The Role of Consumers’ Perceived Security, Perceived Control, Interface Design Features, and Conscientiousness in Continuous Use of Mobile Payment Services

Abstract

:1. Introduction

2. Literature Review and Hypotheses

2.1. Interface Design, Perceived Control, and Perceived Security

2.2. Perceived Security and Continuous Use Intention

2.3. Personality Traits and Conscientiousness

3. Methodology

3.1. Instrument Development

3.2. Data Collection

3.3. Participants

4. Results

4.1. Reliability and Validity

4.2. Model Fit

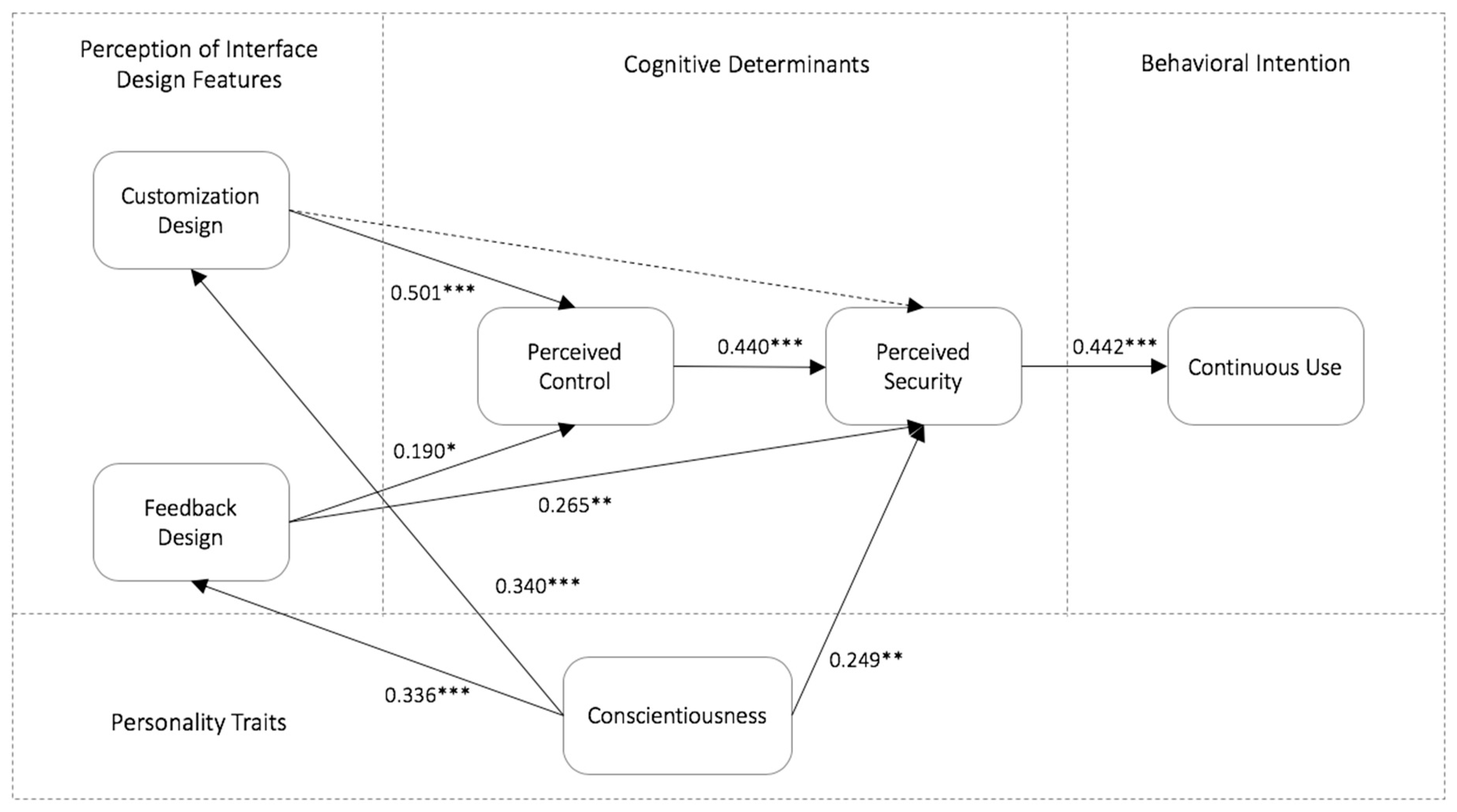

4.3. Hypothesis Testing and Path Analysis

5. Discussion and Implications

6. Limitations and Future Studies

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Zhou, T. An empirical examination of continuance intention of mobile payment services. Decis. Support Syst. 2013, 54, 1085–1091. [Google Scholar] [CrossRef]

- Yang, S.; Lu, Y.; Gupta, S.; Cao, Y. Does Context Matter? The Impact of Use Context on Mobile Internet Adoption Does Context Matter? The Impact of Use Context on Mobile Internet Adoption. J. Hum. Comput. Interact. 2012, 28, 530–541. [Google Scholar] [CrossRef]

- Johnson, V.L.; Kiser, A.; Washington, R.; Torres, R. Limitations to the rapid adoption of M-payment services: Understanding the impact of privacy risk on M-Payment services. Comput. Hum. Behav. 2018, 79, 111–122. [Google Scholar] [CrossRef]

- Lin, X.; Wu, R.; Lim, Y.T.; Han, J.; Chen, S.C. Understanding the Sustainable Usage Intention of Mobile Payment Technology in Korea: Cross-Countries Comparison of Chinese and Korean Users. Sustainability 2019, 11, 5532. [Google Scholar] [CrossRef]

- Shao, Z.; Zhang, L.; Li, X.; Guo, Y. Antecedents of trust and continuance intention in mobile payment platforms: The moderating effect of gender. Electron. Commer. Res. Appl. 2019, 33, 100823. [Google Scholar] [CrossRef]

