Strategies of Forestry Carbon Sink under Forest Insurance and Subsidies

Abstract

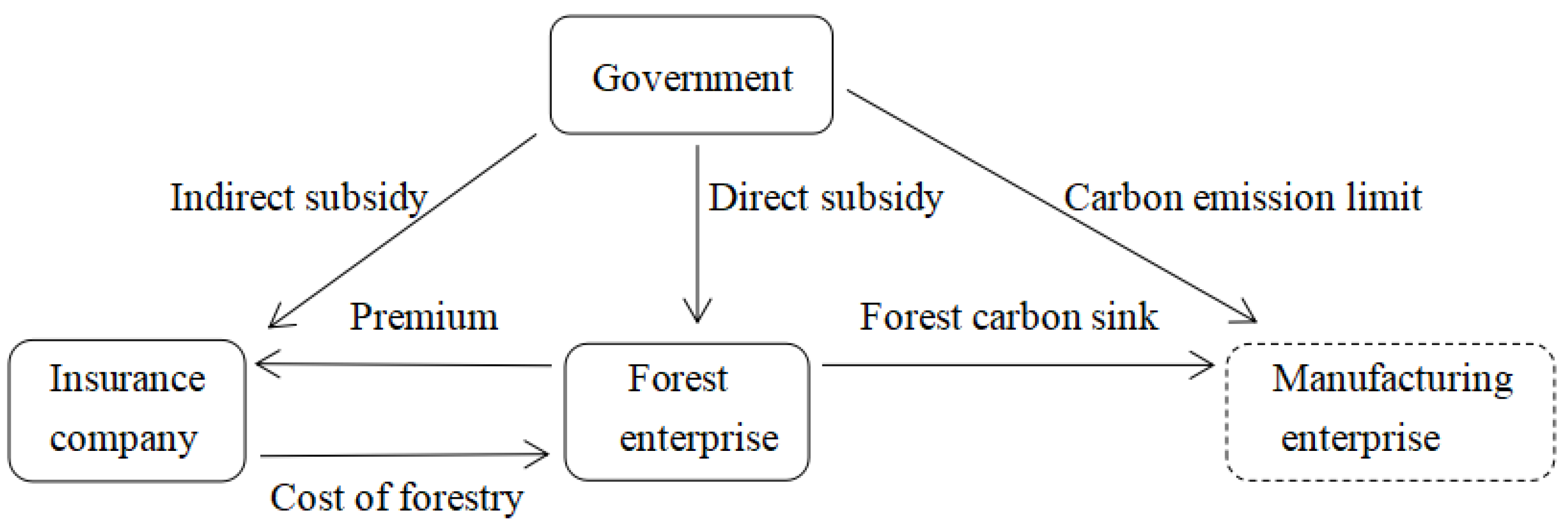

:1. Introduction

2. Assumptions and Parameter Settings

2.1. Parameter Setting

2.2. Basic Assumptions

- Both the scale of the carbon sink forest and the average carbon limit level affect the market price of the carbon sink: When the scale of the carbon sink forest expands, the forestry enterprise can provide more forestry carbon sinks, so the price of the forestry carbon sinks will drop. On the other hand, when the carbon limit policy of the government is looser, the market demand of the manufacturing enterprise will be smaller, the price will also drop [39]. Therefore, the carbon sink price iswhere represents the impact of the average carbon limit level on the price and represents the impact of the scale of the carbon sink forest on the price. In order to continue the study, we assume that is much larger than and .

- The operating costs of the insurance company are positively related to the scale of the carbon sink forest insured. We express it with the following formula:From the formula, we can see that the larger the scale of the carbon sink forest insured, the greater the costs of relevant surveys, loss assessment, equipment use, and professional employment.

