The Rediscovery of Brand Experience Dimensions with Big Data Analysis: Building for a Sustainable Brand

Abstract

:1. Introduction

2. Literature Review

2.1. Brand Experience Dimensions

2.2. Research Method for Consumer Behavior

3. Research Design

3.1. Background

3.2. Brand Selection

3.3. Data Collection

3.4. Data Preprocessing

3.5. Methodology

3.5.1. Topic Modeling

3.5.2. Brand Experience Dimension Analysis

3.5.3. Conjoint Analysis

4. Results

4.1. Topic Modeling Result

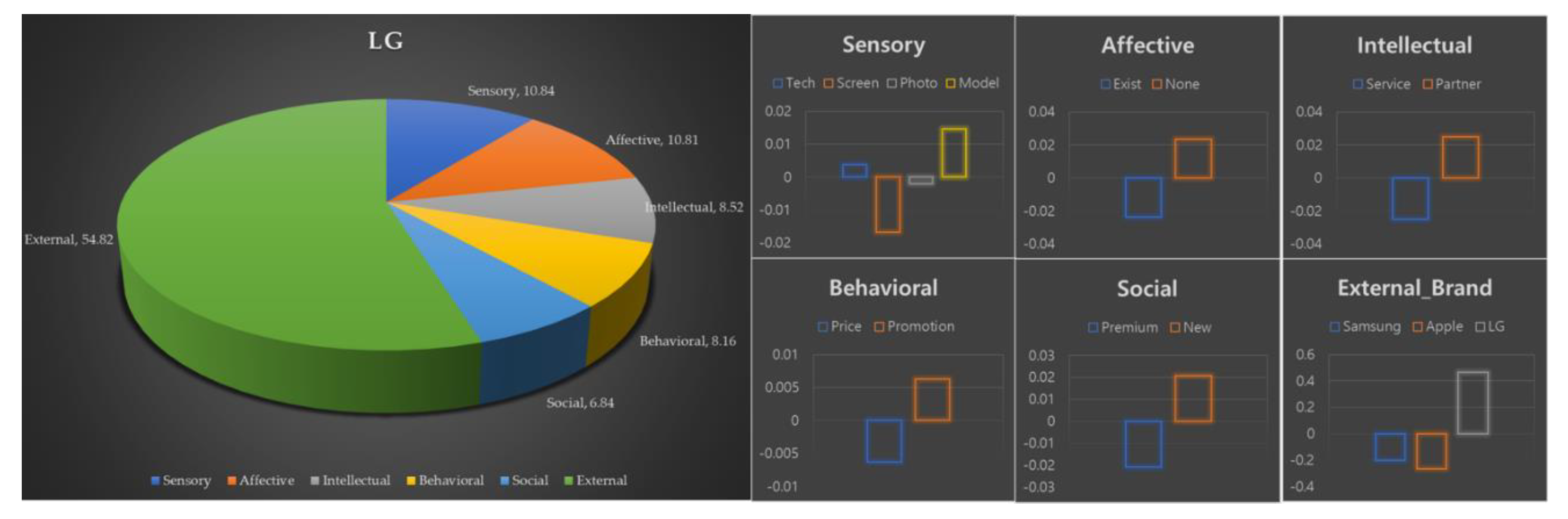

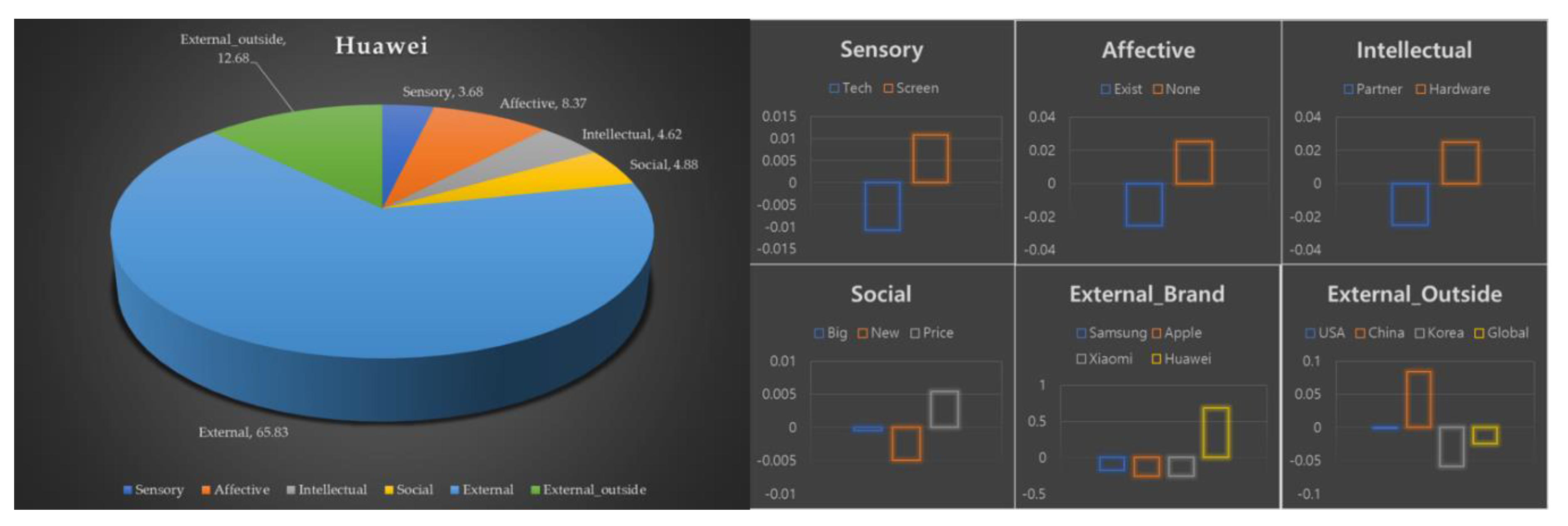

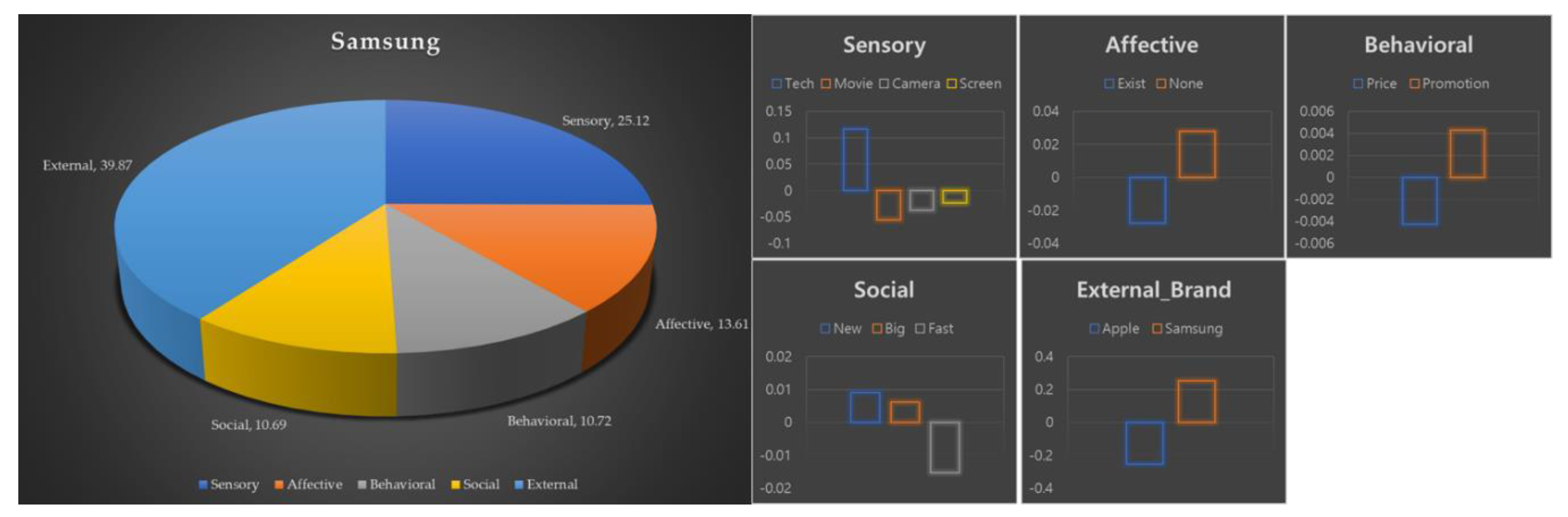

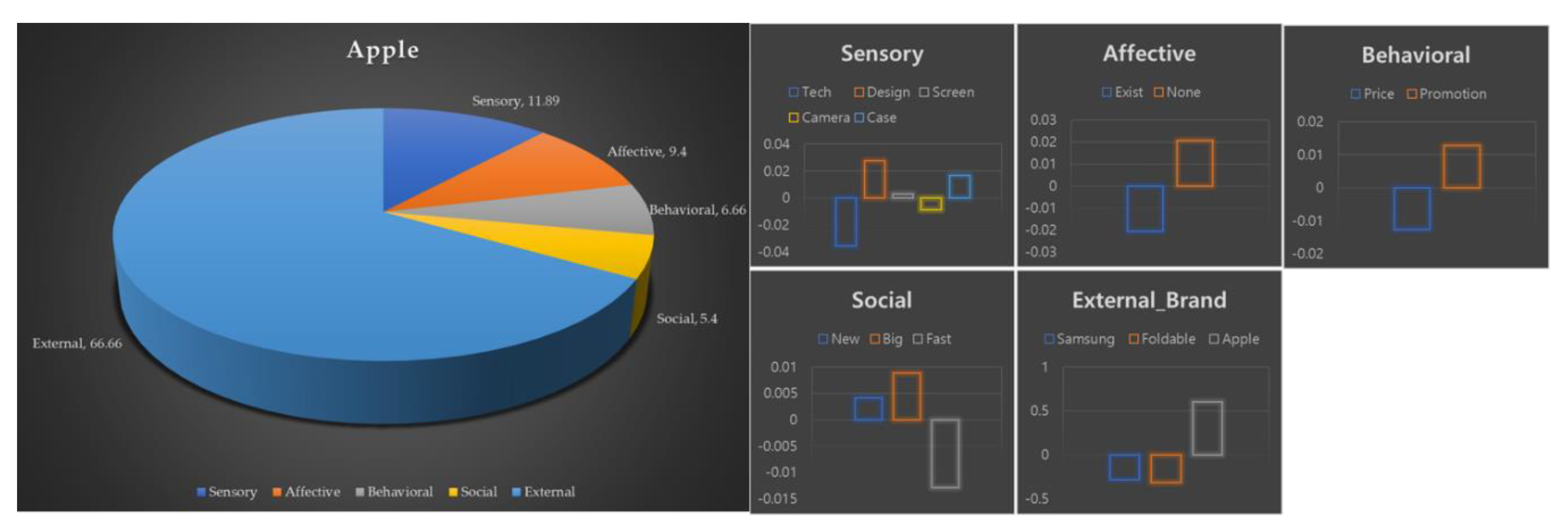

4.2. Brand Experience Dimension Analysis

- The topic corresponding to “Sensory” is “Feature,” a keyword relating to the product’s functionality. The color, image, screen, camera, and the case of the product can be considered similar to the consumer’s sensory responses.

- Meanwhile, “Negative Expression” can be considered to correspond to “Affective.” While the causative stimuli will likely vary, we can infer that negative expressions already contain emotions.

- The topics corresponding to “Intellectual” include certain “Feature” keywords (Gaming, Camera) and “Service & Partner.” These keywords can be classified as behavioral dimensions and responses that impact consumers’ purchasing behavior. However, they can also be classified under Schmitt’s “Think” as part of the purchase decision-making process.

- “Event” corresponds to “Behavioral,” reflecting the consumer’s response to product launch, price, and reservation leading to actual purchasing behavior.

- Meanwhile, “Review” can be considered to correspond to “Social.” While “Review” can be classified as “Intellectual” due to the objective information and assessments of various consumers, as most keywords contain standards for comparison in the market, they can be assigned to “Relate to.” Here, “Good” has the meaning of “Like,” which is an “Affective” aspect; however, its contextual meaning is interpreted as “Better” in the overall social standard and assessment of the product.