- 2019 China Mobile Payment Development Report. Payment & Clearing Association of China, 2018. Available online: http://www.pcac.org.cn/index.php/focus/list_details/ids/654/id/50/topicid/3.html. (accessed on 21 September 2019).

- Hartono, E.; Holsapple, C.W.; Kim, K.Y.; Na, K.S.; Simpson, J.T. Measuring perceived security in B2C electronic commerce website usage: A respecification and validation. Decis. Support Syst. 2014, 62, 11–21. [Google Scholar] [CrossRef]

- Dahlberg, T.; Guo, J.; Ondrus, J. A critical review of mobile payment research. Electron. Commer. Res. Appl. 2015, 14, 265–284. [Google Scholar] [CrossRef]

- Khalilzadeh, J.; Ozturk, A.B.; Bilgihan, A. Security-related factors in extended UTAUT model for NFC based mobile payment in the restaurant industry. Comput. Hum. Behav. 2017, 70, 460–474. [Google Scholar] [CrossRef]

- Schierz, P.G.; Schilke, O.; Wirtz, B.W. Understanding consumer acceptance of mobile payment services: An empirical analysis. Electron. Commer. Res. Appl. 2010, 9, 209–216. [Google Scholar] [CrossRef]

- Huang, D.-L.; Rau, P.L.P.; Salvendy, G. Perception of information security. Behav. Inf. Technol. 2010, 29, 221–232. [Google Scholar] [CrossRef]

- Shin, D.H. Towards an understanding of the consumer acceptance of mobile wallet. Comput. Hum. Behav. 2009, 25, 1343–1354. [Google Scholar] [CrossRef]

- Fan, J.; Shao, M.; Li, Y.; Huang, X. Understanding users’ attitude toward mobile payment use: A comparative study between China and the USA. Ind. Manag. Data Syst. 2018, 118, 524–540. [Google Scholar] [CrossRef]

- Oliveira, T.; Thomas, M.; Baptista, G.; Campos, F. Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Comput. Hum. Behav. 2016, 61, 404–414. [Google Scholar] [CrossRef]

- Salisbury, W.D.; Pearson, R.A.; Pearson, A.W.; Miller, D.W. Perceived security and World Wide Web purchase intention. Ind. Manag. Data Syst. 2001, 101, 165–177. [Google Scholar] [CrossRef]

