Integrated Approaches for Business Sustainability: The Perspective of Corporate Social Responsibility

Abstract

:1. Introduction

2. Literature Review and Hypotheses

2.1. Corporate Social Responsibility (CSR)

2.2. CSR and Corporate Reputation

2.3. CSR and Corporate Financial Performance (CFP)

2.4. Corporate Reputation and CSR: The Mediating Role of Corporate Financial Performance

2.5. Hypotheses

3. Methodology

3.1. Sample and Data Collection

3.1.1. Corporate Reputation (CR) and Corporate Social Responsibility (CSR)

3.1.2. Corporate Financial Performance (CFP)

ROA and ROE

Tobin’s Q

Quick Ratio

Operating Cycle

Debt to Tangible Assets Ratio

3.1.3. Data Collection

3.2. Descriptive Statistics

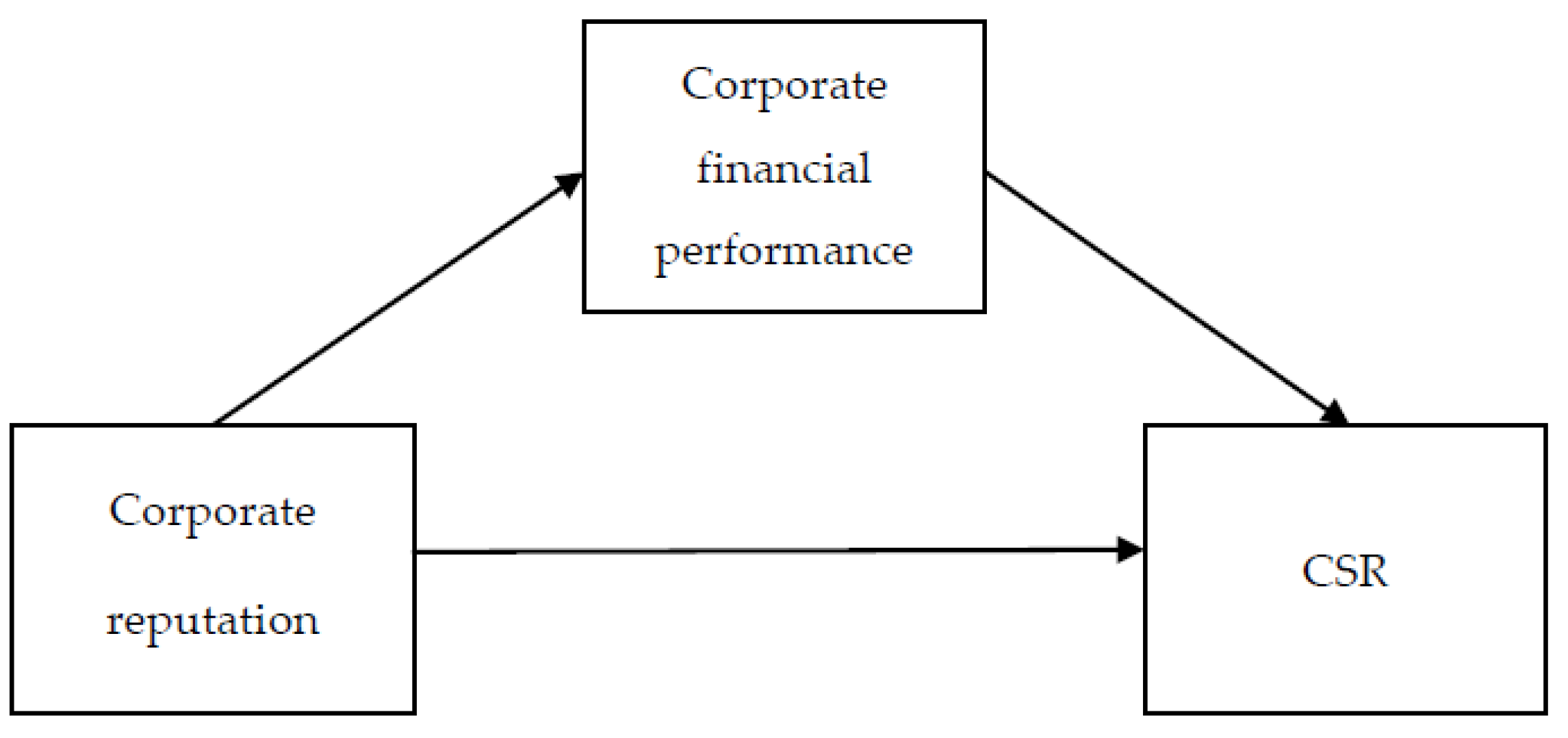

3.3. Research Framework

3.4. Research Method

Control Variable

4. Empirical Results

4.1. Confirmatory Factor Analysis

