The Effect of Brand Experience on Customers’ Engagement Behavior within the Context of Online Brand Communities: The Impact on Intention to Forward Online Company-Generated Content

Abstract

:1. Introduction

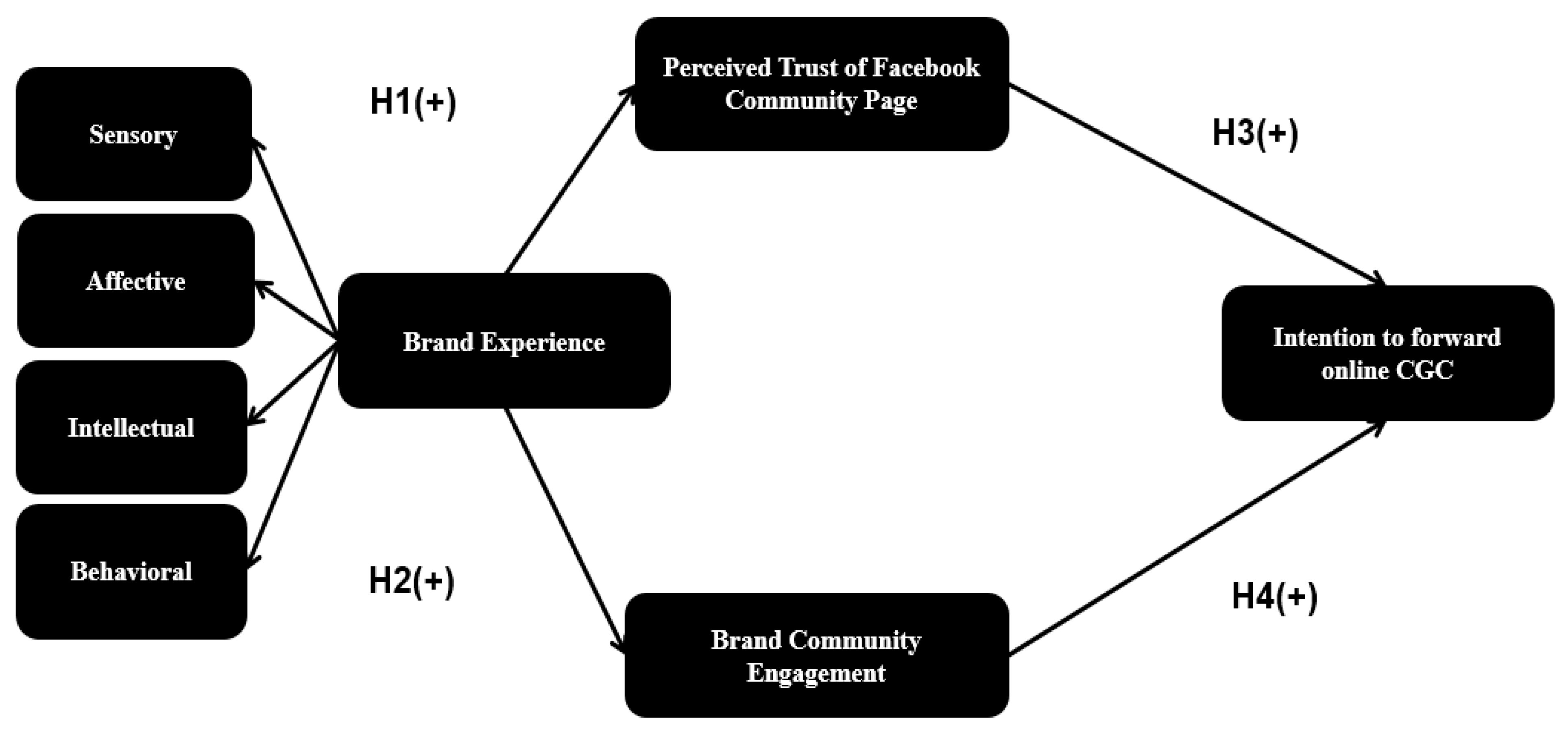

2. Literature Review

2.1. Subject of the Study: the Islamic Banking and Finance Systems

2.2. Brand Experience

2.3. Customer Engagement within the Social Media Setting

2.4. Consumer Intention

2.5. Mediating Factors

2.5.1. Perceived Trust of Brand Community Pages

2.5.2. Online Brand Community Engagement

3. Materials and Methods

3.1. Data Collection and Sample Design

3.2. Measurements

4. Data Analysis and Results

4.1. Reliability and Validity

4.2. Structural Equation Model

4.3. Hypothesis Testing

5. Discussion and Conclusions

5.1. Practical Implications

5.2. Limitations and Avenues for Future Research

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Naeem, M. Role of social networking platforms as tool for enhancing the service quality and purchase intention of customers in Islamic country. J. Islamic Mark. 2019. [Google Scholar] [CrossRef]