- Huang, D.L.; Rau, P.L.P.; Salvendy, G.; Gao, F.; Zhou, J. Factors affecting perception of information security and their impacts on IT adoption and security practices. Int. J. Hum. Comput. Stud. 2011, 69, 870–883. [Google Scholar] [CrossRef]

- Chang, H.H.; Chen, S.W. Consumer perception of interface quality security, and loyalty in electronic commerce. Inf. Manag. 2009, 46, 411–417. [Google Scholar] [CrossRef]

- Meskaran, F.; Ismail, Z.; Shanmugam, B. Online Purchase Intention: Effects of Trust and Security Perception. Aust. J. Basic Appl. Sci. 2013, 7, 307–315. [Google Scholar]

- Uffen, J.; Kaemmerer, N.; Breitner, M.H. Personality Traits and Cognitive Determinants-An Empirical Investigation of the Use of Smartphone Security Measures. J. Inf. Secur. 2013, 4, 203–212. [Google Scholar] [CrossRef]

- Yuan, S.; Liu, Y.; Yao, R.; Liu, J. An investigation of users’ continuance intention towards mobile banking in China. Inf. Dev. 2016, 32, 20–34. [Google Scholar] [CrossRef]

- Zhou, T. Examining continuance usage of mobile Internet services from the perspective of resistance to change. Inf. Dev. 2014, 30, 22–31. [Google Scholar] [CrossRef]

- Kim, C.; Mirusmonov, M.; Lee, I. An empirical examination of factors influencing the intention to use mobile payment. Comput. Hum. Behav. 2010, 26, 310–322. [Google Scholar] [CrossRef]

- Gao, L.; Waechter, K.A.; Bai, X. Understanding consumers’ continuance intention towards mobile purchase: A theoretical framework and empirical study-A case of China. Comput. Hum. Behav. 2015, 53, 249–262. [Google Scholar] [CrossRef]

- Gao, L.; Waechter, K.A. Examining the role of initial trust in user adoption of mobile payment services: An empirical investigation. Inf. Syst. Front. 2017, 19, 525–548. [Google Scholar] [CrossRef]

- Su, P.; Wang, L.; Yan, J. How users’ Internet experience affects the adoption of mobile payment: A mediation model. Technol. Anal. Strateg. Manag. 2018, 30, 186–197. [Google Scholar] [CrossRef]

- Yang, S.; Lu, Y.; Gupta, S.; Cao, Y.; Zhang, R. Mobile payment services adoption across time: An empirical study of the effects of behavioral beliefs, social influences, and personal traits. Comput. Hum. Behav. 2012, 28, 129–142. [Google Scholar] [CrossRef]

- Lu, J.; Wei, J.; Yu, C.S.; Liu, C. How do post-usage factors and espoused cultural values impact mobile payment continuation? Behav. Inf. Technol. 2017, 36, 140–164. [Google Scholar] [CrossRef]

- Zhou, T. An empirical examination of users’ post-adoption behaviour of mobile services. Behav. Inf. Technol. 2011, 30, 241–250. [Google Scholar] [CrossRef]

- Chellappa, R.K.; Pavlou, P.A. Perceived information security, financial liability and consumer trust in electronic commerce transactions. Logist. Inf. Manag. 2002, 15, 358–368. [Google Scholar] [CrossRef]

- Burger, J.M. Negative Reactions to Increases in Perceived Personal Control. J. Pers. Soc. Psychol. 1989, 56, 246–256. [Google Scholar] [CrossRef]

- Hajli, N.; Lin, X. Exploring the Security of Information Sharing on Social Networking Sites: The Role of Perceived Control of Information. J. Bus. Ethics 2016, 133, 111–123. [Google Scholar] [CrossRef]

- Arcand, M.; Nantel, J.; Arles-Dufour, M.; Vincent, A. The impact of reading a web site’s privacy statement on perceived control over privacy and perceived trust. Online Inf. Rev. 2007, 31, 661–681. [Google Scholar] [CrossRef]

