The Influence of Corporate Social Responsibility on Competitive Advantage with Multiple Mediations from Social Capital and Dynamic Capabilities

Abstract

:1. Introduction

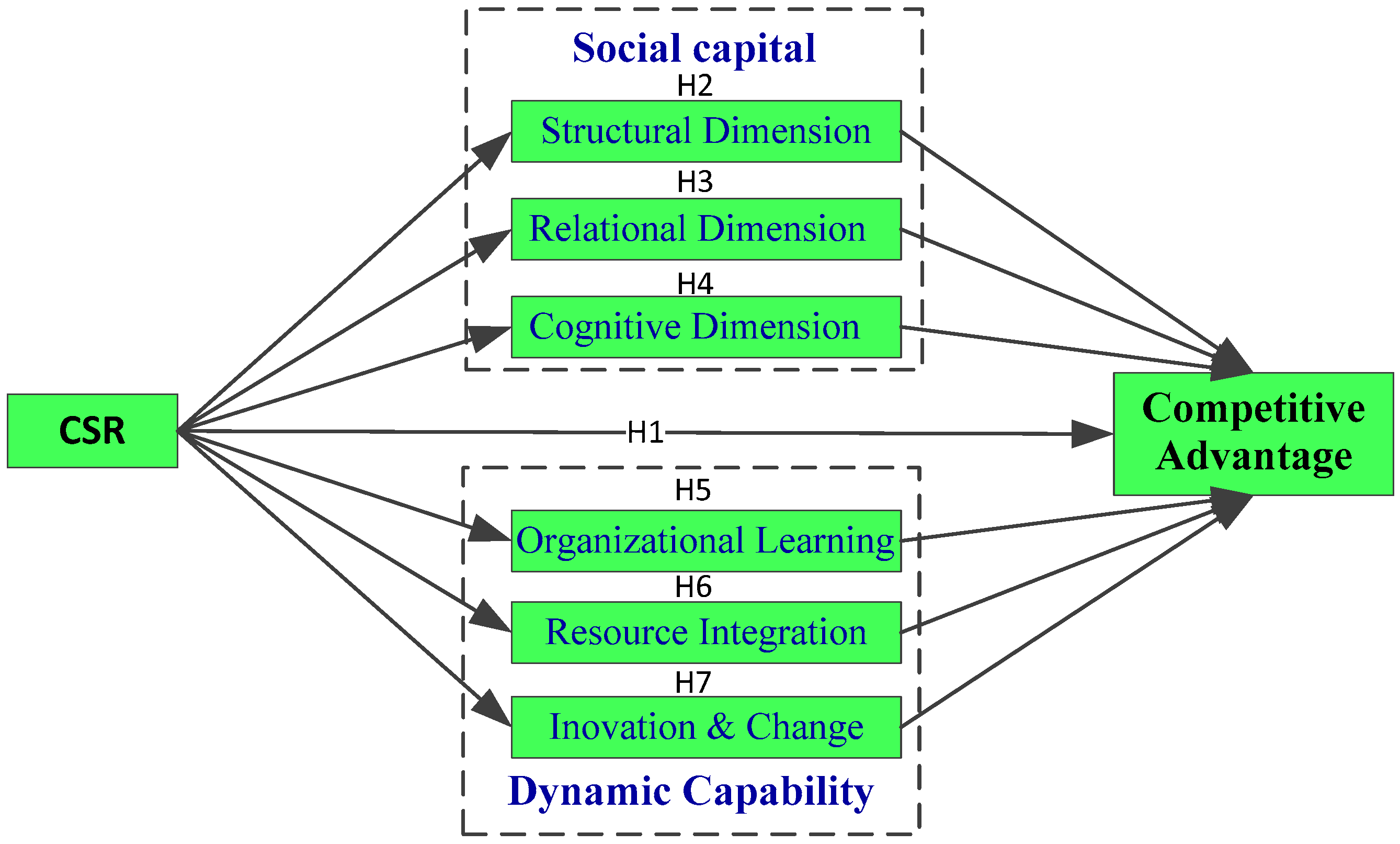

2. Literature Review and Hypotheses

2.1. Corporate Social Responsibility

2.2. CSR and CA

2.3. Mediating Role of SC

2.4. Mediating Role of Dynamic Capability

3. Methodology

3.1. Questionnaire Designing

- (1)

- First, all these measuring items were taken from the related literature. According to the work of Maignan and Ralston [58], CSR were measured through five dimensions: public charities, employee development, fair operation, environmental protection as well as customer orientation, and each dimension contained three items. Based on the work of Pavlou and Sawy [59], Xu [60], the ability of resource integration, organizational learning capability and innovation and change capability were also measured with different items. Items of the three dimensions of SC were adapted from the work of Wei [61] and Protogerou et al. [62]. Based on the work of Protogerou et al. [62], Chen and Zhou [63], we measured CA in two dimensions: financial and market CA, with six items. In all, the questionnaire had 39 items, and they were presented in Appendix A.

