Abstract

This study explored the effect of corporate governance on disclosure transparency, coming from the changes of the largest shareholder and the designation as an unfaithful disclosure firm. In addition, the study verified whether this designation on a firm increases voluntary disclosure level the following year. According to results of analyzing nonfinancial firms listed in the Korea stock market from 2009 to 2017, the more frequently the largest shareholder changed in the recent three years, the significantly higher the possibility of the firm in being designated as an unfaithful disclosure firm. For firms that were designated as unfaithful disclosure firms, voluntary disclosure significantly increased the following year. These results were strengthened by the addition of several more analyses including quality of management forecasts, consideration of fixed-effects regression and the mediation modeling. These results imply the necessity for the supervision of authorities to take caution, while it shows the effectiveness of the unfaithful disclosure designation regulation in improving disclosure transparency.

1. Introduction

Corporate sustainability is gaining considerable attention in the aftermath of the recent financial crisis in the US and Asian countries deriving from accounting and remuneration scandals. Research on corporate sustainability is taking place to ensure the long-term sustainability of companies and their accountability for a variety of stakeholders. Global investors demand, regulators require, and companies disclose their economic, governance, social, ethical, and environmental sustainability performance [1,2]. An important factor in the sustainability of a firm is its proclivity for transparent communication regarding its operational and financial information. As many investors believe, the transparent disclosure of information allows for a more accurate evaluation of a firm’s long-term financial condition. An honest corporate information disclosure environment strengthens communication between managers and investors by building both knowledge and trust, therefore promoting the sustainability of the company [3]. For this reason, corporate sustainability can be achieved by the desire for being honest by the corporation to improve and actively sustain the transparency of its information disclosure environment.

Transparency refers to a process by which information about existing conditions, decisions and action is made accessible, visible, and understandable. Specifically, there is a widespread availability of relevant, reliable information about the periodic performance, financial position, investment opportunities, governance value, and risk of publicly traded firms [4]. Due to this reason, transparency indicates the sharing of information via timely disclosure of firm-specific information to outside constituents of the firm. This is an integral part of corporate governance practice [5]. Transparency is a special tool to enhance ways and opportunities for stakeholders of the company to help understand whether the company’s running business is suitable for long-term, sustainable objectives or not. For this reason, transparency is a way to achieve accountability and trust in organizations, which leads to increase sustainability in information disclosure environment [6,7].

This study examines the relations between corporate governance and transparent disclosure by using the designation of unfaithful disclosure firms. It will then analyze the effects of penalties on unfaithful disclosure firms by additionally verifying management forecasts after receiving penalties. Since South Korea does not have an objective measurement of disclosure quality, there is a considerable shortage of research on how disclosure quality differences influence the capital market. In the US, there are various tools to measure disclosure quality including financial analysts’ disclosure levels based on AIMR (The Association for Investment Management and Research) and disclosure levels developed by individual researchers. However, the limitation of these measurements is that they can be subjectively affected by financial analysts and individual researchers. On one hand, the US’ disclosure quality measurement is usually based on voluntary disclosure. Timely disclosures that have a high percentage of voluntary disclosure in the US are, in the case of Korea, referred to as forced disclosures where firms that break regulations receive penalty from the public regulatory organization. Also, regulatory organizations in KSE or KOSDAQ market hold objective processes and assessment on disclosures including timely disclosures. If there are unfaithful actions, the firm receive penalties and is designated as an ‘unfaithful disclosure firm’. Therefore, Korea may have an environment with objective standards for disclosure qualities since low disclosure quality firms are designated by regulatory organizations [8]. This study is expected to provide important implications about disclosure quality, as it explores upon unfaithful disclosure firms.

According to materials from the Financial Supervisory Service in March, 2010, both financial and non-financial perspectives were mentioned on the features of delisting firms that deteriorate sustainability of the firm in one go. A financial perspective of the characters of delisting firms is that 91% take up factors that question the ‘going concern’ as the financial structures are vulnerable regarding short-term net loss and continuous debt. Whereas, non-financial perspectives found factors of weak governance structure and low management stability due to frequent changes of the largest shareholders as the main cause. A Firm that frequently goes through these situations would have a high possibility of being designated as an unfaithful disclosure firm. Repeated designations would lead to accumulated unfaithful disclosure penalty points, making it subject for ‘delisting substantive examination’, which deteriorates corporate sustainability.

Observing these tendencies, this study analyzes how the frequent change of the largest shareholder of the firm, which can be regarded as weak corporate governance, influences unfaithful disclosure designation. The largest shareholder (the largest shareholder is also referred as the controlling shareholder or the majority shareholder according to the researcher) is a person or people with a special relationship with the person who holds the largest amount of shares with voting rights of the firm [9]. The supervisory authorities place concern on the change of the largest shareholder since it can increase instability of the firm. Korea Exchange includes the number of changes of the largest shareholder as an investment caution item for considering the firm’s financial position and management transparency. In addition, the change of the largest shareholder is prescribed, as an important management matter in the firm’s management activity so that disclosure of the change when the largest shareholder changes is required. Firms that change the largest shareholder more than twice a year disclose it as investment caution items. In this way, previous studies also showed that the change of the largest shareholder gave a negative influence on credit rating, possibility of delisting, and firm risk [10,11,12,13]. It was also reported to have an adverse influence on earnings management behavior [14]. It also showed to be related to whether the internal control system was under development through examination [15].

The corporate governance is a decision-making system that maximizes firm value by providing trustworthy information to minority shareholders and by limiting opportunistic or personal actions of majority shareholders and managers [7,16]. Therefore, an effective corporate governance enables the firm to disclose transparent information flow to market participants and fosters sustainable growth. However, for firms that do not have an efficient corporate governance, information unbalance between market participants occur, distorting the information environment of the market. This study expected that the more frequent the largest shareholder is changed in a firm, the higher the instability of firm management and weaker the monitoring of the manager, causing a less transparent disclosure and increasing the possibility of being designated as an unfaithful disclosure firm.

We examined the effects the frequent change of the largest shareholder has on unfaithful disclosure designation using a sample of 13,233 firm-year observations from South Korean firms from 2009 to 2017. Our findings indicate that the lack of strong corporate governance is more likely to increase the designation points on unfaithful disclosure. Furthermore, unfaithful disclosure designated firms are inclined to increase the frequency of managerial earnings guidance and precision of management earnings forecasts. These results suggest that unfaithful disclosure designation system allows for better monitoring on the corporate information disclosure environment and reduces managers’ incentive to shirk or engage in value-destroying behaviors [16]. Consequently, one might expect more guidance and higher precision on guidance to reduce the likelihood of repeated designation due to unfaithful disclosure, as managers in more transparent information environment signal the transparent disclosing behavior. Given that unfaithful disclosure designation system acts as a self-discipline mechanism to the disclosure environment that influences outside investors, our findings illustrate the importance of understanding the interdependence between governmental policies and managerial incentives to implement them. The implicit suggestion in these findings is that the effectiveness of unfaithful disclosure designation system depends on the honest desire of management to improve and actively sustain the transparency of its information disclosure environment.

2. Backgrounds and Hypotheses

2.1. Prior Research on the Largest Shareholder

In recent research fields of finance and accounting, related to corporate governance, the difference between nations regarding their legal environment has been reported to be an important variable determining development of the financial market, the quality of the firm’s ownership structure, firm policies and accounting information [17,18]. In principle, listed corporations should separate ownership and management, so that the directors take care of the management activity, not the firm’s stockholders who are the real owners. The board of directors would be held to decide on management policies. In principle, they would select a representative director who would then execute the policies (Commercial Law paragraph 1 of article 389). When the policy execution appears externally, it becomes the representative act of the firm. Thus, under South Korea’s corporation law or commercial law, the director who implements the firm’s work is named the representative director. Based on commercial law, the executive organ of a stock corporation is dualized as the board of directors and the representative director. The board of directors determine the proceedings of the management execution, while the representative director represents the actual implementation and the firm itself.

