Stakeholders and Long-Term Sustainability of SMEs. Who Really Matters in Crisis Contexts, and When

Abstract

:1. Introduction

2. Background and Hypotheses

2.1. Stakeholders and the Likelihood of SME Failure

2.1.1. Shareholders and SMEs’ Financial Distress Likelihood

2.1.2. Lenders and SMEs’ Financial Distress Likelihood

2.1.3. Workers and SMEs’ Financial Distress Likelihood

2.1.4. Customers and SMEs’ Financial Distress Likelihood

2.1.5. Suppliers and SMEs’ Financial Distress Likelihood

2.2. Crisis Development and Stakeholders Influence

3. Methodology

3.1. Sample

3.2. Description of the Variables

3.3. Statistical Analysis and Methodology

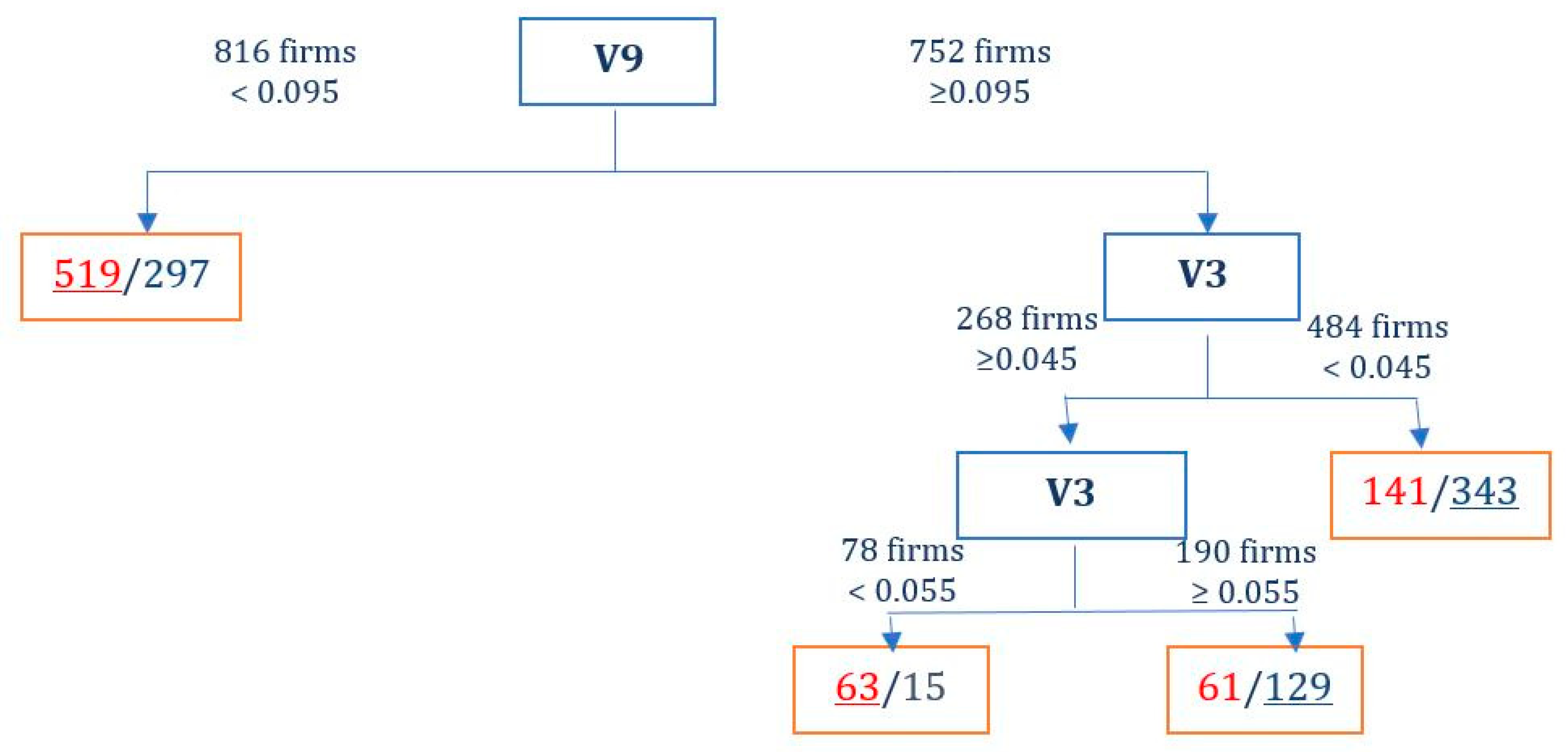

4. Results

5. Further Analysis

6. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Rodriguez, M.A.; Ricart, J.E.; Sanchez, P. Sustainable Development and the Sustainability of Competitive Advantages: A Dynamic and Sustainable View of the Firm. Sustain. Dev. Compet. Advant. 2002, 11, 135–146. [Google Scholar] [CrossRef]

- Stubbs, W.; Cocklin, C. Conceptualizing a “Sustainability Business Model”. Organ. Environ. 2008, 21, 103–127. [Google Scholar] [CrossRef]

- Tencati, A.; Perrini, F. The sustainability perspective: A new governance model. In Corporate Social Responsibility. Reconciling Aspiration with Application; Kakabadse, A., Morsing, M., Eds.; Palgrave Macmillan: London, UK, 2006; pp. 94–111. [Google Scholar]

- Caputo, F.; Buhnova, B.; Walletzky, L. Investigating the role of smartness for sustainability: Insights from the Smart Grid domain. Sustain. Sci. 2018, 13, 1299–1309. [Google Scholar] [CrossRef]

