3.1. Dataset

The existing literature on SII as an alternative asset class that can be used for portfolio allocation is quite limited. The results of those studies are difficult to compare with each other because the datasets used in these empirical analyses are very narrow. The OECD Social Impact Investment Initiative [

34], indeed, pointed out the strong need for transparent and standardized data sharing in order to foster social capital market.

We attempt to address the lack of availability of data on SII by creating a unique dataset of SIFs with the following characteristics: (i) relies on independent and publicly available criteria to define impact investments; (ii) is not limited to a specific market nor a geographical area; and (iii) allows for reproducible quantitative analysis of SII. To select our sample of SIFs, we started out with the full list of companies reported on wikipositive.org, a public portal on private and public enterprises that meet the highest financial, social, and environmental standards. This starting sample is ideal for selecting SIFs as it is not limited to a negative screening (e.g., screening out weapons, tobacco, and gambling products), but it includes only those companies with expected positive products and/or services. Moreover, the platform includes a wide range of companies (slightly more than 1000) from different geographical areas.

We further relied on the framework provided by the OECD [

7] in order to identify any company included in the wikipositive.org list that might or might not be considered a SIF. This framework helped to operationalize the SII definition during the data collection process, and was previously employed by La Torre et al. [

35] and Chiappini [

36] to a sample of microfinance vehicles and social impact funds.

According to the OECD [

7], the criteria for any investments to be eligible for SII include the following:

- (1)

Social target areas: It provides a range of social areas that could potentially be considered SII under various circumstances. There are overall 8 core SII areas that can be eligible, that are: ageing, disability, health, children and families, public order and safety, affordable housing, unemployment, and education and training. In addition, there are 5 other areas, leaning towards the core areas, such as: agriculture, environment and energy, water and sanitation, financial services (including microfinance), and Information and Communications Technology (ICT. The inclusion of these last 5 areas as SIIs depends on the other characteristics of the investments described below.

- (2)

Beneficiary context: It relates to who benefits from the firm’s operations. To the extent that a company operates in order to fulfil the needs of populations at risk or those living in underserved or developing areas, the investment might be considered to be SII. More precisely, if the area of business of a company is not among those that are considered as core SIIs, but it provides a benefit to a population that is at risk, then it could be considered as a SII.

- (3)

Degree of publicness: It relates to the type of good or service provided by the company. SII eligibility will apply to goods or services within the continuum between the two boundaries (public and private). Indeed, social goods have different characteristics than pure private or public goods insofar as they would not completely exclude benefits accruing to non-target beneficiaries.

- (4)

Delivery organization intent: It deals with a verifiable demonstration of the firm’s social intent. Specifically, merely having the intent stated on the mission is not enough to be considered SII as the delivery organization must put sufficient effort into demonstrating that they are committed to the social cause. A strong level of commitment can be demonstrated, for instance, through (i) some form of compulsory reporting of social outcomes to shareholders within the organization’s statutes; (ii) an external certification or label; and (iii) legally binding constraints, which provide the strongest indication of a commitment to social goals.

- (5)

Measurability of social impact: It refers to the fact that a firm that does not have any form of social impact measurement cannot be considered as a SII. The assessment of the impact of the investments can be qualitative or quantitative.

Compared to the work of La Torre et al. [

35] and Chiappini [

36], we excluded two additional requirements, i.e., investor intent and return expectation. Indeed, while the aforementioned studies applied OECD [

7] criteria to verify whether existing investment vehicles (specifically microfinance vehicles or social impact funds) are “compliant” to the perimeter of SII, our aim was to select internationally listed firms that show potential as a social impact target company. Therefore, our focus was on those criteria that primarily refer to the investee rather than to the investor.