In contrast, Claessens et al. [19] demonstrate that companies in East Asian countries do not have a clear separation between the control and management of majority shareholders. South Korea is one of the countries where firms have no separation between ownership and control, thus have a high characteristic of centralized ownership. Due to this, they hold the characteristics such as the existence of controlling shareholders, less developed stock markets, high premiums for the management rights, weak disclosure policies, and the absence of hostile firm undertaking roles. The directors apart from the representative director officially only have rights to participate in the decisions at the board of directors. However, usually firms give titles such as president, vice-president, executive director, managing director for them to partake in the internal work. In Korea, apart from the marketing management director, directors have titles such as department head, general manager according to the area of work. Along with the representative director, they are called the management executives. Also, in Korea, there are many cases where the management executives are not separated from the board of directors since commercial law states that the manager who is the representative director must be a director. Furthermore, for affiliates of conglomerates, even if they are grand scale listed companies, the majority shareholders or owners of the firm still participate in the decision making of the main policies, execute top management and internal control as they take on titles such as president, representative director, and part-time director.

For firms like these, where ownership and management are not separated, and it is an ownership centralized firm, there could be an advantage of owners and managers having agreed interest and thus the reduction of agency problems between majority and minority shareholders. It seems that the majority shareholders will not pursue activities that reduce the wealth of a company because they have greater interests as shareholders when the proportion of ownership held by majority shareholders is higher. Watts and Zimmerman [20] find that owner–management with larger equity provides an incentive to act in alignment with the company’s value maximization. Klassen [21] finds that a higher level of majority shareholder ownership lowers the managers’ opportunistic financial reporting incentive and increases the tax reporting incentive. He concludes that profit from property disposition decreases when majority shareholder ownership increases, if a company has a higher tax rate. In addition, discretionary expenses (DE) have a negative relationship with ownership concentration [22]. Using Japanese firms, Darrough et al. [23] show that firms with higher managerial ownership tend to use less income-increasing accruals. Choi and Kim [24] show that, in Korea, a company with a higher majority shareholder ownership also has a lower absolute value of discretionary accruals. Based on this finding, they claim that management has a lower incentive for opportunistic earnings management when the investment of majority shareholders is higher. Overall, the majority of shareholders will not pursue activities that reduce the value of a company because they have a vested interest as shareholders in its success, even more so as their proportion of ownership increases [21,23,24,25].

Among these, the largest shareholder is a person or people with a special relationship with that person who holds the largest number of shares with voting rights of the firm. According to the Financial Supervisory Service report from 3rd of March, 2010, before and after the change of the largest shareholder, there were more frequent occurrences of illegal acts such as embezzlement or breach of duty by the manager. Many of these firms were weak companies with short-term net loss and impaired capital. The more frequent the change of the largest shareholder, the higher the percentage of it being a weak firm. In this way, the frequent change of the largest shareholder weakens the function of monitoring management executives and negatively influences the firm in having corruption and the loss of sustainability. Also, based on Korea’s domestic studies on internal control, many results were derived that the largest shareholders usually took on positive roles. In detail, the larger the holdings of the largest shareholder, the lower the probability of vulnerability disclosure from the Internal Control System occurred, and the probability of vulnerability disclosure became low especially when the largest shareholder was also the representative director, causing intense monitoring [26]. Like Jensen and Meckling [27]’s claim, these results show that the larger the holdings of the largest shareholder, the less the probability of vulnerability disclosure of the Internal Accounting Control System, it would cause since internal control and operation would be reinforced by the monitoring on the manager. In addition, the ownership management method of the largest shareholder could reduce agency costs through agreed management and the demonstration of the owner’s leadership could raise the possibility of sustainable growth by maximizing the firm’s value on the long-term [28].

There are many studies on how the frequent change of the largest shareholder cause negative outcomes. Son and Park [10] shows results of the fall of credit rating after frequent changes of the largest shareholder. Kim [29] proves the correlation between the year of the change of the largest shareholder and the loss of the accounting income. A report (2014) analyzing the causes for delisting of the delisting companies, numerous firms showed to have changed their largest shareholder during the last 3 years before being delisted. The Korea Exchange’s statistics reports high possibility of the firm being delisted or designated when the largest shareholder changes more than twice a year. The reason for this was that frequent transfer if the firm’s representative causes the firm to lose business continuity and agency of responsible management, damaging the firm value.

2.2. Prior Research on the Unfaithful Disclosure Designation

‘Corporate Disclosure System’ is how listed firms completely open information for investors and stakeholders by regularly and spontaneously reporting information that could considerably affect the stock price. Information includes the firm’s business performance, financial health, merge, and capital increase. This enables the investors to accurately understand the state of the firm and protects them by letting them decide on investment freely by themselves with responsibility. It also pursues to raise efficiency of resource distribution through the stock market. Therefore, listed corporations should faithfully report mandatory disclosure obligatory items based on the ‘Capital Market and Financial Investment Services Act’, ‘Stock Market Disclosure Regulation’, or ‘KOSDAQ Disclosure Regulation’. They should take caution in not changing or reversing any of the reported facts. Also, they have responsibility in being careful not to let information leak out through stock market rumors or coverages before the disclosure.