- Aslam, U.; Muqadas, F.; Imran, M.K. Exploring the sources and role of knowledge sharing to overcome the challenges of organizational change implementation. Int. J. Organ. Anal. 2018, 26, 567–581. [Google Scholar] [CrossRef]

- Aslam, U.; Muqadas, F.; Imran, M.K.; Saboor, A. Emerging organizational parameters and their roles in implementation of organizational change. J. Organ. Chang. Manag. 2018, 31, 1084–1104. [Google Scholar] [CrossRef]

- Kim, J.; Ko, E. Do social media marketing activities enhance customer equity? An empirical study of luxury fashion brand. J. Bus. Res. 2012, 65, 1480–1486. [Google Scholar] [CrossRef]

- Akar, E.; Topçu, B. An examination of the factors influencing consumers’ attitudes toward social media marketing. J. Internet Commer. 2011, 10, 35–67. [Google Scholar] [CrossRef]

- Scott, D.M. The New Rules of Marketing and PR: How to Use Social Media, Online Video, Mobile Applications, Blogs, News Releases, and Viral Marketing to Reach Buyers Directly; John Wiley and Sons: Noboken, NY, USA, 2015. [Google Scholar]

- Valos, M.J.; Habibi, F.H.; Casidy, R.; Driesener, C.B.; Maplestone, V.L. Exploring the integration of social media within integrated marketing communication frameworks: Perspectives of services marketers. Mark. Intell. Plan. 2016, 34, 19–40. [Google Scholar] [CrossRef]

- Garg, R.; Rahman, Z.; Qureshi, M.N. Measuring customer experience in banks: Scale development and validation. J. Model. Manag. 2014, 9, 87–117. [Google Scholar] [CrossRef]

- Meyer, C.; Schwager, A. Understanding customer experience. Harv. Bus. Rev. 2007, 85, 116. [Google Scholar] [PubMed]

- Zeithmal, V.A.; Bitner, M.J.; Gremler, D.D.; Pandit, A. Service Marketing, 5th ed.; Tata Mc Graw Hill Education Pvt Ltd.: New Delhi, India, 2011. [Google Scholar]

- Gentile, C.; Spiller, N.; Noci, G. How to sustain the customer experience: An overview of experience components that co-create value with the customer. Eur. Manag. J. 2007, 25, 395–410. [Google Scholar] [CrossRef]

- Al-Salem, F. The size and scope of the Islamic finance industry: An analysis. Int. J. Manag. 2008, 25, 124. [Google Scholar]

- Khan, M.S.; Mirakhor, A. Islamic Banking: Experiences in the Islamic Republic of Iran and Pakistan; IMF Working Paper No. WP/89/12; International Monetary Fund: Washington, DC, USA, 1989. [Google Scholar]

- Iqbal, Z. Islamic financial systems. Financ. Dev. 1997, 43, 42–45. [Google Scholar]

- Kpodar, K.; Imam, P.A. Islamic Banking: How Has It Diffused; IMF: Washington, DC, USA, 2010; pp. 1–29. [Google Scholar]

- Husain, I. Islamic finance: Growth and poverty alleviation. In Proceedings of the 3rd Annual International Conference on Islamic Banking, Karachi, Pakistan, 11 September 2007. [Google Scholar]

- Kwak, H.; Lee, C.; Park, H.; Moon, S. What is Twitter, a social network or a news media. In Proceedings of the 19th international conference on World Wide Web, New York, NY, USA, 26–30 April 2010. [Google Scholar]

- Holbrook, M.B.; Hirschman, E.C. The experiential aspects of consumption: Consumer fantasies, feelings, and fun. J. Consum. Res. 1982, 9, 132–140. [Google Scholar] [CrossRef]

