The Impact of Government Subsidies on Private R&D and Firm Performance: Does Ownership Matter in China’s Manufacturing Industry?

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Relationship between Government Subsidies and R&D Investment

2.2. Relationship between Government Subsidies and Firm Performance

3. Research Method

3.1. Sample

3.2. Variables

3.3. Model

4. Results

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Estimation Results

4.4. Robustness Check

5. Additional Analyses

5.1. Analysis by Industry

5.2. Analysis by Region

5.3. Analysis by Subsidy Intensity

5.4. Analysis by R&D Intensity

6. Conclusions and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Variable (Mean) | Chemical Raw Material and Chemical Products | Medicine | Special-Purpose Machinery | Electrical Machinery and Equipment | Communications and Other Electronic Equipment |

|---|---|---|---|---|---|

| ROA | 0.0354 | 0.0784 | 0.0303 | 0.0429 | 0.0421 |

| RD | 0.0237 | 0.0324 | 0.0421 | 0.0422 | 0.0637 |

| Sub | 0.0058 | 0.0061 | 0.0062 | 0.0078 | 0.0091 |

| Size | 9.5007 | 9.4768 | 9.5312 | 9.4589 | 9.4396 |

| Lev | 0.4192 | 0.3521 | 0.4442 | 0.4262 | 0.3810 |

| Staff | 3.3166 | 3.3928 | 3.3470 | 3.3215 | 3.3947 |

| Age | 1.1438 | 1.1877 | 1.1666 | 1.1724 | 1.1706 |

| Own | 0.39 | 0.33 | 0.42 | 0.19 | 0.34 |

Appendix B

| Variable (Mean) | Eastern Provinces | Central Provinces | Western Provinces |

|---|---|---|---|

| ROA | 0.0454 | 0.0336 | 0.0334 |

| RD | 0.0372 | 0.0310 | 0.0272 |

| Sub | 0.0065 | 0.0074 | 0.0057 |

| Size | 9.4862 | 9.5553 | 9.6371 |

| Lev | 0.3984 | 0.4554 | 0.4797 |

| Staff | 3.3771 | 3.4716 | 3.5093 |

| Age | 1.1626 | 1.1748 | 1.1858 |

| Own | 0.25 | 0.52 | 0.59 |

Appendix C

| Variable (Mean) | Low Subsidy Intensity | High Subsidy Intensity |

|---|---|---|

| ROA | 0.0408 | 0.0420 |

| RD | 0.0288 | 0.0404 |

| Sub | 0.0019 | 0.0113 |

| Size | 9.5640 | 9.4779 |

| Lev | 0.4320 | 0.4098 |

| Staff | 3.4192 | 3.4089 |

| Age | 1.1655 | 1.1709 |

| Own | 0.38 | 0.33 |

Appendix D

| Variable (Mean) | Low R&D Intensity | High R&D Intensity |

|---|---|---|

| ROA | 0.0373 | 0.0455 |

| RD | 0.0148 | 0.0543 |

| Sub | 0.0060 | 0.0072 |

| Size | 9.5966 | 9.4453 |

| Lev | 0.4751 | 0.3666 |

| Staff | 3.4954 | 3.3326 |

| Age | 1.1802 | 1.1562 |

| Own | 0.42 | 0.28 |

Notes

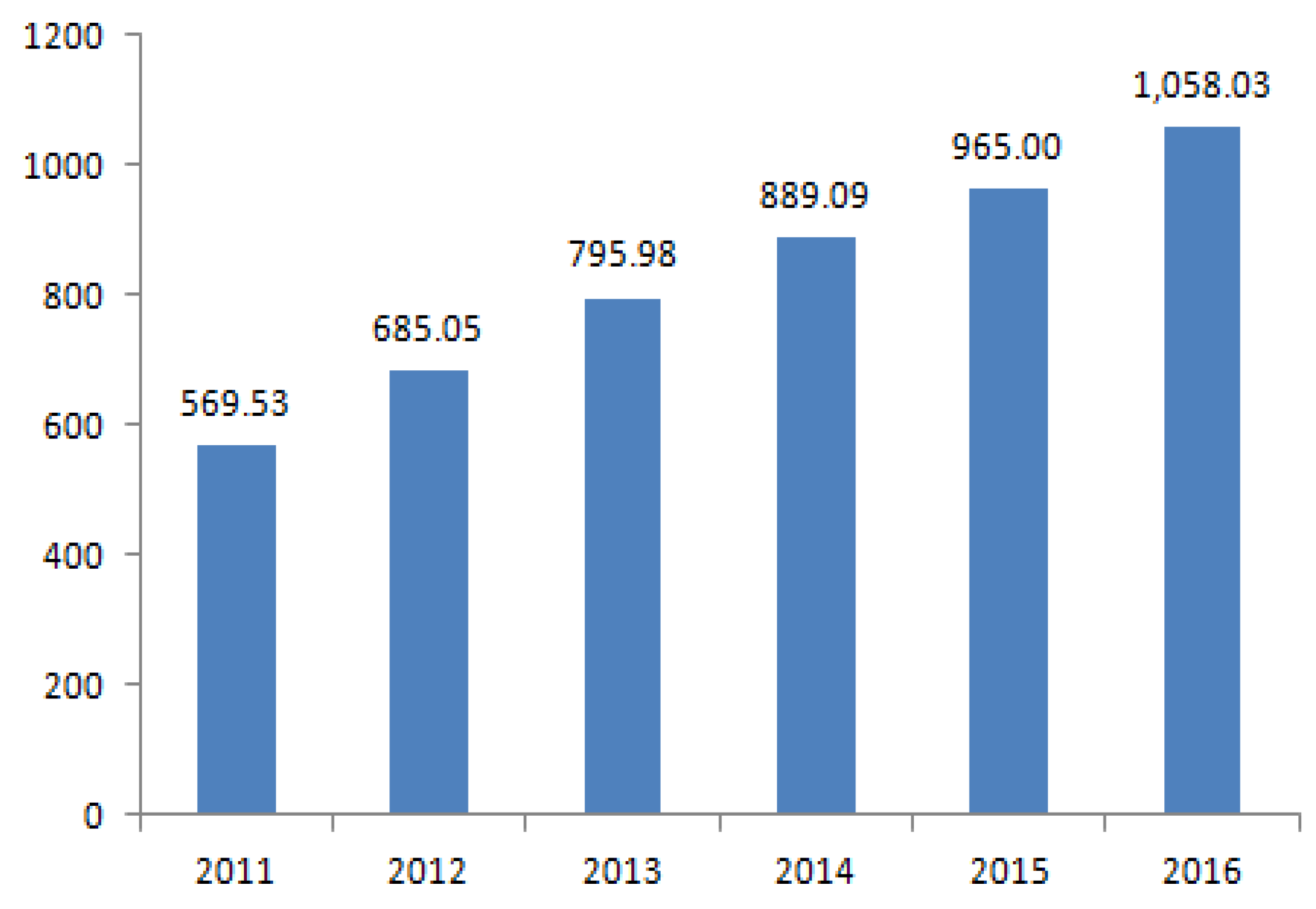

- These data are based on China Statistical Yearbook on Science and Technology, which is provided by the National Bureau of Statistics of China.

- Ricardian equivalence provides an explanation for this crowding-out effect.

- Government subsidy aims to stimulate enterprises’ R&D activities, while enterprises’ private R&D input aims to gain core competitiveness and economic profits. Thus, government subsidy indirectly affects the quality of R&D output.

