Corporate Social Responsibility and Intellectual Capital: Sources of Competitiveness and Legitimacy in Organizations’ Management Practices

Abstract

1. Introduction

- (1)

- Can CSR initiatives increase human capital in organizations?

- (2)

- Can CSR initiatives increase relational capital in organizations?

- (3)

- Can CSR initiatives increase structural and/or organizational capital in organizations?

- (4)

- Are CSR and IC a source of competitiveness for organizations?

- (5)

- If so, does CSR-related competitiveness lead to the expansion of organizations’ legitimacy in their sector?

2. Literature Review and Conceptual Model

3. Development of Hypotheses

3.1. CSR and Human Capital

3.2. CSR and Relational Capital

3.3. CSR and Structural and/or Organizational Capital

3.4. Human Capital and Competitiveness

3.5. Relational Capital and Competitiveness

3.6. Structural and/or Organizational Capital and Competitiveness

3.7. Competitiveness and Legitimacy

4. Methods

4.1. Structural Equation Models

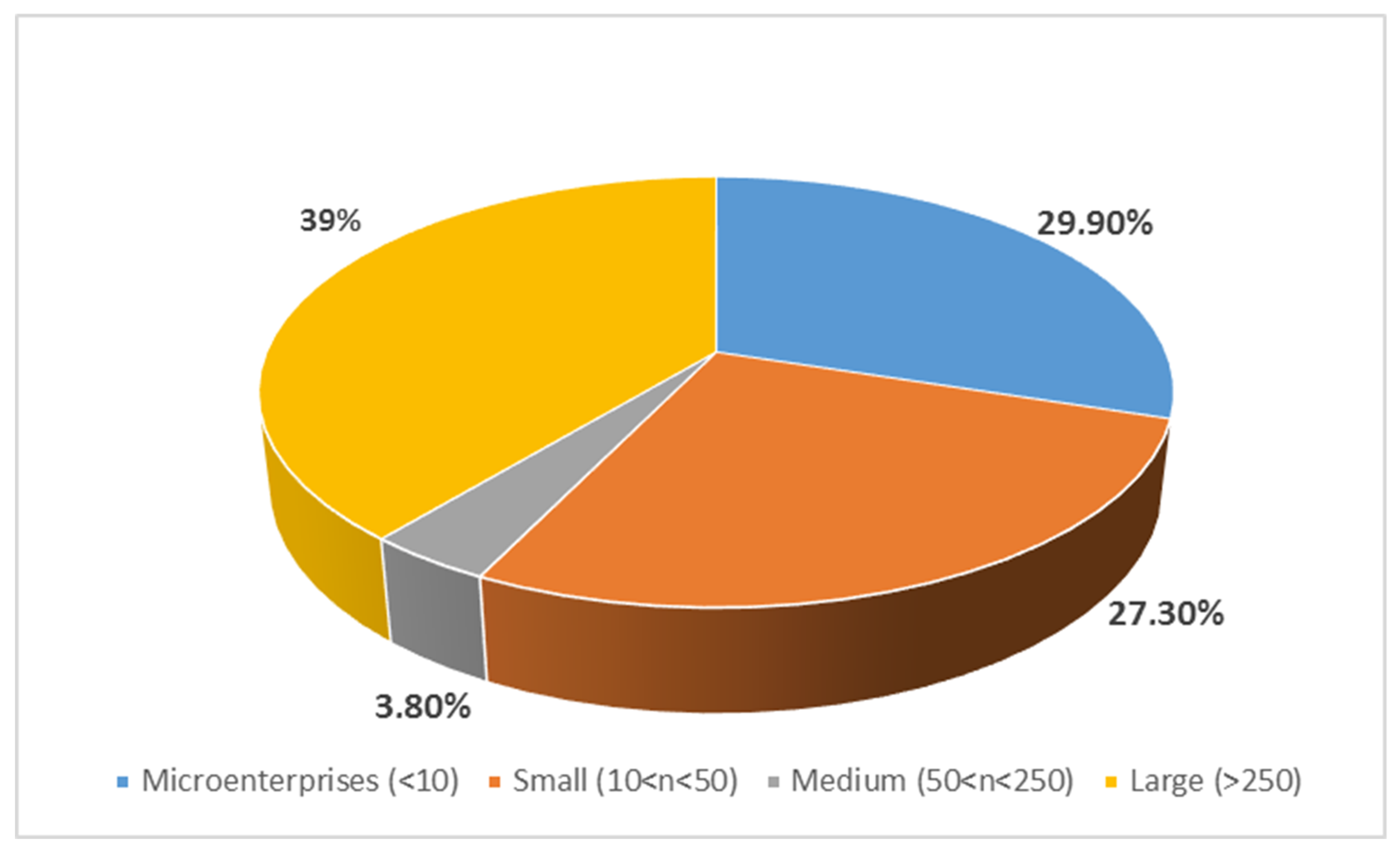

4.2. Population and Sample Selection

4.3. Measurement Instrument, Study Management, Data Collection, and Questionnaire Pretest

5. Results

5.1. Assessment of Measurement Model

5.2. Assessment of Structural Model

6. Discussion

7. Conclusions, Limitations, and Future Lines of Research

Author Contributions

Funding

Conflicts of Interest

References

- Boulouta, I.; Pitelis, C.N. Who needs CSR? The impact of corporate social responsibility on national competitiveness. J. Bus. Ethics 2014, 119, 349–364. [Google Scholar] [CrossRef]

- Calabrese, A.; Costa, R.; Menichini, T.; Rosati, F.; Sanfelice, G. Turning corporate social responsibility-driven opportunities into competitive advantages: A two-dimensional model. Knowl. Process. Manag. 2013, 20, 50–58. [Google Scholar] [CrossRef]

- Díez Martín, F.; Blanco González, A.; Cruz Suárez, A.; Prado Román, C. Efecto de la responsabilidad social empresarial sobre la legitimidad de las empresas. Anu. Juríd. Econ. Escur. 2014, 97, 325–348. [Google Scholar]

- Marín, L.; Rubio, A.; Maya, S.R. Competitiveness as a strategic outcome of corporate social responsibility. Corp. Soc. Responsib. Environ. Manag. 2012, 19, 364–376. [Google Scholar] [CrossRef]

- Iazzolino, G.; Laise, D. Value creation and sustainability in knowledge-based Strategies. J. Intellect. Cap. 2016, 17, 457–470. [Google Scholar] [CrossRef]

- Johnson, M.P.; Schaltegger, S. Two decades of sustainability management tools for SMEs: How far have we come? J. Small Bus. Manag. 2016, 54, 481–505. [Google Scholar] [CrossRef]

- Petrovic-Randelovic, M.; Stevanovi, T.; Ivanovi-Dukic, M. Impact of corporate social responsibility on the competitiveness of multinational corporations. Procedia Econ. Financ. 2015, 19, 332–341. [Google Scholar] [CrossRef]

- Khan, S.Z.; Yang, Q.; Waheed, A. Investment in intangible resources and capabilities spurs sustainable competitive advantage and firm performance. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 285–295. [Google Scholar] [CrossRef]

- Borisova, G.; Brown, J.R. R&D sensitivity to asset sale proceeds: New evidence on financing constraints and intangible investment. J. Bank Financ. 2013, 37, 159–173. [Google Scholar]