The analysis of each item was based on various sources of information that met the criteria of transparency and trust worthiness. Specifically, we used several sources of data. From each company’s webpage, we analyzed the company’s overview, mission, article of association, and financial statements in order to clearly identify the social target area, the kind of beneficiaries, the degree of publicness, and the social delivery organization intent. More precisely, we analyzed the delivery intent of the company by further requiring that the company has one of the following: (i) a sustainability report; (ii) an external certification or label, or (iii) legally binding constraints within the article of association. Finally, sustainability reports retrieved from the company’s webpage were used to investigate the effective measurement of the company social impact. Specifically, we required that each company disclosed at least two sustainability reports and that each of them included a measure (i.e., figures or absolute amounts) of the actual social impact of the company’s projects.

To be eligible for inclusion in our sample, a firm in the wikipositive.org website had to be compliant with at least four out of the five criteria outlined by the OECD [

7]. Moreover, we asked the firm to be listed on a stock exchange. Overall, these criteria led us to a final sample of 41 SIFs across 13 countries. We further added to the sample 11 SIFs that were admitted to the London Social Stock Exchange (SSX). Therefore, we ended up with 52 SIFs (see

Appendix A for more details). Our sample of SIFs is quite different from other datasets (e.g., Asset4, KLD, and CSRHUB), which provide environment, social, and governance (ESG) scores/ratings and other performance indicators in order to assess how well companies manage their ESG risks and opportunities. As explained in

Section 2.2, ESG principles and SII are similar in purpose, but different in practice. In our sample, 44.2% (23) of firms are incorporated in Europe, 38.5% (20) are incorporated in the USA and Canada, 15.4% (8) in Asia, and 1 firm in South Africa. With respect to the social investment areas,

Table 1 shows that our sample was characterized by a high presence of firms in the environmental and energy sector (51.9%) and in the health sector (15.4%).

In order to construct our social impact finance stock index (that we will call SIFSI hereafter), we gathered the total return index, market capitalization, and free float rate for each SIF included in the sample on a daily basis from January 2002 to September 2018 from Thomson Reuters Datastream. Total returns were calculated on adjusted prices in order to consider corporate events, like, e.g., stock splits, etc.

To perform our portfolio analysis, we further obtained from Thomson Reuters Datastream the daily total return of the following two indexes: Morningstar Global Government Bond Index USD (MGGBI) and MSCI International All Country World Index (ACWI).

3.2. The Social Impact Finance Stock Index

In order to aggregate SIFs’ data and build our SIFSI, we followed the methodology applied by Morgan Stanley Capital International (MSCI) to construct its indices. In particular, we used the MSCI All Country World Index (MSCI ACWI) as a global stock market benchmark, because it takes into account all the countries issuing securities belonging to our SIFSI, including both developed and emerging markets (23 developed and 24 emerging markets). Indeed, the MSCI ACWI is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world.

Due to the availability of the daily data of the aforementioned indices, as underlined in the previous section, the period taken into consideration in the analysis started from January 2002 and finished at the end of September 2018; for the construction of our SIFSI, we used the daily total return index of the selected stocks. Although we started out with 52 possible constituents, we deleted two of them because their price series were overly lacking.

Given the different time of entry in the stock market of each constituent, we followed one of the two MSCI methodologies to update the indices. The first methodology is quarterly reviews (in February and August the so-called quarterly index reviews, and in May and November the so-called semi-annual index reviews) in which new small Initial Public Offerings (IPOs) are included. The second methodology used is ongoing event-related changes in which changes are implemented in the indexes as they occur; more specifically, significantly large IPOs are included in the indexes after the close of the company’s 10th day of trading. We decided to follow the second methodology for all of our securities (also for small IPOs). Therefore, in order to achieve a greater overlap with the MSCI ACWI methodology, we excluded the first 10 days of listing after the IPO. This choice allowed us to make the securities available in the index as soon as possible, thus increasing the descriptive capacity of the index.

The calculation method of the MSCI ACWI imposes that once 99% of the market capitalization is reached, smaller securities are excluded from the index. However, to avoid a reduction in the number of constituents of SIFSI, we decided not to apply this rule.

At the beginning of the analyzed period (January 2002), the SIFSI index was composed of 26 stocks. During the 17 years, another 24 stocks were added and 5 were deleted because of default or delisting. At most, the index included 47 out of the 50 considered constituents at the same time.