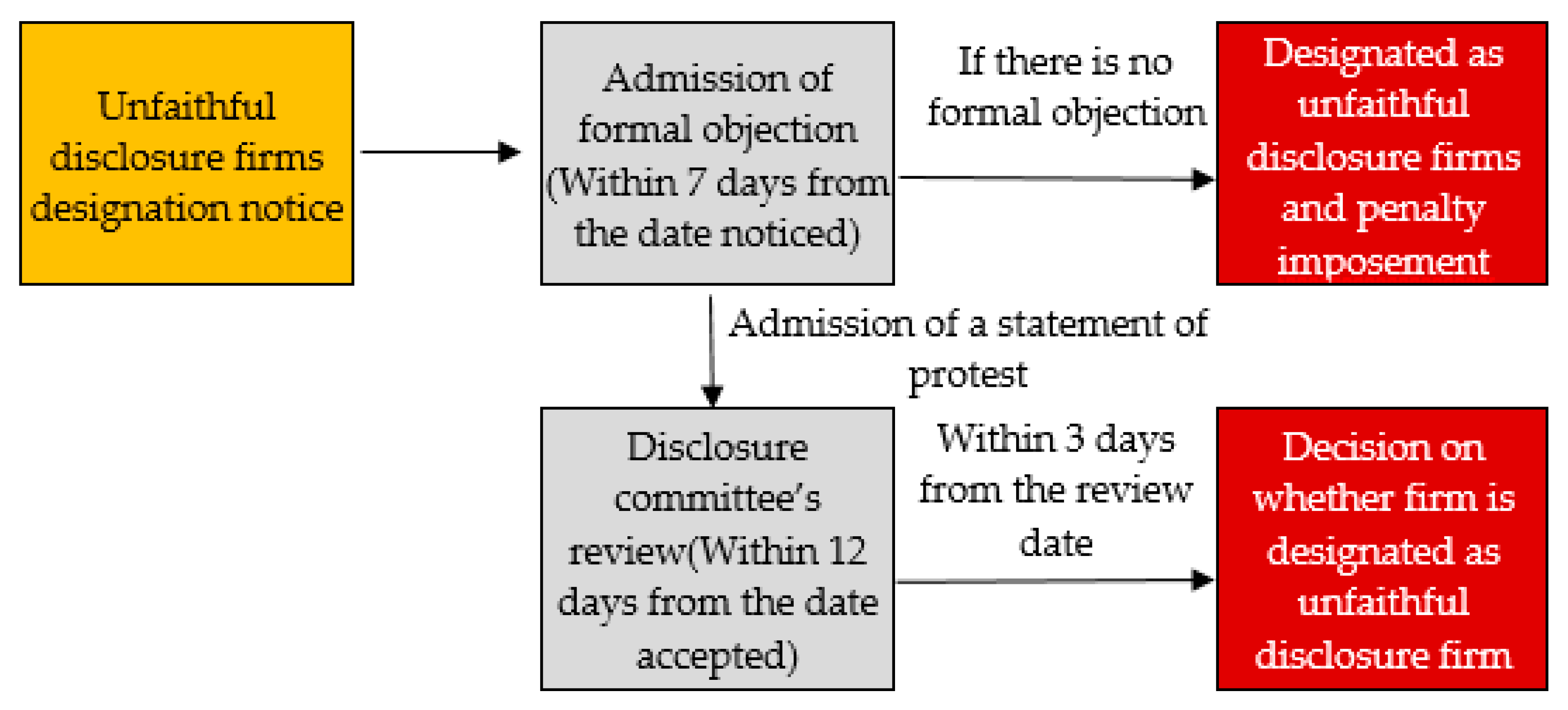

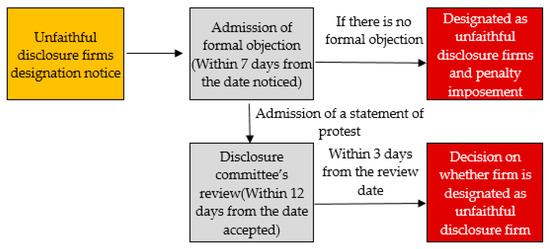

Unfaithful disclosure means the stock-listed corporation does not faithfully follow duties of reporting regulations or changes and overrules the content of what they already reported (Stock Market Disclosure Regulation Article 2, Section 3). Unfaithful Disclosure is divided into three types, failure to disclose, reversal of disclosure, or changed disclosure. Failure to disclose is not reporting the disclosure items within the appointed time or fraud disclosure. Reversal of disclosure is disclosing something that completely cancels or denies the original disclosure. Changed disclosure is when an important part of the disclosure is altered. In Korea Exchange, when a listed corporate is found to have an item of unfaithful disclosure, they are given seven days’ period (date of sale standard) to make an appeal after for warning designation of an unfaithful disclosure firm. If there is no appeal from the corporate, they are designated as an unfaithful disclosure firm after the appeal filing period. In the case where they do appeal, they would go through the process of deliberation by the disclosure committee within 12 days (date of sale standard) from the day of filing the appeal. Whether or not they would be designated as an unfaithful disclosure firm or would receive penalty points would be finally decided within the three days from the start of deliberation. For stock market firms, according to the seriousness of the violation and the delayed time of disclosure, unfaithful disclosure firm penalty points are imposed from a minimum of two to maximum 12 points for each item of unfaithful disclosure. The firm is designated as an issue of administration if 15 or more points are accumulated from the previous year. For listed firms in KOSDAQ, the motive for violation, importance, effect on investors, and the general practice of faithful disclosure of the firm are considered to aggravate or mitigate the number of designations as an unfaithful disclosure firm.

According to the Stock Market Disclosure Committee’s sanction review standard, the motives of violation are divided into 4 types: intentional, gross negligence, negligence, and simple error. ‘Intentional’, knowing the violation and having been aware of the possibility of violation. ‘Gross negligence’, seriously lacking the duty to take caution. ‘Negligence’, taking normal caution or defying caution as a good manager. ‘Simple error’, having committed to the duty of caution however being wrongly aware of the facts or not being able to be aware of the possibility of violation. Depending on the level of the disclosure violation, weight of the violation is classified as ‘Severe violation’, ‘General violation’, or ‘Minor violation’. They are shown in the stock market disclosure regulation according to the evidence of violation for each item. KOSDAQ also has a similar sanction deliberation standard.

For firms that are designated as an unfaithful disclosure firm or receive penalty points, measures are taken by the stock market or the Financial Supervisory Committee such as trading suspension, publicizing the designation and penalty points, education about unfaithful disclosure firms, and requiring them to submit a plan for improvement. For stock-listed corporates that are designated as an unfaithful disclosure firm, trading suspension means transactions are suspended for 1 day on the day of designation and the fact of designation and penalty points are publicized through the stock market or electronic disclosure system [30] where the list, reason for designation, and imposed penalty points are reported as following Figure 1 [31].

Figure 1.

Process on designating unfaithful disclosure firms.

Unfaithful disclosure is the measure of disclosure transparency. A firm that is designated as an unfaithful disclosure firm shows that it not only failed to fulfill periodic disclosure, but also did not faithfully carry out timely disclosure, fair disclosure, inquiry disclosure, and voluntary disclosure. Since unfaithful disclosure downgrades the transparency of disclosure, if a firm is unfaithful in disclosure, investors have difficulty in engaging with and utilizing various firm information. As a result, firms which investors lose interest of eventually become incapable of sustainable growth. In this context, previous literature on unfaithful disclosure usually displayed much interest in information utility of the unfaithful disclosure firms. Sohn [32] verified the informativeness of unfaithful disclosure through 247 samples of listed firms from the stock exchange from 1990 to 1998. As a result, it was found that unfaithful disclosure had a negative information effect even for the fact that they reported this. Park et al. [33] verified whether accounting earnings of an unfaithful disclosure firm is useful through (1) relations between cash flow—earnings (2) relations between price earnings ratio—future earnings. Through empirical analysis, the results showed that whatever way they verified, earnings information of an unfaithful disclosure firm was not useful. Also, the capital market showed to negatively evaluated firms designated as an unfaithful disclosure firm. The higher the number of designations as an unfaithful disclosure firm and the more the imposed penalty points, the worse the negative reaction was. In detail, Lee et al. [34] presented results that unfaithful disclosure firms have low credit ratings and high costs of debt capital. The higher the number of designations as an unfaithful disclosure firm, the lower the drop of credit rating and higher the increase of debt financing costs. Choi et al. [35] found a significant market reaction on the expected date of designation and the day of designation as an unfaithful disclosure firm. According to Kim et al. [36]’s study, the more the firm is an earnings management firm, the higher the possibility of it being designated as an unfaithful disclosure firm. The higher the intensity of earnings management, the more it tended to repeatedly receive designation as an unfaithful disclosure firm. Furthermore, firms that were designated as an unfaithful disclosure firm were small in scale, had low profitability, and also had a characteristic of having a higher percentage of receiving audit from Non-Big 4 auditors [36].

Unfaithful disclosure firm designation is also connected to weak corporate governance. Firms with strong corporate governance are able to establish management transparency, owner rights protection, and operating practices of the board which leads to high quality of disclosure. Related to this, Choi et al. [35] used corporate governance scores (CG) for the analysis. According to the results, firms that were designated as unfaithful disclosure firms found to have lower corporate governance structure scores than those that were not designated as unfaithful disclosure firms.

2.3. Hypothesis Development

Most literature assumes the symmetrical and honest disclosure of information by the management of a firm [37]. This ignores the fact that managers, when not monitored by outside investors, determine which information is shared and the speed with which it is reported. If a dishonest manager personally benefits from the nondisclosure of certain information, to the detriment of shareholders, he or she may choose to withhold that information. By manipulating the release of information, managers can obscure the information disclosure environment and reduce sustainability throughout the system. Only effective external monitoring mechanisms help to minimize these opportunistic behaviors. The largest shareholders’ ownership may encourage managers to disclose private information, and the degree of external monitoring may differ according to the degree of largest shareholders’ holding and the consistency of monitoring by the largest shareholders. This paper investigates these possibilities.

The fact that a firm is designated as an unfaithful disclosure firm means that it did not implement its duty of disclosure faithfully or it overruled or changed the reported contents. A firm that is designated as an unfaithful disclosure firm showed to have low quality in earnings, and a detrimental accounting system due to receiving examination and audit opinions for the internal control system beyond what is optimal [31,38,39]. In addition, the capital market shows a negative reaction towards the designation of unfaithful disclosure firms [34,35,40], which is interpreted as a result of an overall decrease of reliability on the firm’s disclosure information. To enhance the firm’s sustainable management, it is important to identify the determinants of unfaithful disclosure, which would result in a doubt on going concern.

Corporate governance is a factor that can critically influence the firm’s disclosure quality. For firms where corporate governance has weakened, they have a larger possibility of being designated as an unfaithful disclosure firm. Choi et al. [35]’s study verified by using corporate governance scores (CG) that the possibility of being designated as an unfaithful disclosure firm increased, as the corporate governance became lower. In corporate governance, the largest shareholder has controlling power in influencing the firm’s financial policies and business policies [12]. The controlling shareholder has the role of effectively restraining the managers from taking opportunistic actions by error occurrences [41], which implies that the changes of the largest shareholder may weaken the monitoring function towards the manager. Especially for South Korea where the corporate governance has the characteristic of ownership and control being centralized, the largest shareholder takes on a significant role. This would mean that the effect on the monitoring function would lead to a greater influence on the firm, as a whole [42,43].

Firms that change their largest shareholder show to have an increased possibility in being included in the group of firms with high risks (Financial Supervisory Service, 2014). The supervisory authorities place frequent change of the largest shareholder, as an important factor for investors to be aware of and for the designation investment caution items. According to the revised Act on External Audit of Stock Companies, which was enacted in November 2018, there are cases where the government designates a monitor for dangerous stock-listed corporations. A case for this includes firms where the largest shareholder has changed more than twice during the period of three years. Thus, the frequent change of the largest shareholder connects to a dangerous corporate governance, forecasting situations where the monitoring role of external monitors upon the manager cannot operate properly.

