The Effects of Air Pollution on Firms’ Internal Control Quality: Evidence from China

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Literature on the Consequences of Air Pollution

2.2. Literature on the Determinants of Internal Control Quality

2.3. Hypotheses Development

3. Research Design

3.1. Data and Sample Selection

3.2. Model Construction

4. Empirical Results and Analysis

4.1. Descriptive Statistics

4.2. Multivariate Regression Analysis

5. Further Analysis and Robustness Tests

5.1. Further Analysis on Specific Internal Controls and Air Pollutants

5.1.1. Analysis of Internal Control Components

5.1.2. Analysis of Specific Air Pollutants

5.2. Further Analysis on the Cross-Sectional Variations

5.2.1. Analysis Conditional on Ownership Features

5.2.2. Analysis of the External Environment

5.2.3. Analysis Conditional on the Chairman’s Demographic Characteristics

5.2.4. Analysis Conditional on Employee-Related Factors

5.3. The Heavy Pollution Industry

5.4. The Institutional Cost of Air Pollution: Test on Other Economic Consequences

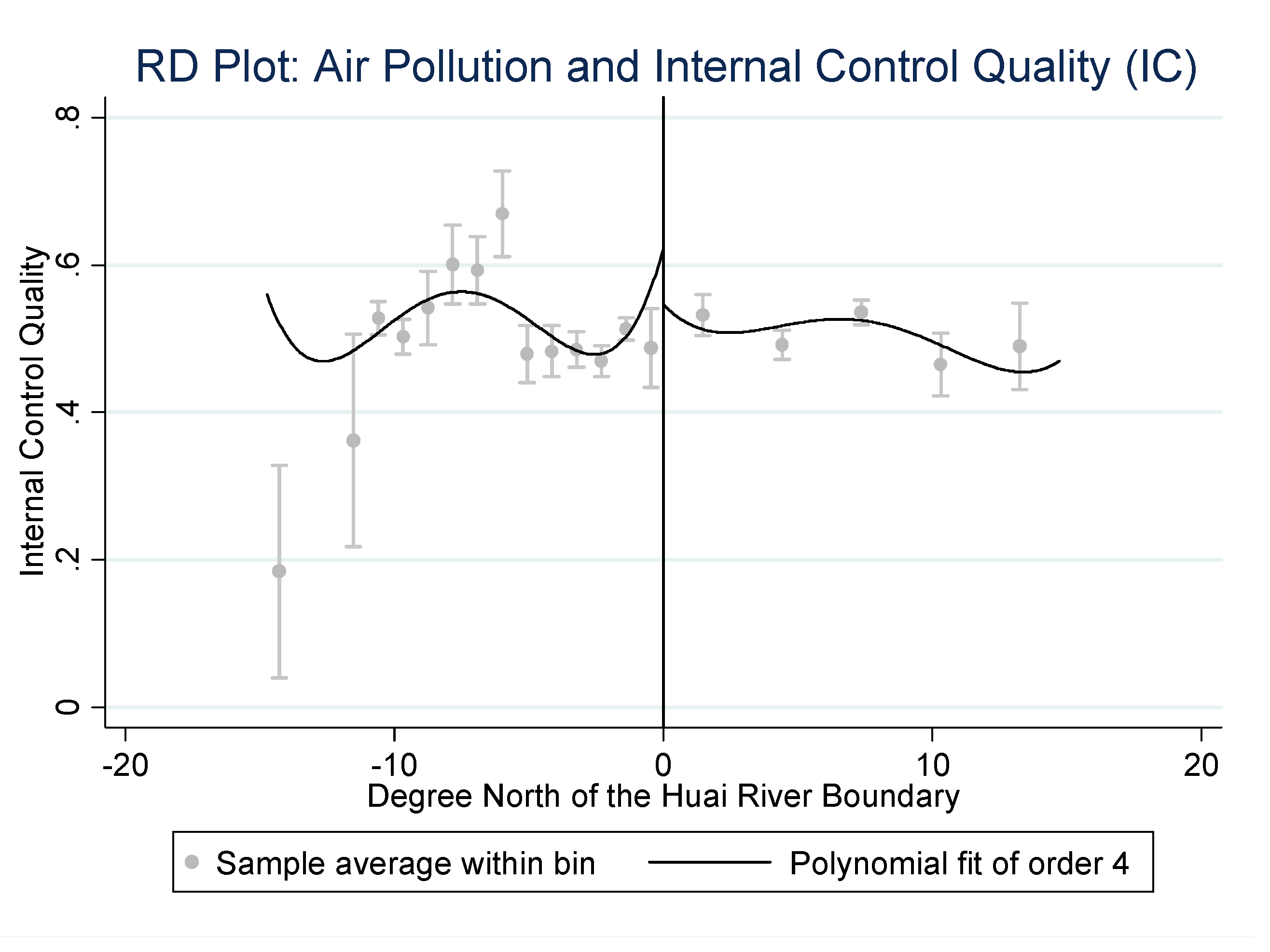

5.5. Regression Discontinuity Design

5.6. City Fixed Effect

5.7. Propensity Score Matched Sample

5.8. Robustness Tests

5.8.1. Alternative Sample and Measures

5.8.2. Controlling for Climate

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Zhang, I.X. Economic consequences of the Sarbanes–Oxley Act of 2002. J. Account. Econ. 2007, 44, 74–115. [Google Scholar] [CrossRef]

- Nee, V. New Institutionalism in Economic and Sociology. In The Handbook of Economic Sociology, 2nd ed.; Neil, J.S., Richard, S., Eds.; Russell Sage: New York, NY, USA, 2005. [Google Scholar]

- Beatty, T.K.; Shimshack, J.P. Air Pollution and Children’s Respiratory Health: A Cohort Analysis. J. Environ. Econ. Manag. 2014, 67, 39–57. [Google Scholar] [CrossRef]

- Currie, J.; Neidell, M. Air Pollution and Infant Health: What Can We Learn from California’s Recent Experience? Q. J. Econ. 2005, 120, 1003–1030. [Google Scholar]

- Power, M.C.; Kioumourtzoglou, M.-A.; Hart, J.E.; Okereke, O.I.; Laden, F.; Weisskopf, M.G. The relation between past exposure to fine particulate air pollution and prevalent anxiety: Observational cohort study. BMJ 2015, 350, 1111. [Google Scholar] [CrossRef] [PubMed]

- Szyszkowicz, M. Air Pollution and Emergency Department Visits for Depression in Edmonton, Canada. Int. J. Occup. Med. Environ. Health 2007, 20, 241–245. [Google Scholar] [CrossRef] [PubMed]

- Lu, J.G.; Lee, J.J.; Gino, F.; Galinsky, A.D. Polluted Morality: Air Pollution Predicts Criminal Activity and Unethical Behavior. Psychol. Sci. 2018, 29, 340–355. [Google Scholar] [CrossRef] [PubMed]

- Chang, T.Y.; Zivin, J.G.; Gross, T.; Neidell, M. Particulate Pollution and the Productivity of Pear Packers. Am. Econ. J. Econ. Policy 2016, 8, 141–169. [Google Scholar] [CrossRef]

- Chang, T.Y.; Zivin, J.G.; Gross, T.; Neidell, M. The Effect of Pollution on Worker Productivity: Evidence from Call-Center Workers in China. NBER Working Paper No. 22328. Am. Econ. J. Appl. Econ. 2019, 11, 151–172. [Google Scholar] [CrossRef]

- Chang, T.Y.; Huang, W.; Wang, Y. Something in the Air: Pollution and the Demand for Health Insurance. Rev. Econ. Stud. 2018, 85, 1609–1634. [Google Scholar] [CrossRef]

- Hanna, R.; Oliva, P. The effect of pollution on labor supply: Evidence from a natural experiment in Mexico City. J. Public Econ. 2015, 122, 68–79. [Google Scholar] [CrossRef]

- Luo, J. How does smog affect firms’ investment behavior? A natural experiment based on a sudden surge in the PM2.5 index. China J. Account. Res. 2017, 10, 359–378. [Google Scholar] [CrossRef]

- Zivin, J.G.; Neidell, M. The Impact of Pollution on Worker Productivity. Am. Econ. Rev. 2012, 102, 3652–3673. [Google Scholar] [CrossRef]

- The Committee of Sponsoring Organizations (COSO). Enterprise Risk Management-Integrating with Strategy and Performance (2017). 2017. Available online: https://www.coso.org/Pages/erm.aspx (accessed on 7 September 2019).