- (2)

- Second, these items were developed by foreign scholars in English, so we should translate them into Chinese and take some essential modification to make it more understandable in the context of Chinese. In this process, we discussed the translated items with several experts and doctoral students who are experienced in CSR, DCs or SC research with the questionnaire survey method. Besides, according to their suggestions, a 7-point Likert Scale, ranging from strongly disagree(1), to greatly agree(7) was selected to measure all the items.

- (3)

- Third, to ensure validity and rationality of questionnaire, pre-test was taken in five enterprises located in the Zhongguancun area of Beijing from September 2016 to December 2106. The questionnaire was then revised and improved according to 20 feedbacks.

3.2. Data Collection

4. Data Analysis and Results

4.1. Reliability and Validity of Measures

4.2. Structural Model: Goodness of Fit Results

4.3. Hypothesis Testing Results

5. Conclusions, Suggestions and Limitations

- (1)

- Fulfilling CSR can become an effective way for enterprises to create CA and promote economic rent with the partial multiple mediations of SC and DCs. The high cost of assuming CSR will be offset by the increase in employee loyalty and sense of identity, which can reduce opportunism and loaf on the job, and by promoting of customer satisfaction as well as getting more support from stakeholders. This finding is basically consistent with the research of Kotler and Lee [7] as well as Peng and Liu [16].

- (2)

- This study also shows that structural and relational SC has significant mediating effects between CSR and CA, while the cognitive SC does not. This finding is consistent with the empirical analysis of Antoni and Sacconi [37], and similar to the theoretical analysis of Yu et al. [38]. One possible explanation is that no matter how much CSR enterprises take on, it will not change their pursuit of benefits. Thus, conflicts of interest among enterprises, consumers and other stakeholders will inevitably not be completely eliminated, and more cognitive SC will make these conflicts even more clear.

- (3)

- CSR activities can promote resource integration capability and organizational learning capability, which are high-level capabilities of enterprises that will contribute to CA. However, due to lack of innovation consciousness and investment, and the high cost of CSR cannot be offset by the return on innovation investment. Moreover, just as Protogerou et al. [62] stated, most enterprises tend to characterize CSR practices through simple social donation. The creation and sharing of technology and knowledge in the interaction with stakeholders have been ignored when approaching CSR, there by rendering the ability of innovation and transformation absent in playing an indirect role between CSR and CA.

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Variable | Dimensions | Items | Reference |

|---|---|---|---|

| CSR | Public Charities | 1. The company can bring more harmonious and wealth to local residents. | |

| 2. will carry out welfare activities to vulnerable groups. | Maignan and Ralston [58] | ||

| 3. often donate to charities and to poor areas. | |||

| Employee Development | 4. pays wages on time and buys enough social insurance for employees. | ||

| 5. actively make staff training and design career plan for them. | |||

| 6. makes good working environment for employees and pay attention to their health. | |||

| Fair Operation | 7. discloses the operation information timely, truly, and completely. | ||

| 8. abides laws, regulations and safeguards the fair market environment. | |||

| 9. can always legally use and dispose of property and insist property rights protection. | |||

| Environmental Protection | 10. actively participates in social activities protecting environment. | ||

| 11. uses more environmentally friendly technologies and materials as far as possible. | |||

| 12. strives to reduce waste of resources and improve the use of resources. | |||

| Customer Orientation | 13. provides customers with products and service at reasonable pricing. | ||

| 14. has established a communication channel, and feedback customers in time. | |||

| 15. makes a strict and standardized customer information protection. | |||

| DCs | Resource Integration Capability | 16. can obtain valuable information by communicating with external stakeholders. | |

| 17. can quickly reasonably allocate different resources when the environment changes. | Pavlou and Sawy [59]; Xu [60] | ||

