1. Introduction

Shopping has been at the heart of urbanity since the earliest cities developed as sites of exchange. One sees and touches the product, perhaps smells and tastes it, bargains with the trader and experiences the larger social, political and cultural life that comes with traditional marketplaces. When purchasing most products, people now have a choice: go to town or go online. The latter has been increasingly accepted in recent years. Between 2014 and 2016, online sales grew by 31% in the United States (US) [

1], 33% in Canada [

2], 41% in Australia [

3], and 85% in China [

4]. However, brick-and-mortar retailing seems to be stifled—what the media calls the ‘retail apocalypse’ [

5]. For example,

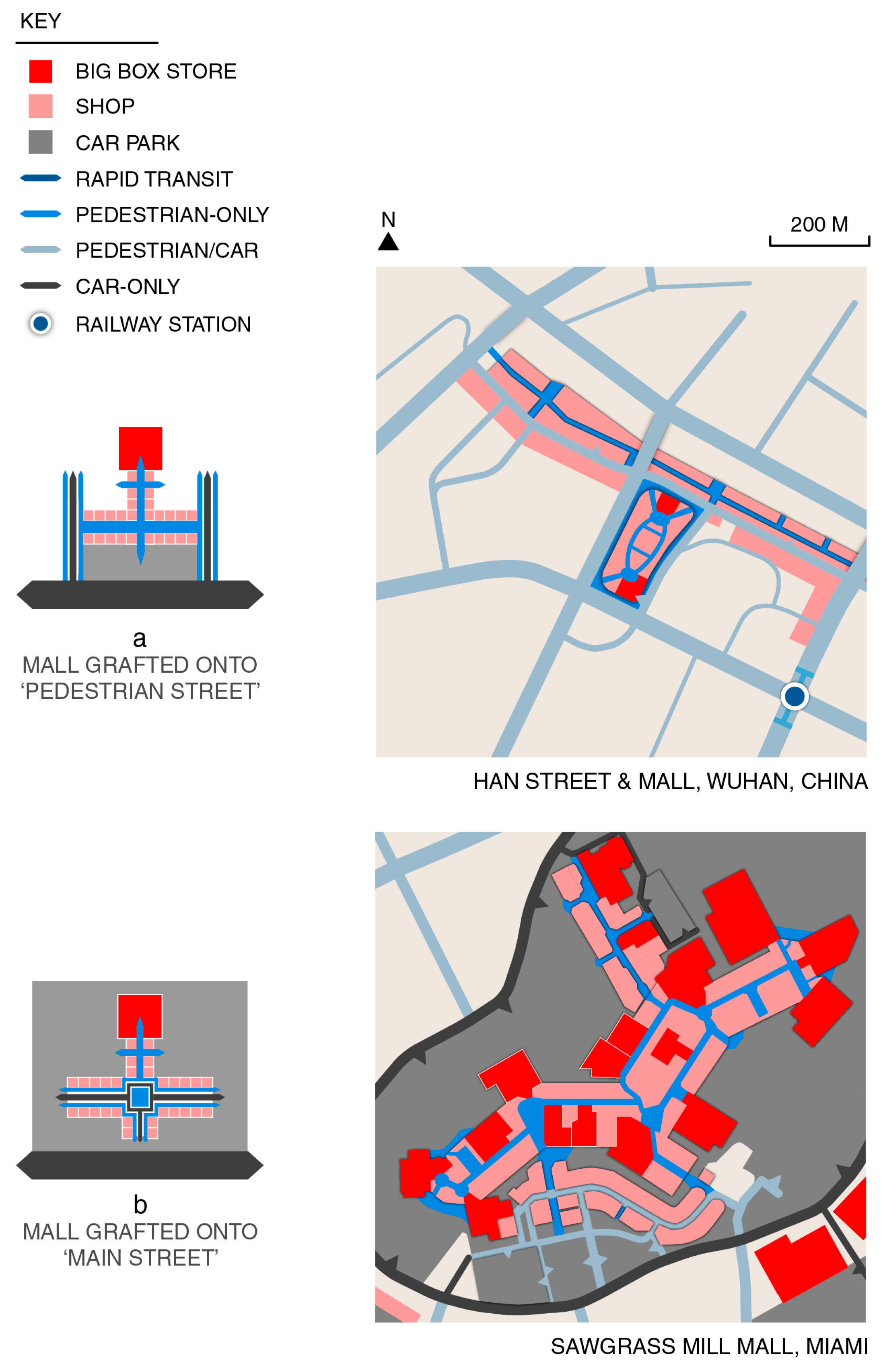

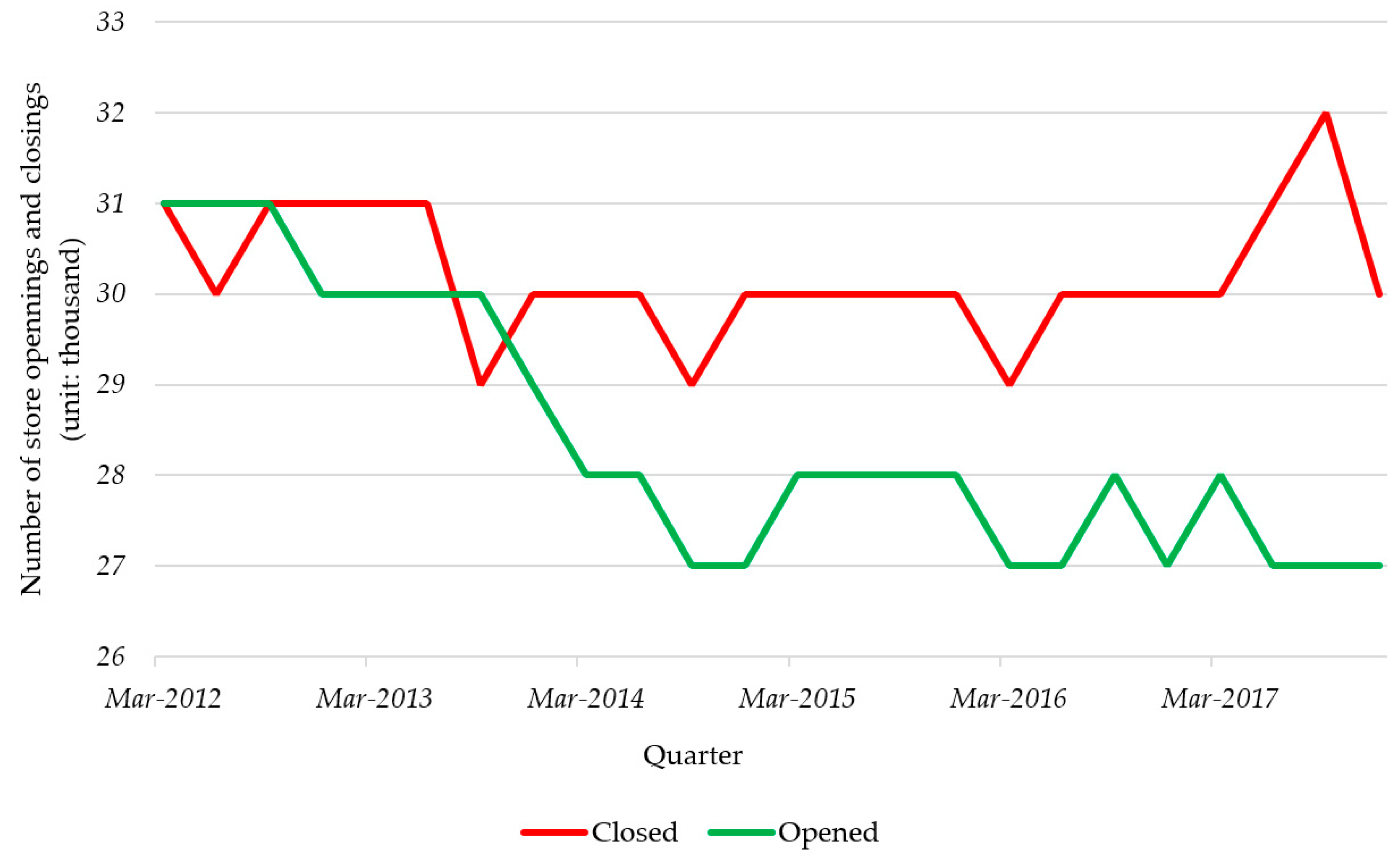

Figure 1 shows the number of quarterly store openings and closings in the US between 2012 and 2017 [

6]: the number of net store closings remained positive after the third quarter of 2013 and peaked in the third quarter of 2017 at around 5000. At the same time, a long list of retail chains around the globe filed for bankruptcy [

7,

8], such as Toys “R” Us, Sears Canada, and Masters (a home improvement chain in Australia). This decline of brick-and-mortar retailing could have a ‘domino effect’ [

9] on the shopping center (defined as an evolved or planned agglomeration of shops). If the material shopping space is less frequented, a weakening of urban public life could be triggered.