- AccountAbility. AccountAbility 1000 (AA1000) Framework. Standard, Guidelines and Professional Qualification; ISEA: London, UK, 1999. [Google Scholar]

- Post, J.E.; Preston, L.E.; Sachs, S. Managing the extended enterprise: The new stakeholder view. Calif. Manag. Rev. 2002, 45, 5–27. [Google Scholar] [CrossRef]

- Saviano, M.; Caputo, F. Managerial choices between systems, knowledge and viability. In Contributions to Theoretical and Practical Advances in Management. A Viable Systems Approach (VSA); Barile, S., Ed.; Aracne: Roma, Italy, 2013; pp. 219–242. [Google Scholar]

- Del Giudice, M.; Khan, Z.; De Silva, M.; Scuotto, V.; Caputo, F.; Carayannis, E. The micro-level actions undertaken by owner-managers in improving the sustainability practices of cultural and creative small and medium Enterprises: A United Kingdom-Italy comparison. J. Organ. Behav. 2017, 38, 1396–1414. [Google Scholar] [CrossRef]

- Pojasek, R.B. A framework for business sustainability. Environ. Qual. Manag. 2007, 17, 81–88. [Google Scholar] [CrossRef]

- Box, M. The death of firms: Exploring the effects of environment and birth cohort on firm survival in Sweden. Small Bus. Econ. 2008, 31, 379–393. [Google Scholar] [CrossRef]

- Organisation for Economic Co-Operation and Development. The Impact of the Global Crisis on SME and Entrepreneurship Financing and Policy Responses. 2009. Available online: http://www.oecd.org/cfe/smes/43183090.pdf (accessed on 3 March 2018).

- European Commission. A Partial and Fragile Recovery. Annual Report on European SMEs 2013/2014. Available online: http://ec.europa.eu/enterprise/policies/sme/facts-figures-analysis/performance-review/files/supporting-documents/2014/annual-report-smes-2014_en.pdf (accessed on 10 April 2018).