- Li, S.T.; Tsa, M.H.; Lin, C. Building a taxonomy of a firm’s knowledge assets: A perspective of durability and profitability. J. Inf. Sci. 2010, 36, 36–56. [Google Scholar] [CrossRef]

- Lin, C.S.; Huang, C.P. Measuring competitive advantage with an asset-light valuation model. Afr. J. Bus. Manag. 2011, 5, 5100–5108. [Google Scholar]

- Niebel, T.; O’Mahony, M.; Saam, M. The contribution of intangible assets to sectoral productivity growth in the EU. Rev. Income Wealth 2017, 63, S49–S67. [Google Scholar] [CrossRef]

- Roulstone, D.T. Discussion of intangible investment and the importance of firm-specific factors in the determination of earnings. Rev. Account. Stud. 2011, 16, 574–586. [Google Scholar] [CrossRef]

- Yu, H.C.; Kuo, L.; Kao, M.F. The relationship between CSR disclosure and competitive advantage. Sustain. Account. Manag. Policy J. 2017, 8, 547–570. [Google Scholar] [CrossRef]

- Barrena-Martínez, J.; López-Fernández, M.; Romero-Fernández, P.M. The link between socially responsible human resource management and intellectual capital. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 71–81. [Google Scholar] [CrossRef]

- European Commission. Green Book. Promoting a European Framework for Corporate Social Responsibility; Publications Office of the European Communities: Luxembourg, 2001. [Google Scholar]

- Asociación Española de Contabilidad y Administración de Empresas (AECA). Marco Conceptual de la Responsabilidad Social Corporativa; Documento nº 1 de la Comisión de RSC de AECA; AECA: Madrid, Spain, 2004. [Google Scholar]

- European Commission. Renewed Strategy of the European Union 2011–2014 for the Social Responsibility of Companies. 2011. Available online: http://eur-lex.europa.eu (accessed on 8 August 2019).

- Aguinis, H.; Glavas, A. What we know and don’t know about corporate social responsibility: A review and research agenda. J. Manag. 2012, 38, 932–968. [Google Scholar] [CrossRef]

- Campbell, J.L. Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Acad. Manag. Rev. 2007, 32, 946–967. [Google Scholar] [CrossRef]

- Kostova, T.; Roth, K.; Dacin, M.T. Institutional theory in the study of multinational corporations: A critique and new directions. Acad. Manag. Rev. 2008, 33, 994–1006. [Google Scholar] [CrossRef]

- Maignan, I.; Ralston, D.A. Corporate social responsibility in Europe and the US: Insights from businesses self-presentations. J. Int. Bus. Stud. 2002, 33, 497–514. [Google Scholar] [CrossRef]

- Matten, D.; Moon, J. “Implicit” and “explicit” CSR: A conceptual framework for a comparative understanding of corporate social responsibility. Acad. Manag. Rev. 2008, 33, 404–424. [Google Scholar] [CrossRef]

- Musibah, A.S.; Alfattani, W.S.B.W.Y. Impact of intellectual capital on corporate social responsibility: Evidence from Islamic banking sector in GCC. Int. J. Finan. Account. 2013, 2, 307–311. [Google Scholar]

- Williams, C.A.; Aguilera, R.V. Corporate social responsibility in comparative perspective. In Oxford Handbook of Corporate Social Responsibility; Crane, A., McWilliams, A., Matten, D., Moon, J., Siegel, D., Eds.; Oxford University Press: Oxford, UK, 2008; pp. 452–472. [Google Scholar]

- Cañibano Calvo, L.; García-Ayuso Covarsi, M.; Sánchez Múñoz, M.P. La relevancia de los intangibles para la valoración y la gestión de empresas: Revisión de la literature. Span. J. Financ. Account. 1999, 28, 17–88. [Google Scholar]

- Lev, B. Intangibles: Medición, Gestión e Información; Deusto: Barcelona, Spain, 2003. [Google Scholar]

- Branswijck, D.; Everaert, P. Intellectual capital disclosure commitment: Myth or reality? J. Intellect. Cap. 2012, 13, 39–56. [Google Scholar] [CrossRef]

- Holland, J. Corporative Value Creation, Intangibles and Disclosure; Working Paper. No. 2001; Department of Accounting & Finance, University of Glasgow: Glasgow, UK, 2001. [Google Scholar]

- Scherer, A.G.; Palazzo, G. The new political role of business in a globalized world: A review of a new perspective on CSR and its implications for the firm, governance, and democracy. J. Manag. Stud. 2011, 48, 899–931. [Google Scholar] [CrossRef]

- Odriozola, M.D.; Baraibar-Diez, E. Is corporate reputation associated with quality of CSR reporting? Evidence from Spain. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 121–132. [Google Scholar] [CrossRef]

- Jain, P.; Vyas, V.; Roy, A. Exploring the mediating role of intellectual capital and competitive advantage on the relation between CSR and financial performance in SMEs. Soc. Responsib. J. 2017, 13, 1–23. [Google Scholar] [CrossRef]

- Lungu, C.I.; Cariani, C.; Dascalu, C. Intellectual capital research through corporate social responsibility: (Re)constructing the agenda. World Acad. Sci. Eng. Technol. 2012, 6, 50–57. [Google Scholar]

- Frynas, J.G.; Stephens, S. Political corporate social responsibility: Reviewing theories and setting new agendas. Int. J. Manag. Rev. 2015, 17, 483–509. [Google Scholar] [CrossRef]

- Ayuso, S.; Navarrete-Báez, F.E. How does entrepreneurial and international orientation influence SMEs’ commitment to sustainable development? Empirical evidence from Spain and Mexico. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 80–94. [Google Scholar] [CrossRef]

- Bontis, N. There is a price on your head: Managing intellectual capital strategically. Bus. Q. 1996, 60, 40–47. [Google Scholar]

- Brooking, A. El Capital Intelectual. El Principal Activo de Las Empresas del Tercer Milenio; Paidós Ibérica S.A: Barcelona, Spain, 1997. [Google Scholar]

- Edvinsson, L. Developing intelectual capital at Skandia. Long. Range Plan. 1997, 30, 366–373. [Google Scholar] [CrossRef]

- Sofian, S.; Tayles, M.E.; Pike, R.H. Intellectual Capital: An Evolutionary Change in Management Accounting Practices; Working Paper Series No. 04/29; Bradford University School of Management: Bradford, UK, 2008. [Google Scholar]

- Castilla-Polo, F.; Gallardo-Vázquez, D. The main topics of research on disclosures of intangible assets: A critical review. Account. Audit Account. 2016, 29, 323–356. [Google Scholar] [CrossRef]

- Marzo, G.; Scarpino, E. Exploring intellectual capital management in SMEs: An in-depth Italian case study. J. Intellect. Cap. 2016, 17, 27–51. [Google Scholar] [CrossRef]

- Cañibano, L.; García-Ayuso, M.; Sánchez, P.; Chaminade, C. Guidelines for Managing and Reporting on Intangibles. Intellectual Capital Report; Fundación Airtel Móvil: Madrid, Spain, 2002. [Google Scholar]

- Delgado-Verde, M.; Martín-de-Castro, G.; Navas-López, J.E.; Cruz-González, J. Capital social, capital relacional e innovación tecnológica. Una aplicación al sector manufacturero español de alta y media-alta tecnología. Cuad. Econ. Dir. Empres. 2011, 14, 207–221. [Google Scholar] [CrossRef]

