On the Unsustainable Macroeconomy with Increasing Inequality of Firms Induced by Excessive Liquidity

Abstract

:1. Introduction

2. Theoretical Background

3. A Brief Review of Mark0

3.1. Firm

3.2. Household

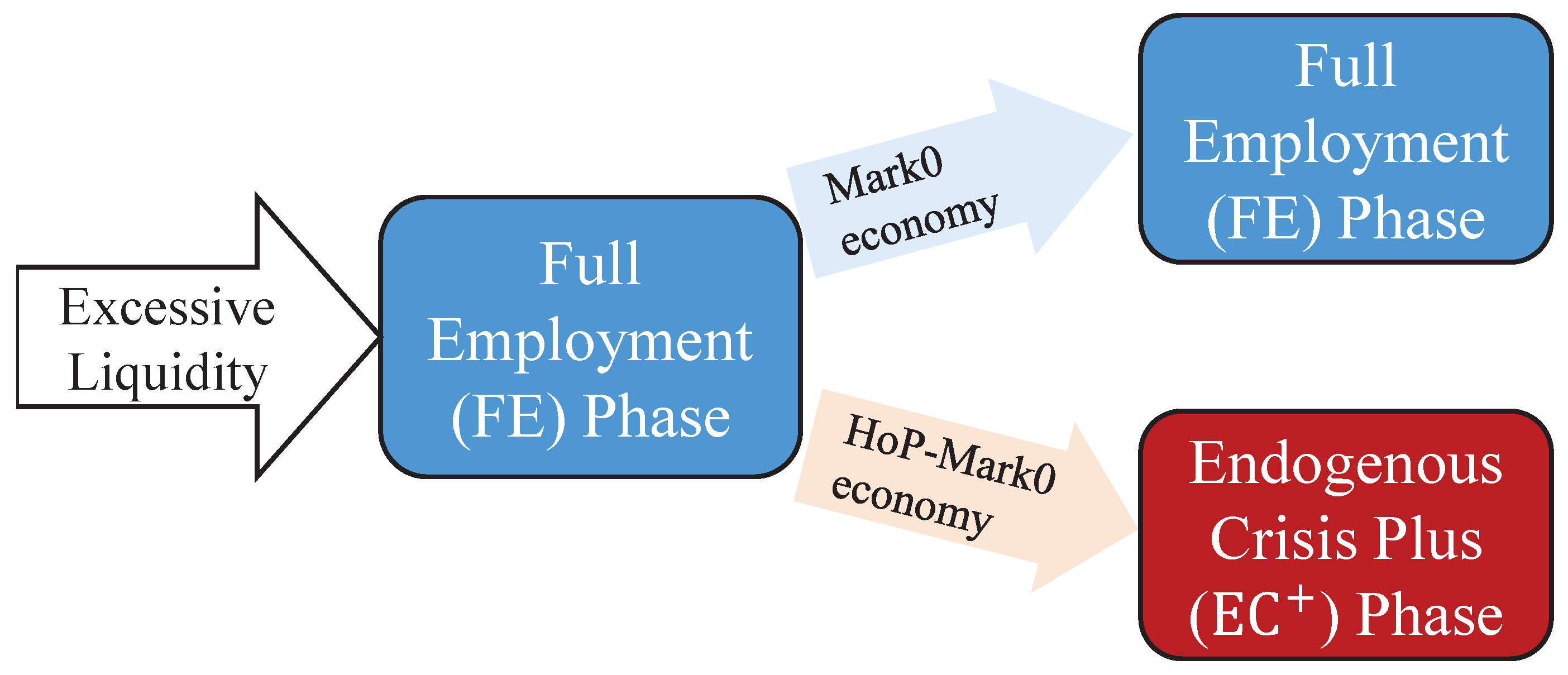

3.3. Simulation Results and Phase Diagram

4. Heterogeneous Economic Performance of Firms

4.1. The Extended Model

4.2. Result: Dynamics

4.3. Result: Phase Diagram

4.4. The Origins of Endogenous Crises

5. Other Factors and the Robustness of Crises

5.1. Production Cycles

5.2. Variable Wages

6. Implication on the Measurement of Risk for Endogenous Crises

7. Conclusions

7.1. Summary of Results and Insights

7.2. Limitations and Future Tasks

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| ABM | Agent-based model |

| DSGE | Dynamic stochastic general equilibrium |

| RE | Residual employment |

| EC | Endogenous crisis |

| FE | Full employment |

| FU | Full unemployment |

| CF | Cyclical fluctuation |

| HoP | Heterogeneity of economic perfomance |

Appendix A. Evolution of Firms’ Wealth in Mark0 and HoP-Mark0

References

- Spangenberg, J.H. Economic sustainability of the economy: concepts and indicators. Int. J. Sustain. Dev. 2005, 8, 47–64. [Google Scholar] [CrossRef]