- Ambler, T.; Bhattacharya, C.B.; Edell, J.; Keller, K.L.; Lemon, K.N.; Mittal, V. Relating brand and customer perspectives on marketing management. J. Serv. Res. 2002, 5, 13–25. [Google Scholar] [CrossRef]

- Brakus, J.J.; Schmitt, B.H.; Zarantonello, L. Brand experience: What is it? How is it measured? Does it affect loyalty? J. Mark. 2009, 73, 52–68. [Google Scholar] [CrossRef]

- Nysveen, H.; Pedersen, P.E.; Skard, S. Brand experiences in service organizations: Exploring the individual effects of brand experience dimensions. J. Brand Manag. 2013, 20, 404–423. [Google Scholar] [CrossRef]

- Chase, R.B.; Dasu, S. Experience psychology—A proposed new subfield of service management. J. Serv. Manag. 2014, 25, 574–577. [Google Scholar] [CrossRef]

- Same, S. Experience marketing in country branding: Theoretical developments and an Estonian case study. Res. Econ. Bus. Cent. East. Eur. 2014, 6, 65–88. [Google Scholar]

- Schmitt, B. The concept of brand experience. J. Brand Manag. 2009, 16, 417–419. [Google Scholar] [CrossRef] [Green Version]

- Cheng, E.; Khan, N. Game of Trust: Brand-Generated Content vs Consumer-Generated Advertising: A Qualitative Study of Arla Foods; Uppsala University: Uppsala, Sweden, 2017. [Google Scholar]

- Ha, H.Y.; Perks, H. Effects of consumer perceptions of brand experience on the web: Brand familiarity, satisfaction and brand trust: An International Research Review. J. Consum. Behav. 2005, 4, 438–452. [Google Scholar] [CrossRef]

- Lee, S.A.; Jeong, M. Enhancing online brand experiences: An application of congruity theory. Int. J. Hosp. Manag. 2014, 40, 49–58. [Google Scholar] [CrossRef]

- Vivek, S.D.; Beatty, S.E.; Morgan, R.M. Customer engagement: Exploring customer relationships beyond purchase. J. Mark. Theory Pract. 2012, 20, 122–146. [Google Scholar] [CrossRef]

- Helm, C. From tech-led to brand-led—Has the internet portal business grown up? J. Brand Manag. 2007, 14, 368–379. [Google Scholar] [CrossRef]

- Garg, R.; Rahman, Z.; Qureshi, M.N.; Kumar, L. Identifying and ranking critical success factors of customer experience in banks: An analytic hierarchy process (AHP) approach. J. Model. Manag. 2012, 7, 201–220. [Google Scholar] [CrossRef]

- Chahal, H.; Dutta, K. Measurement and impact of customer experience in banking sector. Decision 2015, 42, 57–70. [Google Scholar] [CrossRef]

- Phan, K.N.; Ghantous, N. Managing brand associations to drive customers’ trust and loyalty in Vietnamese banking. Int. J. Bank Mark. 2013, 31, 456–480. [Google Scholar] [CrossRef]

- Khan, I.; Rahman, Z.; Fatma, M. The concept of online corporate brand experience: An empirical assessment. Mark. Intell. Plan. 2016, 34, 711–730. [Google Scholar] [CrossRef]

- Hamzah, Z.L.; Alwi, S.F.S.; Othman, M.N. Designing corporate brand experience in an online context: A qualitative insight. J. Bus. Res. 2014, 67, 2299–2310. [Google Scholar] [CrossRef]

- Malthouse, C.; Haenlein, M.; Skiera, B.; Wege, E. Managing customer relationships in the social media era: Introducing the social CRM house. J. Interact. Mark. 2013, 274, 270–280. [Google Scholar] [CrossRef]

- Bijmolt, T.H.; Leeflang, P.S.; Block, F.; Eisenbeiss, M.; Hardie, B.G.; Lemmens, A.; Saffert, P. Analytics for customer engagement. J. Serv. Res. 2010, 13, 341–356. [Google Scholar] [CrossRef]

- Brodie, R.J.; Hollebeek, L.D.; Juric, B.; Ilic, A. Customer engagement: Conceptual domain, fundamental propositions, and implications for research. J. Serv. Res. 2011, 14, 252–271. [Google Scholar] [CrossRef]