- The premise to consider here is that the topic and aforementioned experience dimensions cannot be accurately matched by brand. Thus, “Feature” for LG may contain more “Social Dimension” characteristics. However, for this study, we validated the methodology through conjoint analysis based on the premise of one-to-one matching of the dimensions for each brand.

- Finally, for the new dimensions, “External” has some possibility. Brand experience stems from brand-related stimuli. Of course, while there is no explicit statement that everything originates from within the brand, we generally recognize that stimuli stem from the brand or the company to which the brand belongs. Nonetheless, as the global economy grows more interconnected, the same products become consumed worldwide, and the speed of information dissemination accelerates, it is evident that even issues not directly related to the Korean market also affect consumers’ responses. Moreover, the benchmark brand for comparison now has a natural association in the market and affects consumer behavior.

4.3. Conjoint Analysis

4.3.1. Conjoint Attributes

4.3.2. Conjoint Analysis Results

5. Discussion

Author Contributions

Funding

Conflicts of Interest

References

- Lewnes, A.; Keller, K.L. 10 principles of modern marketing. MIT Sloan Management Review, 3 April 2019. [Google Scholar]

- Pine, B.J.; Gilmore, J.H. Welcome to the experience economy. Harv. Bus. Rev. 1998, 76, 97–105. [Google Scholar] [PubMed]

- Channel News Asia. Starwars Galaxy Theme Park. Available online: https://www.channelnewsasia.com/news/world/star-wars-theme-park-opens-at-disneyland-11587246 (accessed on 29 June 2019).

- Adobe. The Business Impact of Investing in Experience; Forrester Research Inc.: New York, NY, USA, 2018. [Google Scholar]

- Bhamra, T.; Lilley, D.; Tang, T. Design for sustainable behaviour: Using products to change consumer behaviour. Des. J. 2011, 14, 427–445. [Google Scholar] [CrossRef]

- Gordon, R.; Carrigan, M.; Hastings, G. A framework for sustainable marketing. Mark. Theory 2011, 11, 143–163. [Google Scholar] [CrossRef]

- Khan, I.; Rahman, Z. A review and future directions of brand experience research. Int. Strateg. Manag. Rev. 2015, 3, 1–14. [Google Scholar] [CrossRef] [Green Version]

- Hamari, J.; Sjöklint, M.; Ukkonen, A. The sharing economy: Why people participate in collaborative consumption. J. Assoc. Inf. Sci. Technol. 2016, 67, 2047–2059. [Google Scholar] [CrossRef]

- Richard, B.; Cleveland, S. The future of hotel chains: Branded marketplaces driven by the sharing economy. J. Vacat. Mark. 2016, 22, 239–248. [Google Scholar] [CrossRef]

- Brakus, J.J.; Schmitt, B.H.; Zarantonello, L. Brand experience: What is it? How is it measured? Does it affect loyalty? J. Mark. 2009, 73, 52–68. [Google Scholar] [CrossRef]

- Schmitt, B. Experiential marketing. J. Mark. Manag. 1999, 15, 53–67. [Google Scholar] [CrossRef]

- Nysveen, H.; Pedersen, P.E.; Skard, S. Brand experiences in service organizations: Exploring the individual effects of brand experience dimensions. J. Brand Manag. 2013, 20, 404–423. [Google Scholar] [CrossRef]

- Zarantonello, L.; Schmitt, B.H. The impact of event marketing on brand equity: The mediating roles of brand experience and brand attitude. Int. J. Advert. 2013, 32, 255–280. [Google Scholar] [CrossRef]

- Chattopadhyay, A.; Laborie, J.-L. Managing brand experience: The market contact audit™. J. Advert. Res. 2005, 45, 9–16. [Google Scholar] [CrossRef]

- Fransen, M.L.; van Rompay, T.J.L.; Muntinga, D.G. Increasing sponsorship effectiveness through brand experience. Int. J. Sports Mark. Spons. 2013, 14, 37–50. [Google Scholar] [CrossRef]

- Morrison, S.; Crane, F.G. Building the service brand by creating and managing an emotional brand experience. J. Brand Manag. 2007, 14, 410–421. [Google Scholar] [CrossRef]