- Striukova, L.; Uneman, J.; Guthrie, J. Corporate reporting of intellectual capital: Evidence from UK companies. Brit. Account. Rev. 2008, 40, 297–313. [Google Scholar] [CrossRef]

- Youndt, M.; Snell, S. Human resource configuration, intellectual capital and organization performance. J. Manag. Issues 2004, 16, 337–360. [Google Scholar]

- Dabić, M.; Lažnjak, J.; Smallbone, D.; Švarc, J. Intellectual capital, organisational climate, innovation culture, and SME performance: Evidence from Croatia. J. Small Bus. Enterp. Dev. 2018. [Google Scholar] [CrossRef]

- Scherer, A.G.; Palazzo, G.; Seidl, D. Managing legitimacy in complex and heterogeneous environments: Sustainable development in a globalized world. J. Manag. Stud. 2013, 50, 259–284. [Google Scholar] [CrossRef]

- Carroll, A.B.; Shabana, K.M. The business case for corporate social responsibility: A review of concepts, research and practice. Int. J. Manag. Rev. 2010, 12, 85–105. [Google Scholar] [CrossRef]

- Du, S.; Vieira, E.T. Striving for legitimacy through corporate social responsibility: Insights from oil companies. J. Bus. Ethics 2012, 110, 413–427. [Google Scholar] [CrossRef]

- Sumita, T. Japanese Efforts on Intellectual Assets and Non-Financial Information; Paper Presented at the METI; METI: Tokyo, Japan, 2005. [Google Scholar]

- Barnett, M. Stakeholder influence capacity and the variability of financial returns to corporate social responsibility. Acad. Manag. Rev. 2007, 32, 794–816. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D.S.; Wright, P.M. Corporate social responsibility: Strategic implications. J. Manag. Stud. 2006, 43, 1–18. [Google Scholar] [CrossRef]

- Hillman, A.; Keim, G.D. Shareholder value, stakeholder management, and social issues: What’s the bottom line? Strat. Manag. J. 2001, 22, 125–139. [Google Scholar] [CrossRef]

- Branco, M.; Rodrigues, L.L. Corporate social responsibility and resource based perspectives. J. Bus. Ethics 2006, 69, 111–132. [Google Scholar] [CrossRef]

- Ballow, J.; Burgman, R.; Roos, G.; Molnar, M. A New Paradigm for Managing Shareholder Value; Accenture Institute for High Performance: Boston, MA, USA, 2004. [Google Scholar]

- Altuner, D.; Çelik, S.; Can Güleç, T.C. The linkages among intellectual capital, corporate governance and corporate social responsibility. Corp. Gov. 2015, 15, 491–507. [Google Scholar] [CrossRef]

- Helfat, C.E.; Martin, J.A. Dynamic managerial capabilities: Review and assessment of managerial impact on strategic change. J. Manag. 2015, 41, 1281–1312. [Google Scholar] [CrossRef]

- Wright, P.M.; Coff, R.; Moliterno, T.P. Strategic human capital: Crossing the great divide. J. Manag. 2014, 40, 353–370. [Google Scholar] [CrossRef]

- Lin, C.; Yu-Ping Wang, C.; Wang, C.Y.; Jaw, B.S. The role of human capital management in organizational competitiveness. Soc. Behav. Pers. 2017, 45, 81–92. [Google Scholar] [CrossRef]

- Delgado Ferraz, F.A.; Gallardo-Vázquez, D. Measurement tool to assess the relationship between corporate social responsibility, training practices and business performance. J. Clean Prod. 2016, 129, 659–672. [Google Scholar] [CrossRef]

- Voegtlin, C.; Greenwood, M. Corporate social responsibility and human resource management: A systematic review and conceptual analysis. Hum. Resour. Manag. Rev. 2016, 26, 181–197. [Google Scholar] [CrossRef]

- Redington, I. Making CSR Happen: The Contribution of People Management; The Chartered Institute of Personnel and Development: London, UK, 2005. [Google Scholar]

- Zhang, Y.; Li, J.; Jiang, W.; Zhang, H.; Hu, Y.; Liu, M. Organizational structure, slack resources and sustainable corporate socially responsible performance. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 1099–1107. [Google Scholar] [CrossRef]

- Razafindrambinina, D.; Kariodimedjo, D. Is Company Intellectual Capital Linked to Corporate Social Responsibility Disclosure? Findings from Indonesia. King of Prussia, PA: Communications of the IBIMA, IBIMA Publishing. 2011. Available online: http://www.ibimapublishing.com/journals/CIBIMA/cibima.html (accessed on 15 July 2019).

- Pulic, A. The Principles of Intellectual Capital Efficiency. A Brief Description; Croatian Intellectual Capital Center: Zagreb, Croatia, 2008. [Google Scholar]

- Bhattacharya, C.B.; Sen, S. Doing better at doing good: When, why and how consumers respond to corporate social initiative. Calif. Manag. Rev. 2004, 47, 9–25. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. The link between competitive advantage and corporate social responsibility. Harv. Bus. Rev. 2006, 84, 78–92. [Google Scholar] [PubMed]

- Mont, O.; Leire, C. Socially Responsible Purchasing in Supply Chains: The Present State in Sweden and Lessons from the Future; Working Paper; International Institute for Industrial Environmental Economics, University of Lund: Lund, Sweden, 2008. [Google Scholar]

- Gupta, K.; Krishnamurti, C. Does corporate social responsibility engagement benefit distressed firms? The role of moral and exchange capital. Pac. Basin. Financ. J. 2018, 50, 249–262. [Google Scholar] [CrossRef]

- Oh, W.Y.; Chang, Y.K.; Jung, R. Experience-based human capital or fixed paradigm problem? CEO tenure, contextual influences, and corporate social (ir)responsibility. J. Bus. Res. 2018, 90, 325–333. [Google Scholar] [CrossRef]

- Ramón-Llorens, M.C.; García-Meca, E.; Pucheta-Martínez, M.C. The role of human and social board capital in driving CSR reporting. Long Range Plan. 2018. [Google Scholar] [CrossRef]

- Fordham, A.E.; Robinson, G.M.; Cleary, J.; Blackwell, B.D.; Van Leeuwen, J. Use of a multiple capital framework to identify improvements in the CSR strategies of Australian resource companies. J. Clean Prod. 2018, 200, 704–730. [Google Scholar] [CrossRef]

- McWilliams, A.; Parhankangas, A.; Coupet, J.; Welch, E.; Barnum, D.T. Strategic decision making for the triple bottom line. Bus. Strat. Environ. 2016, 25, 193–204. [Google Scholar] [CrossRef]

- Kao, E.H.; Yeh, C.C.; Wang, L.H.; Fung, H.G. The relationship between CSR and performance: Evidence in China. Pac. Basin. Financ. J. 2018, 51, 155–170. [Google Scholar] [CrossRef]

- Kim, M.S.; Kim, D.T.; Kim, J.I. CSR for sustainable development: CSR beneficiary positioning and impression management motivation. Corp. Soc. Responsib. Environ. Manag. 2014, 21, 14–27. [Google Scholar] [CrossRef]

- Surroca, J.; Tribó, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strat. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate social responsibility: A theory of the firm perspective. Acad. Manag. Rev. 2001, 26, 117–127. [Google Scholar] [CrossRef]