- Brodie, R.J.; Ilic, A.; Juric, B.; Hollebeek, L. Consumer engagement in a virtual brand community: An exploratory analysis. J. Bus. Res. 2013, 66, 105–114. [Google Scholar] [CrossRef]

- Hollebeek, L. Exploring customer brand engagement: Definition and themes. J. Strateg. Mark. 2011, 19, 555–573. [Google Scholar] [CrossRef]

- Hollebeek, L. Demystifying customer brand engagement: Exploring the loyalty nexus. J. Mark. Manag. 2011, 27, 785–807. [Google Scholar] [CrossRef]

- Hollebeek, L.; Glynn, M.; Brodie, R. Consumer brand engagement in social media: Conceptualization, scale development and validation. J. Interact. Mark. 2014, 28, 49–165. [Google Scholar] [CrossRef]

- Van Doorn, J.; Lemon, K.; Mittal, V.; Nass, S.; Pick, D.; Pirner, P.; Verhoef, P. Customer engagement behavior: Theoretical foundations and research directions. J. Serv. Res. 2010, 13, 253–266. [Google Scholar] [CrossRef]

- Dolan, R.; Conduit, J.; Fahy, J.; Goodman, S. Social media engagement behaviour: A uses and gratifications perspective. J. Strateg. Mark. 2016, 24, 261–277. [Google Scholar] [CrossRef]

- Algesheimer, R.; Dholakia, U.M.; Herrmann, A. The social influence of brand community: Evidence from European car clubs. J. Mark. 2005, 69, 19–34. [Google Scholar] [CrossRef]

- McAlexander, J.H.; Schouten, J.W.; Koenig, H.F. Building brand community. J. Mark. 2002, 66, 38–54. [Google Scholar] [CrossRef]

- Sprott, D.; Czellar, S.; Spangenberg, E. The importance of a general measure of brand engagement on market behavior: Development and validation of a scale. J. Mark. Res. 2009, 46, 92–104. [Google Scholar] [CrossRef]

- Chang, A.; Hsieh, S.H.; Tseng, T.H. Online brand community response to negative brand events: The role of group eWOM. Internet Res. 2013, 23, 486–506. [Google Scholar] [CrossRef]

- Calder, J.; Malthouse, E.C.; Schaedel, U. An experimental study of the relationship between online engagement and advertising effectiveness. J. Interact. Mark. 2009, 23, 321–331. [Google Scholar] [CrossRef]

- Baldus, J.; Voorhees, C.; Calantone, R. Online brand community engagement: Scale development and validation. J. Bus. Res. 2015, 68, 978–985. [Google Scholar] [CrossRef]

- Wang, Y.; Yu, Q.; Fesenmaier, D.R. Defining the virtual tourist community: Implications for tourism marketing. Tour. Manag. 2002, 23, 407–417. [Google Scholar] [CrossRef]

- Madupu, V. Online Brand Community Participation: Antecedents and Consequences; The University of Memphis: Memphis, TN, USA, 2006. [Google Scholar]

- Wang, Y.; Fesenmaier, D.R. Modeling participation in an online travel community. J. Travel Res. 2004, 42, 261–270. [Google Scholar] [CrossRef]

- Dholakia, U.M.; Bagozzi, R.P.; Pearo, L.K. A social influence model of consumer participation in network- and small-group-based virtual communities. Int. J. Res. Mark. 2004, 21, 241–263. [Google Scholar] [CrossRef]

- Gong, T. Customer brand engagement behavior in online brand communities. J. Serv. Mark. 2018, 23, 286–299. [Google Scholar] [CrossRef]

- Cvijikj, P.; Michahelles, F. Online engagement factors on Facebook brand pages. Soc. Netw. Anal. Min. 2013, 3, 843–861. [Google Scholar] [CrossRef]

- Nambisan, S.; Baron, R.A. Interactions in virtual customer environments: Implications for product support and customer relationship management. J. Interact. Mark. 2007, 21, 42–62. [Google Scholar] [CrossRef]

- Tsai, H.T.; Huang, H.C.; Chiu, Y.L. Brand community participation in Taiwan: Examining the roles of individual-, group-, and relationship-level antecedents. J. Bus. Res. 2012, 65, 676–684. [Google Scholar] [CrossRef]

- Eisenbeiss, M.; Blechschmidt, B.; Backhaus, K.; Freund, P.A. The (real) world is not enough: Motivational drivers and user behavior in virtual worlds. J. Interact. Mark. 2012, 26, 4–20. [Google Scholar] [CrossRef]

