Abstract

Capital is key to achieve the standardized operation of public–private partnership (PPP) projects. The capital structure of PPP projects stresses the structure of equity and debt funds, which are important for securing life-cycle ample funds and achieving the expected outcomes of projects. By incorporating sustainability into PPP projects, the capital structure not only secures current needs of funds, it also focuses on life-cycle stable operations and achieves economic, social, and environmental benefits. This study first set the equity–debt ratio and equity investment ratio of the private sector as the dependent variables and built a selection model of the capital structure of PPP projects from a sustainability perspective using the benefit, cost, and project conditions as core factors based on multi-objective programming and a discounted cash-flow model. Then, the qualitative analysis could be achieved according to the analysis of critical factors that had not been calculated. Afterwards, a selection process which combined the multi-objective programming model with qualitative analysis was proposed to achieve a comprehensive selection of the capital structure of PPP projects from the sustainability perspective. Finally, the process was applied to a real project to verify its rationality and usability. This study not only enriches the theoretical research of PPP projects and provides a new idea on which to build the capital structure selection model, it also proposes a selection process that can provide scientific references for the selection and optimization of the capital structure of PPP projects in practice.

1. Introduction

The idea of sustainability came from the Brundtland Report, which indicated that behaviors should not impact future development while meeting current needs [1]. It covers three dimensions—economy, society, and environment—and is closely correlated to public–private partnership (PPP) projects from several sustainable development goals (SDGs), including infrastructure, sustainable cities, and partnerships [2,3]. The United Nations Economic Commission for Europe [4] proposed 27 criteria that relate the PPP mode with each SDG, including pensions in infrastructure financing, standards and mechanisms for PPP units, and compliance evaluation tools. The introduction of sustainability in PPP projects aims to ensure the long-term sustainable operation of the projects, to achieve their economic, social, and environmental goals, and to create positive impact in the industrial, regional, and social levels.

Moreover, capital represents the total funds of PPP projects, including equity and debt, which play an important role in achieving sustainability in PPP projects. The capital structure shows the resources and structures of equity and debt in PPP projects, which determine the sufficiency and stability of funds [5]. The UK’s Treasury [6] decided not to apply Private Finance Ⅱ (PF2) in new British projects due to its inflexibility and complexity, both of which would have brought huge financial risks for the government. Yang et al. [7] indicated that the overly high rate of return of the private sector as well as the incomplete information disclosure of project debts and investors’ return led to the termination of PF2 in the UK. It shows that the operation difficulties of PF2 are strongly linked to project funds. Furthermore, there are also many PPP projects suffering from the problem of capital structure; these include the Taiwan High Speed Rail [8], Hungary M1–M15 road [9], and Hangzhou Bay Sea-crossing Bridge [10]. An unreasonable capital structure caused many problems in PPP projects from a sustainability perspective, including a lack of money during the operation stage, huge debt pressure, and an unstable equity structure, which negatively impacted the success of PPP projects. Therefore, an analysis of capital structure is important for promoting the standardized development and life-cycle healthy operation of PPP projects.

Integrating sustainability into PPP projects throughout the project life-cycle, including finance, construction and operation, provides new ideas for the management of PPP projects from economic, social, and environmental perspectives. However, current research concerning the innovation of concepts is primarily limited to the implementation of sustainability from a single level. It is thus necessary to analyze the specific implementation processes of PPP projects by integrating their economic, social, and environmental dimensions.

Considering sustainability from the economic, social, and environmental levels, this study focuses on a traditional economic issue under a new perspective by making the capital structure meet the needs of all parties and respond to the current goal of global sustainable development. Integrating traditional economic indicators with the new non-economic indicators, the scientific capital structure aims to ensure long-term sustainable operation by considering social and environmental benefits, which can bring positive impact on the industry, region, and whole society after providing ample funds for PPP projects and satisfying the needs of stakeholders [11,12,13].

Based on a capital structure consisting of critical influence factors, this study established a selection model of capital structure from a sustainability perspective. It is built from a selection process combining the quantitative model and qualitative analysis. The process was then applied to real-world projects to verify its science and usability. This study not only provides a new idea of selecting the capital structure from the sustainability perspective, it also serves as a reference for designing the capital structure in practice, which can promote the scandalized development of PPP projects.

This paper first reviews the literatures about sustainability in PPP projects and the selection and theory of capital structure to address the current research gap. Afterwards, the methodology section provides the discussion of the selection of a multi-objective programming model and discounted cash-flow model before introducing the procedure of establishing the quantitative model. Then, the selection model of the capital structure from a sustainability perspective is built and discussed. By combing qualitative analysis with the quantitative model, a selection process then proposed. Finally, a case study is conducted to verify the feasibility and usability of the selection process.

2. Literature Review

2.1. PPP Projects from the Sustainability Perspective

It is a new perspective to analyze PPP projects while considering sustainability. Koppenjan and Enserink [14] indicated that the private sector should not only focus on the short-term return of investment, it should also try to achieve long-term sustainable goals of the urban infrastructures and improve the sustainability of the urban environment. Kyvelou et al. [15] also believed that the PPP mode is an important way for governments to build urban environmental infrastructure and promote the sustainable development of cities. Considering agriculture, Ferroni and Castle [16] claimed that the beneficial institutional environment provided by the public sector, the expertise of product development, and the deployment from the private sector can effectively support sustainable development.

However, sustainability shows limited importance in current PPP projects [17]. From the social dimension, Bennett [18] emphasized the importance of social sustainability in PPP projects and believed that indicators of sustainability should be used by all participants of PPP projects. Moreover, social relationships, social organization activities, and other social factors play an essential role in breaking through technical and institutional limitations which are related to the financial sustainability of PPP projects [19]. From the economic perspective, financial sustainability is of core importance for all stakeholders in PPP projects [18]. Shen et al. [20] proposed benefit distribution between the public and private sectors as a core factor that impacts the sustainable performance of PPP projects, meaning that a proper benefit distribution plan can help achieve better sustainable results. As for the environmental level, Kościelniak and Górka [21] showed that a PPP is an advantageous way to improve urban environmental protection through a revolving financial mechanism and a green investment considering sustainability. Villalba-Romero et al. [22] indicated that the environmental perspective of sustainability shows great importance during the operation and maintenance stages. Combining the three levels, Schachler and Navare [23] used the reasonable governance framework and contract structure to achieve effective the identification and distribution of risks, further ensureing the sustainable development of PPP projects.

