Abstract

This paper aims to investigate the relationship between board governance and sustainability disclosure in Singapore. Regression analysis is performed using cross-sectional data of Singapore-listed companies to examine the relationship between sustainability disclosure and various board governance factors, including board capacity, board independence, and board incentive. The findings show the presence of significant associations between board governance and sustainability disclosure. In terms of board capacity, companies with larger board sizes and a higher number of board meetings are more likely to practice sustainability reporting, and their reporting qualities are higher. For board independence, the percentage of independent directors positively impacts the firm’s reporting probability and quality on sustainability in Singapore. For board incentives, the practice of long-term incentives for executive directors can significantly improve both the probability and quality of sustainability reporting. The study adds to the literature on corporate governance and sustainability disclosure. It provides empirical evidence and guidance for firms and policy-makers in Singapore and beyond on how sustainability disclosure can be improved through robust board governance.

1. Introduction

The awareness of sustainability raises among stakeholders significantly over the last decades, especially in the aftermath of environmental disasters and episodes of market turmoil. Companies start to face mounting pressure to report non-financial information on their operations [1], giving rise to a growing attention on sustainability disclosure [2]. As a result, theories are developed in the literature to explain the practice. According to agency theorists, companies can reduce information asymmetry through voluntary disclosures, therefore protecting stakeholders’ interests with lower agency costs incurred [3].

Since sustainability disclosure forms a strategic part of stakeholder engagement process, it is naturally related to boards of directors who actively direct the development and change of companies’ strategies [4,5]. Additionally, boards are undeniably heavily involved in the communication process with stakeholders, where material information about companies are shared. This is because boards connect the investors with the managers, as well as the enterprise with the wider community in which it operates; they have to balance the demands of various interested parties [6].

Currently, the main method of sustainability disclosure is through reporting. Sustainability, as a theme, has been well developed in research and practice. However, its reporting has not been fully explored, although this has increasingly received attention amongst scholars particularly in the last decade. The current evolution and form of sustainability reporting had been based on corporate social responsibility (CSR) and environment reporting. Even though a significant increase in sustainability reporting has been witnessed around the world [7], due to the absence of a common development framework and the voluntary nature of reporting in most countries, a considerable diversity exists in the reporting practices of companies [8]. Indeed, the use of sustainability reporting has been to highlight the positive achievements of the company, albeit very interestingly, it may be used to even legitimize the negative aspects [9].

Invariably, corporate leadership, particularly the board of directors, is crucial in promulgating sustainability reporting. Given the central role of the boards in influencing the company’s disclosure, we would like to conduct a cross-sectional study to test the relationship between board governance and the observed variations in sustainability reporting among companies in Singapore. This study focuses on three aspects of board governance, i.e., board capacity, board independence, and board incentive. It offers a comprehensive understanding of the association between board governance, which is the most vital part of corporate governance, and sustainability disclosure from a Singapore perspective. Our study addresses a gap in the literature through examining a unique point in the special context of Singapore where it is in an advanced stage of voluntary reporting. It is interesting because board processes in Singapore’s listed companies have received guidance through the existing Code of Corporate Governance and, yet, sustainability reporting has been left alone. This is in contrast with many other countries in Asia, such as the Southeast Asian countries of Indonesia, Malaysia, and Thailand, where sustainability reporting is mandated. The unique voluntary context of Singapore provides a rich experimental setting to strengthen conceptual understanding of the actual commitment of boards in embarking on disclosures in the company’s sustainability efforts. Our positive findings on the association also provides an empirical basis of policy-making for policy-makers and regulators in Singapore and beyond.

This paper is structured as follows: In Section 2, we review the related literature and develop our hypotheses. Then the data sample and research methodology are explained in Section 3. Section 4 presents the descriptive and regression results, together with discussions on our findings. Lastly, we conclude the paper in Section 5.

