Determinants of Enterprises Radical Innovation and Performance: Insights into Strategic Orientation of Cultural and Creative Enterprises

Abstract

1. Introduction

2. Literature Review

2.1. Strategic Orientations and Radical Innovation

2.2. Radical Innovation and Firms Competitive Advantage and Performance

2.3. Competitive Advantage and Firm Performance

3. Research Methodology

3.1. Industrial Background, Sampling, and Survey

3.2. Data Analysis Methods and Data Background

4. Data Analysis

4.1. Factor Analysis, Reliability, Discriminant Validity, and CMV Test

4.2. Regression Models

4.3. Second-Order PLS SEM Analysis of the Concept Model

5. Discussion and Conclusions

5.1. Discussion of Study Findings

5.2. Management Implications and Theory Contributions

5.3. Limitation and Future Research

Acknowledgments

Conflicts of Interest

Appendix A. Questionnaire Development in This Study

- Cuo1: Competitive advantage of our firm is based on understanding customer need.

- Cuo2: Our firm measures customer satisfaction systematically and frequently.

- Cuo3: Our firm pays close attention to after sales service.

- Cuo4: Our firm constantly monitors the level of commitment and orientation to serving customer needs.

- Cmo1: Our firm responds rapidly to competitors’ actions.

- Cmo2: Our top management regularly discusses competitors’ strengths, weaknesses, and strategies.

- Cmo3: Customers are targeted when our firm has an opportunity for a competitive advantage.

- Inc1: All of our managers understand how everyone in our business can contribute to creating customer value.

- Inc2: Our firm emphasizes functional integration in strategy.

- Inc3: Information about customers is freely communicated throughout our organization.

- Inc4: Business functions within are integrated to serve the target market need.

- CoA1: Our firm tries hard to take market share from competitors.

- CoA2: Our firm typically adopts a very competitive “undo-the-competitors” posture.

- CoA3: Our firm is very aggressive and intensely competitive.

- RiT1: In our firm, many people want to take risks.

- RiT2: Our firm prefers high risk projects with a high return.

- RiT3: Our firm thinks that bold and wide-ranging acts are needed to achieve our goals.

- RiT4: Our firm adopts risk taking decisions when facing uncertainty.

- Pro1: Our firm tries out marketing, fundraising programs, and new opportunity continuously.

- Pro2: Our firm intends to get into markets before our competitors.

- Pro3: Our firm does things which our competitors then respond to.

- Pro4: Our firm is typically ahead of the competition in presenting new products or procedures.

- RaI1: Compared with competitors, our firm introduces new products that are more radically new to the market (e.g., adopting new technology).

- RaI2: Compared with competitors, our firm introduces new products that offer more radical features (e.g., adopting new design or new elements).

- RaI3: Compared with competitors, our firm introduces new products that require radically changes in the customer’s way of using them.

- PrA1: Our products offer unique features/attributes to customers than competing products.

- PrA2: Our products are superior to competing products.

- PrA3: Our products are superior in technical performance than competing products.

- PrA4: Our products offer benefits (specific features and styles) that are not found in competing products.

- PrA5: Our products are of higher quality than competing products.

- BrA1: Our firm has a strong reputation than competitors.

- BrA2: Compared with competitors, our firm reaches the desired brand image in the market.

- BrA3: Our firm has built a strong customer brand loyalty than competitors.

- BP1: Compared with competitors, our firm has achieved high sales goal.

- BP2: Compared with competitors, our firm has achieved high satisfaction on profit goal.

- BP3: Our firm has achieved higher profit than competitors.

- BP4: Our firm has achieved better sales than competitors.

References

- Porter, M. Competitive Advantage of Nations: Creating and Sustaining Superior Performance; Free Press Edition: New York, NY, USA, 2011. [Google Scholar]

- Hill, C.W.L.; Schilling, M.A.; Jones, G.R. Strategic Management: An Integrated Approach: Theory & Cases; Cengage Learning: Boston, MA, USA, 2016. [Google Scholar]

- Nayyar, P.R. Information asymmetries: A source of competitive advantage for diversified service firms. Strateg. Manag. J. 1990, 11, 513–519. [Google Scholar] [CrossRef]

- Bharadwaj, S.G.; Varadarajan, P.R.; Fahy, J. Sustainable competitive advantage in service industries: A conceptual model and research propositions. J. Mark. 1993, 57, 83–99. [Google Scholar] [CrossRef]

- Shih, T.Y. The determinate effects of competences and decision process factors on firms internationalization. Serv. Ind. J. 2010, 30, 2329–2350. [Google Scholar] [CrossRef]