2.3. Profit Function

3. Optimal Strategies of Insurance Parties

3.1. Optimal Strategy of Forest Enterprise

3.2. Optimal Strategy of Insurance Company

4. Discussions and Numerical Analysis

4.1. Impact of Insurance Subsidies

4.2. Impact of the Probability of Deforestation Occurrence

4.3. Impact of Carbon Limit Levels

4.4. Impact of Unit Management Cost of Insurance Company

4.5. Impact of Insurance Compensation Ratio

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

Appendix A.1. Proof of Proposition 1

Appendix A.2. Proof of Proposition 2

Appendix A.3. Proof of Proposition 3

Appendix A.4. Proof of Proposition 4

Appendix A.5. Proof of Proposition 5

Appendix A.6. Proof of Proposition 6

Appendix A.7. Proof of Proposition 7

References

- Zhou, T.; Shi, P.; Jia, G.; Dai, Y.; Zhao, X.; Shangguan, W.; Du, L.; Wu, H.; Luo, Y. Age-dependent forest carbon sink: Estimation via inverse modeling. J. Geophys. Res. Biogeosci. 2015, 120, 2473–2492. [Google Scholar] [CrossRef]

- Woodbury, P.B.; Smith, J.E.; Heath, L.S. Carbon sequestration in the US forest sector from 1990 to 2010. For. Ecol. Manag. 2007, 241, 14–27. [Google Scholar] [CrossRef]

- Lin, B.Q.; Ge, J.M. Valued forest carbon sinks: How much emissions abatement costs could be reduced in China. J. Clean. Prod. 2019, 224, 455–464. [Google Scholar] [CrossRef]

- She, W.; Wu, Y.; Huang, H.; Chen, Z.; Cui, G.; Zheng, H.; Guan, C.; Chen, F. Integrative analysis of carbon structure and carbon sink function for major crop production in China’s typical agriculture regions. J. Clean. Prod. 2017, 162, 702–708. [Google Scholar] [CrossRef]

- Birdsey, R.A. Carbon Accounting Rules and Guidelines for the United States Forest Sector. J. Environ. Qual. 2006, 35, 1518–1524. [Google Scholar] [CrossRef] [PubMed]

- Gren, I.M.; Aklilu, A.Z.; Zeleke, A.A. Policy design for forest carbon sequestration: A review of the literature. For. Policy Econ. 2016, 70, 128–136. [Google Scholar] [CrossRef] [Green Version]

- Valade, A.; Bellassen, V.; Magand, C.; Luyssaert, S. Sustaining the sequestration efficiency of the European forest sector. For. Ecol. Manag. 2017, 405, 44–55. [Google Scholar] [CrossRef]

- Li, P.; Zhu, J.; Hu, H.; Guo, Z.; Pan, Y.; Birdsey, R.; Fang, J. The relative contributions of forest growth and areal expansion to forest biomass carbon. Biogeosciences 2016, 13, 375–388. [Google Scholar] [CrossRef] [Green Version]

- Noormets, A.; Epron, D.; Domec, J.; McNulty, S.; Fox, T.; Sun, G.; King, J. Effects of forest management on productivity and carbon sequestration: A review and hypothesis. For. Ecol. Manag. 2015, 355, 124–140. [Google Scholar] [CrossRef] [Green Version]

- Daniels, T.L. Integrating Forest Carbon Sequestration into a Cap-and-Trade Program to Reduce Net CO2 Emissions. J. Am. Plan. Assoc. 2010, 76, 463–475. [Google Scholar] [CrossRef]

- Sun, M.J.; Peng, H.J.; Cong, J. A review of carbon finance and forestry carbon sink project financing. Issues For. Econ. 2018, 38, 90–98. [Google Scholar]

- Boscolo, M.; Van Dijk, K.; Savenije, H. Financing Sustainable Small-Scale Forestry: Lessons from Developing National Forest Financing Strategies in Latin America. Forest 2010, 1, 230–249. [Google Scholar] [CrossRef]

- Shu, S.M.; Zhu, W.Z.; Wang, W.Z.; Jia, M.; Zhang, Y.Y.; Sheng, Z.L. Effects of tree size heterogeneity on carbon sink in old forests. For. Ecol. Manag. 2019, 432, 637–648. [Google Scholar] [CrossRef]

- Jiang, L.H.; Zhao, W.; Lewis, B.J.; Wei, Y.W.; Dai, L.M. Effects of management regimes on carbon sequestration under the Natural Forest Protection Program in northeast China. J. For. Res. 2018, 29, 1187–1194. [Google Scholar] [CrossRef]

