Abstract

In recent years, technological mergers and acquisitions (M&As) have become important strategic tools for enterprises to access and utilize new external knowledge. In particular, in the biopharmaceutical industry, M&A activities are actively being progressed due to an increase in new drug development costs, a decrease in R&D productivity, and the patent expiration of blockbuster drugs. However, there is a lack of research on the integrated view of (1) the acquirer’s capability and (2) the dyadic relationship of the knowledge base between the acquirer and target on the innovation performance of the acquirer. Furthermore, there are few empirical studies on the impact of these factors on ambidextrous innovation; that is, exploitative and explorative innovation. Therefore, with this integrated view in mind, this study analyzed the effect of each factor on the exploitative and exploratory innovation performance of the acquirer. A negative binomial regression was conducted using patent data to measure the innovation outcome of the acquirer after M&A. The findings suggest that (1) the acquisition experience of the acquirer and (2) the technological commonness between the acquirer and the target both had a significant impact on the exploitation and exploration innovation performance.

1. Introduction

The trends in technology and product development have been rapidly evolving, with knowledge and technology converging across a wide range of areas [1]. Consequently, it has become of prime importance for a firm to quickly adopt and internalize a range of expert knowledge and technologies for its long-term survival and technological competitiveness. However, it is impossible for a firm to possess all the technologies required for internal innovation and to create sustainable core competencies solely from internal capabilities [2,3,4]. For these reasons, most corporations depend on mergers and acquisitions (M&As) to absorb other firms with promising technology, in order to bridge the gap in their technological resources and expand their knowledge base for future innovation.

Many previous studies have explored why a firm may choose M&As as a growth strategy. Specifically, M&As are used to resolve uncertainties in the economy, in specific industries, and in transactions with other firms. Additionally, M&As enable relocation of existing resources for more productive uses [5,6,7]. In some cases, corporations are able to diversify their technological portfolio through M&As much faster than through inside research and development (R&D) efforts [8]. The tendency for most firms is to strengthen the past technological trajectory, leaning toward self-reinforcement for short-term performance [9,10]. However, high-tech businesses faced with dramatic technological changes need to focus on acquiring outside knowledge [10]. Therefore, acquisition of external knowledge can promote a firm’s sustainable innovation, long-term survival, and growth, which can be easily overlooked.

There have been many studies on the factors influencing the technological innovation of corporations after M&As. Studies on the acquisition of outside knowledge through M&As have divided the elements of technological innovation roughly into a firm’s capability and the attributes of the knowledge base of the merger (dyadic relationship of the knowledge base). From a resource-based viewpoint, transferability of a firm’s resources and capabilities is a key factor in continuously obtaining a competitive advantage while maximizing profits [11]. As such, it is particularly important for knowledge resources to be transferrable inside the firm, as well as between firms [12]. Furthermore, the technologies of an organization can be developed and retained only through experience [13], and the existing competence and experience of firms help them fully understand and exploit new outside knowledge and influence firm performance after M&As [10,13,14,15,16]. In addition, a considerable number of studies argue that the dyadic relationship of the knowledge base between the acquirer and target influences M&A outcomes through technological relatedness [17,18,19,20].

Previous studies have explored a firm’s capability and attributes of the knowledge base in relation to innovation results from their own perspectives. Although these studies have pointed out that both perspectives significantly influence innovation performance, there is limited research that attempts to integrate the two major perspectives and explore the relationship with innovation results from a mixed perspective. Additionally, most of the preceding research has analyzed innovation results with a single-dimensional approach and failed to provide sufficient explanation of the differences in management performance in relation to the major knowledge characteristics. Within this context, this study analyzes the influence of the capability of acquirers and the dyadic relationship of the knowledge base on exploitative and explorative innovation after M&As.

This study targets the biopharmaceutical industry as a representative case of M&As that are aimed at expanding a corporation’s knowledge base. This industry not only has the biggest market size globally but also has huge social and economic impacts. Furthermore, the technological development of biopharmaceutical technologies requires high uncertainty, a high degree of convergence, and high technological cumulativeness [21,22,23,24]. Therefore, the firms’ knowledge base in the industry needs to be constantly upgraded through acquiring external knowledge and technology. There are various open innovation methods for this in the biopharmaceutical industry, and M&A activities have been actively progressed due to an increase in new drug development costs, a decrease in R&D productivity, and the patent expiration of blockbuster drugs. Consequently, the results of this study will have practical implications for the management of a firm that is considering an M&A, or for consulting agencies, to make an optimal decision in the biopharmaceutical industry.

Furthermore, the topic of corporate management in recent years is a long slump of the global economy, regardless of developed and emerging countries, which have a common task of “overcoming the low growth period” [25]. Although there are various strategies for overcoming the era of low growth, the management strategy for exploitative and explorative innovation is more important than anything. Tushman and O’Reilly [26] established it as the concept of “innovation by ambidextrous organization”, that is, “ambidextrous innovation”. It means that a firm should be able to use both left and right hands for exploitative and explorative innovation. Incorporating this into an organization can be defined as the coexistence of “exploitation”, which is the ability to increase the efficiency of the company itself and reduce the risk, and “exploration”, which is the ability to take risks for creativity. Therefore, ambidextrous strategy through M&A is important for firm’s sustainable innovation and growth [27].

Generally, startups and small–medium enterprises as the open innovation economy contribute to big business as the closed innovation economy [25]. It can also lead to the social innovation economy and ultimately help to emergence of creative and innovative startups in the open innovation economy. This is called “entrepreneurial cyclical dynamics of open innovation” [28]. M&A is not only a means of open innovation but also an important way to overcome the limitations of low growth by developing an industry dynamically. Likewise, the various M&A events among firms in biopharmaceutical industry can lead to evolutionary industrial economic change as a complex adaptive system [29]. Therefore, the results of this study can also provide implications for the dynamic development of the industry by demonstrating how the results of ambidextrous innovations result from M&A events in the biopharmaceutical industry.

2. Literature Review and Hypothesis

2.1. M&A Activities in the Biopharmaceutical Industry

Despite a recent decline in the size of the M&A market, the biopharmaceutical industry is steadily gaining ground. In 2009, global M&A activities decreased by 28% to USD 2.1 trillion, while pharmaceuticals and biotechnology-led healthcare transactions accounted for 11% in the pharmaceutical industry out of the top four industry sectors [30].

M&A is an important tool to strengthen or increase a firm’s existing competencies [31]. Some researchers insist that M&As have increased in the biopharmaceutical industry primarily because of the rise in the cost of new drug development and the fall in R&D productivity [32,33]. To address these issues, corporations utilize M&As as a short-term solution to acquire products released to the market, thereby supplementing their pipeline and narrowing their sales gap.

Additionally, as the expiration of a patent for a blockbuster product can cause negative changes in the financial structure of a biopharmaceutical firm, such a firm is faced with market pressure which forces it to continue to develop new drugs to grow profits [34,35]. To solve this problem, corporations tend to choose M&As as a quick solution [32]. Besides this, firms resort to M&As to deal with the rise in marketing costs, to secure a competitive advantage by maintaining their scale and scope, and to expand into new fields through market fragmentation [30].

