1. Introduction

The digital economy is shaping many new business models. The development of business models based on the Internet initiates many solutions [

1]. The Internet is constantly opening new spaces for creating added value [

2]. The dynamic development of networking is driving by the fast-paced evolution of digital technologies that foster the shaping of innovative business models. A key topic for modern approaches to business model design is achieving sustainability.

Digital economy business models based on the assumptions of contemporary trends, such as the sharing economy, the network economy, the Big Data and the circular economy, in addition to being based on IT applications in many cases, are also based on rules that are different from the traditional approaches to the neoclassical economy. The applicability of these solutions means that they are increasingly adopted by business practice, which results in undermining existing business models. Sometimes doubts arise about the integrity and even in some cases, the legality, of the proposed solutions. Their important attribute is that they are based on community development. It ensures better availability of goods, rationality of their use and improvement of people’s quality of life. Trends in the digital economy influence changes in the perception and understanding of the essence of the modern world and the approach to social, ecological and economic aspects.

The concept of sustainability, widely explored in science in recent years, can play an important role in shaping and adjusting these innovative business models. As regards the concept of sustainability, the key role is played by a longer perspective of studying business, which, in the context of the dynamic development of new technologies creates new challenges, such as positive or negative perceptions of digital platforms by society.

Generally, Sustainable Development ensures the preservation of natural resources, which ensures the natural function of local ecosystems and of nature in general. Sustainable Development influence on solidarization and cooperation with other communities. Economic Sustainable Development ensures quality of life through economic self-determination and self-development of both individuals and societies [

3]. Based on the assumptions of this concept, which ideologically refers to the macroeconomic approach, its narrower trend focused on building the theory and application solutions called sustainability has emerged. It is a model to keep managers predisposing their specific attitude to business management.

Generally, in theory and practice, several approaches to sustainability can be distinguished:

The classic approach broadly described in the literature and well-recognized as the Triple Bottom Line [

4]. This approach is often used by mature companies which create the strategy based on stakeholder analysis and corporate social responsibility [

5]. Their business model incorporates a balance of ecological, social and economic factors. In their strategy of competitive advantage these companies apply the triple bottom line rules for example by including ecologically friendly products into their offer, undertaking activities for positive impact on environmental protection, and striking a balance between all stakeholders interests. There are different aspects, which are described in the range of classical approaches to sustainability, for example: typology [

6], aspect of life cycle of enterprises [

7], rules for corporate social responsibility [

8], and green supply chain [

9].

The second approach is based on assumptions, for example of S. Schaltegger et al., who say that: ‘The value proposition must provide both ecological or social and economic value through offering products and services–business models for sustainability describe, analyze, manage, and communicate (i) a company’s sustainable value proposition to its customers, and all other stakeholders; (ii) how it creates and delivers this value; (iii) and how it captures economic value while maintaining or regenerating natural, social, and economic capital beyond its organizational boundaries [

10]. In this holistic approach ‘no sustainable value can be created for customers without creating value to a broader range of stakeholders’. This also includes a management approach which aims at achieving success in a fair manner for employees. This topic is widely developed in the literature [

11,

12,

13]. Schaltegger approach to sustainability is focused on the assumption that the condition for companies’ success is to design business models for sustainability, not as in the approach of Triple Bottom Line to meet conditions adequate to social, economic and ecological behavior. The essence of the newly designed business model is the use of sustainability attributes to build a competitive advantage.

The third approach addresses the specific aspect of economic sustainability in combination with the emerging shared economy business models that are enabled by the networked economy. It is very important for the sustained continuity of these business models to consider topics such as social, ecological and labor rules, which may be captured in legal requirements but also in social norms and values. The concept of the sharing economy is now widely discussed in literature [

14,

15,

16,

17]. This approach differs significantly from the previous ones because it focuses on the ethics of business behavior in the context of legal conditions. Especially, that new solutions undermine existing business models which raises a lot of controversy. In addition, new concepts using social communication platforms provide opportunities for better access to goods for those social groups that could not afford it. In this way, a new social order is shaped, which requires extensive theoretical research and verification of application solutions.

The fourth approach to the understanding of the concept of sustainability is sustainability’s role in creating the New Theory of Property Rights, which will be important in the context of designing business models [

18]. Property rights emphasize the importance of individual and transferable property rights for an effective allocation of resources in the economy. The theory of property rights assumes that property rights allow for limiting the scope of non-changeable relations in the economy [

19].

This concept refers to the difficult relationship and even contradictions between ownership and the fulfillment of sustainability requirements. These dilemmas are crucial for the success of the implementation of balanced solutions in the social, economic and environmental spheres. To some, sustainability primarily refers to energy efficiency or to the slightly broader principles of efficient resource conservation. To others, sustainability requires radical changes in our social and political institutions. Indeed, some proponents of sustainable development argue for “socially just development world-wide” that “should attempt to address important social and political issues related to the inequitable allocation of the world’s resources.” Still others envision sustainability as a fundamental human right [

18]. In this context the right to property and the freedom to dispose of it can be limited by the demands placed on enterprises in the aspect of social pressure of various groups of stakeholders sensitive to the balance in many aspects of life.

The fifth approach to the sustainability concept that can be distinguished is the approach related to the concept of Corporate Social Responsibility. The assumptions of this concept are presented in the Carrol Pyramid. The key issue is the approach to corporate responsibility towards business. There is a philanthropic, economic, legal and ethical responsibility in this context [

20]. The context of creating values through applying the Corporate Social Responsibility (CSR) assumptions is also important [

21].