| 18. can adjust the operation process in time and keep flexibility. | |||

| Organizational Learning Capability | 19. can quickly and effectively apply new knowledge to related products and services. | ||

| 20. often seeks solutions to problems with stakeholders. | |||

| 21. can effectively introduce new knowledge needed and share it with employees. | |||

| Innovation and Change Capability | 22. actively promotes innovative activities and gives full incentives. | ||

| 23. can actively promote technological innovation and product innovation. | |||

| 24. attaches great importance to fostering an innovative corporate culture. | |||

| SC | Structural Dimension | 25. often tries to establish different relationships with partners, customers. | |

| 26. communicates with partners, customers, and consumers in a variety of ways. | Wei [61]; Protogerou et al. [62] | ||

| 27. often tries to establish different relationships with partners, customers, and consumers. | |||

| Relational Dimension | 28. has close relationship with partners, suppliers, and consumers. | ||

| 29. can trust and cooperate sincerely with partners, suppliers, and consumers. | |||

| 30. When interacting with partners or consumers, the company tends to be self-serving. | |||

| Cognitive Dimension | 31. has similar value orientations with partners, suppliers, and consumers. | ||

| 32. partners, suppliers and consumers can understand each other easily in communication. | |||

| 33. The company, partners and consumers will find solutions together for conflicts. | |||

| CA | Financial competitive advantage | 34. The total assets of the company have been increasing in the past three years. | Protogerou et al. [62]; Chen and Zhou [63] |

| 35. The profit level of the company has been rising in the past three years. | |||

| 36. The company’s return on investment has been increasing in the past three years. | |||

| Market competitive advantage | 37. Compared with competitors, the company’s performance in last three years is desirable. | ||

| 38. the company’s customer satisfaction has improved significantly in last three years. | |||

| 39. the market share of the company has increased significantly in last three years. |

References

- Du, S.; Bhattacharya, C.B.; Sen, S. Corporate social responsibility and competitive advantage: Overcoming the trust barrier. Manag. Sci. 2011, 57, 1528–1545. [Google Scholar] [CrossRef]

- Flammer, C.; Luo, J. Corporate social responsibility as an employee governance tool: Evidence from a quasi-experiment. Strateg. Manag. J. 2017, 38, 163–183. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Strategy and society: The link between competitive advantage and corporate social responsibility. Harv. Bus. Rev. 2006, 84, 78–92. [Google Scholar] [PubMed]

- Lima Crisóstomo, V.; de Souza Freire, F.; Cortes de Vasconcellos, F. Corporate Social Responsibility, Firm Value and Financial Performance in Brazil. Soc. Responsib. J. 2011, 7, 295–309. [Google Scholar] [CrossRef]

- Smith, A. Fortune 500 Companies Spend More than $15bn on Corporate Responsibility. Financial Times. 2014. Available online: http://www.ft.com/cms/s/0/95239a6e-4fe0-11e4-a0a4-00144feab7de.html (accessed on 13 October 2014).

- Jamali, D.; Karam, C. Corporate social responsibility in developing countries as an emerging field of study. Int. J. Manag. Rev. 2018, 20, 32–61. [Google Scholar] [CrossRef]

- Kotler, P.; Lee, N. Corporate Social Responsibility: Doing the Most Good for Your Company and Your Cause; John Wiley & Sons: Hoboken, NJ, USA, 2008. [Google Scholar]

- Michelon, G.; Boesso, G.; Kumar, K. Examining the link between strategic corporate social responsibility and company performance: An analysis of the best corporate citizens. Corp. Soc. Responsib. Environ.Manag. 2013, 20, 81–94. [Google Scholar] [CrossRef]

- Frooman, J. Socially Irresponsible, Illegal Behavior and Shareholder Wealth: A Meta-Analysis of Event Studies. Bus. Soc. 1997, 3, 221–249. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate social responsibility and Financial Performance: Correlation or Misspecification? Strateg. Manag. J. 2000, 21, 603–609. [Google Scholar] [CrossRef]

- Simpson, G.W.; Kohers, T. The Link between Corporate Social Responsibility and Financial Performance: Evidence from the Bank Industry. J. Bus. Ethics 2002, 35, 97–110. [Google Scholar] [CrossRef]

