Venture Capital and Industrial Structure Upgrading from the Perspective of Spatial Spillover

Abstract

:1. Introduction

2. The Influence Mechanism and Theoretical Model Construction

2.1. The Influence Mechanism of Venture Capital on Industrial Structure Upgrading

2.2. Model Construction

2.3. Spatial Correlation Test

2.3.1. Global Spatial Autocorrelation

2.3.2. Local Spatial Autocorrelation

2.4. Setting of the Spatial Weight Matrix

3. Variable Selection and Data Sources

3.1. Variable Selection

3.1.1. Explained Variable

3.1.2. The Explaining Variable

3.1.3. Control Variables

3.2. Data Sources

4. Empirical Analysis and Results

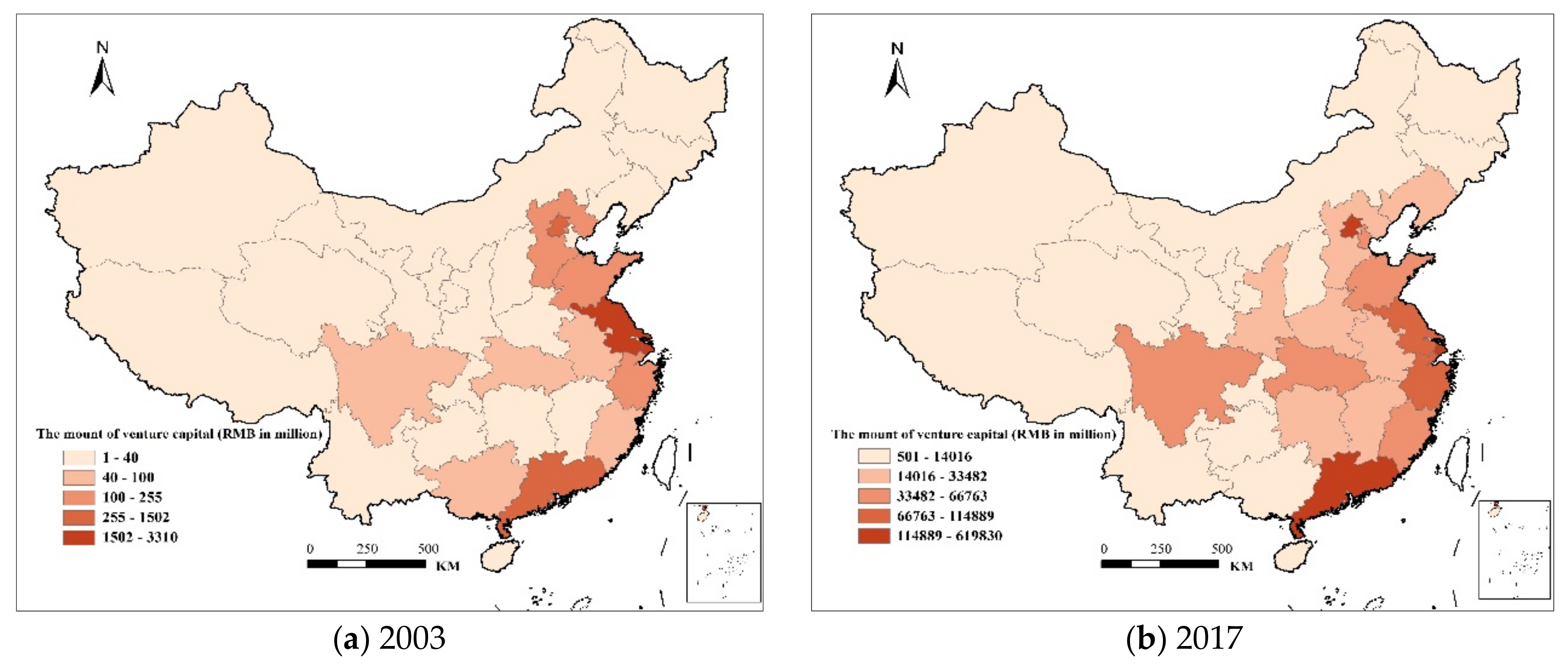

4.1. The Characteristics of Spatial Agglomeration of Venture Capital and Industrial Structure Upgrading

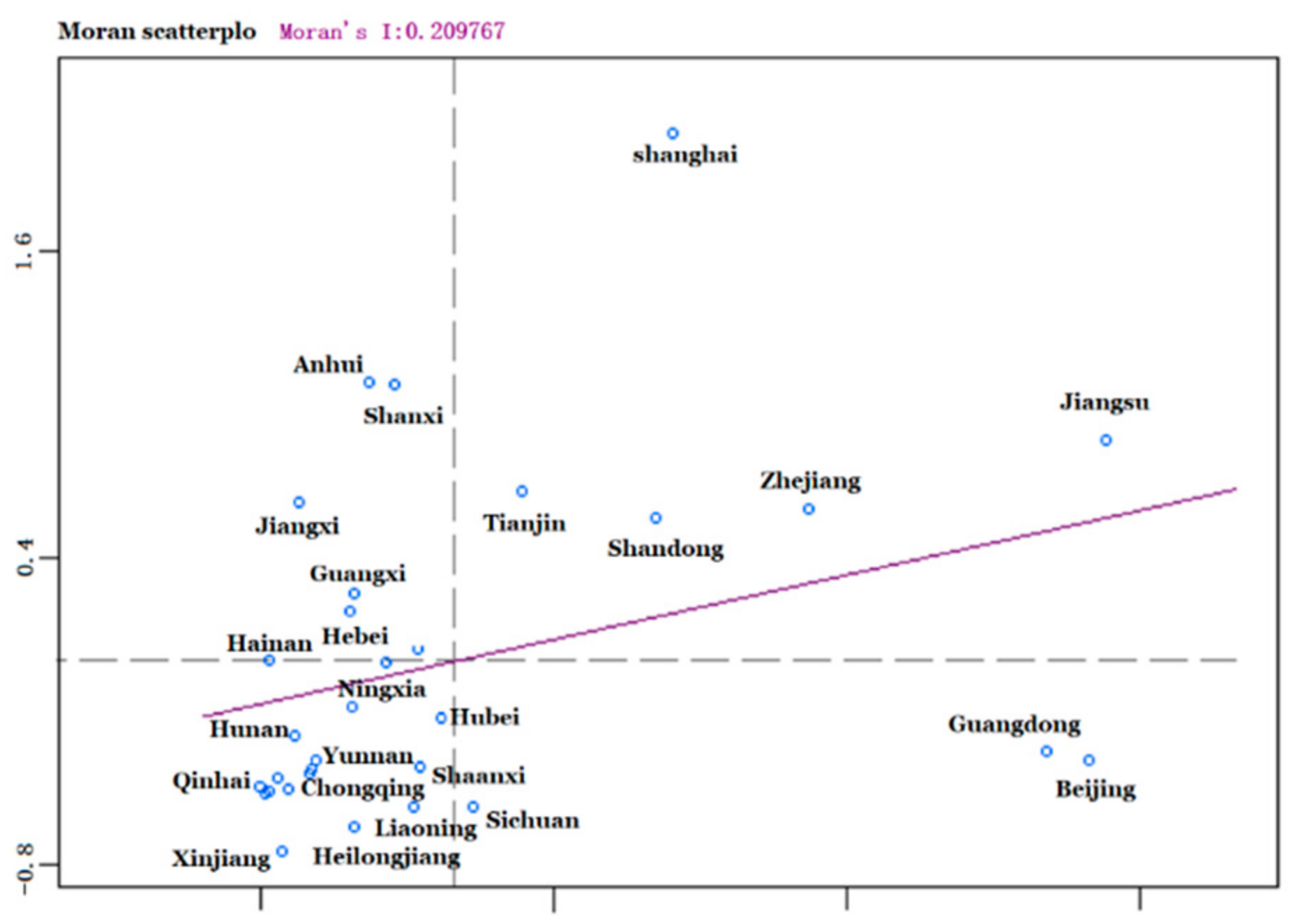

4.2. Spatial Correlation Analysis

4.3. Results and Discussion

4.3.1. Data Test

4.3.2. Estimation Results and Analysis of Spatial Econometric Model

4.3.3. Robustness Test of the Model

5. Conclusions and Recommendations

Author Contributions

Funding

Conflicts of Interest

References

- Wang, M.; Wei, Y.; Qiu, J. Spatial Agglomeration and Urban Network of Venture Capital Investment in China. J. Financ. Econ. 2014, 40, 117–131. [Google Scholar]

- Florida, R.; Kenney, M. Venture capital and high technology entrepreneurship. J. Bus. Venturing 1988, 3, 301–319. [Google Scholar] [CrossRef]