CSR assumptions support the conceptualization and operationalization of sustainability assumptions and may include many approaches depending on many factors. The most important thing, however, is that, instead of emphasizing profits, the most important concern for a company should be value [

6].

An important approach to the development of the sustainability concept are the assumptions of the stakeholder theory. Honest relations with stakeholders create a business ecosystem based on respect [

22,

23].

Modern sustainability approaches are complex and based on a holistic approach [

24].

The third approach to the understanding of the sustainability concept can be directly applied to a research problem defined. The social aspect of designing digital business models that provides opportunities for building a community and the creation of environmentally friendly technologies may influence value migration to attractive business models.

Sustainability should thus be seen in the context of building competitive advantage with an ethical approach to market play, supporting innovative solutions that have a positive impact on society, creating social value and social profit. The standard approach based on classic economy is designing innovative business models in the Internet environment that will provide the company a monopoly or dominance position. Often the related business models are based on a comprehensive data platform. Such central position allows these companies to reap the benefits of high margins. Recently this approach is strongly criticized.

In modern business models, classic economics provides only a partial answer as argued above and is furthermore challenged by the emergence of the sharing economy. The latter case requires to investigate sustainability in business models again. A firm’s business model is relevant to its ability to capture value because it is through its business model that the firm exercises its bargaining ability [

25].

Several key challenges that are developed in the context of creating sustainable business models can be distinguished:

Triple bottom line—The co-creation of profits, social and environmental benefits and the balance among them are challenging for moving towards Sustainable Business Models.

Mind-set—The business rules, guidelines, behavioral norms and performance metrics prevail in the mind-set of firms and inhibit the introduction of new business models.

Resources—Reluctance to allocate resources to business model innovation and reconfigure resources and processes for new business models.

Technology innovation—Integrating technology innovation, e.g., clean technology, with business model innovation is multidimensional and complex.

External relationships—Engaging in extensive interaction with external stakeholders and business environment requires extra efforts.

Business modelling methods and tools—Existing business modelling methods and tools [

26].

Companies operating in modern conceptual trends that use the potential of the digital economy are often not focused on maximizing shareholder value, but rather, on creating social value. Although the original intentions may not be of an economic nature, the economic aspect is, however, a priority in the long-run. The technologies underpinning the new digital economy, most importantly and in rough order of maturity, include: (1) advanced robotics and factory automation (sometimes referred to as advanced manufacturing); (2) new sources of data from mobile and ubiquitous Internet connectivity (sometimes referred to as the Internet of things); (3) cloud computing; (4) big data analytics and (5) artificial intelligence (AI). The transformative potential of the New Digital Economy can only be realized if and when these elements mature, become better integrated, more interoperable, and broadly used. This is unlikely to be a simple, even, uncontested, or rapid process. Social and technical factors, such as data security risks or a backlash across various digital divides, could slow or even derail the development of the New Digital Economy [

27].

Thus, the concept of strategic value plays a crucial role. Strategic value examined in this way and combining economic and social values determines the design of contemporary sustainable business models in the digital economy.

Digital platforms that ensure the creation of social relationships in the global world influence the emergence of sustainable business models that emerge directly from the assumptions of individual concepts and trends in the digital economy. They include the Circular Economy, Big Data, and the sharing economy. The traditional approach to designing business models following Circular Economy assumptions is based on the stages of the value chain delivery process, such as design, production, remanufacturing, distribution, consumption, use, reuse, repair, collection, recycling and recovery. The use of virgin materials and the development of solutions from the sphere of obtaining residual waste should close the circular economy circulation process. Many different approaches have been proposed for designing either circular or sustainable business models, however there is no consensus of an integrated vision of both concepts [

28]. The assumptions of the Circular Economy are based on the application of the following principles, which in whole or in part constitute a configuration of business models focused on their implementation. ReSOLVE is a checklist of Circular Economy (CE) requirements proposed by the Ellen MacArthur Foundation that consists of six actions: regenerate, share, optimize, loop, virtualize, and exchange, each presenting an opportunity for CE implementation [

29]. The scope and interpretation of these six activities covers the following areas:

Regenerate—shift to renewable energy and materials, reclaim, retain and regenerate health of ecosystems, return recovered biological resources to the biosphere.

Share—keep product loop speed low, maximize utilization of products by sharing them among users, reuse products throughout their technical lifetime, prolong life through maintenance, repair and design for durability.

Optimize—increase performance/efficiency of a product, remove waste in production and the supply chain, leverage big data, automation, remote sensing and steering.

Loop—keep components and materials in closed, loops and prioritize inner loops.

Virtualize—deliver utility virtually.

Exchange—replace old materials with advanced non-renewable materials, apply new technologies [

30].

The literature recognizes digital business models and digital technologies as factors that facilitate the transition to the Circular Economy. They can be used to overcome the challenges of the Circular Economy [

31].

Companies’ fundamental challenge in implementing circular economy principles is to rethink their supply chains, and as a consequence the way they create and deliver value through their business models [

32]. Circular economy business models have powerful innovation potential, which must be released by the creators of modern business.

The assumptions of the Triple Bottom Line concept, in turn, shape the understanding of a pro-ecological, ethical and economic approach to managing limited resources in a traditional way.