2. Literature Review and Hypotheses Development

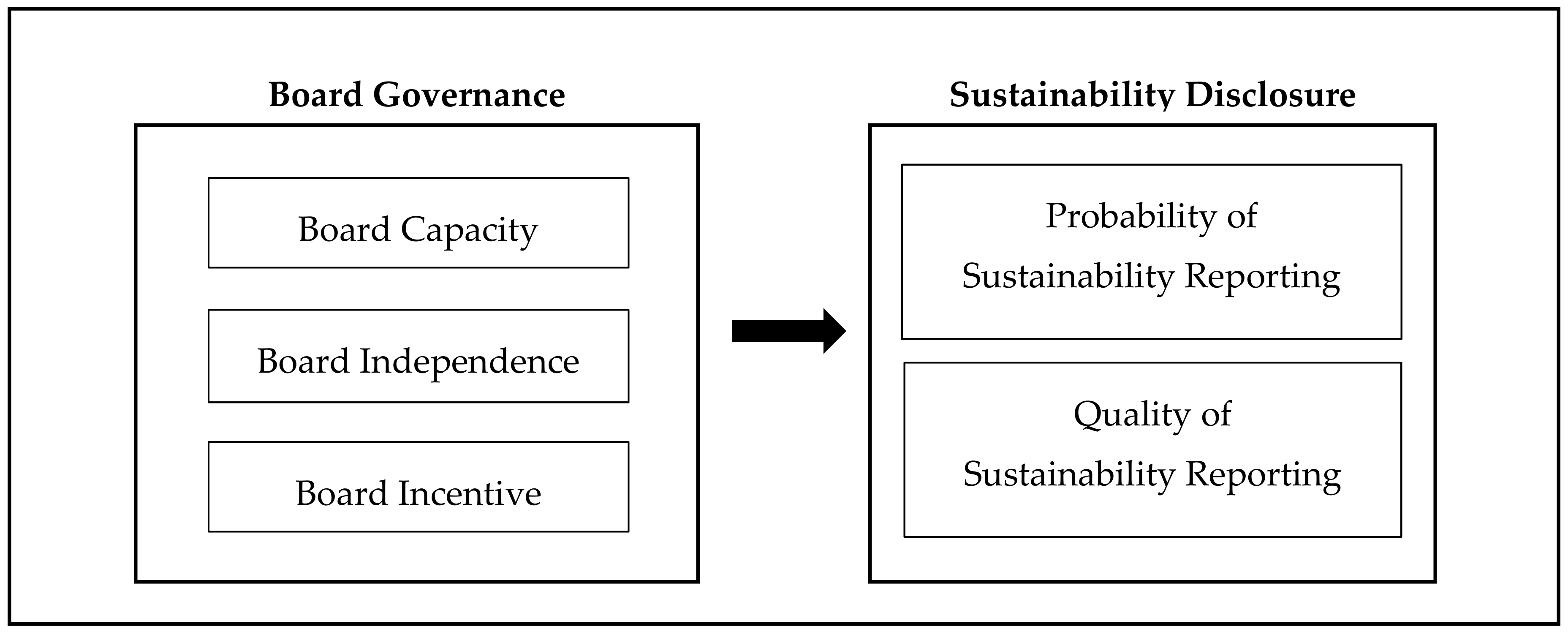

Before the financial year of 2017, sustainability reporting was practiced on a voluntary basis for all listed companies in Singapore. This gives the companies ample discretion in deciding whether to report and how much to report on their sustainability performance. For this study, we constructed the conceptual model in Figure 1 below. The impacts of board governance on both the probability of sustainability reporting and the quality of sustainability reporting are investigated. Three factors are identified for board governance, including board capacity, board independence, and board incentives. These factors will be discussed in detail in Section 2.1, Section 2.2 and Section 2.3.

Figure 1.

The conceptual model for board governance and sustainability disclosure.

2.1. Board Capacity: Board Size and Board Meetings

Based on agency theory, larger board size can reduce managerial domination of the board, thus large boards are often found more effective at mitigating potential conflict of interests [10,11]. Boards of directors are also important sources of human and social capital to companies as they bring valuable expertise, as well as associations with companies’ external environments [12]. A larger board represents a larger pool of talent and resources, thus having a higher resource capacity to advising firms on sustainability issues. Moreover, since directors facilitate the inter-organizational imitation of strategies and practices [13], companies with larger boards are more likely to keep abreast with the latest sustainability reporting trends through director networks. Empirical evidence suggests a positive impact of board size on sustainability reporting. For example, it is found that board size is positively related with sustainability reporting quality among 113 Asia-pacific firms [14]. The same positive association is found in Taiwan-listed and Pakistan-listed companies [15,16].