- Florida, R.; Smith, D.F. Venture capital formation, investment, and regional industrialization. Ann. Assoc. Am. Geogr. 1993, 83, 434–451. [Google Scholar] [CrossRef]

- Savaneviciene, A.; Venckuviene, V.; Girdauskiene, L. Venture capital a catalyst for start-ups to overcome the “Valley of death”: Lithuanian case. Procedia Econ. Finance 2015, 26, 1052–1059. [Google Scholar] [CrossRef]

- Li, Z.; Xu, M.; He, C.; Pan, F. Review and prospects on financial geography. Econ. Geogr. 2018, 38, 7–15. [Google Scholar]

- Liu, G.; Liu, Y. Study on the Effect of Venture Capital on the Industrial Transformation and Upgrading. Ind. Econ. Rev. 2019, 10, 45–55. [Google Scholar]

- French, K.; Poterba, J. Investor diversification and international equity markets. Am. Econ. Rev. 1991, 81, 222–226. [Google Scholar]

- Martin, R.; Berndt, C.; Klagge, B.; Sunley, P. Spatial proximity effects and regional equity gaps in the venture capital market: Evidence from Germany and the United Kingdom. Environ. Plan. A 2005, 37, 1207–1231. [Google Scholar] [CrossRef]

- Xu, Y.; Pan, F.; Jiang, X.; Qu, Y.; Liang, J. The geography and syndication investment networks of venture capital in Beijing. Prog. Geogr. 2016, 35, 358–367. [Google Scholar]

- Stolpe, M. Distribution dynamics in European venture capital (No. 1191). Kiel Working Paper 2003. [Google Scholar]