- Anand, S.; Sen, A. Human development and economic sustainability. World Dev. 2000, 28, 2029–2049. [Google Scholar] [CrossRef]

- Schneider, F.; Kallis, G.; Martinez-Alier, J. Crisis or opportunity? Economic degrowth for social equity and ecological sustainability. Introduction to this special issue. J. Clean. Prod. 2010, 18, 511–518. [Google Scholar] [CrossRef]

- Geels, F.W. The impact of the financial–economic crisis on sustainability transitions: Financial investment, governance and public discourse. Environ. Innov. Soc. Transit. 2013, 6, 67–95. [Google Scholar] [CrossRef]

- Novo-Corti, I.; Țîrcă, D.M.; Ziolo, M.; Picatoste, X. Social Effects of Economic Crisis: Risk of Exclusion. An Overview of the European Context. Sustainability 2019, 11, 336. [Google Scholar] [CrossRef]

- Stockhammer, E. Rising inequality as a cause of the present crisis. Camb. J. Econ. 2015, 39, 935–958. [Google Scholar] [CrossRef]

- Atkinson, A.B.; Bourguignon, F. Handbook of Income Distribution; Elsevier: Amsterdam, The Netherlands, 2014; Volume 2. [Google Scholar]

- Galbraith, J.K. Inequality and Instability: A Study of the World Economy Just before the Great Crisis; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- Kumhof, M.; Rancière, R.; Winant, P. Inequality, leverage, and crises. Am. Econ. Rev. 2015, 105, 1217–1245. [Google Scholar] [CrossRef]

- Gualdi, S.; Tarzia, M.; Zamponi, F.; Bouchaud, J.P. Monetary policy and dark corners in a stylized agent-based model. J. Econ. Interact. Coord. 2017, 12, 507–537. [Google Scholar] [CrossRef]

- Stiglitz, J.E. Towards a General Theory of Deep Downturns; Technical Report; National Bureau of Economic Research: Cambridge, MA, USA, 2015. [Google Scholar]

- Colander, D.; Howitt, P.; Kirman, A.; Leijonhufvud, A.; Mehrling, P. Beyond DSGE models: Toward an empirically based macroeconomics. Am. Econ. Rev. 2008, 98, 236–240. [Google Scholar] [CrossRef]

- Bookstaber, R. The End of Theory: Financial Crises, the Failure of Economics, and the Sweep of Human Interaction; Princeton University Press: Princeton, NJ, USA, 2017. [Google Scholar]

- Ormerod, P. Information cascades and the distribution of economic recessions in capitalist economies. Phys. A Stat. Mech. Appl. 2004, 341, 556–568. [Google Scholar] [CrossRef] [Green Version]

- Ormerod, P. Risk, recessions and the resilience of the capitalist economies. Risk Manag. 2010, 12, 83–99. [Google Scholar] [CrossRef]

- Kirman, A.P. Whom or what does the representative individual represent? J. Econ. Perspect. 1992, 6, 117–136. [Google Scholar] [CrossRef]

- Galí, J. Monetary Policy, Inflation, and the Business Cycle: An Introduction to the New Keynesian Framework; Princeton University Press: Princeton, NJ, USA, 2008. [Google Scholar]

- Fagiolo, G.; Roventini, A. Macroeconomic policy in DSGE and agent-based models. Revue de l’OFCE 2012, 5, 67–116. [Google Scholar]

- Blanchard, O. Do DSGE models have a future? Revista de Economía Institucional 2016, 18, 39–46. [Google Scholar] [CrossRef]

- Christiano, L.J.; Motto, R.; Rostagno, M. Risk shocks. Am. Econ. Rev. 2014, 104, 27–65. [Google Scholar] [CrossRef]

- Korinek, A.; Simsek, A. Liquidity trap and excessive leverage. Am. Econ. Rev. 2016, 106, 699–738. [Google Scholar] [CrossRef]

- Bilbiie, F.O. The New Keynesian Cross; University of Oxford: Oxford, UK, 2017. [Google Scholar]

