The Effect of Systematic Default Risk on Credit Risk Premiums

Abstract

:1. Introduction

2. Theoretical Background

2.1. The Merton Model

2.2. CDS Pricing

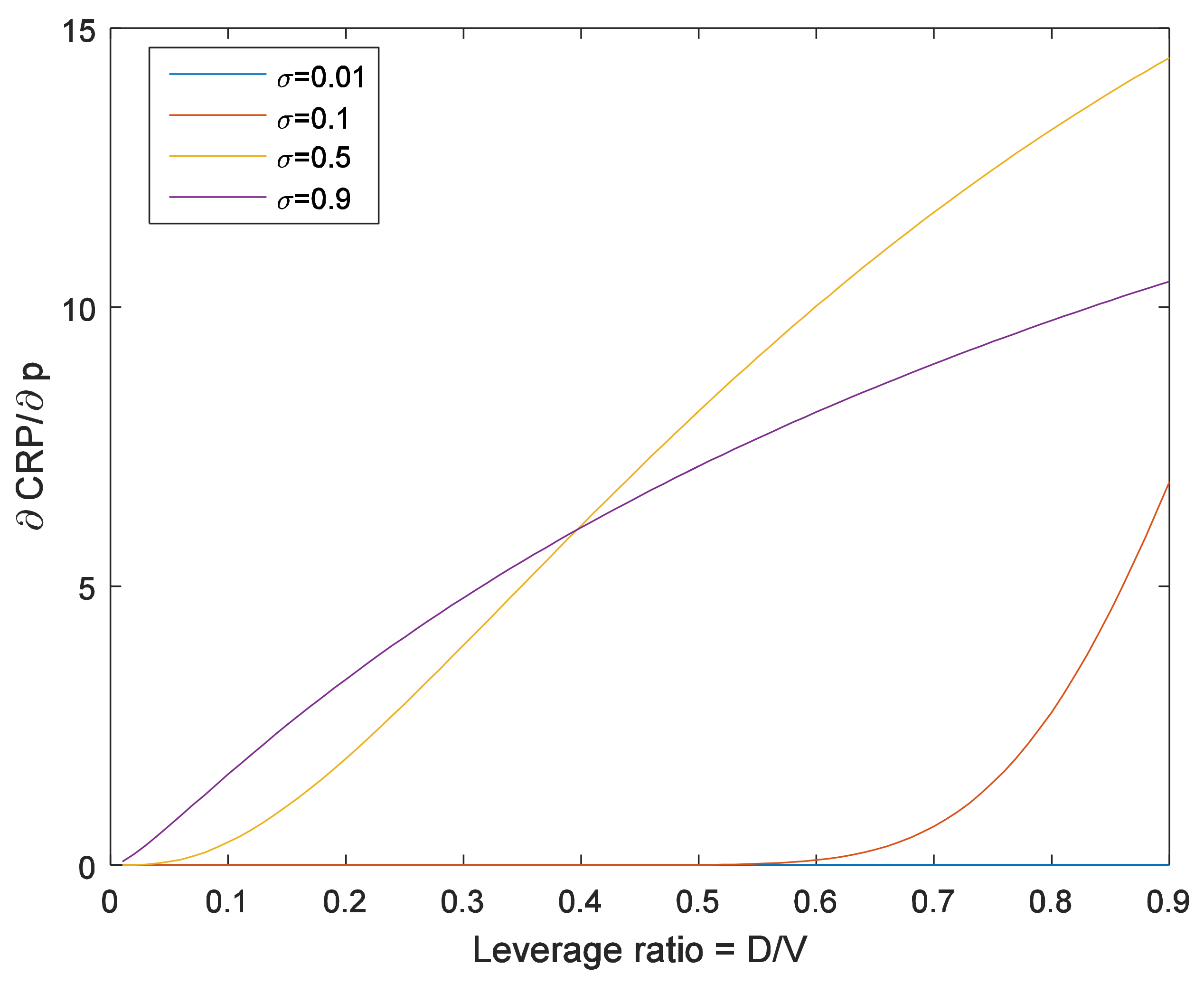

2.3. Credit Risk Premiums

3. Hypothesis Development

4. Methodology

4.1. Independent Variable: Decomposition of Systematic Default Risk

4.1.1. Firm Value Beta Estimation

4.1.2. Distance-to-Default Estimation

4.2. Dependent Variable: Estimation of Credit Risk Premiums (CRPs)

5. Empirical Tests

5.1. Raw Data

5.2. Estimation of CRPs and Distance-to-default

5.3. Systematic Factors in the CDS Market

5.4. Effect of Systematic Default Risks on CRPs

6. Conclusions

Funding

Acknowledgments

Conflicts of Interest

References

- Stulz, R.M. Credit Default Swaps and the Credit Crisis. J. Econ. Perspect. 2010, 24, 73–92. [Google Scholar] [CrossRef] [Green Version]

- Anderson, M. Contagion and Excess Correlation in Credit Default Swaps; Social Science Research Network: Rochester, NY, USA, 2011. [Google Scholar]

- Benzoni, L.; Collin-Dufresne, P.; Goldstein, R.S.; Helwege, J. Modeling credit contagion via the updating of fragile beliefs. Rev. Financ. Stud. 2015, 28, 1960–2008. [Google Scholar] [CrossRef]

- Collin-Dufresne, P.; Goldstein, R.S.; Helwege, J. Is Credit Event Risk Priced? Modeling Contagion via the Updating of Beliefs; National Bureau of Economic Research: Cambridge, MA, USA, 2010. [Google Scholar]

- Lando, D.; Nielsen, M.S. Correlation in corporate defaults: Contagion or conditional independence? J. Financ. Intermed. 2010, 19, 355–372. [Google Scholar] [CrossRef]