Such constant growth of the biopharmaceutical industry’s M&A market is a characteristic that differentiates it from other industries. This industry is a representative science-based industry characterized by instant and close connections between basic scientific research and industrial performance. It is an industry where technologies from a wide range of areas, including medicine, chemistry, microbiology, pharmacology, and physiology, are converged, and a diversity of expertise is involved in the development process. This process can be considered a science-driven development related to the area of scientific advances where new knowledge is introduced, enabling progress to the next stage [36]. Such scientific development requires more progress than the past for a firm to create value. At the same time, a new discovery triggers an increase of strict government regulations against risks and uncertainties, heightening development costs. Additionally, it is impossible for a firm to develop drugs for all diseases because different treatment areas require different expertise. Therefore, M&As are considered the main tool for biopharmaceutical firms to expand their expertise to other areas.

However, some studies suggest there are negative effects of M&As in the biopharmaceutical industry. For instance, the drivers of M&As, according to the attributes of the biopharmaceutical industry, can solve problems faced by firms, but these solutions may be no more than a quick fix that is heavily dependent on decision-making instead of being a long-term future strategy [30]. Others argue that M&A has slightly or no positive influence on R&D productivity [34], or has no positive effect on a firm’s profits [37]. Besides, some researchers believe that the expansion from an M&A negatively influences R&D creativity in the initial stage of the integration and has a negative effect on synergy and innovation after the M&A [38].

However, notwithstanding all the different opinions on the effects of M&As in the biopharmaceutical industry, the size of M&As is increasing, which is believed to reflect management’s belief that M&As provide a fast and easy path to reach firm’s goals and achieve growth [31]. These mixed results may confuse managers, as many studies on M&As have resorted to financial measurement as an indicator of value creation. Therefore, it is necessary to evaluate the performance of M&As using a different approach.

2.2. The Effect of M&As on the Innovation Performance of an Acquirer

M&As can be divided into technological and non-technological M&As; not all acquisitions are conducted for technological reasons [39]. M&As may take place for different purposes related to market entry and market structure, financial synergy, market dominance, or expansion of a firm’s product range in the global market [30,40,41]. These varied purposes may motivate an acquirer to pursue non-technological acquisitions that are less likely to provide them technological knowledge. In particular, acquisitions that focus on non-technological interests such as short-term profit growth may require much attention from an acquirer’s management, which dampens executive commitment to long-term investments in innovation [38]. With few technological elements involved, such M&As cannot affect technology systems and innovation routines, decreasing their influence on innovation performance.

In comparison, technological M&As are defined as M&As with the purpose of absorbing the acquired firm’s knowledge base to create technological innovation and secure sustainable competitiveness [18,29,42]. The main goal of technological M&As is access to technology and technological knowledge [6,43,44]. Acquirers conduct technological M&As to expand their knowledge base by absorbing the knowledge of the acquired firm, or to create innovation by introducing resources that they cannot create on their own [18].

Ahuja and Katila [18] argued that the size of the acquired knowledge base positively influences the effect of technological M&As on innovation performance. Particularly in a knowledge-intensive high-tech industry characterized by rapid technological innovation and complexity, it is extremely important to gain external knowledge to create innovation [45]. High-tech firms in areas such as biotechnology, and information and communications technology (ICT) mostly conduct M&As to acquire external technology. The results of such M&As, with the purpose of acquiring external knowledge, are directly shown in the R&D input, process, and innovation performance of the acquiring firm, thereby positively influencing profitability and productivity [46].

Furthermore, a technological M&A is a process which provides new knowledge to the acquirer and creates innovation through new knowledge; therefore, a technological M&A itself is an important factor for future innovation [47,48]. Most innovations do not come from entirely new knowledge but from the recombination of various existing knowledges. Consequently, it is possible to diversify a firm’s technology portfolio faster through acquisition of new external technologies than through in-house R&D efforts, and also by enabling creative recombination through increasing the number of internal and external knowledge elements available to the acquirer [18,49].

Meanwhile, if the acquirer fails to add a new knowledge base or adds just an insignificant amount, the risk is very high. In such cases, an M&A can negatively impact innovation performance, as it is time-consuming and costly to acquire and commercialize a new knowledge base [38,50,51].

2.3. Hypotheses

2.3.1. Acquirer’s Technological Capability

Acquisition of external knowledge is a type of learning, and a firm’s learning ability is determined by its internal knowledge base [13,16]. A firm’s knowledge base is a factor that influences firm innovativeness in absorbing external knowledge, and innovation creates new value by recombining existing capabilities, resources, and knowledge [7,12]. Consequently, one of the firms in an M&A transaction develops absorptive capacity as a way to promote innovation [52].

Additionally, introducing external knowledge is directly related to absorptive capacity and indirectly related to innovation. Technological innovation is a driving force for a firm to stay competitive, and absorptive capacity influences a firm’s innovation performance directly and indirectly [53]. In other words, absorptive capacity, a key element of organizational learning and innovation, is the ability to recognize new external knowledge and routinize it for commercial purposes.

Previously accumulated knowledge serves as an absorptive capacity to collect potentially useful information that exists in the external environment, to facilitate the process of complementing the missing parts needed to solve problems and create new knowledge [13]. This may accelerate the pace of innovation by enabling firms to understand and assess the importance of technological progress [54].

Since much of the useful information in the knowledge-intensive high-tech industry is based on science, scientific capabilities within the firm are essential to assessing and appreciating information that comes from outside the firm [36]. To maximize innovation performance, firms need to invest in developing internal competence to successfully integrate and institutionalize an external knowledge base [13]. In the biopharmaceutical industry, it is more difficult to assimilate and exploit new knowledge due to its huge volume and the difficulty in learning such knowledge, as it is highly specialized. As learning becomes more difficult, it is increasingly important to accumulate knowledge through R&D efforts for effective learning. Cassiman et al. [46] insisted that the effect of an M&A depends on whether a firm is undertaking more R&D investment and getting more involved in other innovation activities. Constant development of absorptive capacity provides a basis for developing and applying explicit knowledge [55], which in turn positively influences profitability after an M&A by reducing restructuring costs and allowing the acquirer to choose a target that can complement the current knowledge base, with confidence in the required knowledge [56].

Prabhu et al. [57] argued that the width and depth of the knowledge possessed by the acquirer influence post-M&A performance, while Datta and Roumani [58] stated that innovativeness and the size of the knowledge of the acquirer are the factors that impact performance. Based on these theories, this study presents the following hypotheses:

Hypothesis 1a.

The acquirer’s technological capability before an M&A positively (+) influences exploitation innovation performance after the M&A.

Hypothesis 1b.

The acquirer’s technological capability before the M&A positively (+) influences exploration innovation performance after the M&A.

2.3.2. The Acquirer’s M&A Experience as Management Capability

Past acquisition experiences facilitate the development of richer knowledge by exposing a firm to a variety of events and ideas [14]. This means that M&A events can provide knowledge to improve future performance through acquisition-specific capability. In other words, the M&A experience can cultivate the capacity to manage the M&A process well. Therefore, the more experience in M&As acquirers have, the better M&A performance and more successful M&As they can make.

Henderson and Cockburn [49] pointed out in a study on biotech firms that acquirers generally seek access to external knowledge so that when there are additional acquisitions, the acquirers can benefit from the structural capabilities developed in the process. Firms that have gone through a number of acquisitions can develop a routine using accumulated knowledge from past experiences, are more likely to pursue additional M&As [38], and are able to prevent failure factors from occurring in subsequent acquisitions [46]. Finkelstein and Haleblian [59] pointed out that routines and practices formed in previous acquisition experiences could be transferred to succeeding acquisitions, while organizational learning mechanisms useful in absorbing and integrating previous knowledge and skills are built to affect performance [60].