- Zhang, J.; Reithel, B.J.; Li, H. Impact of perceived technical protection on security behaviors. Inf. Manag. Comput. Secur. 2009, 17, 330–340. [Google Scholar] [CrossRef]

- Suh, B.; Han, I. The impact of customer trust and perception of security control on the acceptance of electronic commerce. Int. J. Electron. Commer. 2003, 7, 135–161. [Google Scholar]

- Ingaldi, M.; Ulewicz, R. How to Make E-Commerce More Successful by Use of Kano’s Model to Assess Customer Satisfaction in Terms of Sustainable Development. Sustainability. 2019, 18, 4830. [Google Scholar] [CrossRef] [Green Version]

- Tarasewich, P. Designing Mobile Commerce Applications; Communications of the ACM: New York, NY, USA, 2003; Volume 46, pp. 57–60. [Google Scholar]

- Lee, Y.E.; Benbasat, I. A Framework for the Study of Customer Interface Design for Mobile Commerce. Int. J. Electron. Commer. 2004, 8, 79–102. [Google Scholar] [CrossRef]

- Nilashi, M.; Ibrahim, O.; Mirabi, V.R.; Ebrahimi, L.; Zare, M. The role of Security, Design and Content factors on customer trust in mobile commerce. J. Retail. Consum. Serv. 2015, 26, 57–69. [Google Scholar] [CrossRef]

- Kim, K.; Schmierbach, M.G.; Chung, M.Y.; Fraustino, J.D.; Dardis, F. Is it a sense of autonomy, control, or attachment? Exploring the effects of in-game customization on game enjoyment. Comput. Hum. Behav. 2015, 48, 695–705. [Google Scholar] [CrossRef]

- Marathe, S.; Sundar, S.S. What drives customization? Control or Identity? In Proceedings of the 2011 annual conference on Human factors in computing systems-CHI, Vancouver, BC, Canada, 13 June 2011; pp. 781–790. [Google Scholar]

- Huang, L.; Ba, S.; Lu, X. Building Online Trust in a Culture of Confucianism. ACM Trans. Manag. Inf. Syst. 2014, 5, 4. [Google Scholar] [CrossRef]

- Muñoz-Arteaga, J.; González, R.M.; Martin, M.V.; Vanderdonckt, J.; Álvarez-Rodríguez, F. A methodology for designing information security feedback based on User Interface Patterns. Adv. Eng. Softw. 2009, 40, 1231–1241. [Google Scholar] [CrossRef]

- Bauer, S.; Bernroider, E.W.N.; Chudzikowski, K. Prevention is better than cure! Designing information security awareness programs to overcome users’ non-compliance with information security policies in banks. Comput. Secur. 2017, 68, 145–159. [Google Scholar] [CrossRef] [Green Version]

- Walter, N.; Ortbach, K.; Niehaves, B. Designing electronic feedback-Analyzing the effects of social presence on perceived feedback usefulness. Int. J. Hum. Comput. Stud. 2015, 76, 1–11. [Google Scholar] [CrossRef]

- Povey, R.; Conner, M.; Sparks, P.; James, R.; Shepherd, R. Application of the Theory of Planned Behaviour to two dietary behaviours: Roles of perceived control and self-efficacy. Br. J. Health Psychol. 2000, 2, 121–139. [Google Scholar] [CrossRef]

- Chun, S.H. E-commerce liability and security breaches in mobile payment for e-business sustainability. Sustainability 2019, 11, 715. [Google Scholar] [CrossRef] [Green Version]

- Liao, C.; Chen, J.L.; Yen, D.C. Theory of planning behavior (TPB) and customer satisfaction in the continued use of e-service: An integrated model. Comput. Hum. Behav. 2007, 23, 2804–2822. [Google Scholar] [CrossRef]

- Ye, C.; Seo, D.; Desouza, K.C.; Sangareddy, S.P.; Jha, S. The Role of Innovation and Wealth in the Net Neutrality Debate. J. Am. Soc. Inf. Sci. Technol. 2008, 59, 2115–2132. [Google Scholar] [CrossRef]