- Barney, J.B. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Saranga, H.; George, R.; Beine, J.; Arnold, U. Resource configurations, product development capability, and competitive advantage: An empirical analysis of their evolution. J. Bus. Res. 2018, 85, 32–50. [Google Scholar] [CrossRef]

- Salavou, H.; Lioukas, S. Radical product innovations in SMEs: The dominance of entrepreneurial orientation. Creat. Innov. Manag. 2003, 12, 94–108. [Google Scholar] [CrossRef]

- Chang, W.; Franke, G.R.; Butler, T.D.; Musgrove, C.F.; Ellinger, A.E. Differential mediating effects of radical and incremental innovation on market orientation-performance relationship: A Meta-Analysis. J. Mark. Theory Pract. 2014, 22, 235–250. [Google Scholar] [CrossRef]

- Slater, S.F.; Mohr, J.J.; Sengupta, S. Radical product innovation capability: Literature review, synthesis, and illustrative research propositions. J. Prod. Innov. Manag. 2014, 31, 552–566. [Google Scholar] [CrossRef]

- Chen, C.K.; Reyes, L. A quality management approach to guide the executive management team through the product/service innovation process. Total Qual. Manag. Bus. 2017, 28, 1003–1022. [Google Scholar] [CrossRef]

- Lin, L.H. Process and product innovation in virtual organisations: An investigation of Taiwanese information firms. Total Qual. Manag. Bus. 2012, 23, 1061–1072. [Google Scholar] [CrossRef]

- Seo, Y.W.; Kim, Y.S.; Kim, D.; Yu, Y.M.; Lee, S.H. Innovation patterns of manufacturing and service firms in Korea. Total Qual. Manag. Bus. 2016, 27, 718–734. [Google Scholar] [CrossRef]

- Story, V.; O’Malley, L.; Hart, S.; Saker, J. The development of relationships and networks for successful radical innovation. J. Consum. Behav. 2008, 7, 187–200. [Google Scholar] [CrossRef]

- Zhang, H.; Ko, E.; Lee, E. Moderating effects of nationality and product category on the relationship between innovation and customer equity in Korea and China. J. Prod. Innov. Manag. 2013, 30, 110–122. [Google Scholar] [CrossRef]

- Gehani, R.R. Corporate brand value shifting from identity to innovation capability: From Coca-Cola to Apple. J. Technol. Manag. Innov. 2016, 11, 11–20. [Google Scholar] [CrossRef]

- Xin, J.Y.; Yeung, A.C.; Cheng, T.C.E. Radical innovations in new product development and their financial performance implications: An event study of US manufacturing firms. Oper. Manag. Res. 2008, 1, 119–128. [Google Scholar] [CrossRef]

- Naidoo, V. Firm survival through a crisis: The Influence of market orientation, marketing innovation and business strategy. Ind. Mark. Manag. 2010, 39, 1311–1320. [Google Scholar] [CrossRef]

- Wu, Y.C.; Lin, B.W.; Chen, C.J. How do internal openness and external openness affect innovation capabilities and firm performance? IEEE Trans. Eng. Manag. 2013, 60, 704–716. [Google Scholar] [CrossRef]

- Lassen, A.H.; Gertsen, F.; Riis, J.O. The nexus of corporate entrepreneurship and radical innovation. Creat. Innov. Manag. 2006, 15, 359–372. [Google Scholar] [CrossRef]

- Tellis, G.J.; Prabhu, J.C.; Chandy, R.K. Radical innovation across nations: The preeminence of corporate culture. J. Mark. 2009, 73, 3–23. [Google Scholar] [CrossRef]

- Yu, L. Measuring the culture of innovation. MIT Sloan Manag. Rev. 2007, 48, 7. [Google Scholar]

- Chang, C.H. The Influence of corporate environmental ethics on competitive advantage: The mediation role of green innovation. J. Bus. Ethics 2011, 104, 361–370. [Google Scholar] [CrossRef]

- DCMS. Creative Industries Mapping Document; Department for Culture, Media and Sport: London, UK, 1998.

- Caves, R.E. Creative Industries: Contracts between Art and Commerce (No. 20); Harvard University Press: Cambridge, MA, USA, 2000. [Google Scholar]

- Hesmondhalgh, D. The Cultural Industries; Sage Publications Ltd.: Thousand Oaks, CA, USA, 2013. [Google Scholar]

- Ministry of Culture. Development Law of Cultural and Creative Industries. Ministry of Culture: Taiwan, 2000. Available online: http://law.moc.gov.tw/law/NewsContent.aspx?id=14 (accessed on 21 February 2018).