- Turner, M.R.; McIntosh, T.; Reid, S.W.; Buckley, M.R. Corporate implementation of socially controversial CSR initiatives: Implications for human resource management. Hum. Resour. Manag. Rev. 2019, 29, 125–136. [Google Scholar] [CrossRef]

- Herrera Madueño, J.; Larrán Jorge, M.; Martínez Conesa, I.; Martínez-Martínez, D. Relationship between corporate social responsibility and competitive performance in Spanish SMEs: Empirical evidence from a stakeholders’ perspective. BRQ Bus. Res. Q. 2016, 19, 55–72. [Google Scholar] [CrossRef]

- Kudłak, R.; Szőcs, I.; Krumay, B.; Martinuzzi, A. The future of CSR-selected findings from a Europe-wide delphi study. J. Clean Prod. 2018, 183, 282–291. [Google Scholar] [CrossRef]

- Wickert, C.; Scherer, A.G.; Spence, L.J. Walking and talking corporate social responsibility: Implications of firm size and organizational cost. J. Manag. Stud. 2016, 53, 1169–1196. [Google Scholar] [CrossRef]

- Organization for Economic Co-Operation and Development (OECD). The Well-Being of Nations: The Role of Human and Social Capital; OECD: Paris, France, 2001. [Google Scholar]

- Rastogi, P.N. Sustaining enterprise competitiveness—Is human capital the answer? Hum. Syst. Manag. 2002, 19, 193–203. [Google Scholar]

- Bontis, N.; Fitzenz, J. Intellectual capital ROI: A current map to human capital antecedents and consequences. J. Intellect. Cap. 2002, 3, 223–247. [Google Scholar] [CrossRef]

- Foss, N.J. Why micro-foundations for resource-based theory are needed and what they may look like. J. Manag. 2011, 37, 1413–1428. [Google Scholar] [CrossRef]

- Hsu, I.C.; Lin, C.Y.Y.; Lawler, J.J.; Wu, S.H. Toward a model of organizational human capital development: Preliminary evidence from Taiwan. Asia Pac. Bus. Rev. 2007, 13, 251–275. [Google Scholar] [CrossRef]

- Kalchenko, O.A. The Role of Human Capital in Aspects of Innovations for Sustainable Socio-Economic Development. In Proceedings of the International Conference on ICT Management for Global Competitiveness and Economic Growth in Emerging Economies, Wroclaw, Poland, 7–8 November 2016. [Google Scholar]

- Marimuthu, M.; Arokiasamy, L.; Ismail, M. Human capital development and its impact on firm performance: Evidence from developmental economics. J. Int. Soc. Res. 2009, 2, 265–272. [Google Scholar]

- Sarlija, N.; Stanic, M. Does intellectual capital lead to higher firm growth? In Proceedings of the 9th European Conference on Intellectual Capital, Lisbon, Portugal, 6–7 April 2017. [Google Scholar]

- Seleim, A.; Ashour, A.; Bontis, N. Human capital and organizational performance: A study of Egyptian software companies. Manag. Decis. 2007, 45, 789–801. [Google Scholar] [CrossRef]

- Selvarajan, T.T.; Ramamoorthy, N.; Flood, P.C.; Guthrie, J.P.; MacCurtain, S.; Liu, W. The role of human capital philosophy in promoting firm innovativeness and performance: Test of a causal model. Int. J. Hum. Resour. Manag. 2007, 18, 1456–1470. [Google Scholar] [CrossRef]

- Garavan, T.N.; Morkey, M.; Gunnigle, P.; Collins, E. Human capital accumulation: The role of human resource development. J. Eur. Ind. Train. 2001, 25, 48–68. [Google Scholar] [CrossRef]

- Iles, P.; Mabey, C.; Robertson, I. HRM practices and employee commitment: Possibilities, pitfalls and paradoxes. Brit. J. Manag. 1990, 1, 147–157. [Google Scholar] [CrossRef]

- Noudhaug, O. Competencies specificities in organizations. Int. Stud. Manag. Organ. 1998, 28, 8–29. [Google Scholar]

- Roberston, I.T.; Iles, P.A.; Gratton, L.; Sharpley, D. The psychological impact of selection procedures on candidates. Hum. Relat. 1991, 44, 1963–1982. [Google Scholar]

- Cogan, M.L.; Duran, D.C.; Draghici, A. The impact of relational capital on competitiveness of the organization. Netw. Intell. Stud. 2014, 2, 233–240. [Google Scholar]

- Cabrita, M.; Landeiro Vaz, J. Intellectual capital and value creation: Evidence from the Portuguese baking industry. Electron. J. Knowl. Manag. 2005, 4, 11–20. [Google Scholar]

- Ordónez de Pablos, P. Intellectual capital reporting in Spain: A comparative review. J. Intellect. Cap. 2003, 4, 61–81. [Google Scholar] [CrossRef]

- Roos, G.; Bainbridge, A.; Jacobsen, K. Intellectual capital as a strategic tool. Strat. Lead. 2001, 29, 21–26. [Google Scholar] [CrossRef]

- Hormiga, E.; Batista-Canino, R.M.; Sánchez-Medina, A. The impact of relational capital on the success of new business start-ups. J. Small Bus. Manag. 2011, 49, 617–638. [Google Scholar] [CrossRef]

- Teece, D.J. Managing Intellectual Capital, Organizational, Strategic and Policy Dimensions; Oxford University Press: Oxford, UK, 2000. [Google Scholar]

- Wathne, K.H.; Heide, J.B. Relationship governance in a supply chain network. J. Mark. 2004, 68, 73–89. [Google Scholar] [CrossRef]

- Dyer, J.H.; Hatch, N.W. Relation-specific capabilities and barriers to knowledge transfers: Creating advantage through network relationships. Strat. Manag. J. 2006, 27, 701–719. [Google Scholar] [CrossRef]

- Nahapiet, J.; Ghoshal, S. Social capital, intellectual capital, and the organizational advantage. Acad. Manag. Rev. 1998, 23, 242–266. [Google Scholar] [CrossRef]

- Foss, K.; Foss, N.J. Resources and transaction costs: How property right economics furthers the resource-based view. Strat. Manag. J. 2005, 26, 541–553. [Google Scholar] [CrossRef]

- Yli-Renko, H.; Autio, E.; Sapienza, H.J. Social capital, knowledge acquisition, and knowledge exploitation in young technology-based firms. Strat. Manag. J. 2001, 22, 587–613. [Google Scholar] [CrossRef]

- Conner, K.R.; Prahalad, C.K. A resource-based theory of the firm: Knowledge versus opportunism. Organ. Sci. 1996, 7, 477–501. [Google Scholar] [CrossRef]

- Dhanaraj, C.; Lyles, M.A.; Steensma, H.K.; Tihanyi, L. Managing tacit and explicit knowledge transfer in IJVs: The role of relational embeddedness and the impact on performance. J. Int. Bus. Stud. 2004, 35, 428–442. [Google Scholar] [CrossRef]

- Grant, R.M.; Baden-Fuller, C. A knowledge accessing theory of strategic alliances. J. Manag. Stud. 2004, 41, 61–84. [Google Scholar] [CrossRef]

- Inkpen, A.C.; Pien, W. An examination of collaboration and knowledge transfer: China-Singapore Suzhou industrial park. J. Manag. Stud. 2006, 43, 779–811. [Google Scholar] [CrossRef]