- Nicholson, N.; Soane, E.; Fenton-O’Creevy, M.; Willman, P. Personality and domain-specific risk taking. J. Risk Res. 2005, 8, 157–176. [Google Scholar] [CrossRef]

- Mcelroy, J.C.; Hendrickson, A.R.; Townsend, A.M.; Demarie, S.M. Dispositional factors in Internet use: Personality versus cognitive style. MIS Q. 2007, 31, 809–820. [Google Scholar] [CrossRef] [Green Version]

- John, O.P.; Srivastava, S. Handbook of Personality: Theory and Research, 2nd ed.; Guilford: New York, NY, USA, 1999. [Google Scholar]

- Junglas, I.A.; Johnson, N.A.; Spitzmüller, C. Personality traits and concern for privacy: An empirical study in the context of location-based services. Eur. J. Inf. Syst. 2008, 17, 387–402. [Google Scholar] [CrossRef]

- Shropshire, J.; Warkentin, M.; Sharma, S. Personality, attitudes, and intentions: Predicting initial adoption of information security behavior. Comput. Secur. 2015, 49, 177–191. [Google Scholar] [CrossRef]

- McCormac, A.; Zwaans, T.; Parsons, K.; Calic, D.; Butavicius, M.; Pattinson, M. Individual differences and Information Security Awareness. Comput. Hum. Behav. 2017, 69, 151–156. [Google Scholar] [CrossRef]

- Goldberg, L.R. A broad-bandwidth, public-domain, personality inventory measuring the lower-level facets of several five-factor models. Personal. Psychol. Eur. 1999, 7, 7–28. Available online: https://ipip.ori.org/A%20broad-bandwidth%20inventory.pdf (accessed on 21 November 2019).

- Goldberg, L.R.; Johnson, J.A.; Eber, H.W.; Hogan, R.; Ashton, M.C.; Cloninger, C.R.; Gough, H.G. The international personality item pool and the future of public-domain personality measures. J. Res. Pers. 2006, 40, 84–96. [Google Scholar] [CrossRef]

- Donnellan, M.B.; Oswald, F.L.; Baird, B.M.; Lucas, R.E. The Mini-IPIP scales: Tiny-yet-effective measures of the Big Five factors of personality. Psychol. Assess. 2006, 18, 192–203. [Google Scholar] [CrossRef] [PubMed]

- Zhou, T.; Lu, Y. The effects of personality traits on user acceptance of mobile commerce. Int. J. Hum. Comput. Interact. 2011, 27, 545–561. [Google Scholar] [CrossRef]

- Halevi, T.; Lewis, J.; Memon, N. A Pilot Study of Cyber Security and Privacy Related Behavior and Personality Traits. In Proceedings of the International Conference on World Wide Web, New York, NY, USA, 13–17 May 2013; pp. 737–744. [Google Scholar]

- Safa, N.S.; Sookhak, M.; von Solms, R.; Furnell, S.; Ghani, N.A.; Herawan, T. Information security conscious care behaviour formation in organizations. Comput. Secur. 2015, 53, 65–78. [Google Scholar] [CrossRef] [Green Version]

- Kim, C.; Tao, W.; Shin, N.; Kim, K.S. An empirical study of customers’ perceptions of security and trust in e-payment systems. Electron. Commer. Res. Appl. 2010, 9, 84–95. [Google Scholar] [CrossRef]

- Johnston, J.; Eloff, J.H.P.; Labuschagne, L. Security and human computer interfaces. Comput. Secur. 2003, 22, 675–684. [Google Scholar] [CrossRef]

- Meade, A.W.; Craig, S.B. Identifying careless responses in survey data. Psychol. Methods 2012, 17, 437–455. [Google Scholar] [CrossRef] [Green Version]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis; Pearson: Essex, UK, 2014. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Yi, Y. On the evaluation of structural equation models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Lee, Y.E.; Benbasat, I. Interface design for mobile commerce. Commun. ACM 2003, 12, 48–52. [Google Scholar] [CrossRef]