3.3. Portfolio Macro Asset Allocation

As already explained, the aim of the paper was to compare the out-of-sample results of portfolios including or not the above mentioned social impact finance stock index among the feasible assets. In particular, the investor (or the asset management company) builds the portfolio using three macro asset classes represented by the three indices mentioned above, all computed in local currencies. We used the three indices in the following combinations:

Portfolio 1 is composed of the MSCI ACWI and the MGGBI;

Portfolio 2 can invest in SIFSI and MGGBI;

Portfolio 3 has no restriction on the feasible assets, therefore it invests in SIFSI, MSCI ACWI, and MGGBI.

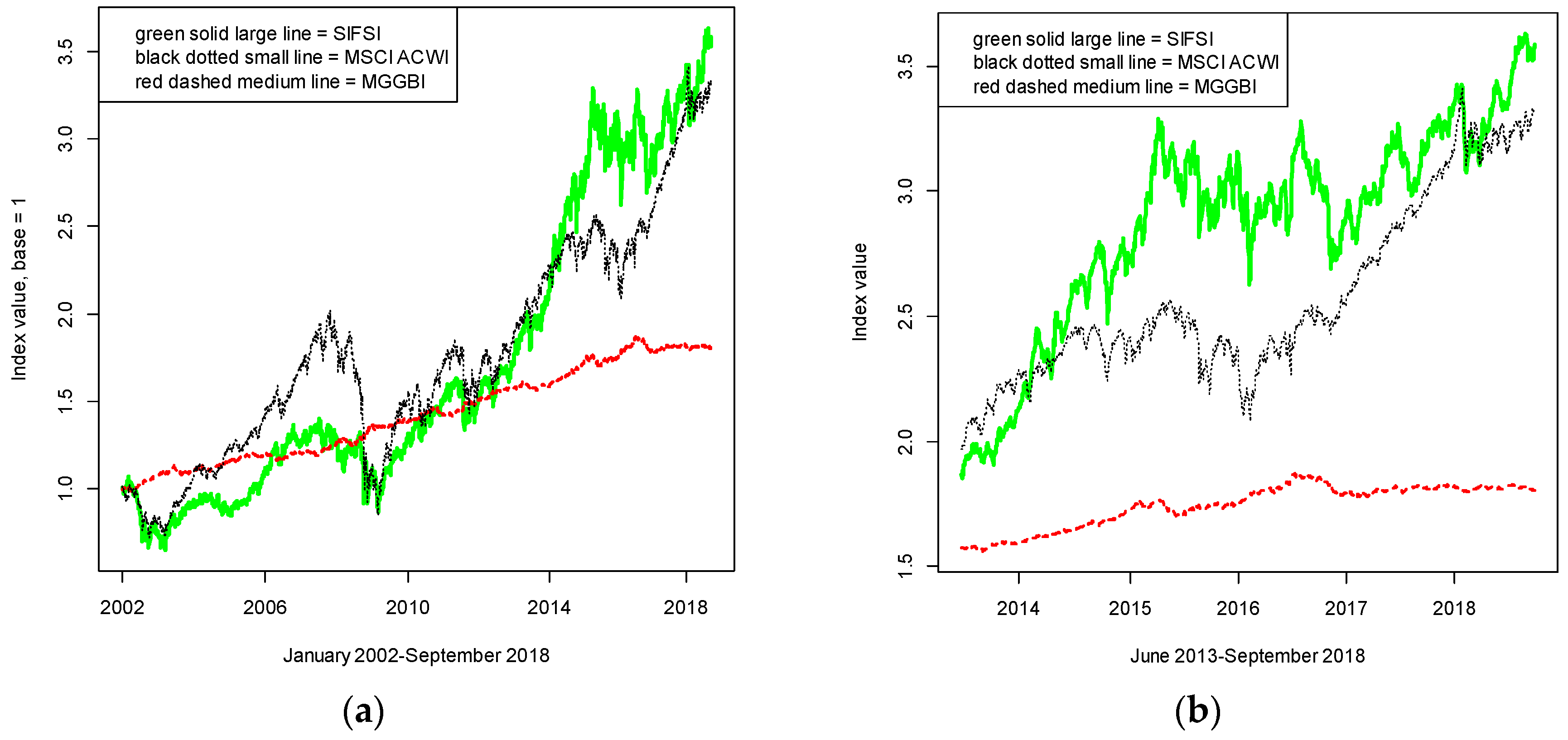

We performed some simplifying assumptions. First, we assumed there are no transaction costs, that is, no costs for portfolio rebalancing or for short-selling. Moreover, we disregarded savings decisions and intermediate consumption: We invested an amount of money at the beginning of the period (for simplicity and without loss of generality, equal to 1) and we did not receive or disinvest anything until the end of the analyzed period. The allocation was done for about five years left out-of-sample, with a monthly portfolio rebalancing. Indeed, assuming that a month is composed by 22 working days, we allocated the portfolio 60 times, every 22 working days. The data, as already said, started from the beginning of January 2002 to the end of September 2018. Therefore, excluding the last 1320 observations (22 × 60), the out-of-sample period starts at the end of June 2013. The time series of the three indices are plotted in

Figure 1: The left panel represents the whole time series, while the right panel focuses on the out-of-sample period. The descriptive statistics of the data for the whole sample are reported in

Table 2. These statistics show that the two stock indices have a similar average and standard deviation of the returns on the whole period, while the bond index shows, as expected, lower levels of return and risk. However, observing also the higher central moments, we can state that the SIFSI performs better than the overall stock market index because it seems to be safer (and even with a slightly higher mean return). Indeed, the former presents a higher skewness and a lower kurtosis. That is, a lower probability of extreme events especially in the negative tail of the distribution or, in other words, a lower probability of crashes.

The left panel of

Figure 2 highlights the strong positive correlation (0.67) between the two stock indices, SIFSI and MSCI ACWI. The presence of some joint extreme events could signal the existence of the so-called tail dependence that can be modelled with different kind of copulas.