- Ministry of Finance of the People’s Republic of China (MOF). Enterprise Internal Control Basic Norms. 2008. Available online: http://kjs.mof.gov.cn/zhuantilanmu/neibukongzhibiaozhunjianshe/200807/t20080704_55983.html (accessed on 7 September 2019).

- Doyle, J.T.; Ge, W.; Mcvay, S. Accruals Quality and Internal Control Over Financial Reporting. Account. Rev. 2007, 82, 1141–1170. [Google Scholar] [CrossRef]

- Ashbaugh-Skaife, H.; Collins, D.W.; Kinney, W.R.; Lafond, R. The Effect of Sox Internal Control Deficiencies and their Remediation on Accrual Quality. Account. Rev. 2008, 83, 217–250. [Google Scholar] [CrossRef]

- Dhaliwal, D.; Hogan, C.; Trezevant, R.; Wilkins, M. Internal Control Disclosures, Monitoring, and the Cost of Debt. Account. Rev. 2011, 86, 1131–1156. [Google Scholar] [CrossRef]

- Kim, J.B.; Song, B.Y.; Zhang, L. Internal Control Weakness and Bank Loan Contracting: Evidence from SOX Section 404 Disclosures. Account. Rev. 2011, 86, 1157–1188. [Google Scholar] [CrossRef]

- Cheng, M.; Dhaliwal, D.S.; Zhang, Y. Does Investment Efficiency Improve after the Disclosure of Material Weaknesses in Internal Control over Financial Reporting? SSRN Electron. J. 2013, 56, 1–18. [Google Scholar]

- Feng, M.; Li, C.; McVay, S.E.; Skaife, H.A. Does Ineffective Internal Control over Financial Reporting affect a Firm’s Operations? Evidence from Firms’ Inventory Management. Account. Rev. 2015, 90, 529–557. [Google Scholar] [CrossRef]

- Chhaochharia, V.; Grinstein, Y. Corporate Governance and Firm Value: The Impact of the 2002 Governance Rules. J. Financ. 2007, 62, 1789–1825. [Google Scholar] [CrossRef]

- Balsam, S.; Jiang, W.; Lu, B. Equity Incentives and Internal Control Weaknesses. Contemp. Account. Res. 2014, 31, 178–201. [Google Scholar] [CrossRef]

- Goh, B.W. Audit Committees, Boards of Directors, and Remediation of Material Weaknesses in Internal Control. Contemp. Account. Res. 2009, 26, 549–579. [Google Scholar] [CrossRef]

- Johnstone, K.; Li, C.; Rupley, K.H. Changes in Corporate Governance Associated with the Revelation of Internal Control Material Weaknesses and their Subsequent Remediation. Contemp. Account. Res. 2011, 28, 331–383. [Google Scholar] [CrossRef]

- Krishnan, J. Audit Committee Quality and Internal Control: An Empirical Analysis. Account. Rev. 2005, 80, 649–675. [Google Scholar] [CrossRef]

- Guo, J.; Huang, P.; Zhang, Y.; Zhou, N. The Effect of Employee Treatment Policies on Internal Control Weaknesses and Financial Restatements. Account. Rev. 2016, 91, 1167–1194. [Google Scholar] [CrossRef]

- Kanagaretnam, K.; Lobo, G.J.; Ma, C.; Zhou, J. National Culture and Internal Control Material Weaknesses around the World. J. Account. Audit. Financ. 2016, 31, 28–50. [Google Scholar] [CrossRef]

- Schlenker, W.; Walker, W.R. Airports, Air Pollution, and Contemporaneous Health. Rev. Econ. Stud. 2016, 83, 768–809. [Google Scholar] [CrossRef]

- Chay, K.Y.; Greenstone, M. The Impact of Air Pollution on Infant Mortality: Evidence from Geographic Variation in Pollution Shocks Induced by a Recession. Q. J. Econ. 2003, 118, 1121–1167. [Google Scholar] [CrossRef]

- World Health Organization (WHO). Ambient Air Pollution: A Global Assessment of Exposure and Burden of Disease. 2016. Available online: http://apps.who.int/iris/bitstream/10665/250141/1/9789241511353-eng.pdf?ua=1 (accessed on 7 September 2019).

- World Health Organization (WHO). 2017 Global Platform on Air Quality and Health. Available online: http://www.who.int/phe/health_topics/outdoorair/global_platform/en/Yang (accessed on 18 August 2017).

- Jazani, R.K.; Saremi, M.; Rezapour, T.; Kavousi, A.; Shirzad, H. Influence of traffic-related noise and air pollution on self-reported fatigue. Int. J. Occup. Saf. Ergon. 2015, 21, 193–200. [Google Scholar] [CrossRef] [PubMed]

- Yang, A.C.; Tsai, A.C.S.J.; Huang, N.E. Decomposing the Association of Completed Suicide with Air Pollution, Weather, and Unemployment Data at Different Time Scales. J. Affect. Disord. 2011, 129, 275–281. [Google Scholar] [CrossRef]

- Cheung, C.; Law, R. The impact of air quality on tourism: The case of Hong Kong. Pac. Tour. Rev. 2001, 5, 69–74. [Google Scholar]

- Herrnstadt, E.; Heyes, A.; Muehlegger, E.; Saberian, S. Air Pollution as A Cause of Violent Crime: Evidence from Los Angeles and Chicago. 2016. Available online: http://www.evanherrnstadt.com/docs/CrimePollution_JM.pdf (accessed on 7 September 2019).

- Petrovits, C.; Shakespeare, C.; Shih, A. The Causes and Consequences of Internal Control Problems in Nonprofit Organizations. Account. Rev. 2011, 86, 325–357. [Google Scholar] [CrossRef]

- Gong, G.; Ke, B.; Yu, Y. Home Country Investor Protection, Ownership Structure and Cross-Listed Firms’ Compliance with SOX-Mandated Internal Control Deficiency Disclosures. Contemp. Account. Res. 2013, 30, 1490–1523. [Google Scholar] [CrossRef]

- Hoitash, U.; Hoitash, R.; Bedard, J.C. Corporate Governance and Internal Control over Financial Reporting: A Comparison of Regulatory Regimes. Account. Rev. 2009, 84, 839–867. [Google Scholar] [CrossRef]

- Li, C.; Sun, L.; Ettredge, M. Financial executive qualifications, financial executive turnover, and adverse SOX 404 opinions. J. Account. Econ. 2010, 50, 93–110. [Google Scholar] [CrossRef]

- Yun, J. External regulation and the quality of internal control: An empirical analysis of China’s A-share markets. In Proceedings of the 2016 13th International Conference on Service Systems and Service Management (ICSSSM), Kunming, China, 24–26 June 2016; pp. 1–4. [Google Scholar]

- Murphy, S.R.; Schelegle, E.S.; Miller, L.A.; Hyde, D.M.; Van Winkle, L.S. Ozone Exposure Alters Serotonin and Serotonin Receptor Expression in the Developing Lung. Toxicol. Sci. 2013, 134, 168–179. [Google Scholar] [CrossRef] [PubMed]

- Uboh, F. Effect of Inhalation Exposure to Gasoline on Sex Hormones Profile in Wistar Albino Rats. Acta Endocrinol. 2007, 3, 23–30. [Google Scholar] [CrossRef][Green Version]

- Pérez-González, F.; Yun, H. Risk Management and Firm Value: Evidence from Weather Derivatives. J. Financ. 2013, 68, 2143–2176. [Google Scholar] [CrossRef]

- Chen, H.; Dong, W.; Han, H.; Zhou, N. A comprehensive and quantitative internal control index: Construction, validation, and impact. Rev. Quant. Financ. Account. 2017, 49, 337–377. [Google Scholar] [CrossRef]

- The Committee of Sponsoring Organizations (COSO). Internal Control—Integrated Framework. 1992. Available online: https://www.coso.org/Pages/guidance.aspx (accessed on 7 September 2019).