- Mitroff, I.I.; Pearson, C.M.; Harrington, L.K. The Essential Guide to Managing Corporate Crises; Oxford University Press: New York, NY, USA, 1996. [Google Scholar]

- Altman, E.I. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J. Financ. 1968, 23, 589–609. [Google Scholar] [CrossRef]

- Ohlson, J.A. Financial ratios and the probabilistic prediction of bankruptcy. J. Account. Res. 1980, 18, 109–131. [Google Scholar] [CrossRef]

- Platt, H.D.; Platt, M.B. Development of a class of stable predictive variables: The case of bankruptcy prediction. J. Bus. Financ. Account. 1990, 17, 31–51. [Google Scholar] [CrossRef]

- Lee, D.Y.; Tsang, E.W.K. The effects of entrepreneurial personality, background and network activities on venture growth. J. Manag. Stud. 2001, 38, 583–602. [Google Scholar] [CrossRef]

- Schutjens, V.A.; Wever, E. Determinants of new firm success. Pap. Reg. Sci. 2000, 79, 135–153. [Google Scholar] [CrossRef]

- Brixy, U.; Grotz, R. Regional patterns and determinants of birth and survival of new firms in western Germany. Entrep. Reg. Dev. 2007, 19, 293–312. [Google Scholar] [CrossRef]

- Everett, J.; Watson, J. Small business failure and external risk factors. Small Bus. Econ. 1998, 11, 371–390. [Google Scholar] [CrossRef]

- Carter, R.; Van Auken, H. Small firm bankruptcy. J. Small Bus. Manag. 2006, 44, 493–512. [Google Scholar] [CrossRef]

- Schlierer, H.; Werner, A.; Signori, S.; Garriga, E. How do European AME owner-managers make sense of “Stakeholder Management”? Insights from a cross-national study. J. Bus. Ethics 2012, 109, 39–51. [Google Scholar] [CrossRef]

- Mutezo, A. Credit rationing and risk management for SMES: The way forward for South Africa. Corp. Ownersh. Control 2013, 10, 153–163. [Google Scholar] [CrossRef]

- Fraser, S.; Storey, D.; Frankish, J.; Roberts, R. The relationship between training and small business performance: An analysis of the Barclays Bank small firms training loan scheme. Environ. Plan. C Gov. Policy 2002, 20, 211–233. [Google Scholar] [CrossRef]

- Mulling, D.; Silveira, M.; Dutra, M.; Lauren, A. Value Creation from Internationalization of Sugar Cane by-products: A multi-stakeholder view of artisanal cachaça production. Rev. Bras. Gestão Neg. 2015, 17, 890–910. [Google Scholar] [CrossRef]

- Hill, R.; Stewart, J. Human resource development in small organizations. J. Eur. Ind. Train. 2000, 24, 105–117. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Strategy; Free Press: New York, NY, USA, 1980. [Google Scholar]

- Hillman, A.J.; Hitt, M.A. Corporate political strategy formulation: A model of approach, participation, and strategy decisions. Acad. Manag. Rev. 1999, 24, 825–842. [Google Scholar] [CrossRef]

- Jenkins, H. Small business champions for corporate social responsibility. J. Bus. Ethics 2006, 67, 241–256. [Google Scholar] [CrossRef]

- James, S. Strategic bankruptcy: A stakeholder management perspective. J. Bus. Res. 2016, 69, 492–499. [Google Scholar] [CrossRef]

- Pajunen, K. Stakeholders Influences in Organizational Survival. J. Manag. Stud. 2006, 43, 1261–1288. [Google Scholar] [CrossRef]

- Altman, E.; Sabato, G. Modelling credit risk for SMEs evidence from the US market. Abacus 2007, 43, 332–356. [Google Scholar] [CrossRef]

- Gray, S.; Mirkovic, A.; Ragunathan, V. The determinants of credit ratings Australian evidence. Aust. J. Manag. 2006, 31, 333–353. [Google Scholar] [CrossRef]

- Flores-Jimeno, R.; Jimeno-García, I. Dynamic analysis of different business failure process. Probl. Perspect. Manag. 2017, 15, 486–499. [Google Scholar] [CrossRef]

- Jimeno-García, I.; Rodriguez-Merayo, M.A.; Vidal-Blasco, M.A. The failure processes and their relation to the business interruption moment. Int. J. Manag. Financ. Account. 2017, 9, 68–83. [Google Scholar] [CrossRef]