- In 2015, China’s State Council announced the establishment of a national leading group to upgrade the country’s manufacturing sector. One of the group’s main responsibilities will be to plan and coordinate the overall work to raise the country’s manufacturing power.

- In 2012, all listed companies were required by the China Securities Regulatory Commission (CSRC) to disclose detailed information about R&D expenditure in their annual financial statements.

- Market value for those firms is different from firms with only A shares.

- ROA tells you what earnings were generated from invested capital (assets). ROA for public companies can vary substantially and will be highly dependent on the industry. This is why we use ROA as a comparative measure.

- In 2016, the amount of R&D expenditure in these five industries accounted for almost half of the total R&D expenditure in the entire manufacturing industry. The amount of R&D expenditure in these five industries is 84.07 billion yuan, 48.85 billion yuan, 57.71 billion yuan, 110.24 billion yuan, and 181.10 billion yuan, respectively.

- The eastern provinces are Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan; the central provinces are Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, and Hunan; and the western provinces are Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang, and Tibet.

- In 2016, the amount of R&D expenditure in eastern, central, and western provinces was 1106.2 billion yuan, 267.02 billion yuan, and 194.43 billion yuan, respectively.

- The Matthew effect, described in sociology, is a phenomenon sometimes summarized by the adage “the rich get richer and the poor get poorer.”

References

- Aschauer, D.A. Does public capital crowd out private capital? J. Monetary Econ. 1989, 24, 171–188. [Google Scholar] [CrossRef]

- Agarwal, M.; Mitra, S. Role of government in trade and investment boom: Lessons from East Asia. J. Econ. Policy Reform 2010, 13, 285–304. [Google Scholar] [CrossRef]

- Xu, X.; Yan, Y. Does government investment crowd out private investment in China? J. Econ. Policy Reform 2014, 17, 1–12. [Google Scholar] [CrossRef]

- Xu, J.; Sim, J.W. Are costs really sticky and biased? Evidence from manufacturing listed companies in China. Appl. Econ. 2017, 49, 5601–5613. [Google Scholar] [CrossRef]

- Connolly, M.; Li, C. Government spending and economic growth in the OECD countries. J. Econ. Policy Reform 2016, 19, 386–395. [Google Scholar] [CrossRef]

- Ricardo, D. Essay on the Funding System. The Works of David Ricardo, McCulloch ed.; John Murray: London, UK, 1888. [Google Scholar]

- Guellec, D.; Pottelsberghe, B.V. Does government support stimulate private R&D? OECD Econ. Stud. 1997, 29, 95–122. [Google Scholar]

- Meuleman, M.; Maeseneire, W.D. Do R&D subsidies affect SMEs’ access to external financing? Res. Policy 2012, 41, 580–591. [Google Scholar]

