How Taxes Relate to Potential Welfare Gain and Appreciable Economic Growth

Abstract

:1. Introduction

2. Literature Review

3. Data and Methodology

4. Results and Discussions

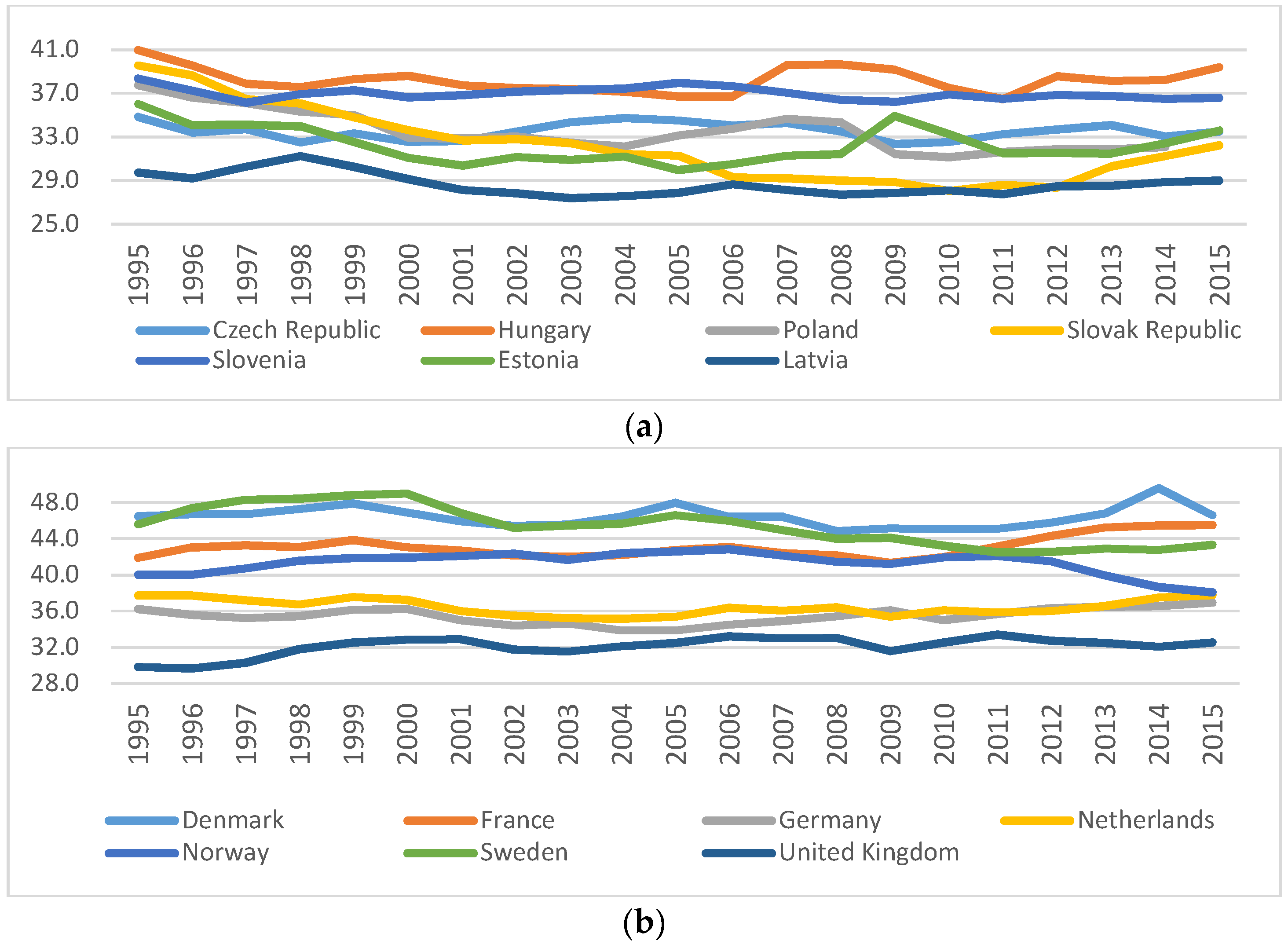

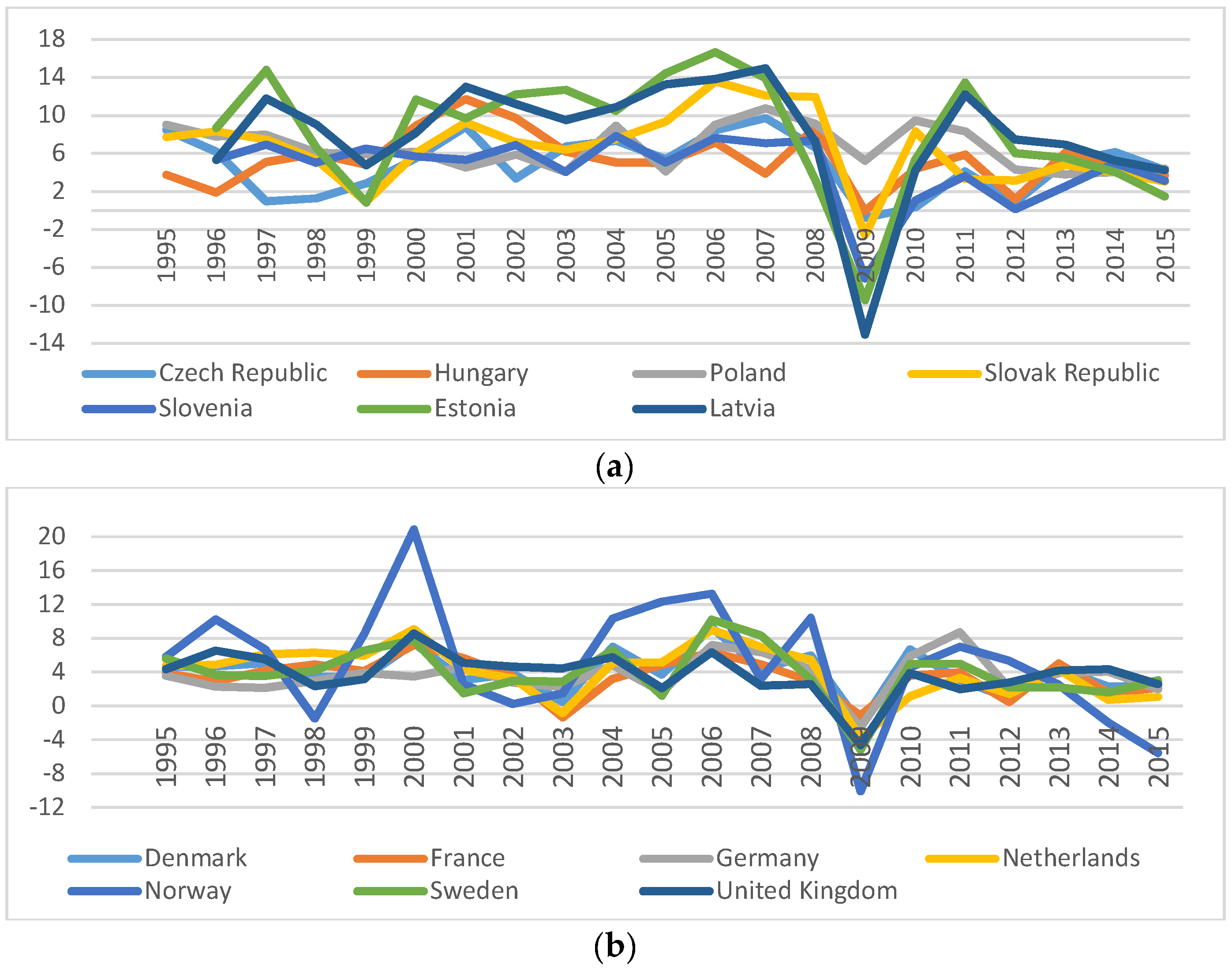

4.1. Descriptive Statistics

4.2. Granger Causality Statistics

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Lee, Y.; Gordon, R. Tax Structure and Economic Growth. J. Public Econ. 2005, 89, 1027–1043. [Google Scholar] [CrossRef]

- Angelopoulos, K.; Economides, G.; Kammas, P. Tax−Spending Policies and Economic Growth: Theoretical Predictions and Evidence from the OECD. Eur. J. Political Econ. 2007, 23, 885–902. [Google Scholar] [CrossRef]

- Padovano, F.; Galli, E. Tax Rates and Economic Growth in the OECD Countries (1950–1990). Econ. Inq. 2001, 39, 44–57. [Google Scholar] [CrossRef]

- Piketty, T.; Saez, E.; Stantcheva, S. Optimal Taxation of Top Labor Incomes: A Tale of Three Elasticities. Natl. Bur. Econ. Res. Working Paper 17616. 2011. Available online: http://www.nber.org/papers/w17616.pdf (accessed on 18 February 2019).