- Bowden, J.L.H. The process of customer engagement: A conceptual framework. J. Mark. Theory Pract. 2009, 17, 63–74. [Google Scholar] [CrossRef]

- De Vries, N.J.; Carlson, J. Examining the drivers and brand performance implications of customer engagement with brands in the social media environment. J. Brand Manag. 2014, 21, 495–515. [Google Scholar] [CrossRef]

- Gambetti, R.; Graffigna, G. The concept of engagement: A systematic analysis of the ongoing marketing debate. Int. J. Mark. Res. 2010, 52, 801–826. [Google Scholar] [CrossRef]

- American Bankers Association. The State of Social Media in Banking; American Bankers Association: Washington, DC, USA, 2017. [Google Scholar]

- Macknight, J. Banks-Say-Social-Media-is-Important-But-How-Many. 2017. Available online: https://www.thebanker.com/.../Banks-say-social-media-is-important-but-how-many- (accessed on 15 May 2018).

- Ray, A. Four Studies on the Adoption of Social Media by Financial Advisors and Investors. 2013. Available online: https://www.socialmediatoday.com/.../four-studies-adoption-social-media-financial-ad (accessed on 22 May 2018).

- Watts, D.J.; Peretti, J.; Frumin, M. Viral Marketing for the Real World; Harvard Business School Publishing: Brighton, MA, USA, 2007. [Google Scholar]

- Weman, E. Consumer Motivations to Join a Brand Community on Facebook; Hanken School of Economics: Helsinki, Finland, 2011. [Google Scholar]

- Taylor, D.G.; Strutton, D.; Thompson, K. Self-enhancement as a mmotivation for sharing online advertising. J. Interact. Advert. 2012, 12, 213–228. [Google Scholar] [CrossRef]

- TRW Consultant, Why Your Social Media is Not Working, Nairland Forum. 2016. Available online: www.nairaland.com/2862827/why-social-media-not-working (accessed on 17 June 2018).

- Tang, J.; Liu, H. Trust in Social Media; Morgan & Claypool Publishers: San Rafael, CA, USA, 2015. [Google Scholar]

- Akkucuk, U.; Turan, C. Mobile use and online preferences of the millenials: A study in Yalova. J. Internet Bank. Commer. 2016, 21, 1–11. [Google Scholar]

- Kivetz, R.; Simonson, I. The effects of incomplete information on consumer choice. J. Mark. Res. 2000, 37, 427–448. [Google Scholar] [CrossRef]

- Choi, B.; Lee, I. Trust in open versus closed social media: The relative influence of user- and marketer-generated content in social network services on customer trust. Telemat. Inform. 2017, 34, 550–559. [Google Scholar] [CrossRef]

- Goh, K.-Y.; Heng, C.-S.; Lin, Z. Social media brand community and consumer behavior: Quantifying the relative impact of user- and marketer-generated content. Inf. Syst. Res. 2013, 24, 88–107. [Google Scholar] [CrossRef]

- Muniz, M.; O’guinn, T.C. Brand community. J. Consum. Res. 2001, 27, 412–432. [Google Scholar] [CrossRef]

- Trusov, M.; Bucklin, R.E.; Pauwels, K. Effects of word-of-mouth versus traditional marketing: Findings from an internet social networking site. J. Mark. 2009, 73, 90–102. [Google Scholar] [CrossRef]

- Habibi, M.R.; Laroche, M.; Richard, M.O. Brand communities based in social media: How unique are they? Evidence from two exemplary brand communities. Int. J. Inf. Manag. 2014, 34, 123–132. [Google Scholar] [CrossRef]

- Blazevic, V.; Wiertz, C.; Cotte, J.; de Ruyter, K.; Keeling, D.I. GOSIP in cyberspace: Conceptualization and scale development for general online social interaction propensity. J. Interact. Mark. 2014, 28, 87–100. [Google Scholar] [CrossRef]

- Shao, W.; Jones, R.G.; Grace, D. Brandscapes: Contrasting corporate-generated versus consumer-generated media in the creation of brand meaning. Mark. Intell. Plan. 2015, 33, 414–443. [Google Scholar] [CrossRef]