- Chou, C. Organizational Orientations, Industrial Category, and Responsible Innovation. Sustainability 2018, 10, 1033. [Google Scholar] [CrossRef]

- Laukkanen, T.; Nagy, G.; Hirvonen, S.; Reijonen, H.; Pasanen, M. The effect of strategic orientations on business performance in SMEs: A multigroup analysis comparing Hungary and Finland. Int. Mark. Rev. 2013, 30, 510–535. [Google Scholar] [CrossRef]

- Kohli, A.K.; Jaworski, B.J. Market orientation: The construct, research propositions, and managerial implications. J. Mark. 1990, 54, 1–18. [Google Scholar] [CrossRef]

- Guo, C.; Wang, Y. How manufacturer market orientation influences b2b customer satisfaction and retention: Empirical investigation of the three market orientation components. J. Bus. Ind. Mark. 2015, 30, 182–193. [Google Scholar] [CrossRef]

- Tse, A.C.; Sin, L.Y.; Yau, O.H.; Lee, J.S.; Chow, R. A Firm’s role in the marketplace and the relative importance of market orientation and relationship marketing orientation. Eur. J. Mark. 2004, 38, 1158–1172. [Google Scholar] [CrossRef]

- Day, G.S.; Nedungadi, P. Managerial Representations of competitive advantage. J. Mark. 1994, 58, 31–44. [Google Scholar] [CrossRef]

- Huang, S.K.; Wang, Y.L. Entrepreneurial orientation, learning orientation, and innovationin small and medium enterprises. Procedia Soc. Behav. Sci. 2011, 24, 563–570. [Google Scholar] [CrossRef]

- Zhang, J.; Duan, Y. Empirical study on the impact of market orientation and innovation orientation on new product performance of Chinese manufacturers. Nankai Bus. Rev. Int. 2010, 1, 214–231. [Google Scholar] [CrossRef]

- Miller, D.; Friesen, P.H. Innovation in conservative and entrepreneurial firms: Two models of strategic momentum. Strateg. Manag. J. 1982, 3, 1–25. [Google Scholar] [CrossRef]

- Cho, Y.S.; Jung, J.Y. The relationship between metacognition, entrepreneurial orientation, and firm performance: An empirical investigation. Acad. Entrepreneurship J. 2014, 20, 71. [Google Scholar]

- Lee, S.M.; Lim, S. Entrepreneurial orientation and the performance of service business. Serv. Bus. 2009, 3, 1–13. [Google Scholar] [CrossRef]

- Hakala, H.; Kohtamäki, M. Configurations of entrepreneurial-customer-and technology orientation: Differences in learning and performance of software companies. Int. J. Entrepreneurial Behav. Res. 2011, 17, 64–81. [Google Scholar] [CrossRef]

- Giraud Voss, Z.; Voss, G.B.; Moorman, C. An empirical examination of the complex relationships between entrepreneurial orientation and stakeholder support. Eur. J. Mark. 2005, 39, 1132–1150. [Google Scholar] [CrossRef]

- Li, C.R.; Lin, C.J.; Chu, C.P. The nature of market orientation and the ambidexterity of innovations. Manag. Decis. 2008, 46, 1002–1026. [Google Scholar] [CrossRef]

- Cai, L.; Liu, Q.; Zhu, X.; Deng, S. Market orientation and technological innovation: The moderating role of entrepreneurial support policies. Int. Entrepreneurship Manag. J. 2015, 11, 645–671. [Google Scholar] [CrossRef]

- Serna, M.D.C.M.; Guzman, G.M.; Castro, S.Y.P. The relationship between market orientation and innovation in Mexican manufacturing SME’s. Adv. Manag. Appl. Econ. 2013, 3, 125–137. [Google Scholar]

- Gatigono, H.; Xuereb, J.M. Strategic orientation of the firm and new product performance. J. Mark. Res. 1997, 34, 77–90. [Google Scholar] [CrossRef]

- Zhai, Y.M.; Sun, W.Q.; Tsai, S.B.; Wang, Z.; Zhao, Y.; Chen, Q. An empirical study on entrepreneurial orientation, absorptive capacity, and SMEs’ innovation performance: A sustainable perspective. Sustainability 2018, 10, 314. [Google Scholar] [CrossRef]

- Rodriguez, C.M.; Wise, J.A.; Martinez, C.R. Strategic capabilities in exporting: An examination of the performance of Mexican firms. Manag. Decis. 2013, 51, 1643–1663. [Google Scholar] [CrossRef]

- Dewar, R.D.; Dutton, J. The adoption of radical and incremental innovations: An empirical analysis. Manag. Sci. 1986, 32, 1422–1433. [Google Scholar] [CrossRef]