The number of board meetings is a representation of boards’ time capacity as frequency of meetings reflect the level of board activities. In fact, the most common problem that limits the effectiveness of boards is the lack of time to perform their duties [17]. Some researchers suggest that an adequate frequency of board meetings is necessary for directors to make effective decisions [18]. At board meetings, directors discuss the company’s sustainability disclosure and stakeholder engagement strategies [19]. With more interaction through board meetings, directors would better monitor the requests and address the needs of stakeholders in order to secure legitimacy. Therefore, we would expect to observe an improvement in the likelihood and quality of sustainability reporting as the number of board meetings increases.

The above discussions lead us to the following hypotheses on board capacity:

Hypothesis 1a.

The board size is positively associated with the probability of sustainability reporting.

Hypothesis 1b.

The board size is positively associated with the quality of sustainability reporting.

Hypothesis 2a.

The number of board meetings is positively associated with the probability of sustainability reporting.

Hypothesis 2b.

The number of board meetings is positively associated with the quality of sustainability reporting.

2.2. Board Independence: Independent Directors and CEO Duality

Under agency theory, a fundamental responsibility of boards is to reduce agency costs through monitoring the activities of managements in the interest of shareholders. Comparing to non-independent directors, independent directors are found to be more vigilant and effective in their monitoring functions, and less likely to tolerate managerial opportunism at shareholders’ expenses [20,21]. Hence, companies with higher percentages of independent directors are expected to display higher levels of accountability and transparency. These arguments are supported empirically. For example, outside directors are found to be more concerned about firms’ corporate social responsibilities and less oriented towards economic performance than the inside board members [22]. Additionally, outside directors’ representation is positively associated with firms’ corporate social performance [23]. Empirically, researchers also investigated the effect of board independence on corporate disclosures. For instance, it is found that companies with more independent boards practice more comprehensive financial disclosures [24]. A study on Spanish firms shows that there is a positive relationship between the proportion of independent directors and voluntary disclosure [25]. Furthermore, boards with a majority of independent directors voluntarily disclose more forward-looking information in annual reports [26].

While board independence is strengthened with a higher concentration of independent directors, it can be compromised by CEO duality [27]. CEO duality exists if one person serves as both the company’s CEO and the chairman of the board [28]. Under this structure, the CEO is given superior governance power, thus, the board’s ability to objectively assess the performance of the firm’s top management (including the CEO) can be undermined, rendering the board less effective in its controlling and monitoring function [29]. Moreover, duality threatens the completeness of information transfer from the CEO to other directors on the board [30], which may lead to less voluntary disclosure [31]. Although theories seem to suggest a negative effect of the duality structure on disclosure, empirical evidences are mixed. When researchers tried to link CEO duality with various types of voluntary disclosure, financial or non-financial, some of them established negative relationships [31,32,33], but others found insignificant relationships [34,35].

Following theories and prior studies on board independence, we developed the following hypotheses on board independence:

Hypothesis 3a.

The proportion of independent directors on board is positively associated with the probability of sustainability reporting.

Hypothesis 3b.

The proportion of independent directors on board is positively associated with the quality of sustainability reporting.

Hypothesis 4a.

CEO duality is negatively associated with the probability of sustainability reporting.

Hypothesis 4b.

CEO duality is negatively associated with the quality of sustainability reporting.

2.3. Board Incentives: Short-Term and Long-Term Incentives for Executive Directors on Board

On top of a fixed portion that consists of board fees for the directors, most companies includes a variable portion into the directors’ remuneration package based on companies’ performance, especially for executive directors. The arrangement of this incentive-based compensation aims to align directors’ individual interests with that of stakeholders, hence minimizing agency problems. Unlike independent directors, executive directors are the top level of management, thus, they are heavily involved in the daily operations of the company. Rewarding them on the basis of short-term performances without regard for long-term considerations exposes the company to the risks of “short-termism”, causing damage to the company’s long run value creation [36]. Since sustainability reporting focuses on companies’ long-term strategies, the orientation of the financial incentives for executive directors could be an important determinant of the companies’ disclosure. Therefore, we would like to test the following hypotheses:

Hypothesis 5a.