In this research, I explore how material forms of shops and shopping centers may be transformed to adapt to the rise of online retailing and investigate the extent to which the emerging material forms of shopping may foster or endanger urban public life. This focus on ‘space’ does not intend to ignore or oversimplify the complexity of the retail system, which comprises multiple stakeholders (e.g., retailers, developers, and planners), being multiscale (e.g., shops and shopping centers) and multidimensional (e.g., economic, social, cultural, and spatial). Instead, ‘space’ is emphasized in response to the context of online retailing, where retailing is not threatened generally (it continues to expand yet mostly online), yet all forms of brick-and-mortar retail space in different locations and markets are seemingly challenged.

In what follows, I first review ‘resilience’ theories, with a focus on ‘retail resilience’ (

Section 2). I then describe my research methods, including interviews, observations, and mapping (

Section 3). Next, I present the results of qualitative and morphological analyses. I show that brick-and-mortar retailing is not being replaced by online retailing; rather, they form material/digital synergies, giving rise to spatial transformations of the shop and shopping center. The shop space can now often be a non-retail space where an enhanced touch-and-feel experience is produced and may be capitalized (

Section 4). On the larger scale, shopping centers are being transformed into material forms that are geared toward the urban experience. This may bolster main street development/reinvigoration and stimulate a wide range of synergies between the main street and the suburban mall/power center (

Section 5). While shops and shopping centers show strong capacity for adapting to online retailing, the emerging forms of shopping do not necessarily foster vibrant urban public life (

Section 6).

2. Retail Resilience

Resilience theories mainly emerge from ecology. According to C. S. Holling [

10,

11], ecosystems are situated in a world of random events and unanticipated disturbances. Therefore, after a shock appears, ecosystems cannot bounce back to the previous state. Rather, they may adapt to the shock by making changes without lurching into a new regime, leading to ‘ecological resilience’ [

12].

Whereas avoiding a regime shift is key to the resilience of an ecosystem, a human system largely continues by fostering new regimes [

13,

14]; for example, as a village becomes a town, the mode of production, urban form, and social life of its inhabitants are substantially converted. Many researchers therefore argued that when applying ‘resilience’ to studies of human systems, the focus should shift from the persistence of the current regime to the capacity of the system for change [

15,

16,

17]. In light of this, Ron Martin coined the term ‘adaptive resilience’ [

16], meaning the ability of a human system to persist through new regimes while maintaining a strong adaptive capacity for change. Drawing on this thought, Wrigley and Dolega found that some successful main streets in the United Kingdom (UK) were transformed into new regimes when a chained supermarket, often considered a killer of main street shops, entered the main street and spurred a revitalization [

18].

Furthermore, whereas the resilience of an ecosystem generally contributes to sustainability, the resilience of a human system may endanger sustainable development [

14,

19]; for example, urban sprawl is a resilient socio-spatial pattern that diminishes the sustainability of cities in the US [

20]. Researchers have combined the notions of ‘resilience’ and ‘sustainability’ together to develop the concept of ‘retail resilience’, referring to the ability of a retail system to absorb a shock without failing to perform its functions in a sustainable way [

21,

22,

23,

24]. ‘Retail resilience’ has been used to study the ongoing transitions of the town center, the main street, and the suburban mall [

25,

26,

27] and to investigate the transformations of retail planning systems and policies [

28,

29]; however, it has rarely been applied to explore how the retail system may respond to online retailing [

30].

Three key factors influencing retail resilience have been identified in the literature. The first is related to ‘control’. Being more adaptive and resilient, a polycentric approach to managing shopping centers enables a quicker response to a shock via a wider range of actions than a centralized approach [

23,

28]. The second is the ‘tenant mix’. A redundancy of retailers supplying everyday demands [

31] and/or a mix of corporate and independent retailers [

18,

30,

32] can enhance the resilience of a shopping center. The last key factor contributing to retail resilience is the ‘typological mix’. Several scholars have found that a main street and a suburban mall in close proximity can complement each other by offering different products and experiences, and they may thus be more resilient in addressing unexpected market turmoil [

24,

27,

33]. Kärrholm, et al. [

24] introduced the notion of ‘spatial resilience’, by which shopping space is conceived of as ‘loose space’ that can be adapted into different forms, giving rise to retail resilience. They suggest, in particular, that stronger retail resilience may emerge from a ‘hybrid’ of different types of shopping centers. To examine retail resilience in this study, I specify three key terms as follows: the retail system, sustainable development, and shock.

2.1. Retail System

I focus on a key strand of the retail system, the material shopping space, for two key reasons. The material shopping space is significantly threatened by the rise of online retailing, e.g., the ‘retail apocalypse’ [

5,

9,

34]. Moreover, the adaption of the material shopping space can be considered a process and form of retail resilience [

24]. In this paper, the term ‘material shopping space’ is used interchangeably with ‘retail system’. The material shopping space of a city operates at multiple interrelated scales: an agglomeration of shops leads to the shopping center, and a series of shopping centers constitutes the major body of city retailing. Different shops or shopping centers cooperate and compete and thus generate economic spillovers and innovations (e.g., new business models and material forms) to individual shops or centers [

27]. Furthermore, an innovation by a shop or shopping center may be a shock to others and may stimulate changes in the retail system [

35,

36].