Big Data and the sharing economy focus on a completely different approach to the aspects of sustainable business. Their approach creates conditions for the creation of value from fast data processing and using the effect of community activity. While there is no universal definition of big data, there appears to be an emerging consensus about its uniqueness that distinguishes big data from what we recognize a large database to be like in a traditional sense. Three Vs of big data, namely volume, variety and velocity, have been introduced at an early stage of the development of this notion which reflect the continuous expansion of data in terms of multiplicity [

33,

34,

35,

36,

37]. The use of large data sets for a broad approach to sustainability is developmental and, together with other concepts, is revolutionizing the world’s economy. The sharing economy holds the promise for a more sustainable world by giving access to underutilized resources, at a fraction of the cost, to some who cannot or do not want to buy new products, and the chance of making an extra income for those who already own such underutilized resources. The sharing economy is seen as instrumental in facing wicked problems such as overconsumption and income inequality [

38]. The sharing economy as: a socioeconomic system enabling an intermediated set of exchanges of goods and services between individuals and organizations which aim to increase efficiency and optimization of under-utilized resources in society [

39]. From this perspective, the original assumptions of the sharing economy concept are part of the general assumptions of sustainable management, creating opportunities to implement sustainability assumptions by using innovative technological solutions on a previously impossible scale.

An important and noteworthy problem is value migration from less to more attractive business models. Adrian Slywotzky defines value migration as a flow of economic and shareholder value away from obsolete business models to new, more effective designs that are better able to satisfy customers’ most important priorities. It reflects changing customer needs that will be satisfied by new competitive offerings. Value migration occurs when there is a disconnect between customer priorities and existing business designs [

40]. The reason why value flows from business models may be the lack of mechanisms built into the way companies operate that ensure meeting environmental protection requirements and social and legal standards, which may generate a risk of lowering the market value of companies. This is especially important for companies at the early stage of development and listed on the stock exchange, including start-up companies, where investors assess potential chances and threats to an increase or decrease in company’s market value very carefully. Because this type of market concerns a large number of companies that operate in the digital economy, the problem of value migration is also worth considering in terms of meeting sustainability requirements. Sustainability can generate a positive impact on value migration when sustainability features are a distinctive component of the business model. Then the value may flow from companies that do not apply sustainability assumptions to companies that use business models based on these assumptions. Sustainability can be an attribute that determines value migration. Therefore, a decision was made to conduct scientific research into the migration of the value of the business model of digital economy companies.

The theoretical framework presented was used to identify the theoretical and practical gaps in terms of the impact of sustainability factors built into the business models of digital economy companies on achieving their success. Undoubtedly, sustainability factors in the DNA of business models should have an impact on value migration on capital markets.

The aim of the article is, therefore, to present the key results of research into value migration to sustainable business models of companies operating in the digital economy on the capital market.

2. Trends in the Use of the Concept of Sustainability in the Digital Economy

The development of electronic markets is dominated by modern business. The number of areas implemented through digital technologies increases each year. This evolution has lasted for many years. R. Alt and H.-D. Zimmermann distinguish six stages in the development of the subject of electronic markets

Table 1:

The digital economy has provided much stronger change than changes in the previous decades, due to the following unique features (Watanabe et al., 2018b):

Expanding Information and Communication Technology (ICT) and the digital economy at a tremendous pace;

Value can be provided free of charge;

ICT prices decrease and productivity declines;

Digital goods are mobile and intangible, thus leading to substantially different business models;

The boundary between consumer and producer is thinning, and consumers are becoming “prosumers;”

Barriers of entry are low, making companies to innovate seamlessly;

Companies can enjoy fully network externalities and the subsequent self-propagation phenomenon embedded in ICT products and services6;

Companies are polarized between those enjoying network externality and those not;

Digital companies have a tendency toward a gigantic monopoly;

Contrary to a traditional monopoly, this new monopoly can enhance convenience [

42].

It can be expected that in the near future, all the areas of human activity will be implemented with the participation of electronic media. They also contribute to changes in the behavior of consumers, which is important for the development of the sustainability concept [

43].

The areas of human activity create new solutions by means of social media and it is important to define how they are used, whether this way is honest and does not harm other people, and whether it is in accordance with generally accepted social norms. This subject certainly requires a lot of research and analysis.

The traditional definitions of business models are based on an economic approach. According to D. Teece, a business model describes the design or architecture of the value creation, delivery, and capture mechanisms [a firm] employs. The essence of a business model is in defining the manner by which the enterprise delivers value to customers, entices customers to pay for value, and converts those payments to profit [

44].

Extensive literature research into the issue of business model sustainability conducted by R. Biloslavo, C. Bagnola and D. Edgar indicates that the traditional approach refers to the pro-environmental, ethical and effective conduct of business regardless of whether it is run in the standard or digital form [

45].

The sustainability is part of the trend of the verification of the social acceptance and legal and moral compliance of electronic media use. Sustainability is addressed in many areas related to electronic media [

46]. As F. Lüdeke-Freund and K. Dembek indicate, foundational beliefs and concepts, a base of practical tools and resources, authorities and a community of actors emerge around the research and practice of sustainable business models that operate in both digital and physical spaces [

47].