- Luo, L.; Yang, Y.; Luo, Y.; Liu, C. Export, subsidy and innovation: China’s state-owned enterprises versus privately-owned enterprises. Econ. Polit. Stud. 2016, 4, 137–155. [Google Scholar] [CrossRef]

- Li, J.; Rugman, A.M. Real options and the theory of foreign direct investment. Int. Bus. Rev. 2007, 16, 687–712. [Google Scholar] [CrossRef]

- Chen, Y.Y.; Young, M.N. Cross-border mergers and acquisitions by Chinese listed companies: A principal-principal perspective. Asia Pac. J. Manag. 2010, 27, 523–539. [Google Scholar] [CrossRef]

- Lach, S. Do R&D subsidies stimulate or displace private R&D? Evidence from Israel. J. Ind. Econ. 2002, 50, 369–390. [Google Scholar]

- Czarnitzki, D.; Hussinger, K. The Link between R&D Subsidies, R&D Spending and Technological Performance. Available online: https://ssrn.com/abstract=575362 or http://dx.doi.org/10.2139/ssrn.57536 (accessed on 17 February 2015).

- Lee, E.Y.; Cin, B.C. The effect of risk-sharing government subsidies on corporate R&D investment: Evidence from Korea. Technol. Forecast. Soc. Chang. 2010, 77, 881–890. [Google Scholar]

- Jiang, C.; Zhang, Y.; Bu, M.; Liu, W. The effectiveness of government subsidies on manufacturing innovation: Evidence from the new energy vehicle industry in China. Sustainability 2018, 10, 1692. [Google Scholar] [CrossRef]

- Guellec, D.; Pottelsberghe, B.V. The impact of public R&D expenditure on business R&D. Econ. Innv. New Technol. 2003, 12, 225–243. [Google Scholar]

- Wu, A. The signal effect of government R&D subsidies in China: Does ownership matter? Technol. Forecast. Soc. Chang. 2017, 117, 339–345. [Google Scholar]

- Almus, M.; Czarnitzki, D. The effects of public R&D subsidies on firms’ innovation activities: The case of eastern Germany. J. Bus. Econ. Stat. 2003, 21, 226–236. [Google Scholar]

- Davidson, C.; Segerstrom, P. R&D subsidies and economic growth. RAND J. Econ. 1998, 29, 548–577. [Google Scholar]

- González, X.; Jaumandreu, J.; Pazo, C. Barriers to innovation and subsidy effectiveness. RAND J. Econ. 2005, 36, 930–950. [Google Scholar]

- Khandan, A.; Nili, M. Government interventions and the size of the informal economy. The case of Iran (1971–2007). J. Econ. Policy Reform 2014, 17, 71–90. [Google Scholar] [CrossRef]

- Hewitt-Dundas, N.; Roper, S. Output additionality of public support for innovation: Evidence for Irish manufacturing plants. Eur. Plan. Stud. 2010, 18, 107–122. [Google Scholar] [CrossRef]

- Busom, I. An empirical evaluation of the effects of R&D subsidies. Econ. Innov. New Technol. 2000, 9, 111–148. [Google Scholar]

- Clausen, T.H. Do subsidies have positive impacts on R&D and innovation activities at the firm level. Struct. Chang. Econ. Dyn. 2009, 20, 239–253. [Google Scholar]

- Goolsbee, A. Does government R&D policy mainly benefit scientists and engineers? Am. Econ. Rev. 1998, 88, 298–302. [Google Scholar]

- Zúñiga-Vicente, J.Á.; Alonso-Borrego, C.; Forcadell, F.J.; Galán, J.I. Assessing the effect of public subsidies on firm R&D investment: A survey. J. Econ. Surv. 2014, 28, 36–67. [Google Scholar]

- Wallsten, S.J. The effects of government-industry R&D programs on private R&D: The case of the small business innovation research program. Rand J. Econ. 2000, 31, 82–100. [Google Scholar]

- Cheng, H.; Zhao, X. Size of enterprise, intensity of R&D, intensity of subsidies, and government subsidies performance: Empirical study on Zhejiang private science and technology enterprises. Sci. Res. Manag. 2008, 29, 37–43. [Google Scholar]

- Yu, F.; Guo, Y.; Le-Nguyen, K.; Barnes, S.J.; Zhang, W. The impact of government subsidies and enterprises’ R&D investment: A panel data study from renewable energy in China. Energy Policy 2016, 89, 106–113. [Google Scholar]

- Zang, Z.P. Government subsidies, R&D investment and the performance of listed cultural companies-An empirical study based on the mediating effect of the panel data of 161 listed cultural companies. East China Econ. Manag. 2015, 29, 80–88. [Google Scholar]

- Tõnurist, P. Framework for analysing the role of state owned enterprises in innovation policy management: The case of energy technologies and Eesti Energia. Technovation 2015, 38, 1–14. [Google Scholar] [CrossRef]

- Chan, H.S.; Rosenbloom, D.H. Public enterprise reforms in the United States and the People’s Republic of China: A drift towards constitutionalization and departmentalization of enterprise management. Public Admin. Rev. 2009, 69, S38–S45. [Google Scholar] [CrossRef]