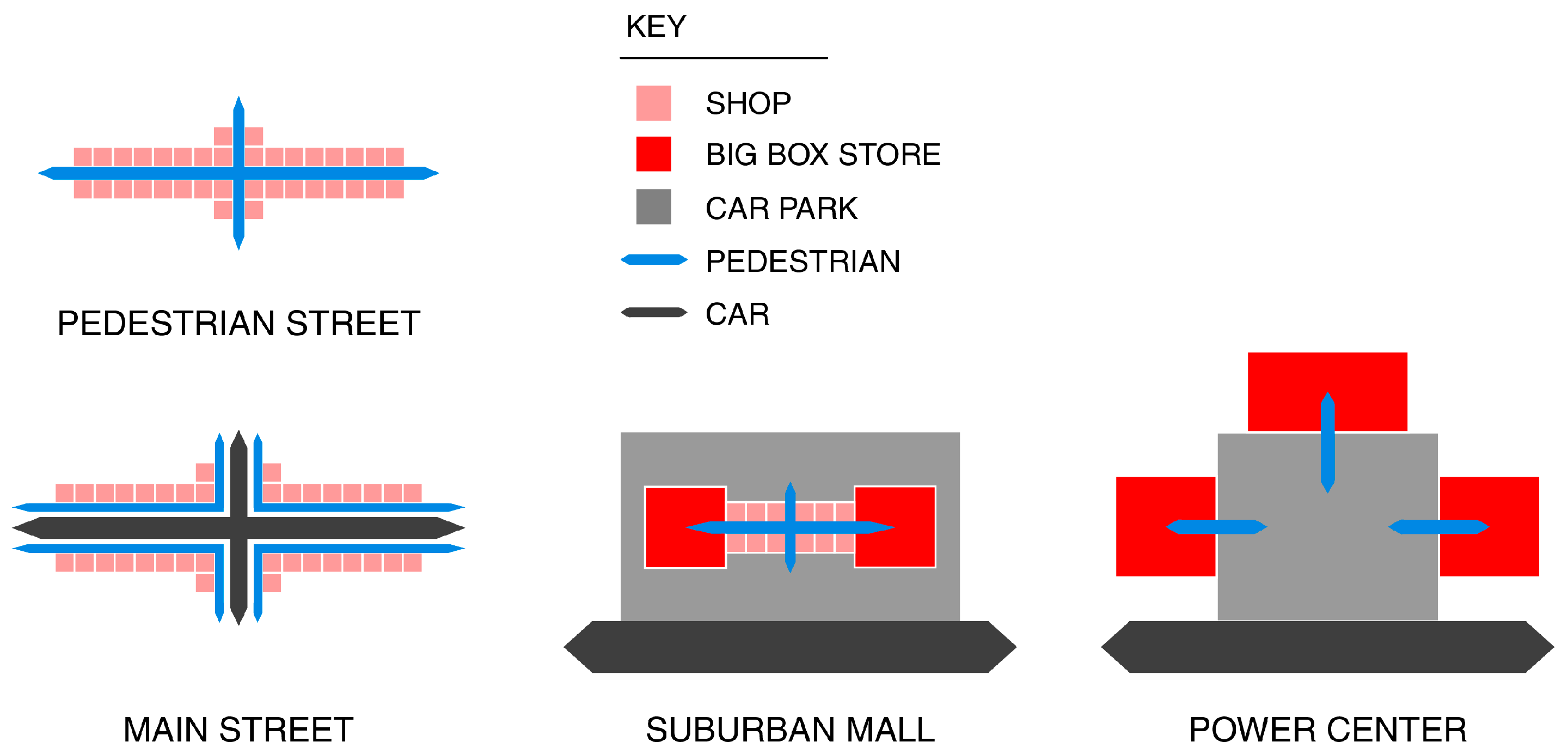

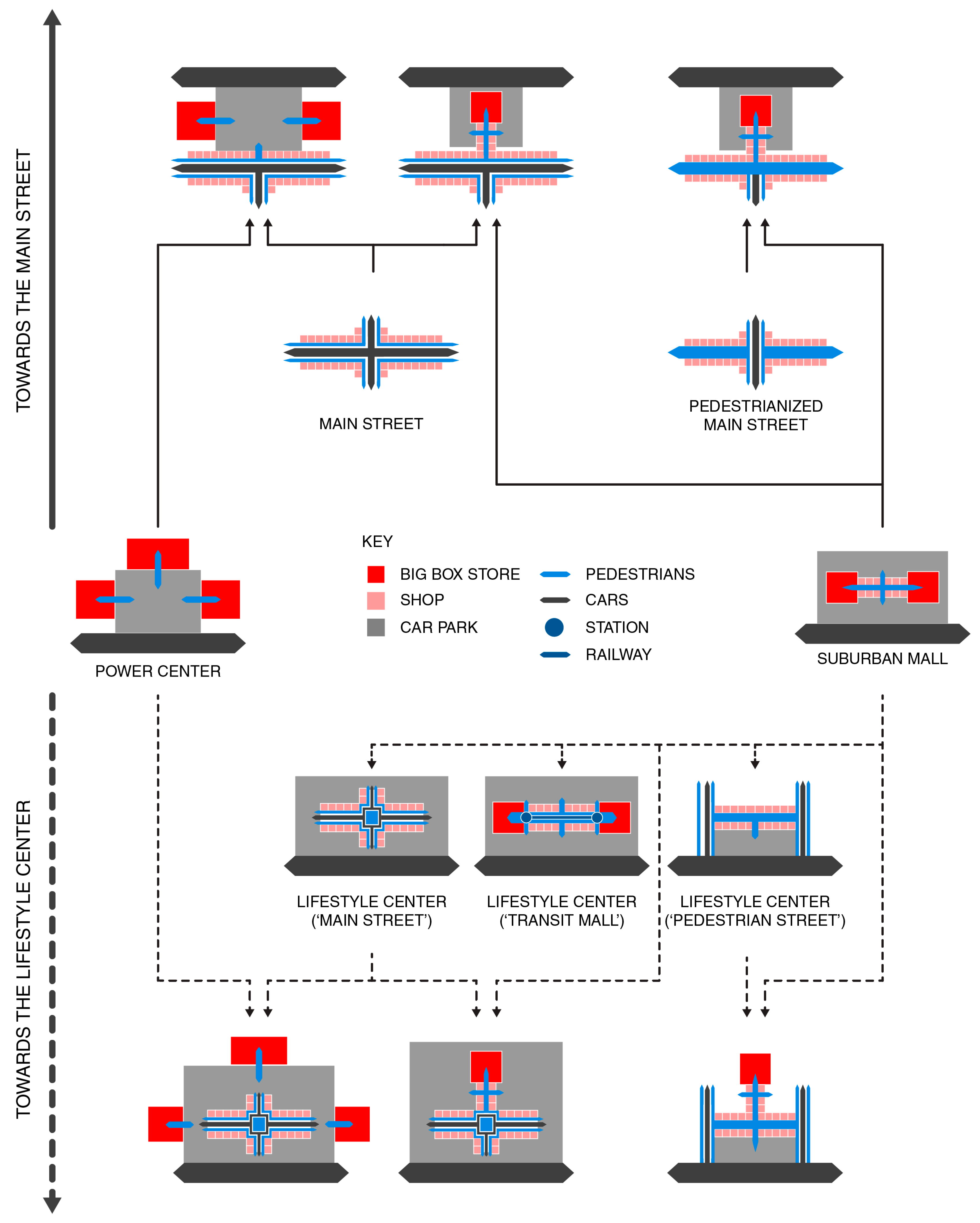

Throughout history, a variety of types of shopping centers have emerged, from ‘traditional retail forms’, such as the pedestrian street, the market, and the main street [

37,

38], to ‘nineteenth-century retail forms’, such as the arcade and the department store [

39,

40], to ‘twentieth-century retail forms’, such as the strip mall, the car-based strip, the suburban mall, and the power center [

41,

42]. In this paper, three are considered key types: the ‘main street’, ‘suburban mall’, and ‘power center’; they are shown in

Figure 2. I define them based on a morphological typology: here, a ‘type’ does not refer to an ‘archetype’ that can be replicated in different contexts. Rather, it is shown by a diagram depicting something that works in general while still being geared toward the particularity of each instance [

43,

44,

45]; in such a diagram, the spatial arrangement of shops is able to imply the ways in which a shopping center 1) operates economically and 2) influences the production of urban public life [

44].

The ‘main street’ is largely derived from the ‘pedestrian street’, where a pedestrian flow is lined by various shops and is centered on a street intersection. When vehicular traffic is introduced to cut the pedestrian flow into a pair of sidewalks, the main street emerges [

31,

46,

47]. While the main street is adapted to the needs of cars, its retail business mainly survives on the pedestrian traffic flowing through the sidewalk, and it is integrated into the city at the human scale.

The ‘suburban mall’ reconfigures the pedestrian street. Here, shops are arranged according to a ‘dumbbell diagram’—two anchors at the ends of an arcade, in which shops in the arcade have access to the (guaranteed) pedestrian traffic flowing between the anchors [

48,

49]. This dumbbell cluster of shops is often surrounded by car parks. In this way, while the suburban mall contains a pedestrian-only shopping path, it works differently from the pedestrian street. In a pedestrian street, people are attracted to the central street intersection, from which they can explore the surrounding community. In a suburban mall, however, people are manipulated to walk in between the anchors inside an enclosed quasi-public space [

50,

51]. The entrance/exit only leads them to the car park.