- Liu, C.-L.; Ghauri, P.N.; Sinkovics, R.R. Understanding the impact of relational capital and organizational learning on alliance outcomes. J. World Bus. 2010, 45, 237–249. [Google Scholar] [CrossRef]

- Tsang, E.W.K. Acquiring knowledge by foreign partners from international joint ventures in a transition economy: Learning-by-doing and learning myopia. Strat. Manag. J. 2002, 23, 835–854. [Google Scholar] [CrossRef]

- Kotabe, M.; Martin, X.; Domoto, H. Gaining from vertical partnerships: Knowledge transfer, relationship duration, and supplier performance improvement in the U.S. and Japanese automotive industries. Strat. Manag. J. 2003, 24, 293–316. [Google Scholar] [CrossRef]

- Nold, H.A., III. Linking knowledge processes with firm performance: Organizational culture. J. Intellect. Cap. 2012, 13, 16–38. [Google Scholar] [CrossRef]

- Andreeva, T.; Garanina, T. Do all elements of intellectual capital matter for organizational performance? Evidence from Russian context. J. Intellect. Cap. 2016, 17, 397–412. [Google Scholar] [CrossRef]

- Jordao, D.; Vinicius, R.; Novas, J.C. Knowledge management and intellectual capital in networks of small-and medium-sized enterprises. J. Intellect. Cap. 2017, 18, 667–692. [Google Scholar] [CrossRef]

- Edvinsson, L.; Malone, M.S. El Capital Intelectual; Gestión 2000: Barcelona, Spain, 1999. [Google Scholar]

- Cabrita, M.R.; Bontis, N. Intellectual capital and business performance in the Portuguese banking industry. Int. J. Technol. Manag. 2008, 43, 212–237. [Google Scholar] [CrossRef]

- Khasmafkan Nezam, M.H.; Ataffar, A.; Isfhani, A.N.; Shahin, A. The impact of structural capital on new product development performance effectiveness—The mediating role of new product vision and competitive advantage. Int. J. Hum. Resour. Stud. 2013, 3, 281–301. [Google Scholar] [CrossRef][Green Version]

- Martín de Castro, G.; Delgado-Verde, M.; López-Sáez, P.; Navas-López, J.E. Towards an intellectual capital-based view of the firm: Origins and nature. J. Bus. Ethics 2011, 98, 649–662. [Google Scholar] [CrossRef]

- Esper, T.L.; Fugate, B.S.; Sramek, B.D. Logistic learning capability: Studying the competitive advantage gained through logistic learning. J. Bus. Logist. 2007, 28, 58–81. [Google Scholar] [CrossRef]

- Chen, C.H.; Lin, M.J. An assessment of post-M&A integration influences on new product development performance: An empirical analysis from China, Taiwan, and HK. Asia Pac. J. Manag. 2011, 28, 807–831. [Google Scholar]

- Yeh, T.M.; Pai, F.Y.; Yang, C. Performance improvement in new product development with effective tools and techniques adoption for high-tech industries. Qual. Quant. 2010, 44, 131–152. [Google Scholar] [CrossRef]

- Linzalone, R. Leveraging knowledge assets to improve new product development Performances. Meas. Bus. Excel. 2008, 12, 38–50. [Google Scholar] [CrossRef]

- McElroy, M.W. Social innovation capital. J. Intellect. Cap. 2002, 3, 30–39. [Google Scholar] [CrossRef]

- Alama Salazar, E.M. Capital Intelectual y Resultados Empresariales en las Empresas de Servicios Profesionales de España; Departamento de Organización de Empresas, Universidad Complutense de Madrid: Madrid, Spain, 2008. [Google Scholar]

- Chen, Y.S.; Lin, M.J.J.; Chang, C.H. The influence of intellectual capital on new product development performance—The manufacturing companies of Taiwan as an example. Total Qual. Manag. 2006, 17, 1323–1339. [Google Scholar] [CrossRef]

- Seleim, A.; Bontis, N. National intellectual capital and economic performance: Empirical evidence from developing countries. Knowl. Process. Manag. 2013, 20, 131–140. [Google Scholar] [CrossRef]

- Matos, F.; Vairinhos, V.M.; Dameri, R.P. Increasing smart city competitiveness and sustainability through managing structural capital. J. Intellect. Cap. 2017, 18, 693–707. [Google Scholar] [CrossRef]

- Williamson, D.; Lynch-Wood, G. Social and environmental reporting in UK company law and the issue of legitimacy. Corp. Gov. Int. J. Bus. Soc. 2008, 8, 128–140. [Google Scholar] [CrossRef]

- Lamberti, L.; Lettieri, E. Gaining legitimacy in converging industries: Evidence from the emerging market of functional food. Eur. Manag. J. 2011, 29, 462–475. [Google Scholar] [CrossRef]

- Alcántara, L.; Mitsuhashi, H.; Hoshino, Y. Legitimacy in international joint ventures: It is still needed. J. Int. Manag. 2006, 12, 389–407. [Google Scholar] [CrossRef]

- Tornikoski, E.T.; Newbert, S.L. Exploring the determinants of organizational emergence: A legitimacy perspective. J. Bus. Ventur. 2007, 22, 311–335. [Google Scholar] [CrossRef]

- Goergen, M.; Chahine, S.; Wood, G.; Brewster, C. Public listing, context and CSR: The effects of legal origin. J. Comp. Int. Manag. 2016, 19, 47–73. [Google Scholar]

- Anwar, Z.; Abbas, K.; Khan, M.; Razak, D.A. CSR disclosure and financial Access: A case study of Pakistan. Int. J. Econ. Manag. Account. 2019, 27, 167–186. [Google Scholar]

- Chin, W.W. Issues and opinion on structural equation modeling. MIS Q. 1998, 22, 7–16. [Google Scholar]

- Rigdon, E.E. Rethinking partial least squares path modeling: In praise of simple methods. Long Range Plan. 2012, 45, 341–358. [Google Scholar] [CrossRef]

- Sarstedt, M.; Hair, J.F.; Ringle, C.M.; Thiele, K.O.; Gudergan, S.P. Estimation issues with PLS and CBSEM: Where the bias lies! J. Bus. Res. 2016, 69, 3998–4010. [Google Scholar] [CrossRef]

- Rigdon, E.E. Choosing PLS path modeling as analytical method in European management research: A realist perspective. Eur. Manag. J. 2016, 34, 598–605. [Google Scholar] [CrossRef]

- Pandey, A.; Chandwani, R.; Navare, A. How can mindfulness enhance moral reasoning? An examination using business school students. Bus. Ethics 2018, 27, 56–71. [Google Scholar] [CrossRef]

- Roldán, J.L.; Sánchez-Franco, M.J. Variance-based structural equation modeling: Guidelines for using partial least squares in information systems research. In Research Methodologies, Innovations and Philosophies in Software Systems Engineering and Information Systems; Mora, M., Gelman, O., Steenkamp, A., Raisinghani, M.S., Eds.; Information Science Reference: Hershey, PA, USA, 2012; pp. 193–221. [Google Scholar]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Lawrence Erlbaum Associates: Hillsdale, NJ, USA, 1988. [Google Scholar]

- Green, S.B. How many subjects does it take to do a regression analysis. Multivar. Behav. Res. 1991, 26, 499–510. [Google Scholar] [CrossRef]