- Qu, J.; Cao, J.; Wang, X.; Tang, J.; Bukenya, J.O. Political connections, government subsidies and technical innovation of wind energy companies in China. Sustainability 2017, 9, 1812. [Google Scholar] [CrossRef]

- Wang, D.; Sutherland, D.; Ning, L.; Wang, Y.; Pan, X. Exploring the influence of political connections and managerial overconfidence on R&D intensity in China’s large-scale private sector firms. Technovation 2018, 69, 40–53. [Google Scholar]

- Lee, C.W.J. Financial restructuring of state owned enterprises in China: The case of Shanghai Sunve Pharmaceutical Corporation. Account. Org. Soc. 2001, 26, 673–689. [Google Scholar]

- O’Connor, N.G.; Deng, J.; Luo, Y.D. Political constraints, organization design and performance measurement in China’s state-owned enterprises. Account. Org. Soc. 2006, 31, 157–177. [Google Scholar] [CrossRef]

- Hou, Q.; Hu, M.; Yuan, Y. Corporate innovation and political connections in Chinese listed firms. Pac.-Basin Financ. J. 2017, 46, 158–176. [Google Scholar] [CrossRef]

- Arqué-Castells, P. Persistence in R&D performance and its implications for the granting of subsidies. Rev. Ind. Organ 2013, 43, 193–220. [Google Scholar]

- Beason, R.; Weinstein, D.E. Growth, economies of scale, and targeting in Japan (1955–1990). Rev. Econ. Stat. 1996, 78, 286–295. [Google Scholar] [CrossRef]

- Bergström, F. Capital subsidies and the performance of firms. Small Bus. Econ. 2000, 14, 183–193. [Google Scholar] [CrossRef]

- Tzelepis, D.; Skuras, D. The effects of regional capital subsidies on firm performance: An empirical study. J. Small Bus. Enterp. Dev. 2004, 11, 121–129. [Google Scholar] [CrossRef]

- Tang, Q.Q.; Luo, D.L. Empirical analysis on government subsidy motivation and its effects. Financ. Res. 2007, 6, 149–163. [Google Scholar]

- McKenzie, J.; Walls, W.D. Australian films at the Australian box office: Performance, distribution, and subsidies. J. Cult. Econ. 2013, 37, 249–269. [Google Scholar] [CrossRef]

- Sun, W.; Gan, S. The impact of government subsidy on listed companies’ R&D investment and performance in IT industry. Econ. Probl. 2014, 35, 83–88. [Google Scholar]

- Zhang, H.; Li, L.; Zhou, D.; Zhou, P. Political connections, government subsidies and firm financial performance: Evidence from renewable energy manufacturing in China. Renew. Energy 2014, 63, 330–336. [Google Scholar] [CrossRef]

- Lee, E.; Walker, M.; Zeng, C. Do Chinese government subsidies affect firm value? Account. Org. Soc. 2014, 39, 149–169. [Google Scholar] [CrossRef]

- Desai, M.A.; Hines, J.R. Market reactions to export subsidies. J. Int. Econ. 2008, 74, 459–474. [Google Scholar] [CrossRef]

- Girma, S.; Gong, Y.D.; Gorg, H.; Yu, Z.H. Can production subsidies explain China’s export performance? Evidence from firm-level data. Scand. J. Econ. 2009, 111, 863–891. [Google Scholar] [CrossRef]

- Yang, Y. Government Preference and the Optimal Choice of R&D Subsidy Policy: Innovation Subsidy or Product Subsidy? Available online: http://downloads.hindawi.com/journals/jam/2014/536370.pdf (accessed on 12 February 2014).

- Tao, Q.; Sun, Y.; Zhu, Y.; Yang, X. Political connections and government subsidies: Evidence from financially distressed firms in China. Emerg. Mark. Financ. Trade 2017, 53, 1854–1868. [Google Scholar] [CrossRef]

- Jacob, M.; Johan, S.; Schweizer, D.; Zhan, F. Corporate finance and the governance implications of removing government support programs. J. Bank. Financ. 2016, 63, 35–47. [Google Scholar] [CrossRef]

- Lim, C.Y.; Wang, J.; Zeng, C. China’s “Mercantilist” government subsidies, the cost of debt and firm performance. J. Bank. Financ. 2018, 86, 37–52. [Google Scholar] [CrossRef]

- Zhang, H.; Zheng, Y.; Zhou, D.; Zhu, P. Which subsidy mode improves the financial performance of renewable energy firms? A panel data analysis of wind and solar energy companies between 2009 and 2014. Sustainability 2015, 7, 16548–16560. [Google Scholar] [CrossRef]

- Einiö, E. R&D subsidies and company performance: Evidence from geographic variation in government funding based on the ERDF population-density rule. Rev. Econ. Stat. 2014, 96, 710–728. [Google Scholar]

- Czarnitzki, D.; Thorwarth, S. Productivity effect of basic research in low-tech and high-tech industries. Res. Policy 2012, 41, 1555–1564. [Google Scholar] [CrossRef]