The ‘power center’, also known as the ‘retail park’ [

36,

52], incorporates a cluster of big box stores lining a central car park [

53,

54]. Here, the diagram of the pedestrian street vanishes: the need to walk to/between the shops is reduced to a minimum as people are supposed to drive to each storefront. In the extreme case of the ‘drive-through’ of a fast food restaurant (a common power center tenant), a customer drives around the store to order, pay, and get food without leaving the car. The power center thus frees people from the manipulation of mall anchors and facilitates the efficiency of driving and shopping at the cost of face-to-face social interactions [

54].

2.2. Sustainable Development

‘Sustainable development’ is a broad concept, embodying a wide range of goals around resilient growth, environmental preservation, social justice, and so forth [

55]. Resilience is a necessary but insufficient condition of sustainability [

13,

14]. I selected two main aspects of sustainable retail development for this study. One is the resilient material form of shopping. This does not mean that every shop or shopping center must operate resiliently; rather, it refers to a general trend that shops or shopping centers are made functional through incremental changes instead of being forced into a boom-and-bust cycle.

The other selected aspect of sustainability is ‘urbanity’, meaning intensive random encounters between people—a strong urban public life. Urbanity is at the core of a sustainable urban economy; it fosters frequent face-to-face interactions, giving rise to ‘urban buzz’ [

56], through which knowledge can be efficiently produced, shared, and refined. Urbanity is also geared toward a sustainable form of governance: ‘street science’ [

57]; it draws on bottom-up/everyday participation/collaboration to stimulate decision-making towards social and environmental justice. Employing the notions of ‘sidewalk ballet’ by Jane Jacobs [

46], ‘global sense of place’ by Doreen Massey [

58], and ‘open city’ by Richard Sennett [

59], I measure urbanity by two factors: how well the shopping space 1) is integrated into the city at the pedestrian scale and 2) is controlled by the public.

2.3. Shocks

One of the most profound ‘shocks’ to the retail system today is the rise of online retailing [

60]. Retail economists have explored the economic impacts of online retailing in depth. They consider brick-and-mortar and online retailing to be different ‘channels’ that can combine in two key models [

61]. The first model is ‘multi-channel’ retailing, in which the online channel is primarily used as a means of advertising (e.g., an online catalogue) to boost sales in stores [

62,

63]. In the second and more recent model of ‘omni-channel’ retailing, shops expand their sales through online retailing, while online retailers also open shops and expand into brick-and-mortar retailing [

64,

65]. In two recent examples, Nordstrom estimated that its online sales would reach 50% of its total sales by 2022 [

66], while Amazon.com announced its acquisition of the brick-and-mortar retailer Whole Foods Market [

67].

The influences of these shocks on the shopping space are insufficiently discussed. A few researchers suggest that online retailing challenges city center retailing while also bringing about opportunities: shops in the city center can complement online retailing with more attractive physical spaces for touch-and-feel than other locations; city center retailing may thus gain advantages over suburban retailing [

30,

68]. However, there is a counter opinion that online retailing is better matched with the out-of-town car-dependent shopping center than the city center, because the former provides ample free car parks and thus allows drivers to pick up the products ordered online more easily [

69].

In short, while there is much conjecture about changes in urban retail markets, there is a lack of investigation on the impacts of online retailing on 1) the material forms of shops and shopping centers and 2) the production of urban public life. Here, the key research question unfolds: to what degree is retail resilience generated as brick-and-mortar and online retailing are combined in material/digital synergies? To answer this question, I will first examine the ways in which the retail system is transformed at the scales of the shop and shopping center—namely measuring how adaptable the retail system is. I then investigate the degree to which the emerging material forms of shopping may foster or endanger urbanity.

3. Methods

As the focus of this paper is on material forms of shopping and their impacts on urban public life, I adopted qualitative and morphological methods as the main modes of inquiry, including interviews, observations, and mapping.

The participants of the interview consisted of planning (urban planners/designers working at public agencies) and development (consultants and developers) professionals with over 10 years of experience in shopping center development. I chose these two groups of professionals because they investigate the ‘shopping space’—defined as the space in between the shops within a shopping center—with different focuses: while consultants and developers largely seek to produce a viable retail economy through different spatial arrangements of shops, planning professionals mostly work to balance economic growth, environmental preservation, and social benefits within a project.

The participants were from four cities (at the metropolitan level): Edmonton (Canada), Melbourne (Australia), Portland (Oregon), and Wuhan (China). These four cities are different with respect to size, population, governance, and so forth; however, they are comparable with respect to the research topic of this study: their respective countries have active online retail economies as introduced earlier, and they are at the forefront of shopping center development or transformation in their respective countries (as summarized in

Table A1).

I recruited the participants using snowball sampling. I first identified a key informant in each city through archival data (e.g., newspaper, literature) and established a connection with them. I then contacted other participants through the key informants. In total, there were 23 participants.

Table 1 summarizes the composition of the participants by profession (columns) and city (rows).

Each interview was face to face and semi-structured, and each interview was recorded with the consent of the participant and lasted around one hour. To establish a good rapport with the participants, I started with a broad question (e.g., “How has the rise of online retailing influenced shopping center development in your city?”). While the participant was answering my questions, I took notes and prepared new questions that related to the following topics: 1) how shops and shopping centers may be adapted to online retailing, and 2) why some adaptations work while others fail. I transcribed the recordings myself and analyzed them using NVivo. I first coded the transcripts using four themes: changes in the ‘shop’, ‘shopping center’, ‘urban retailing’, and ‘shopping center industry’. I then identified the key forms of changes in each theme inductively and explored the interrelations between these changes.

The second key method employed in this study was field/virtual observation. I asked the participants to recommend shops and shopping centers that are likely to persist in the market. I conducted field observation on those projects that were accessible while investigating others through Google Maps/Street View and other online sources (e.g., online floor plans), leading to field/virtual observation of a total of 37 shopping centers from 14 cities (

Table A2). These 37 shopping center cases in different contexts were used to explore the emerging forms of shopping inductively, such that they should not be seen as being statistically representative.

Lastly, I analyzed 13 typical shopping centers (showing potential transformations of the main street, suburban mall, and power center) through morphological mapping (see

Table A2). I first retrieved satellite images of these 13 shopping centers from Google Earth and cropped the images into squares covering a one-square-kilometer area (often regarded as a walkable range [

70,

71]) centered on the shopping center. I used one-square-kilometer as the scale for morphological analysis, because my focus was on walkable shopping. I then conducted the mapping in Adobe Illustrator, focusing on three spatial elements: the shop (big box store and others), traffic (rapid transit, pedestrian-only, pedestrian/car, and car-only), and car park. While the size of the big box store largely ranges from 1800 to 14,000 m

2 [

72,

73], there is no absolute threshold. To enable a workable definition, I conceptualized the big box store as a shop with a retail space that is no less than 3500 m

2—roughly the size of the smallest type of Wal-Mart (one of the most common big box retailers worldwide) big box store. By this standard, the anchor store of the mall, usually a department store, is considered to be a kind of the big box store. Based on the map, I visualized the socio-spatial logic by which the shopping center operates as a spatial diagram. Next, I investigated the degree to which different spatial diagrams of shopping centers may nurture or threaten urban public life.

4. Adaptations of Shops

Brick-and-mortar retailing has three key disadvantages when competing with online retailing. First, while the big box store—a shop type with a larger retail space than most urban stores—can display a wide range of products, the website or app of a retailer can show a full range. Second, while the big box store frequently claims to beat the price of any other shop in the city, a search in Google often leads to a lower price because it reaches the global market. Third, while brick-and-mortar retailing often requires high-rent shops, online retailing can be ‘shopless’, allowing retailers to work from low-rent warehouses or even their homes, possibly reducing the prices of products. In short, online retailing enables one to check, compare, and obtain a better price more efficiently than any brick-and-mortar shop.