- Kenourgios, D.; Dimitriou, D. Contagion of the Global Financial Crisis and the real economy: A regional analysis. Econ. Model 2015, 44, 283–293. [Google Scholar] [CrossRef]

- Merton, R.C. On the pricing of corporate debt: The risk structure of interest rates. J. Financ. 1974, 29, 449–470. [Google Scholar]

- Collin-Dufresne, P.; Goldstein, R.S.; Martin, J.S. The determinants of credit spread changes. J. Financ. 2001, 56, 2177–2207. [Google Scholar] [CrossRef]

- Ericsson, J.; Jacobs, K.; Oviedo, R. The determinants of credit default swap premia. J. Financ. Quant. Anal. 2009, 44, 109–132. [Google Scholar] [CrossRef]

- Galil, K.; Shapir, O.M.; Amiram, D.; Ben-Zion, U. The determinants of CDS spreads. J. Bank. Financ. 2014, 41, 271–282. [Google Scholar] [CrossRef] [Green Version]

- Berndt, A.; Douglas, R.; Duffie, D.; Ferguson, M. Corporate credit risk premia. Rev. Financ. 2018, 22, 419–454. [Google Scholar] [CrossRef]

- Díaz, A.; Groba, J.; Serrano, P. What drives corporate default risk premia? Evidence from the CDS market. J. Int. Money Financ. 2013, 37, 529–563. [Google Scholar] [CrossRef] [Green Version]

- Friewald, N.; Wagner, C.; Zechner, J. The Cross-Section of Credit Risk Premia and Equity Returns. J. Financ. 2014, 69, 2419–2469. [Google Scholar] [CrossRef] [Green Version]

- Campbell, J.Y.; Hilscher, J.; Szilagyi, J. In Search of Distress Risk. J. Financ. 2008, 63, 2899–2939. [Google Scholar] [CrossRef] [Green Version]

- George, T.J.; Hwang, C.-Y. A resolution of the distress risk and leverage puzzles in the cross section of stock returns. J. Financ. Econ. 2010, 96, 56–79. [Google Scholar] [CrossRef]