- Kortum, S.; Lerner, J. Assessing the Contribution of Venture Capital to Innovation. J. Econometrics 2000, 31, 674–692. [Google Scholar] [CrossRef]

- Langeland, O. Financing innovation: The role of Norwegian venture capitalists in financing knowledge-intensive enterprises. Eur. Plann. Stud. 2007, 15, 1143–1161. [Google Scholar] [CrossRef]

- Yao, L. Venture Capital, Regional Technological Innovation and Spatial Spillover Effects—An Empirical Research Based on the Spatial Panel Data from 31 Provinces in China. Contemp. Econ. Manag. 2018, 40, 7–12. [Google Scholar]

- Gupta, A.K.; Sapienza, H.J. Determinants of venture capital firms’ preferences regarding the industry diversity and geographic scope of their investments. J. Bus. Venturing 1992, 7, 347–362. [Google Scholar] [CrossRef]

- Chary, T.S. Role of Venture Capital in Promotion of New Enterprises. Financ. India 2015, 19, 1003–1011. [Google Scholar]

- Wei, Z.; Jin, Y.; Wang, J. Greenization of venture capital and green innovation of Chinese entity industry. Ecol. Indic. 2018, 51, 31–41. [Google Scholar] [CrossRef]

- Ding, M.; Jin, X. Equity Investment & Economic Transformation and Upgrading; Zhejiang University Press: Hangzhou, China, 2011. [Google Scholar]

- Florida, R.L.; Kenney, M. Venture capital, high technology and regional development. Reg Stud. 1988, 22, 33–48. [Google Scholar] [CrossRef]