- Phang, C.W.; Zhang, C.; Sutanto, J. The influence of user interaction and participation in social media on the consumption intention of niche products. Inf. Manag. 2013, 50, 661–672. [Google Scholar] [CrossRef]

- Hajli, M.; Hajli, M. Organisational development in sport: Co-creation of value through social capital. Ind. Commer. Train. 2013, 45, 283–288. [Google Scholar] [CrossRef]

- Morgan, R.M.; Hunt, S.D. The commitment-trust theory of relationship marketing. J. Mark. 1994, 58, 20–38. [Google Scholar] [CrossRef]

- Kim, M.; Chung, N.; Lee, C. The effect of perceived trust on electronic commerce: Shopping online for tourism products and services in South Korea. Tour. Manag. 2011, 32, 256–265. [Google Scholar] [CrossRef]

- Davis, D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Nunnally, J.C. Psychometric Theory, 2nd ed.; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Hair, J.; Anderson, R.; Tatham, R.; William, C. Multivariate Data Analysis with Readings; Prentice-Hall, Inc.: Upper Saddle River, NJ, USA, 1995. [Google Scholar]

- West, S.G.; Finch, J.F.; Curran, P.J. Structural Equation Models with Nonnormal Variables: Problems and Remedies; Sage publications Inc.: Thousand Oaks, CA, USA, 1995. [Google Scholar]

- Sobel, M.E. Asymptotic confidence intervals for indirect effects in structural equation models. Sociol. Methodol. 1982, 13, 290–312. [Google Scholar] [CrossRef]

- Preacher, K.J.; Hayes, A.F. Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 2008, 40, 879–891. [Google Scholar] [CrossRef]

- Khan, M.N.; Aabdean, Z.; Salman, M.; Nadeem, B. The impact of product and service quality on brand loyalty: Evidence from quick service restaurants. Am. J. Mark. Res. 2016, 2, 84–94. [Google Scholar]

- Sekhon, H.; Yap, K.B.; Wong, D.H.; Loh, C.; Bak, R. Offline and online banking—Where to draw the line when building trust in e-banking? Int. J. Bank Mark. 2010, 28, 27–46. [Google Scholar]