- Huang, J.-Z.; Huang, M. How Much of the Corporate-Treasury Yield Spread Is Due to Credit Risk? Rev. Asset Pricing Stud. 2012, 2, 153–202. [Google Scholar] [CrossRef] [Green Version]

- Black, F.; Scholes, M. The pricing of options and corporate liabilities. J. Polit. Econ. 1973, 637–654. [Google Scholar] [CrossRef]

- Carr, P.; Wu, L. Stock options and credit default swaps: A joint framework for valuation and estimation. J. Financ. Econ. 2010, 8, 409–449. [Google Scholar] [CrossRef]

- Pan, J.; Singleton, K.J. Default and recovery implicit in the term structure of sovereign CDS spreads. J. Financ. 2008, 63, 2345–2384. [Google Scholar] [CrossRef]

- Vassalou, M.; Xing, Y. Default Risk in Equity Returns. J. Financ. 2004, 59, 831–868. [Google Scholar] [CrossRef]

- Bharath, S.T.; Shumway, T. Forecasting default with the Merton distance to default model. Rev. Financ. Stud. 2008, 21, 1339–1369. [Google Scholar] [CrossRef]

- Gilchrist, S.; Zakrajšek, E. Credit Spreads and Business Cycle Fluctuations. Am. Econ. Rev. 2012, 102, 1692–1720. [Google Scholar] [CrossRef]

- Fender, I.; Hayo, B.; Neuenkirch, M. Daily pricing of emerging market sovereign CDS before and during the global financial crisis. J. Bank. Financ. 2012, 36, 2786–2794. [Google Scholar] [CrossRef]

- Griffin, P.A.; Hong, H.A.; Kim, J.-B. Price discovery in the CDS market: The informational role of equity short interest. Rev. Account. Stud. 2016, 21, 1116–1148. [Google Scholar] [CrossRef]

- Hilscher, J.; Pollet, J.M.; Wilson, M. Are Credit Default Swaps a Sideshow? Evidence That Information Flows from Equity to CDS Markets. J. Financ. Quant. Anal. 2015, 50, 543–567. [Google Scholar] [CrossRef] [Green Version]

- Oehmke, M.; Zawadowski, A. The anatomy of the CDS market. Rev. Financ. Stud. 2016, 30, 80–119. [Google Scholar] [CrossRef]

- Fama, E.F.; MacBeth, J.D. Risk, return, and equilibrium: Empirical tests. J. Polit. Econ. 1973, 607–636. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. Common risk factors in the returns on stocks and bonds. J. Financ. Econ. 1993, 33, 3–56. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. Multifactor Explanations of Asset Pricing Anomalies. J. Financ. 1996, 51, 55–84. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. A five-factor asset pricing model. J. Financ. Econ. 2015, 116, 1–22. [Google Scholar] [CrossRef] [Green Version]

- Newey, W.; West, K. A Simple, Positive Semi-Definite, Heteroskedasticity and Autocorrelation Consistent Covariance Matrix. Econometrica 1987, 55, 703–708. [Google Scholar] [CrossRef]

- Cremers, M.; Weinbaum, D. Deviations from Put-Call Parity and Stock Return Predictability. J. Financ. Quant. Anal. 2010, 45, 335–367. [Google Scholar] [CrossRef] [Green Version]

- Hou, K.; Loh, R.K. Have we solved the idiosyncratic volatility puzzle? J. Financ. Econ. 2016, 121, 167–194. [Google Scholar] [CrossRef]