2.2. Selection of Capital Structure of PPP Projects

2.2.1. Capital Structure Theory

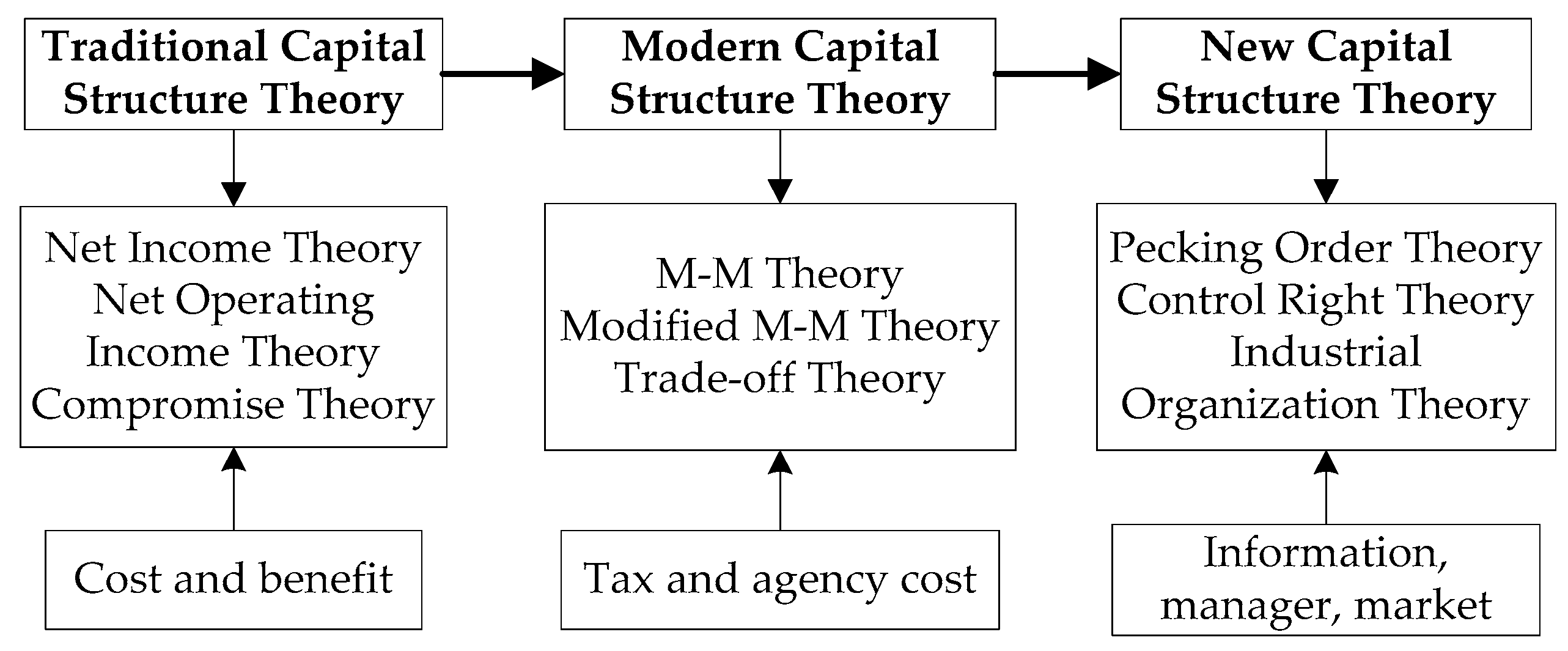

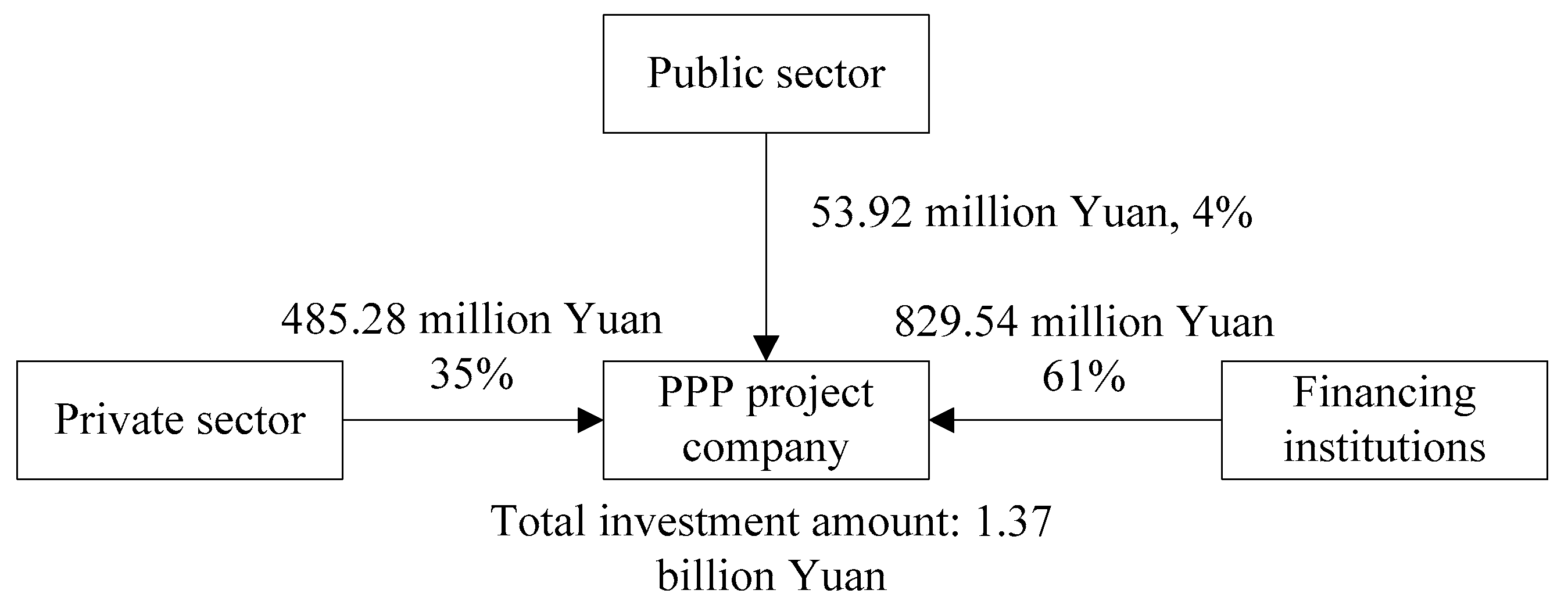

Capital structure indicates the amount and ratio of debt and equity funds during the corporate financing stage, which is a dynamic and complicated process [24]. It can be divided into three categories: Traditional capital structure theory, modern capital structure, and new capital structure theory, which is shown in Figure 1.

Figure 1.

The development of capital structure theory.

Durand [25] summarized the three types of traditional capital structure theory. The Net Income Theory shows that when debt funds cover 100%, enterprise value can be maximized. Moreover, according to the Net Operating Income Theory, the value of an enterprise is independent of capital structure [25]. To achieve a balance between the two methods, the compromise theory was proposed. The balance between equity and debt funds should be concerned to achieve the minimization of Weighted Average Cost of Capital (WACC) and the maximization of the total value of an enterprise [26]. Traditional capital structure theory weighs benefits and financing costs as core attributes and indicates that the key issue is balancing financing costs and risks [27,28].

Moreover, Modigliani and Miller [29] began the modern capital structure theory by proposing the M–M theory. Without considering corporate income tax, the enterprise value correlates with risk, but it is not influenced by capital structure [30]. However, Rose [31] indicated that the assumption that investors have potential arbitrage opportunities is unreasonable, and the two methods use different interest rates. Thus, Modigliani and Miller [32] proposed that debt interests can avoid taxes, which means that financial leverage leads to the increase of enterprise value and tax advantages. Nevertheless, the modified M–M theory also has a drawback, which is that it does not consider the bankrupt risk brought by a large amount of debts. Therefore, researchers proposed the trade-off theory [33,34], which shows that capital structure is the balance between tax benefits and bankruptcy costs [35].

Finally, in the new capital structure theory, Ross [36] believed that information asymmetry makes external financing possible with transaction costs. Taking the governance framework into account, Harris and Raviv [37] showed that it is necessary to find the optimal share of equity to maximize the value of the enterprise and personal interests of managers when minimizing agent costs. Matemilola et al. [38] also believed that top managers’ experience is positively related to the value of their enterprise. Stulz [39] also indicated that enterprise value can be maximized with the optimal equity structure. Besides, in the oligopoly market, indebted enterprises will be more active, and the product and market are key influencing factors of the equity–debt ratio [40].

Therefore, based on tradition capital structure theory and the key ideas of modern and new capital structure theories, this study selects the capital structure from the perspective of PPP project companies.

2.2.2. Selection Model of the Capital Structure of PPP Projects

On the optimization and selection of the capital structure of PPP projects, many models have been applied. Ning [41] built a game model based on the benefits of a project company, creditors, the public sector, and the private sector to obtain an optimal capital structure. Liu [42] relied on the enterprise value and yield of debts to develop a Leland model which adopted the trade-off theory. It was found that the private sector care about the added value of equity, while the creditors care about the benefits of debts in the models [43]. Moreover, current research has expanded to other objectives when selecting and optimizing the capital structure, including the cost of stakeholders [44], public welfare [45], and the operation of PPP projects [46] to enrich the selection model of the capital structure of PPP projects.

As for the equity structure, Sheng [47] determined the equity structure using the benefit function of each participant. Sharma et al. [48] applied linear programming to obtain an optimal structure which can maximize the benefits of private investment while ensuring public interests. Feng et al. [49] set the social costs as the objective to build an equity allocation model using the Monte Carlo simulation and genetic algorithm. Chen [50] focused on risk allocation to develop a real option investment income model to obtain the equity ratio. Taking the equity–debt ratio into account, Jr. and Ioannou [51] indicated that the debt capacity of a PPP project is less than 100% of debt financing.

To sum up, researchers mostly established selection and optimization models from the economic perspective, while the social and environmental levels of PPP projects were overlooked. Thus, this study builds a selection model and process which consider economic, social, and environmental indicators from a sustainability perspective.

3. Methodology

3.1. Selection of Methods

3.1.1. Multi-Objective Programming Model

From the sustainability perspective, selecting the capital structure of PPP projects is a complicated process to balance several objectives. Therefore, a model should consider several objectives and constraints to balance the benefits and costs of each participant. The multi-objective programming model [52], game theory [53], and principal–agent theory [54] are often used to solve this type of problem.

Game theory is often applied to solve conflicts considering cost and benefit, including financing renegotiation [55,56,57], risk allocation [58,59], and compensation for the early termination [60]. In this study, the objectives cover economy, society, and environment, rather than just the cost and benefit. Moreover, the selection of a capital structure is not the resolution of conflicting goals but the coordination and unification of multiple objectives; hence, the game model is not applicable. The principal–agent theory is a way to analyze the opportunistic behaviors of the private sector and the incentive behavior of the public sector [61,62]. It addresses the principal relationship to maximize the benefits of stakeholders, which is not in line with the objectives of this study. Therefore, the principal–agent theory is not applicable either.

Multi-objective programming is a mathematical model from operations research. It aims to solve the problems with multiple objectives by quantitatively expressing complex problems using multi-objective functions and constraints [63]. It has been applied to pricing problems and risk analysis of PPP projects [64]. The selection of the capital structure of PPP projects includes many objectives from different participants and satisfies many restraints of resources and abilities. This method can generate an optimal capital structure under multiple objectives, factors, and constraints expressed by equations.

Thus, this study applied the multi-objective programming model to build a selection model of the capital structure based on core factors influencing the capital structure of PPP projects from the sustainability perspective, including cost, benefit, and project conditions [11].

3.1.2. Discounted Cash-Flow Model

When building a model, it is necessary to obtain a quantitative expression of objectives and constraints through equations. The portfolio model is a common way to obtain these equations. The Markowitz model focuses on the balance between investment return and risk [65]. Moreover, the capital asset pricing model cares about the market factor and considers the risk premium as a core concern [66]. In addition, the arbitrage pricing model cares about the relationship between project returns and risk [67]. However, the risk factor does not show obvious importance in the capital structure of PPP projects from a sustainability perspective [11]. Thus, portfolio models are not applicable. Based on the capital structure theory and engineering economics, the discounted cash-flow model (DCF) can clearly show the inflow and outflow of funds of PPP projects and achieve a comprehensive analysis of costs and benefits considering the time value of capital [68]. In this study, cost and benefit are the core factors in the model, and the project condition can be analyzed through a life-cycle cash-flow. Therefore, this method can achieve a quantitative analysis of core factors based on a cash-flow calculation.

Thus, this study utilizes the DCF to calculate the life-cycle inflow and outflow of capital in PPP projects to develop the selection model of the capital structure of PPP projects from the sustainability perspective.

3.1.3. Case Study

A case study is a mainly used as a way to investigate the current phenomena in a particular situation [69], focusing on the understanding of the occurrence and dynamic changes of research issues [70]. It is an effective method to apply current findings on real cases to explore the advantages and disadvantages of them. After establishing the selection model and process, a case study was conducted. The selection process was applied to a PPP project to obtain the capital structure from a sustainability perspective to verify its rationality and usability.