Short-term incentive is negatively associated with the probability of sustainability reporting.

Hypothesis 5b.

Short-term incentive is negatively associated with the quality of sustainability reporting.

Hypothesis 6a.

Long-term incentive is positively associated with the probability of sustainability reporting.

Hypothesis 6b.

Long-term incentive is positively associated with the quality of sustainability reporting.

3. Methodology and Data

This cross-sectional study involves 462 companies primarily listed on Singapore Exchange (SGX) Mainboard as of 30 June 2016, excluding those that are delisted, suspended, and with missing or outlying financial data. We use sustainability reporting scores, which are obtained from the study “Sustainability Reporting in Singapore” [37], as a measurement of the reporting quality of the companies. Companies are first assessed from four aspects, governance, economics, environmental, and social. Then a total score is calculated with the sub-score of each indicator equally weighted. The total score has a scale of 0 to 100, with 0 indicating a non-disclosure on sustainability and 100 indicating a detailed disclosure furnished with measurements. It is calculated according to the sustainability reporting guideline Global Reporting Initiative (GRI) G4. Data on board governance factors are collected from companies’ annual reports, whereas financial data are extracted from Bloomberg. All data used are for the financial year of 2015.

We constructed two models to examine the hypotheses regarding the impacts of board governance on sustainability reporting:

Model 1

Model 2

where SR = sustainability reporting, SR_Q = quality of sustainability reporting, NOD = no. of directors, NOM = no. of board meetings, IND = % of independent directors, CEO = CEO duality, STI = short-term incentive, LTI = long-term incentive, LNTA = company size, DE = leverage, ROA = productivity, HI = high-impact industry, and , = error terms.

Model 1 is used to investigate the relationship between board governance and the probability of companies voluntarily reporting sustainability. The dependent variable, sustainability reporting (SR), is a dummy variable. It equals 1 if the company’s SR score is positive, meaning the company reported sustainability for the financial year. It equals 0 if the company’s SR score is 0, i.e., the company did not report sustainability for the financial year.

The independent variables consist of six board governance variables, i.e., NOD, NOM, IND, CEO, STI, and LTI, and four control variables, i.e., LNTA, DE, ROA, and HI. Board capacity is measured by the number of directors on board (NOD) and the number of board meetings held during the financial year (NOM). Board independence is captured by the percentage of independent directors on board (IND) and the presence of CEO duality (CEO). IND is calculated as the number of independent directors divided by the number of board directors. The variable CEO is a dummy variable where it equals 1 if the company’s chairman of board is also the company’s CEO and equals 0 if CEO duality is not observed. The dummy variable short-term incentive (STI) and long-term incentive (LTI) are used to indicate the inclusion of respective remuneration incentives for executive directors. Based on previous studies, we control for company size (LNTA), leverage (DE), and profitability (ROA) using the natural log of total asset, debt to equity ratio and return on assets, respectively [38,39,40,41,42,43,44].

In consideration of the SGX reporting guidelines, we further added high-impact sectors (HI) as a control variable. Under the “Guide to Sustainability Reporting for Listed Companies” in Singapore, SGX listed ten high-impact sectors and encouraged companies operating in these sectors to undertake sustainability reporting. The high-impact sectors are agriculture, air transport, chemicals, and pharmaceuticals, construction, food and beverages, forestry and paper, mining and metals, oil and gas, shipping, and water. Moreover, many studies observed a higher level of sustainability reporting for environmentally-sensitive industries [7,43,45,46,47]. Therefore, we expect sustainability efforts to be better reported in the high-impact sectors in Singapore. To identify HI companies, we first classify the 462 companies according to the Singapore Standard Industrial Classification (SSIC), then we manually filtered for companies that falls under the ten HI sectors. The dummy variable HI will be assigned 1 when the company belongs to one of the high-impact sectors and 0 otherwise.