Moreover, firms that had frequent changes of the largest shareholder showed a decrease in credit rating, increase in the possibility of being delisted, and rise in firm risk [10,11,12,13]. Firms that changed their largest shareholder twice or more a year influenced the firm’s earnings management structure negatively [14]. The frequent change of the largest shareholder implies the possibility of the internal control system not functioning properly [15]. This is because firms that change their largest shareholder frequently downgrades the function of monitoring which raises instability across all areas of management. It is possible to predict that there is a high chance disclosure items previously disclosed may have been distorted. This study focused on the weakening of corporate governance due to the frequent change of the largest shareholder. The following hypothesis was made to verify the relationship between the frequent change of the largest shareholder with the possibility of the firm being designated as an unfaithful disclosure firm.

Hypothesis 1.

There is significant relationship between the frequent change of the largest shareholder and designation points of unfaithful disclosure.

The unfaithful disclosure designation system is implemented to raise transparency in disclosure. To be specific, it is a disciplinary measure taken by the stock exchange towards listed firms when they do not faithfully follow the capital market law or the duty of the stock market’s disclosure regulations by reversing (disclosure of reversal) or changing (changed disclosure) their disclosed information. In the case where a firm is designated as an unfaithful disclosure firm, the stock exchange publicly discloses this in the capital market to actively warn information users.

The fact that a firm is designated as an unfaithful disclosure firm means it not only failed to faithfully follow duties for regular disclosures, but also duties for timely disclosures, fair disclosures, inquiry disclosures, and voluntary disclosures. Namely, the more frequent a firm is designated as an unfaithful disclosure firm, the higher the possibility of the firm being designated as an issue for administration. This also implicates a high possibly of the firm becoming delisted if it violated the disclosure duty intentionally or through gross negligence upon an item that could cause severe impact on firm management [34]. It does not stop here, but the firm may have to receive education training regarding unfaithful disclosure designation and receive measures while having to answer the report on the occurrence of unfaithful disclosure. Apart from the future exchange, the Financial Supervisory Committee can also impose measures in requiring announcement of the concerned fact, ordering correction, limiting issue of stock, requiring public announcement about an illegal dismissal of a board member, claiming memorandum, or placing warnings.

The reaction and measures of the capital market from the designation of an unfaithful disclosure firm provides a useful structure for verifying the effect of the designation regulation. Also, since the samples of unfaithful disclosure firms are spread across many years, the possibility of an external factor other than the regulation causing the result can be excluded. When there is enough time series data, there is especially the advantage of being able to compare the change of the firm’s characteristics before and after the designation to meaningfully understand the effect of the regulation.

A firm that is designated as an unfaithful disclosure firm goes through substantial decrease in stock price. In addition, if it is repeatedly designated as an unfaithful disclosure firm, the burden of expenses become heavier. Specifically, if the designation is repeated on the accumulated penalty points add to more 15 or more points, the firm’s stock becomes designated as an issue of administration. Likewise, since the negative effect of being designated as an unfaithful disclosure firm is not minor, it is possible to assume that designated firms would actively place effort into avoiding being designated again by raising the quality of disclosure and improving the transparency of the disclosure environment.

Beyer et al. [44], in assessing the relative importance of various corporate disclosures on stock return variance, estimate that earnings guidance accounts for 66% of the total variance explained by all accounting-based disclosures, compared to 12% from mandatory disclosures such as earnings announcements and reports to the Securities and Exchange Commission. The traditional disclosure theory typically focuses on the role of disclosure to provide information, predicting that increased levels of disclosure will lead to lower information asymmetry [45]. Consistent with the notion that managerial guidance reduces information asymmetry, Coller and Yohn [46] document a reduction in bid-ask spreads after guidance is issued. Frankel et al. [47] provide further evidence that managers issue more guidance before accessing capital markets to obtain better terms, such as lowering the costs of raising capital. There is also evidence that once firms stop providing guidance, their information environment deteriorates as analyst forecast dispersion widens and analyst forecast error increases [48,49]. In addition to adjusting investors’ expectations, the information imparted during earnings guidance also allows for better monitoring and reduces managers’ incentives to shirk or engage in value-destroying behaviors [16,50,51].

Given the importance of earnings guidance in the corporate information environment [44], a positive association may be expected between unfaithful disclosure designation and subsequent management forecasts for two reasons. First, more management forecasts reduce managers’ information advantage regarding a declining business condition, thereby making it difficult for them to hide and delay bad news. This ultimately leads to a sustainable information disclosure environment. Next, as management forecasts provide “snapshots” of a firm’s operational condition and allow for better investor monitoring, they reduce managers’ incentives to engage in opportunistic behaviors via the disclosure system. Thus, the second hypothesis in this study is as follows:

Hypothesis 2.

The frequency of management forecasts is increased in firms with unfaithful disclosure designation.

3. Research Design and Sample Description

3.1. Empirical Models

The Hypothesis 1 tests whether how the frequent change of the largest shareholder influences the possibility of designation as an unfaithful disclosure firm. The logistic regression model shown as Equation (1) was used for the analysis. The dependent variable of Equation (1) indicates whether the firm has been designated as an unfaithful disclosure firm or not (Dummy_UD). The variable has the value of 1 if the firm has been designated as an unfaithful disclosure firm in the current year and 0 otherwise. The variable of interest is the number of times the largest shareholder has changed (CH_OWN), which is calculated by referring to the number of changes in the recent 3 years. It is predicted that the increase in the number of changes of the largest shareholder would raise the possibility of the firm being designated as an unfaithful disclosure firm. In other words, it is interpreted that the number of changes of the largest shareholder (CH_OWN) would have a positive (+) value.

where Dummy_UD = if designated as an unfaithful disclosure firm in the current year: 1, if not: 0; CH_OWN = the number of changes of the largest shareholder in the recent 3 years; SALES = Ln(sales); LEV = debt ratio; ROA = return on assets; LOSS = if reported loss in the current year: 1, if not: 0; FOR = foreign ownership; BLOCK = largest shareholder’s ownership; AGE = Ln(period of being a listed firm); CONFIRM = number of subordinate companies; BIG4 = if audited by the Big4 auditors: 1, if not: 0; MARKET = if listed in the KSE market: 1, if not: 0.

For a firm that is designated as an unfaithful disclosure firm to have high penalty points mean that there is importance in the violated act and the motive for the violation was not a simple error but due to negligence or intentional. This is shown by how firms with high penalty points come to receive sanctions that are more intense. The accumulated points are related to opinions of extra examination upon the internal control system [31]. The higher the accumulated penalty points, the more negative the capital market reacts [40].

The fact that the firm’s disclosure information was created and disclosed through the internal control system implies the possibility that the firm that is designated as an unfaithful disclosure firm does not have an internal control system operating effectively. Also, firms where the largest shareholder frequently changed showed to have an internal control system that did not operate well [15]. Connecting these thoughts, compared to firms where there is no change in the largest shareholder, firms where the largest shareholder frequently changes have a high possibility of committing severe violation due to an ineffective internal control system and increased possibility of the violation being from negligence or deliberation can be forecasted.

This analysis is intended to verify whether the change of the largest shareholder is related to the imposed penalty points when a firm is designated as an unfaithful disclosure firm. A regression model presented as Equation (2) was used for the analysis. The dependent variable of Equation (2) is the number of penalty points imposed from the designation as an unfaithful disclosure firm (Dummy_UD) and is found by adding the imposed penalty points of a firm designated as an unfaithful disclosure firm that year and the substitute penalty points from a firm that substituted penalty points to the disclosure violation fines. P indicates the level of violation of the disclosure regulation by showing if the disclosure level has decreased due to a major violation or an intentional violation. The variable of interest from the equation is the number of changes of the largest shareholder within the recent three years (CH_OWN). As the number of changes of the largest shareholder increases, the more it negatively influences the disclosure system. This raises the possibility of violation on crucial matters and the possibility that the motivation for violation may be negligence or intentional. In this case, high penalty points would be imposed which makes it predicable that the number of changes of the largest shareholder would have a positive (+) value.

where P = imposed penalty points of the designation as an unfaithful disclosure firm; CH_OWN = the number of changes of the largest shareholder in the recent 3 years; SALES= Ln(sales); LEV = debt ratio; ROA = return on assets; LOSS = if reported loss in the current year: 1, if not: 0; FOR = foreign ownership; BLOCK = largest shareholder’s ownership; AGE = period of being a listed firm; CONFIRM = number of subordinate companies; BIG4 = if audited by the Big4 auditors: 1, if not: 0; MARKET = if listed in the KSE market: 1, if not: 0.