- Shi, J.W.; Hu, L.J.; Fu, H.Y. Corporate Social Responsibility, Social Capital and Organizational Competitive Advantage: A Perspective of Strategic Interaction. China Ind. Econ. 2009, 11, 87–98. [Google Scholar]

- Jamali, D.; Neville, B. Convergence versus divergence of CSR in developing countries: An embedded multi-layered institutional lens. J. Bus. Ethics 2011, 102, 599–621. [Google Scholar] [CrossRef]

- Okoye, A. Exploring the relationship between corporate social responsibility, law and development in an African context: Should government be responsible for ensuring corporate responsibility? Int. J. Law Manag. 2012, 54, 364–378. [Google Scholar] [CrossRef]

- Barnett, M.L.; Salomon, R.M. Does it pay to be really good? Addressing the shape of the relationship between social and financial performance. Strateg. Manag. J. 2012, 33, 1304–1320. [Google Scholar] [CrossRef]

- Xuerong, P.; Yang, L. Strategic Corporate Social Responsibility and Competitive Advantage: Mediation and Moderation Mechanisms. Manag. Rev. 2015, 27, 156–167. [Google Scholar]

- Hsu, K.T. The Advertising Effects of Corporate Social Responsibility on Corporate Reputation and Brand Equity: Evidence from the Life Insurance Industry in Taiwan. J. Bus. Ethics 2012, 109, 189–201. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Barney, J.B. Is the resource-based “view” a useful perspective for strategic management research? Yes. Acad. Manag. Rev. 2001, 26, 41–56. [Google Scholar]

- Stratman, J.K.; Roth, A.V. Enterprise resource planning (ERP) competence constructs: Two-stage multi-item scale development and validation. Decis. Sci. 2002, 33, 601–628. [Google Scholar] [CrossRef]

- Adler, P.S.; Kwon, S.W. Social capital: Prospects for a new concept. Acad. Manag. Rev. 2002, 27, 17–40. [Google Scholar] [CrossRef]

- Moran, P. Structural vs. relational embeddedness: Social capital and managerial performance. Strateg. Manag. J. 2005, 26, 1129–1151. [Google Scholar] [CrossRef]

- Stam, W.; Elfring, T. Entrepreneurial orientation and new venture performance: The moderating role of intra-and extraindustry social capital. Acad. Manag. J. 2008, 51, 97–111. [Google Scholar] [CrossRef]

- Blyler, M.; Coff, R.W. Dynamic Capabilities, Social Capital, and Rent Appropriation: Ties that Split Pies. Strateg. Manag. J. 2003, 24, 677–686. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef] [Green Version]

- Wang, C.L.; Ahmed, P.K. Dynamic capabilities: A review and research agenda. Int. J. Manag. Rev. 2007, 9, 31–51. [Google Scholar] [CrossRef]

- Wu, L.Y. Applicability of the resource-based and dynamic-capability views under environmental volatility. J. Bus. Res. 2010, 63, 27–31. [Google Scholar] [CrossRef]

- Bowen, H. Social Responsibilities of the Businessman; Harper Row: New York, NY, USA, 1953. [Google Scholar]

- Carroll, A.B. Corporate Social Responsibility: Evolution of a Definitions Construct. Bus. Soc. 1999, 38, 268–295. [Google Scholar] [CrossRef]

- Vlachos, P.A.; Panagopoulos, N.G.; Bachrach, D.G.; Morgeson, F.P. The effects of managerial and employee attributions for corporate social responsibility initiatives. J. Organ. Behav. 2017, 38, 1111–1129. [Google Scholar] [CrossRef]

- Dahlsrud, A. How corporate social responsibility is defined: An analysis of 37 definitions. Corp. Soc. Responsib. Environ. Manag. 2008, 15, 1–13. [Google Scholar] [CrossRef]

- Du, S.; Bhattacharya, C.B.; Sen, S. Maximizing Business Returns to Corporate Social Responsibility: The Role of CSR Communication. Internet J. Manag. Rev. 2010, 12, 8–19. [Google Scholar] [CrossRef]

- Nan, X.; Heo, K. Consumer responses to corporate social responsibility (CSR) initiatives: Examining the role of brand-cause fit in cause-related marketing. J. Advert. 2007, 36, 63–74. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B. The Corporate Social Performance-Financial Performance Link. Strateg. Manag. J. 2005, 18, 303–319. [Google Scholar] [CrossRef]