- Chandy, R.; Tellis, G. Organizing for Radical product innovation: The overlooked role of willingness to cannibalize. J. Mark. Res. 1998, 35, 474–487. [Google Scholar] [CrossRef]

- Song, M.; Thieme, J. The role of suppliers in market intelligence gathering for radical and incremental innovation. J. Prod. Innov. Manag. 2009, 26, 43–57. [Google Scholar] [CrossRef]

- Govindarajan, V.; Kopalle, P.K.; Danneels, E. The effects of mainstream and emerging customer orientations on radical and disruptive innovations. J. Prod. Innov. Manag. 2011, 28, 121–132. [Google Scholar] [CrossRef]

- OECD. Radical and Incremental Innovation. The Innovation Policy Platform 2013. Available online: https://www.innovationpolicyplatform.org/content/radical-and-incremental-innovation (accessed on 20 February 2018).

- Schumpeter, J. Capitalism, Socialism, and Democracy; Harper: New York, NY, USA, 1942. [Google Scholar]

- Song, X.M.; Montoya-Weiss, M.M. Critical development activities for really new versus incremental products. J. Prod. Innov. Manag. 1998, 15, 124–135. [Google Scholar] [CrossRef]

- Hurley, R.F.; Hult, T.M. Innovation, market orientation, and organizational learning: An integration and empirical examination. J. Mark. 1998, 62, 42–54. [Google Scholar] [CrossRef]

- Tangkit, K.; Panjakajornsak, V. The radical innovation affecting competitive advantage of the Thai furniture industry. In Proceedings of the Management and Innovation Technology International Conference (MITicon 2016), Chonburi, Thailand, 12–14 October 2016; pp. MIT-204–MIT-208. [Google Scholar]

- Buisson, B.; Daidj, N. Explaining successful radical innovations with effectuation. In Proceedings of the XXVIe Conférence Internationale de Management Stratégique, Lyon, France, 7–9 June 2017; pp. 1–24. [Google Scholar]

- McDermott, C.M.; O’Connor, G.C. Managing radical innovation: An overview of emergent strategy issues. J. Prod. Innov. Manag. 2002, 19, 424–438. [Google Scholar] [CrossRef]

- Lengler, J.F.B.; Jimenez, D.J.; Pontifícia, M.G.P.; Cegarra-Navarro, J.G.; Sampaio, C.H. Learning orientation and radical innovation as antecedents of business performance. In Cultural Perspectives in a Global Marketplace; Springer: Cham, Switzerland, 2015; pp. 15–16. [Google Scholar]

- Rosenbusch, N.; Brinckmann, J.; Bausch, A. Is innovation always beneficial? A meta-analysis of the relationship between innovation and performance in SMEs. J. Bus. Ventur. 2011, 26, 441–457. [Google Scholar] [CrossRef]

- Boso, N.; Story, V.M.; Cadogan, J.W.; Annan, J.; Kadić-Maglajlić, S.; Micevski, M. Enhancing the sales benefits of radical product innovativeness in internationalizing small and medium-sized enterprises. J. Bus. Res. 2016, 69, 5040–5045. [Google Scholar] [CrossRef]

- Cheng, C.C.; Shiu, E.C. The inconvenient truth of the relationship between open innovation activities and innovation performance. Manag. Decis. 2015, 53, 625–647. [Google Scholar] [CrossRef]

- Chiao, Y.C.; Yang, K.P.; Yu, C.M.J. Performance, internationalisation, and firm-specific advantages of SMEs in a newly-industrialized economy. Small Bus. Econ. 2006, 26, 475–492. [Google Scholar] [CrossRef]

- Powell, T.C.; Dent-Micallef, A. Information technology as competitive advantage: The role of human, business, and technology resources. Strateg. Manag. J. 1997, 18, 375–405. [Google Scholar] [CrossRef]

- Shih, T.Y. An empirical study of food and beverage chains’ internationalisation: Advancing intangible resource theory and research. Eur. J. Int. Manag. 2017, 11, 660–687. [Google Scholar] [CrossRef]

- Lau, A.K.; Yam, R.C.; Tang, E.P. Supply chain product co-development, product modularity and product performance: Empirical evidence from Hong Kong manufacturers. Ind. Manag. Data. Syst. 2007, 107, 1036–1065. [Google Scholar] [CrossRef]

- Kim, N.; Shin, S.; Min, S. Strategic marketing capability: Mobilizing technological resources for new product advantage. J. Bus. Res. 2016, 69, 5644–5652. [Google Scholar] [CrossRef]