- Wang, X.L.; Fan, G.; Hu, L.P. Marketization Index of China’s Provinces: Neri Report; Social Sciences Academic Press: Beijing, China, 2016. [Google Scholar]

- Chen, H.; Yang, D.; Zhang, X.; Zhou, N. The Moderating Role of Internal Control in Tax Avoidance: Evidence from a COSO-Based Internal Control Index in China. J. Am. Tax. Assoc. 2019. [Google Scholar] [CrossRef]

- Chen, S.; Sun, Z.; Tang, S.; Wu, D. Government intervention and investment efficiency: Evidence from China. J. Corp. Financ. 2011, 17, 259–271. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of Ownership and Control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Bloom, N.; Bond, S.; van Reenen, J. Uncertainty and Investment Dynamics. Rev. Econ. Stud. 2007, 74, 391–415. [Google Scholar] [CrossRef]

- Chay, J.; Suh, J. Payout policy and cash-flow uncertainty. J. Financ. Econ. 2009, 93, 88–107. [Google Scholar] [CrossRef]

- Covas, F.; den Haan, W.J. The Cyclical Behavior of Debt and Equity Finance. Am. Econ. Rev. 2017, 101, 877–899. [Google Scholar] [CrossRef]

- Hasan, M.; Taylor, G.; Richardson, G. Does a firm’s life cycle explain its propensity to engage in corporate tax avoidance? Eur. Account. Rev. 2017, 26, 469–501. [Google Scholar] [CrossRef]

- Chhaochharia, V.; Grinstein, Y.; Grullon, G.; Michaely, R. Product market competition and internal governance: Evidence from the Sarbanes–Oxley Act. Manag. Sci. 2016, 63, 1405–1424. [Google Scholar] [CrossRef]

- Giroud, X.; Mueller, H.M. Corporate Governance, Product Market Competition, and Equity Prices. J. Financ. 2011, 66, 563–600. [Google Scholar] [CrossRef]

- Zhang, C.; Chen, H. Product market competition, state ownership and internal control quality. China J. Account. Stud. 2016, 4, 1–27. [Google Scholar] [CrossRef]

- Gaspar, J.M.; Massa, M.; Matos, P. Favoritism in Mutual Fund Families? Evidence on Strategic Cross-Fund Subsidization. J. Financ. 2006, 61, 73–104. [Google Scholar] [CrossRef]

- Peress, J. Product Market Competition, Insider Trading, and Stock Market Efficiency. J. Financ. 2010, 65, 1–43. [Google Scholar] [CrossRef]

- Huang, J.; Kisgen, D.J. Gender and corporate finance: Are male executives overconfident relative to female executives? J. Financ. Econ. 2013, 108, 822–839. [Google Scholar] [CrossRef]

- Srinidhi, B.; Gul, F.A.; Tsui, J. Female Directors and Earnings Quality. Contemp. Account. Res. 2011, 28, 1610–1644. [Google Scholar] [CrossRef]

- Fraser, S.; Greene, F.J. The Effects of Experience on Entrepreneurial Optimism and Uncertainty. Economica 2006, 73, 169–192. [Google Scholar] [CrossRef]

- Ge, W.; Li, Z.; Liu, Q.; McVay, S. When Does Internal Control over Financial Reporting Curb Resource Extraction? Evidence from China; Working Paper; University of Washington: Washington, DC, USA, 2019. [Google Scholar]

- Goh, B.W.; Li, D. Internal Controls and Conditional Conservatism. Account. Rev. 2011, 86, 975–1005. [Google Scholar] [CrossRef]

- Khan, M.; Watts, R.L. Estimation and Empirical Properties of a Firm-Year Measure of Accounting Conservatism. J. Account. Econ. 2009, 48, 132–150. [Google Scholar] [CrossRef]

- Chen, Y.; Ebenstein, A.; Greenstone, M.; Li, H. Evidence on the impact of sustained exposure to air pollution on life expectancy from China’s Huai River policy. Proc. Natl. Acad. Sci. USA 2013, 110, 12936–12941. [Google Scholar] [CrossRef] [PubMed]

- Ebenstein, A.; Fan, M.; Greenstone, M.; He, G.; Zhou, M. New evidence on the impact of sustained exposure to air pollution on life expectancy from China’s Huai River Policy. Proc. Natl. Acad. Sci. USA 2017, 114, 10384–10389. [Google Scholar] [CrossRef] [PubMed]

- Madsen, J.; DeHaan, E.; Piotroski, J.D. Do Weather-Induced Moods Affect the Processing of Earnings News? J. Account. Res. 2017, 75, 245–550. [Google Scholar]

- Hirshleifer, D.; Shumway, T. Good Day Sunshine: Stock Returns and the Weather. J. Financ. 2003, 58, 1009–1032. [Google Scholar] [CrossRef]

| Variables | Definitions |

|---|---|

| IC | Internal control quality, measured as the standardized score of the Internal Control Index of the year. |

| AP | Air pollution, measured as the average of daily air pollution index over on year (from 1 January to 31 December) in the city where the firm is located, and then divided by 100. |

| SIZE | Firm size, calculated as the natural logarithm of total asset at year end (in million CNY). |

| ROA | Return on assets, calculated as pretax income divided by total assets at year end. |

| LEV | Financial leverage, calculated as the total liabilities divided by the total assets. |

| SEO | Equity refinancing, calculated as cash flows through equity financing divided by the total assets at year end. |

| GROW | Growth, calculated as changes in sales from the last year to current years divided by sales in of the last year. |

| INVE | Inventory intensity, calculated as net inventory at year end divided by total assets at year end. |

| MA | Mergers and acquisitions (M&A), an indicator that equals 1 if M&A occurs in the year, and 0 otherwise. |

| SEGM | Business segments, calculated as the natural logarithm of one plus the number of business segments. |

| EXPO | Foreign sales, an indicator that equals 1 if foreign sales occur during the year, and 0 otherwise. |

| AGE | Listing years, calculated as the logarithm of 1 plus the number of years the firm has been listed. |

| BORD | The size of board of directors, calculated as the logarithm of the number of board directors. |

| DUAL | Duality, an indicator that equals 1 if the chairman is also the CEO, and 0 otherwise. |

| TOP1 | The shares hold by the largest shareholder, calculated as the number of shares the largest shareholder holds divided by the number of total shares. |

| BIG4 | “Big Four” auditors, an indicator if the firm is audited by a “Big Four” audit firm, and 0 otherwise. |

| OWNER | The types of ultimate owners, an indicator that equals 0 for firms with no controller, 1 for private companies, 2 to 5, respectively, for firms controlled by the county, city, province, and the central government. |

| GDP | The macroeconomic condition, measured as the GDP growth rate of the city where the firm is located in. |

| MKT | The degree of marketization, measured as the Marketization Index ranking of the province where the listed firm is in year t (equaling 0 to 2, respectively, from low to high ranking). |

| Variables | Obs. | Mean | Std. Dev. | 25% | Median | 75% |

|---|---|---|---|---|---|---|

| IC | 7227 | 0.510 | 0.283 | 0.268 | 0.515 | 0.756 |

| AP | 7227 | 0.824 | 0.227 | 0.674 | 0.804 | 1.003 |

| SIZE | 7227 | 8.379 | 1.265 | 7.500 | 8.226 | 9.088 |

| ROA | 7227 | 0.049 | 0.055 | 0.024 | 0.046 | 0.076 |

| LEV | 7227 | 0.432 | 0.210 | 0.263 | 0.418 | 0.591 |

| SEO | 7227 | 0.039 | 0.086 | 0.000 | 0.000 | 0.020 |

| GROW | 7227 | 0.191 | 0.571 | −0.054 | 0.081 | 0.258 |

| INVE | 7227 | 0.147 | 0.145 | 0.056 | 0.109 | 0.181 |

| MA | 7227 | 0.307 | 0.461 | 0.000 | 0.000 | 1.000 |

| SEGM | 7227 | 2.410 | 0.940 | 1.792 | 2.398 | 2.996 |

| EXPO | 7227 | 0.284 | 0.451 | 0.000 | 0.000 | 1.000 |

| AGE | 7227 | 2.215 | 0.737 | 1.609 | 2.303 | 2.890 |

| BORD | 7227 | 2.128 | 0.199 | 1.946 | 2.197 | 2.197 |

| DUAL | 7227 | 0.261 | 0.439 | 0.000 | 0.000 | 1.000 |

| TOP1 | 7227 | 0.344 | 0.148 | 0.226 | 0.325 | 0.446 |

| BIG4 | 7227 | 0.055 | 0.227 | 0.000 | 0.000 | 0.000 |

| OWNER | 7227 | 2.102 | 1.561 | 1.000 | 1.000 | 4.000 |

| GDP | 7227 | 0.078 | 0.036 | 0.067 | 0.083 | 0.099 |

| MKT | 7227 | 1.653 | 0.615 | 1.000 | 2.000 | 2.000 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Dep. Variable= | IC | IC | IC | IC |

