requested outputs and sells the final productions to the outsourcing company [

1]. Subsequently, outsourcing has been defined by different authors, for example, as:

“the extent of components and finished products supplied to the firm by independent suppliers” [

2] (p. 103);

“the reliance on external sources for manufacturing components and other value-adding activities” [

3] (p. 836);

“an agreement in which one company contracts-out a part of their existing internal activity to another company” [

4] (p. 68).

In recent years, outsourcing strategies have changed profoundly, moving from simple contracts to agreements that involve activities, sometimes entire functions, which in the past were considered inseparable from the organization [

5,

6,

7]. Recently, Gilley and Rasheed [

8] have argued that outsourcing is a highly strategic decision capable of generating knock-on effects across the entire organization.

Various factors have spurred the spread of outsourcing. Foremost has been the need to concentrate resources on the core business; also important, however, were the development of new information technologies, the increase in competition, which increasingly involves prices, and the fact that a large amount of production is of the “commodity” type. Other spurs have come from the popularity of a free-trade ideology in the economic field and, above all, the wider acceptance of value creation for shareholders as a priority objective of the firm.

Quinn and Hilmer [

9] have stated that the first step is to distinguish between two strategic processes: (1) concentrating the own resources on the distinct and inimitable core capacities that generate value for the customer; (2) entrusting to third parties the activities considered non-core and for which the company has no special competencies. The concept of core competence was introduced into the economic literature by Prahalad and Hamel in 1990 [

10], giving rise to many definitions with only slight variations. A firm’s core competence is a competitively valuable activity that a company performs better that its rivals [

11]. Core competencies drive the enterprise. The concept defines activities a firm should retain for competitive advantage. Companies can develop sustainable competitive advantages by focusing resources exclusively on the core competencies and the core business and by transferring those activities, processes, or even entire functions with fewer risks than others [

12]. Management should be able to choose which activities and processes or functions to outsource to third parties.

Various models have been proposed to provide a solution to the choice between insourcing and outsourcing, with the aim of identifying the criteria to adopt and thus the logic behind the choice. Venkatesan’s aim is

“to do just that, with a new method for making sourcing decisions consistent with a strategy of survival in highly engineered products. This approach is based on simple principles. Focus on those components that are critical to the product and that the company is distinctively good at making. Outsource components where suppliers have a distinct comparative advantage—greater scale, fundamentally lower cost structure, or stronger performances incentives. Use outsourcing as a means of generating employee commitment to improving manufacturing performance” [

13].