- Falk, M. Quantile estimates of the impact of R&D intensity on firm performance. Small Bus. Econ. 2012, 39, 19–37. [Google Scholar]

- Shleifer, A.; Vishny, R. The Grabbing Hand: Government Pathologies and Their Cures; Harvard University Press: Cambridge, MA, USA, 1998. [Google Scholar]

- Megginson, W.; Netter, J. From state to market: A survey of empirical studies on privatization. J. Econ. Lit. 2001, 39, 321–389. [Google Scholar] [CrossRef]

- Saeed, A.; Belghitar, Y.; Clark, E. Do political connections affect firm performance? Evidence from a developing country. Emerg. Mark. Financ. Trade 2015, 52, 1876–1891. [Google Scholar] [CrossRef]

- Ling, L.; Zhou, X.; Liang, Q.; Song, P.; Zeng, H. Political connections, overinvestments and firm performance: Evidence from Chinese listed real estate firms. Financ. Res. Lett. 2016, 18, 328–333. [Google Scholar] [CrossRef]

- Lee, M.H.; Hwang, I.J. Determinants of corporate R&D investment: An empirical study comparing Korea’s IT industry with its non-IT industry. ETRI J. 2003, 25, 258–265. [Google Scholar]

- Zhu, P.; Xu, W. On the impact of government’s S&T incentive policy on the R&D input and its patent output of large and medium-sized industrial enterprises in Shanghai. Econ. Res. J. 2003, 6, 45–53. [Google Scholar]

- Qiu, L.; Chen, Z.Y.; Lu, D.Y.; Hu, H.; Wang, Y.T. Public funding and private investment for R&D: A survey in China’s pharmaceutical industry. Health Res. Policy Syst. 2014, 12, 27. [Google Scholar] [PubMed]

- Zhao, J.W.; Yin, C.B.; Niu, M.J. Spatial-temporal difference and trends of agricultural eco-civilization level in China. Financ. Trade Res. 2017, 28, 47–57. [Google Scholar]

- Fan, Q.; Han, M.C. The impact of government R&D subsidy on the performance of national and regional independent innovations. J. Ind. Eng. Eng. Manag. 2011, 25, 183–188. [Google Scholar]

- Elston, J.A.; Audretsch, D.B. Financing the entrepreneurial decision: An empirical approach using experimental data on risk attitudes. Small Bus. Econ. 2011, 36, 209–222. [Google Scholar] [CrossRef]

- Antonelli, C.; Crespi, F. The ‘Matthew effect’ in R&D public subsidies: The Italian evidence. Technol. Forecast. Soc. Chang. 2013, 80, 1523–1534. [Google Scholar]

- Boeing, P. The allocation and effectiveness of China’s R&D subsidies: Evidence from listed firms. Res. Policy 2016, 45, 1774–1789. [Google Scholar]

| Panel A: Distribution of Sample Firms by Industry | ||

| Industry Sector | Number of Firms | Percent of Sample (%) |

| Processing of food from agricultural products | 21 | 2.39 |

| Foods | 14 | 1.59 |

| Wine, drinks, and refined tea | 14 | 1.59 |

| Textiles | 22 | 2.50 |

| Textile wearing apparel and finery | 17 | 1.93 |

| Leather, fur, feathers, and their products and footwear | 2 | 0.23 |

| Processing of timber, manufacturing of wood, bamboo, rattan, palm, and straw products | 5 | 0.57 |

| Furniture | 2 | 0.23 |

| Paper and paper products | 18 | 2.05 |

| Printing and reproduction of recorded media | 4 | 0.46 |

| Culture, education, arts and crafts, sport, and entertainment goods | 6 | 0.68 |

| Processing of petroleum, cooking, and nuclear fuel | 7 | 0.80 |

| Chemical raw materials and chemical products | 85 | 9.67 |

| Medicines | 90 | 10.24 |

| Chemical fibers | 14 | 1.59 |

| Rubber and plastic | 24 | 2.73 |

| Nonmetallic mineral products | 27 | 3.07 |

| Processing of ferrous metals | 20 | 2.28 |

| Manufacturing and processing of nonferrous metals | 41 | 4.66 |

| Metal products | 28 | 3.19 |

| General-purpose machinery | 54 | 6.14 |

| Special-purpose machinery | 62 | 7.05 |

| Automotive | 54 | 6.14 |

| Railroad, marine, aerospace, and other transportation equipment | 21 | 2.39 |

| Electrical machinery and equipment | 93 | 10.58 |

| Computer, communications, and other electronic equipment | 123 | 13.99 |

| Measuring instruments | 6 | 0.68 |

| Other manufacturing | 5 | 0.57 |

| Total | 879 | 100 |

| Panel B: Distribution of Sample Firms by Ownership | ||

| Company Ownership | Number of Firms | Percent of Sample (%) |

| State-owned enterprises | 310 | 35.27 |

| Private-owned enterprises | 569 | 64.73 |

| Total | 879 | 100 |

| Variable | Definition |

|---|---|

| ROA | Return on assets of enterprise |

| RD | Ratio of R&D expenditures to total sales |

| Subt | Ratio of government subsidies to total assets in the period t |

| Subt1 | Ratio of government subsidies to total assets in the first lagged period of period t |