The Hypothesis 2 of this study is to test whether if a firm that is designated as an unfaithful disclosure firm later increases its voluntarily disclosure. A regression model shown as Equation (3) was used for the analysis. The dependent variable in Equation (3) indicates whether voluntary disclosure exists (Dummy_D). The Dummy_D is counted as 1 if the firm has made fair disclosure in that year related to (tentative) operating performance, prospect towards operating performance, future business, or management plan. If not, the value is counted as 0. The variable of interest of the equation indicates whether the firm has been designated as an unfaithful disclosure firm (Dummy_UD). If the firm was designated as an unfaithful disclosure firm in the previous year, the value of Dummy_UD is 1, and 0 otherwise. Firms that have been designated as an unfaithful disclosure firm and is known to the market to have low disclosure level would later place effort in improving its disclosure level through voluntary disclosure. Therefore, it is predicted that the variable indicating the existence of designation as an unfaithful disclosure firm would have a positive (+) value.

where Dummy_D = if made voluntarily disclosure in the current year: 1, if not: 0; Dummy_UD = if designated as an unfaithful disclosure firm in the current year: 1, if not: 0; SALES = Ln(sales); LEV = debt ratio; ROA = return on assets; FOR = foreign ownership; AGE = ln(period of being a listed firm); HORIZON = period between disclosure of forecasted earnings of the manager and the announcement date of the annual announcement STD = standard variation of monthly excess earnings rate from 6 months prior to the disclosure of earnings; MARKET = if listed in the KSE market: 1, if not: 0.

The dependent variables from Equation (1) to Equation (3) are variables regarding the firm’s disclosure transparency. The dependent variable of Equation (1), Dummy_UD shows the possibility of the firms having a low disclosure level. The dependent variable of Equation (2), P shows the level of violation of the disclosure regulation by showing if the disclosure level has decreased due to a major violation or an intentional violation. The dependent variable of Equation (3), Dummy_D shows the firm’s level of voluntary disclosure and indicates the possibility of improvement in disclosure level through voluntary disclosure. Therefore, control variables that may affect the firm’s disclosure level were added in the model. Control variables used in the equation are similar, however Equations (1) and (2)’s dependent variables are related to the deterioration of disclosure transparency, while Equation (3)’s dependent variable is related to the improvement of disclosure transparency. This leads to the prediction that the control variable’s positive or negative direction would be opposite.

The SALES variable was added to control the effect of firm size on disclosure level. The smaller the size of the firm, the more of a chance that it would have low disclosure level since an effective disclosure system would not have yet been established. If the firm’s size is large, it would be able to create much open information which would bring the information asymmetry between the firm and its external stakeholders relatively low [52]. Therefore, SALES would have negative (−) relations with Equations (1) and (2) while having positive (+) relations with Equation (3). According to the debt contract hypothesis, debt contracts have a high possibility of influencing the firm’s disclosure policy. The higher the debt percentage of the firm, there exists a possibility of the firm not transparently disclosing due to worries in costs from debt contract violation [53]. In considering this, the debt ratio (LEV) was added. Referring to prior literature that firms with positive performances choose transparent disclosure methods, return of assets (ROA) and indication of loss (LOSS) was added in the model to control firms’ profitability [26,54]. Considering that the relationship with external stakeholders would affect disclosure policy, the largest shareholder’s ownership (OWN) and foreign ownership (FOR) were added as control variables. The Big4 auditors use various developed auditing methods, which enhances the control mechanism. Thus, whether or not auditing is received from the Big4 auditors can affect the disclosure level [26,55]. BIG4 is predicted to have negative (−) relations with Equations (1) and (2), while having positive (+) relations with Equation (3). Also, the number of subordinate firms (CONFIRM), whether it is listed in the KSE market (MARKET), and the period of being listed (AGE) was controlled. Industry Dummy (IND) and Year Dummy (YEAR) was added to control the fixed effects of industry and year characteristics.

3.2. Sample Selection

This study targets non-financial firms with December closing accounts that were listed in the KSE and KOSDAQ market from the year 2009 to 2017. The data for the analysis were annual reports, auditory reports, unfaithful disclosure designation announcements, (tentative) operating performance disclosures, disclosures of prospect on operating performance, disclosures on future business, and disclosures of management plans. They were retrieved from Korea Listed Companies Association’s TS2000 database, Financial Supervisory Service’s Data Analysis, Retrieval and Transfer System (DART), and Korea Exchange’s Korea Investor’s Network for Disclosure System (KIND).

Table 1 shows the process of sample selection. The firm-year observations of non-financial firms listed in the KSE and KOSDAQ market during the sampling period from 2009 to 2017 counts to 15,018. Excluding 1785 firm-year observations which show difficulty finding financial data, shareholder related data, and stock price data, the total number of firm-year observations used in the study counted to 13,233. To handle outliers in the samples, continuous variable values within the top and bottom 1% were winsorized, as the value of the top and bottom 1%.

Table 1.

The sample.

The change of the largest shareholder in a listed firm is a matter that must be disclosed according to the KSE and KOSDAQ market disclosure regulations. Article 7 (major management item) of the KSE market disclosure regulation states that firms must disclose if the largest shareholder has changed. Article 6 (disclosure announcement item) of the KOSDAQ market disclosure regulation specifies that the firm should disclose if the largest shareholder or the CEO has changed. Whether the largest shareholder changed was checked by the disclosure in the Financial Supervisory Service’s DART system following its disclosure regulation.

Data related to the designation of an unfaithful disclosure firm was gathered by the unfaithful disclosure firm announcement provided by the Financial Supervisory Service’s DART system. We checked the relevant disclosure and found whether it was designated as an unfaithful disclosure firm. The imposed penalty points and substituted penalty points which were substituted as disclosure violation fines were also checked. In the case of the KSE market, we verified the amount of disclosure violation fine recorded in the unfaithful disclosure firm announcement item and calculated the substitute penalty points according to the stock market’s detailed disclosure enforcement regulation Article 13, Section 3 (imposing standard of disclosure violation fine, etc.). The sample distribution of unfaithful disclosure firms according to each market is presented in Table 2.

Table 2.

Sample Distribution of Unfaithful Disclosure Firms.

Fair disclosure regulation exists to mitigate information asymmetry among the stakeholders. In November, 2002, the regulation of disclosing the same information to the general investors when previously just certain people received information before the disclosure date or when the disclosure is not mandatory. Contents of fair disclosure include (tentative) operating performance, prospect towards operating performance, fair disclosure of future industry and management plan. Other than that, it is classified as disclosure related to discretionary disclosure items. (Tentative) operating performance disclosure is disclosure on operating performance related to the relevant management report before the report is submitted. Disclosure on the prospect of operating performance includes disclosure of prospects on sales, operating income and loss, continuing income and loss before income taxes, net income and loss, etc. In addition, fair disclosure and discretionary disclosure regarding future business and management plans are classified as fair disclosure information which are items that have not yet past the reporting deadline (stock market disclosure regulation Article 15, Section 1). This study confines the analysis of firms’ voluntary disclosure to (tentative) business performance, prospects of business performance, future business and management plans (Future business and management plans refer to items that heavily influence the firm’s business activities and firm performance. These plans indicating up till the next three years are to be disclosed. Examples presented from disclosure regulations include plans regarding a new industry, market, item, or technology. Plans also include the firm’s core business, corporate structure, change of the current industry, strategical cooperation, etc. Prospects of business performance refer to the disclosure of business performance and prospect within the next three years or disclosures regarding forecasts. They are to be disclosed with evidence of the hypothesis and judgement upon the prospects and forecasts. In cases where business performance is given to a few fair disclosure information providers before submitting the financial statement, (tentative) business performance would refer to information provided with numerical comparisons such as concerning the previous year’s motivations and performances before submitting the financial statement).

Table 3 shows the number of voluntary disclosures and disclosure firms according to each type and year. Panel A shows the number of voluntary disclosures. During the sampling period, voluntary disclosures counted to a total of 16,705 while (tentative) operating performance disclosures counted highest reaching 14,655. Disclosures on prospects toward operating business were 1611, on future business and management plans were 449. Panel B shows the number of firms that gave voluntary disclosure in the relevant year. During the sampling period, 6048 firms gave voluntary disclosure. 4455 firms gave disclosure on (tentative) operating performance, 1279 firms on prospects of operating performance, and 314 firms on future business and management plans.