This approach is part of the European approach to the sustainable business model [

48]. Digitalization opens new pathways for sustainability that will also affect the characteristics of sustainable entrepreneurial ecosystems [

49,

50]. The first attempts at identifying the concept of sustainability have already been made. F. Welle Donker and B. van Loenen referred the concept of sustainability to the concept of Big Data. In resolving the tension between the problem of lost revenue due to open data and the need to maintain adequate data service quality, a solution could be to develop a sustainable business model for open government data providers that ensures the availability of quality open data in the long-run. They focused on the service component as it forms the starting point of any business model, and on the financial component as this component determines the sustainability of all other components, i.e., the finances determine the level of service, the technical and organizational aspects. Their approach provides several hands-on proposals for self-funding agencies having to implement an open data policy whilst ensuring their long-term sustainability [

51].

The concept of sustainability is examined in the context of the sharing economy, which is characterized by many features that are part of sustainable business model philosophy. Business models based on the sharing economy share resources, making natural resources less exploited (fuel consumption when sharing space in the car, energy consumption to heat the house in the case of sharing a flat or other resources). In addition, sharing creates a positive attitude and reduces the level of consumption, which, in global terms, affects the social and environmental factors of the quality of life. This approach creates sustainable consumption and makes the users of goods and services seek to use limited resources intelligently. In this case, ownership is not a priority but sharing is preferred, which from an economic point of view, generates less consumption and optimal use of limited resources [

38].

The perspectives of the sustainable development of the sharing economy suggest the use of perspectives to measure the performance of sharing economy business models in economic, environmental, social and technological areas.

The economic area is defined as an organizational domain that emphasizes practices, discourses, and material expressions associated with the production, use, and management of resources.

The ecological area is defined as an organizational domain that emphasizes the practices, discourses, and material expressions that occur across the intersection between the organizational and the natural realms.

The social area is defined as an organizational domain that emphasizes the practices, discourses, and material expressions associated with the formal and informal processes; systems; structures; and relationships actively support the capacity of current and future generations to create healthy and liveable communities.

The technological area is defined as an organizational domain that supports and enhances a “good life” for all of its employees, customers and society as well without compromising the Earth’s ecosystem or the prospects of later generations [

52].

The discussion on the application of sustainable business model assumptions is also developing in reference to Peer-to-Peer (P2P) sharing platforms.

P2P sharing platforms such as Airbnb, Uber, TaskRabbit and Peerby are ‘multisided platforms’: intermediaries that bring together two (or more) distinct groups of users (e.g., hosts and guests, drivers and riders) and enable their direct interaction.

The triadic business model, involving a platform operator and two customer groups, the suppliers and consumers of the service of these two-sided markets has been variously referred to ‘sharing-based’, ‘accessibility based’ as guests, drivers, riders and enable their direct interaction. Arguably, the criteria to assess the success of sharing-based business models (especially if adopted by social enterprises) should go beyond traditional financial metrics (e.g., revenues) and take into account the platform’s market penetration, the level and type of user engagement, and the social and environmental impact [

53]. In this aspect psychological drivers shapes customer’s willingness to participate in co-creation activities. Being a participant in a larger community conducing similar views builds social identity and sensitivity to social and ecological factors. Co-creation then has significance, not only in the context of business and consumption aspects, but also in the improvement of the world.

The concept of the circular economy, important for sustainability, deals with environmental aspects. The circular economy (CE) can be a driver of sustainability and it can be promoted and supported by the creation of new and innovative business models, which embed CE principles into their value propositions throughout the value chains [

30]. The modern concepts of the digital economy require assessment in terms of sustainability, not only in the context of social, economic and environmental assumptions, but also in terms of the concept of value, which can be created. Using a sustainable business model, value can be captured from the market. Company market value and social profit can be created by means of a sustainable business model. Value migration plays a key role in this respect. While value migrates to business models of the digital economy, it disrupts other traditional industries that are becoming unstable and labile.

3. Value Migration to the Sustainable Business Models of Digital Economy Companies

The digital economy is now a turning point and the driving force of global business. This results in the emergence of new business models, whose existence depends on the development of this trend. A crop of concepts as well as related business formulas are emerging. The key trends that create opportunities for the emergence of new and innovative business models include concepts such as the sharing economy, the network economy, the circular economy and Big Data. These solutions are based on technological assumptions and a wide impact on social phenomena. The value captured from an enabling technology is thus likely to be highly limited relative to the social returns to the innovation. Because the private returns do not reflect their value to society, inventors will underinvest compared to the level that would be socially optimal [

54].

In the context of these trends, the book value of the company is of less importance, whereas intangible assets play an increasing role. They determine the attractiveness of the business model resulting from its functionality. Data is increasingly the basic component of the assets of digital economy companies. It is evidenced by the dynamic development of the Big Data concept, which changes the approach to the valuation of companies. In many cases, having access to a large number of data sets determines the high market valuation of companies [

55]. The trend focused on the creation of strategic value is the concept of the sharing economy. In the relevant literature, this approach has been dynamically developed in recent years. The sharing economy was first used by Prof. Lawrence Lessig from Harvard University, where he described it as consumption resulting from sharing, exchanging and hiring resources without the need for goods. This activity began to spread by sharing unused resources between people [

14]. Authors such as R. Botsman and R. Rogers [

56], A. Stephany [

15], R. Belk [

17] and others contributed to the recognition of this approach. In the relevant literature, the concept of sharing resources and relationships between cooperation actors may refer to at least several varieties. The collaborative economy, the peer to peer economy, the sharing economy, the collaborative consumption and the mesh economy can be defined. In practice, the concept of the sharing economy refers mainly to the forms of cooperation in terms of Business to Consumer (B2C) and Consumer to Consumer (C2C) transactions. This is of fundamental importance in the area of the construction of business models and the interfaces that take place between these entities, both in the sphere of relationships and the construction of business models that interact with companies. Contemporary business continuously being disrupted by startups and established firms utilizing sharing economy approaches [