- Laitinen, E.; Lukason, O.; Suvas, A. Are firm failure processes different? Evidence from seven countries. Investig. Manag. Financ. Innov. 2014, 11, 212–222. [Google Scholar]

- Lukason, O.; Hoffman, R. Firm failure causes: A population level study. Probl. Perspect. Manag. 2015, 13, 45–55. [Google Scholar]

- Lukason, O.; Laitinen, E. Firm failure processes and components of failure risk: An analysis of European bankruptcy firms. J. Bus. Res. 2019, 98, 380–390. [Google Scholar] [CrossRef]

- Manzaneque, M.; Banegas, R.; García-Pérez-De-Lema, D. Different business failure processes. Dynamic analysis through the application of cluster analysis. Rev. Eur. Dir. Econ. Empresa 2010, 19, 67–88. [Google Scholar]

- Ooghe, H.; Prijcker, S. Failure processes and causes of company bankruptcy: A typology. Manag. Decis. 2008, 46, 223–242. [Google Scholar] [CrossRef]

- Mitchell, R.K.; Agle, B.R.; Wood, D.J. Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Acad. Manag. Rev. 1997, 22, 853–886. [Google Scholar] [CrossRef]

- Pearson, C.M.; Clair, J.A. Reframing Crisis Management. Acad. Manag. Rev. 1998, 23, 59–77. [Google Scholar] [CrossRef]

- Ulmer, R.R. Effective Crisis Management through Established Stakeholder Relationships. Manag. Commun. Q. 2001, 14, 590–615. [Google Scholar] [CrossRef]

- Freeman, E. Strategic Management: A Stakeholder Approach; Pitman: Boston, MA, USA, 1984. [Google Scholar]

- Fassin, Y. Stakeholders management, reciprocity and stakeholder responsibility. J. Bus. Ethics 2012, 109, 83–96. [Google Scholar] [CrossRef]

- Weerawardena, J.; O’Cass, A.; Julian, C. Does industry matter? Examining the role of industry structure and organizational learning in innovation and brand performance. J. Bus. Res. 2006, 59, 37–45. [Google Scholar] [CrossRef]

- Becchetti, L.; Cicirettim, R.; Hasan, I.; Kobeissi, N. Corporate social responsibility and shareholder’s value. J. Bus. Res. 2012, 65, 1628–1635. [Google Scholar] [CrossRef]

- Pereira, Y.; Rossetto, C.R. Stakeholder management capability and performance in Brazilian cooperatives. Rev. Bras. Gestão Neg. 2015, 17, 870–889. [Google Scholar] [CrossRef] [Green Version]

- Chatterjee, S.; Dhillon, U.S.; Ramirez, G.G. Resolution of financial distress: Debt restructuring in chapter 11, prepackaged bankruptcy, and workouts. Financ. Manag. 1996, 25, 5–18. [Google Scholar] [CrossRef]

- Jenkins, H. A Critique of Conventional CSR Theory: An SME Perspective. J. Gen. Manag. 2004, 29, 37–57. [Google Scholar] [CrossRef]

- Gallo, M. The family business and its social responsibilities. Fam. Bus. Rev. 2004, 17, 135–147. [Google Scholar] [CrossRef]

- Fiegener, M.K.; Brown, B.M.; Dreux, D.R.; Dennis, W.J. The adoption of outside boards by small private US firms. Entrep. Reg. Dev. 2000, 12, 291–309. [Google Scholar] [CrossRef]

- Ullmann, A. Data in search of a theory: A critical examination of the relationships among social performance, social disclosure, and economic performance of U.S. firms. Acad. Manag. Rev. 1985, 10, 540–557. [Google Scholar]

- Petersen, M.A.; Rajan, R.G. The benefits of lending relationships: Evidence from small business data. J. Financ. 1994, 49, 3–38. [Google Scholar] [CrossRef]

- Myers, S.C.; Majluf, N.S. Corporate Financing and Investment Decisions when Firms Have Information that Investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef] [Green Version]

