Does Sustainability Affect Real Estate Market Values? Empirical Evidence from the Office Buildings Market in Milan (Italy)

Abstract

:1. Introduction

2. The Development of Green Buildings in Italy and in the World

3. The Market Investigated: Real Estate for Management Use in Milan

4. Hedonic Prices and Absorption Rates in Green Properties

5. Sustainability Turns into Value: Survey Results

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- IPCC. Global Warming of 1.5 C. 2018. Available online: http://www.ipcc.ch/report/sr15/ (accessed on 13 November 1988).

- RICS. Supply, Demand and the Value of Green Buildings. Rics Research. 2012. Available online: http://www.breeam.es/images/recursos/inf/informe_rics_supply_demand_and_the_value_of_green_buildings.pdf (accessed on 21 October 2018).

- Micelli, E.; Mangialardo, A. Recycling the City—New Perspective on the Real-estate Market and Construction Industry. In Smart and Sustainable Planning for Cities and Regions; Bisello, A., Vettorato, D., Stephens, R., Elisei, P., Eds.; Springer: Cham, Switzerland, 2015; pp. 115–125. [Google Scholar]

- Brown, D.; Dillard, J.; Marshall, R.S. Triple Bottom Line: A Business Metaphor for a Social Construct; School of Business Administration, Portland State University: Portland, OR, USA, 2006. [Google Scholar]

- McGraw Hill Construction. Green Building Smart Report; McGraw Hill: Bedford, UK, 2008. [Google Scholar]

- Fuerst, F.; Mcallister, P. Green Noise or Green Value? Measuring the Price Effects of Environmental Certification in Commercial Buildings; School of Real Estate and Planning, Henley Business School, University of Reading: Reading, MA, USA, 2008. [Google Scholar]

- Fuerst, F.; Mcallister, P. Pricing sustainability: An empirical investigation of the value impacts of green building certification. In Proceedings of the American Real Estate Society Conference, Captiva Island, FL, USA, 10–14 April 2008. [Google Scholar]

- Attardi, R.; Cerreta, M.; Sannicandro, V.; Torre, C.M. Non-compensatory composite indicators for the evaluation of urban planning policy: The Land-Use Policy Efficiency Index. Eur. J. Oper. Res. 2018, 264, 491–507. [Google Scholar] [CrossRef]

- Boyd, T.; Kimmet, P. The Triple Bottom Line Approach to Property Performance Evaluation; School of Construction Management and Property, Queensland University of Technology: Brisbane, Australia, 2006. [Google Scholar]

- Fedrizzi, R.S.; Morri, G.; Pavesi, A.S.; Soffietti, F.; Verani, E. Uno strumento per la creazione di valore nella realizzazione di edifici sostenibili: La certificazione LEED. Territorio Italia 2016, 2, 37–47. [Google Scholar] [CrossRef]

- Morri, G. Greenbuilding sustainability and market premium in Italy. J. Eur. Real-Estate Res. 2013, 6, 303–332. [Google Scholar] [CrossRef]

- Matisoff, D.C.; Noonan, D.S.; Mazzolini, A.M. Performance or market benefits? The case of LEED certification. Environ. Sci. Technol. 2014, 48, 2001–2007. [Google Scholar] [CrossRef] [PubMed]

- Energy and Sustainability. Available online: https://www.cbre.it/it-it/servizi/settori/energy-and-sustainability (accessed on 13 November 2018).

- Documenti e Risorse. Available online: http://www.gbcitalia.org (accessed on 13 November 2018).

- Chappell, T.W.; Corps, C. High Performance Green Building: What’s It Worth? Investigating the Market Value of High Performance Green Buildings; Cascadia Region Green Building Council: Seattle, WA, USA, 2010. [Google Scholar]

- Pavesi, A.S.; Verani, E. Introduzione Alla Certificazione LEED®: Progetto, Costruzione, Gestione—Ottimizzazione del Processo Edilizio Secondo i Principi Della Sostenibilità; Maggioli Editore: Rimini, Italy, 2012. [Google Scholar]

- Chegut, A.; Eicholtz, P.; Kok, N. The Value of Green Buildings—New Evidence from the United Kingdom. Available online: http://immobilierdurable.eu/images/2128_uploads/Chegut_Eichholtz_Kok_green_value_in_the_uk.pdf (accessed on 13 November 2018).