- Nahapiet, J.; Ghoshal, K. Social Capital, Intellectual Capital and the Organizational Advantage. Acad. Manag. Rev. 1998, 23, 242–266. [Google Scholar] [CrossRef]

- Inkpen, A.C.; Tsang, E.W.K. Social capital, networks, and knowledge transfer. Acad. Manag. Rev. 2005, 30, 146–165. [Google Scholar] [CrossRef]

- Antoni, G.D.; Sacconi, L. Modeling Cognitive Social Capital and Corporate Social Responsibility as Preconditions for Sustainable Networks of Relations. Econ. Work. Pap. 2010, 19, 1–19. [Google Scholar]

- Yu, H.Y.; Huang, X.Z.; Cao, X. The Relationship between Corporate Social Responsibility and Corporate Performance, the Moderating Role of Enterprises’ Social Capital. Manag. Rev. 2015, 27, 169–180. [Google Scholar]

- Albinger, H.S.; Freeman, S.J. Corporate social performance and attractiveness as an employer to different job seeking populations. J. Bus. Ethics 2000, 28, 243–253. [Google Scholar] [CrossRef]

- Elfring, T.; Hulsink, W. Networks in entrepreneurship: The case of high-technology firms. Small Bus. Econ. 2003, 21, 409–422. [Google Scholar] [CrossRef]

- Jiang, T.Y.; Zhang, Y.Q.; Wang, J.J. A research on the relationship between corporate social capital and competitive advantages: Based on knowledge. Stud. Sci. Sci. 2010, 28, 1212–1221. [Google Scholar]

- Teece, D.; Pisano, G. The dynamic capabilities of firms: An introduction. Ind. Corp. Chang. 1994, 3, 537–556. [Google Scholar] [CrossRef]

- Jian, Z.Q. Strategic Orientation, Dynamic Capability and Technological Innovation: Moderating Role of Environmental Uncertainty. R & D Manag. 2015, 27, 65–76. [Google Scholar]

- Teece, D.J. Explicating dynamic capabilities: The nature and micro-foundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Bao, G.M.; Long, S.Y. Dynamic Capabilities Research: The Latest Review and Prospects. Foreign Econ. Manag. 2015, 37, 75–88. [Google Scholar]

- Jiao, H. Dynamic Capabilities and Firms Performance: Moderating Effect of Environmental Dynamism. Soft Sci. 2008, 22, 112–117. [Google Scholar]

- Dong, B.B.; Ge, B.S.; Wang, K. The Process of Resources Integration, the Dynamic Capability and the Competitive Advantage: The Mechanism and the Path. Manag. World 2011, 3, 92–101. [Google Scholar]

- Du, M.Q. Integration of resources, capabilities, external environment, strategy and competitive advantage. Manag. World 2003, 10, 145–146. [Google Scholar]

- Zahra, S.A.; Sapienza, H.J.; Davidsson, P. Entrepreneurship and dynamic capabilities: A review, model and research agenda. J. Manag. Stud. 2006, 43, 917–955. [Google Scholar] [CrossRef]

- Griffith, D.A.; Harvey, M.G. A resource perspective of global dynamic capabilities. J. Int. Bus. Stud. 2001, 32, 597–606. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic Capabilities: What Are They? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Barnett, M.L. Stakeholder Influence Capacity and the Variability of Financial Returns to Corporate Social Responsibility. Acad. Manag. Rev. 2007, 2, 794–816. [Google Scholar] [CrossRef]

- Zhang, G.; Yu, X. Learning mechanism and innovating efficiency in process of organizational networking development. Sci. Res. Manag. 2005, 26, 87–93. [Google Scholar]

- Lee, Y.; Hwang, J. External knowledge search, innovative performance and productivity in the Korean ICT sector. Telecommun. Policy 2010, 4, 562–571. [Google Scholar]

- Deng, X.; Kang, J.; Low, B.S. Corporate social responsibility and stakeholder value maximization: Evidence from mergers. J. Financ. Econ. 2013, 110, 87–109. [Google Scholar] [CrossRef]

- Li, J.; He, X.G. Family Authority in TMT and Innovation: An Empirical Study in Chinese Family-Owned Firms. Chin. J. Manag. 2012, 9, 1314–1322. [Google Scholar]