- Berger, A.N.; Udell, G.F. The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle. J. Bank. Financ. 1998, 22, 613–673. [Google Scholar] [CrossRef] [Green Version]

- Aybar, C.; Casino, A.; López, J. La reestructuración financiera de las pymes en crisis. Endogeneidad en la Elección entre vía privada y vía concursal. Investig. Econ. 2006, 30, 137–162. [Google Scholar]

- Bourgeois, L.J. On the measurement of organizational slack. Acad. Manag. Rev. 1981, 6, 29–39. [Google Scholar] [CrossRef]

- George, G. Slack resources and the performance of privately held firms. Acad. Manag. J. 2005, 48, 661–676. [Google Scholar] [CrossRef]

- Ou, C.; Haynes, G.W. Acquisition of additional equity capital by small firms—Findings from the national survey of small business finances. Small Bus. Econ. 2006, 27, 157–168. [Google Scholar] [CrossRef]

- Coleman, S. Access to capital and terms of credit: A comparison of men and women-owned small businesses. J. Small Bus. Manag. 2000, 38, 37–52. [Google Scholar]

- Wruck, K. Financial Distress: Reorganization and organization efficiency. J. Financ. Econ. 1990, 27, 419–444. [Google Scholar] [CrossRef]

- Altman, E. A further investigation of the bankruptcy cost question. J. Financ. 1984, 39, 1067–1089. [Google Scholar] [CrossRef]

- Pettit, R.R.; Singer, R.F. Small business finance: A research agenda. Financ. Manag. 1985, 14, 47–60. [Google Scholar] [CrossRef]

- Fazzari, S.M.; Petersen, B. Working capital and fixed investment: New evidence on financing constraints. RAND J. Econ. 1993, 24, 328–342. [Google Scholar] [CrossRef]

- Gallego, S.; García, A.; Saurina, J. The Sian and European Banking System: The Case of Spain in the Quest for Development and Stability. [Working Paper Banco de España, n. 217] Servicio de Estudios. 2002. Available online: https://ideas.repec.org/p/bde/wpaper/0217.html (accessed on 16 March 2018).

- McEvoy, G.M. Small business personnel practices. J. Small Bus. 1984, 22, 1–8. [Google Scholar]

- Denis, D.; Kruse, T. Managerial discipline and corporate restructuring following performance declines. J. Financ. Econ. 2000, 55, 391–424. [Google Scholar] [CrossRef]

- Goss, D. Social Harmony and the Small Firm: A Reappraisal. Sociol. Rev. 1988, 36, 114–132. [Google Scholar] [CrossRef]

- Becker, B.; Gerhart, G. The impact of human resource management on organizational performance: Progress and prospects. Acad. Manag. J. 1996, 39, 779–801. [Google Scholar]

- Wang, H.-M.D.; Sengupta, S. Stakeholder relationship, brand equity, firm performance: A resource-based perspective. J. Bus. Res. 2016, 69, 5561–5568. [Google Scholar] [CrossRef]

- Ruf, B.M.; Muralidhar, K.; Brown, R.M.; Janney, J.J.; Paul, K. An empirical investigation of the relationship between change in corporate social performance and financial performance: A stakeholder theory perspective. J. Bus. Ethics 2001, 32, 143–156. [Google Scholar] [CrossRef]

- Bird, R.; Hall, D.A.; Momenté, F.; Reggiani, F. What corporate social responsibility activities are valued by the market? J. Bus. Ethics 2007, 76, 189–206. [Google Scholar] [CrossRef]

- Holmlund, M.; Kock, S. Buyer dominated relationships in a supply chain—A case study of four small sized suppliers. Int. Small Bus. J. 1996, 15, 26–40. [Google Scholar] [CrossRef]

- Khan, M.R.; Rocha, J. Recurring managerial problems in small business. Am. J. Small Bus. 1982, 7, 50–58. [Google Scholar] [CrossRef]