| Subt2 | Ratio of government subsidies to total assets in the second lagged period of period t |

| Own | Dummy variable that takes 1 if enterprise is state-owned, 0 otherwise |

| Size | Logarithm of total assets |

| Lev | Ratio of total liabilities to total assets |

| Staff | Logarithm of number of employees |

| Age | Logarithm of years since setup of enterprise |

| Panel A: Descriptive Statistics of Full Sample | ||||

| Variable | Mean | Standard Deviation | Min | Max |

| ROA | 0.0414 | 0.0686 | −0.7765 | 1.2162 |

| RD | 0.0346 | 0.0409 | 0 | 1.6943 |

| Sub | 0.0066 | 0.0102 | 0 | 0.2248 |

| Size | 9.5210 | 0.4532 | 8.2854 | 11.8651 |

| Lev | 0.4209 | 0.2079 | 0.0075 | 2.3940 |

| Staff | 3.4140 | 0.4355 | 1.4472 | 5.2144 |

| Age | 1.1682 | 0.1372 | 0.4771 | 1.7559 |

| Own | 0.35 | 0.478 | 0 | 1 |

| Panel B: Descriptive Statistics of SOEs and POEs | ||||

| Variable (Mean) | SOEs (Own = 1) | POEs (Own = 0) | Difference t-Statistic | |

| ROA | 0.0289 | 0.0482 | −9.004 | |

| RD | 0.0310 | 0.0365 | −4.305 ** | |

| Sub | 0.0070 | 0.0064 | 1.863 *** | |

| Size | 9.7050 | 9.4207 | 20.833 *** | |

| Lev | 0.5051 | 0.3751 | 20.756 *** | |

| Staff | 3.5876 | 3.3194 | 20.403 *** | |

| Age | 1.1885 | 1.1571 | 7.298 *** | |

| Variables | ROA | RD | Sub | Size | Lev | Staff | Age | Own |

|---|---|---|---|---|---|---|---|---|

| ROA | 1 | |||||||

| RD | −0.010 | 1 | ||||||

| Sub | 0.006 | 0.106 *** | 1 | |||||

| Size | 0.010 | −0.112 *** | −0.073 *** | 1 | ||||

| Lev | −0.409 *** | −0.177 *** | 0.019 | 0.412 *** | 1 | |||

| Staff | 0.033 ** | −0.146 *** | −0.026 ** | 0.580 *** | 0.388 *** | 1 | ||

| Age | −0.061 *** | −0.027 ** | 0.013 | 0.077 *** | 0.112 *** | 0.097 *** | 1 | |

| Own | −0.135 *** | −0.065 *** | 0.028 ** | 0.300 *** | 0.299 *** | 0.294 *** | 0.088 *** | 1 |

| Variables | Predicted Sign | Model (1) | Model (3) | Model (5) |

|---|---|---|---|---|

| Constant | 0.035 ** (2.111) | 0.047 * (1.794) | 0.031 * (1.915) | |

| Subt | + | 0.442 *** (7.423) | 0.558 *** (6.590) | |

| Subt1 | + | 0.470 *** (4.271) | ||

| Subt2 | + | 0.174 * (1.780) | ||

| Sub × Own | − | −0.199 * (−1.934) | ||

| Size | + | 0.006 ** (2.564) | 0.006 * (1.680) | 0.006 *** (2.672) |

| Lev | − | −0.030 *** (−9.363) | −0.024 *** (−4.820) | −0.030 *** (−9.182) |

| Staff | + | −0.012 *** (−5.561) | −0.014 *** (−3.960) | −0.012 *** (−5.528) |

| Age | − | −0.001 (−0.167) | −0.009 (−1.156) | −0.001 (−0.160) |

| N | 4395 | 2637 | 4395 | |

| F | 47.322 *** | 17.189 *** | 40.083 *** | |

| Adj.R2 | 0.050 | 0.036 | 0.051 |

| Variable | Predicted Sign | Model (2) | Model (4) | Model (6) |

|---|---|---|---|---|

| Constant | −0.108 *** (−4.314) | −0.174 *** (−5.188) | −0.111 *** (−4.443) | |

| Subt | + | 0.186 ** (2.056) | 0.327 ** (2.532) | |

| Subt1 | + | 0.061 (0.427) | ||

| Subt2 | + | −0.017 (−0.138) | ||

| Sub × Own | − | −0.240 (−1.529) | ||

| Size | + | 0.016 *** (4.920) | 0.019 *** (4.442) | 0.017 *** (5.000) |

| Lev | − | −0.168 *** (−34.145) | −0.175 *** (−26.831) | −0.167 *** (−33.920) |

| Staff | + | 0.024 *** (6.949) | 0.026 *** (5.973) | 0.024 *** (6.975) |

| Age | − | −0.015 ** (−2.161) | 0.007 (0.703) | −0.015 ** (−2.156) |

| N | 4395 | 2637 | 4395 | |

| F | 241.598 *** | 123.678 *** | 201.783 *** | |

| Adj.R2 | 0.215 | 0.218 | 0.215 |

| SOEs (Own = 1) | POEs (Own = 0) | |||

|---|---|---|---|---|

| Variable | Model (1) | Model (2) | Model (1) | Model (2) |

| Constant | 0.016 (0.478) | −0.069 * (−1.661) | 0.044 *** (2.633) | −0.211 *** (−6.386) |