- Sonedda, D. The output effects of labor income taxes in OECD countries. Public Financ. Rev. 2009, 37, 686–709. [Google Scholar] [CrossRef]

- Tanzi, V.; Zee, H. Tax policy for emerging markets: Developing countries. Natl. Tax J. 2000, 53, 299–322. [Google Scholar] [CrossRef]

- Stiglitz, J. Pareto Efficient and Optimal Taxation and the New Welfare Economics. Natl. Bur. Econ. Res. Working Paper 2189. 1987. Available online: http://www.nber.org/papers/w2189.pdf (accessed on 18 February 2019).

- Li, W.; Sarte, P.D. Growth Effects of Progressive Taxes. Federal Reserve Bank of Philadelphia, 2003. Available online: https://ideas.repec.org/p/fip/fedpwp/03-15.html (accessed on 16 February 2019).

- Wojciechowska−Toruńska, I. Tax Progression vs Economic Growth & Development Index (GDI). Ann. Univ. Mariae Curie−Skłodowska, Sect. H 2017, 51, 331–338. [Google Scholar] [CrossRef]

- Angelopoulos, K.; Malley, J.; Philippopoulos, A. Tax structure, growth, and welfare in the UK. Oxf. Econ. Pap. 2012, 64, 237–258. [Google Scholar] [CrossRef]

- Booth, P.; Bourne, R.; Meakin, R.; Minford, L.; Minford, P.; Smith, D. Taxation, Government Spending and Economic Growth. The Institute of Economic Affairs, 2016. Available online: https://iea.org.uk/wp-content/uploads/2016/11/Tax-and-Growth-PDF.pdf (accessed on 16 February 2019).

- Angell, O.H. Challenges to Equality in the Welfare State: The Norwegian Case of Drammen. Int. Beliefs Values 2011, 3, 41–50. [Google Scholar]

- Thakur, S.; Michael, K.; Balazs, H.; Valerie, C. Sweden’s Welfare State. Can the Bumblebee Keep Flying? International Monetary Fund: Washington, DC, USA, 2003. [Google Scholar]

- Dumitrescu, E.I.; Hurlin, C. Testing for Granger non−causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Wu, T.; Fan, D.; Chang, T. The relationship between globalization and military expenditures in G7 countries: Evidence from a panel data analysis. Econ. Comput. Econ. Cybern. Stud. Res. 2016, 3, 285–392. [Google Scholar]

- Moldovan, N.C. The tax competition between theory and practice. Efforts and effects at the level of the European Union. Theor. Appl. Econ. 2009, 12, 77–83. [Google Scholar]

| Variable | CEE Countries | Developed Countries | ||||||

|---|---|---|---|---|---|---|---|---|

| Mean | Std. Dev. | Min | Max | Mean | Std. Dev. | Min | Max | |

| TotTax | 33.622 | 3.426 | 27.4 | 41 | 40.031 | 5.210 | 29.7 | 49.6 |

| TaxIPrCap | 7.556 | 1.194 | 5.3 | 10.9 | 15.129 | 6.501 | 6.8 | 32.2 |

| SSC | 12.403 | 1.973 | 7.9 | 16.4 | 10.141 | 5.212 | 0.1 | 18 |

| TaxProp | 0.733 | 0.373 | 0.2 | 1.7 | 1.966 | 1.057 | 0.8 | 4.1 |

| TaxGS | 12.555 | 1.737 | 9.9 | 17.2 | 11.83 | 1.878 | 9.2 | 16.3 |

| GDP | 6.273 | 4.316 | −13.087 | 16.668 | 3.981 | 3.571 | −10.079 | 20.856 |

| GNI | 3.548 | 3.763 | −12.406 | 12.380 | 1.511 | 2.177 | −7.330 | 6.655 |

| HDI | 0.809 | 0.045 | 0.674 | 0.89 | 0.889 | 0.029 | 0.825 | 0.949 |

| Variables Considered | CEE Countries | Developed Countries | ||||

|---|---|---|---|---|---|---|

| GDP | GNI | HDI | GDP | GNI | HDI | |

| TotTax | 3.21 (0.0731) | 2.19 (0.1385) | 0.35 (0.5517) | 5.58 ** (0.0181) | 1.36 (0.2444) | 0.16 (0.6883) |