- Peneder, M. The impact of venture capital on innovation behaviour and firm growth. Venture Cap. 2010, 12, 83–107. [Google Scholar] [CrossRef]

- Wang, G.; Xu, Y.; Wang, Y. An Analysis on the Impact of Technological Innovation on Industrial Transformation and Upgrading in China. East. China Econ. Manag. 2016, 3, 83–90. [Google Scholar]

- Xu, Q.; Wang, T. On the Relationship Between the Venture Investment and the Regional Economic Development: An Empirical Study Based on the Listed Companies of the Yangtze River Delta. J. Manag. 2018, 31, 22–33. [Google Scholar]

- Miller, H.J. Tobler’s first law and spatial analysis. Ann. Assoc. Am. Geogr. 2004, 94, 284–289. [Google Scholar] [CrossRef]

- Li, L.; Ding, Y.; Liu, Z. The Spatial Econometric Analysis of Spatial Spillover from Finance Agglomeration to Regional Economic Growth. J. Financ. Res. 2011, 5. [Google Scholar]

- Johansson, B.; Quigley, J.M. Agglomeration and networks in spatial economics. Pap. Reg Sci. 2004, 83, 165–176. [Google Scholar] [CrossRef]

- Varga, A. University Research and Regional Innovation: A Spatial Econometric Analysis of Academic Technology Transfers; Kluwer Academic Publishers: Boston, MA, USA; Dordrecht, The Netherlands; London, UK, 1998. [Google Scholar]

- Moreno, R.; Paci, R.; Usai, S. Spatial spillovers and innovation activity in European regions. Environ. Plan. A. 2005, 37, 1793–1812. [Google Scholar] [CrossRef]

- Rey, S.J.; Janikas, M.V. Regional convergence, inequality, and space. J. Econ. Geogr. 2005, 5, 155–176. [Google Scholar] [CrossRef]

- Le Gallo, J.; Fingleton, B. Regional growth and convergence empirics. In Handbook of Regional Science; Springer: Heidelberg, Germany; New York, NY, USA; Dordrecht, The Netherlands; London, UK, 2019; pp. 1–28. [Google Scholar]

- Humphrey, J.; Schmitz, H. Governance and Upgrading: Linking Industrial Cluster and Global Value Chain Research; Institute of Development Studies: Brighton, UK, 2000. [Google Scholar]

- Lall, S. Competitiveness, Technology and Skills; Edward Elgar: Cheltenham, UK, 2001. [Google Scholar]

- Ergas, H. Does technology policy matter? In Technology and Global Industry: Companies and Nations in the World Economy; National Academic Press: Washington, DC, USA, 1987; pp. 191–245. [Google Scholar]

- Gereffi, G. International trade and industrial upgrading in the apparel commodity chain. J. Int. Econ. 1999, 48, 37–70. [Google Scholar] [CrossRef]

- Amin, A.; Goddard, J. Technological Change, Industrial Restructuring and Regional Development; Routledge: London, UK; New York, NY, USA, 2018. [Google Scholar]

- Greenwood, J.; Jovanovic, B. Financial development, growth, and the distribution of income. J. Polit Econ. 1990, 98, 1076–1107. [Google Scholar] [CrossRef]

- Chen, Z.; Yang, D. Research on Coordinated Development Strategy of Industrial Structure and Finance; Economic Publishing House: Beijing, China, 2007. [Google Scholar]

- Jensen, C. Foreign direct investment, industrial restructuring and the upgrading of Polish exports. Appl. Econ. 2002, 34, 207–217. [Google Scholar] [CrossRef]

- Pavlínek, P.; Domański, B.; Guzik, R. Industrial upgrading through foreign direct investment in Central European automotive manufacturing. Eur. Urban Reg. Stud. 2009, 16, 43–63. [Google Scholar] [CrossRef]

- Galbraith, J.K.; Lu, J. Sustainable development and the Open-Door policy in China. Sustain. Dev. Open-Door Policy. China 2000. [Google Scholar]