- Huh, J.H.; Verma, S.; Sri, S.; Rayala, V.; Bobba, R.; Beznosov, K.; Kim, H. I Don’t Use Apple Pay Because It’s Less Secure Perception of Security and Usability in Mobile Tap-and-Pay. In Proceedings of the 2017 Workshop on Usable Security, San Diego, CA, USA, 26 February 2017. [Google Scholar]

| Construct | Definition | Measure Item | Reference |

|---|---|---|---|

| Perception of customization design (CD) | Customization design refers to a system’s capability that allows users to tailor it according to their needs. It usually involves customizing the information function, payment methods, and security settings in mobile payment system [5,38]. | CD1: I feel that I can customize the payment methods according to my own preference. | [5] |

| CD2: I feel that I can customize the privacy settings according to my own preference. | |||

| CD3: I feel that I can customize the security settings according to my own preference. | |||

| Perception of feedback design (FD) | Feedback design describes different forms of communication from the system to a user. The information feedback should allow related information to security and the internal state of the system [42]. Regarding the Security HCI proposed by Johnston, Eloff, and Labuschagne [62], feedback design should include suggestions of secure action for problems and connections to additional information or external assistance. | FD1: I feel that the feedback information helps me to settle a payment transaction securely. | [42,62] |

| FD2: I feel that the feedback information provides me with information about the account changes in my mobile payment platforms. | |||

| FD3: I feel that the feedback information allows me the consequences of each performance in my mobile payment platform. | |||

| Perceived control (PC) | Perceived control is referred to the extent that people believe the event or situation is under their control [31]. It was studied as one of the cognitive determinants of perceived security in IT appliances [16]. | PC1: I think I have the skill to keep my privacy in mobile payment platforms securely. | [31,60] |

| PC2: I think that I am in control over the data securely in mobile payment platforms. | |||

| PC3: I think that I am capable of preventing security risk in mobile payment platforms. | |||

| Perceived security (PS) | Adapting from literature [7,15], perceived security is defined as the degree to which the mobile payment user believes that transaction on mobile payment platforms is secure in both financial and personal information aspects. | PS1: I perceive secure using my credit/debit card information through mobile payment platforms. | [9] |

| PS2:I would feel safe providing sensitive information about myself over the mobile payment platforms. | |||

| PS3:I perceive that mobile payment platforms are secure systems to conduct a transaction. | |||

| Continuous use (CU) | Continuous use reflects users’ intention to continuously use mobile payment services. It is one of the important post-adoption behaviors in IS use [28]. | CU1: I frequently use my mobile payment platform. | [28,61] |

| CU2: I will continue to use my mobile payment platform. | |||

| Conscientiousness (C) | Conscientiousness describes the extent to which a person is reliable, responsible, and expresses careful consideration [55,56,57,58]. People with a high score of conscientiousness tend to have higher level of self-control and they tend to make a plan and stick to it [58,59]. | C1: I often forget to put things back in their proper place. | [55,56,57] |

| C2: I make a mess of things. |

| Construct | Cronbach’s Alpha | Variable | Standardized Factor Loading | CR (t-value) | SMC | AVE | Composite Reliability |