| TaxIPrCap | 0.27 (0.6049) | 1.18 (0.2766) | 0.09 (0.7682) | 3.10 (0.0781) | 0.11 (0.7423) | 0.48 (0.4901) |

| SSC | 7.87 *** (0.005) | 0.06 (0.8044) | 2.65 (0.1036) | 3.13 (0.0767) | 2.82 (0.0933) | 0.01 (0.9043) |

| TaxProp | 2.26 (0.1326) | 0.70 (0.4031) | 0.44 (0.5062) | 1.61 (0.2049) | 0.91 (0.3396) | 1.19 (0.2759) |

| TaxGS | 0.06 (0.8104) | 0.23 (0.6326) | 5.89 *** (0.0152) | 6.67 *** (0.0098) | 0.05 (0.8219) | 0.06 (0.8008) |

| Lag 1 | TotTax→GDP | TaxIPrCap→GDP | SSC→GDP | TaxProp→GDP | TaxGS→GDP | |

| CEE | Wald stat. | 0.991 | 5.134 | 1.294 | 2.178 | 1.095 |

| Z-bar | −0.213 | 5.954 *** | 0.239 | 1.554 | −0.058 | |

| Dev | Wald stat. | 1.055 | 0.968 | 0.888 | 1.278 | 1.414 |

| Z-bar | −0.117 | −0.246 | −0.365 | 0.216 | 0.418 | |

| Lag 1 | GDP→TotTax | GDP→TaxIPrCap | GDP→SSC | GDP→TaxProp | GDP→TaxGS | |

| CEE | Wald stat. | 0.596 | 2.545 | 1.158 | 3.048 | 0.912 |

| Z-bar | −0.7998 | 2.101 ** | 0.037 | 2.849 *** | −0.329 | |

| Dev | Wald stat. | 1.841 | 0.885 | 0.49 | 2.167 | 47.338 |

| Z-bar | 1.054 | −0.369 | −0.957 | 1.538 | 11.093 *** | |

| Lag 1 | TotTax→GNI | TaxIPrCap→GNI | SSC→GNI | TaxProp→GNI | TaxGS→GNI | |

| CEE | Wald stat. | 0.719 | 2.393 | 2.264 | 1.624 | 0.582 |

| Z-bar | −0.617 | 1.874 * | 1.683 * | 0.73 | −0.819 | |

| Dev | Wald stat. | 1.371 | 1.166 | 0.416 | 2.788 | 1.349 |

| Z-bar | 0.353 | 0.048 | −1.067 | 2.463 *** | 0.321 | |

| Lag 1 | GNI→TotTax | GNI→TaxIPrCap | GNI→SSC | GNI→TaxProp | GNI→TaxGS | |

| CEE | Wald stat. | 0.904 | 3.592 | 0.912 | 3.888 | 1.735 |

| Z-bar | −0.342 | 3.658 *** | −0.329 | 4.099 *** | 0.896 | |

| Dev | Wald stat. | 1.281 | 0.675 | 0.659 | 1.415 | 2.168 |

| Z-bar | 0.22 | −0.683 | −0.706 | 0.419 | 1.539 | |

| Lag 1 | TotTax→HDI | TaxIPrCap→HDI | SSC→HDI | TaxProp→HDI | TaxGS→HDI | |

| CEE | Wald stat. | 2.116 | 1.263 | 3.241 | 1.547 | 0.889 |

| Z-bar | 1.463 | 0.192 | 3.136 *** | 0.615 | −0.363 | |

| Dev | Wald stat. | 1.438 | 2.089 | 1.303 | 0.479 | 1.872 |

| Z-bar | 0.453 | 1.422 | 0.253 | −0.973 | 1.099 | |

| Lag 1 | HDI→TotTax | HDI→TaxIPrCap | HDI→SSC | HDI→TaxProp | HDI→TaxGS | |

| CEE | Wald stat. | 2.326 | 1.542 | 1.709 | 0.809 | 1.347 |

| Z-bar | 1.775 * | 0.609 | 0.856 | −0.418 | 0.318 | |

| Dev | Wald stat. | 3.652 | 1.439 | 1.643 | 2.158 | 1.321 |

| Z-bar | 3.747 *** | 0.456 | 0.758 | 1.524 | 0.279 | |

| Lag 1 | TotTax→GDP | TaxIPrCap→GDP | SSC→GDP | TaxProp→GDP | TaxGS→GDP | |