Model 2 is constructed to examine the effects of board governance on the quality of sustainability reporting (SR_Q). Since the SR score is a measurement of the quality of the company’s sustainability reporting in FY2015, it is taken as our dependent variable. The independent variables for Model 1 and Model 2 are the same.

A summary of variables can be found in Table 1.

Table 1.

A summary of variables.

We conducted our research through regression analysis. Both linear regression and logistic regression methods are used for Model 1 because its dependent variable, SR, is a dummy variable. Then least square regression is used for Model 2.

4. Analysis and Results

4.1. Descriptive statistics

Table 2 presents the descriptive statistics of the research variables. The mean of the dummy variable SR is 0.39, reflecting the fact that 39% of the companies (180 out of 462) reported sustainability for FY2015. As for SR_Q, companies obtained an average score of 16.81 for the quality of their sustainability reporting, with a maximum score of 72.51 out of 100. On average, Singapore companies have about seven directors on board, and nearly half of the board are independent. We observe that a large proportion of companies adopted incentive-based remuneration packages to motivate their executive directors, though the fraction of companies using the long-term incentives (47%) is much smaller than that of the short-term incentives (91%).

Table 2.

Descriptive statistics for variables.

As shown in Table 3, low correlations exist between various independent variables, with the highest correlation (0.4059) observed between NOD and LNTA. This ensures the absence of multicollinearity in our regression analyses.

Table 3.

Correlation statistics for variables.

4.2. Regression Results

Table 4 shows our regression results for Model 1, with standard errors in parentheses. As mentioned in Section 3, we estimated both a linear probability model (LPM) and a logit model as the dependent variable SR is dummy. White heteroscedasticity-robust standard errors are used for the LPM. Consistent results are obtained for the two models as we observed the same significant variables and same signs of the coefficients. Among the board related variables, NOD, NOM, IND, and LTI have significant and positive relationships with SR, which are consistent with our hypotheses H1a, H2a, H3a, and H6a respectively. However, H4a and H5a are not supported as the coefficient estimates for CEO and STI are insignificant. For control variables, LNTA and ROA are significantly and positively related to SR, whereas the results for DE and HI are insignificant. Overall, the variables are jointly significant for both models, which correctly predicts approximately 70% of the observations.

Table 4.

Regression results for Model 1.

We use the average partial effects (APE) of the independent variables to interpret the estimations of the logit model. The APEs are reported side by side with the estimated coefficients of the LPM in Table 5 for an easy comparison of the magnitudes of the estimates between the two models. We can see that the APEs estimated using the logic model are very close to the LPM estimates. This evidently shows the consistency and robustness of our results.

Table 5.

A comparison of LPM and Logit estimations.

Table 6 presents the linear regression results for Model 2 on the relationships between board governance and the quality of sustainability reporting. White heteroscedasticity-robust standard errors are reported in parentheses. We found that the significant variables in Model 2 (i.e., NOD, NOM, IND and LTI) are the same significant variables in Model 1. The positive impacts of these variables on reporting quality are consistent with our expectations, thus providing evidence for the hypotheses H1b, H2b, H3b, and H6b. Again, we see insignificant estimates for CEO and STI, therefore, H4b and H5b are not supported.

Table 6.

Regression results for Model 2.

The results for Model 1 and Model 2 tell us a consistent story for the effects of board governance on sustainability disclosure in Singapore. In terms of board capacity, companies with larger board sizes and a greater number of board meetings are more likely to practice sustainability reporting and, at the same time, their reporting qualities are higher. This is consistent with prior findings [14,15,16]. For board independence, the proportion of independent directors positively impacts the firm’s reporting probability and quality on sustainability in Singapore while no significant effect of CEO duality has been found. For board incentives, our results suggest that the practice of long-term incentives for executive directors can significantly improve both the probability and quality of sustainability reporting, while short-term incentives are insignificant in driving sustainability reporting. Although the insignificant impact of CEO duality contradicts our prediction based on agency theory, this could be an indication of the strong capability of Singapore CEOs in handling their management and monitoring roles simultaneously. Another reason could be the effect of long-term incentives. If CEOs’ compensation is tied to the sustainability of companies, agency problems caused by the duality role could be significantly lessened. For short-term incentives, the insignificant result might be due to the prevalence of practicing short-term incentives in Singapore. As shown by our descriptive statistics, around 90% of the firms listed on SGX adopt short-term incentives. With a low variability in the independent variable STI, it could be very hard for the model to detect significant outcomes. A summary of results can be found in Table 7.