- Robinson, S.; McAllister, P. Heterogeneous Price Premiums in Sustainable Real Estate? An Investigation of the Relation between Value and Price Premiums. Joisre 2015, 1, 1–20. [Google Scholar]

- Antoniucci, V.; Marella, G. The influence of building tipology on the economic feasibilityof urban developments. Int. J. Appl. Eng. Res. 2018, 15, 4946–4954. [Google Scholar]

- Antoniucci, V.; Marella, G. Is social polarization related to urban density? Evidence from the Italian housing market. Landsc. Urban Plan. 2018, 177, 340–349. [Google Scholar] [CrossRef]

- Del Giudice, V.; Salvo, F.; DE Paola, P. Resampling Techniques for Real Estate Appraisals: Testing the Bootstrap Approach. Sustainability 2018, 10, 3085. [Google Scholar] [CrossRef]

- Warren-Myers, G. The value of sustainability in real estate: A review from a valuation Perspective. J. Prop. Invest. Financ. 2012, 30, 115–144. [Google Scholar] [CrossRef]

- Mangialardo, A.; Micelli, E. Rethinking the Construction Industry Under the Circular Economy: Principles and Case Studies. In Smart and Sustainable Planning for Cities and Regions; Bisello, A., Vettorato, D., Laconte, P., Costa, S., Eds.; Springer: Cham, Switzerland, 2018. [Google Scholar]

- Fuerst, F.; McAllister, P. New evidence on the green building rent and price premium. In Proceedings of the Annual Meeting of the American Real Estate Society, Monterey, CA, USA, 3 April 2009. [Google Scholar]

- Entrop, A.G.; Brouwers, H.J.H.; Reinders, A.H.M.E. Evaluation of energy performance indicators and financial aspects of energy saving techniques in residential real estate. Energy Build. 2010, 42, 618–629. [Google Scholar] [CrossRef]

- D’Alpaos, C.; Bragolusi, P. Approcci valutativi alla riqualificazione energetica degli edifici: Stato dell’arte e future sviluppi. Valori e Valutazioni 2018, 20, 1–15. [Google Scholar]

- Altomonte, S.; Schiavon, S. Occupant satisfaction in LEED and non-LEED certified buildings. Build. Environ. 2013, 68, 66–76. [Google Scholar] [CrossRef] [Green Version]

- Mangialardo, A.; Micelli, E. Off-site Retrofit to Regenerate Multi-family Homes: Evidence from Some European Experiences. In International Symposium on New Metropolitan Perspectives; Calabrò, F., Della Spina, L., Bevilacqua, C., Eds.; Springer: Cham, Switzerland, 2018. [Google Scholar]

- McGraw Hill Construction. Green Building Smart Report; McGraw Hill: Bedford, UK, 2009. [Google Scholar]

- Warren-Myers, G.; Reed, R. Sustainability: Measurement and valuation?—Insight from Australia and New Zealand. In Proceedings of the 15th Annual Pacific Rim Real Estate Society Conference, Sydney, Australia, 18–21 January 2009. [Google Scholar]

- Zieba, M.; Belniak, S.; Gluszak, M. Demand for sustainable Office space in Poland: The results from a conjoint experiment in Krakow. Prop. Manag. 2013, 31, 404–419. [Google Scholar] [CrossRef]

- Gabe, J.; Rehm, M. Do tenants pay energy efficiency rent premiums? J. Prop. Invest. Financ. 2014, 32, 333–351. [Google Scholar] [CrossRef]

- Pivo, G.; Fisher, J.D. Investment Returns from Responsible Property Investments: Energy Efficient, Transit-Orientated and Urban Regeneration Office Properties in the US from 1998–2008; Working Paper; Responsible Property Investing Center, Boston College and University of Arizona Benecki Center for Real Estate Studies, Indian University: Boston, MA, USA, 2009. [Google Scholar]