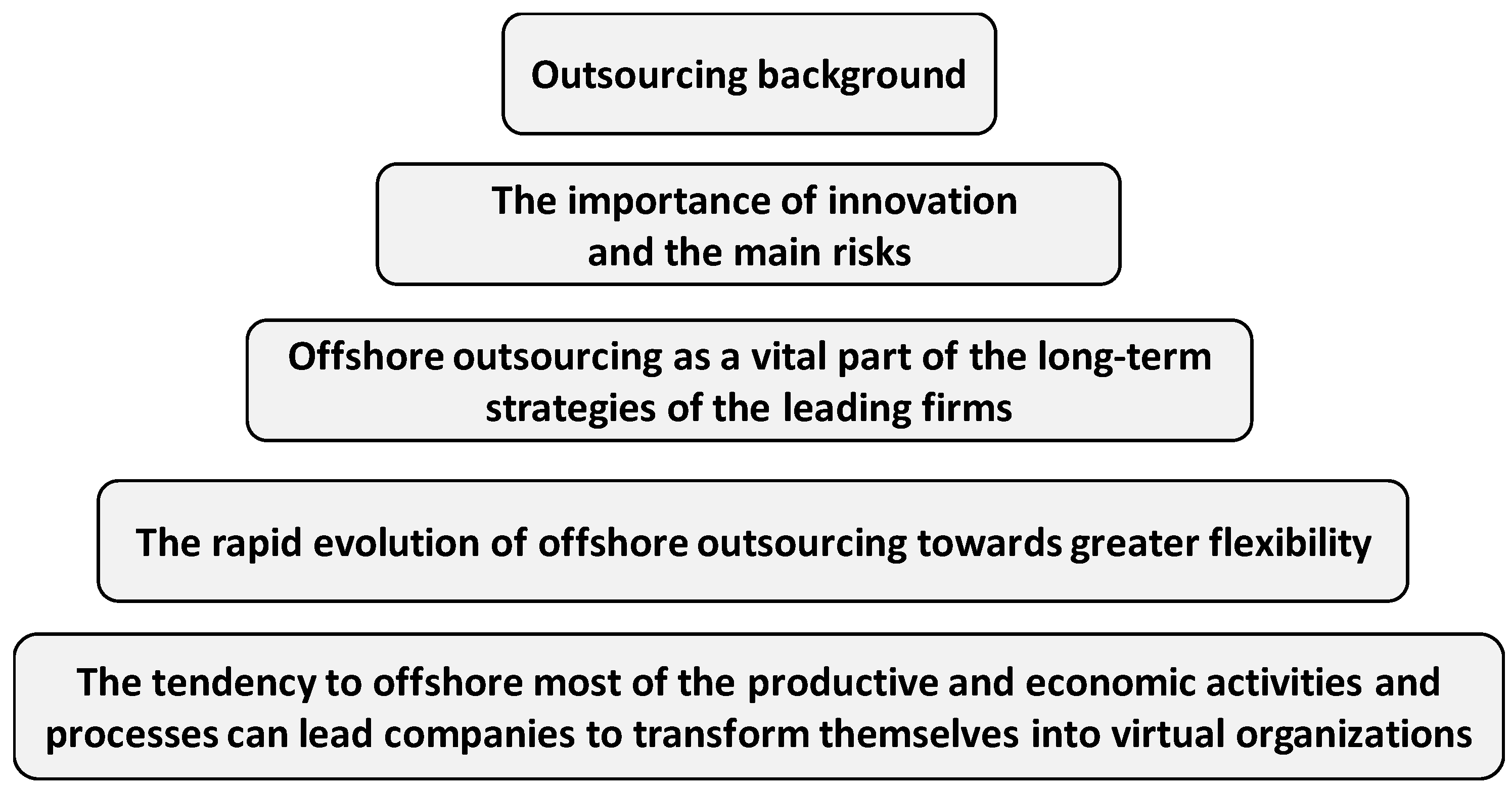

The main steps of the proposed analysis are illustrated in

Figure 1.

2. Outsourcing Background

The theme of outsourcing has been studied by many authors in management literature since the first definitions. It has been described

“as the practice followed by management of contracting out in-house functions that companies do not do particularly well to outside firms that do” [

14]. It refers to

“the practice of transferring activities traditionally done within a firm to third party providers within the country or ‘off-shore’” [

15] (p. 147). In this context,

“the first question that managers need to ask themselves is: which are the activities that their organization should outsource and which are those that it needs to conduct in-house” [

16] (p. 109).

The benefits of outsourcing in a strategic perspective could be summarized in the following [

9]:

To maximize the efficiency of internal resources by focusing on investments and engaging in core competencies;

To develop core competencies by building barriers to current or future competitors seeking to enter the areas of interest of the enterprise, thus protecting competitive advantages;

To use the investments of external firms, their innovations, their skills and their specializations, that could be kept in house with continuous investment and innovation;

To reduce the risks in rapidly changing markets with high technologies; an outsourcing strategy reduces the risks of technological upgrading and R&D costs by shortening production cycles and making the response to customer needs more flexible and quick.

Numerous researchers have argued that the most important step toward outsourcing is to define the core competencies of the firm and the values that are produced for the consumer [

9,

17,

18].

Jennings [

19] have identified some fundamental elements for a successful outsourcing strategy: (1) what are the objectives and what is their position in the overall strategy; (2) which activities to entrust to outsourcing; (3) the selection of suppliers; (4) contract negotiations; (5) the transference of activities and functions from the outsourcer to the supplier; (6) the choice of relationship to undertake with the supplier.