3.2. Procedure of Building Selection Model and Process

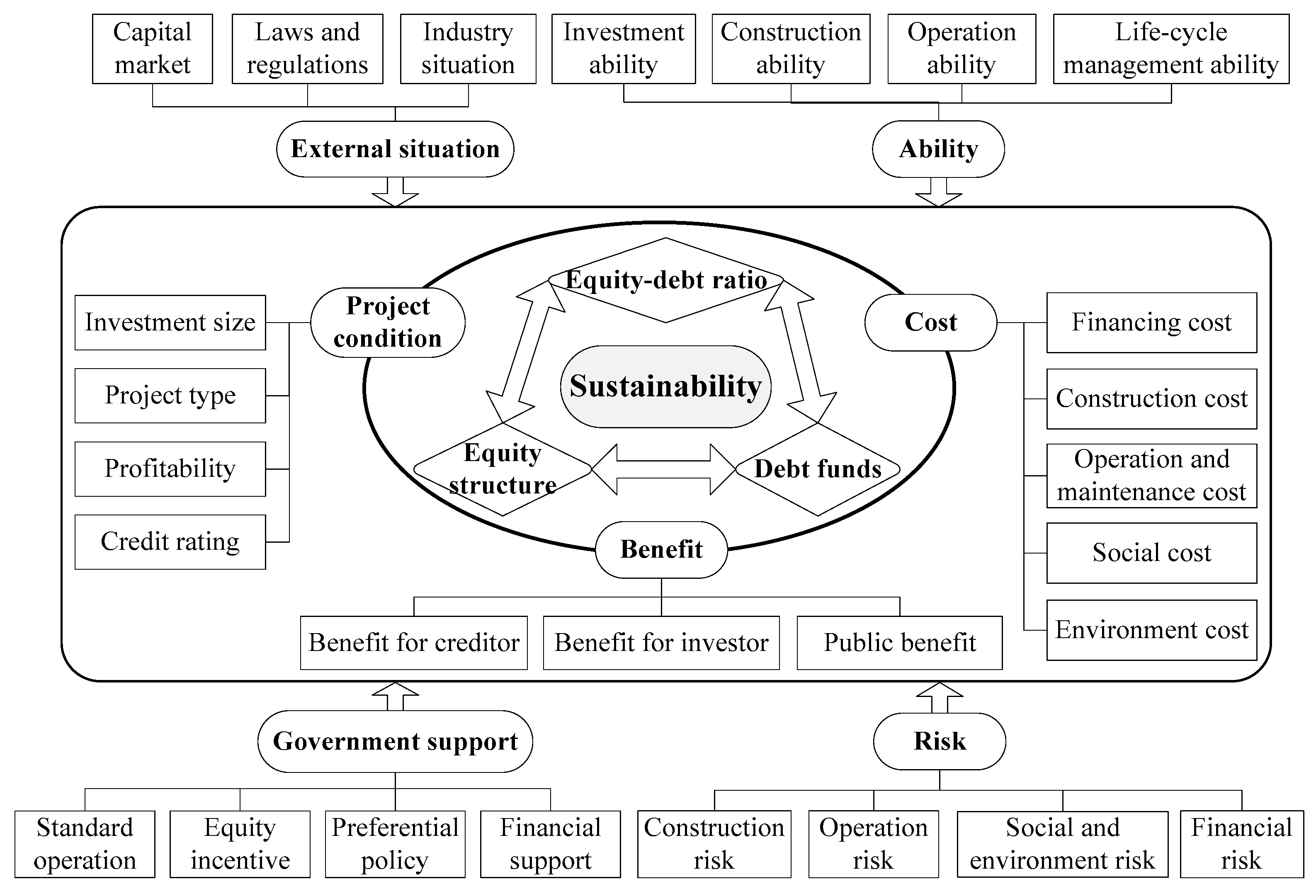

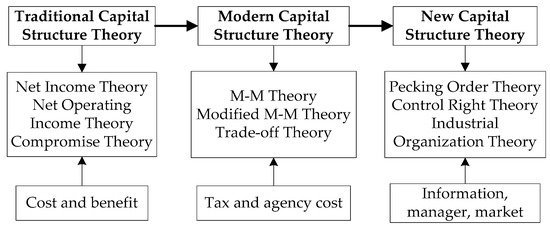

In previous research, Du et al. [11] explored the critical factors influencing the capital structure of PPP projects from a sustainability perspective using literature analysis and qualitative comparative analysis (QCA) methods. They indicated that cost, benefit, project conditions, the external situation, ability, government support, and risk are seven core factors when selecting the capital structure of PPP projects. Based on the results of QCA, a framework of the seven factors and their indicators is proposed as Figure 2 [11], which is a base of this study.

Figure 2.

Framework of critical factors influencing the capital structure of public–private partnership (PPP) projects from the sustainability perspective.

Cost, benefit, and project conditions are the core factors, while the external situation, ability, government support, and risk are considered additional influencing factors. All of them have several indicators that cover economic, social and environmental levels. According to the framework displayed in Figure 2, this study aims to further investigate the selection of the capital structure of PPP projects from a sustainability perspective. Multi-objective programming and DCF were applied to establish a selection model incorporating core factors: Benefit, cost, and project conditions. Afterwards, a qualitative analysis of indicators not included in the model was conducted. Combining the quantitative model with qualitative analysis, the selection process was proposed.

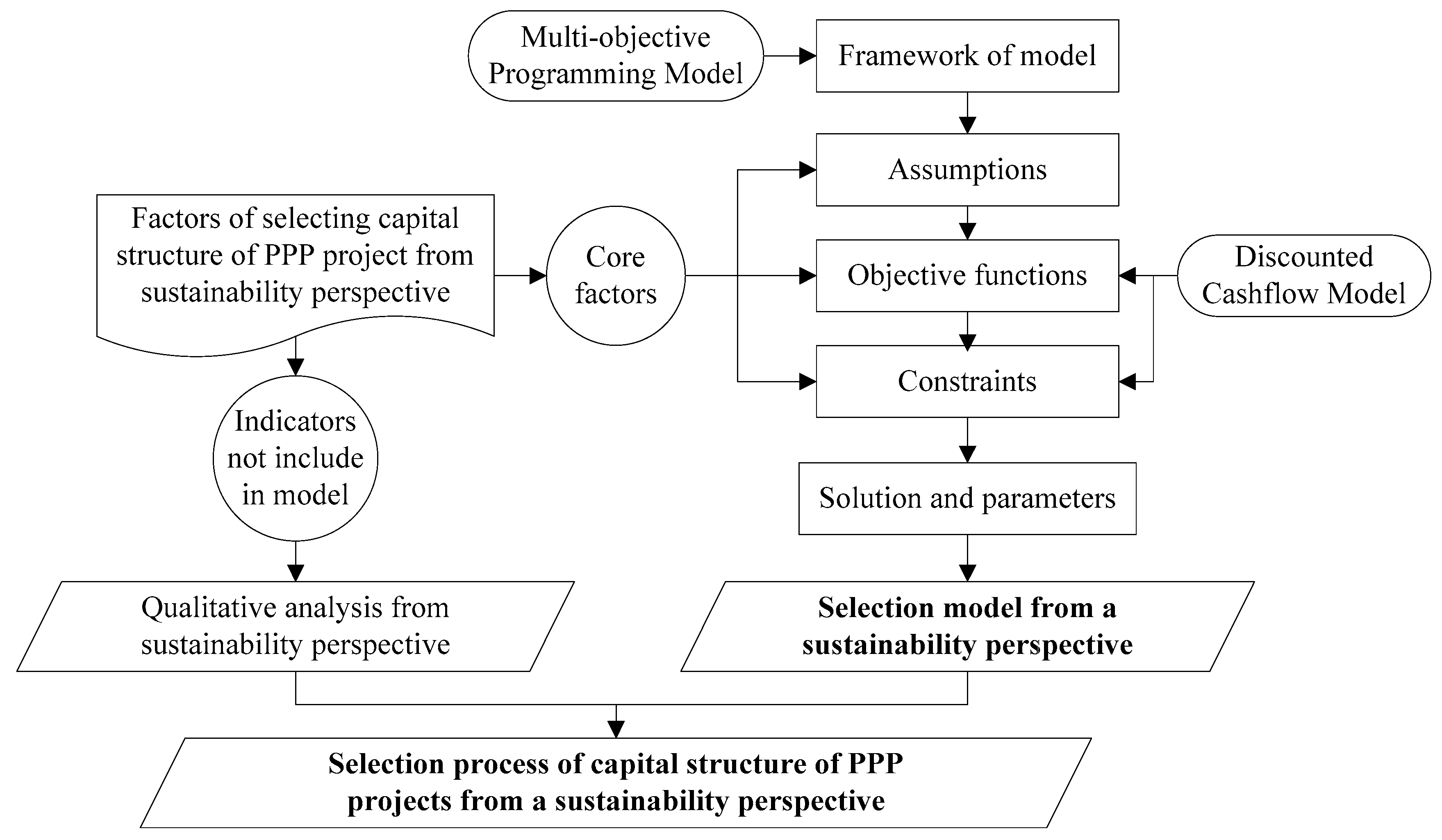

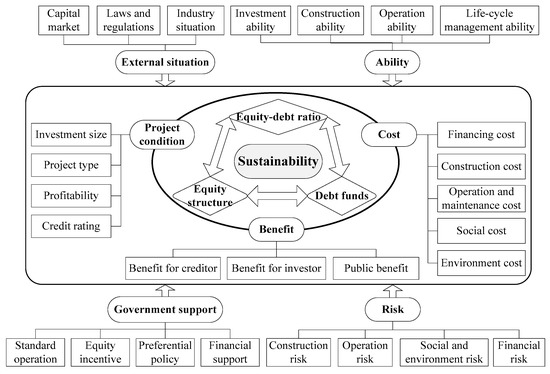

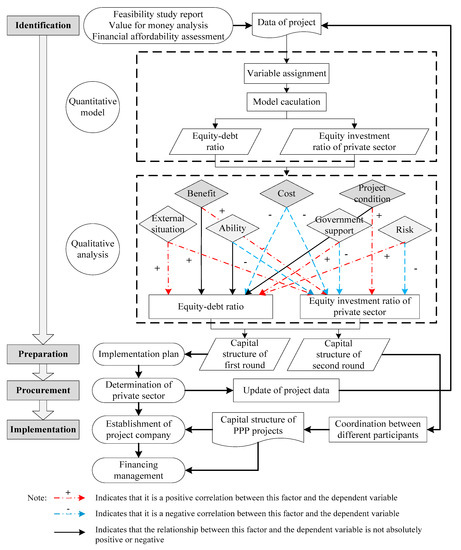

The procedure of building the selection model and process is shown in Figure 3.

Figure 3.

The procedure of establishing the selection model and process of a PPP capital structure.