- Linnainmaa, J.T.; Roberts, M.R. The History of the Cross-Section of Stock Returns. Rev. Financ. Stud. 2018, 31, 2606–2649. [Google Scholar] [CrossRef] [Green Version]

| Mean | Max | Min | Std | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1Y | 5Y | 10Y | 1Y | 5Y | 10Y | 1Y | 5Y | 10Y | 1Y | 5Y | 10Y | |

| Panel A: Sector | ||||||||||||

| None | 143 | 156 | 164 | 1892 | 2149 | 1899 | 4 | 16 | 22 | 308 | 280 | 259 |

| Fin | 206 | 207 | 200 | 27,441 | 19,287 | 17,291 | 1 | 7 | 14 | 852 | 583 | 487 |

| Ind | 83 | 139 | 155 | 27,247 | 18,304 | 16,007 | 1 | 3 | 5 | 301 | 251 | 229 |

| Tech | 126 | 198 | 214 | 9834 | 6952 | 6608 | 1 | 5 | 7 | 364 | 339 | 299 |

| CS | 221 | 320 | 325 | 23,098 | 15,075 | 14,413 | 1 | 5 | 10 | 680 | 593 | 517 |

| BM | 132 | 189 | 207 | 35,637 | 19,384 | 16,841 | 1 | 9 | 15 | 768 | 497 | 429 |

| CG | 168 | 218 | 225 | 35,868 | 24,427 | 21,397 | 2 | 6 | 8 | 923 | 648 | 549 |

| HC | 66 | 124 | 142 | 1692 | 1526 | 1326 | 1 | 3 | 6 | 114 | 160 | 159 |

| Eng | 90 | 148 | 165 | 7280 | 5910 | 5900 | 1 | 2 | 5 | 291 | 271 | 247 |

| Tel | 200 | 313 | 325 | 6095 | 3996 | 3027 | 3 | 12 | 24 | 409 | 446 | 400 |

| Uti | 80 | 126 | 144 | 6871 | 3568 | 3611 | 2 | 10 | 23 | 208 | 171 | 160 |

| Panel B: Rating | ||||||||||||

| AAA | 19 | 32 | 40 | 679 | 564 | 496 | 1 | 2 | 5 | 56 | 51 | 45 |

| AA | 28 | 43 | 52 | 1167 | 975 | 818 | 1 | 3 | 5 | 60 | 59 | 55 |

| A | 50 | 69 | 79 | 5805 | 3370 | 2576 | 1 | 4 | 8 | 169 | 126 | 106 |

| BBB | 73 | 110 | 126 | 7355 | 4307 | 3611 | 1 | 5 | 13 | 201 | 155 | 133 |

| BB | 175 | 269 | 285 | 17,550 | 9192 | 7647 | 1 | 19 | 22 | 372 | 322 | 279 |

| B | 407 | 546 | 538 | 12,098 | 8387 | 7228 | 2 | 13 | 20 | 858 | 687 | 583 |

| CCC | 990 | 926 | 846 | 35,868 | 24,427 | 21,397 | 3 | 11 | 19 | 3037 | 2019 | 1703 |

| D | 156 | 251 | 275 | 13,811 | 12,057 | 11,108 | 3 | 22 | 27 | 539 | 507 | 472 |

| None | 113 | 239 | 266 | 16,037 | 10,235 | 8479 | 2 | 10 | 13 | 366 | 322 | 291 |

| RP (bp) | CDS (bp) | LEV (%) | HVOL (%) | |

|---|---|---|---|---|

| Mean | 67.24 | 172.73 | 31.71 | 36.96 |

| Std | 874.38 | 208.13 | 20.73 | 17.31 |

| Min | −3083.92 | 15.62 | 0.31 | 16.34 |

| Max | 14,477.76 | 2108.36 | 99.93 | 207.44 |

| Skew | 14.71 | 4.09 | 96.42 | 435.66 |

| Kurt | 236.46 | 26.36 | 61.09 | 3374.85 |

| Market Equity ($millions) | Default Point ($millions) | Default Probability | σ | |