The decisions regarding the objectives that the firm intends to achieve through outsourcing and the activities to assign to outsourcing are the most important phases for an outsourcing strategy concern. The following actions are considered necessary [

19]: (1) define the long-term strategy for the function designated for outsourcing; (2) consider the impact outsourcing will have on the attainment of the “mission” and on the organization’s strategies, including costs, quality, flexibility; (3) consider the changes in the environment that require a change in strategy.

2.1. The Growing Importance of Outsourcing for Innovation

In the late 1990s, the push towards outsourcing had further support from the literature that tried to compare the evolution of the fundamental conceptions concerning decisions on the boundaries of enterprises: the “tactical” concept and the “strategic” one.

According to the “tactical” concept, the boundaries of the company’s strategies are cadenced by a short-term tactical programming. The decision criterion is based on cost reduction, which takes advantage of the economies of scale and scope that the supplier is able to achieve, obtaining outsourced services with greater efficiency. The economic boundaries cover only activities or processes that generate lower costs than would occur through outsourcing. In this case, the correct extension of the boundaries would be guaranteed by monitoring the make-or-buy choices.

The “strategic” content focuses on the capacity to compete with other firms. This perspective involves several key factors [

20,

21]: the allocation of resources to the core skills, the value chain activities and process analysis, and supplier and customer relations, in order to evaluate and produce sustainable and stable long-term competitive advantages [

22]. Many other researchers [

23,

24,

25] argued that following this approach would produce better results for the companies involved. The “strategic” view is considered a tool to manage uncertainty and is oriented towards the creation of value. Thanks to the “strategic” view, the company revises the corporate portfolio and allocates its main resources to the core competencies and the core businesses [

18,

26,

27], focusing its own resources on the markets and sectors it knows best and develops more efficiently [

9].

Brown and Wilson [

28] underlined that companies, in order to maintain the ability to compete, might constantly redefine themselves and the markets before the markets redefine businesses.

Identifying the core competencies means drawing a line between these and the non-core competencies [

17], which is the first step in defending companies against the erosion from competition and, above all, from changes in the economic, technological and legal environment.

It is rare for the boundaries of the core competencies to remain stable for long. Every important change in the outsourcing environment and market prompts outsourcers to ask what to outsource and how to do this with providers. The needs of customers are changing, there are more generic products, and more services have become factors for market differentiation. Most providers upgrade their production continuously and extend their range of services, becoming strong competitors not just in their market of origin.

At the same time, firms have historically invested in innovation and sustainable growth. The innovation process is described as a problem of search (how to find opportunities for innovation), selection (what to do and why), and implementation and capture (how to achieve results and benefits) [

29,

30]. Many researchers argue that innovation is one of the core activities of a firm’s competitive advantage [

31,

32,

33].

Recently, companies have recognized that good ideas can come from outside the organization, and a more open model, called ‘open innovation’, is emerging [

34]. Henry Chesbrough [

35] coined the term to describe innovation processes in which firms interact with the environment, leading to a significant amount of external knowledge exploration and exploitation [

35,

36]. In this way open innovation has been defined as

“the use of purposive inflows and outflows of knowledge to accelerate internal innovation, and expand the markets for external use of innovation, respectively” [

34] (p. 1). Chesbrough [

35] argued the company becomes more porous by redefining its borders with the environment. This implies that the firms can achieve and sustain innovation using a wide range of external actors and sources; a central part of the innovation process involves the search for new ideas that have commercial potential [

37,

38].