Fowler and Schmidt [61] argued that failed acquisitions, as well as successful ones, influence the success of future M&As. Haleblian and Finkelstein [62] discussed the effect of acquisition experience on M&A performance according to the similarity between goals of the past and the present. Bauer et al. [63] stated that M&A experience positively influences exploitation and exploration performance. In short, firms with past acquisition experience are more likely to succeed in converting acquired knowledge into innovation. Based on this understanding, the following hypotheses are established:

Hypothesis 2a.

The acquirer’s M&A experiences before an M&A positively (+) influences exploitation innovation performance after the M&A.

Hypothesis 2b.

The acquirer’s M&A experiences before an M&A positively (+) influences exploration innovation performance after the M&A.

2.3.3. Technological Commonness

A significant number of researchers have pointed out the importance of technological relatedness in the integration of different knowledge bases and innovation performance. A firm’s capability to exploit internal knowledge leads to innovation by detecting market changes and adjusting strategic directions [35]. There are arguments that similar targets generate M&A effects [46], and technological similarities between firms enhance the acquirer’s capability to absorb and exploit the target’s knowledge base [13,46,64].

Furthermore, a situation where two partners share a similar language and cognitive structure [48] is favorable to the transfer and integration of knowledge by the acquiring firm [7,12]. By repetitively using technological knowledge in specific areas, firms can accumulate relevant experience and build distinctive competence over their competitors [65]. This leads to efficiency gains by avoiding errors and minimizing the possibility of innovation in the wrong direction [65].

Meanwhile, a firm’s creative competence increases its capability to convert knowledge into elements that are highly complementary or substitutive, and as a consequence exerts a positive influence on innovation performance [35]. Development of new knowledge is made possible by changing existing knowledge through learning from experience [18], and the exploitation of existing knowledge can produce more efficient and effective results [66]. Based on existing know-how, firms will be able to create subsequent innovations in an orderly manner [17], avoiding failures attributable to unpredictable business experiments [65].

In contrast, if the technological knowledge of the partners overlaps excessively, it can be difficult to receive sufficient new knowledge and recognize new information and stimulus from the outside [19]. Additionally, as technological learning in a specific area has limitations due to its path-dependence, iterative learning in similar technology may improve capabilities, but at the same time may reinforce structural inertia and reduce motivation to secure new technology and knowledge, thereby threatening the long-term survival of the firm [26].

Therefore, the same knowledge base of the partners has a positive impact on business performance up to a certain level, but if the similarity exceeds this level, it will adversely affect business performance. Within this context, the following hypotheses can be drawn:

Hypothesis 3a.

The degree a similar knowledge base exists between the acquirer and target has an inverted-U relationship with exploitation innovation performance of the acquirer.

Hypothesis 3b.

The degree a similar knowledge base exists between the acquirer and target has an inverted-U relationship with exploration innovation performance of the acquirer.

2.3.4. Technological Newness

New external knowledge leads to significant changes in the way existing knowledge and knowledge systems are used, which drives innovation [67]. Firms can develop routines once they are familiar with the newly acquired knowledge by repeatedly using it [68] and enhance their future technological competence [46]. This routine provides the structure in which exploration of knowledge can evolve into exploitation [68,69]. In addition, the target’s new technological knowledge influences rethinking of the acquirer’s existing knowledge and the creation of new opportunities, thereby making it more likely to develop radical innovation capability [70].

Firms maintain and activate new knowledge based on prior knowledge through their transformation capability, which enables the retention and activation of existing knowledge. New knowledge is accumulated as a firm’s absorptive capacity enables the early development of new functions [71]. This is an open and flexible learning method that allows firms to create radical innovation [72]. Additionally, firms are able to conduct various knowledge experiments using new external knowledge and to reap different results from those of the past [73]. Thus, it is more likely for the acquirer to absorb the new knowledge base of the partner and to produce new knowledge, which in turn contributes to the creation of exploration innovation performance [74].

In contrast, some researchers have predicted that the integration of the knowledge base may consume more resources, thereby decreasing productivity [50], as different technology areas between firms can have different research methods and innovation routines [7]. Even if the target firm possesses valuable knowledge, entirely different new knowledge may interfere with the transfer of knowledge within the organization, making it difficult for the acquirer to absorb newly obtained knowledge [75]. Firms on the explorative extreme of the continuum can fall into the trap of failure, repeating exploration, and failure [14,76,77]. Based on this understanding, the following hypotheses can be set:

Hypothesis 4a.

The size of the new knowledge base from the target has an inverted-U relationship with the exploitation innovation performance of the acquirer.

Hypothesis 4b.

The size of the new knowledge base from the target has an inverted-U relationship with the exploration innovation performance of the acquirer.

3. Methodology

3.1. Data

In this study, the following data was used for analysis. The M&A data of the acquirers and targets were derived from the Medtrack data provided by INFORMA, including 1989 M&A deals sealed by 4714 firms in the United States, Europe, and other countries between 1985 and 2012. Fifty-one percent (34 out of 67 nations) of the M&A transactions were carried out in the United States and European nations. To clarify the M&A trends, re-acquisition deals were excluded. As for patent data, PASTAT data between 1960 and 2017 from LexisNexis (which provides patent information in association with the patent offices of more than 200 countries in the world) was used. Financial data between 1985 and 2012 were derived from materials from Medtrack.

3.2. Variables

3.2.1. Dependent Variable

This study used M&A performance (the number of technological innovations in the five years after the M&A) as a dependent variable to assess the acquirer’s technological innovation performance. With a five-year examination period, we were able to consider the annual variation, the delayed effect of the internal knowledge base, and the effect of yearly changes of knowledge base accumulation of each variable [78].

To analyze innovation performance after the M&A, the partners’ patent data (the number of registered patents by the acquirer between 1985 and 2017) were used. Patents are effective instruments to protect firm technology and maintain technological advantages and a good indicator of different innovation capabilities [79,80]. The indexing code of a patent represents the technologies used in the present invention and enables the preceding technologies influencing the patent to be inferred, thus providing more diverse information about the scope of a specific technology [81].

The innovation performance of firms was measured using two criteria. The types of innovation performance were classified into exploration and exploitation performance, and subdivided into: (1) the number of patents after the M&A in the areas which did not exist prior to the M&A and (2) the number of patents after the M&A in the same areas as prior to the merger. This classification enables the researchers to see how the attributes of the acquirer and the knowledge base of the target influence specific types of innovation results by measuring the absolute size of the same knowledge before the M&A and the new knowledge after the M&A.

3.2.2. Independent Variables

This research used technological capability, M&A experience as the management capability of the acquiring firm, and technological relatedness between partners as independent variables. The observation period was set as five years to match that of the dependent variable.

Technological capability: To evaluate the acquirer’s technological capability, its R&D intensity for the five years prior to the M&A was measured. R&D intensity was used as the main independent variable instead of a firm’s absorptive capacity. Since the study of Cohen and Levinthal [13], R&D intensity has frequently been used to determine firm’s capability [56,82] and is the most widely used criteria for absorptive capacity. R&D intensity was calculated by dividing R&D intensity (annual R&D expenditure of the acquirer) by the annual gross sales [83,84,85].

Acquirer’s experience: Firms that implement M&A strategies tend to conduct M&As several times. Therefore, it is necessary to examine M&A experience in the context of technological M&As to understand innovation performance after the merger [52]. The acquirer’s experience was measured by the number of M&As the firm went through before the year of the M&A.