4.1.1. Reliability analysis

4.1.2. Validity Analysis

Convergent Validity Analysis

CR

CFP

CSR

4.1.3. Discriminant Validity Analysis

4.2. Structural Equation Model Analysis

4.2.1. Overall Mode Description

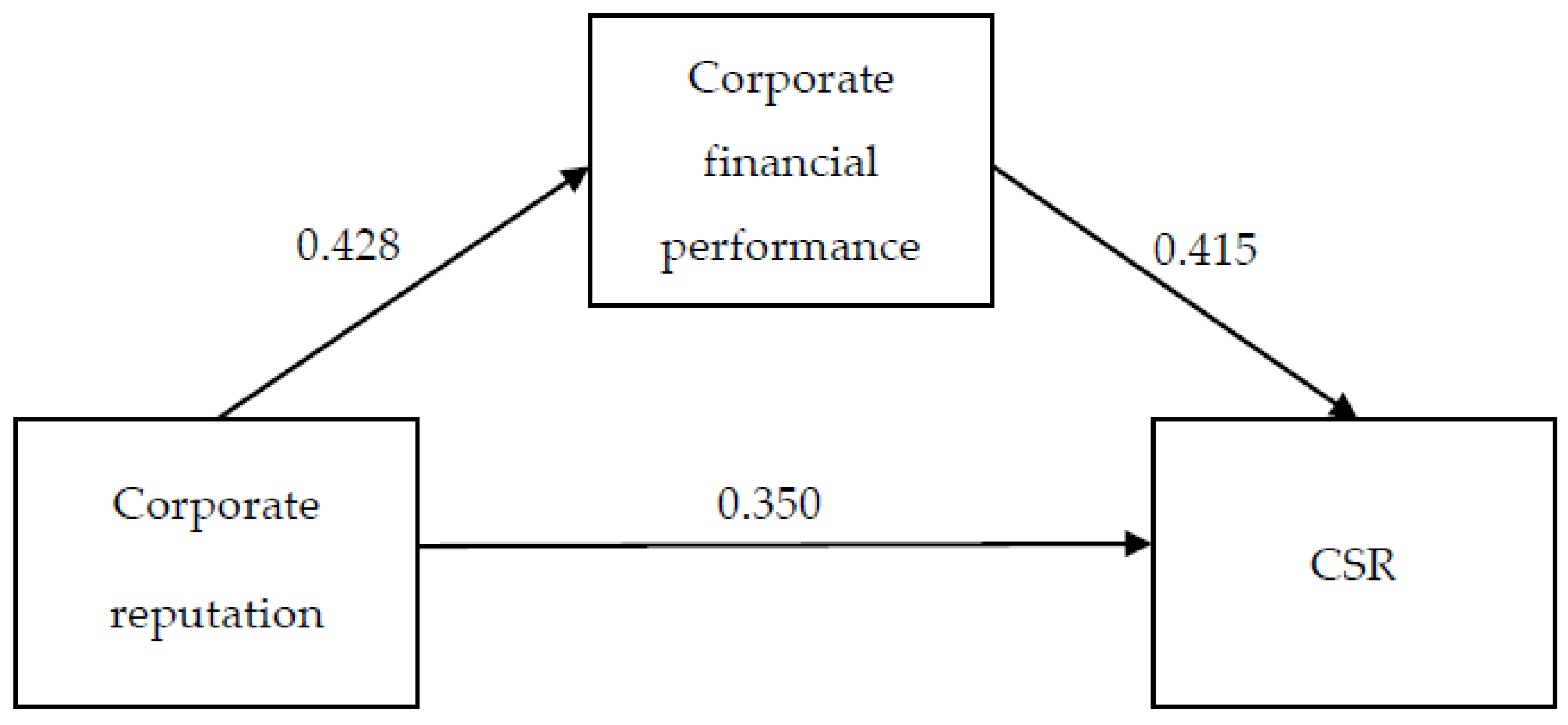

4.2.2. Result

Theoretical Measures

Preliminary Fit Criteria

Overall Model Fit

Fit of Internal Structure of Model

4.3. Hypothesis Relationship Verification

4.3.1. Mediation Test

4.3.2. Control Variable

5. Discussion

5.1. Verification of Hypotheses and Results

5.2. Research Limitations

6. Conclusions

6.1. Research Contribution and Policy Implications

6.2. Future Research Directions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Schaltegger, S.; Burritt, R. Business Cases and Corporate Engagement with Sustainability: Differentiating Ethical Motivations. J. Bus. Ethics 2018, 140, 241–259. [Google Scholar] [CrossRef]