| Item | Frequency | Percentage (%) |

|---|---|---|

| Gender | ||

| Male | 248 | 64.1 |

| Female | 139 | 35.9 |

| Marital Status | ||

| Married | 258 | 66.7 |

| Unmarried | 129 | 33.3 |

| Education level | ||

| High school | 16 | 4.1 |

| Professional training | 91 | 23.5 |

| Diploma (2 years) | 44 | 11.4 |

| 1st university degree (4 years) | 121 | 31.3 |

| Post-graduate studies | 115 | 29.7 |

| Age | ||

| Under 18 | 9 | 2.3 |

| 18–25 | 86 | 22.2 |

| 26–30 | 62 | 16.0 |

| 31–35 | 89 | 23.0 |

| 36–40 | 66 | 17.1 |

| 41–45 | 24 | 6.2 |

| 46–50 | 16 | 4.1 |

| 51–55 | 33 | 8.5 |

| 56–60 | 2 | 0.5 |

| 61–65 | 0 | 0 |

| Over 65 | 0 | 0 |

| Activity | ||

| Unemployed | 49 | 12.7 |

| Student | 141 | 36.4 |

| Retired | 110 | 28.4 |

| Employed | 87 | 22.5 |

| Monthly income (US$) | ||

| Less than 500 | 11 | 2.8 |

| 500–899 | 133 | 34.4 |

| 900–1299 | 11 | 2.8 |

| 1300 and above | 232 | 59.9 |

| Facebook profile | ||

| Yes | 387 | 100.0 |

| No | 0 | 0.0 |

| Comment on FB | ||

| Yes | 387 | 100.0 |

| No | 0 | 0.0 |

| Comments for the bank page on the social media | ||

| Yes | 387 | 100.0 |

| No | 0 | 0.0 |

| Experience in FB | ||

| Same or Less than 1 years | 8 | 2.1 |

| Between 2 and 3 years | 60 | 15.5 |

| Between 3 and 5 years | 145 | 37.5 |

| More than 5 years | 174 | 45.0 |

| Bank Name | ||

| Arab Islamic Bank | 156 | 40.3 |

| Palestine Islamic Bank | 127 | 32.8 |

| Safa Bank | 104 | 26.9 |

| Variable | Item | Standard Coefficient | Cronbach’s Alpha | CR | AVE |

|---|---|---|---|---|---|

| BE (Affective) | BEA1 | 0.824 | 0.904 | 0.906 | 0.762 |

| BEA2 | 0.897 | ||||

| BEA3 | 0.896 | ||||

| BE (Behavioral) | BEE1 | 0.891 | 0.884 | 0.890 | 0.731 |

| BEE2 | 0.899 | ||||

| BEE3 | 0.769 | ||||

| BE (Intellectual) | BEI1 | 0.843 | 0.878 | 0.879 | 0.707 |

| BEI2 | 0.857 | ||||

| BEI3 | 0.823 | ||||

| BE (Sensory) | BES1 | 0.874 | 0.890 | 0.890 | 0.730 |

| BES2 | 0.844 | ||||

| BES3 | 0.844 | ||||

| BCE | BCE1 | 0.838 | 0.878 | 0.888 | 0.666 |

| BCE2 | 0.789 | ||||

| BCE3 | 0.806 | ||||

| BCE4 | 0.830 | ||||

| PTF | PTF1 | 0.817 | 0.921 | 0.923 | 0.749 |

| PTF2 | 0.884 | ||||

| PTF3 | 0.901 | ||||

| PTF4 | 0.858 | ||||

| IFCGC | IFCGC1 | 0.843 | 0.912 | 0.913 | 0.724 |

| IFCGC2 | 0.882 | ||||

| IFCGC3 | 0.832 | ||||

| IFCGC4 | 0.846 |

| Fit Indices | Recommended Value | Value in the Model |

|---|---|---|

| CMIN/DF | 2 < CMIN/DF < 5 | 3.208 |

| GFI | >0.90 | 0.890 |

| RFI | >0.90 | 0.903 |

| NFI | >0.90 | 0.915 |

| CFI | >0.90 | 0.939 |

| TLI | >0.90 | 0.931 |

| IFI | >0.90 | 0.940 |

| RMSEA | <0.08 | 0.076 |

| Hypothesis | Effect | Coefficients | S.E. | Sig. | Support | ||

|---|---|---|---|---|---|---|---|

| H1 | BE | → | PTF | 0.768 | 0.051 | <0.001 | Yes |

| H2 | BE | → | BCE | 0.900 | 0.048 | <0.001 | Yes |

| H3 | PTF | → | IFCGC | 0.150 | 0.054 | <0.001 | Yes |

| H4 | BCE | → | IFCGC | 0.793 | 0.066 | <0.001 | Yes |

| Mediator (Path) | Coefficient | Standard Error | Sobel Test | p-Value |

|---|---|---|---|---|

| BE→ PTF | 0.768 | 0.051 | 2.731 | 0.006 |

| PTF→ IFCGC | 0.150 | 0.054 | ||

| BE→ BCE | 0.900 | 0.048 | 2.873 | 0.004 |

| BCE→ IFCGC | 0.793 | 0.066 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yasin, M.; Porcu, L.; Liébana-Cabanillas, F. The Effect of Brand Experience on Customers’ Engagement Behavior within the Context of Online Brand Communities: The Impact on Intention to Forward Online Company-Generated Content. Sustainability 2019, 11, 4649. https://doi.org/10.3390/su11174649

Yasin M, Porcu L, Liébana-Cabanillas F. The Effect of Brand Experience on Customers’ Engagement Behavior within the Context of Online Brand Communities: The Impact on Intention to Forward Online Company-Generated Content. Sustainability. 2019; 11(17):4649. https://doi.org/10.3390/su11174649

Chicago/Turabian StyleYasin, Mahmoud, Lucia Porcu, and Francisco Liébana-Cabanillas. 2019. "The Effect of Brand Experience on Customers’ Engagement Behavior within the Context of Online Brand Communities: The Impact on Intention to Forward Online Company-Generated Content" Sustainability 11, no. 17: 4649. https://doi.org/10.3390/su11174649

APA StyleYasin, M., Porcu, L., & Liébana-Cabanillas, F. (2019). The Effect of Brand Experience on Customers’ Engagement Behavior within the Context of Online Brand Communities: The Impact on Intention to Forward Online Company-Generated Content. Sustainability, 11(17), 4649. https://doi.org/10.3390/su11174649