Table 3.

Sample Distribution of Voluntary Disclosure.

4. Empirical Results

4.1. Descriptive Statistics

Table 4 shows descriptive statistics of major variables used in the study. Most of the variables used were found to not have a wide gap between the mean and median value. Standard deviation was also small, which shows the distribution was similar to normal distribution. The value indicating whether the firm was designated as an unfaithful disclosure firm (Dummy_UD) was 0.329. This shows that 3.29% of the total sample were designated as unfaithful disclosure firms. Value (P) was derived by placing a natural log on the unfaithful disclosure firm penalty points, and its mean was 0.0448. The mean of the 436 firm-year observations’-imposed penalty points was 3.11 points. The value indicating the existence of voluntary disclosure (Dummy_D) had the mean of 0.3706, which shows 37.06% of the total sample gave voluntary disclosure.

Table 4.

Descriptive Statistics.

Table 5 shows the results of analyzing the correlations of the major variables used in the study. The dependent variable of Hypothesis 1, Dummy_UD, found to have a significantly positive (+) relation with CH_OWN shows that the more frequent the change of the largest shareholder, the higher the possibility of the firm in being designated as an unfaithful disclosure firm. Dummy_UD found to have significantly positive (+) relations with the control variables LEV, LOSS, and MARKET, while having significantly negative (−) relations with SALES, ROA, FOR, BLOCK, HORIZON, and STD.

Table 5.

A Correlation Matrix.

Another dependent variable of Hypothesis 1, P, found to have a significantly positive (+) relation with CH_OWN which shows that the more frequent the change of the largest shareholder, the higher the penalty points of the firm in designated as an unfaithful disclosure firm. P found to have significantly positive (+) relations with the control variables LEV, LOSS, and MARKET, while having significantly negative (−) relations with SALES, ROA, FOR, BLOCK, CONFIRM, HORIZON, and STD.

The dependent variable of Hypotheses 2, Dummy_D, showed to have a significantly negative (−) relation with Dummy_UD. Firms that were designated as an unfaithful disclosure firm due to violation with negligence or intention had low voluntary disclosure levels during the relevant year and thus had low overall disclosure levels. Dummy_D found to have significantly positive (+) relations with control variables SALES, ROA, FOR, CONFIRM, BIG4, HORIZON, and STD, while having significantly negative (−) relations with LOSS, BLOCK, AGE, and MARKET.

4.2. Main Results

Panel A in Table 6 shows results of a multivariate analysis in verifying Hypothesis 1 regarding the influence of the number of changes of the largest shareholder on the possibility of being designated as an unfaithful disclosure firm. The rare event logistic regression model was used since the dependent variable was a dummy variable that indicated whether it was designated as an unfaithful disclosure firm (When there are only a small number of cases observed, the estimation becomes lopsided. To solve this problem, we adjusted the cases by sampling the data and using the relogit model through the Zelig model in the R program to operate a preceding process [56]. The log-likelihood value and the pseudo R2, etc., cannot be extracted through the relogit model since it makes lopsided estimations using the sampling method which differs from general logit models’ method of estimating maximum likelihood [57]). In result to the analysis, CH_OWN showed to have a positive (+) coefficient under the 1% significance level supported Hypothesis 1. Unfaithful disclosure means to not faithfully follow the disclosure obligations or to change, or deny the original disclosure. A firm being designated as an unfaithful disclosure firm indicates that the firm’s disclosure transparency has deteriorated. The result showing that the more frequent the changes of the largest shareholder in the recent 3 years, the higher the possibility of the firm in being designated as an unfaithful disclosure firm, can be interpreted that the change of the largest shareholder weakens the corporate governance and negatively influences the disclosure system. This shows a similar result to prior literature which states that a weak corporate governance negatively influenced disclosure transparency [12,35]. Among the control variables, LEV, CONFIRM were found to have significantly positive coefficient values. Conversely, SALES, ROA, BLOCK, BIG4 exhibited significantly negative coefficient values.

Table 6.

Effects of the number of changes of the largest shareholder on the unfaithful disclosure.

Panel B in Table 6 reflects the results of the regression analysis in regard to the effects of the number of changes of the largest shareholder on the unfaithful disclosure penalty points. Results from the analysis showed that CH_OWN had a positive (+) value when below the 1% significance level, which supported Hypothesis 1. Unfaithful disclosure penalty point is an important item in the disclosure violation contents. The increase of penalty points due to long delayed disclosure, or intentional disclosure violation, mean disclosure level has worsened. Among the control variables, LEV was found to have a significantly positive value, while LOSS showed a significantly negative value. This indicates that firms that have a degenerating corporate governance and low profitability tend to receive higher penalty points.

The Hypothesis 2 investigates whether the firm is designated as an unfaithful disclosure firm effects on the future form of voluntary disclosure. The rare event logistic regression model was used since the dependent variable was a dummy variable that indicated whether made voluntarily disclosure in the current year. Results in Table 7 showed that Dummy_UD has a significantly positive coefficient value. This indicates that firms designated as an unfaithful disclosure firm have a greater chance of making voluntary disclosure in the future. This supports Hypothesis 2. It can be interpreted that firms that have been designated as an unfaithful disclosure firm make voluntary disclosure in effort to raise disclosure transparency. In cases where firms repeatedly violate the disclosure system, penalty points increase. For firms with 15 or more accumulated penalty points in the recent year, they are designated as an administrative issue, thus have a reason to improve their disclosure system. Also, the fact that a firm is designated as an unfaithful disclosure firm means that its disclosed information is distorted and the firm’s reliability damaged. Hence, being designated as an unfaithful disclosure firm brings a negative response from the capital market. Therefore, after a firm is designation as an unfaithful disclosure firm, it is possible that it would increase voluntary disclosure in order to raise disclosure transparency. This signifies that the unfaithful disclosure system made by the market to decrease information asymmetry is effective. Among control variables, SALES, ROA, FOR, CONFIRM, HORIZON, STD, and BIG4 were found to have significantly positive values. In opposite, LEV, AGE, MARKET reflected significantly negative values.

Table 7.

Effect of the designation as an unfaithful disclosure on voluntary disclosure.

4.3. Effect of Unfaithful Disclosure Firm Designation on the Quality of Management Forecasts

Healy and Palepu [50] caution that the extent to which voluntary disclosure mitigates resource misallocation in the capital market depends on the degree of information credibility. Since managers have incentives to make self-serving voluntary disclosures, those disclosures may or may not be credible. Core [58] further reports that managers’ incentives should be carefully considered in evaluating optimal disclosure policies. More recent theories have relaxed the assumption of truthful disclosure and assumed that at least some managers have incentives to provide biased disclosure. For instance, Fischer and Verrecchia [59] demonstrate that managers have incentives to report biased information under conditions of sufficient uncertainty as to their reporting objectives. Hermalin and Weisbach [60] also predict that career concerns such as job security or compensation may induce managers to behave opportunistically by distorting disclosed information if their evaluations depend on them. Bergman and Roychowdhury [61] also provide evidence that managers use guidance to maintain optimistic earnings valuations, especially in times of low investor sentiment. In addition, Shroff et al. [62] find that managers use guidance to inflate stock prices artificially before seasoned equity offerings. Feng et al. [63] further show that firms engaging in accounting manipulations use guidance to delay the detection of such manipulations.

Prior studies also demonstrate that investors have concerns about the credibility of management forecasts. Hutton et al. [64] find that bad news earnings forecasts are always informative, but that good news forecasts are informative only when supplemented by verifiable forward-looking statements that bolster firm credibility. Rogers and Stocken [65] also document a stronger investor response to good news relative to bad news forecasts, consistent with the notion that investors always suspect an upward misrepresentation in guidance [66,67]. As far as the unfaithful disclosure designation system has discipline effects on the designated firms, we expect credible management forecasts to increase sustainability of the information disclosure environment for firms with unfaithful disclosure designation experience.

Dependent variable is the absolute value of the difference between manager’s sales forecast and real sales, divided by end of March total market value. This means, the smaller the value, the higher the accuracy of the forecast. Therefore, we can predict that it would have a negative relationship with Dummy_UD, which shows whether the firm is designated as an unfaithful disclosure firm. Table 8 targets 787 firm-years from those that disclosed management forecasts. It displays whether the accuracy of the management forecast increases for firms that were designated as unfaithful disclosure firm the previous year. According to the results of the analysis, Dummy_UD portrayed a significant negative (−) value, meaning that the disclosed firm did increase their accuracy of management forecast. This result supports Hypothesis 2 that states the unfaithful disclosure designated firm would raise its disclosure level.