- Da Cruz, N.F.; Marques, R.C. Revisiting the determinants of local government performance. Omega 2014, 44, 91–103. [Google Scholar] [CrossRef]

- Jones, G.; Jones, B.; Little, P. Reputation as reservoir: Buffering against loss in times of economic crisis. Corp. Reput. Rev. 2000, 3, 21–29. [Google Scholar] [CrossRef]

- Schnietz, K.; Epstein, M. Exploring the financial value of a reputation for corporate social responsibility during a crisis. Corp. Reput. Rev. 2005, 7, 327–345. [Google Scholar] [CrossRef]

- Duthler, G.; Dhanesh, S. The role of corporate social responsibility (CSR) and internal CSR communication in predicting employee engagement: Perspectives from the United Arab Emirates (UAE). Public Relat. Rev. 2018, in press. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, corporate reputation and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Sun, K.A.; Kim, D.Y. Does customer satisfaction increase corporate financial performance? An application of American Customer Satisfaction Index (ACSI). Int. J. Hosp. Manag. 2013, 35, 68–77. [Google Scholar] [CrossRef]

- Ali, R.; Lynch, R.; Melewar, T.; Jin, Z. The moderating influences on the relationship of corporate reputation with its antecedents and consequences: A meta-analytic review. J. Bus. Res. 2015, 68, 1105–1117. [Google Scholar] [CrossRef]

- Brammer, S.J.; Pavelin, S. Corporate reputation and social performance: The importance of fit. J. Manag. Stud. 2006, 43, 435–455. [Google Scholar] [CrossRef]

- Niap, D.T.F.; Taylor, D. CEO personal corporate reputation: Does it affect remuneration during times of economic turbulence? Procedia Econ. Financ. 2012, 2, 125–134. [Google Scholar] [CrossRef]

- Tang, A.K.; Lai, K.H.; Cheng, T. Environmental governance of enterprises and their economic upshot through corporate reputation and customer satisfaction. Bus. Strateg. Environ. 2012, 21, 401–411. [Google Scholar] [CrossRef]

- Godfrey, P.C. The relation between corporate philanthropy and shareholder wealth: A risk management perspective. Acad. Manag. Rev. 2005, 30, 777–798. [Google Scholar] [CrossRef]

- Fombrun, C.J.; Fombrun, L.J.; Ponzi, W.N. Stakeholder tracking and analysis: The RepTrak® system for measuring corporate reputation. Corp. Reput. Rev. 2015, 18, 3–24. [Google Scholar] [CrossRef]

- Fatma, M.; Rahman, Z. The CSR’s influence on customer responses in Indian banking sector. J. Retail. Consum. Serv. 2016, 29, 49–57. [Google Scholar] [CrossRef]

- Van Beurden, P.; Gössling, T. The worth of values—A literature review on the relation between corporate social and financial performance. J. Bus. Ethics 2008, 82, 407–424. [Google Scholar] [CrossRef]

- Holme, R.; Watts, P. Corporate Social Responsibility; World Business Council for Sustainable Development: Geneva, Switzerland, 1999. [Google Scholar]

- Carroll, A.B. A three-dimensional conceptual model of corporate performance. Acad. Manag. Rev. 1979, 4, 497–505. [Google Scholar] [CrossRef]

- Friedman, M. The Social Responsibility of Business is to Increase Its Profits. New York Times Magazin. 13 September 1970; reprint in Donaldson, T. In Ethical Issues in Business. A Philosophical Approach; Werhane, P.H., Ed.; Prentice Hall: Englewood Cliffs, NJ, USA, 1970; pp. 217–223. [Google Scholar]

- Gössling, T.; Vocht, C. Social role conceptions and CSR policy success. J. Bus. Ethics 2007, 74, 363–372. [Google Scholar] [CrossRef]