- Srinivasan, S.S.; Till, B.D. Evaluation of search, experience and credence attributes: Role of brand name and product trial. J. Prod. Brand Manag. 2002, 11, 417–431. [Google Scholar] [CrossRef]

- Coomber, L.; Poore, J. From good to branded: Using immersive design to deliver a positive brand experience for British Gas. J. Brand Strategy 2012, 1, 318–326. [Google Scholar]

- Hanna, S.; Rowley, J. A practitioner-led strategic place brand-management model. J. Mark. Manag. 2013, 29, 1782–1815. [Google Scholar] [CrossRef]

- Berry, L.L.; Carbone, L.P.; Haeckel, S.H. Managing the total customer experience. Mit Sloan Manag. Rev. 2002, 43, 85–89. [Google Scholar]

- Kaufman, B. Stories that sell, stories that tell. J. Bus. Strategy 2003, 24, 11–15. [Google Scholar] [CrossRef]

- Lundqvist, A.; Liljander, V.; Gummerus, J.; Van Riel, A. The impact of storytelling on the consumer brand experience: The case of a firm-originated story. J. Brand Manag. 2013, 20, 283–297. [Google Scholar] [CrossRef]

- Wiedmann, K.-P.; Labenz, F.; Haase, J.; Hennigs, N. The power of experiential marketing: Exploring the causal relationships among multisensory marketing, brand experience, customer perceived value and brand strength. J. Brand Manag. 2018, 25, 101–118. [Google Scholar] [CrossRef]

- Iglesias, O.; Singh, J.J.; Batista-Foguet, J.M. The role of brand experience and affective commitment in determining brand loyalty. J. Brand Manag. 2011, 18, 570–582. [Google Scholar] [CrossRef]

- Ha, H.Y.; Perks, H. Effects of consumer perceptions of brand experience on the web: Brand familiarity, satisfaction and brand trust. J. Consum. Behav. Int. Res. Rev. 2005, 4, 438–452. [Google Scholar] [CrossRef]

- Delgado-Ballester, E.; Luis Munuera-Alemán, J. Brand trust in the context of consumer loyalty. Eur. J. Mark. 2001, 35, 1238–1258. [Google Scholar] [CrossRef]

- Brown, T.J.; Barry, T.E.; Dacin, P.A.; Gunst, R.F. Spreading the word: Investigating antecedents of consumers’ positive word-of-mouth intentions and behaviors in a retailing context. J. Acad. Mark. Sci. 2005, 33, 123–138. [Google Scholar] [CrossRef]

- Oliver, R.L. Cognitive, affective, and attribute bases of the satisfaction response. J. Consum. Res. 1993, 20, 418–430. [Google Scholar] [CrossRef]

- Oliver, R.L.; Rust, R.T.; Varki, S. Customer delight: Foundations, findings, and managerial insight. J. Retail. 1997, 73, 311–336. [Google Scholar] [CrossRef]

- Chaudhuri, A.; Holbrook, M.B. The chain of effects from brand trust and brand affect to brand performance: The role of brand loyalty. J. Mark. 2001, 65, 81–93. [Google Scholar] [CrossRef]

- Aaker, D.A.; Equity, M.B. Capitalizing on the Value of a Brand Name; Free Press: New York, NY, USA, 1991; Volume 28, pp. 35–37. [Google Scholar]

- Mitchell, A.A.; Olson, J.C. Are product attribute beliefs the only mediator of advertising effects on brand attitude? J. Mark. Res. 1981, 18, 318–332. [Google Scholar] [CrossRef]

- Aaker, J.L. Dimensions of brand personality. J. Mark. Res. 1997, 34, 347–356. [Google Scholar] [CrossRef]

- Lee, H.J.; Kang, M.S. The effect of brand experience on brand relationship quality. Acad. Mark. Stud. J. 2012, 16, 87–98. [Google Scholar]

- Matt, C.; Hess, T.; Benlian, A. Digital transformation strategies. Bus. Inf. Syst. Eng. 2015, 57, 339–343. [Google Scholar] [CrossRef]

- Andreini, D.; Pedeliento, G.; Zarantonello, L.; Solerio, C. Reprint of “A renaissance of brand experience: Advancing the concept through a multi-perspective analysis”. J. Bus. Res. 2019, 96, 355–365. [Google Scholar] [CrossRef]