2.2. The Greatest Risks in Outsourcing Strategies

In dealing with the outsourcing background, it is appropriate to highlight the main risks in outsourcing strategy. Researchers highlight the numerous disadvantages in adopting a long-term outsourcing strategy, in particular in the following areas. (1) As far as labor is concerned, the unions are opposed to outsourcing in principle. They maintain that outsourcing is undertaken more to improve the firm’s profit and loss account than to improve productivity. Many studies suggest that this opposition from labor can be avoided or reduced by paying a particular attention to workers’ concerns regarding the consequences of restructuring following the decision to outsource; (2) Many firms have difficulty identifying the core competencies; (3) The specialized suppliers are often scarce or the selection phase is difficult; (4) There is also the risk of the loss of intellectual property. Not all firms think in the same way. Some hold that part of the risk can be eliminated by paying particular attention to the agreements with the suppliers and by clearly describing these in the contract [

9,

18,

39]. Bodine et al. [

40] have illustrated a risk matrix to support management in outsourcing decisions, identifying in particular the content-specific risks for the company.

Quinn and Hilmer [

9] suggest maintaining the critical activities, in particular in the innovation field, and transferring only the less important activities the firm can acquire from suppliers.

Carrying out an activity internally means exchanging know-how among several of the firm’s functions, which can give rise to or consolidate new ideas about products or processes. An excessive dependence on outside suppliers creates difficulties in generating know-how and spreading this among the various functions. Clark and Fujimoto [

41] agree with this risk, which the firm can avoid by maintaining close contact with its suppliers. A lot of this depends on the number of suppliers: if they are numerous, there is a substantial reduction in the possibility for an effective coordination.

We must remember that the responsibility to the final client regarding product or service performance always belongs to the outsourcer. Apart from the responsibility imposed by the law, rarely does a client perceive the quality of a product component as distinct from that of the overall product. Having said this, the loss of control over the supplier can be interpreted in two different ways. The first form of loss of control occurs when the supplier has information on the technologies, strategic choices or tactics of the outsourcer and uses this to its own advantage. A situation can develop in which one or more suppliers use this knowledge against the interests of the firm that has outsourced activities to them [

9,

12]. Contractual clauses are not enough to defend against this. Some firms maintain ownership of the equipment and production facilities the outsourcer uses. In cases of conflict, they can block the use of this equipment or shut down the entire production line.

The second form of loss of control arises when the supplier cannot provide the agreed upon quality or quantities; this situation emerges when there is no time left to take corrective measures. The risk involves the loss of market share, which is always difficult to regain. This risk is high when there is a lack of continual information on the supplier’s activities [

41]. Much more serious is the situation where the supplier deliberately does not respect the production specifications, uses materials dangerous to people’s health, or does not respect basic human rights. The risk of a loss in reputation is high when the supplier can, in turn, rely on a sub-supplier. Economic damage (free replacement of defective parts) is directly or indirectly associated with a loss in reputation. For example, Mattel removed millions of toys produced in China from the market. The paint on these toys contained high levels of lead. After a brief dispute, which hundreds of millions of consumers became aware of through media coverage, Mattel accepted responsibility for the problem. The paint used by the suppliers was the kind specified in the contracts [

28,

42,

43].

The expression “extended retail industry” has a particular meaning for the vertical integration of clothing and footwear firms. The products are manufactured all over the world, often in developing countries with low labor costs. Many of these countries have regulations that are lax or even non-existent regarding working conditions and human rights. Clothing and footwear manufacturers have recently started to realize that “fair” working conditions are an important component of “fair trade”. Reebok practices “ethical sourcing”, which is the application of a code of conduct based on the international recognition of human rights and working standards throughout the “supply chain”. This code was drafted in collaboration with Amnesty International [

44].

The risks we have mentioned are the most obvious ones, though not the only ones. A particular risk regards the internal capacities of the firm. The firm may lose crucial capacities for thinking up and developing new products. This is especially true for firms whose main competitive advantage lies in product innovation. These capacities are generally the result of experience and group work. Transferring these capacities and working groups to a supplier can represent a serious loss.

The risk is even greater if the supplier uses the acquired know-how and capacities to compete with the outsourcer. This is not necessarily fraudulent behavior. The supplier can gain an advantage from working for more than one outsourcer; it can grow and find its own niche. To reduce this risk, the firm must maintain control over product and process innovation, which provides a sustainable, long-term and unique competitive advantage; it should transfer only those activities that can be easily imitated [

28].