- Lee, Y.M.; Yang, C. The relationships among network ties, organizational agility and organizational performance: A study of the flat glass industry in Taiwan. J. Manag. Organ. 2014, 20, 206–226. [Google Scholar] [CrossRef]

- Nejati, M.; Ghasemi, S. Corporate social responsibility in Iran from the perspective of employees. Soc. Responsib. J. 2012, 8, 578–588. [Google Scholar] [CrossRef]

- Gotsi, M.; Wilson, A.M. Corporate reputation: Seeking a definition. Corp. Commun. 2001, 6, 24–30. [Google Scholar] [CrossRef]

- Sen, S.; Bhattacharya, C.B. Does doing good always lead to doing better? Consumer reactions to corporate social responsibility. J. Mark. Res. 2001, 38, 225–243. [Google Scholar] [CrossRef]

- Mutch, N.; Aitken, R. Being fair and being seen to be fair: Corporate reputation and CSR partnerships. Australas. Mark. J. 2009, 17, 92–98. [Google Scholar] [CrossRef]

- Docherty, S.; Hibbert, S. Examining company experiences of a UK cause-related marketing campaign. Int. J. Nonprofit Volunt. Sect. Mark. 2003, 8, 378–389. [Google Scholar] [CrossRef]

- Marx, J.D. Corporate philanthropy: What is the strategy? Nonprofit Volunt. Sect. Q. 1999, 28, 185–198. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. The competitive advantage of corporate philanthropy. Harv. Bus. Rev. 2002, 80, 56–68. [Google Scholar] [PubMed]

- Fombrun, C.J. Corporate Reputation: Realizing Value from the Corporate Image; Harvard Business School Press: Boston, MA, USA, 1996. [Google Scholar]

- Park, J.; Lee, H.; Kim, C. Corporate social responsibilities, consumer trust and corporate reputation: South Korean consumers’ perspectives. J. Bus. Res. 2014, 67, 295–302. [Google Scholar] [CrossRef]

- Bendixen, M.; Abratt, R. Corporate identity, ethics and corporate reputation in supplier–buyer relationships. J. Bus. Ethics 2007, 76, 69–82. [Google Scholar] [CrossRef]

- Lange, D.; Lee, P.M.; Dai, Y. Organizational corporate reputation: A review. J. Manag. 2011, 37, 153–184. [Google Scholar]

- Casado, A.; Peláez, J. Intangible management monitors and tools: Reviews. Expert Syst. Appl. 2014, 41, 1509–1529. [Google Scholar] [CrossRef]

- Ponzi, L.J.; Fombrun, C.J.; Gardberg, N.A. RepTrak™ pulse: Conceptualizing and validating a short-form measure of corporate reputation. Corp. Reput. Rev. 2011, 14, 15–35. [Google Scholar] [CrossRef]

- Ducassy, I. Does Corporate Social Responsibility Pay Off in Times of Crisis? An Alternate Perspective on the Relationship between Financial and Corporate Social Performance. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 157–167. [Google Scholar] [CrossRef]

- Barnett, M.L. Stakeholder influence capacity and the variability of financial returns to corporate social responsibility. Acad. Manag. Rev. 2007, 32, 794–816. [Google Scholar] [CrossRef]

- Da Cruz, N.F.; Marques, R.C. Structuring composite local governance indicators. Policy Stud. 2017, 38, 109–129. [Google Scholar] [CrossRef] [Green Version]

- Simpson, W.G.; Kohers, T. The link between corporate social and financial performance: Evidence from the banking industry. J. Bus. Ethics 2002, 35, 97–109. [Google Scholar] [CrossRef]

- Tuhin, M.H. Does Corporate Social Responsibility Expenditure Affect Financial Performance of Islamic Banks in Bangladesh? Middle East J. Bus. 2014, 9, 44–50. [Google Scholar] [CrossRef]

- Hasanudin, A.I.; Budianto, R. The implications of corporate social responsibility and corporate financial performance with corporate reputation as intervening variable empirical study in the manufacturing company in Indonesia. J. Bus. Rev. 2014, 2, 106–109. [Google Scholar]

- Huang, C.F.; Lien, H.C. An empirical analysis of the influences of corporate social responsibility on organizational performance of Taiwan’s construction industry: using corporate image as a mediator. Constr. Manag. Econ. 2012, 30, 263–275. [Google Scholar] [CrossRef]

- Vong, F.; Wong, I.A. Corporate and social performance links in the gaming industry. J. Bus. Res. 2013, 66, 1674–1681. [Google Scholar] [CrossRef]