Table 8.

Designation as an Unfaithful Disclosure Firm and the Quality of Management Forecast.

4.4. Fixed-Effects Regression

Table 9 and Table 10 are analyzed results of securing the robustness of the study through the Fixed-effect Regression. Table 9 shows the results of implementing the Fixed-effects Regression to verify Hypothesis 1, which investigates how the changes of the largest shareholder effects designation as an unfaithful disclosure firm. According to the results, CH-OWN had a positive (+) value under the significant 1% level, which was similar to the results of Table 6. This also supported Hypothesis 1. The more frequently the largest shareholder changes, disclosure transparency would deteriorate, leading to increased possibility of the firm in being designated as an unfaithful disclosure firm.

Table 9.

Effects of the number of changes of the largest shareholder on the unfaithful disclosure.

Table 10.

Effect of the designation as an unfaithful disclosure on voluntary disclosure.

Table 10 depicts results of implementing the Fixed-effects Regression to verify Hypothesis 2, which searches how the designation as an unfaithful disclosure firm later effects voluntary disclosure. Results showed that Dummy_UD had a positive (+) value under the significant 5% level, similar to the results of Table 7. This too supports Hypothesis 2. It can be interpreted that unfaithful disclosure designated firms later increase their voluntary disclosure level in order to strengthen disclosure transparency.

4.5. Alternative Proxy for Transparency: Opacity

The alternative measure of transparency is the three-year moving sum of the absolute value of annual discretionary accruals [68]:

Dechow, et al. [69] show that firms generally manipulate reported earnings from one to three years before being detected and that the overstated accruals of the firms typically reverse quickly, with negative discretionary accruals following the prior positive ones in the years immediately following the periods of earnings manipulation. Taken together, these facts motivate a simple, but intuitively appealing, measure of opacity in financial statements.

Table 11 shows the results to verify Hypothesis 1 which investigates how the changes of the largest shareholder affect corporate opacity. According to the results, CH-OWN had a positive (+) value under the significant 1% level which was similar to the results of Table 6. In addition, the designation of unfaithful disclosure is positively associated with the opacity. Overall, the more frequently the largest shareholder changes, transparency measured by opacity would deteriorate, leading to increased possibility of the firm in being designated as an unfaithful disclosure firm.

Table 11.

Effects of the number of changes of the largest shareholder and the designation of unfaithful disclosure on Opacity Index.

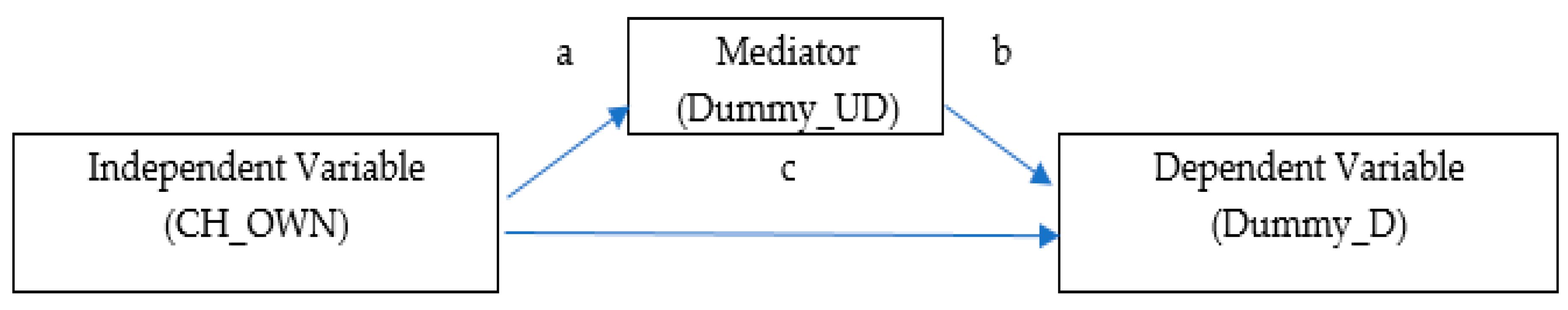

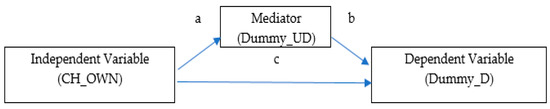

4.6. Mediation Modeling: Sobel’s Test

Mediation modeling is an analytical tool that can be employed to explain the nature of the relationship among three or more variables [70]. This paper firstly investigates the effects of the change of the largest shareholder on the designation of unfaithful disclosure firms and then examines whether these firms increase voluntary disclosure frequency. Thus, instead of showing this relationship simply, it can be used to show how a variable mediates the relationship between levels of intervention and outcome. Recent studies provide a statistical test for the mediation path known as the Sobel Test. In the structure of this paper, independent variable is the change of the largest shareholder and dependent variable is the frequency of voluntary disclosure. In addition, the mediator would be a dummy variable to check the designation of unfaithful disclosure. The central idea in this model is that the effects of independent variables on dependent variables are mediated by various transformation processes such as mediator as following Figure 2 [70].

Figure 2.

Mediation Modeling.

Table 12 shows the results for Sobel’s test. The mediation effect of Dummy_UD can be checked from the multiple value of ‘a’ and ‘b’ in above Figure 2. The significance of mediation effect can be verified from the Sobel’s Z statistics, indicating that the Dummy_UD has mediation effect at the 1% significance level. Overall, we can conclude that the changes of the largest shareholder directly affect the voluntary disclosure frequency and it can also influence indirectly to the voluntary disclosure through the mediation effect of Dummy_UD.

Table 12.

Mediation modeling: Sobel’s test.

5. Conclusions

This study first analyzed effects of the change of the largest shareholder on disclosure transparency of listed firms from 2009 to 2017. We expected that when the largest shareholder changes, there would be a high chance that changes on corporate governance, entrance of new businesses, and staff replacement also occur. This would increase management uncertainty, leading to influence disclosure quality. This study used a variable indicating whether the firm is designated an unfaithful disclosure firm and another variable regarding the imposed penalty points to verify disclosure transparency. Further, we investigated whether firms that were designated as an unfaithful disclosure firm later increased their voluntary disclosure level. The unfaithful disclosure regulation was established to select firms with degenerating disclosure quality and induce them to make improvement. We expected that a firm that is designated as an unfaithful disclosure firm and is known in the market to have a low disclosure level would later place effort in improving its disclosure level. This was analyzed by investigating voluntary disclosures.

The empirical results show that frequent change of the largest shareholders is positively related to the likelihood of being designated as an unfaithful disclosure firm. In addition, the number of changes of the largest shareholder is positively associated with the unfaithful disclosure penalty points, which supports Hypothesis 1. In conclusion, the more frequent the number of changes of the largest shareholder, the higher the possibility of the firm is in being designated as an unfaithful disclosure firm and of those firms in receiving higher penalty points. This is interpreted that the firm’s disclosure quality can decline the more frequent the change of the largest shareholder. Second, results showed from the analysis that firms which were designated as unfaithful disclosure firms documented significant increase in voluntary disclosure level the following year. This indicates that firms designated as an unfaithful disclosure firm have a greater chance of making voluntary disclosure in the future to improve its disclosure quality. This supports Hypothesis 2.

This study adds the incremental contributions to the prior studies in following aspects. First, compared to previous studies that usually focused on the research on the designated year of the unfaithful disclosure firm, this study’s strongest contribution is that it investigates how the designation brings change on the structure of the firm by contrasting the years before and after the designation. This study predicted that if the unfaithful disclosure designation system is operating effectively, it would bring upon a self-regulating effect and influence managers to voluntary disclose. This is because, Beyer et al. [44], in assessing the relative importance of various corporate disclosures on stock return variance, estimate that voluntary disclosure accounts for 66% of the total variance explained by all accounting-based disclosures, compared to 12% from mandatory disclosures such as earnings announcements and SEC filings. Since companies make voluntary disclosure that go beyond minimum disclosure requirements in response to market demand, management forecasts which represent voluntary disclosure could be an effective variable that enables observation of change in the disclosure form by managers who self-reflect after the firm is designated as an unfaithful disclosure firm. If the frequency and accuracy of managerial guidance increases after designation, it would mean that positive change on the manager’s disclosure form occurred through the application of effective regulation. This would be evidence that the firm’s manager is actively signaling the will to increase the corporate sustainability through the form of disclosure.