- Gallardo-Vázquez, D.; Sánchez-Hernández, M.I.; Corchuelo Martínez-Azúa, M.B. Validación de un instrumento de medida para la relación entre la orientación a la responsabilidad social corporativa y otras variables estratégicas de la empresa. Rev. Contab. 2013, 16, 11–23. [Google Scholar] [CrossRef]

- Gallardo-Vázquez, D.; Sánchez-Hernandez, M.I. Measuring Corporate Social Responsibility for competitive success at a regional level. J. Clean Prod. 2014, 72, 14–22. [Google Scholar] [CrossRef]

- Gallardo-Vázquez, D.; Sánchez-Hernández, M.I. Structural analysis of the strategic orientation to environmental protection in SMEs. BRQBus. Res. Q. 2014, 17, 115–128. [Google Scholar] [CrossRef]

- Moneva-Abadía, J.M.; Gallardo-Vázquez, D.; Sánchez-Hernández, M.I. Corporate Social Responsibility as a Strategic Opportunity for Small Firms during Economic Crises. J. Small Bus. Manag. 2018, 1–28. [Google Scholar] [CrossRef]

- Alama-Salazar, E.; Martín-de Castro, G.; López-Sáez, P. Capital intelectual. Una propuesta para clasificarlo y medirlo. Acad. Rev. Lat. Adm. 2006, 37, 1–16. [Google Scholar]

- Carmeli, A.; Tishler, A. The relationships between intangible organizational elements and organizational performance. Strat. Manag. J. 2004, 25, 1257–1278. [Google Scholar] [CrossRef]

- Hatch, N.; Dyer, J. Human capital and learning as a source of sustainable competitive advantage. Strat. Manag. J. 2004, 25, 1155–1178. [Google Scholar] [CrossRef]

- Youndt, M.; Subramanian, M.; Snell, S. Intellectual capital profiles: An examination of investments and returns. J. Manag. Stud. 2004, 42, 335–361. [Google Scholar] [CrossRef]

- King, A.W.; Fowler, S.; Zeithaml, C. Managing organizational competencies for competitive advantage: The middle-management edge. Acad. Manag. Exec. 2001, 15, 95–106. [Google Scholar] [CrossRef]

- Tippins, M.; Sohi, R. IT competency and firm performance: Is organizational learning a missing link? Strat. Manag. J. 2003, 24, 745–761. [Google Scholar] [CrossRef]

- Carmeli, A. The link between organizational elements, perceived external prestige and performance. Corp. Reput. Rev. 2004, 6, 314–331. [Google Scholar] [CrossRef]

- Tsai, W.; Ghosal, S. Social capital and value creation: The role of intrafirm networks. Acad. Manag. J. 1998, 41, 464–476. [Google Scholar]

- De Carolis, D. Competencies and inimitability in the pharmaceutical industry: An analysis of their relationship with firm performance. J. Manag. 2003, 29, 27–50. [Google Scholar]

- Chen, J.; Zhu, Z.; Yuan, H. Measuring intellectual capital: A new model and empirical study. J. Intellect. Cap. 2004, 5, 195–212. [Google Scholar] [CrossRef]

- Joia, A. Are frequent customer always a company’s intangible asset?: Some findings drawn from an exploratory case study. J. Intellect. Cap. 2004, 5, 586–601. [Google Scholar] [CrossRef]

- Gallego, I.; Rodríguez, L. Situation of intangibles assets in Spanish firms: An empirical analysis. J. Intellect. Cap. 2005, 6, 105–126. [Google Scholar] [CrossRef]

- Warn, J. Intangibles in commercialisation: The case of Air Navigation Services in the South Pacific. J. Intellect. Cap. 2005, 6, 72–88. [Google Scholar] [CrossRef]

- Lizcano Álvarez, J.L.; Gallardo-Vázquez, D. Aspectos distintivos de las mipymes relacionados con la responsabilidad social corporativa. Factores para la competitividad determinantes de legitimidad. In Proceedings of the II Congreso Iberoamericano de Investigación sobre Mipyme, San José, Costa Rica, 20–21 April 2017. [Google Scholar]

- Carmines, E.G.; Zeller, R.A. Reliability and Viability Assessment; Newbury Park Sage Publications: Thousand Oaks, CA, USA, 1991. [Google Scholar]

- Chin, W.; Dibbern, J. An introduction to a permutation based procedure for multi-group PLS analysis: Results of tests of differences on simulated data and a cross cultural analysis of the sourcing of information system services between Germany and the USA. In Handbook of Partial Least Squares; Vinzi, V.E., Ed.; Springer: Berlin, Germany, 2010; pp. 171–193. [Google Scholar]

- Vinzi, V.E.; Chin, W.W.; Henseler, J.; Wang, H. Handbook of Partial Least Squares: Concepts, Methods and Applications; Springer: Berlin, Germany, 2010. [Google Scholar]

- Falk, R.F.; Miller, N.B. A Primer for Soft Modeling; The University of Akron Press: Akron, OH, USA, 1992. [Google Scholar]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. SEM: Confirmatory factor analysis. In Multivariate Data Analysis; Hair, J.F., Black, W.C., Babin, B.J., Anderson, R.E., Eds.; Pearson Prentice Hall: Upper Saddle River, NJ, USA, 2006; pp. 770–842. [Google Scholar]

- Nunnally, J.C. Psychometric Theory; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Nunnally, J.C.; Bernstein, I.H. Psychometric Theory, 3rd ed.; McGraw-Hill: New York, NY, USA, 1994. [Google Scholar]

- Henseler, J.; Ringle, C.M.; Sinkovics, R.R. The use of partial least squares path modeling in international marketing. Adv. Int. Mark. 2009, 20, 277–320. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a silver bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Rodrigo-Alarcón, J.; García-Villaverde, P.M.; Ruiz-Ortega, M.J.; Parra-Requena, G. From social capital to entrepreneurial orientation: The mediating role of dynamic capabilities. Eur. Manag. J. 2018, 36, 195–209. [Google Scholar] [CrossRef]

- Wright, R.T.; Campbell, D.E.; Thatcher, J.B.; Robert, N. Operationalizing multidimensional constructs in structural equation modeling: Recommendations for IS research. Commun. J. Assoc. Inf. Syst. 2012, 30, 367–412. [Google Scholar] [CrossRef]

- Chin, W.W. How to write up and report PLS analyses. In Handbook of Partial Least Squares: Concepts, Methods and Applications; Vinzi, V., Chin, W.W., Henseler, J., Wang, H., Eds.; Springer: Berlin, Germany, 2010; pp. 655–690. [Google Scholar]