- Gardberg, N.A.; Fombrun, C.J. Corporate Citizenship: Creating Intangible Assets across Institutional Environments. Acad. Manag. Rev. 2006, 31, 329–346. [Google Scholar] [CrossRef]

- Margolis, J.D.; Walsh, J.P. Misery loves companies: Rethinking social initiatives by business. Adm. Sci. Q. 2003, 48, 268–305. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Abimbola, T.; Trueman, M.; Iglesias, O.; Abratt, R.; Kleyn, N. Corporate identity, corporate branding and corporate reputations: Reconciliation and integration. Eur. J. Mark. 2012, 46, 1048–1063. [Google Scholar]

- Fombrun, C.; Shanley, M. What’s in a name? Corporate reputation building and corporate strategy. Acad. Manag. J. 1990, 33, 233–258. [Google Scholar]

- Kotha, S.; Rindova, V.P.; Rothaermel, F.T. Assets and actions: Firm-specific factors in the internationalization of US Internet firms. J. Int. Bus. Stud. 2001, 32, 769–791. [Google Scholar] [CrossRef]

- Roberts, P.W.; Dowling, G.R. Corporate reputation and sustained superior financial performance. Strateg. Manag. J. 2002, 23, 1077–1093. [Google Scholar] [CrossRef] [Green Version]

- Shamsie, J. The context of dominance: An industry-driven framework for exploiting corporate reputation. Strateg. Manag. J. 2003, 24, 199–215. [Google Scholar] [CrossRef]

- Cabral, L. Living Up to Expectations: Corporate Reputation and Sustainable Competitive Advantage; New York University: New York, NY, USA, 2012. [Google Scholar]

- Helm, S. The role of corporate reputation in determining investor satisfaction and loyalty. Corp. Reput. Rev. 2007, 10, 22–37. [Google Scholar] [CrossRef]

- Vidaver-Cohen, D.; Simcic Broon, D. Reputation, Responsibility and Stakeholder Support in Scandinavian Firms: A Comparative Analysis. J. Bus. Ethics 2013, 127, 49–64. [Google Scholar] [CrossRef]

- Jackson, K. Building Reputational Capital; Oxford University Press: New York, NY, USA, 2004. [Google Scholar]

- Mirvis, P.H. Building Reputation Here, There and Everywhere Worldwide Views on Local Impact of Corporate Responsibility; Boston College Center for Corporate Citizenship: Chestnut Hill, MA, USA, 2009. [Google Scholar]

- Hull, C.E.; Rothenberg, S. Firm performance: The interactions of corporate social performance with innovation and industry differentiation. Strateg. Manag. J. 2008, 29, 781–789. [Google Scholar] [CrossRef]

- Wang, H.; Qian, C. Corporate philanthropy and corporate financial performance: The roles of stakeholder response and political access. Acad. Manag. J. 2011, 54, 1159–1181. [Google Scholar] [CrossRef]

- Dressel, C. For effective CSR campaigns, sincerity starts at home. PR News, 18 August 2003; 1–3. [Google Scholar]

- Rose, C.; Thomsen, S. The Impact of Corporate reputation on Performance: Some Danish Evidence. Eur. Manag. J. 2004, 22, 201–210. [Google Scholar] [CrossRef]

- Walsh, G.; Mitchell, V.W.; Jackson, P.R.; Beatty, S.E. Examining the antecedents and consequences of corporate reputation: A customer perspective. Br. J. Manag. 2009, 20, 187–203. [Google Scholar] [CrossRef]

- Godfrey, P.; Merrill, C.; Hansen, J. The relationship between corporate social responsibility and shareholder value: an empirical test of the risk management hypothesis. Strateg. Manag. J. 2009, 30, 425–445. [Google Scholar] [CrossRef] [Green Version]

- Minor, D. Corporate Social Responsibility as Reputation Insurance: Theory and Evidence; Working Paper; Haas School of Business: UC Berkeley, CA, USA, 2010. [Google Scholar]

- Sami, H.; Wang, J.; Zhou, H. Corporate governance and operating performance of Chinese listed firms. J. Int. Account. Audit. Tax. 2011, 20, 106–114. [Google Scholar] [CrossRef]

- Battaglia, F.; Gallo, A. Risk governance and Asian bank performance: An empirical investigation over the financial crisis. Emerg. Mark. Rev. 2015, 25, 53–68. [Google Scholar] [CrossRef]