- Delli Gatti, D.; Palestrini, A.; Gaffeo, E.; Giulioni, G.; Gallegati, M. Emergent Macroeconomics: An Agent-Based Approach to Business Fluctuations; Springer: Berlin, Germany, 2008. [Google Scholar]

- Pogson, M.; Smallwood, R.; Qwarnstrom, E.; Holcombe, M. Formal agent-based modelling of intracellular chemical interactions. Biosystems 2006, 85, 37–45. [Google Scholar] [CrossRef]

- Batty, M. Cities and Complexity: Understanding Cities with Cellular Automata, Agent-Based Models, and Fractals; The MIT Press: Cambridge, MA, USA, 2007. [Google Scholar]

- Bonabeau, E. Agent-based modeling: Methods and techniques for simulating human systems. Proc. Natl. Acad. Sci. USA 2002, 99, 7280–7287. [Google Scholar] [CrossRef] [Green Version]

- Sornette, D. Physics and financial economics (1776–2014): Puzzles, Ising and agent-based models. Rep. Prog. Phys. 2014, 77, 062001. [Google Scholar] [CrossRef]

- Janssen, M.; Ostrom, E. Empirically based, agent-based models. Ecol. Soc. 2006, 11, 37. [Google Scholar] [CrossRef]

- Wu, X.; Xu, Y.; Lou, Y.; Chen, Y. Low carbon transition in a distributed energy system regulated by localized energy markets. Energy Policy 2018, 122, 474–485. [Google Scholar] [CrossRef]

- Aoki, M.; Yoshikawa, H. Reconstructing Macroeconomics: A Perspective from Statistical Physics and Combinatorial Stochastic Processes; Cambridge University Press: Cambridge, MA, USA, 2011. [Google Scholar]

- Caiani, A.; Godin, A.; Caverzasi, E.; Gallegati, M.; Kinsella, S.; Stiglitz, J.E. Agent based-stock flow consistent macroeconomics: Towards a benchmark model. J. Econ. Dyn. Control 2016, 69, 375–408. [Google Scholar] [CrossRef] [Green Version]

- Dawid, H.; Gemkow, S.; Harting, P.; Van der Hoog, S.; Neugart, M. The eurace@ unibi model: An agent-based macroeconomic model for economic policy analysis. Bielef. Work. Pap. Econ. Manag. 2012. [Google Scholar] [CrossRef]

- Deissenberg, C.; Van Der Hoog, S.; Dawid, H. EURACE: A massively parallel agent-based model of the European economy. Appl. Math. Comput. 2008, 204, 541–552. [Google Scholar] [CrossRef] [Green Version]

- Gatti, D.D.; Desiderio, S.; Gaffeo, E.; Cirillo, P.; Gallegati, M. Macroeconomics from the Bottom-Up; Springer Science & Business Media: Berlin, Germany, 2011; Volume 1. [Google Scholar]

- Dosi, G.; Fagiolo, G.; Roventini, A. Schumpeter meeting Keynes: A policy-friendly model of endogenous growth and business cycles. J. Econ. Dyn. Control 2010, 34, 1748–1767. [Google Scholar] [CrossRef] [Green Version]

- Bouchaud, J.P.; Gualdi, S.; Tarzia, M.; Zamponi, F. Optimal inflation target: Insights from an agent-based model. Econ. Discuss. Pap. 2017. [Google Scholar] [CrossRef]

- Gualdi, S.; Tarzia, M.; Zamponi, F.; Bouchaud, J.P. Tipping points in macroeconomic agent-based models. J. Econ. Dyn. Control 2015, 50, 29–61. [Google Scholar] [CrossRef] [Green Version]

- Tesfatsion, L. Agent-based computational economics: Growing economies from the bottom up. Artif. Life 2002, 8, 55–82. [Google Scholar] [CrossRef]

- McCoy, B.M.; Wu, T.T. The Two-Dimensional Ising Model; Courier Corporation: Chelmsford, MA, USA, 2014. [Google Scholar]

- Yang, C.N. The spontaneous magnetization of a two-dimensional Ising model. Phys. Rev. 1952, 85, 808. [Google Scholar] [CrossRef]

- Goldenfeld, N. Lectures on Phase Transitions and the Renormalization Group; CRC Press: Boca Raton, FL, USA, 2018. [Google Scholar]

- Bak, P. How Nature Works: The Science of Self-Organized Criticality; Springer Science & Business Media: Berlin, Germany, 2013. [Google Scholar]