- Lee, J.; Lee, K.; Rho, S. An evolutionary perspective on strategic group emergence: A genetic algorithm-based model. Strateg. Manag. J. 2002, 23, 727–746. [Google Scholar] [CrossRef]

- Maignan, I.D.; Ralston, A. Corporate social Responsibility in Europe and the US. Insights from Business self-presentations. J. Int. Bus. Stud. 2002, 33, 497–514. [Google Scholar] [CrossRef]

- Pavlou, P.A.; EL-Sawy, T.J. Understanding the elusive black box of dynamic capabilities. Decis. Sci. 2011, 42, 239–273. [Google Scholar] [CrossRef]

- Xu, J.S. The Relation Study of Dynamic capabilities, Institution and Business Performance. Ph.D. Thesis, Jilin University, Changchun, China, 2011. [Google Scholar]

- Ying, W. Measurement of corporate social capital. Stud. Sci. Sci. 2007, 25, 518–522. [Google Scholar]

- Protogerou, A.; Caloghirou, Y.; Lioukas, S. Dynamic capabilities and their indirect impact on firm performance. Ind. Corp. Chang. 2011, 21, 615–647. [Google Scholar] [CrossRef]

- Chen, C.; Zhou, Z.L. Research on the Influence of Corporate Social Responsibility on the Persistence of Corporate Competitive Advantage. Forum Sci. Technol. China 2014, 5, 68–73. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

- Anderson, J.C.; Gerbing, D.W. Structural equation modeling in practice: A review and recommended two-step approach. Psychol. Bull. 1988, 103, 411. [Google Scholar] [CrossRef]

- MacKinnon, P.D. Introduction to Statistical Mediation Analysis; Lawrence Erlbaum Associate: Hillsdale, NJ, USA, 2008. [Google Scholar]

- Preacher, K.J.; Hayes, F. Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 2008, 40, 879–891. [Google Scholar] [CrossRef] [PubMed] [Green Version]

| Items | Classification | Sample Amounts | Percentage (%) |

|---|---|---|---|

| Enterprise Ownership | State-owned enterprises | 27 | 24.1 |

| Private enterprise | 45 | 40.2 | |

| Foreign (or joint-venture) enterprises | 22 | 19.6 | |

| Others | 18 | 15.1 | |

| Enterprise Age | 1 year or less | 5 | 4.5 |

| 1–5 years | 18 | 16.1 | |

| 6–10 years | 22 | 19.6 | |

| 11–20 years | 25 | 22.3 | |

| More than 20 years | 42 | 37.5 | |

| Total | 112 | 100 | |

| Respondents Position | First-level Managers | 52 | 19.4 |

| Middle-level managers | 77 | 28.6 | |

| High-level managers | 40 | 14.9 | |

| Department Manager/Supervisor | 55 | 20.4 | |

| General Staff | 45 | 16.7 | |

| Total | 269 | 100 |

| Variable | Dimension | Factor Loading | CR | AVE | Cronbach’s Alpha | Variable | Dimension | Factor Loading | CR | AVE | Cronbach’s Alpha | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CSR | Public Charities | Aa1: 0.842 | 0.871 | 0.693 | 0.869 | 0.918 | DCs | Resource Integration Capability | Ba1: 0.85 | 0.892 | 0.733 | 0.889 | 0.897 |

| Aa2: 0.85 | Ba2: 0.9 | ||||||||||||

| Aa3: 0.805 | Ba3: 0.817 | ||||||||||||

| Employee Development | Ab1: 0.859 | 0.864 | 0.680 | 0.867 | Organizational Learning Capability | Bb1: 0.858 | 0.887 | 0.723 | 0.886 | ||||

| Ab2: 0.783 | Bb2: 0.823 | ||||||||||||

| Ab3: 0.83 | Bb3: 0.869 | ||||||||||||

| Fair Operation | Ac1: 0.831 | 0.842 | 0.641 | 0.838 | Innovation and Change Capability | Bc1: 0.857 | 0.900 | 0.750 | 0.900 | ||||

| Ac2: 0.73 | Bc2: 0.87 | ||||||||||||

| Ac3: 0.836 | Bc3: 0.871 | ||||||||||||

| Environmental Protection | Ad1: 0.762 | 0.848 | 0.65 | 0.845 | SC | Structural Dimension | Ca1: 0.896 | 0.890 | 0.730 | 0.89 | 0.831 | ||