Technological Commonness and Newness: Previous studies have measured the technological relatedness between the acquirer and the target in a single dimension. However, such a method has limitations: a target firm with a similar knowledge base as that of the acquirer may provide a high level of new knowledge base, but firms with high similarities are likely to have a low level of newness [74]. In other words, the results of systematic exploitation activities create continuous innovation [86], and technological diversity prefers new combination and leads to knowledge change by rethinking existing knowledge, thereby enhancing the possibility of developing innovative capability [70].

In this study, technological relatedness was divided into technological commonness and technological newness to measure the influence on innovation performance. The classification of technological knowledge was based on the International Patent Classification (IPC) and used the first four digits of the patent classification.

Technological commonness was measured using the ratio of the same kinds of IPC codes shared by the acquirer and target out of the patents registered for the five years prior to the M&A. Technological newness was measured using the ratio of the kinds of IPC codes which existed only in the target out of the patents registered for the five years prior to the M&A.

3.2.3. Control Variable

The size and age of the firm, and the M&A period, which are presumed to influence innovation performance in addition to the independent variables, were set as control variables.

Firm Size: Prior research on the relationship between a firm’s size and innovation performance revealed that the economy of scale and access to funding for a large-scale R&D project have positive effects on innovation performance [87]. Furthermore, larger firms, in general, can put in more resources to create more patents, consequently enhancing innovation performance [38]. To control these elements, firm size was included as a control variable. A firm’s size was obtained through the natural logarithm of the number of employees. According to previous studies, biopharmaceutical firms are likely to have intangible assets and often make no sales; so, a firm’s size can be best measured by the number of employees [88].

Firm Age: Prior research has shown a close relationship between a firm’s age and innovation performance [89], so we selected firm age as the second control variable. Startup firms tend to be more driven by innovation, and this may lead to a difference in innovativeness. To measure the age of a firm, the number of years from the financial year on the relevant financial data to the year of the M&A was used.

Period: To control the effect of the level of industrial development at the time of the M&A for biopharmaceutical firms, the period of the M&A was adopted as a control variable. As this research examines innovation performance of the firms that had M&A transactions by 2012, the base point was set as 2007, based on several issues in the biopharmaceutical industry before 2012.

The biopharmaceutical industry is a technology-intensive area with high potential for growth and expansion, along with the advance of science and technology. Recently, biotechnology has begun making a leap in terms of technology and economy and is currently highly likely to create new innovations. This study has paid attention to the relevant technology and industrial environment and noted that the industry is faced with challenges due to the patent expiration of blockbuster drugs, a major source of revenue for pharmaceuticals, and the increasing permissions for over-the-counter drugs, which may expose pharmaceutical giants to financial risks and limitations in new drug development, making it difficult for them to maintain a competitive advantage.

Additionally, the recession and financial crisis in the late 2000s generally caused difficulty in the economy, and the number of M&A deals between pharmaceutical firms started to decline after 2007 (The Institute of Mergers, Acquisitions and Alliances (IMAA), worldwide M&A trend). It is presumed that this was due to a number of environmental factors we have previously mentioned. In sharp contrast, biotech firms witnessed a rise in annual revenue by 11% on average between 2003 and 2007. The value of more specialized treatment based on biology made biotech firms a more appealing target for pharmaceutical firms to acquire. Since 2000, M&As have increasingly been preferred [30]. As new technology and changes in the social environment are highly likely to influence M&A performance, M&A activities after the base point were set as 1, and M&A activities before the base point as 0.

3.3. Model

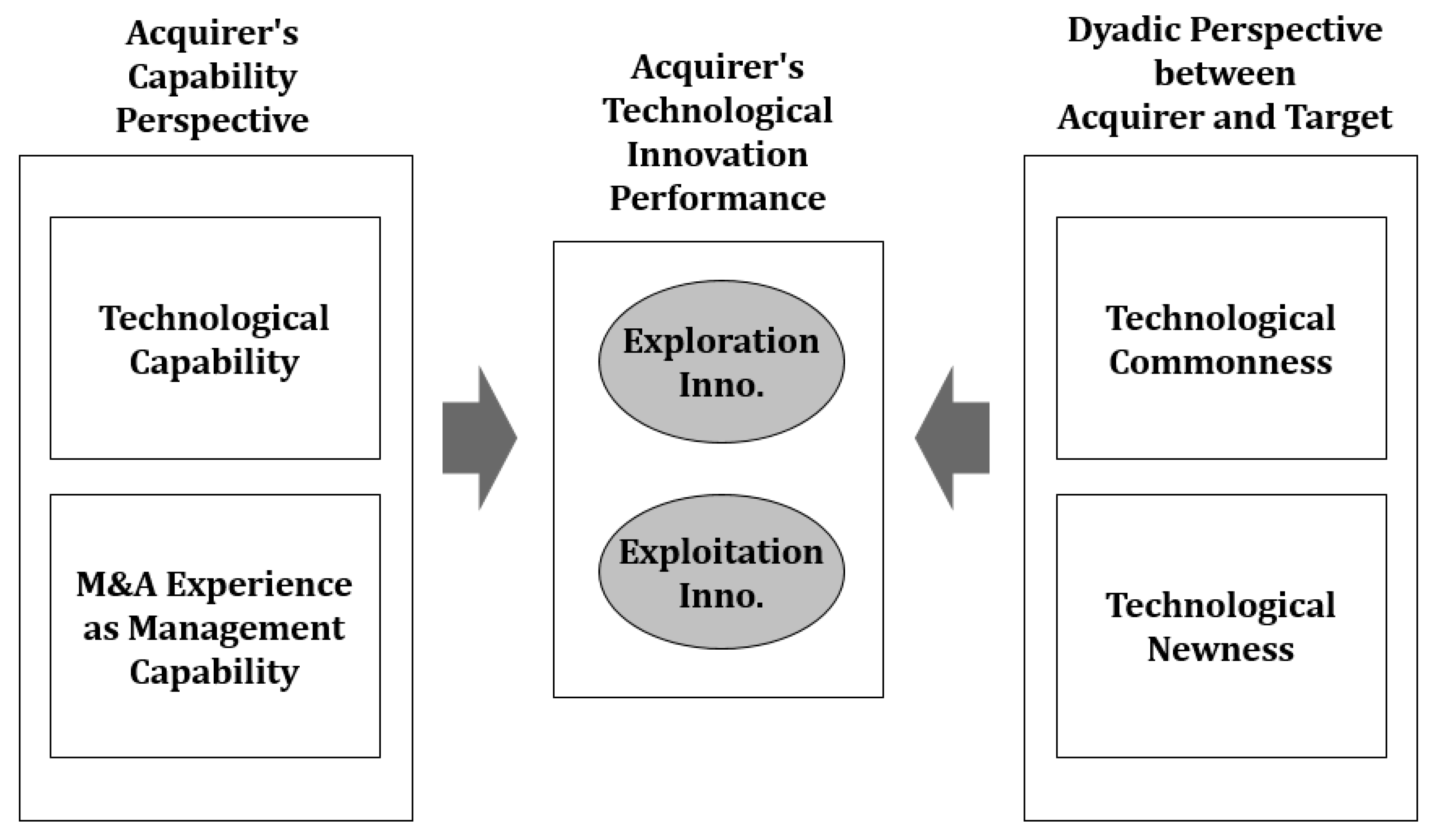

The research model of this study is illustrated in Figure 1. This study analyzed the effect of a firm’s capabilities, acquisition experience, technological commonness, and technological newness on its exploitation and exploration innovation performance.