|---|---|---|---|---|

| Mean | 14,164 | 5.64 | 0.08 | 0.43 |

| Std | 31,907 | 33.82 | 0.14 | 0.20 |

| Min | 56 | 0.00 | 0.00 | 0.08 |

| Max | 350,620 | 583.86 | 0.89 | 1.87 |

| Skew | 5 | 12.34 | 2.49 | 2.40 |

| Kurt | 38 | 175.50 | 6.99 | 10.12 |

| Explanatory Variables | M1 | M2 | M3 | M4 | M5 | M6 |

|---|---|---|---|---|---|---|

| Intercept | 0.00 | 0.03 *** | 0.00 *** | −0.02 *** | −0.02 *** | −0.02 *** |

| (0.31) | (10.86) | (2.65) | (−3.71) | (−3.10) | (−3.11) | |

| MCDS | 1.13 *** | 1.01 *** | 0.79 *** | 0.64 *** | ||

| (7.23) | (7.82) | (4.99) | (7.04) | |||

| MSLOPE | −1.04 *** | −0.23 * | −0.84 ** | −0.46 | ||

| (−5.75) | (−1.89) | (−2.05) | (−1.25) | |||

| LEV | 0.03 ** | 0.07 *** | 0.04 *** | |||

| (2.31) | (9.28) | (3.29) | ||||

| HVOL | 0.01 *** | 0.03 *** | 0.02 ** | |||

| (4.10) | (3.40) | (2.40) | ||||

| N | 664 | 664 | 664 | 664 | 664 | 664 |

| Adj.R2 | 0.41 | 0.21 | 0.55 | 0.65 | 0.59 | 0.71 |

| M1 | M2 | M3 | M4 | M5 | |

|---|---|---|---|---|---|

| Intercept | 1.488 *** | 1.348 *** | 1.631 *** | 2.056 *** | 2.116 *** |

| (4.66) | (4.60) | (4.72) | (4.04) | (3.97) | |

| 0.033 ** | 0.060 ** | 0.040 ** | |||

| (2.47) | (2.18) | (2.22) | |||

| −0.011 | 0.013 | 0.007 | |||

| (−0.99) | (0.77) | (0.61) | |||

| −0.679 * | −0.525 | ||||

| (−1.78) | (−1.43) | ||||

| −0.254 * | −0.212 | ||||

| (−1.68) | (−1.41) | ||||

| −0.387 *** | −0.367 *** | ||||

| (−3.85) | (−3.49) | ||||

| Adj.R2 | 0.003 | 0.002 | 0.005 | 0.007 | 0.012 |

| M1 | M2 | M3 | M4 | M5 | |

|---|---|---|---|---|---|

| Intercept | 4.511 *** | 4.538 *** | 4.572 *** | 4.604 *** | 4.691 *** |

| (6.08) | (6.02) | (6.04) | (6.43) | (6.41) | |

| 0.025 ** | 0.042 ** | 0.023 ** | 0.037 ** | ||

| (2.10) | (2.13) | (2.04) | (2.15) | ||

| −0.010 | 0.005 | 0.009 | |||

| (−1.02) | (0.36) | (0.78) | |||

| −0.175 | −0.126 | ||||

| (−0.38) | (−0.26) | ||||

| −0.027 | −0.009 | ||||

| (−0.14) | (−0.04) | ||||

| −0.225 * | −0.219 * | ||||

| (−1.75) | (−1.69) | ||||

| LEV | −6.937 *** | −6.929 *** | −6.972 *** | −7.187 *** | −7.213 *** |

| (−6.20) | (−6.09) | (−6.09) | (−6.36) | (−6.23) | |

| HVOL | −3.728 *** | −4.125 *** | −3.651 *** | −2.985 | −3.170 |

| (−3.01) | (−3.41) | (−3.10) | (−1.39) | (−1.46) | |

| Adj.R2 | 0.019 | 0.019 | 0.022 | 0.026 | 0.029 |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, J. The Effect of Systematic Default Risk on Credit Risk Premiums. Sustainability 2019, 11, 6039. https://doi.org/10.3390/su11216039

Kim J. The Effect of Systematic Default Risk on Credit Risk Premiums. Sustainability. 2019; 11(21):6039. https://doi.org/10.3390/su11216039

Chicago/Turabian StyleKim, Jungmu. 2019. "The Effect of Systematic Default Risk on Credit Risk Premiums" Sustainability 11, no. 21: 6039. https://doi.org/10.3390/su11216039