| Ad2: 0.825 | Ca2: 0.839 | ||||||||||||

| Ad3: 0.83 | Ca3: 0.827 | ||||||||||||

| Customer Orientation | Ae1: 0.844 | 0.879 | 0.707 | 0.878 | Relational Dimension | Cb1: 0.777 | 0.832 | 0.623 | 0.823 | ||||

| Ae2: 0.825 | Cb2: 0.779 | ||||||||||||

| Ae3: 0.854 | Cb3: 0.812 | ||||||||||||

| CA | Financial competitive advantage | Da1: 0.814 | 0.870 | 0.691 | 0.869 | 0.887 | Cognitive Dimension | Cc1: 0.88 | 0.876 | 0.702 | 0.874 | ||

| Da2: 0.829 | Cc2: 0.784 | ||||||||||||

| Da3: 0.851 | Cc3: 0.846 | ||||||||||||

| Market competitive advantage | Db1: 0.871 | 0.898 | 0.745 | 0.897 | |||||||||

| Db2: 0.864 | |||||||||||||

| Db3: 0.855 | |||||||||||||

| Variable | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| 1. CSR | (0.758) | |||||||

| 2. Resource Integration Capability | 0.216 ** | (0.856) | ||||||

| 3. Organizational Learning Capability | 0.212 ** | 0.507 ** | (0.850) | |||||

| 4. Innovation and Change Capability | 0.214 ** | 0.514 ** | 0.491 ** | (0.866) | ||||

| 5. Structural Dimension | 0.218 ** | 0.388 ** | 0.424 ** | 0.337 ** | (0.854) | |||

| 6. Relational Dimension | 0.215 ** | 0.359 ** | 0.320 ** | 0.403 ** | 0.316 ** | (0.789) | ||

| 7. Cognitive Dimension | 0.215 ** | 0.348 ** | 0.376 ** | 0.331 ** | 0.272 ** | 0.346 ** | (0.838) | |

| 8. CA | 0.384 ** | 0.483 ** | 0.509 ** | 0.469 ** | 0.423 ** | 0.374 ** | 0.509 ** | (0.807) |

| Variable | Fit Indices | χ2 | df | χ2/df | RMSEA | GFI | AGFI | NFI | CFI | IFI |

|---|---|---|---|---|---|---|---|---|---|---|

| Judgment Criteria | — | — | <3~5 | <0.08 | >0.85 | >0.9 | >0.9 | >0.9 | >0.9 | |

| CSR | Model Results | 102.003 | 85 | 1.2 | 0.026 | 0.955 | 0.936 | 0.962 | 0.993 | 0.995 |

| DCs | Model Results | 53.657 | 24 | 2.236 | 0.065 | 0.963 | 0.931 | 0.971 | 0.983 | 0.970 |

| SC | Model Results | 35.039 | 24 | 1.46 | 0.039 | 0.973 | 0.95 | 0.975 | 0.992 | 0.991 |

| CA | Model Results | 12.53 | 8 | 1.566 | 0.044 | 0.986 | 0.964 | 0.989 | 0.996 | 0.995 |

| Conclusion | — | — | Excellent | Excellent | Acceptable | Acceptable | Acceptable | Acceptable | Acceptable |

| Path Relation | Modified Standardized Estimate (Initial) | Modified CR (Initial) | Modified P (Initial) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Organizational Learning Capability | <--- | CSR | 0.381 (0.432) | 5.396 (6.068) | *** (***) | ||||

| Structural Dimension | <--- | CSR | 0.432 (0.402) | 6.083 (5.728) | *** (***) | ||||

| Relational Dimension | <--- | CSR | 0.375 (0.404) | 5.038 (5.415) | *** (***) | ||||

| Cognitive Dimension | <--- | CSR | 0.263 (0.386) | 3.768 (5.465) | *** (***) | ||||

| Resource Integration Capability | <--- | CSR | 0.385 (0.419) | 5.427 (5.884) | *** (***) | ||||

| Innovation and Change Capability | <--- | CSR | 0.401 (0.421) | 5.649 (5.937) | *** (***) | ||||

| CA | <--- | CSR | 0.349 (0.289) | 3.759 (2.783) | 0.001 (0.005) | ||||

| CA | <--- | Resource Integration Capability | 0.249 (0.154) | 3.872 (2.402) | *** (0.016) | ||||