| AP | −0.040 ** | −0.032 * | −0.045 ** | −0.041 ** |

| (−2.15) | (−1.72) | (−2.38) | (−2.16) | |

| SIZE | 0.092 *** | 0.082 *** | 0.071 *** | 0.072 *** |

| (22.73) | (16.77) | (13.38) | (13.54) | |

| ROA | −0.045 | 0.008 | 0.021 | −0.002 |

| (−0.58) | (0.10) | (0.27) | (−0.03) | |

| LEV | −0.173 *** | −0.193 *** | −0.194 *** | −0.187 *** |

| (−6.69) | (−7.45) | (−7.52) | (−7.23) | |

| SEO | −0.136 *** | −0.103 *** | −0.084 ** | −0.081 ** |

| (−3.60) | (−2.73) | (−2.21) | (−2.14) | |

| GROW | −0.043 *** | −0.043 *** | −0.039 *** | −0.039 *** |

| (−7.23) | (−7.19) | (−6.48) | (−6.47) | |

| INVE | 0.088 ** | 0.086 ** | 0.083 ** | 0.077 ** |

| (2.38) | (2.29) | (2.21) | (2.06) | |

| MA | −0.009 | −0.004 | −0.003 | |

| (−1.25) | (−0.49) | (−0.45) | ||

| SEGM | 0.015 *** | 0.020 *** | 0.018 *** | |

| (2.81) | (3.62) | (3.24) | ||

| EXPO | 0.005 | 0.004 | 0.002 | |

| (0.57) | (0.49) | (0.29) | ||

| AGE | 0.033 *** | 0.024 *** | 0.027 *** | |

| (5.08) | (3.50) | (3.86) | ||

| BORD | 0.033 | 0.033 | ||

| (1.56) | (1.59) | |||

| DUAL | −0.018 ** | −0.019 ** | ||

| (−1.98) | (−2.11) | |||

| TOP1 | 0.023 | 0.021 | ||

| (0.78) | (0.71) | |||

| BIG4 | 0.032 | 0.027 | ||

| (1.60) | (1.34) | |||

| OWNER | 0.013 *** | 0.014 *** | ||

| (3.99) | (4.12) | |||

| GDP | 0.071 | |||

| (0.65) | ||||

| MKT | 0.025 *** | |||

| (3.43) | ||||

| Intercept | −0.166 *** | −0.190 *** | −0.187 *** | −0.234 *** |

| (−3.48) | (−3.89) | (−2.90) | (−3.59) | |

| Year & Ind. | Yes | Yes | Yes | Yes |

| N | 7227 | 7227 | 7227 | 7227 |

| Adj. R2 | 0.131 | 0.138 | 0.144 | 0.147 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Dep. Variable= | Internal Environment | Risk Assessment | Control Activities | Information and Communication | Monitoring |

| AP | −0.015 | −0.036 * | 0.007 | −0.085 *** | 0.017 |

| (−0.76) | (−1.93) | (0.39) | (−3.92) | (1.04) | |

| SIZE | 0.071 *** | 0.038 *** | 0.037 *** | 0.049 *** | 0.012 ** |

| (13.95) | (7.08) | (7.05) | (8.38) | (2.57) | |

| ROA | 0.206 *** | −0.127 * | −0.002 | −0.014 | 0.050 |

| (2.63) | (−1.68) | (−0.02) | (−0.17) | (0.71) | |

| LEV | −0.172 *** | −0.083 *** | −0.162 *** | −0.111 *** | −0.007 |

| (−6.80) | (−3.29) | (−6.34) | (−3.83) | (−0.29) | |

| SEO | −0.125 *** | −0.012 | −0.067 | −0.120 *** | 0.042 |

| (−3.28) | (−0.32) | (−1.63) | (−2.97) | (1.00) | |

| GROW | −0.029 *** | −0.019 *** | −0.026 *** | −0.019 *** | −0.025 *** |

| (−4.69) | (−3.03) | (−3.96) | (−2.88) | (−3.79) | |

| INVE | 0.181 *** | −0.035 | 0.104 ** | −0.027 | 0.047 |

| (4.81) | (−0.90) | (2.58) | (−0.67) | (1.39) | |

| MA | −0.019 *** | 0.013 * | 0.002 | 0.004 | −0.007 |

| (−2.62) | (1.68) | (0.27) | (0.46) | (−0.90) | |

| SEGM | −0.000 | 0.010 * | 0.008 | 0.025 *** | 0.008 * |

| (−0.06) | (1.86) | (1.51) | (4.25) | (1.69) | |

| EXPO | −0.010 | −0.018 ** | −0.002 | 0.012 | 0.024 *** |

| (−1.11) | (−1.99) | (−0.27) | (1.26) | (2.88) | |

| AGE | −0.012 * | 0.034 *** | 0.009 | 0.009 | 0.034 *** |

| (−1.85) | (5.07) | (1.33) | (1.19) | (5.76) | |

| BORD | 0.013 | −0.006 | 0.040 * | 0.019 | −0.001 |

| (0.61) | (−0.31) | (1.81) | (0.80) | (−0.04) | |

| DUAL | −0.000 | −0.005 | −0.021 ** | −0.001 | −0.017 ** |

| (−0.03) | (−0.62) | (−2.18) | (−0.09) | (−2.09) | |

| TOP1 | −0.012 | 0.067 ** | 0.012 | −0.004 | 0.023 |

| (−0.43) | (2.26) | (0.41) | (−0.11) | (0.90) | |

| BIG4 | 0.096 *** | −0.014 | −0.013 | 0.028 | −0.006 |

| (5.20) | (−0.68) | (−0.63) | (1.26) | (−0.37) | |

| OWNER | 0.015 *** | 0.007 ** | 0.008 ** | −0.003 | 0.008 *** |

| (4.32) | (2.17) | (2.36) | (−0.90) | (2.91) | |

| GDP | 0.016 | −0.044 | 0.056 | −0.012 | 0.092 |

| (0.15) | (−0.40) | (0.53) | (−0.10) | (0.92) | |

| MKT | 0.033 *** | 0.022 *** | 0.017 ** | 0.007 | −0.020 *** |

| (4.37) | (3.02) | (2.24) | (0.89) | (−3.17) | |

| Intercept | −0.088 | 0.078 | 0.080 | 0.097 | 0.272 *** |

| (−1.37) | (1.17) | (1.17) | (1.33) | (4.94) | |

| Year & Ind. | Yes | Yes | Yes | Yes | Yes |

| N | 7227 | 7227 | 7227 | 7227 | 7227 |

| Adj. R2 | 0.129 | 0.048 | 0.041 | 0.071 | 0.033 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Dep. Var.= | IC | IC | IC | IC | IC | IC |