The “non-competition” clause in contracts is not enough to defend firms from this risk. The supplier could transfer the acquired know-how to the outsourcer’s competitor. One defense against this is to introduce contract clauses that require the “restitution” of information at the end of the project or when there is consensual rescission of the contract. However, this defense is not entirely effective, since the know-how becomes part of the patrimony of individuals and of the entire organization [

9,

18].

Another large risk from outsourcing concerns the workforce, which fears (often justifiably) the loss of jobs [

27,

28,

29,

30,

31,

32,

33,

34,

35,

36,

37,

38,

39,

40,

41,

42,

43,

44,

45]. Malhorta [

45] and Quinn [

27] warn that outsourcing can also lead to a worsening in the social climate within a firm, which in turn can cause a worsening in performance.

Other risks concern the supplier. In a constantly changing environment, the conditions that lay behind the decision to outsource often do not persist for long. The supplier can have a financial crisis; it can change its strategy and decide no longer to supply the agreed upon services; it can be engaged by another firm that is not interested in producing through outsourcing; the technology to produce the service can change and the supplier is not able or willing to acquire the new technology. These risks can be mitigated if there are several competing suppliers and if the revision or rescission of the contract is not burdensome [

42].

3. Offshore Outsourcing as a Vital Part of the Long-Term Strategies of the Leading Firms

Before the late 1990s, offshoring was rarely considered in the long-term plans of companies; since the beginning of 2000, however, it has been the center of strategic planning for almost every business. The large companies outsource existing business processes internationally to reduce costs and achieve greater efficiency [

46,

47,

48].

Offshoring allows firms to extend their business boundaries and acquire skills from other countries [

49,

50].

Various definitions of offshoring have been given by academics, policy analysts, and the press in the economic field [

51,

52,

53]. Offshoring is introduced as

“an organizational reconfiguration in which originally co-located activities are relocated across distances in captive or outsourced arrangements, which must subsequently be reintegrated” [

54] (p. 1515).

“Offshoring connotes sourcing products or services from either a foreign-based supplier that is independent of the domestic firm (outsourced operation) or a foreign-based subsidiary of the firm whose home country is where the headquarter is located (captive operation)” [

55] (p. 443).

Recent theoretical research exclusively focuses on internationally outsourced activities (offshore outsourcing) [

17,

55,

56]. Offshore outsourcing exists when the entrustment of activities occurs in another continent or country at a great distance from the outsourcer. Forrester Research considers offshoring as production occurring at a distance of more than 500 miles from the final assembly site [

57].

The structure of international trade and investment has changed dramatically beginning in the second half of the 1980s [

58,

59,

60,

61].

Offshoring has evolved rapidly since the financial crisis of 2008–2009. Although the main phases of offshoring projects have not changed in recent years, the context of this evolution and the conditions affecting its implementation have changed considerably. Management has had to continually modify the boundaries of the core competencies and search for maximum flexibility due to the quickened pace of change during the first half of the 2010s. An additional consequence is the more vital role offshore outsourcing has come to play in the long-term strategies of key firms.

To be effective, the offshoring project must start by identifying the reasons for outsourcing. At the beginning, outsourcers sought to lower production costs. Companies have recently sought greater flexibility to reduce risk and gain access to world-class capabilities. The second step of the project identifies the functions or the processes to outsource, which means identifying the company’s core and non-core activities in a context of relentless change. To defend and improve profitability and market differentiation, non-core activities should be outsourced. Outsourcing allows companies to focus more on core competencies, which are those activities management does best and which create the most value. But the dividing line between core and non-core activities and the boundaries among core competencies are more and more difficult to identify and defend, since boundaries are shifting relentlessly in a fast-changing environment.

Large companies have been the main promoters of offshore outsourcing in order to lower costs, labor ones in particular. Due to the heightened price competition in Western markets, management has had no choice but to look for the most effective cost-control measures, thus making offshore outsourcing an inevitable choice. A growing number of firms have shifted some or even all of their production abroad, with design, R&D and marketing the only activities remaining in the home country. Examples of this are Dell Computer, Gap, and many Italian apparel firms. In fact, some manufacturers today do not produce anything in their home countries, which only serve for the management of their Global Value Chain (GVC).