1. Selection Model

First, the framework of a multi-objective programming model was proposed, including two parts: Objective functions and constraints. Afterwards, due to the difficulty and complexity of qualifying all the seven factors in Figure 2, the three core factors (benefit, cost, and project conditions) and their indicators were selected as the base for establishing the quantitative model. The objective functions and constraints were determined under assumptions based on the three factors and their indicators. Then, the functions were obtained using a DCF model according to the cash-flow calculation of the PPP project to represent the multiple objectives and constraints. Further, the model was solved by MATLAB software to obtain the equity–debt ratio and equity investment ratio of the private sector, and some key parameters were discussed.

2. Selection Process

Economic indicators show great importance in the model, while some social and environmental indicators cannot be quantified in the equations. Thus, a qualitative analysis was conducted to adjust the solutions obtained by the multi-objective programming model, considering the factors and indicators that are not shown in the model. According to Figure 2, the qualitative analysis targets the ability, risk, government support, and external situation factors, as well as the indicators of the three core factors that have not been analyzed before. Finally, after combining the quantitative model with qualitative analysis, a comprehensive selection process was proposed to achieve a scientific selection of the capital structure of PPP projects from the sustainability perspective including the economic, social, and environmental levels.

4. Selection Model of the Capital Structure of PPP Projects from the Sustainability Perspective

Based on the cost, benefit, and project condition factors, a multi-objective programming model was established to obtain critical data regarding the structure of equity and debt funds in PPP projects.

4.1. Assumptions

According to the character of PPP projects, including the rationality of decision makers, the situation that the public and private sectors that play a major part in equity investing, and some common practices in the calculation of the financial statement of PPP projects (including the investment mode of funds, the way of discounting, and how to distribute the income), the model was based on the following assumptions:

- The model does not consider other equity investors, and the equity investors of PPP projects are the public and private sectors.

- The participants of PPP projects are rational decision makers who pursue the maximization of their own interests.

- The equity funds of PPP projects are all invested at time t=0, while the debt funds are invested at stages according to reality.

- All the cash-flow is discounted to t=0, in accordance with the present value.

- The income of a PPP project company should be used for debt repayment first, and then the remaining can be distributed.

4.2. Selection Model of the Capital Structure Based on Multi-Objective Programming

4.2.1. Objective Functions

There are three objective functions which were proposed based on benefit and cost factors.

- The maximization of benefits for investors: The maximization of the net present value (NPV)where CIt indicates cash inflow of the PPP project at time t, such as government payment or user payment; COt shows cash outflow at time t, including project costs, interests of debt, and taxes; N means the contract term of the PPP project; and iA is the discounted rate.

- The maximization of public interests: The minimization of social costs, including user payment (or user fee, feasibility gap subsidy, or government payment) and the opportunity cost of funds from the public sector.where is the debt funds of the PPP project; DSt shows debt–service payment of the project company at time t; indicates the financial expense of the PPP project; E2 is the equity investment of the public sector; and γ shows the opportunity cost coefficient of equity capital invested by the public sector. Thus, is the opportunity cost of funds from the public sector. E1 indicates the equity investment of the private sector; P1t shows the profit obtained by the private sector at time t; means the benefits of the private sector in the project. If the PPP project relies on user payment, the sum of the above two is the sum of the user payments of the PPP project (if the public sector pays for the PPP project, the sum of the above two is the sum of the government payment; if it is a project with a feasibility gap subsidy, the sum is the user payment plus the feasibility gap subsidy). The minimization of the above three parts shows the minimum social costs of the PPP project [48,71].

- The minimization of WACC: The weighted average cost of debt and equity.where Kd, Ke1, and Ke2 indicate the cost ratio of debt funds, the equity capital from the private sector, and the equity capital from the public sector, respectively.

4.2.2. Constraints

Then, the constraints come from the three core factors. Constraints 1, 3, and 4 originate from the benefit factor, while constraints 2 and 5 are from the project condition factor. In addition, constraints 6 and 7 are common variable constraints.

- The constraint of the solvency: The funds available for repayment of the principal and interest should be greater than or equal to the solvency requirements set by the creditors, aiming at ensuring that the PPP project company is able to repay debts to protect the interests of creditors.where DSCR(min) shows the minimum solvency ratio of the PPP project; iB is the rate of return for creditors, namely the interest rate of loans, bonds, etc.; n means the construction period of the PPP project; and indicates the present value of total debt service payment. Moreover, EBITDAt shows the funds available for repayment at time t, including profits before interest, tax, depreciation, and amortization; and Taxt is the income tax of the PPP project company at time t. Since the model is conducted before the financing plan, the adjusted income tax, whose calculation base does not cover interest, is used to increase this variable, which reduces the risk. Thus, means the present value of funds that can be used to repay the principal and interest.

- The constraint of the total investment: The sum of equity and debt funds raised by the project company should be equal to the total investment amount of the project, and they should be greater than or equal to the total cost required by the project to ensure ample funds during the whole life cycle of the PPP project.where I is total investment of the project—that is, the sum of equity and debt funds.

- The constraint of the attractiveness of the private sector: The profit obtained by the private sector (profit distribution minus equity investment) is greater than zero, which means that the rate of return of the private sector is not lower than the minimum value stipulated in the contract. This concept attracts the private sector to participate in the PPP project and ensures a reasonable profit for the private sector.where iP(min) shows the minimum rate of return for the private sector.

- The constraint of the public interest: The upper limit of rate of return of the private sector—that is, it should not be higher than the highest value agreed in the contract to avoid unjust profits of the private sector and damage to the public interest.where iP(max) indicates the maximum rate of return for the private sector.

- The constraint of the equity–debt ratio: The equity–debt ratio should meet the national regulations, considering different project types and industries.where α shows Chinese minimum equity ratio of a project in the industry to which the project belongs. This ratio is stated by the government.

- Non-zero constraint: Non-zero variables in the model, including cost, equity capital, debt capital, income, etc.where Ct is total costs of the PPP project at time t, including financing cost, construction cost, operation cost, management cost, etc. The total cost is . Dt shows debt funds of the PPP project at time t, while the total debt is . P2tindicates the profit obtained by the public sector at time t.

- Other constraints: Coefficient variables between 0 and 1 in the model, including return rate, opportunity cost ratio, and capital ratio.

4.3. Solution of Model and Analysis of Key Parameters

4.3.1. Solution of the Multi-Objective Programming Model

If , , and , the capital structure selection model of PPP projects from a sustainability perspective can be represented as Equation (12):

This study solved the model through the ideal point method based on MATLAB [72]. The evaluation function method is a way to divide p objective functions into p single objective programming problems and build an evaluation function to obtain the final optimal solution after getting the solution of each single objective problem and the corresponding objective function value . This method has many types according to different evaluation functions [73]. The ideal point method aims to get the optimal solution , which makes sure that the distance between and (the ideal point) is the smallest.

Setting , and as the objective functions to solve three single objective programming models (), we can get the optimal solutions , and their corresponding objective function values . When , is the ideal point that cannot be achieved. Therefore, the evaluation function can be built as Equation (13):

With the constraints above used to solve this model, the optimal solution is the optimal solution of Equation (12). After that, the equity–debt ratio and equity investment ratio of the private sector, which are shown in Equations (14) and (15), can be obtained as the core data of the capital structure of PPP projects.

4.3.2. Analysis of Key Parameters in the Model

When solving the model, many parameters have considerable impact on the result. Thus, these key parameters should be analyzed in order to achieve a scientific result.

1. Discount rate:

The discount rate is a ratio that converts the future value within a certain period into the present value, and it directly relates to the financial evaluation results of PPP projects. Small changes of the discount rate can lead to a big difference of the result, which means that this rate should be considered carefully. The usual discount rate can be 3.5%, 6.5%, 8%, 9.5%., or others [74]. Generally, this parameter will be agreed in the project implementation plan and contracted by the public sector and private sector. In this model, it is determined according to the value in the project document.

2. Solvency ratio of the PPP project: DSCR(min)

The solvency ratio is an indicator that judges the solvency of a project. Creditors make their decisions largely depending on this indicator when investing in PPP projects. It correlates closely to stable benefits for creditors. Generally, 1.10 ≤ DSCR < 1.25 indicates the project financing is feasible, 1.25 ≤ DSCR < 1.40 shows good solvency of the project company, and 1.40 ≤ DSCR < 1.60 means the project company has strong solvency [75]. Profitability is not the most important goal of PPP projects, and social and environmental benefits are also critical. In addition, most PPP projects rely on government payment or a feasibility gap subsidy, which means the source of debt repayment is mainly from the public sector. If the solvency ratio is too high, it will bring great financial pressure on the government. Therefore, the solvency ratio generally does not reach a high level but at least ensures a financing feasibility.

3. Opportunity cost coefficient of equity invested by the public sector:

In PPP projects, the financial plan of the local government should consider avoiding high fiscal expenditure, which may harm the public interests and bring about huge financial risk for the government. The opportunity cost coefficient indicates that the costs that this fund could not be used to support other infrastructures because they were invested in this project. A low opportunity cost coefficient can ensure public interests and achieve long-term scientific plans and usages of local financial funds. Sharma et al. [48] set as 2% in an Alabama highway PPP project, while was 6% in an equity optimization model of an urban rail transit PPP project [71].

4. Rate of return for the private sector: and

Profitability is one of the main indicators that concerns the private sector in PPP projects. It directly relates to the benefits for the private enterprises. Thus, the minimum rate of return for the private sector is designed to ensure the income demand of the private sector, which is an important condition to attract enterprises to participate in PPP projects. On the other hand, the maximum value of the rate of return aims to control the behaviors of the private sector and to avoid excessive profits for enterprises, which results in losses of government funds and public interests. This parameter is generally determined in the contract. In this model, it is assigned according to the project data.

5. Cost ratio of debt and equity capital: , ,

These parameters show the ratio between the capital occupation fee and the net amount of funds. They are essential parameters to determine the financial cost, which is a core indicator in selecting the financing plan for both the project company and investors. According to different types of debt funds, the cost is different. In this model, the debt funds of PPP projects are set as long-term borrowings. Thus, the cost ratio of debt funds is shown as Equation (16):

where is the financing expense ratio of debt funds and T is the income tax rate, which is 25%.