| CEE | Wald stat. | 0.991 | 5.134 | 1.294 | 2.178 | 1.095 |

| Z-bar | −0.213 | 5.954 *** | 0.239 | 1.554 | −0.058 | |

| Dev | Wald stat. | 1.055 | 0.968 | 0.888 | 1.278 | 1.414 |

| Z-bar | −0.117 | −0.246 | −0.365 | 0.216 | 0.418 | |

| Lag 1 | GDP→TotTax | GDP→TaxIPrCap | GDP→SSC | GDP→TaxProp | GDP→TaxGS | |

| CEE | Wald stat. | 0.596 | 2.545 | 1.158 | 3.048 | 0.912 |

| Z-bar | −0.7998 | 2.101 ** | 0.037 | 2.849 *** | −0.329 | |

| Dev | Wald stat. | 1.841 | 0.885 | 0.49 | 2.167 | 47.338 |

| Z-bar | 1.054 | −0.369 | −0.957 | 1.538 | 11.093 *** | |

| Lag 1 | TotTax→GNI | TaxIPrCap→GNI | SSC→GNI | TaxProp→GNI | TaxGS→GNI | |

| CEE | Wald stat. | 0.719 | 2.393 | 2.264 | 1.624 | 0.582 |

| Z-bar | −0.617 | 1.874 * | 1.683 * | 0.73 | −0.819 | |

| Dev | Wald stat. | 1.371 | 1.166 | 0.416 | 2.788 | 1.349 |

| Z-bar | 0.353 | 0.048 | −1.067 | 2.463 *** | 0.321 | |

| Lag 1 | GNI→TotTax | GNI→TaxIPrCap | GNI→SSC | GNI→TaxProp | GNI→TaxGS | |

| CEE | Wald stat. | 0.904 | 3.592 | 0.912 | 3.888 | 1.735 |

| Z-bar | −0.342 | 3.658 *** | −0.329 | 4.099 *** | 0.896 | |

| Dev | Wald stat. | 1.281 | 0.675 | 0.659 | 1.415 | 2.168 |

| Z-bar | 0.22 | −0.683 | −0.706 | 0.419 | 1.539 | |

| Lag 1 | TotTax→HDI | TaxIPrCap→HDI | SSC→HDI | TaxProp→HDI | TaxGS→HDI | |

| CEE | Wald stat. | 2.116 | 1.263 | 3.241 | 1.547 | 0.889 |

| Z-bar | 1.463 | 0.192 | 3.136 *** | 0.615 | −0.363 | |

| Dev | Wald stat. | 1.438 | 2.089 | 1.303 | 0.479 | 1.872 |

| Z-bar | 0.453 | 1.422 | 0.253 | −0.973 | 1.099 | |

| Lag 1 | HDI→TotTax | HDI→TaxIPrCap | HDI→SSC | HDI→TaxProp | HDI→TaxGS | |

| CEE | Wald stat. | 2.326 | 1.542 | 1.709 | 0.809 | 1.347 |

| Z-bar | 1.775 * | 0.609 | 0.856 | −0.418 | 0.318 | |

| Dev | Wald stat. | 3.652 | 1.439 | 1.643 | 2.158 | 1.321 |

| Z−bar | 3.747 *** | 0.456 | 0.758 | 1.524 | 0.279 | |

| Lag 6 | TotTax→GDP | TaxIPrCap→GDP | SSC→GDP | TaxProp→GDP | TaxGS→GDP | |

| CEE | Wald stat. | 1220.34 | 23200 | 377.04 | 418.406 | 732.26 |

| Z-bar | 345.28 *** | 6595.45 *** | 105.03 *** | 116.81 *** | 206.23 *** | |

| Dev | Wald stat. | 43400 | 20.939 | 7731.77 | 80.899 | 47.338 |

| Z-bar | 12,400 *** | 3.572 *** | 2200.40 *** | 20.65 *** | 11.093 *** | |

| Lag 6 | GDP→TotTax | GDP→TaxIPrCap | GDP→SSC | GDP→TaxProp | GDP→TaxGS | |

| CEE | Wald stat. | 77.37 | 2376.11 | 48.71 | 4318.09 | 252.66 |

| Z-bar | 19.65 *** | 674.56 *** | 11.485 *** | 1227.84 *** | 69.58 *** | |

| Dev | Wald stat. | 90.958 | 916.22 | 3633.32 | 4094.31 | 204.696 |