- Chin, W.W. The partial least squares approach to structural equation modeling. In Modern Methods for Business Research; Marcoulides, G.A., Ed.; Lawrence Erlbaum: Hillsdale, NJ, USA, 1998; pp. 295–336. [Google Scholar]

| Sample population | 200 companies and institutions contacted |

| Geographic region | Spain |

| Instrument used for data collection | Structured questionnaire administered to managers responsible for CSR |

| Sample | 77 companies |

| Sampling procedure | Simple random sampling |

| Type of population | Finite sample |

| Participation rate | 38.5% |

| CSR Measurement Scale Adapted from Gallardo-Vázquez et al. [144] | |

| First Order Subconstructs | Indicators |

| Social Dimension | |

| SD1: We seek to increase the employment of people at risk of social exclusion. | |

| SD2: We value the contribution of disabled people to the business world. | |

| SD3*a: We are aware of employees’ quality of life. | |

| SD4*: We pay wages above the industry average. | |

| SD5*: Employees’ compensation is related to their skills and results. | |

| SD6*: We maintain standards of health and safety beyond the legal minimum. | |

| SD7*: We are committed to job creation (e.g., fellowships and creation of job opportunities in the firm). | |

| SD8*: We foster our employees’ training and development. | |

| SD9*: We have human resource policies that seek to facilitate a balance between employees’ professional and personal lives. | |

| SD10*: Employees’ initiatives are extensively taken into account in management decisions. | |

| SD11*: Equal opportunities exist for all employees. | |

| SD12: We participate in social projects that benefit the surrounding community. | |

| SD13: We encourage employees to participate in volunteer activities or in collaborations with non-governmental organizations. | |

| SD14*: We have dynamic mechanisms in place to encourage dialogue with employees. | |

| Economic dimension | |

| ED1*: We take particular care to offer high-quality products and/or services to our customers. | |

| ED2*: We provide our customers with accurate, complete information about our products and/or services. | |

| ED3*: Respect for consumer rights is a management priority. | |

| ED4*: We strive to enhance stable relationships that include collaborations with and mutual benefits for our suppliers. | |

| ED5*: We understand the importance of incorporating responsible purchasing (i.e., we prefer responsible suppliers). | |

| ED6*: We foster business relationships with companies in this region. | |

| ED7: We have effective procedures for handling complaints. | |

| Environmental dimension | |

| ND*: We use consumables, goods-in-process, and/or processed goods with a low environmental impact. | |

| ND2*: We take energy savings into account to improve our levels of efficiency. | |

| ND3*: We attach high value to the introduction of alternative sources of energy. | |

| ND4*: We participate in activities related to the protection and enhancement of our natural environment. | |

| ND5*: We are aware of the importance of investment planning as a way to reduce the environmental impacts that firms generate. | |

| ND6*: We are in favor of reductions in gas emissions and waste production, as well as recycling materials. | |

| ND7*: We have a positive predisposition to the use, purchase, or production of environmentally friendly goods. | |

| ND8*: We value the use of recyclable containers and packaging. | |

| First order constructs | Indicators |

| Human capital measurement scale Adapted from Alama-Salazar et al. [148] | |

| HC1*: No one knows their work better than our employees do [149]. | |

| HC2*: Our employees have the required previous experience [150]. | |

| HC3*: Our employees are trained enough to do their job effectively (adapted from Carmeli and Tishler [149]). | |

| HC4*: Our employees develop new ideas and knowledge [45]. | |

| HC5*: Our employees are experts in their work and functions [151]. | |

| HC6*: Problems are easy to solve because our employees have the ability to understand their actions’ consequences (adapted from Carmeli and Tishler [149]). | |

| Structural capital measurement scale Adapted from Alama-Salazar et al. [148] | |

| SC1*: We all have a set of values, beliefs, and symbols [149]. | |

| SC2*: Our organization knows its external environment and responds appropriately [149]. | |

| SC3*: Our organizational objectives are clear and agreeable to all members [149]. | |

| SC4*: Our employees have a strong sense of responsibility to their company [149]. | |

| SC5: Our organization has the capacity to develop young talent [152]. | |

| SC6*: Our organization has the necessary knowledge and ability to link operational objectives and goals with compensation plans [152]. | |

| SC7*: We have procedures that help employees to execute routine operations (adapted from Tippins and Sohi [153]). | |

| SC8: We have standard procedures for handling customer complaints [153]. | |

| SC9*: Our employees and managers make real efforts to solve common problems [154]. | |

| SC10*: Our employees feel that their working conditions are good [154]. | |

| SC11*: Trust exists between our managers and employees [154]. | |

| SC12: Our organization uses patents and licenses as a way to retain knowledge [45]. | |

| Relational capital measurement scale Adapted from Alama-Salazar et al. [148] | |

| RC1*: Our employees develop ties with clients, suppliers, partners, and others to develop solutions [151]. | |

| RC2*: Our employees interact and exchange ideas with people from other areas of the company [151]. | |

| RC3*: In our company, different areas can be connected without fear of opportunistic behavior (adapted from Tsai and Ghosal [155]). | |

| RC4: Our company spends more on advertising annually than our biggest competitor does (adapted from De Carolis [156]). | |

| RC5*: Our company has the ability to detect customer needs (adapted from Chen et al. [157]). | |

| RC6: Our company has a wide portfolio of loyal customers (adapted from Joia [158]). | |

| RC7: In general, our company’s relationships with customers are long term (adapted from Gallego and Rodríguez [159]). | |

| RC8*: Our company’s annual customer complaints index is quite low (adapted from Chen et al. [157]). | |

| RC9: Our company’s customer turnover rate is quite low (adapted from Chen et al. [157]). | |

| RC10*: In general, our company’s relationships with suppliers and other entities linked to the business are long term (adapted from Gallego and Rodríguez [159] and Warn [160]). | |

| RC11*: Our company’s managerial quality has a favorable reputation [149]. | |

| RC12*: Our company has a better reputation than our key competitors due to our high level of innovation [154]. | |

| RC13*: Our company has a better reputation than our key competitors due to our high quality management [154]. | |

| RC14: Our organization has a track record solid enough to compete in the global market (adapted from King et al. [152]). | |

| Competitiveness measurement scale Adapted from Gallardo-Vázquez et al. [144] | |

| G1*: Our company has high quality human resource management. | |

| G2*: Our personnel have a high level of training and empowerment. | |

| G3*: Our managers have good leadership capabilities. | |

| G4*: Our capabilities in the field of marketing are good. | |

| G5*: Our products and services are high quality. | |

| G6*: Our organizational and administrative management is excellent. | |

| G7*: We have good technological resources and information systems. | |

| G8*: Our financial management is quite transparent. | |

| G9*: Our corporate values and culture are cohesive. | |

| G10*: We have a high level of market knowledge, know-how, and accumulated experience. | |

| Legitimacy measurement scale Adapted from Lizcano-Álvarez and Gallardo-Vázquez [161] | |

| H1*: Our company has experienced increasing returns since implementing CSR. | |

| H2*: We have observed an increase in productivity. | |

| H3*: We can say that our company is competitive. | |

| H4*: We have seen an increase in investment profitability. | |

| H5*: We have reduced costs through the implementation of CSR initiatives. | |

| H6*: We have improved our customer relationships. | |

| H7*: Our company has been able to attract new investment. | |

| H8*: Our company has the ability to attract new talent. | |

| H9*: Our company has a culture of social awareness. | |

| H10*: We observe a high degree of involvement in and pride about belonging to the company. | |

| H11*: We have noticed that the company’s communication and credibility has been reinforced after CSR initiatives. | |

| H12*: Our employees are more committed to the company. | |

| H13*: Our reputation has been consolidated through CSR initiatives. | |

| H14*: We have observed an increase in brand loyalty. | |

| H15*: Our image is very positive. | |

| H16*: We have received special recognition in our sector and market. | |

| First-Order Subconstructs | Second-Order Constructs | ||||||

|---|---|---|---|---|---|---|---|

| Social Dimension of CSR | Economic Dimension of CSR | Environmental Dimension of CSR | CSR | ||||

| Indicator | Loads (λ) | Indicator | Loads (λ) | Indicator | Loads (λ) | Indicator | Loads (λ) |