| PM2.5 | −0.054 ** | |||||

| (−2.23) | ||||||

| PM10 | −0.024 | |||||

| (−1.61) | ||||||

| SO2 | −0.072 ** | |||||

| (−2.27) | ||||||

| NO2 | −0.059 | |||||

| (−1.35) | ||||||

| CO | 0.002 | |||||

| (0.15) | ||||||

| O3 | −0.059 | |||||

| (−1.35) | ||||||

| SIZE | 0.072 *** | 0.071 *** | 0.071 *** | 0.071 *** | 0.071 *** | 0.071 *** |

| (13.54) | (13.51) | (13.55) | (13.46) | (13.38) | (13.43) | |

| ROA | −0.002 | −0.002 | −0.004 | −0.001 | −0.004 | −0.003 |

| (−0.03) | (−0.03) | (−0.05) | (−0.02) | (−0.05) | (−0.04) | |

| LEV | −0.187 *** | −0.187 *** | −0.186 *** | −0.187 *** | −0.188 *** | −0.189 *** |

| (−7.23) | (−7.20) | (−7.18) | (−7.22) | (−7.24) | (−7.27) | |

| SEO | −0.082 ** | −0.081 ** | −0.081 ** | −0.081 ** | −0.079 ** | −0.079 ** |

| (−2.15) | (−2.12) | (−2.12) | (−2.12) | (−2.08) | (−2.08) | |

| GROW | −0.039 *** | −0.039 *** | −0.039 *** | −0.039 *** | −0.039 *** | −0.039 *** |

| (−6.46) | (−6.49) | (−6.51) | (−6.48) | (−6.50) | (−6.50) | |

| INVE | 0.078 ** | 0.078 ** | 0.080 ** | 0.078 ** | 0.079 ** | 0.078 ** |

| (2.07) | (2.08) | (2.13) | (2.08) | (2.10) | (2.09) | |

| MA | −0.003 | −0.004 | −0.004 | −0.003 | −0.004 | −0.004 |

| (−0.45) | (−0.48) | (−0.48) | (−0.46) | (−0.50) | (−0.50) | |

| SEGM | 0.018 *** | 0.018 *** | 0.017 *** | 0.019 *** | 0.019 *** | 0.019 *** |

| (3.25) | (3.29) | (3.21) | (3.46) | (3.48) | (3.49) | |

| EXPO | 0.002 | 0.002 | 0.002 | 0.002 | 0.002 | 0.002 |

| (0.29) | (0.28) | (0.28) | (0.24) | (0.24) | (0.28) | |

| AGE | 0.026 *** | 0.027 *** | 0.028 *** | 0.027 *** | 0.028 *** | 0.028 *** |

| (3.84) | (3.94) | (4.03) | (3.91) | (4.00) | (4.09) | |

| BORD | 0.033 | 0.034 | 0.035* | 0.033 | 0.033 | 0.033 |

| (1.59) | (1.61) | (1.65) | (1.59) | (1.59) | (1.57) | |

| DUAL | −0.019 ** | −0.019 ** | −0.019 ** | −0.019 ** | −0.018 ** | −0.018 ** |

| (−2.10) | (−2.11) | (−2.14) | (−2.07) | (−2.03) | (−2.04) | |

| TOP1 | 0.021 | 0.021 | 0.022 | 0.023 | 0.023 | 0.023 |

| (0.70) | (0.73) | (0.74) | (0.78) | (0.77) | (0.78) | |

| BIG4 | 0.027 | 0.026 | 0.025 | 0.028 | 0.027 | 0.028 |

| (1.34) | (1.32) | (1.27) | (1.38) | (1.35) | (1.39) | |

| OWNER | 0.014 *** | 0.013 *** | 0.013 *** | 0.013 *** | 0.013 *** | 0.013 *** |

| (4.14) | (4.01) | (3.90) | (4.00) | (3.85) | (3.84) | |

| GDP | 0.075 | 0.086 | 0.029 | 0.092 | 0.114 | 0.086 |

| (0.69) | (0.79) | (0.27) | (0.85) | (1.05) | (0.79) | |

| MKT | 0.026 *** | 0.024 *** | 0.022 *** | 0.027 *** | 0.026 *** | 0.028 *** |

| (3.55) | (3.17) | (3.02) | (3.61) | (3.43) | (3.68) | |

| Intercept | −0.240 *** | −0.245 *** | −0.245 *** | −0.249 *** | −0.270 *** | −0.238 *** |

| (−3.73) | (−3.78) | (−3.82) | (−3.84) | (−4.13) | (−3.52) | |

| Year & Ind. | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 7227 | 7227 | 7227 | 7227 | 7227 | 7227 |