- Forte, F.; Russo, Y. Evaluation of users satisfaction in public residential housing—A study in the outskirtsof Naples, Italy. In IOP Conference Series: Materials Science and Engineering; IOP Publishing: Bristol, UK, 2017; Volume 245, pp. 52–63. [Google Scholar]

- Fuerst, F.; McAllister, P. Green noise or green value? Measuring the effects of environmental certification on office value. Real Estate Econ. 2011, 39, 45–69. [Google Scholar] [CrossRef]

- Kok, N.; Kahn, M.E. The Value of Green Labels in the California Housing Market, 2012, UCLA Institute of the Environment and Sustainability. Available online: http://www.environ-ment.ucla.edu/newsroom/the-value-of-green-la-bels-in-the-california-housing-market/ (accessed on 13 November 2018).

- Bienert, S.; Schuzenhofer, C.; Leopoldberger, G.; Bobsin, K.; Leugtob, K.; Huttler, W.; Popescu, D.; Mladin, E.C.; Iasi, T.; Rodica, B.; et al. Integration of Energy Performance and life-Cicle Costing into Property Valuation Practice, 2011. Report Summary. Available online: http://immovalue.e-sieben.at/pdf/immvalue_result_oriented_report.pdf (accessed on 13 November 2018).

- Meins, E.; Burkhard, H.-P. Der Nachhaltigkeit von Immobilien Einen Finanziellen Wert Geben; ESI Immobilienbewertung—Nachhaltigkeit inclusive: Zürich, Switzerland, 2009. [Google Scholar]

- RICS. Supply, Demand and the Value of Green Buildings. Available online: https://www.isurv.com/downloads/download/1492/supply_demand_and_the_value_of_green_buildings_rics (accessed on 13 November 2018).

- Hyland, M.; Lyons, R.C.; Lyons, S. The value of domestic building energy efficiency—Evidence from Ireland. Energy Econ. 2012, 40, 943–952. [Google Scholar] [CrossRef]

- Brounen, D. Kok, N. On the economics of energy labels in the housing market. J. Environ. Econo. Manag. 2011, 62, 166–179. [Google Scholar] [CrossRef]

- SBi. Cost-optimal Levels of Minimum Energy Performance Requirements in the Danish Building Regulations. Available online: https://sbi.dk/Pages/Cost-optimal-levels-of-minimum-energy-performance-requirements-in-the-Danish-Building-Regulations.aspx (accessed on 13 November 2018).

- Popescu, D.; Bienert, S.; Schutzenhofer, C.; Bozau, R. Impact of energy efficiency measures on the economic value of buildings. Appl. Energy 2012, 89, 454–463. [Google Scholar] [CrossRef]

- Audanaert, A.; De Boeck, L.; Roelants, K. Economic analysis of the profitability of energy—Saving architectural measures for the achievement of the EPBD standard. Energy 2010, 35, 2965–2971. [Google Scholar] [CrossRef]

| Increased Market Value (%) | Rental Premium (%) | Type of Certificate | Data Origin | References | Country |

|---|---|---|---|---|---|

| Average: 10.90 | Average: 6.10 | LEED | Perception | [5] | USA |

| Average: 6.80 | Average: 1.00 | LEED | Perception | [28] | USA |

| LEED: 9.94; Energy Star: 5.76 | Average: 8.93 | Energy Star | Empirical data | [29] | USA |

| LEED: 16 | LEED: 3; Energy Star: 5 | Energy Star | Empirical data | [29] | USA |

| LEED: 35; Energy Star: 31 | LEED: 6; Energy Star: 5 | LEED-Energy Star | Empirical data | [29] | USA |