- González-Bailón, S. Social science in the era of big data. Policy Internet 2013, 5, 147–160. [Google Scholar] [CrossRef]

- Biesta, G. Pragmatising the curriculum: Bringing knowledge back into the curriculum conversation, but via pragmatism. Curric. J. 2014, 25, 29–49. [Google Scholar] [CrossRef]

- Dewey, J. Human Nature and Conduct; Courier Corporation: North Chelmsford, MA, USA, 2002. [Google Scholar]

- Dewey, J. Experience and Nature; Courier Corporation: North Chelmsford, MA, USA, 1958; Volume 471. [Google Scholar]

- Dubé, L.; Le Bel, J. The content and structure of laypeople’s concept of pleasure. Cogn. Emot. 2003, 17, 263–295. [Google Scholar] [CrossRef] [PubMed]

- Pinker, S. How the mind works. Ann. N. Y. Acad. Sci. 1999, 882, 119–127. [Google Scholar] [CrossRef]

- Holbrook, M.B.; Hirschman, E.C. The experiential aspects of consumption: Consumer fantasies, feelings, and fun. J. Consum. Res. 1982, 9, 132–140. [Google Scholar] [CrossRef]

- Zarantonello, L.; Schmitt, B.H. Using the brand experience scale to profile consumers and predict consumer behaviour. J. Brand Manag. 2010, 17, 532–540. [Google Scholar] [CrossRef]

- De Oliveira Santini, F.; Ladeira, W.J.; Sampaio, C.H.; Pinto, D.C. The brand experience extended model: A meta-analysis. J. Brand Manag. 2018, 25, 519–535. [Google Scholar] [CrossRef]

- Stebbins, R.A. Exploratory Research in the Social Sciences; Sage: New York, NY, USA, 2001; Volume 48. [Google Scholar]

- Hofacker, C.F.; Malthouse, E.C.; Sultan, F. Big data and consumer behavior: Imminent opportunities. J. Consum. Mark. 2016, 33, 89–97. [Google Scholar] [CrossRef]

- Gartner Inc. Gartner’s Big Data Definition Consists of Three Parts, Not to Be Confused with Three “V”s. Available online: https://www.forbes.com/sites/gartnergroup/2013/03/27/gartners-big-data-definition-consists-of-three-parts-not-to-be-confused-with-three-vs/#484071e842f6 (accessed on 17 July 2019).

- Janssen, M.; van der Voort, H.; Wahyudi, A. Factors influencing big data decision-making quality. J. Bus. Res. 2017, 70, 338–345. [Google Scholar] [CrossRef]

- LaValle, S.; Lesser, E.; Shockley, R.; Hopkins, M.S.; Kruschwitz, N. Big data, analytics and the path from insights to value. MIT Sloan Manag. Rev. 2011, 52, 21–32. [Google Scholar]

- Provost, F.; Fawcett, T. Data science and its relationship to big data and data-driven decision making. Big Data 2013, 1, 51–59. [Google Scholar] [CrossRef] [PubMed]

- Blackwell, R.D.; Miniard, P.W.; Engel, J.F. Consumer Behavior; Thomson/South-Western: Mason, OH, USA, 2006. [Google Scholar]

- Ginsberg, J.; Mohebbi, M.H.; Patel, R.S.; Brammer, L.; Smolinski, M.S.; Brilliant, L. Detecting influenza epidemics using search engine query data. Nature 2009, 457, 1012. [Google Scholar] [CrossRef] [PubMed]

- Goel, S.; Hofman, J.M.; Lahaie, S.; Pennock, D.M.; Watts, D.J. Predicting consumer behavior with Web search. Proc. Natl. Acad. Sci. USA 2010, 107, 17486–17490. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Choi, H.; Varian, H. Predicting the present with Google trends. Econ. Rec. 2012, 88, 2–9. [Google Scholar] [CrossRef]

- Lorigo, L.; Pan, B.; Hembrooke, H.; Joachims, T.; Granka, L.; Gay, G. The influence of task and gender on search and evaluation behavior using Google. Inf. Process. Manag. 2006, 42, 1123–1131. [Google Scholar] [CrossRef]