- Kestens, K.; van Cauwenberge, P.; Bauwhede, H.V. Trade credit and com- pany performance during the 2008 financial crisis. Account. Financ. 2012, 52, 1125–1151. [Google Scholar] [CrossRef]

- Martínez-Sola, C.; García-Teruel, P.-J.; Martínez-Solano, P. Trade credit and SME profitability. Small Bus. Econ. 2014, 42, 561–577. [Google Scholar] [CrossRef]

- Meltzer, A.H. Mercantile credit, monetary policy, and size of firms. Rev. Econ. Stat. 1960, 42, 429–437. [Google Scholar] [CrossRef] [Green Version]

- Bowen, R.; Daley, L.; Huber, C. Evidence on the existence and determinants of inter-Industry leverage differences. Financ. Manag. 1982, 11, 10–20. [Google Scholar] [CrossRef]

- Fitzgerald, T. Predicting and pre-empting the corporate heart attack. Bus. Credit 2006, 108, 68. [Google Scholar]

- Altman, E. Corporate Financial Distress and Bankruptcy, 2nd ed.; Wiley: New York, NY, USA, 1993. [Google Scholar]

- Gazengel, A.; Thomas, P. Les Défaillances d´Entreprises; Cahiers de Recherche, 92; École Superieure de Comerse: Paris, France, 1992. [Google Scholar]

- Chowdhury, S.D.; Lang, J.R. Crisis, decline, and turnaround: A test of competing hypotheses for short-term performance improvement in small firms. J. Small Bus. Manag. 1993, 31, 8–17. [Google Scholar]

- Hambrick, D.C.; D’Aveni, R.A. Large corporation failures as downward spirals. Adm. Sci. Q. 1988, 33, 1–23. [Google Scholar] [CrossRef]

- Ross, S.A.; Westerfield, R.W.; Jaffe, J. Corporate Finance, 7th ed.; McGraw-Hill International: Singapore, 2005. [Google Scholar]

- BOE (Official State Bulletin). Law 22/2003, Spanish Insolvency Act 22-2003. 164, 10 July; Spanish State Agency: Madrid, Spain, 2003. [Google Scholar]

- Keasey, K.; Watson, R. Non-financial symptoms and the prediction of small company failure: A test of the Argenti hypotheses. J. Bus. Financ. Account. 1987, 14, 335–354. [Google Scholar] [CrossRef]

- Alfaro, E.; Gámez, M.; García, N. Linear discriminant analysis versus AdaBoost for failure forecasting. Span. J. Financ. Account. 2008, 37, 13–32. [Google Scholar]

- Richardson, F.; Kane, G.; Lobingier, P. The Impact of Recession on the Prediction of Corporate Failure. J. Bus. Financ. Account. 1998, 25, 167–186. [Google Scholar] [CrossRef]

- Mishina, Y.; Pollock, T.G.; Porac, J.F. Are more resources always better for growth? Resource stickiness in market and product expansion. Strateg. Manag. J. 2004, 25, 1179–1197. [Google Scholar] [CrossRef]

- Sui, S.; Baum, M. Internationalization strategy, firm resources and the survival of SMEs in the Export Market. J. Int. Bus. Stud. 2014, 45, 821–841. [Google Scholar] [CrossRef]

- Routledge, J.; Gadenne, D. Financial distress, reorganization and corporate performance. Account. Financ. 2000, 40, 233–259. [Google Scholar] [CrossRef]

- Steijvers, T.; Voordeckers, W.; Van Hoof, K. Collateral, relationship lending and family firms. Small Bus. Econ. 2010, 34, 243–259. [Google Scholar] [CrossRef]

- Binks, M.R.; Ennew, C.T.; Reed, G.V. Information asymmetries and the provision of finance to small firms. Int. Small Bus. J. 1992, 11, 35–46. [Google Scholar] [CrossRef]

- Smith, C.W.; Warner, R.L. On financial contracting: An analysis of bond covenants. J. Financ. Econ. 1979, 7, 117–161. [Google Scholar] [CrossRef]