The other two panels of

Figure 2 show, instead, that the bond index is weakly inversely correlated with SIFSI and MSCI ACWI (−0.24 and −0.32, respectively) and, therefore, it is very important for the diversification process of portfolio allocation. Moreover, the range of the axes confirms the very different standard deviations and kurtosis between the two stock indices (with returns also above +5% and below −5%) and the bond index (with return always included between ±1%).

The comparison among the performances of the portfolios was evaluated in terms of:

In detail, we evaluated the performance of the analyzed portfolios using the Sharpe ratio, following La Torre et al. [

6] and Rachev et al. [

38]. Even if it proxies the utility analysis with the analysis of only the first two moments (mean and variance) of the return distribution, it has the advantage of not assuming a particular utility function.

Instead, the utility was computed with the CRRA function on monthly returns, as done by many authors, such as Patton [

37] and Riccetti [

8]:

where γ is the risk aversion parameter, R

port is the portfolio capitalization factor (1 plus the portfolio return), and P

0 is the initial investment that we set as equal to 1 (without loss of generality, as already said). The values of the risk aversion parameter, γ, used are 2, 5, 10, and 15, as suggested by Bucciol and Miniaci [

39], and as performed in other papers, such as Jondeau and Rockinger [

40] and Riccetti [

8]. When γ = 2, we are simulating an investor that is relatively risk prone and, for an increasing value of γ, we are simulating a more and more risk averse investor.

However, the utility displays a number that is able to rank the portfolios from the best to the worst, but does not give an economic insight on the strength of the preference. Therefore, we associated to the utility the forecast premium, also called the opportunity cost, because it is the return that needs to be added to the returns obtained by a benchmark portfolio (in our case, the naïve equally divided portfolio that does not use any information and allocation models) so that the investor becomes indifferent to the returns obtained by the analyzed model. Formally:

where r

m is the return obtained by the portfolio allocated using the copula or the mean-variance model, re is the return obtained by the naïve equally divided portfolio, and θ is the forecast premium. Sometimes, the forecast premium is interpreted as a sort of management fee, because it is the maximum amount that the investor would be willing to pay to an asset manager to switch from the benchmark portfolio (in our case, naïve equally divided) to the proposed allocation.