| Adj. R2 | 0.147 | 0.146 | 0.147 | 0.146 | 0.146 | 0.146 |

| (1) | (2) | |

|---|---|---|

| Dep. Variable= | IC | IC |

| AP | −0.073 *** | −0.143 *** |

| (−3.05) | (−3.15) | |

| AP × SOE | 0.086 ** | |

| (2.37) | ||

| SOE | −0.082 ** | |

| (−2.21) | ||

| AP × CONTSHR | 0.003 ** | |

| (2.41) | ||

| CONTSHR | −0.002 | |

| (−1.58) | ||

| SIZE | 0.071 *** | 0.073 *** |

| (13.52) | (13.44) | |

| ROA | −0.000 | −0.004 |

| (−0.01) | (−0.06) | |

| LEV | −0.189 *** | −0.184 *** |

| (−7.31) | (−6.95) | |

| SEO | −0.084 ** | −0.084 ** |

| (−2.21) | (−2.18) | |

| GROW | −0.039 *** | −0.040 *** |

| (−6.49) | (−6.64) | |

| INVE | 0.080 ** | 0.073 * |

| (2.13) | (1.94) | |

| MA | −0.003 | −0.001 |

| (−0.44) | (−0.14) | |

| SEGM | 0.017 *** | 0.017 *** |

| (3.22) | (3.14) | |

| EXPO | 0.003 | 0.007 |

| (0.35) | (0.84) | |

| AGE | 0.027 *** | 0.028 *** |

| (3.91) | (3.97) | |

| BORD | 0.036* | 0.041 * |

| (1.72) | (1.90) | |

| DUAL | −0.020 ** | −0.018 * |

| (−2.19) | (−1.96) | |

| TOP1 | 0.019 | −0.028 |

| (0.66) | (−0.46) | |

| BIG4 | 0.027 | 0.028 |

| (1.37) | (1.39) | |

| OWNER | 0.016 ** | 0.012 *** |

| (2.00) | (3.59) | |

| GDP | 0.070 | 0.095 |

| (0.65) | (0.87) | |

| MKT | 0.024 *** | 0.024 *** |

| (3.26) | (3.19) | |

| Intercept | −0.213 *** | −0.184 ** |

| (−3.18) | (−2.47) | |

| Year & Ind. | Yes | Yes |

| N | 7227 | 6938 |

| Adj. R2 | 0.147 | 0.151 |

| (1) | (2) | |

|---|---|---|

| Dep. Variable= | IC | IC |

| AP | −0.062 *** | −0.050 ** |

| (−2.93) | (−2.55) | |

| AP × INDOWN | 0.092 ** | |

| (2.55) | ||

| INDOWN | −0.049 | |

| (−1.56) | ||

| AP × PCM | 0.093 * | |

| (1.72) | ||

| PCM | −0.037 | |

| (−0.67) | ||

| SIZE | 0.072 *** | 0.070 *** |

| (13.51) | (13.15) | |

| ROA | 0.004 | −0.068 |

| (0.04) | (−0.79) | |

| LEV | −0.186 *** | −0.187 *** |

| (−7.16) | (−7.19) | |

| SEO | −0.081 ** | −0.088 ** |

| (−2.14) | (−2.31) | |

| GROW | −0.038 *** | −0.040 *** |

| (−6.42) | (−6.57) | |

| INVE | 0.078 ** | 0.069 * |

| (2.07) | (1.83) | |

| MA | −0.004 | −0.004 |

| (−0.48) | (−0.56) | |

| SEGM | 0.018 *** | 0.018 *** |

| (3.24) | (3.39) | |

| EXPO | 0.002 | 0.003 |

| (0.23) | (0.34) | |

| AGE | 0.027 *** | 0.028 *** |

| (3.86) | (4.04) | |

| BORD | 0.033 | 0.035 * |

| (1.59) | (1.65) | |

| DUAL | −0.019 ** | −0.019 ** |

| (−2.08) | (−2.15) | |

| TOP1 | 0.021 | 0.021 |

| (0.70) | (0.71) | |

| BIG4 | 0.026 | 0.030 |

| (1.32) | (1.49) | |

| OWNER | 0.014 *** | 0.014 *** |

| (4.13) | (4.12) | |

| GDP | 0.080 | 0.083 |

| (0.73) | (0.76) | |

| MKT | 0.025 *** | 0.025 *** |

| (3.45) | (3.42) | |

| Intercept | −0.218 *** | −0.223 *** |

| (−3.32) | (−3.41) | |

| Year & Ind. | Yes | Yes |

| N | 7227 | 7182 |

| Adj. R2 | 0.147 | 0.148 |

| (1) | (2) | |

|---|---|---|

| Dep. Variable= | IC | IC |

| AP | −0.046 ** | −0.084 *** |

| (−2.39) | (−2.61) | |

| AP × FEMALE | 0.134 * | |

| (1.70) | ||

| FEMALE | −0.161 ** | |

| (−2.46) | ||

| AP × TENURE | 0.006 * | |

| (1.71) | ||

| TENURE | −0.001 | |

| (−0.26) | ||

| SIZE | 0.071 *** | 0.069 *** |

| (13.51) | (13.03) | |

| ROA | 0.000 | −0.023 |

| (0.01) | (−0.29) | |

| LEV | −0.189 *** | −0.184 *** |

| (−7.29) | (−7.15) | |

| SEO | −0.082 ** | −0.081 ** |

| (−2.16) | (−2.14) | |

| GROW | −0.039 *** | −0.035 *** |

| (−6.54) | (−5.87) | |

| INVE | 0.080 ** | 0.078 ** |

| (2.14) | (2.11) | |

| MA | −0.003 | −0.003 |

| (−0.42) | (−0.40) | |

| SEGM | 0.018 *** | 0.016 *** |

| (3.26) | (2.92) | |

| EXPO | 0.002 | 0.002 |

| (0.25) | (0.18) | |

| AGE | 0.027 *** | 0.015 ** |

| (3.97) | (2.01) | |

| BORD | 0.033 | 0.031 |

| (1.59) | (1.48) | |

| DUAL | −0.019 ** | −0.020 ** |

| (−2.14) | (−2.28) | |

| TOP1 | 0.023 | 0.030 |

| (0.78) | (1.01) | |

| BIG4 | 0.027 | 0.030 |

| (1.32) | (1.50) | |

| OWNER | 0.013 *** | 0.015 *** |

| (3.95) | (4.39) | |

| GDP | 0.080 | 0.064 |

| (0.73) | (0.59) | |

| MKT | 0.026 *** | 0.025 *** |

| (3.50) | (3.41) | |

| Intercept | −0.229 *** | −0.182 *** |

| (−3.51) | (−2.68) | |

| Year & Ind. | Yes | Yes |

| N | 7225 | 7225 |

| Adj. R2 | 0.148 | 0.150 |

| (1) | (2) | |

|---|---|---|

| Dep. Variable= | IC | IC |

| AP | −0.064 ** | −0.079 *** |

| (−2.20) | (−3.14) | |

| AP × LABINT | −0.045 * | |

| (−1.80) | ||

| LABINT | −0.017 | |

| (−0.86) | ||

| AP × EMPEDU | 0.058 * | |

| (1.77) | ||

| EMPEDU | −0.018 | |

| (−0.63) | ||

| SIZE | 0.068 *** | 0.071 *** |

| (16.46) | (13.41) | |

| ROA | −0.001 | −0.016 |

| (−0.01) | (−0.20) | |

| LEV | −0.189 *** | −0.184 *** |

| (−9.51) | (−7.13) | |

| SEO | −0.079 ** | −0.079 ** |

| (−2.15) | (−2.08) | |

| GROW | −0.038 *** | −0.039 *** |

| (−7.01) | (−6.61) | |

| INVE | 0.082 *** | 0.078 ** |

| (2.87) | (2.08) | |

| MA | −0.003 | −0.003 |

| (−0.42) | (−0.40) | |

| SEGM | 0.016 *** | 0.017 *** |

| (3.68) | (3.16) | |

| EXPO | 0.002 | 0.005 |

| (0.28) | (0.55) | |

| AGE | 0.026 *** | 0.028 *** |

| (3.06) | (4.01) | |

| BORD | 0.031 * | 0.033 |

| (1.71) | (1.58) | |

| DUAL | −0.019 ** | −0.020 ** |

| (−2.51) | (−2.26) | |

| TOP1 | 0.017 | 0.024 |

| (0.78) | (0.82) | |

| BIG4 | 0.028 * | 0.024 |

| (1.80) | (1.21) | |

| OWNER | 0.014 *** | 0.013 *** |

| (4.37) | (3.80) | |

| GDP | 0.087 | 0.082 |

| (0.93) | (0.76) | |

| MKT | 0.026 *** | 0.025 *** |

| (3.51) | (3.39) | |

| Intercept | −0.188 *** | −0.212 *** |

| (−2.80) | (−3.21) | |

| Year & Ind. | Yes | Yes |

| N | 7225 | 7225 |

| Adj. R2 | 0.148 | 0.150 |

| Panel A: Descriptive Statistics for The Heavy Pollution Industry | |||

|---|---|---|---|

| Variables | Non-Pollution (Obs = 4582) | Pollution (Obs = 2635) | Dif. |

| IC | 0.503 | 0.522 | −0.018 *** |

| AP | 0.813 | 0.842 | −0.029 *** |

| SIZE | 8.350 | 8.431 | −0.082 *** |

| ROA | 0.047 | 0.053 | −0.005 *** |

| LEV | 0.439 | 0.421 | 0.018 *** |

| SEO | 0.042 | 0.036 | 0.006 *** |

| GROW | 0.237 | 0.111 | 0.126 *** |

| INVE | 0.163 | 0.119 | 0.044 *** |

| MA | 0.327 | 0.271 | 0.057 *** |

| SEGM | 2.459 | 2.326 | 0.134 *** |

| EXPO | 0.270 | 0.308 | −0.038 *** |

| AGE | 2.183 | 2.272 | −0.089 *** |

| BORD | 2.118 | 2.146 | −0.029 *** |

| DUAL | 0.277 | 0.235 | 0.042 *** |

| TOP1 | 0.340 | 0.352 | −0.012 *** |

| BIG4 | 0.054 | 0.055 | −0.001 |

| LEVE | 2.066 | 2.165 | −0.098 *** |

| GDP | 0.081 | 0.073 | 0.008 *** |

| MKT | 1.740 | 1.502 | 0.237 *** |

| Panel B: Cross-sectional Test for Heavy Pollution Industry | |||

| Dep.Variable= | IC | ||

| AP | −0.055 * | ||

| (−1.75) | |||

| AP × Pollution | 0.039 * | ||

| (1.82) | |||

| Pollution | 0.071 *** | ||

| (17.82) | |||

| SIZE | −0.003 | ||

| (−0.05) | |||

| ROA | −0.187 *** | ||

| (−9.39) | |||

| LEV | −0.081 ** | ||

| (−2.21) | |||

| SEO | −0.039 *** | ||

| (−7.00) | |||

| GROW | 0.077 *** | ||

| (2.75) | |||

| INVE | −0.003 | ||

| (−0.36) | |||

| MA | 0.018 *** | ||

| (4.08) | |||

| SEGM | 0.003 | ||

| (0.38) | |||

| EXPO | 0.027 *** | ||

| (3.20) | |||