- Feldman, R.; Sanger, J. The Text Mining Handbook: Advanced Approaches in Analyzing Unstructured Data; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Hotho, A.; Nürnberger, A.; Paaß, G. A brief survey of text mining. LDV Forum. 2005, 20, 19–62. [Google Scholar]

- Gupta, V.; Lehal, G.S. A survey of text mining techniques and applications. J. Emerg. Technol. Web Intell. 2009, 1, 60–76. [Google Scholar] [CrossRef]

- Meyer, D.; Hornik, K.; Feinerer, I. Text mining infrastructure in R. J. Stat. Softw. 2008, 25, 1–54. [Google Scholar]

- Pang, B.; Lee, L. Opinion mining and sentiment analysis. Found. Trends Inf. Retr. 2008, 2, 1–135. [Google Scholar] [CrossRef]

- Hwang, H.J.; Shim, H.R.; Choi, J. Exploration of user experience research method with big data analysis: Focusing on the online review analysis of echo. J. Korea Contents Assoc. 2016, 16, 517–528. [Google Scholar] [CrossRef]

- Kim, E.-G.; Chun, S.-H. Analyzing online car reviews using text mining. Sustainability 2019, 11, 1611. [Google Scholar] [CrossRef]

- Kim, L.; Kim, N. Connecting opinion, belief and value: Semantic network analysis of a UK public survey on embryonic stem cell research. J. Sci. Commun. 2015, 14, A01. [Google Scholar] [CrossRef]

- Molla, R. How Apple’s iPhone Changed the World: 10 Years in 10 Charts. Available online: https://www.vox.com/2017/6/26/15821652/iphone-apple-10-year-anniversary-launch-mobile-stats-smart-phone-steve-jobs (accessed on 19 July 2019).

- Silver, K.T.A.L. Pew-Research-Center_Global-Technology-Use-2018_2019-02-05.Pdf; Pew Research Center: Washington, DC, USA, 2019; p. 33. [Google Scholar]

- Statistics Korea. Population of Korean. Available online: http://www.index.go.kr/potal/main/EachDtlPageDetail.do?idx_cd=1009 (accessed on 19 July 2019).

- Kim, S.H. Samsung, No 1. Smartphone Market in Korea. Available online: https://www.mk.co.kr/news/business/view/2019/06/438070/ (accessed on 20 July 2019).

- Counterpoint. Global Smartphone Market Share: By Quarter. Available online: https://www.counterpointresearch.com/global-smartphone-share/ (accessed on 20 July 2019).

- Open Survey. Social Media and Search Portal in Korea; Opensurvey: Seoul, Korea, 2018; p. 24. Available online: https://docs.opensurvey.co.kr/opensurvey_socialmedia_report_2018.pdf?mkt_tok=eyJpIjoiWW1FNE5HUTJZV05oTldSayIsInQiOiJwekhVellPMXUwN3RSeTdtQTBMb2thWldvWU1JUFpxeUdkM0FLSjVoUFhoNWJkT2hEMWRpQ3FueU5ubzNmVEx2dUFIMmxoNDFPRFcwdVVvd0UzTzR1akFwMkZ4OXVzV3NONmFtNllkMkRsdytVajlkVHAyMFV1b1wvQWg0aFhLRDgifQ%3D%3D (accessed on 25 May 2019).

- Blei, D.M. Probabilistic topic models. Commun. Acm 2012, 55, 77–84. [Google Scholar] [CrossRef] [Green Version]

- Yoon, B.; Park, Y. Development of new technology forecasting algorithm: Hybrid approach for morphology analysis and conjoint analysis of patent information. IEEE Trans. Eng. Manag. 2007, 54, 588–599. [Google Scholar] [CrossRef]

- Wever, R.; Van Kuijk, J.; Boks, C. User-centred design for sustainable behaviour. Int. J. Sustain. Eng. 2008, 1, 9–20. [Google Scholar] [CrossRef]