Figure 1.

Research model.

In this study, a negative binomial regression analysis was conducted to verify hypotheses on the effect of the acquirer’s capability and the dyadic relationship of the knowledge base between the acquirer and target on innovation performance as a proxy of patents since an M&A was undertaken. Patent as proxy is a count variable. Poison regression and negative binomial regression are generally used when the dependent variable is a count variable and its value leans toward zero. The Poisson model assumes that the mean and variance of observed distributions are the same. However, a negative binomial model has the advantage of being able to model heteroscedastic data by allowing overdispersion. Therefore, we were able to verify our hypotheses through negative binomial regression.

4. Results and Discussion

Table 1 shows statistical descriptions of all variables used in the analysis and the correlations between variables. Analytical results revealed a statistically significant relationship between some variables, and the variance inflation factor (VIF) was examined with multicollinearity among variables in mind. Table 2 shows the VIF result. The analysis revealed that there is no multicollinearity, as the biggest value was 1.48 for all cases and all of the variables were included in the regression equation. Table 3 and Table 4 show the results of the negative binomial analysis.

Table 1.

Statistical descriptions and correlations (n = 1989).

Table 2.

Variance inflation factor value (n = 1989).

Table 3.

Negative binomial regression results on exploitation performance (n = 1989).

Table 4.

Negative binomial regression results on exploration performance (n = 1989).

Control variables were found to have a significant influence on both exploitation and exploration innovation performance. The firm size (FS) was strongly supported (p < 0.01), the exploitation performance at the time of the M&A was p < 0.05, and exploration performance was p < 0.01; these were all statistically significant. As for the firm age (FA), both exploitation innovation performance (p < 0.05) and exploration innovation performance (p < 0.01) showed strong negative correlations, supporting the argument that profit falls as the acquirer grows [90]. This explains the situation where the aging of a firm increases rigidity, raises operational costs, slows growth, causes problems in governance and among the board of directors, and consequently decreases a firm’s motivation to engage in new innovations [90].

The first hypothesis was not supported by statistically significant results for both exploitation (−0.01) and exploration performance (−0.03) in the regression analyses. Therefore, H1a and H1b were not supported. Some researchers argued that R&D intensity has a positive effect on innovation performance [91]. However, there is no guarantee that R&D investment necessarily leads to innovative performance.

Characterized by environmental factors such as high uncertainty and risks, and implicitness of knowledge, the pharmaceutical industry displays a lower level of efficiency in R&D investment. Recently, the R&D productivity of the industry has been declining since the Food and Drug Administration (FDA) of the US and the EMA have begun tightening regulations on new drug permissions, and clinical trials are becoming more complicated, larger, and extended. The R&D investment of the pharmaceutical industry is among the highest in the research-intensive industries, and the failure rate at each stage of development is also high. Additionally, previous R&D efforts have raised the standard for success of any new research, while the approval result of new drugs based on the New Drug Application (NDA) has been less than desirable despite the substantial increase in R&D investment. This implies that it has become difficult to translate R&D outcomes into a patent or new product in the current structure. Second, acquisition experience (AE) showed almost the same results for exploitation performance (0.1321) and exploration performance (0.1381).

Both are statistically significant results, supporting Hypothesis 2a and Hypothesis 2b. These results underpin the previous arguments that the acquirers’ acquisition experience (AE) exposes them to different events and ideas, making it easy for them to adapt to a new environment [14,92], and firms with rich acquisition experience are able to select the appropriate target for the needs and interests of the organization and develop a purchase routine, thereby putting themselves in a better position to adapt, improve, and deal with management problems in future transactions [93].

Third, the results of the statistical analysis of technological commonness (TCN) support Hypothesis 3a at the level of p < 0.1, and 3b showed a stronger explanatory power at p < 0.05. In order to verify the hypotheses, a squared term of the variable was included in the model. When a single term and squared term are statistically significant and represent a positive coefficient (+) and a negative coefficient (−), respectively, it can be said that they have an inverted-U relationship. Exploration innovation performance was supported more strongly than exploitation innovation performance; the existing knowledge base enables an effective absorption of more knowledge after the acquisition, as the two partners share similar languages and recognition structures, thereby promoting the transfer of explicit and implicit knowledge [17,52]. The above results also support the argument that the use of skills and capabilities within the existing technological trajectory [68] accompanies the development of knowledge [76], as an organization’s exploration activity comes from the exploitation of existing knowledge [65].

Finally, as for technological newness (TN), neither Hypothesis 4a nor 4b was supported. The analysis result showed that the regression coefficient was consistent with that of Hypothesis 4b in terms of direction (TC squire: −0.2839, TC: 0.7630), but without any statistically significant result. Some researchers insisted that diverse and new knowledge would promote innovation of the firms [94,95,96].

However, new knowledge, entirely different from existing knowledge, hampers transfer, absorption, and digestion of knowledge and does not help to create technological innovation [7,75].

The results of this study imply that new technological knowledge, different from the existing knowledge base, poses difficulties in its exploitation in the process of producing outcomes. In other words, it is highly likely that the new knowledge base, which did not exist before, has no influence on a firm’s exploitation and exploration performance. It takes a substantial amount of time and energy for complex knowledge to be converged, assimilated, and digested in an organization in order to create innovative technology. Two different knowledge bases between partners in the biopharmaceutical industry, which is highly specialized and characterized by convergence, do not have an effect on technological innovation performance. In short, it is crucial to select a target that is similar enough to the acquirer to enable learning from each other but different enough to provide new knowledge based on which new innovations can be achieved.

5. Conclusions

First, it was found that an acquirer, rich in acquisition experience, tends to have higher exploitation and exploration performance after a merger. M&A is an effective strategy to address environmental and technological uncertainties, and acquisition experience helps to eliminate risk factors and provides empirical knowledge for choosing appropriate partners in future M&A transactions, contributing to the creation of short- and long-term results after the M&A. Furthermore, if M&As can provide the acquirer with opportunities to access new technologies, markets, and knowledge, they will be accumulated as an internal knowledge base, serving as a basis for achieving innovative performance. Therefore, it is evident that a firm’s M&A effort is important for exploitation and exploration performance.

Second, it is necessary for the acquirer to consider a target with which it has a common knowledge base to maximize its exploitation and exploration performance. It was concluded that a certain level of shared technological knowledge is a prerequisite for an easy entry to a new technological area, to create exploration innovation performance. It is recommended that the management or personnel considering M&As carefully examine similarities of the technological expertise between the acquirer and target, and whether the acquirer can absorb new knowledge effectively through the understanding and analysis of existing internal resources.

Third, although this study has limitations in terms of representation of the M&A cases of all biopharmaceutical firms, given that M&A deals in 67 countries (including 34 European nations) were used and most major firms are based in the United States and Europe, it was able to present a meaningful research model on the strategy for innovation performance in the biopharmaceutical industry.

Finally, this study provided practical implications for firms and related parties (e.g., consulting agencies) that may be considering M&As by analyzing the characteristics of firm activities and knowledge necessary to formulate strategies for the progress of existing technology or the creation of new knowledge.

Despite its significant implications for future research on innovation after M&As, this study has some limitations. First, patents are a key indicator of the creation of innovative knowledge, but it is also likely for a firm to be evaluated as a potential partner based on the pipeline, not just the portfolio of patents [97]. It is also important to compare various performance indicators such as products and financial data by applying the exploitation and exploration performance model according to the attributes of the knowledge base.