E1 and E2 are both common stocks whose benefits are determined according to the project company’s annual profit. Therefore, and are calculated according to Equations (17) and (18).

where is the present value of the total benefits for the private sector; the annual benefit for the private sector can be obtained according to ; and is the financing expense ratio of equity capital from the private sector.

This model cares more about economic and social indicators because some environmental indicators are hard to quantify. The public interest, the upper limit of rate of return of the private sector, and the minimum value of the equity–debt ratio are all reflected in the social level. Moreover, the other equations care about the economic aspect. In addition, the environmental indicators and some social and economic indicators that are not analyzed in this model are discussed in the following qualitative analysis to achieve the selection of a capital structure from a sustainability perspective.

5. Selection Process of the Capital Structure of PPP Projects from the Sustainability Perspective

The selection model cannot represent all the factors and their indicators, because some indicators from the social and environmental levels are hard to quantify. To more reasonably select the capital structure from a sustainability perspective, a qualitative analysis, which considered the four factors that cannot be calculated and some indicators of the three factors that were not shown in the model, was conducted. After that, the quantitative model was combined with qualitative analysis to propose a selection process, which can cover all the critical factors from the economic, social, and environmental levels shown in Figure 2.

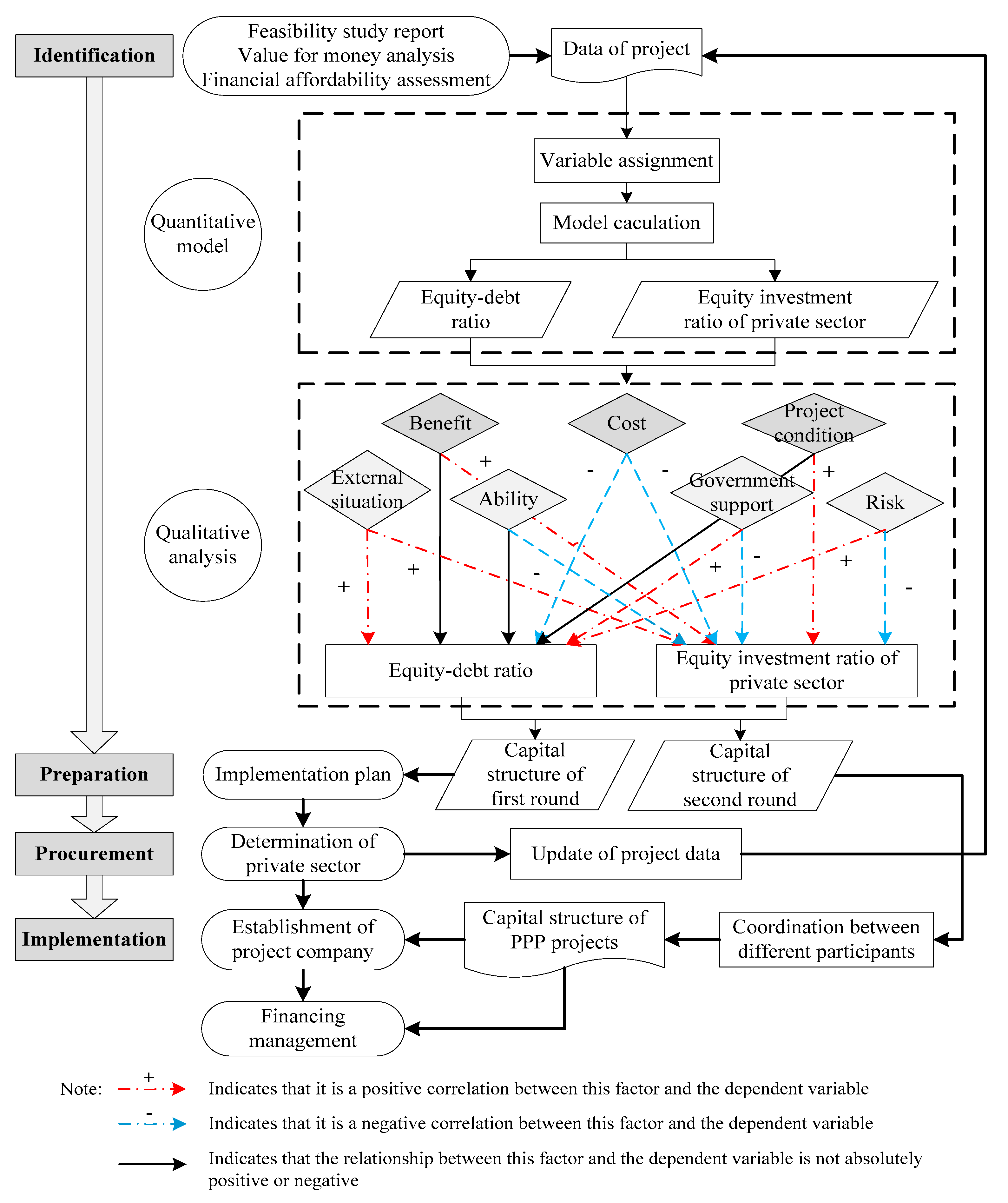

The life-cycle of a PPP project is divided into five stages: Identification, preparation, procurement, implementation, and project ending [76]. The selection of the capital structure covers the identification, preparation, and implementation stages. According to the difference of data at different stages, the selection process can be conducted through two rounds, including six steps: Data collection, quantitative calculation, qualitative analysis, data update, re-analysis, and discussion, as shown in Figure 4.

Figure 4.

Selection process of the capital structure from the sustainability perspective.

The first round starts at the identification stage of PPP projects. Firstly, project data are obtained from a feasibility study report, a value-for-money analysis, a financial affordability assessment, and other documents. Secondly, variables are assigned according to the data to establish the multi-objective programming model, which focuses on the benefit, cost, and project condition factors. Thirdly, using MATLAB to solve the model, the key data of the capital structure of the PPP project, the equity–debt ratio and the equity investment ratio of the private sector, are obtained. Afterwards, considering the influence of factors and indicators that are not considered in the model, especially the risk, government support, ability, and the external situation, the two dependent variables are adjusted, and a specific ratio of equity and debt funds is determined. Thus, the first round of selection of the capital structure is completed.

Then, at the preparation stage, the result of the first round will be the core of the financing plan, which is important for the early stage of a PPP project. Based on the implementation report, the private sector is determined through bidding, competitive consultation, or other processes at the procurement stage. During the negotiation, data can be updated to the project budget data from the estimation data in the first round. After that, these data are applied to the quantitative model, and qualitative analysis again done to adjust and refine the primary result to obtain the second-round result of the capital structure.

Finally, at the implementation stage, the private sector, the public sector, creditors, and other stakeholders of the PPP project discuss the second-round result and coordinate their demands and opinions to obtain the final capital structure of the PPP project from a sustainability perspective. Guided by this capital structure, the PPP project company is established, raises ample funds, and completes financing management work to ensure the healthy and stable operation of the PPP project.

As for the qualitative analysis, the seven factors show different relationships with the equity–debt ratio and equity investment ratio of the private sector.

1. Equity–debt ratio

For the equity–debt ratio, three of the seven factors show a positive correlation, one factor shows a negative correlation, and the remaining three factors have complicated and multifaceted relationships with the variable.

The external situation, risk, and government support have a positive impact on the equity–debt ratio. First, the better the external situation of the PPP project is, the greater the chance of success of the project and the confidence of investors will be. Therefore, the equity–debt ratio should be increased. The positive development of capital market, a good development trend of the industry, and the support of relevant laws and regulations are important indicators to judge the positive external situation. Secondly, the risk factor is the focus of creditors. When the project risk is at a high level, creditors will be more cautious to invest, which means that it will be more difficult for the project to attract debt funds. Therefore, it is necessary to increase the equity–debt ratio to increase creditors’ confidence and attract more funds by more equity capitals. The risk analysis is a comprehensive process that covers risk types, the probability of occurrence, and treatment methods; this analysis considers various stages from economic, societal, and environmental perspectives. In addition, the increase of the government support level will also stimulate the investment behavior of investors and increase the equity–debt ratio. From the economic perspective, relevant measures of equity incentive and financing support from the public sector are important. At the same time, from the societal and environmental perspectives, other preferential policies and the system of standard operation for PPP projects should be considered—these might include the positive impact of policies about standard operation on the life-cycle healthy operation of PPP projects.

As a core factor, cost has a negative impact on the equity–debt ratio, which means that the higher the cost is, the smaller the equity–debt ratio should be. Qualitative analysis pays more attention to social and environmental costs, while economic costs are considered in the quantitative model. On the one hand, social cost mainly refers to the social loss brought by the PPP project, such as the inconvenience to the lives of surrounding residents and the restrictions on regional traffic caused by construction. On the other hand, environmental cost mainly focuses on the adverse impact on the environment, such as the damage on the surrounding environment due to construction, and the long-term impact upon the natural environment. In addition, other economic costs, such as the sunk cost, that have not been reflected in the cash-flow of the PPP project should also be considered. By combining economic, social, and environmental costs, the project risk will increase with the increase of costs, and the investment willingness of equity investors will decrease. Therefore, it is necessary to attract more debt funds to guarantee the construction and operation of the project, a guarantee which leads to a decrease of the equity–debt ratio.

There is no clear positive or negative relationship between benefit, project conditions, ability factors, and the equity–debt ratio. Firstly, the creditors’ interest, investors’ interest, and public interest are calculated in the model. Thus, the qualitative analysis mainly focuses on other special conditions related to these indicators. If the PPP project brings other benefits besides equity returns, such as positive social evaluation, improvement of the social image of enterprises, to investors, the equity–debt ratio will increase correspondingly with the positive attitude of investors. Second, the investment scale, profitability, and other indicators of the project condition factor are also reflected in the model, while the unquantified indicators, such as the project type, should be mainly reflected in the qualitative analysis. When this project type belongs to the key investment direction of potential creditors, with the increase of the creditors’ investment willingness, the equity–debt ratio should decrease. Furthermore, the ability factor is mainly considered at the qualitative stage. This factor focuses on the experience and ability of the private sector about investment, construction, operation, and life-cycle management. On the one hand, when the private sector has a strong investment strength, the equity–debt ratio should be increased to gain more benefits from the equity. On the other hand, when the construction, operation, and life-cycle management ability of the private sector are strong but the investment capacity is insufficient, this kind of private sector reduces the risk of the PPP project, and creditors are willing to invest more funds; as such, the equity–debt ratio is correspondingly reduced. It is necessary to make a comprehensive analysis of the abilities and to balance various conditions to adjust the equity–debt ratio reasonably.