- Almor, T.; Hashai, N.; Hirsch, S. The product cycle revisited: Knowledge intensity and firm internationalization. Manag. Int. Rev. 2006, 46, 507–528. [Google Scholar] [CrossRef]

- Li, T.; Calantone, R.J. The impact of market knowledge competence on new product advantage: Conceptualization and empirical examination. J. Mark. 1998, 13–29. [Google Scholar] [CrossRef]

- Wah, S.S.; Meng, M.T.C. The effects of agency costs among interfirm alliances: A study of Singapore small- and medium-sized enterprises (SMEs) in China. Int. J. Manag. 2011, 28, 379–390. [Google Scholar]

- Hua, S.Y.; Wemmerlöv, U. Product change intensity, product advantage, and market performance: An empirical investigation of the PC industry. J. Prod. Innov. Manag. 2006, 23, 316–329. [Google Scholar] [CrossRef]

- Doyle, P. Building successful brands: The strategic options. J. Consum. Mark. 1990, 7, 5–20. [Google Scholar] [CrossRef]

- Lee, J.; Nguyen, M.J. Product attributes and preference for foreign brands among Vietnamese consumers. J. Retail. Consum. Serv. 2017, 35, 76–83. [Google Scholar] [CrossRef]

- Lee, Y.K.; Park, J.W. Impact of a sustainable brand on improving business performance of airport enterprises: The case of Incheon International Airport. J. Air Transp. Manag. 2016, 53, 46–53. [Google Scholar] [CrossRef]

- Kam-Sing Wong, S. The Influence of green product competitiveness on the success of green product innovation: Empirical evidence from the Chinese electrical and electronics industry. Eur. J. Innov. Manag. 2012, 15, 468–490. [Google Scholar] [CrossRef]

- Su, Y.M. Analysis of the Pricing Strategy of Cultural Commodities. Taiwan Cultural Creative Industries, Ministry of Culture. Available online: http://cci.culture.tw/cht/index.php?code=list&flag=detail&ids=57&article_id=13793 (accessed on 5 July 2017).

- Shih, T.Y.; Liu, Z.A. Wrong Gallery—A new paradigm for art space. J. Cases Inform. Technol. 2016, 18, 13–29. [Google Scholar] [CrossRef]

- Chin, W.W.; Newsted, P.R. Structural equation modeling analysis with small samples using partial least squares. In Statistical Strategies for Small Sample Research; Hoyle, R., Ed.; Sage Publications: Thousand Oaks, CA, USA, 1999; pp. 307–341. [Google Scholar]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; L. Erlbaum Associates: Hillside, NJ, USA, 1998. [Google Scholar]

- Chin, W.W. Issues and opinion on structural equation modeling. Manag. Inform. Syst. Q. 1998, 22, 7–16. [Google Scholar]

- Goldschmidt, P.; Tan, C. A Model for the Adoption of Agent Technology. Available online: https://www.researchgate.net/profile/Peter_Goldschmidt/publication/229037081_A_model_for_the_adoption_of_agent_technology/links/0046351a3fb95de4ae000000.pdf (accessed on 3 June 2018).

- Henseler, J.; Ringle, C.M.; Sinkovics, R.R. The use of partial least squares path modeling in international marketing. In New Challenges to International Marketing; Emerald Group Publishing Limited: Bingley, UK, 2009; pp. 277–319. [Google Scholar]

- Barclay, D.W.; Higgins, C.A.; Thompson, R. The partial least squares approach to causal modeling: Personal computer adoption and use as illustration. Technol. Stud. 1995, 2, 285–309. [Google Scholar]

- Yoo, Y.; Alavi, M. Media and group cohesion: Relative influences on social presence, task participation, and group consensus. MIS Q. 2001, 371–390. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Organ, D.W. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Teo, H.H.; Oh, L.B.; Liu, C.; Wei, K.K. An empirical study of the effects of interactivity on web user attitude. Int. J. Hum. Comput. Stud. 2003, 58, 281–305. [Google Scholar] [CrossRef]

- Grapentine, T. Managing multicollinearity. Mark. Res. 1997, 9, 10. [Google Scholar]

- Fornell, C.; Cha, J. Partial least squares. In Advanced Methods of Marketing Research; Bagozzi, R.P., Ed.; Blackwell Publishers: Oxford, UK, 1994. [Google Scholar]

- Reid, S.E.; Roberts, D.; Moore, K. Technology vision for radical innovation and its impact on early success. J. Prod. Innov. Manag. 2015, 32, 593–609. [Google Scholar] [CrossRef]

- Carmeli, A.; Tishler, A. The relationships between intangible organizational elements and organizational performance. Strateg. Manag. J. 2004, 25, 1257–1278. [Google Scholar] [CrossRef]