Following Jondeau and Rockinger [

40], in the context of a fourth-order Taylor approximation with the CRRA utility function, Equation (2) can be written as follows:

where m represents the non-central moments of order i: m

i = mean (r

i).

We used Equation (3) to calculate the forecast premium. It clearly shows that an investor is willing to pay a forecast premium in order to obtain a portfolio that increases the mean and skewness (odd moments) and decreases the variance and kurtosis (even moments) of the return distribution, as usual for a rational risk averse investor within the expected utility framework (see, for instance, Scott and Horvath [

41]).

The returns used for the out-of-sample evaluation were computed monthly, that is, every 22 working days. Even if we rebalanced the portfolio monthly and we evaluated the performance on monthly returns, we used daily returns in our allocation procedure. In this way, we covered quite a long time period without rebalancing (and this reduced the problem of not considering rebalancing costs), but we used more information compared to few monthly returns. Similar procedures were applied, for instance, by Riccetti [

8] or by Morana [

42], who computed monthly realized betas from daily data. However, to do this procedure, we needed to simulate a path of 22 returns to allocate the portfolio for each out-of-sample month. Now, we will describe the model used for the allocation.

Following Riccetti [

8], the portfolios were built with three different methodologies: naïve allocation, the GARCH-copula model, and Markowitz [

9] mean-variance optimization.

For the naïve allocation, we did not need a model: We simply equally divided the portfolios among the feasible assets. Therefore, portfolios 1 and 2 show the 50%–50% allocation, while portfolio 3 includes a 33.33% allocation of the investment to each stock index (MSCI ACWI and SIFSI) and a 33.34% allocation to the bond index (MGGBI).

The GARCH-copula model was structured in the following way:

Means are unconditional. We also attempted to model the returns using ARMA processes, but these models are not theoretically justifiable and, as often happens in these cases, they are effective in-sample, but not useful for the out-of-sample forecast;

Variances are modelled with a GARCH (1,1), using error terms extracted from a Skewed-t distribution. We chose the GARCH (1,1) because it is the most used GARCH model and, in practice, it often performs better than other (more complex) GARCH models for the out-of-sample forecast. GARCH residuals present negative skewness and excess kurtosis, therefore the error terms were extracted from a skewed-t distribution, following Jondeau and Rockinger [

40], Patton [

37], and Riccetti [

8];

The joint behavior of the residuals of the indices is modelled by a copula function. We attempted Clayton, normal, and student-t copulas. These copulas possess different tail dependences: The Clayton copula catches the lower tail dependence (high probability that a large negative value of one variable corresponds to a large negative value of the other variable), the student-t copula implies both lower and upper tail dependences (but symmetrical), while the normal copula does not present any tail dependence. We selected the copula presenting the best value of the maximum likelihood. In line with most of the empirical papers applying static copula models, the student-t copula is always preferred and this choice can be confirmed, for instance, by the observation of the left panel of

Figure 2 in which the presence of both lower and upper tail dependence is very evident.

The following three steps were used to build the optimal portfolio:

- (1)

Estimate using the maximum likelihood the parameters of the explained model;

- (2)

Perform a 10,000 times Monte Carlo simulation of the path of assets’ returns on the 22 day investment horizon;

- (3)

Choose the optimal weights in order to maximize the investor’s expected utility, assuming that the utility function is represented by the CRRA function, as previously explained.

For the Markowitz [

9] mean-variance optimization, we followed a similar method, because in the presence of a CRRA utility function, a simple closed form cannot be derived for the optimal weights. Therefore, we used, as an approximation of the weight for the mean-variance approach, a model that uses GARCH (1,1) for the univariate variances and shocks extracted from a multivariate normal with correlations equal to the in-sample historical ones.