2. Equity investment ratio of the private sector

In terms of the equity structure of PPP projects, there are relatively obvious relationships between the seven factors and the equity investment ratio of the private sector. Three factors have a positive impact, while four factors show a negative correlation.

On the one hand, the external situation, benefit, and project conditions are positively correlated with the equity investment ratio of the private sector. Firstly, a good external situation can promote the implementation of the PPP project and make the private sector more confident in the project and willing to invest more capital. Thus, the equity investment ratio of the private sector will increase. On the contrary, a depressed capital market, a lack of promotion of industry development, and restrictions of laws, regulations, and other adverse external situations negatively affect the investment behavior and reduce the equity investment ratio of the private sector. Moreover, the positive drive of various interests has a positive impact on the PPP project, which is also a main incentive for the equity investment of the private sector. Therefore, if there are other conditions that may lead to the increase of interests, the equity investment ratio of the private sector will increase. In addition, better project conditions can attract investment from the private sector, reduce risks, and increase equity returns. Thus, indicators that show project conditions are good, such as that the project type is strongly supported by the country, can lead to a higher proportion of equity investment from the private sector.

On the other hand, cost, government support, risk, and ability have a negative impact on the equity investment ratio of the private sector. First, increases of social costs, environmental costs, and other hidden costs are a pressure on the PPP project company which limit the investment behavior of the private sector. Thus, the private sector may reduce risk by decreasing the equity investment ratio. It is necessary to support the project by increasing the investment of the public sector. Second, government support aids the life-cycle healthy operation of the PPP project, which plays an important role in improving the adverse conditions of PPP projects. When government support increases, investments from the public sector will increase, which reduces pressure on the private sector. Therefore, the equity investment ratio of the private sector can be reduced. Third, risk factors run through the life-cycle of the PPP project. The increase of economic, social, and environmental risks is a core reason for the private sector to adopt a conservative investment strategy. By reducing the equity investment ratio, the risk isolation of the PPP project can be realized to guarantee the basic interests of private enterprises. Meanwhile, since it is the implementer of PPP projects, when the private sector’s ability is strong, the project has a high probability of success, which means it does not need a large amount of equity capital to reduce the risks. Thus, the government is willing to provide more funds to obtain a reasonable return. On the contrary, when the private sector’s ability is weak, it is necessary to increase the ratio of the equity investment of the private sector to make up for deficiencies to strengthen the stakeholders’ confidence and promote the successful implementation of the PPP project.

6. Case Study

This study adopts the Number 9 and 10 universal terminals of Huanghua Port in the Bohai new area, Cangzhou, Hebei province as a case study. The selection model and process of the capital structure of PPP projects from the sustainability perspective were applied to validate the model and process.

6.1. Project Background

This is the third batch of national PPP demonstration projects in China, and it was launched on 1 March 2016 [77]. As the project implementation agency, Cangzhou Huanghua Port authority is responsible for supervising the project company, and the Cangzhou Port group CO Ltd. is the investment representative of the public sector. The private sector is a joint venture formed by China Communications Tianjin Navigation Bureau CO., Ltd., and Tianjin Number 3 Construction Engineering CO., Ltd.

It aims to construct and operate two 50,000 ton general berths, three trestles, and corresponding supporting facilities. The contract term is 20 years (including a two year construction period), while the total investment is 1.419 billion Yuan. This project is implemented by a BOT (Build–Operate–Transfer) mode and obtains returns through user payments, which are used for the repayment of capital and interest, as well as the payment of profit for investors. According to the financing costs, the benchmark rate of return is 7%. The current capital structure is as follows: 75% is funded by domestic loans, and 25% is funded by the private sector. Based on the project documents, this study applies the selection process of the capital structure from a sustainability perspective on the project to realize a scientific and reasonable capital structure selection.

6.2. Application of the Selection Model and Process

6.2.1. Application of Multi-objective Programming Model

1. Setting Parameters

According to the project documents, all the variables in the model, including the key parameters established before, were assigned as shown Table 1. The independent variables are : Equity investment of the private sector; : Equity investment of the public sector; and : Debt funds. The equity–debt ratio of the project is hence expressed as , while the equity investment ratio of the private sector is expressed as .

Table 1.

Variable assignment within the capital structure selection model.

As a port infrastructure project, the minimum equity ratio is 25% [78]. Moreover, based on the implementation report, the debt financing source is a domestic loan, with an annual interest rate of 4.9%. Furthermore, the minimum rate of return of the private sector is 7%, and the maximum rate of return is 12%. Meanwhile, the project relies on user payments, which means it has strong profitability and solvency. However, as an infrastructure, profitability is not the focus of project. Thus, the solvency cannot reach the optimal level. Therefore, the DSCR was set as 1.3. In addition, according to the characteristics of the project and the data of similar PPP projects, the opportunity cost coefficient of public funds was set as 2%, and the discount rate was set 6%.In addition, the capital cost rates are shown in Equations (19)–(21):

Because the financing expense ratio of bank loans is generally 2–5%, was set as 3%. The financing cost of equity capital is generally lower than that of bank loans, so is 2%. Since the public sector does not participate in the profit distribution, the cost rate of equity capital from the public sector is 0.

2. Model building

The cash-flow of this PPP project was calculated using DCF. The debt fund was invested 1:1 according to the two year construction period, and it was repaid in the way of annual equal amount of principal and interest payment. The capital structure selection model of this PPP project from a sustainability perspective is shown in Equation (22).

3. Solution

Using the ideal point method, this model was divided into three single-objective programming problems, all of which can be solved by the linprog function in MATLAB because the objective functions and constraints are all linear functions.

Setting as the objective function, the optimal solution is , whose corresponding value of the objective function is . This means that the equity investment of the private sector is 308.89 million yuan, and the public sector provides 33.30 million yuan. The debt offered by the bank is 1026.55 million yuan. The result of the maximization of benefits for the investors is 171.07 million yuan. As for , the optimal solution is and the value of objective function is . The result shows that the public sector does not offer any equity funds for the PPP project, while the private sector covers all the equity for about 625.78 million yuan. The debt is 742.96 million yuan. The maximization of public interests is 88.14 million yuan. Taking into account, the optimal solution is the same as , which is . The value of the objective function is , which indicates that the minimization of WACC is 84.44 million yuan.

Because , is the impossible ideal point. Thus, the evaluation function is shown in Equation (23):

Setting this equation as the objective function, this single-objective programming can be solved under the same constraints. Because the evaluation function is non-linear, the fmincon function in MATLAB was used.

First, objfun.m was established to define this objective function:

function f=objfun(x)

f=sqrt((0.9434*x(1)+0.9434*x(2)+0.9167*x(3)-126390)^2+

(-(1)+0.02*x(2)-0.8903*x(3)+128720)^2+(-0.0288*x(3)+2956.5)^2)

Then, setting as the start point—that is, —the optimal solution of this problem was obtained as.

Therefore, the capital structure of the PPP project from a sustainability perspective figured out by solving by this model is shown as follows. The equity investment of the private sector is 593.34 million yuan, and the public sector does not participate in the equity investment; that is, the equity investment ratio of the private sector is 100%. Moreover, the rest of the capital is 775.40 million yuan from bank loans, which means that the equity–debt ratio is 0.765 (about 3:4). Thus, the equity capital accounts for 43.35% of the total investment, and the debt capital accounts for 56.65%.

6.2.2. Qualitative Analysis of the Capital Structure

Firstly, the three core factors: Benefit, cost, and project conditions have been reflected in the model. Considering the social and environmental costs that have not been calculated, the project has a positive effect on the development of shipping and materials circulation, and it can promote the development of Cangzhou city and the whole Bohai new area. During the process of construction and operation, there will not be adverse effects on society and the environment, which means there are no potential social and environmental costs. Thus, the capital structure should not be adjusted.

Secondly the private sector requires a strong professional ability of the PPP project company to realize the construction, operation, and management of two 50,000 ton general berths, three piers, and the supporting facilities. At the same time, the project has a large amount of investment and a wide range of influences, which means that the investment and life-cycle management abilities are also important indicators when selecting the private sector. Therefore, the private sector has a strong ability to achieve a successful construction and operation, which indicates that this project has a strong financing attraction and good project conditions. Thus, the equity–debt ratio and the ratio of equity investment of the private sector can be reduced.

Third, regarding governmental support, this project is an important transportation infrastructure that gains strong support from the government, which has a positive impact on the social, economic, and environmental development of Huangye Port and the whole area. Strong financing support, equity incentives, preferential policies, etc., all support the implementation of the project, supervise its standard operation, and promote its success. Therefore, the equity–debt ratio should increase, and the equity investment ratio of the private sector should decrease accordingly.

Under the influence of the external situation, transportation infrastructure is an important development direction in China, and it is also a kind of PPP project with strong profitability. The industry shows a positive upward trend and has relatively complete laws and regulations, which can guarantee the standardized implementation of the project. At the same time, although the domestic capital market does not show significant growth, the investment in infrastructure projects still has a positive trend, which indicates that private companies often have a strong willingness to invest. Therefore, this factor is in the positive direction to increase the equity–debt ratio and equity investment ratio of the private sector.

Finally, taking risk into account, the implementation report shows that the transportation supply is enough and the market demand can be guaranteed. As such, the market risk is weak. Moreover, the technology and equipment related to construction are mature with moderate technical risks and a low occurrence probability. Furthermore, the financial evaluation result indicates that the income of the PPP project company is high, which shows that the investment and financing risk is low. Meanwhile, from the perspective of construction conditions, Huangye Port has abundant sand sources and urban supporting conditions that offer good construction conditions. Thus, the construction risk is low. After the construction is finished, the project can provide about 296 jobs and help local and regional economic development, all of which lead to low social risk. In addition, during construction and operation, there will be a series of measures to prevent air pollution, noise, sewage, and other pollution brought by the project to decrease environmental risks. To sum up, the overall risk is low, so the equity–debt ratio should be reduced, and the equity investment ratio of the private sector can be increased.