| LEED: 17.30; Energy Star: 8.62 | Energy Star | Empirical data | [23] | USA | |

| LEED: 9; Energy Star: 9 | LEED-Energy Star | Empirical data | [36] | USA | |

| Minimum: 4.71; maximum: 13.60 | - | Empirical data | [37] | Germany | |

| Minimum: 3.97; maximum: 15.17 | - | Empirical data | [37] | Germany | |

| Minimum: 6.60; maximum: 15.90 | Minimum: 0.41; maximum: 5.87 | - | Empirical data | [37] | Switzerland |

| Relative to D-labelled houses: A/B: 5; C: 1.7; E: −0.7; F: −0.9; G: −6.8 | - | Empirical data | [38] | UK | |

| Average: 28 | BREEAM | Empirical data | [39] | UK | |

| Average: 10 | Average: 6 | BREEAM | Empirical data | [7] | UK |

| Relative to D-labelled houses: A: 9.3; B: 5.2; C: 1.7; E: 0; F/G: −10 | Empirical data | [40] | Ireland | ||

| Relative to D-labelled houses: A: 10.2; B: 5.5; C: 2.1; E: −0.5; F: −2.3; G: −4.8 | Empirical data | [41] | Netherlands | ||

| Relative to D-labelled houses: A/B: 6.4; C: 6; E: −0.7; F: −12.3; G: −19.4 | Empirical data | [42] | Denmark | ||

| Average: 10% | Perception | [11] | Italy |

| Neighborhood | Year | Minimum Real Estate Market Value | Maximum Real Estate Market Value | Average Market Value | Percentage of Increase Compared to the Average Value |