- Gao, S.; Zhou, T.; Zhao, X.; Wu, D.; Li, Z.; Wu, H.; Du, L.; Luo, H. Age and climate contribution to observed forest carbon sinks in East Asia. Environ. Res. Lett. 2016, 11, 034021. [Google Scholar] [CrossRef]

- Lin, B.Q.; Ge, J.M. Carbon sinks and output of China’s forestry sector: An ecological economic development perspective. Sci Total Environ. 2019, 655, 1169–1180. [Google Scholar] [CrossRef]

- Zhang, C.; Ju, W.; Chen, J.M.; Wang, X.; Yang, L.; Zheng, G. Disturbance-induced reduction of biomass carbon sinks of China’s forests in recent years. Environ. Res. Lett. 2015, 10, 114021. [Google Scholar] [CrossRef]

- Magnússon, R.Í.; Tietema, A.; Cornelissen, J.H.; Hefting, M.M.; Kalbitz, K. Tamm Review: Sequestration of carbon from coarse woody debris in forest soils. For. Ecol. Manag. 2016, 377, 1–15. [Google Scholar] [CrossRef]

- Xu, B.; Pan, Y.; Plante, A.F.; Johnson, A.; Cole, J.; Birdsey, R. Decadal change of forest biomass carbon stocks and tree demography in the Delaware River Basin. For. Ecol. Manag. 2016, 374, 1–10. [Google Scholar] [CrossRef]

- Yang, H.Q.; Li, X. Potential variation in opportunity cost estimates for REDD plus and its causes. For. Policy. Econ. 2018, 95, 138–146. [Google Scholar] [CrossRef]

- Subak, S. Replacing carbon lost from forests: An assessment of insurance, reserves, and expiring credits. Clim. Policy 2003, 3, 107–122. [Google Scholar] [CrossRef]

- Luyssaert, S.; Schulze, E.D.; Börner, A.; Knohl, A.; Hessenmöller, D.; Law, B.E.; Ciais, P.; Grace, J. Old-growth forests as global carbon sinks. Nature 2008, 455, 213–215. [Google Scholar] [CrossRef]

- Phelan, L.; Henderson-Sellers, A.; Taplin, R. Climate change, carbon prices and insurance systems. Int. J. Sustain. Dev. World Ecol. 2010, 17, 95–108. [Google Scholar] [CrossRef]

- Couture, S.; Reynaud, A. Forest management under fire risk when forest carbon sequestration has value. Ecol. Econ. 2011, 70, 2002–2011. [Google Scholar] [CrossRef] [Green Version]

- Cairns, R.D.; Lasserre, P. Reinforcing economic incentives for carbon credits for forests. For. Policy Econ. 2004, 6, 321–328. [Google Scholar] [CrossRef] [Green Version]

- Qin, T.; Deng, J.; Pan, H.; Gu, X. The effect of coverage level and premium subsidy on farmers’ participation in forest insurance: An empirical analysis of forest owners in Hunan Province of China. J. Sustain. For. 2016, 35, 191–204. [Google Scholar] [CrossRef]

- Qin, T.; Gu, X.; Tian, Z.; Pan, H.; Deng, J.; Wan, L. An empirical analysis of the factors influencing farmer demand for forest insurance: Based on surveys from Lin’an County in Zhejiang Province of China. J. For. Econ. 2016, 24, 37–51. [Google Scholar] [CrossRef]

- Peng, H.J.; Pang, T. Optimal strategies for a three-level contract-farming supply chain with subsidy. Int. J. Prod. Econ. 2019, 216, 274–286. [Google Scholar] [CrossRef]

- Pinheiro, A.; Ribeiro, N. Forest property insurance: An application to Portuguese wood lands. Int. J. Sustain. Soc. 2013, 5, 284–295. [Google Scholar] [CrossRef]

- Liesivaara, P.; Myyrä, S. The demand for public–private crop insurance and government disaster relief. J. Policy Model. 2017, 39, 19–34. [Google Scholar] [CrossRef]

- Luo, L.; Wang, Y.; Qin, L. Incentives for promoting agricultural clean production technologies in China. J. Clean. Prod. 2014, 74, 54–61. [Google Scholar] [CrossRef]