Second, this research aimed to identify the influence of the characteristics of knowledge on ambidextrous innovation, that is, exploitation and exploration innovation performance. However, the results of our analysis demonstrate no significant difference in these characteristics’ influence on the two kinds of innovation performance. In this study, patents were used to assess innovation performance, but that might not be enough to show the results of the ambidextrous innovation of the acquirer. To explain that the results of M&A in the biopharmaceutical industry are dynamically circulating from startup and small–medium enterprises to big business, the future study based on the financial performance (ex. revenue or profit) and new products or services is needed [29].

Third, although this research provided a meaningful contribution by conducting a dynamic analysis of the influence on exploitation and exploration performance for the five years after the M&A, five years may not be sufficient to observe improvements made by the firm’s exploration activities given the characteristics of the biopharmaceutical industry. It takes a number of years for a patent to be applied for and registered. It can be presumed that the above observation is also related to this study’s result, showing that technological newness has no significant influence on performance. Since exploration activities are characterized by a high level of uncertainty and an even higher rate of failure [98], and the outcome of the exploration takes so long to be realized, it is not surprising that exploration firms may show lower performance in the short-run [98,99]. Future research would greatly benefit, as well as gain more accurate implications on the influence of M&As on management performance, by adding the analysis of long-term data.

Author Contributions

Conceptualization, Y.J.L. and K.S.; methodology, K.S.; validation, K.S. and E.K.; formal analysis, Y.J.L.; data curation, E.K.; writing—original draft preparation, Y.J.L.; writing—review and editing, K.S.; project administration, K.S. and E.K.

Funding

This study has been supported by the Innopolis Foundation grant funded by the Korea government (Ministry of Science and ICT: MSIT) (No. 2019-DD-SB-0202-01), by the Medical Research Information Center (MedRIC) through the National Research Foundation of Korea (NRF), funded by the Ministry of Science and ICT of Korean Government (NRF No. 2018R1A6A6040880), and by Korea Institute for Advancement of Technology (KIAT) grant funded by the Korea Government (MOTIE) (The Human Resources Development Program for Creative Industry Convergence Specialist).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Pyka, A. Dedicated innovation systems to support the transformation towards sustainability: Creating income opportunities and employment in the knowledge-based digital bioeconomy. J. Open Innov. Technol. Mark. Complex. 2017, 3, 27. [Google Scholar] [CrossRef]

- Chesbrough, H. Open Innovation; Harvard Business Press: Brighton, MA, USA, 2003. [Google Scholar]

- Kang, K.H.; Kang, J. How do firms source external knowledge for innovation? Analysing effects of different knowledge sourcing methods. Int. J. Innov. Manag. 2009, 13, 1–17. [Google Scholar] [CrossRef]

- Kang, K.H.; Jo, G.S.; Kang, J. External technology acquisition: A double-edged sword. Asian J. Technol. Innov. 2015, 23, 35–52. [Google Scholar] [CrossRef]

- Anand, J.; Singh, H. Asset redeployment, acquisitions and corporate strategy in declining industries. Strateg. Manag. 1997, 18, 99–118. [Google Scholar] [CrossRef]

- Capron, L.; Dussauge, P.; Mitchell, W. Resource redeployment following horizontal acquisitions in Europe and North America, 1988–1992. Strateg. Manag. J. 1998, 19, 631–661. [Google Scholar] [CrossRef]

- Kogut, B.; Zander, U. Knowledge of the firm, combinative capabilities, and the replication of technology. Organ. Sci. 1992, 3, 383–397. [Google Scholar] [CrossRef]

- Capron, L.; Mitchell, W. Selection capability: How capability gaps and internal social frictions affect internal and external strategic renewal. Organ. Sci. 2009, 20, 294–312. [Google Scholar] [CrossRef]

- Benner, M.J.; Tushman, M. Process management and technological innovation: A longitudinal study of the photography and paint industries. Adm. Sci. Q. 2002, 47, 676–707. [Google Scholar] [CrossRef]

- March, J.G. Exploration and exploitation in organizational learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Grant, R.M. Toward a knowledge-based theory of the firm. Strateg. Manag. J. 1996, 17, 109–122. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. The implications of spillovers for R&D investment and welfare: A new perspective. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar]

- Levinthal, D.A.; March, J.G. The myopia of learning. Strateg. Manag. J. 1993, 14, 95–112. [Google Scholar] [CrossRef]

- Desyllas, P.; Hughes, A. Do high technology acquirers become more innovative? Res. Policy 2010, 39, 1105–1121. [Google Scholar] [CrossRef]

- Zhang, J.; Baden-Fuller, C. The influence of technological knowledge base and organizational structure on technology collaboration. J. Manag. Stud. 2010, 47, 679–704. [Google Scholar] [CrossRef]

- Lane, P.J.; Lubatkin, M. Relative absorptive capacity and interorganizational learning. Strateg. Manag. J. 1998, 19, 461–477. [Google Scholar] [CrossRef]

- Ahuja, G.; Katila, R. Technological acquisitions and the innovation performance of acquiring firms: A longitudinal study. Strateg. Manag. J. 2001, 22, 197–220. [Google Scholar] [CrossRef]

- Makri, M.; Hitt, M.A.; Lane, P.J. Complementary technologies, knowledge relatedness, and invention outcomes in high technology mergers and acquisitions. Strateg. Manag. J. 2010, 31, 602–628. [Google Scholar] [CrossRef]

- Bento, F. Complexity in the oil and gas industry: A study into exploration and exploitation in integrated operations. J. Open Innov. Technol. Mark. Complex. 2018, 4, 11. [Google Scholar] [CrossRef]

- Pisano, G. Can science be a business. Harv. Bus. Rev. 2006, 10, 1–12. [Google Scholar]

- Coriat, B.; Orsi, F.; Weinstein, O. Does biotech reflect a new science-based innovation regime? Ind. Innov. 2003, 10, 231–253. [Google Scholar] [CrossRef]

- Hwang, B.Y.; Jun, H.J.; Chang, M.H.; Kim, D.C. A case study on the improvement of institution of “High-Risk High-Return R&D” in Korea. J. Open Innov. Technol. Mark. Complex. 2017, 3, 19. [Google Scholar]

- Gay, B.; Dousset, B. Innovation and network structural dynamics: Study of the alliance network of a major sector of the biotechnology industry. Res. Policy 2005, 34, 1457–1475. [Google Scholar] [CrossRef]

- Yun, J.J. How do we conquer the growth limits of capitalism? Schumpeterian Dynamics of Open Innovation. J. Open Innov. Technol. Mark. Complex. 2015, 1, 17. [Google Scholar] [CrossRef]

- Tushman, M.L.; O’Reilly, C.A., III. Ambidextrous organizations: Managing evolutionary and revolutionary change. Calif. Manag. Rev. 1996, 38, 8–29. [Google Scholar] [CrossRef]

- Kollmann, T.; Kuckertz, A.; Stöckmann, C. Continuous innovation in entrepreneurial growth companies: Exploring the ambidextrous strategy. J. Enterp. Cult. 2009, 17, 297–322. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Entrepreneurial cyclical dynamics of open innovation. J. Evol. Econ. 2018, 28, 1151–1174. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Dynamics from open innovation to evolutionary change. J. Open Innov. Technol. Mark. Complex. 2016, 2, 7. [Google Scholar] [CrossRef]