| Sub | 0.331 *** (3.055) | 0.245 * (1.846) | 0.587 *** (9.024) | 0.128 (0.988) |

| Size | 0.011 ** (2.357) | 0.012 ** (2.045) | 0.003 (1.474) | 0.027 *** (6.407) |

| Lev | −0.024 *** (−3.266) | −0.169 *** (−18.738) | −0.034 *** (−11.467) | −0.160 *** (−27.296) |

| Staff | −0.022 *** (−3.864) | 0.022 *** (3.168) | −0.008 *** (−4.441) | 0.025 *** (6.480) |

| Age | −0.005 (−0.434) | −0.010 (−0.675) | 0.0005 (0.131) | −0.014 * (−1.860) |

| N | 1550 | 1550 | 2845 | 2845 |

| F | 9.391 *** | 71.560 *** | 55.893 *** | 164.071 *** |

| Adj. R2 | 0.026 | 0.186 | 0.088 | 0.223 |

| Chemical Raw Material and Chemical Products | Medicine | Special-Purpose Machinery | Electrical Machinery and Equipment | Communications and Other Electronic Equipment | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Variable | Model (5) | Model (6) | Model (5) | Model (6) | Model (5) | Model (6) | Model (5) | Model (6) | Model (5) | Model (6) |

| Constant | 0.092 *** (4.142) | −0.111 (−1.530) | 0.002 (0.061) | −0.170 * (−1.910) | −0.046 (−1.301) | −0.166 * (−1.851) | 0.077 * (1.925) | −0.094 (−1.462) | −0.143 (−1.401) | −0.189 ** (−2.399) |

| Sub | −0.038 (−0.290) | 0.335 (0.775) | 0.543 *** (3.291) | 1.052 ** (2.105) | 0.276 (1.295) | 1.502 *** (2.813) | 0.640 *** (5.055) | 0.089 (0.437) | 0.923 ** (2.223) | 0.671 ** (2.088) |

| Sub × Own | 0.112 (0.803) | −0.147 (−0.323) | −0.559 *** (−3.095) | −1.238 ** (−2.264) | −0.321 (−1.372) | −0.937 (−1.599) | −0.275 (−0.717) | −0.432 (−0.703) | 0.610 (1.148) | 0.515 (1.251) |

| Size | −0.004 (−1.251) | 0.026 ** (2.580) | 0.007 * (1.802) | 0.029 ** (2.498) | 0.015 *** (3.034) | 0.021* (1.727) | −0.005 (−0.930) | 0.006 (0.780) | 0.041 *** (3.030) | 0.025 ** (2.351) |

| Lev | −0.021 *** (−4.964) | −0.157 *** (−11.217) | −0.028 *** (−5.379) | −0.142 *** (−8.955) | −0.038 *** (−6.381) | −0.133 *** (−8.984) | −0.048 *** (−5.865) | −0.141 *** (−10.672) | −0.021 (−1.078) | −0.148 *** (−9.975) |

| Staff | −0.010 *** (−3.014) | 0.016 (1.569) | −0.003 (−0.724) | 0.001 (0.105) | −0.013 ** (−2.587) | 0.036 *** (2.823) | 0.004 (0.865) | 0.038 *** (4.599) | −0.050 *** (−4.006) | 0.022 ** (2.291) |

| Age | 0.008 (1.494) | −0.078 *** (−4.555) | −0.016 * (−1.792) | 0.011 (0.410) | 0.006 (0.597) | −0.063 ** (−2.509) | 0.009 (1.039) | 0.010 (0.745) | −0.013 (−0.593) | −0.025 (−1.427) |

| N | 425 | 425 | 450 | 450 | 310 | 310 | 465 | 465 | 615 | 615 |

| F | 19.759 *** | 28.454 *** | 9.007 *** | 17.213 *** | 9.199 *** | 19.128 *** | 13.433 *** | 22.667 *** | 5.483 *** | 22.071 *** |

| Adj. R2 | 0.210 | 0.280 | 0.097 | 0.178 | 0.137 | 0.260 | 0.139 | 0.219 | 0.042 | 0.171 |

| Eastern Provinces | Central Provinces | Western Provinces | ||||

|---|---|---|---|---|---|---|

| Variable | Model (5) | Model (6) | Model (5) | Model (6) | Model (5) | Model (6) |

| Constant | 0.043 *** (2.864) | −0.148 *** (−4.709) | 0.030 (1.107) | −0.155 ** (−2.364) | −0.057 (−0.730) | −0.013 (−0.173) |

| Sub | 0.683 *** (9.502) | 0.282 * (1.878) | 0.326 ** (2.405) | 0.396 (1.611) | −0.191 (−0.306) | 0.657 (1.134) |

| Sub × Own | −0.226 ** (−2.440) | −0.052 (−0.269) | −0.212 (−1.425) | −0.468 * (−1.730) | 1.063 (1.501) | −0.893 (−1.357) |