The reasons behind the move to offshore outsourcing have evolved from cost savings to greater market flexibility, from lowering the time to market to acquiring world-class capabilities, from allowing companies to focus more on strategic issues to enabling them to reduce risk.

4. The Rapid Evolution of Offshore Outsourcing towards Greater Flexibility

As D’Aveni stated decades ago, constantly evolving technology, new waves of globalization, and relentless strategic positioning by lead firms will result in frequent or almost constant disequilibrium in which new entrants and established competitors disrupt the balance of power and gain temporary superiority [

62].

For companies, flexibility is more important than ever, as relationships with suppliers are managed through networked organizations and multinational global supply chains. An important reason for lead firms to establish a global supply chain is the flexibility it provides, allowing as it does for rapid adjustments to changes in market demand and, to a greater extent, a shift in the risk to supplier firms from possible declines in demand and excessive inventory. The supply chain must be flexible to respond to change faster than competitors can. Flexibility is the key to competitiveness, regardless of whether the company is asset-intensive, has a high material cost content, or is distribution-dependent.

In many industries, only companies that are globally competitive can aspire to attain sustainable competitive advantages over rivals. Rapidly shifting marketplace conditions have made offshoring a vital part of any search for sustainable competitive advantage, and consequently for global strategies to lead the way to new business models, on the one hand by reducing costs, and therefore improving profitability, and on the other by reducing the investment needs of outsourcers, thereby increasing shareholder value.

In the last twenty-five years, the intensity of price competition in Western domestic markets has increased, prompting more and more companies to look for any way to lower costs. Many firms have looked offshore for their manufacturing and service needs, often keeping at the center of their organization design, R&D and marketing. For this reason, and under the pressure of technological and political change and global excess capacities, offshoring has gradually become an integral part of a broader business strategy.

Lowering costs and having access to new skills is the first motive for offshoring; however, a policy that prioritizes strategic factors such as increased flexibility, finding an engine for innovation, gaining access to global markets, and inducing changes in the organization has gained hold. In many industries, only companies that are globally competitive can hope to achieve sustainable competitive advantages over their rivals.

There has been a dramatic change in offshore outsourcing decisions by management in recent years due to the increased complexity and disturbances from the new waves of globalization and the inexorable advance of technological changes.

Although globalization has led to progress for emerging countries as well as for developed ones, by nature it is also destabilizing. The “new waves of globalization” can be defined as sudden changes in the extent to which production is internalized and in the range of offshore transactions that have recently taken place. International trade and investment activities dramatically changed after the outbreak of the financial crisis in 2008, leading many companies in the industrialized world that had shifted their focus abroad for manufacturing and services and invested at home in core competencies to reconsider their offshoring strategies.

Technological progress in the last two decades has strongly impacted offshoring decisions and implementation. As novel methods continue to overturn conventional practices, supply chains are being challenged and companies are forced to overhaul the existing supplier networks. In addition, new market segments may open up to competitors, who are often cash rich and in search of new investments (for example, Apple and Google), from sectors far removed from those the firms had to deal with in the past. These changes have led to the re-emergence of reshoring and to frequent power shifts among firms in the supply chain. Most significantly, there now exists an “unbeatable” uncertainty that can be dealt with only through increased flexibility in the design and management of the supply chain.

Production has become increasingly complex due to technological innovation [

63], with companies now trying to manage complexity by outsourcing. The progressive industrialization of some emerging countries, such as China and India, has led to new forms of outsourcing—entrusting to third parties entire production functions—and many companies are increasingly at the center of choices on how to achieve sustainable advantage. The creation of firms able to sign contracts for the provision of outsourcing services on a global scale has changed the object of outsourcing. Currently, they compete in the areas of innovation, value added, and the analysis of consumer demand for goods and services [

64,

65]. In this context, the best companies in emerging countries seek their own competitive advantages [

66] by taking the following actions: paying adequate attention to quality and design, building a solid “brand image”, reacting before other companies to new market trends, acquiring Western companies to use patents, brands and know-how, maintaining an advantage over rivals in Information Technology, choosing the best market niches, and adopting unconventional marketing strategies. Some of these companies can compete with Western companies with a long tradition.