| Z-bar | 23.52 *** | 258.64 *** | 1032.75 *** | 1164.08 *** | 55.93 *** | |

| Lag 6 | TotTax→GNI | TaxIPrCap→GNI | SSC→GNI | TaxProp→GNI | TaxGS→GNI | |

| CEE | Wald stat. | 2176.87 | 2636.83 | 91.289 | 118.204 | 198.91 |

| Z-bar | 617.8 *** | 748.84 *** | 23.62 *** | 31.28 *** | 54.277 *** | |

| Dev | Wald stat. | 142.21 | 244.705 | 221.21 | 127.41 | 42.203 |

| Z-bar | 38.13 *** | 67.324 *** | 60.63 *** | 33.906 *** | 9.63 *** | |

| Lag 6 | GNI→TotTax | GNI→TaxIPrCap | GNI→SSC | GNI→TaxProp | GNI→TaxGS | |

| CEE | Wald stat. | 18100 | 1420000 | 222.95 | 743.82 | 2202.82 |

| Z−bar | 5155.99 *** | 406,000 *** | 61.13 *** | 209.52 *** | 625.19 *** | |

| Dev | Wald stat. | 284.25 | 154000 | 147.97 | 113.35 | 122.16 |

| Z-bar | 78.59 *** | 43,700 *** | 39.76 *** | 29.902 *** | 32.41 *** | |

| Lag 6 | TotTax→HDI | TaxIPrCap→HDI | SSC→HDI | TaxProp→HDI | TaxGS→HDI | |

| CEE | Wald stat. | 2.116 | 1.265 | 575.59 | 1.547 | 0.889 |

| Z-bar | 1.463 | 0.192 | 161.59 *** | 0.615 | −0.363 | |

| Dev | Wald stat. | 1.438 | 2.089 | 1.303 | 0.479 | 1.872 |

| Z-bar | 0.453 | 1.422 | 0.253 | −0.973 | 1.099 | |

| Lag 6 | HDI→TotTax | HDI→TaxIPrCap | HDI→SSC | HDI→TaxProp | HDI→TaxGS | |

| CEE | Wald stat. | 1390.83 | 658.95 | 1559.92 | 165.86 | 2505.12 |

| Z-bar | 393.86 *** | 185.34 *** | 442.03 *** | 44.86 *** | 711.32 *** | |

| Dev | Wald stat. | 1116.07 | 2655.98 | 30400 | 540.07 | 1008.57 |

| Z-bar | 315.57 *** | 754.3 *** | 8644.57 *** | 151.47 *** | 284.95 *** | |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vatavu, S.; Lobont, O.-R.; Stefea, P.; Brindescu-Olariu, D. How Taxes Relate to Potential Welfare Gain and Appreciable Economic Growth. Sustainability 2019, 11, 4094. https://doi.org/10.3390/su11154094

Vatavu S, Lobont O-R, Stefea P, Brindescu-Olariu D. How Taxes Relate to Potential Welfare Gain and Appreciable Economic Growth. Sustainability. 2019; 11(15):4094. https://doi.org/10.3390/su11154094

Chicago/Turabian StyleVatavu, Sorana, Oana-Ramona Lobont, Petru Stefea, and Daniel Brindescu-Olariu. 2019. "How Taxes Relate to Potential Welfare Gain and Appreciable Economic Growth" Sustainability 11, no. 15: 4094. https://doi.org/10.3390/su11154094

APA StyleVatavu, S., Lobont, O.-R., Stefea, P., & Brindescu-Olariu, D. (2019). How Taxes Relate to Potential Welfare Gain and Appreciable Economic Growth. Sustainability, 11(15), 4094. https://doi.org/10.3390/su11154094