One simple reaction of brick-and-mortar retailers is to reduce store size. For big box retailers, as it is more convenient for shoppers to browse a wider range of products online and use the store for pick-up, the required store size decreases. For example, IKEA experimented with a new store format tailored to online retailing: the IKEA pick-up and order point. Such a store in London, ON (Canada) is as small as 2500 m2, whereas the IKEA big box store in Portland is around 18,000 m2.

Once the required store size is diminished, it then becomes more rational for independent retailers to co-locate in a shop and share the rent. One example is a shop called in.cube8r on Smith Street, Melbourne (

Figure 3a), which houses a mini-bazaar of around 100 retailer/artists, each of whom leases a cubicle within the store to offer a pick-up point for online orders and to display a few featured products (

Figure 3b). On the website, all the retailers are shown through images that resemble the in-store cubicles (

Figure 3c); each image is linked to the website of the artist where a full range of artwork is listed.

Brick-and-mortar retailing, however, has an enduring advantage over online retailing, as it fosters a diverse range of actual experiences that can hardly be produced through virtual interactions (from afar), such as touching and feeling a product. In many modern shops, although people can touch and feel different products, the focus of the store is largely to facilitate the distribution and exchange of goods. As one retail consultant puts it:

If you go to a Macy’s and then you go back there a month later, it’s the same stuff … They’re motivated to sell you what they have in stock: this may not look perfect on you, but I need to sell it because I need to clear out this inventory... It is a horrible experience, right? (P2)

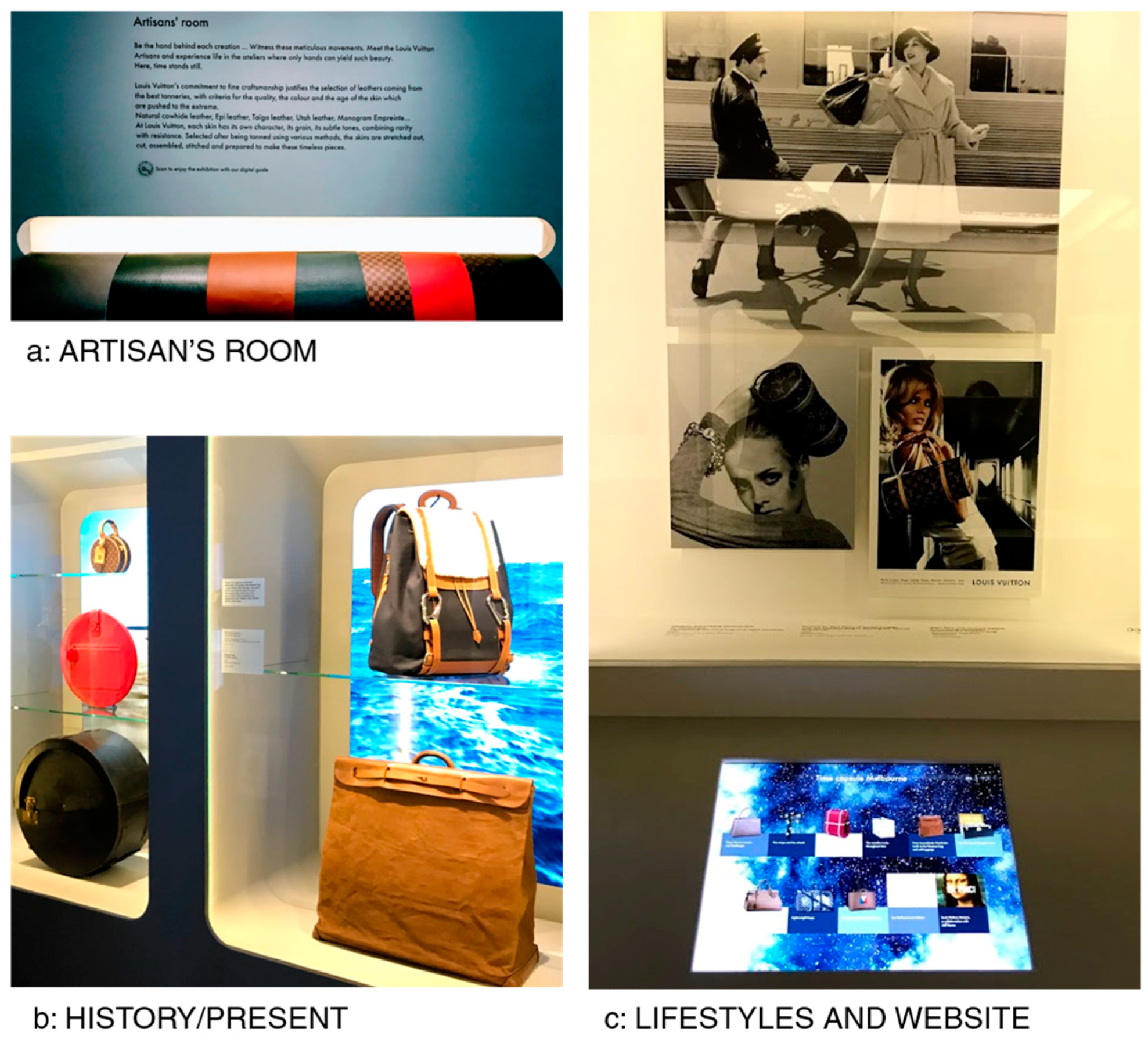

In emerging forms of shops that co-function with online retailing, the retail space largely turns into a ‘showroom’, where the touch-and-feel experience becomes the core. One example is the Louis Vuitton Time Capsule Exhibition in Chadstone Shopping Center in Melbourne. Here, the shop is transformed into an exhibition of the artisan’s craft of leatherwork (

Figure 4a). Thus, one is invited into the production process in the ‘Artisan’s room’ to touch and feel different types of leather before seeing the products, which are juxtaposed with antiques and photographs that collectively evoke a transcendent feel—the combined effect of a narrative of tradition, fine craftmanship, and an elegant lifestyle (

Figure 4b). The exhibition concludes with a tablet through which a full range of current products can be bought online (

Figure 4c).

Online retailers also seek to offer customers the touch-and-feel experience; they are experimenting with brick-and-mortar stores. One example is the men’s suit retailer Indochino, which emerged from online retailing and is now setting up shops as showrooms—here, people can touch and feel a variety of suits and get their bodies measured while making an order online. Another example is Amazon Books, which first sold books online, then merchandized e-books and e-readers, and now operates bookstores in shopping centers. In the Amazon bookstore at Washington Square Shopping Center in Portland, multiple tablets are offered for shoppers to search for or buy books online (

Figure 5a), and a special ‘book’, the Kindle e-reader, is positioned in the middle of bestseller books (

Figure 5b). This juxtaposition of electronic and paper books highlights the convenience of the Kindle—the gateway to all books, the best book.