- Zhang, Y.; Na, S.; Niu, J.; Jiang, B. The Influencing factors, regional difference and temporal variation of industrial technology innovation: Evidence with the FOA-GRNN model. Sustainability 2018, 10, 187. [Google Scholar] [CrossRef]

| Factor Names and Question Items | Factor Loadings (t Values) | AVE | Cronbach α | Composite Reliability | Communality | R2 | Redundancy |

|---|---|---|---|---|---|---|---|

| Customer orientation (Cuo) | |||||||

| Cuo1 | 0.690 (6.99) | 0.54 | 0.72 | 0.82 | 0.54 | 0.69 | 0.37 |

| Cuo2 | 0.750 (14.56) | ||||||

| Cuo3 | 0.710 (9.04) | ||||||

| Cuo4 | 0.803 (15.86) | ||||||

| Competitor orientation (Cmo) | |||||||

| Cmo1 | 0.847 (20.99) | 0.69 | 0.78 | 0.87 | 0.69 | 0.60 | 0.41 |

| Cmo2 | 0.804 (11.27) | ||||||

| Cmo3 | 0.852 (30.59) | ||||||

| Inter-functional coordination (InC) | |||||||

| InC1 | 0.826 (18.18) | 0.72 | 0.87 | 0.91 | 0.72 | 0.73 | 0.53 |

| InC2 | 0.867 (29.09) | ||||||

| InC3 | 0.859 (22.33) | ||||||

| InC4 | 0.854 (20.44) | ||||||

| Competitive aggressiveness (CoA) | |||||||

| CoA1 | 0.884 (30.90) | 0.68 | 0.77 | 0.82 | 0.68 | 0.79 | 0.54 |

| CoA2 | 0.839 (26.90) | ||||||

| CoA3 | 0.761 (12.98) | ||||||

| Risk taking (RiT) | |||||||

| RiT1 | 0.805 (9.03) | 0.65 | 0.82 | 0.88 | 0.65 | 0.83 | 0.54 |

| RiT2 | 0.815 (19.94) | ||||||

| RiT3 | 0.813 (25.54) | ||||||

| RiT4 | 0.795 (14.04) | ||||||

| Proactiveness (Pro) | |||||||

| Pro1 | 0.572 (4.26) | 0.54 | 0.72 | 0.82 | 0.54 | 0.77 | 0.41 |

| Pro2 | 0.648 (5.73) | ||||||

| Pro3 | 0.819 (21.06) | ||||||

| Pro4 | 0.879 (39.84) | ||||||

| Radical innovation (RaI) | |||||||

| RaI1 | 0.869 (33.53) | 0.75 | 0.83 | 0.90 | 0.93 | 0.54 | 0.40 |

| RaI2 | 0.863 (25.24) | ||||||

| RaI3 | 0.870 (30.60) | ||||||

| Product advantage (PrA) | |||||||

| PrA1 | 0.715 (7.67) | 0.59 | 0.83 | 0.88 | 0.59 | 0.40 | 0.24 |

| PrA2 | 0.851 (23.91) | ||||||

| PrA3 | 0.714 (11.38) | ||||||

| PrA4 | 0.764 (10.93) | ||||||

| PrA5 | 0.814 (25.32) | ||||||

| Brand advantage (BrA) | |||||||

| BrA1 | 0.886 (24.15) | 0.72 | 0.81 | 0.88 | 0.72 | 0.64 | 0.43 |

| BrA2 | 0.912 (48.45) | ||||||

| BrA3 | 0.757 (13.66) | ||||||

| Business Performance (BP) | |||||||

| BP1 | 0.719 (6.89) | 0.58 | 0.76 | 0.84 | 0.58 | 0.35 | 0.22 |

| BP2 | 0.760 (9.76) | ||||||

| BP3 | 0.779 (11.38) | ||||||

| BP4 | 0.801 (18.48) | ||||||

| Factor Names | Factor Loadings (t Values) | AVE | Composite Reliability | Cronbach’s α | Communality |

|---|---|---|---|---|---|

| Market orientation (MaO) | |||||

| Customer orientation (Cuo) | 0.835 (16.85) | 0.41 | 0.91 | 0.87 | 0.41 |

| Competitor orientation (Cmo) | 0.776 (18.18) | ||||

| Inter-functional coordination (InC) | 0.859 (26.94) | ||||

| Entrepreneurial orientation (EnO) | |||||

| Competitive aggressiveness (CoA) | 0.891 (27.53) | 0.40 | 0.89 | 0.89 | 0.40 |

| Risk taking (RiT) | 0.915 (55.57) | ||||

| Proactiveness (Pro) | 0.882 (36.01) | ||||

| 1. | 2. | 3. | 4. | 5. | 6. | 7. | 8. | 9. | 10. | |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. Customer orientation (Cuo) | 0.734 | |||||||||