|---|---|---|---|---|---|

| CBD | 2018 | 6.700 | 9.200 | 7.950 | +36% |

| 2008 | 4.900 | 6.800 | 5.850 | ||

| Porta Nuova | 2018 | 6.500 | 8.000 | 7.250 | +110% |

| 2008 | 2.800 | 4.100 | 3.450 |

| Summary | ||||

|---|---|---|---|---|

| R-squared | 0.183168 | |||

| Adjusted R2 | 0.151751 | |||

| Standard deviation | 59.30195 | |||

| Observations | 55 | |||

| Variance analysis | ||||

| DF | Sum of squares | Mean square | F ratio | |

| Model | 3 | 41,035.90 | 20,503.5 | 5.8303 |

| Error | 52 | 182,859.53 | 3515.7 | Prob > F |

| C.total | 54 | 223,878.44 | 0.0552 | |

| Parameters evaluation | ||||

| Evaluation | ST. Error | T ratio | ||

| Intercept | 412.95182 | 12.9596 | 31.94 | <0.0001 |

| Submarket | 44.020393 | 18.52337 | 2.85 | 0.0107 |

| Type of certification | 15.285029 | 7.012145 | 2.18 | 0.0338 |

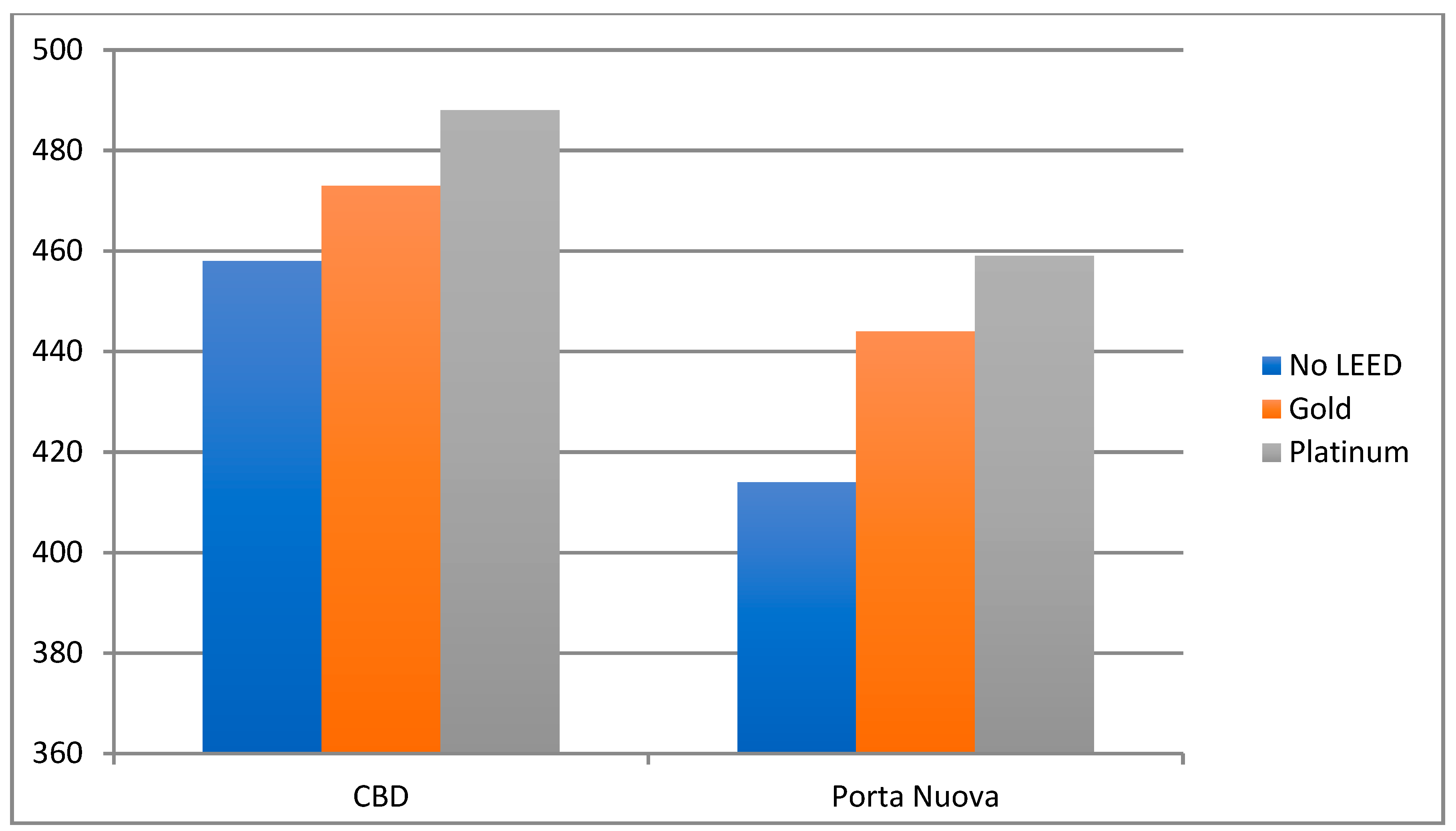

| Market Rent | Neighborhood | Price (+44 Euro) | Type of Certificate | Price +15 Euro |

|---|---|---|---|---|

| 414 | CBD +11% | 458 | None 0% | 458 |

| Gold +7.38% | 488 | |||

| Platinum +11.08% | 503 | |||

| Porta Nuova +0% | 414 | None 0% | 414 | |

| Gold +7.38% | 444 | |||

| Platinum +11.08% | 459 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mangialardo, A.; Micelli, E.; Saccani, F. Does Sustainability Affect Real Estate Market Values? Empirical Evidence from the Office Buildings Market in Milan (Italy). Sustainability 2019, 11, 12. https://doi.org/10.3390/su11010012

Mangialardo A, Micelli E, Saccani F. Does Sustainability Affect Real Estate Market Values? Empirical Evidence from the Office Buildings Market in Milan (Italy). Sustainability. 2019; 11(1):12. https://doi.org/10.3390/su11010012

Chicago/Turabian StyleMangialardo, Alessia, Ezio Micelli, and Federica Saccani. 2019. "Does Sustainability Affect Real Estate Market Values? Empirical Evidence from the Office Buildings Market in Milan (Italy)" Sustainability 11, no. 1: 12. https://doi.org/10.3390/su11010012

APA StyleMangialardo, A., Micelli, E., & Saccani, F. (2019). Does Sustainability Affect Real Estate Market Values? Empirical Evidence from the Office Buildings Market in Milan (Italy). Sustainability, 11(1), 12. https://doi.org/10.3390/su11010012