| SD1 | 0.663 | ED1 | 0.838 | ND1 | 0.760 | Social Dimension | 0.936 |

| SD2 | 0.620 | ED2 | 0.851 | ND2 | 0.831 | Economic Dimension | 0.895 |

| SD3 | 0.801 | ED3 | 0.724 | ND3 | 0.755 | Environmental Dimension | 0.890 |

| SD4 | 0.739 | ED4 | 0.881 | ND4 | 0.793 | ||

| SD5 | 0.761 | ED5 | 0.845 | ND5 | 0.834 | ||

| SD6 | 0.711 | ED6 | 0.682 | ND6 | 0.878 | ||

| SD7 | 0.738 | ED7 | 0.639 | ND7 | 0.870 | ||

| SD8 | 0.781 | ND8 | 0.866 | ||||

| SD9 | 0.755 | ||||||

| SD10 | 0.834 | ||||||

| SD11 | 0.809 | ||||||

| SD13 | 0.645 | ||||||

| SD14 | 0.823 | ||||||

| First-Order Constructs | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Human Capital | Relational Capital | Structural Capital | Competitiveness | Legitimacy | |||||

| Indicator | Loads (λ) | Indicator | Loads (λ) | Indicator | Loads (λ) | Indicator | Loads (λ) | Indicator | Loads (λ) |

| HC2 | 0.793 | RC2 | 0.721 | SC1 | 0.712 | G1 | 0.835 | H1 | 0.873 |

| HC3 | 0.912 | RC3 | 0.788 | SC2 | 0.807 | G2 | 0.817 | H2 | 0.870 |

| HC4 | 0.802 | RC5 | 0.776 | SC3 | 0.921 | G3 | 0.819 | H3 | 0.845 |

| HC5 | 0.916 | RC10 | 0.822 | SC4 | 0.882 | G4 | 0.787 | H4 | 0.833 |

| HC6 | 0.775 | RC11 | 0.838 | SC7 | 0.768 | G5 | 0.853 | H5 | 0.837 |

| RC12 | 0.783 | SC9 | 0.911 | G6 | 0.872 | H6 | 0.870 | ||

| RC13 | 0.796 | SC10 | 0.885 | G9 | 0.784 | H7 | 0.723 | ||

| SC11 | 0.833 | G10 | 0.707 | H8 | 0.864 | ||||

| H9 | 0.759 | ||||||||

| H10 | 0.781 | ||||||||

| H11 | 0.896 | ||||||||

| H12 | 0.893 | ||||||||

| H13 | 0.890 | ||||||||

| H14 | 0.874 | ||||||||

| H15 | 0.817 | ||||||||

| H16 | 0.778 | ||||||||

| Construct | Cronbach’s Alpha | Composite Reliability | AVE |

|---|---|---|---|

| SocDim | 0.934 | 0.942 | 0.559 |

| EcoDim | 0.893 | 0.917 | 0.616 |

| EnvDim | 0.932 | 0.944 | 0.680 |

| CSR | 0.892 | 0.933 | 0.823 |

| Human capital | 0.896 | 0.924 | 0.709 |

| Relational capital | 0.899 | 0.921 | 0.624 |

| Structural capital | 0.941 | 0.951 | 0.710 |

| Competitiveness | 0.925 | 0.939 | 0.657 |

| Legitimacy | 0.972 | 0.974 | 0.704 |

| Construct | Competitiveness | CSR | Human Capital | Legitimacy | Relational Capital | Structural Capital |

|---|---|---|---|---|---|---|

| Competitiveness | 0.885 | |||||

| CSR | 0.746 | 0.907 | ||||

| Human capital | 0.806 | 0.695 | 0.842 | |||

| Legitimacy | 0.508 | 0.552 | 0.523 | 0.839 | ||

| Relational capital | 0.811 | 0.824 | 0.785 | 0.585 | 0.790 | |

| Structural capital | 0.837 | 0.822 | 0.800 | 0.551 | 0.743 | 0.877 |

| Constructs | R2 |

|---|---|

| Human capital | 0.483 |

| Relational capital | 0.679 |

| Structural capital | 0.676 |

| Competitiveness | 0.820 |

| Legitimacy | 0.259 |

| Hypotheses | Path Coefficients (β) | Correlation | R2 (%) |

|---|---|---|---|

| H1: CSR initiatives influence human capital in organizations. | 0.695 | 0.695 | 48.30% |

| H2: CSR initiatives influence relational capital in organizations. | 0.824 | 0.824 | 67.90% |

| H3: CSR initiatives influence structural and/or organizational capital in organizations. | 0.822 | 0.822 | 67.57% |

| H4: A high level of human capital is a source of competitiveness for organizations. | 0.247 | 0.806 | 19.91% |

| H5: A high level of relational capital is a source of competitiveness for organizations. | 0.564 | 0.885 | 49.91% |

| H6: A high level of structural and/or organizational capital is a source of competitiveness for organizations. | 0.145 | 0.837 | 12.14% |

| H7: Competitiveness is a source of legitimacy for organizations. | 0.508 | 0.508 | 25.81% |

| Constructs | Q2 (1-SSE/SSO) |

|---|---|

| Human capital | 0.319 |

| Relational capital | 0.393 |

| Structural capital | 0.444 |

| Competitiveness | 0.493 |

| Legitimacy | 0.166 |

| Hypotheses | Path Coefficients (β) | t-Statistic (Bootstrap) | Validation of Relationship |

|---|---|---|---|

| H1: CSR → HC | 0.695 *** | 10.355 | Validated |

| H2: CSR → RC | 0.824 *** | 23.132 | Validated |

| H3: CSR → SC | 0.822 *** | 21.461 | Validated |

| H4: HC → Competitiveness | 0.247 * | 2.150 | Validated |

| H5: RC → Competitiveness | 0.564 *** | 4.547 | Validated |

| H6: SC → Competitiveness | 0.145 | 1.259 | Not validated |

| H7: Competitiveness → Legitimacy | 0.508 *** | 4.183 | Validated |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gallardo-Vázquez, D.; Valdez-Juárez, L.E.; Lizcano-Álvarez, J.L. Corporate Social Responsibility and Intellectual Capital: Sources of Competitiveness and Legitimacy in Organizations’ Management Practices. Sustainability 2019, 11, 5843. https://doi.org/10.3390/su11205843

Gallardo-Vázquez D, Valdez-Juárez LE, Lizcano-Álvarez JL. Corporate Social Responsibility and Intellectual Capital: Sources of Competitiveness and Legitimacy in Organizations’ Management Practices. Sustainability. 2019; 11(20):5843. https://doi.org/10.3390/su11205843

Chicago/Turabian StyleGallardo-Vázquez, Dolores, Luis Enrique Valdez-Juárez, and José Luis Lizcano-Álvarez. 2019. "Corporate Social Responsibility and Intellectual Capital: Sources of Competitiveness and Legitimacy in Organizations’ Management Practices" Sustainability 11, no. 20: 5843. https://doi.org/10.3390/su11205843

APA StyleGallardo-Vázquez, D., Valdez-Juárez, L. E., & Lizcano-Álvarez, J. L. (2019). Corporate Social Responsibility and Intellectual Capital: Sources of Competitiveness and Legitimacy in Organizations’ Management Practices. Sustainability, 11(20), 5843. https://doi.org/10.3390/su11205843