With retailers increasingly operating their business through the synergy between brick-and-mortar and online channels, a new shopping behavior has emerged, by which customers try products in the shop and buy online—what Helen Couclelis calls ‘free-riders’ [

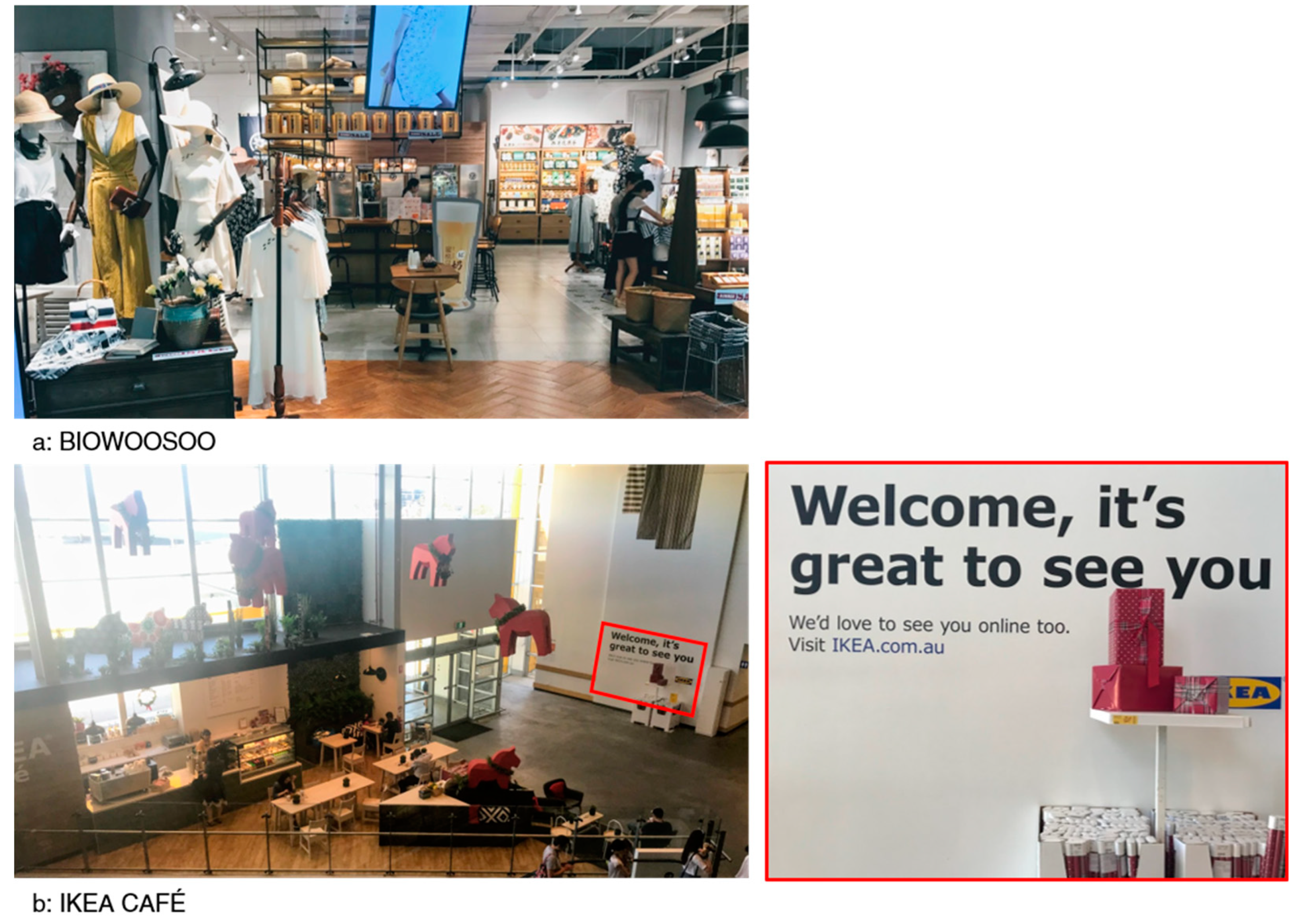

74]. Some retailers sense a business opportunity here; they commodify the touch-and-feel experience. For example, a clothing and beauty retailer called Biowoosoo in China has established an innovative store layout, wherein a tea bar occupies the center of the storefront and is surrounded by racks and shelves of durable goods (

Figure 6a). The retailer invites shoppers to try different products for as long as they wish and encourages them to order online if there is a better deal. The longer a shopper stays in the store, the greater the possibility that they may buy a tea—the price of the touch-and-feel experience.

This commodification of the experience is taken further in the next two examples, where shoppers are supposed to pay first and then touch and feel the products. The IKEA big box store in Richmond, Melbourne, has recently replaced its display of seasonal, discounted products at the entrance with a café (

Figure 6b: left), and everything in the café is sold in IKEA, such as the furniture, dinnerware, and coffee beans. Here, people experience the products at a price—e.g., a cup of coffee—and are encouraged to buy what they want online (

Figure 6b: right). In a recent MUJI ‘shop’ experiment in Tokyo—a hybrid hotel and retail space—each hotel suite doubles as a showroom where travelers can actually use the products and order the desired ones online. In this case, people touch and feel the

MUJI products at the cost of the hotel expenses.

As shown in

Table 2, there are largely three stages of shop transformation as retailers combine brick-and-mortar and online retailing. The first is to turn the shop into a ‘pick-up point’ and to mainly sell products online, leading to a reduction of the required store size (multi-channel retailing). Second, a retailer can transform the shop into a ‘showroom’ offering an elevated touch-and-feel experience while operating retail exchange online (omni-channel retailing). The focus of the shop shifts from distribution/exchange to display. The shop can thus go beyond the retail space, e.g., turning the shop into an exhibition. In the third stage of shop transformation, an enhanced touch-and-feel experience is created to stimulate online sales and is sold to customers, enabling the showroom to generate extra revenue (omni-channel retailing + the merchandizing of the experience). Here, the showroom is often established as a non-retail space, e.g., a teahouse, a café, or even a hotel. In short, the material shop space is increasingly geared toward the experience, the required retail space is generally decreasing, and the conceptual boundary between the shop and other material spaces is blurring.

5. Adaptations of Shopping Centers

In response to the downsizing of the required retail space and the growing demand for the non-retail experiential space, there is a movement for developers to mix shopping with living and working at the human scale to produce an urban experience, leading to new shopping center formats that “are central to, and fully integrated with, the communities that surround them” [

75] (p. 12). One developer points out the following:

The interesting synergies are happening beyond retail, retail types, or retail morphologies. It is actually happening within the interconnectedness between the retail and other functions and embedding shopping centers more into the daily public life of people as opposed to just being a singular destination for a specific purpose. (M1)

This urban experience, as a developer puts it, resembles what people would feel in the traditional shopping street:

We spent a lot of time and effort trying to get that right in terms of the shopping center’s pedestrian connectivity back to the residential environment and the office environment around … The test is whether this is a nice place to come for a walk in that European sense, like passeggiata. (M10)

I now consider the ways in which the material forms of the three key retail types—the main street, suburban mall, and power center—may produce the ‘urban experience’, characterized by density, mixed-use spaces, and walkability. With respect to main streets, more investments would be diverted to main street development/reinvigoration, as the main street is a form of traditional shopping street that often nurtures urbanity. One possible spatial transformation of the main street is to pedestrianize the road, through which the pedestrian experience is enhanced and the urban experience is intensified.

Figure A1 contains three examples of the pedestrianized main street. In Santa Monica, California, the Third Street Promenade features a pedestrianized main street. In two European cities, Stockholm and Manheim, the pedestrianization of the main street is more progressive, where several main street districts are converted into car-free shopping spaces.

With respect to suburban malls and power centers, however, certain barriers must be overcome when creating the urban experience. Recall that the socio-spatial logic of the suburban mall is based on a dumbbell diagram, where two anchors occupy the ends of an arcade. In this way, shoppers are largely manipulated to walk in between the anchors in an enclosed and fully controlled space, contrary to the urban experience where people freely stroll on the sidewalk and encounter something new. In the past, many malls sought to retain people’s curiosity by adding new anchors, and some grew into mega-malls with a series of attractions, such as department stores, cinemas, theme parks, and hotels. However, as one retail consultant suggests, “they [suburban malls] are now starting to run out of who the next anchor is” (M8). In the 1980s, West Edmonton Mall (WEM) quickly expanded from an ordinary dumbbell mall into a mega-mall within one decade by introducing various retail and non-retail attractions [

76], but it failed to cope with the recent downfall of Sears Canada. Sears’ problems were disclosed several years ago [

77], but WEM maintained its Sears store until the company announced a full liquidation in 2017 [

78].