| 2. Competitor orientation (Cmo) | 0.530 ** | 0.830 | ||||||||

| 3. Inter-functional coordination (InC) | 0.609 ** | 0.432 ** | 0.848 | |||||||

| 4. Competitive aggressiveness (CoA) | 0.180 | 0.582 ** | 0.164 | 0.824 | ||||||

| 5. Risk taking (RiT) | 0.068 | 0.351 ** | 0.130 | 0.744 ** | 0.806 | |||||

| 6. Proactiveness (Pro) | 0.362 ** | 0.476 ** | 0.353 ** | 0.650 ** | 0.690 ** | 0.734 | ||||

| 7. Radical innovation (RaI) | 0.414 ** | 0.569 ** | 0.447 ** | 0.581 ** | 0.582 ** | 0.603 ** | 0.866 | |||

| 8. Product advantage (PrA) | 0.578 ** | 0.580 ** | 0.502 ** | 0.424 ** | 0.426 ** | 0.545 ** | 0.631 ** | 0.768 | ||

| 9. Brand advantage (BrA) | 0.485 ** | 0.489 ** | 0.467 ** | 0.502 ** | 0.474 ** | 0.557 ** | 0.634 ** | 0.770 ** | 0.848 | |

| 10. Business Performance (BP) | 0.302 ** | 0.401 ** | 0.371 ** | 0.447 ** | 0.426 ** | 0.649 ** | 0.391 ** | 0.503 ** | 0.599 ** | 0.761 |

| Mean | 4.09 | 3.43 | 3.79 | 3.13 | 3.06 | 3.50 | 3.50 | 3.98 | 3.96 | 3.52 |

| Std | 0.60 | 0.79 | 0.76 | 0.96 | 0.85 | 0.72 | 0.86 | 0.66 | 0.74 | 0.59 |

| Factors | Model 1 RaI | Model 2 RaI | Model 3 PrA | Model 4 BrA | Model 5 BP |

|---|---|---|---|---|---|

| β (t Value) | β (t Value) | β (t Value) | β (t Value) | β (t Value) | |

| Customer orientation (Cuo) | 0.047 (0.279) | ||||

| Competitor orientation (Cmo) | 0.494 *** (4.322) | ||||

| Inter-functional coordination (InC) | 0.264 * (2.079) | ||||

| Competitive aggressiveness (CoA) | 0.210 (1.806) | ||||

| Risk taking (RiT) | 0.187 (0.178) | ||||

| Proactiveness (Pro) | 0.386 ** (2.723) | ||||

| Radical innovation (RaI) | 0.482 *** (7.453) | 0.211 ** (2.847) | −0.003 (−0.042) | ||

| Product advantage (PrA) | 0.691 *** (7.142) | 0.094 (0.722) | |||

| Brand advantage (BrA) | 0.418 *** (3.605) | ||||

| Constant | 0.622 (1.196) | 0.923 * (2.608) | 2.292 *** (9.802) | 0.467 (1.539) | 1.504 *** (4.621) |