Table 7.

A summary of results.

5. Conclusions

This study examines the relationship between board governance and sustainability disclosure in Singapore. We found that board capacity, board independence, and board incentive are associated with the likelihood and quality of sustainability reporting. Our findings provide evidence for firms and policy-makers on how sustainability disclosure can be improved through robust board governance. Especially, our results suggest that companies can enhance their sustainability reporting through having a larger board, encouraging directors’ communication with more board meetings, increasing the representation of independent directors on the board, and implementing long-term incentives for executive directors. These results are useful not only for the Singapore context, but may also guide regulatory development in many jurisdictions as sustainability reporting is being mandated. An empirical understanding of the drivers and inhibitors of sustainability reporting will help policy-makers in knowing the specific effects of board nuances on voluntary sustainability reporting and where the possible areas of attention and action are.

By using cross-sectional data of all primary-listed companies on SGX, we cover highly diversified companies with a wide range of sizes, leverages, productivities, and industries, hence, enhancing the generalizability of our findings. Furthermore, since this study investigates six board-related factors from three different aspects of board governance, we avoid the problem of focusing narrowly on only one specific board characteristic, hence, minimizing the probability of omitting important variables in our regression analysis. Future research may actually explore even finer contextual delineations, such as family versus non-family firms [48] or other categories of stakeholders beyond shareholders as represented by the boards of directors [49].

Nevertheless, this analysis has limitations. Our regression results rely on information collected from published annual reports, however, the accuracy of board information can be affected by the disclosure level of companies. Additionally, significant associations identified in our analysis do not imply causation. We adopt a cross-sectional approach in our study because the decision to disclose may be more contemporaneous with the board of the reporting year. This is especially so as there are periodic changes in board appointments, as in board turnovers. However, further studies can look at the possibility of adopting time series analysis to establish the causal relationships between board governance and sustainability disclosure.

Author Contributions

Conceptualization: M.H. and L.L.; formal analysis: M.H.; supervision: L.L.; writing—original draft: M.H.; writing—review and editing: L.L.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Logsdon, J.M.; Lewellyn, P.G. Expanding accountability to stakeholders: Trends and predictions. Bus. Soc. Rev. 2000, 105, 419–435. [Google Scholar] [CrossRef]

- Burritt, R.L.; Schaltegger, S. Sustainability accounting and reporting: Fad or trend? Account. Audit. Account. J. 2010, 23, 829–846. [Google Scholar] [CrossRef]

- Cormier, D.; Magnan, M.; Van Velthoven, B. Environmental disclosure quality in large german companies: Economic incentives, public pressures or institutional conditions? Eur. Account. Rev. 2005, 14, 3–39. [Google Scholar] [CrossRef]

- Johnson, J.L.; Daily, C.M.; Ellstrand, A.E. Boards of directors: A review and research agenda. J. Manag. 1996, 22, 409–438. [Google Scholar] [CrossRef]

- Westphal, J.D.; Fredrickson, J.W. Who directs strategic change? Director experience, the selection of new ceos, and change in corporate strategy. Strateg. Manag. J. 2001, 22, 1113–1137. [Google Scholar] [CrossRef]

- Cadbury, S.A. The corporate governance agenda. Corp. Gov. Int. Rev. 2000, 8, 7–15. [Google Scholar] [CrossRef]

- Kolk, A. A decade of sustainability reporting: Developments and significance. Int. J. Environ. Sustain. Dev. 2004, 3, 51–64. [Google Scholar] [CrossRef]

- Adams, C.A.; Frost, G.R. Integrating sustainability reporting into management practices. Account. Forum 2008, 32, 288–302. [Google Scholar] [CrossRef]

- Hahn, R.; Lülfs, R. Legitimizing negative aspects in gri-oriented sustainability reporting: A qualitative analysis of corporate disclosure strategies. J. Bus. Ethics 2014, 123, 401–420. [Google Scholar] [CrossRef]