- Berman, S.L.; Wicks, A.C.; Kotha, S.; Jones, T.M. Does stakeholder orientation matter? The relationship between stakeholder management models and firm financial performance. Acad. Manag. J. 1999, 42, 488–506. [Google Scholar]

- McGuire, J.B.; Sundgren, A.; Schneeweis, T. Corporate social responsibility and firm financial performance. Acad. Manag. J. 1988, 31, 854–872. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Huang, C.J. The Determinants and Performance of R&D Cooperation: Evidence from Taiwan’s High-Technology Industries. Ph.D. Thesis, Department of Accounting National Chengchi University, Taipei, Taiwan, 2007. [Google Scholar]

- Lin, B.W.; Lee, Y.; Hung, S.C. R&D intensity and commercialization orientation effects on financial performance. J. Bus. Res. 2006, 59, 679–685. [Google Scholar]

- Nagaoka, S. Assessing the R&D management of a firm in terms of speed and science linkage: Evidence from the U.S. patents. J. Econ. Manag. Strateg. 2007, 16, 129–156. [Google Scholar]

- Calantone, R.J.; Cavusgil, S.T.; Zhao, Y. Learning orientation, firm innovation capability and firm performance. Ind. Mark. Manag. 2002, 31, 515–524. [Google Scholar] [CrossRef]

- Nunnally, C.J. Psychometric Methods; Harper and Row: New York, NY, USA, 1978. [Google Scholar]

- Anderson, J.C.; Gerbing, D.W. Structural equation modeling in practice: A review and recommended two-step approach. Psychol. Bull. 1988, 103, 411–423. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Yi, Y. On the Evaluation of Structural Equation Models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Gefen, D.; Straub, D.W.; Boudreau, M.C. Structural equation modelling and regression: Guidelines for research practice. Commun. Assoc. Inf. Syst. 2000, 4, 1–78. [Google Scholar]

- Gaski, J.F.; Nevin, J.R. The differential effects of exercised and unexercised power sources in a marketing channel. J. Mark. Res. 1985, 22, 130–142. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Williams, L.J.; Hazer, J.T. Antecedents and consequences of satisfaction and commitment in turnover models: A reanalysis using latent variable structural equation methods. J. Appl. Psychol. 1986, 71, 219–231. [Google Scholar] [CrossRef]

- Hair, J.F.J.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis; Pearson Education: London, UK, 2006. [Google Scholar]

| Variables | Average | Unit | Standard Deviation | Min | Max | K–S | Distinctiveness |

|---|---|---|---|---|---|---|---|

| CSR | 70.67 | Score | 4.63 | 60.22 | 81.40 | 0.151 | <0.001 * |

| CR | 73.13 | Score | 4.18 | 63.22 | 84.36 | 0.075 | <0.001 * |

| Tobin’s Q | 1.16 | Ratio | 0.73 | 0.06 | 5.01 | 0.148 | <0.001 * |

| ROA | 7.32 | Ratio | 6.14 | −13.20 | 30.76 | 0.081 | <0.001 * |

| Quick ratio | 2.25 | Ratio | 0.84 | 0.33 | 3.68 | 0.102 | <0.001 * |

| Operating cycle | 189.42 | Days | 26.71 | 113.83 | 299.57 | 0.074 | <0.001 * |

| Debt to tangible assets ratio | 1.58 | Ratio | 0.53 | 0.67 | 3.66 | 0.139 | <0.001 * |

| Sales growth rate | 20.38 | Percentage | 8.26 | 5.42 | 43.99 | 0.228 | <0.001 * |

| Firm size | 90.51 | Ratio | 119.88 | 5.91 | 781.90 | 0.240 | <0.001 * |

| Age | 88.52 | Years | 46.51 | 10.00 | 208.00 | 0.082 | <0.001 * |

| Interest coverage ratio | 4.47 | Ratio | 1.31 | 1.98 | 7.64 | 0.113 | <0.001 * |