38]. The same applies to the concept of the circular economy. It also changes the approach to business, especially in the sphere of environmental protection. In the relevant literature, a significant and dynamic increase in the number of publications devoted to this subject can be observed [

30]. The circular economy, indeed, is based on the establishment of closed production systems, where resources are reused and kept in a loop of production and usage, allowing for generating more value and for a longer period. Despite the interest in the circular economy by politicians and practitioners, scholars, particularly in the strategic management field, are still struggling with a lack of a framework explaining how companies willing to become circular adapt their existing business model or create a new one [

57]. The development of the digital economy mainly involves the processing of large data sets (Big Data), which has become a leading scientific area with reference to the name of data science. An increased number of companies from the private sector as well as government agencies and public institutions benefit from the results obtained in the analysis of large data sets. This has a significant impact on the creation of innovative business models based on a large amount of data. In recent years, a very dynamic new trend initiating innovative business models has been developing, namely Open Data. Open Data portals collect various data that may be helpful in the design of new and innovative business models, which could not exist without the potential of these databases.

The aforementioned concepts function within the framework of the network paradigm, where a distinctive factor is cooperation and coopetition, disrupting existing business models, creating opportunities to develop new and innovative solutions in the field of business. The dynamics and the impact of new business models generate changes in individual industries and sectors of the economy. Business models may survive by striving to achieve sustainability, which can be considered a decisive feature that determines the investment attractiveness of business models. It can be assumed that a sustainability attribute is the key value of modern business models, which affects business and social ecosystems [

30]. According to G. Mahajan, value is balance between the effort and the result, and if the value is positive (that is, the perceived effort is less than the perceived result), value is created. If the reverse happens, value is destroyed. Value is also the benefit one gets versus the cost, and is generally is seen in competitive situations, since actors have alternatives. The difficulty with value is that it is intangible because value depends on the value ecosystem and their perception of value. Value is fundamental, it is what we are seeking (it exist whether we notice it and not see it); value is what is good (or meritorious), useful, important or worthwhile [

58]. It is visible on the capital markets, which is manifested in value migration from less attractive to more attractive models. Value migration will depend on the qualitative attributes, which include the features of sustainability, which can be considered as a key platform for the business model formula, which may translate into value migration described by means of quantitative variables. The quantitative variables of value migration include:

The relationship between market value and sales revenue [

40],

The growth rate of sales revenues,

The growth rate of company market value,

The growth rate of the Price-to-Equity (P/E) ratio,

The growth rate of the Price-to-Book Value (P/BV) ratio,

The scalability of the business model measured by the quantitative state, in which an increase does not force expenses out of proportion to the scale of growth. A perfectly scalable state is when companies, by gaining increased returns, create ever higher profitability.