| AGE | 0.033 * | ||

| (1.85) | |||

| BORD | −0.019 ** | ||

| (−2.52) | |||

| DUAL | 0.020 | ||

| (0.94) | |||

| TOP1 | 0.028 * | ||

| (1.76) | |||

| BIG4 | 0.014 *** | ||

| (4.47) | |||

| LEVE | 0.090 | ||

| (0.96) | |||

| GDP | 0.025 *** | ||

| (3.37) | |||

| MKT | −0.223 *** | ||

| (−3.27) | |||

| Intercept | −0.055 * | ||

| (−1.75) | |||

| Year & Ind. | Yes | ||

| N | 7227 | ||

| Adj. R2 | 0.147 | ||

| (1) | (2) | (3) | |

|---|---|---|---|

| Information Quality | Perquisite Consumption | Firm Value | |

| Dep. Variable= | C-SCORE | PERK | BHAR |

| AP | −0.002 ** | 0.004* | −0.051 ** |

| (−2.46) | (1.69) | (−2.14) | |

| SIZE | 0.017 *** | −0.004 *** | −0.088 *** |

| (43.32) | (−5.76) | (−12.04) | |

| ROA | −0.007 | −0.046 *** | 0.465 *** |

| (−1.20) | (−5.65) | (3.70) | |

| LEV | 0.004 | −0.008 *** | 0.268 *** |

| (1.51) | (−2.75) | (7.36) | |

| SEO | 0.003* | −0.005 ** | 0.363 *** |

| (1.65) | (−2.57) | (5.09) | |

| GROW | −0.001 ** | −0.002 *** | 0.093 *** |

| (−2.49) | (−3.71) | (6.83) | |

| INVE | −0.002 | −0.008 | −0.040 |

| (−0.68) | (−0.97) | (−0.80) | |

| MA | −0.001 ** | 0.000 | 0.108 *** |

| (−2.02) | (0.29) | (7.44) | |

| SEGM | −0.001 ** | 0.001 ** | −0.015 ** |

| (−2.41) | (2.45) | (−2.02) | |

| EXPO | −0.004 *** | −0.002 *** | −0.082 *** |

| (−6.27) | (−3.57) | (−6.65) | |

| AGE | −0.001 *** | 0.002 *** | −0.028 *** |

| (−3.78) | (2.58) | (−2.78) | |

| BORD | 0.002 | 0.000 | −0.034 |

| (1.29) | (0.07) | (−1.25) | |

| DUAL | −0.000 | 0.001 | 0.020 |

| (−0.17) | (0.60) | (1.56) | |

| TOP1 | 0.001 | −0.007 *** | 0.078 ** |

| (0.74) | (−3.18) | (2.10) | |

| BIG4 | −0.002 * | 0.005 ** | 0.062 *** |

| (−1.77) | (2.44) | (2.74) | |

| OWNER | 0.000 ** | −0.001 *** | −0.008 ** |

| (2.17) | (−2.64) | (−2.02) | |

| GDP | −0.004 | 0.006 | −0.012 |

| (−0.64) | (0.35) | (−0.08) | |

| MKT | −0.001 | −0.002 *** | 0.011 |

| (−1.60) | (−3.10) | (1.33) | |

| Intercept | −0.106 *** | 0.044 *** | 0.689 *** |

| (−30.31) | (8.01) | (8.72) | |

| Year & Ind. | Yes | Yes | Yes |

| N | 6718 | 7227 | 7209 |

| Adj. R2 | 0.567 | 0.084 | 0.301 |

| Dep. Var. | = IC |

| Panel A: non-parametric test | |

| North | −0.108 ** |

| (−2.25) | |

| Control Variable | Yes |

| Panel B:Local parameter OLS(Ordinary Least Squares) regression test | |

| TREAT | −0.036 * |

| (−1.96) | |

| SIZE | 0.075 *** |

| (10.09) | |

| ROA | −0.009 |

| (−0.08) | |

| LEV | −0.204 *** |

| (−5.69) | |

| SEO | −0.063 |

| (−0.95) | |

| GROW | −0.030 *** |

| (−3.15) | |

| INVE | 0.025 |

| (0.42) | |

| MA | 0.010 |

| (0.77) | |

| SEGM | 0.010 |

| (1.32) | |

| EXPO | −0.000 |

| (−0.03) | |

| AGE | 0.017 * |

| (1.86) | |

| BORD | 0.060 * |

| (1.94) | |

| DUAL | −0.011 |

| (−0.90) | |

| TOP1 | −0.068 |

| (−1.62) | |

| BIG4 | 0.052 ** |

| (2.10) | |

| LEVE | 0.025 *** |

| (5.53) | |

| GDP | 0.216 |

| (0.85) | |

| MKT | 0.031 * |

| (1.90) | |

| Intercept | −0.297 *** |

| (−2.95) | |

| Year & Ind. | Yes |

| Bandwidth | 2.45° |

| N | 2299 |

| Adj. R2 | 0.202 |

| (1) | (2) | |

|---|---|---|

| Dep. Variable= | IC | IC |

| AP | −0.062 * | −0.093 * |

| (−1.69) | (−1.71) | |

| SIZE | 0.080 *** | 0.075 *** |

| (16.31) | (16.29) | |

| ROA | −0.112 | −0.086 |

| (−1.34) | (−1.00) | |

| LEV | −0.191 *** | −0.195 *** |

| (−8.77) | (−8.77) | |

| SEO | −0.122 *** | −0.118 ** |

| (−2.67) | (−2.51) | |

| GROW | −0.037 *** | −0.034 *** |

| (−3.38) | (−3.03) | |

| INVE | 0.088 ** | 0.096 *** |

| (2.51) | (2.67) | |

| MA | −0.003 | −0.005 |

| (−0.49) | (−0.69) | |

| SEGM | 0.022 *** | 0.021 *** |

| (4.54) | (4.17) | |

| EXPO | −0.001 | −0.002 |

| (−0.15) | (−0.29) | |

| AGE | 0.019 *** | 0.021 *** |

| (3.38) | (3.59) | |

| BORD | 0.044 ** | 0.043 ** |

| (2.19) | (2.08) | |

| DUAL | −0.016 ** | −0.017 ** |

| (−2.17) | (−2.23) | |

| TOP1 | 0.013 | 0.009 |

| (0.53) | (0.34) | |

| BIG4 | 0.053 *** | 0.038 ** |

| (3.66) | (2.53) | |

| LEVE | 0.016 *** | 0.015 *** |

| (5.81) | (5.61) | |

| GDP | 0.045 | 0.479 |

| (0.23) | (1.23) | |

| MKT | 0.046 *** | 0.041 ** |

| (2.85) | (2.40) | |

| Intercept | −0.435 *** | −0.447 *** |

| (−6.25) | (−5.70) | |

| Ind | Yes | Yes |

| Year | Yes | No |

| City | Yes | No |

| City × Year | No | Yes |

| N | 7227 | 7227 |

| Adj. R2 | 0.166 | 0.150 |

| Panel A: Descriptive Statistics for PSM Sample | |||||||

| Pooled Sample | PSM Sample | ||||||

| Variables | Lower Polluted Cities (Obs = 3614) | Higher Polluted Cities (Obs = 3603) | Dif. | Lower Polluted Cities (Obs = 2626) | Higher Polluted Cities (Obs = 2626) | Dif. | |

| IC | 0.509 | 0.511 | −0.002 | 0.502 | 0.515 | −0.013 | |

| SIZE | 8.453 | 8.306 | 0.148 *** | 8.353 | 8.366 | −0.013 | |

| ROA | 0.047 | 0.052 | −0.005 *** | 0.050 | 0.049 | 0.000 | |

| LEV | 0.443 | 0.421 | 0.022 *** | 0.428 | 0.432 | −0.004 | |

| SEO | 0.036 | 0.043 | −0.006 *** | 0.041 | 0.039 | 0.002 | |

| GROW | 0.183 | 0.199 | −0.016 | 0.192 | 0.188 | 0.004 | |

| INVE | 0.144 | 0.150 | −0.006 * | 0.146 | 0.147 | −0.000 | |

| MA | 0.306 | 0.308 | −0.002 | 0.308 | 0.316 | −0.008 | |

| SEGM | 2.363 | 2.458 | −0.096 *** | 2.398 | 2.395 | 0.004 | |

| EXPO | 0.285 | 0.282 | 0.003 | 0.280 | 0.269 | 0.010 | |

| AGE | 2.237 | 2.194 | 0.043 ** | 2.205 | 2.219 | −0.014 | |

| BORD | 2.136 | 2.120 | 0.015 *** | 2.128 | 2.129 | −0.001 | |

| DUAL | 0.234 | 0.288 | −0.054 *** | 0.260 | 0.258 | 0.003 | |

| TOP1 | 0.347 | 0.341 | 0.006 * | 0.342 | 0.339 | 0.003 | |

| BIG4 | 0.061 | 0.049 | 0.012 ** | 0.056 | 0.057 | −0.001 | |

| LEVE | 2.340 | 1.864 | 0.475 *** | 2.036 | 2.084 | −0.048 | |

| GDP | 0.073 | 0.083 | −0.011 *** | 0.077 | 0.079 | −0.001 | |

| MKT | 1.577 | 1.730 | −0.153 *** | 1.656 | 1.658 | −0.003 | |

| Panel B: PSM Sample Regression | |||||||

| (1) | |||||||

| Dep.Variable= | IC | ||||||

| AP | −0.032 * | ||||||

| (−1.91) | |||||||

| SIZE | 0.070 *** | ||||||

| (14.45) | |||||||

| ROA | 0.056 | ||||||

| (0.75) | |||||||

| LEV | −0.176 *** | ||||||

| (−7.44) | |||||||

| SEO | −0.068 | ||||||

| (−1.55) | |||||||

| GROW | −0.040 *** | ||||||

| (−5.89) | |||||||

| INVE | 0.104 *** | ||||||

| (2.96) | |||||||

| MA | −0.004 | ||||||

| (−0.43) | |||||||

| SEGM | 0.018 *** | ||||||

| (3.49) | |||||||

| EXPO | 0.004 | ||||||

| (0.48) | |||||||

| AGE | 0.029 *** | ||||||

| (4.59) | |||||||

| BORD | 0.049 ** | ||||||

| (2.48) | |||||||

| DUAL | −0.017 ** | ||||||

| (−2.00) | |||||||

| TOP1 | 0.013 | ||||||

| (0.46) | |||||||

| BIG4 | 0.020 | ||||||

| (1.14) | |||||||

| LEVE | 0.013 *** | ||||||

| (4.29) | |||||||

| GDP | 0.083 | ||||||

| (0.76) | |||||||

| MKT | 0.025 *** | ||||||

| (3.79) | |||||||

| Intercept | −0.264 *** | ||||||

| (−4.35) | |||||||

| Year & Ind. | Yes | ||||||

| N | 5252 | ||||||

| Adj. R2 | 0.158 | ||||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Exclude Most Polluted Provinces/Cites | Alternative IC Measure | Alternative AP Measure | ||||