- Cai, H.; Xu, Y. Does Trade Openness Affect the Upgrading of China’s Industrial Structure? J. Quant. Tech. Econ. 2017, 34, 3–22. [Google Scholar]

- Wernerfelt, L.; Navas, L. The Underground Revolution in the Sino Vallery: A Comparison of Upgrading in Global and National Value; Edward Elgar Publishing: Cheltenham, UK; Northampton, MA, USA, 2004. [Google Scholar]

- Antarciuc, E.; Zhu, Q. Almarri. Sustainable venture capital investments: An enabler investigation. Sustainability 2018, 10, 1204. [Google Scholar] [CrossRef]

- Alperovych, Y.; Hübner, G.; Lobet, F. How does governmental versus private venture capital backing affect a firm’s efficiency? Evidence from Belgium. J. Bus. Venturing 2015, 30, 508–525. [Google Scholar] [CrossRef]

- Pan, X.; Zhang, J.; Song, M.; Ai, B. Innovation resources integration pattern in high-tech entrepreneurial enterprises. Int. Entrep. Manag. J. 2018, 14, 51–66. [Google Scholar] [CrossRef]

- Wang, H. Historical investigation and enlightenment of industrial structure upgrading at home and abroad. Econ. Perspect. 2014, 6, 4–15. [Google Scholar]

- Anselin, L. Spatial Econometrics: Methods and Models; Kluwer Academic Publishers: Dordrecht, The Netherlands, 1988. [Google Scholar]

- Anselin, L. The Econometrics of Panel Data; Springer: Berlin/Heidelberg, Germany, 2008. [Google Scholar]

- LeSage, J.; Pace, R. Interpreting spatial econometric models. In Handbook of Regional Science; Springer: Heidelberg, Germany; New York, NY, USA; Dordrecht, The Netherlands; London, UK, 2014; pp. 1535–1552. [Google Scholar]

- Zhu, X.Z. A review on the role of venture capital in technological innovation. Financ. Theory. Pract. 2008, 3, 102–106. [Google Scholar]

| Year | Venture Capital Investment Level | Z Value | Industrial Structure Upgrading | Z Value |

|---|---|---|---|---|

| 2003 | 0.228 | 2.43 | 0.283 | 3.046 |

| 2004 | 0.218 | 2.36 | 0.247 | 2.816 |

| 2005 | 0.240 | 2.55 | 0.250 | 2.757 |

| 2006 | 0.293 | 2.94 | 0.225 | 2.422 |

| 2007 | 0.173 | 1.99 | 0.133 | 1.599 |

| 2008 | 0.165 | 1.96 | 0.245 | 3.073 |

| 2009 | 0.174 | 2.01 | 0.218 | 2.604 |

| 2010 | 0.172 | 2.00 | 0.197 | 2.460 |

| 2011 | 0.252 | 2.59 | 0.255 | 2.817 |

| 2012 | 0.195 | 2.02 | 0.267 | 2.863 |

| 2013 | 0.155 | 1.73 | 0.343 | 4.119 |

| 2014 | 0.161 | 1.77 | 0.291 | 3.407 |

| 2015 | 0.176 | 1.91 | 0.256 | 2.879 |

| 2016 | 0.365 | 3.59 | 0.267 | 2.747 |

| 2017 | 0.209 | 2.40 | 0.266 | 3.169 |

| Variables | Minimum | Maximum | Mean | Std. Dev. | Levin, Lin & Chu t * | Im, Pesaran and Shin W-stat |