- Theng, L.G.; Boon, J.L.W. An exploratory study of factors affecting the failure of local small and medium enterprises. Asia Pac. J. Manag. 1996, 13, 47–61. [Google Scholar] [CrossRef]

- Molina, C.A.; Preve, L.A. Trade receivables policy of distressed firms and its effect on the costs of financial distress. Financ. Manag. 2009, 38, 663–686. [Google Scholar] [CrossRef]

- Von Stein, J.H.; Ziegler, W. The prognosis and surveillance of risks from commercial credit borrowers. J. Bank. Financ. 1984, 8, 249–268. [Google Scholar] [CrossRef]

- García-Teruel, P.J.; Martínez-Solano, P. A dynamic approach to accounts receivable: A study of Spanish SMEs. Eur. Financ. Manag. 2010, 16, 400–421. [Google Scholar] [CrossRef]

- Breiman, L.; Friedman, J.H.; Olshen, R.; Stone, C.J. Classification and Regression Trees; Wadsworth International Group: Belmont, TN, USA, 1984. [Google Scholar]

- Therneau, T.; Atkinson, B.; Ripley, B. rpart: Recursive partitioning and regression trees. R Package Version 2015, 4, 1–9. [Google Scholar]

- R Development Core Team. R: A Language and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria, 2017. [Google Scholar]

- Emery, G.W. A pure financial explanation for trade credit. J. Financ. Quant. Anal. 1984, 19, 271–285. [Google Scholar] [CrossRef]

- Alfaro, E.; García, N.; Gámez, M.; Elizondo, D. Bankruptcy forecasting: An empirical comparison of AdaBoost and neural networks. Decis. Support Syst. 2008, 45, 110–122. [Google Scholar] [CrossRef]

- Pfeffer, J.; Salancik, G.R. The External Control of Organizations; Harper & Row: New York, NY, USA, 1978. [Google Scholar]

- Jarillo, J.C. Entrepreneurship and growth: The strategic use of external resources. J. Bus. Ventur. 1989, 4, 133–147. [Google Scholar] [CrossRef]

- Sen, S.; Cowley, J. The relevance of stakeholder theory and social capital theory in the context of CSR in SMEs: An Australian perspective. J. Bus. Ethics 2013, 118, 413–427. [Google Scholar] [CrossRef]

| Industry Distribution | N | % |

|---|---|---|

| 1. Manufacturing | 432 | 27.55 |

| 2. Construction | 356 | 22.70 |

| 3. Services | 780 | 49.75 |

| Total | 1568 | 100.00 |

| Variables (a) | Failed Firms | Non-Failed Firms | p-Value | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| t-4 | t-3 | t-2 | t-1 | t-4 | t-3 | t-2 | t-1 | t-4 | t-3 | t-2 | t-1 | |