| CA | <--- | Cognitive Dimension | 0.079 (0.305) | 1.306 (4.612) | 0.192 (***) | ||||

| CA | <--- | Organizational Learning Capability | 0.409 (0.135) | 5.303 (2.119) | *** (0.064) | ||||

| CA | <--- | Structural Dimension | 0.235 (0.143) | 3.491 (2.270) | *** (0.023) | ||||

| CA | <--- | Innovation and Change Capability | 0.091 (0.222) | 1.279 (3.377) | 0.201 (***) | ||||

| CA | <--- | Relational Dimension | 0.112 (0.049) | 1.723 (0.750) | 0.015 (0.453) | ||||

| Fit Indices | χ2 | df | χ2/df | RMSEA | GFI | AGFI | NFI | IFI | |

| Initial Model Results | 1144.346 | 682 | 1.678 | 0.048 | 0.817 | 0.791 | 0.857 | 0.937 | |

| Modified Model Results | 1026.618 | 681 | 1.570 | 0.0425 | 0.855 | 0.847 | 0.870 | 0.952 | |

| Point Estimate | Bias-Corrected | Percentile | Mackinnon | ||||

|---|---|---|---|---|---|---|---|

| 95%CI | 95%CI | PRODCLIN2 | |||||

| Lower | Upper | Lower | Upper | Lower | Upper | ||

| Total effects | |||||||

| CSR--CA | 0.663 | 0.419 | 0.845 | 0.432 | 0.845 | ||

| Indirect effects | |||||||

| CSR--CA | 0.380 | 0.227 | 0.671 | 0.183 | 0.597 | ||

| CSR--Cognitive dimension-CA | 0.109 | −0.021 | 0.097 | ||||

| CSR--Relational dimension-CA | 0.020 | 0.051 | 0.234 | ||||

| CSR--Structural dimension-CA | 0.055 | 0.009 | 0.146 | ||||

| CSR--Innovation and change capability--CA | 0.051 | −0.00018 | 0.152 | ||||

| CSR--Organizational learning capability--CA | 0.088 | 0.033 | 0.201 | ||||

| CSR--Resource integration capability--CA | 0.058 | 0.007 | 0.162 | ||||

| Direct effects | |||||||

| CSR--CA | 0.283 | 0.069 | 0.527 | 0.074 | 0.530 | ||

| Direct Correlation | Judgment Standard | Hypothesis Results | ||

|---|---|---|---|---|

| p-Value | Significant Level | |||

| CSR—CA | 0.001 | ** | H1 | Supported |

| Mediating relationships | Mediating effects | 95%CI | ||

| CSR—Structural dimension—CA | 0.055 | Not Contain 0 | H2 | Supported |

| CSR—Relational dimension—CA | 0.020 | Not contain 0 | H3 | Supported |

| CSR—Cognitive dimension—CA | 0.109 | Contain 0 | H4 | Not supported |

| CSR—Organizational learning capability—CA | 0.088 | Not contain 0 | H5 | Supported |

| CSR—Resource integration capability—CA | 0.058 | Not contain 0 | H6 | Supported |

| CSR—Innovation and change capability—CA | 0.051 | Contain 0 | H7 | Not supported |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, Z.; Meng, F.; He, Y.; Gu, Z. The Influence of Corporate Social Responsibility on Competitive Advantage with Multiple Mediations from Social Capital and Dynamic Capabilities. Sustainability 2019, 11, 218. https://doi.org/10.3390/su11010218

Zhao Z, Meng F, He Y, Gu Z. The Influence of Corporate Social Responsibility on Competitive Advantage with Multiple Mediations from Social Capital and Dynamic Capabilities. Sustainability. 2019; 11(1):218. https://doi.org/10.3390/su11010218

Chicago/Turabian StyleZhao, Zhonghua, Fanchen Meng, Yin He, and Zhouyang Gu. 2019. "The Influence of Corporate Social Responsibility on Competitive Advantage with Multiple Mediations from Social Capital and Dynamic Capabilities" Sustainability 11, no. 1: 218. https://doi.org/10.3390/su11010218

APA StyleZhao, Z., Meng, F., He, Y., & Gu, Z. (2019). The Influence of Corporate Social Responsibility on Competitive Advantage with Multiple Mediations from Social Capital and Dynamic Capabilities. Sustainability, 11(1), 218. https://doi.org/10.3390/su11010218