|---|---|---|---|---|---|---|

| Ln(ISU) | 0.3549 | 0.997 | 0.7831 | 0.1042 | −1.383(−0.083) | −3.274(0.000) |

| Ln(VC) | 0.000 | 13.337 | 7.3765 | 2.4486 | −8.954(0.000) | −3.687(0.000) |

| Ln(RD) | 6.2146 | 16.741 | 13.226 | 1.8613 | −14.976(0.000) | −12.523(0.000) |

| Ln(FIX) | 4.8975 | 10.919 | 8.6086 | 1.1997 | −14.295(0.000) | −6.583(0.000) |

| Ln(PHED) | 2.7726 | 12.715 | 8.8491 | 1.8021 | −1.191(−0.116) | −5.588(0.000) |

| Ln(GDP) | 8.2122 | 11.768 | 10.214 | 0.7182 | −18.522(0.000) | −9.802(0.000) |

| Variables | Ln(VC) | Ln(RD) | Ln(FIX) | Ln(PHED) | Ln(GDP) |

|---|---|---|---|---|---|

| Coefficient Variance | 2.63 | 1.87 | 1.88 | 4.13 | 3.33 |

| Variables | OLS | SLM | SDM | ||

|---|---|---|---|---|---|

| Geographical Distance Matrix | Economic Distance Matrix | Geographical Distance Matrix | Economic Distance Matrix | ||

| VC | 0.136 ** | 0.158 ** | 0.118 *** | 0.140 *** | 0.141 *** |

| RD | 0.289 *** | 0.456 *** | 0.356 *** | 0.361 *** | 0.276 *** |

| FIX | 0.357 *** | 0.444 *** | 0.417 *** | 0.423 *** | 0.295 *** |

| PHED | 0.046 ** | 0.014 | 0.035 * | 0.046 ** | 0.041 ** |

| GDP(P) | 0.048 ** | 0.057 ** | 0.067 ** | 0.037 ** | 0.085 ** |

| W*VC | 0.161 *** | 0.169 *** | |||

| W*RD | 0.417 *** | 0.416 *** | |||

| W*FIX | 0.468 *** | 0.207 *** | |||

| W*PHED | −0.091 | −0.002 | |||

| W*GDP(P) | 0.041 ** | 0.054 ** | |||

| ρ | 0.189 *** | 0.215 *** | 0.201 *** | 0.224 *** | |

| R2 | 0.711 | 0.932 | 0.952 | 0.964 | 0.965 |

| Adjust-R2 | 0.656 | 0.845 | 0.821 | 0.867 | 0.866 |

| Log-L | 834 | 851 | 846 | 864 | 872 |

| Hausman test | χ2 = 39.851 *** | ||||

| Variables | SDM | |

|---|---|---|

| Geographical Distance Matrix | Economic Distance Matrix | |

| VC | 0.043 ** | 0.083 ** |

| RD | 0.059 ** | 0.067 ** |

| FIX | 0.089 ** | 0.061 ** |

| PHED | 0.021 | 0.022 * |

| GDP(P) | 0.082 * | 0.105 * |

| W*VC | 0.058 ** | 0.023 ** |

| W*RD | 0.019 ** | 0.064 ** |

| W*FIX | 0.016 ** | 0.012 * |

| W*PHED | −0.030 | −0.036 * |

| W*GDP(P) | 0.378 * | 0.124 * |

| ρ | 0.054 ** | 0.004 ** |

| R2 | 0.531 | 0.514 |

| Adjust-R2 | 0.503 | 0.487 |

| Log-L | 521 | 514 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yao, L.; Lu, J.; Sun, P. Venture Capital and Industrial Structure Upgrading from the Perspective of Spatial Spillover. Sustainability 2019, 11, 6698. https://doi.org/10.3390/su11236698

Yao L, Lu J, Sun P. Venture Capital and Industrial Structure Upgrading from the Perspective of Spatial Spillover. Sustainability. 2019; 11(23):6698. https://doi.org/10.3390/su11236698

Chicago/Turabian StyleYao, Li, Jie Lu, and Pingjun Sun. 2019. "Venture Capital and Industrial Structure Upgrading from the Perspective of Spatial Spillover" Sustainability 11, no. 23: 6698. https://doi.org/10.3390/su11236698

APA StyleYao, L., Lu, J., & Sun, P. (2019). Venture Capital and Industrial Structure Upgrading from the Perspective of Spatial Spillover. Sustainability, 11(23), 6698. https://doi.org/10.3390/su11236698