Second, studies on the largest shareholder have focused on the largest shareholder’s share ratio, and the point in time of any change. However, this study focuses on the frequent change of the largest shareholder that have more than two changes a year. Even though there are also many researches analyzing the effect of corporate governance on disclosure quality, they were mainly concerning the board of directors and the audit committee. Regarding this, the study verified how the largest shareholder’s change is important for disclosure transparency and corporate sustainability by using unfaithful disclosure designation system and expanded the study to the voluntary disclosure level.

Finally, the study can be intriguing to the standard-setters and regulatory bodies that monitor the corporate financial statements. For instance, the supervision of authorities is taking concern by setting the standard for designating the change of the largest shareholder as an investment caution item, or appointing an auditor, etc. This study showed how the change of the largest shareholder negatively influences disclosure transparency and presented empirical evidence exhibiting the supervision of authorities’ concern regarding this phenomenon by using government’s disclosure system. Also, unfaithful disclosure regulation exists to mitigate information asymmetry and to increase transparency of the market by using the self-regulatory effect. This study empirically verified the effectiveness of this regulation in that the firms’ voluntary disclosure level increases after being designated as an unfaithful disclosure firm, which proves the self-regulatory effects of unfaithful disclosure regulation.

Caution should be made in the adoption of the outcome of this study. First, the correlation between corporate governance and unfaithful disclosure regulation may be affected by other types of corporate governance mechanisms besides largest shareholders. Future studies should be conducted to explore with the relevant control variables and the degree to which they have an effect. Secondly, the unique disclosure environments and nature of the South Korea should be considered when interpreting the outcomes of unfaithful disclosure regulation in South Korea. Regulators in other international countries should assess their own disclosure environments when implementing disclosure regulation in order for it to accomplish the anticipated consequence. Furthermore, even if the study includes various robust regressions, there could be probable difficulties about the omitted variables. Researchers cannot completely measure voluntary disclosure quality because fair disclosure regulation is subject to be affected by the managerial discretionary judgement on disclosure level. Nevertheless, this paper still provides insightful understanding to the literature through its investigation of the relation between unfaithful disclosure regulation and voluntary disclosure by comparing them with the behaviors of non-voluntary disclosure firms. Besides, it is vital to reflect the idiosyncratic settings of South Korea, where financial regulatory bodies have recently implemented new plans to improve the disclosure environment. Administrative authorities are now attentive on self-regulatory effect through penalty points, which encourages possible improvement of that information environment.

Author Contributions

Conceptualization, J.L. and J.S.P.; methodology, E.C.; software, E.C..; validation, J.L. and J.S.P.; formal analysis, E.C.; investigation, E.C.; resources, J.L.; data curation, J.L.; writing—original draft preparation, J.L.; writing—review and editing, E.C.; supervision, J.L. and J.S.P.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Brockett, A.; Rezaee, Z. Corporate Sustainability: Integrating Performance and Reporting (Volume 630); John Wiley & Sons: Hoboken, NJ, USA, 2012. [Google Scholar]

- Rezaee, Z. Business Sustainability: Performance, Compliance, Accountability, and Integrated Reporting; Greenleaf Publishing Limited: Yorkshire, UK, 2015; pp. 45–70. [Google Scholar] [CrossRef]

- Amelio, S. The connection between IAS/IFRS and social responsibility. Manag. Dyn. Knowl. Econ. 2016, 4, 7–30. [Google Scholar]

- Bushman, R.M.; Smith, A.J. Transparency, financial accounting information, and corporate governance. Financial Accounting Information, and Corporate Governance. Econ. Policy Rev. 2003, 9, 65–87. [Google Scholar] [CrossRef][Green Version]

- Pattnaik, C.; Gray, S. Differences in corporate transparency between MNC subsidiaries and domestic corporations: Empirical evidence from India. In Transparency and Governance in a Global World; Emerald Group Publishing Limited: Bingley, UK, 2012; pp. 173–196. [Google Scholar] [CrossRef]

- Bae, J.; Lee, J.; Kim, E. Does Fixed Asset Revaluation Build Trust between Management and Investors? Sustainability 2019, 11, 3700. [Google Scholar] [CrossRef]

- Park, J.H.; Lee, J.; Choi, Y.S. The Effects of Divergence between Cash Flow and Voting Rights on the Relevance of Fair Disclosure and Credit Ratings. Sustainability 2019, 11, 3657. [Google Scholar] [CrossRef]

- Wang, B.; Xu, S.; Ho, K.C.; Jiang, I.; Huang, H.Y. Information Disclosure Ranking, Industry Production Market Competition, and Mispricing: An Empirical Analysis. Sustainability 2019, 11, 262. [Google Scholar] [CrossRef]

- Park, S.; Jung, H. The effect of managerial ability on future stock price crash risk: Evidence from Korea. Sustainability 2017, 9, 2334. [Google Scholar] [CrossRef]

- Son, H.C.; Park, S.K. The effect internal control weakness and investor alert on credit rating. Korean Int. Account. Rev. 2013, 52, 1–22. [Google Scholar]

- Moon, J.G.; Hwang, B.Y. An empirical study on a firm’s fail prediction model by considering whether there are embezzlement, malpractice and the largest shareholder changes or not. Asia Pac. J. Bus. Ventur. Entrep. 2014, 9, 119–132. [Google Scholar]

- Na, G.U.; Jo, S.J.; Shin, C.W. The effects of the changes of the largest shareholder on the delisting—Focused on KOSDAQ. J. Financ. Account. Inf. 2014, 14, 241–273. [Google Scholar]

- Kim, H.R. The effect of the type of largest shareholder change on firm risk. J. Bus. Educ. 2018, 32, 71–98. [Google Scholar]

- Son, H.C.; Park, S.K. The effect of Frequent Change of the Largest Shareholder and Embezzlement and Misappropriation on Earnings Management. Korean Account. J. 2016, 25, 485–522. [Google Scholar]

- Kim, Y.S.; Hwang, K.J. The effect of the Largest Shareholder and Auditor Change on the Remediation of Internal Control Review Opinion. Korean Account. Rev. 2015, 40, 117–152. [Google Scholar]

- Bushman, R.M.; Smith, A.J. Financial Accounting Information and Corporate Governance. J. Account. Econ. 2001, 32, 237–333. [Google Scholar] [CrossRef]

- Shleifer, A.; Vishny, R.W. A survey of corporate governance. J. Financ. 1997, 52, 737–783. [Google Scholar] [CrossRef]

- Ball, R.; Kothari, S.P.; Robin, A. The effect of international institutional factors on properties of accounting earnings. J. Account. Econ. 2000, 29, 1–51. [Google Scholar] [CrossRef]

- Claessens, S.; Djanjov, S.; Lang, L. The Separation of Ownership and Control in East Asian Corporations. J. Financ. Econ. 2000, 58, 81–112. [Google Scholar] [CrossRef]

- Watts, R.; Zimmerman, J. Positive Accounting Theory; Prentice-Hall: Englewood Cliffs, NJ, USA, 1986. [Google Scholar]

- Klassen, K.J. The impact of inside ownership concentration on the trade-off between financial and tax reporting. Account. Rev. 1997, 72, 455–474. [Google Scholar]

- Warfield, T.D.; Wild, J.J.; Wild, K.L. Managerial ownership, accounting choices, and informativeness of earnings. J. Account. Econ. 1995, 20, 61–91. [Google Scholar] [CrossRef]

- Darrough, M.N.; Pourjalali, H.; Saudagaran, S. Earnings management in Japanese companies. Int. J. Account. 1998, 33, 313–334. [Google Scholar] [CrossRef]

- Choi, W.; Kim, J.W. Underreaction, Trading Volume and Post Earnings Announcement Drift. Working Paper. 2001. Available online: http://dx.doi.org/10.2139/ssrn.287817 (accessed on 24 October 2001).

- Gulamhussen, M.A.; Pinheiro, C.; Sousa, R. The influence of managerial ownership on bank market value, performance, and risk: Evidence from banks listed on the stoxx global index. J. Int. Financ. Manag. Account. 2012, 23, 121–153. [Google Scholar] [CrossRef]