|---|---|---|---|---|---|---|---|

| CD | 0.795 | cd1 | 0.637 | 0.406 | 0.578 | 0.802 | |

| cd2 | 0.814 | 9.934 | 0.663 | ||||

| cd3 | 0.816 | 9.839 | 0.666 | ||||

| FD | 0.803 | fd1 | 0.803 | 0.645 | 0.586 | 0.809 | |

| fd2 | 0.700 | 10.713 | 0.490 | ||||

| fd3 | 0.789 | 11.569 | 0.623 | ||||

| PC | 0.853 | pc1 | 0.801 | 0.642 | 0.661 | 0.854 | |

| pc2 | 0.800 | 12.969 | 0.640 | ||||

| pc3 | 0.838 | 13.476 | 0.702 | ||||

| PS | 0.805 | ps1 | 0.820 | 0.672 | 0.593 | 0.813 | |

| ps2 | 0.766 | 11.524 | 0.587 | ||||

| ps3 | 0.720 | 10.959 | 0.518 | ||||

| CU | 0.744 | cu1 | 0.670 | 0.449 | 0.615 | 0.758 | |

| cu2 | 0.884 | 5.217 | 0.781 | ||||

| C | 0.657 | con1 | 0.617 | 0.381 | 0.578 | 0.727 | |

| con2 | 0.881 | 4.664 | 0.776 |

| Measurement | AVE | CD | FD | PC | PS | C | CU |

|---|---|---|---|---|---|---|---|

| CD | 0.578 | (0.760) | |||||

| FD | 0.586 | 0.596 *** | (0.765) | ||||

| PC | 0.661 | 0.614 *** | 0.489 *** | (0.812) | |||

| PS | 0.593 | 0.299 *** | 0.432 *** | 0.501 *** | (0.771) | ||

| C | 0.578 | 0.338 *** | 0.334 *** | 0.230 ** | 0.352 *** | (0.755) | |

| CU | 0.615 | 0.206 * | 0.280 ** | 0.201 * | 0.432 *** | 0.336 ** | (0.782) |

| Category | Measure | Acceptable Values [64,66] | Value |

|---|---|---|---|

| Absolute fit indices | Chi-square | 159.081 | |

| df | 93 | ||

| Chi-square/df | 1–5 | 1.711 | |

| GFI | 0.90 or above | 0.927 | |

| AGFI | 0.80 or above | 0.893 | |

| SRMR | 0.08 or below | 0.033 | |

| RMSEA | 0.05–0.08 | 0.053 | |

| Incremental fit indices | NFI | 0.90 or above | 0.908 |

| IFI | 0.90 or above | 0.960 | |

| TLI | 0.90 or above | 0.947 | |

| CFI | 0.90 or above | 0.959 |

| Hypothesis | Path | Standardized Coefficient | Standard Error | CR (t-Value) | p | Result |

|---|---|---|---|---|---|---|

| H1 | Perceived Control > Perceived Security | 0.440 | 0.077 | 4.577 | 0.001 | Supported |

| H2 | Customization Design > Perceived Control | 0.501 | 0.149 | 5.034 | 0.001 | Supported |

| H3 | Customization Design > Perceived Security | −0.206 | 0.134 | −1.843 | 0.065 | Rejected |

| H4 | Feedback Design > Perceived Control | 0.190 | 0.117 | 2.127 | 0.033 | Supported |

| H5 | Feedback Design > Perceived Security | 0.265 | 0.102 | 2.710 | 0.007 | Supported |

| H6 | Perceived Security > Continuous Use | 0.442 | 0.067 | 3.129 | 0.002 | Supported |

| H7 | Conscientiousness > Feedback Design | 0.336 | 0.082 | 4.023 | 0.001 | Supported |

| H8 | Conscientiousness > Customization Design | 0.340 | 0.073 | 3.962 | 0.001 | Supported |

| H9 | Conscientiousness > Perceived Security | 0.249 | 0.081 | 3.129 | 0.002 | Supported |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, J.; Luximon, Y.; Song, Y. The Role of Consumers’ Perceived Security, Perceived Control, Interface Design Features, and Conscientiousness in Continuous Use of Mobile Payment Services. Sustainability 2019, 11, 6843. https://doi.org/10.3390/su11236843

Zhang J, Luximon Y, Song Y. The Role of Consumers’ Perceived Security, Perceived Control, Interface Design Features, and Conscientiousness in Continuous Use of Mobile Payment Services. Sustainability. 2019; 11(23):6843. https://doi.org/10.3390/su11236843

Chicago/Turabian StyleZhang, Jiaxin, Yan Luximon, and Yao Song. 2019. "The Role of Consumers’ Perceived Security, Perceived Control, Interface Design Features, and Conscientiousness in Continuous Use of Mobile Payment Services" Sustainability 11, no. 23: 6843. https://doi.org/10.3390/su11236843

APA StyleZhang, J., Luximon, Y., & Song, Y. (2019). The Role of Consumers’ Perceived Security, Perceived Control, Interface Design Features, and Conscientiousness in Continuous Use of Mobile Payment Services. Sustainability, 11(23), 6843. https://doi.org/10.3390/su11236843