| Construct | Sub-Construct | Cronbach’s α |

|---|---|---|

| Corporate Reputation (CR) | Admiration and respect (AR) | 0.918 |

| Recognized reputation (RR) | 0.961 | |

| Good feeling (CF) | 0.958 | |

| Trust | 0.942 | |

| Corporate Financial Performance (CFP) | ROA | 0.915 |

| Tobin’s Q (TQ) | 0.939 | |

| Quick ratio (QR) | 0.912 | |

| Debt to tangible assets ratio (DT) | 0.917 | |

| Operating cycle (OC) | 0.872 | |

| CSR | 0.929 |

| AR | RR | GF | Trust | Correlation Coefficient | AVE | |

|---|---|---|---|---|---|---|

| AR | 0.860 | 0.9192 | 0.7399 | |||

| RR | 0.757 ** | 0.911 | 0.9607 | 0.8303 | ||

| GF | 0.874 ** | 0.828 ** | 0.907 | 0.9588 | 0.8231 | |

| Trust | 0.885 ** | 0.818 ** | 0.924 ** | 0.875 | 0.9424 | 0.7659 |

| Cronbach’s α | 0.918 | 0.961 | 0.958 | 0.942 |

| ROA | TQ | QR | DT | OC | Correlation Coefficient | AVE | |

|---|---|---|---|---|---|---|---|

| ROA | 0.857 | 0.9170 | 0.7347 | ||||

| TQ | 0.695 ** | 0.895 | 0.9414 | 0.8009 | |||

| QR | 0.791 ** | 0.722 ** | 0.823 | 0.9131 | 0.6775 | ||

| DT | 0.704 ** | 0.739 ** | 0.804 ** | 0.859 | 0.9183 | 0.7382 | |

| OC | 0.738 ** | 0.799 ** | 0.748 ** | 0.749 ** | 0.844 | 0.8807 | 0.7124 |

| Cronbach’s α | 0.915 | 0.939 | 0.912 | 0.917 | 0.872 |

| Evaluation Items | Standard Value or Result |

|---|---|

| Preliminary Fit Criteria: Detection errors, identification problems, or incorrect input | |

| Is there any negative error variation? | Yes |

| Has the error variation reached a significant level? | Yes |

| Is the absolute value of the correlation between the parameters not too close? | Yes |

| Factor loading is between 0.5 ~ 0.95 | Yes |

| There is no tremendous standard error | Yes |

| Overall Model Fit: Assessing the fit of the entire pattern and observation data | |

| 1. Model Fit→CMIN: Significant level of χ2; p > 0.05 | A smaller chi-square value is better |

| 2. Model Fit→CMIN→CMIN/DF: χ2/d.f. | <5 |

| 3. Model Fit→RMR, GFI→RMR (<0.05) | <0.05 |

| 4. Model Fit→RMR, GFI→GFI (>0.9) | >0.8 |

| 5. Model Fit→RMR, GFI→AGFI (>0.9) | >0.9 |

| 6. Model Fit→Baseline Comparisons→NFI (>0.9) | >0.9 |

| 7. Model Fit→Baseline Comparisons→TLI (>0.90) | >0.9 |

| 8. Model Fit→Baseline Comparisons→CFI (>0.9) | >0.9 |

| 9. Model Fit→RMSEA (<0.05) | <0.08 |

| Intrinsic quality of the model | |

| Reliability of individual items (reliability analysis) | >0.5 |

| Potential variable CR (measurement model) | >0.7 |

| AVE of potential variables (measurement model) | >0.5 |

| Relationship between Constructs | Path Coefficient | t-Value | Hypothesis | Testing Result | ||

|---|---|---|---|---|---|---|

| CR | → | CFP | 0.428 *** | 8.604 | H1 | Accepted |

| CFP | → | CSR | 0.415 *** | 8.174 | H2 | Accepted |

| CR | → | CSR | 0.350 *** | 7.387 | H3 | Accepted |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, Y.-M.; Hu, J.-L. Integrated Approaches for Business Sustainability: The Perspective of Corporate Social Responsibility. Sustainability 2018, 10, 2318. https://doi.org/10.3390/su10072318

Lee Y-M, Hu J-L. Integrated Approaches for Business Sustainability: The Perspective of Corporate Social Responsibility. Sustainability. 2018; 10(7):2318. https://doi.org/10.3390/su10072318

Chicago/Turabian StyleLee, Yu-Muo, and Jin-Li Hu. 2018. "Integrated Approaches for Business Sustainability: The Perspective of Corporate Social Responsibility" Sustainability 10, no. 7: 2318. https://doi.org/10.3390/su10072318

APA StyleLee, Y.-M., & Hu, J.-L. (2018). Integrated Approaches for Business Sustainability: The Perspective of Corporate Social Responsibility. Sustainability, 10(7), 2318. https://doi.org/10.3390/su10072318