The power center, designed as a cluster of big box stores lining a car park, is conducive to the needs of cars—being anti-urban. Developers have sought to make power centers more walkable and urban, for example by landscaping the sidewalk along the big box storefronts or transforming the plain big box storefronts into a mixed townscape. They have also tried to establish a functional mix between shopping, living, and working within the power center. As one developer notes: “we are not building it [the power center] into a new suburbia. We are taking advantage of existing land infrastructure, and we are putting people in an area where there are lots of goods and services already” (E3). However, the capacities of these spatial changes to nurture the urban atmosphere are constrained by the car-based morphology of the power center: how urban can it be if pedestrians are always next to a sea of car parks?

Through a morphological analysis of 10 key shopping centers, one major strategy for the suburban mall/power center to foster the urban experience was revealed: i.e., to form synergies with the main street. This is a reasonable approach as the main street is the only one of the three key retail types that is geared toward urbanity. While such retail synergies emerged earlier than the rise of online retailing, they show that the suburban mall and power center can generate the urban experience in a wide range of ways.

There are three possible kinds of mall/main street assemblages. In the first option, the mall is grafted onto the main street and thus acquires the urban experience (

Figure A2a), as shown by Northcote Plaza Shopping Center in Melbourne, Lloyd Center in Portland, and Mix City in Chengdu (China). Such a mall/main street assemblage can also emerge between the mall and the pedestrianized main street (

Figure A2b). For example, the southeast end of the aforementioned pedestrianized main street in Santa Monica is occupied by a suburban mall.

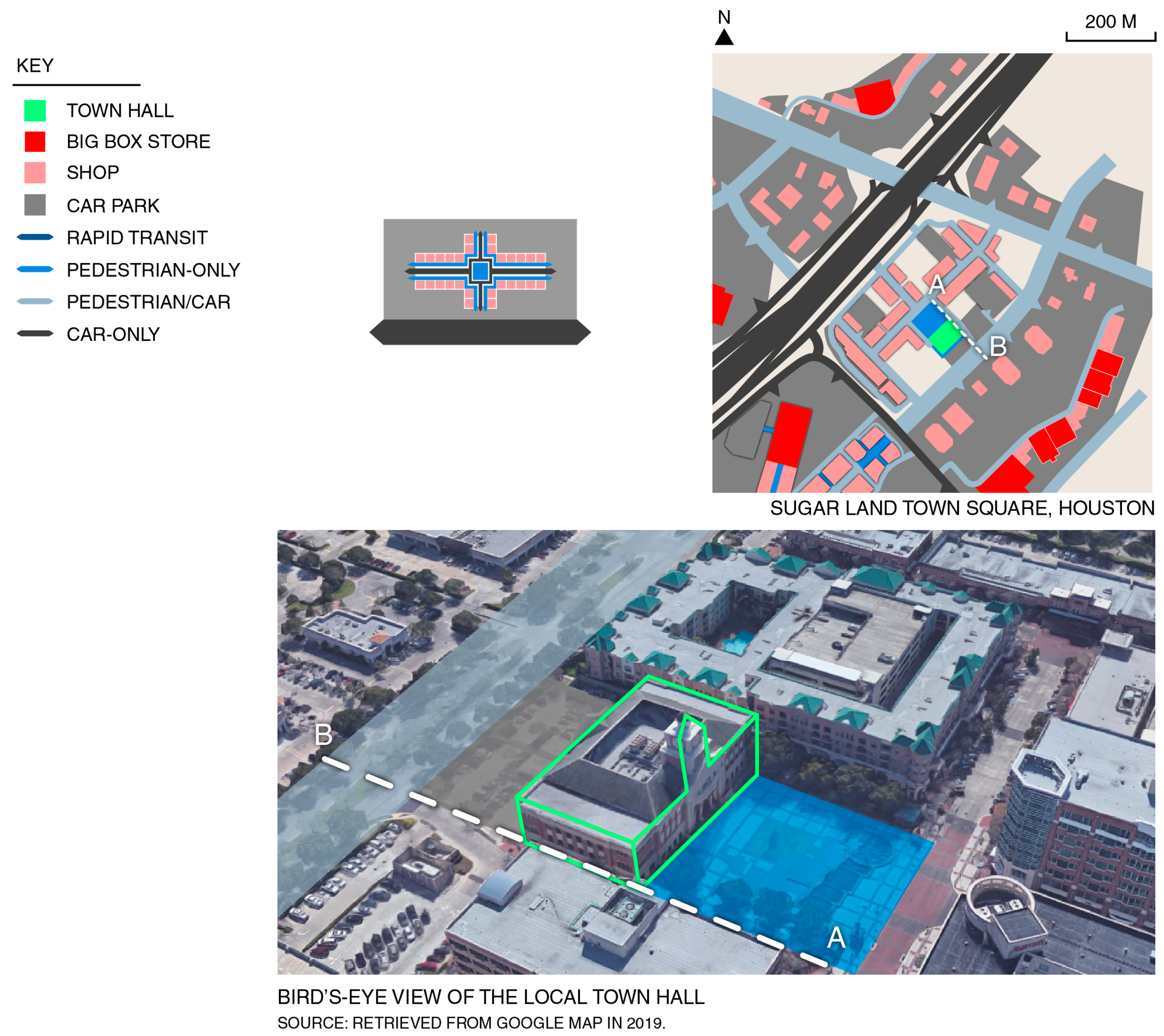

Second, the mall morphology can be reconfigured based on the spatial arrangement of the main street/pedestrianized main street, leading to the ‘lifestyle center’—a hybrid of mall-becoming-street, a suburban substitute for the urban street.

Figure A3 presents three possible forms of the lifestyle center, where the shopping paths feature the pedestrian street (

Figure A3a: Han Street, Wuhan), the transit mall (

Figure A3b: the Grove, Los Angeles), and the main street (

Figure A3c: Sugar Land Town Square, Houston). As a result, the lifestyle center generates an urban streetscape that may evoke strong nostalgia for the ‘good old’ street life.

Third, the mall can be combined with the lifestyle center to create a hybrid in which their shopping spaces are seamlessly connected. The mall can thus capture the urban experience of the lifestyle center. For example, a suburban mall is grafted onto the aforementioned Han Street (a ‘pedestrian street’) in Wuhan (

Figure A4a), and in the Sawgrass Mill Mall in Miami there is a lifestyle center (a ‘main street’) being added to the south of the enclosed mall (

Figure A4b).

It is seemingly impossible for the urban forms of the power center and the main street to overlap, as these two retail types are based on conflicted modes of transportation. While the power center is car-based, the main street is pedestrian-friendly. However, there are two possible forms of the power center/main street assemblage. One is where the power center morphology is integrated into the main street by sharing a line of shops, as shown in Camberwell Junction in Melbourne (

Figure A5a). In this way, the power center incorporates a main street experience. The other and more prevalent form of the power center/street assemblage appears by integrating the power center and the lifestyle center. In this retail synergy, the lifestyle center (e.g. in the form of the main street) occupies the core of the power center, bringing the urban experience to the center of the car park. Three examples are presented in

Figure A5b: Southlands Town Center in Denver, Zona Rosa Town Center in Kansas City, and Currents of Windermere in Edmonton.

Through the morphological analysis above, it can be concluded that there are a lot of experiments going on in the market through which developers may bring the urban experience to malls and power centers. This finding is partially supported by the International Council of Shopping Centers (ICSC), which suggests that the market now increasingly favors new shopping center formats [

75]. The ICSC also asserts that there is unlikely to be a rush of investment in new forms of shopping centers, as they are often expensive [

75]. For example, the lifestyle center usually includes quality urban facilities and mixed-use buildings, requiring a larger investment than a typical mall or power center project. However, recent statistics of the gross leasable areas (GLA) in the US indicate a different story. From 2013 to 2017, the GLA of the lifestyle center grew by 10.6% in a market where the GLA of the suburban mall and power center slowly increased by 1.7% and 2.2%, respectively [

79]. This robust lifestyle center development may be stimulated by developers attempting to adapt the shopping center industry to online retailing.