- Qin, T.; Gu, X.S.; Li, J.Y.; Deng, J. Literature Review and Research Prospects in Forest Insurance Subsidies Policy. J. Agro. For. Econ. Manag. 2017, 16, 310–315. [Google Scholar]

- Zheng, B.; Gao, L. Evaluation of efficiency of forest insurance premium subsidies—Based on se-dea model and malmquist index. Res. Dev. Market. 2019, 35, 7–12. [Google Scholar]

- Wang, C.; Nie, P.Y.; Peng, D.H.; Li, Z.H. Green insurance subsidy for promoting clean production innovation. J. Clean. Prod. 2017, 148, 111–117. [Google Scholar] [CrossRef]

- Sauter, P.A.; Möllmann, T.B.; Anastassiadis, F.; Mußhoff, O.; Möhring, B. To insure or not to insure? Analysis of foresters’ willingness-to-pay for fire and storm insurance. For. Policy Econ. 2016, 73, 78–89. [Google Scholar] [CrossRef]

- Ma, N.; Zuo, Y.; Liu, K.; Qi, Y. Forest insurance market participants’ game behavior in China: An analysis based on tripartite dynamic game model. J. Ind. Eng. Manag. 2015, 8, 1533–1546. [Google Scholar] [CrossRef]

- Niu, B.Z.; Jin, D.L.; Pu, X.J. Coordination of channel members’ efforts and utilities in contract farming operations. Eur. J. Oper. Res. 2016, 255, 869–883. [Google Scholar] [CrossRef]

- Ye, F.; Huang, J.H.; Lin, Q. The optimal production strategies of the farmer in contract-farming supply chain under capital constraint. Syst. Eng. Theory Pract. 2017, 37, 1467–1478. [Google Scholar]

- Sun, M.; Peng, H.J.; Wang, S. Cost-Sharing Mechanisms for a Wood Forest Product Supply Chain under Carbon Cap-and-Trade. Sustainability 2018, 10, 4345. [Google Scholar] [CrossRef]

- Peng, H.J.; Pang, T.; Cong, J. Coordination contracts for a supply chain with yield uncertainty and low-carbon preference. J. Clean. Prod. 2018, 205, 291–302. [Google Scholar] [CrossRef]

| Notations | Meaning |

|---|---|

| The marginal contribution rate of carbon limit to the market price of carbon sink | |

| The influence coefficient of the carbon sink forest’s scale on the market price of carbon sink | |

| The initial market price of forestry carbon sink | |

| The cost of producing unit product, including necessary means of production, etc. | |

| The cost coefficient of carbon sink forest of the forestry enterprise | |

| The unit operating cost of the insurance company | |

| The average carbon limit level, indicating the stringency of carbon constraint policy | |

| The probability of disaster occurrence | |

| The scale of carbon sink forest | |

| The unit insurance premium of carbon sink forest | |

| The carbon sequestration rate of unit carbon sink forest | |

| The proportion coefficient of insurance company’s compensation for operating cost of carbon sink forest when deforestation disaster occurs | |

| The subsidy rate for forestry enterprise’s insurance premium | |

| The subsidy rate for insurance company | |

| The expected profit of forestry enterprise | |

| The expected profit of insurance company |

| Parameter | |||||||||||

| Value | 0.01 | 0.005 | 60 | 25 | 15 | 500 | 0.2 | 0.9 | 0.8 | 0.5 | 0.5 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Song, Y.; Peng, H. Strategies of Forestry Carbon Sink under Forest Insurance and Subsidies. Sustainability 2019, 11, 4607. https://doi.org/10.3390/su11174607

Song Y, Peng H. Strategies of Forestry Carbon Sink under Forest Insurance and Subsidies. Sustainability. 2019; 11(17):4607. https://doi.org/10.3390/su11174607

Chicago/Turabian StyleSong, Ye, and Hongjun Peng. 2019. "Strategies of Forestry Carbon Sink under Forest Insurance and Subsidies" Sustainability 11, no. 17: 4607. https://doi.org/10.3390/su11174607