For these reasons, offshore outsourcing is transforming the functions of traditional firms into a network of competencies. It has also spread to new fields, from customer service to research and development, in the search for new business models, even in the area of health care services. The pharmaceutical industry has witnessed the great evolution of outsourcing towards new areas [

67].

However, there are strong concerns among policy makers in the most advanced countries regarding the continuous bleeding of jobs. The weapon of protectionism could become ineffective since, in a global economy, prohibiting the use of outsourcing would make the domestic companies less competitive. The only effective defense is to focus and invest in innovation which, by requiring large investments in training and often large amounts of capital, is normally precluded by low-cost and low-tech companies.

5. Conclusions

Many authors hold that the difficulty for many companies in giving the global value chain the necessary flexibility in a short period of time depends on the desire to solve new, largely unexplored problems using old instruments. Managers need more practical tools to understand the challenges ahead. Many of the instruments used by companies in the 1980s and ‘90s to build and sustain their strategies—e.g., Porter’s Five Forces, Hamel and Prahalad’s core competencies concept—have become weakened, worn out, rendered incapable of adapting to the relentlessly changing environment.

“The increasing trend towards globalization and outsourcing is, in fact, leading many industrial sectors to entrust relevant parts of their business to suppliers often located in developing countries” [

68].

Management is now confronted with a higher level of complexity and disruptions brought about in particular by the new waves of globalization and the irresistible march of technological changes.

Offshore outsourcing is changing the geography of business functions. Companies are moving towards new organizational structures such as “networks”, which are also defined as holonic networks, which broaden and continually shift the perimeter of the economic activities, thereby generating many difficulties in determining the boundaries of such activities [

69,

70].

The typical structure of a networked firm involves a group of companies linked by outsourcing or offshoring contracts, which allow them to be autonomous while at the same time to cooperate and coordinate operations through the network, which makes them similar to a single economic enterprise [

70,

71]. These companies are also called holonic:

“An holonic organization is a group of autonomous operational units that act in an integrated and organic manner within a system of holonic networks in order each time to best organize themselves as a chain of value that is most suited to take advantage of the business opportunities presented by the market” [

72] (p.17). A holon can be thought as an entity that is part of a vaster whole.

“Within the holonic networks the holons maintain their autonomy and their whole/part relationship, which together characterize holarchies” [

73] (p. 5).

As Wang and Chang [

74] argue that future business competition would be probably between supply chain networks, rather than between companies [

75,

76] and this can lead to the evolution of virtual organizations.

A virtual organization is defined as

“a collection of geographically distributed, functionally and/ or culturally diverse entities that are linked by electronic forms of communication and rely on lateral, dynamic relationships for coordination” [

77] (p. 695).

Referring to firms, [

78] (p. 642) defined a virtual enterprise as a

“production system with mainly independent enterprises as single elements, which can be dynamically insourced or outsourced depending on the market demands”.

“The recent proliferation of cloud-based technologies will further boost

“virtualization” of firms. The progression of the corporation from a national to a multinational entity will evolve to the next generation, possibly into a seamless web of best-sourced people and processes around the globe bound together by a common vision and mission and managed through collaborative tools leading to a plethora of innovations” [

39] (p. 165).

The tendency of companies to offshore most of their productive and economic activities and processes can transform them into virtual organizations, where all the functions could be outsourced through the formation of flexible networks and agile organizational structures and this transformation could act positively pushing the company towards open innovation [

79].

6. Limitations and Research Directions for the Future Research

The proposed themes in this study have been analyzed from the theoretical point of view and giving importance to the main changes that have shaken the global markets. Future research could further analyze the aspects of outsourcing that can lead firms to transform themselves into networks and virtual organizations.