- Mak, Y.T.; Roush, M.L. Factors affecting the characteristics of boards of directors: An empirical study of new zealand initial public offering firms. J. Bus. Res. 2000, 47, 147–159. [Google Scholar] [CrossRef]

- Zahra, S.A.; Pearce, J.A. Boards of directors and corporate financial performance: A review and integrative model. J. Manag. 1989, 15, 291–334. [Google Scholar] [CrossRef]

- Certo, S.T. Influencing initial public offering investors with prestige: Signaling with board structures. Acad. Manag. Rev. 2003, 28, 432–446. [Google Scholar] [CrossRef]

- Haunschild, P.R. Interorganizational imitation: The impact of interlocks on corporate acquisition activity. Adm. Sci. Q. 1993, 38, 564–592. [Google Scholar] [CrossRef]

- Amran, A.; Lee, S.P.; Devi, S.S. The influence of governance structure and strategic corporate social responsibility toward sustainability reporting quality. Bus. Strateg. Environ. 2014, 23, 217–235. [Google Scholar] [CrossRef]

- Mahmood, Z.; Kouser, R.; Waris, A.; Ahmad, Z.; Salman, T. Does corporate governance affect sustainability disclosure? A mixed methods study. Sustainability 2018, 10, 207. [Google Scholar] [CrossRef]

- Wang, M.-C. The relationship between firm characteristics and the disclosure of sustainability reporting. Sustainability 2017, 9, 624. [Google Scholar] [CrossRef]

- Lipton, M.; Lorsch, J.W. A modest proposal for improved corporate governance. Bus. Lawyer 1992, 48, 59–77. [Google Scholar]

- Conger, J.A.; Finegold, D.; Lawler, E.E., 3rd. Appraising boardroom performance. Harv. Bus. Rev. 1998, 76, 136–148. [Google Scholar]

- Herremans, I.M.; Nazari, J.A.; Mahmoudian, F. Stakeholder relationships, engagement, and sustainability reporting. J. Bus. Ethics 2016, 138, 417–435. [Google Scholar] [CrossRef]

- Kesner, I.F.; Johnson, R.B. An investigation of the relationship between board composition and stockholder suits. Strateg. Manag. J. 1990, 11, 327–336. [Google Scholar] [CrossRef]

- Kosnik, R.D. Greenmail: A study of board performance in corporate governance. Adm. Sci. Q. 1987, 32, 163–185. [Google Scholar] [CrossRef]

- Ibrahim, N.A.; Angelidis, J.P. The corporate social responsiveness orientation of board members: Are there differences between inside and outside directors? J. Bus. Ethics 1995, 14, 405–410. [Google Scholar] [CrossRef]

- Johnson, R.A.; Greening, D.W. The effects of corporate governance and institutional ownership types on corporate social performance. Acad. Manag. J. 1999, 42, 564–576. [Google Scholar]

- Chen, C.J.P.; Jaggi, B. Association between independent non-executive directors, family control and financial disclosures in hong kong. J. Account. Public Policy 2000, 19, 285–310. [Google Scholar] [CrossRef]

- Babío Arcay, M.R.; Muiño Vázquez, M.F. Corporate characteristics, governance rules and the extent of voluntary disclosure in spain. Adv. Account. 2005, 21, 299–331. [Google Scholar] [CrossRef]

- Lim, S.; Matolcsy, Z.; Chow, D. The association between board composition and different types of voluntary disclosure. Eur. Account. Rev. 2007, 16, 555–583. [Google Scholar] [CrossRef]

- Boyd, B.K. Board control and ceo compensation. Strateg. Manag. J. 1994, 15, 335–344. [Google Scholar] [CrossRef]

- Rechner, P.L.; Dalton, D.R. Ceo duality and organizational performance: A longitudinal analysis. Strateg. Manag. J. 1991, 12, 155–160. [Google Scholar] [CrossRef]

- Mallette, P.; Fowler, K.L. Effects of board composition and stock ownership on the adoption of “poison pills”. Acad. Manag. J. 1992, 35, 1010–1035. [Google Scholar]