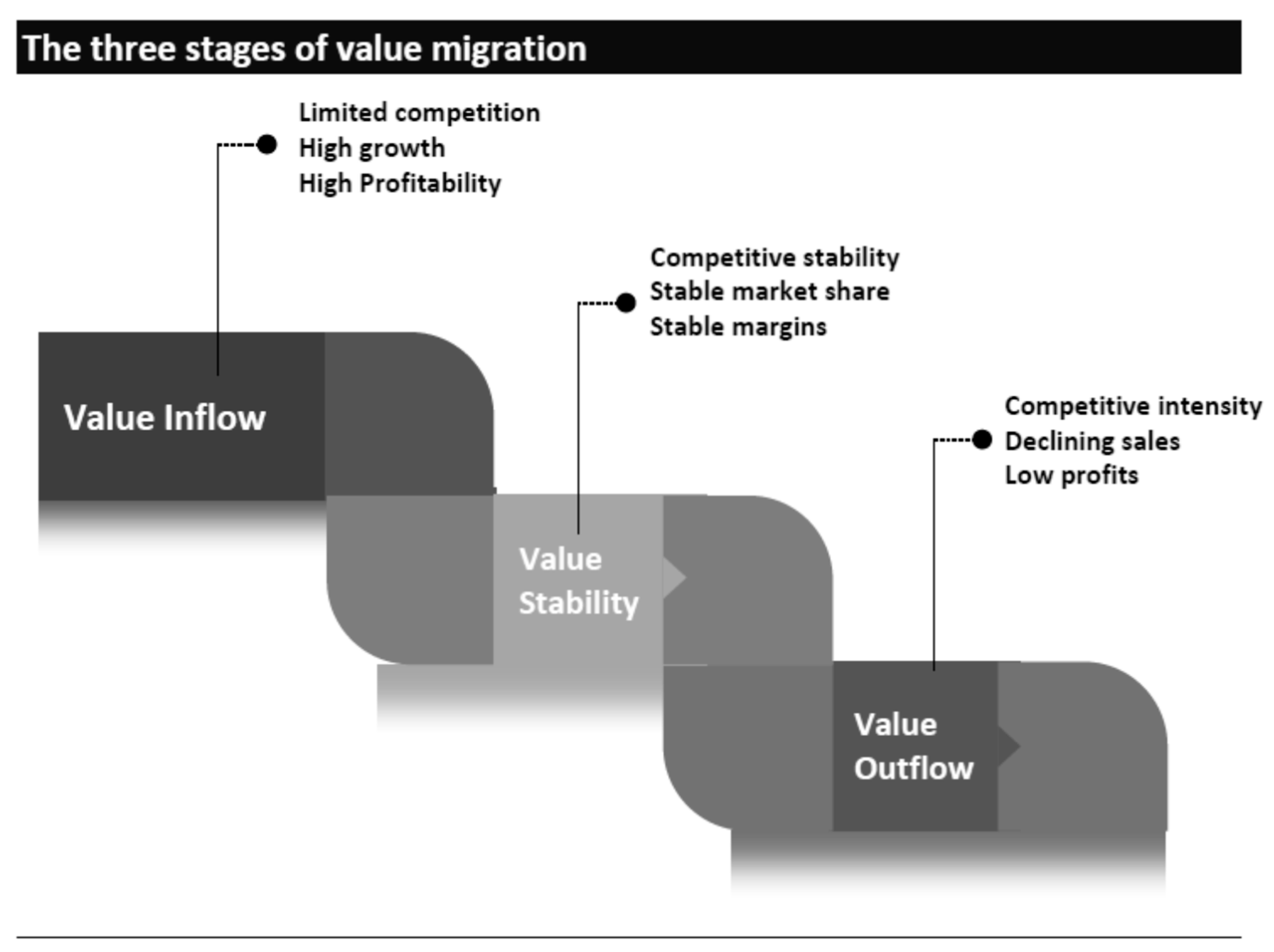

Essentially, value migration has three stages which were presented in

Figure 1: (A) Value inflow: In this phase, a company or an industry captures value from other industries or companies due to superior value proposition. The market share and profit margins of the company or industry expand. (B) Stability: In this phase, competitive equilibrium is established. Growth rates moderate. (C) Value outflow: Value starts to move away towards companies or industries meeting evolving customer needs. In this phase, market share declines, margins contract, and growth stops [

59].

The causes of value migration are: Customer priorities, an essential catalyst for value migration, change due to a multitude of factors. Hence, there could be several drivers of value migration. Some time-tested drivers are (1) technology; (2) cost; (3) convenience; (4) lowering of entry barriers; (5) lower switching costs; (6) easier access to capital and (7) innovation [

60].

Generally, in services, the value is considered from the point of view of two approaches. Value in use and Value in exchange. Value in use refers to the tangible features of a commodity (a tradeable object) which can satisfy some human requirement, want or need, or which serves a useful purpose. Value in exchange it is the ability to trade an asset, such as money, for goods and services. Money has no “value in use.” In itself, it does not satisfy wants or needs. To satisfy wants and needs, it must be traded. Although money has no value in use, it has value in exchange [

60]. In this article value in exchange has leading character.

In addition to the financial approach to value, other categories of values should be defined, resulting directly from the nature and specificity of the ontological nature of the business model. An aspect leading to value migration is the innovation attribute of the business model.

Figure 2 presents the selected types of innovative business models in the context of value migration [

61]. Research conducted by F. Hacklin, J. Bjorkdahl and Martin W. Wallin indicates that when value rapidly migrates across industries and between firms, proactively substituting key elements of the primary business model provides a better fit with the new value landscape than launching secondary business models in parallel [

61]. Therefore, it is advisable to quickly reconfigure business models in terms of their components to ensure their ability to capture value from the market with the help of the created value proposition for customers, which means that the company, by retaining value, contributes to the growth of value for shareholders/investors.

Value migration in the examples of business models presented depends on the primary and secondary innovation of the business model. Primary innovations are based on the initial idea of the component structure of business models, while secondary innovations are created during the life cycle of a company, when the initial principles of the business model operation may change due to new market expectations.

Pattern 1. Secondary business model innovation under lower value migration. A variety of firms who found themselves in an environment of lower value migration—Yahoo, Intel, Ericsson, TeliaSonera, Swisscom and France Télécom—pursued. Pattern 2. Primary business model innovation under lower value migration.

At the same time, a second group of firms in equally stable environments adopted a different response resulting in both better and worse performance than the first group of firms. This group of firms—Cisco, Google, and Qualcomm—chose to probe, pivot and implement substantial changes to their primary business models. Pattern 3. Secondary business model innovation under higher value migration Nokia, Sony-Ericsson, and HP are cases in point. In the case of Hewlett-Packard Company (HP), value started to migrate from their traditional PC business towards online offers. HP complemented their primary business model of selling computing and printing hardware with an ecosystem for online digital photo printing, free online photo albums, and free photo-sharing services. Pattern 4. Primary business model innovation under higher value migration Apple, on the other hand, successfully adapted their primary business model to be at par with a rapidly changing business environment. Apple realized that as computing and mobile technologies converged, value would start to migrate toward smarter devices and services. As they were at that time strongly in a device business related to personal computers (the Mac and later the iMac), in response the company started to pivot their primary business model. Initiating a number of such pivots, Apple launched the iPod in an effort to bring music experience through a new form of MP3 players to a wider consumer market on the basis of a simpler and slicker user interface [

61].

The model should therefore be subject to dynamic changes to ensure the ability to retain value and ensure the inflow of value due to the attributes of the business model. When an industry is characterized by rapid value migration, companies are most successful because they adopt a proactive attitude, replacing the key elements of their basic business model by adjusting their business model to current business conditions.