- Challet, D.; Marsili, M.; Zhang, Y.C. Minority games: Interacting agents in financial markets. In OUP Catalogue; Oxford University Press: Oxford, UK, 2013. [Google Scholar]

- Challet, D.; Zhang, Y.C. Emergence of cooperation and organization in an evolutionary game. Phys. A Stat. Mech. Appl. 1997, 246, 407–418. [Google Scholar] [CrossRef] [Green Version]

- Cont, R.; Bouchaud, J.P. Herd behavior and aggregate fluctuations in financial markets. Macroecon. Dyn. 2000, 4, 170–196. [Google Scholar] [CrossRef]

- Alfi, V.; Cristelli, M.; Pietronero, L.; Zaccaria, A. Minimal agent based model for financial markets I. Eur. Phys. J. B 2009, 67, 385–397. [Google Scholar] [CrossRef] [Green Version]

- Alfi, V.; Cristelli, M.; Pietronero, L.; Zaccaria, A. Minimal agent based model for financial markets II. Eur. Phys. J. B 2009, 67, 399–417. [Google Scholar] [CrossRef] [Green Version]

- Mantegna, R.N.; Stanley, H.E. Introduction to Econophysics: Correlations and Complexity in Finance; Cambridge University Press: Cambridge, UK, 1999. [Google Scholar]

- Gualdi, S.; Bouchaud, J.P.; Cencetti, G.; Tarzia, M.; Zamponi, F. Endogenous crisis waves: Stochastic model with synchronized collective behavior. Phys. Rev. Lett. 2015, 114, 088701. [Google Scholar] [CrossRef]

- Anderson, S.P.; De Palma, A.; Thisse, J.F. Discrete Choice Theory of Product Differentiation; MIT Press: Cambridge, MA, USA, 1992. [Google Scholar]

- Porter, M.E. How competitive forces shape strategy. In Readings in Strategic Management; Springer: Berlin, Germany, 1989; pp. 133–143. [Google Scholar]

- Kitchin, J. Cycles and trends in economic factors. Rev. Econ. Stat. 1923, 5, 10–16. [Google Scholar] [CrossRef]

- Thornton, D. The downside of quantitative easing. Econ. Synop. 2010. [Google Scholar] [CrossRef]

- Bank of England. Quarterly Bulletin Retrieved on 13th September 2018; Bank of England: London, UK, 2018. [Google Scholar]

- Lerner, A. The concept of monopoly and the measurement of monopoly power. In Essential Readings in Economics; Springer: Berlin, Germany, 1995; pp. 55–76. [Google Scholar]

- Rhoades, S.A. The herfindahl-hirschman index. Fed. Res. Bull. 1993, 79, 188. [Google Scholar]

- Gaffeo, E.; Gallegati, M.; Palestrini, A. On the size distribution of firms: additional evidence from the G7 countries. Phys. A Stat. Mech. Appl. 2003, 324, 117–123. [Google Scholar] [CrossRef]

- Kang, S.H.; Jiang, Z.; Cheong, C.; Yoon, S.M. Changes of firm size distribution: The case of Korea. Phys. A Stat. Mech. Appl. 2011, 390, 319–327. [Google Scholar] [CrossRef]

- Gao, B.; Chan, W.K.V.; Li, H. On the increasing inequality in size distribution of China’s listed companies. China Econ. Rev. 2015, 36, 25–41. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zheng, W.; Lou, Y.; Chen, Y. On the Unsustainable Macroeconomy with Increasing Inequality of Firms Induced by Excessive Liquidity. Sustainability 2019, 11, 3075. https://doi.org/10.3390/su11113075

Zheng W, Lou Y, Chen Y. On the Unsustainable Macroeconomy with Increasing Inequality of Firms Induced by Excessive Liquidity. Sustainability. 2019; 11(11):3075. https://doi.org/10.3390/su11113075

Chicago/Turabian StyleZheng, Wenzhi, Yuting Lou, and Yu Chen. 2019. "On the Unsustainable Macroeconomy with Increasing Inequality of Firms Induced by Excessive Liquidity" Sustainability 11, no. 11: 3075. https://doi.org/10.3390/su11113075

APA StyleZheng, W., Lou, Y., & Chen, Y. (2019). On the Unsustainable Macroeconomy with Increasing Inequality of Firms Induced by Excessive Liquidity. Sustainability, 11(11), 3075. https://doi.org/10.3390/su11113075