Considering the above combined qualitative analysis of seven factors from a sustainability perspective, the result of model should be adjusted, as shown in Table 2.

Table 2.

Qualitative analysis result of the capital structure.

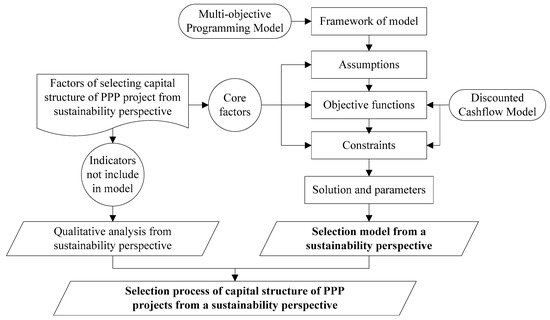

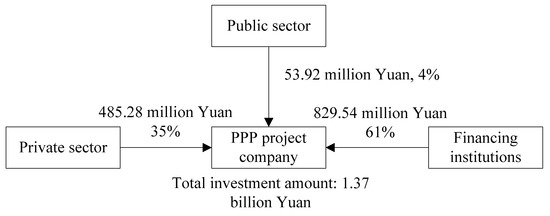

As for the equity–debt ratio, its decrease was mostly influenced by the risk factor, while the external situation had the weakest impact. Moreover, this ratio decreased with the ability advantage of the private sector and increased at the rate with government support. In addition, due to the large investment amount of the project, a higher equity ratio will bring huge investment pressure to the private sector. It is difficult for the enterprise to provide such a large amount of equity capital, which means that it is necessary to increase the debt ratio. In a word, the equity–debt ratio of the PPP project should be lowered to reduce the financial pressure of the private sector and attract enough debt funds to maintain the implementation of the project. According to the project data, the equity–debt ratio was reduced by 15%, from 0.765 to 0.65 (about 4:6).

In the same way, taking the equity investment ratio of the private sector into account, although the risk and external situation factors increase the equity investment of the private sector, the ability and government support factors leads to a decrease of this variable. Appropriately increasing the public sector’s equity investment not only enhances the financing capacity and attractiveness of PPP projects but also increase the right of the public sector in the PPP project company. Even though the public sector cannot control the project company, appropriate equity investment can help the public sector to conduct supervision more effectively. According to the project data, the equity investment ratio of the private sector is reduced by 10%, and the equity structure of the private sector and the public sector is 9:1.

After combining the qualitative analysis with the quantitative model, the capital structure of universal terminals Numbers 9 and 10 of Huanghua Port in Bohai new area from a sustainability perspective is shown in Figure 5. The equity investment of the private sector is E1 = 485.28 million yuan, which coveris 90% of equity, and the equity of the public sector is E2 = 53.92 million yuan. Moreover, the debt fund is D = 829.54 million yuan, thus, the equity to debt ratio is 0.65 (4:6), meaning that the equity ratio is 39.39%.

Figure 5.

The capital structure of the case from a sustainability perspective.

6.3. Discussion

6.3.1. Analysis of the Quantitative Calculation Results

The solution of the multi-objective programming model shows that, when setting the maximization of benefits for investors and the minimization of WACC as the objective functions, the optimal solution is the same, the equity–debt ratio is 1:3, and the equity investment ratio of the private sector is 90.27%. This result is equal to the minimum equity ratio set by the government [78]. Therefore, the benefit factor and cost factor reached an agreement in the selection model of the capital structure, aiming to improve the leverage and realize the maximization of the economic benefits of the PPP project company within the constraint conditions. Meanwhile, in the equity structure, the private sector accounts for 90%, while the public sector only provides a small part of equity to improve the project financing ability and attract creditors.

On the contrary, when the goal is to maximize the public interest, the optimal solution is: An equity–debt ratio of about 4:5 and an equity investment ratio of the private sector of 100%. Thus, considering the non-economic indicators, the equity–debt ratio and the equity investment ratio of the private sector are both changed. Due to the strong profitability of this PPP project and the fact that all the project profits are distributed to the private sector, the increase of the equity–debt ratio will raise the capital pressure of the private sector, control the income of enterprises from the PPP project, and avoid the loss of public interests [79]. At the same time, if the government does not participate in the equity investment, the opportunity cost of government funds will be zero. These government funds can be used for other infrastructures and public services to benefit the public.

It has been indicated that the three objective functions are contradictory, which means the maximization of public interests and economic interests cannot be achieved at the same time [48,49,71]. Therefore, the introduction of sustainability by combining the economic, social, and environmental levels is essential to obtain a more scientific capital structure rather than just caring about economic factors. By building the evaluation function, a balance between the three goals was achieved to obtain an optimal solution: E1 = 593.34 million yuan and E2 = 0, D = 775.40 million yuan. This result is between the optimum solutions of the three single objective programming problems and can gain an equilibrium of economic, social, and environmental sustainability.

6.3.2. Analysis of the Application Results of Selection Process

After the quantitative calculation, sustainability is, throughout the whole process, part of the qualitative analysis in the selection process [11,15,18]. Each factor that has not been calculated should be analyzed. After comprehensive consideration, the reasonable capital structure can be obtained through adjusting these two variables. Thus, this capital structure can meet economic goals while guaranteeing sustainability from the social and environmental levels to promote the success and long-term healthy operation of the PPP project.

Meanwhile, the result of the quantitative model shows that the optimal solution has a high amount of equity, a low proportion of debt funds, and no equity input from the public sector, a combination which is inconsistent with the actual situation. The high proportion of equity capital increases the pressure of enterprises, setting a high threshold for the private sector to participate in PPP projects. Moreover, such an equity–debt ratio is conservative and hence not conducive for the revitalization of funds and marketization of the PPP project company. In addition, if the public sector does not participate in the equity structure, the financing attraction of the project will be reduced, making the project more difficult to finance. Therefore, a qualitative analysis is essential to make the capital structure more in line with market requirements to promote the long-term healthy operation of the PPP project.

6.3.3. Comprehensive Analysis of the Selection Model and Process from the Sustainability Perspective

General terminals Numbers 9 and 10 of Huanghua Port in Bohai new area have entered the implementation stage. The current capital structure is directly set as the minimum equity ratio of 25%, of which the public sector accounts for 10% and the enterprise accounts for 90%, with the remaining 75% of the investment from the bank loans. It shows that the selection of a capital structure is a simple thing without a scientific process. This capital structure is consistent with the result of the maximization of investors’ interests and the minimization of the capital cost. It verifies that current selection of the capital structure of PPP projects only considers the economic indicators while ignoring the social and environmental levels.

However, after introducing sustainability, the result of the capital structure of PPP projects has changed. While considering the traditional economic level, the sustainability factors from the social and environmental levels also show great importance in the selection process. Considering the public interests, the upper limit of return rate for the private sector, and other indicators, the capital structure can be selected from a sustainability perspective rather than only an economic aspect. Compared to the actual capital structure, the result increases the proportion of equity and reduces the amount of debt funds to ensure the social and environmental benefits of the project while guaranteeing the economic benefits of all parties. Therefore, through the process, the selection of the capital structure is no longer a simple economic behavior but a comprehensive decision with sustainability from economic, social, and environmental aspects, making the capital structure of PPP projects more scientific and reasonable to support the long-term healthy operation of PPP projects and promote the positive impact on the region, industry, and society.

7. Conclusions

As a key to capital problems, the selection of a capital structure is an important part of the standardized operation and reasonable implementation of PPP projects. Moreover, sustainability from economic, social, and environmental aspects impacts the whole process of PPP projects. This study analyzed the capital structure selection process of PPP projects from a sustainability perspective. It changed the selection of a capital structure from a simple economic behavior to a comprehensive process by considering seven factors from the economic, social, and environmental levels, this making the capital structure meet the current funding needs and ensuring the life-cycle healthy operation.

With three core factors, benefit, cost, and project conditions, a multi-objective programming model was built by setting the maximization of investors’ benefits and public interests, as well as the minimization of the capital costs, as the objective functions. The coordination of these three objectives achieved a balance between the economic and social aspects. Afterwards, a qualitative analysis was conducted to consider other indicators from the social and environmental levels that had not been calculated in the model. The external situation, government support, and risk were positively correlated with the equity–debt ratio, while cost was negatively related to this variable. As for the equity investment ratio of the private sector, the external situation, benefits, and project conditions were positive factors, while ability, cost, government support, and risk were negative factors. Based on the quantitative model with qualitative analysis, the two-round selection process of the capital structure from a sustainability perspective was realized to achieve an equilibrium of the economic, social, and environmental levels to promote the life-cycle healthy operation of PPP projects. Finally, the process was applied to a port PPP project in China to verify its feasibility and usability.

This study enriches the research of PPP projects by contributing to the solution of the problem of life-cycle stable funds and achieving the scientific selection of the capital structure from a new perspective. In addition, this feasible selection process can provide a reference for the scientific and rational selection of a capital structure and enhance the consideration of sustainability in PPP projects in practice.

Nevertheless, there are also some limitations. On the one hand, there are important parameters in the model, such as the discount rate, solvency ratio, and opportunity cost coefficient. However, only a preliminary analysis was conducted, and the assignment of parameters was mostly based on the experience of similar projects. In the future, the parameters should be deeply analyzed to explore their influence on the result and the approach of how to assign appropriate values for them. On the other hand, there are many methods to solve the multi-objective programming model. In this study, the ideal point method was adopted, but other methods were not discussed. The results of different methods can be compared to choose a more reasonable solution method in the future study to validate the result. Besides, some indicators, especially those related to the social and environmental levels, have not been quantified yet in this study. In the future, more work should be done on the quantify of social and environmental factors to achieve a more objective model to select the capital structure of PPP projects from a sustainability perspective.

Author Contributions

J.D. and H.W. conceived and designed the study. H.W. analyzed the data and wrote the paper. R.J. and J.D. reviewed and revised the original draft.

Funding

This study was supported by The Ministry of education of Humanities and Social Science Foundation [15YJAZH012].

Conflicts of Interest

The authors declare no conflict of interest. The founding sponsors had no role in the design of the study; in the collection, analyses, and interpretation of data; in the writing of the manuscript; and in the decision to publish the results.