Sustainability as a parameter that describes business models in a positive way for different groups of stakeholders should increase their investment attractiveness. A sustainable business model should inspire increased investor confidence. Therefore, value should migrate from unsustainable to sustainable business models. The relationship between the degree of business model sustainability and value migration is a new research area in the field of value-based management.

5. Research Methodology

Qualitative and quantitative research was used to assess value migration to the Sustainable Business Models of digital economy companies. Research triangulation was applied, that is, a combination of different approaches used as one method to strengthen the rigor of the research methodlogy. A method means a procedure covering different methodological approaches. A starting point was the assumption that qualitative and quantitative methods should be perceived as complementary and not competitive [

63]. As quantitative research, the analysis of companies’ financial performance in terms of market value ratios was adopted, while as regards qualitative research, the analysis of the description of business model features was conducted, which was based on the publicly available information documents of the companies examined. As part of quantitative research, key ratios determining value migration on the capital market, namely the P/BV and P/E ratios were calculated. According to A. Slywotzki, a company is included in the stage of value stabilization if the quotient of the market value to sales revenues is within (1.0 ÷ 2.0). Extreme values are the stage of the outflow of value (the value of the indicator below 1.0), i.e., within the range (0 ÷ 1.0). At the stage of value inflow, the value of this indicator is above 2.0, within the range (2.0 ÷ ∞). A sustainable business model is characterized by stability in the sphere of quantitative and qualitative variables [

40]. The calculations were made in 2016 and 2017 based on data from the financial reports of companies listed on the NewConnect market of the Warsaw Stock Exchange.

In order to assess quality criteria that describe the level of saturation of sustainability features in the digital business models of companies listed on the NewConnect market, qualitative research was used and publicly available information documents were analyzed.

Appendix A Table A1 presents selected digital economy companies listed on the NewConnect Alternative Investment. As regards the identification of sustainability features, three criteria related to environmental aspects, twelve for ethical ones and one financial criterion were defined. In total, thirteen criteria were used in the assessment of value migration and description of the sustainability features of business models.

The research procedure covered:

Collecting the relevant literature on the subject of sustainable business models.

Analyzing the evolution of the concept of a sustainable business model and its key trends.

Defining the key attributes of digital business models and their development trends, taking into account strategic reflection.

Selecting a research sample of value migration to the sustainable business models of companies operating in the digital economy and listed on the NewConnect market.

Defining the features of the sustainable business models of companies operating on the NewConnect market based on the analysis of data contained in information documents.

Defining and using indicators defining value migration to sustainable business models.

Developing the results of research into value migration to sustainable business models.

Developing the methodology of value retention through sustainability factors in digital economy business models.

Formulating conclusions.

5.1. A Research Sample

From among all the companies surveyed listed on the NewConnect market of the Warsaw Stock Exchange such companies were selected that operate in the digital economy. The total number of these companies is 70, which is 17% percent of all companies. During research, information referring to business models contained in the publicly available information documents of the companies in question was used. Information documents are a simplified version of the prospectus. They are issued in both printed and electronic versions and they can be found on the NewConnect market website and the websites of individual companies and this is mandatory. Information documents contain a lot of reliable data about the company and its industry. The data is verified by an authorized adviser, who bears liability for them. Each information document contains floatation data, data on the company and its activities, risk factors for share buyers, information on company managers and supervisors, data on main shareholders and the financial statements of the company. Information about the company’s activity includes basic data on products, goods and services and markets that the company operates in. It is important to discuss the industry and its development prospects. Data on the attributes of business models can be found in the part devoted to the business model, development strategy implemented, and risk factors.

5.2. Research Hypotheses

With reference to the research problem, two research hypotheses were formulated:

Hypothesis 1. The digital economy is a new space in which it is important to guarantee an ethical approach to designing business models to ensure the long-term success of the company.

Hypothesis 2. Sustainability is a factor conducive to the capture of value by the business models of companies operating in the digital economy on the capital markets.

In order to identify the attributes of sustainable business models, the criteria for qualifying business models in this category were defined. Criteria were defined in terms of the classical approach to the concept of sustainability, defining them in the areas of ecology, ethics and economics.

The following criteria for assessing the application level of sustainability principles in business models were defined. The data proposed, that characterize sustainability features, were developed based on the review of the relevant literature and the selection of such attributes that refer to the specificity of digital economy business models. While selecting the criteria, the proposal of sustainable business model archetypes was used, which were significantly modified [

64]. The following criteria for the assessment and classification of business models were adopted.

Within the area of ecology:

The business model of the company is oriented towards activities for sustainable development (e.g., for environmental protection with the use of the circular economy, for energy efficiency, renewable energy sources, etc.),

A business model exposes the sustainable consumption of goods and services,

A company engages in pro-environmental undertakings.

Within the area of ethics:

- 4.

A condition for the existence of a business model is embedding it in the idea of supporting social integration-social values,

- 5.

A business model does not violate the law or the generally accepted principles of business ethics,

- 6.

A business model does not violate the principles of market competitiveness—it does not violate antitrust rules—it does offer excessive prices, which would be an abuse of its position in relation to customers,

- 7.

A business model is not based on using unrealistically low prices, which could be used to eliminate competitors from the market,

- 8.

A business model is not based on discriminating customers,

- 9.

A business model is not based on forcing contractors into certain commercial terms,

- 10.

A business model is not based on the assumption of setting minimum or fixed prices for the sale of products to the distributor/broker,

- 11.