- Burns, L.R.; Nicholson, S.; Wolkowski, J.P. Pharmaceutical Strategy and the Evolving Role of Merger and Acquisition. In The Business of Healthcare Innovation; Cambridge University Press: New York, NY, USA, 2012. [Google Scholar]

- Demirbag, M.; Chang-Keong, N.G.; Tatoglu, E. Performance of Mergers and Acquisitions in the Pharmaceutical Industry: A Comparative Perspective. Multinatl. Bus. Rev. 2007, 15, 41–61. [Google Scholar] [CrossRef]

- Higgins, M.J.; Rodriguez, D. The outsourcing of R&D through acquisitions in the pharmaceutical industry. J. Financ. Econ. 2006, 80, 351–383. [Google Scholar]

- Danzon, P.M.; Epstein, A.; Nicholson, S. Mergers and acquisitions in the pharmaceutical and biotech industries. Manag. Decis. Econ. 2007, 28, 307–328. [Google Scholar] [CrossRef]

- Shin, K.; Lee, D.; Shin, K.; Kim, E. Measuring the Efficiency of US Pharmaceutical Companies Based on Open Innovation Types. J. Open Innov. Technol. Mark. Complex. 2018, 4, 34. [Google Scholar] [CrossRef]

- Shin, K.; Kim, E.; Jeong, E. Structural Relationship and Influence between Open Innovation Capacities and Performances. Sustainability 2018, 10, 2787. [Google Scholar] [CrossRef]

- Arora, A.; Gambardella, A. Evaluating technological information and utilizing it: Scientific knowledge, technological capability, and external linkages in biotechnology. J. Econ. Behav. Organ. 1994, 24, 91–114. [Google Scholar] [CrossRef]

- Heracleous, L.; Murray, J. The urge to merge in the pharmaceutical industry. Eur. Manag. J. 2001, 19, 430–437. [Google Scholar] [CrossRef]

- Hitt, M.A.; Hoskisson, R.E.; Ireland, R.D.; Harrison, J.S. Effects of acquisitions on R&D inputs and outputs. Acad. Manag. J. 1991, 34, 693–706. [Google Scholar]

- Hamel, G. Competition for competence and interpartner learning within international strategic alliances. Strateg. Manag. J. 1991, 12, 83–103. [Google Scholar] [CrossRef]

- Berkovitch, E.; Narayanan, M.P. Motives for Takeovers: An Empirical Investigation. J. Financ. Quant. Anal. 1993, 28, 347–362. [Google Scholar] [CrossRef]

- Chakrabarti, A.K.; Hauschildt, J.; Suverkrup, C. Does it pay to acquire technological firms? R D Manag. 1994, 24, 47–56. [Google Scholar] [CrossRef]

- Cloodt, M.; Hagedoorn, J.; Van Kranenburg, H. Mergers and acquisitions: Their effect on the innovative performance of companies in high-tech industries. Res. Policy 2006, 35, 642–654. [Google Scholar] [CrossRef]

- Puranam, P.; Singh, H.; Zollo, M. A bird in the hand or two in the bush? Integration trade-offs in technology-grafting acquisitions. Eur. Manag. J. 2003, 21, 179–184. [Google Scholar] [CrossRef]

- Rossi, M.; Yedidia Tarba, S.; Raviv, A. Mergers and acquisitions in the hightech industry: A literature review. International. J. Organ. Anal. 2013, 21, 66–82. [Google Scholar] [CrossRef]

- Ranft, A.L.; Lord, M.D. Acquiring new technologies and capabilities: A grounded model of acquisition implementation. Organ. Sci. 2002, 13, 420–441. [Google Scholar] [CrossRef]

- Cassiman, B.; Colombo, M.G.; Garrone, P.; Veugelers, R. The impact of M&A on the R&D process. Res. Policy 2005, 34, 195–220. [Google Scholar]

- Wagner, M. To explore or to exploit? An empirical investigation of acquisitions by large incumbents. Res. Policy 2011, 40, 1217–1225. [Google Scholar] [CrossRef]

- Valentini, G. Measuring the effect of M&A on patenting quantity and quality. Strateg. Manag. J. 2012, 33, 336–346. [Google Scholar]

- Henderson, R.; Cockburn, I. Measuring competence? Exploring firm effects in pharmaceutical research. Strateg. Manag. J. 1994, 15, 63–84. [Google Scholar] [CrossRef]

- Haspeslagh, P.C.; Jemison, D.B. Managing Acquisitions; Free Press: New York, NY, USA, 1991. [Google Scholar]

- Heimeriks, K.H.; Schreiner, M. Relational Quality, Alliance Capability, and Alliance Performance: An Integrated Framework. In Enhancing Competences for Competitive Advantage; Emerald Group Publishing Limited: Bingley, UK, 2010; pp. 145–171. [Google Scholar]

- Jo, G.S.; Park, G.; Kang, J. Unravelling the link between technological M&A and innovation performance using the concept of relative absorptive capacity. Asian J. Technol. Innov. 2016, 24, 55–76. [Google Scholar]

- Kostopoulos, K.; Papalexandris, A.; Papachroni, M.; Ioannou, G. Absorptive capacity, innovation, and financial performance. J. Bus. Res. 2011, 64, 1335–1343. [Google Scholar] [CrossRef]

- Quintana-García, C.; Benavides-Velasco, C.A. Innovative competence, exploration and exploitation: The influence of technological diversification. Res. Policy 2008, 37, 492–507. [Google Scholar] [CrossRef]

- Deng, P. Absorptive capacity and failed cross-border M&A. Manag. Res. Rev. 2010, 33, 673–682. [Google Scholar]

- Kuiper, L. Absorptive Capacity and Post-M&A Performance: Exploring Role of Absorptive Capacity in Post-Deal Firm Profitability. Master’s Thesis, Utrecht University, Utrecht, The Netherlands, 2016. [Google Scholar]

- Prabhu, J.C.; Chandy, R.K.; Ellis, M.E. The impact of acquisitions on innovation: Poison pill, placebo, or tonic? J. Mark. 2005, 69, 114–130. [Google Scholar] [CrossRef]

- Datta, P.; Roumani, Y. Knowledge-acquisitions and post-acquisition innovation performance: A comparative hazards model. Eur. J. Inf. Syst. 2015, 24, 202–226. [Google Scholar] [CrossRef]

- Finkelstein, S.; Haleblian, J. Understanding acquisition performance: The role of transfer effects. Organ. Sci. 2002, 13, 36–47. [Google Scholar] [CrossRef]

- Hayward, M.L.A. When do firms learn from their acquisition experience? Evidence from 1990–1995. Strateg. Manag. J. 2002, 23, 21–39. [Google Scholar] [CrossRef]

- Fowler, K.L.; Schmidt, D. Determinants of tender offer post acquisition financial performance. Strateg. Manag. J. 1989, 10, 339–350. [Google Scholar] [CrossRef]

- Haleblian, J.; Finkelstein, S. The influence of organizational acquisition experience on acquisition performance: A behavioral learning perspective. Adm. Sci. Q. 1999, 44, 29–56. [Google Scholar] [CrossRef]

- Bauer, F.; Strobl, A.; Dao, M.A.; Matzler, K.; Rudolf, N. Examining Links Between Pre And Post M&A Value Creation Mechanisms—Exploitation, Exploration and Ambidexterity in Central European SMEs. Long Range Plan. 2018, 51, 185–203. [Google Scholar]