- Kim, K.-H.; Al-Shammari, H.A.; Kim, B.; Lee, S.-H. Ceo duality leadership and corporate diversification behavior. J. Bus. Res. 2009, 62, 1173–1180. [Google Scholar] [CrossRef]

- Samaha, K.; Khlif, H.; Hussainey, K. The impact of board and audit committee characteristics on voluntary disclosure: A meta-analysis. J. Int. Account. Audit. Tax. 2015, 24, 13–28. [Google Scholar] [CrossRef]

- Allegrini, M.; Greco, G. Corporate boards, audit committees and voluntary disclosure: Evidence from italian listed companies. J. Manag. Gov. 2013, 17, 187–216. [Google Scholar] [CrossRef]

- Forker, J.J. Corporate governance and disclosure quality. Account. Bus. Res. 1992, 22, 111–124. [Google Scholar] [CrossRef]

- Haniffa, R.M.; Cooke, T.E. Culture, corporate governance and disclosure in malaysian corporations. Abacus 2002, 38, 317–349. [Google Scholar] [CrossRef]

- Michelon, G.; Parbonetti, A. The effect of corporate governance on sustainability disclosure. J. Manag. Gov. 2012, 16, 477–509. [Google Scholar] [CrossRef]

- Laverty, K.J. Economic “short-termism”: The debate, the unresolved issues, and the implications for management practice and research. Acad. Manag. Rev. 1996, 21, 825–860. [Google Scholar]

- Loh, L.; Nguyen, T.P.T.; Sim, I.; Thomas, T.; Wang, Y. Sustainability Reporting in Singapore: The State of Practice among Singapore Exchange (sgx) Mainboard Listed Companies 2015; The ASEAN CSR Network, Centre for Governance, Insitutions and Organisations (CGIO), NUS Business School, National University of Singapore: Singapore, 2016. [Google Scholar]

- Kelly, G.J. Australian social responsibility disclosure: Some insights into contemporary measurement. Account. Financ. 1981, 21, 97–107. [Google Scholar] [CrossRef]

- Trotman, K.T.; Bradley, G.W. Associations between social responsibility disclosure and characteristics of companies. Account. Organ. Soc. 1981, 6, 355–362. [Google Scholar] [CrossRef]

- Leftwich, R.W.; Watts, R.L.; Zimmerman, J.L. Voluntary corporate disclosure: The case of interim reporting. J. Account. Res. 1981, 19, 50–77. [Google Scholar] [CrossRef]

- Lang, M.; Lundholm, R. Cross-sectional determinants of analyst ratings of corporate disclosures. J. Account. Res. 1993, 31, 246–271. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Hahn, R.; Kühnen, M. Determinants of sustainability reporting: A review of results, trends, theory, and opportunities in an expanding field of research. J. Clean. Prod. 2013, 59, 5–21. [Google Scholar] [CrossRef]

- Gavana, G.; Gottardo, P.; Moisello, A.M. Sustainability reporting in family firms: A panel data analysis. Sustainability 2017, 9, 38. [Google Scholar] [CrossRef]

- Cho, C.H.; Patten, D.M. The role of environmental disclosures as tools of legitimacy: A research note. Account. Organ. Soc. 2007, 32, 639–647. [Google Scholar]

- Dumitru, M.; Dyduch, J.; Gușe, R.-G.; Krasodomska, J. Corporate reporting practices in poland and Romania—An ex-ante study to the new non-financial reporting european directive. Account. Eur. 2017, 14, 279–304. [Google Scholar] [CrossRef]

- Dyduch, J.; Krasodomska, J. Determinants of corporate social responsibility disclosure: An empirical study of polish listed companies. Sustainability 2017, 9, 1934. [Google Scholar] [CrossRef]

- Gavana, G.; Gottardo, P.; Moisello, A.M. The effect of equity and bond issues on sustainability disclosure. Family vs non-family italian firms. Soc. Responsib. J. 2017, 13, 126–142. [Google Scholar] [CrossRef]

- Gray, R. Social, environmental and sustainability reporting and organisational value creation? Account. Audit. Account. J. 2006, 19, 793–819. [Google Scholar] [CrossRef]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).