Developers have long understood that close proximity to a shopping center generally increases the value of living and working spaces [

80]: while developing a viable shopping center (the majority of revenue), they might purchase the land surrounding the center and thus capture the value increase. With the rise of online retailing, however, the composition of revenue has changed in shopping center development projects. In a recent business model, developers mainly use the shopping center to foster the urban experience; the shopping center is considered to be more of an input than a source of revenue, whereas revenue is primarily generated by selling/leasing apartments or offices attached to the shopping center. As one retail consultant explains, “if you have a Whole Foods [a supermarket], you can increase your rents 19% … You make your money on the units … And you will give them [Whole Foods] almost free space” (P3). This business model is taken further in the Chinese market, as one urban planner describes:

Many recent shopping center development projects in China are basically gambles. Developers invite top architects and designers to propose ambitious plans, and they actually build it, while they clearly know that they have spent so much on the shopping center that would never be paid off by the income of retail leases. Developers run the risk as they find that the money spent on the shopping center may increase, and in many cases multiply, the return from the increased value of the nearby residential or office properties they own. (W2)

While such wild shopping center development may not be applicable to other parts of the world, it shows that the developer now has an incentive to invest more in shopping centers: to leverage greater profits from the associated apartments or offices. This incentive may spur the development of the synergies between the main street and the suburban mall/power center, including but not limited to the lifestyle center.

6. Resilience and Urbanity

The ways in which shop and shopping center development are adapted to online retailing largely converge at the production of experiential shopping. While more and more retail revenue are diverted to the online channel, the shop space is increasingly dependent on different modes of touch-and-feel experience. Simultaneously, the focus of shopping center development has shifted from generating lease incomes to fostering the urban experience, with the majority or even all of the profits reaped from the increased value of the on-top or nearby apartments or offices.

Spatially, the shop is increasingly being modified into a variety of non-retail spaces, such as the exhibition, café, and hotel. On the larger scale, the suburban mall and power center form synergies with the main street, giving rise to a variety of new shopping center formats. In

Figure 7, the synergistic shopping morphologies are juxtaposed in two genealogies of shopping centers. In the upper figure (indicated by solid arrows), the mall or power center is combined with the main street or pedestrianized main street. In the lower figure (shown by dashed arrows), the design of the mall draws from the morphology of the main street, and the mall is turned into three lifestyle centers with its streetscapes being the pedestrian street, transit mall, and main street. Then, the mall or power center forms synergies with these lifestyle centers.

While not all of these material forms of shopping may be successful in the long term, they show that the retail system is able to produce various material spaces geared toward experiential shopping—a form of resilience in the retail system amid the rise of online retailing. This is ‘adaptive resilience’ rather than ‘ecological resilience’, as many of the emerging forms of shopping centers result from ‘regime shifts’ of the shop (from retail space to non-retail experiential space) and existing retail types (where the main street and the suburban mall/power center are combined into new assemblages). The adaptive resilience of the material shopping space, however, does not necessarily lead to strong urban public life.

When the mall or power center is combined with a real main street (

Figure 7: towards the main street), the retail synergy may bolster vigorous urban public life. For example, in Camberwell Junction in Melbourne (

Figure 8), the power center morphology is connected to the nearby main street through multiple pedestrian linkages, such as the laneway and shops with double storefronts facing the car park and sidewalk, and through the main street, the power center is linked to multiple tram stops and a railway station. This pedestrian-based assemblage of the main street, power center, and public transit also enables a temporary transformation of the shared car park. Every Sunday, the car park turns into a flea market, with the parking lots being modified as shops and with parking isles being converted into pedestrian streets or plazas, giving rise to bustling urban public life resembling a vibrant town square.

However, when the mall emulates the main street and becomes the lifestyle center or the mall or power center is joined with the lifestyle center (

Figure 7: towards the lifestyle center), the synergistic shopping center threatens urbanity, because the lifestyle center generates stronger private control of the shopping space. For example, in Sugar Land Town Square, a lifestyle center in Houston (

Figure 9), a plaza occupies the core of the shopping space. Around the plaza there are mixed-use buildings with shops on the ground floor; there is also a town hall by the plaza. The town hall faces the private shopping center while leaving its back to the public road, and the interface between the town hall and the public road is a car park. This town hall is thus spatially integrated into the private shopping center (rather than the public city) and largely serves as its core attraction, leading to a new level of privatization of public space. In this case, the private control of the shopping space is camouflaged with a significant public sense of place in a more nuanced way than the suburban mall, where there is a clear sense of private control. This more nuanced private control blurs the demarcation between the public and private in the shopping space. As a consequence, the private may be misconstrued as the public in the lifestyle center. While this lifestyle center is conceived and branded as the ‘town square’—the heart of the local city—its real identity is revealed by the spatial diagram shown in

Figure 9—a private shopping enclave that is segregated from the surrounding neighborhood by car parks and auto-based roads.

7. Conclusions

In this research, I investigated the ways in which the shop and shopping center are transformed, as brick-and-mortar and online retailing are combined. There are two key spatial changes in the shop: a reduction of the required retail space and a conversion from retail space to non-retail space geared toward the touch-and-feel experience. Responding to these modifications of the shop space, shopping center development tends to mix shopping with living, working, and other activities at the human scale to foster a more urban experience of shopping. This finding is largely consistent with the works by Singleton et al. [

30] and Weltevreden [

68] while rejecting the scenario where online retailing embraces car-dependency [

69].

The trend towards the urban experience in shopping center development leads to different impacts on the main street, suburban mall, and power center. The main street can naturally produce the urban experience that people desire today so that main street development/reinvigoration may be bolstered, and the main street can enhance its urban experience by pedestrianizing the road. However, the two modern retail types generally lack the urban experience: the mall offers a manipulative walking experience, and the power center exhibits a car-based morphology; both of them are largely anti-urban. However, they can foster the urban experience by forming various synergies with the main street. The two genealogies of retail synergies in

Figure 7 indicate that the mall and power center as spatial types are not in a stage of deterioration, as they have been involved in a diverse range of morphological experiments. Additionally, these two retail genealogies show that the resilience of the retail system is hardly based on a static equilibrium. Rather, it is more geared toward a strong adaptive capacity—a continuous evolution.

I also examined the degree to which retail resilience is produced amid the rise of online retailing. With shops and shopping centers being converted into a variety of experiential spaces, the retail system shows great adaptive capacity for change. Some synergistic forms of shopping centers may generate a vibrant urban public life where the mall or power center is integrated with the main street at the pedestrian scale. However, the lifestyle center and the retail synergy containing it create the urban buzz/experience through a more nuanced and more powerful private control of the shopping space, thus endangering urbanity. To summarize, while the material shopping space shows adaptive resilience, it does not necessarily generate sustainable outcomes, raising opportunities for and challenges to retail resilience.

This paper mainly contributes to the theory of retail resilience with respect to two aspects. First, I investigated retail resilience in a multi-dimensional and multi-scalar setting. Here, I introduced the digital space of online retailing into the research of material shopping space, and I studied the spatial transformations/adaptations on two scales: the shop and shopping center. Second, I went beyond the stereotyped retail typology (as suggested by Kärrholm, et al. [

24]) and explored retail synergies that may be fostered between the main street, the suburban mall, and the power center—the emerging shopping morphologies.

For future research, there are two key areas of study. First, I showed that the suburban mall and the power center may adapt to the rise of online retailing by forming various synergies with the main street. However, the typology and morphology of retail synergies have received little attention prior to this study (see the works by Ann Forsyth [

81] and Michael Southworth [

82]). An in-depth typomorphology of retail synergies is required. What are the key types and forms of retail synergies? In what ways do they threaten or contribute to resilient growth and vigorous urban public life?

Second, other aspects of sustainable development should be considered in the research regarding the socio-spatial impacts of online retailing on the city. Here, I raise one important topic: housing affordability. I showed that developers are now more interested in mixed-use projects (which may increase the housing supply) while relying on the increased value of apartments or offices to make profits (which may stimulate a rise in rent levels). To what extent can this business model make housing more or less affordable?