- Hagedoorn, J.; Duysters, G. External sources of innovative capabilities: The preference for strategic alliances or mergers and acquisitions. J. Manag. Stud. 2002, 39, 167–188. [Google Scholar] [CrossRef]

- Katila, R.; Ahuja, G. Something old, something new: A longitudinal study of search behavior and new product introduction. Acad. Manag. J. 2002, 45, 1183–1194. [Google Scholar]

- Jansen, J.J.; Van Den Bosch, F.A.; Volberda, H.W. Exploratory innovation, exploitative innovation, and performance: Effects of organizational antecedents and environmental moderators. Manag. Sci. 2006, 52, 1661–1674. [Google Scholar] [CrossRef]

- Nesta, L.; Dibiaggio, L. Technology strategy and knowledge dynamics: The case of biotech. Ind. Innov. 2003, 10, 331–349. [Google Scholar] [CrossRef]

- Lavie, D.; Stettner, U.; Tushman, M.L. Exploration and exploitation within and across organizations. Acad. Manag. Ann. 2010, 4, 109–155. [Google Scholar] [CrossRef]

- Rothaermel, F.T.; Deeds, D.L. Exploration and exploitation alliances in biotechnology: A system of new product development. Strateg. Manag. J. 2004, 25, 201–221. [Google Scholar] [CrossRef]

- Abernathy, W.J.; Clark, K.B. Innovation: Mapping the winds of creative destruction. Res. Policy 1985, 14, 3–22. [Google Scholar] [CrossRef]

- Lavie, D.; Kang, J.; Rosenkopf, L. Balance within and across domains: The performance implications of exploration and exploitation in alliances. Organ. Sci. 2011, 22, 1517–1538. [Google Scholar] [CrossRef]

- Atuahene-Gima, K. Resolving the capability—Rigidity paradox in new product innovation. J. Mark. 2005, 69, 61–83. [Google Scholar] [CrossRef]

- Andriopoulos, C.; Lewis, M.W. Exploitation-exploration tensions and organizational ambidexterity: Managing paradoxes of innovation. Organ. Sci. 2009, 20, 696–717. [Google Scholar] [CrossRef]

- Han, J.; Jo, G.S.; Kang, J. Is high-quality knowledge always beneficial? Knowledge overlap and innovation performance in technological mergers and acquisitions. J. Manag. Organ. 2018, 24, 258–278. [Google Scholar] [CrossRef]

- Mowery, D.C.; Oxley, J.E.; Silverman, B.S. Technological overlap and interfirm cooperation: Implications for the resource-based view of the firm. Res. Policy 1998, 27, 507–523. [Google Scholar] [CrossRef]

- He, Z.L.; Wong, P.K. Exploration vs. exploitation: An empirical test of the ambidexterity hypothesis. Organ. Sci. 2004, 15, 481–494. [Google Scholar] [CrossRef]

- Ha, S. The Impact of Exploitation and Exploration on the Firm Performance: SMEs in the Korean Electronic Parts Industry. J. Manag. 2010, 39, 907–937. [Google Scholar]

- Kang, K.H.; Choi, S.C.; Kang, J.A. How Does Knowledge Depth/Breadth Moderate Between Alliance Intensity and Innovative Performance. Korean Soc. Strateg. Manag. 2015, 18, 31–55. [Google Scholar]

- Griliches, Z. Patent statistics as economic indicators: A survey. J. Econ. Lit. 1990, 28, 1661–1707. [Google Scholar]

- Almeida, P. Knowledge sourcing by foreign multinationals: Patent citation analysis in the US semiconductor industry. Strateg. Manag. J. 1996, 17, 155–165. [Google Scholar] [CrossRef]

- Silverman, B.S. Technological resources and the direction of corporate diversification: Toward an integration of the resource-based view and transaction cost economics. Manag. Sci. 1999, 45, 1109–1124. [Google Scholar] [CrossRef]

- Stock, G.N.; Greis, N.P.; Fischer, W.A. Absorptive capacity and new product development. J. High Technol. Manag. Res. 2001, 12, 77–91. [Google Scholar] [CrossRef]

- Tsai, W. Knowledge transfer in interorganizational networks: Effects of network position and absorptive capacity on business unit innovation and performance. Acad. Manag. J. 2001, 44, 996–1004. [Google Scholar]

- Veugelers, R. Internal R&D expenditures and external technology sourcing. Res. Policy 1997, 26, 303–316. [Google Scholar]

- Zahra, S.A.; Hayton, J.C. The effect of international venturing on firm performance: The moderating influence of absorptive capacity. J. Bus. Ventur. 2008, 23, 195–220. [Google Scholar] [CrossRef]

- Tani, M.; Papaluca, O.; Sasso, P. The system thinking perspective in the open-innovation research: A systematic review. J. Open Innov. Technol. Mark. Complex. 2018, 4, 38. [Google Scholar] [CrossRef]

- Cohen, W.M.; Klepper, S. Firm size and the nature of innovation within industries: The case of process and product R&D. Rev. Econ. Stat. 1996, 78, 232–243. [Google Scholar]

- Powell, W. Inter-organizational collaboration in the biotechnology industry. J. Inst. Theor. Econ. 1996, 152, 197–215. [Google Scholar]

- Sørensen, J.B.; Stuart, T.E. Aging, obsolescence, and organizational innovation. Adm. Sci. Q. 2000, 45, 81–112. [Google Scholar] [CrossRef]

- Loderer, C.; Waelchli, U. Firm Age and Performance; University of Bern: Bern, Switzerland; ECGI European Corporate Governance Institute: Brusseles, Belgium, 2010. [Google Scholar]

- Shin, S.R.; Han, J.; Marhold, K.; Kang, J. Reconfiguring the firm’s core technological portfolio through open innovation: Focusing on technological M&A. J. Knowl. Manag. 2017, 21, 571–591. [Google Scholar]

- Vermeulen, F.; Barkema, H. Learning through acquisitions. Acad. Manag. J. 2001, 44, 457–476. [Google Scholar]

- Bruton, G.D.; Oviatt, B.M.; White, M.A. Performance of acquisitions of distressed firms. Acad. Manag. J. 1994, 37, 972–989. [Google Scholar]

- Patel, P.; Pavitt, K. The technological competencies of the world’s largest firms: Complex and path-dependent, but not much variety. Res. Policy 1997, 26, 141–156. [Google Scholar] [CrossRef]

- Christensen, J.F. Building Innovative Assets and Dynamic Coherence in Multi-Technology Companies. In Resources, Technology and Strategy; Routledge: London, UK, 2005; pp. 131–158. [Google Scholar]

- Rosenkopf, L.; Nerkar, A. Beyond local search: Boundary-spanning, exploration, and impact in the optical disk industr. Strateg. Manag. J. 2001, 22, 287–306. [Google Scholar] [CrossRef]

- Koenig, M.E.D.; Mezick, E.M. Impact of mergers and acquisitions on research productivity within the pharmaceutical industry. Scientometric 2003, 59, 157–169. [Google Scholar]

- Mitchell, W.; Singh, K. Incumbents’ use of pre-entry alliances before expansion into new technical subfields of an industry. J. Econ. Behav. Organ. 1992, 18, 347–372. [Google Scholar] [CrossRef]

- Geerts, A.; Leten, B.; Belderbos, R.; Van Looy, B. Does spatial ambidexterity pay off? On the benefits of geographic proximity between technology exploitation and exploration. J. Prod. Innov. Manag. 2018, 35, 151–163. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).