A business model is based on the sales process with the use of transparent regulations, sales conditions and standard contracts, which are easy to understand by the average consumer,

- 12.

A business model is based on activities that provide consumers with an easy and cost-free way of contact, and in particular, it gives the opportunity to contact by phone, informing consumers about the hours of their availability, and in the case of contact via e-mail, it informs consumers about the maximum wait time for a response.

Within the area of economics:

- 13.

The company is focused on creating value for shareholders.

The P/BV ratio was used in the assessment of the economic aspects of business models of the companies surveyed.

Selected NewConnect companies that fulfill qualification criteria for studying sustainability factors Information Technology companies using of the concepts of the sharing economy, the circular economy, and Big Data are presented in

Appendix A Table A2.

6. The Results of Research into Value Migration to the Sustainable Business Models of Digital Economy Companies Listed on the NewConnect Alternative Investment Market

The information documents of digital economy companies listed on the NewConnect market were used during research. Information documents and websites of all 70 companies surveyed were analyzed. They indicated that four of them operate in the area of the sharing economy, 1—the circular economy, 15—Big Data, 31—E-commerce and 32—others IT see

Figure 4.

Most companies listed on the NewConnect market of the Warsaw Stock Exchange operate in the field of e-commers and IT systems. Fourteen of them use the Big Data assumptions. The Sharing Economy and Circular Economy concepts are particularly poorly represented. In this respect, there are not many companies in this market yet. Therefore, the research in question is worth replicating in the future.

In order to assess the investment attractiveness of companies in terms of the economic criterion, the P/BV ratio was used.

Figure 5.

Figure 5 shows companies with a minimum P/BV value and 10 companies with a minimum P/BV value. For improved readability, a logarithmic scale was used. The best results of the P/BV ratio for the surveyed companies are in the range of 52 to 7, while those characterized by its low value are close to 0.

A total of 10 companies with a maximum P/BV value (outer circle) and 10 companies with a minimum P/BV value (inner circle) by sector are presented in

Figure 6. The most companies that have achieved the highest values belong to the group of companies operating in the field of e-commerce and in the field of software development and IT systems.

Eleven companies that meet sustainability criteria were isolated from the digital economy companies that were analyzed. This accounts for 15.71% of the total population surveyed. The list of companies that meet sustainability criteria is presented in

Table 2. The research was conducted by identifying individual sustainability features for the area of ecology, ethics and economics, seeking information on the subject and other secondary data in company information documents and on websites. An answer to the question whether sustainability is a new source of company value was sought.

In order to analyze the economization of the business models of companies operating in the digital economy, the analysis of P/BV and P/E ratios achieved by these companies was conducted.

Table 3.

Table 3 presents the values of P/BV and P/E ratios achieved by companies that meet the Digital Sustainability criteria in the last two years, i.e., 2016 and 2017. The values of these indices vary.

The

Table 3 also presents the results of analyzes of the average value of obtained P/BV and P/E.

The mean value for P/BV for sustainability companies in 2016 (11.26) was lower than the mean value for 70 digital economy companies, which was 53.82. However, in 2017 the situation reversed because the mean value for digital sustainability was 5.33 and the mean for the digital economy was 5.29. Nevertheless, in both cases the maximum value for P/BV was lower for digital sustainability (75.85—2016, 12.62—2017). At the same time, minimum values for P/BV were higher for digital sustainability (0.26—2016, 0.17—2017) than for the digital economy (0.22—2016, 0.07—2017).

P/BV: mean DS < mean DE (2016), mean DS > mean DE (2017)

max DS < max DE (2016), max DS < max DE (2017)

min DS > min DE (2016), min DS > min DE (2017)

The obtained results indicate that companies with sustainability features do not achieve the higher values of market P/BV ratios than other companies operating in the digital economy. This means that these features are not yet perceptible to investors and are not a key factor determining their decisions to buy shares. Better results were achieved in the assessment of the P/E ratio. Taking into account P/E values, the mean value in 2016–2017 for digital sustainability was much higher than for all digital economy companies. The value of a P/E ratio for digital sustainability was then 26.73 in 2016 and 103.93 in 2017, while for the digital economy 19.96 in 2016 and 46.02 in 2017. Interestingly, in 2017, the maximum and minimum values for eleven digital sustainability companies were the same as for all digital economy companies analyzed. This means that companies with both the highest and the lowest P/E value in 2017 were included in the digital sustainability list. In this situation, Hypothesis 2. Sustainability is a factor conducive to the capture of value by the business models of companies operating in the digital economy on the capital markets, was not verified positively.

P/E: mean DS > mean DE (2016), mean DS > mean DE (2017)

max DS < max DE (2016), max DS = max DE (2017)

min DS > min DE (2016), min DS = min DE (2017)

Digital sustainability companies generated about 13% of the total capitalization in the years 2016–2017 in the area of the digital economy

Table 4. The mean value of the capitalization of sustainable companies amounted to EUR 92.90 million in 2016 (compared to the mean value for other companies amounting to EUR 121.81 million) and EUR 90.37 million in 2017 (it was EUR 124.17 million for other companies). Thus, the mean value of capitalization for digital sustainability was lower. The median capitalization of sustainability in 2016 (EUR 47.47 million) was higher than the median capitalization for other companies (EUR 43.59 million). However, in 2017 the situation reversed and the median for digital sustainability was EUR 24.21 million, and for the digital economy—EUR 31.26 million.