| Dep. Variable= | IC | IC | IC | IC | IC | IC |

| AP | −0.062 *** | −0.064 *** | −0.110 ** | −0.921 * | −0.000 *** | −0.062 ** |

| (−3.04) | (−3.07) | (−2.05) | (−1.77) | (−2.59) | (−2.39) | |

| SIZE | 0.071 *** | 0.072 *** | 0.199 *** | 1.978 *** | 0.072 *** | 0.072 *** |

| (13.16) | (13.36) | (13.36) | (12.96) | (13.58) | (13.56) | |

| ROA | −0.000 | −0.014 | 0.000 | 1.626 | −0.004 | −0.002 |

| (−0.00) | (−0.18) | (0.00) | (0.73) | (−0.04) | (−0.03) | |

| LEV | −0.182 *** | −0.183 *** | −0.526 *** | −5.397 *** | −0.187 *** | −0.187 *** |

| (−6.96) | (−6.94) | (−7.22) | (−7.28) | (−7.24) | (−7.23) | |

| SEO | −0.080 ** | −0.080 ** | −0.209 * | −2.704 ** | −0.082 ** | −0.082 ** |

| (−2.00) | (−2.08) | (−1.92) | (−2.49) | (−2.17) | (−2.15) | |

| GROW | −0.037 *** | −0.038 *** | −0.112 *** | −1.147 *** | −0.039 *** | −0.039 *** |

| (−5.91) | (−6.12) | (−6.56) | (−5.95) | (−6.48) | (−6.47) | |

| INVE | 0.060 | 0.071 * | 0.208 ** | 2.893 *** | 0.078 ** | 0.077 ** |

| (1.56) | (1.86) | (1.97) | (2.71) | (2.06) | (2.06) | |

| MA | −0.004 | −0.002 | −0.007 | −0.052 | −0.003 | −0.003 |

| (−0.50) | (−0.25) | (−0.36) | (−0.25) | (−0.45) | (−0.46) | |

| SEGM | 0.017 *** | 0.015 *** | 0.050 *** | 0.434 *** | 0.017 *** | 0.017 *** |

| (3.10) | (2.78) | (3.30) | (2.99) | (3.23) | (3.21) | |

| EXPO | −0.000 | 0.003 | 0.008 | 0.127 | 0.003 | 0.002 |

| (−0.01) | (0.31) | (0.32) | (0.55) | (0.33) | (0.29) | |

| AGE | 0.026 *** | 0.026 *** | 0.076 *** | 0.451 ** | 0.027 *** | 0.027 *** |

| (3.73) | (3.78) | (3.93) | (2.37) | (3.86) | (3.86) | |

| BORD | 0.021 | 0.030 | 0.085 | 0.646 | 0.033 | 0.033 |

| (0.95) | (1.41) | (1.44) | (1.13) | (1.60) | (1.58) | |

| DUAL | −0.020 ** | −0.021 ** | −0.054 ** | −0.466 * | −0.019 ** | −0.019 ** |

| (−2.22) | (−2.35) | (−2.13) | (−1.93) | (−2.12) | (−2.11) | |

| TOP1 | 0.022 | 0.019 | 0.062 | 0.816 | 0.021 | 0.020 |

| (0.72) | (0.64) | (0.75) | (1.03) | (0.71) | (0.69) | |

| BIG4 | 0.027 | 0.030 | 0.075 | 1.108 * | 0.027 | 0.027 |

| (1.34) | (1.46) | (1.32) | (1.86) | (1.34) | (1.34) | |

| OWNER | 0.015 *** | 0.014 *** | 0.037 *** | 0.389 *** | 0.014 *** | 0.014 *** |

| (4.26) | (4.13) | (3.96) | (4.26) | (4.15) | (4.14) | |

| GDP | 0.071 | 0.050 | 0.182 | 0.241 | 0.065 | 0.073 |

| (0.62) | (0.44) | (0.59) | (0.08) | (0.60) | (0.68) | |

| MKT | 0.031 *** | 0.030 *** | 0.071 *** | 0.643 *** | 0.025 *** | 0.026 *** |

| (4.05) | (3.93) | (3.43) | (3.22) | (3.38) | (3.48) | |

| Intercept | −0.177 *** | −0.201 *** | −0.744 *** | 27.277 *** | −0.260 *** | −0.253 *** |

| (−2.63) | (−3.07) | (−4.05) | (15.33) | (−4.09) | (−3.97) | |

| Year & Ind. | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 6638 | 6890 | 7227 | 7227 | 7227 | 7227 |

| Adj. R2 | 0.142 | 0.148 | 0.156 | 0.140 | 0.147 | 0.147 |

| (1) | (2) | (3) | (4) | |

| Dep. Variable = | IC | IC | IC | IC |

| AP | −0.042 ** | −0.037 * | −0.044 ** | −0.040 ** |

| (−2.21) | (−1.95) | (−2.28) | (−2.08) | |

| HOT | 0.298 | |||

| (1.11) | ||||

| WIND | −0.060 *** | |||

| (−2.75) | ||||

| BAD | −0.042 | |||

| (−1.05) | ||||

| CLIMATE | 0.004 | |||

| (1.15) | ||||

| SIZE | 0.072 *** | 0.072 *** | 0.072 *** | 0.072 *** |

| (13.53) | (13.53) | (13.54) | (13.53) | |

| ROA | −0.001 | 0.002 | −0.002 | −0.001 |

| (−0.01) | (0.03) | (−0.02) | (−0.01) | |

| LEV | −0.188 *** | −0.189 *** | −0.187 *** | −0.188 *** |

| (−7.23) | (−7.28) | (−7.24) | (−7.23) | |

| SEO | −0.081 ** | −0.080 ** | −0.081 ** | −0.082 ** |

| (−2.14) | (−2.11) | (−2.13) | (−2.15) | |

| GROW | −0.039 *** | −0.039 *** | −0.039 *** | −0.039 *** |

| (−6.46) | (−6.48) | (−6.48) | (−6.46) | |

| INVE | 0.076 ** | 0.079 ** | 0.079 ** | 0.077 ** |

| (2.04) | (2.12) | (2.09) | (2.04) | |

| MA | −0.003 | −0.003 | −0.003 | −0.003 |

| (−0.46) | (−0.42) | (−0.44) | (−0.46) | |

| SEGM | 0.018 *** | 0.017 *** | 0.018 *** | 0.018 *** |

| (3.26) | (3.17) | (3.23) | (3.24) | |

| EXPO | 0.002 | 0.002 | 0.003 | 0.002 |

| (0.25) | (0.28) | (0.32) | (0.25) | |

| AGE | 0.026 *** | 0.027 *** | 0.026 *** | 0.027 *** |

| (3.82) | (3.93) | (3.84) | (3.86) | |

| BORD | 0.033 | 0.033 | 0.033 | 0.033 |

| (1.58) | (1.59) | (1.58) | (1.59) | |

| DUAL | −0.019 ** | −0.019 ** | −0.019 ** | −0.019 ** |

| (−2.09) | (−2.09) | (−2.12) | (−2.09) | |

| TOP1 | 0.020 | 0.023 | 0.021 | 0.021 |

| (0.69) | (0.76) | (0.70) | (0.71) | |

| BIG4 | 0.027 | 0.027 | 0.027 | 0.027 |

| (1.34) | (1.34) | (1.33) | (1.34) | |

| LEVE | 0.014 *** | 0.014 *** | 0.014 *** | 0.014 *** |

| (4.14) | (4.11) | (4.12) | (4.13) | |

| GDP | 0.052 | −0.054 | 0.116 | 0.016 |

| (0.48) | (−0.48) | (1.02) | (0.14) | |

| OWNER | 0.024 *** | 0.025 *** | 0.027 *** | 0.024 *** |

| (3.24) | (3.37) | (3.58) | (3.21) | |

| Intercept | −0.230 *** | −0.208 *** | −0.217 *** | −0.224 *** |

| (−3.54) | (−3.15) | (−3.25) | (−3.42) | |

| Year & Ind. | Yes | Yes | Yes | Yes |

| N | 7227 | 7227 | 7227 | 7227 |

| Adj. R2 | 0.147 | 0.148 | 0.147 | 0.147 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, S.; Yang, D.; Liu, N.; Liu, X. The Effects of Air Pollution on Firms’ Internal Control Quality: Evidence from China. Sustainability 2019, 11, 5068. https://doi.org/10.3390/su11185068

Liu S, Yang D, Liu N, Liu X. The Effects of Air Pollution on Firms’ Internal Control Quality: Evidence from China. Sustainability. 2019; 11(18):5068. https://doi.org/10.3390/su11185068

Chicago/Turabian StyleLiu, Siyi, Daoguang Yang, Nian Liu, and Xin Liu. 2019. "The Effects of Air Pollution on Firms’ Internal Control Quality: Evidence from China" Sustainability 11, no. 18: 5068. https://doi.org/10.3390/su11185068

APA StyleLiu, S., Yang, D., Liu, N., & Liu, X. (2019). The Effects of Air Pollution on Firms’ Internal Control Quality: Evidence from China. Sustainability, 11(18), 5068. https://doi.org/10.3390/su11185068