| Adjust R2 | 0.351 | 0.418 | 0.391 | 0.620 | 0.340 |

| Durbin Watson | 1.571 | 1.613 | 1.560 | 1.909 | 1.779 |

| F value | 16.339 *** | 21.338 *** | 55.554 *** | 70.422 *** | 15.575 *** |

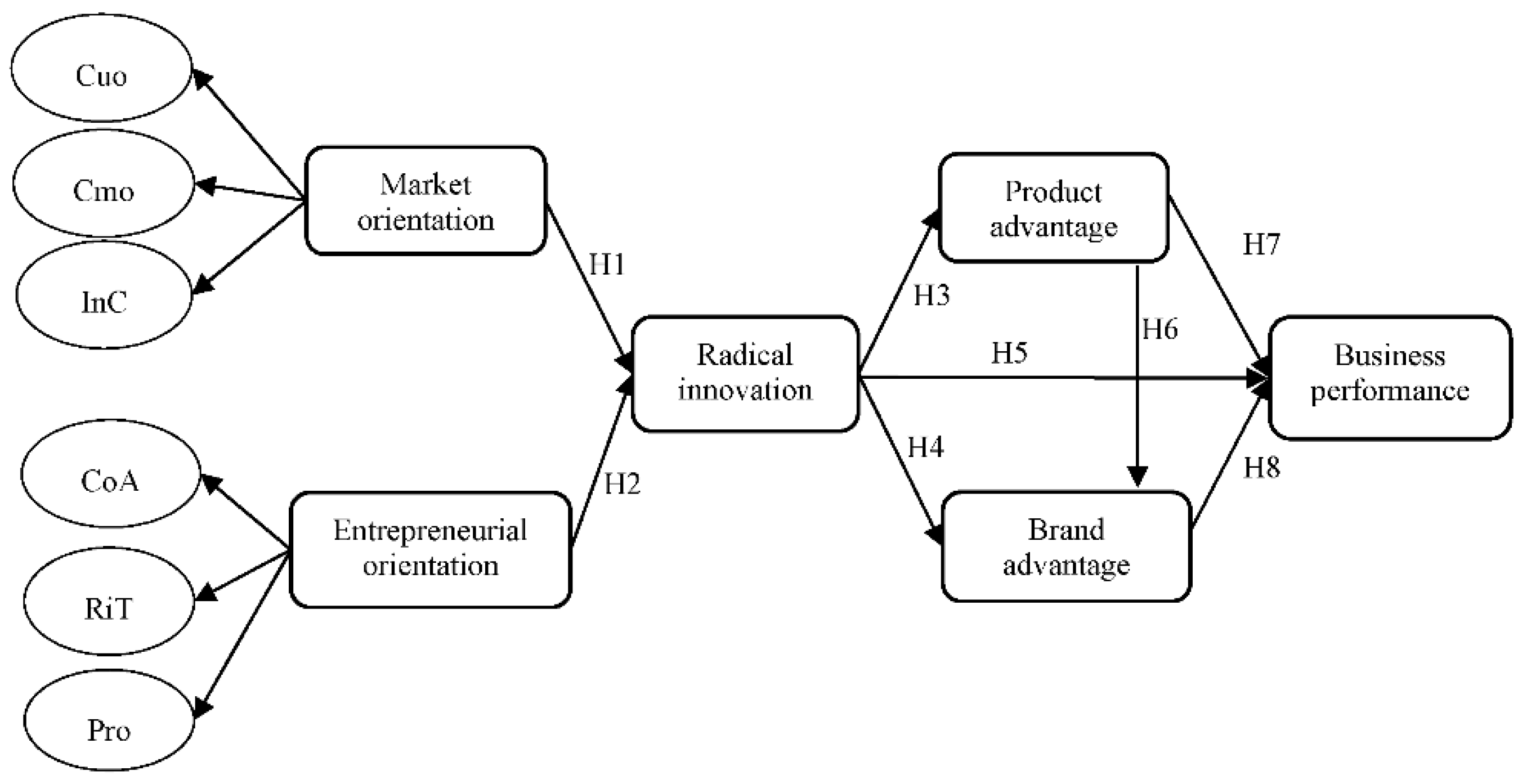

| Full Model | |||

|---|---|---|---|

| Mean-Original Sample | t Statistics | Sig. | |

| H1: Market orientation → Radical innovation | 0.389 *** | 5.695 | +S |

| H2: Entrepreneurial orientation → Radical innovation | 0.484 *** | 8.315 | +S |

| H3: Radical innovation → Product advantage | 0.636 *** | 9.392 | +S |

| H4: Radical innovation → Brand advantage | 0.217 * | 2.561 | +S |

| H5: Radical innovation → Business performance | 0.012 | 0.119 | |

| H6: Product advantage → Brand advantage | 0.646 *** | 7.580 | +S |

| H7: Product advantage → Business performance | 0.101 | 0.584 | |

| H8: Brand advantage → Business performance | 0.520 ** | 2.860 | +S |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shih, T.-Y. Determinants of Enterprises Radical Innovation and Performance: Insights into Strategic Orientation of Cultural and Creative Enterprises. Sustainability 2018, 10, 1871. https://doi.org/10.3390/su10061871

Shih T-Y. Determinants of Enterprises Radical Innovation and Performance: Insights into Strategic Orientation of Cultural and Creative Enterprises. Sustainability. 2018; 10(6):1871. https://doi.org/10.3390/su10061871

Chicago/Turabian StyleShih, Tsui-Yii. 2018. "Determinants of Enterprises Radical Innovation and Performance: Insights into Strategic Orientation of Cultural and Creative Enterprises" Sustainability 10, no. 6: 1871. https://doi.org/10.3390/su10061871

APA StyleShih, T.-Y. (2018). Determinants of Enterprises Radical Innovation and Performance: Insights into Strategic Orientation of Cultural and Creative Enterprises. Sustainability, 10(6), 1871. https://doi.org/10.3390/su10061871