| Size | 0.004 * (1.795) | 0.020 *** (4.815) | 0.006 (1.540) | 0.019 *** (2.904) | 0.018* (1.673) | 0.007 (0.736) |

| Lev | −0.034 *** (−11.727) | −0.182 *** (−29.860) | −0.031 *** (−6.192) | −0.155 *** (−16.959) | −0.0003 (−0.019) | −0.110 *** (−7.048) |

| Staff | −0.008 *** (−3.841) | 0.026 *** (6.300) | −0.012 *** (−3.300) | 0.028 *** (4.426) | −0.034 *** (−2.778) | 0.009 (0.784) |

| Age | −0.004 (−0.961) | −0.009 (−1.127) | 0.001 (0.116) | −0.053 *** (−3.560) | 0.028 (1.015) | −0.003 (−0.116) |

| N | 2930 | 2930 | 835 | 835 | 630 | 630 |

| F | 57.114 *** | 154.154 *** | 13.358 *** | 55.844 *** | 2.185 ** | 9.318 *** |

| Adj.R2 | 0.103 | 0.239 | 0.082 | 0.283 | 0.011 | 0.074 |

| Low Subsidy Intensity | High Subsidy Intensity | |||

|---|---|---|---|---|

| Variable | Model (5) | Model (6) | Model (5) | Model (6) |

| Constant | 0.043 * (2.106) | −0.038 (−1.024) | −0.003 (−0.130) | −0.213 *** (−6.335) |

| Sub | 2.538 *** (2.839) | 4.174 *** (2.926) | 0.270 *** (3.012) | 0.453 *** (3.516) |

| Sub × Own | 0.048 (0.052) | −4.249 *** (−2.888) | −0.051 (−0.516) | −0.240 * (−1.682) |

| Size | 0.002 (0.619) | 0.007 (1.423) | 0.014 *** (4.350) | 0.028 *** (6.217) |

| Lev | −0.017 *** (−3.596) | −0.137 *** (−18.078) | −0.040 *** (−9.182) | −0.195 *** (−30.900) |

| Staff | −0.010 *** (−3.211) | 0.023 *** (4.439) | −0.019 *** (−6.017) | 0.025 *** (5.507) |

| Age | 0.005 (0.692) | −0.008 (−0.813) | −0.008 (−1.313) | −0.018 ** (−2.078) |

| N | 2198 | 2198 | 2197 | 2197 |

| F | 9.414 *** | 65.292 *** | 30.124 *** | 171.386 *** |

| Adj.R2 | 0.022 | 0.149 | 0.074 | 0.318 |

| Low R&D Intensity | High R&D Intensity | |||

|---|---|---|---|---|

| Variable | Model (5) | Model (6) | Model (5) | Model (6) |

| Constant | 0.034 *** (6.646) | −0.049 (−1.389) | −0.031 (−0.941) | −0.199 *** (−5.520) |

| Sub | 0.010 (0.373) | 0.037 (0.195) | 0.976 *** (6.032) | 0.800 *** (4.546) |

| Sub × Own | −0.012 (−0.355) | −0.132 (−0.581) | −0.070 (−0.358) | −0.344 (−1.613) |

| Size | −0.001 (−1.586) | 0.012 *** (2.660) | 0.014 *** (3.175) | 0.025 *** (5.217) |

| Lev | −0.009 *** (−8.717) | −0.165 *** (−22.810) | −0.010 (−1.571) | −0.178 *** (−25.732) |

| Staff | −0.001 (−1.160) | 0.021 *** (4.217) | −0.018 *** (−4.310) | 0.025 *** (5.312) |

| Age | −0.001 (−0.928) | −0.021 * (−1.891) | 0.010 (1.368) | −0.012 (−1.524) |

| N | 2198 | 2198 | 2197 | 2197 |

| F | 22.385 *** | 92.137 *** | 13.146 *** | 117.980 *** |

| Adj.R2 | 0.055 | 0.199 | 0.032 | 0.242 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jin, Z.; Shang, Y.; Xu, J. The Impact of Government Subsidies on Private R&D and Firm Performance: Does Ownership Matter in China’s Manufacturing Industry? Sustainability 2018, 10, 2205. https://doi.org/10.3390/su10072205

Jin Z, Shang Y, Xu J. The Impact of Government Subsidies on Private R&D and Firm Performance: Does Ownership Matter in China’s Manufacturing Industry? Sustainability. 2018; 10(7):2205. https://doi.org/10.3390/su10072205

Chicago/Turabian StyleJin, Zhenji, Yue Shang, and Jian Xu. 2018. "The Impact of Government Subsidies on Private R&D and Firm Performance: Does Ownership Matter in China’s Manufacturing Industry?" Sustainability 10, no. 7: 2205. https://doi.org/10.3390/su10072205

APA StyleJin, Z., Shang, Y., & Xu, J. (2018). The Impact of Government Subsidies on Private R&D and Firm Performance: Does Ownership Matter in China’s Manufacturing Industry? Sustainability, 10(7), 2205. https://doi.org/10.3390/su10072205