- Lilley, D. Design for sustainable behaviour: Strategies and perceptions. Des. Stud. 2009, 30, 704–720. [Google Scholar] [CrossRef]

| LG | Huawei | Xiaomi | Samsung | Apple |

|---|---|---|---|---|

| LG V50 LG q9 LG Smartphone LG 5G | Huawei Smartphone Huawei foldable phone Huawei Mate X Huawei 5G | Xiaomi Blackshark2 Xiaomi mi9 Xiaomi 5G | Galaxy Galaxy Fold Galaxy 5G Samsung Galaxy S10 5G | iPhone XI iPhone XI notch iPhone 2020 iPhone Foldable iPhone 5G iPhone XS Max iPhone XR |

| NNG1 | NNG2 | NNG(NNG1+NNG2) |

|---|---|---|

| Foldable | Phone | Foldable phone |

| Dark | Mode | Dark mode 1 |

| Smart | Phone | Smartphone |

| Augmented | Reality | Augmented Reality |

| Cell | Phone | Cell phone |

| Air | Pod | Air pod |

| Triple | Camera | Triple Camera |

| Dual | Camera | Dual Camera |

| Dual | Screen | Dual Screen |

| Black | Shark | Black Shark |

| Hole | Display | Hole Display |

| Topic | LG | Huawei | Xiaomi | Samsung | Apple |

|---|---|---|---|---|---|

| Feature | Spec Screen Photo Model Tech | Folding Screen Security | Color White Red Gaming Battery Camera WiFi | Spec Screen Fold Camera Movie Display | Screen Notch Design Camera Photo Display Case Patent |

| Event | Launch Price Experience | Launch | Launch Unpack Price Reservation | Launch Price Experience | |

| Service & Partner | A/S Fee Google play U Plus 1 | U Plus Hardware | Qualcomm Market | ||

| Review | Premium Possible | Big First Price | Bang for the Buck New Style First | Big New Style First Fast Good Multiple | Big New Style Same Multiple Good Fast |

| Negative Expression | None Exist | None Exist Expelled | None Exist Not Working | None Exist Problem | None Exist |

| Other Brand & Outside | Samsung Galaxy iPhone | Samsung Galaxy Apple Xiaomi USA China Government Global Market | Hong mi mi Samsung Galaxy Huawei | iPhone USA | Galaxy Foldable Phone Samsung |

| Dimension Attribute | Level | ||||

|---|---|---|---|---|---|

| LG (192) * | Huawei (384) * | Xiaomi (120) * | Samsung (96) * | Apple (180) * | |

| Sensory Feature | Tech Screen Photo Model | Tech Screen | Color Game Battery Camera WiFi | Tech Camera Movie Screen | Tech Design Camera Screen Case |

| Behavioral Event | Price Promotion | Price Promotion | Price Promotion | ||

| Intellectual Service & Partner | Service Partner | Partner Hardware | Qualcomm Market | ||

| Social Review | Premium New | Big First Price | Price New | Big New Fast | Big New Fast |

| Affective Negative Expression | Exist None | Exist None | Exist None | Exist None | Exist None |

| External Other Brand | Samsung Apple LG 1 | Samsung Apple Xiaomi Huawei 1 | Hong mi Xiaomi 1 Samsung Huawei | Apple Samsung 1 | Foldable Samsung Apple 1 |

| & Outside | USA China Korea Global |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Oh, J.; Connerton, T.P.; Kim, H.-J. The Rediscovery of Brand Experience Dimensions with Big Data Analysis: Building for a Sustainable Brand. Sustainability 2019, 11, 5438. https://doi.org/10.3390/su11195438

Oh J, Connerton TP, Kim H-J. The Rediscovery of Brand Experience Dimensions with Big Data Analysis: Building for a Sustainable Brand. Sustainability. 2019; 11(19):5438. https://doi.org/10.3390/su11195438

Chicago/Turabian StyleOh, JooSeok, Timothy Paul Connerton, and Hyun-Jung Kim. 2019. "The Rediscovery of Brand Experience Dimensions with Big Data Analysis: Building for a Sustainable Brand" Sustainability 11, no. 19: 5438. https://doi.org/10.3390/su11195438

APA StyleOh, J., Connerton, T. P., & Kim, H.-J. (2019). The Rediscovery of Brand Experience Dimensions with Big Data Analysis: Building for a Sustainable Brand. Sustainability, 11(19), 5438. https://doi.org/10.3390/su11195438