References

- United Nations Brundtland Commission. World Commission on Environment and Development (WCED): Our Common Future; Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- Kuhlman, T.; Farrington, J. What is Sustainability? Sustainability 2010, 2, 3436–3448. [Google Scholar] [CrossRef]

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development; United Nations: New York, NY, USA, 2014. [Google Scholar]

- United Nations Economic Commission for Europe. List of PPP Standards in Support of the United Nations Sustainable Development Goals; United Nations Economic Commission for Europe: Geneva, Switzerland, 2015. [Google Scholar]

- Yildirim, R.; Masih, M.; Bacha, O.I. Determinants of capital structure: Evidence from Shari’ah compliant and non-compliant firms. Pac.-Basin Financ. J. 2018, 51, 198–219. [Google Scholar] [CrossRef]

- HM Treasury. Budget 2018; HM Treasury: London, UK, 2018. [Google Scholar]

- Yang, S.; Yang, Q.; Yuan, S. Survey Report of Major Changes of PFI/PF2 in UK. Available online: http://www.zgppp.cn/hyzx/zxdt/7592.html (accessed on 18 December 2018). (In Chinese).

- Chang, L.-M.; Chen, P.-H. BOT Financial Model: Taiwan High Speed Rail Case. J. Constr. Eng. Manag. 2001, 127, 214–222. [Google Scholar] [CrossRef]

- European Commission. Resource Book on PPP Case Studies; European Commission: Brussels, Belgium, 2004. [Google Scholar]

- Wang, Y. Analysis of privatization mode of public utilities-an empirical study based on Hangzhou Bay Sea-crossing Bridge. J. Sichuan Adm. Coll. 2010, 98–101. (In Chinese) [Google Scholar] [CrossRef]

- Du, J.; Wu, H.; Zhao, X. Critical Factors on the Capital Structure of Public–Private Partnership Projects: A Sustainability Perspective. Sustainability 2018, 10, 2066. [Google Scholar] [CrossRef]

- Kavishe, N.; Jefferson, I.; Chileshe, N. Evaluating issues and outcomes associated with public–private partnership housing project delivery: Tanzanian practitioners’ preliminary observations. Int. J. Constr. Manag. 2018, 19, 354–369. [Google Scholar] [CrossRef]

- Yuan, J.; Li, W.; Guo, J.; Zhao, X.; Skibniewski, M.J. Social Risk Factors of Transportation PPP Projects in China: A Sustainable Development Perspective. Int. J. Environ. Res. Public Health 2018, 15. [Google Scholar] [CrossRef] [PubMed]

- Koppenjan, J.F.M.; Enserink, B. Public-Private Partnerships in Urban Infrastructures: Reconciling Private Sector Participation and Sustainability. Public Adm. Rev. 2009, 69, 284–296. [Google Scholar] [CrossRef]

- Kyvelou, S.; Marava, N.; Kokkoni, G. Perspectives of local public-private partnerships towards urban sustainability in Greece. Int. J. Sustain. Dev. 2011, 14, 95–111. [Google Scholar] [CrossRef]

- Ferroni, M.; Castle, P. Public-Private Partnerships and Sustainable Agricultural Development. Sustainability 2011, 3, 1064–1073. [Google Scholar] [CrossRef]

- Hueskes, M.; Verhoest, K.; Block, T. Governing public–private partnerships for sustainability—An analysis of procurement and governance practices of PPP infrastructure projects. Int. J. Proj. Manag. 2017, 35, 1184–1195. [Google Scholar] [CrossRef]

- Bennett, A. Sustainable public/private partnerships for public service delivery. Nuturd Rerourm Forum 1998, 22, 193–199. [Google Scholar] [CrossRef]

- Biygautane, M.; Neesham, C.; Al-Yahya, K.O. Institutional entrepreneurship and infrastructure public-private partnership (PPP): Unpacking the role of social actors in implementing PPP projects. Int. J. Proj. Manag. 2019, 37, 192–219. [Google Scholar] [CrossRef]

- Shen, L.; Tam, V.; Gan, L.; Ye, K.; Zhao, Z. Improving Sustainability Performance for Public-Private-Partnership (PPP) Projects. Sustainability 2016, 8, 289. [Google Scholar] [CrossRef]

- Kościelniak, H.; Górka, A. Green Cities PPP as a Method of Financing Sustainable Urban Development. Transp. Res. Procedia 2016, 16, 227–235. [Google Scholar] [CrossRef]

- Villalba-Romero, F.; Liyanage, C.; Roumboutsos, A. Sustainable PPPs: A comparative approach for road infrastructure. Case Stud. Transp. Policy 2015, 3, 243–250. [Google Scholar] [CrossRef]

- Schachler, M.H.; Navare, J. Port risk management and Public Private Partnerships: Factors relating to risk allocation and risk sustainability. World Rev. Intermodal Transp. Res. 2010, 3, 150–166. [Google Scholar] [CrossRef]

- Myers, S.C. The Capital Structure Puzzle. J. Financ. 1983, 39, 575–592. [Google Scholar] [CrossRef]

- Durand, D. Costs of debt and equity funds for business: Trends and problems of measurement. In Conference on Research in Business Finance; NBER: Cambridge, MA, USA, 1952. [Google Scholar]

- Barth, J.R.; Miller, S.M. Benefits and costs of a higher bank “leverage ratio”. J. Financ. Stab. 2018, 38, 37–52. [Google Scholar] [CrossRef]

- Thippayana, P. Determinants of Capital Structure in Thailand. Procedia-Soc. Behav. Sci. 2014, 143, 1074–1077. [Google Scholar] [CrossRef]

- Chen, J.J. Determinants of capital structure of Chinese-listed companies. J. Bus. Res. 2004, 57, 1341–1351. [Google Scholar] [CrossRef]

- Modigliani, F.; Miller, M.H. The cost of capital, corporation finance and the theory of investment. Am. Econ. Rev. 1958, 48, 261–297. [Google Scholar]

- Ardalan, K. Capital structure theory: Reconsidered. Res. Int. Bus. Financ. 2017, 39, 696–710. [Google Scholar] [CrossRef]

- Rose, J.R. The Cost of Capital, Corporation Finance, and the theroy of Investment. Am. Econ. Rev. 1959, 49, 638–639. [Google Scholar]

- Modigliani, F.; Miller, M.H. Corporate income taxes and the cost of capital: A correction. Am. Econ. Rev. 1963, 53, 433–443. [Google Scholar]

- Antill, S.; Grenadier, S.R. Optimal capital structure and bankruptcy choice: Dynamic bargaining versus liquidation. J. Financ. Econ. 2019, 133, 198–224. [Google Scholar] [CrossRef]

- Dierker, M.; Lee, I.; Seo, S.W. Risk changes and external financing activities: Tests of the dynamic trade-off theory of capital structure. J. Empir. Financ. 2019, 52, 178–200. [Google Scholar] [CrossRef]

- Kraus, A.; Litzenberger, R.H. A state-preference model of optimal financial leverage. J. Financ. 1973, 28, 911–922. [Google Scholar] [CrossRef]

- Ross, S.A. The determination of financial structure—The incentive-signalling approach. Bell J. Econ. 1977, 8, 23–40. [Google Scholar] [CrossRef]

- Harris, M.; Raviv, A. Corporate governance: Voting rights and majority rules. J. Financ. Econ. 1988, 20, 203–235. [Google Scholar] [CrossRef]

- Matemilola, B.T.; Bany-Ariffin, A.N.; Azman-Saini, W.N.W.; Nassir, A.M. Does top managers’ experience affect firms’ capital structure? Res. Int. Bus. Financ. 2018, 45, 488–498. [Google Scholar] [CrossRef]

- Stulz, R. Managerial control of voting rights: Financing policies and the market for corporate control. J. Financ. Econ. 1988, 20, 25–54. [Google Scholar] [CrossRef]

- Brander, J.A.; Lewis, T.R. Oligopoly and financial structure the limited liability effect. Am. Econ. Rev. 1986, 76, 956–970. [Google Scholar]

- Ning, Y. Research on the Selection of Optimal Capital Structure for Highway PPP Projects. Master’s Thesis, Beijing University of Civil Engineering and Architecture, Beijing, China, 2018. [Google Scholar]

- Liu, Y. Optimal Capital Structure for Public-Private Partnership Projects’ Refinance. Master’s Thesis, Tsinghua University, Beijing, China, 2011. [Google Scholar]

- Long, J. Analysis on the optimal capital structure of PPP project refinancing. Adm. Assets Financ. 2015, 42, 47. (In Chinese) [Google Scholar]

- Nie, Y.; Guo, Y.; Li, F. Research on fiscal control strategy of PPP mode. Local Financ. Res. 2016, 8, 78–83. (In Chinese) [Google Scholar]

- Zhang, M. The Optimal Capital Structure and Its Influencing Factors of PPP Projects in New Type Urbanization-Based on General Equilibrium Perspective to Win-win Cooperation. Ind. Technol. Econ. 2017, 89–97. (In Chinese) [Google Scholar] [CrossRef]

- Li, C. The Research for the Capital Structure of Quasi-Profit Infrastructure PPP Projects. Master’s Thesis, Tianjin University, Tianjin, China, 2013. [Google Scholar]

- Sheng, H. Study on the Capital Structure of PPP/BOT Projects. Ph.D. Thesis, Tsinghua University, Beijing, China, 2013. [Google Scholar]

- Sharma, D.; Cui, Q.; Chen, L.; Lindly, J. Balancing Private and Public Interests in Public-Private Partnership Contracts Through Optimization of Equity Capital Structure. Transp. Res. Rec. J. Transp. Res. Board 2010, 2151, 60–66. [Google Scholar] [CrossRef]

- Feng, K.; Wang, S.; Xue, Y. Optimization of PPP Project Equity Structures Based on the Satisfactions of the Main Stakeholder. J. Tsinghua Univ. (Sci. Technol.) 2017, 57, 376–381. (In Chinese) [Google Scholar] [CrossRef]

- Chen, W. Research on the Equity Structure of a Highway PPP Project Based on Risk Sharing. Master’s Thesis, Xian University of Architecture and Technology, Shanxi, China, 2017. [Google Scholar]