| V1 | 1.09 | 0.79 | 0.77 | 0.84 | 1.15 | 1.29 | 1.57 | 1.52 | 0.85 | 0.00 *** | 0.00 *** | 0.03 ** |

| V2 | 0.09 | 0.07 | 0.07 | 0.11 | 0.05 | 0.07 | 0.09 | 0.07 | 0.05 * | 0.84 | 0.79 | 0.55 |

| V3 | 8.18 | 5.98 | 8.07 | 2.77 | 4.92 | 4.00 | 2.76 | 2.41 | 0.08 * | 0.25 | 0.00 *** | 0.71 |

| V4 | 40.73 | 47.96 | 34.60 | 46.16 | 11.53 | 12.64 | 12.46 | 15.10 | 0.03 ** | 0.02 ** | 0.00 *** | 0.02 ** |

| V5 | 1.27 | 4.01 | 0.77 | 5.73 | 0.57 | 0.64 | −0.21 | −0.15 | 0.05* | 0.06 * | 0.48 | 0.35 |

| V6 | 2.18 | 1.83 | 1.72 | 1.31 | 0.75 | 0.67 | 0.70 | 0.59 | 0.03 ** | 0.02 ** | 0.06 * | 0.00 *** |

| V7 | 108.54 | 113.24 | 123.87 | 169.62 | 94.20 | 92.76 | 99.98 | 109.12 | 0.05 ** | 0.00 *** | 0.00 *** | 0.00 *** |

| V8 | 1.32 | 2.84 | 1.16 | 1.17 | 1.18 | 2.122 | 0.97 | 1.05 | 0.56 | 0.19 | 0.08 * | 0.22 |

| V9 | 0.32 | 0.29 | 0.27 | 0.18 | 0.40 | 0.43 | 0.49 | 0.52 | 0.11 | 0.00 *** | 0.00 *** | 0.00 *** |

| V10 | 0.02 | 0.20 | −0.36 | −0.57 | 0.04 | 0.31 | 0.08 | −0.10 | 0.03** | 0.12 | 0.00 *** | 0.00 *** |

| Variables (b) | t-4 | t-3 | t-2 | t-1 |

|---|---|---|---|---|

| V1 | ||||

| V2 | ||||

| V3 | 58.900 | 36.582 | ||

| V4 | 3.212 | |||

| V5 | 2.273 | 5.846 | ||

| V6 | 4.345 | |||

| V7 | 69.258 | 20.947 | ||

| V8 | 11.789 | |||

| V9 | 13.468 | 14.306 | 63.418 | 28.497 |

| V10 | 67.157 |

| Panel A. Total Error (a) | ||||||||

| Training sample | ||||||||

| t-4 | t-3 | t-2 | t-1 | |||||

| Stakeholders’ variable models | 30.67% | 32.65% | 32.78% | 28.44% | ||||

| Control variable models | 38.78% | 40.63% | 35.84% | 28.38% | ||||

| Test sample | ||||||||

| t-4 | t-3 | t-2 | t-1 | |||||

| Stakeholders’ variable models | 37.37% | 36.22% | 34.05% | 28.57% | ||||

| Control variable models | 41.45% | 37.88% | 34.82% | 29.97% | ||||

| Panel B. Error Type I and II (b) | ||||||||

| Training sample | ||||||||

| t-4 | t-3 | t-2 | t-1 | |||||

| Type I error | Type II error | Type I error | Type II error I | Type I error | Type II error | Type I error | Type II error | |

| Stakeholders’ variable models | 33.04% | 28.31% | 22.83% | 42.48% | 39.79% | 25.76% | 25.89% | 30.99% |

| Control variable models | 40.43% | 37.11% | 40.81% | 40.43% | 35.88% | 33.80% | 19.64% | 37.12% |

| Test sample | ||||||||

| t-4 | t-3 | t-2 | t-1 | |||||

| Type I error | Type II error | Type I error | Type II error | Type I error | Type II error | Type I error | Type II error | |

| Stakeholders’ variable models | 39.29% | 35.45% | 29.08% | 43.37% | 43.62% | 24.49% | 23.72% | 33.42% |

| Control variable models | 45.66% | 37.25% | 39.03% | 36.73% | 40.05% | 29.59% | 19.39% | 40.56% |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Manzaneque-Lizano, M.; Alfaro-Cortés, E.; Priego de la Cruz, A.M. Stakeholders and Long-Term Sustainability of SMEs. Who Really Matters in Crisis Contexts, and When. Sustainability 2019, 11, 6551. https://doi.org/10.3390/su11236551

Manzaneque-Lizano M, Alfaro-Cortés E, Priego de la Cruz AM. Stakeholders and Long-Term Sustainability of SMEs. Who Really Matters in Crisis Contexts, and When. Sustainability. 2019; 11(23):6551. https://doi.org/10.3390/su11236551

Chicago/Turabian StyleManzaneque-Lizano, Montserrat, Esteban Alfaro-Cortés, and Alba María Priego de la Cruz. 2019. "Stakeholders and Long-Term Sustainability of SMEs. Who Really Matters in Crisis Contexts, and When" Sustainability 11, no. 23: 6551. https://doi.org/10.3390/su11236551